It has never been more important for Sellers and Buyers to understand how Listing Agents and Buyer’s Agents manage a real estate transaction. Most homes in our market area that are in market ready condition (your agent can help you with this!) and strategically priced-think sweet spot- (and yes, your agent can help you with this!) will sell and sell well. By well, I mean the property will sell at a value and with terms that meets or exceeds comparable properties that are currently on the market or have recently closed.

When you hire a real estate brokerage and pay them a commission, you’re compensating them not only for the time, effort and skill they just put into your transaction, but for the benefit of their connections, resources, knowledge and expertise that have taken years to develop:

• Network. Agents have trusted resources from mortgage lenders to inspectors to plumbers and these relationships can facilitate or uncover opportunities you may never have found.

• Knowledge Active agents understand the local market- neighborhoods, current trends and what clients are looking for. This helps you make informed decisions.

• Negotiations. Agents hone these skills over many, many transactions. This can help you get the best price for your property or help get you the home of your dreams.

• The fine print. There is a growing amount of legal paperwork required in a transaction. An experienced agent can help you navigate contracts, quickly, reducing the risk of costly mistakes.

• Agents save you time Agents provide analytics, market research, critical strategy and behind the scenes are talking with other agents, handling lots of paperwork and facilitating the deal.

• Issues. Every transaction has its challenges. Agents have encountered and overcome many hurdles so they know where to go when issues arise.

• Resource for life. Agents can offer advice on future home improvements, keep you up to date on market trends and where the market is in the event you’re contemplating a move.

• Managing emotions-BIG. Buying or selling a home is often emotionally charged. An experienced agent can help ensure that those emotions don’t cloud judgment or derail a transaction.

An agent’s commission is compensation the many hours and many dollars they have invested to develop the skill and instincts that help you achieve your goals. You benefit from their connections, resources , knowledge and expertise.

And that is value that we find, frankly, priceless.

Your Laura McCarthy Agent

The First Key to Success - Your Agent

Buyer’s Agent Value Wheel

First Things First Agency

Finding The Right House for the Right Price

The Terms of Success

Useful Information and Closing Practices

The Next Key to Success - Pre-Approval

• Successful buyers work with agents who are active, connected, and part of a network.

• Buyers need agents who understand where the market is and where the market will be.

• Buyers need agents who anticipate the next opportunity, who know about properties “in the pipeline,” soon to be marketed.

• Buyers need agents who are more than chauffeurs. They need responsive advisors who provide feedback, perspective, and counsel.

• Buyers need agents who make sure business is conducted in an efficient and worry-free manner.

Your Laura McCarthy agent and office manager and Closing Department monitor every phase of every transaction from the signing of the buyer agency agreement to the review of the settlement (escrow) statement. With Laura McCarthy you have more than a dedicated agent, you enjoy the benefits of a total support team.

We prepare you to recognize opportunity so that you can act quickly and with confidence.

