There are important risks associated with transacting in any of the Cboe Company products discussed

products, it is important for market participants to

claimers. Prior to

or

engaging

His book, The Lords of Easy Money, reveals “How the Federal Reserve Broke the American Economy.”

Our panelists are split on what issues will motivate voters, but they’re unified in predicting some surprises.

Ballots cast by voters under the age of 30 matter. Here’s how the age group’s concerns could influence this election cycle.

Ranked Choice Voting is gaining in popularity from Maine to California and from Alaska to Virginia. But does it work?

Televised presidential debates can make or break candidates, but without reform they’re in danger of disappearing.

Legalizing recreational marijuana in more states may affect the markets and could influence federal lawmakers.

The Normal Deviate’s analysis of statistical metrics may change your perspective on the predictive power of polls.

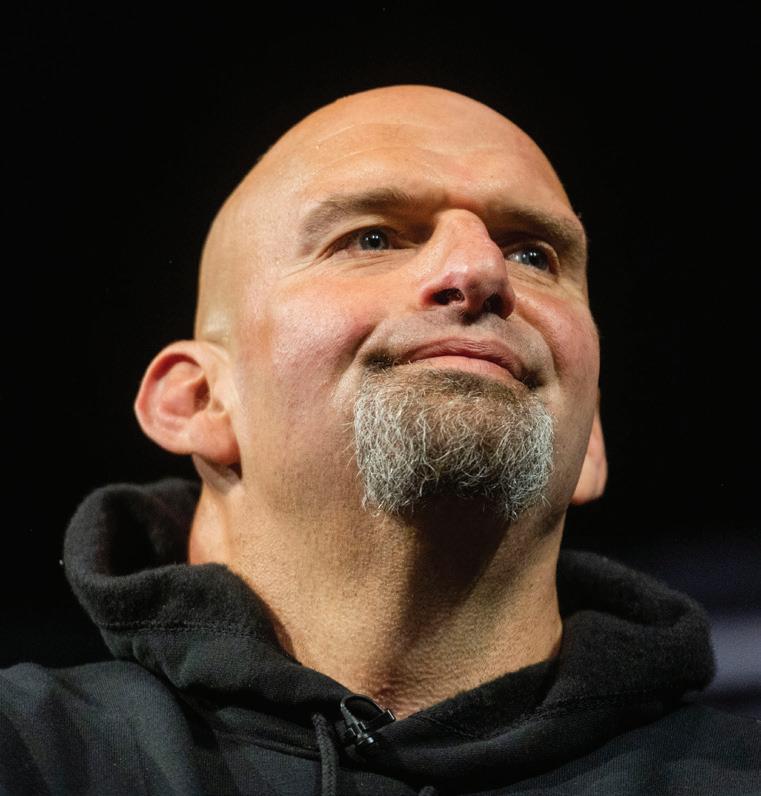

2022 It’s a game of chance when it comes to the markets and the economy, and the Federal Reserve holds all of the cards. Politicos and politicians face off during the midterms: (From top left clockwise) Federal Reserve Chair Jerome Powell; Dr. Mehmet Oz (R) who faces Lt. Gov. Ron Fetterman (D) in the Pennsylvania Senate race; Herschel Walker (R) faces Sen. Raphael Warnock (D) in Georgia; Sen. Mark Kelly (D) faces Blake Masters (R) in Arizona.

editor in chief ed mckinley

managing editors

yesenia duran elizabeth schiele associate editors kendall polidori mike reddy editor at large garrett baldwin technical editor james blakeway contributing editors vonetta logan, tom preston mike rechenthin

creative directors tim hussey, gail snable contributing photographer garrett roodbergen editorial director jeff joseph

comments, tips & story ideas feedback@luckboxmagazine.com contributor’s guidelines, press releases & editorial inquiries editor@luckboxmagazine.com advertising inquiries advertise@luckboxmagazine.com subscriptions & service support@luckboxmagazine.com media & business inquiries

associate publisher elizabeth schiele es@luckboxmagazine.com publisher jeff joseph jj@luckboxmagazine.com

Luckbox magazine, a tastytrade publication, is published at 19 N. Sangamon, Chicago, IL 60607

Editorial offices: 312.761.4218 ISSN: 2689-5692

Printed at Lane Press in Vermont luckboxmagazine.com

Luckbox magazine @luckboxmag

Luckbox magazine content is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities and futures can involve high risk and the loss of any funds invested. luckbox magazine, a brand of tastytrade, Inc., does not provide investment or financial advice or make investment recommendations through its content, financial programming or otherwise. The information provided in luckbox magazine may not be appropriate for all individuals, and is provided without respect to any individual’s financial sophistication, financial situation, investing time horizon or risk tolerance. luckbox magazine and tastytrade are not in the business of executing securities or futures transactions, nor do they direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. luckbox magazine and tastytrade are not licensed financial advisers, registered investment advisers, or registered broker-dealers. Options, futures and futures options are not suitable for all investors. Transaction costs (commissions and other fees) are important factors and should be considered when evaluating any securities or futures transaction or trade. For simplicity, the examples and illustrations in these articles may not include transaction costs. Nothing contained in this magazine constitutes a solicitation, recommendation, endorsement, promotion or offer by tastytrade, or any of its subsidiaries, affiliates or assigns. While luckbox magazine and tastytrade believe that the information contained in luckbox magazine is reliable and make efforts to assure its accuracy, the publisher disclaims responsibility for opinions and representation of facts contained herein. Active investing is not easy, so be careful out there!

PHOTO: ALAN MATTHEWI’m sentimental if you know what I mean I love the country but I can’t stand the scene

And I’m neither left or right

I’m just staying home tonight

Getting lost in that hopeless little screen

But I’m stubborn as those garbage bags

That time cannot decay

I’m junk but I’m still holding up this little wild bouquet

Democracy is coming to the USA

—Democracy, Leonard Cohen, 1992

The tribes at the forefront of our political division complain bitterly about the inci vility of our discourse. Opposing chieftains point fingers at each other on social media and on tribal cable channels, slinging slurs like “snowflake,” “extremist,” “militant,” “radical,” “hateful” and “dangerous.” They’re not out to convert the opposition but to rally their own clan’s warriors for the imminent judgment day—the upcoming midterm elections.

As this issue of Luckbox goes to press, midterm candidates have spent nearly $7 billion on advertising, with $50 million going to Google and Facebook. The total is expected to be near $10 billion by election day.

In Pennsylvania, a “purple” swing state, spending in the Senate race between Demo cratic Lt. Gov. John Fetterman and Repub lican candidate Dr. Mehmet Oz, is expected to top $160 million, shattering the previous all-time spending high for the Keystone State’s Senate battles.

But record-high spending isn’t the only controversy in Pennsylvania. Oz has been hammering the Fetterman campaign to agree to a public debate that might shed light on the lieutenant governor’s fitness to hold office after a recent stroke. With a comfortable lead in the

polls, the Fetterman camp has been reluctant to commit to an appearance on the debate stage.

His campaign isn’t alone in its reticence. For years, candidates with big leads have shied away from formal debates.

Instead, they rely on ads to deliver care fully crafted messages. Why give your oppo nent a “gotcha” moment when you can avoid it? Then there are the estimated 60 hours of preparation required for a debate. The risks outweigh the potential benefits for a front-run ner focused on winning.

But when candidates eschew debates, the public invariably loses. At this writing, elec tion debates have been confirmed in just two competitive Senate races.

Here’s what the nonpartisan National Democratic Institute has to say: “Debates are generally the only time in the course of a political campaign where the candidates come together in a neutral setting that allows citi zens to make a side-by-side comparison of their positions and leadership styles. Debates are really the ultimate job interview for elected officials.”

That appears to be the prevailing sentiment among voters, as well. Check out the Luckbox Readers Survey results which appear on p. 30.

What’s more, the first 2016 Presiden tial debate between Democrat Hillary Clin ton and Republican Donald Trump was the most-watched of all time with an estimated 84 million viewers. For context, only the farewell episode of M*A*S*H* and some Super Bowls have attracted larger audiences.

Yes, voters appreciate debates. But televised debate suffered a setback when comedian Jon Stewart appeared on Crossfire, the nightly political show that ran on CNN for 12 years.

Stewart blew up the program, hosted by conservative Tucker Carlson and liberal Paul Begala, by proclaiming it was “hurting Amer ica.” The program was canceled shortly after that, and nearly 20 years later, not a single show provides opposing viewpoints with equal time and an immediate opportunity for cross-examination.

