is produced 4 times per year

Summer Issue (July)

Deadline – June 15th Fall Issue (October)

Deadline – September 15th Winter (January) Deadline – December 15th Spring (May) Deadline – April 15th

Articles of interest to condominium owners and directors are welcome. See details for submissions on page 50.

To advertise contact: Golden Horseshoe Chapter of the Canadian Condominium Institute

Box 37, Burlington, Ontario L7R 3X8

Tel: 905-631-0124 | 1-844-631-0124 Fax: 416-491-1670 Email: admin@cci-ghc.ca

The authors, the Canadian Condominium Institute, and its representatives will not be held liable in any respect whatsoever for any statement or advice contained herein. Articles should not be relied upon as a professional opinion or as an authoritative or comprehensive answer in any case. Professional advice should be obtained after discussing all particulars applicable in the specific circumstances in order to obtain an opinion or report capable of absolving condominium directors from liability [under s. 37 (3) (b) of the Condominium Act, 1998].

Authors’ views expressed in any article are not necessarily those of the Canadian Condominium Institute. All contributors are deemed to have consented to publication of any information provided by them, including business or personal contact information.

Advertisements are paid advertising and do not imply endorsement of or any liability whatsoever on the part of CCI with respect to any product, service or statement.

#LifeIsGolden

Its hard to believe, as I am writing this, we are less than 2 weeks away from the festive holiday break. 2022 has flown by. Its been a whirlwind of covid, restrictions, re-opening, shortages of so many things that we used to take for granted, incredible cost increases and trying our best to get back to normal.

Fall has been busy for the Golden Horseshoe Chapter. Our annual general meeting was held in October. We welcome 4 new members to our Board of Directors. Alicia Gatto (Gatto Professional Corporation), Patrick Greco (Shibley Righton, LLP), Will MacKay (CIBC Wood Gundy) and Denis Theriault (Exp Services).

At our first board meeting, they have all jumped in to take an active role on the board and our committees. Alicia will take over the Treasurer position and Will has volunteered for the Secretary position. Special thanks to our wonderful sponsors for the AGM: Belanger Engineering, CIBC Wood Gundy, CWB Maximum Financial, Detail Roofing, McIntosh Perry & Morrison Financial.

The 2022 Condo of the Year Award went to WSCC 514, also known as the Dundas District Lofts. Thomas Nederpel was present to accept the award on behalf of his Condo Corporation.

We would like to extend our appreciation to the outgoing board members; Gail Cote, Joe Gaeten, Tony Gatto and Stephanie Sutherland. Your contributions on the board have been invaluable. We know that we can look forward to your ongoing support to our committees in the coming years.

After many long years on the Board, we regret to advise that Ed Keenleyside has decided to resign from the Board. He has been a very active board and committee member over the years, and we will most definitely miss his contributions to our meetings and events. Diana Lawrie has been appointed to fill Ed’s position on the board.

We thank all of the new volunteers that have joined our committees this fall. Its great to hear that we have some new faces on these committees, we look forward to your new and exciting ideas.

All of our committees are busy at work planning events for 2023.

• Jan 11th is a Level 300 course – The Life of a Condo, from Infant to Toddler.

If you are in a new condo or board member in a condo that is under 2 years old, this course is a must attend.

It is an in-person evening event at the Burlington Art Centre.

• Jan 17th is a Condo Talk – Security Cameras and Privacy This is a virtual event at noon.

• Jan 20th is the first in person Lunch and Learn in a few years - Breaking Down Barriers – Understanding your Condo’s Accessibility Obligations

• Feb 21st is another Condo Talk on Aging, Death and Mental Health and the Role of Condos

• More Tool Talks are anticipated as well

• Check out the CCI website for events already being planned for March, April and May. We have lots of exciting topics coming up.

•

Golden Horseshoe Chapter of the Canadian Condominium Institute Box 37, Burlington, Ontario L7R 3X8 Tel: 905-631-0124 | Toll Free 1-844-631-0124 Fax: 416-491-1670 | Email: admin@cci-ghc.ca Website: Website: www.cci-ghc.ca

Sandy Foulds, RCM, BA

PAST-PRESIDENT

Maria Durdan, B.A., LL.B., ACCI (Member Education Committee, Member Finance Committee, Member Ron Danks Award Committee)

VICE-PRESIDENT

Richard Elia, B.Comm., LL.B, LL.M (ADR) ACCI (Board Liaison Education Committee)

TREASURER

Alicia Gatto, CPA, CA, LPA (Chair Finance Committee)

SECRETARY

Will MacKay, CFP, CIM (Member Finance Committee)

Carole Booth, B.Ed., M.A. (Board Liaison Communications Committee, Member Education Committee, Member External Relations Committee, Member Governance/Policy Committee)

Sally-Anne Dooman, RCM (Member Education Committee)

Tom Gallinger, BBA, FCIP

Patrick Greco, B.A.Sc., LL.B. (Chair Policy & Governance Committee)

Diana Lawrie

Thomas F. Nederpel, BSc, PEng (Chair External Relations Committee)

Kevin Shaw, B.Tech (Arch. Sc) (Board Liaison Professional & Business Partners’ Committee)

Denis Theriault

Our conference committee is also preparing for the annual conference. It will be held on Sept 15th. Mark your calendars for this great event.

Our education committee is also finalizing the plans for running the new education program which CCI has now standardized for the province. This will replace the previous Level 200 sessions. This new program will begin in February and run through May. There are 8 sessions in the program. The education committee expects to run 2 sessions per month, each session taking about 2 hours. These sessions will be remote; there will be a two-day in person session in the fall. Stay tuned for more details on this exciting new program.

In closing, I extend my great appreciation to our dedicated volunteers and sponsors, my fellow board members and everyone behind the scenes at Association Concepts. Your enthusiasm and commitment to CCI helps to ensure we continue to be a very successful chapter.

We wish you all the best in 2023!

Sandy Foulds, RCM, B.A.

The GHC-CCI Communication Committee is an extremely busy and dedicated committee with members from a variety of backgrounds. The committee has nine members; they are Gail Cote and Craig McMillan (Co-Chairs), Carole Booth (Board Liaison), Colin Ogg, Bill Clark, Jeremy Nixon, Dave Williams, Paola Beci Gjata, and Tim Van Zwol.

The committee meets approximately 6 to 8 times a year via Zoom to discuss and designate articles and authors for upcoming issues Condo News. During the year the committee produces four digital issues (Winter, Spring, Summer, and Fall) focusing on timely, relevant and seasonal topics, which impact condominium communities –including the residents, directors, property managers and companies that provide services. The Winter issue features the GCH-CCI Professional and Business Partners Committee members as well.

If you have an idea for an article, would like to contribute an article or advertise in the magazine, please contact the administration office at 905-631-0124 or via email at admin@cci-ghc.ca

In July, 73 Burlington Community Service Awards were presented by Karina Gould, MP Burlington and Mayor Marianne Meed Ward, to celebrate Queen Elizabeth II’s Platinum Jubilee. Each award winner received a commemorative pin and a certificate.

Ed Keenleyside was recognized for his dedication, accomplishments and contributions in the following organizations: Scouts Canada, Royal Botanical Gardens, Legion, Bruce Trail Association, Historical Society. Friends of Freeman Station. Teen Tour Band, Burlington Condominium Association, and the Golden Horseshoe Chapter of Canadian Condominium Institute.

In addition, Ed is devoted to preserving the history of Burlington. His research identified several errors etched on the Burlington Cenotaph and resulted in those errors being corrected in time for the Cenotaph Centennial on April 9, 2022.

As a condominium director or manager, it can feel like every year there are new laws to comply with and therefore worry about. Within the past five years, the amendments to the Condominium Act, 1998 (the “Condo Act”) and the Condominium ManagementServicesAct are just two examples. But every rare once in a while, one of the laws that applies to condominiums actually gives condos a bit of a break. Such was the case when Bill 118 came into force two years ago, on January 29, 2021.