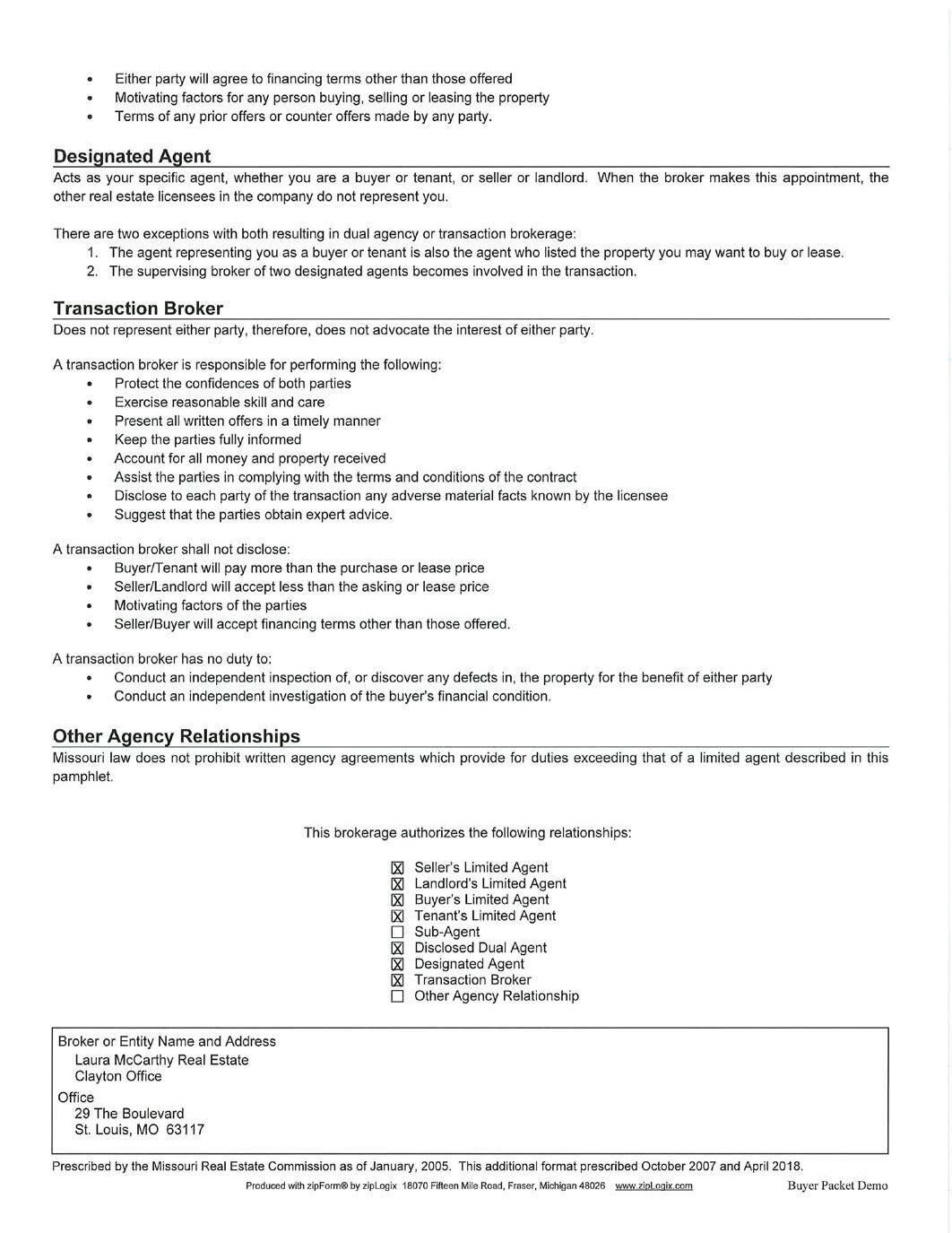

Agency is for your protection. The Missouri Law requires that an agent provide you with the Missouri Broker Disclosure Form. This form explains different types of agency relationships. Should you wish to have professional representation, you must confirm this in writing with a signed buyer’s agency agreement. It is the law.

• Some brokers work exclusively for sellers. Some brokers work exclusively for buyers.

• For 80+ years Laura McCarthy agents have worked with both buyers and sellers. We fully understand the dynamic realities of the market: every seller needs a buyer and every buyer needs a seller.

• When acting as a designated buyer’s agent, we act specifically in the buyer’s best interests. We help the buyer analyze each available option in the decision process.

• In the heat of the moment, when the pace quickens and emotions heighten, an agent’s clear perspective can be the difference between success and failure.

Ours is a balanced perspective that helps informed buyers succeed.

• Once buyers know how much house they can afford, they concentrate their search in the areas where home values correspond to their price range.

• Learning the market is a matter of comparison shopping. Buyers learn value by comparing the location, size, condition and amenities of one home with those of another, similarly priced home.

• An agent’s feedback and perspective will help you rate priorities and sort through many choices. For instance,

9 Is new and perfect better for you than historic and mellow?

9 Do the interior spaces of House A fit your lifestyle better than the floorplan of House B?

9 Should the yard be low maintenance or provide play space?

9 What is more important, privacy or good views?

9 What is the price of convenience - the value of nearby schools, shopping and easy commutes?

• The more homes buyers evaluate, the better they learn the market. The more they know, the more confident they become. With confidence comes decisive action followed by success.

