By: Mark Hinkle blog.ssa.gov

This year, the Social Security Administration (SSA) celebrates 50 years of administering the Supplemental Security Income (SSI) program.

President Richard Nixon signed the bill in 1972, and in January 1974, SSA began issuing the first SSI payments to nearly 4 million eligible people. The goal of the SSI program was to aid aged, blind, and individuals with disabilities with very limited income and resources.

Fifty years later, the SSI program remains a lifeline by providing cash assistance to about 2% of the U.S. population, approximately 7.5 million people, with limited income and resources, including nearly 1 million low-income children with disabilities. SSI benefits can help pay for basic needs like rent, food, clothing, and medicine, reducing the number of people in extreme poverty, and alleviating the burden on other family members.

"SSI works, and has for the last 50 years, because of hardworking and dedicated SSA employees. SSI is an effective yet complex program, and SSA employees work hard to ensure

payments are accurate and timely," said Martin O'Malley, Commissioner of Social Security. "Recently, we made great progress in strengthening the SSI program by simplifying the rules and helping more people access these benefits. As we celebrate 50 years of SSI, we will continue to look for ways to improve the program and eliminate barriers."

The agency recently announced it will expand access to the SSI program by updating the definition of a public assistance household. (Refer to Press Release | Press Office | SSA) The agency also announced it will exclude the value of food from SSI benefit calculations.

(Refer to Press Release | Press Office | SSA) Additionally, the agency announced it will expand its rental subsidy exception, currently only in place for SSI applicants and recipients residing in seven States, as a nationwide policy. (Refer to Press Release | Press Office | SSA)

The agency will commemorate SSI's 50th anniversary with local and national events throughout the year, including a celebration on June 4th hosted by the National Academy of Social Insurance (NASI) featuring Commissioner O'Malley and U.S. Senator Tom Harkin (Ret-IA).

By: Nate Osburn ssa.gov/news

Last month, the Social Security Administration announced a large step in a multiyear effort to simplify processes for people who are applying for Supplemental Security Income (SSI) by starting to offer an online, streamlined application for some applicants starting in December. SSI provides monthly payments to people with disabilities and older adults who have little or no income and resources.

The initial step - known as iClaim expansion - aims to establish a fully online, simplified iClaim application that leverages user-tested, plain-language questions, prepopulated answers where possible, seamless step-by-step transitions, and more. The online application aims to reduce the time spent applying as well as the processing time for initial claim decisions.

"Over the past year, we have asked many applicants and advocates - as well as our workforce - how we could make the SSI application process easier and simpler. Now, we are taking an important first step to do just that," said Martin O'Malley, Commissioner of Social Security. "People in our communities who need this crucial safety net deserve the dignity of an application process that is less burdensome and more accessible than what we now have, and we're committed to achieving that vision over the next few years."

The rollout of the iClaim expansion will generally be available to first-time applicants between 18 and almost 65 who never married and are concurrently applying for Social Security benefits and SSI. A goal of the second phase - currently targeted for late 2025 - is to expand this to all applicants.

The Federal Register Notice that supports this effort was published today and reflects changes based on what Social Security previously received. To read it, please visit Federal Register :: Agency Information Collection Activities: Proposed Request.

Subsequent SSI simplification steps will incorporate lessons learned from the iClaim expansion into in-person, phone, mobile, and paper-based processes for SSI applications. As part of that, the agency plans to develop a separate simplified child SSI application.

All of these efforts will support and streamline the way Social Security's staff technicians and applicants work together, providing an applicant journey that reflects continuous feedback gathered from the agency's Customer Experience team, particularly from underserved communities.

By: Lizbeth Portalatin-Perez blog.ssa.gov

If you tied the knot this summer – one of the most popular seasons for weddings – your big day is over. However, you may have at least one more thing to cross off your “To Do” list.

If you need to change your last name on your Social Security card due to your marriage, you may be able to apply online for a replacement card using your personal my Social Security account.

If you got married in one of 21 participating states, you may be able to complete the process online – without the need to visit a Social Security office.

You must have a valid driver’s license or state-issued identification (ID) card and a marriage certificate from a participating state to complete the application electronically. Current participating states are Arkansas, Colorado, Connecticut, Delaware, Georgia, Hawaii, Idaho, Iowa, Kentucky, Maine, Maryland, Michigan, Missouri, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Virginia, Wisconsin, and Wyoming. This list will grow as we work to include more states. If you were married in one of the participating states and you want to apply online

NEWLYWEDS cont. on page 8

By: Lizbeth Portalatin-Perez blog.ssa.gov

Nearly 1 million children who have disabilities and limited income and resources receive Supplemental Security Income (SSI) every month. That’s money that helps pay for basic needs like food, rent, clothing, and medicine.

