ABSTRACT

LOD3 DAO IS A DECENTRALIZED AUTONOMOUS ORGANIZATION DEDICATED TO THE TOKENIZATION OF PRECIOUS METALS LIKE GOLD AND SILVER THROUGH THE LOD3 ECOSYSTEM, WE PROVIDE SECURE AND TRANSPARENT ACCESS TO DIGITAL PRECIOUS METALS, REDUCING CORRUPTION, CURBING INFLATION, AND PROTECTING AGAINST CURRENCY DEVALUATION. THE LOD3 DAO WILL MANAGE THE LOD3 TREASURY, VOTE ON NEW ROADMAP ITEMS, AND PIONEER THE ADOPTION OF DEFI SOLUTIONS WITHIN THE PRECIOUS METALS MARKET.

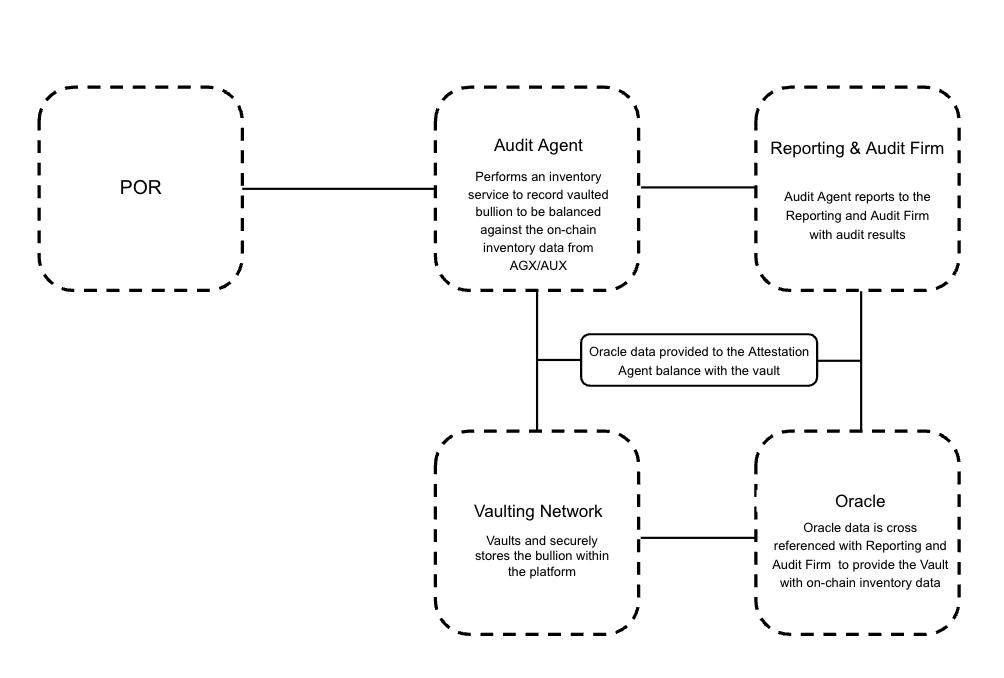

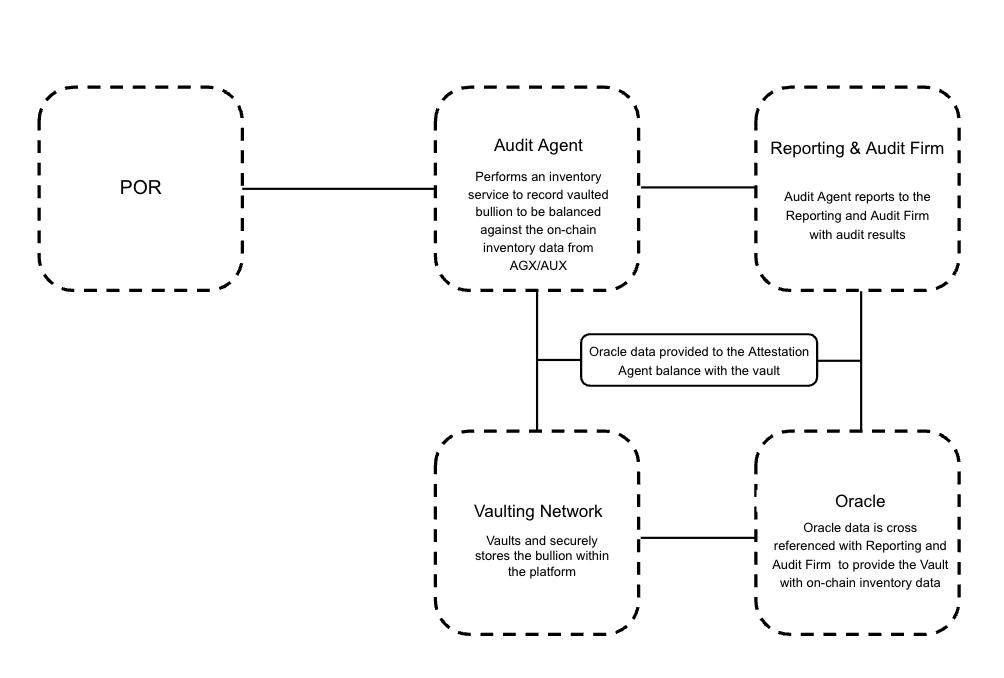

A key component of the LOD3 Ecosystem is the Proof-of-Reserves (PoR) mechanism, which ensures that all AGX and AUX Coins are fully backed by physical reserves of silver and gold This mechanism leverages regular audits by third-party entities and real-time data feeds from Chainlink oracles that enhance transparency and trust Additionally, LOD3 supports cross-chain functionality, allowing seamless interaction with multiple blockchain networks, thereby increasing the utility and accessibility of our digital precious metals. The decentralized governance structure empowers the community to participate in decision-making processes and it ensures a transparent and democratic operation of the DAO

This document contains proprietary information. Written consent is required for the distribution or duplication of any portion contained therein. This document is version-coded and may be updated in the future to reflect updates. Concepts herein are subject to change.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 2

NOTICES: This document does not constitute nor imply a prospectus No wording contained herein should be construed as a solicitation for investment, and this whitepaper does not pertain in any way to an offering of securities in any jurisdiction worldwide whatsoever This document has not been registered or approved by any financial services regulator for the purposes of securities or digital assets. $LOD3 Tokens are used as utility tokens within the LOD3 DAO Ecosystem They also serve as membership units for the DAO This whitepaper outlines the LOD3 DAO business model, product-market fit, technology stack, token use cases, governance model, and additional information on how to become involved with the project.

● Participating in cryptocurrencies and digital assets is speculative in nature. Although the LOD3 DAO does not believe any of the digital assets it interacts with are a security or financial instrument, users should be aware that some governments do not share that view.

● You should NOT participate in the LOD3 DAO Ecosystem, purchase $LOD3, hold $LOD3, or otherwise interact with any of LOD3 websites, promotions, or the ecosystem if you believe that digital assets are a security or you are looking to profit from the use of, swapping of, or trading of digital assets

● If you are in a location such as the United States of America, which has conflicting or differing views on digital assets, you should not participate in the LOD3 Ecosystem or hold $LOD3 Tokens

● Using digital assets and blockchain technology comes with a level of risk. You should undertake your own due diligence and research before participating in the use of digital assets Users of $LOD3 Tokens will have to agree to the Token Terms of Service? before they are permitted to hold or use these tokens.

● This document is for informational purposes only and is not designed to be a prospectus, invitation, or solicitation. It is also not designed for due diligence purposes.

● Citizens of countries where the promotion of crypto assets is/are regulated should not review this document

● Any and all statements are for information only and do not constitute promised results.

● Any numbers are for illustrative purposes only, and the information in this document, along with the goals and objectives of the project, can change at any time

● You should not circulate this document.

FOR THE LATEST UPDATES, PLEASE REFERENCE OUR WEBSITE LOD3.FI

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 3

GLOSSARY

AGX Decentralized Yield silver token, representing digital silver backed by physical silver reserves.

AUX Decentralized Yield gold token, representing digital gold backed by physical gold reserves.

CAR3 Safety Contract for Lending / Borrowing Pools, providing a secure platform for lending and borrowing within the LOD3 Ecosystem.

DVP3 Dynamic Vault Protocol, a protocol ensuring the secure storage and management of digital assets.

GIV3 Donation Contract, enabling users to donate a portion of their LOD3 Tokens, AGX, and AUX Coins to various causes supported by the LOD3 DAO.

LOD3 Digital Lead Service Provider to the LOD3 DAO, responsible for compliance, financial management, and strategic partnerships.

LOD Labs Lead developer and technology team to the LODE technology

G3NUINE Metals Critical Technology Provider to the LODE DAO, responsible for technology development, including smart contract deployment and maintenance.

LOD3 Protocol Decentralized, Permissionless DeFi Protocol underpinning the LOD3 DAO Ecosystem.

LOD3.fi

The official website of the LOD3 DAO.

RG3N

Reward Generator, a smart contract system that distributes rewards to LOD3 Token Holders who stake their tokens.

R3SERVE Proof of Reserve, ensuring that AGX and AUX Coins are backed by corresponding physical reserves.

R3DEEM Proof of Redemption, a mechanism ensuring the redemption of digital tokens and coins for their physical counterparts.

SAF3 Goodwill Card Funding Contract, facilitating the funding of prepaid Visa Debit cards within the ecosystem.

S3TTLE Merchant Pay Tools, providing solutions for merchants to accept payments in digital tokens.

V3ST

Vesting Contract, allowing users to vest their LTCs for LOD3 Tokens over a set period.

VOT3 Governance Contract, enabling community governance through the voting mechanism.

VOT3 Token Non-transferable governance token awarded to $LOD3 Stakers, used for voting on proposals.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 4

ADDITIONAL TECHNICAL TERMS

Blockchain A decentralized digital ledger that records transactions across many computers securely

EVM (Ethereum Virtual Machine)

Smart Contract

The runtime environment for smart contracts in Ethereum, allowing developers to deploy decentralized applications.

A self-executing contract with the Terms of the Agreement directly written into lines of code.

ERC-20 A standard for tokens on the Ethereum blockchain, ensuring interoperability between different tokens and platforms.

PoS (Proof of Stake)

DeFi (Decentralized Finance)

A consensus mechanism where validators are chosen to create new blocks and validate transactions based on the number of tokens and/or coins that they hold and are willing to "stake" as collateral.

Financial services using smart contracts on blockchain technology that remove intermediaries.