• A designated buyer’s agent can help you interpret key information about recent neighborhood sales which relate to the subject property, the length of time a property has been on the market, and its original asking price.

Trust and communication are the foundation of a productive buyer-agent working relationship.

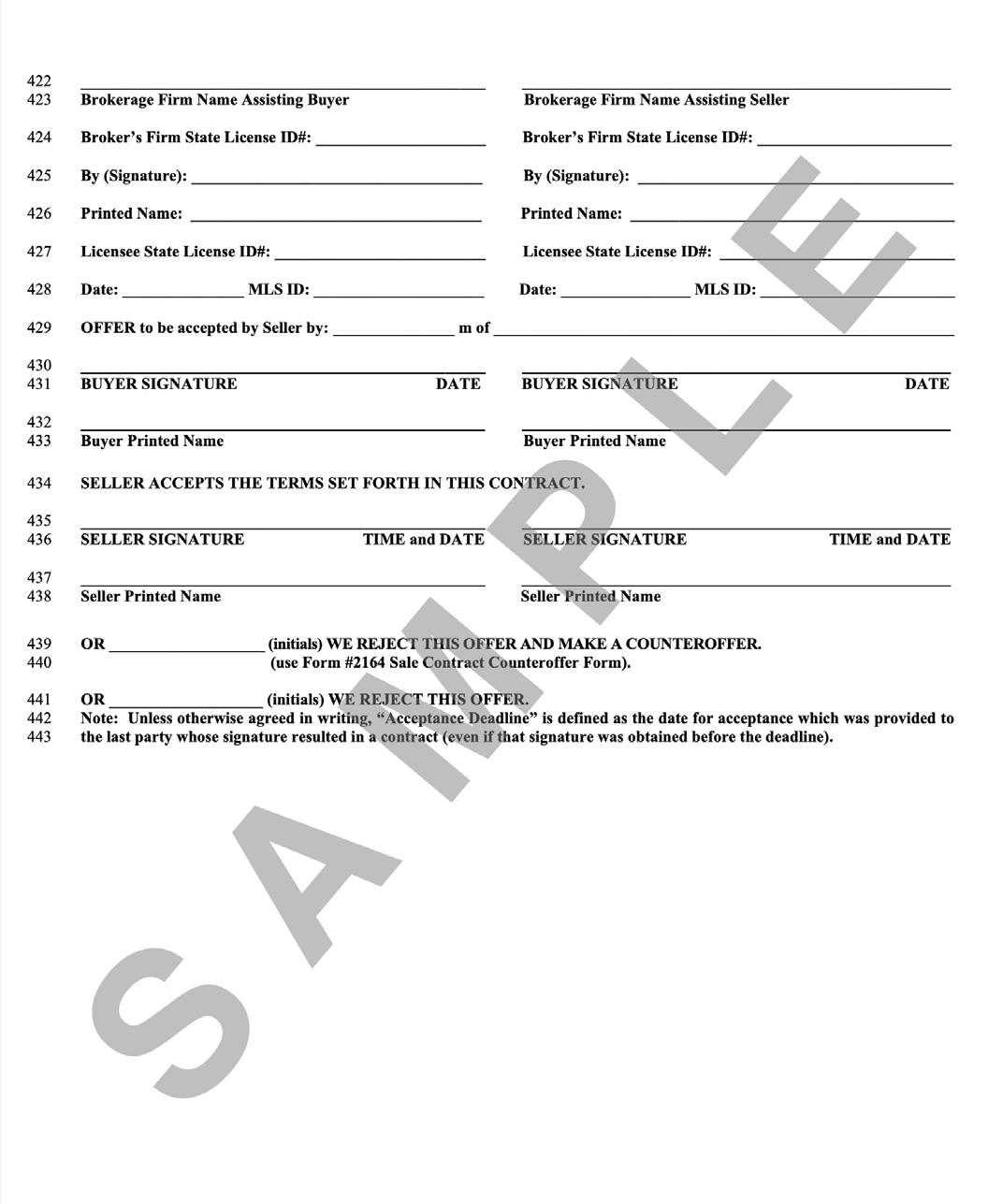

The Residential Sale Contract is a preprinted form, approved by Counsel for the St. Louis Association of Realtors and by the Bar Association of Metropolitan St. Louis. This instrument sets forth all the terms and conditions of the purchase/sale.