The maximum federal SSI payment in 2024 is $943 a month. The amount may be lower based on a child’s income and living arrangements, parents’ income, and other factors. A child who is eligible for SSI is typically eligible for health coverage through Medicaid.

To get SSI, a child must meet nonmedical and medical requirements.

NON-MEDICAL REQUIREMENTS FOR A MINOR CHILD

We consider a child’s income and

resources to determine if they are eligible for SSI. We also count the income and resources of the child’s parents (including a stepparent) if they live in the same household. The process of determining how much of the parents’ income and resources we count is called “deeming“. We do not consider the income and resources of other family members. If a child meets our non-medical requirements, then we will review our medical requirements to decide if the child has a disability.

MEDICAL REQUIREMENTS FOR A MINOR CHILD

To be medically eligible for SSI a child younger than age 18 must have a medical condition that:

• Results in “marked and severe functional limitations”.

• Is expected to last for at least 12 months or to result in death.

Compassionate Allowances are a way we quickly identify diseases and other medical conditions that, by definition, meet our standards for disability benefits. Thousands of children receive SSI payments because they have a condition on the list.

If a child receives SSI when they turn 18, we will contact them by mail about their age-18 redetermination. We must make a new medical decision to determine if they are eligible for SSI as an adult. They must have a condition(s) that is expected to prevent them from doing “substantial gainful activity” (SGA) for at least 12 months or to result in death.

in 2024 is $1550 a month. Visit our SSI page to learn more about our eligibility requirements and to start the application process.

SPECIAL RULES FOR CHILDREN IN FOSTER CARE

If a child wasn’t eligible for SSI before their 18th birthday, they may be able to get SSI after age 18. That’s because we only count their income and resources, not their parents.

Youth who live in foster care who are blind or have a qualifying disability can start the SSI application process before their 18th birthday. They can contact us 180 days before their foster care eligibility will end due to age. For specific requirements, read our Spotlight on SSI Benefits for youth with disabilities in foster care.

To be eligible for disability benefits, a person generally must earn less than a certain amount each month. The SGA earnings amounts increase each year. Under the SSI program, the SGA amount

We offer many resources at our Youth page to connect young people with disabilities to important information about education, career, and life goals. To learn more about supports for youth transition, read the publications in our updated Youth Toolkit 2024. Please share this information with families or friends who need our help.

FACT: MANY PEOPLE WHO REQUIRE NURSING HOME CARE CANNOT AFFORD TO PAY THE COSTS .

Because of the high costs, a high percentage of residents that live in nursing homes rely on Medicaid to pay for their care. Today, an estimated four percent of the over 65 age population lives in a nursing home. As the proportion of the older people increases due to longer life expectancies, it is likely that more and more people will need nursing home care.

By definition, Medicaid is a jointly funded program managed by both state and federal governments. Medicaid offers medical treatment, including nursing home care for low-income individuals who are 65 or older, blind or disabled.

The rules for qualifying for Medicaid change often and vary state to state and from country to country. Medicaid is not considered an entitlement program like Social Security; rather it is a needs-based program. Because it is based on the need, a person is not eligible to receive Medicaid benefits as a matter of right. Each person must make himself or herself eligible.

As a component of qualifying for Medicaid, a person must have limited assets. To limit assets, a person may be required to “spend down” his or her assets to a level as determined by the appropriate regulatory agency in his or her area. The concept of “spending down” is simple. Essentially, the Medicaid agencies will provide funding for nursing home care only once a person’s assets have been reduced to the specified limits.

FACT: THERE ARE SEVERAL METHODS TO “SPEND DOWN” ASSETS, ONE OF WHICH IS TO PREPAY FUNERAL EXPENSES.

If a person’s assets exceed the specified limits, then he or she may have to use his or her own assets to pay for his or her care in a nursing home. There are several methods to “spend down” assets, one of which is to prepay funeral or cremation expenses. Most agencies will exclude a prepaid funeral plan (within limits) when determining eligibility for assistance.

The qualifications for Medicaid eligibility vary from state to state and from country to country. An attorney who understands Medicaid should be contacted before attempting to qualify for Medicaid coverage. In order to qualify, you typically need to meet the following requirements:

• Be a U.S. citizen living in the U.S.

• Be over 65, disabled or blind

• Have a “medical necessity”

When it comes to funeral costs, Social Security pays very little, leaving your family with unexpected payments.

Pre-planning provides you with the time needed to make practical, detailed decisions that reflect your standards, lifestyle, taste and budge t. We can advise you of the total cost, and the funds you set aside today can help your family in the future.

