Modest gold watches made with superior manufacturing skill, have a centuries-old tradition in Germany. After Glashutte‘s new rise, the watchmakers and their fine watches were able to attain a world-renowned reputation once again. With the Patria, we keep Glashutte’s deep-rooted horological tradition alive: the watch must be noble, beautiful, and precise.

Patria · manufacture caliber · 6600-01

TO OBTAIN FURTHER INFORMATION IN NORTH AMERICA, PLEASE CONTACT Tutima USA, Inc. • 1-888-462-1927 • info@tutimausa.com • www.tutima.com

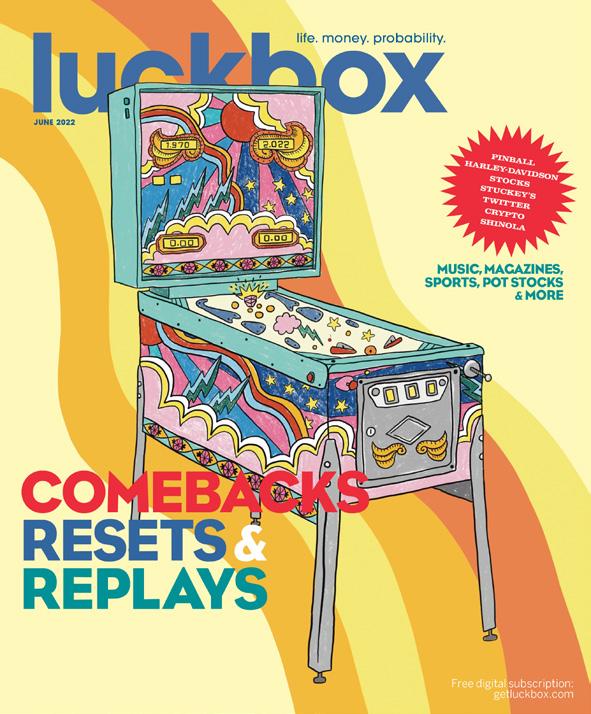

editor in chief ed mckinley managing editors

yesenia duran elizabeth schiele associate editor kendall polidori editor at large garrett baldwin technical editor james blakeway contributing editors

vonetta logan, tom preston, eddie rajcevic, mike rechenthin creative directors tim hussey, gail snable contributing photographer garrett roodbergen editorial director jeff joseph

comments, tips & story ideas feedback@luckboxmagazine.com contributor’s guidelines, press releases & editorial inquiries editor@luckboxmagazine.com advertising inquiries advertise@luckboxmagazine.com subscriptions & service support@luckboxmagazine.com

media & business inquiries associate publisher elizabeth schiele es@luckboxmagazine.com publisher jeff joseph jj@luckboxmagazine.com

Luckbox magazine, a tastytrade publication, is published at 19 N. Sangamon, Chicago, IL 60607 Editorial offices: 312.761.4218 ISSN: 2689-5692

Printed at Lane Press in Vermont luckboxmagazine.com

@luckboxmag

Luckbox magazine content is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. Trading securities and futures can involve high risk and the loss of any funds invested. luckbox magazine, a brand of tastytrade, Inc., does not provide investment or financial advice or make investment recommendations through its content, financial programming or otherwise. The information provided in luckbox magazine may not be appropriate for all individuals, and is provided without respect to any individual’s financial sophistication, financial situation, investing time horizon or risk tolerance. luckbox magazine and tastytrade are not in the business of executing securities or futures transactions, nor do they direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. luckbox magazine and tastytrade are not licensed financial advisers, registered investment advisers, or registered broker-dealers. Options, futures and futures options are not suitable for all investors. Transaction costs (commissions and other fees) are important factors and should be considered when evaluating any securities or futures transaction or trade. For simplicity, the examples and illustrations in these articles may not include transaction costs. Nothing contained in this magazine constitutes a solicitation, recommendation, endorsement, promotion or offer by tastytrade, or any of its subsidiaries, affiliates or assigns. While luckbox magazine and tastytrade believe that the information contained in luckbox magazine is reliable and make efforts to assure its accuracy, the publisher disclaims responsibility for opinions and representation of facts contained herein. Active investing is not easy, so be careful out there!

Hope you got your things together Hope you are quite prepared to die Looks like we’re in for nasty weather One eye is taken for an eye Well don’t go around tonight Well it’s bound to take your life There’s a bad moon on the rise

The Prophet Baba Vanga, an elderly Bulgarian mystic and herbalist, has been blind since childhood. But she still sees plenty of trouble ahead.

Her warnings of carnage in 2023 include an explosion at a nuclear power plant in some undisclosed location and the use of bioweap ons by a “large country” to slaughter thou sands, according to an IndiaTV report.

Perhaps inspired by the reversal of Roe v. Wade, the seer is indicating governments will restrict natural childbirth next year to promote lab-grown reproduction.

On the cosmological level, Earth’s orbit of the sun will shift in some unspecified way in the coming months, she said. Meanwhile, she anticipates massive solar storms capable of triggering a host of terrestrial problems in 2023, like knocking out electrical service and interrupting communications.

Those predictions qualify as darkly momen tous by any measure, so this Annual Issue With Forecasting of Luckbox might seem tame by comparison. But there’s a far greater probability the predictions on these pages will come to pass.

We begin with Fake Financial News

musings on the weather forecasts in the Farmers’ Almanac and The Old Farmer’s Almanac. Don’t confuse the two. Skepticism aside, our columnist finds both annual publi cations provide some pleasant reading and useful advice.

Next comes a report on using predictive analytics to forecast when and where crime will occur. It’s no longer science fiction. Actual scientific analysis indicates it makes the streets safer.

That’s followed by a noted futurist’s thoughts on the promise and perils of artifi cial intelligence, especially as it applies to law enforcement.

After that, look for a mashup of irony, sarcasm, cynicism, humor, seriousness and perhaps even alarm in the Luckbox editors’ annual predictions for the upcoming year.

Then there’s the yearly prediction challenge that pits Luckbox readers against a panel of financial pros. Yes, the two sides sometimes agree—but not always.

In the magazine’s Trends section, The Rock hound offers four prognostications for the coming year, concerning indie artists moving to major labels, TikTok’s flirtation with the

Thinking Inside the Luckbox Luckbox is dedicated to helping active investors achieve skill-derived, outlier results.

1 Probability is the key to improving outcomes in the markets and in life.

2 Greater market volatility brings greater opportunity for astute active investors.

3 Options are the best vehicle to manage risk and exploit market volatility.

4 Don’t rely on chance. Know your options because luck smiles upon the prepared.

music business, legends selling the right to their entire catalogs and the burgeoning distri bution of vinyl.

The Rockhound’s coverage continues with an account of how an app called “The Ultimate Playlist” is combining the newest in music, gaming and lotteries and then paying music fans for listening.

But it wouldn’t be Luckbox without plenty of advice on investing. This issue’s Trades & Tactics section delivers on the forecasting theme, opening with an article on Palantir Technologies, a public company specializing in predicting the future of crime, terror and other subjects.

The Trades & Tactics section continues with sound, forward-looking counseling on the fate of the U.S. dollar, projections on what’s in store for cryptocurrency, a collec tion of tasty trading strategies and lots more actionable intel.

Yet, forecasting isn’t everything, so the magazine gets into the spirit of the season by presenting a holiday gift guide. Sure, you’ll find ideas for presents—but don’t hesitate to bestow some of these treasures upon yourself. You deserve it.

After all, we’ll all need a diversion from the calamities Baba Vanga says will soon be upon us.

We asked Luckbox readers what surprises lie ahead in 2023

The use of nuclear weapons in Ukraine and China’s takeover of Taiwan.

—Christopher McKinnon, Los Angeles

Republicans eliminate the filibuster. Joseph Chizik, Irvine, CA

Circuit breakers on down days, capitulation stage of the bear market.

—Diego Krukever, Aventura, FL

A government shutdown over debt ceiling negotiations accompanied by a steep increase in Consumer Price Index numbers will cause the S&P to drop another 15%-20% before beginning a broader recovery.

—Robert Haney, Grand Rapids, MI

Readers and our panel of financial experts share more surprises for 2023, beginning on p. 24.

What Young Voters Want—I’m 73 and found this article as scary as my grandfather found what young voters wanted when I was 23. And the beat goes on ...

—Tom Molitor, Mequon, WI

The policy discussions that Luckbox has brought to the public are very interesting and enlightening for me. Thank you Luckbox!

—Md. Juwel, Dhaka, Bangladesh

Luckbox is amazing. A joyful convergence of risk, probabilities, pop culture and options trading. I love the magazine!

—Luiz Carvalho, Stamford, CT

I appreciate that your content remains objective. Politics is not an easy topic.

—Tim Radle, Cleveland

Love all of the math and data in your stories. Wonderful work, team! Thank you!

—Drew Baja, San Diego

The article on ranked choice voting was very helpful. In general, Luckbox scratches me where I itch.

—Michael McKinney, Bristol, TN

Two ways to send comments, criticism and suggestions to Luckbox

Email tips@luckboxmagazine.com

Visit luckboxmagazine.com/survey A new survey every issue.

Your thoughts on this issue? Take the reader survey at luckboxmagazine.com/survey

There’s more to Luckbox than meets the page.

Look for this QR code icon for videos, websites, extended stories and other additional digital content. QR codes work with most cell phones and tablets with cameras. Open your camera

I understand that everyone has their opinion, but there are ways to communicate events affected by political decisions objectively. I hate when the content from sources is clearly trying to stoke a fire by using inflammatory language directed toward specific political leaders or groups. I didn’t see that with Luckbox, which I liked.

—Tim Bartleman, Polk City, IA

I always enjoy coverage of the political markets utilizing predictit.org markets and the creativity of Vonetta Logan. Whether it is DeFi [decentralized finance] or ranked voting, Luckbox has a knack for explaining complicated subjects in a simplified manner. I may not always agree with the summary, but the explanation is always fair.

—Kirk Sattazahn, Womelsdorf, PA

The Washington Post

“It’s tough to make predictions, especially about the future.”