Bill 118 amended the Occupiers’ Liability Act (the “OLA”). Under the OLA, an “occupier” is defined as any person in physical control of a premises or who controls any of the con-dition of, activities on, or persons on a premises. The occupier has a legal duty to take all reasonable steps to ensure that people and property entering the premises are kept rea-sonably safe. Under section 26 of the Condo Act, a condominium corporation is deemed to be the occupier of its common elements and is therefore bound by the obligations under the OLA.

An occupier found to be in breach of its duties under the OLA can be found liable and ordered to pay damages to a party who suffered as a result. Site conditions that could expose an occupier to liability under the OLA in the case of an incident include:

• Snow and ice that has not been properly cleared or salted;

• Unexpected elevation changes;

• Uneven surfaces due to cracks, gaps or potholes;

• Slippery surfaces, such as wet floors or spills;

• Missing or loose handrails on stairs;

• Debris on walkways; and

• Inadequate lighting

Generally, in Ontario, someone who suffers damages due to an occupier’s breach of the OLA must file a lawsuit within two years of the date when they knew or ought to have known that they had a legal claim, which most usually falls on the date that the incident occurred.

Bill 118 added an important additional requirement for slip-and-fall claims caused by snow or ice. It is important to emphasize that this does not apply to any other type of claim under the OLA. The injured person must inform the occupier (here, the condominium corporation) of the incident in within 60 days of the date of the incident. The notice must be in writing and include the date, time and location of the incident. For a condominium corporation, it must be served personally on the manager or a director. With very few exceptions, if this notice is not given, the injured person is prohibited from filing a lawsuit for damages within the usual two-year limitation period.

The benefits of Bill 118 to occupiers, including condominium corporations, are fairly clear. The condominium will be given the opportunity to make more timely investigation of claims while records and memories are still fresh, especially those of which it was not previously aware. This is fairer than expecting an occupier to later piece together the details of an incident that may have happened two or more years earlier by the time a lawsuit is filed and served. More broadly, the new reporting requirement may reduce the overall number of claims against a condominium, allowing it to better manage its insurance premiums and deductibles.

A condominium that receives notice of an incident under the OLA must deliver a copy to its snow removal contractor and any other condominium corporation (if snow removal is a shared service).

However, Bill 118 is no substitute for

proper risk mitigation measures. In addition to always making sure the condominium’s liability insurance is sufficient and up to date, implementing preventive measures – and keeping detailed written records of them – can mean the difference between liability and the condominium successfully defending a case. The standard is not perfection, but rather reasonable attention to controlling possible risks. Below are some steps that every condominium should consider.

Develop, implement and regularly review and update written plans and policies for keeping the common elements safe. These should be informed by industry standards and accepted best practices.

Employees, agents and/or contractors of the condominium should perform and document routine checks and inspections of site conditions, equipment, etc. The scope and frequency of these will depend on the details of the site, but it is important that there be a set, demonstrable program in place that is adhered to. Detailed logs and records must be kept, including specifics of dates and times, inspections conducted, maintenance performed and any remedial actions taken.

Clear and adequate signage should be posted alerting people to risks of injury. This includes permanent signage for things like safe use of recreational amenities (gyms, pools, barbecues, etc.) and proper conduct in parking garages, as well as any temporary signage required by temporary risks (spills, tripping hazards, broken equipment) before they have been remedied.

Staff (or directors where there is no staff) should be trained on proper steps

if there is a personal injury incident on the property, including:

• Carefully assisting the injured person, while not risking further injury;

• Recording the names and contact information of the injured person(s) and any witnesses;

• Completing an incident report;

• Not discussing liability with potential claimants;

• Preserving any evidence (e.g. camera footage); and

• Putting insurance on notice.

If your condominium receives a claim (either a 60-day notice for snow or ice or any other kind of notice or lawsuit), the following steps should immediately be taken:

• Take steps immediately to preserve evidence, e.g., surveillance video of the incident, photos of the place of incident, etc.

• Investigate and rule out the possibility of a common element deficiency in a timely manner. If a deficiency is discovered, it should be rectified promptly after first speaking with the condominium’s lawyers and/or insurers.

• Contact the condominium corporation’s lawyers. Extensive involvement may not be required, but they can offer some general guidance on next steps.

• Notify the condominium corporation’s insurer.

While incidents can never be 100% avoided, with proper ongoing due diligence, a condominium can both reduce the risk of injuries at its site and, if an incident occurs, reduce the condominium’s ultimate risk of liability.

Stephanie Sutherland, LL.B., ACCI Cohen Highley LLP

Stephanie Sutherland, LL.B., ACCI Cohen Highley LLP

The relationship between the Residential Tenancies Act and the Condominium Act, 1998 is a complex one. Even for individuals who have been working in the condo industry for years, the information is not always clear with respect to the ways in which tenants different from unit owners, how a tenancy in a condominium corporation is different than in a non-condo home, and how that affects both the tenant and the condominium corporation.

For those working in the condo industry as well as the multi-residential industry, including residential tenancies, we frequently see the complexities that can arise in interactions between condos, tenants, and landlords. There is often a negative association with tenants in condos, from the perspective of the condo corporations and professionals. However, when each of the condo, landlord, and tenant understands and complies with their rights and obligations, it can contribute to a harmonious condominium community.

First, it is important to understand how tenancies in a condo differ from tenancies in other types of residential rentals. In a condo, a tenant is required to comply not only with the Landlord’s Rules that may have been set with respect to the Unit, but also to comply with the Condominium Act, 1998 (the Act) and the Declaration, By-laws, and Rules of the condominium corporation. This is why landlord unit owners are required to provide tenants with a copy of those documents; unfortunately, that often does not occur, and sometimes landlord unit owners don’t even let the condo know that they have leased out their unit. When a tenant is provided with those documents and the landlord makes sure to communicate to the tenant the importance and necessity of complying, problems are much less likely to arise.

It is also useful for tenants to understand that condos do have the ability to place certain restrictions on lifestyle that would not be permitted in a non-condo living situation. For example, while a private landlord generally cannot unilaterally prohibit pets, a condominium corporation’s Declaration or Rules is legally permitted to do so. In that case, all residents of the condo, including tenants, are required to abide by the no-pets provision. This is why it is a very good idea for landlord unit owners to confirm to potential tenants that it is a condominium unit that is being rented, and to provide a copy (or at least a summary) of the Declaration, By-laws, and Rules before entering into the lease. That way, the tenants are aware of what they are agreeing to.

Another difference between condo and non-condo tenancies is that the condominium’s property manager (PM) is very rarely also the rental manager (RM). Many landlords will hire an RM, but that person should not be confused with the

In a condo, a tenant is required to comply not only with the Landlord’s Rules that may have been set with respect to the Unit, but also to comply with the Condominium Act, 1998 (the Act) and the Declaration, By-laws, and Rules of the condominium corporation.

entitled under the Act to bring certain types of legal proceedings against the condo, including at the Condominium Authority Tribunal (CAT), whereas tenants do not (at least yet) have that right. On the other hand, the condo is permitted to bring legal proceedings against both owners and tenants (as occupiers of a unit).

condo’s PM. The PM should not be contacted about the tenant’s concerns relating to the unit; those concerns should be addressed to the landlord who can then, as a unit owner, communicate with the condo through the PM to address the situation – assuming that it is something that is the condo’s responsibility and not the unit owner/landlord’s responsibility. It is important for landlord unit owners to make their tenants aware of the communication chain.

In addition to the difference in who problems should be reported to, there are several other differences between tenants and unit owners in condos. Owners are entitled to receive information about the condo, such as the budget, financial statements, reserve fund study, while tenants are not. Owners are entitled to vote at owners’ meetings; tenants are not. Owners can make decisions on behalf of their unit, whereas tenants must refer the question to their landlord unit owner.