It’s a situation contributing columnist Clea Conner (The Case for Political Debates, p. 30) would like to change. She’s CEO of Intelli gence Squared, a non-profit operating a live event and internet platform for structured, Oxford-style debates on politics, economics and culture.

Conner says honest debate could help bring civility to American politics. Perhaps the warring tribes would even come to agree on a truce. Everyone would benefit.

Luckbox is dedicated to helping active investors achieve skill-derived, outlier results.

1 Probability is the key to improving outcomes in the markets and in life.

2 Greater market volatility brings greater opportunity for astute active investors.

3 Options are the best vehicle to manage risk and exploit market volatility.

4 Don’t rely on chance. Know your options because luck smiles upon the prepared.

Ed McKinley Editor in Chief Jeff Joseph Editorial DirectorYour thoughts on this issue? Please take the next reader poll at luckboxmagazine.com/survey

We asked Luckbox readers if the current political climate prevents them from saying things they believe because others might find them offensive.

Agree 68%

Disagree 32%

Should voters be required to show an I.D. at the voting booth?

Yes 89% No 7%

Would you say that the U.S. economy is currently ...

In a recession 66%

Not in a recession 22%

Do you approve or disapprove of the job Joe Biden is doing as President?

Luckbox Readers Morning Consult + POLITICO

Strongly approve 11% Somewhat approve 23% Somewhat disapprove 11% Strongly disapprove 55%

READERS SURVEY17% 26% 13% 42%

While inflation is clearly among the most important issues, elected officials must find ways to work across party lines. The electorate has to reject the political grandstanding at extremes from both sides. Politics isn’t a reality show and shouldn’t be accepted as such.

—Aaron Montell, Denver

Getting new blood into our system of government. The establishment has proven that they (both sides) are so far out of touch with the populace that we need to start talking about term limits or maximum age.

—Andy Ream, Tucson, AZ

The economy. My 401K’s 38 years’ worth of savings has lost 25%.

—Name withheld by editor

Great criticisms of crypto. I’ve been in crypto since 2016 and have always supported it, but the last two to three years have been painful to watch and I’m not happy with a lot of the developments or lack of development in the space. The need for more education and coverage is vital for the market to decide on crypto’s future.

—Spencer Beyer, New York

We asked Luckbox readers what they think is the most important issue in the midterm elections. Here’s what they had to say:

The Border. You can’t have a sovereign country with no border control. You can see the hypocrisy with the recent Martha’s Vineyard incident. Great example of NIMBY [Not in my backyard].

—Marty Mallek, Hobe Sound, FL

Authoritarianism. We seem to disagree on fundamentals. A fair segment of the population appears willing to disregard democracy and is intent on destroying this one. If we don’t get this right, then none of the other issues matter.

Michael Conley, Asheville, NC

Inflation, the economy, excessive spending, open southern border, lack of unbiased news reporting and unpunished crime!

—Jim Lorence, Ankeny, IA

Two ways to send comments, criticism and suggestions to Luckbox

Love crypto discussions. It is the future currency of the world.

—Caleb Bolander, Loveland, CO

I do not find any point in digital assets, and while I have always liked glittery things, they do not produce a return.

—Katherine Wildey, Lakewood Ranch, FL

I always look at the Trades & Tactics articles; these provide a good reminder of when to use the various options strategies. I loved the pickleball article. I started playing the game four years ago in Florida, where we stay for three months of the winter. It is a great workout.

—Kevin Callagy, Stamford, NY

In general, I like the timeliness, brevity and clarity of the content in Luckbox. The subjects chosen for discussion are typically current and relevant. I like how the content is factual and data-driven.

—John Andrick, Kahului, HI

Email tips@luckboxmagazine.com

Your thoughts on this issue? Take the reader survey at luckboxmagazine.com/survey

There’s more to Luckbox than meets the page.

Look for this QR code icon for videos, websites, extended stories and other additional digital content. QR codes work with most cell phones and tablets with cameras. Open your camera

1

2

Hover over the QR code

3

Click on the link that pops up

4

Enjoy the additional content

“After the global financial crisis, the response to disinflation was zero rates, printing a lot of money and quantitative easing. That created an asset bubble in everything. [The Fed is] like reformed smokers. They’ve gone from printing a bunch of money, like driving a Porsche at 200 miles an hour, to not only taking the foot off the gas, but just slamming the brakes on.”

size of the global legal cannabis market in 2021.

It’s expected to reach $22.1 billion this year.

—Grand View Research

SEE PAGE 12

Hedge fund manager Stanley Druckenmiller on central bank efforts to combat inflation with tighter monetary policy

“I believe there’s going to be a Republican turnout in most states that is higher than anyone is going to predict, including us.”

Midterm musings from Robert Cahaly, an American pollster and founder of the Trafalgar Group

SEE PAGE 20

SEE PAGE 30

Heading into the U.S. midterm elections, debate appears to be in decline, a casualty of fragmented digital media, a deeply polarized political culture and a democracy losing its sense of cohesion.

—The Guardian

SEE PAGE 34

the number of newly eligible voters in the upcoming 2022 Midterm

—Center for Information & Research on Civic Learning and Engagement

SEE PAGE 24

U.S. jurisdictions used ranked choice voting in their most recent elections.

—FairVote, September 2022

SEE PAGE 26

The S&P 500 Index tends to underperform in the year leading up to midterm elections. Its average annual return in the 12 months before a midterm election is 0.3%—significantly lower than the historical average of 8.1%. It tends to outperform the market in the 12 months following a midterm election, with an average return of 16.3%.

—U.S. Bancorp Investments

SEE PAGE 52

“IN MANY WAYS, ETHEREUM IS ALREADY THE DOMINANT CRYPTOCURRENCY [NETWORK BECAUSE] 70% OF TOKENS ARE BUILT ON ETHEREUM. IF THE MERGE IS SUCCESSFUL, IT WILL ENCOURAGE EVEN MORE UPGRADES TO ETHEREUM AND THAT SHOULD PUT IT IN A STRONG POSITION TO ALSO BE THE DOMINANT CURRENCY IN MARKET-CAP TERMS.”

—Niclas Sandström, CEO of investment firm Hilbert Group, CoinDesk

people participated in Burning Man 2022 in Nevada’s Black Rock Desert

USA Today

SEE PAGE 39

pounds of cannabis are expected to be cultivated legally in the U.S. in 2030 (20 million pounds more than in 2020)

—New Frontier Data

SEE PAGE 42

people attended Bourbon & Beyond in Louisville, Kentucky, over four days— a record for the festival

The number of NICS (National Instant Criminal Background) checks performed for Americans purchasing firearms in 2021.

The total nearly equals the number of first-year NICS checks during the administrations of former presidents Donald Trump and Barack Obama combined.

SEE PAGE 58

SEE PAGE 60

SEE

54

With midterms approaching, our reporter relives the rapture of expressing anger— and she didn’t have to clean up her mess

By Vonetta LoganIn the words of the great philosopher Frederick Durst from the band Limp Bizkit, “It’s just one of those days, where you don’t want to wake up, everything is fucked, everybody sucks. It’s all about the he-says, shesays bullshit. I think you better quit, talking that shit. And if my day keeps going this way, I just might, break something tonight. Just give me something to break.”

Every day, it seems another story pops up in the media that makes me say, “We are on the dumbest timeline.” Everyone is angry. But this isn’t a pissing match. We’re all entitled to that visceral rage. So, we found it fitting for this issue of Luckbox, which is filled with political hot takes, to also offer a bit of lighter fare on the rapturous experience of rage rooms. If we can’t all get along, can we at least agree that smashing stuff from plates to printers to the patriarchy is a damn good time?

Rage rooms, anger rooms or break rooms— where you pay a small fee to destroy everything in a room without having to clean it up—are a quickly growing institution dedicated to that lesser known sin, wrath. Think of it as your own private frat house. All of the destruction— none of the criminal charges. In the U.S., an estimated 60 of these venues are operating,

according to CNN.

I visited Kanya Lounge, Chicago’s only rage room, to see if hulking out could bring me peace. Kanya features three custom rage rooms that patrons can rent for 30-minute incre ments. Your $98 fee gets you one premium item, like a computer monitor, printer or TV; one small item, like a VCR, keyboard or DVD

solid steel pipe feels cold and hefty in your hand. You get into a rhythm. As you arc that pipe into motion, your rage becomes corpo real, vivid and almost a living, breathing thing. Everything else just falls away.

player; and a mix of seven standard items, like plates and glasses.

Your rage concierge (OK, I just invented that but it’s a good description) escorts you to your private rage room and outfits you with an apron, gloves, and a helmet with sound-reducing ear muffs and a fold-down face shield. My RC, Chris, told me to “choose my weapon,” and like a scene from The Warriors, I selected a metal pipe from a five-gallon bucket. Can you dig it?