DAO (Decentralized Autonomous Organization)

Proof of Reserve (PoR)

A method ensuring that the digital tokens and/or coins issued by an entity are fully backed by corresponding physical or financial reserves.

Cross-Chain The ability for blockchain networks to interact and communicate with each other, allowing assets to be transferred between different blockchains.

Liquidity In the context of DeFi, the availability and ease with which liquid assets can be traded to a market or company

Staking The process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network, earning rewards in the process.

Yield Farming

The practice of staking or lending crypto assets to generate high returns or rewards in the form of additional cryptocurrency

Token Burn The process of permanently removing tokens and/or coins from circulation to reduce the total supply, often to increase the value of the remaining tokens and/or coins.

An organization represented by rules encoded as a transparent computer program, controlled by organization members and not influenced by a central government.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 5

PROBLEM STATEMENT

Traditionally, access to precious metals like gold and silver has been limited to physical ownership, which comes with significant challenges such as storage, security, and liquidity. Additionally, holding physical precious metals does not provide any yield or rewards, and users cannot leverage these assets in the growing world of decentralized finance (DeFi) This lack of integration with modern financial systems restricts the potential benefits that precious metals can offer in a digital economy

CHALLENGES WITH PHYSICAL PRECIOUS METALS

● Storage and Security: Owning physical precious metals requires secure storage solutions, often incurring additional costs There is also the risk of theft or loss

● Liquidity Issues: Physical metals are not easily divisible or transportable, making them less liquid compared to digital assets Transactions involving physical metals can be slow and cumbersome

● No Yield: Physical metals do not generate interest or dividends, limiting their potential as income-generating assets

LIMITATIONS OF EXCHANGE-TRADED FUNDS (ETFS)

While ETFs for precious metals offer some degree of liquidity and convenience, they also present several limitations:

● Global Access Restrictions: ETFs are often subject to regional regulations, limiting access for investors in certain jurisdictions For example, some ETFs are only available to investors in specific countries, excluding a large portion of the global population.

● Redemption Limitations: ETFs typically do not allow for the direct redemption of physical metals Investors are exposed to the market value of the metals without the ability to claim the underlying physical assets, which can be a significant drawback for those seeking tangible security

● Custodial Risks: ETFs rely on custodians to hold the physical metals, introducing counterparty risk. Investors must trust that these custodians maintain the appropriate reserves and manage them securely

○ For instance, In 2019, the SPDR Gold Shares ETF faced scrutiny due to concerns over the transparency of its gold holdings. This issue highlighted the counterparty risk associated with ETFs that rely on custodians to manage physical reserves, as investors must trust these entities to maintain and secure the appropriate reserves Such scrutiny emphasizes the need for transparency and robust management in ETFs, ensuring investors can verify the backing of their assets.

○ For more details on this topic, you can refer to the information provided by Business Wire on the SPDR Gold Shares ETF (Business Wire)

● Lack of Integration with DeFi: ETFs are not integrated with DeFi platforms, preventing investors from leveraging their holdings in decentralized lending, borrowing, or other

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 6

financial activities. This limits the potential to maximize the value and utility of precious metal investments

NEED FOR INNOVATION

These challenges highlight the need for a more innovative and integrated approach to precious metals investment, one that leverages modern technology to offer security, liquidity, and financial utility. For instance, the global gold market is valued at over $10 trillion, yet the integration of gold into digital financial systems remains limited. The digital tokenization of precious metals could bridge this gap, offering a seamless blend of traditional asset stability with modern financial flexibility.

By addressing these issues, we can unlock the true potential of precious metals in the digital economy, providing investors with a secure, liquid, and yield-generating investment option that integrates seamlessly with DeFi platforms This would not only enhance the utility of precious metals but also democratize access to these valuable assets on a global scale

Comparison with Other Precious Metals Options

DIGITAL GOLD ALTERNATIVES

Tether Gold (XAUT)

Tether Gold (XAUT) is a digital asset backed by physical gold reserves Each XAUT Token represents one fine troy ounce of gold stored in secure vaults. While this provides the convenience of gold ownership without physical storage challenges, it also has its limitations:

● Centralization: The gold reserves backing XAUT are managed by TG Commodities Limited, a centralized entity This introduces counterparty risk, as users must trust the central authority to manage the reserves properly.

● Limited DeFi Integration: XAUT can be traded on some DeFi platforms, but its integration is not as extensive as fully decentralized tokens This limits the opportunities for users to leverage their holdings in diverse DeFi applications.

● Regulatory Risks: As a centralized entity, XAUT is subject to stringent regulatory requirements, which can affect its availability and utility in different jurisdictions, posing challenges for global accessibility and liquidity.

Paxos Gold (PAXG)

Paxos Gold (PAXG) is another digital asset backed by physical gold reserves, with each token representing one fine troy ounce of gold stored in secure vaults While offering similar benefits, PAXG also faces certain issues:

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 7

● Centralization: The physical gold reserves are managed by Paxos Trust Company, a centralized entity regulated by the New York State Department of Financial Services This centralization provides security and regulatory oversight but introduces counterparty risk.

● Limited DeFi Integration: Although PAXG can be traded on Ethereum-based DeFi platforms, its integration is not as comprehensive as other fully decentralized tokens. This limits the use of PAXG across diverse DeFi applications

● Regulatory Risks: As a centralized entity, Paxos must comply with stringent regulatory requirements, which can affect the availability and utility of PAXG in various jurisdictions. This poses challenges for global accessibility and liquidity

Aurus Gold (AWG)

Aurus Gold (AWG) is a digital gold token backed by physical gold, offering similar benefits of liquidity and ease of transfer. However, it also has encountered several issues:

● Centralization: AWG relies on centralized custodians to manage its gold reserves, introducing counterparty risks similar to PAXG and XAUT. This centralization can lead to concerns about the actual backing of the token and the management of physical reserves

● Limited DeFi Integration: The use of AWG in DeFi platforms is growing but does not yet offer the same level of integration and utility as more established DeFi-centric tokens This can limit users' ability to maximize the value of their AWG holdings through lending, borrowing, or other DeFi activities.

● Regulatory Risks: Like other centralized digital gold tokens, AWG must navigate various regulatory landscapes, which can affect its use and acceptance in different regions

Comparative Table

(TG Commodities Limited)

(Paxos Trust Company)

(New York State Department of Financial Services)

Feature Tether Gold (XAUT) Paxos Gold (PAXG) Aurus Gold (AWG) Backed by Physical Gold Yes Yes Yes Centralization Centralized

Centralized

Centralized

Regulatory Oversight Yes Yes

Yes DeFi Integration Limited Limited Growing Counterparty Risk High High High LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 8

Custodians

Global Access

Subject to regional regulations

Subject to regional regulations

Subject to regional regulations

Physical Redemption No No No

This comparative table succinctly presents the differences and limitations of these digital gold alternatives, highlighting the areas where LOD3 DAO aims to provide a superior solution.

LOD3 DAO Solution

LOD3 DAO offers a unique approach to precious metals investment by leveraging blockchain technology to provide a decentralized, transparent, and community-governed ecosystem Here’s how LOD3 stands out:

TOKENIZATION OF PRECIOUS METALS

● AGX and AUX Coins: Users can hold digital representations of silver (AGX) and gold (AUX), backed by physical reserves This ensures their value is secure and transparent, with regular audits and real-time data feeds via Chainlink oracles verifying the physical reserves.

DECENTRALIZATION AND TRANSPARENCY

● Community Governance: LOD3 is governed by its community through a Decentralized Autonomous Organization (DAO) This ensures transparency and reduces the centralization risks associated with traditional options and centralized digital gold tokens.

● On-Chain Proof of Reserves: All transactions and holdings are recorded on the blockchain, ensuring full transparency and security Regular audits by third-party entities validate the physical reserves backing the tokens and/or coins.

ENHANCED FINANCIAL UTILITY

● Staking and Rewards: LOD3 provides staking opportunities where users can earn rewards on their AGX and AUX Coins, enhancing the utility and profitability of their precious metals.

● DeFi Integration: Digital precious metals can be used as collateral in lending protocols, traded on DeFi platforms, and integrated into various financial applications, providing liquidity and flexibility.

ACCESSIBILITY AND FLEXIBILITY

● No Hardware Requirements: Users do not need any specialized hardware to participate, making it easy and accessible for everyone

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 9

● Flexible Staking Options: Unlike traditional staking models, LOD3 allows users to earn rewards without long lock-up periods, enabling them to participate in other profitable opportunities within the DeFi ecosystem

By addressing the limitations of centralized digital gold tokens, LOD3 DAO creates a modern, decentralized financial ecosystem where precious metals can be effectively utilized. This provides stability, security, and growth opportunities for all participants, ensuring a truly global and inclusive financial system

VISUAL ILLUSTRATIONS (SUGGESTED)

To enhance understanding, here are suggested visuals to illustrate the LOD3 DAO solution:

1. Tokenization Process Flowchart: A diagram showing how physical gold and silver are tokenized into AGX and AUX Coins

2 Community Governance Model: An infographic showing the LOD3 DAO governance structure, including proposal submission, voting, and implementation processes.

3 Staking and Rewards Mechanism: A visual representation of how users can stake AGX and AUX tokens to earn rewards, and how these tokens can be used within DeFi platforms

4 Cross-Chain Integration: A diagram illustrating the cross-chain functionality, showing how AGX and AUX Coins interact with multiple blockchain networks.

State of the Market

OVERVIEW

The blockchain ecosystem is rapidly evolving, with various platforms offering unique advantages in terms of speed, security, and cost-efficiency. Ethereum, a highly successful blockchain platform, enables the creation of programmable tokens and smart contracts, fostering a robust environment for decentralized applications (dApps) and initial coin offerings (ICOs). However, Ethereum’s network congestion and high transaction fees have led to the development of alternative solutions like Shibarium and AVAX C-Chain

ETHEREUM

● Decentralized Security: Ethereum's decentralized nodes provide security for its Proof of Stake (PoS) architecture, enabling users to create and manage a wide range of digital assets, including fungible and non-fungible tokens (NFTs).

● Challenges: Despite its success, Ethereum faces challenges with transaction speed and cost, prompting the exploration of more scalable and cost-effective blockchains

LOD3 DAO on AVAX C-Chain and Shibarium

LOD3 DAO leverages the capabilities of AVAX C-Chain and Shibarium to provide a decentralized, transparent, and efficient ecosystem for precious metals tokenization LOD3

DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 10

Benefits of Using AVAX C-Chain and Shibarium for LOD3 DAO

● Security:

● AVAX C-Chain: Uses the Avalanche consensus protocol, which offers high security and low latency.