One of the largest and most frequently encountered differences between owners and tenants is that owners are

On top of a unit owner’s usual obligations under the Condo Act, such as paying common expenses, repairing and maintaining their unit, and complying with the condo’s governing documents, a landlord unit owner also has to abide by the provisions of the Residential Tenancies Act (RTA). This can be a difficult balancing act for landlord unit owners, particularly when it comes to non-compliance by tenants.

A condo is entitled to require a landlord unit owner to ensure a tenant’s compliance. However, the landlord unit owner must follow the process set out in the RTA for addressing tenant compliance issues. In non-tenant situations, condos will often expect problems to be resolved within a reasonable time frame, or legal proceedings will be commenced. What is considered a ‘reasonable’ time frame for dealing with problems at the Landlord and Tenant Board (LTB), however, is vastly different than what would usually be considered reasonable when a condo is dealing directly with a unit owner or a non-tenant occupier.

In these situations, the best-case scenario is one where the landlord unit owner and the condo work cooperatively to resolve the situation. If the tenant does not know or understand their obligations with respect to the condo’s governing documents, then a meeting or discussion with the tenant, landlord unit owner, and condo representative may be an easy solution to address the problem.

If non-compliance continues and the landlord unit owner commences an application at the Landlord and Tenant Board, then it may be very helpful for the landlord unit owner to receive information and evidence (within the bounds of privacy laws) from the condo to support the landlord unit owner’s case. Generally, if a landlord unit owner can demonstrate that they are taking reasonable steps to address the situation, I recommend the condo holding off on taking its own legal steps beyond initial demand letters and any informal discussions that might take place.

As discussed above, tenants are not entitled to commence applications against a condo at the CAT. That may change as the CAT’s jurisdiction evolves – at this point, anything is possible with the CAT – but for now that restriction stands. Generally, a landlord unit owner

must bring any issue with a tenant to the LTB. There have been situations at the CAT where a tenant has been brought into the application by the condo (as permitted under the Act) or the landlord unit owner, where the tenant’s non-compliance is the problem. So far, the CAT has (as is appropriate) restricted its orders against tenants to governing how the tenant behaves with respect to the condo’s Declaration, By-laws, and Rules. It has not interfered with the relationship between the landlord unit owner and the tenant, and has made it clear that the CAT does not have any jurisdiction to rule on the tenancy itself, and particularly not with respect to termination of the tenancy.

However, as cases continue to be brought to the CAT, likely with more and more complex fact situations, and if rental tenancies in condos continue to increase as is expected, the line between the CAT and the LTB may be pushed by

the CAT. It will be interesting to watch how that develops.

Residential rentals in condos increase every year, and this seems unlikely to change. As affordable housing needs also continue to escalate, and housing providers move into the condominium market, that will add even more to the numbers of rental units in condos. Rather than focusing on trying to prevent or limit tenants in condos, which many condos still do, Boards may want to consider ways in which it can improve and build the relationships between the condos and their occupant unit owners, landlord unit owners, and tenants. Then, when the rental numbers inevitably grow, those condos will be better equipped to foster and maintain harmonious communities.

At its Annual General Meeting on October 19, 2022, the Golden Horseshoe Chapter of the Canadian Condominium Institute elected four new members to its 2022-2023 Board of Directors.

This group of dedicated volunteers, their level of enthusiasm, and their commitment helps to ensure the success of CCI.

Q – Who inspires you?

A – My kids

Q – What kind of music do you like?

A – Rock.

Q – What’s the most exciting part of your job?

A – The opportunity to see the city from various rooftops

Q – What’s your favourite animal?

A – Dogs.

Q – Do you have any pets?

A – Yes, Elmer, a Sheppard/Husky Mix.

Q – What’s your favourite food?

A – Surf and Turf.

Q – What’s your favourite movie?

A – The Godfather

Q – Do you have any hidden talents or hobbies?

A – Woodworking.

Q – Are you a coffee or tea person?

A – Coffee.

Q – 10. Have you ever met anyone famous?

A – Yes, Al Pacino.

The Saxony is an intimate 6 storey boutique residence classic – with 5-star luxurious condominium living in its design. Located at the heart of downtown Burlington at the corner of Elgin Street and Locust Street, The Saxony is mere steps away from the scenic waterfront, with easy access to the thriving and vibrant downtown core featuring shopping, theatres, cultural venues, and a neighborhood of cafes and restaurants.

This sophisticated, urban address has the artistry of exterior Arriscraft renaissance stone masonry, with a professional concierge from 8:00 am until 12:00 am to receive guests and packages. The Saxony is designed by Mike Niven Interior Design Inc., a premium firm focused on leading edge residential, commercial, and hospitality designs. MNID has been a powerhouse in Toronto for over 17 years, with a portfolio that consists of an infinite number of high-profile works in retail, residential, and development industries. Their numerous, well-recognized projects are a true testament to their timeless approach to design which The Saxony will represent for years to come.

One of the prideful features of the Saxony is that these suites are made for living, being more spacious than today’s typical condominium. Beginning with grand foyers to spectacular dining rooms, the gourmet kitchens feature Miele appliances and extended custom cabinets

with contemporary panel doors and pantries. The master bedrooms feature huge walk-in closets and ensuites featuring oversized soaker tubs, with expansive windows showcasing natural light for an airy elegance. The largest residences incorporate large family rooms, and up to three bathrooms to provide the look and feel of a gracious single family home.

The Saxony recognizes how important quality of life is, offering a multitude of amenities such as but not limited to: a party room with a fireside lounge, private dining & meeting room with a catering kitchen, sky deck for outdoor entertaining, theatre room and an exercise room. Your peace of mind and convenience has also been designed to include the comfort of heated, underground parking with smart technology garage entry.

The Saxony is a statement of exquisite architecture with renaissance stone, modern design, and grandiose suites. With many amenities and access to downtown Burlington being mere steps away, the residents are offered a multitude of experiences that energize, elevate and compliment the standard of living The Saxony offers.

The world unfolds from your doorstep at The Saxony.Ann Palmer Director John DiViesti Director Mac Sparrow Secretary Pat Whittingham President Susan Tristani

Treasurer

“We are using our work experience to manage a building we love.”Private dining & meeting room with a catering kitchen. Theatre room. Justin Deboer Skyline Contracting

The preparation time during fall is important for condominium owners to prepare for the winter. Successfully managing a property will save a lot of money and grief in the middle of winter. This means being on top of pre-winter maintenance, buying and implementing the right protective measures, and reinforcing rules for tenants to make sure your condominium is ready. Unanticipated issues will always come up despite all the planning. Some issues are minor and can be solved easily with some preparation while others are more serious and need to be handled quickly.

With these preparations made, your property will be ready to withstand the cold winter months. You will save money on utilities and repairs if you have done your homework during this time.

Staying informed and being prepared is the best way to reduce the risk of expensive damages and repairs. Let me walk you through some common problems condominium owners run into and ways to prevent and solve them:

Routine building inspection should never be underestimated. Buildings without proper sealing and insulation is vulnerable to severe damage from snowfall. This can also be troublesome for residents. Start off by hiring a general contractor to inspect rooftops for leaks and have a look at a building's exterior to ensure all of the common culprits have been sealed. Repairs for a tiny leak or a gap in a window is much easier than repairing the damage caused by weather-related problems like water infiltration.

What we usually look for are shingles that have been discolored, cracking, or fallen shingles. One or two damaged shingles can be easily done but for more severe cases, a roofing company or contractor is your best bet.

Don't be doing this on your own. The hazards of clearing snow-covered roofs are plenty. Surfaces are slippery from layers of ice or the building's structure might not be sound when covered in snow.