By: Dawn Astry/Associate Commissioner blog.ssa.gov

With various reports of data breaches involving Social Security numbers in the media, we’d like to remind you about the importance of protecting your personal information. Someone illegally using your Social Security number (SSN) and possibly assuming your identity can cause many problems.

YOUR SOCIAL SECURITY NUMBER HAS BEEN STOLEN

Identity thieves can use your SSN and other personal information to apply for loans and credit cards and open cellphone and utility accounts in your name. If you believe your information has been stolen and you may be a victim of identity theft, you can:

• Visit IdentityTheft.gov to make a report and get a recovery plan. IdentityTheft. gov is a one-stop resource managed by the Federal Trade Commission, the nation’s consumer protection agency. Or you can call 1-877-IDTHEFT (1877-438-4338).

• File a police report and keep a copy for your records in case problems arise in the future.

• File an online report with the Internet Crime Complaint Center (IC3) at ic3. gov. Its mission is to receive, develop, and refer cybercrime complaints to law enforcement and regulatory agencies.

PROTECT cont. on page 8

By: BJ Jarrett blog.ssa.gov

If you receive Social Security, you can help to make sure we pay you the right benefit each month. You can do that by telling us about relationship or other life changes that could affect your eligibility for retirement, survivors, or disability benefits – or your benefit amount.

You and your family may miss out on additional payments you may be due if you don’t report changes to us in a timely manner. Or you may be overpaid benefits and have to pay us back.

To make sure you are paid correctly and receive the payments for which you are eligible, let us know right away if:

• You get married or divorced.

• Your spouse or former spouse dies.

• You become the parent of a child (including an adopted child).

• The child (or stepchild) who gets benefits on your record gets married.

• The child (or stepchild) who gets benefits on your record no longer lives with you. Note: We will need the name and address of the person with whom the child is living.

CHANGES cont. on page 8

By: Sue Denny/Public Affairs Specialist blog.ssa.gov

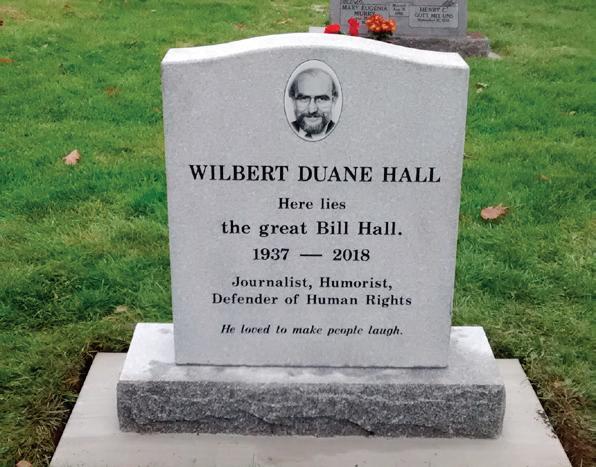

Social Security is one of the most successful anti-poverty programs in the history of our country. For 89 years, our benefits have provided financial security to countless families. Today more than 71 million Americans receive about $1.5 trillion in benefits during the year.

President Franklin D. Roosevelt signed the Social Security Act on Aug. 14, 1935. He said, “We can never insure one hundred percent of the population against one hundred percent of the hazards and vicissitudes of life, but we have tried to frame a law which will give some measure of protection to the average citizen and to his family against the loss of a job and against povertyridden old age.”

“Vicissitudes” are hardships or difficulties, usually beyond someone’s control.

When challenges and tragedies occur, people can rely on Social Security. That includes my own family. That’s why I serve and why I’m so proud to have worked for Social Security for more than 25 years. No other federal agency has a greater impact on the American people.

a monthly check for 28 years – longer than he worked for his last employer. His benefits will continue for the rest of his life.

A 1939 law added payments for the wife and minor children of retired and deceased workers. Social Security became an economic security program for workers and their families.

My uncle died in a car accident at 40, leaving behind 3 young children. They each received a monthly Social Security survivors check until they graduated from high school.

Throughout my career, I have heard from many people who lost a parent during their childhood: “My family wouldn’t have made it without Social Security.”

A 1956 law added monthly benefits for workers with disabilities (ages 5065) who are no longer able to work. Other changes over the next few years extended benefits to younger workers and to family members of people getting disability benefits.

Security has become an invaluable part of American life by providing financial security to millions of families over the last nearly 90 years.

At the beginning, Social Security was strictly a retirement program for some retired workers 65 and older.