● Shibarium: Employs a PoS algorithm, ensuring validator commitment and network security

● Transparency: The decentralized nature of both blockchains allows for transparent tracking of transactions and activities

● Efficiency: Both AVAX C-Chain and Shibarium offer efficient transaction processing with low latency.

● Cost-effectiveness: Transaction fees on AVAX C-Chain and Shibarium are significantly lower than on Ethereum.

● Decentralization: Both blockchains operate without a single controlling entity, ensuring decentralization and reducing the risk of manipulation

Transaction Lifecycle on AVAX C-Chain and Shibarium

1. User Initiates Transaction: Users begin transactions on either AVAX C-Chain or Shibarium, typically through a smart contract function call

2. Validation by Public Checkpoint Nodes: Public checkpoint nodes validate the transaction against the current state of the blockchain

3 Checkpoint Creation and Submission: Validated transactions are grouped into a checkpoint, created, and submitted to core contracts on the Ethereum Mainnet (for Shibarium) or directly processed on AVAX C-Chain

4 Verification by Core Contracts: Core contracts verify the checkpoint's validity, ensuring fraud proofs for added security.

5 Transaction Execution: Upon successful verification, the transaction is executed, and state changes are committed to the sidechain.

6 Asset Transfer (Optional): If necessary, assets can be transferred back to the mainnet via an exit queue in the core contracts

7. Cycle Reiteration: The process can be initiated again by the user, returning to step 1.

AVAX C-Chain

● Speed and Scalability: Capable of processing thousands of transactions per second

● Flexibility and Simplicity: Fully compatible with Ethereum Virtual Machine (EVM), allowing for seamless deployment of smart contracts and easy integration with existing Ethereum tools and dApps

● Cost-Effective Transactions: Transaction fees on AVAX C-Chain are lower compared to Ethereum

Shibarium

● Security: Employs a PoS algorithm requiring users to stake their tokens to participate in the network, enhancing security

● Transparency: Allows users to track all transactions via a block scanner.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 11

● Efficiency: Processes transactions quickly and easily.

● Cost-effectiveness: Lower transaction fees make it a cost-effective platform

● Decentralization: A network of nodes maintains the blockchain, ensuring it is tamper-proof and immune to manipulation.

STATE OF THE MARKET SUMMARY

By leveraging both AVAX C-Chain and Shibarium, LOD3 DAO ensures a robust, secure, and cost-effective environment for the tokenization of precious metals. This dual-chain approach not only enhances the efficiency and flexibility of the ecosystem but it also provides a scalable solution that meets the growing demands of the digital economy.

KEY POINTS

● Ethereum: Secure but faces challenges with speed and cost

● AVAX C-Chain and Shibarium: Offer enhanced security, transparency, efficiency, cost-effectiveness, and decentralization

● Transaction Lifecycle: Efficient process on both blockchains ensuring secure and fast transactions.

● Dual-Chain Approach: Provides a scalable and flexible solution for the tokenization of precious metals in the digital economy

The LTC Vesting and LOD3 Staking Smart Contracts

The LTC Vesting Contract and the LOD3 Rewards Generator are pivotal components of the LOD3 DAO Ecosystem. They are designed to reward users who actively engage in protocol operations and participate in governance These smart contracts provide a transparent and structured mechanism for users to earn rewards and influence protocol decisions By staking tokens and participating in governance, users can enhance their engagement with the LOD3 Protocol, fostering a dynamic and involved community

The following section illustrates the inner workings of the new features of the LOD3 Protocol: the LTC Vesting Contract (V3ST) and the LOD3 Rewards G3nerator (RG3N) These two features are designed to reward LODE users who actively engage in protocol operations and participate in governance by voting on improvement proposals

EXAMPLE SCENARIO

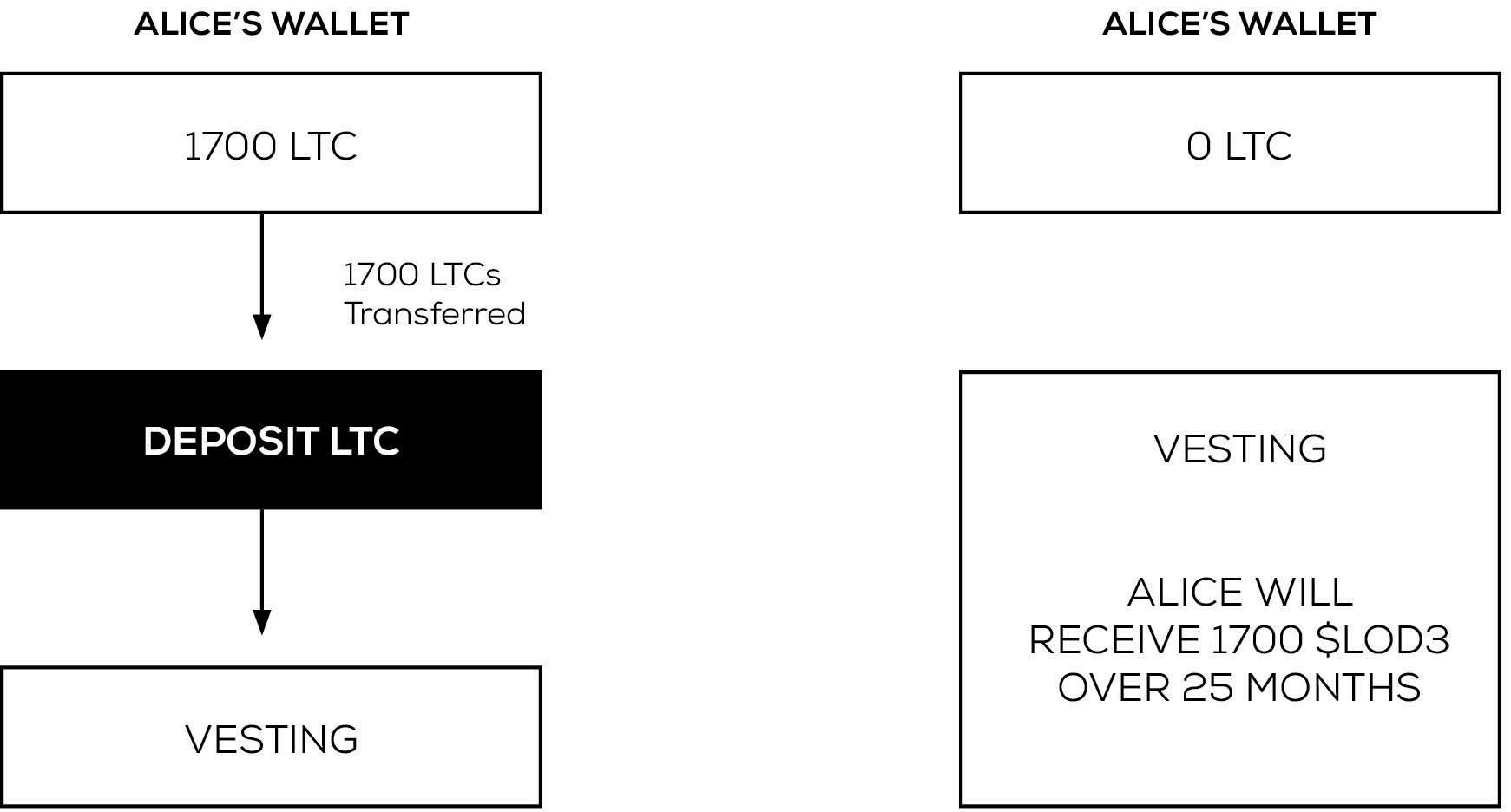

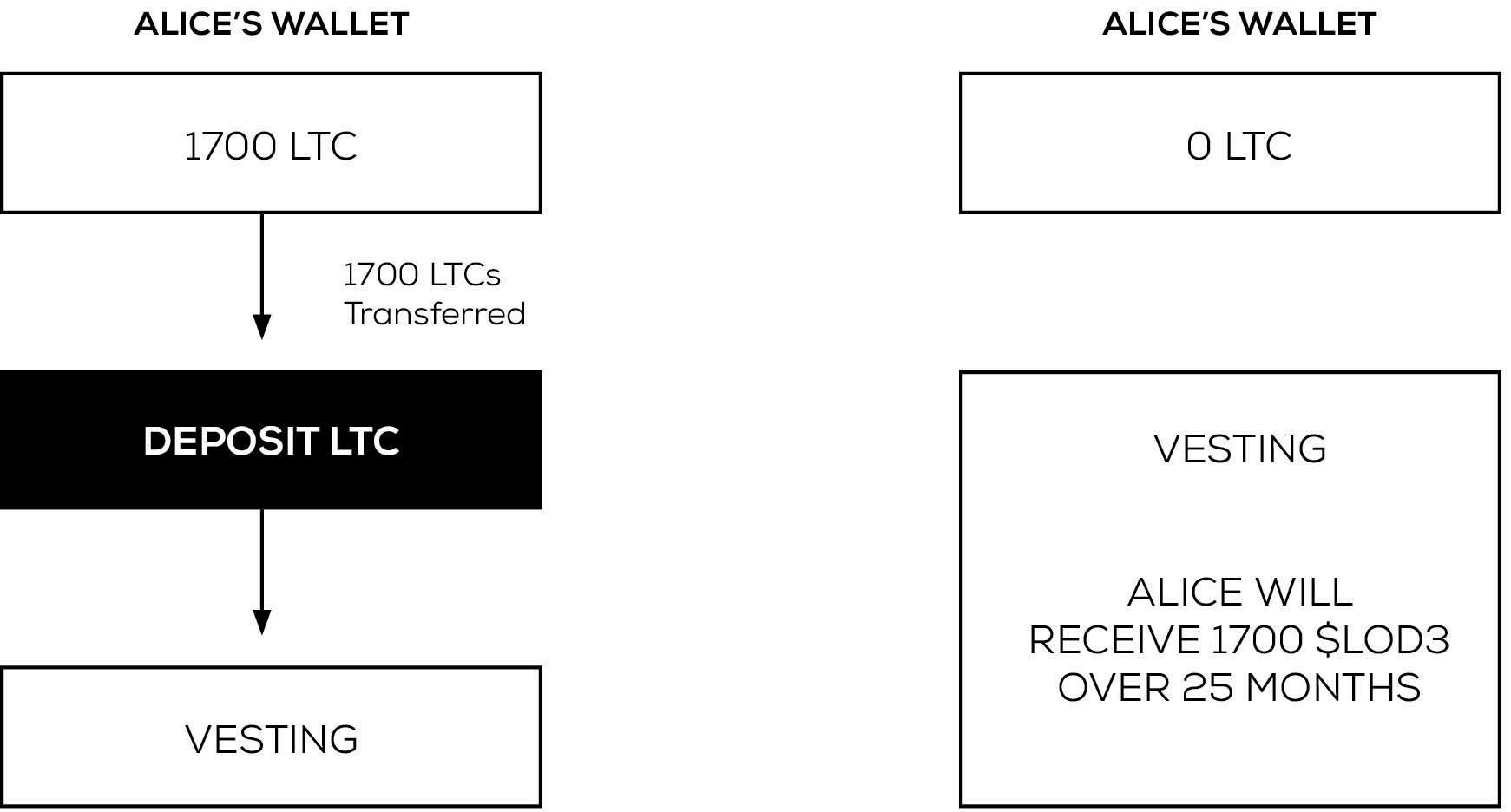

Consider Alice and Bob, both LOD3 Protocol users. Bob holds 500 LOD3 Tokens in his wallet, while Alice holds 1700 LTCs in hers This differentiation highlights the various ways users can engage with the protocol:

