PUT YOUR MONEY WHERE YOUR MOUTH IS

A Kroger-Albertsons merger would create a grocery behemoth.

Extra virgin olive oil has incredible health benefits. But watch out for fakes.

Plant-based bioactives: The biggest dietary news since the discovery of vitamins?

Portillo’s is expanding its number of locations by

In the frenzy surrounding Nvidia, investors neglect this steady

The future could hold a “fourth wave” of robust prices.

Proteins made from plants or cultivated in the lab are finding a place on America’s menu.

PUT YOUR MONEY WHERE YOUR MOUTH IS

“Bring me your most impossible burger.”

“We’re not a fad or a flop.”

—PETER MCGUINNESS, CEO OF IMPOSSIBLE FOODS

“White Castle is doubling down on Flippy after more than a year of tests.”

Our candlestick technician sees an upside opportunity for Beyond Meat. 56 Macro

The war in Ukraine sent agricultural commodity prices soaring for a while. What’s ahead?

Putin is holding down the price of exports to maintain market share.

Digesting the volatility, correlation and capitalization of food-related stocks.

59 Trader MEET

TIMBERLAKE

The Technician

approving

FOOD AND BEVERAGE stocks are having their worst year relative to the S&P 500 in more than two decades. This sector, known for stability, is leaving too many investors with a queasy feeling of FOMO.

At press time, prices had declined 2% for the year while the S&P had risen by 16%. This lackluster performance began in May with double-digit declines piling up for big brands like Kellogg, General Mills, Kraft Heinz, Conagra Brands and Campbell Soup.

But despite the sector’s struggles, we see reasons to consider investing in food stocks. Valuations have come down and appear reasonable. Dividends are ample and well-covered by earnings, with many in the sector offering dividends of 3.5% or even nearly 5%. Leverage ratios are also at multiyear lows,

At the end of each working day she’s waiting there

I’m in love with the Queen of the Supermarket

But aside from traditional value investors like Warren Buffet, Wall Street traders are lukewarm on the sector, favoring growth and tech stocks. In a world of Nvidia and 5% shortterm rates, dividend yields of 4% may not appear compelling.

While value-minded investors view these companies as defensive safe havens during extended periods of inflation, recession and market downturns, Luckbox has a different perspective. We choose to focus on food-related stocks exhibiting growth potential—the ones taking the offensive by acquiring competitors, embracing advances in biotechnology, employing artificial intelligence or capitalizing on consumer trends.

Jeff Joseph EDITORIAL DIRECTORproviding room for higher dividends or stock buybacks.

The timing may also be right for investing in food stocks. Over the past 50 years, food stocks have tended to outperform the market in the final four months of the year, as portfolio managers seek to protect gains from earlier in the year.

In this food-focused issue we explore the sector’s opportunities. It begins with an assessment of the proposed Kroger-Albertsons merger. Next comes a run-down on the amazing health benefits and rampant fraud in the olive oil business. It continues with a visit to the scientists transforming food into medicine—perhaps the most momentous nutritional research since the discovery of vitamins.

We profile an agriculture-related company that has a familiar name but harbors one of the best-kept secrets in the world of artificial intelligence. That’s followed by a story on the market prospects of a key fertilizer ingredient, and then there’s an update on the industry churning out artificial meat.

Email: feedback@luckboxmagazine.com

We offer two reports on the Ukraine war’s effect on the food supply; a study of the negative effects of market-distorting short selling; a piece on the volatility, correlation and capitalization of food-related stocks; and an article on the food industry’s plungers, recoveries and steadies.

It’s time to consider food beyond meat. The sector offers investors plenty of opportunity amid its woes.

We asked Luckbox readers ...

Grocery store you frequent the most? (ranked)

• Kroger

• Costco

• Walmart

• Aldi

• Trader Joe’s

Nutrition label information you pay most attention to? (ranked)

• Total sugars

• Added sugars

• Calories

• Sodium

• Protein

• Carbohydrates

Fast-food chain you visit most? (ranked)

• Chik-fil-A

• Starbucks

• McDonald’s

• Subway

• Taco Bell

Diets most recently followed? (ranked)

• Intermittent fasting

• Low-carb

• Mediterranean

Do you consume plant-based milk? Yes 27%

Do you abstain from alcohol?

Luckbox is insightful and beautiful to look at. I find content I wouldn’t find anywhere else. As an expat living outside the U.S., it’s nice to see non-mainstream, original, unbiased, factual content and real-world perspectives.

—ROBERT HILL | MEXICALI, BAJA CALIFORNIA, MEXICO

Much of what you believe is wrong. Now that we have your attention, we’ll walk that back a bit—but not completely. All of us carry around plenty of misconceptions.

Most of our errors, illusions and flawed perceptions result from outdated “facts.” We harbor beliefs that have been disproved decades ago. Truth evolves.

With that in mind, Luckbox is setting out to dispel myths, present new data and combat disinformation.

“TK” is journalism lingo for “to come.” The answers to the questions posed here are found in the stories that follow.

1. In the U.S. grocery market, which retail channel has the fastest-growing market share?

Online grocery sellers (Amazon, Thrive Market, etc.)

Mass merchants (Walmart, Target, etc.)

Supermarkets (Kroger, Safeway, etc.)

Dollar stores (Dollar General, Dollar Tree, etc.)

2. What percentage of olive oil is improperly labeled “extra virgin” and consequently lacks the full potential to promote wellness?

20% to 40% 40% to 60% 60% to 70%

70% to 80%

3. The U.S. is the world’s largest importer of potash, a key fertilizer ingredient. We get roughly 80% of our imported potash from one country. Which country is that?

Belarus

Canada

China

Russia

See answers on pages 22, 26 and 41

EDITOR IN CHIEF

Ed McKinley

MANAGING EDITORS

Yesenia Duran

James Melton

ASSOCIATE EDITORS

Kendall Polidori

Navpreet Dhillon

EDITOR AT LARGE

Garrett Baldwin

TECHNICAL EDITOR

Nick Battista

CONTRIBUTING EDITORS

Vonetta Logan, Tom Preston, Mike Rechenthin

CREATIVE DIRECTORS

AptCDesign + Gail Snable

CONTRIBUTING PHOTOGRAPHER

Garrett Roodbergen

EDITORIAL DIRECTOR

Jeff Joseph

COMMENTS, TIPS & STORY IDEAS

Feedback@Luckboxmagazine.com

CONTRIBUTOR’S GUIDELINES, PRESS RELEASES & EDITORIAL INQUIRIES

Editor@Luckboxmagazine.com

ADVERTISING INQUIRIES

Advertise@Luckboxmagazine.com

SUBSCRIPTIONS & SERVICE

Support@Luckboxmagazine.com

MEDIA & BUSINESS INQUIRIES

PUBLISHER: JEFF JOSEPH jj@Luckboxmagazine.com

Luckbox Magazine, a tastylive publication, is published at 19 N. Sangamon, Chicago, IL 60607 Editorial Offices: 312.761.4218

Printed

Issn: 2689-5692

Luckbox Magazine is a product and service offered by tastylive, Inc. (“tastylive”). Luckbox Magazine content is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involves risk and may result in a loss greater than the original amount invested. The information provided in Luckbox Magazine may not be appropriate for all individuals, and is provided without respect to any individual’s financial sophistication, financial situation, investing time horizon or risk tolerance. Transaction costs (commissions and other fees) are important factors and should be considered when evaluating any securities, futures, or digital asset transaction or trade. For simplicity, the examples and illustrations in these articles may not include transaction costs. Nothing contained in this magazine constitutes a solicitation, recommendation, endorsement, promotion or offer by Luckbox Magazine or tastylive, Inc., or any of its subsidiaries, affiliates or assigns. While Luckbox Magazine and tastylive believe that the information contained in Luckbox Magazine is reliable and make efforts to assure its accuracy, the publisher disclaims responsibility for opinions and representation of facts contained therein. Active investing is not easy, so be careful!

Financial News

WHEN YOU THINK of food innovation, the mind naturally wanders to Silicon Valley tech bros wearing lab coats over Patagonia vests and calculating ways to hack nutrition.

Remember Soylent, the “food” horribly or brilliantly named after the cannibalistic movie? It was marketed as a “meal in a can” so you’d never have to think about meal prep.

The point is you align your thoughts on food innovation with young experimenters at the nexus of the tech universe. You don’t think of White Castle, America’s first fast food

chain, which has been making hot and tasty sliders since 1921. But you should. For the Luckbox food issue, we traveled to a White Castle just outside Chicago in Whiting, Indiana, to eat food fried by a robot.

In 2022, White Castle, a family business based in Ohio that

Illustration by Tyson Cole

Illustration by Tyson Cole

owns and operates more than 350 stores, announced it was rolling out the Miso Robotics robot arm called Flippy to 100 of its locations.

Now in its second iteration, Flippy 2 (electric boogaloo) “takes over the work for an entire fry station and performs more than twice as many food preparation tasks compared [with] the previous version, including basket filling, emptying and returning,” Miso Robotics said in a statement.

Flippy 2 uses AI to identify White Castle sides, such as chicken rings, french fries, mozzarella sticks and onion rings, which it then autonomously prepares for customers.

