The PAC works toward progressive outcomes on legislative issues affecting CPAs, educates legislators about matters that are important to the CPA profession, and keeps MACPA members informed. Your contribution will help ensure Maryland CPAs have influence in Annapolis and build a vibrant future for the CPA profession.

MEMBER SERVICES

Lauren Baker Sydney Glen

PEER REVIEW

Cora Edwards

PROFESSIONAL DEVELOPMENT

Natalie Antonakas

Kelly Brown

Chris Dougherty

Emily Trott

SPONSORSHIP / ADVERTISING SALES

Amy Puente

Krislyn Suljak

2022–2023 BOARD OF DIRECTORS

Herbert J. Geary III, CPA, CGMA Chair

Christine Aspell, CPA Vice Chair

Thomas White, CPA, CGMA Secretary/Treasurer

Lexy Kessler, CPA Immediate Past Chair

Karl Ahlrichs, SHRM-SCP, SPHR, CSP

Maxene M. Bardwell, CPA, CIGA, CIA, CFE, CISA, CITP, CRMA

Elise Brouillette, CPA

Michael Kimbrough, Ph.D., CPA

Kimberly Mustard, CPA, CGMA

Dave Ryan, Esq., CPA (retired)

Brett Sanders, CPA

Savedra N. Scott, CPA, CGMA, CrFAC, MSA, MBA

Rebekah Brown, CPA CEO

Skip Falatko, CPA CFO

Bill Sheridan, CAE CCO

Mary Beth Halpern Director Technical Services/ Regulatory Affairs

Dee Sullivan Director of Learning

First, the bad news: Our profession’s pipeline is a problem — a potentially huge problem.

The AICPA’s 2021 Trends Report found that on a national scale, fewer students are studying accounting in college, and only 30 to 40% of those who do actually plan to pursue a CPA designation — something that 60% of accounting graduates did just a few years ago.

That means fewer accounting professionals for you to hire. “Total hiring of new accounting graduates for accounting and finance functions by U.S. CPA firms in 2020 decreased by 10% from 2018 and was down to 27,751 from a high of 43,252 just six years earlier,” the Journal of Accountancy reports (https://bit.ly/ TopFirmIssues).

Maryland is feeling the pain as well. The number of new Maryland CPAs who have earned their designations this year is 392 — that’s down from 634 just five years earlier.

Most leaders hear these numbers and rightfully worry about their ability to recruit and retain new employees. Studies show that staffing and talent are among the most pressing issues facing CPA firms of all sizes.

But concerns about our profession’s shrinking pipeline extend well beyond recruitment and retention. In a recent Washington Post article (https://bit. ly/CPAshortage), Bloomberg reporter Adrian Wooldridge studies the causes of our pipeline issues and reaches one inescapable conclusion: A dearth of CPAs is a threat to capitalism itself.

“The obvious result of the talent shortage is an erosion in the quality of audits,” Wooldridge writes. “Public companies are finding it harder to get accountants to audit their books and, when they do

find them, must often work them harder. Important checks are skipped, and errors go unnoticed. If companies are late filing, then they risk running afoul of the SEC; if they include errors, then they risk fines and adverse market reaction. Even small errors can lead to a plunge in stock prices.

“The chances that U.S. regulators will catch errors, or worse, are arguably also being reduced by the shortage of accountants,” the article continues. “The SEC faces an attrition rate of more than 6%, with a growing proportion of the work done by temps. Poorer oversight increases the likelihood of another Enron out there: a big company that is playing fast and loose with its finances and will eventually collapse, bringing economic havoc in its wake.”

So yes, we have some issues to overcome. That brings me to the good news: Some really smart and talented people are working on some creative solutions.

For years, the AICPA has spent considerable time, talent, and resources on a number of programs designed to address the pipeline issue. Initiatives like CPA Evolution, “Start Here, Go Places,” and “This Way to CPA” have joined the list of AICPA programs, scholarships, diversity / equity / inclusion efforts, and committees that are focused on bringing more talented people into the profession.

In addition, the Center for Audit Quality has launched an initiative called Accounting+, a national marketing campaign designed to strengthen the

“Our profession will thrive going forward through purposeful, transparent collaboration that recognizes that a rising tide will raise all boats.”

accounting and finance pipeline. What sets this initiative apart from others is, in a word, money. The CAQ and its partners are planning to invest $50 million in the program over the next two years.

Accounting+ is also unique in that it is aiming to increase the profession’s diversity at the same time it fills our pipeline. During a recent presentation to the MACPA Foundation’s Board of Directors, CAQ Vice President of Operations and Talent Initiatives Liz Barentzen said the initiative is focused particularly on reaching Black and Latinx students, more than 80 percent of whom are open to the idea of pursuing accounting as a career but may lack interest or passion in the work itself. “This campaign is about shifting perceptions and providing resources that can explain what accounting is … and what it isn’t,” Barentzen told us.

You can learn more by visiting JoinAccountingPlus.com or watching this video at vimeo.com/747110757

The MACPA Foundation is keenly interested in these projects and lending its support where appropriate, because the success of these initiatives are victories for our profession. They speak to what I believe are two of the most critical tasks facing our profession: creating a more diverse and inclusive profession, and recruiting and training our next generation of leaders.

MACPA CEO Rebekah Brown puts it this way:

“These issues go far beyond the reach of any one firm or corporation, and beyond any association. Our profession will thrive going forward through purposeful, transparent collaboration that recognizes that a rising tide will raise all boats. We are a critical piece of the infrastructure that supports our economy, and our world. Having the talent to serve and maintain that infrastructure is essential.”

The MACPA Foundation’s initiatives are focused not only on maintaining but strengthening that infrastructure in a number of ways, including:

• Providing learning opportunities and scholarships for students and young professionals and resources for the educators who teach them.

• Advancing the diversity, equity and inclusion of the profession to ensure all voices are heard and respected.

• Facilitating mentorship connections to increase growth, success, and engagement in the profession.

Our profession, and perhaps our economy itself, depend on these efforts. I hope you’ll take a moment to visit MACPA.org/ Foundation and learn more about the MACPA Foundation’s important work — and that you’ll consider joining that effort by contributing time or money to the cause.

More than ever, we need your support to help ensure the vitality of the CPA profession in Maryland and beyond for years to come.

Editor’s note: The following article originally appeared in the Aug. 29, 2022 online edition of The Journal of Accountancy. It is reprinted here with permission.

BY ALISTAIR M. NEVIUS, J.D.

The budget reconciliation bill, P.L. 117169, known as the Inflation Reduction Act, was signed into law on Aug. 16. It includes numerous tax provisions, including new corporate taxes. It also contains numerous clean-energy-related tax incentives, and money for IRS enforcement and other initiatives.

Earlier budget reconciliation bill proposals were known as the Build Back Better Act

and had included much more far-ranging tax provisions, most of which did not make it into the bill as enacted. The enacted bill, for example, makes no change to the $10,000 SALT deduction cap; earlier versions had proposed to increase the cap. Earlier proposals to increase the child tax credit, extend changes to the earned income tax credit, and tax high-income individuals were also abandoned.

Late in the Senate negotiation process, proposed changes to the taxation of carried interests were also dropped.

The enacted bill features a wide array of nontax provisions, many aimed at promoting clean energy initiatives. The act also includes prescription drug pricing reform.

Here is an in-depth look at the tax items in the act.

Legislation promises increased IRS funding, climate protections. What does it mean for tax professionals and their clients?

The act introduces a new corporate alternative minimum tax (AMT). The last corporate AMT was repealed by the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, in 2017.

The new corporate AMT is based on book income rather than taxable income. Specifically, it imposes a 15% tax on the excess of the corporation’s adjusted financial statement income over its corporate AMT foreign tax credit for the year. The new corporate AMT applies only to certain large corporations, specifically corporations (but not S corporations, regulated investment companies, or real estate investment trusts) with average annual adjusted financial statement income of more than $1 billion for the three consecutive tax years ending with the tax year, or, for members of certain foreign-parented multinational groups, where the combined annual adjusted financial statement income of all members of the group is $1 billion for three consecutive years and the member has average annual adjusted financial statement income of more than $100 million.