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 12

● Bob's Engagement: Given that Bob holds LOD3 Tokens, he can stake his balance fully or partially in the RG3N This action entitles him to two benefits:

1 He receives an equal amount of VOT3 Tokens, which he can use to vote on protocol improvement proposals.

2 He will be able to claim a share of the rewards on each of the token balances that are deposited into the RG3N over time.

● Alice's Engagement: Provided that Alice holds LTCs, she can engage in the Vesting scheme. Upon depositing her LTC balance, she will be entitled to 4% of that amount in LOD3 Tokens every 30 days At each milestone, she can choose to:

1 Claim her LOD3 balance: Receiving it into her wallet address

2. Stake it within the LTC V3ST: For which she will be compensated with a fee every 15 days, paid in LOD3 Tokens If she chooses to claim, the LOD3 balance she holds in her wallet will be at her disposal to engage in the RG3N, just like Bob.

Both the LTC V3ST and the LOD3 RG3N are smart contracts that operate with their own internal logic The LTC V3ST is designed for users to deposit their LTCs to eventually collect their share of LOD3 Tokens This contract also places incentives to encourage users to keep their LOD3 balances within it. In contrast, the RG3N is designed for LOD3 Holders to stake their positions and participate in protocol decisions in exchange for rewards

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 13

Table 1: LTC Vesting and LOD3 Staking Diagram

V3ST Workflow Overview

The V3ST is a crucial element of the LOD3 DAO Ecosystem, designed to incentivize and reward users who participate in the protocol by depositing their LTCs. Its primary objective is to provide a transparent and structured mechanism through which users can exchange their LTCs for LOD3 Tokens over time, while also offering additional rewards for continued engagement. This system ensures that users who commit their assets to the protocol are recognized and compensated, fostering a loyal and active community

Initially, Alice is holding a positive LTC balance, which she intends to exchange for LOD3 Tokens over the course of twenty-five (25) months Once Alice deposits her LTC balance, those LTCs are burnt by the V3ST and the vesting process kickstarts. The deposit is non-reversible, due to those LTCs being burnt, and each wallet address can execute a single deposit

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 14

Table 2: Vesting Process Diagram

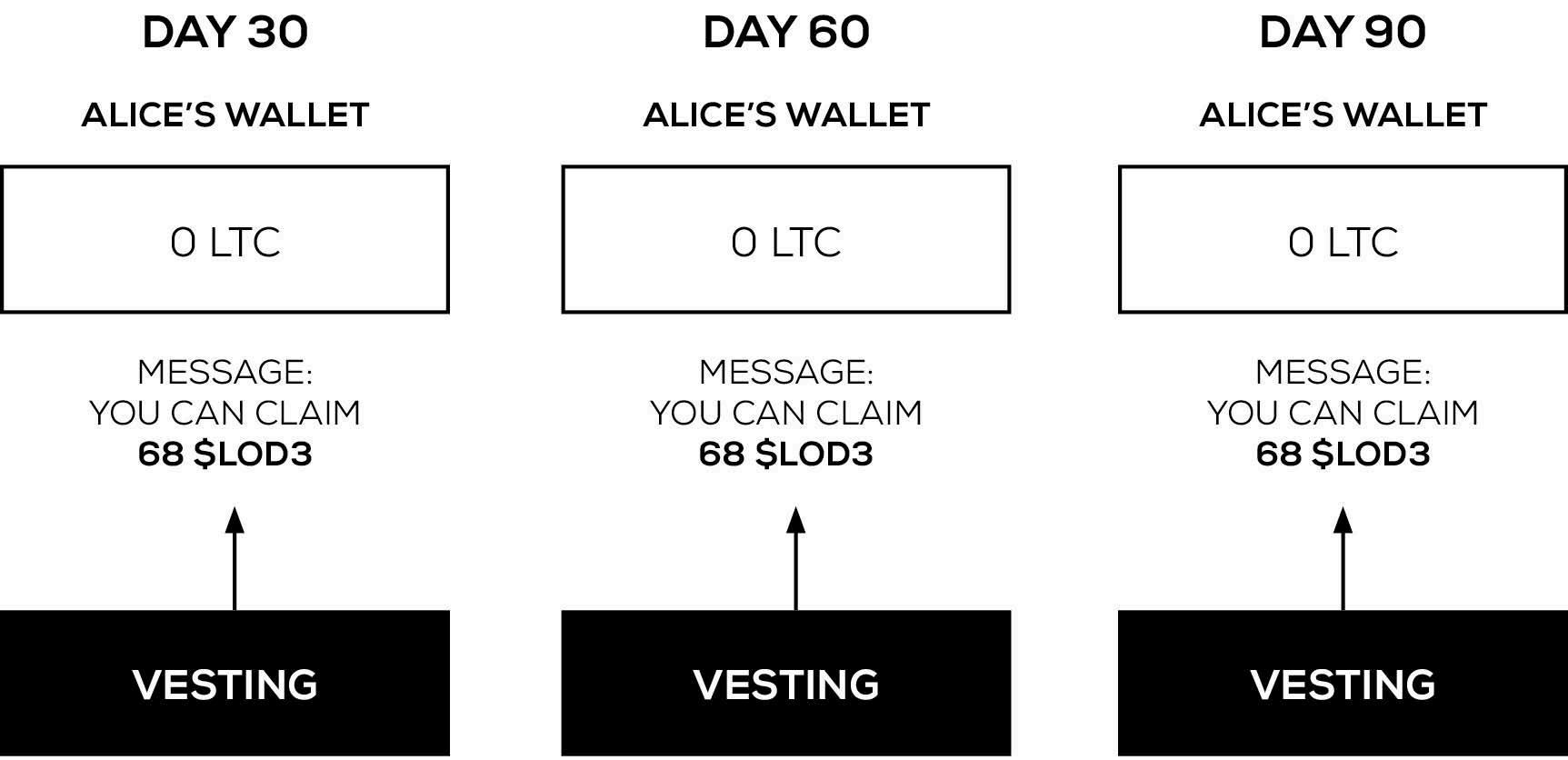

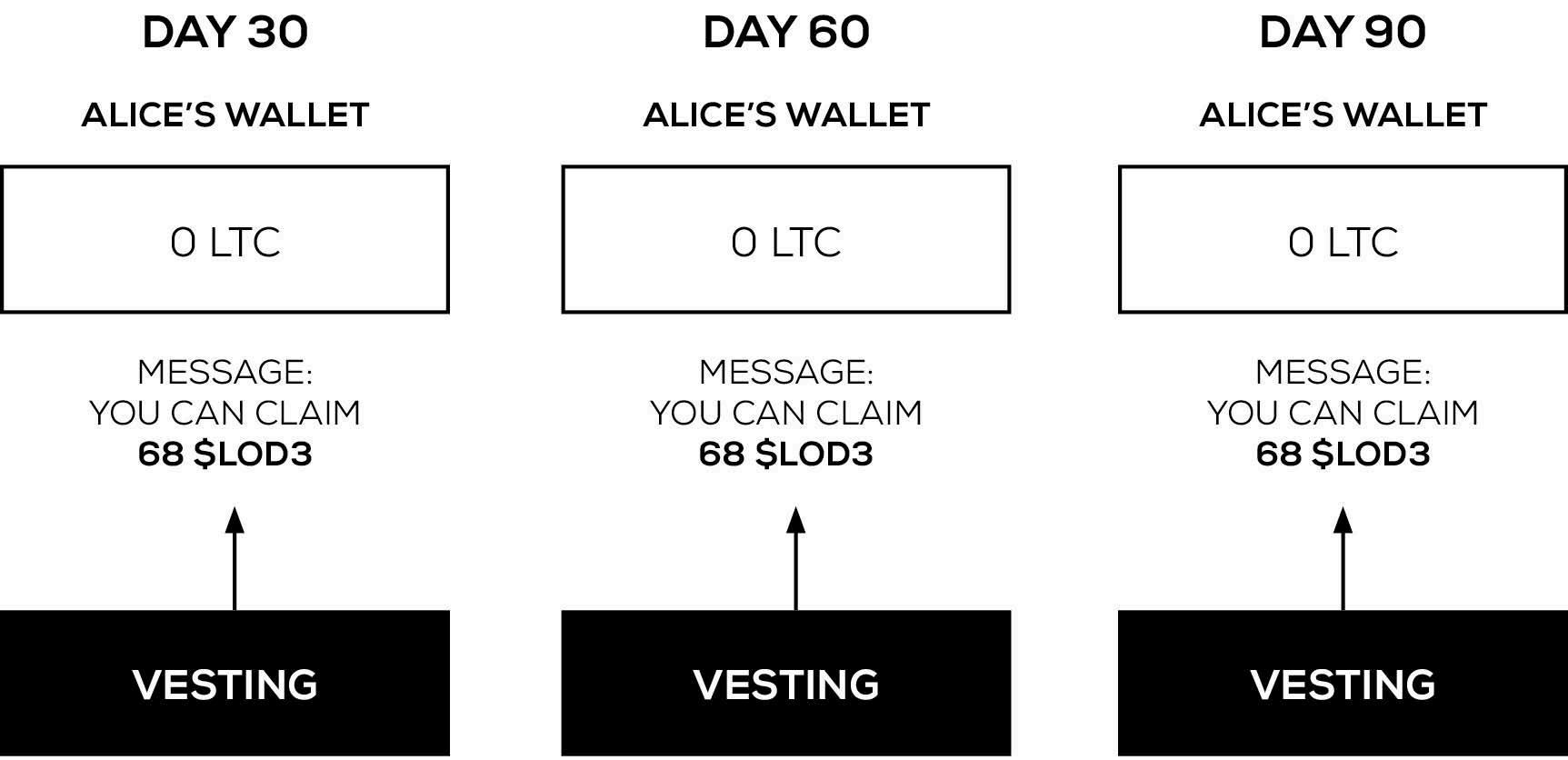

Every thirty (30) days, Alice will be able to claim (or stake within the V3ST) four percent (4%) (or 68 LOD3 Tokens) of her initial deposited balance After the first ninety (90) days, Alice can either claim or stake 204 LOD3 Tokens