Then, it’s just you, your personal demons and a printer from the early ’80s. I did my best Carrie Underwood Before He Cheats bat twirl and went at it. My first few smashes were tentative. Like, is this OK? I feel bad. But that

Plates are the most satisfying to smash. There’s a wild explosion as the tiny shards fly toward your face. As a writer on deadline, I took delighted girlish glee in smashing a multi tude of computer keyboards. Who’s QWERTY now, bitch? And the flatscreen monitors had a most satisfying crack that started in the center, then spread outwards like a thousand tiny spider webs. Sometimes, I screamed when I smashed things. Other times, my resolute determination just rendered satisfied grunts when my steel pipe made contact.

The 30-minute session flew by. When I was done, I was sweaty, and my heart rate was so elevated that my rage session measured as a full-fledged workout on my Apple Watch. Who knew? Rage burns calories! Afterward, I felt great. Lighter, freer, less heaviness in my chest.

It’s just you, your personal demons and a printer from the early ’80s you can smash.

Kind of like I had simultaneously had some excellent Indica, took a Xanax and actually went to bed with a competent man.

As I exited the room, I ran into a young lady named Bethany whose eyes were bright and wild behind her glasses, her cheeks flushed with exertion. “Holy crap, I bent my pipe!” she exclaimed. I asked what brought her and her partner, Ethan, to Kanya Lounge. “She’s had a lot of pent-up anger,” Ethan tells me. “For the past 21 years!” Bethany pipes in. “It’s my birthday today.” Ethan says he googled “rage rooms,” and this was the only thing that popped up. So, the couple made the drive from Aurora, a suburb of Chicago.

I then went downstairs into the lounge to speak to the manager, Guss Castro, about why rage rooms are such an experience. Kanya opened in 2020 during the height of the pandemic. Guss, who started as a bartender, but now manages the lounge, said he truly believes in the efficacy of rage rooms. “The pandemic messed up a lot of people,” he said. “So many people are sad and a little angry. There’s so many stories told in the room. We’ve seen people crying, people really

angry, stopping, then just crying. It really works, though. I think doctors should recommend this place.”

During the pandemic, business was hampered by occupancy restrictions, but now the lounge sees an average of 40-60 reservations a day.

Who’s showing up? Nearly “99% of the reservations are from women,” Castro said. He laughs and in a lilting accent recounts a common occurrence. “Women come in with this (angry) face, and I start to see they need something extra and I open the door and throw a couple extra plates in there.” He goes on to explain that when the rooms are booked by

“I have a daughter who is 14,” he said. “She comes in with a little attitude. I say bring a couple friends with you. I asked the owner (rooms are tech nically for 18+), and he says, take it. Maybe 25 minutes, the kids were sweating, breaking keyboards, printers and monitors—everything. Kids have a lot of things on their mind that they don’t want to share with their parents.”

Anecdotally, rage rooms are the best thing that ever happened to me. Scientifically, the jury is still out.

“We have this culture in which people are often really angry,” clinical psychol ogist Dr. Scott Bea said in an inter view for the Cleveland Clinic. “Yet, we’ve not taught people how to express anger in healthy ways or what anger’s all about or how it’s sometimes useful.” According to Dr. Bea, anger rooms and other physi cal outlets for anger may temporarily expel the bad feelings. But they don’t address the underlying cause of anger or help people learn healthier ways to manage their emotions. “I think it’s fine if you want to go have fun with it, but I don’t think it’s particularly therapeutic,” he said.

couples, men often just stand in the corner, mouths agape as their ladies seek revenge on a 40-pound printer. He also mentions that TikTok is bringing in a younger clientele who want more experiences, and that he’s seen the positive change the room can bring even in his own daughter.

For me, my first rage room foray was a catharsis—a reawakening, a rebirth of a kinder, less rage-y me. Nothing is more satis fying for a woman than making a mess that she doesn’t have to clean up.

Vonetta Logan, a writer and comedian, appears daily on the tastytrade network. @vonettalogan

THE ESTIMATED NUMBER OF RAGE ROOMS IN THE U.S.

Chicago’s Kanya Lounge, kanyalounge.com

Vonetta Logan raging!

Vonetta Logan, a writer and comedian, appears daily on the tastytrade network. @vonettalogan

THE ESTIMATED NUMBER OF RAGE ROOMS IN THE U.S.

Chicago’s Kanya Lounge, kanyalounge.com

Vonetta Logan raging!

The Federal Reserve dictates to the markets and the economy at its whim, but not many Americans understand its monetary game.

Since 1977, the Fed has had a dual mandate to manage prices (inflation) and maximize employment. To reach those goals, the Fed engages in “open market operations.”

These operations include hiking and cutting the Fed funds interest rate, a figure that affects the credit of every citi zen and business in America. The bank can also provide or tighten liquidity to the financial system by buying or selling assets that include U.S. Treasury bonds and mortgage-backed securities. It can set capital reserve requirements on lending institutions.

This isn’t the full story behind the Fed. It’s just the elevator pitch. That pitch, however, is foreign to most Americans.

Twenty-one percent of Americans admit they “know nothing at all about the responsibilities of the Federal Reserve,” according to an April

2022 poll by Axios/Ipsos. Only 7% say they “know a lot about the Fed’s responsibilities.”

This shocking poll is reason for concern.

With the central bank signaling intent to raise interest rates above its current 3.0% to

On Sept. 21, the Federal Reserve hiked its Fed funds rate by 75 basis points. This was the third consecutive meeting where the central bank increased interest rates by that amount, bringing its official rate to 3.0% for the first time since 2008. Markets expect the Fed will hike rates by 75 basis points again during its November meeting.

The markets also have priced in a higher likelihood that the Fed will raise rates to at least 4.25% by 2023 to contain and, hope fully, reduce inflation.

3.25% range, the central bank’s decisions will have a greater immediate financial impact than those of any politician running for office this fall or any presidential candidate in 2024. These actions will change the labor market, credit access, housing prices and much more.

So, why aren’t more Americans paying attention?

But all this language—basis points, funds rate, liquidity—strikes most people as wonky and unintelligible. The financial news that’s generally available is edited for bond traders, not blue-collar workers.

Could this tilt be why only 7% of Americans know how the Fed really works?

Perhaps. But help is on the way in a new book called The Lords of Easy Money Author Christopher Leonard offers a simple

Financial news delivered in plain English would shock the public.

but deep dive into the role the Federal Reserve has played for decades in America’s economy. (See Monopoly: By the Rules, p. 15).

Leonard says financial media haven’t provided adequate insight into what the Fed’s decisions mean for the average citizen.

“For the financial press, there is this guiding idea that you cover the Fed for the bond markets or for the traders,” Leonard said in an interview with Luckbox. “You write how [Fed Chair Jerome] Powell signals large-scale asset purchases to produce more market liquidity.”

That jargon-laden coverage leaves the general public in the dark. “Every time someone hears about the Fed, it’s boring,” Leonard continued. “It doesn’t seem applica ble to their lives. If they’re not trying to make a move in the bond market, they don’t care.”

If the Fed increased the funds’ rate from 0% in early 2022 to more than 4% by December, it would have far-reaching consequences for the economy. The media should report how people are affected.

“The public does want to understand the critical role the Fed plays in both stoking infla tion and then fighting inflation,” Leonard said, “or how the Fed dramatically increased the price tag that must be paid to fight inflation.”

The right way of explaining all that seems clear, he maintained. “More media outlets and newspapers should start [covering] the Fed in plain English,” he said. “The focus is on the way it impacts everyday people and our economy, as opposed to the idea of ‘how can I make a buck off this news?’”

Financial news delivered in plain English would shock the public, Leonard insisted.

People would learn higher interest rates reduce access to credit, constrain consumer spending and discourage investment in busi nesses. Rate hikes drive up the interest on mortgages and drive down house prices. The Fed’s tightening can threaten the labor market, potentially costing individuals their current jobs or depriving them of new opportunities.

Yet, just 8% of respondents correctly recog nized that the Fed’s mandate includes “maxi mizing employment,” according to the Axios/ Ipsos poll.

Most Americans aren’t aware of the Fed’s role in the fight against inflation, either. While Congress passed the Inflation Reduc tion Act this year, monetary policy based on higher interest rates will do much more to lower prices. The poll showed only 34% knew the Fed’s role includes managing inflation or stabilizing prices.

Then, there’s the Fed’s influence in the hous ing market.