A new Sec. 56A defines “adjusted financial statement income.” It generally means a corporation’s net income (or loss) as set forth in the taxpayer’s applicable financial statement, as defined in Sec. 451(b)(3). Adjusted financial statement income is reduced by the amount of tax depreciation deductions the taxpayer claims when calculating taxable income for the year.

Sec. 56A also provides for general adjustments for other situations such as financial statements that cover different tax years, consolidated financial statements of related entities, and corporations that are partners in a partnership. Also, adjustments are made for certain items of foreign income, for effectively connected income, for certain taxes, and for other items.

The new corporate AMT generates a minimum tax credit under Sec. 53 that the taxpayer can then use against regular tax liabilities in future years.

The act introduces a new corporate AMT foreign tax credit in Sec. 59(l). The corporate AMT foreign tax credit is available to taxpayers who claim a foreign tax credit.

The new corporate AMT is effective for tax years beginning after Dec. 31, 2022.

The AICPA has expressed concerns about basing tax liability on the nontax criterion

of book income. The two have several distinct “key conceptual differences … including the concept of materiality,” a letter the AICPA wrote to congressional tax-writing committee leaders on Aug. 4 stated. “Public policy taxation goals should not have a role in influencing accounting standards or the resulting financial reporting. Independence and objectivity of accounting standards are the backbone of our capital markets system.”

In addition, the AICPA said, the provision will introduce new and substantial complexities to tax law that “could result in uncertain results to taxpayers and a costly compliance requirement.”

The act introduces a new 1% excise tax on corporate stock repurchases (new Sec. 4501). Covered corporations must pay the tax on the fair market value (FMV) of any stock the corporation repurchases during the tax year. A “covered corporation” is any domestic corporation, the stock of which is traded on an established securities market. Special rules apply for the acquisition of stock of certain foreign corporations.

The amount taken into account for purposes of the tax is reduced by the FMV of any new stock issued by the corporation during the tax year.

ownership plan, or similar plan.

The tax also does not apply where the total value of stock repurchased during a tax year is $1 million or less.

The excise tax applies to repurchases of stock after Dec. 31, 2022.

The act extends through 2025 the rule allowing the Sec. 36B premium tax credit to taxpayers whose household income exceeds 400% of the poverty line.

The Sec. 25C nonbusiness energy property credit is extended through 2032 and is renamed the energy-efficient home improvement credit. The credit now equals 30% of the sum of the amount paid or incurred by the taxpayer for energyefficient improvements installed during the tax year, the amount of residential energy property expenditures paid or incurred by the taxpayer during the tax year, and the amount paid by the taxpayer for home energy audits. (Previously, the credit equaled 10% of the amount paid or incurred for qualified energy-efficiency improvements plus the amount of residential energy property expenditures paid or incurred by the taxpayer during the tax year.)

The amount of the 25C credit is changed from a $500 maximum lifetime credit to a credit of up to $1,200 per year. Certain limits also apply to the credit for purchases of certain types of qualifying property and home audits.

The modified Sec. 25C credit is available for property placed in service after Dec. 31, 2022.

The act extended the Sec. 25D residential energy-efficient property credit through 2034 and renamed it the residential clean energy credit. Qualified battery storage technology expenditures are added to the list of qualifying expenses.

The excise tax does not apply to stock repurchases that are part of a reorganization under Sec. 368(a) in which no gain or loss is recognized by the shareholder. The excise tax also does not apply where the repurchased stock is contributed to an employer-sponsored retirement plan, employee stock

The act also extended the Sec. 45L new energy-efficient home credit through 2032. The amount of the credit is increased, and various modifications are made to the energy savings requirements. The changes apply to dwelling units acquired after Dec. 31, 2022.

The act modified the $7,500 Sec. 30D credit for electric vehicles in several ways. First, it changes the name of the credit to the clean vehicle credit. It also imposes

“The Sec. 25C nonbusiness energy property credit is extended through 2032 and is renamed the energy-efficient home improvement credit”

a requirement that the final assembly of the vehicle must occur in North America (effective Aug. 16, 2022). The act also removes the limitation on the number of vehicles eligible for the credit, so electric vehicles purchased from manufacturers that had formerly reached their cap will now be eligible for the credit. However, there are price caps, so the credit is not allowed for cars with a manufacturer’s suggested retail price over $55,000 or for vans, SUVs, or pickup trucks with a manufacturer’s suggested retail price over $80,000.

However, the act imposes a new requirement that a percentage of critical minerals used in the car must have been extracted or processed in the United States or in a country with which the United States has a free trade agreement or recycled in North America. This requirement phases in and applies to 40% of such minerals before 2024 and to 80% after 2026. A percentage of the battery components for the vehicle must also be manufactured or assembled in North America. This requirement applies to 50% of a battery’s components before 2024 and phases in until it applies to 100% of a battery’s components after 2028.

The credit is allowed once per vehicle (and includes a requirement that the taxpayer include the vehicle identification number on the return). Also, the credit is not allowed for taxpayers whose modified adjusted gross income (MAGI) exceeds certain thresholds ($300,000 on joint returns, $225,000 for heads of household, and $150,000 for single taxpayers).

The changes to Sec. 30D are generally effective for vehicles placed in service after Dec. 31, 2022 (the final assembly requirement, as noted, was effective when the law was enacted). The credit will expire after 2032. Taxpayers who purchased a clean vehicle or entered into a written binding contract to purchase a clean vehicle between Jan. 1 and Aug. 15, 2022, but placed it in service on or after Aug. 16, can elect to have the former Sec. 30D credit rules apply to that vehicle.

The act also creates a new credit for used clean vehicles (new Sec. 25E). Qualified buyers can claim a credit of up to $4,000. Their MAGI must be under $150,000 on joint returns, $112,500 for heads of household, and $75,000 for single taxpayers. The sales price for the used vehicle must be $25,000

or less. The used clean vehicle credit applies to vehicles acquired after Dec. 31, 2022.

The act also creates a new credit for qualified commercial clean vehicles (new Sec. 45W). The credit equals the lesser of 15% of the basis of the vehicle or the “incremental cost” of the vehicle. For commercial clean vehicles with no gasoline or diesel engine, the credit amount is the lesser of 30% of the basis of the vehicle or the “incremental cost.” The incremental cost is the amount the cost of the commercial clean vehicle exceeds the cost of a comparable gasoline or diesel-powered vehicle. The credit cannot exceed $7,500 for vehicles with a gross vehicle weight under 14,000 lbs. and cannot exceed $40,000 for all other vehicles. The commercial clean vehicle credit is effective for vehicles acquired after Dec. 31, 2022.

The Sec. 30C alternative fuel vehicle refueling property credit is extended through 2032 and modified. The maximum credit is increased from $30,000 to $100,000. The changes are effective for property placed in service after Dec. 31, 2022.

The act extends the Sec. 48C advanced energy project credit by making allocations for up to $10 billion more in awards for qualified investments, effective Jan. 1, 2023.

The act also creates a new advanced manufacturing production credit (new Sec. 45X) for U.S. production of various photovoltaic cells and other solar and wind energy property.

To encourage the clean production of electricity, the act creates a new credit in Sec. 45Y for the production of electricity at qualified facilities. Qualified facilities (which includes certain expansions of existing facilities) must be placed in service after

Dec. 31, 2024, and have a greenhouse gas emissions rate of zero. New Sec. 48E creates a clean electricity investment credit, effective for eligible property placed in service after Dec. 31, 2024. Qualified facilities under Sec. 48E and 45Y are made five-year property under Sec. 168(e)(3)(B).