Let’s assume that Alice claims the 204 LOD3 Tokens In this scenario, the tokens are transferred to her wallet. This action is also non-reversible, provided that only LTCs can be deposited on the Vesting contract

Table 3: V3ST Over Time Diagram

Table 3: V3ST Over Time Diagram

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 15

Table 4: Non-Reversible LOD3 Token Claiming Process Diagram

If Alice decides to stake her LOD3 Tokens, that means that the balance is kept within the V3ST, She will receive a reward fee every fifteen (15) days, paid out in LOD3 Tokens Additionally, she will receive VOT3 Tokens and she’ll be able to vote as long as she keeps her staked position (NOTE: in order to guarantee a fee reward equivalent to 7% APY over the course of two (2) years, the 15-day fee per LOD3 Token should account to 0 00289 LODE The fee is a reward for providing a service to the LOD3 Protocol and ensuring the continuity of operations).

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 16

Table 5: User Stakes LOD3 Tokens to V3ST Diagram

Assuming that Alice stakes every fifteen (15) days, she will be entitled to a reward fee and will be able to get that balance once she unstakes her position (NOTE: See below what happens at day one hundred and twenty (120), she will receive the reward fee AND she can also claim another 68 LODE).

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 17

Table 6: LOD3 Token Staking Rewards Diagram

If Alice decides to unstake her staked position, she will receive the staked capital plus the reward fees that she has collected over time In exchange for that, she will send 204 VOT3 Tokens that she received when staking the LODE balance While her LOD3 balance is unstaked, Alice can no longer cast a vote on any proposal. If she unstakes at day one hundred and thirty five (135), she receives a total amount of 210 LOD3 Tokens in her wallet Remember that once she gets that balance in her wallet, she is no longer able to stake it back into the V3ST - I tried to simplify this a bit - Please read

The final piece in the Vesting Program is “the Jackpot” From the moment that the V3ST is launched and up to twenty five (25) months afterwards, users can stake their claimable LOD3 balance in exchange for a reward fee calculated every fifteen (15) days. At the end of the twenty five (25) month period, only users who have kept their LODE balance staked will be able to claim a share in the Jackpot. It is composed of AUX/AGX/USDC/AVAX rewards that have been collected over time in the RG3N contract.

Table 7: Unstaking a Users Staked Position Diagram

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 18

If Alice has staked her full LOD3 balance prior to the staking deadline, the following scenario may apply:

Table 8: Jackpot Self-Claim Redemption Process Diagram

When Alice claims her Jackpot, she receives the total Jackpot balance accrued to her plus her staked position She can no longer stake any LOD3 balance after the staking period is over

What can she do with her LOD3 balance? Alice can stake it into the RG3N, which we’ll analyze in the next section

Reward Generator Workflow Overview

The Reward Generator is a key component of the LOD3 DAO Ecosystem, designed to incentivize and reward active participation among LOD3 Token Holders Its primary objective is to provide a structured and transparent mechanism through which users can earn rewards by staking their LOD3 Tokens, thereby enhancing their engagement with the protocol. This system not only offers financial incentives but also empowers participants with governance capabilities through VOT3 Tokens, fostering a vibrant and participatory community

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 19

Bob has 500 LOD3 Tokens. Using the RG3N, he can stake any amount of the balance and benefit from claimable rewards The first step is to actually stake the LOD3 Tokens, for which he will receive an equal amount of VOT3 Tokens Let’s assume that he staked 400 out of 500 LOD3 Tokens:

At such time as the rewards are deposited into the Generator or RG3N?, Bob will be able to see his share of the rewards that he is entitled to Provided that the rewards are available, he will be able to claim them, and thereafter, they are transferred to his wallet.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 20

If Bob decides to purchase other LOD3 Assets (ie. AUX and/or AGX Coins) using the LOD3 Protocol, he can lock his LOD3 balance for a period of six (6) months This balance will be automatically unlocked when the period expires Assuming the minimum threshold to lock is 200 and that Bob locks 250 LODE tokens:

Any non-locked balance can be unstaked at any time by Bob. For example, he could unstake 150 LOD3 Tokens and those tokens will appear in his wallet balance If he unstakes 100 LOD3 Tokens, an equal amount of VOT3 Tokens will be sent into the RG3N to be burnt, then the wallet display will appear as follows:

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 21

LOD3 Money Market / CAR3 Contracts Overview

The LOD3 Money Market, underpinned by the CAR3 contracts, represents a significant advancement in the LOD3 Ecosystem. This innovative smart contract protocol facilitates the lending and borrowing of RWA-backed tokens such as AUX (gold), AGX (silver) Coins, and LOD3 Tokens By leveraging the power of blockchain technology, the LOD3 Money Market aims to provide users with secure, transparent, and efficient financial services that enhance the utility and value of their precious metal-backed digital assets

WHY INTRODUCE THE LOD3 MONEY MARKET?

The introduction of the LOD3 Money Market addresses several key needs within the LOD3 Ecosystem:

1. Increased Utility for Tokens: By enabling lending and borrowing, the LOD3 Money Market increases the utility of AGX and AUX Coins, and LOD3 Tokens Users can now leverage their assets for additional financial activities, enhancing their overall value proposition.

2 Enhanced Liquidity: The money market creates liquidity pools for various coins/tokens, facilitating easier and more efficient transactions This increased liquidity supports market stability and encourages greater participation in the ecosystem.

3 Decentralized Financial Services: The LOD3 Money Market offers decentralized financial services that are accessible to anyone with a compatible wallet. This aligns with

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 22

the core principles of blockchain technology, promoting financial inclusion and reducing reliance on centralized financial institutions

4 Flexible Collateral Options: By allowing the use of multiple assets, including stablecoins and network currencies, as collateral, the LOD3 Money Market provides users with greater flexibility and options for managing their financial needs

BENEFITS OF THE LODE MONEY MARKET

1. Overcollateralized Lending: Ensures the security and solvency of the protocol by requiring borrowers to deposit collateral that exceeds the value of their loans This mitigates risk and protects lenders' interests.

2 Dynamic Interest Rates: Interest rates are determined by the supply and demand dynamics of each token's funds This market-driven approach ensures fair and competitive rates for both borrowers and lenders.

3 Liquidity Safeguards: A portion of the interest rate spread is allocated to the CAR3 Module, which acts as a liquidity safeguard in stressful scenarios This feature ensures the stability and resilience of the money market protocol.

4 Rewards for Stakers: LOD3 Holders who stake their tokens in the CAR3 Module receive rewards from the interest rate spread, incentivizing participation and supporting the overall health of the ecosystem

5 Decentralized Governance: The protocol operates under the governance of the LOD3 DAO, ensuring that all decisions regarding the money market are made transparently and democratically by the community

HOW IT WORKS

The LOD3 Money Market is a smart contract protocol intended for users to freely lend and borrow any of the issued RWA-backed tokens - that is, AUX and AGX Coins - as well as the LOD3 Token Interest rates are determined by supply and demand of each token’s funds according to a calculation which is independent among the available tokens. The lending program is overcollateralized at all times, meaning that not only borrowers must deposit a collateral whose value is higher than the value of the amount lent, but also that this must hold throughout the borrowing period - or else they may get liquidated.

There is a spread between the rate that borrowers pay and the one that lenders receive. The spread is assigned to guaranteeing a liquidity safeguard in stressful scenarios as well as rewarding the CAR3 module liquidity providers, who deposit LOD3 balances to be used in case of solvency issues.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 23

WORKFLOW DESCRIPTION

The LOD3 Money Market is a smart contract protocol composed of many token pools, each one with their own rules in terms of liquidity management and interest rate calculation Not only LOD3 Protocol assets are listed, but also the network currency as well as stablecoins. The reason for that is to expand the options for collateral and liquidity pairing and arbitraging:

Lenders can deposit their lent asset balances in the liquidity pools in exchange for liquidity assets that act as a receipt and enables lenders to track their balance in real time. For instance, Alice holds 100 AGX in her wallet and lends that balance into the pool, receiving mmAGX(money market AGX) - in exchange.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 24

Borrowers must first deposit collateral in order to borrow. Assuming that AGX is worth 1 USD and that the collateral-to-debt ratio is 0 8, Bob should deposit 125 USDC as collateral to borrow 100 AGX This collateral deposit is a loan and Bob will get paid a passive rate Then, he should proceed as follows:

Assuming that Alice lends 100 AGX, then Bob can borrow up to 100 AGX as long as the dollar value of his collateral is sufficient to exceed the collateral-to-debt ratio:

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 25

So far, the explanation has been focused on lending and borrowing quantities. In this model, the interest rate that is charged to borrowers is higher than the rate paid up to lenders to cover protocol expenses and rewards:

A share of that interest rate spread goes to the CAR3 Module: a contract where LOD3 Holders will be able to stake their balances to secure the operations of the money market protocol in stressful scenarios where there are solvency risks This share of the spread will be deposited to reward the CAR3 Module Stakers

LOD3 CAR3 MONEY MARKET SUMMARY

The LOD3 Money Market, powered by the CAR3 contracts, is a transformative addition to the LOD3 Ecosystem. It enhances the utility, liquidity, and overall value of precious metal-backed digital assets by providing decentralized lending and borrowing services. By introducing this money market, LOD3 DAO aims to foster a more dynamic and resilient financial ecosystem that empowers users and promotes long-term growth and stability. The inclusion of the CAR3 Module further strengthens the protocol by ensuring liquidity safeguards and rewarding participants, thereby creating a robust and inclusive financial platform

Proof-of-Reserves System

The Proof-of-Reserves (PoR) mechanism is fundamental to ensuring that the total supply of AGX and AUX Coins is always backed by corresponding physical reserves of silver and gold This mechanism guarantees transparency and trust within the LOD3 Ecosystem, providing users with confidence that their digital assets are securely backed by tangible, valuable resources

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 26

Implementation

The PoR System integrates various entities, each playing a crucial role in establishing a robust and verifiable proof of reserve These entities include the Attestation Agent, Vaulting Network, Reporting Agent, and the Oracle. Below is a detailed breakdown of how the PoR System works:

Attestation Agent

The Attestation Agent is responsible for verifying the physical reserves of silver and gold that back the AGX and AUX Coins. The Agent conducts regular audits and provides independent verification to ensure that the reported reserves match the actual holdings

Vaulting and Storage

Globally distributed vaulting networks provide secure vaulting and storage of the physical silver and gold assets. Their involvement ensures that the precious metals are stored in secure, insured, and audited facilities, providing a physical foundation for the digital tokens

Reporting and Audit

A designated network firm oversees the preparation of detailed reports and audit structures related to the reserves This firm ensures that all financial and physical audits adhere to stringent standards, offering a clear and accurate representation of the reserves.