Contractors opt for methods where snow-removal doesn't require us climbing up roofs and if going up is a must, they're prepared with fall arrest systems, aerial lifts, and other protective equipment to ensure their safety.

It's no surprise that one of the most common issues we contractors come across are water leaks. Water leaks can occur in many places, and could have several causes from a damaged roof, failure in weather stripping, pipes fitted poorly, a broken appliance or a forgetful resident who left a faucet running.

To help reduce unexpected issues, actively looking for signs of water damage on your property can lead you to undetected leaks. Also, consider installing water sensors that can help detect leaks early to reduce the likelihood of major damage.

When there's a leak, determine the source of the leak, shut off the water at the source (if possible) and contact a professional. For example, if the ceiling is leaking, you wiII have to resort to calling a roofer to take a look at and patch your roof.

• All exposed pipes in your attic and basement should be insulated to prevent them from bursting.

• Outside faucets should be off and pipes cleared.

• Avoid mildew or mold by insulating walls and ceilings to prevent condensation.

• Debris, snow, and ice and snow can tear down your gutters roof damage so keep those gutters clear.

• Check if your sump pump works properly and if there's nothing blocking the exterior drain.

This is because drafts are a major source of heat loss. Drafts can come in through cracks in walls, doors and windows.

The most important thing one can do to reduce drafts is to seal air leaks and cracks properly.

There are many ways to do this, but one of the most effective ways is by using caulking around doors, windows and other gaps. Applying caulk, weatherstripping, or foam around moving doors is very effective.

A good way to know if there are cracks or gaps that need caulking is to use a flashlight at night when everything else is dark. Any light shining through could mean gaps where drafts could come in. Mail slots and pet doors should also have insulation to keep in that precious warm air.

Waterproofing and paint can wear out so it's important to check your home at least once a year.

You want to keep an eye out for chipping or cracking, discolored, and seals and paint that look faded. These are signs that resealing, or entirely new paint needs to be applied to an area.

Ice dams that form near the edge of your roof actually trap melt-water and snow above. This water has nowhere to

drain and can end up leaking in your home. The leak can damage inside ceilings and walls, and soak into insulation which can become an expensive mess. Ice damming often occurs because of, other issues, so prevention is the priority.

Pipes can end up frozen, swollen, cracked, clogged, or burst. If any of these instances happen, make sure you contact a licensed plumber to fix it right away.

Ask tenants if they've noticed any wet spots or dripping below pipes (like under a sink), as these could be signs of a joint disconnection. Even significant damage can be caused by small leaks if left alone for too long.

Inform your tenants to keep pipes from freezing during winter. For example, it's critical they keep the thermostat set to a minimum of 13°C and let water drip from faucets when outdoor temperatures fall below 0°C.

It's quite common to find drywall damage when tenants move out. This is usually from accidents or heavy wallhangings. In some wall cases, the drywall's painted surface is the only thing acting as the air barrier in the exterior walls. Drywall can be patched up quickly in most cases, but some larger holes will need drywall replacement, which takes more time.

Justin Deboer is the president of Skyline Contracting. Since 2004, Skyline Contracting has been providing expert roofing in Burlington, Hamilton, Ancaster, Grimsby, and Stoney Creek, along with property maintenance services to multi-unit complexes. With years of experience showing the value of responsive service and quality workmanship, it is Justin’s privilege to serve on the Professional Partner’s Committee where he gets to add even more value for all clients.

The summer of 2022 was a scorcher, with thousands of people dying all over the world. But if you had solar power would life be easier for you. Condominiums are now being built to accommodate solar power. (Bronte West Condominums in Milton and Terra Condos in Guelph, (Both under construction) and Beech House Condos in the Upper Beaches. As a Condominium Board, you are always looking at ways to save money and all research indicates that solar power is the way to go. But at what cost? This article is going to look at the pros and cons of Solar energy plus look at a number of questions that were asked of a local solar energy supplier.

Homeowners who install solar power systems can receive numerous benefits: lower electric bills, lower carbon footprints, and potentially higher home values. But these benefits typically come with significant installation and maintenance costs and the magnitude of the gains can vary from one house to another.

1) Cost - The upfront cost will vary from house to house, by company, province and whether there is a payback grant system in place. Each homeowner will have to decide if the number of years payback is too long to make switching a viable option.

2) Solar energy is an intermittent energy source - There are three reasons why solar energy is considered an intermittent energy source: the sun doesn’t shine at night so no power is generated; clouds, snow and foliage can cover the panels and battery storage. Although improving quickly, storage may not be a problem in the near future.

3) Aesthics - This is very subjective. Many people say that the panels are ugly and take away the look of their roofs. Beauty is in the eyes of the beholder or your bank account.

4) Solar panels have some environmental impact - Some solar panels contain harmful pollutants like sulfur hexafluoride, which is more potent than carbon dioxide. (But the impact of solar panels is minimal compared to the amount of damage associated with the mining and burning of fossil fuels.)

5) Solar panels require space - Depending on how many panels are needed and where they have to be located, space could be a problem. Roofs are good but aesthics could be a problem.

6) Efficiency Ratings - According to a study by the Qualitative Reasoning Group of Northwestern University, solar panels installed on roofs of houses only convert 14% of available solar energy into power. According to the laws of thermodynamics, solar

According to the laws of thermodynamics, solar panels can never achieve 100% efficiency.

ready by simply running an empty conduit from the electrical room (panel) to the attic.

OR, if you want to do it now, the cost can run between $3500 to $16,000 or more depending on what you want.

panels can never achieve 100% efficiency… Efficient affordable battery storage can improve solar power in the future.

7) You can’t take solar with you - To take the panels with you when you move could and can be very expensive. But if you do move, you are likely to see the value of your panels reflected in a higher sale price. However, if there is a solar lease or a power of purchase agreement, the new home owner will have to take this over, and that could be a hassle.

1) Carbon Reduction - Solar panels produce 5-10X less carbon emissions per unit of energy to coal or natural gas. We as a society have to combat climate change and mitigate the effects. Installing solar panels is just one way we can be better in this area.

2) Economics - If you are building a new home, the costs can be built right into your mortgage and is an easy option and installed during the construction stage for a highly costeffective solution.

OR, if you are building a new home and don’t want to install the panels right away, you can make it solar

BUT, all these costs can be offset by doing some research on grants and/ or tax incentives depending on where you live. Alberta has at least 4 programs that can help the homeowner. While NWT, Saskatchewan, BC also have programs, Ontario has a FeedIn-Tarriff (F.I.T.).

The two things to consider about putting in a solar energy system is pay-back. These systems can last up to 35 years and if you pay it off in 15 years, that’s ten years of free energy. Secondly, if your system over-produces solar energy, you can store it and sell it back to the local electrical company. (Again, do your research.)

3) Jobs - Out of all the energy systems in service, hydro, wind, solidbiomass, biogas, geothermal, and concentrated solar power, solar energy employs the greatest number of people. For example, in the U.S., the coal industry currently employs 160,119 people while the solar industry currently employs 373,807 people. (Based on 2017 stats).

4) Aesthic - Although listed earlier as a disadvantage, with new technology continuing to advance, it is only fair to state that that things will improve in this area also.

5) Energy Sovereignty - This is a hidden pro. Owning your own energy so that you are not relying on a third-party entity and providing for yourself a clean sustainable source of energy can be a very empowering feeling.

6) Property Value - There are many factors to consider when selling and evaluating your home. But the longterm warranty and secured economics of solar panels will certainly help. The intrinsic value of your initial capital investment can be calculated and added to your home’s value. However, as mentioned earlier, you probably cannot take the solar energy with you when you move (It will be expensive).

7) Decentralization - By decentralizing your power, or at least a portion of it, will reduce overall demand on the energy distribution infrastructure since energy does not to be distributed dozens or even hundreds of kilometers. By generating your own solar energy, you no longer need to import as much, and your transmission and distribution costs will be reduced as well as your energy charges.