Sixty-four percent of Americans own real estate, according to the research firm The Zebra. That means roughly 35% of Americans do not own their own houses.

Millennials, defined as those born between 1981 and 1996, are reaching the age when past generations were buying homes. But insuffi cient income and high house prices are forcing many of them to keep renting.

Maybe the policies of the Federal Reserve are also contributing to the generation’s finan cial malaise.

“Nearly a third incorrectly indicated that the Federal Reserve controls mortgage rates, while a plurality (45%) say they don’t know,” the Axios/Ipsos poll indicated.

The Fed’s decisions affect the labor market, house prices and access to credit. So, why aren’t more Americans paying attention?

While the Fed doesn’t control mortgage rates, it directly influ ences the housing market through its Fed funds rate and its owner ship of Treasury bonds and mort gage-backed securities. Buying bonds helps the Fed constrain yields on these assets and provides liquidity to the financial markets.

Mortgage-backed securities comprise a bundle of home loans typically originated by compa nies like Fannie Mae, Freddie Mac, or Ginnie Mae. The real estate backs the loans. The buyer of these assets receives a payment each time homeowners pay their mortgage and interest.

In 2022, the Fed owned about 33% of all mortgage-backed securities (MBS)—a portfo lio valued at $2.71 trillion. Studying the data leads one to the conclusion that it’s difficult to argue there isn’t a direct relationship between the Fed holdings of MBS and housing prices in the last 14 years.

In 2020, The New York Times reporter Jeanna Smaller penned an article with this headline: Home Prices Are Roaring. Is That the Fed’s Problem? She noted that experts worried that “the central bank’s big bond purchases could be helping to inflate … the housing boom.”

Housing prices, measured by the Case-Schil ler Index, surged by 30% between March 2020 and December 2021. That was the largest jump since the run-up to the 2008 financial crisis.

In August 2022, housing prices added another 8.8% year-to-date, according to Fitch Ratings.

While demand indeed outstripped supply in the post-COVID era, the Fed’s commit ment to lower interest rates and large balance sheets helped fuel a run on available units. Meanwhile, the Fed also engaged in one of the more questionable decisions of this infla tionary cycle.

In 2021, while the central bank warned that inflation was “transitory,” it still aggres sively purchased billions in mortgage-backed securities. That helped keep interest rates low and offered cheap liquidity to the market. But by failing to raise the Fed funds rate earlier and suppressing market rates through bond purchases, the era of easy money helped

THE FEDERAL RESERVE uses its monopoly on the underlying cost of capital in the United States to distort financial markets and promote economic inequality. To understand how that’s happening, consider Has bro’s popular Monopoly board game.

In 1903, Elizabeth J. Magie Phil lips, a feminist who hated the mo nopolies of the gilded age, created The Landlord’s Game—the precur sor to Monopoly. That was a decade before the founding of the Fed.

In the version of Monopoly that became popular during the Great Depression, players start the game with $1,500 and earn $200 every time they pass “Go.” Along the way, they can purchase properties, collect rent, build houses and hotels, and pay taxes and fines to the bank.

The game ends when other players go bankrupt. Monopoly is essentially a game of “liquidity.”

One of the primary complaints about Monopoly is that it takes too long to complete a game. It should take an hour but usually lasts much longer. That’s because players often engage in “house rules” that inject too much cash back into the game.

A popular house rule allows

players to pay taxes and fines to the center of the board instead of back to the bank (as the rules dictate). Then, players who land on the “Free Park ing” square can collect the money.

That’s the problem. The written rules of Monopoly don’t say anyone should collect money when they land on Free Parking. The landing space offers no gains or losses. It’s a free place to park your piece.

But the popular house rule allows players to collect hundreds or thou sands of dollars, granting them more capital to purchase properties or avoid bankruptcy. The distortion of Monopoly’s integrity with these cap ital injections lengthens the game.

A 2014 survey by Hasbro, the maker of the game, found 68% of respondents openly admit to having never read the rules in their entirety. In addition, 49% have made up their own rules. But these numbers still reflect a populace more knowledge able about Monopoly than about the inner workings of the Federal Reserve.

The Federal Reserve’s continued quantitative easing over the last 13 years has distorted business cycles, fueled asset bubbles and prevent

ed certain Americans from owning homes and other assets.

A popular meme on U.S. econom ic inequality—driven by Fed policy— relates to the popular board game: “Imagine playing Monopoly and never buying anything that could produce more money—just collecting $200 for passing go,” it reads. “This is how most people live their lives.”

Meanwhile, the game’s central bank can never run out of money.

The bank of Monopoly starts with $20,580 and can always create more money.

The rules state: “The Bank never ‘goes broke.’ If the Bank runs out of money, the Banker may issue as much as may be needed by writing on any ordinary paper.”

In simple terms, the players don’t follow the rules—and end up length ening the game’s boom and bust nature to their own detriment.

Instead, they add new liquidity… and keep the game going.

Likewise, the Federal Reserve’s commitment to such easing has extended business cycles and kept the wealth inequality game humming since 2009. Now, we’ll find out what happens when interest rates rise, unemployment increases and some one decides to flip over the board.

drive home prices up significantly.

While the Fed says it plans to reduce its balance sheet over the next 18 months, it has largely missed its targets so far.

Who benefits from the Fed’s policies of cheap money and housing inequality? Leonard devoted an entire chapter of his book to the subject.

“First of all, it’s these little entities you’ve never heard of: Blackstone and Goldman Sachs and Wells Fargo and JPMorgan,” Leonard wrote jokingly. “Then there’s Larry Fink’s BlackRock, who was on the phone with Jerome Powell like eight times a day during the crisis. Carlyle Group and other private equity firms benefit from these policies, time and time again.”

People find news about the Fed boring. It doesn’t seem applicable to their lives.

In the book, Leonard offered an example of the Fed’s accommodations during the Repo Meltdown in September 2019 and described how the Fed bails out institutional traders.

“The Fed was doing everything to normal ize the market, another symptom of just how distorted they’ve made everything,” he wrote. At the time, those hedge funds bet big on the Treasury market with forward contracts. “Those folks were about to lose their shirts. But they didn’t. The Fed stepped in to calm the repo market, and pumped cash into the banking system.”

Some would argue the Fed has helped some Americans by keeping rates low and enabling people to make money in the hous ing market in the last few years. But anyone who bought a house in the last 12 months may face falling home valuations if the econ omy rolls over soon.

And non-homeowners? They receive no reprieve from the Fed’s monetary policies.

Instead, many non-homeowners may pay higher rents. With less supply on the market (artificially created by a run on the assets and now more competition from investment management firms like BlackRock), rent may only climb higher—as it has in 2022.

How much do Americans understand the role of the Federal Reserve Bank?

A lot: 7%

A little: 38%

Not very much: 33%

Not at all: 21%

When you play Monopoly, what does a player receive for landing on Free Parking?

46% The money in the middle of the board

44% Nothing 10% $100

LUCKBOX READERS SURVEYof Americans believe the Fed is doing a good job, compared with 38% in 2021.

The Fed’s reviews are largely influenced by party affiliations: 39% of Democrats believe the Fed is doing a good job versus just 17% of Republicans and 27% of Independents.

AXIOS/IPSOS POLL, APRIL 2022

Perhaps the less the citizenry knows, the more the investment firms benefit, according to Leonard. He’s convinced that the only hope for most people is that the media will openly discuss the impact of the Fed’s policies and shine a light on practices that could improve the situation.

Companies like BlackRock and Blackstone don’t just win—they’re also shielded from fail ure, he maintained.

“Not only did the Fed save them from a really bad bet,” Leonard said, “but when the

Fed did that, they piled in even further so then the price tag of saving them will be even higher next time.”

For Leonard, here’s the bottom line: “What the central bank is doing absolutely benefits the richest of the rich and the most sophisti cated financial players.”

Garrett Baldwin, a commodity and trade economist, serves as Luckbox editor-at-large. He actively trades value and momentum stocks and wagers on sports and prediction markets.

Investigative reporter Christopher Leonard wrote The Meat Racket and Kochland before turning his attention to the Federal Reserve System in his 2022 book, The Lords of Easy Money: How the Federal Reserve Broke the American Econ omy. Financial journalist Matthew Taibbi described the new book as “a gift to media audiences that rarely get a clear look at a confounding topic.” Leonard uses simple language and a quick pace to explain complex subjects like quantitative easing and what the Fed’s actions have meant for the U.S. economy over the last few decades. To read the full interview, visit luckboxmagazine.com.

Luckbox: Why do you want Americans to read your book?