On-Chain Data Provision

Oracles bridge the gap between real-world audits and the blockchain. They provide real-time, tamper-proof data feeds to the blockchain, ensuring that the on-chain representation of reserves is always current and accurate

INTEGRATING THE COMPONENTS

1. Data Collection and Verification

● Attestation Agent: Conducts regular audits of the physical reserves and provides verified data to the network firm

● Report and Audit Firm: Prepares detailed reports based on these audits, ensuring compliance with stringent standards.

2. Secure Storage

● Vaulting Network: Securely stores the physical silver and gold in insured and audited vaults They regularly report on the status of these reserves

3. On-Chain Integration

● Oracles: Integrate the verified data from the Attestation Agent and the Vaulting Network on to the blockchain, providing real-time updates on the reserve status

● PoR Dashboard: This data is fed into the LOD3 Ecosystem's PoR dashboard, accessible to all stakeholders for transparency.

4. Transparency and User Verification

● PoR Dashboard: Token holders and potential investors can independently verify the backing of AGX and AUX Coins via the PoR dashboard. The dashboard

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 27

displays real-time data on the reserves, enhancing trust and stability in the LOD3 Ecosystem

SUGGESTED IMPROVEMENT

1. Real-Time Data Flow Chart: Showing how data moves from physical audits to the blockchain via oracles

2. User Verification Process: A step-by-step guide on how users can access and interpret the PoR dashboard to verify token backing.

DIAGRAM OF THE PROOF-OF-RESERVES WORKFLOW

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 28

Liquidity and Market Integration

DEX & CEX LIQUIDITY

Providing Liquidity on Selected Decentralized Exchanges:

LOD3 Tokens will be made available on various decentralized exchanges (DEXs) to facilitate seamless trading and liquidity By strategically selecting DEXs, the goal is to enhance the accessibility and market presence of LOD3 Tokens.

Market Presence:

LOD3 continuously assesses and supports Ethereum Virtual Machine (EVM) chains based on their performance and compatibility with the ecosystem This proactive approach allows integration with high-performing chains, ensuring optimal functionality and user experience

TOKEN ALLOCATION FOR LIQUIDITY

Seeding Liquidity:

LOD3 plans to allocate a percentage of its total token supply to seed liquidity on both centralized exchanges (CEXs) and decentralized exchanges (DEXs). This allocation aims to ensure sufficient liquidity, reduce price volatility, and support healthy trading volumes Providing initial liquidity enhances market stability and attracts new investors and traders to LOD3 Tokens

TIMELINES AND PHASES FOR LIQUIDITY PROVISION AND MARKET INTEGRATION

Phase 1: Initial Liquidity Provision (Q3 2024)

● CEX Integration: Listing LOD3 Tokens on a major centralized exchange to ensure broader market access

● DEX Integration: Providing initial liquidity on selected decentralized exchanges to facilitate seamless trading (Trader Joe and ShibaSwap)

● Marketing Campaign: Launching a comprehensive marketing campaign to promote LOD3 Token listings and attract token holders.

● Community Engagement: Enhancing community engagement through AMAs, webinars, and partnerships to increase awareness and adoption

Phase 2: Expanding Market Presence (Q4 2024)

● Liquidity Incentives: Introducing liquidity mining programs and other incentives to encourage users to provide liquidity on DEXs

● Community Engagement: Enhancing community engagement through AMAs, webinars, and partnerships to increase awareness and adoption.

Phase 3: Long-Term Liquidity Strategy (2025 and Beyond)

● Sustained Liquidity Support: Continuously monitoring and adjusting liquidity provisions to ensure market stability and support healthy trading volumes

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 29

● Cross-Chain Integration: Expanding cross-chain capabilities to integrate LOD3 Tokens with multiple blockchain networks, enhancing liquidity and accessibility

● Ongoing Development: Investing in ongoing development to enhance the LOD3 Ecosystem's functionality, user experience, and market integration capabilities.

● Community Engagement: Enhancing community engagement through AMAs, webinars, and partnerships to increase awareness and adoption.

By implementing these phases, the LOD3 DAO aims to build a robust and sustainable liquidity foundation for LOD3 Tokens, ensuring their widespread adoption and integration within the global financial ecosystem

Governance and Rewards

DAO GOVERNANCE

Operating as a DAO:

LOD3 operates as a Decentralized Autonomous Organization (DAO), empowering token holders with voting rights to influence key decisions within the ecosystem. This governance model is facilitated through Snapshot.org, known for its secure and transparent voting processes

Quadratic Voting:

To support governance operations, LOD3 has implemented quadratic voting This innovative voting system ensures a more equitable distribution of voting power by giving smaller holders a proportionally larger influence on the outcomes Quadratic voting helps prevent dominance by large stakeholders and encourages broader community participation

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 30

KEY GOVERNANCE FEATURES AND REWARDS

Feature Description

DAO Structure

Decentralized Autonomous Organization (DAO) empowering token holders with governance rights

Voting Platform Uses Snapshot org for secure and transparent voting processes

Quadratic Voting

Proposal Submission

Ensures equitable distribution of voting power, preventing dominance by large stakeholders and encouraging broader community participation.

Token holders with a minimum of 1,000,000 LOD3 Tokens can submit proposals for protocol changes, new features, or other significant decisions.

Voting Rights

Implementation

Reward Distribution

Monitoring and Reporting

VOT3 Token Holders can vote on submitted proposals, with each VOT3 Token representing one vote.

Approved proposals are implemented by relevant teams within the DAO, such as LOD3 Labs or other designated Service Providers

Stakers and active participants are rewarded with additional LOD3 Tokens or other incentives

Ongoing monitoring of implemented changes to ensure they meet desired objectives, with regular reports provided to the community for transparency and accountability.

GOVERNANCE WORKFLOW

1 Proposal Submission: Community members with at least 1,000,000 LOD3 Tokens can submit proposals.

2 Discussion and Review: Proposals are discussed in community forums and reviewed by relevant committees.

3 Voting: VOT3 Token Holders vote on proposals using Snapshot org

4 Implementation: Approved proposals are executed by relevant teams

5. Reward Distribution: Active participants and stakers receive rewards.

6 Monitoring and Reporting: Regular updates and reports are shared with the community

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 31

AGX AND AUX COIN DISTRIBUTION

AGX and AUX Coins represent digital silver and gold, respectively. Each AGX Coin is backed by one gram of silver, and each AUX Coin is backed by one milligram of gold

Category

Allocation Description

Minted Based on Reserves Variable

Staking Rewards TBD

Community and Incentives

TBD

Liquidity Fund TBD

Reward Generator Workflow

AGX and AUX Coins are minted based on the amount of physical silver and gold held in reserve.

Rewards distributed to users staking AGX and AUX Coins

Used for community initiatives and incentivizing participation

Ensures sufficient liquidity for AGX and AUX Coins on various platforms

The Reward Generator incentivizes LOD3 Token Holders to stake their tokens and participate in governance Here’s how it works:

Step Description

Staking

Reward Accumulation

Reward Claiming

Additional Benefits

Unstaking

Users stake their LOD3 Tokens to receive VOT3 Tokens

Rewards are periodically deposited into the RG3N Contract

Users can claim their share of rewards, which are transferred into their wallet.

Users can lock their LOD3 Tokens for additional benefits such as buying AGX or AUX Coins at spot price

Non-locked balances can be unstaked at any time, with VOT3 Tokens burnt accordingly.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 32

VESTING CONTRACT WORKFLOW

The Vesting Contract allows users to deposit LTCs and receive LOD3 Tokens over time. Below is the detailed process:

Step

Initial Deposit

Monthly Claims

Staking Rewards

Final Unlocking

Description

Users deposit LTCs, which are then burnt, initiating the vesting process.

Every thirty (30) days, users can claim four percent (4%) of their initial deposited balance in LOD3 Tokens

Users can choose to stake their claimed LOD3 Tokens within the Vesting contract for additional rewards

After twenty five (25) months, users can claim any remaining LOD3 Tokens and receive a jackpot of additional rewards.

GOVERNANCE STRUCTURE

The governance structure ensures that major decisions are made by the community, leveraging the decentralized nature of the DAO

Role Responsibility

Community Members

Participate in discussions, submit proposals, and vote on protocol changes.

Foundation Provides legal and structural support, manages treasury, and ensures regulatory compliance.

Technical Committee Oversees technical development and security of the protocol

Financial Committee Manages financial operations, including budgeting and auditing.

Service Providers LOD3 Digital focuses on technology development.

Suggested Improvement: Pie chart to visually represent the token allocation.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 33

Governance

LODE DAO GOVERNANCE

The LOD3 DAO is managed by its community members to ensure the efficiency and stability of the protocol. Beyond technical development, the DAO's mandate is to promote the adoption of LOD3’s precious metals-backed digital assets and recruit new users, fostering the growth of decentralized finance (DeFi) applications within the LOD3 Ecosystem and across other compatible blockchains.

For a full overview of the responsibilities of the LOD3 DAO, please refer to the DAO Charter available on the LOD3 DAO website

DECENTRALIZED AUTONOMOUS ORGANIZATION (DAO)

The LOD3 DAO operates as a Decentralized Autonomous Organization, which governs the LOD3 Ecosystem

A DAO is the optimal structure for LOD3 because it ensures adaptability and continuous improvement of the protocol. Governance decisions made by the DAO are more democratic and inclusive compared to decisions made by a single developer or team The DAO will accumulate service fees from LOD3’s various products and services, which can be funneled into future development, growth funds, and distributed by the DAO.