Jamie Richardson, White Castle vice president, told Luckbox how a historic company became the leading edge of food innovation. “I think for White Castle, innovation is something that we embrace because it allows us to better express our heart for hospitality,” he said.

The first version of Flippy, tested in a Chicago-area restaurant in 2020, required a lot of steps and needed the assistance of two human team members. Flippy 2 is less obtrusive and more independent, freeing the team to focus on other tasks.

“Flippy’s really grown tremendously in terms of just versatility and being able to better manage orders and get more done quickly and gives us a certain level of absolute consistency that we’re really thankful for,” Richardson noted.

ing forlornly in the breeze as potential workers stay home to focus their webcams on their feet for their Only Fans hustle.

Richardson is adamant that Flippy 2 is a workplace enhancement, not a replacement for human workers. “It’s been amazing to see the warmth with which Flippy has been welcomed to the team,” he said. “Team members say, ‘Hey, this is like any other investment you make. It makes our jobs and our life easier.’”

Standing in front of a scalding hot deep fryer and getting popped on the forearms by hot oil for hours on end is not a super fun time. Flippy 2 is an enclosed robotic arm that liberates workers from the deep fryer. Richardson says the integration of Flippy at

In the interest of science? Journalism? The munchies? I decided to hit the road and see Flippy 2 in action. The White Castle in Whiting was built in 1935 and recently remodeled to showcase the chain’s new foray into technological innovation.

The drive-thru features an AI-powered menu board that takes customer orders and a Flippy-equipped fry station. The newly designed store is sleek, modern and the cleanest fast food restaurant I have ever set foot in.

The open concept kitchen enables customers to see Flippy in action. White Castle District Supervisor Dianna Williams served as our guide into the world of Flippy. In 2020, during White Castle’s pilot test, Williams oversaw the first Flippy and helped provide feedback to upgrade the capabilities of Flippy 2.

After a customer’s order is taken, the information is displayed on Flippy’s graphic interface, and a human team member selects the corresponding food from drawers just to the left of Flippy. The team member places the food in Flippy’s metal bins and the fry sequence begins.

Some 65% of restaurant owners say finding workers is their main issue, according to Fox Business. Take a stroll through any mall, and you’re likely to see help wanted signs flutter-

White Castle has “been amazing to see the warmth with which Flippy has been welcome to the team.”

Most White Castles operate 24 hours a day, and a robot never calls in sick only to show up later in Instagram photos on their cousin Jeff’s jet ski.

No more human intervention is needed. Flippy takes the food from the bins and drops it into a metal fry basket. Deftly placing the basket in the deep fryer, Flippy patiently waits the precise amount time for the food to cook, never getting distracted by TikTok or some hot office gossip.

Flippy plucks the basket from the oil, gives it a shake and deposits it onto a warmer tray to be packaged by a human. I watched, en-

raptured, like a kid seeing an automated car wash for the first time.

Indefatigable, the robot arm reaches for bins full of customer food time and time again, never needing a break. A black, rubberized sleeve protects the robotic arm from the hot grease, and an enclosure protects employees from the robot.

Williams remarked that White Castle’s side item/deep fry menu has more than 21 possible combinations of sizes and options, but Flippy cooks each one with precision.

What’s it like working with Flippy? “Oh, he has an attitude sometimes,” one employee noted with a laugh.

I went all in with my order and asked for onion rings, chicken rings, mozzarella sticks and classic french fries. Flippy prepared my feast, and the food came out hot and fast. Everything was perfectly fried.

Anyone who has ever reached into a soggy bag of fries or grabbed a fry browner than George Hamilton knows fast food prep can be a hit or miss. But at White Castle, the crinkle-cut fries were crisp on the outside but fluffy on the inside. The chicken rings’ outer breading was crunchy and well-seasoned, and the chicken on the inside was juicy and tender. The mozzarella sticks were fried to perfection, while still allowing an Instagrammable pull of gooey, melted cheese. Imagine having this experience every single visit.

According to the Miso Robotics website, Flippy’s pricing starts at around $3,000 a month. As labor costs skyrocket, $36,000 a year seems like a good investment.

Miso Robotics is also working with Buffalo Wild Wings (BWLD) on a wing-cooking robot named Wingy. Sweetgreen (SG), the salad chain, has launched an automated restaurant in Naperville, Illinois. Reporters at the 2022 Beijing Winter Olympics had some of their meals prepared and served by robots.

And, taking a page from White Castle’s book, franchisers like Sonic (SONC), McDonald’s (MCD) and Checkers are looking to AI to streamline orders. No word yet on whether there will ever be a sushi-making robot, but I’ve got mozzarella sticks to tide me over.

By Garth Davis

By Garth Davis

Too much protein? Dr. Garth Davis, a weight-loss surgeon, argues that Americans do indeed consume too much protein, thinking it will help them lose weight. But protein isn’t the key to weight loss, Davis asserts, and carbs are not the enemy. Animal protein is associated with diabetes, hypertension, heart disease, Alzheimer’s and cancer, he says.

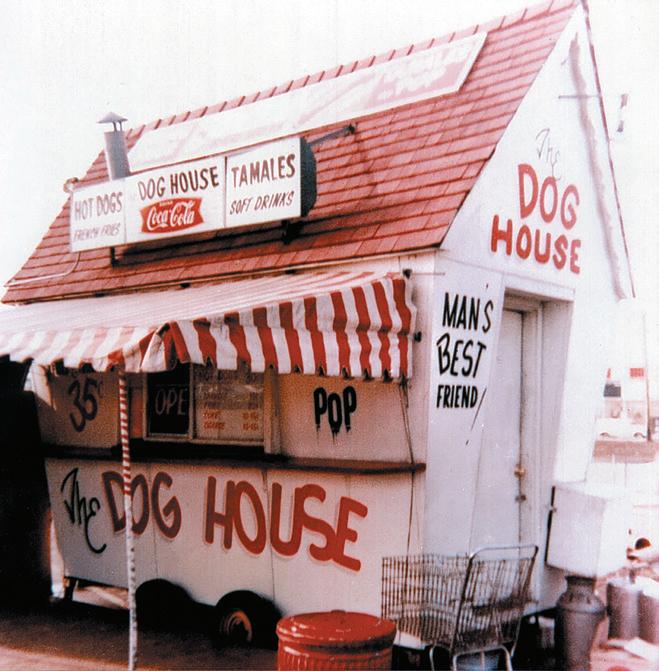

Written by Dick Portillo, founder of Portillo’s, and Don Yaeger, Out of the Dog House follows the story of how he turned a modest shack into a corporation worth billions of dollars. From his upbringing to his time as CEO of Portillo’s, Portillo details his trials as a business owner and explains how he expanded his business to 60 locations without franchising a single restaurant.

Although published 10 years ago, Extra Virginity tells a tale that’s just as relevant today as it was then—corruption in the extra virgin olive oil industry. Tom Mueller’s book guides readers on a journey through the rich history of olive oil while detailing the confusion, snobbery and ignorance that shroud the product. European officials have even compared the counterfeit olive oil business to cocaine trafficking.

By Benjamin Lorr

By Benjamin Lorr

After five years of research and hundreds of interviews, Benjamin Lorr writes an immersive expose on the surprisingly secretive supermarket industry. He investigates the secrets of Trader Joe’s success, reveals what it takes for food to earn “organic” or “fair trade” labels, and more. It’s an unpredictable industry, and running it demands a combination of passion and intuition, Lorr maintains.

