Private Education Matters

January 2023

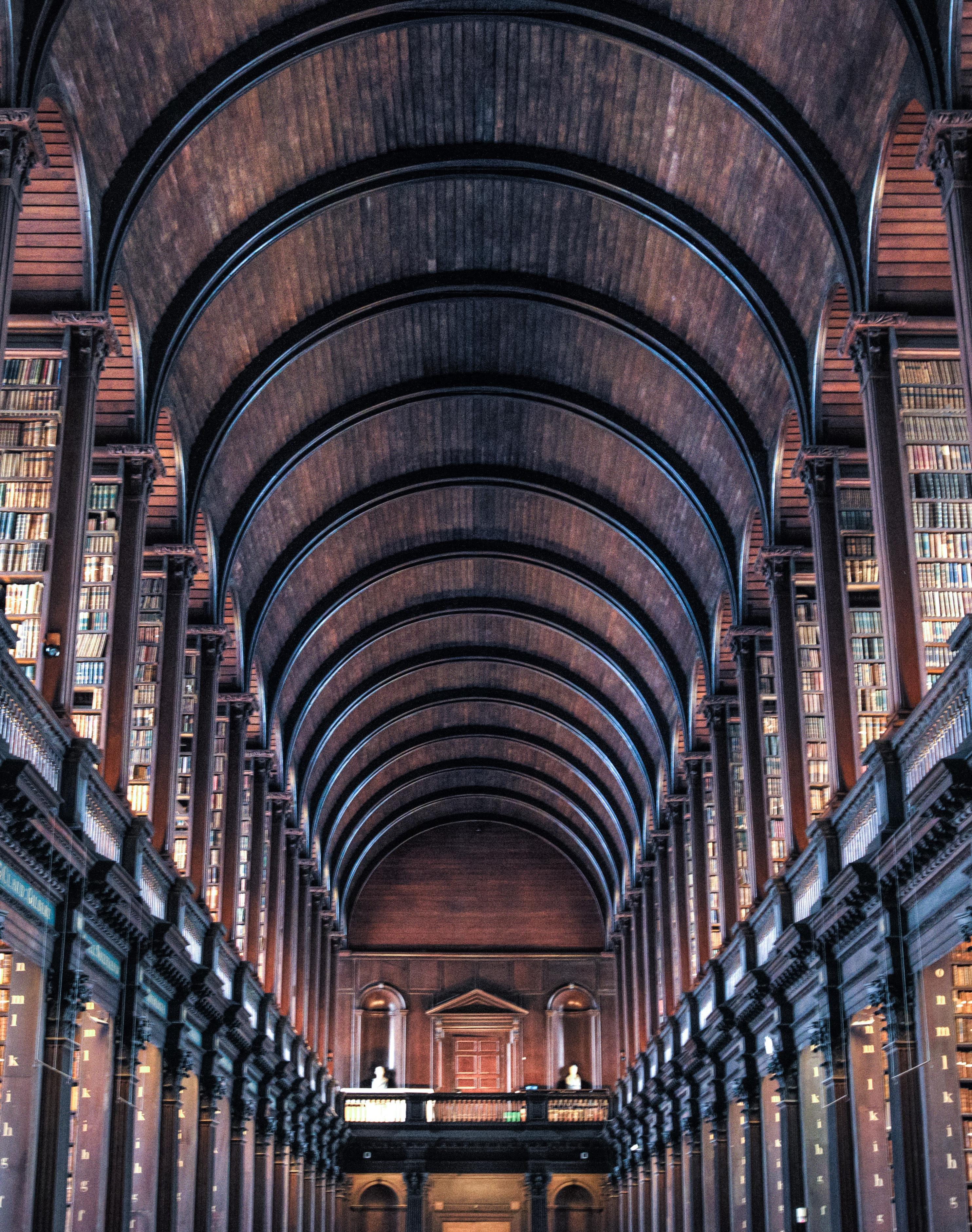

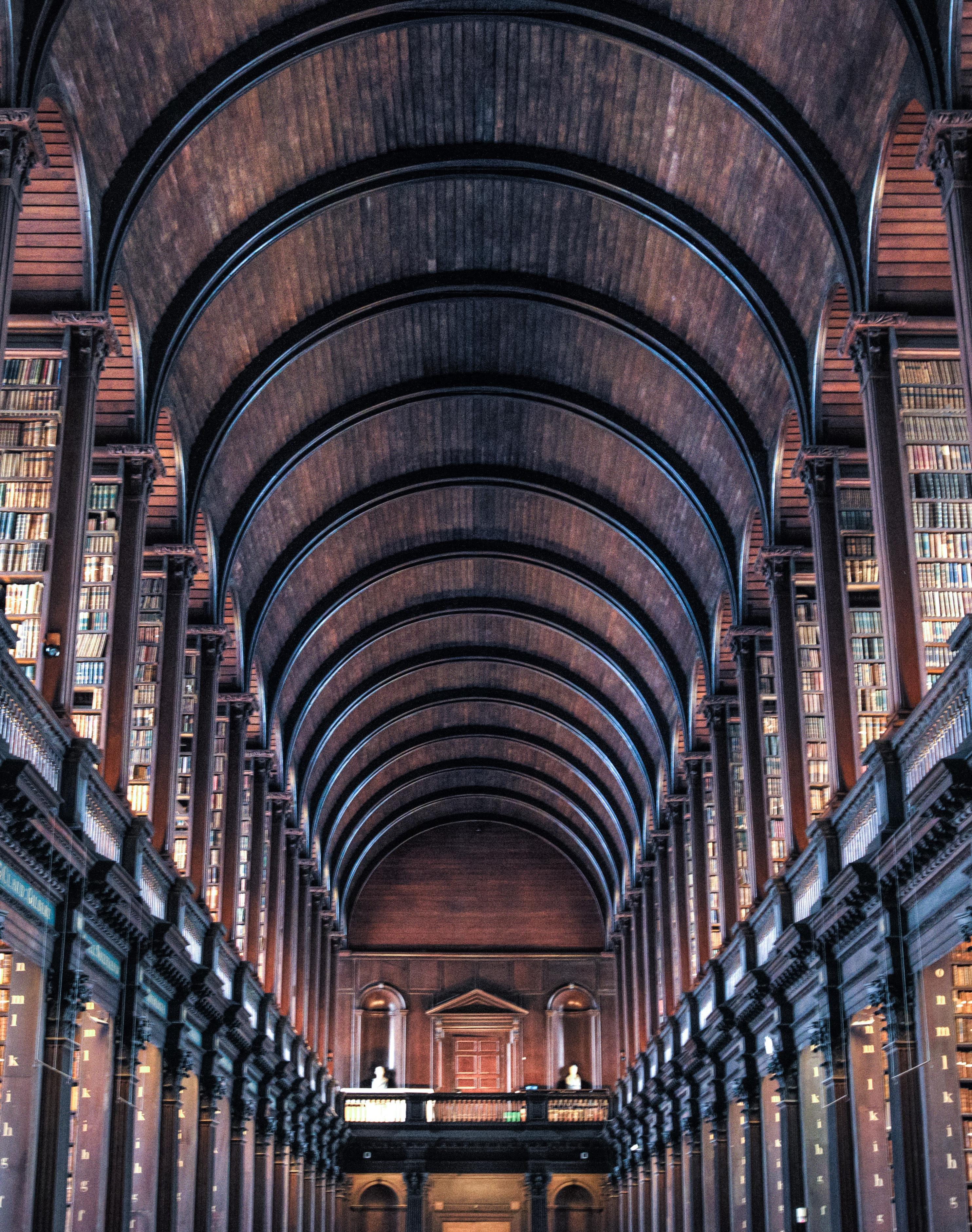

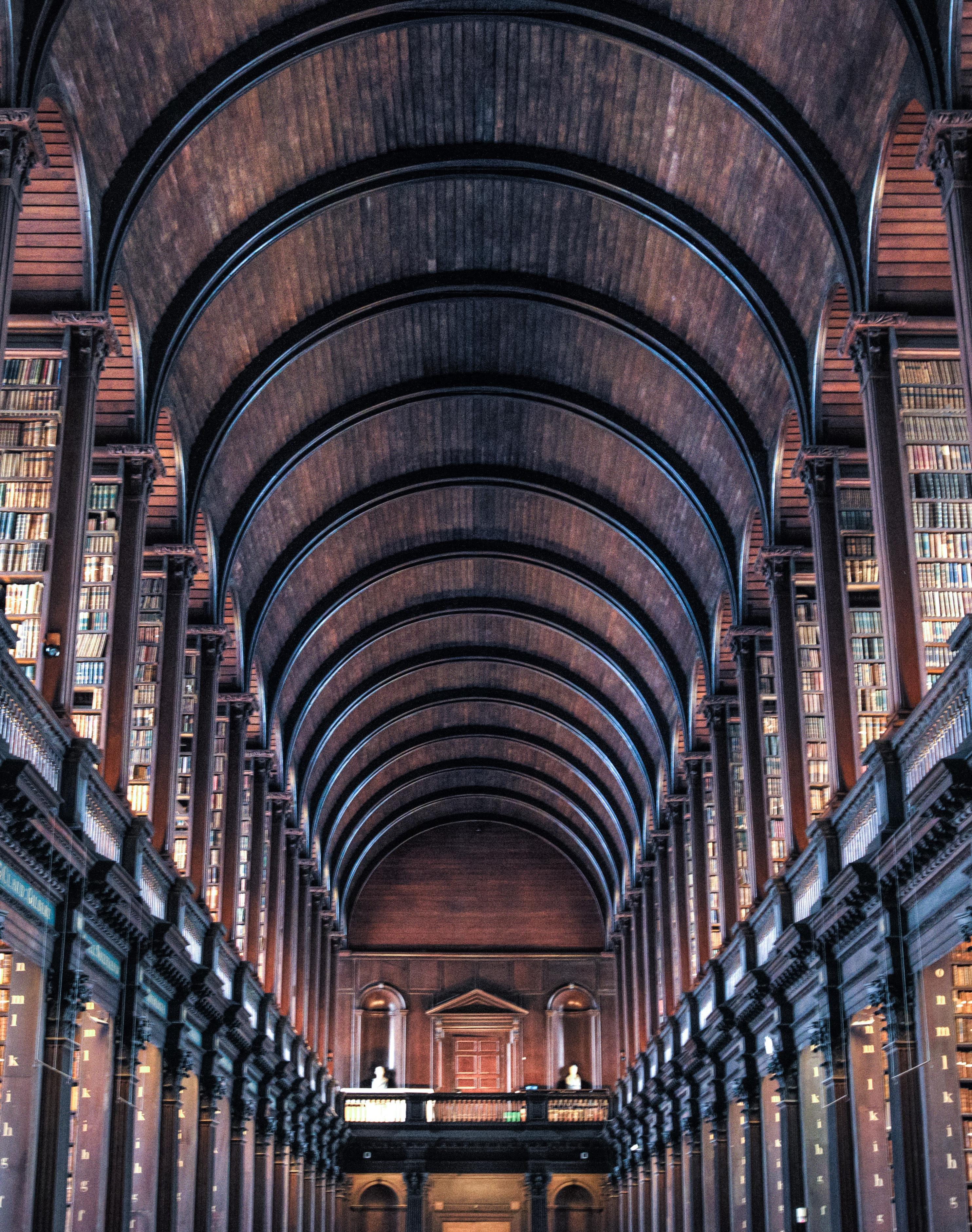

2 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento • 03 Insurance 05 Arbitration 06 First Amendment 09 Title IX 10 Did You Know? 11 Negligence Table Of Contents Copyright © 2023 Requests for permission to reproduce all or part of this publication should be addressed to Cynthia Weldon, Director of Marketing and Training at 310.981.2000. Cover Photo: Attributed to pexels.com Private Education Matters is published monthly for the benefit of the clients of Liebert Cassidy Whitmore. The information in Education Matters should not be acted on without professional advice. To contact us, please call 310.981.2000, 415.512.3000, 559.256.7800, 916.584.7000 or 619.481.5900 or e-mail info@lcwlegal.com. 12 Criminal Background Checks 14 LCW Best Practices Timeline 17 Construction Corner 18 Consortium Call Of The Month Connect With Us! @lcwlegal Contributors: Grace Chan Partner | San Francisco Millicent O. Usoro Associate | Los Angeles Madison Tanner Associate | San Diego Abigail W. Clark Associate | San Francisco STUDENTS EMPLOYEES

Court Of Appeals Reverses Dismissal Of COVID-19 Business Interruption Claim.

