life. money. probability.

MAY 2019

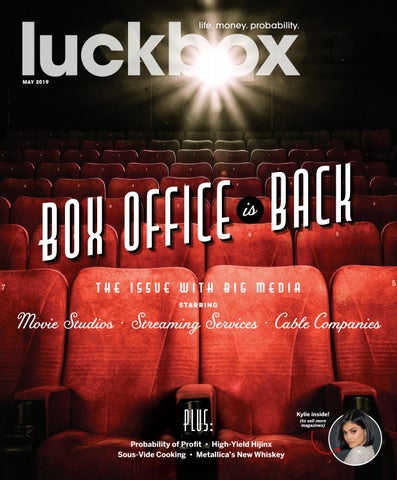

e c i f f o x Bo

is

back

THE ISSUE WITH BIG MEDIA S TA R R I N G

Movie Studios • Streaming Services • Cable Companies

Plus: Probability of Profit • High-Yield Hijinx Sous-Vide Cooking • Metallica’s New Whiskey

Kylie inside! (to sell more magazines)

May 2019

Special Report: Big Media & Entertainment

25 No End in Sight Tentpoles in the 27 House of Mouse Movie theaters bounce back.

Disney is looking toward bigger global box office revenues.

28

AMC Entertainment: Time to Buy a Ticket An optimistic outlook for brick & mortar theaters.

30

Disney vs. Netflix: The Battle for Big Media

A clear favorite is emerging as they co-opt each other’s business models.

37

Cable TV? Cut It Out

41

The Low Spark of High-Yield Stocks

Cord cutting is trending. The numbers, winners & losers.

A look at the false allure of high-dividend stocks.

2

luckbox | may 2019

1905-TOCs.indd 2

3/29/19 1:49 PM

MT_Ad 1804_M

Higher, faster, further. Why not more beautiful?

Patria Modest gold watches made with superior manufacturing skill, have a centuries-old tradition in Germany. After Glashutte‘s new rise, the watchmakers and their fine watches were able to attain a world-renowned reputation once again. With the Patria, we keep Glashutte’s deep-rooted horological tradition alive: the watch must be noble, beautiful, and precise. Patria · manufacture caliber · 6600-01

MADE FOR THOSE WHO DO.

TO OBTAIN FURTHER INFORMATION IN NORTH AMERICA, PLEASE CONTACT Tutima USA, Inc. • 1-888-462-1927 • info@tutimausa.com • www.tutima.com

MT_Ads_June.indd 842 1804_MT_ADS_.indd 1905-TOCs.indd 3

4/21/17 3:49 PM 3/7/18 11:09 AM 3/29/19 1:45 PM

think big. Small. Standard. Simple. That’s how we’ll bring more participants to the futures market. Self-directed investors need more appropriate ways to manage their risk, hedge their positions, and speculate on market movements.

For a limited time, you can subscribe to the Small Exchange to lock in reduced exchange and market data fees for life. No annual or renewal fees, no obligations.

This is a new kind of exchange where you enjoy the best of futures without the institutional baggage that keeps you in the past.

If you want to trade the Smalls, visit www.thesmallexchange.com.

The Small Exchange’s application was submitted to the CFTC in December 2018. The CFTC generally reviews the application for 180 days; however, there are no guarantees that the Small Exchange will be approved by the CFTC within this timeframe or at all. The launch of the exchange is contingent upon approval. Please visit the website for full terms and conditions.

1905-TOCs.indd 4

3/29/19 1:45 PM

managing editor yesenia duran technical editor mike rechenthin features editor tom preston contributing editors vonetta logan, wolf richter creative director jacqueline cantu contributing art director cassie scroggins

Metallica’s new Blackened American Whiskey

contributing producers adrienne applegate, jessica mcdermott

P. 44

editorial director jeff joseph PHOTOGRAPHS: (BLACKENED) COURTESY OF LION & LAMB COMMUNICATIONS; (JENNER) REUTERS/ANDREW KELLY

n l

editor-in-chief ed mckinley

submit a story idea tips@luckboxmagazine.com comments & critiques feedback@luckboxmagazine.com request contributor’s guidelines, submit press releases & editorial inquiries editor@luckboxmagazine.com advertising inquiries advertise@luckboxmagazine.com subscriptions & service service@luckboxmagazine.com media & business inquiries publisher: jeff joseph jj@luckboxmagazine.com luckbox magazine is published at 19 n. sangamon, chicago, IL. 60607. editorial offices: 855.468.2789 printed at Lane Press www.luckboxmagazine.com

trades actionable trading ideas

LIGHT THIS CANDLE

13 CNK: Movie Moves

trends life, luxury & the pursuit of happiness LIQUID ASSETS

44 Heavy-Metal Whiskey

THE TECHNICIAN

WELLNESS

MACRO TRADER

47 Movies About the Markets & More Reviews

14 The Simple Clarity of Trendlines

16 The Forex FAANG Trade OPTIONS

18 The Media Trade FUTURES

20 Buns Up? DO DILIGENCE

luckbox magazine

21 Media Matters

@luckboxmag

22 Highly Liquid Media Stocks

46 Sous Vide ARTS & MEDIA

THE POKER TRADE

50 Russian Illusion FINANCIAL FITNESS

52 Keto Veto

techniques essential trading strategies BASIC

55 Going Long INTERMEDIATE

57 Probability of Profit ADVANCED

62 The Short Put 64 luckbox of the month

See why this face sells so much stuff

53 Calendar

CHERRY PICKS

luckbox magazine content is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities and futures can involve high risk and the loss of any funds invested. luckbox magazine, a brand of tastytrade, Inc., does not provide investment or financial advice or make investment recommendations through its content, financial programming or otherwise. The information provided in luckbox magazine may not be appropriate for all individuals, and is provided without respect to any individual’s financial sophistication, financial situation, investing time horizon or risk tolerance. luckbox magazine and tastytrade are not in the business of executing securities or futures transactions, nor do they direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. luckbox magazine and tastytrade are not licensed financial advisers, registered investment advisers, or registered broker-dealers. Options, futures and futures options are not suitable for all investors. Transaction costs (commissions and other fees) are important factors and should be considered when evaluating any securities or futures transaction or trade. For simplicity, the examples and illustrations in these articles may not include transaction costs. Nothing contained in this magazine constitutes a solicitation, recommendation, endorsement, promotion or offer by tastytrade, or any of its subsidiaries, affiliates or assigns. While luckbox magazine and tastytrade believe that the information contained in luckbox magazine is reliable and make efforts to assure its accuracy, the publisher disclaims responsibility for opinions and representation of facts contained herein. Active investing is not easy, so be careful out there!

may 2019 | luckbox

1905-TOCs.indd 5

5

3/29/19 1:50 PM

OPEN OUTCRY

THE ISSUE WITH BIG MEDIA

R

eaders will find this issue of luckbox long on media. It’s filled with stats, facts, analysis, opinion and probabilities, most of it related to movies, television, cable and big media. The upshot? Even after a banner year for box office revenue in 2018, the entertainment industry continues to fret about what lies ahead for brick-andmortar movie theaters. Studios and cable providers alike are wondering whether Disney’s “tentpole” strategy will increase its already huge share of box office receipts. Netflix is producing content like mad in an effort to maintain its edge in streaming video in the face of an explosion in competition. Cord cutters and moochers are producing a chilling effect on pay TV and streaming revenues. If that’s not enough, we wrap up the issue with movie and TV rankings and reviews. Plenty of big data shows up in the pages of this issue, too. We can’t get enough numbers. We were surprised, for example, when our research indicated that 32% of Americans who went to the movies last year went once a month. We weren’t surprised, however, that the most recent Academy Award for Best Picture went to a film that ranked 85th at the box office and that fewer than 3% of American moviegoers saw it at the theater. Personally, we’d rather make a profitable film than the award-winning film, but that’s just us. Readers will find that luckbox often expresses numbers in dollars or percentages. It’s what the magazine’s all about…life, money and probabilities, particularly probabilities. To understand any investment opportunity (including stocks, marriage or movies), know the numbers and recognize the odds. So, get off your ath, let’s do some math. Tom Preston features editor

We were thrilled a month ago to put the debut issue of luckbox magazine in your hands! We were even more thrilled to receive so much feedback from readers. Please take a moment to visit luckboxmagazine.com/survey. Give it to us straight and help us choose the next luckbox of the month!