Yogi Berra

SEE

SEE PAGE 58

The number of copies of the Old Farmer’s Almanac circulated each year

—The Old Farmer’s Almanac Media Group

SEE PAGE 10

of U.S. adults who report an increase in crime where they live marks a 5% uptick from last year.

—Gallup, Oct. 28, 2022

SEE PAGE 14

Tom Sosnoff, co-CEO of tastytrade

SEE PAGE 24

Morgan Stanley’s Mike Wilson, a known stock market skeptic, Bloomberg

SEE PAGE 62

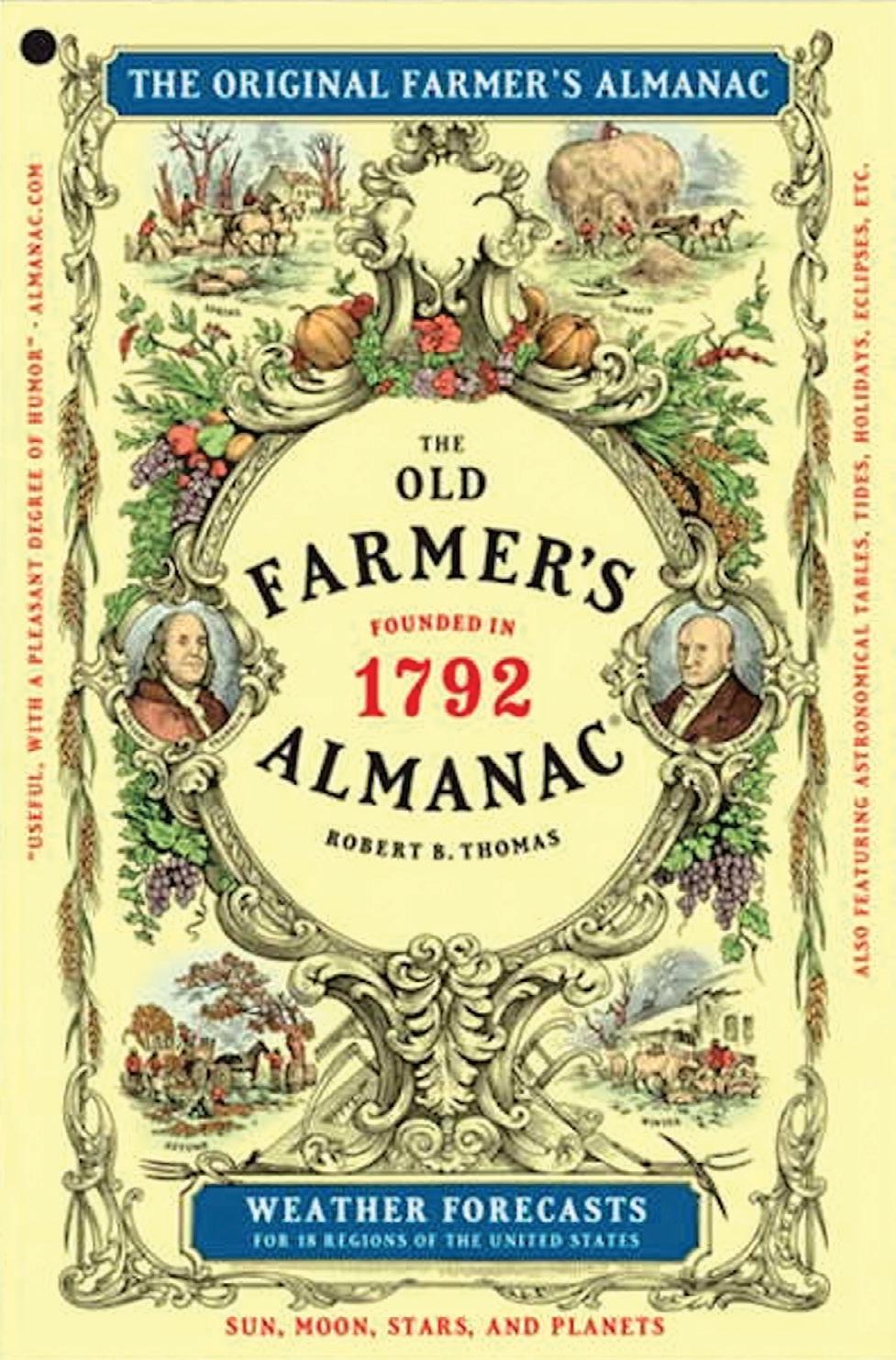

Long-range weather predictions have helped keep the Old Farmer’s Almanac in business for centuries. The editors must be doing something right.

By Vonetta LoganAs I sit down to write in my lavishly appointed solarium, it’s 79 degrees outside and my air conditioner is running like it’s trying to qualify for a marathon … a week before Halloween.

So, how in the world can a publication that rests between Us Weekly and the National Enquirer in the grocery store checkout line accurately predict complex weather patterns 16 months in advance? I’m referring, of course, to the Farmers’ Almanac.

I have the farm cred to ask that question. At 13 years old, I took to the fields as a day laborer, detasseling corn in Indiana and Michigan.

That’s why it seemed natural for me to consult the latest issue of the Farmers’ Alma nac to see if it’s still relevant in the digital age. Besides, this issue of Luckbox is all about forecasting.

I ordered my Farmers’ Almanac from Amazon for $7.99. When it arrived, I was shocked at how flimsy it’s become. The newsprint seemed as thin as tissue paper. I thought the Alma nac was rugged, robust and, well, yellow. This book’s cover was a garish mash of pumpkin orange and spring green.

In a quandary, I took to Google and learned there are actually two different farmers’ alma nacs. There’s the Old Farmer’s Almanac and then there’s the plain Farmers’ Alma nac . Seems we have a “Fleet Farm” versus “Farm and Fleet” situation. (This joke kills in Wisconsin.)

The Old Farmer’s Almanac debuted during George Washington’s first term in 1792 (**starts singing One Last Time from Hamil ton**). The “new” Farmers’ Almanac is a spring chicken comparatively, founded in 1918.

“They’re similar in that they offer yearly weather predictions—along with fun facts, stories, recipes, humor and other practical recommendations—but they differ in the way they make those predictions,” according to the Trivia Genius website.

Forecasting couch

I asked Tom Sosnoff, tastytrade’s founder and resident contrarian, how accurate he thought an almanac could be. “Best guess? Less than 50%. They’re just guessing,” he remarked as he

desecrated a bowl of Korean chicken.

Then I asked tastytrade’s resident quant, Dr. Michael Rechenthin, an actual data scien tist. “They’re probably more accurate than just 50-50,” he said, “but I’d have to take a look at their forecasting tools.”

Trivia Genius had something to say about it. The Old Farmer’s Almanac uses “a mix of solar science, prevailing weather patterns and a study of the atmosphere,” it said.

Meanwhile, the Farmers’ Almanac report edly relies on “solar science, lunar tidal action and planetary positions.”

Both claim accuracy rates of over 80% but keep the details of their forecasting methods a closely guarded secret. The former locks them up in a black box hidden in the office, and the latter uses the pseudonym Caleb Weatherbee to protect the identity of its prognosticators. As a drag queen name, it could use some work. Might I suggest Ivanna Warmfront?

According to a study at the University of Illinois, the Old Farmer’s Almanac is only 51.9% accurate with precipitation fore casts and 50.7% accurate with monthly temperature estimates. But it’s like finan cial forecasting. When you’re right, people go nuts. When you’re wrong, they just forget.

But back to the current issue. Are you ready to Shake, Shiver and Shovel? a headline asked in the current issue. Um, that’s a no from me, dog. But as I thumbed through the publication, which is about the size of Reader’s Digest, I found myself smiling.

Y’all, the almanac is funny. They got jokes. Because I’m an elderly millennial, I could easily envision every single article becom ing a life hack video on TikTok. Gen Z loves

tips your granny probably knew back in the day that the digital generation is just now discovering.

Take for example, the article entitled Plants that Double as Weather Forecasters. Type out the info from the article into your video, and sync it to the Weather Girls singing It’s Rain ing Men. Boom! Ten million views.

A story called Can I Freeze That? is a helpful guide to freezing milk, bread and eggs. Sync that to Ice, Ice, Baby. Boom! Twenty million views, and you can quit your job now, kid.

Seriously, I could envision every article as a quick TikTok. I did actually learn a lot, but let’s

nationwide, but especially over the North Central region.”

It’s predicting snow, rain and slush. So, get your hot chocolate, thermal undies and maybe a large, bearded man to keep you warm because the ‘nac is forecasting record-breaking cold temps.

Despite scrutiny by skeptics, the almanacs manage to be fun, fresh and insightful after all these years. Too bad we can’t say the same about Congress, but I digress.

I found a dope recipe for honey churro cook

get to the goods.

Weather predictions? Well, an article in last year’s almanac with the headline Frosty, FlipFlop Winter summarized the winter ahead for 2021-22. “For winter enthusiasts and snow lovers, December 2021 was one to forget,” the almanac said.

Dang y’all, they were right! Last December was one to remember for wearing flip-flops as you hung your stockings. I camped last year in the Mark Twain National Forest in Missouri a few days after Christmas. December 2021 was the warmest in the 127-year history of weather records, and the almanac nailed the call.

The Farmers’ Almanac’s winter forecast for this winter, however, isn’t as rosy: “The big takeaway from this winter will be frigid temperatures that will flow into many areas

ies, learned about climate-friendly plants and got some insight into how long I might be able to get away with riding my motorcycle before I freeze important body parts off.

Old Farmer’s Almanac publisher Robert B. Thomas probably put it best when he said “our main endeavor is to be useful, but with a pleas ant degree of humor.”

That’s been the key to success at the “new” almanac for nearly a century and at the “old” one for more than twice that long—and counting. Now, if you’ll excuse me, I need to figure out the best days for catching a large, bearded man.

THIS WINTER? Be ready to shake, shiver and shovel, the almanac warns.

The almanac claims 80% accuracy but keeps details of its forecasting methods SECRET.

Computers are predicting when and where crimes will occur—but don’t expect a real-life remake of the 2002 sci-fi film Minority Report.