La Cava is a restaurant in Sherman Oaks, a neighborhood in Los Angeles. La Cava purchased comprehensive insurance from Century-National, which included commercial property insurance and general liability coverage for a one-year period beginning November 22, 2019.

The policy states, in part, that Century-National will pay for actual loss of business income sustained due to the “necessary suspension” of operations. The policy provides that suspension “must be caused by direct physical loss of or damage to property” and defines suspension as “the slowdown or cessation of… business activities.” The policy also provides that CenturyNational “will pay for the actual loss of business income… sustain[ed] and necessary extra expense caused by action of civil authority that prohibits access to the described premises due to direct physical loss of or damage to property, other than at the described premises, caused by or resulting from any covered cause of loss.”

La Cava was forced to shut down its premises in March 2020 due to the COVID-19 pandemic in accordance to local and state public health orders. In May 2020, restaurants were permitted to serve customers by moving dining outdoors, limiting group size, spacing tables, and other restrictions. However, in November 2020, the Los Angeles County Department of Health suspended outdoor dining at restaurants and the Governor did not lift the statewide stay-at-home orders to allow restaurants to open outdoor dining until January 25, 2021.

In March 18, 2020, two days after its initial suspension of operations, La Cava submitted a claim to CenturyNational for the loss of income suffered as a result of its closure. Three weeks later, Century-National denied La Cava’s claim.

La Cava sued Century-National for breach of contract, bad faith and violation of unfair competition law. La Cava alleged it suffered physical loss of or damage to its dining rooms and other property “caused by the actual presence of virus droplets in the air and on the surfaces in the vicinity of and in [its] restaurant.” La Cava also alleged in its complaint that three of its employees suffered from COVID-19 in December 2020 and January 2021; therefore, the virus was present in the restaurant which led to La Cava’s closure and constituted physical damage to its premises.

In addition to lost revenue, La Cava alleged it also “incurred substantial costs in an attempt to mitigate the suspension of its operations, including but not limited to expenses incurred for reconfiguration to outside dining and increased sanitation procedures. [La Cava] would not have incurred those costs but for the direct physical loss or damage caused by the coronavirus, COVID-19, and the [government] Orders.”

Century-National filed a demurrer to dismiss the lawsuit, arguing that La Cava could not allege its loss of business income was attributable to any physical alteration of La Cava’s property by the COVID-19 virus. The trial court granted Century-National’s demurrer without leave for La Caca to amend its complaint.

The Court of Appeal disagreed with the trial court, holding that La Cava adequately alleged it suffered direct physical loss or damage to its property caused by the COVID-19 virus after shutting down the restaurant in response to government closure orders. The Court of Appeal held that insured entities “are not required to provide [legal] authority at the pleading stage to support its position that contamination with the COVID-19 virus caused damage to the surfaces of its premises.” The Court also determined that Century-National’s denial of La Cava’s claim after “just three weeks and in the earliest days… of the novel COVID-19 virus” was not in good faith as a matter of law.

3 January 2023 • www.lcwlegal.com •

insurance

Shusha, Inc. v. Century-National Insurance. Co. (Cal. Ct. App. Dec. 14, 2022) 2022 WL 18110247.

Note: LCW reported on a similar case in the December 2022 Private Education Matters. This case continues the trend that motions to dismiss are improper where there are allegations that COVID-19 physically altered the insured’s property.

Insurance Policy Defense Provisions Do Not Automatically Bestow Defense Rights On Third Parties Not Named As Additional Insureds.

Chris LaBarbera hired Knight Construction (Knight) to remodel a house. Their contract required Knight to defend and indemnify LaBarbera for all claims arising out of the work. Knight obtained a general liability insurance policy from Security National Insurance Company (Security National) that covered damages Knight was obligated to pay for third party bodily injury. Knight was the “insured” under the policy. LaBarbera was not named as an “additional insured” under the policy.

A stucco subcontractor, Nicholas Paz-Ramirez, was electrocuted while working on the house and suffered catastrophic injuries. Paz-Ramirez sued both LaBarbera and Knight. Security National defended Knight in the litigation and LaBarbera’s personal insurance provider, Underwriters, defended him.

LaBarbera feared that his liability might exceed the limits of his personal policy; accordingly, his personal counsel sent a letter to Knight’s counsel tendering defense and indemnity based on the indemnity provision of the construction contract. Security National received a copy of this letter and responded that it did not need to provide a defense as LaBarbera was not an additional insured under the insurance policy.

LaBarbera ultimately settled with Paz-Ramirez for an amount of $465,000. In turn, LaBarbera and Underwriters sued Knight and Security National, but ultimately dismissed their claims against Knight for breach of the construction contract. They pursued claims against Security National for breach of the insurance policy terms by failing to defend and indemnify LaBarbera. LaBarbera and Underwriters sought damages to cover the $465,000 settlement amount, $100,000 for attorneys’ fees, and other costs and damages.

Security National argued that LaBarbera was not an insured, additional insured, or an intended third party beneficiary of the insurance policy. Security National also argued that they had no obligation to defend LaBarbera as the indemnitee defense clause in the insurance policy only required them to defend LaBarbera if certain conditions were met, including that there is not conflict between the interests of the insured and the indemnitee. Here, Security National’s defense was to blame the accident on LaBarbera, which created a conflict between Knight’s and LaBarbera’s interests. The trial court agreed with Security National and held that there was an apparent conflict in litigation strategies and thus a condition of the indemnity clause was not met. It granted summary judgment in favor of Security National. LaBarbera and Underwriter appealed.

On appeal, the court agreed with Security National that LaBarbera was not an insured or intended third party beneficiary of the Knight insurance policy and therefore is not a party to that policy and had no standing to bring claims against Security National. LaBarbera could only benefit if Security National and Knight intended that LaBarbera personally obtain the benefits of the indemnitee defense clause in the insurance policy. The court found that Security National and Knight intended the indemnitee defense clause benefit themselves by permitting them to provide a joint defense to any claims. If the indemnitee defense clause conditions were met, meaning LaBarbera’s and Knight’s interests did not conflict, LaBarbera would have been an incidental beneficiary to the policy. However the parties did not enter into the policy with the intention to benefit LaBarbera.