luckbox letters I purchased the print edition of the first issue of luckbox magazine and, wow, it was phenomenal. The look and feel really stood out as exceptional. The story on Tom Sosnoff was great, and Jonathan Little’s (The Poker Trade) contribution was very welcome. There are strong parallels between poker and trading – particularly selling option premium – so there’s a great synergy there. For trading content, you’re off to a good start but I’m looking forward to more challenging content for seasoned traders. I understand there’s a balancing act as you try to reach a new audience while also keeping in mind more experienced traders, like me. Perhaps a deeper and longer Advanced Techniques section is appropriate for that exploration. Keep up the great work! — Will Buelow, Minneapolis, MN

Bravo!!! What a great magazine April 2019 was. I cannot wait for more. My favorite part is the “tile” view (of the digital reader). It makes getting through all of the material very easy. I love the information. Keep it coming. — Cory Bishop Tewksbury, MA

I liked the articles about trading. Direct and to the point. Thanks guys! I’m an investment newbie but already see some things I will try out. I think I’m going to like this. — Saundra Blanchard Muskegon, MI

Jeff Joseph editorial director

Please email suggestions, criticism and comments to feedback@luckboxmagazine.com

6

I really enjoyed the story on Tom Sosnoff. Written well, articulate, without the need to sound Shakespearean. The honesty of the man and tastytrade was highlighted, without being boastful. So, “Well done,” to the editorial and design team at luckbox. A really good effort. Now that the benchmark has been set, you have a lot to live up to! Good Luck. — Kris Warrior Melbourne, Australia

vote on luckbox of the month & take our first reader survey

luckbox | may 2019

1905-letters.indd 6

3/29/19 1:50 PM

L U X U R Y P E R F O R M A N C E P A S S I O N

Custom Outdoor Kitchens by Kalamazoo

888 340 4361

Crafted without compromise

kalamazoogourmet.com

1905-letters.indd 7

3/29/19 1:50 PM

SHORT INTEREST

Google (Alphabet) 91% share of search engine revenue Facebook 72% share of social networking site revenue Amazon 49% share of e-commerce revenue Sources: America’s Concentration Crisis (2017 data), Open Markets Institute (2019)

8

“CEOs in general are paid far too much. Jesus Christ himself isn’t worth 500 times his median worker’s pay.” Abigail Disney, granddaughter of Roy Disney – who founded The Walt Disney Co. with brother Walt Disney – expressed her thoughts on executive compensation to CNBC. luckbox: Don’t expect that assessment from a Disney heir to shake up the Magic Kingdom. It’s still the place where dreams come true when top managers wish upon a star. Disney CEO Bob Iger was awarded $65.6 million for his performance last fiscal year, the result of a pay bump for extending his tenure at Disney through 2021 and stock awards in excess of $35 million. General counsel Alan Braverman knocked down $10.4 million in 2018 and chief human resources officer Jayne Parker brought in $6.8 million But probabilities suggest that more “median workers” are in the crosshairs and apt to fall prey to reductions in redundancy. In March, Iger closed Disney’s $71.3 billion acquisition of 21st Century Fox’s film and TV assets (see page 30), and two days later it started layoffs that are expected to cost as many as 4,000 Fox employees their jobs.

luckbox | may 2019

1905-shortinterest.indd 8

3/29/19 1:52 PM

“Nearly half of all e-commerce goes through Amazon. More than 70% of all internet traffic goes through sites owned or operated by Google or Facebook.” Sen. Elizabeth Warren, D-Mass, took the lead among 2020 Presidential hopefuls in calling out the big tech companies that she says control the way Americans use the internet. In her view, the tech giants wield power in ways that punish small businesses, quash innovation and substitute their own financial interests for the broader interests of the American people. “To restore the balance of power in our democracy, to promote competition, and to ensure that the next generation of technology innovation is as vibrant as the last, it’s time to break up our biggest tech companies,” Warren maintains.

“We’re now in a second Gilded Age — ushered in by semiconductors, software and the internet — which has spawned a handful of hi-tech behemoths and a new set of barons.” Robert Reich, chancellor’s professor of public policy at the University of California at Berkeley and former secretary of labor in the Clinton administration, agrees with Warren declaring, “Bust up the monopolies.” The combined wealth of Facebook’s Mark Zuckerberg ($62.3 billion), Amazon’s Jeff Bezos ($131 billion), Google’s Sergey Brin ($49.8 billion) and Google’s Larry Page ($50.8 billion) has grown larger than the combined wealth of the bottom half of the American population, he says.

luckbox: A trend is emerging – governmental agencies here and abroad are taking action against monopoly power. European regulators recently hit Alphabet’s Google with its third antitrust fine in two years for “illegal practices in search advertising brokering to cement its dominant market position.” That brings the two-year total of EU fines assessed against Google to more than $9 billion. Meanwhile, the Federal Trade Commission has created the Technology Task Force with a mandate to bring sharper focus to antitrust issues with respect to big tech. In much the way that Republicans and Democrats came together last year to enact landmark criminal justice sentencing reform (The First Step Act), luckbox foresees an increased probability that bipartisan political forces will begin to turn up the heat on Facebook, Amazon and Google before the 2020 elections. We like this trend. luckbox values free and fair markets.

WHAT IS THIS THYNG? Scan this page for additional content!

THYNG, an augmented reality app, links luckbox magazine articles to additional digital content. Simply scan any page with a THYNG icon to view video footage, photos and other web-based content on your device.

Download the free THYNG app

Select the “Targets” mode, scan any luckbox page that contains the THYNG icon

Watch the page come to life with enhanced content!

may 2019 | luckbox

1905-shortinterest.indd 9

9

3/29/19 1:52 PM

FAKE FINANCIAL NEWS

Influencers: The New Pump & Dump Cons

W

hen 50 wealthy parents from eight states were indicted for allegedly using a Brinks truck full of bribes to get their shockingly average spawn into the nation’s elite universities (and the University of San Diego), the Twittersphere was awash in jokes. “Aunt Becky’s going to jail,” some online comedians wrote. “Man, these housewives sure are desperate,” wrote others. What got lost in the shuffle, however, was how federal authorities caught on to the biggest college-admissions scam ever. According to the Wall Street Journal, “Morrie Tobin, a Los Angeles financial executive who was being investigated in….an alleged pumpand-dump investment scheme... offered a tip to federal authorities in an effort to obtain leniency.” Ah, pump-and-dump. It could be the tagline of dating apps like Tinder and Bumble, but it’s a scam as old as time: boy meets stock, boy “hypes stock” by endorsing it and getting others to invest, boy sells stock at higher price, boy never calls stock again. It’s essentially a financial ghosting. It seems Tobin didn’t like being the object of a shakedown by a Yale women’s soccer coach, so he sang like a canary to the Feds. (Tobin’s no financial savant, by the way, having tried to sell pharma stock by not registering it.) Anyway, the admissions scandal has once again focused the financial spotlight on pump-anddump schemes. And there’s no better topic for luckbox fake financial news than an oldie but goodie scam.

10

Oprah Winfrey

DJ Khaled

Floyd Mayweather

“On (messaging apps) Telegram and Discord, 10% of the pumps increased the price by more than 18% and 12% respectively in just five minutes. Given that trading volume and crypto prices were falling during the January-July 2018 period, even modest percentage increases were considered ‘an achievement for the pump.’” – The Economics of Cryptocurrency Pump and Dump Schemes (2018)