THE LOD3 COUNCIL

The LOD3 Council is a set of elected individuals from the DAO who act as a security layer for the DAO. The council has veto power and the responsibility to monitor transactions. This becomes necessary if there is undue influence on the governance process, where an individual or group of individuals attempts to purchase enough tokens to form a controlling interest within the DAO

The mandate of the LOD3 Council is to further the mission of LOD3 DAO in promoting DeFi solutions backed by precious metals, ensuring that actions taken are in good faith and for the betterment of the community

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 34

GOVERNANCE STRUCTURE

The governance structure ensures that major decisions are made by the community, leveraging the decentralized nature of the DAO

Role Responsibility

Community Members Participate in discussions, submit proposals, and vote on protocol changes.

Foundation Provides legal and structural support, manages treasury, and ensures regulatory compliance

Technical Committee Oversees technical development and security of the protocol.

Financial Committee Manages financial operations, including budgeting and auditing

G3NUINE Metals product platform

Service Providers

LOD3 Labs focuses on technology development

G3NUINE Digital: Administration and Operations

KEY COMPONENTS OF LOD3 DAO GOVERNANCE

Community members within the LOD3 DAO can actively participate in governance by submitting proposals for protocol changes, new features, or other significant decisions, provided they hold a minimum of 1,000,000 LOD3 Tokens This requirement ensures that only significant stakeholders can propose changes, promoting stability and thoughtful decision-making.

Voting on these proposals is conducted by VOT3 Token Holders, utilizing a decentralized platform like Snapshot.org to ensure transparency and security. Each VOT3 Token represents one vote, and the decentralized nature of the platform ensures that the voting process is secure and transparent.

Once a proposal is approved, it is implemented by the relevant teams within the DAO, such as LODE Labs, G3NUINE Digital and G3NUINE Metals or other designated service providers. This structured approach ensures that all approved proposals are executed efficiently and effectively

Reward distribution is an integral part of the governance model. Stakers and active participants are rewarded with additional LOD3 Tokens or other incentives, encouraging continuous engagement and participation in the governance process

Finally, ongoing monitoring and reporting ensure that the implemented changes meet the desired objectives. Regular reports are provided to the community, maintaining transparency and accountability, and allowing for adjustments to be made if necessary This comprehensive

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 35

governance structure fosters a robust, inclusive, and transparent environment for all LOD3 DAO stakeholders

By adopting a DAO structure, LOD3 ensures that its governance is transparent, inclusive, and adaptable, fostering a robust and resilient ecosystem for its precious metals-backed digital assets.

Reward Generator Distribution

The MotherLOD3: Unlocking 7 Streams of Staking Revenue

R3GN

REWARD SOURCES (INFLOWS)

Fee Type Description

Spot Plus Fees from above spot price transactions

Spot Under Fees from below spot price transactions

Redemption Fees for redeeming to physical precious metals

Arbitrage Fees from arbitrage activities

Money Market Fees from lending and borrowing spreads

Transaction Fees collected from transactions

Card Program Fees Fees collected from card program

RG3N R3WARDS

The inflow sources and their allocations are structured to ensure balanced growth and reward distribution within the LOD3 Ecosystem. This allocation strategy ensures that the rewards are distributed equitably across different areas, promoting overall growth and stability of the LOD3 DAO Ecosystem By integrating these mechanisms, LOD3 DAO aims to foster a robust, secure, and engaging ecosystem where participants are rewarded for their contributions, ensuring long-term sustainability and success

LOD3 DAO WHITEPAPER / JUNE 2024

Inflow Source To Stakers Liquidity Pools Operation s Ecosystem Growth Total Allocation RG3N Inflows 30% 20% 20% 30% 100%

THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 36

NEW LOD3 WALLET

The new LOD3 Wallet is designed to support the advanced features and functionality of the LOD3 Ecosystem It offers enhanced security, user-friendly interfaces, and integrated support for staking, vesting, and reward claiming. This wallet is crucial for managing digital assets and interacting with the various components of the LOD3 Ecosystem, including the Proof-of-Reserves (PoR) dashboard and the G3nuine Platform

DASHBOARD FOR POR AND G3NUINE PLATFORM

The new dashboard will provide a comprehensive interface for managing the PoR and integrating the G3nuine Platform into the LOD3 Ecosystem This dashboard will offer real-time data on reserves, transaction tracking, and support for various financial activities, including the card program The integration of the G3nuine Platform will enhance the ecosystem's robustness, offering features like seamless payments, lending, and borrowing.

PILOT LAUNCH WITH G3NUINE

LOD3 will be the pilot client for the G3nuine Platform, which will offer LOD3 Labs and the LOD3 DAO access to its advanced functionalities. In exchange, G3nuine will receive a revenue share associated with profits earned from their platforms use within LOD3 Also, G3nuine will hold LOD3 Tokens to support the ongoing partnership, contributing to the ecosystem's rewards streams and overall growth.

Roadmap and Future Development

MILESTONES

Liquidity and Trading:

Establishing liquidity on selected decentralized exchanges (DEXs) and integrating with centralized exchanges (CEXs) will facilitate the trading of LOD3 Tokens, AGX, and AUX Coins on AVAX and Shibarium This step is crucial for enhancing market access and ensuring that users can easily buy, sell, and trade their tokens

Proof-of-Reserves (PoR):

Full implementation of the Proof-of-Reserves system will ensure that all AGX and AUX Coins are backed by corresponding physical reserves of silver and gold. This mechanism involves regular audits by third-party entities and real-time data feeds from Chainlink oracles, enhancing transparency and trust within the ecosystem.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 37

CAR3 Contract to Support Lending and Borrowing:

The CAR3 contract will introduce an “Aave-like” borrowing and lending platform within the LOD3 Ecosystem This will enable users to lend and borrow LOD3 Tokens, AGX, and AUX Coins, providing greater rewards and utility for LOD3 Token Holders.

FUTURE PLANS

Cross-Chain

Expansion:

LOD3 DAO plans to support additional EVM-compatible chains, expanding the ecosystem's reach and interoperability This cross-chain expansion will enable users to interact with LOD3 Tokens, AGX, and AUX Coins across various blockchain networks, increasing their utility and accessibility

Lending Market:

The development of a native money market for LOD3 Tokens, AGX, and AUX Coins will provide users with opportunities to lend and borrow within the ecosystem. By leveraging the CAR3 contract, users can earn greater rewards and enhance the utility of their LOD3 Tokens, fostering a more dynamic and robust financial ecosystem

Acquisition Strategy:

Establishing conditions for the acquisition of LOD3 Tokens and their migration to LOD3 will ensure a smooth transition and integration within the new DAO framework. This strategy will focus on enhancing liquidity, supporting ongoing development, and ensuring that the LOD3 Ecosystem remains competitive and resilient.

GIV3 Donation Contract:

The GIV3 contract will enable users to donate a portion of their LOD3 Tokens, AGX, and AUX Coins to various causes and projects supported by the LOD3 DAO This initiative will not only promote philanthropic activities within the community but also foster a culture of giving and social responsibility. Donations made through the GIV3 contract will be transparent and trackable, ensuring that funds are allocated appropriately and effectively

Token Burning Mechanism:

To help manage the token supply and promote the value of LOD3, a token burning mechanism will be implemented. Periodically, a portion of the LOD3 Tokens collected from transaction fees, unused rewards, and other sources will be permanently removed from circulation This reduction in supply will help counteract inflationary pressures and support the long-term value appreciation of the LOD3 Token. The burning events will be transparent and verifiable on the blockchain, ensuring trust and confidence among the community members

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 38

Roadmap Summary

By achieving these milestones and executing future plans, the LOD3 DAO aims to create a comprehensive and decentralized financial ecosystem The integration of the CAR3 contract will significantly enhance the lending and borrowing capabilities within the platform, offering users more ways to engage with and benefit from their LOD3 Tokens, AGX, and AUX Coins. The GIV3 contract and token burning mechanism further strengthen the ecosystem by promoting social responsibility and maintaining token value. This roadmap underscores LOD3 DAO’s commitment to innovation, transparency, and community-driven growth, ensuring a sustainable and inclusive financial future LOD3

Milestone

Token Release

Date/Quarter Description

Q3 2024

Cross-Chain Expansion Q3 2024

Liquidity and Trading Q3-Q4 2024

Proof-of-Reserves (PoR) Q4 2024

CAR3 Contract Q1 2025

Lending Market Q3 2025

Acquisition Strategy Q4 2025

GIV3 Donation Contract

Q1 2026

Token Burning Mechanism Q2 2026

Launch of the LOD3 Token and continued support for AGX and AUX Coins.

Support for Shibarium and AVAX C-Chain for AGX and AUX Coins.

Establish liquidity on selected decentralized exchanges (DEXs) and integrate with centralized exchanges (CEXs)

Full implementation of the PoR mechanism with regular audits and real-time data feeds

Launch of the CAR3 contract to support lending and borrowing within the ecosystem.

Develop a native money market for LOD3 Tokens, AGX, and AUX Coins, leveraging the CAR3 contract.

Establish conditions for the acquisition of LOD3 Tokens and their migration to LOD3.

Implement the GIV3 contract to enable token donations for various causes and projects.

Introduce a token burning mechanism to manage supply and support token value

DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 39

Roadmap with Timeline

RISKS

Smart Contract Security

● Importance: Ensuring the security of the LOD3 DAO Ecosystem is paramount

● Risk: Potential vulnerabilities in smart contracts.

● Mitigation: Rigorous public audits and collaborations with reputable bug bounty partners to identify and address security issues promptly

Blockchain Technology Risks

● AVAX C-Chain and Shibarium Chain Technical Risk:

● Risk: Failures or issues within the AVAX C-Chain and Shibarium blockchains could impact LOD3 DAO's success.

● Mitigation: Leveraging the robust security protocols and strong uptime records of these reputable blockchains

Adoption Risks

● Shibarium and AVAX Chain Adoption Risk:

● Risk: Slow or limited adoption of Shibarium and AVAX chains could impact the rewards earned through the LOD3 DAO Ecosystem.

● Mitigation: Continuous marketing efforts, strategic partnerships, and proactive user engagement to drive adoption.