The act also creates a clean fuel production credit in new Sec. 45Z for clean transportation fuels produced in the United States. The credit is based on the emissions rate of the fuel compared to a base rate of 50 kg of CO2-equivalent global warming potential per metric million British thermal units. The credit is effective for qualified fuel produced after Dec. 31, 2024.

The Sec. 45 credit for electricity produced from certain renewable sources (including geothermal, solar, and wind facilities) is extended through 2024. The base credit amount is modified. The credit rate reduction for qualified hydroelectric production and marine and hydrokinetic renewable energy is eliminated after 2022.

The Sec. 48 energy credit is extended through 2024 and modified. For certain energy property (defined in Sec. 48(a)(3) (A)(vii)), the credit is extended through 2034. The phaseout of the credit for certain energy property is modified.

Sec. 48 is also amended to provide an increase in the energy credit for qualified solar and wind facilities placed in service in connection with low-income communities.

The Sec. 45Q credit for carbon oxide sequestration is modified and extended. Under the act, construction of a qualified facility must begin before Jan. 1, 2033. The applicable dollar amount for purposes of the credit is modified.

“The enacted bill features a wide array of nontax provisions, many aimed at promoting clean energy initiatives. The act also includes prescription drug pricing reform.”

The act creates a zero-emission nuclear power production credit (in new Sec. 45U). The credit equals 0.3 cents times the kilowatt hours of electricity produced by the taxpayer at a qualified nuclear power facility and sold by the taxpayer to an unrelated person during the tax year, minus a reduction amount. The 0.3 cents amount will be adjusted for inflation. The credit is effective for electricity produced and sold after Dec. 31, 2023.

Several alternative fuel credits are extended through 2024. These include the Sec. 40A biodiesel and renewable fuel credit; the Sec. 6426 biodiesel mixture credit; the Sec. 6426 alternative fuel credit; the Sec. 6426 alternative fuel mixture credit; and payments for alternative fuels under Sec. 6427. The second-generation biofuel incentives under Sec. 40 are also extended through 2024.

The act creates a new sustainable aviation fuel credit in new Sec. 40B, effective for fuel sold or used after Dec. 31, 2022.

The act also creates a credit for production of clean hydrogen in new Sec. 45V, effective for hydrogen produced after Dec. 31, 2022. Alternatively, taxpayers can elect to treat clean hydrogen production facilities as energy property under Sec. 48, in which case no credit would be available under new Sec. 45V or 45Q (the carbon oxide sequestration credit).

The act changed the method for determining the maximum amount of the Sec. 179D energy-efficient commercial buildings deduction. The efficiency standard is also modified — for tax years after 2022, the energy-efficient property will have to be installed as part of a plan to reduce overall applicable energy costs by 25% compared to a reference building under the American Society of Heating, Refrigerating, and Air Conditioning Engineers and the Illuminating Engineering Society of North America’s Reference Standard 90.1-2007, rather than 50%.

The former Sec. 179D lifetime cap on the deduction is generally converted to a rolling three-year cap. The final determination period is extended to four years from two. These changes are effective for tax years beginning after Dec. 31, 2022.

The act also introduces an alternative deduction under Sec. 179D for taxpayers that retrofit property to be more energy efficient. This change is effective for property placed in service after Dec. 31, 2022, if it is placed in service pursuant to a qualified retrofit plan.

Under new Sec. 6417, eligible taxpayers can elect to treat certain energy credits as tax payments. For facilities owned by S corporations or partnerships, the S corporation or partner will make the election.

The credits eligible for this election include:

• The Sec. 30C alternative fuel refueling property credit;

• The Sec. 45(a) renewable electricity production credit;

• The Sec. 45Q carbon oxide sequestration credit;

• The Sec. 45U zero-emission nuclear power production credit;

• The Sec. 45V clean hydrogen production credit;

• The Sec. 45W qualified commercial vehicle credit (for tax-exempt entities only);

• The Sec. 45X credit for advanced manufacturing production;

• The Sec. 45Y clean electricity production credit;

• The Sec. 45Z clean fuel production credit;

• The Sec. 48 energy credit;

• The Sec. 48C qualifying advanced energy project credit; and

• The Sec. 48E clean electricity investment credit.

Under new Sec. 6418, eligible taxpayers generally can transfer these credits (except the qualified commercial vehicle credit) in any tax year to another taxpayer. Any amount paid by the transferee taxpayer must be in cash, is not deductible by the transferee taxpayer, and is not included in the transferor taxpayer’s income.

Both of these provisions are effective for tax years beginning after Dec. 31, 2022.

The limitation amount for the Sec. 41(h) research credit against payroll tax for small businesses is increased by $250,000, for tax years beginning after Dec. 31, 2022.

The Sec. 461(l)(1) limitation on excess business losses of noncorporate taxpayers is extended through 2028. The TCJA limited individuals from using more than $250,000 ($500,000 for married taxpayers filing jointly) of business losses to offset nonbusiness income, but the effective date was delayed. The provision finally became effective in 2021. It was originally scheduled to run through 2026.

The act levies an excise tax on drug manufacturers during periods when they are not in compliance with drug price negotiation requirements imposed by the act, which are designed to lower the price of certain single-source drugs.

Finally, the act makes permanent the Sec. 4121 coal tax to fund the black lung disability trust fund.

The act appropriates approximately $80 billion in funds for the IRS. Funds are directed to taxpayer services ($3 billion), enforcement ($46 billion), operations ($25 billion), and business systems modernization ($5 billion). The act also directs the IRS to study the cost of developing and running a free direct e-file system.

The Congressional Budget Office estimates that the IRS enforcement appropriations will increase federal revenues by $204 billion through 2031.

Before the act was passed, Treasury Secretary Janet Yellen wrote to IRS Commissioner Charles Rettig, directing him that the increased IRS enforcement funds should not be used to increase audits of small businesses or taxpayers with household incomes under $400,000.

Alistair M. Nevius, J.D., is publishing and editorial senior director with the Association of International Certified Professional Accountants.

Two outstanding business leaders have been chosen by the Maryland Association of CPAs as Maryland’s “Women to Watch” for 2022.

The honorees are:

• Renee Collins, CPA, a principal in the Audit and Accounting Department of Ellin & Tucker in Baltimore, in the “Emerging Leader” category.

• Kathryn Klose, Ph.D., CPA, accounting coordinator with Montgomery College, in the “Experienced Leader” category. Launched in 2014 by the American Institute of CPAs, the awards highlight the accomplishments and contributions of women in the CPA profession and demonstrate to emerging female leaders that success is not out of reach.

“We are incredibly proud of this year’s winners — indeed, of all the honorees for this year’s awards,” said MACPA CEO Rebekah Brown, CPA. “They represent the best this profession has to offer, and they serve as role models not only for other women in the profession, but for every accounting and finance professional on the planet.”

“We had 21 total honorees for this year’s awards,” said Herb Geary, CPA, chair of the MACPA’s 2022-23 Board of Directors. “This symbolizes a commitment on the part of every person in this room and once again sets Maryland CPAs apart in a way that makes me proud.”

Here’s a closer look at the winners and honorees in each of the two “Women to Watch” categories:

KLOSE, PH.D., CPA

Dr. Klose is an accomplished faculty and administrator at Montgomery College with more than 18 years of experience in higher education. She possesses a

unique blend of education and work experience with demonstrated success in educational and corporate settings. She is accomplished in the areas of strategic, operational and financial management; program design and administration; curriculum development; online education; educational research; and student learning assessment. She is an expert faculty member who is committed to helping students achieve their educational goals through innovative curriculum design and best pedagogical practices. She is adept at designing, implementing, and teaching various experiential learning models, including competency, project, proficiency, and action-based learning.

Her research has focused on issues of social class and socioeconomic status in educational environments; success of

first-generation and underrepresented college students; educational finance; tutoring and coaching initiatives for learners; employing technology to build richer learning experiences; partnering with external organizations to bring realworld case analyses to the classroom; and issues of ethics and personal integrity in education and carry over in to professional conduct.