In other words, Tom Cruise won’t be swooping down in a futuristic bladeless heli copter to stop an aggrieved husband from plunging a pair of scissors into the chest of his cheating wife.

Instead, police are driv ing their cruisers through certain neighborhoods more often at a particular time on a specific day or night. And it works—statistics indicate the mere pres ence of law enforcement deters bad guys from doing wrong.

“We probably disrupted criminal activ ity eight to 10 times a week,” observed Sean Malinowski, formerly a captain in the Los Angeles Police Department Foothill Divi sion. His testimonial to crime-prediction technology appears on the website of a company that supplies the software.

Such programming, often called predic tive analytics, is demonstrably correct at predicting crime 90% of the time, according to University of Chicago researchers. Other experts contend it’s only a little better than guessing—but still significant.

They agree it’s important because reduc

ing wrongdoing always pays off in this crime-ridden country.

Last year, homicide claimed the lives of 13,537 victims in the United States, accord ing to reports filed with the FBI’s Crime Data Explorer website. But the law enforce ment agencies providing the data cover only 64% of the nation’s population, so the

theft, phishing, extortion, romance scams, confidence schemes, fake investments, and failure to pay for or deliver goods. In 2020, victims filed 791,790 complaints of suspected internet crime with the nation’s 18,000 law enforcement agencies, up from about 300,000 in 2019, according to the FBI. Losses in 2020 exceeded $4.2 billion, the bureau said.

So, what’s to be done?

real total would be much higher. Numbers derived from a full accounting would most likely surpass the 16,899 members of the American military who died in Vietnam in 1968. That was the conflict’s bloodiest year, according to the National Archives.

Plus, those stats don’t take into account the toll of lesser but still heinous violent crimes like manslaughter, forcible rape, robbery and aggravated assault. Then there are property crimes like auto theft, burglary and vandal ism. And don’t forget the white-collar crimes of fraud, embezzlement, money laundering, securities and commodities scams, and theft of intellectual property rights.

Meanwhile, more crime has moved online during the pandemic in the form of identity

Geolitica, a 10-year-old Santa Cruz, California-based predictive policing company formerly called PredPol, is working with police departments and security companies to head off property crimes.

Nearly 50 police forces and sheriff’s departments are using the company’s service to help protect about 10 million citi zens, said Geolitica CEO Brian MacDonald.

He declined to discuss how much his company charges but acknowledged that an initial cost of $60,000 posted on his website has increased of late.

Whatever the price, Geolitica gathers and crunches huge amounts of data to predict when and where crimes are most likely to occur.

“We start with two really basic concepts,” MacDonald said. “The first one is known

AROUND 2% TO 5% OF A CITY GENERATES MORE THAN HALF OF ANY DESIGNATED TYPE OF STREET CRIME.

informally as the law of crime concentra tion, which states that crimes do tend to cluster. Somewhere around 2% to 5% of a city generally generates more than half of any designated type of street crime.”

The law of clustering has been documented scientifically in the work of David Weisburd, a noted criminologist at George Mason Univer sity and Hebrew University in Israel.

Geographic hot spots include anything from obviously troubled neighborhoods plagued by socioeconomic woes to rela tively clean and seemingly secure Walmarts where criminals break into shoppers’ cars, MacDonald noted.

“The second principle is that you can actually deter crimes by putting someone in those places before the crimes occur,” he continued. “Rolling a black and white

The two-step approach of identifying high-crime areas and then policing them prevents street crime but doesn’t deal with vice, like prostitution or drug peddling, and doesn’t prevent crimes, such as forgery, domestic violence or cybercrime, MacDon ald noted.

What’s more, the data underlying the company’s work springs from police reports filed by citizens who are clearly victims. People almost always call the authorities to report a stolen car but seldom turn them selves in for smoking crystal meth.

Geolitica extracts three elements from police reports: the type of crime, the place where it occurred, and what day and time it went down, MacDonald said. Stated concisely, they’re focusing on “what,” “where” and “when” and leaving specific informa tion about victims, perpetrators and neighborhoods untouched.

Crime clusters occur around the same time and in the same locations, he said, explaining robberies tend to occur down town on weekdays around noon or in entertainment districts at night and on weekends.

In one example of typical criminal behavior, burglars who hit commercial enterprises instead of residences often move around a city, MacDon ald noted. Veteran police offi cers know those patterns from

much more data than people can compile and interpret on their own, he maintained.

But how does it work?

When a law enforcement agency signs on with Geolitica, it provides two to five years of data. The company uses the stats to build a model that’s updated every day. If a depart ment has three, eight-hour shifts on 10 beats, it receives 30 sets of predictions daily.

The predictions look like a Google map with two or three boxes, each encompassing a chunk of the city measuring 500 feet by 500 feet. The probability of specified crimes is greatest inside those boxes.

Between radio calls from the dispatch ers, officers are expected to spend more time patrolling those areas and engaging with citizens there.

At the start of a shift, sergeants and patrol officers click on the boxes to see what crimes have high probabilities, said Deputy Police Chief Rick Armendariz of the Anaheim, California, police department. He imple mented the Geolitica system while serv ing in the police department in Modesto, California.

During a six-month period, the Modesto department tracked auto theft, residen tial burglaries and commercial burglaries and managed to reduce each category by 40% to 60%, Armendariz said in an Inter national Association of Chiefs of Police convention presentation. But the benefits didn’t end there.

through a parking lot with a lot of auto thefts on a random, irregular basis through out a shift has proven to have a strong deter rent effect on crime.”

Christopher Koper, also a George Mason professor, conducted research in Milwau kee supporting this premise. If officers spend 10 to 15 minutes in an area, they have a chilling effect on crime for about two hours, Koper found. It’s what MacDonald calls “the center of the bell curve in terms of presence and deterrence.”

experience and proactively work those areas at those times, even without the help of predictive analytics.

But relying on hunches opens the door to bias and thus makes officers less effective, he said. Plus, putting pins in a wall-mounted squad room map to locate high-crime areas is backward-looking and doesn’t point to days of the week or times of day.

Automating the process, as Geolitica does with predictive analytics, enables police departments or sheriff’s offices to draw upon

“It made our department mission-spe cific,” he observed. Instead of allow ing Modesto officers to create their own “missions” as self-appointed specialists pursuing crimes of their own choosing, like drug arrests or traffic stops, it improved the department’s efficiency by keeping the entire force “on the same page” and sending members out to follow the same priorities, he continued.

High-tech preventive policing seemed natural to Modesto’s younger officers but required a cultural shift for veterans of the force who were accustomed to relying

on their personal knowledge of the city, Armendariz noted.

But even when officers want to follow the system’s mandate to spend time in certain areas, they’re often taken elsewhere in response to calls, noted Philip Lukens, chief of police in Alliance, Nebraska. Some times, they simply forget to follow up on the predictions, he said.

“If it’s up to the officer to look at the map and then go patrol that area, it just doesn’t happen,” Lukens maintained.

If an officer needs to work traffic from 3 p.m. to 3:15 p.m. at a certain intersec tion on a particular date, there’s an 80% chance of missing the appointed task, he

said, adding that sergeants are simply too overburdened to make sure officers are complying.

That’s why Alliance is working with Geolitica to set up automatic “ghost calls” to dispatch an officer to the area at the right time. Instead of relying on officers to patrol a designated location, the system occasion ally dispatches them to that spot. If the officer who would be receiving the call is otherwise engaged, the ghost call rolls to another officer.

“We need to pull and push data at the same time because that’s how we become effective at intercepting the issue,” Lukens said, “and then we’re analyzing it to see if we’re effective.”

His department also uses the preventive policing data to locate hot spots and then park an unstaffed, marked police car in the area as a deterrent to crime during a 6-hour to 8-hour window. The practice of using

squad car decoys has reduced property crime in Alliance by 18% this year, he said.

But police may someday act upon preven tive analytics without having to commit an officer or even an empty squad car. They could dispatch robots to do it.

Knightscope, a Mountain View, Califor nia-based public company, began oper ations in 2013 and deployed its first crime-preventing robots two years later, according to CEO William Santana Li.

“Our mission is to make the U.S. the safest country in the world,” Li said. “What if a robot could save your life?”

The company’s robots operate on predictive polic ing data from other companies to make their rounds. They

come in both indoor and outdoor models, and the most popular, known as the K5, stands 5 feet tall, measures 3 feet wide, weighs in at 400 pounds and roams around autonomously.

The robots combine four difficult-to-ex ecute technologies: robotics, electric vehi cles, artificial intelligence and autonomous self-driving capability, Li said.

Knightscope doesn’t sell the robots but instead rents them out for 75 cents to $9 an hour, depending upon the application. The company provides the hardware, software, docking stations, telecom connections, data storage, support and maintenance.

About 100 of the roving robots are on the

job, joining the company’s thousands of stationary devices that are capable of such tasks as facial recognition and capturing license plate numbers.

Some police departments are using the mobile robots to patrol areas where predictive analytics forecasts crime is most likely to happen, Li said, offering anecdotes about the machines assisting in the arrest of a sexual predator and an armed robber.

A unit nicknamed “HP RoboCop” has made the rounds at a city park in Huntington Park, California, urging in a pleasant voice that people “please help keep the park clean.” The city is spending less than $70,000 a year to rent the device, Cosme Lozano, the town’s chief of police, told a local NBC News outlet before the pandemic.

Vandals once tipped over HP Robo Cop, but the machine recorded images of its attackers on videotape, and the police took the alleged miscreants into custody within hours of the incident, Lozano said.

Effective police work aside, most Knightscope units are finding homes in casinos, hospitals, warehouses, schools and apartment complexes—relieving guards of the monotonous duty of monitoring large spaces.

Li estimates 90% of the robots are working in the private sector and 10% for government agencies, including police departments. But he envisions having a million of them on the job in the next two decades, aiding law enforce ment officers and security guards.

Whether robots proliferate or not, using predictive analytics to deter wrongdoing doesn’t end with head ing off street crime. Banks can use it to detect and prevent money laundering, and insurance companies can use it to set rates keyed to the likelihood certain customers will commit fraud or take up dangerous lifestyles.