DAO Threshold Key Management Risk

● Risk: Potential failure in the distributed threshold key management system

● Mitigation: Employing robust security measures, regular audits, and using the most secure threshold management protocols available

Token Price Volatility

● LOD3 Token, AGX, and AUX Coin Price Risk:

● Risk: Market prices of LOD3 Token, AGX, and AUX Coins may be volatile due to various factors

● Mitigation: Implementing arbitrage mechanisms, risk-free market making, automated liquidity management, and incentivizing user-added liquidity

Slashing Risk

● Risk: Validators on AVAX C-Chain and Shibarium networks may face staking penalties and slashing

● Mitigation: Distributing stakes to reliable node operators, employing multiple heterogeneous setups, and ensuring adherence to best practices by validators.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 40

Governance and Operational Risks

● DAO Governance Risks:

● Risk: Challenges related to decision-making delays, governance attacks, and undue influence by large stakeholders.

● Mitigation: Implementing robust governance frameworks, transparent voting mechanisms, and establishing checks and balances through the LOD3 DAO Council.

Legal and Regulatory Risks

● Compliance and Regulatory Risks:

● Risk: Navigating complex and evolving regulatory landscapes.

● Mitigation: Regular legal reviews, adherence to regulatory requirements, and proactive engagement with regulatory bodies

Conclusion

LOD3 DAO represents a significant evolution in the tokenization of precious metals, leveraging blockchain technology to create a decentralized, transparent, and community-driven ecosystem By addressing the limitations of traditional precious metals investment options and centralized digital gold tokens, the LOD3 DAO provides a secure, efficient, and inclusive financial system

KEY POINTS OF THE WHITEPAPER

1. Tokenization of Precious Metals:

● Introduction of AGX and AUX Coins, backed by physical silver and gold reserves

● Tangible and verifiable investments through regular audits and real-time data feeds.

2. Innovative Governance Structure:

● Empowered by the LOD3 Token, promoting active community participation and decision-making.

● Transparent and democratic operational environment

3. Enhanced Utility and Value:

● Integration of the PoR mechanism for transparency

● Introduction of the CAR3 lending and borrowing platform

● Implementation of the GIV3 donation contract to promote social responsibility.

● Planned token burning mechanism to manage supply and support long-term value appreciation

4. Cross-Chain Capabilities and Lending Market:

● Expansion to support additional EVM-compatible chains

● Development of a native money market for LOD3 Token, AGX, and AUX Coins

5. Commitment to Innovation and Growth:

● Comprehensive roadmap highlighting strategic initiatives

● Focus on fostering a resilient and adaptable financial ecosystem.

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 41

UNIQUE SELLING POINTS

● Decentralization and Transparency: Community-governed ecosystem ensuring transparency and reducing centralization risks

● Tangible Backing: AGX and AUX Coins backed by physical precious metals, providing secure and verifiable investments

● Enhanced Financial Utility: Staking, lending, and borrowing opportunities, along with DeFi integration.

● Social Responsibility: GIV3 contract promoting philanthropy and community involvement

● Sustainable Growth: Token burning mechanism to manage supply and enhance token value

CALL-TO-ACTION

As LOD3 DAO continues to expand its cross-chain capabilities and develop its lending market, it aims to provide users with greater flexibility and opportunities within the DeFi ecosystem The comprehensive roadmap underscores LOD3 DAO's commitment to innovation, transparency, and community-driven growth, ensuring a resilient and adaptable financial future.

By fostering a robust, secure, and transparent ecosystem, the LOD3 DAO is poised to lead the market in digital precious metals, providing users worldwide with a stable and decentralized financial alternative We invite potential investors and participants to join us in this pioneering journey, contributing to and benefiting from the continuous success and evolution of the LOD3 Ecosystem Become a part of LODE DAO today and help shape the future of decentralized finance

SOURCES

Technical review of both the Shibarium and LOD3 DAO whitepapers assisted in producing the document above. The LOD3 DAO took inspiration from both projects in creating this document and also made its own technical breakthroughs. Additionally, insights from K9 Finance, AVAX, and Shibarium were integral to shaping the LOD3 DAO framework and functionalities

DISCLAIMER

PLEASE READ THIS DISCLAIMER SECTION CAREFULLY IF YOU ARE IN ANY DOUBT AS TO THE ACTION YOU SHOULD TAKE, YOU SHOULD CONSULT YOUR LEGAL, FINANCIAL, TAX, OR OTHER PROFESSIONAL ADVISOR(S)

The information set forth below may not be exhaustive and does not imply any elements of a contractual relationship While the LOD3 DAO makes every effort to ensure that any material in this whitepaper is accurate and up-to-date, such material in no way constitutes the provision of professional advice The LOD3 DAO does not guarantee and accepts no legal liability whatsoever arising from or connected to the accuracy, reliability, currency, or completeness of any material contained in this whitepaper Investors and potential LOD3 Token Holders should seek appropriate independent professional advice before relying on or entering into any commitment or transaction based on material published in this whitepaper, which material is purely published for reference purposes alone

LOD3 Tokens are not intended to constitute securities in any jurisdiction This whitepaper does not constitute a prospectus or offer document of any sort and is not intended to constitute an offer of securities or a solicitation for investment in securities in any jurisdiction The LOD3 DAO does not provide any opinion or advice to purchase, sell, or otherwise transact with LOD3 Tokens, and

LOD3 DAO WHITEPAPER / JUNE 2024

THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 42

the fact of the presentation of this whitepaper shall not form the basis of, or be relied upon in connection with, any contract or investment decision No person is bound to enter into any contract or binding legal commitment in relation to the sale and purchase of LOD3 Tokens, and no cryptocurrency or other form of payment is to be accepted on the basis of this whitepaper

This whitepaper is for informational purposes only We do not guarantee the accuracy of or the conclusions reached in this whitepaper, and this whitepaper is provided “as is” This whitepaper does not make and expressly disclaims all representations and warranties, express, implied, statutory, or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or non-infringement; (ii) that the contents of this whitepaper are free from error; and (iii) that such contents will not infringe third-party rights The LOD3 DAO and its affiliates shall have no liability for damages of any kind arising out of the use, reference to, or reliance on this whitepaper or any of the content contained herein, even if advised of the possibility of such damages In no event will the LOD3 DAO or its affiliates be liable to any person or entity for any damages, losses, liabilities, costs, or expenses of any kind, whether direct or indirect, consequential, compensatory, incidental, actual, exemplary, punitive, or special for the use of, reference to, or reliance on this whitepaper or any of the content contained herein, including, without limitation, any loss of business, revenues, profits, data, use, goodwill, or other intangible losses

The LOD3 DAO makes no representations or warranties (whether express or implied) and disclaims all liability arising from any information stated in the whitepaper In particular, the “Roadmap” as set out in the text of the whitepaper is subject to change, which means that LOD3 DAO is not bound by any representations to the future performance and the returns of LOD3 The actual results and the performance of the LOD3 DAO may differ materially from those set out in the LOD3 DAO whitepaper

Please note that contents of the LOD3 DAO whitepaper may be altered or updated at any time in future by the project’s management team; thus the DAO The whitepaper has been exclusively prepared to address the token generation aspect of LOD3 Tokens No shares or other securities of the LOD3 DAO are being offered in any jurisdiction pursuant to the whitepaper The whitepaper does not constitute an offer or invitation to any person to subscribe for or purchase shares, rights, or any other securities in the LOD3 DAO The shares of the LOD3 DAO are not being presently offered to be registered under the Securities Act of any country, or under any securities laws of any state The tokens referred to in this whitepaper have not been registered, approved, or disapproved by any regulatory authority nor any of the foregoing authorities examined or approved the characteristics or the economic realities of this token sale or the accuracy or the adequacy of the information contained in this whitepaper under the US Securities Act of 1933 as amended, or under the securities laws of any state of the United States of America or any other jurisdiction Purchasers of the tokens referred to in this whitepaper should be aware that they bear any risks involved in acquisition of LOD3 Tokens, if any, for an indefinite period of time Some of the statements in the whitepaper include forward-looking statements which reflect LOD3 DAO's current views with respect to product development, execution roadmap, financial performance, business strategy, and future plans, both with respect to the company and the sectors and industries in which the company operates Statements which include the words ''expects'', ''intends'', ''plans'', ''believes'', ''projects'', ''anticipates'', ''will'', ''targets'', ''aims'', ''may'', ''would'', ''could'', ''continue'' and similar statements are of a future or forward-looking nature All forward-looking statements address matters that involve risks and uncertainties Accordingly, there are or will be important factors that could cause the group's actual results to differ materially from those indicated in these statements These factors include but are not limited to those described in the part of the whitepaper entitled ''Risk Factors'', which should be read in conjunction with the other cautionary statements that are included in the whitepaper Any forward-looking statements in the whitepaper reflect the group's current views with respect to future events and are subject to these and other risks, uncertainties, and assumptions relating to the group's operations, results of operations, and growth strategy These forward-looking statements speak only as of the date of the whitepaper Subject to industry acceptable disclosure and transparency rules and common practices, the company undertakes no obligation publicly to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise All subsequent written and oral forward-looking statements attributable to the LOD3 DAO or individuals acting on behalf of LOD3 DAO are expressly qualified in their entirety by this paragraph No statement in the whitepaper is intended as a profit forecast and no statement in the whitepaper should be interpreted to mean that the earnings of the LOD3 DAO for the current or future years may be implied in this whitepaper By agreeing to acquire LOD3 Tokens, I hereby acknowledge that I have read and understand the notices and disclaimers set out above

No regulatory authority has examined or approved of any of the information set out in this whitepaper Thus, no action has been or will be taken under the laws, regulatory requirements, or rules of any jurisdiction The publication, distribution, or dissemination of this whitepaper does not imply that the applicable laws, regulatory requirements, or rules have been complied with Please refer to our website for Terms & Conditions of participating in LOD3 DAO token offering

The purchase of LOD3 Tokens is not a financial opportunity. The Tokens have no underlying value and are for utility purposes only. They can only be used within a specific ecosystem to engage with licensed software or reward mechanisms for online purchases

DO NOT PURCHASE THIS TOKEN OR ENGAGE WITH ANY OF THE LODE SERVICES (AS DEFINED IN THE TOKEN TERMS) IF YOU EXPECT PROFIT, GAIN, OR TO BENEFIT FINANCIALLY FROM ACQUIRING THIS TOKEN

LOD3 DAO WHITEPAPER / JUNE 2024 THE FUTURE OF DECENTRALIZED PRECIOUS METALS TOKENIZATION 43

Table 3: V3ST Over Time Diagram