Christopher Leonard: So they understand the mechanics of how the Fed interacts with our economy. I explain the machinery and the plumbing of how the Fed creates money and how it executes monetary policy. It’s so important to understand quantitative easing, money being created inside these reserve accounts on Wall Street. I feel that reporting gave me a clearer understanding of how the system works.

Second, I hope people understand the decision-making process inside the Fed. Remember, these are people—the FOMC [Federal Open Market Committee] has 12 voting members. These are human beings like everybody else. One of the biggest myths of the Alan Green span era is that the people who run this institution are super geniuses and know everything. They don’t. I appreciated the chance to read through their internal debates and interview people to capture the human element of that decision-making.

[Also,] I wanted to write about quantitative easing so your aver age tired business traveler could understand the size and scale. I became much more negative toward the Fed’s policy during the investigation.

What is the underlying problem with the financial media’s coverage of the Fed?

If someone takes a job as an average city hall reporter in a metro news paper, they understand their job is to be fair but to be the watchdog and to be critical. When you come to the Fed, the watchdog role is totally neglected.

The Wall Street Journal’s Dion Rabouin is one of the brightest guys in the financial press. He covered the Fed for Axios. And he made the mistake of asking tough questions. They would stop taking questions from him during the press conference. They put people last in line. They shut off access. It leads to a press pool that can be trained.

Why do you think the market doesn’t believe Loretta Mester of the Cleveland Federal Reserve when she says the central bank will raise the fed funds rate to 4% to confront inflation?

Because the market has observed this time and time again. When asset prices start to fall, the Fed reverses course. There has been a pattern that started with Greenspan, which we refer to as the “Fed put.” When

One of the biggest myths of the Alan Greenspan era is that the people who run [the Fed] are super geniuses and know everything. They don’t.

asset prices start to fall, the Fed will step in and bail them out. [Federal Reserve Chair Jerome “Jay” Powell], in my mind, is most famous for the Powell pivot of 2019. When he said tightening and interest rate hikes were on automatic pilot, the markets fell over the holidays in 2018. And he said, ‘Sorry, just kidding. I don’t mean it. I didn’t mean it was on autopilot.’ And he stopped. So the market has bet against the Fed being serious about tightening.

Why is this time different? I think the problem is that we haven’t fully factored in how much infla tion is embedded. It’s deep. It’s widespread. Inflation expectations are way higher than people would want them to be. This is a serious thing that really might force Jay Powell to follow in the footsteps of Paul Volcker in a real way.

THE BASIC MECHANICS and goals of quantitative easing are actually pretty simple. It was a plan to inject trillions of newly created dollars into the banking system, at a moment when the banks had almost no in centive to save the money. The Fed would do this by using one of the most powerful tools it already had at its disposal: a very large group of financial traders in New York who were already buying and selling assets from the select group of twenty-four financial firms that were known as “primary dealers.” The primary dealers have special bank vaults at the Fed, called reserve accounts. To execute quanti tative easing, a trader at the New York Fed would call up one of the primary dealers, like JPMorgan Chase, and of fer to buy $8 billion worth of Treasury bonds from the bank. JPMorgan would sell the Treasury bonds to the Fed trader. Then the Fed trader would hit a few keys and tell the Morgan banker

to look inside their reserve account. Voila, the Fed had instantly created $8 billion out of thin air, in the reserve ac count, to complete the purchase. Mor gan could, in turn, use this money to buy assets in the wider marketplace. This is how the Fed creates money—it buys things from the primary dealers, and it does so by simply creating mon ey inside their reserve accounts.

[Ben S. Bernanke, former chair of the Federal Reserve] planned to do such transactions over and over again until the Fed had purchased $600 billion worth of assets. In other words, the Fed would buy things using mon ey it created until it had filled the Wall Street reserve accounts with 600 billion new dollars. Bernanke wanted to do this over a period of months. Before the crisis, it would have taken about 60 years to add that many dollars to the monetary base.

There was one more thing about quantitative easing that made it so powerful. Bernanke was planning to buy long-term government debt, like 10-year Treasury bonds. This was a bigger deal than it sounds. The Fed had always bought short-term debt because its job was to control shortterm interest rates. But the central bank was now targeting long-term debt for a strategic reason: Long-term debt was Wall Street’s equivalent of a savings account. It was the safe place where investors tied up their money to earn a dependable return. With quan titative easing, the Fed would take that savings account away. It would

reduce the supply of 10-year Treasury bills that were available. All the money that the Fed was creating would now be under a great deal of pressure because it could no longer find a safe home in a 10-year Treasury. All the new cash would be pushed out on the yield curve, out there into the risky in vestments. The theory was that banks would now be forced to lend money, whether they wanted to or not. Quan titative easing would flood the system with money at the very same moment that it limited the refuge where that money might be safely stored. If eco nomic growth was weak and fragile during 2010, then quantitative easing would shower the landscape with more money and cheaper loans and easy credit, enticing banks to fund new businesses that they might not have funded before.

From The Lords of Easy Money by Christopher Leonard. Copyright © 2022 by Christopher Leonard. Excerpted with permission by Simon & Schuster, a Division of Simon & Schuster Inc.

“My current view is that it will be necessary to move the fed funds rate up to somewhat above 4% by early next year and hold it there … I do not anticipate the Fed cutting the Fed funds rate target next year.”

LORETTA MESTER,POLITICOS AND POLLSTERS ARE SPLIT ON A LOT OF ISSUES, BUT THEY’RE PREDICTING SOME SURPRISING RESULTS IN THE UPCOMING BALLOTING.

BY ELIZABETH OWENS-SCHIELEWhat issues are motivating Americans to vote in the midterms?

JUDY: What we’re seeing in the polling, and this is something that hasn’t changed, is the economy and inflation are the abso lute biggest issues for voters. The Dobb’s deci sion has energized Democrats. [In Dobbs v. Jackson Women’s Health Organization, the U.S. Supreme Court overturned Roe v. Wade and revoked the constitutional right to abor tion]. While the environment is still favorable toward Republicans, it’s gotten slightly less favorable over the last few months. Repub licans are the proverbial dog who caught the car on Roe v. Wade—they have had 50 years trying to overturn this, and now that it’s overturned it feels like they haven’t thought very much about where to go next. They’re being defined by a position that very few actual Republican voters—and not that many Republican elected officials hold—which is an abortion policy that allows no abortions in any circumstance ever. The Democrats have worked very hard to define them that way. They haven’t done a great job of laying out a more moderately pro-life policy. But the economy and abortion are the top issues right now. When you pit them against each other, the economy is still most important for most people. But the abortion issue has sort of energized Democratic turnout and enthusiasm.

THE PANEL Rachel Bitecofer Robert Cahaly Nick Gillespie Dan Judy Scott KeeterVICE PRESIDENT OF NORTH STAR OPINION RESEARCH IN ALEXANDRIA, VIRGINIA. HE HAS BEEN A POLLSTER FOR 21 YEARS, AND HIS FIRM WORKS ON THE REPUBLICAN SIDE OF THE AISLE BUT ALSO CONDUCTS NONPARTI SAN, ISSUE-BASED PUBLIC AFFAIRS POLLING. JUDY HAS WORKED ON SEVERAL WINNING U.S. SENATORIAL CAMPAIGNS.

of the other party as people like to think about it. It’s a fear and threat response to the other party. The in-party makes the out-party’s voters feel threat ened, because they control the levers of power, and they use them to do things. That’s why the midterm effect has always benefited the out-party. This time, though, because of Roe and these trigger laws, there’s this massive threat reaction in the other part of the coali tion. What we’re now looking at are two different waves that will run into each other. It’s going to make predicting this outcome very difficult

BITECOFER: The main issue that will define this cycle is the evisceration of Roe. It changed the fundamentals of the cycle in which the midterm helped the Republican Party as the out-party. It’s a long-standing, empirically robust pattern in American poli tics. It would have been a pattern that we probably would have seen play out to some degree had it not been for the Roe eviscera tion that’s upset everything. It has inflamed negative partisanship, which is not just hate

CAHALY: Inflation, crime, the border, and the general frustration with how the federal government handles things are the driving main issues that are affecting people. Others will be abortion related to some of the state’s reactions to Dobb’s decision. One [issue] I see with the same intensity is student loan forgiveness, which I see creating great inten sity on the other side.

GILLESPIE: I don’t think you can get away from the basic, economic direction of the country. I think everything is an epiphe nomenon of that. There’s no question that things like foreign policy and what we saw

Dan Judy@danjudy

Nevada is a pretty swingy state, so that’s probably the Republicans’ best opportunity for a pickup.