To become familiar with its contents, a buyer should read and understand the contract at the beginning of the process.

• The Financing Contingency allows you to apply for and attempt to secure specific financing within a determined period of time (usually 3-4 weeks). If you cannot obtain the loan amount or terms noted in the contract, the purchase is terminated provided you furnish the seller with a denial letter from your lender or a notarized affidavit that you have complied with all the terms necessary to obtain the loan.

• The Inspection Contingency is your opportunity to hire qualified inspectors to evaluate the physical integrity of the property and its improvements and to provide written reports that cover environmental hazards, termites, plumbing and electrical systems, structural elements, heating and cooling/mechanical equipment and appliances. Professional inspections are always recommended. Inspections are to be completed and requests for repairs/remediation are to be delivered to the seller within 10 days (unless otherwise stated) of contract acceptance deadline.

Note: The purpose of the “Inspections” is to determine the condition of the property and its improvements. Normal wear and tear is to be expected in pre-owned homes. The inspection is your opportunity to discover unacceptable conditions, such as a defective roof, a structurally deficient foundation or a faulty electrical or plumbing system. It is also the time to verify the information contained in the Seller’s Disclosure Statement, and any other important information provided by either the Seller or broker of Multiple Listing Service.

Page 1 of 2

• Title Insurance and a Survey (boundary or stake) are always recommended to protect the buyer against liens and other defects affecting the property. The buyer has 25 days (unless otherwise stated) from acceptance deadline to notify the seller or seller’s agent, in writing, of objections to any title or survey-discovered defects or discrepancies that must be corrected by the seller.

• A Municipal Inspection. A municipality may require the property to be inspected and to comply with its housing code before it issues an occupancy permit to new owners or tenants. Codes vary by jurisdiction. Some lenders require proof that an occupancy permit has been issued prior to closing.

Note: It is customary, but not mandatory, that the seller satisfy these predications. The Sale Contract provides a period for negotiating required corrections.

• Insurability is another condition of the contract. You have 10 days (unless otherwise agreed) after the acceptance deadline to verify that you can obtain hazard insurance on the subject property. If, within the stated period, you can provide the seller with written notice that you cannot obtain hazard insurance, the contract is terminated.

Note: Don’t wait to secure your insurance. As soon as your offer is accepted, call your insurance agent and arrange for coverage. In fact, try to choose an insurance company/ agent before you write an offer.

• The Final Walk-Through gives you and, at your option, the inspector(s) you hired the right to revisit the property within 4 days of closing to determine that the property is in the same condition as it was on the date of the contract and that any negotiated repairs have been completed in a workmanlike manner.

Note: This is your opportunity to determine that all items that were included in the contract are still in place: all appliances are operating and all systems are functional.

• Riders: appraisal rider, indentures, etc.

• The Earnest Money Deposit is part of the cash consideration representing a portion of the down payment. It is a “good faith” commitment and shows the earnest intent to perform on the part of the buyer. The larger the earnest money deposit, the stronger the offer appears in the eyes of the seller.

• Note: Earnest Money checks must be deposited within 10 banking days of the contract acceptance deadline, but are, in practice deposited immediately.

• Length of Time to Close. Although each contract is unique, the normal period of time between agreement and final settlement is 6-8 weeks. Three to four weeks are usually needed to obtain financing. After the buyer’s loan has been secured, another week or so is needed to gather and process the information needed to complete the final closing documents.

• Costs to Close. Most closing costs are borne by the purchaser and are determined by the terms of the contract and the buyer’s lending institution. The lender must provide a good faith estimate of all closing costs as a part of the loan application process. This estimate will be very close to the actual costs if you are using a reliable lender.