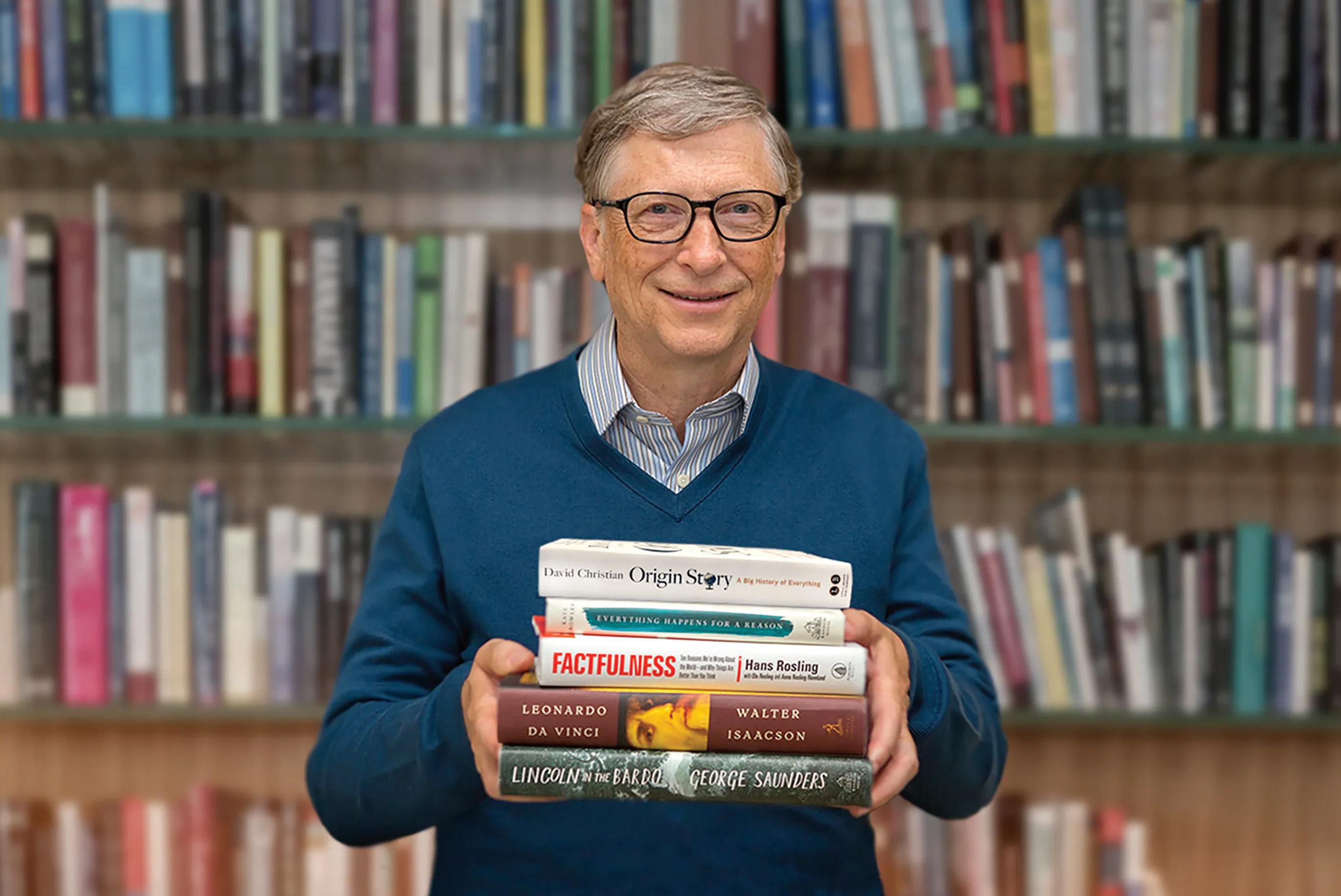

Far too often, book reviews drive readers away. They’re written from the viewpoint of just one stranger, and taking them to heart leaves great books undiscovered. That’s why the Book Value offers profiles instead of reviews. Don’t look to this page for opinions. Think of it as a place to find writing that educates, entertains and challenges entrenched beliefs.

AAFTER A NIGHT OF 20 DRINKS and a morning after without a hangover, JW Wiseman reevaluated his relationship with alcohol and searched for something interesting to drink without the ABV. But his hunt revealed there wasn’t much beyond club soda and tonic. So, a year later, he founded Curious Elixirs. It was 2013, making his company one of the original entries in a new wave of mainstream mocktails (cocktails without alcohol).

Wiseman found a willing audience. Thirtysix percent of American adults choose to live alcohol-free, and the nonalcoholic industry has reached $11 billion in annual sales. Nonalcoholic options include aperitifs, wines, beers, spirits and canned mocktails. One company, All the Bitter, has even created nonalcoholic bitters.

Today’s mocktails have come a long way

36% of American adults choose to live alcohol-free, and the nonalcoholic industry has reached $11 billion in annual sales.

from the sickly sweet drinks that prevailed for decades after the invention of the Shirley Temple in the 1930s. Until recently, the major issues with nonalcoholic beverages were the lack of viscosity and density that comes from not using ethanol, and the inability to mimic the burn of alcohol, says Ila Byrne, co-founder of Parch, a maker of nonalcoholic agave spirits and mocktails.

Many companies replace the hit of alcohol by overloading mocktails with spices, but she created Parch to bring in complexity: the aromatics that impact the mouthfeel, how ice dilution shifts the sipping taste and how the beverage builds in your mouth.

With 80% of nonalcoholic purchases made by consumers who also drink alcohol, the nonalcoholic industry doesn’t take business away from alcohol sales but instead adds a new product to consumer spending, according to Töst, a company that manufactures sparkling nonalcoholic wines.

Using water instead of ethanol to extract flavor from ingredients requires more ingredients and more time, leading to higher prices, says Chris Wilfred, founder of the British-based nonalcoholic aperitif company Wilfred’s. While a 750-milliliter bottle of Aperol—the aperitif most like Wilfred’s—costs around $25, Wilfred’s costs $32 for a 500-milliliter bottle. Similarly, Ritual Zero Proof’s whiskey alternative costs $33, while a similar caliber alcoholic bourbon such as Bulleit costs $30.

Higher prices enable producers of nonalcoholic products to maintain margins like those of companies that produce alcoholic drinks. That sometimes confuses consumers but

benefits restaurants.

“Alcohol is a big part of why restaurants are able to stay in business,” says Wiseman. “So, I designed Curious to have similar margins for the venue operators.”

Those margins may have helped entice Diageo (DLC), owner of Guinness, Crown Royal and other major brands, to purchase a majority stake in the nonalcoholic spirit maker Seedlip for a rumored $250 million, and a minority position in Ritual Zero Proof through its startup accelerator Distill Ventures.

But it’s not all about price and margin. Consider presentation.

If one didn’t look closely enough, it would be easy to confuse a nonalcoholic bottle with an ABV bottle. Optimist Drinks, Free Spirits, Wilfred’s, Ghia and Ritual Zero Proof all present their alcohol alternatives in clear bottles with clean labeling and minimalist but modern designs. The makers say the look reflects the craftsmanship behind the drink.

Perhaps the most intriguing company is All the Bitter, a nonalcoholic bitters company founded by Ian Blessing. Bitters are sharp and add a ton of flavor in just a few dashes—all while sporting a high ABV. Angostura dominates the bitters market and is known for aromatic bitters (44.7% ABV) and orange bitters (28% ABV). When Blessing, a former sommelier at the French Laundry in Napa Valley, California, decided to live alcohol-free after becoming a parent, he found many restaurants and bars were adding alcoholic bitters to an otherwise nonalcoholic cocktail.

Because of the minimal number of bitters used in a cocktail, adding two dashes of

bitters—a common number used in a martini or an old fashioned—to a 0% ABV cocktail would make a 5-ounce cocktail roughly .5% alcohol. Technically, for a company to claim it is nonalcoholic it must be below .5% ABV, but if a nonalcoholic spirit contains that amount, a mocktail of the same size would have a .65% ABV. “That’s like cooking your veggie burger in bacon fat,” Blessing says.

In recent years, consumer preferences have shifted toward health. The $450 billion U.S. wellness industry is growing by 5% annually, according to McKinsey and Co. Plus, with alcohol-related deaths increasing for men 12.5% and women at 14.7%, according to a study led by Hofstra University, alcohol moderation reveals clear benefits.

When Wiseman created Curious Elixirs, he asked, “What if we can make something delicious? And what if we could make it to help support your body instead of poison your body?” His time at Daily Harvest, a ready-toeat delivery service based in New York, exposed him to adaptogens, plant substances that may promote homeostasis in the body to help balance adrenal glands.

While the results of studies vary on the effectiveness of adaptogens, Curious Elixirs, Parch, All the Bitter and Three Spirit all use them to add flavor and change the effect of the drink.

Adaptogens aside, whether someone chooses not to drink because of health concerns, a history of alcohol abuse, religious reasons or anything else, the nonalcoholic movement’s advances have provided delicious, functional alternatives.

“You can get a pack of tomato seeds for around $2 for at-home use, which comes with 50 to 60 seeds,” Walker says. “So, if you start your own plants, that’s 50 or 60 plants right there.”

Walker hopes every town or neighborhood will someday have a community garden, and she believes everyone should get involved in growing their own food. The two watermelon plants in her own home garden save her about $8 per watermelon, she notes.

For anyone without access to a community garden—or those who want a more personalized approach—at-home and indoor gardens provide herbs, vegetables and flowers.

TThe price of processed fruits and vegetables will rise even more, reaching 9.3% this year, the USDA says.

Moreover, this year’s price hikes come on top of an 11.3% increase in the tab at supermarket checkout counters between January 2022 and January 2023, a CNN report says.

No wonder community gardens where urbanites can get the exclusive use of a small plot of ground are flourishing across the United States. More than 29,000 community gardens dot the concrete landscape in the 100 largest American cities, according to Garden Pals, a website dedicated to nature, gardening and plants.

For more than 45 years, the American Community Garden Association has been building communities by increasing and enhancing community gardens and green space across the U.S. and Canada.

An even easier method, hydroponic gardening, has provided a user-friendly and non-demanding option for people to grow their own food. Hydroponic gardens use water-based mineral nutrient solutions instead of soil to grow plants. Like hydroponics, aeroponics doesn’t need soil to grow plants but instead relies on air to deliver nutrients.

“Orchids in Japanese forests that grow clinging to trees with their roots dangling in the air served as an inspiration for this technology,” says Mattias Lepp, CEO of Click & Grow, a company he started 14 years ago to help gardeners use hyrdoponics at home.

But aeroponics and hydroponics are far from simple, so Lepp facilitates the process through biomimicry—technology that imitates natural processes. Think of Velcro, which mimics burdock, a common weed with sticky burrs; or football helmets that mimic a woodpecker’s head.