Businesses are using computing power to enhance their ability to deal with malfeasance, according to Runhuan Feng, a University of Illinois math ematics professor. He directs the school’s new master’s degree program in predictive analytics and risk manage ment for insurance and finance.

For many years, bankers and insur ers have relied on imprecise rulesbased pattern recognition in their attempts to curb impropriety. They might, for example, flag an account when a depositor transfers more than $10,000, Feng said.

But unaided humans can’t apply enough rules to achieve much accu racy. Now, however, computers are amassing and evaluating enough data to create models that generate much more valid predictions.

Such predictions are benefitting an insurer that sought Feng’s advice. He not only helps the insurance company manage its own data but also adds data from other sources. That results in better models that identify risk ier customers who should pay higher rates. It alleviates the need for lowerrisk customers to subsidize those more likely to indulge in fraud.

Fraud constitutes a real problem for insurers because criminals file false claims with several companies, he noted.

Yet, fraud isn’t the only reason insur ance claims can increase in number or severity. In one example, bring ing in information from third-party sources might reveal that a customer engages in extreme sports, Feng said. That means the insurer should charge a higher premium for life or health coverage, he noted.

Before the insurance company approached Feng, it was predicting fraud and other problems with 50% to 60% accuracy, not much better than

Crunching numbers to predict the future isn’t limited to forecasting crime. It can tell us, for example, that vegetarians miss their flights less often than meat eaters. (True, by the way.)

Who would care about that? Well, that type of granular information helps airlines set ticket prices and adjust schedules, thanks to something called “predictive analytics.”

It’s a phrase that might seem vague, so Luckbox turned to an expert to pin down the definition. He’s Eric Siegel, a former professor at Columbia University and author of Predictive Analytics: The Power to Predict Who Will Click, Buy, Lie, or Die.

“Predictive analytics is essentially a synonym for machine learning,” Siegel said. “It’s a major subset of machine learning applications in business.”

Machine learning occurs when computers compile data, and data is defined as a recording of things that have happened, he continued. It renders predictive scores for each individual—indicating how likely customers are to miss a flight, cancel a subscription, commit fraud or turn out to be a poor credit risk.

“These are all outcomes or behavior that would be valuable for an organization to predict,” Siegel noted. “It’s actionable because it’s about putting probabilities or odds of things.”

Plus, predictive analytics isn’t just about humans. It can forecast the likelihood of a satellite running out of battery power or a truck breaking down on the highway.

Just about every large company uses it, and most medium-sized ones do, too. Cell phone providers predict which customers will switch to another network, and FICO screens two-thirds of the world’s credit card transactions to understand who might commit fraud.

“Prediction is the holy grail for improving all the large operations we do,” Siegel maintained. “It doesn’t necessarily let you do it in an ‘accurate’ way in the conventional sense of the word, but it does it better than guessing.”

40% to 60% REDUCTION IN AUTO THEFT, RESIDENTIAL BURGLARIES AND COMMERCIAL BURGLARIES IN MODESTO, CALIFORNIA, DUE TO PREDICTIVE POLICING–PHILIP LUKENS, THE CITY’S FORMER DEPUTY POLICE CHIEF In the movie Minority Report, a precog registers alarm when she “sees” a crime is about to happen. PHOTO: AMBLIN

flipping a coin. The new models get it right more than 90% of the time, Feng said.

Meanwhile, better models can also alert banks to money laundering.

“What usually happens is these individu als get money from illegal activities,” Feng noted, “and they open lots of accounts and deposit small amounts. Then they use them to buy luxury products and sell them quickly.”

The machine learning model captures and combines the extensive and far-flung information needed to establish that sort of pattern and link it to an individual and compare it to known money laundering, he observed.

Few would argue against halting money laundering activities or preventing fraud, but some still aren’t comfortable with using predictive analytics to foil criminal activ ity. Critics view it as an authoritarian “Big Brother” approach to invasive surveillance.

Multiple sources note that discrimination can come into play with predictive analytics.

But proponents have responses to those concerns.

Racial bias can creep into predictive policing. Including drug arrests in the data set, for example, introduces bias against African Americans because they’re more likely than members of other ethnic or racial groups to be charged with possession or selling, according to many skeptics.

“It has nothing to do with whether there are more drugs in those neighborhoods,” MacDonald said, “it just happened to be where those officers made more arrests for that particular crime.”

That’s why Geolitica doesn’t include arrests in its data gathering, instead rely ing solely on complaints phoned in to police dispatchers, MacDonald said. Besides, police often arrest suspects far from where the crime occurred and almost always after the fact, not during the commission of the crime.

But fear of bias has prompted some municipalities to ban predictive policing. Santa Cruz, California, home of Geolit ica, began testing the technology in 2011, suspended its use in 2017 and banned it by city ordinance in 2020, according to the Los Angeles Times.

The technology became particularly inva

sive in Chicago, where authorities went so far as to notify individuals that they were likely to become involved in a shooting. The authorities just didn’t know from the predictive analytics which side of the gun the citizen would be on. By some accounts, the list included more than half of the African American residents of the city, said multiple sources.

“If you have this kind of predictive analytics, then does that give the state too much power?” asked Ishanu Chatto padhyay, a University of Chicago profes sor who’s spent the better part of a decade researching the subject. “Are the cops going to round people up? Put them in jail? Are we going to be in a Minority Report world?”

Chattopadhyay’s research team came under fire from skeptics this summer when it published the results of its predictive polic

Using data to fight crime has a parallel in the business world. In marketing, small numbers can add up to create huge gains in return on investment.

Take the example of a company that produces a product that interests 1% of the general population. If predictive analytics can identify a segment in which 3% are open to the product, the company can concentrate its marketing on the group three times more likely to buy.

That can boost sales while reducing the ad budget.

ing research in Chicago and other cities. He reported receiving “hate mail written in very polished language.”

The letter writers had not read the team’s report, he speculated, or else they would have realized that the research centered on aggre gated statistics instead track ing individuals.

Still, Chattopadhyay takes exception to identifying crime hotspots. They become a self-fulfilling prophecy because if you’re looking for crime more often in an area, you’re likely to find it, he said.

Crime fighters aren’t the only ones turning to algorithms.

Feed the right kind of information into a computer and it spits out a strategy for trading stocks and options called a black box model.

Two states of mind justify the ominoussounding name. Sometimes, investors or advisors use the term because they don’t understand the mysterious logic behind the model.

On other occasions, they see how the machine derived the strategy but consider it proprietary knowledge they don’t want to share.

BlackBoxStocks (BLBX), a platform based on the idea, is traded on Nasdaq.

At any rate, he explained the results of his research by saying that if 10 crimes are going to happen in the future, his team flagged 11 crimes and was correct eight times, had mixed results three times and false positives twice. Those results were presented in media reports as being 90% accurate.

The predictions, which produced a flurry of news coverage a few months ago, were made seven days in advance, plus or minus one day, and they were restricted to a couple of city blocks.

So complaints aside, the tools for predictive policing have become a reality that’s unlikely to disappear, according to Chattopadhyay.

“Some people are upset about AI in general and see it taking over their lives,” he said, “but artificial intelligence is here to stay. The real question is, are we going to go for the worst possible outcome or make the best of it?”

Will new technology address rising crime rates?

Across a range of contexts, it’s becoming clear that police and law enforcement must have access to new tools. But unless there is trust within the communities where they operate, the tools—especially the shiny new tech—become a hindrance, obstacle and point of contention. For example, facial recognition applications can reduce the hours needed to review video footage, but such programs can reflect biases that make policing more of a challenge.

What role do you think AI will play in reducing crime?

The promises and perils of AI are extraordi nary, especially for police and law enforce ment. Deep fakes have already been at the center of court cases, and it’s becoming clear that the only way to fight fire is with fire. So, many police and law enforcement are looking to utilize AI-enabled apps, even though the technology is still maturing. The Dubai Police [in the United Arab Emirates] have a center focused on AI applications, and predictive policing is growing in popularity.

One thing that police and law enforce ment learned during COVID-19 is that crime doesn’t disappear but adapts. Online scams and ransomware attacks skyrocketed during the pandemic, and AI—when appropriately developed—can be a powerful tool not only to catch criminals but to dissuade them.

Considering data privacy issues and the spread of video surveillance, what do you predict our Minority Report future may look like?

There are clear signals that a possible future—one similar to the 2002 sci-fi film Minority Report—may be emerging across some contexts. Specifically, the coming together of enhanced facial recognition with an increase in wearable devices, as well as other data-capturing objects and garments,

tainty, I’ve been struck by the impact of “unknown knowns.” These are the things that we think we know then it turns out that we don’t. So, it’s possible, if not likely, that anything that I might imagine now would be far less weird, and impactful, than what might actually come to pass next year.

is leading to a boom in data. Some see that as a mechanism of societal control, and perhaps that’s possible. But there are always exploits, as Minority Report depicts in a rather gory way when the protagonist is forced to change his eye. New policing and law enforcement tactics always spur new evasion strategies, and this dynamic should remind us that truth is often far stranger than fiction.

The year 2022 has offered many surprises. What black-swan events do you anticipate from now through the end of 2023?

“Expect the unexpected” should continue to ring true in 2023. While it is essential to challenge our assumptions about what is truly possible in a time of radical uncer

With that said, there’s a perfect storm brewing: economic uncertainty fueling inten tional and unintentional shifts in consump tion and lifestyle, climate emergency-driven action and reaction, and a widespread desire to move beyond the pandemic, even though it continues to be felt around the world. [These factors] all point toward more people on the move. When this happens, and communities are not prepared for change, things can become post-normal, which means that the familiar will feel strange and the strange feels, perhaps a bit too familiar.

JOHN A. SWEENEY is co-holder of the UNESCO Chair for Futures Studies for Anticipatory Governance and Sustainable Policy at West minster International University in Tashkent, Uzbekistan. Sweeney also serves as the trans formative foresight lead at the School of Interna tional Futures, co-edits World Futures Review: A Journal of Strategic Foresight and is a member of the graduate faculty for the University of Hous ton’s Strategic Foresight program. He belongs to the Association of Professional Futurists and the World Futures Studies Federation.

THE PROMISES AND PERILS OF AI ARE EXTRAORDINARY, ESPECIALLY FOR POLICE AND LAW ENFORCEMENT.