LaBarbera v. Security National Insurance Company (Cal. App. December 28, 2022) 2022 WL 17974912.

Note:

This case signals the importance of ensuring a vendor’s insurance policy names the school as an additional insured under that policy to avoid facing claims that they are not an intended beneficiary of the policy and are not owed any defense under that policy.

4 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento •

New Federal Law Prohibits Pre-Dispute Non-Disclosure And Non-Disparagement Clauses Related To Sexual Assault And Sexual Harassment Allegations.

On December 7, 2022, President Biden signed into law the Speak Out Act, which limits the enforceability of non-disclosure and nondisparagement clauses related to allegations of sexual assault and sexual harassment.

Under the Act, a non-disclosure clause is a “provision in a contract or agreement that requires the parties to the contract or agreement not to disclose or discuss conduct, the existence of a settlement involving conduct, or information covered by the terms and conditions of the contract or agreement.” A non-disparagement clause is “a provision in a contract or agreement that requires 1 or more parties to the contract or agreement not to make a negative statement about another party that relates to the contract, agreement, claim, or case.”

The new law renders unenforceable such clauses related to allegations or sexual assault/ sexual harassment and that are entered into “before the dispute arises.” In other words, non-disclosure and non-disparagement clauses are unenforceable in contracts entered into after the dispute has arisen. As such, the Act does not apply to agreements resolving claims already made.

The Act also covers agreements signed before December 7, 2022 but only applies to disputes that have arisen after December 7, 2022.

The Act also specifically states that the Act does not prevent the application of more restrictive state or local laws.

Note:

The Speak Out Act follows federal legislation that prohibits mandatory pre-dispute arbitration agreements for claims of sexual harassment and sexual assault, which LCW reported in the February/March Private Education Matters. Private K-12 schools, colleges, and universities should consult with an LCW attorney about the impact of this new law on existing agreements and how to proceed with agreements moving forward.

5 January 2023 • www.lcwlegal.com • LCW In The News To view these articles and the most recent attorney-authored articles, please visit: www.lcwlegal.com/news • LCW Partner Lisa S. Charbonneau was quoted in Law360’s recent article “Worker Organizing At UC, Private Schools Faces Distinct Tests.”

arbitration

students first amendment

New York Appeals Court Rules Yeshiva University Must Recognize LGBTQ+ Student Organization.

After significant litigation, a New York appeals court has ruled Yeshiva University (Yeshiva) is not a religious corporation exempt from a New York public accommodations law. The case, which garnered significant media attention, made its way to the U.S. Supreme Court.

Yeshiva University is a private Orthodox Jewish school located in New York City. The university was originally chartered in 1897 under the Membership Corporations Law as the Rabbi Isaac Elchanan Theological Seminary Association (RIETS), with the stated purpose to “promote the study of Talmud” and prepare Orthodox Jewish rabbis for ministry. Over several decades, the charter was amended to allow numerous secular degrees to be awarded and RIETS was eventually spun off as its own corporation that offered religious degrees. Yeshiva also amended its charter to be incorporated under New York’s education law and to clarify that the university is a “nondenominational institution of higher learning.” Yeshiva is now comprised

of three undergraduate colleges and seven graduate schools, and RIETS is a separate corporate entity housed on one of Yeshiva’s campuses.

YU Pride Alliance, a student LGBTQ+ organization, sued Yeshiva University in state court, alleging the university denied formal recognition to undergraduate LGBTQ+ organizations for over a decade in violation the New York City Human Rights Law (NYCHRL), which bars discrimination in public accommodations including on the basis of gender, gender identity, and sexual orientation. In addition to monetary damages, YU Pride Alliance sought an injunction to compel Yeshiva to officially recognize the group as an official student organization.

In defense, Yeshiva argued that the university is a religious corporation under the NYCHRL, and is therefore exempt from the NYCHRL. Yeshiva also argued that the university has the right to decide matters of its faith and doctrine, citing the First Amendment’s free exercise clause and recent U.S. Supreme Court decisions to that effect.

A New York trial court granted YU Pride Alliance’s injunction, and ordered Yeshiva to recognize the organization. The trial court

determined that Yeshiva organized itself as an educational corporation and for educational purposes under the state’s education law. Further, Yeshiva’s amendment to its charter was a departure from its initial charter, which initially stated an exclusively religious purpose. In its amended charter, Yeshiva broadened the scope of education it was to provide to include secular degrees, and therefore, education became Yeshiva’s primary purpose.

Yeshiva filed a petition with the U.S. Supreme Court to overturn the injunction. The Supreme Court suspended the trial court’s ruling that compelled Yeshiva to recognize YU Pride Alliance and directed the parties to continue litigation in state court.

The New York appeals court agreed with the trial court’s ruling that Yeshiva is not a religious corporation under New York’s education law or the state’s religious corporation law, which would exempt it from the NYCHRL.

On Yeshiva’s First Amendment arguments, the appeals court held that providing YU Pride Alliance with full and equal access to public accommodations does not intrude on Yeshiva’s asserted right to decide matters of faith and doctrine.

6 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento •

Additionally, Yeshiva already recognizes LGBTQ+ student organizations at three of its graduate schools, which are legally part of Yeshiva’s corporation, and has done so for over 25 years. Therefore, the appeals court found Yeshiva’s denial of recognition of YU Pride Alliance is not essential to Yeshiva’s central mission as an institute of higher education.

The appeals court also rejected Yeshiva’s argument that recognizing the student group would violate the university’s free exercise of religion. The appeals court determined the NYCHRL is neutral and generally applicable law. The First Amendment does not protect individuals from valid and neutral laws of general applicability, even when those laws compel conduct which goes against the grain of a religion.

Finally, the appeals court rejected Yeshiva’s argument that recognizing the student club violates Yeshiva’s freedom of expression and association because recognition of a student group does not suggest approval or endorsement by a university. The appeals court noted that Yeshiva has made clear it does not endorse or accept the views of its already exiting LGBTQ+ groups, and the NYCHRL does not require such an endorsement. Moreover, there was no violation of Yeshiva’s associational rights when YU Pride Alliance members are already enrolled students.

YU Pride Alliance v. Yeshiva Univ. (N.Y. App. Div. Dec. 15, 2022) 2022 WL 17684269.