Tilling the soil by hand can engender a sense of oneness with nature. It’s a lifestyle, a source of exercise and a moving meditation. Plus, growing your own herbs and veggies in a community garden, backyard vegetable patch or high-tech application can also save you some money on groceries.

The economic angle is no small matter. The cost of food at the supermarket is expected to increase by about 6.2% this year, according to the United States Department of Agriculture.

“I always say I believe that every community should have a community garden,” says Cathy Walker, president of the American Community Gardening Association (ACGA). “It’s a safe space; it provides food for those that are in the community; it increases the quality of life.”

Community gardens can lower household food insecurity by up to 90%, according to Garden Pals, and every $1 invested in a community garden yields around $6 worth of produce.

Viewed another way, an 8x12 raised-bed garden can produce $1,000 worth of food a year, ACGA research indicates.

“Technology is just a means to bring modern humans and nature back together,” Lepp says. His company uses tech to offer about 75 varieties of herbs, flowers, leafy greens and more.

by Kendall PolidoriThe price of processed fruits and vegetables is expected to soar 9.3% this year, on top of last year’s 11.3% increase.

Click & Grow’s smallest product, The Smart Garden 3, costs $99.95 and has three pod slots. It grows herbs and flowers all year. But for higher yield and long-term use, the company offers its largest product, The Click & Grow 25. It costs $599 and comes with 54 plant pods and a guaranteed five-week growth and harvest cycle.

Smart gardens are pricey, but someone who cooks with fresh herbs and vegetables can use them to save on groceries. How much you save depends upon what you grow.

At Click & Grow, one pod of regular basil costs $2.66. There’s no limit to the number of seedlings per pod, but the basil plant lasts only up to 12 weeks before it needs replacement.

Fresh basil costs $2-$4 per ounce at the supermarket. On average, an ounce contains 11 leaves. So, one ounce of fresh basil every week for $3 costs at most $156 a year ($3 x 52 weeks = $156). But a Click & Grow basil pod produces enough leaves for a cost of $19.70 a year (52 weeks / 7 weeks = 7.4 weeks; $2.66 x 7.4 weeks = $19.70).

Besides saving money, smart gardens and shared community gardens reduce food waste and water use. Smart gardens use 95% less water than commonplace agricultural methods, according to the Click & Grow website. In the last year, Click & Grow alone saved 2,089,498 liters of water, while preventing 143,544 kilograms of food waste and 364,382 kilograms of carbon dioxide emissions, the site says.

$1,000

The average value of food raised annually in an 8x12 raised-bed garden

— The American Community Gardening Association

29,000

“You can harvest exactly what you need from a plant, and the plant continues to grow—so nothing goes to waste,” Lepp says.

Smart indoor gardens require less than 15 minutes of work per month, depending on the size of the garden, he notes. There’s no need to add fertilizers or measure the water’s pH level. Smart garden herbs and vegetables also have more vitamins and bioactive substances than vegetables from traditional gardens.

“We don’t often consider the significant role that living nature and plants play in our lives,” Lepp says, “but in reality, everything— the air we breathe, the food we eat—is connected with plants.”

needs soil? Hydroponic gardens grow vegetables in water-based mineral nutrient solutions, and aeroponics rely on air to deliver nutrients.

As someone who lives and breathes music, I like to consider myself “plugged in” to the indie scene. But at Pitchfork, I often find myself shocked by a handful of artists who I’d barely heard of before. Nation of Language was that band for me this weekend.

On Friday, July 21, anyone listening from afar would have thought The Cure was playing during Nation of Language’s set. With only three members on stage, the band’s full sound was brought to life through synth and a physically expressive frontman.

The ’80s-esque synth and dance-rock drew a large crowd to the stage, as singer Ian Richard Devaney belted out lyrics and sporadically wriggled. The shimmering lo-fi breathed life into the first day of the festival. It was the kind of music you wouldn’t expect to be as good live as on the recordings because of its beckoning production, but it was.

You’d never guess they were using a cheap pawn shop guitar—they just knew how to use it well. Start with their song I’ve Thought About Chicago, and it’ll feel like it was written for you.

The LA-based punk-rock band brought a fierce energy to their string-focused set. The band, led by Sarah Tudzin, has a playful approach to playing music, interacting with each other on stage and letting the set take on a life of its own.

Black Belt Eagle Scout brought forth inspiring grunge tunes. Under the shade of the trees by the Blue Stage, the band’s singer and guitarist Katherine Paul lost themself in the music— closing their eyes for every guitar solo and singing interpersonally.

Toronto-based band Alvvays returned to the scene last year after nearly five years without releasing new music or playing live shows. At Pitchfork, the band played several new songs from their 2022 album Blue Rev, but the real excitement oozed from the crowd when older hits like Archie, Marry Me and Dreams Tonite echoed throughout the park.

Though Chicago band Deeper’s set was cut short by bad weather, they still took listeners back in time through groovy guitar melodies, punchy vocals and a dance-feel vibe.

Saturday was more rock-focused and before another weather delay kicked everyone out of the fest for over an hour, MJ Lenderman brought a varied rock set to the Red Stage. He jumped from acoustic-driven folk-rock tunes to a post-punk energy that kept the audience intrigued. He even had Chicago’s very own Spencer Tweedy on the drums.

A fan would yell, “Let’s fucking go!” and Lenderman would dive into a slow ballad full of his twangy talk-singing voice, like Kurt Vile.

The most anticipated performance of the weekend for me was interrupted by the weather delay, but once the gates reopened at 5:50 p.m., I found myself sprinting to the Blue Stage with a slice of pizza in my mouth to catch Julia Jacklin playing four songs. The Australian singer-songwriter doesn’t tour the U.S. as often as American artists, so it was the first time I had the chance to see her live. Though she played only four songs, her set was one of the best of the festival weekend.

Jacklin’s awkward nervousness was met with laughter from the crowd. She played solo on stage, “Julia’s guitar” in hand and angelic vocals floating like clouds.

Members of the alternative indie-pop group all carried some form of nostalgia with them, playing old songs that originally drew their primary audience to their music. Michael Alden Hadreas puts on a theatrical performance, sauntering around stage, making it impossible to look away.

Kendall Polidori is The Rockhound, Luckbox’s resident rock critic. Follow her reviews on Instagram and Twitter. @rockhoundlb

Kendall Polidori is The Rockhound, Luckbox’s resident rock critic. Follow her reviews on Instagram and Twitter. @rockhoundlb

This was a wow set for me. At the ripe age of 24, I don’t tend to throw myself int0 the crowd anymore. I can appreciate music from afar, more comfortably than having to mosh with rabid fans jostling in the front row. But Foals was a band that I absolutely needed to be close to.

I can’t describe what the band looked like; it was one of those shows where I had my eyes closed most of the time—dancing like I hadn’t danced before. It’s been a while since I felt the urge to get up and really be part of the show instead of just a bystander. And it seemed that everyone in the crowd felt the same way. There wasn’t a soul standing still during that set.

I was even planning to leave the set early to catch more of Declan McKenna on a separate stage but could not bear to leave and miss a single moment. Foals are the rock band to pay attention to right now.

I had no expectations going into Portugal. The Man’s set. I knew a few songs by the band—the

ones I’d heard on the radio, such as Feel It Still, but hadn’t had the band on my radar too much. And as soon as Portugal. The Man played the first note of its first song, I was in shock.

The band rocked harder than I expected, with nearly 10 people on stage putting their whole beings into the performance. Even the songs I had heard before sounded different live. Portugal. The Man moved from a traditional rock sound to energetic pop-rock, to a groovy psych-rock. The band was unexpectedly dynamic.

Bands like Portugal. The Man are what makes festivals like Lollapalooza so appealing. It’s a space to see bands you’d normally not think twice about paying to see as a headliner. Now, I can hardly wait until I can see the band headline their own show.

I can honestly say Dehd is one of my favorite bands right now. I not only made sure I was deep in the crowd for their set at Lolla, but I also showed up ready to dance at the band’s after-show that same night at Chicago’s Thalia Hall—where they played until 1 a.m. Yes, I’m exhausted. But I’ll never miss a Dehd show.

The alternative rock band is bare bones, with one guitar, bass and a standup drum set, yet its sound exceeds all expectations. It’s a lively rock act, with the duo of shouting vocals from Emily Kempf and Jason Balla. When comparing the two crowds, I’ll always choose the more intimate, small venue shows that Dehd puts on. At 1 a.m. I was huddled close to random people, singing every word at the top of our lungs and brushing up against each other as we danced.

McBurger, please!

Fast food got its start in America when White Castle opened its first hamburger stand in Wichita, Kansas, in 1921. Then it soared in popularity in the 1950s with the rise of McDonald’s and Burger King.

Today, McDonald’s reigns as the world’s most popular fast-food joint with about 13,500 locations nationwide and 38,000 worldwide. It’s in 118 of the world’s 195 countries.

The price of a McDonald’s cheeseburger in the 1950s was 19 cents, compared with $1.69 today. But small tickets add up. McDonald’s has become the world’s most valuable fast-food brand with a market cap of roughly $204 billion, and it generated revenue of $23.2 billion in 2022.