As part of your research into solar power, you should put together a series of questions that need to be asked of any solar contractors. The following are questions I asked the VCT Group, a solar power provider:

1) Are there any special grants from the province for switching to solar power? Note: This company is in Ontario, other provinces will vary.

Currently, there are no grants available. The Federal Tax Provision for Clean Energy Equipment can be used to fully expense the solar system. A CCA rate of 100% is still available until 2024 but begins to diminish at the end of 2023.

2) How do you decide how much energy/solar panels you need? E.g., apartment buildings vs homes.

We look at industry estimates for energy use and a year’s worth of electricity billing to determine the amount of power (how many kilowatts it needs to produce) that is required by the facility. Using that information, we are able to match the system.

3) How is cost determined and payback?

Cost is determined on the market price of the equipment installed,

These systems can last up to 35 years and if you pay it off in 15 years, that’s ten years of free energy.

installation and labour. The payback of the system is calculated by determining the cost savings realized through self-generating credits to be used against procuring power from the grid when the sun isn’t shining.

4) Where is excess energy stored and what about winter usage?

Excess Stored Energy - This system would be net-metered which means it is always connected to the electrical grid and can send power to and from the grid. Surplus power created by the system, that is not first used by the facility is sent to the grid to be used elsewhere and credit given to the facility. Essentially, rolling the meter backwards.

Winter usage - Although power is produced during the winter, it is diminished due to snow covering, cloudier weather and less sunnier days, but all that is included in the original modeling of the proposal. Even though the panels will get covered by snow, reducing the output, the panels do melt the snow, so power does continue to be generated.

5) What is the process to install solar panels?

1

• Gather energy bills from past year to several years to determine total building energy requirement.

• Create a proposal for management team, which includes a draft of a solar design, a quote for the system as well as financials pertaining to your system’s return on investment.

Phase 2 - Plans, Drawings and Design

• Engineers create a drawing to spec of the facility.

• Connection impact assessment with LDC (local energy distributor) is carried out to ensure that the grid has capacity.

• Once approved, enter official agreement with LDC (called a CCA - Connection Cost Agreement).

• Company will procure necessary panels, racking system and inverters and ship to location.

• This process tends to be a 2-3 month wait.

• Building permits initiated.

• Crane is set-up and construction begins once all panels and material are on the roof.

• Electrical safety authority completes multiple checks throughout construction process.

• Skilled technicians carry out install.

• Once fully installed, a final check is done by LDC, electrical engineer and structural engineer.

• System is turned on

• Operations and maintenance, plus data analysis is ongoing to ensure system is running at peak efficiency

• Warranty on maintenance and labour come into effect ( length will depend on company chosen)

• Not only is solar power good for the environment, but you can earn money selling back excess power to the grid.

• While costs have come down over the years, installation and maintenance of solar panels can be quite expensive.

• Solar panels are best suited for facilities that receive ample sun exposure throughout the year.

• Solar power is not 100% efficient.

• Before committing to solar power, be sure to understand both the social and economic factors.

I would like to thank the various publications and authors who I used in doing the research for this article:

K. Ruby of Renewable Energy Ltd.

Solar Review- Andrew Sandy ( Home Solar Journalist)

Investopelic- The cost of Solar Panels: Is It Worth It?

Aerin Venema and Ian Spence of VCT Group

Tom Rhodes- 10 Biggest Disadvantages of Solar Energy

Bill Clark

Condo Board of Director WCC439

Even though the panels will get covered by snow, reducing the output, the panels do melt the snow, so power does continue to be generated.

After over 40 years of being self-managed, and having excellent, dedicated Boards during that time, the Board of Directors for HCC #116 decided to investigate the concept of becoming managed. There were many issues the Board wanted to consider in their decision-making process – doing their due diligence. Below is a summary of the main items that were considered.

• Succession – being able to get enough Owners/Residents to continue to join the Board going forward (an eight-member Board);

• Knowledge - Board members willing to attend courses in addition to the required online government course (this info is just the tip of the iceberg); need to keep abreast of the changes in the Condo Act and all other Acts that apply to the Condo community; know when to use a professional or not;

• Liability increasing for Boards – re quickly changing legislation – the need to be up to date regarding the CAT, Occupiers Liability Act, Construction Act, municipal by-laws, etc.;

Growing Pains of Switching from Self-Management to Property Management after 40 Years!

• Engagement of Owners/Residents – volunteering for the Board; younger owners with families and careers – they have a life and find it difficult to commit; and

• New Stewardship – time for new and younger Owners/Residents to take the reins, but no one to do so – how to encourage Owners/Residents to “step up” and do their part – volunteer!

The Board first broached the subject with the owners/residents at the AGM three-and-a-half years ago. The topic of succession – having enough Owners/ Residents stepping up to join the Board each year is important. This topic was addressed again at the next two AGM’s.

In the fall of 2021, the Board asked a PM (Property Manager) to come to a Board meeting and present a general overview of what a PM would do for a Board and Condominium Corporation, responsibilities of the Board and what the Owners/Residents could expect with a Q&A following the presentation. This meeting was very informative. Three PM’s were interviewed over the next few months. All discussions regarding PM’s were noted in the minutes to keep everyone (owners) informed.

At the 2022 January Board meeting, the Board further discussed the pros and cons of remaining self-managed versus becoming managed. In February, 2022, after the final deliberation and discussion, the Board put forth a motion and approved hiring a PM. In addition to the recorded motion in the minutes, the Board prepared a letter for the Owners/ Residents confirming that the Board had made the decision to become managed and had approved the hiring of a PM. The letter included the rational and a brief description of what this would mean to HCC #116 to have a PM to become effective June 1, 2022. As well, our new PM was introduced in the March Wellington Green News and Views Newsletter with a

photo and short biography.

After receiving the contract, it was reviewed by the Board and the Corporation’s lawyer; a motion was made and approved to accept the contract to become effective June 1, 2022; the contract was signed at a Board meeting in March. June 1, 2022 was chosen to coincide with the new fiscal year so the Budget could be aligned with what would now require monthly Management fees.

In June, the Property Management Company sent an Introduction package to each Owner which again explained what role is of a PM. A Special Meeting was called for in August, to change the number of Board Members from 8 to 3 in the Corporation’s By-Laws to be reset at the AGM. The changed was approved.

As the title of the article alludes to, there are many growing pains for everyone involved – Owners/Residents, Board members, current contractors and definitely the PM – this learning curve is enormous; it is not one sided! There are new protocols that everyone now needs to follow; all concerned parties!

Now instead of sending a concern or request to the Board, Owners/Residents need to send their questions, concerns, requests for repairs, etc. to the PM. If they send their emails to the Board, the Board needs to acknowledge the email and then forward it to the PM. The Owner/Resident should also be reminded that in the future all correspondence goes to the PM. We are almost there!

A self-managed Board has to remember that the PM will now deal with day to day issues (repairs, compliance, complaints, conflict, contracts, etc.) of the Corporation. Therefore, Board members have to remember not to step in and do something – that the info they get from Owners/Residents needs to be forwarded to the PM. There are proper channels that need to be followed to make sure that everything runs smoothly.

Your new PM has a tremendous amount of information to learn regarding

about your community. They are as follows:

• The Documentation (Declaration, ByLaws, and Rules;

• Unique characteristics of the condo and condo community;

• Layout of the property – the buildings and grounds;

• Amenities of the condo community;

• Ongoing projects;

• Vendors/Contractors corporation would like to continue to use;

• New projects to be tendered;

• Current processes in place;

• Specifications that the condo adheres to;

• All of the idiosyncrasies of the Corporation; and

• Etc.