Note:

While this case is from New York and not binding in California, it does provide insight on how a court would interpret First Amendment defenses asserted by a private religious organization. LCW will be closely monitoring any appeals to the U.S. Supreme Court.

For more information on some of our upcoming events and trainings, click on the icons below:

7 January 2023 • www.lcwlegal.com •

Consortium Seminars Webinars

2023

Premium Perks on Liebert Library!

Liebert Library is an online tool that provides our subscribers access to LCW’s extensive collection of reference materials. We offer 2 levels of subscription for Liebert Library at economical prices that will allow you to lower future legal costs for your school:

1. Basic Membership - access to digital and fully-searchable versions of our Administrator’s Guide to California Private School Law and its Compendium. You can search and reference the most up-todate versions of these publications at any time. Consortium members receive a complimentary Basic Membership to the Library, where they can digitally access these materials.

2. Premium Membership - access to all of the benefits of our Basic Membership (see above), as well as the ability to download our entire collection of sample forms, policies and checklists in Word and PDF formats that can be used as templates for your school. We are also continually adding Model Policies that can be used to update existing school policies to our library. This is only available for Premium members.

Our Model Policies have been updated to meet the new requirements for 2023. Register and begin exploring the Liebert Library site today!

If you have any questions about your subscription, the materials on the site, or if you are having difficult accessing your account, please email Library@lcwlegal.com

8 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento •

titleix

Federal Court Upholds

Title IX Religious Exemption.

Title IX prohibits educational programs or activities receiving federal funds from excluding, denying benefits to, or subjecting to discrimination any person on the basis of sex. One narrow exception to Title IX is when an educational institution is controlled by a religious organization with “religious tenets” inconsistent with the application of Title IX.

Regulations implementing Title IX set forth procedures for an educational institution wishing to invoke the religious exemption. In 2020, the Department of Education clarified that institutions are no longer required to submit a written statement to the Assistant Secretary for Civil Rights prior to invoking the religious exemption. Additionally, the Department of Education revised the regulations addressing how educational institutions may demonstrate that they are “controlled by a religious organization” within the meaning of the religious exemption. The revised regulation now sets forth a list of six criteria, any one of which is sufficient to establish that the institution is controlled by a religious organization.

Plaintiffs filed a class action lawsuit in federal court in Oregon against the Department Education on behalf of over 40 current and former LGBTQ+ students at more than 20 Christian colleges and universities that receive federal funding. The Plaintiffs allege these schools have discriminated against them by subjecting them to discipline, rejecting their applications for admission, and rescinding their applications for admission because of their sexual orientation or gender identity in violation of the Fifth and First Amendments of the U.S. Constitution.

The Plaintiffs requested a preliminary injunction to prohibit the use of the religious exemption. The Department of Education moved to dismiss the case, alleging the Plaintiffs’ claims fail to state a claim for relief. Three Christian universities and an association of Protestant Christian institutions intervened in the case and also joined the motion to dismiss the case with the Department of Education.

The trial court granted the Defendants’ motion to dismiss and denied the Plaintiffs’ request for an injunction. The trial court held that the Plaintiffs failed to allege claims that the Defendants violated the Equal Protection Clause and the Due Process Clause of the

U.S. Constitution. Specifically, the trial court reasoned the Plaintiffs failed to provide any evidence of discriminatory motivation on the part of Congress or the Christian schools that requested and invoked the religious exemption. As such, the trial court held it could not conclude that “Plaintiffs’ assertion that Congress enacted the religious exemption to permit discrimination based on sex, sexual orientation, and gender identity” is sufficient to survive a motion to dismiss. Moreover, the court concluded that exempting religious institutions from Title IX only to the extent that a particular application of Title IX would be inconsistent with a specific tenet of the religious organization advances the government’s objective of accommodation of religious free exercise.

As for the due process claim, the court held that the Plaintiffs failed to allege facts supporting violations of due process by the Department of Education and only vaguely referenced due process principles in their complaint.

The trial court also rejected the Plaintiffs’ claim that the religious exemption violates the Establishment Clause of the First Amendment because it benefits religious educational institutions over non-

9 January 2023 • www.lcwlegal.com •

religious educational institutions. The trial court found the Plaintiffs did not demonstrate that the federal government was motivated to discriminate against LGBTQ+ students with the Title IX religious exemption. Moreover, the trial court cited Supreme Court precedent which held that a law is not unconstitutional simply because it allows churches to advance religion. As such, the religious exemption did not have the “primary effect” of advancing religion or sponsoring targeted discrimination on the basis of sex, and the Plaintiffs did not provide any evidence that would explain how the Department of Education advanced religion through the religious exemption.

The trial court also rejected the Plaintiffs’ argument that the religious exemption creates “excessive entanglement” between the government and religion. Rather, the religious exemption prevents excessive entanglement because in the absence of the religious exemption, the Department of Education must scrutinize religious schools’ compliance with anti-discrimination policies of Title IX, even if such policies would conflict with the schools’ religious tenants.

The trial court also rejected the Plaintiffs’ claims that the religious exemption to Title IX creates a “chilling effect” on the Plaintiffs’ exercise of religion and speech,

and prevents the Plaintiffs from expressing their beliefs about sexuality, gender identity and marriage. The trial court held that the Plaintiffs’ complaint in this regard lacked sufficient facts that support their claims. Moreover, the religious exemption does not aim to suppress speech because it does not discriminate on the basis of viewpoint, nor does it allow government entities (like the Department of Education) to administer the statute based on a Title IX complainant’s viewpoint on sexuality or gender identity.

Hunter v. United States Department of Education, et. al. (D. Or. Jan. 12, 2023) 2023 WL 172199 (slip. op.)

Note:

Title IX applies to most private colleges and universities, and in limited circumstances may apply to private and independent K-12 schools that accept certain federal financial assistance. In June 2022, the U.S. Department of Education released proposed changes to the Title IX regulations. The executive summary of the proposed regulations briefly mentions the religious exemption, but the regulations do not include any changes to the exemption. The Department of Education is currently reviewing public comments regarding the proposed changes before releasing the final regulations.

Did You Know?

Whether you are looking to impress your colleagues or just want to learn more about the law, LCW has your back! Use and share these fun legal facts about various topics in labor and employment law.