—Dan Judy

in the early 2000s in the wake of 911, then the subsequent launching of the War on Terror, really have an impact. I think even questions like abortion are not as important as unemployment, inflation and whether the country is going in a good or a bad direction. Typically, polls before the Dobbs decision, showed that maybe 20% of people really put abortion rights as one of the absolute top issues they would vote on, and they were split evenly between pro- and anti-abortion forces. I don’t know that it will be a particu larly strong issue for people. Younger people are split and vexed on the issue, and they don’t show up in large numbers. Because this is a midterm election, there is not a galvaniz ing candidate like a Barack Obama or in a negative way, a Donald Trump, to really get the youth vote out.

Should pollsters correct their process if they haven’t already done so?

KEETER: We did think after 2016 that we might have found a smoking gun, which was that some pollsters were not adequately accounting for the educational composition of their samples. One of the changes in American politics in the past 10 to 20 years has been that less-educated white, non-Hispanic Americans have become more conservative and more supportive of Republicans. If your samples underrepresent less-educated people, which almost all survey samples will in their raw form, then you have to address that statistically through the process of weighing the data. But it is a very difficult problem if a particular type of person, by their attitudes, is less willing to be interviewed. Because there’s almost no way to adjust for that in a direct fashion other than just putting your thumb on the scale, which maybe pollsters are tempted to do.

CAHALY: Republicans are about five times as hard to get to participate in polls as were Democrats—so you have to go the extra mile. Most [polling] groups don’t acknowledge a simple fact—people are hesitant to take polls, and people lie. If you can’t acknowledge that, then you can’t really get to the truth.

What races are you following in the midterm elections? Why?

JUDY: On the Senate side, the Republicans can’t afford to lose any seats they currently

POLITICAL COMMENTATOR AND COAUTHOR OF THE DECLARATION OF INDEPENDENTS: HOW LIBERTARIAN POLITICS CAN FIX WHAT’S WRONG WITH AMERICA. HE IS AN EDITOR AT LARGE FOR REASON, WHERE HE HOSTS THE WEEKLY REASON INTER VIEW PODCAST.

@nickgillespiehold. That’s one of the reasons they’re in a little bit of a bind because some of the seats they currently hold are leaning Democratic, or many are tossups. You have to look at Pennsyl vania, Ohio, North Carolina—the Republicans can’t afford to lose any of those. The Senate races generate more interest, partially because there are fewer races so it’s easier to focus. The candidates, especially on the Republican side, are kind of unorthodox and that makes them a little more interesting to follow. The Repub lican takeover of the House—I don’t want to say it’s a foregone conclusion, but it would be a major upset even now for the Repub licans not to take the House. In the Senate, the control is very much in the air, it could go either way, so I think that’s one of the reasons why the Senate races tend to get a little more attention. Nevada is one of the better oppor tunities—it hasn’t gotten quite as much oppor tunity or quite as much attention as Georgia and Arizona, partially because the candidate there, Adam Laxalt, is a little more orthodox and not quite out there like a Herschel Walker [Georgia] or Dr. Oz [Pennsylvania]. Nevada, it’s a pretty swingy state, so that’s probably the Republicans’ best opportunity for a pickup.

GILLESPIE: Regarding Senate races, I’m interested in the Peter Thiel candidate in

Arizona, Blake Masters, and J.D. Vance in Ohio. I’m curious to see how they fare because they’re doing less well than they should be, given those states and their party affiliation. They represent a particularly toxic version of populism. If we see either of them lose, or barely squeak by in victory, it shows that populism of a Trumpian variety is kind of a paper tiger, which I think would be a good outcome. Anti-immigration people and people who are anti-free trade might be able to win by attract ing Democratic votes in certain instances and Republican votes, but in the long haul, those are loser positions.

CAHALY: There are races that people don’t think could flip, but we think keep your eye on Patty Murray in Washington state. I think that’s one that needs to be very carefully watched—there’s a lot of frustration up there, and she’s running against a very good candi date [Republican Tiffany Smiley]. We think the Republicans are going to be victorious in Nevada in both the Senate and governor’s races, but watch the Patty Murray [Senate] seat, and possibly the Colorado Senate seat, [where Republican Joe O’Dea is challeng ing Democratic Sen. Michael Bennet]. But we see Murray a little more on the bubble. We also see Republicans in most trouble with Ron Johnson [of Wisconsin] because I think this is an anti-incumbent year and so I think for incumbents to win, they have to be particularly well-liked and particularly well attentive to the needs of their state. We think Herschel Walker [of Georgia] will win and we don’t think that’s a surprise—better than 50% that Herschel Walker wins. Same thing in Arizona—even money. We don’t think J.D. Vance has any trouble. We think North Carolina is not really hotly contested— it’s a tight margin but it’s the same kind of tight margin Republicans will continue to win by in North Carolina. We think [Republican Blake] Masters has even money chances of winning in Arizona [against Democratic Sen. Mark Kelly] and probably the same thing in New Hampshire with [Republican Don] Bolduc [facing Sen. Maggie Hassan]. They’re even— not a surprise if they win and not a surprise if they lose. Washington state would be a surprise and Colorado would be a surprise.

The biggest shifts you’re going to see are in minority groups ... that have been routinely ceded to the Democratic Party.

—Nick Gillespie

ASSISTANT DIRECTOR AT WASON CENTER FOR PUBLIC POLICY. SHE HAS LAUNCHED A LIBERAL SUPER PAC NAMED STRIKE PAC, WHICH SHE DESCRIBES AS “A WAR MACHINE FOR THE LEFT.” SHE HOSTS THE ELECTION WHISPERER PODCAST AND IS A SENIOR ADVISOR TO THE LINCOLN PROJECT.

@RACHELBITECOFER

in Virginia. Frankly, many of that crowd is engaged now, and they’ve been pouring into school board races and paying attention. It’s just a whole bunch of average moms and dads who used to be a little too busy for politics to realize that it’s more important than maybe it had been to them in the past. We’re watching to see how close that turnout mimics what we saw of Virginia, as a percentage, because it usually is not a huge percentage of a midterm turnout.

JUDY: We’re looking at college-educated voters in the suburbs, especially suburban women. Those were the voters in the 2018 midterms, and also in 2016, and 2020 presi dential elections who really sort of swung from being traditionally Republican to voting for Democrats, and that was all driven by Donald Trump. With Trump not on the ballot, the question is how many voters return to Repub licans. Ideologically and culturally, they might be a little more center-left. A few months ago, those voters would be swinging back pretty strongly toward Republicans. In the wake of Dobb’s, that’s been muted a little bit. Hispanic voters have started to take more steps toward Republican candidates over the last couple of election cycles. Republicans still have a long way to go among many Hispanic voters. Still, they seem to be gaining in strength there, especially with many big races in Texas and in Florida, where you have a big concen tration, and on the Senate side in Nevada and Arizona. If the Republicans could improve their standing among the Hispanic blocks in those states, it would give them a much bigger chance to swing those Senate seats.

CAHALY: We’re watching parents with school-aged children because some of them seem to be the most frustrated after what they have witnessed, whether it was mask mandates or vaccine mandates or some of the things they think their children were taught outside of their belief system. They got very, very engaged

GILLESPIE: It’s particularly tough to know because I think turnout will be lower than people expect. We’ve had a couple of recent midterm elections that have drawn pretty big crowds. I suspect that’s not going to be as big as we’ve seen in recent midterms. I think in 2024, the biggest shifts you’re going to see are in minority groups, particularly Blacks and Latinos that have been routinely just kind of ceded to the Democratic Party. We’ve seen this over the past few national elections where that is starting to break down in a way that maybe 50 or 60 years ago, the Catholic vote started breaking down or the union vote started breaking down. I think that is arguably the most important shift that is coming. But in these midterms, what we’re going to see is a reversion to older people and wealthier people coming out in large numbers to vote, I don’t think the youth vote is going to be particularly strong or particularly impactful.

JUDY: Polling is not predictive. It’s a snap shot in time. If you’re polling a race that shows a candidate up by 7 or 8 points, that’s good for that candidate but it does not precede a 7or 8-point win in November. It’s a snapshot of how the electorate feels at a certain time. One of my friends, a good Democratic pollster Mark Mellman, says that we’re not very good at predicting the future; we’re pretty good at predicting the present and good at predicting the past. I always warn people—the close races are harder to poll. Mathematically, the margin of error in a race that’s 48-48 is higher than in a race that’s 55-40. The closer the race gets, the harder it is to get right. That’s not necessarily a misconception, but it’s more of a warning to folks—as they look at polling, take it with a grain of salt because it’s a snapshot in time.