The Board too has adjustments to make. The day-to-day work of the Condominium is streamlined through the PM’s schedule and their companies’ processes, which may be different than a Self-Managed Board would do. HCC #116 had 8 Directors – each took on a specific role on the Board (i.e., Director of landscape, maintenance, security and garbage, pool pavilion, -at-large, secretary, treasurer and president). When becoming a “Managed” site, it now has only 1 person implementing the work. After the decisions have been made, the work is then scheduled in the PM’s timeframes, which can be different than when the Board “did it themselves”.

The Board is required by law to manage the assets of the Corporation; the Board makes the decisions and the PM follows the direction of the Board.

In other words, the Board is governance – sets direction/tone as to the documents of the Corporation and the PM is the enforcer – follows the direction of the Board in implementing compliance.

This can be a good time to reset the way some issues have been handled in the past – make it clean.

Having said all of that, Board members will still need to be involved in some operational aspects of the Corporation (i.e. onsite contact for contractors if required, do routine walkabouts and seasonal walkabouts with PM, open underground overhead garage doors if power failure, turn main water valve off if required, etc.). Another option could be to implement a lockbox system for contractors. If those two possibilities are not working, the Board may want, or have to consider the use of a Superintendent who is on site daily (half days or full time), which of course will add to the expenses of the Corporation.

There is another learning curve for both the Board and the PM which involves working with the contractors. If the Board would like to retain contractors that they have used, the PM needs to es-

tablish a working relationship with these contractors – explain the protocol for contractors dealing with property management. As well, Board members need to become familiar with new contractors and what is required re onsite contact with contractors.

In addition to all of the documentation and information that the PM requests prior to the date the Corporation becomes managed, it is helpful for the PM if the Board compiles an up-to-date list of vendors with name, and contact information for the PM to reference.

As well, if there are outstanding projects or scheduled projects that are to start after the date the Corporation becomes managed, then a comprehensive list should be provided with contractor information, start dates, contracts, etc. Any additional information that the Board can provide the PM will be beneficial in the transition.

Going forward, the retired Board members of HCC #116, with a combined 36 years of experience, will be there to answer “historical” questions – give background information on previous projects, etc. if future Boards and/or the PM have any questions.

During the transition period, everyone will be frustrated, and there will be many questions from all of the involved parties! Going from self-management to management is definitely a process! Working as a team and being patient is definitely a must for everybody.

It has been just over seven months since HCC #116 became managed – the growing pains are now fewer and farther apart! We are well on our way - making a smooth transition to becoming managed.

By June 1, 2023 – one year later, the transition should be finalized.

Tim Bolivar, Minutes On-Time - Oakville, ON

Jordan Stam, STAM Security Controls - Hamilton, ON

Denis Theriault, EXP Services Inc. - Brampton, ON

PROFESSIONAL MEMBERSHIP - ASSOCIATE

Milan Gavric, Fusioncorp Developments - Toronto, ON

Mark Agnew - Hamilton, ON

Golden Horseshoe Chapter of the Canadian Condominium Institute was again please to participate in the Burlington Remembrance Day ceremony and paying our respect to all who served.

Minutes On-Time provides affordable, premium minute taking services for Home Owners Associations and other multiresidential properties. Our services include meeting minutes for Board of Directors meetings, Owners Meetings, and Annual General Meetings. We can complete meeting minutes from recordings, or by attending your meeting virtually!

Because we focus on only multi-residential properties, we provide extremely consistent, concise, and complete minutes for our customers. We have helpful Service Coordinators to schedule your meetings, well-trained Minute Takers to attend your meetings, and skilled Editors to ensure a great set of meeting minutes every time!

We are proud members of the Golden Horseshoe Chapter of the Canadian Condominium Institute.

Based on the Coverages, Clauses and Clawbacks panel session at the September 16, 2022 CCI-GHC Annual Conference given by Tom Gallinger –Atrens-Counsel Insurance Brokers; Karen King – King Condominium Management; Matthew Atkin - GSA Property Management; and Richard Elia – Elia Associates PC

“Quality is generally transparent when present, but easily recognized in its absence.”

Alan Gillies, author

An unfortunate reality of working within the condominium sector relates to pricesensitivity and the number of decisions made purely on the basis of cost – the best is always the cheapest…until it’s not. In the time that passes until the honeymoon is over, a lot can happen – and a lot can be overlooked.

Below are some (certainly not all) items that should be on your (or your new property manager’s) checklist when transitioning between management.

1. Review and understand your Insurance Policy. This should be done with a reputable broker who is knowledgeable in the needs of condominium corporations. For example:

a. When does it renew? Has that date passed?

b. What are the limits in coverage?

c. Are there any restrictions, exclusions, or sub-limits?

d. Do you have a NO-coinsurance clause?

e. What is your proper insurance to value?

f. Is there any additional coverage that might be beneficial? Cyber fraud?

2. Be confident in relation to your existing (Condo) Governing Documents:

a. Don’t accept what you have been given by the outgoing manager as their file may not be complete or up to date. Remember that the incoming manager relies on these documents, both in the performance of his/her work, as well as when they are attached to status certificates.

b. Speak with legal counsel and obtain a complete set of your corporation’s Governing Documents directly from the Land Registry Office.

c. Understand what type of condominium you are involved in, as well as the community around the condominium. For example, a ‘Standard Condominium’ has different insurance requirements than a ‘Vacant Land Condominium’. Are there Shared Facilities? Also, what if your condominium corporation is nested within another condominium?

3. Know and understand your Standard Unit Definition (do you even have one?):

a. Is your Standard Unit definition set out in a by-law or a schedule…or not at all?

b. Does it reflect the interests of all interested parties in managing (not eliminating) insurance risk –the condominium, the owner of the damaged unit, the other owners, and the mortgagee?

4. Know and understand your Insurance Deductible Recovery Policy:

a. Don’t blindly assume that you can charge back every cost that might relate to an owner. Find and understand that authority in the Condominium Act, 1998 (the “Act”), in the Declaration, and, for insurance deductible recovery, perhaps the by-laws.

b. If you have an insurance deductible clause in a by-law, don’t assume that it provides any additional authority than would be found under section 105(2) of the Act. If you have a provision in your by-laws, does it move beyond the requirement to show an act or omission? Consider the merit in establishing a provision that permis recovery from the Owner of the unit from where the damage originated (strict liability).

c. In view of possible changes to the Act, consider proactively establishing a Strict Liability Insurance Deductible Recovery provision in your condominium’s Declaration (along with augmenting your other indemnity provisions).

d. If your corporation has a very high deductible, should payment of this amount be factored into the corporation’s budget (as recovery from an owner is not always possible)?

5. Know and understand the Corporation’s Contracts:

a. Make a detailed list of all contracts that should be in place then and then cross reference that list with the actual contracts turned. Identify any missing or redundant contracts.

b. Advise the various contract vendors: (1) of the change in management so that they can update their records; and (2) that you re-

quire “their” documents - these include but are not limited to WSIB clearance, insurance certificate, Working at Height Certificate, Business license for the applicable municipality, ESA, etc.

c. If there are missing or unsigned contracts (and there usually are), immediately contact the former management company and the vendor in question in writing to both document and inform them of the missing/unsinged contract(s) and request they look for them and reply in writing with what they find (or don’t find). This information should be communicated to the Board of Directors, options discussed at a properly called Board meeting, and instructions minuted on how to move forward.

6. Review and understand the Reserve Fund Study:

a. Ensure that you receive a copy of the most current, full Reserve Fund Study update and Boardsigned Form 15.

b. Advise the Reserve Fund planner of the change in management.

c. Determine when the next update is required and diarize same in your Annual Plan.

d. Thoroughly review the Reserve Fund Study with the Board, and: i. Compare it with the work that has been completed since it was issued and the amount of money spent compared to the plan. Depending of the variance between these two, a study update may be recommended a headed of schedule; and

ii. Review the areas making up the common elements listed in

the study to ensure they match the “reality” of your condominium corporation. Often items are included which should not be or excluded that should be in the study.