Dr. Klose has extensive experience as a thought leader and presenter on topics of importance to the profession, and has been published in several renowned journals and publications.

Other honorees in the Experienced Leader category are:

• Amy Baker, CPA, senior manager with RSM US LLP in Baltimore.

• Robin Booth, CPA, managing principal

of Booth Management Consulting, LLC, in Columbia, Md.

• Marian Brown, CPA, MBA, accounting and advisory services practice leader with OneSource Consulting in Beltsville, Md.

• Michele Chalmers, CPA, principal with CliftonLarsonAllen LLP in Baltimore.

• Nelly Gizdova, CPA, principal with UHY LLP and UHY Mid-Atlantic Advisors in Columbia, Md.

• Angela Lynch, CPA, audit principal with SC&H Group, Inc., in Sparks, Md.

• Maryna Marshall, CPA, managing director with Ernst & Young in Baltimore.

• Sue McGovern, CPA, tax partner with Cohen and Company in Baltimore.

• Maral Nakashian, CPA, co-founding partner of MN Blum LLC in Rockville, Md.

• Laura Shuman, CPA, principal with Gorfine, Schiller & Gardyn, P.A., in Owings Mills, Md.

As a principal in the Audit and Accounting Department of Ellin & Tucker, Collins provides high-quality audit, accounting, tax, and advisory services to some of the firm’s most influential clients. She is a trusted advisor for a wide-range of private business owners, from well-respected, multi-generational, established family businesses to investor-backed, high growth start-up companies.

She is actively involved as a member of the MACPA and the American Institute of CPAs; as a member of the Executive Committee of the Accounting Advisory Board at Towson University; as a member of St. Paul Catholic Church and its Finance Council; as a member of the Finance Committee of Resurrection-St. Paul School; and as a member of the Ellin & Tucker Giving Back Committee.

• Petergay Brown, CPA, senior manager with Booth Management Consulting, LLC, in Columbia, Md.

• Samantha Haines, CPA, director of tax services with Rosen, Sapperstein & Friedlander, LLC, in Towson, Md.

• Alejandra Jensen, CPA, CFE, senior manager, non-profit audit at GRF CPAs & Advisors in Bethesda, Md.

• Sabrina Knott, CPA, CGMA, director of tax and compliance, Enterprise Community Partners, Inc., in Columbia, Md.

• Jacqueline Ray, CPA, senior accountant, Taurus CPA Solutions in Ellicott City, Md.

• Rachael Reiter, CPA, assurance manager with RSM US LLP.

• Christine Stravino, CPA, MS, tax partner with Cohen & Company in Baltimore.

• Brina Zinter, CPA, controller, Maryland Zoological Society in Baltimore.

The 2022 MACPA “Women to Watch” awards were made possible by the MACPA Foundation, which is committed to building a diverse CPA talent pipeline to secure the future of our profession.

EVENT SPONSORS

• Deloitte

• CLA

• RSM

TABLE SPONSORS

• AON

• ADP

• Aronson

• Bookminders

• Booth Management Consulting

• CLA

• Cohen & Company

• Deloitte

• Enterprise Community

• Garbelman Winslow CPAs

• GRF

• GSG

• KET Solutions

• RS&F

• RSM

• SC&H Group

• UHY

The world is in desperate need of more CPAs, and leaders throughout the profession have set out to find them. But here’s the dirty little secret about stocking our profession’s talent pipeline: You can’t find new CPAs. You have to make them. And making them means getting in front of elementary and middle-school students and planting the seeds of a career in accounting while they’re young.

That’s why the MACPA is an official sponsor of Junior Achievement of Central Maryland’s “Biztown” initiative.

“JA BizTown combines in-class learning with a day-long visit to a simulated town,”

the folks at Junior Achievement of Central Maryland explain. “This popular learning experience allows elementary school students to operate banks, manage restaurants, write checks, and vote for mayor. Students are able to connect the dots between what they learn in school and the real world.”

Hopefully, that will lead to more students seeing themselves in these crucial financial roles and aspiring to be CPAs.

To make that happen, we need the help of real-world CPAs like you.

One in five Junior Achievement students follows the career path of their JA mentors or volunteers. As a JA volunteer, that

means you can have significant influence over the career choices these students eventually make — just by spending a few hours with them and sharing with them what life as a CPA looks like.

JA of Central Maryland has posted volunteer opportunities through the end of January. Take a look at the schedule and choose a school, date and time that work best for you.

You’ll be making a huge difference in the lives of Maryland students — and helping to build a stronger profession at the same time.

The American Institute of Certified Public Accountants has received a grant of nearly $120,000 from the Maryland Department of Labor to expand its Registered Apprenticeship for Finance Business Partners in the state.

The funds from the grant will cover instruction-related costs for a minimum of 25 new apprentices.

Through the state’s Apprenticeship and Training Program, more than 12,000 apprentices are registered to be trained in new job skills with 3,879 employers across the state.

“Since day one, Gov. (Larry) Hogan has been focused on utilizing common-sense solutions to grow and expand economic opportunities for all Marylanders,” said Maryland DOL Secretary Tiffany Robinson. “His steadfast support for Registered Apprenticeship has allowed Maryland Labor to not only grow the number of apprentices in our state to an historic level, but also to grow and diversify the industries and occupations that are served by our successful apprenticeship system. Our partnership with the AICPA is a continued step in the right direction.”

The apprenticeship program creates a new path for those looking to pursue accounting and finance careers, while providing employers with a program to help develop, retain, and diversify talent. The apprenticeships combine paid on-thejob training, mentorship at the employer’s site and potential financial incentives to ease employer costs. The AICPA provides online, structured learning for registered apprentices through the CGMA Finance Leadership Program.

“The battle for talent is increasing, making the need for more skilled accounting and finance talent even more pressing,” said Tom Hood, CPA, CGMA, CITP,

executive vice president of business engagement and growth at the AICPA.

“Our apprenticeship combines a world class learning program with mentorship and on-the-job training, which helps employers recruit and grow their own, providing the kind of workplace the 21st century workforce expects – diverse, inclusive, collaborative, and innovative.”

The AICPA’s apprenticeship program, registered in Maryland, is competencybased and flexible, available to new hires and incumbent employees as well as those with four-year degrees and those working on earning their two-year degree. It is the first of its type in the nation for accounting and finance.

“Apprenticeships offer an opportunity to ‘earn while you learn,’ meaning that employees study the CGMA Finance Leadership Program and receive on-thejob training while also earning a living,” said Joanne Fiore, vice president, Pipeline and Apprenticeships, CGMA Americas at the AICPA Association. “And apprenticeships help build a more inclusive accounting and finance team by widening the aperture of candidates to consider. Not every candidate has to have

all the skills, experience and education up front, because the apprenticeship provides the opportunity to gain them.”

Maryland is the first state in which the AICPA has registered its apprenticeship. The AICPA has partnered with the Maryland Association of CPAs to raise awareness of and grow the apprenticeship in the state.

“This apprenticeship is an exciting partnership with the AICPA and the state of Maryland to support more Marylanders, both those seeking to enter the accounting and finance profession and those businesses in need of more talent in this critical area,” said MACPA CEO Rebekah Brown.

The AICPA is also a member of the Greater Washington Apprenticeship Network, a resource for employers seeking to implement apprenticeships.

The first round of apprentices is expected to be registered in the fall. For more information about the apprenticeship program, visit the AICPA’s Finance Business Partner apprenticeship or email ApprenticesUS@aicpa-cima.com.

AuditMiner is trusted in over 33 states by top CPA firms.