PHOTOGRAPHS: (WINFREY) REUTERS/LUCY NICHOLSON; (KHALED) REUTERS/STEVE MARCUS; (MAYWEATHER) REUTERS/ISSEI KATO

By Vonetta Logan

luckbox | may 2019

1905-fakenews.indd 10

3/29/19 1:54 PM

Con game goes digital Today, a pump-and-dump scheme reaches victims through an Instagram feed instead of in the leather-ensconced locker room of the Good Ol’ Boys Club. Gone are the days of charlatans, confidence men and traveling purveyors of snake-oil. Welcome to the era of the influencer. A blonde in a teeny bikini posting #fitspiration advice while hawking #flatbellytea quickly makes more money than most people see in a lifetime. Imagine her commanding her manservant, Timba, to read an article like this aloud whilst spraying her with sunless tanner. The digital age is perfect for digital manipulation. On average, at least two pump-and-dump schemes occur every day, generating $7 million in daily trading volume, according to a study at Imperial College London of 236 pump-and-dump schemes in the crypto space. Bloomberg News cited another study, “The Economics of Cryptocurrency Pump and Dump Schemes,” by researchers at the University of Tulsa, University of New Mexico, and Tel Aviv University, that “identified 4,818 so-called pump-and-dump attempts between January and July.” Researchers called the fraud “widespread and often quite profitable,” Bloomberg said. Trading on fame How about a legendary boxer and a DJ known for pumping up the jams becoming embroiled in a tussle with the Securities and Exchange Commission over an Initial Coin Offering (ICO) pump-and-dump imbroglio? In November 2018, Deeeeee JAAAAAAY Khaled (sorry there’s no way to write that without having his voice in your head), and retired professional pugilist Floyd Mayweather settled out of court with the SEC but racked up a combined $767,520 in fines for failing to disclose the payments they received for promoting ICOs on their social media channels. The case centered

on a cryptocurrency platform called Centra. According to Forbes magazine, “Centra promised investors that funds raised in the ICO would be used to build...a debit card backed by Visa and Mastercard that would enable users to convert thinly traded cryptocurrencies into U.S. dollars.” The card was a scam, but Mayweather and Khaled weren’t charged with fraud. They were accused of “failing to disclose the fact that they were paid to promote Centra’s ICO.” So two multimillionaires get a slap on the wrist and then go about their day while investors get fleeced. Even more ludicrous, stock shenanigans are now working in reverse on the new digital pump-anddump frontier. Yes, child, let luckbox introduce you to an epic pump-anddump scheme. Kylie Jenner, the world’s youngest self-made billionaire is known for inflating her lips while deflating stock prices. In February 2018, Jenner tweeted, “Sooo does anyone else not open Snapchat anymore? Or is it just me….ugh this is so sad.” Then, faster than the Kardashian clan can flock to a camera, Snapchat’s stock (SNAP) lost $1.3 billion in market value. From there, it continued to decline. Jenner tried to ameliorate the situation by tweeting, “Still love you tho snap….my first love.” A year later, Snap shares were still down 50% from BK…before Kylie.(For more on Jenner, see page 64.) The celeb puffery doesn’t end there. In 2015, billionaire media mogul and boss of housewives everywhere, Oprah Winfrey, joined the board of Weight Watchers (WTW) and took a 10% stake in the company, causing the stock price to double in a single day. Subscribers got Winfrey’s cauliflower pizza! Her ability to recruit subscribers powered Weight Watcher’s stock to a record high of more than $100 per share in July 2018. But since those magical days, Winfrey hasn’t been, ahem, pulling her weight. WTW is down

SNAP 1905-fakenews.indd 11

about 80%, and Winfrey unloaded some of her shares before the stock started to trim the fat.

On average, at least two pump-and-dump schemes occur every day, generating

The power of influence In this day and age, influence is its own currency and it’s trading at all-time highs. According to an article in Wired magazine, “becoming a social media star is the fourth most popular career aspiration for Gen Z, ranking well above actor or pop star.” Mama don’t let your kids grow up to be cowboys….er, YouTubers. The American lexicon now includes the words “influencers,” “micro-influencers” and “pet-influencers.” People are taking notice everywhere, from college campuses to local juice bars. Nothing happens by accident anymore, and nothing’s organic. A December article in Fast Company says, “The Casper mattress. The Allbirds sneaker. Birchbox, Prose, Snowe, and Keeps... each of these brands’ Instagram feeds were designed by the same company – the New York-based studio Red Antler.” If that’s not enough to blow your mind, the Fast Company writer continues, “Red Antler partners with companies in their earliest days of forming their business and frequently takes equity in those businesses.” Put your hands together for the new digital pimp, ladies and gents! luckbox asserts that speculative assets like crypto, cannabis or ICOs – while heady with roller coaster price movements and celebrity endorsements – are no place for active and engaged investors. Trading mechanically in viable, listed, liquid underlyings provides the true path to wealth, no matter what a blonde in a teeny bikini tries to tell you.

7 million

$

in daily trading volume.

WTW

Vonetta Logan, a writer and comedian, appears daily on the tastytrade network and hosts the Connect the Dots podcast. @vonettalogan

may 2019 | luckbox

11

3/29/19 1:54 PM

Free your mind.

All this from the think tank that brings you free live trading every minute the markets are open!

GET INSIDE OUR HEADS AT info.tastytrade.com/freemind 1905-trades-candle.indd 12

3/29/19 12:40 PM

trades actionable trading ideas

LIGHT THIS CANDLE

Candlestick chart analysis for intermediate-term trading

CNK: Movie Moves By Doug Busch

C

inemark Holdings (CNK) is up 14% year-to-date and 4% during the last one-year period. Already sporting an attractive dividend yield of 3.3%, Cinemark is looking to extend its winning streak to its longest in 13 months. While this stock has had issues just above $40 since 2015, a decisive break could see a powerful move all the way up to $53.

Cinemark Holdings (CNK)

Douglas Busch, CMT, trades U.S. equities using technical analysis with an emphasis on Japanese candlesticks. @chartsmarter

CNK BUY STOP: Above $42

Source: ChartSmarter

may 2019 | luckbox

1905-trades-candle.indd 13

13

3/29/19 12:40 PM

trades

THE TECHNICIAN

A veteran trader tackles technicals

The Simple Clarity of Trendlines By Tim Knight

T

echnicians draw basic but powerful trendlines on charts to help them understand areas of support, resistance and change. In financial graphs, trendlines can provide perspective on likely price behavior, usually by emphasizing important price levels. They’re the most basic charting tool, but a solid knowledge of using and interpreting them can prove essential to success as a technical analyst. Here are some properties of a well-drawn trendline: • During the time it’s intact, the trendline connects at least two points of a graph (with high points or low points), and the more points it touches (without the price bars going above or below the line), the more valid and useful the line. • It is, during that time, never violated by prices between the starting and ending points; in other words, all of the prices fall either below the trendline (in which case the line is resistance) or above the trendline (in which case the line is support). A trendline’s purpose depends on the user’s relationship with a particular security. If an investor has a position in a stock, the trendline ensures that the trend of the stock is intact so that when the trend is violated the investor can exit the position as profitably as possible. If an investor doesn’t have a position in the stock, the purpose of a trendline is to show when a possible trend change has taken place so that the observer can consider taking a position in the stock based on that trend change. (The term “stock” is used broadly here and can refer to any financial instrument or its derivative). Drawing a trendline seems simple because laying down a straight line to “bound” the uptrend or downtrend of a stock makes intuitive sense. The artfulness, however, is in discerning when to redraw or reposition a trendline. As a stock moves, it may become appropriate to redraw a trendline to take into account the more complete price data. The danger is that an investor can wind up fooling himself. If trend-

DIS 14

Disney trends With this bullish stock, one can draw four trendlines on the top chart. In a shorter timeframe (bottom chart), trendlines can help monitor the shorter-term health of an instrument.

The artfulness is in discerning when to redraw or reposition a trendline

luckbox | may 2019

1905-technician.indd 14

3/29/19 12:42 PM

trades

lines become so elastic that they bend and move no matter what direction prices are heading, then their value is eliminated. The trendlines of two major entertainment stocks can provide some insight. One’s bullish, and another bearish. Starting with the bullish stock, Disney (DIS), a technician can draw four trendlines on top of it. See “Disney trends,” left. The green and red trendlines constitute an ascending channel. Separately, each is a trendline in its own right. But taken together, because they’re parallel, they are a price channel bounding the daily bars for many years of the stock’s price. As long as the price doesn’t break beneath the lower trendline, this uptrend can be considered solidly intact. A closer look at the recent history of DIS illustrates how, in a shorter timeframe, trendlines can help to monitor the shorter-term health of an instrument. The lower line, in green, is the supporting trendline, and just as with the much longerterm trendline, it has never been violated. The horizontal line, in blue, constitutes resistance as of this writing. If and when it manages to push above this blue horizontal, the role of that line will change from resistance to support. These simple lines help affirm the underlying support of the stock and its potential for further price gains, should it break above its resistance level. The notion of “violating” a trendline is important. A trendline provides a line that prices should stay above (if the line is support) or below (if resistance). If prices stray across the trendline, something has changed. Deviating from the lines doesn’t necessarily signal a change, but the trader better start paying closer attention. In the case of the DISH Network (DISH), price has definitely crossed under the green supporting trendline. The uptrend has, by definition, been broken. (See “Dish support breaks,” right.) A closer examination of the chart shows the breakdown in more detail. The long red and blue lines defined the reversal pattern as the stock peaked at about $80 and lost half its value. In spite of that tremendous loss, the actual uptrend failure hadn’t occurred yet. That took place only when the price broke beneath the green trendline. Notice how, once prices have violated the trendline they tried to go above it again but are repeatedly repelled. That illustrates the “role change”

DISH support breaks In the top chart, the prices crossing below the green supporting trendline illustrate that the uptrend has been broken. The second chart provides a closer look, where the long red and blue lines defined the reversal pattern as the stock peaked at about $80 and lost half its value.