KEETER: People place way too much faith in polling—they assign to it much greater speci ficity in its accuracy than it really can sustain, given the fact that it’s based upon a meth odology that depends on random sampling.

CAHALY: The misperception is that poll sters know what they’re doing. When average people look at polls and give them any credi bility, without knowing a little bit about which poll and who did the poll, that’s a mistake.

SENIOR STRATEGIST AND POLLSTER FOR THE ATLANTA-BASED TRAFALGAR GROUP. HE OVERSEES A GROUP OF ALLIED COM PANIES WORKING WITH FEDERAL, STATE AND LOCAL CANDIDATES AND WITH BUSI NESS AND INDUSTRY GROUPS. CAHALY IS AN EXPERT IN STRATEGY, POLLING AND DATA ANALYTICS.

@ROBERTCAHALY

Polling is an industry that has not adjusted to where modern people live because they’re still using a lot of old techniques and old methods and, frankly, a lot of old science to do it. That’s why the results are prob lematic. There is a significant amount of the vote that is going to be very hard to poll. It was one thing when they broke out dirty Walmart shoppers in 2016. In 2020, people were getting canceled, and people were getting called God-knows-whatkind-of-names just for express ing conservative opinions that are out of mainstream media acceptance. So, they chose not to participate in polls. Voters who didn’t want to participate in 2020, [were turned] into submerged voters in 2022. They’re not talking to anybody and not putting signs in the yard. They’re not putting stickers on the car, not posting on social media, and not answering polls—because they don’t want to be labeled.

What voting blocks are you watching and what shifts are you anticipating?

The main issue that will define this cycle is the evisceration of Roe.

—Rachel Bitecofer

Republicans are about five times as hard to get to participate in polls as were Democrats.

—Robert Cahaly

Is the country going in the right direction, or has it gotten off on the wrong track?

Right Direction: 13% 28%

Wrong Track: 87% 72%

LUCKBOX READERS POLITICO/MORNING CONSULT SURVEY OF REGISTERED VOTERS

How enthusiastic are you about voting in the midterm elections?

Extremely: 45% 32%

LUCKBOX READERS POLITICO/MORNING CONSULT SURVEY OF REGISTERED VOTERS

What is the top set of issues on your mind when you cast your vote for federal offices?

Economic Issues: 53% 43%

Security Issues: 14% 10% Women’s Issues: 9% 12%

LUCKBOX READERS POLITICO/MORNING CONSULT SURVEY OF REGISTERED VOTERS

Luckbox readers overwhelmingly feel more confident in Republicans to manage 12 of 14 major national issues but agree Democrats may have a better handle on climate change and the environment.

71%

The probability the Democrats will win the Senate, according to FiveThirtyEight’s forecasting model (as of Sept. 23).

Only 31% of Luckbox readers are confident Democrats will retain control of the U.S. Senate in the midterm elections.

SENIOR SURVEY ADVISOR AT PEW RE SEARCH CENTER. HE HAS CO-AUTHORED FOUR BOOKS, INCLUDING WHAT AMERI CANS KNOW ABOUT POLITICS AND WHY IT MATTERS. IN 2016, KEETER WON THE AMERICAN ASSOCIATION FOR PUBLIC OPINION RESEARCH’S HIGHEST HONOR FOR “OUTSTANDING CONTRIBUTIONS TO THE FIELD OF PUBLIC OPINION RE SEARCH.”

@POLLCAT

People place way too much faith in polling ... given that it’s based upon a methodology that depends on random sampling.

—Scott Keeter

I believe that there’s going to be a Republican turnout in most states that is higher than anyone is going to predict, including us.

GILLESPIE: President Joe Biden has been going on the attack lately to make the midterms into a national election. Weirdly, in many ways, it’s a referendum on Donald Trump, who’s been out of office and who has very low odds of becoming the Republican candidate in 2024. It’s an understandable strategy, but I don’t think it’s going to work and it’s not going to overpower Biden’s performance so far. He has delivered many of his campaigns promises to spend a boatload of money, but that is not particularly popular. He’s below 50% in terms of approval ratings and, historically, when a first-term president goes into the midterms, and when his party goes into the midterms, they’re losing three dozen seats or more. There’s every reason to believe the Democrats will get wiped out in the House. They may hold onto the Senate. Even Mitch McConnell has commented on the low quality of Republican Senate candidates. It’s just the Republican Party’s penchant, both in presidential races as well as elsewhere, for running candidates who have no political experience, or even any experience in administrative positions. It’s kind of staggering. I think that will come back to bite them in the ass.

JUDY: If you cannot turn out your base in the midterms, you have no chance. This cycle with the Senate races, there will be a chunk of swing voters. If you look at what college-educated suburban, ex-ur ban white voters have done over the last three, or four election cycles, those voters still matter, and there are a lot of them that are still in play. Then again, the Hispanic community is going to be in play in a lot of races, so you can’t just count on turning your base out.

By the time Luis Aguilar was 7 years old, he was already serving as a translator to help his immigrant parents and grandparents vote in elections in California’s Central Valley.

“With my grandma, we’d walk to the poll ing place, which was miles away,” Aguilar recalled. “I’d have to tell her, ‘This is who we’re voting for. This is what you have to do.’”

That experience helped prepare him for his current role as a team leader at HeadCount, a nonprofit organization that registers young voters at concerts and music festivals.

It also gave him a keen sense of the impor tance of casting a ballot.

“I’ve seen that growing up in a space that is so dependent on agriculture and migrant farmers that there was a need for representa tion in our leaders,” he said.

But many young people don’t share Agui lar’s faith in the importance of politics. Polls reveal the No. 1 reason they don’t participate in elections is they feel their vote doesn’t matter.

Still, turnout is increasing among voters ages 18-29. Fifty percent of the age group voted in the 2020 presidential election, an 11-point increase from 39% in 2016, according to The Center for Information & Research on Civic Learning and Engagement (CIRCLE). The election of 2020 had “one of the highest rates of youth electoral participa tion since the voting age was lowered to 18,” CIRCLE officials said.

Youth voting in 2022 is on track to match or exceed 2020, with 37% reporting they will

HeadCount meets youth where they are—music festivals, concerts and other events—to make them comfortable with registering to vote.

“definitely” vote in the midterm elections, according to an April 2022 poll by the Insti tute of Politics at Harvard Kennedy School.

Young adults appear likely to vote in the midterms because they’re motivated by high-profile Supreme Court rulings, mass shootings and congressional hearings, NBC reported in June.

Young voters have had the lowest turnout of all age groups in past U.S. elections and shouldn’t be viewed as a monolithic group, said CIRCLE’s Communications Team Leader Alberto Medina.

Half of young people don’t have a college degree, for example, so “what’s going to work to engage one young person and help them

grow into a voter might be vastly different than what another young person needs— based on the community they come from, or their interests and experiences,” Medina said.

Young people are spread fairly evenly along the political spectrum, too. In a 2018 poll, CIRCLE found 56.4% chose to affiliate with a political party—33.1% are indepen dents, 35.5% are Democrats and 20.9% are Republicans.

Politicians would pay more attention to the concerns of young people if more of them came to vote, said Tappan Vickery, HeadCount senior director of programming and strategy. Typically, youth voter turnout drops off by about 50% in midterm elec tions, compared with presidential elections, she said.

Aguilar noted that 8 million 18-19 year olds are now eligible to register to vote for the first time, but many feel disconnected from politics. They’re impatient with slow-moving changes in policy because they’ve grown up seeing things happen in real time in the digital world.

“Young voters want to see change,” Vickery said. “There are people who are not happy with the process because they don’t feel like change is happening enough. But they’ve been turn ing out, and hopefully they’ll turn out again because change is slow.”

Young people tend to vote for change, and a desire to close the political generation gap tops their list of issues.

President Biden is 79 years old. Nancy Pelosi, speaker of the U.S. House of Repre sentatives, is 82 years old. Mitch McConnell, minority leader of the U.S. Senate, is 80 years old. And the list goes on.

The country’s political leadership represents a generation that will not have to live with the long-term effects of their decisions. But they’re shaping the lives of today’s young people.

That’s why investing in young people is the only way democracy will survive, said Maxim Thorne, CEO of the nonpartisan, nonprofit Civic Influencers, a group that works to engage young people in politics.

“From the birth of this nation to current times, young people have led the charge in activism and a belief in democracy,” Thorne said.

Organizations like Civic Influencers and HeadCount meet youth where they are— at colleges and universities, trade schools and even events such as concerts and music festivals.

“It’s a really powerful moment to think about the size of a room or space at a [music event] and the number of people you can connect with and talk to,” Vickery said. “Peerto-peer voter registration is one of the most effective things you can do.”