Our customers range from sole proprietors to the top 100 firms

a u d i t m i n e r c o m TESTIMONIAL

CUSTOMER TRUST SOC 1 REVIEW TOOLKIT VISIT OUR LIBRARY OF 250+ SOC 1 REVIEW TOOLKITS A v a i l a b l e a t w w w a u d i t m i n e r c o m / s o c 1

A u d i t M i n e r s t a n d a r d i z e s 4 0 1 k r e c o r d k e e p e r a u d i t p a c k a g e s , p r o v i d e s t e s t i n g p o p u l a t i o n s a n d s a m p l e s e l e c t i o n s , i n a w o r k p a p e r f o r m a t t h a t i s c o n s i s t e n t a c r o s s a l l r e c o r d k e e p e r s i n t e g r a t e d

INCREASE YOUR EFFICIENCY " T h i s t o o l e l i m i n a t e s s o m u c h o f t h e t i m e c o n s u m i n g d e t a i l t h a t r a r e l y a d d s v a l u e t o t h e c l i e n t s . Y o u c a n s t a y c o m p e t i t i v e i n t h i s p o r t i o n o f a u d i t w o r k w i t h o u t s a c r i f i c i n g q u a l i t y " C P A P R A C T I C E A D V I S O R T E C H N O L O G Y L A B P O D C A S T

Would it surprise you to learn the U.S. House of Representatives passed a bill earlier this year by an overwhelming vote of 414-5? The same politicians who can’t seem to agree on anything apparently do agree that we need to improve retirement plans and allow people to save more for retirement.

The Senate is currently working on its own version of a retirement bill that includes many of the same provisions as “The Securing a Strong Retirement Act” that was passed by the House. Many have dubbed the new legislation “Secure Act 2.0” and expect the legislation to be passed before the end of the year.

You might remember the original SECURE Act, which was passed back in December 2019, as the bill that pushed back the required minimum distribution age to 72 and eliminated the stretch IRA, among other items. (Read more at LKBenson.com/blog/ securefinal.) This new legislation will expand on some of the changes under the original SECURE Act and add some new items.

Here are some of the major provisions included in the proposed legislation.

Just as we were starting to get used to the change from age 70.5 to 72 for the start of RMDs under the original SECURE Act, it looks like more changes are coming.

Under both plans, the RMD start date would be pushed to 75, but it will likely happen gradually. For example, under the House plan, RMDs would start at:

• 73 if you turn 72 from 2023-30;

• 74 if you turn 73 in 2030-33; and

• 75 if you turn 74 in 2033 or later.

While this will likely cause confusion for many, it also could open the door to additional tax planning opportunities for taxpayers who retire prior to their RMD age.

Retirement plan contribution limits are increased regularly to keep up with inflation, but the additional “catch-up” contributions that are allowed after you reach age 50 have not increased since 2006.

The new proposals would increase these catch-up contribution limits, but the amounts and ages at which you qualify differ between the bills and among different types of accounts. Both bills would also index the catch-up contribution limit for IRAs to inflation.

Under current law, SIMPLE and SEP IRAs are not allowed to accept Roth contributions from employees but both versions of this bill would change that. Matching contributions would also be eligible to be made on a Roth basis, whereas they are currently only allowed on a pre-tax basis.

The House bill also includes a provision that would require catch-up contributions to be made on a Roth basis.

The original SECURE Act expanded access to annuities in retirement plans by adding a safe harbor rule for ERISA fiduciaries in selecting a lifetime income provider.

The SECURE Act 2.0 looks to further expand this access by removing the 25% cap on Qualified Longevity Annuity Contracts (QLACs) in retirement plans and eliminating the barriers to including annuities in plans and IRAs from RMD regulations.

A growing number of taxpayers in recent years have taken advantage of the ability to gift up to $100,000 of their required minimum distribution to charity. This allows non-itemizing taxpayers to still receive a tax benefit from that deduction, as the

amount donated would otherwise have been subject to ordinary income tax rates.

The House bill would index that $100,000 limit for inflation and allow a one-time QCD of up to $50,000 to a split-interest entity such as a charitable remainder annuity trust (CRAT) or charitable remainder unitrust (CRUT).

There are several other provisions included the bills that will impact some taxpayers:

• Increased income limitations for the Saver’s credit.

• Expanded automatic enrollment in 401(k) and 403(b) plans.

• Employer matching contributions based on student loan payments.

• Expanded tax credits for small businesses who set up new retirement plans.

Due to the overwhelming support these bills currently enjoy, we expect something to be passed in the not-to-distant future, but the specific provisions are subject to change.

Chris Benson, CPA, PFS, is an MACPA member, and a principal with LK Benson & Company.

SECURE Act 2.0: What you should know

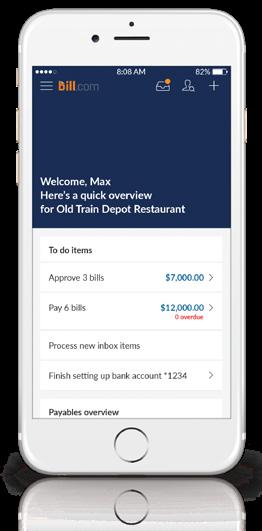

Send Bill.com your

Scan or email your bills to Bill.com. Our automated system takes it from there.

View and approve them online Bill.com routes to approvers and provides one-click access to any needed backup docs.

We pay when you say Bill.com prints and mails the checks or pays electronically & syncs with your software.

Integrates with QuickBooks, Xero, Sage Intacct, Oracle NetSuite, Microsoft Dynamics GP, and Microsoft Dynamics 365 Business Central.

Unlimited online storage of scanned/emailed/faxed bills, contracts, etc.

Automatic routing of bills for internal approval – online or mobile

One-click payment of bills via domestic ACH, international wire, or Vendor Direct virtual card payment

Checks and electronic payments are sent with full voucher/remittance information

Setting permissions and security so the right people can view, approve, pay bills

Ability to view status of any bill, anywhere, anytime – online or mobile

Online access to all cleared checks - searchable by customer/invoice number ?

Automatic sync of vendors, bills, and payments with accounting software

Intelligent Virtual Assistant eliminates data entry by capturing invoice information automatically

Our mobile app gives you 24-hour access to your business so important bills get paid on time.

Get the tools, training, and advice you need for growing your firm with Bill.com. Visit accountants.bill.com to learn more.

© 2022 Bill.com, LLC. Bill.com, the Bill.com logo, and the “b” logo are trademarks of Bill.com, LLC. All other company names and brands are the property of their respective owners.

Too often, many of us in our profession think from a scarcity mindset rather than an abundance mindset.

We think that clients, money, and talent are limited.

For the first time in our lives, there are more jobs than people.

Read that again to fully understand where we are. If every single person who wanted a job had one, there would STILL be job openings.

This means the demand for our services has never been higher. Basic economics says that when demand exceeds supply, the cost of a product or service increases. Therefore, with the abundance of work, it naturally follows that money should also be in abundance, as long as we make the necessary pricing changes.

The voice in the back of your head may have started shouting: “My clients won’t accept a price increase!” Maybe, but here’s some anecdotal data from #TaxTwitter. A couple dozen or more of our colleagues have implemented significant price increases (some in excess of 25%).

Do you know what happened at those firms, my friends? Fewer than 10% of clients left, and the ones that did leave were the aggravating, frustrating, soul-sucking stress creators we have wanted to fire since the first time we worked with them.

The hard part is being bold enough to put the same value on yourself as others put on you.

You can do it. You are worth it.

The pricing change is difficult to navigate mentally. You’re trading the known for

the unknown, which is scary. Think of this: What is the risk of standing still versus the risk of moving forward?

As an example, if you raise fees 10% to 20% and lose 10% to 20% of your clients, your gross revenue is the same.

But you gain at least 10% to 20% of your time back. You can use that reclaimed time to work on a future-oriented firm strategy. You can use the time to talk to your best clients about their business, and likely land a couple of new, exciting advisory projects.

You can use the time to take an extra vacation – rejuvenate your mind, body, and soul. You can use that time to focus on better, cooler, more exciting work (for your firm and for your clients).