DISH that has occurred. Just because the trendline is broken doesn’t mean a financial instrument is headed for a major change, but it often means that the chart is no longer in the defined uptrend. Paradoxically, stocks that break their uptrends can still move higher in price, and stocks that break downtrends can still move lower. A violated trendline, however, is one of the simplest warning signals investors can monitor.

The old saying, “the trend is your friend” has been true ever since charts were invented. In spite of how sophisticated some technical indicators have become, the most minimal of studies — a simple, straight line — can be the most faithful ally. Tim Knight has been using technical analysis to trade the markets for 30 years. He founded Prophet Financial Systems and offers free access to his charting platform at slopecharts.com.

may 2019 | luckbox

1905-technician.indd 15

15

3/29/19 12:42 PM

trades

MACRO TRADER

Intraday declines on tech giants can indicate a short dollar-to-yen trading opportunity

The Forex FAANG Trade By Amelia Bourdeau

F

AANG stands for a collection of popular tech and communication companies that have changed the way most people live. The acronym comes from Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Alphabet (GOOG). These companies, with the exception of Netflix, rank among the Top 10 most-valuable publicly traded companies in the world. Apple, Amazon and Microsoft, which is not a FAANG member, have recently rotated in and out of the No. 1 spot. In August 2018, Apple became the first U.S. company with a $1 trillion valuation and the world’s most valuable publicly traded company. On Dec. 3, 2018, Amazon surpassed both Apple and Microsoft for the title before yielding it back to Microsoft. Because of their popularity and market capitalizations, FAANG stocks can individ-

ually or collectively set the trading-day tone for U.S. equity indexes. Take the example of March 18, 2018, when news of Facebook’s Cambridge Analytica scandal led equity markets lower. The same thing happened with Apple’s Nov. 1, 2018 announcement of a disappointing holiday season forecast and news that it would stop reporting how many iPhones it sells. This is where macro trading comes into play. Moves lower in U.S. equity markets can affect safe-haven currencies – the U.S. dollar (USD), Swiss franc (CHF) and Japanese yen (JPY). Safe-haven currencies tend to strengthen in times of risk-off sentiment. Looking at the charts, USD/JPY has responded to intraday moves lower in FAANG stocks. The safe-haven JPY can appreciate versus USD when FAANG stocks fall intraday.

Any of the FAANG companies can set the tradingday tone for U.S. equity indexes

Horse race Apple, Microsoft and Amazon jockey for the top spot in market capitalization.

Source: Bloomberg LLP

16

luckbox | may 2019

1905-trades-macro.indd 16

3/29/19 12:47 PM

trades

In a recent example of this phenomenon, Facebook shares fell 2.46% on March 15, 2019, as Facebook announced leadership changes caused by a shift in strategy. USD/JPY moved lower as well – in other words, JPY strengthened versus USD. (See “In unison,” below.) On Dec. 4, 2018, Apple shares fell approximately 4.4% as market participants fretted about iPhone sales. USD/JPY moved lower as well – meaning that JPY strengthened versus USD. (See “Twins,” right.) Notice that toward the end of the New York trading day session on the chart – selling seems to accelerate for Apple into the close, but USD/JPY stalls, trading mostly sideways. That’s because FX trading usually slows ahead of Asia open, as liquidity is lower until Singapore starts its trading day. When a FAANG stock is down heavily at the trading session open, investors should monitor USD/JPY intraday price action for opportunities to short USD/JPY.

Twins Apple and the USD/JPY safe-haven currencies stuck together like glue on Dec. 4, 2018.

Amelia Bourdeau is CEO at marketcompassllc.com, an advisory firm that provides global macro education and trading strategy to investors at every level. @ameliabourdeau

Source: Bloomberg LLP

In unison Facebook and the USD/JPY safe-haven currencies rose and declined together on March 15 of this year.

When a FAANG stock is down heavily at the trading session open, monitor USD/JPY intraday price action for opportunities to short USD/JPY

Source: Bloomberg LLP

may 2019 | luckbox

1905-trades-macro.indd 17

17

3/29/19 12:47 PM

trades

OPTIONS

Smaller investors can create a diversified portfolio if they know their options

The Media Trade By Ryan Shaw

A

t least some of the readers who’ve digested the articles on media in this issue of luckbox may have identified trades in that sector with attractive probabilities. If so, they may now be wondering how to use those probabilities in their favor. The answer might be options. Options aren’t just for investors with large accounts. With a smaller account it’s difficult to buy or short enough stocks to create a portfolio that maximizes exposure across asset classes. Single name equities are some of the most attractive trading vehicles and narratives, but trading stocks in a capital-efficient way can prove difficult. Using options trades, investors can simulate stock positions while using about 10% of the capital. That’s one of the advantages options have for traders with modestsized accounts. Many brokers offer 4x leverage intraday and 2x leverage overnight for stock trading, but even that requires a large amount of capital to avoid getting churned up by commissions margin rates – not to mention being limited to only a handful of positions at a time. Sure, one can buy cheap out-of-the-money options, but that’s a world of low-probability trades requiring large moves and perfect timing. Using a $25,000 account as an example, and spreading capital over four media sectors, an investor could go long Disney (DIS) and Imax (IMAX), and short Netflix (NFLX) and Comcast (CMCSA). Assuming an even allocation of the entire account across those equities, a best-case return assuming a 1-month expected move in a favorable direction in each stock (see “$25,000 in stocks,” right). In this case, with 100% of $25,000 in capital at use, there is a probable range of return up to 9%. Using options can significantly increase that return while maintaining a similar probability of profit. Using options, we’ll create strategies with a similar delta as the stock positions in the example above, and cover four trade ideas

18

$25,000 in stocks... With 100% of capital at use, the exposure is approximately 9% in one month. Options can achieve similar results using less capital. Stock

Capital

1-Month Expected Move

Total Return

NFLX

$6,250

11%

$687.50

DIS

$6,250

6%

$343.75

CMCSA

$6,250

6%

$350.00

IMAX Totals

$6,250

8%

$493.75

$25,000

9%

$1,875.00

Put on Netflix While put spreads are typically long volatility plays, this trade is actually a theta positive trade with a higher than 50% probability of profit and no extrinsic premium.

using different strategies for the aforementioned media stocks. Netflix, which has a relatively low IV rank in the 30s, skewed higher by earnings before April expiration. Using a long deep in-themoney put to simulate short stock, one can sell a far out-of-the-money put to completely offset the extrinsic premium of the in-themoney put. Specifically, an investor could buy the 370-345 May put spread for $12.17, which

Using capital efficiently helps traders manage smaller accounts

luckbox | may 2019

1905-trades-options.indd 18

3/29/19 12:51 PM

trades

has no extrinsic premium with the stock trading around 356. While put spreads are typically long volatility plays, this trade is actually theta positive with a higher than 50% probability of profit and no extrinsic premium. With earnings and the elevated IV, this provides a trader a bit of a hedge against significant volatility movement in either direction, which a short stock lacks. (See “Put on Netflix,” left.) Disney’s IV rank is also relatively low at around 24%, but in a low-volatility market that offers both a short or long volatility opportunity. Selling the April 120 call and buying the May 120 call creates a long call calendar spread, playing for a gradual return to the highs. This trades at a $0.75 debit, with over half the May call price offset by selling the April call. This is an extremely low capital play for a $115 stock. While calendar spreads are technically long vega plays, a call calendar could be considered somewhat short volatility, assuming a rise in the stock price will coincide with lower volatility in the April call and a stable volatility in the May call. With an IV rank of 24%, a calendar spread provides a nice option because a significant decrease in price and increase in volatility won’t hurt as much as selling naked options, and lower volatility will likely be offset by the stock’s movement in our favor. A trader would need to buy around 15 of these spreads to equal a similar delta to 100 shares of stock. (See, “Disney has the options,” top right.) Comcast offers an IV rank of almost 0%, which allows a trader to buy in-the-money puts with almost 0 extrinsic value. For instance, the 45 June put has $0.13 of extrinsic premium, giving us nearly an identical profit and loss exposure to short stock. However, the put can be bought for just under $600, as opposed to around $4,000 to short the stock. Buying June locks in the super-low IV rank for a longer time, and enables a trader to sell out-themoney puts in April or May as either the stock moves against/for the position, or any subsequent uptick in volatility. IMAX has an IV rank of around 6%, favoring buying volatility. To simulate long stock, one can buy the June 20 call for $4.05, containing around $0.70 of extrinsic premium. Here, a trader could sell the April 25 call for $.30, and assuming one could sell a similar call in May in the future, there would be theoretically mini-

Disney has the options With an IV rank of 24%, a calendar spread is a nice option in that a significant decrease in price and increase in volatility won’t hurt as much as selling naked options, and lower volatility will likely be offset by the stocks movement in our favor.