• On January 4, 2023, the U.S. Department of Education’s Office for Civil Rights (OCR) released a fact sheet, Protecting Students from Discrimination Based on Shared Ancestry or Ethnic Characteristics, that explains how Title VI of the Civil Rights Act of 1964 applies to students who experience discrimination on the basis of their actual or perceived (1) shared ancestry; or (2) citizenship or residency in a country with a dominant religion or distinct religious identity in any program or activity receiving federal financial assistance. The fact sheet describes ways this protection covers students who are or are perceived to be Jewish, Christian, Muslim, Sikh, Hindu, Buddhist, or of another religious group.

• On December 15, 2022, the California Occupational Safety and Health Standards Board (OSHSB) promulgated new and permanent General Industry Safety Orders (Permanent Standards) addressing workplace health and safety issues related to COVID-19. For more information, see the December 15, 2022, LCW special bulletin for an overview of the changes and related obligations.

10 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento •

Waiver Bars Negligence Claims Against University For Student Athlete’s Injuries.

Concordia University (Concordia) is a private higher education institute in Nebraska. It recruited Konrad Sinu (Sinu) to play for the university’s men’s soccer team. Before Sinu moved to Nebraska from his home in England, he signed an “Assumption of Risk and Waiver of Liability Release.” Because Sinu was 18 years old, Sinu’s mother also signed the release.

About 5 months after arriving at Concordia, Sinu and his teammates were doing their mandatory strength and conditioning workout at the university’s gym. The workout involved circuit training in which the students moved from one exercise station to another in small groups. One station was a “face pull,” an exercise in which an elastic resistance band is secured to a squat rack post and pulled towards the user’s face. When Sinu performed the exercise, the resistance band slid off the hook and caused injury to his eyes.

Sinu and his mother sued Concordia in Nebraska state court, alleging multiple causes of action, including negligence. Concordia asserted a numerous defenses, including that Sinu’s claim was barred by the release signed by Sinu and his mother and by the doctrine of assumption of risk.

Concordia moved for summary judgment. The trial court ruled in favor of Concordia and dismissed Sinu’s complaint. The court rejected Sinu’s arguments that the release was unconscionable, that it did not release Concordia from liability for its own negligence, and that the release did not amount to an assumption of risk. Sinu and his mother appealed to the Nebraska Supreme Court.

The Nebraska Supreme Court agreed with the trial court. The Supreme Court explained that the release is a type of exculpatory clause, which is a “contractual provision relieving a party from liability resulting from a negligent or wrongful act.” Exculpatory clauses deny an injured party the right to recover damages from

the very person or entity who negligently caused the injury. The Court explained that an exculpatory clause is enforceable only when it makes clear the effect of the agreement - meaning, the wording of the agreement “must be so clear and understandable that an ordinary and knowledgeable party will know what [they are] contracting away.”

The Court rejected Sinu and his mothers’s argument that the release was not clear because it did not specifically state that by signing the agreement, Sinu and his mother agree to release Concordia from its own negligence. Instead, the Court examined the language of the release and determined the intended effect of the release was clear. The title of the agreement - “Assumption of Risk and Waiver of Liability Release” appeared in large, boldface type at the top of the release. The release stated “[i]n consideration of ... being provided access and the opportunity to use the Walz” and in recognition of the “risks inherent in such physical activity, I do hereby ... release ... the [u]niversity ... from and against any and all claims, demands, injuries, actions or causes of action, for ... personal injury ... which may result from my presence at or participation in any such [u]niversity activities.” As such, the Court determined that the language of the release clearly demonstrated an intent to eliminate Concordia’s liability.

The Court also rejected Sinu and his mother’s argument that the release was ambiguous in notifying them that they were releasing Concordia from liability caused by Concordia’s own negligence. The Court found the release placed no liability on Concordia for any injury suffered by Sinu. The plain language of the release plainly stated that Sinu released Concordia from and against any and all claims “which may result from [Sinu’s] presence at or participation in any such university activities.”

The Court also held that the release was valid and not unconscionable or void as against public policy. The Court explained that courts should be cautious in voiding contracts, and should only do so if the contract is “quite clearly repugnant to the public conscious.” The Court found there was no disparity in bargaining power between Concordia and Sinu and his mother

11 January 2023 • www.lcwlegal.com •

negligence

when entering into the agreement, an essential fact in determining unconscionability. The Court rejected Sinu’s argument that he was 18 and living in Europe when he signed the release, and was forced to sign the release to attend Concordia. The Court found that Sinu had a reasonable opportunity to understand the terms of the contract because he had a month to review the release before moving to Nebraska. His mother also signed the contract. Additionally, exculpatory agreements in the recreational sports context are not against the public interest.

Ultimately, the Nebraska Supreme Court agreed with the trial court and dismissed the case.

Sinu v. Concordia University (2023) 313 Neb. 218.

Note:

While this case is from Nebraska and not binding in California, this case is an important reminder that private colleges, universities, and K-12 schools need to ensure that waivers, including for recreational activities, must be clear and unambiguous.

employees

criminal background checks

Federal Fair Credit Reporting Act Does Not Preempt State Law.

Under the federal Fair Credit Reporting Act (FCRA), an agency may report a person’s prior conviction to a prospective employer no matter how long ago it occurred. However, under California’s Investigative Consumer Reporting Agencies Act (ICRAA) and the California Consumer Credit Reporting Agencies Act (CCRRA), an agency is prohibited from reporting a “conviction of a crime that, from the date of disposition, release, or parole, antedate the report by more than seven years.” Generally, a state can offer greater protection to a consumer than the federal government.

Sometime in 2011, R. Kemp (Kemp) was convicted of a crime and released on December 11, 2011 on parole. In December 2014, Kemp’s parole ended.

In March 2020, Amazon offered Kemp a job in Sacramento, pending a background check. The consumer reporting agency, Accurate, provided Amazon with a report, which included information about Kemp’s 2011 conviction. As a result, Amazon withdrew its offer of employment.

Kemp filed a class action lawsuit against Accurate alleging Accurate (1) violated the ICRAA, (2) violated the CCRAA, and (3) violated of the state’s Unfair Competition Law (UCL). Accurate moved to dismiss the case, arguing that the federal FCRA preempted Kemp’s state ICRAA claim. Accurate also argued that the phrase “from the date of parole” in the ICRAA refers to the end of parole. The trial court denied Accurate’s motion as to the parole issue but granted the motion as to the preemption issue. The parties appealed.