You know you’re worth it because you’ve never been busier. The tax code and

accounting rules are ever-changing and have never been more complex. During the pandemic we showcased our ability to be client advisors first and technicians second.

We helped companies stay in business and pay their employees – which ensured that those families could continue to put food on their tables and keep a roof over their heads. You made a powerful impact in your community, and you are worth more than just the compliance you deliver.

Work, clients, and revenue are not scarce resources in today’s climate. You can change the type of revenue you have with far less risk than any time in our profession’s history.

Now is the time to move from compliance first to advisory first.

Historically, we offered services that met the needs of the many in order to have the widest swath of potential clients. However, our resources are limited, both in terms of time and talent, while clients are aplenty. With limited resources and an abundance of work comes the opportunity to redirect what we do with those resources.

Unpopular opinion time: Compliance is dying. It’s not dead yet, but for those of us with 20+ years left in the profession, the landscape of compliance is going to change drastically. I think fewer people will need CPAs for their compliance because more and more of it will be automated by the same regulatory bodies that (almost) guarantee we are the ones who do the work now.

It is not a big leap from where we are today to seeing the IRS automating tax preparation for the majority of the taxpayers, or the SEC (and similar bodies) requiring blockchain-enabled accounting

systems that allow for continuous, automatic, real-time auditing.

Rather than throw our limited resources into the part of our profession that has the shortest life, let’s put those resources to use in the areas where the bots can’t touch us: human-to-human interaction. In other words, advisory services.

To be transparent, we are already performing advisory services for many of our clients – we’re just not calling it that, and we’re not leading with it. We lead with the compliance and then tell the client we can also do advisory. We need to switch the order and make compliance the “addon” part of our offerings.

Earlier, we said we would utilize some of our time we reclaimed to talk with our best clients about how else we could help. And those conversations would lead to interesting, cool, impactful projects. As we do more of those for our best clients, we gain the confidence and experience to lead conversations with other clients and prospects differently. We listen to what their real wants and needs are.

As an example: They need a financial statement for the bank. Why? They’re taking on new debt for an expansion. Why? A segment has grown quickly and they want to capture more of it. Now we’re talking! This is awesome news.

The questions change: What issues have you run into? Where can we best support you? Do you need forecasts, industry projections, M&A analysis for a complementary acquisition? These projects are fun, interactive, lucrative, and don’t all have the same deadline!

By reclaiming your time, you can choose the new clients and projects you spend

your resources on. Eventually you can replace more of the compliance projects with advisory-first clients. You can begin to turn into an advisory-first practice.

Tackling talent scarcity is imperative.

Talent scarcity is a real problem, and it’s not going to get better soon. There are fewer accounting graduates, fewer CPA Exam takers, and a boatload of retiring knowledge. Talent is leaving the profession because the hours and effort historically expected are insane and not worth the level of compensation.

While we may disagree with that individually, the fact remains that people are voting with their feet – and they’re walking out of the profession, not into it. They place a very high value on their time, including their personal/family time.

In this job market, they are in a position to have their demands met. Add in the number of retiring folks and smaller pipeline of incoming professionals, and this is not a trend – this is the new normal.

However, there is opportunity in this threat. Here’s the cool part: This has happened before and solutions were found, just not in our industry. Which industry, you ask? Farming.

A hundred years ago, farming made up roughly 40% of the labor force. Today it is less than 1%, yet the food production is many multiples higher than it was a hundred years ago. How did the farming industry do it? Technology and automation. Two words that we have heard over and over again in our profession. The farming labor force was replaced by machinery that could do the work of tens to hundreds of humans.

We are there now with technology available to us today, including robotic process automation (RPA), digital workers (bots), and a host of others. We can use them to supplement the fewer number of humans we have available. And we can deploy our human resources in more lucrative ways and on more exciting advisory projects. We can mitigate the labor scarcity through technology and automation.

“Change the way you manage your time to enhance value, increase talent retention, and move toward expanded advisory services”

To be fair, fighting the war for talent with technology does not directly free up your time. However, by utilizing technology and automation, you allow the firm to be intentional about where it spends its time. You can eliminate mundane, repetitive tasks, and replace them with review and analysis of those tasks. You elevate what your people are doing, and their role becomes advisory by default because they are looking at the output to find meaning for the client.

Reclaim your time by redistributing it to higher value services that your staff enjoy working on. You and your team can choose the clients and projects that bring the most value to the firm, and the most value to you personally. Turn this threat of a talent shortage into an opportunity to maximize your resource deployment and redirect your firm to the future.

How we’ve historically filled capacity that technology has created, and how we should look at filling that capacity as a future-oriented firm

In the hundred-plus years of our profession, we have consistently filled the time that technology and automation have created with more clients and work. In the past,

clients and work have been scarce. This approach made sense. Many firms were very successful by following it.

However, now is different than the past. Stop filling the capacity with more work. Every time we say yes to a new project, we say no to something that is vital to our business’s success. And, yes, we are running a business. It is time that we started filling the time with high priority, future-oriented items. To change where we are going, we have to change our behavior.

Utilize the capacity you create to spend some significant time working on your firm’s strategy to evolve into a futureoriented firm. The strategy sessions may include topics such as technology stacks, automated workflows, new employee benefits, non-geographic talent retention and attraction strategies, new service lines clients want, firm profitability, and succession plans, among others.

While there is a lot on this list, there are resources to help you. You can utilize a business/leadership coach to facilitate firm retreats and regularly scheduled accountability check-ins. Many of these coaches can also help with change management, which is a very real, human

issue that must be a part of any strategy.

To connect strategy with talent retention, bring your team into the firm strategy sessions with some of the capacity you created for them. Let them know you value their opinion, that they will be here to execute and drive the strategy. That helps your succession plan because they are your succession plan. They’re more engaged in the firm direction because they have a say in it.

Ultimately, the major issues facing the profession are still issues in the profession because we lack the time to address them. Take the steps to reclaim your time, so you can work on your business. For the first time, work, clients, and revenue are not scarce resources. You can change the direction of your firm with far less risk than any time in our profession’s history. Use this time of prosperity to redirect your firm to the future.

Michael Maksymiw Jr., CPA, is the leader of April’s Firm Foundation, an alliance of small and mid-size CPA and advisory firms, and chair of the Connecticut Society of CPAs’ Board of Directors.

Do you know your firm’s value? We can help! Understanding what your firm is worth is a great place to start. We know your market and have buyers ready to purchase. We offer a personalized approach to every deal. Our listings receive national exposure and our proven processes throughout the course of the sale have helped over 300 firm owners achieve the “win-win” deal they were looking for.

Editor’s note: The following article originally appeared in the online edition of Financial Management magazine, a publication of the Association of International Certified Professional Accountants. It is reprinted with permission.

BY NEIL AMATOHigh inflation leads to concerns about how organizations price products, but it can have several “second- or third-order effects” that organizations should consider and attempt to mitigate through risk management.

Richard Chambers was the president and CEO of The Institute of Internal Auditors for 12 years before stepping down in March 2021. Now, he continues to advocate for the internal auditing profession as a senior adviser at AuditBoard.

Chambers and Financial Management’s Neil Amato had a conversation recently about inflation and risk. Here is an edited version of that interview.

Inflation in the u.S. Hit 7% in late 2021, the highest year-over year change in almost 40 years. How do you think finance risk managers should react to higher-thannormal inflation?

Richard Chambers: Well, it’s a point that continues to resonate within our profession, that there just isn’t a lot of experience of operating in this environment. If you think about it, it’s been 40 years. I call myself a Jurassic auditor. I have a few Jurassic buddies, and we’ve been talking a lot about what it was like back then.

What were the challenges and the issues? I came into this profession even earlier than the high-water mark for inflation. I came in in 1975, and we were already battling inflation that far

back, and it only got worse. At one point, it actually went up to 13%. As bad as things are right now, they’re not as bad as they were back then.