... or, $3,282 in options These strategies will set a trader back around $3,200, using a little more than 10% of the accounts capital and leaving room for many more trades/positions. Stock

Capital

NFLX

$1,217

11%

$665.72

DIS

$1,125

6%

$282.25

25%

$570

6%

$215.44

38%

CMCSA IMAX Totals

1-Month Expected Move

Total Return

Total Return on Capital 55%

$370

8%

$151.50

41%

$3,282

9%

$1,314.91

40%

mal extrinsic value being paid for this trade. In total, these strategies will set a trader back around $3,200, using a little more than 10% of the account’s capital and leaving room for more trades or positions. Each play uses the leverage options, so note that this elevates the potential gains and losses. However, the idea is to demonstrate options strategies with higher return on capital, while maintaining the 50-50-probability shorting/buying stock provides. Assuming the same move in a trader’s favor as before (and no change in back month volatility) return for the capital deployed increases significantly. “... or, $3,282 in options,” above, shows the return of these options plays versus their stock counterparts, again assuming expected

one-month moves in favor of each position. All four strategies come with their own benefits and drawbacks, but each provide a higher probability play than buying cheap out-the-money options and hoping for a large move in your direction. Each also allows different plays on contracting and expanding volatility, breaking out from the rut of 50-50 straight up bets on stock movement. Using capital efficiently is critical to traders with smaller accounts, and these options strategies offer a creative alternative, using leverage and optimizing probabilities. Ryan Shaw, a futures and derivatives trader, specializes in option spreads and pairs trading at NinjaTrader, analyzing order execution, charting and automated strategies.

may 2019 | luckbox

1905-trades-options.indd 19

19

3/29/19 12:51 PM

trades

FUTURES

A veteran futures trader’s take on the markets

Buns Up? By Pete Mulmat

O

n Fridays, the Ceres Cafe at the Chicago Board of Trade squeezes about five inches of fish between two slim hamburger buns. The fish gets a lot of attention, but nobody cares too much about buns. The wheat that’s used to make the buns doesn’t command much respect, either. Wheat futures fell on March 11 to log their lowest finish since January 2018. The most-active May futures contract had been heavily sold for several weeks. Slow export concerns were confirmed on the U.S. Department of Agriculture’s World Agriculture Supply and Demand Estimates report issued Friday, March 8. The report also showed slowing domestic use as well. Ceres must be onto something. Competition from abroad Prices are under attack due to foreign competition, which is hurting U.S. farmers’ ability to sell grain abroad. Normally, a third of American wheat is sold to foreign buyers, but exports have been slow this year, bottling up grain. The biggest competition comes from Russia, Ukraine and other former Soviet Union nations; whose wheat has been consistently cheaper than U.S. wheat, forcing American farmers to sell at increasingly lower prices. Flooding along the Mississippi River, a waterway that plays a crucial role in the shipment of corn, soybeans and wheat from the Midwest to ports along the Gulf of Mexico, has disrupted barge traffic and could heighten volatility in agricultural markets. Reverse skew Seasonally, a pick-up in wheat volatility begins as the crop emerges from the ground. Wheat usually has a “reverse skew” where equidistant calls are more expensive than puts. At depressed prices, the skew becomes nearly flat, with calls trading relatively cheaply and puts trading relatively rich. With wheat down 26% from its highs last year, a contrarian play (a long bias) may be

20

interesting. Realized volatility is the highest it’s been in these markets all year, and it’s still rising. For the next 60 to 90 days, wheat may provide higher volatility and expanded ranges to trade. Plus, agricultural markets have almost no correlation with the equities markets, making trades in wheat a potentially complimentary uncorrelated trade to a core portfolio. With / ZW option skew the way it is and a higher volatility overall, a bullish wheat trade could be a short out-of-the-money put in the June expiration. In the meantime, it’s almost Friday… Where’s my fish sammich? Pete Mulmat, chief futures strategist at tastytrade, serves as host for a number of daily futures segments on the tastytrade network under the main flagship programming slot called Splash Into Futures.

Grains of truth Approximately 75% of all U.S. grain products are made from wheat flour. A bushel of wheat makes about 90, 1-pound loaves of whole wheat bread. The average American consumes about 134 pounds of wheat flour per year. Source: USDA

Soft red winter wheat For soft red winter (SRW) wheat called /ZW, volatility is increasing. Wheat generally has a reverse skew.

Volatile wheat Realized volatility is the highest it’s been in these markets all year, and it’s still rising. As of 5/15/18

Realized Volatility

RV Rank

Soybeans (SOYB)

18%

48%

Wheat (WEAT)

27%

47%

Corn (CORN)

19%

48%

luckbox | may 2019

1905-trades-futures.indd 20

3/29/19 12:55 PM

trades

DO DILIGENCE

Emerging financial technology helps investors understand their portfolios

Media Matters By James Blakeway

N

etflix (NFLX) and Spotify (SPOT) are making aggressive bids for the public’s eyes, ears and expendable income, forcing the entertainment industry titans of yesteryear to innovate, or acquire innovation, in their struggles to stay relevant and profitable. The threat of takeovers in the video entertainment industry and the uncertainty of licensing deals are keeping prudent investors glued to screens or printed pages to monitor the industry’s news. The headlines include the Disney+ (DIS) video streaming service’s attempt to poach Netflix subscribers. Disney hopes to become the new home for its own content and would remove it from other services as the licenses expire. That would put programming pressure not only on Netflix but also on other services such as Starz (STRZA) and TNT, which is related to WarnerMedia (TWX). Music entertainment is a whole different animal, pitting Spotify head-to-head with Apple (AAPL) and Amazon (AMZN) music. While video producers are differentiated because they don’t have the same TV series or the same movies, firms that stream music have similar libraries. That means that technology

65: On Track

Top publicly traded entertainment companies An equally weighted portfolio of these stocks, initiated when Spotify offered its IPO last year, outpaced the S&P 500 during the same period. Company

Symbol

Market Cap ($ Billions)

Return from 4/3/18 to 3/13/19

Comcast

CMCSA

174.2

18.2%

Disney

DIS

169.9

14.8%

Netflix

NFLX

154.4

27.3%

Twenty First Century Fox

FOX

93.3

43.5%

SiriusXM

SIRI

28.3

-1.1%

Spotify

SPOT

25.3

-3.7%

CBS

CBS

Dish Network Corporation DISH

18.3

-7.9%

15.0

-16.0%

Cinemark Holdings

CNK

4.5

4.5%

AMC Networks

AMCX

3.5

14.6%

and pricing dictate which music providers prevail. The video entertainment industry is rife with mergers and acquisitions. It’s tough for investors to pick a single horse to bet on, and it’s unlikely that any one of these companies will continue to outpace all others. However, it’s possible that all these stocks have a role to play in a portfolio focused on consumer discretionary spending and the entertainment sector. An equally weighted portfolio of these stocks, initiated when Spotify offered its initial public offering last year, has returned 9.6%, compared with the S&P 500, which has returned 6.4% in the same time period. (See “Top publicly traded entertainment companies,” above.) To highlight the strengths and weaknesses

of a sector-specific portfolio like this, investors can run an analysis through the free Quiet Foundation (QF) Exploratory Portfolio Intelligence (EPI) system. That can provide a deeper look at the stocks’ relationships to one another and the overall market. As an example, running these 10 stocks (equally weighted) through the EPI analysis results in a score of 66 (out of 100) and a QF rating of “On Track,” the second highest rating. In the EPI report the QF takes a deeper look at the diversification, which received a poorer score because of a high correlation among these stocks. They tend to move in the same direction day-to-day. This analysis also provides insight into future potential movement of this portfolio over the next year. (Continued on pg. 23)