You’ll be notified of the exact amount you need to bring to closing 24 to 48 hours prior to closing. Your check must be a cashiers check payable to the title company. Bring your checkbook in case there are minor revisions. All parties must have a photo ID with them at closing.

• Pre-approval helps you immediately identify your price range so your home search is more focused and efficient.

• Pre-approval greatly strengthens your negotiating position with the seller who wants to work with “serious” offers only.

• The standard Residential Sale Contract presumes the buyer will apply for the loan terms specifically outlined in the contract. Pre-approval indicates the buyer has already met most of the criteria necessary to obtain an acceptable loan.

• We encourage all buyers, first time or experienced, to interview a lender as early as possible in the home search process. If you need assistance in identifying a competent, reliable lender, we will be happy to supply you with a list of qualified lenders with outstanding credentials.

• Many lenders will provide underwriting approval of a buyer prior to executing a purchase contract. For a full approval on a purchase contract, the house will need to appraise.

• Ask your agent for his or her personal list of recommended lenders.

Common Closing Costs For Buyers Your Lender

Choose a Lender Carefully

Questions to Ask Your Lender

What You Will Need for Your Lender

Do’s and Don’ts During Your Mortgage Process

• When choosing a lender, many buyers tend to consider only the interest rates quoted by the lender, but that is just the first step of discovery.

• Various fees (i.e., loan processing) and terms (i.e., pre-payment penalties) can make loans more costly and far less attractive than they first appear.

• You should inquire about the lender’s reputation among real estate professionals and ask about the institution’s record of customer satisfaction. Because of the specific wording in the Residential Sale Contract that covers financing, it is imperative that your lender deliver commitment and funds exactly as determined by the contract.

• A good loan officer will help you through the entire process, from finding a mortgage that fits your needs to bringing the funds to the closing table.

• If issues arise, a good loan officer can resolve them before they develop into problems.

Laura McCarthy agents monitor the performance of mortgage companies that conduct business in our market. One of the most useful and underrated services we offer our clients is our recommendations of competent lenders.

• When will the lender be able to take the application?

• Will they come to the office or your home to take the application?

• What are the rates? Are there points?

• What is the amortization term?

• Is there a pre-payment penalty? If so, how much and for how long?

• Will the lender “lock-in” the loan rate? How long is the lock? What is the charge for a longer lock?

• How long will it take to get a loan commitment?

• Do they allow second deeds of trust?

• Will they require your present home be sold and/or closed before funding the new home?

• What is the charge for credit report and appraisal?

• Is the fee collected at application or at closing? Are there any other fees due at application?

• Will the lender attend the closing?

• What is the adjustment period?

• What is the rate cap per adjustment period?

• What is the rate cap for the life of the loan?

• Can the loan be converted to a fixed rate? If so, when and how is the rate determined?

• Are there points or other charges for the conversion?

• What is the charge for Private Mortgage Insurance (PMI)?

• Is PMI paid at closing, in the monthly payments or a combination of both?

• Has the lender allowed time to secure PMI approval by the loan commitment date?

• Can they make an 80-20 loan to avoid PMI?

• Can PMI be removed after 20% of the loan is paid down? How is the removal accomplished?

NOTE:

A good lender will carefully assess the requirements of each borrower and suggest appropriate loan products for that borrower’s situation. Just as all real estate professionals offer different levels of service and competence, so do the various lenders.

1. The social security numbers of all applicants and co-applicants.

2. Home phone number and present address of all applicants and co-applicants. Previous addresses if you have been at your current address for less than two years.

3. If you are renting: the name, address and telephone number of the landlord or management company. (Also needed for previous address if you have been at your current address less than two years). The amount of your monthly rent payment.

4. If you are a homeowner: the name, address and phone number of the mortgage company or individual holding your mortgage. The amount of the original loan, the present balance and the amount of the monthly payment. (May also be needed for previous address if you have been at current address for less than two years).

5. If any applicant or co-applicant is divorced, a copy of the divorce decree.

6. Bankruptcy papers (all pages) if applicable.

1. Employment history for all applicants and co-applicants for a minimum of two full years including name, address, and phone number of employers and supervisors, dates of employment, position and salary, and pay stubs for the last two pay periods.