AFTER LEARNING TO LIVE WITH THE TOTALLY UNEXPECTED IN 2022, LUCKBOX MAKES ITS ANNUAL OUTLIER FORECASTS FOR ANOTHER WILD RIDE

BY GARRETT BALDWIN & JEFF JOSEPH

BY GARRETT BALDWIN & JEFF JOSEPH

Janet Yellen steps down as trea sury secretary as inflation remains stubbornly elevated. Concerns arise that the Federal Reserve may need to tolerate 4% to 5% inflation in the coming years. The U.S. runs a massive deficit again. Inflation sits north of 4%. The dollar remains one of the top-performing assets.

Tensions between the super powers escalate because of the Biden administration’s decision to restrict China from importing advanced U.S. semiconductors. China moves on Taiwan.

Russia and Ukraine strike a peace deal. Russia annexes Crimea, and Kyiv declares neutrality while renouncing ambitions to join NATO.

The Fed hikes interest rates to 5.5% to crush aggregate demand, resulting in another leg down in the market. The markets find a bottom in 2023—likely in the first half of the year.

As the financial markets form a bottom,

community banks trading for well under their liquidation value become a favored position of retail investors looking to capitalize on deal flow.

After being hammered by the Fed’s rate hikes in 2022, Palantir Technologies (PLTR) turns around to become one of the top-performing stocks of 2023, thanks to increases in defense and cybersecurity spending.

Crude oil’s bottom: $75 in a demand-driven crush. Oil’s top: $155 thanks to supply shortages.

The investment trend of the 2020s emerges: energy, weap onry, lithium, uranium and land. Billionaires continue to gobble up commodity resources in farm ing, water and even rare earth metals.

Aaron Judge shatters the record for a Major League Baseball contract, inking an eight-year deal averaging more than $40 million per year … with the San Fran cisco Giants. He never hits more than 50 home runs in one season again.

The road to the Super Bowl runs through Buffalo and Phil adelphia, but neither team makes it there. The Kansas City Chiefs win LVII , but most people spend the next day talking about the “Rihanna halftime show controversy.”

Despite losing to Tennessee in 2022, the Alabama Crim son Tide wins the SEC West, defeats Geor gia to win the SEC championship and bests Ohio State to win the national title. Doesn’t this feel inevitable?

In horse racing, Ameri cans meet Cave Rock, a Bob Baffert horse that’s the son of the great Arrogate. If permitted to race, Cave Rock wins two of the three legs of the Triple Crown

The New York Rangers frus trate fans with a loss in the East ern Conference Finals for the second consecutive year. The Calgary Flames lift the Stanley Cup in a convincing series win over the Carolina Hurricanes. Colorado Avalanches’ center Nathan MacKinnon wins the Conn Smythe trophy.

Following months of diesel and heating oil supply short ages, Congress introduces a

bill to create strategic reserves of finished petroleum goods. It’s a move that resembles the way Europe manages its emergency fuel supplies. The bill passes the House but stalls in the Senate, thanks to lobbyist intervention.

The cost of complying with Secu rities and Exchange Commission restrictions on emissions causes another bust on Wall Street for initial public offerings. The tech nology IPO market is worse than during the Great Recession of 2007-2008.

At the end of 2023, prediction market traders at PredictIt.org rank Ron DeSan tis as the top contender for the 2024 Republican presidential nomination and Kamala Harris as the lead candidate for the Democratic presidential nomination.

Companies deploy artifi cial intelligence to track work-from-home employee productivity. Mistrust increases dramatically as companies attempt to bring workers back to the office.

The metaverse finds its mojo around gaming, porn, live entertainment and travel. Mark Zuckerberg steps aside and Meta (META) names a new CEO.

Institutional investors petition the SEC and other financial agencies to alter the rules for initial public offerings.

They complain that the Snap (SNAP) IPO in 2016 gave virtually all of the stock holder voting power to the co-founders. It happened because the terms of the IPO made it impossible for any institution to own enough shares to provide guidance or press for changes at the public company. Yet investors were forced to hold the stock through Index funds. Snap’s stock moved down 90%, and the petitioners don’t want to be caught up in that type of drop again.

Roughly 10% of reading glasses connect with the internet, creating a new device susceptible to hacking.

The Kanye-Parler deal fails to go through.

Bitcoin finds its low at $16,000 in 2023 but finishes the year at $24,000. Ethereum outper forms its rival, pushing back to the $2,500 level or higher, based on the Fed’s policies.

Twitter creates multiple tiers of screens similar to Google Search to filter out bots, racism and extreme speech—the same way Google filters out pornog raphy. But Elon Musk’s true intentions become apparent as Twitter becomes a crypto-em bracing payment platform. Revenues exceed $7 billion by 2024.

LUCKBOX ASKED A PANEL OF EXPERTS TO WEIGH IN ON THE SAME QUESTIONS THE MAGAZINE POSED IN A POLL TO READERS. HERE’S HOW THE RESPONSES FROM THE TWO GROUPS COMPARE.

CHRIS BEAUCHAMP: Chief market analyst at IG Group. @chrisb_ig

DYLAN RATIGAN: Former global managing editor for corporate finance at Bloomberg News and current cohost of the Truth or Skepticism podcast with Tom Sosnoff. @dylanratigan

TOM SOSNOFF: Co-CEO of tastytrade who appears daily on the tastytrade financial network. @tastytrade

ED YARDENI: President and chief investment strategist of Yardeni Research Inc. @yardeni

Will the March 2023 Consumer Price Index (trailing 12 months, to be released in April) indicate higher or lower inflation than the 8.2% reported in September?

Market experts unanimously agree inflation will be lower than 8.1%.

The majority of Luckbox readers also say it will be lower than 8.1%.

Will the all-grades average gasoline price be higher or lower on March 31, 2023, than the current $3.91 per gal lon reported by the U.S. Energy Information Association?

Market experts unanimously agree gas will cost less than $3.90/gallon

Luckbox readers disagree and the majority say gas will cost more than $3.91/gallon.

What will the percentage returns on the S&P 500 Index be from its closing price on Nov. 15, 2022, through closing on March 31, 2023?

Market experts could not agree.

Luckbox readers were also split on this one.

(8.1% or lower) Higher (8.2% and above)

Luckbox Readers

Luckbox Readers

Lower ($3.90 or lower) Higher ($3.91 and above)

A loss of more than 15%

A loss of 10-15%

A loss of 5-10%

A loss of 0-5%

A gain of 0-5%

A gain of 5-10%

A gain of 10-15%

A gain of more than 15%

Luckbox Readers

What will the percentage returns on gold be from its closing price on Nov. 15, 2022, through closing on March 31, 2023?

EXPERTS AND READERS DISAGREE

A loss of more than 15%

A loss of 10-15%

A loss of 5-10%

A loss of 0-5%

A gain of 0-5%

A gain of 5-10%

A gain of 10-15%

A gain of more than 15%

On Oct. 15, President Joe Biden’s ap proval rating sat at 42.2%, according to FiveThirtyEight. What will his rating be as of March 31, 2023?

EXPERTS AND READERS DISAGREE

AFTER A SERIES OF JARRING SURPRISES THIS YEAR, WHAT BLACK-SWAN EVENTS LIE AHEAD THROUGH THE END OF MARCH?

Chris Beauchamp: Ending the Russian invasion of Ukraine by removing Vladimir Putin from power would be a major surprise. A move by Apple or another big tech firm to take over Netflix would send a shock reverberating through the markets.

Dylan Ratigan: Crypto will rally by more than 50%. A cease-fire will be declared in Ukraine.

Tom Sosnoff: The biggest surprise will be the collapse of the U.S. Dollar in 2023. The second biggest will be Donald Trump’s fall from grace. He’ll cease to be a political factor.

Ed Yardeni: The stock market will rise to a new high at the end of the next year.

Recovery of the stock market.

—Luiz Carvalho, Stamford, CT Nuclear war.

—Vickie Lynn Smith, Clarkrange, TN

High inflation for a while, higher gas prices, lower stock market prices, lower home prices and, hopefully, not WW III unless Putin drops a nuclear bomb.

—Mimi Sexto, Dunedin, FL

The [war in] Ukraine will spread across Europe. —Terri Marroquin, Midland, TX

My crystal ball is in the repair shop because of supply chain issues.

—Mike Mueller, Milwaukee

This tabletop fire pit will “elevate your space’s aesthetic,” the maker says. Plus, it’s particularly suitable for urban dwellers with limited outdoor space. The 6.8-inch-high fire pit is easy to ignite and has dual-fuel capability and 360-degree airflow to provide a smokeless fire outdoors. $85, Solo Stove

g

a m e s

Ticket to Ride ranks among the three most well-known modern board games, rivaled only by Settlers of Catan and Cards Against Humanity The objective is to build train routes. The more complex the route, the higher your score. But complicated routes are also riskier. The first 600 copies of the game (Ticket to Ride Europe) were introduced in German in 2004. The game received the prestigious Spiel des Jahres (German for Game of the Year) award that same year. To date, more than 3 million editions of Ticket to Ride have been sold, and it’s available in 20 languages with over 15 expansions. Of the expansion sets, the USA 1910 Expansion is the consensus favorite among game aficio nados, Luckbox included. Two to five players. —$59 for Ticket to Ride Europe plus the USA 1910 Expansion, Amazon

1 2 3 11 h o m e

2018 Spiel des Jahres winner Azul released its fourth edition Queen’s Garden in 2022—a more challenging variant of the original abstract strategy and pattern-matching game. Azul features artfully produced high-quality components, along with a massive range of logic puzzles baked into the core gameplay. Two to four players.

1

/ The Origami Coffee Brewer is made of high-den sity minoware clay and has 400 years of history in the Gifu region of Japan. When used with a filter, the dripper’s heat-retaining properties shorten brewing time.