My father turned 90 this year. He began receiving Social Security retirement benefits at 62. He’s gotten

My mother was chronically ill with lupus and rheumatoid arthritis. When I was in high school, she had a heart attack and had to stop working. When her Social Security disability benefits began, so did payments to her 3 minor children – me and my 2 sisters. My mother received monthly disability benefits for 20 years before she passed away at 65.

Many of you have similar stories. Social Security is with us through life’s journey, securing today and tomorrow.

However, we are facing challenges. Social Security is serving the highest number of customers we’ve ever had with the lowest level of staffing in decades. While customer service has taken a hit, our agency has been making progress using the resources we have while improving access to benefits and services. We are not done!

Social Security created a new roadmap

for many more improvements. We created this Social Security Action Plan for 2024 with input and ideas from our frontline and other employees across the country, and customer feedback. In addition to what’s coming, this Plan highlights many of the accomplishments Social Security has made in the last several months.

We’ll have much to celebrate over the coming months and on our 90th anniversary next year. You can visit our Stronger Together page to learn how our employees are advancing our agency’s mission every day.

cont. from page 6

• Notify 1 of the 3 major credit bureaus and consider adding a credit freeze, fraud alert, or both to your credit report. The company you call is required to contact the others.

• Equifax at 1-800-525-6285.

• Experian at 1-888-397-3742.

• TransUnion at 1-800-680-7289.

• Regularly check your credit report for anything unusual. Free credit reports are available online at AnnualCreditReport.com.

• Contact the IRS to prevent someone else from using your Social Security number to file a tax return to receive your refund. Visit Identity Theft Central or call 1-800-908-4490.

To learn more, read our blog, Protect Yourself from Identity Thieves, and our Identity Theft and Your Social Security Number publication.

Create or sign in to your personal my Social Security account to check for any suspicious activity. If you have not yet applied for benefits:

• You should not find any benefit payment amounts, and you should be able to access your Social Security Statement and view future benefit estimates.

• Review your Statement to verify the accuracy of the earnings posted to your record to make sure no one else is using your Social Security number to work.

If you receive benefits, you can add blocks to your personal my Social Security account:

cont. from page 6

We offer several ways to report changes:

• Call us at 1-800-772-1213 (TTY 1-800-325-0778), Monday to Friday, 8:00 a.m. to 7:00 p.m.

• Call your local Social Security office.

• Fax, mail, or deliver your updates to your local office.

If you get retirement, survivors, or disability benefits and need to update your address, phone number, or direct deposit, it’s easy to make those changes with your personal my Social Security account. Or you can use our automated telephone services.

• The eServices block prevents anyone, including you, from viewing or changing your personal information online.

• The Direct Deposit Fraud Prevention block prevents anyone, including you, from enrolling in direct deposit or changing your address or direct deposit information through my Social Security or a financial institution (via auto-enrollment).

You’ll need to contact us to make changes or remove the blocks.

OTHER WAYS TO SAFEGUARD YOUR INFORMATION

• Don’t carry your Social Security card with you. Keep it at home in a safe place. Be careful about who you give your number to.

• Change your passwords regularly and use a unique password for each account to prevent hackers from accessing multiple accounts if one password is stolen.

• Add an extra layer of security to your online accounts by using multi-factor authentication, which is a sign-in process that requires a password plus additional information.

• Be wary of scammers pretending to be Social Security employees. If you get a suspicious call, text, or email about a problem with your Social Security number or account, ignore it, hang up, and don’t respond! To report the scam and to learn more, visit www.ssa.gov/scam/ .

You’ll find more tips at our Fraud Prevention and Reporting page.

For a complete list of your reporting responsibilities, please refer to our publications, What You Need to Know When You Get Retirement or Survivors Benefits or What You Need to Know When You Get Social Security Disability Benefits.

If you get Supplemental Security Income (SSI) payments, you have extra reporting responsibilities. They are listed in our publication, What You Need to Know When You Get Supplemental Security Income (SSI).

Get the right check, in the right amount, at the right time, by reporting changes right away!

cont. from page 3

for a replacement card in your new name:

• Sign in to your personal my Social Security account.

• Select “Replace Your Social Security Card”.

• Answer the screening questions to confirm eligibility.

• Enter your personal information (name, Social Security number, date of birth, and U.S. mailing address). You should wait at least 30 days after the date of your marriage to request a replacement card. This allows the state time to update its records.

If you got married in another state or the District of Columbia or you are unable to use our online application, visit Your Number and Card webpage. You can start your application online and possibly self-schedule an appointment to visit a local office to show your marriage certificate.

Once you complete your application (online or in person), we’ll mail an updated card to you, usually within 14 business days. There is no charge.

Be sure to let your employer know about your name change so they can update their payroll records, and we can accurately keep track of your earnings.