Dehd provides an alternative take on poppunk, without all the extra production. The sound is raw, edgy and full of color. As someone who has seen the band eight times— thrashing my head and body around with eyes closed—I can say Dehd is the best rock band in Chicago. And they’re making a name for themselves outside the boundaries of the city.

Lollapalooza veterans, but newcomers to the main stage, folk-rock collective Mt. Joy brought good vibes to the festival. The ground surrounding the stage was one big mud pit, with puddles of ankle-deep water covering portions of the grass. It was like a snapshot from Woodstock, only people weren’t yet coated in the mud.

For me, things get harder when bands I enjoy become more acclaimed, playing bigger venues and attracting larger crowds. It takes

away the personal connection with the band. But I enjoyed Mt. Joy from way back on the lawn and felt completely at peace. Its soothing music rocks your mind and body to the beat. It’s perfect festival music—an easy-going groove that gets everyone swaying in their spots, looking up to the sky in pure bliss.

It’s a band that likes to change up its sound a bit at a live show, too. The band’s elongated rendition of their song Julia included transitions to covers of Ain’t No Sunshine by Bill Withers and Crazy by CeeLo Green, bringing it all back to the end of its own song.

If you have a specific taste in music, like rock, it can be hard sometimes to find enough sets to your liking at a festival with artists from nearly every genre on the lineup. But this year’s Lollaplooza Chicago featured some of the hottest names in indie, folk and punk rock, bringing in a whole new level of instrumentation to the festival grounds.

Find the full reviews of these shows and more at luckboxmagazine.com.

460,000 attended for the entire Lollapalooza weekend

14

concert-goers were arrested during the Lolla weekend

55

fans were taken to the hospital during the festival

The Rolling Stones’ new album is billed as their first with all original material in 18 years. It’s also the first since the death of drummer Charlie Watts in 2021.

11.16

National Fast Food Day

11.24 Black Friday

NFL teams have been playing exhibition games in London since 2007 to gain recognition in the United Kingdom. Last year, a U.K. record was set when 86,215 fans turned out to see the Denver Broncos beat the Jacksonville Jaguars 21-17. This year’s three games will feature Atlanta vs. Jacksonville, Jacksonville vs. Buffalo, and Baltimore vs. Tennessee.

America’s original celebrity chef, Julia Child, first appeared on TV in 1963. Since then, chefs like Gordon Ramsay (pictured left), Rachael Ray, Wolfgang Puck and the late Joël Robuchon have become household names. With 31 Michelin stars, Robuchon is considered the premier chef of the modern age. But International Chef’s Day isn’t just for the famous. It honors all of America’s 942,000 chefs, head cooks, and food and serving supervisors.

11.3-4 The Festival of Wood and Barrel-aged Beer CHICAGOFood and beverage-related stocks haven’t performed too well this year, but the sector’s rife with opportunity just the same. Savvy investors can profit when markets are rocked by mergers, geopolitics, artificial intelligence, advances in biotech and changes in consumer habits. In this special section, Luckbox uncovers new food industry investment ideas and contemplates what lies ahead for victuals, libations and nutrition.

IN THIS ISSUE

P. 22 Big Grocery’s Proposed Big Merger

P. 26 Why Extra Virgin Olive Oil is Essential

P. 30 Bioactives: Turning Food Into Medicine

P. 34 Portillo’s Hot Dog Nation Aspiration

P. 38 John Deere: AI & Agriculture Converge

P. 41 Potash Looks Like a Long-Term Buy

P. 44 The Next Wave of Alternative Proteins

P. 49 Beyond Meat: A Study in Short-Selling

ILLUSTRATION BY IAN MURRAY

A Kroger-Albertsons merger would create a supermarket behemoth. But the grocery giant would still be No. 2 in the U.S. market, trailing Walmart.

BY JAMES MELTONTheproposed merger of Kroger (KR) and Albertsons (ACI) would create a national powerhouse, but it wouldn’t dominate grocery retailing.

The deal would result in a conglomerate with stores in almost all 50 states. That scale would be great for Kroger and Albertsons shareholders, industry observers say. But even after the merger—assuming it’s approved by regulators—the grocery-selling crown will remain with Walmart (WMT).

“For the companies themselves, the biggest benefit is that it’s really going to give Kroger and Albertsons an opportunity to step back and take a look at their entire organizations,” retail and supply-chain consultant Brittain Ladd told Luckbox

He said a Kroger-Albertsons mashup would enable the combined company to do things like divest manufacturing

centers and older warehouses and make better use of Kroger’s network of robotic warehouses (see sidebar on page 24). He doesn’t expect the deal to re-make the grocery market, but the combined company would be much stronger than Kroger and Albertsons are separately, he said.

The combined operation would “have a lot of redundancies throughout the company,” Ladd said. The merged company would benefit from economies of scale and could cut costs by streamlining headcount, from senior levels down to workers in the distribution centers, he noted.

The merger requires approval by the Federal Trade Commission (FTC).

According to the merger agreement, Kroger would buy all outstanding Albertsons shares for an estimated $34.10 per share. That per-share price values Albertsons at about $24.6 billion, including the assumption of $4.7 billion of Albertsons’ debt.

Like most mega-mergers, this one would be complicated. One provision gives Kroger the right to reduce the cash part of the $34.10 per share by the value of a newly created standalone public company (SpinCo)—a subsidiary Albertsons

IN 2018, Kroger signed a deal with the United Kingdom-based online grocer Ocado Group to build a network of U.S. robotic customer fulfillment centers (CFCs) using Ocado’s Smart Platform technology. As part of the deal, Kroger boosted its stake in Ocado to more than 6%.

At each hub, robots navigate three-dimensional grids filled with products to fulfill online orders for home delivery. Kroger says the system “uses advanced AI to determine the packing process, ensuring products are packed accurately and correctly (with the heaviest items on the bottom) and the fewest number of bags are used to reduce waste.”

As of late July, Kroger operates Ocado-powered CFCs in Dallas; Monroe, Ohio; Groveland, Florida; Forest Park, Georgia; Pleasant Prairie, Wisconsin; Romulus, Michigan; Aurora, Colorado; and Frederick, Maryland.

Additional CFCs are planned or under construction in Phoenix; Cleveland; Charlotte, North Carolina, and unannounced locations in California, southern Florida and the Northeast.

would spin off to its shareholders at closing, in conjunction with the regulatory clearance process.

Ratings, says it’s more likely competitors will buy up all the divested stores, making the creation of SpinCo unnecessary.

“It’s not going to be one buyer, it’s going to be several,” Garces said. And he expects Amazon and Ahold Delhaize to be among the buyers.

Kroger’s other innovations include becoming the nation’s largest seller of sushi. Last year, it added sushi and flowers to the list of items deliverable via DoorDash.

What’s SpinCo? Call it a back-up plan. To get the regulatory clearance necessary to close the transaction, Kroger and Albertsons expect to divest more than 650 stores. SpinCo would receive any stores not sold off to other grocery retailers. That, the companies say, would eliminate the need to close any stores or cut frontline jobs. In September, media reports said Kroger and Albertsons were working on a deal to sell more than 400 stores to C&S Wholesale Grocers for nearly $2 billion.

Kroger and Albertsons say SpinCo could include between 100 and 375 of the divested stores. Names commonly mentioned as store buyers include Amazon (AMZN) and Netherlands-based Ahold Delhaize (ADRNY). Ahold Delhaize owns several regional U.S. grocery chains, including Food Lion, which runs supermarkets in 10 Mid-Atlantic and Southeastern states and Stop & Shop in the Northeast.

As evidence, Garces pointed to Amazon CEO Andy Jassy’s April letter to shareholders in which he cited the need for “a broader physical store footprint” for Amazon’s grocery store business. Amazon owns the Whole Foods and Amazon Fresh chains.

In an interview published Aug. 6 in The Oregonian newspaper, Kroger CEO Rodney McMullen said the retailer was talking with several potential buyers for the divested stores but said it was too early to name them.

McMullen told The Oregonian that the grocery market has changed, and Kroger must change with it. Kroger’s main competitors, he said, aren’t other grocery chains, but retailers like Walmart, Costco (COST), discount stores like Dollar General (DG) and online retailers like Amazon. Data backs that up. Supermarkets accounted for 66.6% of grocery sales in 2022, down from almost 70% in 2017, according to Coresight research. Meanwhile, the share of household spending going to grocery sales at “dollar” stores grew 89.7% between 2008-2020—making them the fastest-growing sales channel, the American Public Health

In a statement emailed to Luckbox, Kroger reinforced its no-layoff pledge. “Kroger will not lay off any frontline associates or close any stores, distribution centers or manufacturing facilities as a result of this merger.” The statement says Kroger is working with the FTC to “develop a thoughtful divesture plan—either through selling stores to strong buyers or by creating a standalone independent company.”

Pablo Garces, a director at S&P Global

is the fastest-growing category of food retailers. The share of household spending on groceries at dollar stores grew by 89.7% between 2008 and 2020. - American Public Health Association

Kroger, even without buying Albertsons, is the nation’s biggest stand-alone grocery retailer. But Walmart and its Sam’s Club unit hold a combined 23% of the U.S. grocery market compared with Kroger’s 11% share and Albertsons’ 6%, according to data from Flywheel Digital, an Ascential company. Walmart, known primarily as a mass merchant, earns about 60% of its revenue from selling groceries.