—$76, Slow Pour Supply

2 / Picopresso, a hand-held specialty coffee machine by Wacaco, is compact and por table. Home brewers can mas ter the art of manual espresso making by dialing in the cor rect grind size, tamping and perfecting pulling technique. The reward: An authentic cafe-quality espresso. —$130, Wacaco

/ The Bonfire 2.0, also from Solo Stove, is a stain less-steel fire pit built for the backyard and beyond. It weighs only 23 pounds and comes with a carrying bag to take to the beach, campsite or nearly anywhere else. —$239, Solo Stove

3

5 / The Bilboquet Carafe is a stylish—if not scientific —vessel that helps anyone aerate wine like a pro. Use it as a whisky decanter or to serve beverages. The borosil icate glass resists heat and cold, and the amber spherical glass stopper is stunning.

—$115, Design Within Reach

6

/ Bala Bangles make rucking fun with a belt of 1or 2-pound weights worn on wrists or ankles, adding in creased resistance to a workout indoors or outdoors. Made of recycled steel wrapped in silicone.

$55, Shop Bala

9 / Lexon’s Oblio, a wireless smartphone charging station with built-in UV sanitizer, looks like a cup but provides a full charge in three hours while eliminating “99.9% of your smartphone screen and surface germs in 20 minutes,” according to the manufacturer. —$80, Lexon

7

/ The Theragun Wave Solo Vibrating Massage Ball, considered a “modern take on traditional lacrosse ball massage,” features three vibration settings and smart connectivity in a portable package. It uses pinpointed vibration therapy to reduce pain and ease tension.

$79, Therabody

10 / The JBL Go 3, a portable and waterproof pocket-friendly wireless speaker, has good sound for the beach and hiking trails. But if you drop it into a pool, it doesn’t float. At less than a half pound, it’s easy-to-carry bluetooth sound.

—$30, JBL

8

/ The Theragun Mini puts a portable massage in your pocket. The hand-held muscle massager digs deep for sore muscle relief.

$179, Therabody

11 / The Boundless Audio Record Cleaner Kit com bines a record brush and stylus brush. Its carbon-fiber bristles safely and gently remove dust and dirt from the vinyl surface, no liquid required.

—$25, Boundless Audio

12 / Grouphug Window

Solar Charger, an easy-to-in stall, hanging 10W solar panel, charges a variety of devices with the power of the sun. The panel comes with a suction cup hook for any window and a rechargeable 3,400-mAh battery with a USB cable.

—$150, Grouphug Solar

13 / The Ridge, a minimal ist, front-pocket wallet, is de signed to remain slim but can expand to hold up to 12 credit cards. The wallet’s made from a durable blend of resin and carbon fiber that’s also used in golf clubs and sports cars.

—$150, The Ridge

Luckbox’s editorial director savors this mix of 10 luxuries and necessities

The essential hat for those who favor function over fashion. The durable, waxed, all-weather Field Hat is finished with a leather hat band and eyelets for airflow. Available in tobacco, whiskey, hardwood and rye brown. In between sizes? Take the larger of the two.

—$125, Tom Beckbee

Enjoy nine-plus hours of outside-to-bedside cordless illumination from this stylish touch-on/off, dimmable LED table lamp. The Pro Mini is available in seven powder-coat finishes and includes a con tact charging base with a USB and a one-year warranty.

—$159, Zafferano America

Vortic, an artisan watchmak ing company founded by a direct descendant of Amer ican Civil War Gen. George Armstrong Custer, has a classically American entre preneurial story. It transforms U.S.-made railroad pocket watch mechanisms into one-of-a-kind timepieces. —from $2,495, Vortic Watches

4

Hands down, this is the ulti mate vessel for experiencing fine spirits. The Cradle Glass fits comfortably into your hand, and its seductive curves radiate, aerate and liberate your best drams by directing the organic aroma to the nose. Whisky drinkers—this will be your go-to glass.

—$41, Cradle Glass

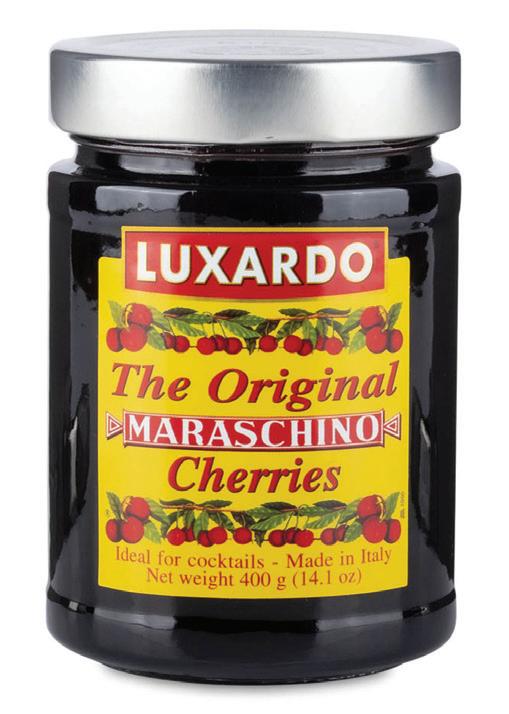

These candied cherries soaked in Luxardo marasca cherry syrup have no preser vatives—the dark red color is all natural. Used by the worlds’ best mixologists in the finest bars, the syrup and the fruit are the secrets to any great Old Fashioned. Also ideal over ice cream.

—$19, liquor stores

The Plasencia family has been growing tobacco for prestige brands like Rocky Patel, Gurkha and Romeo y Julieta for six generations. But only the most skilled rollers can handcraft a Salomon size cigar. Plasencia’s premium Nicaraguan blend delivers hints of cocoa, leather and spice.

—$21, fine cigar stores

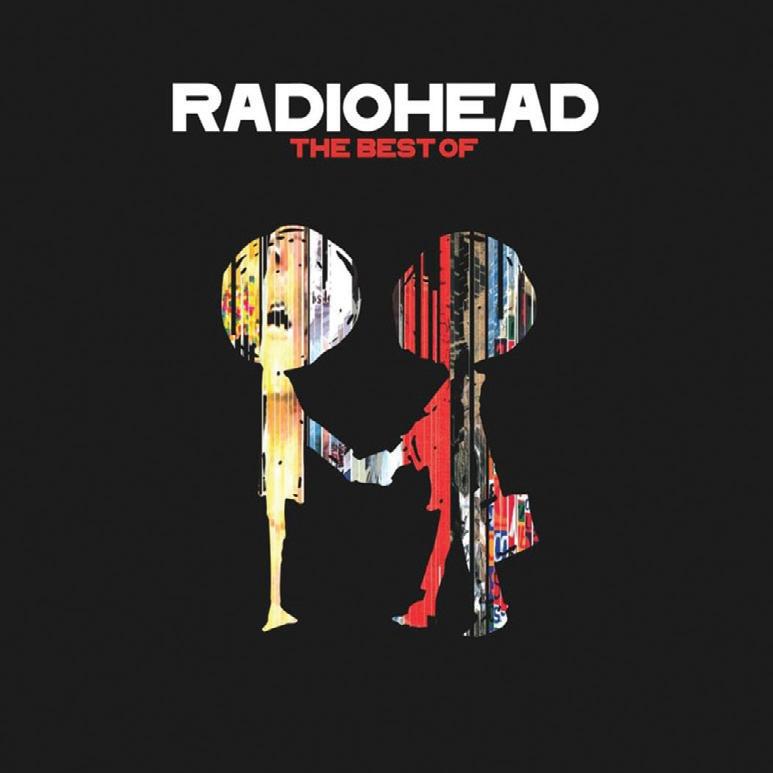

This four-album set curates Thom Yorke & company’s best songs from their 1993 debut Pablo Honey through 2007’s In Rainbows, featuring songs Paranoid Android and Karma Police. And, yes, Creep is included along with 26 other favorites from England’s best post-Beatles rock band. Available in near-mint, preowned condition.

—$199, Discogs

Ever since author Tim Ferriss convinced us that the kettle bell could be the only all-body exercise anyone would ever need, we’ve been hooked. But as you get stronger, you must move up in weight. The practical SelectTech offers 8-, 12-, 20-, 25-, 35- and 40-pound options. —$149, Bowflex

The shifting weight inside the RMT Club creates dynamic resistance through fluid movement exercises designed to engage your entire body. The Club reduces the risk of injury, and it’s used by pro athletes and trainers in virtu ally every sport. Start with the 4-pounder. —$110, Amazon, WeckMethod

Buy this for yourself. A 2018 study of 1 million people identified a causal relation ship between poor oral health and the risk of heart disease. Sonicare’s 4100 runs much more quietly and has a longer-lasting battery than its peers. That’s why it’s consistently rated the best electric toothbrush.