2. Signed offer letter or contract with new employer (if applicable).

3. Green card (if applicable).

4. Amount and verification of other income such as retirement, pension, disability, rental, interest, child support, alimony, etc.

5. Assets:

• Name, address, account number and balance for all checking accounts, savings accounts, CDs, money market accounts and statements, etc.

• List of stocks and bonds (with proof of value if they are to be cashed in).

• Life insurance in force (monthly premiums, face or cash value and owner of policy).

• Description and value of real estate owned, including mortgage statement, current tax bill, insurance agent and phone number, condo statement (if applicable).

• Automobiles: make, model and value.

6. Liabilities:

• Installment debt such as auto loan, notes to banks, finance companies, credit unions, retail stores. Give name, address, account number, current balance and monthly payment.

• Credit cards (name of card, card number, approximate balance and monthly payment).

• Amount and verification of other liabilities such as child support, alimony, etc.

7. Some lenders may require copies of your Federal Tax Returns for the past two years, especially if commissions provide a significant portion of your income.

1. A fully signed copy of the contract with all counter offers and addendums for the home being purchased.

2. A photo listing sheet or computer printout of the home being purchased.

3. A fully signed copy of the contract for the house you are selling, if applicable.

4. Checkbook to pay for credit report and appraisal (and sometimes other fees or points).

5. Copy of your earnest money check.

6. Drivers license for everyone who is going to be on the loan and property.

7. Homeowner’s insurance agent’s name and phone number.

1. Tax returns for the past two years (all pages).

2. Year-to-date profit and loss statement and balance sheet prepared by an accountant. If applying for a VA or FHA loan you may need P and L statements for the past two years.

FOR VA LOANS:

1. Original Certificate of Eligibility, or copy of DD214 to obtain a Certificate of Eligibility.

GIFT LETTER (IF APPLICABLE):

1. Proof this gift has been received. Proof that donor has funds to give.

Congratulations! You finally found the house of your dreams. Keep in mind: applying for a mortgage loan is an ongoing process that takes into account everything you do - right up to the day of closing. Follow these simple suggestions, to make your loan process a smooth one:

• Postpone any career moves until after your closing. If at all possible, try not to make a job change during the time between your mortgage application and closing on the home you are purchasing. One of the factors mortgage companies consider is the length of present employment; they are partial to stability.

• Do not apply for new credit. Why not? Because applying for new credit changes what is called “debt-to-income ratio” (the relationship of your income to your debt). This could impact your ability to qualify for your mortgage loan and may initiate a new round of paperwork.

• Do not incur new debt such as purchasing or leasing a new vehicle. This should go under the general heading of “no new debt”. As with any debt, this will change your “debt-toincome ratio” and may cause you not to qualify for a mortgage.

• Do not charge up your credit card balances.

• Do not make large deposits or withdrawals from your bank account.

• Do not change your mind after locking a rate.

• Do not co-sign for someone else’s loan.

• Do not spend your down payment money.

• Do not file for divorce prior to closing. Filing for divorce affects your marital status in a court of law; this change of status may sometimes complicate the process of finalizing your loan.

• Do mark your closing date on your calendar and make sure you have all necessary paperwork. Please try to schedule vacations for AFTER your closing date. As you pack for a move, remember to keep bank statements, tax returns, and other important paperwork easily accessible.

compliments of Ron Ruzicka

• Down Payment

• Lender charges. These may include:

9 Origination fee, administration fee, underwriting fee

9 Loan closing fee and/or wire transfer fee (if lender does not come to closing with a check)

9 Discount points (fee you pay to receive a lower interest rate)

9 Appraisal

9 Credit report

9 Private mortgage insurance premium (may be required on loans in excess of 80% of the value of the property.)

9 Escrow for two - three months homeowner’s insurance premium (if insurance is being collected as part of the mortgage)

9 Escrow for real property tax (if taxes are being collected as part of the mortgage)

9 Interest adjustment for days before first mortgage payment is due

• Recording fees for deed(s)

• Brokerage Administrative Commission

• Title insurance

• Survey

• Inspections (building, termite, radon, sewer, etc.) if not prepaid

• Notary fee

Any continuing obligations on the property such as real estate taxes, subdivision assessments, and sanitary sewer charges are prorated as of the date of closing.