Association says. Besides Dollar General, retailers in the segment include Dollar Tree, (DLTR) and Family Dollar (FDO).

Tech provider Mercatus and data firm Incisiv estimate online grocery sales will account for 21.5% of the market by 2025, up from less than 15% in 2022 and 3.4% in 2019. But research firm SymphonyAI Retail CPG, says the net number of online grocery shoppers in the U.S. and Europe declined 14% from Q1 2022 and Q1 2023. Online grocery revenue declined just 1% in the period, but inflation accounts for much of the smaller decrease, the firm says.

For a variety of reasons, the merger faces stiff opposition. Among those calling for a halt are several unions; the Economic Policy Institute (EPI), a liberal-leaning think tank; the consumer advocacy group Center for Science in the Public Interest; and politicians that include Sens. Elizabeth Warren (D-Mass.), Bernie Sanders (D-Vt.) and Rep. Jan Schakowsky (D-Ill.) Each side has thrown around accusa-

tions and heated rhetoric.

For example, Sean M. O’Brien, general president of the Teamsters Union, issued a statement that said: “Kroger and Albertsons management likes to talk the talk on job security when they’re sitting in front of Congress but talk means little when it comes to protecting our members. We expected better from these two longtime Teamster employers.”

Kroger clapped back in an email to Supermarket News , calling the EPI findings “erroneous and based on a faulty, biased and poorly sourced analysis.” Ouch.

Despite the opposition, Dan Wasiolek, senior equity analyst at Morningstar, told Luckbox he thinks the Kroger/Albertsons merger will happen—just not necessarily the way the retailers want it to. Wasiolek anticipates any approval to be conditional—probably requiring the combined company to sell more stores than they want to divest.

“Any part of Albertsons that [Kroger] can accumulate, I think over time gives them more scale, more customer data and a more national presence, and in some regional markets they will be stronger, too,” Wasiolek said.

The FTC is expected to make its decision by early 2024.

from unions, consumer advocates, liberal think tanks and politicians.progressive

Just a gulp of extra virgin olive oil every morning can bring incredible health benefits. But watch out for fake substitutes.

BY ED MCKINLEY

BY ED MCKINLEY

virgin olive oil is having its moment. Post-doctoral fellows are documenting the health benefits, videographers are filling social media with testimonials and Jennifer Lopez swears by it for skin care.

Beauty and notoriety aside, science tells us swallowing a tablespoon of extra virgin olive oil (EVOO) once a day can drastically reduce the risk of cancer, strokes, obesity, Alzheimer’s, rheumatoid arthritis, Type 2 diabetes, stomach ulcers and heart disease.

“Highest olive oil consumption was associated with 31% lower likelihood of any cancer,” says a study published by the Public Library of Science (PLOS).

Combining data from a varied range of studies, the authors of the PLOS paper note that EVOO reduces “pooled relative risk” by 33% for breast cancer, 23% for gastrointestinal cancer, 26% for aerodigestive tract cancers and 54% for urinary tract cancer.

So, daily doses of EVOO could have profound significance. This year, 1,958,310 Americans will be diagnosed with cancer, and 609,820 will die from it, The American Cancer Society projects.

But aside from sparing Americans the ravages of cancer, a daily tablespoon of EVOO makes them 28% less likely to die from dementia, the MedicalNewsToday website says.

That means a lot. Dementia’s most common form, Alzheimer’s disease, plagues an estimated 6.7 million Americans over the age of 65, according to the Alzheimer’s Association. More than 134,000 died of Alzheimer’s in the U.S. in 2020, the Centers for Disease Control reports.

In addition to fighting specific diseases, consuming EVOO simply increases longevity, says a communique from Harvard Medical School. Test subjects who replaced butter, margarine or mayonnaise with EVOO had a death rate 34% lower than those who didn’t substitute it for those fats, the Harvard report notes.

Besides postponing death, EVOO can make life better right here and now. Downing four or five spoonfuls at bedtime can tame the midnight hunger pangs that lead to nighttime snacking and obesity. A spoonful combined with a few drops of lemon juice can make a cold disappear more quickly. There’s even evidence a daily dose can ward off COVID-19.

EVOO contains bioactive compounds, which science defines as substances in plants that promote health in humans. (See p. 30.) The bioactives in EVOO have names like oleic acid, oleuropein, oleocanthal and hydroxytyrosol.

Dieticians use other terms, describing EVOO as rich in monounsaturated fats, antioxidants and anti-inflammatory properties.

But there’s a catch. Only genuine extra virgin olive oil promotes these seemingly miraculous health benefits, and charlatans have no compunction about cashing in on fake EVOO.

“Olive oil is kind of like the used cars of the food industry—there’s a very low ethical bar,” says author Tom Mueller. His latest book, How to Make a Killing: Blood, Death and Dollars in American Medicine, takes on problems with kidney transplants and dialysis. But a few years ago, he wrote Extra

“Does over-the-label stuff count?”

Distributing fake olive oil can be as profitable as trafficking cocaine but without the risk.

Virginity: The Sublime and Scandalous World of Olive Oil, and he remains intensely interested in the subject.

Plus, he’s far from alone in pointing out the problem of fake EVOO. Stacy Peterson, CEO of Connoils, a food industry supplier of oils and powders, also provides perspective.

“Here in the United States, they use that term ‘extra virgin’ as a marketing tool to put on the label whether or not it’s truly extra virgin olive oil in that bottle,” Peterson says.

Often, the fakery begins near the Mediterranean Sea. Spain leads the world in olive oil production, but much of it is packaged in bottles or tins in Italy.

Because of the high price of real EVOO, unscrupulous growers, packagers, distributors, exporters, importers and retailers unload oil that’s been compromised in either of two ways. It may be blended with a cheap substitute like sunflower

70% TO

of the olive oil labeled “extra virgin” is fake and doesn’t have the full potential to promote wellness. - Tom Mueller, author

long list of standards.

So, as much as 80% of the product labeled “extra virgin” in the United States really isn’t, according to Mueller. Peterson agrees that bogus bottles of oil crowd the shelves of stores here. They both say most consumers don’t know the difference anyway.

“Consumers are pretty naive,” Peterson observes. But Mueller takes it farther, noting that taste tests demonstrate many Americans actually prefer the inferior olive oil they grew up with to the unfamiliarity of the real thing.

So, how does one go about finding the real EVOO that wards off so many maladies?

Shoppers should begin their search for genuine EVOO with the understanding that they may have to pay a bit more, Peterson advises.

“They’re probably not getting pure extra virgin olive oil if they’re buying the cheapest one on the shelf,” she says, “but it doesn’t necessarily mean that buying the most expensive on the shelf is getting you a legitimate olive oil, either.”

Look for bottles made of dark glass that blocks the UV rays that make the oil deteriorate, Mueller cautions. The label should say where the olives were grown, not just where the oil was packaged. A recent date counts for a lot because olive oil degrades with time instead of aging like fine wine, he says.

But taste is the ultimate test, according to Mueller, and he notes the University of California, Davis and other institutions offer courses in tasting skills. Still, it won’t take long to teach yourself to recognize the taste and aroma of EVOO if you sample a variety of oils, he maintains.

“Think fruit juice, OK?” Mueller told Luckbox. “It needs to have some kind of perceptible fruitiness, some perceptible bitterness and some perceptible pungency—you know, a spiciness in the back of the throat.”

Watch out for oil that’s rancid, moldy or “off” in any way. “Close your eyes and think— is this fresh grapefruit juice? Or is this a heavily processed liquid fat?” Mueller says.

EVOO can reach a high level of quality in the United States if consumers learn to appreciate it and insist that retailers stock only the best of what can be a dismayingly inconsistent product due to the vagaries of weather.

oil, or it may be processed with heat that masks the distressing odor and unpleasant taste of rancid olive oil.

Dealing in fraudulent olive oil can be as profitable as trafficking in cocaine but without the risk, notes Mueller.

It’s high-priced because to qualify as extra virgin, olive oil must pass tests that measure its chemical composition and can detect whether it was cold pressed instead of processed with heat. But that’s not all—it needs the approval of a panel of trained European tasters who have remarkable agreement on a

EVOO could eventually follow the path of wine, Mueller maintains. A few years ago, supermarkets carried only a few lackluster wines, but now the aisles are filled with worthwhile vintages. It changed because customers learned the difference and were willing to pay more.

“I think that process needs to happen in olive oil, too,” he insists. “What better thing to spend your money on than something that really is the elixir of health and life?”

80%

Swallowing a tablespoon of extra virgin olive oil (EVOO) once a day can drastically reduce the risk of cancer, strokes, obesity, Alzheimer’s, rheumatoid arthritis, Type 2 diabetes, stomach ulcers and heart disease.

BY ED MCKINLEY

BY ED MCKINLEY

AI helps researchers recognize, understand and exploit plant-based bioactive chemicals that promote human health and longevity. Some call it “food as medicine,” and it may be the biggest dietary news since the discovery of vitamins.

figured out what to eat long before the dawn of recorded history. In every culture and in every corner of the world, tribal savants knew some foods promoted good health and a few even had the power to heal.