But the point is, there’s just not a lot of experience in facing these kinds of risks. I think it behooves us to draw on whatever information we can as to what we might expect. Assessing risk is always as much art as it is science, and there’s a lot of subjectivity that goes into it. No one is going to have a precise, scientific answer of what the risks are that we’re going to face, but there are some pretty good indicators based on history.

Besides that rise in the cost of so many things that consumers see, such as prices at grocery stores or hotels, what are the risks for organizations posed by high inflation that maybe we haven’t thought about?

Chambers: Well, the obvious overarching risk is margin. When you have surging costs and prices, you’ve got an immediate challenge there to the margins that you need to have to maintain profitability and to create value on behalf of your shareholders and stakeholders. Really, it’s almost from that monolithic risk that inflation presents to companies that all other risks flow.

Some of the things that I’ve been talking about within the financial management community is our own ability to effectively budget and forecast. Budgeting and forecasting is a very critical responsibility that falls on financial managers. How do you

budget when prices are surging and costs are growing at almost unprecedented rates?

It requires you to have a much more forward focus as you look at what the economists are forecasting. What are they saying we’re likely to encounter in the months ahead? Then budgeting, of course, is more of a periodic effort, but forecasting is almost continuous, so you have to recognise the risk there.

The CFO and their teams are at a disadvantage just as the auditors are, because we may have audited or they may have undertaken their responsibilities during a healthy economy, maybe even recessionary periods, but inflationary periods offer us some different experiences.

Then beyond that, just managing the surging costs and other expenses. The early stages of this inflationary cycle presented some really extraordinary price increases, but the deeper we go into the cycle, I think the more pervasive some of their price increases are likely to become.

I think management, guided by advice from financial managers, needs to make strategic decisions when it comes to things like talent. What are we going to do about retaining talent in the face of inflation, when other companies maybe are being more aggressive at raising salaries and creating a more enticing environment for our talent? We have to be careful about that.

I can remember all the way back in the day when cost-of-living increases were very much a norm. In fact, I remember that the federal government in 1980, I think it was, gave us two 6% cost-of-living increases in less than 12 months. It had to do that because of the way the prices were growing.

Management needs advice from financial managers on raw materials purchased, management of infrastructure, and I think even, eventually, capital. There are a lot of things that I think we have to be mindful of as financial managers and the advice that we need to be able to give those who we serve.

I could get into a lot more detail on some things like debts and leases and rental agreements and hedging and budgeting and so forth, but those are, at a very high level, some of the things that I think financial managers need to be concerned about — and the auditors, too.

How should pricing decisions be determined? Do companies have to actually say, “We might need to take a hit so that we don’t have to raise our prices too much.” Is that the art and science thing that’s going on right now with high inflation?

Chambers: Well, absolutely. Most guidance out there, most experts are quick to advise against blanket, across-the-board price increases. Because first of all, it just fuels more inflation, but even more to the point of the success of a company, if

you’re seen as being too aggressive in raising prices, it will have a detrimental effect on your customer relationships. You have to really look at, what are the services or goods that we’re selling where the price of raw materials is increasing the most aggressively?

You need to be thinking in terms of margins on a more finite basis rather than, I’ve got to maintain a margin for my entire company.

You need to be saying, “These are the things that we’re providing where prices or cost of raw materials or the cost of our third-party services are going up most rapidly.” That’s where you need to focus on price increases.

Are there other factors that you think are important to mention regarding pricing decisions?

Chambers: I would say that one should be cognisant of forecasts regarding raw materials. Let’s say we’re talking about pricing of a manufactured product. If all indications are that the price surge is not going to be long term and we’re just seeing a spike in it, then I think you have to be more judicious about increasing your prices. That’s where you may, as you alluded to a few minutes ago, “take a hit” as far as you may have a period where your margins on that particular product or service aren’t going to be as great.

But you have to also be mindful that the economists who are out there are really in many ways not even in agreement on this inflationary cycle.

What I recommend is this idea of triangulation. I’d be looking at several sources, and I wouldn’t be dependent upon any single one.

I think that’s a good rule, multiple sources of information. We remain in a high-inflation environment. What are the risk mitigation strategies organizations should embrace if they haven’t started doing them already?

Chambers: All risks really should emanate from your organization’s objectives. What are the enterprise objectives? Then, look at what those risks are likely to be. I think we also have to be mindful of the second- and third-order effects of inflation.

Talent management — clearly, we’re already starting to see some pressure there as we’re in the midst of the Great Resignation, and we’re still trying to get back to office work from our COVID experience. But I think as the cost of living increases, people are going to be seeking to maintain their own purchasing power. I think we will see more pressure on wages in the coming weeks and months than we maybe have already seen.

Supply chain disruption — our suppliers are going to be facing the same kind of challenges that we do. Let’s say I’m at an enterprise in financial management. I need to be recognizing that our suppliers are going to be facing the same headwinds with inflation we’re facing, and we’re already seeing a supply chain disruption from the COVID years. What’s going to happen when our suppliers are not able to get raw materials

CONTINUED FROM PAGE 23

at affordable prices and they’re going to be impacted on their production?

I think fraud is another interesting second- and third-order risk. As you start to see pressure on your employees in terms of their cost of living and the kinds of pressures that come with that, I think you tend to have an environment where there’s maybe a little more enticement to cut corners and maybe do some things fraudulently. I would say fraud risk is another risk that I would be looking toward on the horizon.

Capital market volatility — certainly, we’ve already started to see that, and this really is an event that I think is likely to create another set of risks entirely. As policymakers increase market rates as early as next month, that’s going to put another degree of pressure in terms of overall pricing in the market. Those are some other things that I would be thinking about.

Who benefits from high inflation?

Chambers: I think inflation has a double-sided coin. Obviously, it creates challenges and risks, but it also creates opportunity. Revenues will likely be going up across the board because of price increases and so forth. Even in the public sector — I spent a good deal of my career in the public sector — tax revenues are often tied to prices, salaries, all kinds of metrics that will be going up. It’s not uncommon to see revenues for public-sector agencies going up as well.

Of course, their costs are going to also be going up. What you hope is that your costs aren’t going up more rapidly than the revenues that are being generated. I would say from an individual standpoint, the pressure comes on your prices going up. That can be mitigated by your salaries going up, but there’s often a lag time between when those happen. The same then extends into the corporate sector.

You have to try to stay as far ahead of the inflationary pressures as you can. But if everybody’s doing that, then it’s a self-fulfilling prophecy and just generates more inflation.

Talent management is one of those second- or thirdorder effects that maybe people aren’t thinking about. What do they have to be doing besides being ready to offer more pay to their workers?

Chambers: When it comes to talent management, we have to be thinking about the fact that money isn’t the only incentive. I’m watching with fascination as some companies are being really hard-line on their return-to-the-workplace requirements while others are maintaining a lot more flexibility.

If I’m making a decision as an employee between where I’m working and someplace else and maybe my company is willing to offer

me a cost-of-living increase, the other company maybe it’s not as aggressive on that, but I’m going to weigh everything. I’m going to say, “OK, I don’t have to do as much travel to the workplace. That saves costs, saves me fuel and commuting expenses.” All of those things factor in. I think the mistake that any company would make at this point is looking at talent management very onedimensionally. It really is far more complex than just how much you pay people.

If inflation starts going back down, what kind of changes should organizations make? Are they undoing things, or what is different when it’s going the other way that it has been?

Chambers: It will happen. It’s not a matter of if. Inflation will go down. Question is how long this inflationary cycle is going to last and how much pain we’re going to endure until it gets back under control. But I would think that as we go through this inflationary cycle, we will start to learn more about some of the fundamentals of our business.