Past performance is no guarantee of future results. Information provided in an EPI Report does not consider the specific profile, objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her investment professional. Investment suitability must be independently determined for each individual investor. QF does not make suitability determinations or investment recommendations for investors. EPI utilizes the S&P 500 as its benchmark given that the S&P 500 is considered a barometer of stock performance in the United States. Aspects of the analysis and information found in an EPI Report is based upon simulated and/or hypothetical performance. Simulated and hypothetical performance have inherent limitations and do not represent the actual performance results of any particular investment products. The EPI Report does not guarantee any results or outcomes in the financial markets. Investors should be aware of the methodology used to produce an EPI Report and the inherent limitations when placing reliance on the results. For additional information about EPI Reports, visit the QF website: quietfoundation.com.

may 2019 | luckbox

1905-trades-dodiligence.indd 21

21

3/29/19 12:58 PM

trades

CHERRY PICKS

Ripe & juicy trade ideas

Highly Liquid Media Stocks By Michael Rechenthin

T

echnology, evolution and acquisitions are rearranging the geography of American media companies. Let’s catch up with the some of the changes by examining the numbers for market capitalization, profits and number of employees. Sorted by market capitalization, three

companies stand out – Comcast (CMCSA), Disney (DIS) and Netflix (NFLX). All have market capitalization of more than $160 billion. But market cap doesn’t tell the whole story of those companies. Disney rakes in four times as much revenue as Netflix and employs 28 times as many workers.

Meanwhile, Comcast is pulling down annual revenue of nearly $100 billion. Netflix and Spotify (SPOT) have both nearly doubled revenue over three years – but Netflix is profitable and Spotify has yet to turn a profit. That makes Spotify a more speculative trade – management still has yet to figure out a struc-

By the numbers Investors can get to know companies by comparing market cap, profits and number of employees.

Price

Market Capitalization (in billions)

Reported Employee Count

2018

2017

2016

2018

2017

2016

Second largest cable TV company and largest internet provider

39.63

179.55

160,000

94.5

85

80.7

yes

yes

yes

DIS

Diversified multinational mass media and entertainment. Owns ESPN.

108.5

162.08

201,000

59.4

55.1

55.6

yes

yes

yes

NFLX

Has 139 million paid members in 190 countries.

365

159.77

7,100

15.8

11.7

8.8

yes

yes

yes

Company

Symbol

Comcast

CMCSA

Disney Netflix

Total Revenue (in billions)

Profitable?

Fox Corp.

FOX

Legal successor of 21st Century Fox.

37.35

70.76

22,400

30.4

28.5

27.3

yes

yes

yes

SiriusXM

SIRI

Provides satellite radio services in the U.S.

5.85

25.21

2,700

5.8

5.4

5

yes

yes

yes

Spotify

SPOT

Provides music streaming services worldwide

138.5

25.13

3,700

5.3

4.1

3

no

no

no

CBS

CBS

Commercial broadcast television and radio

45.35

16.94

32,700

14.5

13.7

13.2

yes

yes

yes

Dish Network Corp.

DISH

Has 12.3 million pay-tv subscribers. Provides access to moves and tv.

31.5

14.72

16,000

Upcoming

14.4

15.2

Upcoming

yes

yes

Discovery

DISCA

Owns Discovery channel, Animal Planet, HGTV, etc.

26.75

14.00

9,000

10.6

6.9

6.5

yes

no

yes

Grupo Televisa

TV

Largest hispanic mass media company

10.6

6.00

39,000

Upcoming

4.9

5

Upcoming

yes

yes

Cinemark Holdings

CNK

Motion picture business -- operates 341 theatres.

39.96

4.68

11,600

Upcoming

3

2.9

yes

yes

yes

Tribune Media

TRCO

Owns 39 tv station across the U.S.

46

4.00

5,800

Upcoming

1.9

1.9

Upcoming

yes

yes

Sinclair Broadcast Group

SBGI

Largest tv operator by number of channels. Has 193 stations

37.8

3.50

9,000

3.1

2.7

2.7

yes

yes

yes

AMC Networks

AMCX

Owns AMC, WE TV, BBC America, Sundance TV, etc.

56.6

3.19

4,400

3

2.8

2.8

yes

yes

yes

Tegna

TGNA

Owns 47 television stations

13.9

3.00

5,300

Upcoming

1.9

2

Upcoming

yes

yes

MSG Networks

MSGN

Primarily a sports channel.

22.05

2.00

180

0.7

0.7

0.7

yes

yes

yes

The E W Scripps

SSP

Currently owns 51 TV stations.

21.65

1.50

4,000

Upcoming

0.9

0.9

Upcoming

no

yes

Nexstar Media Group

NXST

Second largest tv station owner. Owns 171 stations.

105

0.50

3,800

2.8

2.4

1.1

yes

yes

yes

22

luckbox | may 2019

1905-trades-dodiligence.indd 22

3/29/19 2:19 PM

trades

ture that works. Investors might want to avoid Spotify because there’s too much uncertainty. Lastly, what stocks have liquid option markets? Options, particularly sold short, can provide more opportunity for investors because they can theoretically get the direction wrong and still make money on the credit received. In the list to the right, investors would do well to stick with the “highly liquid” stocks – Netflix, Spotify, Discovery Communications (DISCA), Sirius XM Holdings (SIRI), Disney and Comcast. Michael Rechenthin, Ph.D., (aka “Dr. Data”) is head of research and data science at tastytrade.

MEDIA TRADE IDEAS USING OPTIONS: Bearish NFLX (1:1) Short the first out-ofthe-money call and long the 2nd out-ofthe-money call. 50% probability of profit

Bullish DISCA Short the first out-ofthe-money put, which will be below the market. With the credit received, a higher probability of success. The credit + maximum profit potential

DO DILIGENCE

(Continued from pg. 21) These stocks have a higher probability than the S&P 500 of a 10% move in that time frame. The EPI output highlights the liquidity and potential opportunity of these stock holdings. All of the companies, other than AMC Networks (AMCX), trade more than 1 million shares per day, a common threshold for a liquid stock. Liquidity is important in such a dynamic sector because it enables investors to reallocate capital quickly as the industry shifts. The opportunity metric refers to the portfolio’s prospects to use options positions against the stock holdings. Of these companies, most have exchange-listed options, with Comcast (CMCSA), Disney, Netflix and CBS (CBS) standing out as the more liquid contenders. In “Entertainment-related ETFs,” right, the projected dividend yield on this portfolio is approximately 1.1%. This is comparable to the various consumer discretionary ETFs available in the marketplace. Overall, the audio and video entertainment industry provides a blend of older, dividend

Liquid refreshment Stick with the highly liquid stocks. Symbol

Liquidity Level

Volatility Level As Compared to the S&P 500

NFLX

Highly Liquid

Very High

SPOT

Highly Liquid

High

DISCA

Highly Liquid

High

SIRI

Highly Liquid

Moderate

DIS

Highly Liquid

Moderate

CMCSA

Highly Liquid

Moderate

DISH

Moderately Liquid

High

SBGI

Moderately Liquid

High

AMCX

Moderately Liquid

High

TGNA

Moderately Liquid

High

CNK

Moderately Liquid

High

NXST

Moderately Liquid

High

CBS

Moderately Liquid

Moderate

SSP

Slightly Liquid

High

MSGN

Slightly Liquid

High

TV

Slightly Liquid

High

FOX

Slightly Liquid

High

TRCO

Slightly Liquid

Same

To sign up for free cherry picks and daily market insights, visit tastytrade.

Entertainment-related ETFs The projected dividend yield on this portfolio is approximately 1.1%, which is comparable to various other consumer-discretionary ETFs. Name

Symbol

Yield

Return from 4/3/18 to 3/13/19

Options?

Invesco Dynamic Media ETF

PBS

0.81%

15.7%

No

iShares Evolved US Media & Entertainment ETF

IEME

N/A

11.5%

No

Vanguard Communication Services ETF

VOX

2.5%

4.2%

No

SPDR Consumer Discretionary Select Sector Fund

XLY

1.2%

12.0%

Yes

paying stocks with newer, tech and growth-focused companies. To wade into this sector, investors should be as nimble as these corporations moving forward. Whether using ETFs or individual stocks, wise investors may look to keep the QF EPI system in their arsenal, aiding in portfolio allocation analysis. James Blakeway is CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment advisory service for self-directed investors.