Buyer Representation Agreement

Broker Compensation Rider

Missouri Broker Disclosure Form

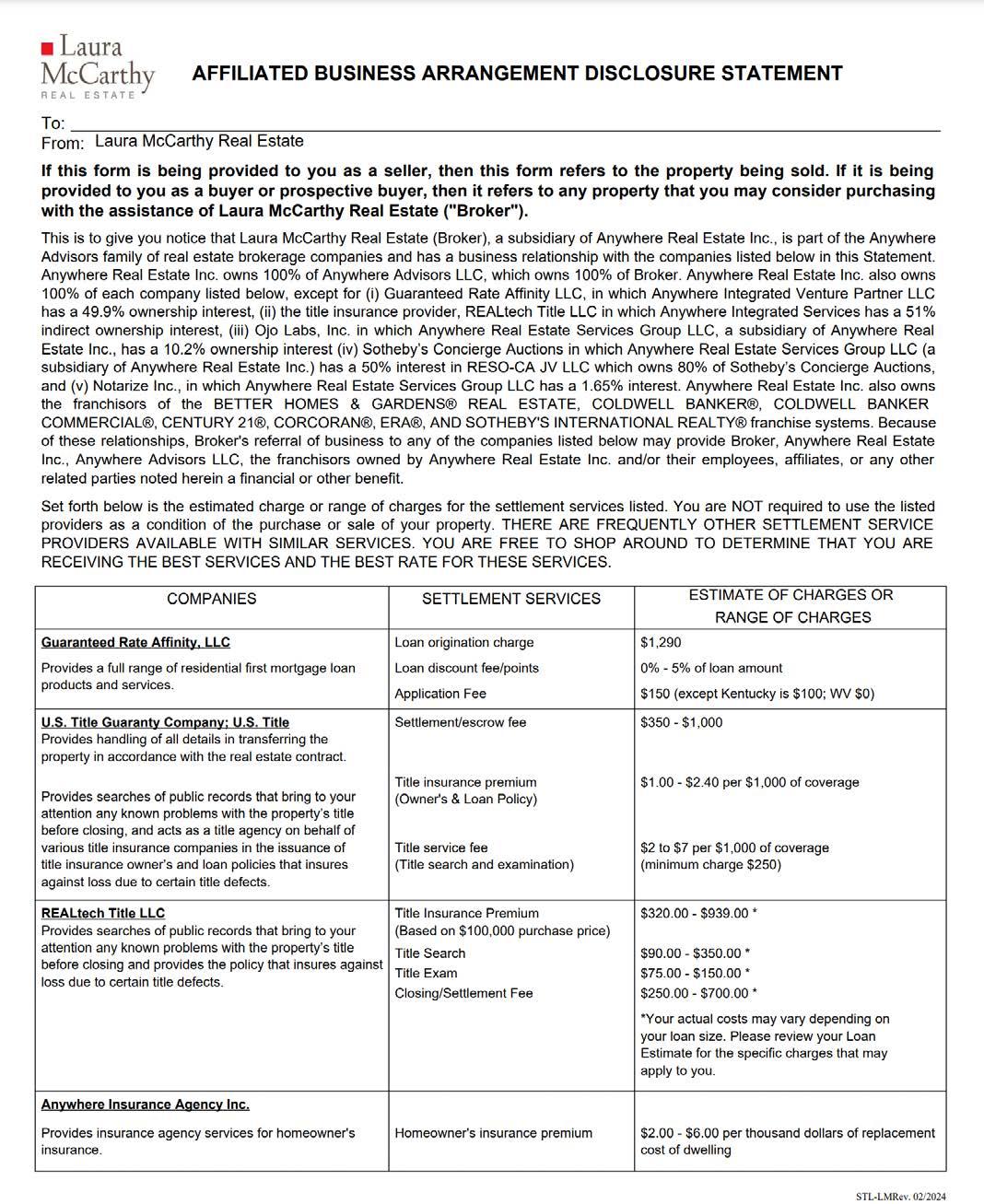