But what made these beneficial foods special? If the inquiring minds of long ago had possessed the technology to accurately add up all the components of a plant, they would have discovered the stalks, leaves, roots, flowers, fruits, seeds—and everything else we can see with the naked eye—doesn’t quite equal 100% of the plant. The world’s flora also contains something else—something seemingly invisible.

Yet only lately has the mystery of what’s unseen begun to unravel. Our understanding increased profoundly over the first half of the 20th century as science discovered the 13 essential vitamins—the first in 1913 and the last in 1948. Making quick progress, companies were turning some vitamins into consumer products by 1935. By the late ’50s, vitamin pills had become commonplace in American households and were ingrained in the national psyche.

Now, another period of discovery is upon us, but it’s moving more quickly than the vitamin revolution and may prove at least as momentous. Artificial intelligence is helping scientists unlock the secrets of compounds often known by the catchy marketing-oriented name “bioactives.” They’re also called more scientific names, like “phytochemicals,” “phytonutrients” or “bioactive phytonutrients.” Ultimately, the public may come to know them as “functional ingredients.” For simplicity, let’s stick with the name “bioactives” for now.

Fraught nomenclature aside, we’re talking about chemical compounds that come from plants and produce biological activity in humans, says Jed Fahey, a nutritional biochemist who’s logged nearly three decades on the faculty at the Johns Hopkins University Medical School. The biological activity can take the form of better sleep, a stronger immune system, reduced inflammation or other benefits. Maybe someday they’ll cure cancer, experts say. Some think of it as “food as medicine.”

“New technologies have allowed the proper identification of a whole slew of compounds that have always been in these plants,” Fahey notes, citing advances in laboratory tools with names like mass spectroscopy and nuclear magnetic resonance spectroscopy.

Every living organism—plants, fungi, animals and humans—produces the compounds, but they earn the name bioactives only when they affect humans, according to Jim Flatt, a scientist who serves as CEO of Brightseed. It’s a privately held company that’s beginning to extract bioactives from plants and then supply them to other firms to use in processed food, dietary supplements

and pharmaceuticals.

Everything alive, including plants, animals and humans, generates phytochemicals. But they’re called bioactives only when they’re made by plants and can benefit humans. Plants develop them for their own survival, says Katie Stebbins, executive director of The Food & Nutrition Innovation Institute at Tufts University.

Plants rely on the compounds for survival because they perform all sorts of functions, Stebbins observes, citing the examples of attracting pollinators, poisoning herbivores, and repelling rot and insects. She likens the evolution of those characteristics to the process of humans developing arms and legs to sustain themselves.

“Bioactives are a really beautiful, amazing part of nature,” Stebbins says.

Eating plants that contain those beautiful bioactives is good for people, but extracting the bioactives and consuming them in more concentrated form can do even more to treat or prevent illness, according to Leena Pradhan-Nabzdyk, a professor of surgery at Harvard and CEO of Canomiks, a bioactives-related company.

“We truly believe in our vision of ‘food as medicine,’” Pradhan-Nabzdyk says of her company’s slogan.

The word “medicine” is key because just eating well won’t provide enough bioactives, agrees Snigdha Guha, a postdoctoral scholar in molecular biology at the University of California at Davis.

“According to my calculations, you need to be eating two kilograms of beans every day, which is an insane amount,” she notes.

At any rate, companies and academics are contributing to research that experts are convinced will realize their vision of better health through bioactives, and they’re learning more about these beneficial compounds at a furious pace.

Twenty years ago, the consensus at a meeting of the Phytochemical Society of America was that there were about 50,000 phytochemical compounds in all of nature, and only a few would qualify as bioactives, recalls Fahey. Ten years ago, researchers were making the educated guess that science would someday discover hundreds of thousands of phytochemicals, he says.

Today, researchers estimate the plant kingdom may produce

upward of 10 million phytochemical compounds, Flatt asserts. Brightseed, where Fahey and Stebbins serve in a coalition of expert advisors, has now isolated and studied 4 million of them and found about 30,000, or 1%, may qualify as bioactive.

How have the numbers grown so prodigiously? It’s thanks partly to the computational power of artificial intelligence, according to just about everyone who spoke with Luckbox for this article. At Brightseed, that technological leap has occurred with the help of a platform

THE FOOD industry is poised to steal market share from the healthcare system, according to Carter Williams, CEO and managing principal of iSelect Fund, an early-stage venture capital firm that invests in agricultural technology.

The shift is happening in reaction to a sequence of events that’s ruining Americans’ health, Williams contends.

The assault began when the quest to improve crop yields bred the taste out of food. Then, the food industry brought back tastiness by manufacturing and promoting junk food. But eating their lessthan-healthful innovations caused tens of millions to get sick and fat. Now, that misery has prompted the healthcare and pharmaceuticals industries to peddle prescription drugs and surgery to the ailing populace.

But the generation coming of age today won’t stand for it, Williams insists. The young adults of Gen Z have a better idea, he says, and they’re winning converts among older generations. To Williams the choice they’re making is clear.

“Are you going to get healthy by eating better—or are you going to get healthy by taking Ozempic?” he asks, summarizing the new generation’s thinking and citing the recently released blockbuster weight-loss drug.

Forager has significantly shortened the time needed for the discovery process, enabling the company to lower costs, compared with old trial-and-error methods, Flatt continues.

Brightseed is using Forager to help companies bring bioactives-enriched products to the public as early as next year. Among those firms are Pharmavite, a dietary supplements company owned by Otsuka Pharmaceutical (OTSKF); Kallyope, a privately held pharmaceuticals company that concentrates on the “gut-brain axis” and has plans to go public; and Nutriquest, a privately held supplier of livestock feed and nutrients.

Another company, Canomiks, uses its platform differently from Brightseed, employing it in three ways, says Pradhan-Nabzdyk, the CEO.

First, Canomiks provides other companies with product validation. It uses human cells in tests to determine which ingredients in a formulation are achieving the desired results. The researchers contend with a lot of variables—the characteristics of compounds from plants change from one batch to the next because of weather, soil type and lots of other factors.

Second, the company is using National Science Foundation funds to test products and issue a “CanTRUST by Canomiks” seal of approval to certify a product’s effectiveness and consistency from one shipment to another. The seal may begin appearing on consumer products next year, Pradhan-Nabzdyk says.

Third, the company is in discussions with customers to help them improve the formulations of their products.

So, companies like Canomiks and Brightseed are furthering the science of bioactives, but much remains to be done to counteract the mistakes of the past.

the company calls Forager.

About 30,000 plant species have been used in one place or another for food or as medicine, and the company has collected and profiled more than 2,000 of them, Flatt says. Researchers analyze slices of the plants and feed the data into Forager.

When Forager detects previously undiscovered compounds in those slices, it compares their properties with a database of knowledge about how the body works. When there’s a match—in other words, the compound appears likely to have a beneficial effect on humans—the testing begins.

If laboratory studies verify the compound might qualify as a bioactive that’s good for people, they’re then tested on humans, Flatt says.

“Oftentimes, we’re able to characterize 10 times or more the number of bioactives that have been characterized previously for many given plant sources,” he says, “and through AI [we can] predict with decent accuracy their role in health.”

It’s a new emphasis on taking action to maintain good health instead of waiting to repair damaged health. Williams predicts that attitude will become the norm within five years.

Fortuitously, that change in attitude happens to coincide with an explosion of scientific knowledge about something called “bioactives.” They’re naturally occurring chemical compounds that enhance health, and companies can use them in supplements, food additives and pharmaceuticals.

For investors, that bodes well not only for the companies that provide bioactive ingredients to the food and pharma industries but also for consumer packaged goods makers with the foresight to put missing bioactives back into their products.

“We don’t consume any more calories as a population than we did 30 years ago, and yet obesity continues to increase. Most of that is attributed to removing bioactives and fibers in making shelf-stable foods.”

– Dr. Jim Flatt

For the last century or so, plant breeders have been modifying fruits, vegetables and grain to increase yield; boost resistance to insects, bacteria and fungus; intensify sweetness; and induce them to mature at a uniform rate to facilitate harvest, Fahey says. Recently, genetic modification has amplified the trend.

“If you taste some heirloom tomatoes or some heirloom apples, they’re not as sugary sweet as a modern Gala or Delicious,” he notes by way of example.

Selective breeding has caused the bioactive content of plants to decline simply because there’s been little or no attempt to increase or even maintain it, Fahey says.

What’s more, agricultural practices like spraying crops with pesticide have reduced the need for plants to develop their own defenses and have thus caused bioactives to decline, he continues.

Food processors squeeze out most of the remaining bioactives by exposing what we eat to heat and extrusion, Fahey notes. Then they lace their products with harmful but inexpensive sugar, oils and salt.

For the last 20 years, Americans have been eating more of the processed food that causes inflammation and is associated with maladies that include diabetes, Alzheimer’s, Crohn’s disease and various cancers, Fahey says.

“Americans are going to have one, two, three, four or even five concurrent chronic conditions by the time we bite the dust,” he maintains, “and they’re making our quality of life worse and worse. Ultra-processed foods are killing us— there’s no question about it.”