Young people engage with politics differ ently than other age groups, Vickery noted. Social media is a great tool, but it’s impersonal. Meeting them in spaces where they already are makes them feel more comfortable to ask questions and interact.

Thorne agreed. “It’s wonderful when the speaker, the president or the major ity leader speak, but young people don’t necessarily listen to these people,” he said.

1. Abortion

2. Mental health

3. Education

—RANKING COURTESY OF CBS/YOUGOV AND INSTITUTE OF POLITICS AT HARVARD KENNEDY SCHOOL SURVEYS

Of people who register with HeadCount and vote for the first time will continue voting. —HEADCOUNT

What is the ideal age for a President?

55-64 / 52%

Age does not matter / 20% 45-54 / 14% 65-74 / 11%

NO survey respondents selected ages 75-84

LUCKBOX READERS SURVEY

% of registered voters who say they have given a lot of thought to the midterm elections...

Ages 18-29 / 20%

Ages 65+ / 50%

LUCKBOX READERS SURVEY

Senate Races Where the Youth Vote Matters in the Midterms

#1 Georgia

Arizona

Pennsylvania

Wisconsin

—CIRCLE’S 2022 YOUTH ELECTORAL SIGNIFICANCE INDEX MEASURES YOUNG PEOPLE’S LIKELY ELECTORAL IMPACT BY IDENTIFYING RACES WHERE YOUTH HAVE AN ESPECIALLY HIGH LIKELIHOOD TO PLAY A DECISIVE ROLE IN 2022—ESPECIALLY IF THEY ARE ENCOURAGED AND SUPPORTED TO VOTE.

RANKINGS AS OF AUGUST 2022

The youth vote could prove decisive in the midterms, research by CIRCLE indicates. The center uses a Youth Electoral Significance Index (YESI) to quantify young people’s likely impact.

“These are database rankings of the races where we believe young people could have a decisive impact on the result, and actually swing the election in many cases,” Medina said.

CIRCLE takes into account election laws, age demographics of a state or district and recent history of youth voter participation.

According to CIRCLE’s findings, the top five Senate races with youth electoral significance are in Georgia, Arizona, Nevada, Pennsylva nia and Wisconsin. They can influence guber

natorial races in Wisconsin, Arizona, Kansas, Michigan and Georgia. They could hold the key to House races in districts that include Washington’s 8th, Kansas’s 3rd, Virginia’s 2nd, Colorado’s 8th and Michigan’s 3rd.

“Young people have power—they can decide elections,” Medina said. “Research consis tently shows that young people are incredi bly passionate about social issues. They care about what’s happening in their communi ties. They care about what’s happening to their peers.”

In 2020, for example, 12 congressional seats were flipped by 1%, which Thorne credits to campus involvement. The House race in Iowa’s 2nd Congressional District was won by just six votes.

Candidates across the country are winning races by fewer votes with each election cycle. But to have a voice in who wins those increas ingly close elections, young voters—and voters in general—should understand the election laws in their states, Vickery said.

“Election laws changed in 2020 because of the pandemic, and 36 states have changed their laws again since 2020,” she noted. “So, I would not make the assumption that voting is exactly the same as it was the last time you turned out. Take the time to make a plan to vote and make sure you understand the process so that you don’t get hung up.”

Youth voting in 2022 is on track to match or exceed 2020.

Ranked choice voting may seem mysterious to most Americans, but this relatively rare way of casting ballots has colored the results of recent elections from New York to Alaska and from Maine to California. Now, it’s poised for its biggest test yet in this month’s midterms.

Proponents declare the current interest in ranked choice voting—or RCV—is just the beginning of a major overhaul of the nation’s elections. Political scientists interviewed by Luckbox agree RCV is having a moment in the spotlight but could slide back into obscurity.

Simply stated, RCV enables voters to rank their preferences on a ballot with more than two candidates. Instead of choosing just one nominee, they indicate their first choice, second choice, third, fourth and so on.

It’s a panacea that could cure many of the political ills of a divided nation, according to FairVote, a Washington-based group that’s been working to spread RCV for 30 years.

“There’s a whole host of exit surveys show ing that voters who have used ranked choice like it, and they understand it and they want to keep using it,” said Deb Otis, the organiza tion’s research director.

Academics seem open to RCV but less enthused.

“On one hand, ranked choice voting is far more prevalent in the United States than it’s ever been today,” noted Mark P. Jones, a professor of political science at Rice Univer sity and author of Voting and Political Repre sentation in America: Issues and Trends. “That said, it’s only used in a small fraction

of U.S. elections.”

“It’s had moments before and gone away, so I would be skeptical about whether it could be different this time,” said Robert G. Boatright, a political science professor at Clark Univer sity and author of Getting Primaried . “I think one problem ranked choice voting has is we’ve had this whole national argument about whether it’s easy for people to under stand it or not.”

On an RCV ballot with more than two candi dates, voters rank their choices. Let’s suppose,

for example, that three nominees are running for an office. Citizens could rank their first, second and third choices.

Office seekers who receive more than 50% of the first-choice votes win. The election’s over.

But if no one earns a majority in the first round, then the third-place candidate is elim inated, and their second-place votes become first-place votes for the other two candidates.

Confused yet? Applying some numbers to the example should help explain the process.

We can use the vote totals from Alaska’s recent special election to fill the seat in the U.S. House of Representatives that became vacant

A sign with a diagram of a marked ballot helped voters understand ranked choice voting in the recent New York mayoral race. PHOTO: REUTERSwith the death of Republican Rep. Don Young.

According to The Washington Post , the count of first-choice votes went 42% for Democrat Mary Peltola, 31.2% for Republi can Sarah Palin, and 28.5% for Republican Nick Begich III.

No one won a majority, so the count went to a second round. Begich was eliminated and his second-choice votes became first-choice votes. That gave Peltola 51.5% to Palin’s 48.5%.

An analysis of Peltola’s victory illustrates some of the purported advantages and possible

Voters

according to Otis.

RCV also discourages negative campaign ing, proponents say, instead rewarding candi dates who form coalitions with rivals. In an example from the recent New York mayoral race, candidates Andrew Yang and Elizabeth Holtzman advised voters to pick the other candidate as a second choice, Jones noted. He also said Palin seemed unusually friendly with Peltola in Alaska.

RCV prevents true extremists with strong minority support from winning, according to Jones. Such candidates might prevail in a system where a plurality wins—say 30%—but reallocating votes under RCV to arrive at a majority helps boost moderate candidates. “You’re reducing the ability of part of the base to influence the outcome of the election, which is one of the goals [of RCV],” he said.

The Alaska special elec tion demonstrated a reassur ing strength of RCV in that the

winner of the first round prevailed in the second count, Otis said.

But that’s not always the case. Republi can incumbent Bruce Poliquin led the first round in a Maine Congressional race in 2018, only to lose to Democratic challenger Jared Golden in the second round of the four-per son contest.

Still, that was a closely contested election in the Pine Tree State of Maine. Otis said that when a candidate leads by 10 points in the first-choice voting, an opponent has almost never come from behind to win.

Yet the resulting confusion in Maine was unsettling, Boatright noted, emphasizing that “it’s easy for Maine Republicans to spin that and say our guy was done wrong.”

As though there weren’t already enough uncertainty surrounding RCV, skeptics cite voter confusion as a drawback.

But the Alaskan special election dispelled that fear, according to Otis. She quoted a study indicating 85% of voters in the state found RCV simple and that 95% received instruc tion on how to fill out their ballots.

weaknesses of RCV. It happened in a system that began with a primary that included nearly 50 candidates from almost as many parties. The primary narrowed the field to four candidates from three parties. One of the four dropped out, pitting three candidates from two parties against each other in the general election.

Advocates maintain that RCV encourages candidates to assume more moderate positions to broaden their appeal to a wide range of voters. That worked for Peltola in Alaska, who showed a degree of openness to fisheries issues and fossil fuel exploration that’s unusual for Democrats,

Boatright agreed with that optimistic view, saying “a lot of the evidence coming out of Alaska is that voters generally knew what they were doing.”

Suppose the candidate with the most first-choice votes fails to receive a majority in the first round of a ranked choice election. That initiates a second round where the office seeker with the smallest number of votes is eliminated. The votes for the eliminated candidate are then reallocated to their supporters’ second-choice candidates to produce a majority.

Although it may not have been a factor in recent voting that Luckbox examined, RCV strengthens third parties, observ ers agree. Voters can express their approval of candidates who have little chance of winning by marking them their first choice, while still maintaining a voice in the election by showing their support for their second choice over their third.