12 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento •

The Court of Appeal explained the statutory framework of the ICRAA and the CCRAA. Both statutes were modeled after the FCRA and were intended to serve complementary, but not identical, goals as the federal statute. The ICRAA and CCRAA have similar purposes to ensure consumer reporting agencies “exercise their grave responsibilities with fairness, impartiality, and a respect for the consumer’s right to privacy.” Under the ICRAA, a consumer report is a report bearing on a consumer’s character and general reputation. Under the CCRA, a consumer credit report is a report bearing on a consumer’s credit worthiness, credit standing, and credit capacity. Under the FCRA, there is no distinction between the two types of reports.

Because the information in the two reports overlap, the ICRAA and the CCRAA may apply to the same report. Under the ICRAA and the CCRAA, agencies are prohibited from reporting “records of arrest, indictment, information, misdemeanor complaint, or conviction of a crime that, from the date of disposition, release, or parole, antedate the report by more than seven years.”

The Court of Appeal rejected Accurate’s argument that the phrase “from the date of parole” means the date of the end of parole. The Court of Appeal explained under California law, the parole date, or the date of parole, refers to the date of an inmate’s release, or the start date of their parole. In other words, the period of parole begins when an inmate is released from prison. Therefore, the ICRAA and CCRA prohibit an agency from reporting a person’s criminal conviction that predates a report by more than seven years as measured from the start date of parole, and not the end of parole. The Court of Appeal also examined past policy guidance by the Federal Trade Commission, which enforces the FCRA. The guidance stated that the seven year reporting period runs from the date of parole, and if a consumer is convicted of a crime and sentenced to confinement, the date of release or placement on parole controls. While the guidance is not controlling, the Court of Appeal did find it informative interpreting the ICRAA and the CCRA.

The Court determined that Kemp went on parole in 2011, which predated Accurate’s 2020 report by more than seven years in violation of the ICRAA and CCRA.

The Court of Appeal also rejected Accurate’s argument that the FCRA preempts the ICRAA. The Court of Appeal found the FCRA expressly preempts state law in the statute itself: The FCRA states that it preempts (1) state consumer reporting statutes if the state law

took effect after September 30, 1996, and (2) when the state statute regulates the disclosure of convictions in consumer reports. Here, the ICRAA was enacted in 1975. Therefore, the ICRAA did not take effect after September 30, 1996, and is not expressly preempted in the FCRA.

Moreover, the Court of Appeal held that the ICRAA does not conflict with the FCRA. State law is only preempted if it is in direct conflict with federal law such that compliance with both is impossible, because the state law impedes the purposes of Congress. Here, a consumer reporting agency can comply with the ICRAA by not reporting a consumer’s conviction that predates an investigative report by more than seven years without violating the FCRA, which allows for, but does not require, the reporting of such convictions. The ICRAA’s prohibition against reporting convictions older than seven years is not an obstacle to the purposes and objectives of Congress; rather, it is entirely consistent with the consumer protection goals of the FCRA. And as the Court of Appeal noted, the ICRAA was modeled after the FCRA.

Kemp v. Superior Ct. of Orange County (Cal. Ct. App. Dec. 22, 2022) 2022 WL 17843980.

Note:

This case is a reminder that private K-12 schools, colleges, and universities should establish reasonable procedures to ensure compliance with the FCRA and the ICRAA, even when using a vendor to perform background checks, to avoid potential liability.

13 January 2023 • www.lcwlegal.com •

lcw best timeline

JANUARY -

FEBRUARY

Review and revise/update annual employment contracts.

Conduct audits of current and vacant positions to determine whether positions are correctly designated as exempt/non-exempt under federal and state laws.

FEBRUARY- EARLY MARCH

Issue enrollment/tuition agreements for the following school year.

Review field trip forms and agreements for any spring/ summer field trips.

Tax documents must be filed if School conducts raffles:

• Schools must require winners of prizes to complete a Form W-9 for all prizes $600 and above. The School must also complete Form W-2G and provide it to the recipient at the event. The School should provide the recipient of the prize copies B, C, and 2 of Form W-2G; the School retains the rest of the copies. The School must then submit Copy A of Form W2-G and Form 1096 to the IRS by February 28th of the year after the raffle prize is awarded.

Planning for Spring Fundraising Event.

Summer Program.

• Consider whether summer program will be offered by the school and if so, identify the nature of the program and anticipated staffing and other requirements.

• Review, revise, and update summer program enrollment agreements based on changes to the law and best practice recommendations.

MARCH- END OF APRIL

The budget for next school year should be approved by the Board.

Issue contracts to existing staff for the next school year.

Issue letters to current staff who the School is not inviting to come back the following year.

Assess vacancies in relation to enrollment.

Post job announcements and conduct recruiting.

• Resumes should be carefully screened to ensure that applicant has necessary core skills and criminal, background and credit checks should be done, along with multiple reference checks.

Summer Program.

• Advise staff of summer program and opportunity to apply to work in the summer, and that hiring decisions will be made after final enrollment numbers are determined in the end of May.

• Distribute information on summer program to parents and set deadline for registration by end of April.

• Enter into Facilities Use Agreement for Summer Program, if not operating summer program.

Transportation Agreements.

14 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento •

Each month, LCW presents a monthly timeline of best practices for private and independent schools. The timeline runs from the fall semester through the end of summer break. LCW encourages schools to use the timeline as a guideline throughout the school year.

• Assess transportation needs for summer/next year.

• Update/renew relevant contracts.

MAY

Complete hiring of new employees for next school year.

Complete hiring for any summer programs.

If service agreements expire at the end of the school year, review service agreements to determine whether to change service providers (e.g., janitorial services, if applicable).

• Employees of a contracted entity are required to be fingerprinted pursuant to Education Code Section 33192, if they provide the following services:

School and classroom janitorial.

School site administrative.

School site grounds and landscape maintenance.

Pupil transportation.

School site food-related.

• A private school contracting with an entity for construction, reconstruction, rehabilitation, or repair of a school facilities where the employees of the entity will have contact, other than limited contact, with pupils, must ensure one of the following:

That there is a physical barrier at the worksite to limit contact with pupils.