While awaiting what many anticipate will be a restoration of bioactives in the American diet, Fahey advises consumers to improve their health by choosing organic produce that hasn’t been robbed of potential bioactives. He also recommends limiting consumption of the boxed foods with lengthy shelf life that occupy the center of the supermarket. Instead, we should choose the produce, meat and dairy offerings on the store periphery.

Flatt agrees, noting that “we don’t consume any more calories as a population than we did 30 years ago, and yet obesity continues to increase, not just in the U.S., but globally. And most of that is attributed to removing bioactives and fibers in making shelf-stable foods. So, this is why the scientific community is really embracing the concept of bioactives.”

RESEARCH into bioactives— chemical compounds in plants that can benefit humans—is continuing at a rapid pace and should soon result in dramatically improved supplements, pharmaceuticals and processed food.

In the meantime, readers can safeguard their health by following the dietary advice of nutrition experts who advocate consuming bioactives.

It’s all about eating berries, according to Jim Flatt, who

holds a Ph.D. in chemical and biochemical engineering and serves as CEO of Brightseed, a company researching bioactives.

“If I want to be less susceptible to colds and infection or I’m concerned about maintaining good cognitive health as I age, cranberries, blackberries and blueberries are all bioactive-rich,” Flatt says.

Don’t leave sprouts out of your diet, advises Jed Fahey, a nutritional biochemist at Johns Hopkins University.

“I grow my own sprouts of various sorts—fenugreek, broccoli, clover, soy and chickpea,” Fahey says. “They’re highly nutritious and full of phytochemicals.” He notes that phytochemicals is a name for a group of compounds that includes bioactives.

Shopping for fruits and vegetables with lots of different colors also helps ensure you’re getting bioactives, notes Katie Stebbins, executive director of The Food and Nutrition Innovation Institute at Tufts University.

“The yellow carrots have something in them that the purple carrots don’t have, and the purple carrots have stuff in them that the orange carrots don’t have,” she maintains.

“So, I try and make sure my salads look like really bright, pretty rainbows, and then I throw some seeds on top,” Stebbins continues. “It’s a good way to interpret whether I’m getting this full spectrum of all the hidden, beautiful plantbased chemicals that are good for me.”

“Ultra-processed foods are killing us— there’s no question about it.”

– Dr. Jed Fahey

is hot dog season. Americans eat an estimated 7 billion franks between Memorial Day and Labor Day, according to the National Hot Dog and Sausage Council.

But despite the popularity of hot dogs, the U.S. has only three major chains: Portillo’s (PTLO), Nathan’s Famous (NATH) and privately held Wienerschnitzel. Nathan’s is known for hosting the Coney Island hot dog eating contest and has become a recognizable grocery store brand, but it tends to stick to the East Coast. Wienerschnitzel, a West Coast staple, sells an iconic chili dog. Portillo’s provides Chicago favorites like the Chicago dog and Italian beefs and is most popular in the Midwest.

Of the three, Portillo’s is growing fastest despite not offering franchises. It plans to increase its number of locations by 10% each year, and it’s on track to become the first national hot dog chain with a strong buy stock rating.

Dick Portillo and his wife, Sharon, founded Portillo’s—originally named The Dog House—in 1963. Starting with an $1,100 investment, equivalent to about $10,700 in 2023, Portillo has turned the original shack into a national chain with more than 60 locations in 10 states.

Garrett Kern, Portillo’s vice president of strategy and culinary, credits the fast-casual restaurant’s success to its authentic, quality ingredients. The Chicago dog, made with a Vienna Beef frank, is topped with mustard, relish, celery salt, chopped onions, sliced tomatoes, a kosher pickle spear and sport peppers on a poppy seed bun.

The Portillo’s Italian beef features roast beef soaked in an au jus—which takes a day to make and is cooked in two Chicagoland commissary kitchens—and topped with either sweet peppers or hot giardiniera peppers on Portillo’s Toronto French bread that diners can dip in gravy for a “wet” sandwich.

Although Portillo’s has fewer locations than Wienerschnitzel and Nathan’s, it outperforms its competitors.

Privately held Wienerschnitzel operates 300 restaurants, while Nathan’s Famous, a public company, has 198.

Portillo’s locations average 7,800 square feet to 8,000 square feet and have an average unit volume (AUV) of $8 million, as reported by Guggenheim Partners in 2021. Wienerschnitzel locations measure 780 square feet to 1,300 square feet. The top 25% of Wienerschnitzel restaurants have an AUV of around $1.4 million, while its bottom 25% have an AUV of around $771,000, according to its 2021 franchise disclosure. Sales at Nathan’s average $725,000.

Portillo’s focuses on the Midwest and the Sun Belt. Chicagoans who have moved south welcome the chain’s expansion. “They’re basically your advertising and your cheerleaders on the ground for the initial opening,” Kern says of the Midwesterners living in the South. “And then as you introduce yourself to the local market more, you become part of their routine.”

What have you learned about consumer interest in a Chicago-centric menu as you move into new markets?

While Chicagoland AUVs are so much higher, if you were to look at our AUVs excluding the Chicago restaurants, they would still be much higher than most fast-casual concepts out there. So, Portillo’s, on its own outside of Chicago, is an A++ restaurant brand as far as AUVs go. We don’t get that business outside of Chicago without replicating some things that made us very successful here. So, when it comes to the menu, yes, we have those core Chicago items, and they’ll start with Italian beef and Chicago-style hot dogs. Hot dogs, I think, are kind of universally accepted and embraced foods.

Why do you think Portillo’s AUVs exceed those of so many other chains?

There are a lot of reasons—the wide menu is part of it. We have a lot of different ways to get you your Portillo’s. We’re known for fast, friendly drive-thrus that do a lot of volume. We have a great dining experience where we do a ton of to-go business. We do digital orders, we do delivery, we do catering—so however you want to get it, whatever the occasion is, we have an option for that.

Another thing that enables our success outside of Chicago is we’re typically on pretty good real estate. We’re not like

LUCKBOX SPOKE WITH GARRETT KERN, PORTILLO’S VICE PRESIDENT OF STRATEGY AND CULINARY, ABOUT THE CHAIN’S EXPANSION FROM CHICAGO ACROSS THE U.S. AND WHAT CHANGES—IF ANY— TO EXPECT ON THE MENU.

LUCKBOX SPOKE WITH GARRETT KERN, PORTILLO’S VICE PRESIDENT OF STRATEGY AND CULINARY, ABOUT THE CHAIN’S EXPANSION FROM CHICAGO ACROSS THE U.S. AND WHAT CHANGES—IF ANY— TO EXPECT ON THE MENU.

The U.S. has only three major hot dog chains: Portillo’s, Wienerschnitzel and Nathan’s Famous.

GarretKern in Times Square at Portillo’s inaugural investor day.

Modest gold watches made with superior manufacturing skill, have a centuries-old tradition in Germany. After Glashutte‘s new rise, the watchmakers and their fine watches were able to attain a world-renowned reputation once again.

With the Patria, we keep Glashutte’s deep-rooted horological tradition alive: the watch must be noble, beautiful, and precise.

Patria · manufacture caliber · 6600-01

ACTOR JEREMY ALLEN WHITE not only won an Emmy for FX Hulu’s hit show The Bear but also helped make Italian beef sandwiches a nationwide phenomenon. The show centers on Carmy, played by White, a former Michelin-star chef who moves back to Chicago to take over his brother’s Italian beef restaurant, The Beef, after his death. Filmed at and inspired by Mr. Beef in the Chicago neighborhood River North, The Bear follows Carmy as he aims to elevate the signature sandwich and eventually turns The Beef into an upscale restaurant, The Bear, in the second season. But immediately after The Bear aired in June 2022, gourmands around the country began a frenzied search for Italian beefs. The Los Angeles Times reported that one of the few places that serves Italian beefs in LA, Comfy Pup, could hardly sell the sandwich until The Bear was released. Four days after the pilot, Comfy Pup sold out of Italian beefs in two hours, which head chef Michael Walker credited directly to The Bear’s popularity. The show led to a 250% increase in sales of Italian beefs for Comfy Pup. Similarly, The New York Times reported Gino’s East of Chicago, a favorite around the city for its deep-dish pizza, saw a 200% increase in Italian beef sales at its Sherman Oaks, California, location, while Pizza Man in Kansas City, Kansas, sold five to six times as many beefs after the pilot than it did in the entire month of July. Garrett Kern, Portillo’s vice president of strategy and culinary, revealed that while Portillo’s in the Chicago area didn’t see a remarkable uptick in Italian beef sales, Portillo’s restaurants around the country generated significantly more interest.

Do you plan to include regional favorites in any of your new markets? There’s a couple reasons that we don’t.

First of all, for a brand as complex as ours in terms of its operations, and how quickly we want to scale, there’s a ton of benefits to having uniformity in our training and operations.

The second is that LTOs (limited time offers), or unique menu items, can be somewhat of a nightmare for supply chain and logistics. And then you often end up distracting your operators and your team members with the thing that’s very new. It’s best to do your core menu—what you do well—and just focus on executing that and proselytizing in the local market.