I think those things that we learned, the wisdom that we derive from the marketplace and how consumers behave, and how welloiled our own internal operational mechanisms are, I would hope that we can use that after the inflationary cycle to be more efficient and more effective and make wiser decisions. There are so many facets to this that it really is a fascinating topic. I think it is starting to get attention. Although, I think a lot of people are still dealing with what they consider to be the more immediate risks, but we’re clearly well into an inflationary cycle that we haven’t seen the likes of in a long time.

I guess it’s possible that those organizations that have been hesitant to bring people back to the office but are now seeing their building rents going up, they may actually go back to remote work. I don’t know if you’re hearing any examples of that, but it seems like a realistic thing right now.

Chambers: We’ve seen a lot of companies during the pandemic make the decision to change their fundamental workplace model. I’ve seen companies giving up leases on their workplace and telling everybody they’re going to be working virtual.

Commuting costs have always been a part of any personal or family budget. Once those are down, that takes a bit of the pain out of the inflationary cycle. But as I said earlier, there are still so many other factors that go into employee satisfaction and comprise good talent management and strategy.

Amato is a senior editor with the Association of International Certified Professional Accountants.

Put a leader to work for you

Serve a wide range of clients, with over 5,700 forms and more than 25,000 error diagnostics for strong accuracy.

Power up your productivity

Tap into 32 built-in timesavers that help pros like you save an average of 46 minutes on every complex return.*

Gain cloud advantages

Get built-in layers of security, automatic backups and updates, and strong IT support with Hosting backed by Intuit.*

Visit IntuitAccountants.com/TryLacerte2022 to explore more and try it free.

Or call 833-239-4893 to get your custom recommendation in minutes.

*See important notes: Time savings based on an Intuit study of tax professionals who primarily used Lacerte software in tax year 2020. Hosting for Lacerte is a monthly subscription. Additional terms, conditions, limitations, and fees may apply.

Over the last few months, Boomer Consulting has been working on upgrading our meeting space on the Plaza in Kansas City into a complete hybrid solution.

It’s an important project because remote and hybrid work isn’t going away. A survey by Capgemini Research Institute shows that one-third of companies expect 70% or more of their employees to work remotely in the coming years.

Hybrid work requires different tools and technology than on-site or fully remote work. People need to be able to move seamlessly from home to office and back again. You may have meetings or events where some employees are together in a conference room while some are on a video conference. While the virtual experience may never be completely on par with the in-person experience, you want to narrow that gap as much as possible.

I don’t want to get too specific on the technologies we’re using — in many cases, we’re still investigating and evaluating solutions. However, I thought it would be helpful to share some considerations to keep in mind when setting up hybrid workspaces for your team members.

When offices shut down in early 2020, many people brought their office equipment home or used personal devices to perform their company work. While everyone did what needed to be done in a crisis, that haphazard approach isn’t viable long term.

We recommend that firms provide everything from the desk up. In other words, employees provide their desk, chair and other office furniture while the firm provides the laptop, camera, screens, etc.

A uniform setup makes it easier for your IT team to assist when needed and ensures your team members have exactly what they need to connect to their workflows and with each other.

When people are on-site, they still need to be able to meet with employees and clients wherever they are in the world. So how do we create that collaborative space?

At the most basic level, employees need a camera, microphone, and a computer or laptop that can connect to Zoom or Microsoft Teams.

But larger meetings with both in-person and remote attendees might need a little more thought to be truly collaborative. Some ideas to consider include:

• Video displays — TVs or projectors and screens — to bring remote attendees’ faces into the room.

• Audio systems so on-site people can hear remote participants.

• Microphones to capture audio

• Cameras that intelligently track speakers.

Remember, the size of the room matters. A big conference room needs a big solution, while a small conference room with a single table doesn’t need to be that elaborate.

Chances are you’ve been in a meeting with a handful of in-person participants and one or two people calling in on a conference phone. In most cases, the people calling in have difficulty hearing what’s happening and knowing who’s speaking. Meanwhile, the on-site attendees forget about the caller.

Putting some thought into your hybrid meeting setup can help avoid that disconnect by leveling the playing field for all employees regardless of where they might be.

Chris Rochford is a technology and business analyst for Boomer Consulting Inc.

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles.

–Cantor Forensic Accounting, PLLC

Trusted by accounting industry professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere.

The accounting world is shifting. With technological advancements and new services like Client Accounting Services, accounting firms are changing their revenue streams and creating more profitable practices.

Adding CAS to your firm’s services can help increase revenue, reduce client churn, and provide a stable foundation for your firm to grow. Here’s your opportunity to learn more about how CAS can benefit both your firm and your clients.

A common misconception about CAS is that it is merely outsourced bookkeeping. While bookkeeping is one of the services that CAS provides for your clients, it’s not the only one. CAS also includes:

• Financial statement preparation

• Accounts payable and bill payment management

• CFO / controller advisory services

• Budgeting and forecasting

• Payroll services

The goal of CAS is to provide your clients with a range of supportive accounting services, including timely insights, to help them become more successful.

CAS isn’t just good for your clients, it’s also a win for you. Here are four reasons more accountants are starting to offer CAS to their clients.

CAS is more than just a side project for your firm. If managed properly, it can become a primary driver of annual revenue.

In fact, a 2020 CPA.com survey reported the median revenue a firm sees from offering CAS is over $1.1 million annually (read more at bit.ly/CASgrowth).

By utilizing technology, it’s possible to automate and digitize timeconsuming processes. For long manual processes like write-ups or after-the-fact processing, you can save as much as 95% of your time by implementing CAS.

When clients choose to use CAS, you become a central part of their company. You gain insights into every aspect of their organization and can help guide your clients who are looking for that extra layer of help. Because you have intimate knowledge of their company, clients may start to rely on you for important financial and business insights when making crucial decisions. Your role changes from being just an accountant to being a trusted financial advisor.

4. Consistent source of revenue

Tax season continues to be a major source of revenue for many accounting practices, but it’s extremely seasonal. This can create major swings in revenue and cause long-term budget problems.

When you offer CAS and use fixed monthly payments for each of your clients, you change your annual structure. Instead of having peaks and valleys caused by relying on tax season, you’re able to have a consistent, stable, and predictable source of revenue every month.

WHY IS CAS GOOD FOR YOUR CLIENTS?

CAS helps your clients have access to professional accounting services they wouldn’t be able to afford otherwise. Here are three of the biggest benefits your clients will see when they choose to use CAS.

1. More informed decision making

Your clients who choose to use CAS are able to leverage your experience and knowledge about finances, the market, and general accounting practices to make better decisions. When your clients have access to unbiased information, they can make better choices for their company because they have a realistic idea about the status of their company.

2. Reduce costs

A full-time accountant is expensive, and not always necessary for small and medium-sized businesses. CAS allows your clients to have all of their accounting needs met without having to pay salary and benefits for an accountant.

3. Save time

Without an accountant on staff, it falls to a company’s leadership to manage and organize its finances. Because they’re not trained in accounting, they make more errors and it takes longer to process even simple tasks. CAS removes all of that worry from leadership and executive teams, freeing up their schedule to focus on what matters, instead of getting stuck in piles of accounting paperwork.

It can feel intimidating to roll out a new service like CAS because it’s new and requires some investment of time. But you’re not alone.

If you’d like more resources and information about how to build your CAS practice, we’re here to help. Visit AccountantsWorld. com/MACPA to learn more about our award-winning CAS software and special discounts for MACPA members.

Client engagement is an important component of the work accountants do, and it can be tricky, even awkward, to navigate. Whether it’s sending a client proposal or an overdue invoice, there is a delicate balancing act between keeping a client happy and providing honest and direct feedback. And this balance must be maintained to provide the best services possible.

Accountants, or anyone in the professional services world, offer their time and experience to clients, which is intrinsically tied to the price of their services. If that scope and pricing are not properly communicated, it can lead to confusion and awkwardness later.

These awkward conversations are a reality of the industry, but avoiding them at all costs will not only negatively affect your client relationships, but also adversely impact the financial and human aspects of your accounting firm.