That there is continual supervision and monitoring of all employees of that entity, which may include either:

- Surveillance of employees of the entity by School personnel; or

- Supervision by an employee of the entity who the Department of Justice has ascertained has not been convicted of a violent or serious felony, which may be done by fingerprinting pursuant to Education Code Section 33192. (See Education Code Section 33193).

If conducting end of school year fundraising:

Raffles:

• Qualified tax-exempt organizations, including nonprofit educational organizations, may conduct raffles under Penal Code Section 320.5.

• In order to comply with Penal Code Section 320.5, raffles must meet all of the following requirements:

Each ticket must be sold with a detachable coupon or stub, and both the ticket and its associated coupon must be marked with a unique and matching identifier.

Winners of the prizes must be determined by draw from among the coupons or stubs. The draw must be conducted in California under the supervision of a natural person who is 18 years of age or older.

At least 90 percent of the gross receipts generated from the sale of raffle tickets for any given draw must be used by to benefit the school or provide support for beneficial or charitable purposes.

15 January 2023 • www.lcwlegal.com •

practices

Auctions:

• The school must charge sales or use tax on merchandise or goods donated by a donor who paid sales or use tax at time of purchase.

Donations of gift cards, gift certificates, services, or cash donations are not subject to sales tax since there is not an exchange of merchandise or goods.

Items withdrawn from a seller’s inventory and donated directly to nonprofit schools located in California are not subject to use tax.

- E.g., if a business donates items that it sells directly to the school for the auction, the school does not have to charge sales or use taxes. However, if a parent goes out and purchases items to donate to an auction (unless those items are gift certificates, gift cards, or services), the school will need to charge sales or use taxes on those items.

ON-DEMAND TRAINING

16 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento •

Don’t Delay. Train Today. VISIT OUR WEBSITE FOR ALL OUR ON-DEMAND OFFERINGS: WWW.LCWLEGAL.COM/EVENTS-AND-TRAINING/ON-DEMAND-TRAINING

construction corner

LCW represents and advises private schools and colleges in various business, construction, and facilities matters, including all aspects of construction projects from contract drafting and negotiations to course of construction issues. Through this Construction Corner, LCW will be giving private schools and colleges monthly helpful tips on a variety of topics applicable to campus construction projects. LCW attorneys are available should you have any questions or need assistance with any construction projects no matter what phase you may be in currently.

The Appropriate Construction Contract for Your Project

By: Abigail W. Clark

Careful planning can minimize the risks of cost overruns for private school construction projects. One aspect of planning that schools sometimes overlook is selection of the best fee structure for their construction project, which varies depending on the type of project and potential unknown variables impacting construction costs.

The two most common fee structures are Fixed Price (also known as Stipulated Sum or Lump Sum) and Cost of the Work plus Fee with a Guaranteed Maximum Price (also known as GMP) fee arrangements. As a general matter, under Fixed Price contracts, schools agree to pay contractors a stipulated or lump sum for all work performed. Under GMP contracts, schools agree to pay contractors for work performed plus a fee that encompasses the contractor’s profit, and the total amount the school agrees to pay is subject to a guaranteed maximum price. Below is a chart regarding the key differences between each type of fee arrangement. Schools should consult with an attorney to determine the best fee arrangement for their project.

Fixed Price Contracts GMP Contracts

Who Bears the Risk Contractor must estimate hours, materials and costs up front, and therefore assumes the risk of unforeseen cost overruns. The contractor bears the risk that it has incorrectly estimated the cost of the project and that it will not be profitable.

Contractor Mark-up

A fixed price contractor may quote a higher fixed price to mitigate its risk, particularly for large or complex projects for which it is harder to estimate the cost of work and account for unforeseen conditions.

Transparency Fixed Price contracts are typically less transparent. The fixed price contractor typically submits invoices to the School based only on the percentage of work completed as compared against the fixed price.

Savings If the contractor underestimates the cost of project and it is completed under budget, savings inure to contractor. Contractor will likely attempt to recoup material costs in excess of the fixed price through change orders.

Contractor bears the risk that project will exceed the guaranteed maximum price, which is the highest amount the school is willing to pay for the project.

There may be somewhat less risk of contractor markup with GMP contracts because school agrees to pay the actual costs of the project plus a percentage of the cost as profit, and audits work of contractor as project progresses.

GMP contracts are more transparent. The GMP contractor submits invoices for the actual cost of the work performed and obtains a set percentage or the actual cost as a fee.

Any savings typically inure to school, or the parties may agree to share in savings to encourage completion of a project under budget.

Administrative Costs Fixed Price contracts involve fewer administrative costs. There is a greater administrative burden associated with GMP contracts because a school representative or construction manager/project manager typically reviews invoices received from GMP contractor to ensure they accurately reflect the actual cost of work performed.

17 January 2023 • www.lcwlegal.com •

If you would like to receive more information about our Consortium services or would like to join, please contact Jaja Hung at jhung@lcwlegal.com.

18 • Los Angeles • San Francisco • Fresno • San Diego • Sacramento • The 411 On Consortiums:

Consortium Call Of The Month

LCW has four private education consortiums across the State! Consortium members enjoy access to quality training throughout the year, discounts on other LCW products and events, and unlimited, complimentary telephone consultation with an LCW private education attorney on matters relating to employment and education law questions (including business & facilities questions and student issues!). We’ve outlined a recent consortium call and the provided answer below. Client confidentiality is paramount to us; we change and omit details in the ERC Call of the Month.

Question:

Because the deadline for employees to exhaust their COVID-19 supplemental paid sick leave was December 31, 2022, can the School continue to offer leave for COVID-19 on its own?

Answer:

The attorney advised the School that it can offer leave for reasons related to COVID-19 if it wants to do so. If it chooses to do so, it should either update its sick leave policy or prepare a separate COVID leave policy as appropriate. It should have the leave in writing so that the leave is implemented consistently. The School can also stop providing SPSL (although it should not deny other, appropriate forms of leave for COVID-related reasons –e.g., a person is sick with COVID and uses sick leave.) The attorney advised that whatever the School does, it should be consistent in its leave policies.

19 January 2023 • www.lcwlegal.com •

Liebert Cassidy Whitmore

Liebert Cassidy Whitmore

Liebert Cassidy Whitmore

Liebert Cassidy Whitmore