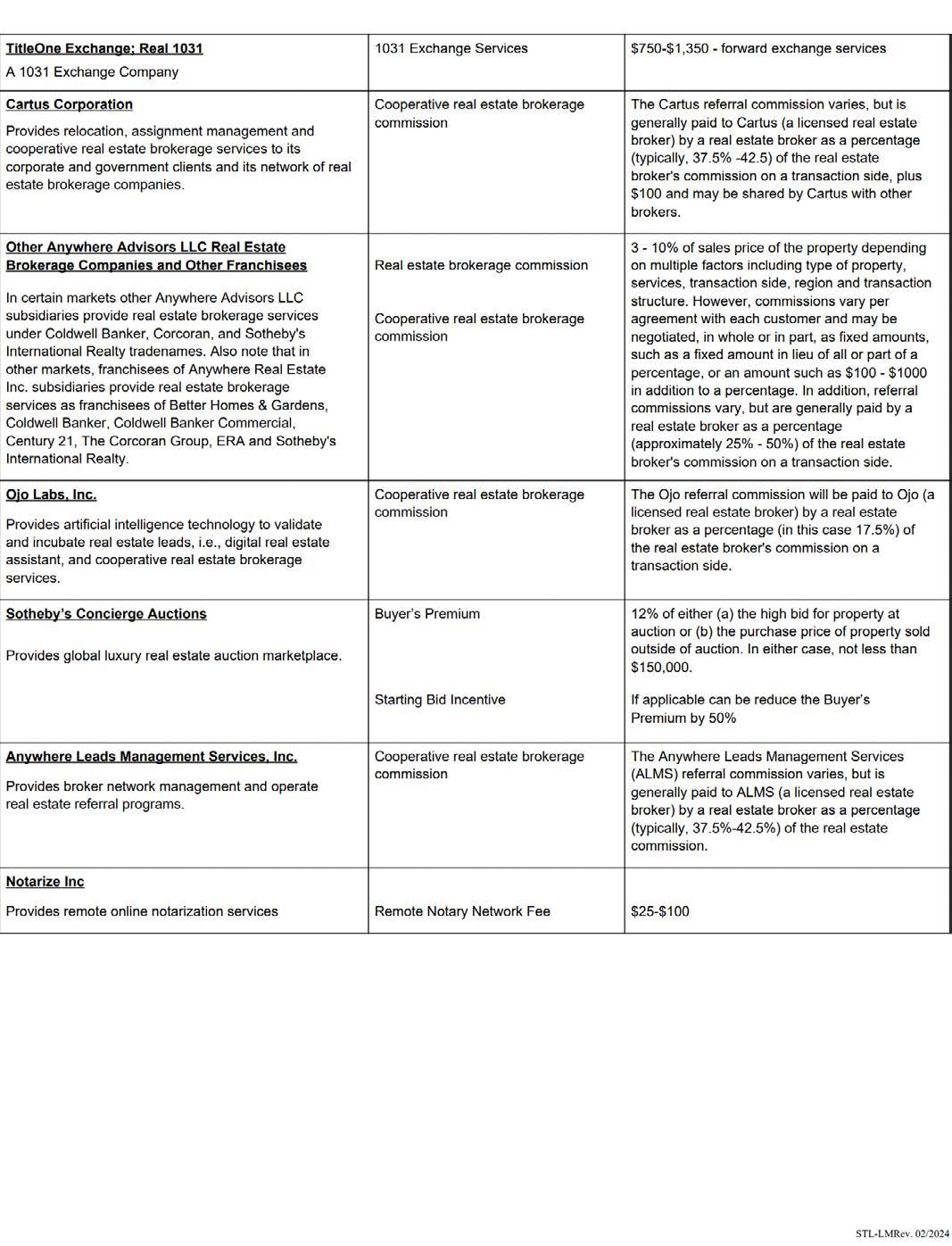

Affiliated Business Arrangement Disclosure Statement

Sample Residential Sale Contract