1 minute read

5.2.Housing Costs and Income

5.2. Housing Costs and Income

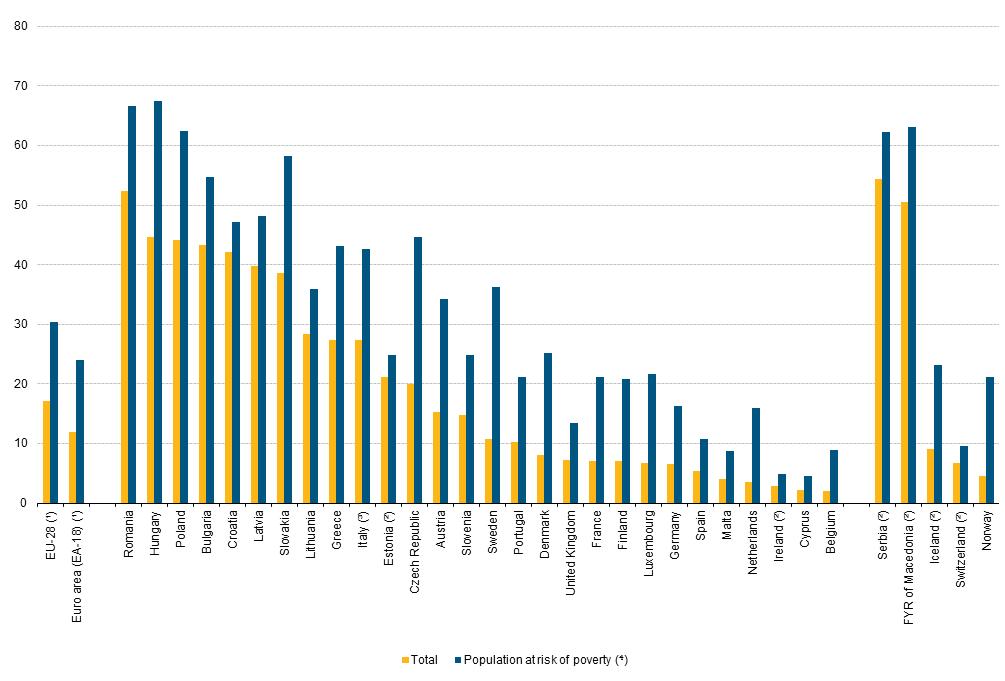

The overburden rate is unexpectedly high compared to the national statistics. The percentage of the respondents affected by overburden is 56.6% (Figure 13). Section 2.3.1 shows that 15.1% of the population in Romania uses 40% or more of their income for the housing costs. This could imply that many of these 15.1% nationally affected, could be young adults aged 18 to 35.

Advertisement

One of the most worrying finding is the income of the respondents: 36.6% earn less than the minimum wage of 1250 RON (236 £) per month, 44.1% between the minimum and medium wage of 2680 RON (497 £) per month and only 19.3% over medium (Figure 14). This seems to agree to the analysis in section 2.3.1 about the income inequality. It could be one of the main factors that affects the possibilities of this age group to acquire a home. This, and the fact that house prices are continuously rising (section 2.3.1), could worsen the housing situation even more. One of the respondents has presented his own opinion, which signifies the same difficulty: “In Romania it is impossible to buy or build a house or to buy an apartment with an income of +3000 RON [557£]” (Appendix B).

Figure 13. Income spent on housing costs Source: Own Figure 14. Income. Source: Own