—$39, Phillips

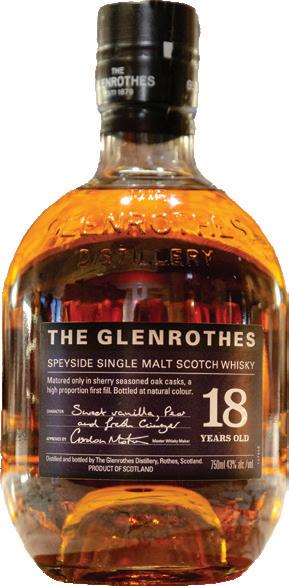

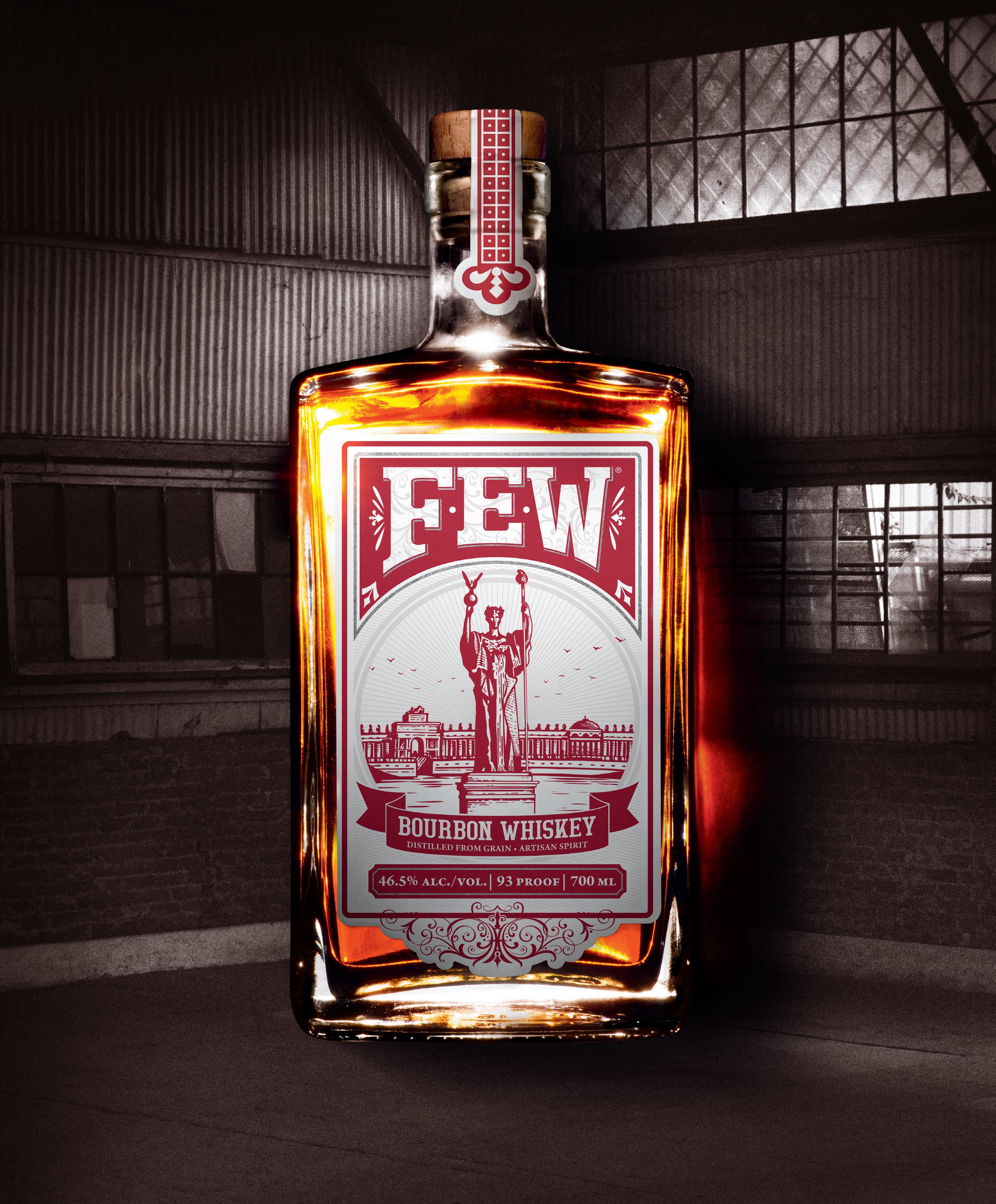

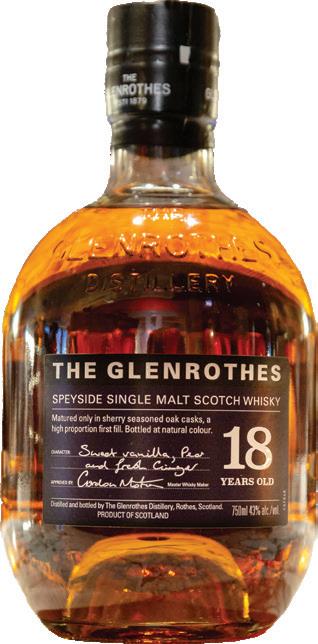

Luckbox turns to expert David Sweet to help curate our annual selection of the best spirits for holiday gifting. He and his panel of experts meet each year with consumers for blind-tastings to identify best-in-class bottles for the Whiskey and Barrel Consumer Choice Awards. Find more winning whiskeys and other spirits at wabcca.com.

Matured 18 years entirely in Sherryseasoned oak casks, this Speyside single malt earned 98 points and ranked No. 3 in the “Top 100 Spirits of 2020 & Chairman’s Trophy for Best Speyside Single Malt” in the Ultimate Spirits Challenge, 2020. A Luckbox favorite.

The music industry changes every day—whether it’s an album release, worldwide tour announcement, company merger or the sale of music rights. Music platforms and businesses are volatile, and next year won’t be any different. With all that in mind, The Rockhound has four music predictions to keep an eye on in 2023.

TikTok, launched in 2016 by the Chinese technology company ByteD ance, enjoyed an intense boom in engagement in the pandemic years of 2020-2021 and hasn’t slowed down since. As of August, the app reached 1 billion active users spread across 154 countries. Music has been a prominent factor in bite-sized videos, either as back ground or groundwork for choreographed dances.

Besides providing a home to social media influencers, the platform has advanced the musical careers of Claire Rosinkranz, Dixie D’Amelio, Powfu, Priscilla Block and Tai Verdes—helping them sign with major record labels. This year, TikTok launched its own promotion and music distribution platform called SoundOn, and it’s even searching for people to fill A&R (artists and reper toire) roles in major cities, as reported by Music Busi ness Worldwide. The A&R people would be respon sible for talent scouting on the platform. Now the question is whether TikTok can compete with major record labels.

Surviving members of the English rock band Pink Floyd are considering the sale of their recorded music catalog. This photo of four members is from 1968.

English rock band Pink Floyd is reportedly considering selling the rights to the band’s recorded music catalog, and The Rockhound predicts they’ll be the next legendary rockers to do so, following the trend of the past three years.

It’s not unusual for musicians to make a deal and hand over the rights to their music as they get older. It’s just been happening at an increasingly rapid pace.

Bob Dylan collected $300 million in 2020 in a deal for his songwriting rights with Universal Music Group, according to the New York Times. Dylan also received an estimated $200 million in a deal for his recordings with Sony Music/Columbia, according to Billboard, although financial terms of the deal were not disclosed.

In August 2021, Aerosmith made a deal with Universal Music Group that moved its Sony Music recordings into a distribution pact with UMG. It covers their entire music catalog, merchandise and audio-video projects.

At the end of 2021, Bruce Springsteen received $550 million from Sony Music Group for both his publishing rights and his recorded music catalog.

The David Bowie estate announced early this year it was moving the late artist’s “entire recordings catalog inside a distribution deal with Warner Music Group,” according to Music Business World wide, for a reported $250 million.

The video-driven app TikTok is taking its own approach to music discovery with SoundOn, and it’s hiring full-time A&Rs (artists and repertoire representatives).

While senior figures in the business are calling for TikTok to adopt a revenue-sharing approach to licensing deals with large rights holders, The Rockhound predicts TikTok will develop a vertical integration strategy for music licensing rights and shift its focus toward artist discovery. The platform is recruit ing employees for positions that resemble the jobs in record companies, and The Rockhound predicts they’ll officially head down that path by the end of 2023.

Pink Floyd is expected to fetch a nine-figure sum if it’s sold, Music Business Worldwide reported.

The Beatles, Stones and Zeppelin were awesome—but rock lives on. Why not break out of the classic rock cocoon and give new rock a chance? Rockhound is here to help. Think of it as a bridge from 1967 to today and beyond.

Revenue will keep increasing, long-established artists will continue to sell the rights to their catalogs and TikTok will operate even more like a record label.Brandi Carlile

TikTok is helping indie artists sign with major labels.

Indie music reached a high point of commer cial success in the mid ‘90s when the Britpop genre achieved immense popularity. It focused on guitar-led indie-pop/rock and meaningful songwriting about class, politics and culture.

Through the years, the definition of indie music has gotten a bit muddled, but it essen tially refers to independent artists signed to

such as the Arctic Monkeys and the Yeah Yeah Yeahs touring and releasing albums, it’s likely other indie musicians will become popular.

The number of independent musicians is rising, too. In May 2019, 1,560 full-time independent musicians were working in the U.S., up from 1,290 the year before, accord ing to Statista. With the apparent decline of the pandemic and the industry’s technologi cal advancements, that number has likely surpassed 3,000 full-time inde pendent artists.

Globally, independent labels and musicians’ share of the market increased by 43.1% in 2021—an all-time high. Indie labels and artists generated $9.9 billion in 2021, MidiA Research estimates. And artists-di rect (self-releasing artists) were big winners, earning $1.5 billion and increasing their market share to 5.3%.

The Rockhound predicts indie labels and artists will generate $10.5 billion this year, and that artists-di rect will surpass $2 billion.

In March, Luckbox reported vinyl records outpaced CDs in physical music sales for the first time in 30 years. In fact, vinyl became the leading format for all album purchases in the U.S.—thanks to the indie sector. As that sector continues to grow in 2023, The Rockhound expects phys ical music sales in general to grow as well.

With the pandemic seemingly in the rearview mirror, music fans are getting out of the house and enjoying live music again.

The market for in-person performances is expected to grow by 85.3% this year to $26.5 billion, Goldman Sachs predicted in June.

But that comeback won’t bring spending on live music up to the level of music streaming, which could reach $37.8 billion this year and $89.3 billion by 2030, Goldman Sachs predicted.

Listeners will continue to increase their spending on streaming in the coming years, but catalog acquisition might slow down, according to the financial services giant.

independent labels instead of major labels.

Definitions aside, there’s never been a short age of indie artists, but as more indie labels develop and musicians become more fluent in music technology, production and distribu tion, indie artists are on the rise.

With bands like Wet Leg commanding the world’s attention despite being signed to indie label Domino Record ing Co., there’s no doubt more indie artists will rise in popu larity in the upcoming year. The Rockhound predicts indie artists will become more prom inent than ever before, with a heavy focus on layered guitar progressions.

Looking at the reemergence of indie artists

Vinyl was responsible for 38.3% of all physical and digital album sales in the U.S., MRC Data and Billboard report. Vinyl accounted for 50.5% of all physical albums, with around 41.77 million sold in 2021, up 51.4% from 27.55 million the year before.

In spite of the popularity and ease of streaming and downloading music digitally, tangible forms of music, such as CDs, vinyl records and cassettes, are growing in sales and getting wider distribution.

of the year. Over the same period in 2021, 18.8 million were shipped.