These stocks have a higher probability than the S&P 500 of a 10% move

Look under your own hood with QF

may 2019 | luckbox

1905-trades-dodiligence.indd 23

23

3/29/19 12:58 PM

luckbox looks at

Big Media & Entertainment 24

luckbox | may 2019

1905-topics-wolfe.indd 24

3/29/19 10:23 AM

Wolf Richter’s assessment of the movie industry’s traditional theater distribution system opens this luckbox look at the media and entertainment business. Last year’s surge in movie box office revenues contradicted the conventional wisdom of media mavens and analysts who predicted that over-thetop streaming services like Netflix (NFLX) and Prime Video by Amazon (AMZN) would take a slice out of movie house ticket sales. That‘s not what has happened. In fact, Ernst & Young’s Quantitative Economics and Statistics team released data earlier this year suggesting that streaming services’ best customers are the same people who spend the most time in movie theaters. But 2018’s healthy box office results mask the industry’s ominous turf wars. Traditional media are under attack by technology and social sharing platforms. Meanwhile, the battle between distributors and content creators is forcing market consolidation, mergers and acquisitions. Big media companies are doing battle in a highstakes turf war that’s likely to produce big winners. In this special section, luckbox assess the probabilities of the front runners.

In Big Media & Entertainment: No End in Sight: Movie Theaters Bounce Back p. 25 Tentpoles in the House of Mouse p. 27 AMC Entertainment: Time to Buy a Ticket p. 28 Disney vs. Netflix: The Battle for Big Media p.30 Cable TV? Cut It Out p. 37

No End in Sight

Movie Theaters Bounce Back By Wolf Richter

M

ovie tickets are expensive, and alternatives are plentiful, convenient and cheap. But the year 2018 became a banner year for the American movie theater industry just the same, with the number of movie tickets sold increasing 9.8% from the year before to 1.35 billion tickets, according to movie data provider The Numbers. That represented the largest increase in the number of tickets sold since 1996, and It felt like a glorious triumph for the industry. Still, ticket sales a year earlier, in 2017, had been the worst since 1995. And that 9.8% bump in 2018, relative to the previous year’s anemic ticket sales, failed to bring the industry back to 2012 levels. Sales remained 15% below 2002 and still fell short of 1997. In terms of per-capita ticket sales, the industry sold 5.4 tickets per person during the record-breaking year 2002, when the U.S. population was 288 million. By 2018, when population reached 327 million, per-capita sales had declined 24% to 4.1 tickets. That’s the brick-andmortar meltdown for the movie theater industry, which is losing out to digital competition. When it comes to dollar sales, the

may 2019 | luckbox

1905-topics-wolfe.indd 25

25

3/29/19 10:23 AM

Big Media & Entertainment Movies, by the numbers

Buy Me a Ticket

Average ticket prices are in red, and ticket revenue is in black.

By 2018, per-capita sales had declined 24% to 4.1 tickets.

Movie Ticket Dollars

Movie Theater Tickets Sold in the U.S., per Year

industry introduced a truly novel concept in 2018, one it hadn’t tried in at least 22 years: Theaters didn’t increase the average ticket price! Maybe someone finally figured out that if you keep jacking up prices, sooner or later people will switch even more rapidly to digital alternatives. The average ticket price remained at $8.97. A Matter of Geography Depending upon where people go to the movies, results vary. For example, a typical movie at an AMC theater in San Francisco might set a moviegoer back about $14 a ticket. But members benefit from “$5 Ticket Tuesdays” and other discounts. In other parts of the country, movies offer a much better deal even without discounts. If a family of four goes to the

movies and pays the average ticket price, it cost roughly $36, not including the transportation and snacks. Compare that with the nominal cost of watching digitally via any one of numerous platforms on a laptop or big-screen TV at home. Despite that price differential, the industry could take solace in one fact. With last year’s 9.8% increase in the number of tickets sold, compared with the previous year, flat ticket prices resulted in a 9.8% rise in revenue to an all-time record of $12.1 billion. Even though the number of tickets sold in 2018 was down 15% from 2002, dollar sales were up 32%. That’s because the average ticket price had soared 54%, from $5.81 to $8.97. Hallelujah, inflation! In dollar terms, inflation covers up a lot of sins.

Winners Save Face People still go to the movies. And in a year with a few big winners, the whole industry looks better even though many studios are still limping along. In 2017, the top four movies grossed $1.82 billion. In 2018, the top four grossed 32% more: $2.4 billion — or 20% of total ticket revenues. Ultimately, whether the industry has a good year or a lousy year depends on just a handful of flicks. This year Disney’s “tentpole” releases could make or break the stats for the industry as a whole despite the structural decline that saw per-capita ticket sales plunge 24% since 2002. Wolf Richter, editor in chief of wolfstreet. com, writes about business and financial issues with an eye toward exposing shenanigans, entanglements and opportunities. @wolfofwolfst

For the first time in 22 years, movie theaters didn’t increase ticket prices last year.

26

luckbox | may 2019

1905-topics-wolfe.indd 26

3/29/19 10:23 AM

Disney’s franchise-movie strategy sets the stage for a marvelous 2019

Tentpoles in the House of Mouse By Jeff Joseph

D

isney dominated the world of movies in 2018, earning roughly 19% of global box office revenues. The way this year’s unfolding, Disney may grab an even bigger percentage of the take. But that’s a bigger slice of a smaller pie. After last year’s record year for box office receipts, January’s revenues were the lowest since 2011. Through February, domestic box office revenue was off nearly 20% from the same period in 2018. But then something marvelous occurred for Disney. Captain Marvel posted the third largest March opening in history with more than 4,300 theaters achieving nearly $800 million in global box office in its opening 10 days. luckbox expects it will close in on $1 billion. That will tilt more global box office revenue share toward Disney – but there’s much more to come from Disney’s “tentpole” release strategy for the remainder of this year. Tentpole movies are mega-budget, franchise-feeding, blockbusters with 360° ancillary revenues. They support Disney’s other business units — such as the theme parks, merchandise and the Disney Music Group — the same way a single tentpole carries most of the burden of keeping a tent upright. Think of the film Frozen. Better

80% luckbox projects

probability that Disney’s box office will exceed 20% of global box office revenues in 2019.

Captain Marvel, starring Brie Larson, earned nearly $1 billion worldwide in March.

yet, don’t think Frozen or else that earworm of a theme song will take hold in your brain. Really, let it go. Anyway, like erecting a tentpole, Disney parlayed Frozen, the all-time highest-grossing animated movie ($1.27 billion), into a franchise whose music and merchandising revenue exceeded revenue brought in by the film itself. Disney has an extraordinarily promising tentpole release queue for 2019 with sequels to Avengers, Toy Story, Frozen and Star Wars; and new live-action remakes of Disney classics including The Lion King, Aladdin and the

recently released Dumbo. Here’s the Disney 2019 release schedule, per ComScore: Penguins (April 17) Avengers: Endgame (April 26) Aladdin (May 24) Toy Story 4 (June 21) The Lion King (July 19) Artemis Fowl (Aug. 9) Frozen 2 (Nov. 22) Star Wars: Episode IX (Dec. 20) Besides that stellar list, Disney also controls the film franchises it picked up with the acquisition of Fox, including Dark Phoenix and New Mutants. It’s looking like another banner year in the House of Mouse.

may 2019 | luckbox

1905-topics-wolfe.indd 27

27

3/29/19 10:23 AM

Big Media & Entertainment This theater sector analyst and trader projects a happy ending

AMC Entertainment: Time to Buy a Ticket By Andrew Cowen

“RGC is the second largest domestic movie theater operator by screen count. Regal (and the movie theater industry, in general) has been a favorite and poorly chosen company among the short-selling community… This down move is an opportunity, particularly in light of a good box office year with a decent looking slate for 2018 as well.” RGC was trading at $20.75 in mid-2017. Six months later, Cineworld Group (CINE) acquired RGC for $23 a share.