7. Review and understand the Audit:

a. Ensure that you receive a signed copy of the most current audit. If the audit for the immediately preceding financial year is not available, find out why.

b. Call the auditing firm and speak with the Partner assigned to the corporation. These conversations tend to be very informative; often, you can quickly get up to speed on the history of the corporation’s financials (both positive and negative) from the auditor.

c. Review the last 3-5 audits with a view to identifying expenditure trends (which in turn can assist in budgeting and discussions with the Board and Reserve Fund planner about capital projects).

8. Review and understand the Preventative Maintenance Policy:

a. Review past policies relating to inspections and preventative maintenance, as well as records evidencing compliance with same.

b. With approval of the Board, develop and implement such policies.

In addition to these eight (8) points, every condominium corporation should operate with an Annual Plan in place. This Plan is a month by month listing of all critical dates and related actions Man-

agement needs to undertake to ensure the professional operation of the property.

Many incoming managers and management companies have the skills and experience to draw on that likely already encompass the points above; however, with the current supply shortage in general licensed site managers, and the strain that this shortage has placed on even the most reputable management company, this can’t be assumed.

We can all agree that transitioning management and learning the complexities of a new condominium community is no simple task. While the foregoing points are by no means an exhaustive list, addressing the above elements will help equip you with a foundation to ease your transition and address the challenges of your new condominium organization.

We are hearing more and more about Sustainability and ESG (Environment, Social, Governance) lately. The references are to our planet, the spaces we live in and the ability of our governments at all levels to move the needle (Greening the planet) forward in a timely fashion. In fact, we as everyday people must face reality and pitch in.

Make no mistake this is a huge subject. It has expensive considerations; it will affect everyone and that means not only us as we are today, but our children and our grandchildren.

A major concern is the propensity for people to stick their heads in the sand and hope for the best. Worse still, they hope the government will look after the problem. There are even conspiracy theories out there that the whole thing is a hoax!

This in the face of worsening catastrophic events…floods, hurricanes, forest fires and the lists go on. If you are over 50 years of age, you will no doubt realize that in summer months, your skin seems to burn ten times faster than it used when you were 20.

I think it is time well spent to look at how we can help with the problem as individuals. We will look at what some of the biggest industrial polluters are doing, the big Canadian Banks and commercial establishments.

How are condos affected and what can condo boards and property managers do to help their residents get on board the ship to repairing the problem… indeed before that ship sails.

“Since 1850 (approximately the time of the industrial revolution), global temperatures have risen at around 0.07 Celsius per decade.” So, we are not dealing with a new phenomenon. “Rapid industrialization and global growth have increased the level of greenhouse gases (GhG), particularly carbon dioxide (CO2), in the atmosphere at an alarming rate. It took 250 years to burn the first half trillion tons of carbon. On current trends, the next half trillion will be released in less than 40 years.”*

As outlined above, carbon dioxide emissions are the worst. Here is a list of the biggest contributors according to Mark Carney:

- Industrial process (32% of current emissions)

- Buildings (18% of current emissions)

- Transport (cars, trucks, shipping and aviation) (16% of current emissions)

- Energy generation (11%)

- Food, agriculture/sources (10%) of both crops and livestock. Yes, manure is an emitter.

You will often hear the term “carbon neutral.” It means that once we equalize carbon capture with carbon emission (technically), only then will the planet stabilize.

Of course, plastics are a huge problem. Think of food items, hardware items and water bottles. Many consumer products are packaged in plastic of some form either rigid or otherwise. There is a sad

side to this packaging as well. Think here of shaving blades in the pharmacy. They are packaged in a combination of hard clear plastic and cardboard for the sole purpose of preventing theft. Many items are similarly packaged for the same reason.

Plastic shopping bags are quickly being phased out by the grocers and shoppers are required to switch to re-usable bags.

Our cars are not helping anything and thankfully, Tesla is leading the way in electric vehicles. That said GM, Ford and others are rushing to adopt the technology in their vehicles. Many started with hybrid (combination of internal combustion and battery), but most are now aimed at fully electric.

As an aside, I had a ride in a Tesla the other day and was impressed. There are 3 charging options which I will categorize as slow, medium, and fast (charging). There is a large information screen on the “dash-board” that not only measures amount of charge but will provide distance to nearest charging station and a list of other stations on the driver’s route. The ride is quiet and smooth. What is not to like?

In aviation, experiments are being conducted with bio-fuels and hydrogenpowered engines. The same technology,

once perfected might also be an option for transport trucks. In fact, I believe that Tesla delivered the first of its battery powered semi-trucks to Pepsico this past week.

Yes, big and small are contributors. The Toronto Star of Saturday August 27th provided a great glimpse of what Toronto Councilor Mike Layton has done to zero the use of Fossil Fuels in his home. A roof mounted solar system, new high efficiency windows, an air-source heat pump are but some of the modifications conducted.

High rise apartments should be considering the installation of charging stations either in their outdoor or underground parking lots for the use of their residents and visitors. It is important for two reasons… one is the atmosphere of course but the other is the property value of the individual units. Think of it this way: as more and more cars become electrified, the owners will want charging availability. It begs the question; will they have any interest in a building that doesn’t offer vehicle charging?

A similar argument can be made for commercial condo buildings and town home communities.

Here is the scoop. Barbara Zvan is the CEO of the University Pension Plan, one that is new and, in the report detailing its first operational year, a “Climate Action Plan” was included. The plan promised that the pension investments would not invest in coal and other “companies that present a significant risk.” Oh! did I mention that Ms Zvan grew up in Stoney Creek and was educated at Mc Master.

The pension fund also committed to a “net-zero” portfolio by or before 2040.

There are tons of examples of large organizations (even a consortium of 6 in the oil patch “Pathways Alliance”) that

It took 250 years to burn the first half trillion tons of carbon. On current trends, the next half trillion will be released in less than 40 years.

are moving quickly now to become “more-green.”

The significance of this is quite incredible really. Consider this. The pension plan must perform for its retirees. To do so it must conduct very careful research to select qualified investments that perform while doing so with sound environmental considerations.

I can already hear the condo community leaders asking what has this got to do with us?

Let’s look at the basics of condo management as it exists today.

Residents/owners generally assume that by purchasing/renting a unit that the condo will look after their needs and interests. After all, the grass gets cut, the snow cleared, garbage gets picked up, the outside walls are not to worry about. All pretty much standard stuff… .right?

But, what about education or the transfer of new information to these residents. Yes, I am thinking about the environmental issues creeping up on all of us.

In asking questions around the subject, I hear answers like what is ESG? Or I hear board members saying well we are not making any decisions until we know more about the subject.

I even reached out by email to an engineering firm and a law firm to ask what advice they may be passing on to their board clients and got no response from either.

Here is a good use of the monthly bulletin to residents. While I get that condo boards cannot “enforce” environmentally sound practices, they can help a lot by educating their residents. Something as simple as “the Climate Corner” that provides suggestions and indeed alerting readers to the progress or lack of getting

things under control.

One of the worst polluting practices at household level is plastic water bottles. I for one will very soon purchase a water cooler for home. Re-usable shopping bags are another item for consideration. Keeping the family car in good repair (exhaust systems) is yet another opportunity.

The new car industry is working at break-neck speed to update their fleets to electrification. So, progress reports on this conversion process is another subject for the monthly bulletin.

The bulletin writer should not concern himself/herself with repeating some of the points often. Sometimes the repetition helps to build awareness.

Does it take some effort? Absolutely it does. The reading and research can be time consuming to a point but better to be ahead of the curve rather than getting a shock.

This brings me to another point. The “greening” of the planet will be a cost to condo dwellers. There is already a carbon tax which will increase. The whole notion of carbon capture is going to cost… in terms of the technological development. In layman’s terms, your car, your gas stove, your gas fireplace, the heating system in the high rise… the list goes on.