As of July, music fans had bought more than 19 million vinyl records for the year. U.S. vinyl sales rose 22% in the first half of the year, according to the Recording Industry Association of America’s mid-year music revenue report. As of September, the number of vinyl records shipped climbed 15.7% to reach 21.8 million records for the first half

The Rockhound predicts vinyl will round out 2022 with more than 50 million sold in the U.S., accounting for 60% of all physical album sales—not bad for a medium once on life support.

Kendall Polidori is The Rockhound, Luckbox’s resident rock music critic. Follow her reviews on Instagram and Twitter @rockhoundlb.

Vinyl will continue to go viral.Indie rock duo Wet Leg of the Isle of Wight has taken the music industry by storm this year with hit singles that include Chaise Lounge and Wet Dream

Afew years ago, Shevy Smith and Khalid Jones opened an artist development company in Los Angeles to work directly with musicians to release and promote their music. But they soon realized the barrier in music promotion. Spotify was releasing about 40,000 songs every day. Now, it’s more like 80,000.

“I’ve always found it puzzling,” says Smith, “that for such a creative busi ness, there are still only two or three paths that people can take for artist discovery or for artists to get their music heard by an audience.”

That’s why she and Jones came up with incen tivized listening. It’s the intersection of music, tech, gaming and lotteries, and it’s being released as The Ultimate Playlist.

It’s powered and owned by the Arizona State Lottery and was developed by Elite Shout, a music tech and production company. Think of it as a free app available for users 18+. It will provide “devel oping artists with a viable channel for reaching new fans and valuable data about how their music is being consumed,” according to a press release.

The app also awards a minimum of $2,000 a day to 18 lucky winners and offers a chance to win a $20,000 jackpot.

The creators raised $2 million from The Arizona Lottery to finance The Ultimate Play list, a sum they say covers the cost of develop ment, prizes and marketing. A patent is pending.

The heart of The Ultimate Playlist is in incen tivized listening, Jones says, which means users get something in return for listening to music.

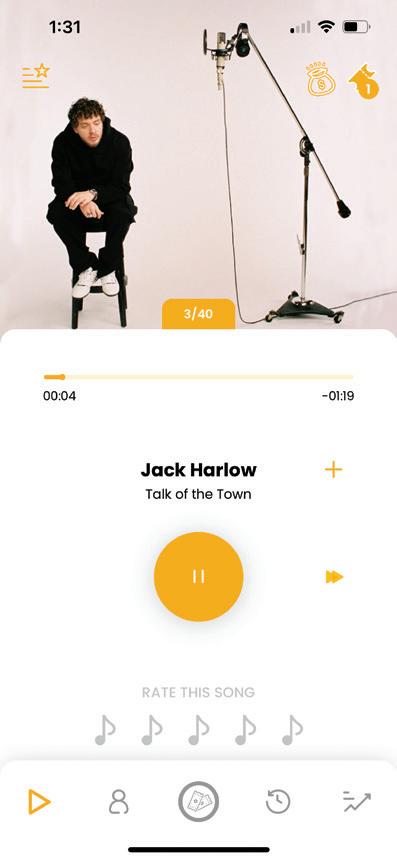

Every day, a playlist of 40 songs will appear on the app, and the more users listen, the more tickets they earn. The tickets go into that day’s raffle. They’re not required to listen more than they want, but engaging in the maximum yields more chances to win. It’s for anyone from a casual listener to a dedicated, engaged player and listener.

However they’re categorized, users earn one ticket for listening for 30 seconds. Hearing an entire song earns three tickets. Adding a song to a playlist outside the app, such as Apple Music, earns another two tickets. Eight tickets win the daily cash draw, but the Ultimate Payout provides a $20,000 jackpot. Each month that no one wins the jackpot, another $5,000 is added.

“So, if you listen to 30 seconds of half a playlist, you get one entry into [the jackpot], and it’s in a Powerball style to pick your lucky numbers,” Smith says. “And then if you listen to 30 seconds of all 40 songs, you get two more entries. So for no money down, you get up to three chances a day to win $20,000, which is pretty significant.”

For the first few months of opera tion, the team behind the app will choose the 40-song play lists. Smith says they have come up with a formula that takes into account each musical genre’s market share in the indus try. She says the playlists will also have a good blend of new and under ground artists, as well as more popu lar artists.

By curating the playlists, Smith says they’ll be able to collect solid data points that identify an artist’s listeners. After the first few months, artists and their teams will have the opportunity to submit songs to appear on the playlists. That creates “incremental wins” for both musi cians and listeners, she notes.

“It’s creating a buzz,” Smith says. “When you’re in that middle class of artists, it can be hard to generate that kind of engagement every day.”

Artists spend part of their promo tional budgets to get songs on the app, and then that money goes back to the listeners. “That’s something that hasn’t been part of the music

landscape before,” Jones says.

“Up until now,” he continues, “a listener was just viewed as a consumer of a product, and we’re sort of turning that on its head by saying, ‘No, you can be part of that ecosystem, too.’”

Besides exposure to more fans, The Ultimate Playlist provides multiple benefits for musicians, Jones says. Having only 40 songs on a playlist each day puts indie artists on the same ground as stars like the Red Hot Chili Peppers, whose new songs might appear on the playlist.

The playlist is also guaranteed to attract human beings who are potential fans who might buy concert tickets. It’s not a 15-second TikTok but instead a “throwback to when people would listen to full songs,” Jones says.

That exposure and support for artists is important to Smith and Jones, but so is the inter section of industries.

“It shows that you can think creatively,” Jones says. “A lot of times [Smith] and I look at the music industry, which is inherently creative, and sometimes the solu tions don’t seem that creative.”

But for Jones, the playlist represents something new. “I think part of the importance,” he says, “is that there are different industries that you can choose to work with to reach your customer. The idea to use your listening as the currency itself is novel.”

The Ultimate Playlist, a mashup of the newest in music, gaming and lotteries, is easy enough to understand.

You listen to music, earn tickets, and automatically become eligible for a daily cash drawing of $2,000 and a chance at the Ultimate Payout Jackpot, which is starting at $20,000.

Your account is free. You just provide your name, phone number, email address, a username of your choice, birthdate, gender and zip code. About the only requirement is that you must be 18 years old or older.

Each day, a playlist of 40 songs appears on the homepage. Users can easily play, pause, save or skip songs, but it allows skipping only six songs in an hour. The app automatically assigns tickets and chances for the drawings based on how long you listen to a song or how many songs you hear. There’s no extra step to earn prizes.

Musicians range from the little-known but up-and-coming to familiar names like Jack Harlow, Elvis Costello and Blur. Put another way, the playlists furnish listeners with a taste of new music and artists to explore, while still offering something they might already know and enjoy. The playlist blends genres and eras.

In its purest form, The Ultimate Playlist is ideal for music discovery, with a bonus in possible cash prizes. It’s free from labels and specific aesthetics, making each song a surprise. The hope is it doesn’t stay too broad or impersonal. It’s about discovering art, not winning a ticket.

To promote the discovery of an artist, the app might need to create a variety of playlists with different “vibes.” That could encourage listeners to stick around for more than the chance of scoring some cash.

jackpot.

What gets measured, gets managed. Know the five key fitness performance indicators.

By Jim Schultz

By Jim Schultz

Do you want to get into the best shape of your life in 2023? Let’s take a data-driven approach to that objective and get a jump on everybody who’s waiting until Jan. 1 to get started.

There’s a saying in the business world that “what gets measured, gets managed.” In other words, whatever you track and record is what you ultimately prioritize.

Without knowing your situation, it’s impossible to give you a perfectly customized protocol for getting into shape. But if you start with these suggestions for handling five key performance indicators (KPI), you’ll build a firm foundation—one you can adjust later.

Most people have no idea how much they’re eating or how that food is broken down into its parts: protein, carbohydrates and fats. If you’re serious about getting into shape, you can’t leave nutrition to chance.

Instead, track everything you eat. Start by consuming 1 gram per pound of bodyweight in protein, 60 to 70 grams of fats and the remain der in carbohydrates to reach a daily caloric intake of 12 times your body weight. When your progress slows (see Fighting Fat), start pulling 5% to 10% from carbs and fats for the week and reassess.

Very simple—lift weights three to five times a week. Do eight to 12 working sets per muscle group per week, with six to 15 reps per set. If you like train ing with heavier weights, lower the number of reps per set. With lighter weights, increase the reps per set.

Or, if you’re knocking on death’s door like I am (age 41), just do what ever your joints will allow.

The important thing is that you’re consistent and put some oomph into your sets. So, ensure every working set approaches at least three to four reps from failure.

If you like cardio, do it. If you don’t like it, don’t do it. It doesn’t matter.

The important thing is that your body is moving, so keep it simple and just track your daily steps. Start with an easy goal: 5,000 steps per day. Work your way up to 5,500, then 6,000, then 7,000, then 8,000.

Drink half your body weight in ounces of water per day—minimum. Not only will you feel amazing and alert, but all the calories you’ll burn after running to the toilet every 45 minutes will shave at least a week off your total dieting time.

Sleep seven to eight hours a night— minimum. Yeah, I know, you’re the busiest person the world has ever known. I don’t care. Do it.

Each week, you should lose about 0.5% of your body weight, on aver age. The progress will not be linear, with big losses in the early weeks and little progress at the end. If you stall for a week, don’t change anything. If you stall for two weeks, start cutting your fuel sources (carbs/fats).

It’s tempting to try to go faster but don’t. In the same way a rubber band builds tension as you stretch it, the harder you push with your calories, training and activity, the greater the potential snapback. You can undo weeks of progress in one late-night pizza bender.

There you go. The plan is set. Now, all that’s left is to do the work.

Jim Schultz, Ph.D., a derivatives trader, fitness expert, owner of livefcubed.com and the daily host of From Theory to Practice on the tastytrade network, was named North American Natural Bodybuilding Federation’s

Calories are simply units of energy, and each component of a calorie commands its own caloric demands. Protein is 4 calories per gram, carbohydrates are 4 calories per gram and fats are 9 calories per gram.

Determine your caloric intake needs by multiplying your body weight by 10-12 if you’re looking to get leaner, or 13-15 if you’re looking to get bigger.