28

PHOTOGRAPH: SHUTTERSTOCK

This month, when luckbox was seeking an authoritative voice on the movie theater sector, the search led to fund manager Andrew Cowen, who’s traded theater stocks for more than 15 years. In mid-2017, when theater stocks were under heavy selling pressure, Cowen was brimming with optimisim for Regal Entertainment Group, which has since been acquired. He made the following statement in a June 2017 article, Rumors of the Movie Theater Industry’s Death are Highly Exaggerated.

luckbox | may 2019

1905-topics-cowen.indd 28

3/29/19 10:29 AM

I

nvestors harbor a dark skepticism of movie theater chains in general, but their distrust of AMC Theatres seems especially deep. AMC’s stock has lost more than half its value since the company acquired a series of competitors in late 2016 and early 2017. The stock remains under pressure despite excellent and relatively steady cash flows and financial results that beat expectations for fourth quarter and full year 2018. AMC has many detractors with 20% short interest. The short thesis is based on two main legs – one old and one new. Neither is correct. The old short thesis holds that Americans don’t go to the movies anymore. There’s supposedly too much competition for their eyeballs from the likes of Netflix, Hulu and Amazon Prime. The competition thesis simply rehashes a concern that surfaces anytime new technology rolls out. Similar arguments were made over the years against movies with the advent of television, cable television with movie channels, home gaming systems, the VCR, pay per view, the DVD and now streaming services. With all of that innovation, some might think movie theaters are going the way of the buggy whip. In reality, U.S. box office receipts set a record in 2018, and it was one of three record years in the past four. What other “dying” industry just posted its best revenue year ever? Still, critics point out that 2018 U.S. movie attendance – the number of people sitting in the seats – decreased 17% from its 2002 peak. But they’re cherry picking the data. The years between 2002 and 2004 were extremely good years for movie attendance. In the mid ‘90s, movie

attendance was about the same as now. Meanwhile, ticket prices have climbed more than 100% in the past 20 years. During the past 10 years, attendance has hovered around 1.3 billion, while ticket prices have increased around 20%. Besides missing the big picture on ticket sales, skeptics are missing the growth in concessions. Ticket sales have a margin of about 50% because of splits with the studios. Concessions have 85% margin. Theaters have aggressively upgraded their concession offerings to include alcohol in many locations. As a result, AMC earned more than $5 in concessions per patron in the U.S. last year, up from $3.95 in 2013 for more than a 30% increase. With those healthy revenue lines and steady margins, it’s difficult to view AMC as part of a dying breed. Yet a significant number of investors manage to do exactly that. While some misread movie industry trends in general, others misread a specific new program at AMC. AMC began offering a subscription service called A-List in June. Depending upon where they lived, initial subscribers paid $19.95 to $23.95 per month to see up to three movies per week. Bearish analysts immediately jumped on a worst-case scenario: A regular moviegoer who sees three movies per week, or 12 per month, at a full price of say $9 per ticket, would suddenly pay only $20-$24. AMC would be giving up $108 per month in revenue. Worse yet, those obsessive patrons would actually cost AMC money because the chain would have to reimburse studios as though those customers were paying full fair. So AMC would be paying

$54 to the studios (half of $108) and only collecting $20-$24. In reality, however, the A-List works exceedingly well for AMC. The average subscriber was going to the movies 2.8 times per month as of AMC’s Q4 2018 earnings release. At worst, AMC is sacrificing only a few dollars of ticket revenue if those customers were normally going 2.8 times per month and paying full fare. However, AMC said on a recent earnings call that the average A-List member was going to the movies only once every two months and bringing full-fare customers with them. In other words, the program is meaningfully increasing attendance. What’s more, the new attendees are spending on high-margin concessions. The A-List could exit 2019 adding 5% to AMC’s EBITDA, and it is doing so by providing steady, predictable revenue – unlike the box office, which depends heavily upon what movie is showing. The data contradicts negative views of the movie theater business and of AMC in particular. Similar flawed arguments were made against Regal Cinemas for years. Regal shareholders were bought out at generous terms by Cineworld Group in 2017. Cineworld, in turn, is doing extremely well with those assets. AMC is close to the low end of its valuation range since it became public. This low multiple does not mesh with the company’s current state or its trajectory.

AMC concession margins

85

%

Andrew Cowen is head of Equities at Community Capital Management, an investment advisor. He’s co-portfolio manager of funds that include Community Capital Alternative Income, Quaker SmallMid Cap Impact Value and Quaker Impact Strategic Growth.

I struggle to think of another industry that is ‘dying’ but also just posted its best revenue year ever.

may 2019 | luckbox

1905-topics-cowen.indd 29

29

3/29/19 10:29 AM

Big Media & Entertainment

A clear favorite is emerging as Disney and Netflix co-opt each other’s business models in a battle for entertainment dollars

Disney vs. Netf lix: The Battle for Big Media By David Trainer & Sam McBride

The Office (U.S. version), the most-viewed show on Netflix last year, accounted for 7.2% of the streaming service’s views. More than 50% of the 50 most popular shows on Netflix are owned by companies planning to launch their own streaming services, including Disney, WarnerMedia and NBCUniversal (which owns The Office). Disney released the three topgrossing films of 2018: Black Panther ($700 million) Avengers: Infinity War ($678 million) and Incredibles 2 ($609 million).

30

luckbox | may 2019

1905-disney.indd 30

3/29/19 10:46 AM

The harder Netflix (NFLX) and Disney (DIS) battle each other, the more they look alike. Netflix got its start by distributing entertainment content and then began producing it, while Disney has done the opposite. The resulting rivalry appears likely to turn vicious this year and may end with a single victor.

I

t’s a clash that’s been a long time in the making. In 1923, brothers Walt and Roy O. Disney began creating silent films that combined live action and animation. (No, Mickey’s Steamboat Willie cartoon wasn’t their first effort.) As the technology changed, the company produced talkies and then television shows. Now, it wants to copy the Netflix business model and begin streaming content. Netflix, founded in 1997 by Reed Hasting and Marc Randolph, found its niche in mailing rental DVDs back and forth with customers, and it later moved into video streaming. Realizing Netflix couldn’t remain a middleman forever, management began running original content six years ago with the release of the company’s first series, House of Cards. Wildfire growth Disney and Netflix have both been growing prodigiously. Netflix has gone from market capitalization of less than $10 billion in 2013 to about $160 billion today and in the process assumed its rightful place among the giants of the entertainment industry. Meanwhile, venerable-butvibrant Disney recently completed the $71 billion acquisition of 21st Century Fox.

So the battle lines have been drawn, but it may come as a surprise that licensed content still accounts for nearly two-thirds of Netflix viewing hours despite the company’s burgeoning inventory of original programming. Netflix still relies heavily on classic television shows like The Office, Friends and Grey’s Anatomy, not to mention its dependence on a catalog of Hollywood, independent and foreign films. As Netflix’s rivals begin launching their own streaming services, they’ll cancel the licenses, making Netflix less attractive to consumers just as the competition heats up. But Netflix has been preparing for the loss of its licensed content for years. As the company’s chief content officer, Ted Sarandos, said on the company’s fourth-quarter earnings call: “Our early investment in doing original content… was betting that…there would come a day when the studios and networks may opt not to license us content in favor of maybe creating their own services.” Still, creating world-class TV shows and movies requires Herculean effort, and the audience’s viewing habits die hard. As you can see in “Most-streamed on Netflix,” right, licensed television hits accounted for three of the top four streaming series

Most-streamed on Netflix Licensed series account for three of the four mostpopular shows on Netflix despite the company’s prolific production of original TV programming. 1

The Office (U.S.)

NBC

2

Chilling Adventures Of Sabrina

Netflix

3

Friends

Warner

4

Grey’s Anatomy

ABC

5

House Of Cards

Netflix

6

The Great British Baking Show

Netflix

7

Marvel’s Daredevil

Netflix

8

Narcos: Mexico

Netflix

9

The Haunting Of Hill House

Netflix

10

Criminal Minds

CBS

Source: Netflix data for November 2018 (U.S.)

Netflix has grown from market capitalization of less than $10 billion in 2013 to about $160 billion today. Meanwhile, Disney recently completed the $71 billion acquisition of 21st Century Fox

may 2019 | luckbox

1905-disney.indd 31

31

3/29/19 10:46 AM

Big Media & Entertainment

Making acquisitions work Disney’s knack for creating value through acquisitions has boosted the company’s financials.

Sources: New Constructs LLC and company filings

on Netflix for November 2018. The most-popular classic TV shows aren’t cheap. Netflix reportedly paid $100 million to keep Friends on its service for 2019, more than triple its previous licensing fee of $30 million. While that’s a hefty price tag for a series that’s been off the air for almost 15 years, it’s still watched more than the vast majority of Netflix’s new releases. Unfortunately for Netflix, it won’t be able to keep Friends forever. Warner Media plans to launch a streaming service later this year. And the potential trouble for Netflix doesn’t end there. Disney, which owns Grey’s Anatomy, will also launch its streaming service in 2019, while NBC Universal will likely want to reclaim the rights to