Condo developments, at least the character of them varies by age, by size, by footprint… you name it. I suspect that the “greening” of each will vary as well particularly in terms of cost.

This may be the opportunity for condo boards, their legal advisers, their property managers and their engineering firms to “think outside the box.” Why not? It is a chance to get ahead of the proverbial curve and lead the way.

A beginning would be for the CCI itself to establish an “environmental committee,” tasked to build a library of

information on “greening.” This way, individual condo developments could draw the information they need to consider projects to help their residents and in fact to build funding (in the reserve) for the same.

This should not and would not mean that individual condo boards would be absolved of the responsibility to establish their own committees.

The point is this. We all have children and grandchildren that will live on in our place and do you really want to leave them with a worn-out planet? Do you really want to trust that some governmental body will find us a better place to live?

I think most airline pilots will tell you that they really earn their money in bad weather. Well, condo engineers, lawyers, condo managers and condo boards, you may be flying into a storm very shortly; will your community be ready to weather the storm?

We always invite any readers to critique our thoughts or to send questions on the subject. There will be a follow-up to this article in the spring edition. Please email any thoughts or ideas to: williamsdavem7@gmail.com

Our thanks to the following publications: Value (s) Building a Better World for All. Mark Carney former Bank of Canada and Bank of England Governor Saving Us. A Climate Scientist’s Case for Hope and Healing in a Divided World.

Katharine Hayhoe Toronto Star Saturday August 27th, 2022. Insight. “Going off The Grid”, “Your Home will never be the same.”

Globe and Mail Report on Business December 2022 CEO of the Year Barbara Zvan

Craig Cook - Tesla Owner

Dave Williams is a graduate of York University and a retired corporate executive. We always appreciate hearing from readers at williamsdavem7@gmail.com.

This year the Communications Committee had a tough choice in selecting the winner, but Wentworth Standard Condominium Corporation 514 was the standout.

What do you do with a beloved schoolhouse that has been left empty for a number of years? Well in the case of the Dundas District school, you sell it to a capable developer and transform it into high end condominiums, and WSCC 514 was born.

The residents have come together as a caring community with many forming deep and abiding friendships, actively involved in the operation of the building.

WSCC 514, with its history, quality finishes, unique layouts and proximity to the Bruce Trail and Dundas Peak, as well being a short walk to downtown Dundas has become a much soughtafter address. The residents cannot imagine living anywhere else.

Congratulations WSCC #514!

Thank you to Elia Associates for providing a $500 gift card to the Keg for the Board of Directors.

The Golden Horseshoe Chapter of the Canadian Condominium Institute would like to give your Condominium $500.

Tell us why your Condominium is worthy of winning the “Condo of the Year” award? We are all proud of our homes, you just need to highlight the following points in your article that describes your condominium:

l What are the qualities and features of your Condominium?

l What are the accomplishments achieved by your Condominium Corporation?

l What is the overall environment like in the Condominium?

l What makes residents proud to live there?

Each entry will be featured in one of the upcoming issues of the “Condo News” magazine. There are four issues per year:

Spring Article deadline March 15th

Summer Article deadline June 15th

Fall Article deadline September 15th

Winter Article deadline December 15th

You can either send an article or we can interview you via phone and write an article about your condo for you! Don’t forget to include photos of your condominium.

Interested applicants should submit their articles or contact information for an interview to:

by mail OR by email

CCI-Golden Horseshoe Chapter, admin@cci-ghc.ca PO Box 37 Burlington, ON L7R 3X8

The Condominium will be selected by the GHC-CCI Communications Committee and will be announced at the Annual General Meeting in the fall.

Jeremy Nixon, P.Eng., BSS Brown & Beattie Ltd.

Jeremy Nixon, P.Eng., BSS Brown & Beattie Ltd.

There is perhaps no more regular means to start a debate in Condominium communities than Reserve Fund Planning. Unlike operational expenses such as insurance, snow and landscaping services, and professional management fees, which have relatively predictable, or at least less potentially volatile year-over-year increases, Reserve Fund Plans and related Reserve Fund Studies (RFS) are often anything but.

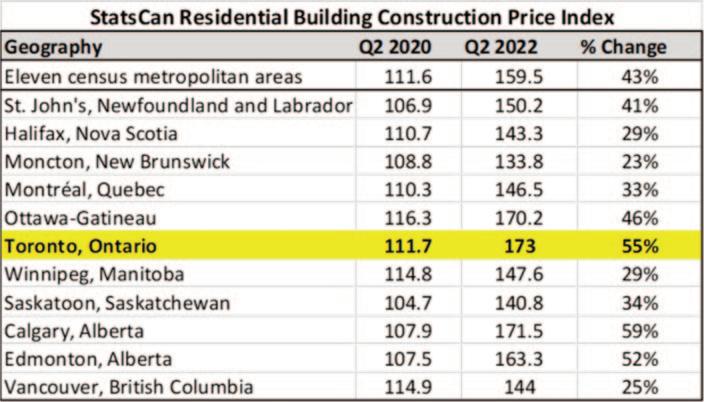

Presently, the cost of absolutely everything has seemingly shot up. That is certainly just as true in the construction world. We’re all tired of hearing how pandemic disruptions to the global supply chains and labour forces have wreaked havoc on supply timings and costs, however it is the current reality like it or not. While delays and cost escalations are nothing new to the construction industry, ask any engineer, owner, or property manager whether they’ve ever experienced something like what we’re currently enduring, and the likely answer is ‘no’.

It has been suggested elsewhere that we’ve experienced perhaps a 25-50% increase in construction costs over the past year. From an RFS planning perspective, no BOD, property manager, or practitioner can be reasonably expected to anticipate such Industry and global chaos. However, the objective of this piece is not to specifically dissect these current, highly unusual circumstances, rather we would look to unpack factors that can at other times result in significant cost variability in Reserve Fund Studies during more ordinary times.

We need to first consider that no two buildings or sites, and no two projects are exactly alike. In essence, each project is in some ways a prototype, completely unique from anything that has ever been done or will be done again; even those different phases of essentially the same site, and even from building to building or unit to unit. It is not like manufacturing products on assembly lines over and over and over again in a well-tuned process. While there is of course significant consistency from project to project from both process and installation perspectives, the subtlety (sometimes not so subtle) and nuance can play a bigger part than one might realize. Site-specific physical, operational, and dare I say ‘political’ parameters are all highly influential. (We all thought that politics was reserved for public office, didn’t we?)

I won’t belabour the political angle here other than to say that just like in

public offices, agendas and objectives of members of Boards of Directors (BODs) can certainly vary. Speaking from experience as a former Condominium Director, as well as having interacted with literally hundreds of BODs in my career, I can attest that most often BODs tend to operate harmoniously, unanimously, and with respect. That is not to say that there aren’t disagreements or sometimes animated discussions, but typically everyone wants to meet the same objectives, even though perceived paths can vary. Occasionally things can get ugly. Those meetings are no fun at all, and can completely derail projects before they even start.

Even on consensus BODs, the time required to make decisions is not always timely (or at least not as timely as Vendors would like them to be). A typical BOD will meet monthly. Depending on the nature of that dynamic and the authority granted to a property manager to take certain actions, it can often take

months to make what otherwise seem like routine decisions. Consider a typical timeline based on monthly meetings:

• Meeting 1 – A project is conceptualized from which a property manager is tasked to get quotes.

• Meeting 2 – Property manager returns with quotes. BOD deliberates but requires more time to thoughtfully consider.

• Meeting 3 – BOD makes a decision on a Vendor. The property manager then begins coordinating.

In this very simple example, 2-3 months were needed at the BOD level to even gain enough information to make a thoughtful decision. Now add in Vendor availability from the point of authorization to proceed. Depending on the time of year, they may be more or less available. From a construction perspective,