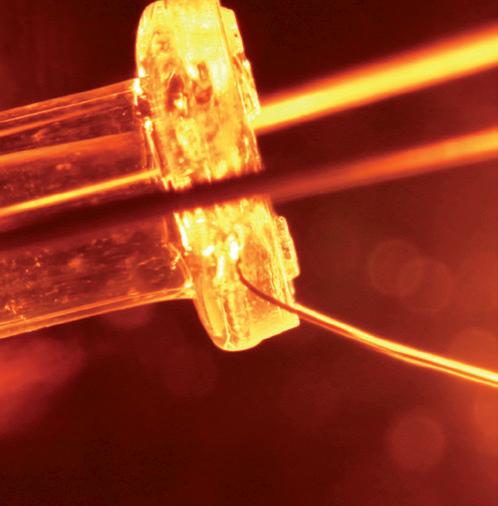

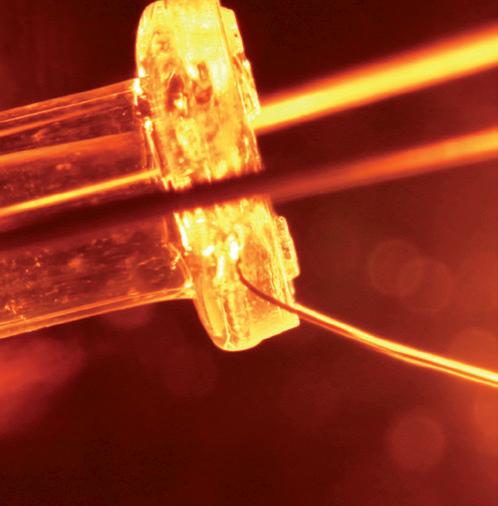

BLOWING A FUSE

We examine the reasons why complaints in the energy sector are up 300 per cent, and highlight what firms need to do in order to break the circuit and re-engage customers

CLEANING UP CONSUMER CREDIT –WHAT CONSUMER CREDIT FIRMS NEED TO DO TO AVOID THE WRATH OF THE FCA

CREATING BRAND FANS –IS YOUR COMPANY DOING ENOUGH TO ENCOURAGE CUSTOMER ADVOCACY?

GOING FOR GOLD –OLYMPIC- WINNING STRATEGIES TO IMPROVE COMPANY PERFORMANCE

Summer 2014

4

Blowing a Fuse

What energy firms need to do to break the circuit of service complaints and how to re-engage customers…

6 Going for Gold

How to develop and sustain the best possible results drawing on key performance principles

10

Cleaning Up Consumer Credit

We examine what action will be required from consumer credit firms hoping to avoid the wrath of the FCA

14 Creating Brand Fans

Grant Leboff asks, is your organisation doing enough to encourage advocacy?

Insight 2 CONTENTS SPRING/SUMMER 2014

Now that the dead hand of PPI is fading the media spotlight seems to have shifted from the banks’ behaviour to that of the UK’s energy rms and with seemingly good cause. After all, with complaints against energy providers tripling in the past year, and Ofgem admitting that since 2010 it has imposed £100 million in nes and redress for various rule breaches – including £39 million for mis-selling – it goes without saying that rms operating in this sector need to roll their sleeves up. Amongst the strict new conduct rules Ofgem has introduced as part of its Retail Market Review is a requirement for rms to publish yearly statements to show what actions they are taking to treat customers fairly. This type of evidentiary burden will leave suppliers with nowhere to hide as they will need to show how they are applying the lessons learnt from customer feedback to drive service improvements and many will nd that their current systems and processes are not equipped to deliver this type of insight. Above all, it is time for energy rms to have their own light bulb moment and wake up to the fact that listening to, and acting upon, the issues causing their customers to complain or, worse still, switch to another provider, should not have to be driven by Ofgem. The bene ts of identifying and xing the root cause of customer concerns go far beyond compliance alone and, in an increasingly competitive market, it will be those rms who recognise this and adapt accordingly that will be the winners in the customer retention battle in the long run. Of course, getting this right often requires a strategic step-change, and in this issue we o er some practical advice on how it can be achieved. As always, this publication is for you and our aim is to address the present and future business challenges you face. If you have any feedback, comments, or suggestions for future topics you would like to see included, I’d love to hear from you.

Sherelle Folkes Editor sherelle.folkes@charter-uk.com

Sherelle Folkes Editor sherelle.folkes@charter-uk.com

WELCOME Editor SHERELLE FOLKES Designer MATT DETTMAR Sub Editor HELEN HUGHES Contributors ANDREW ALDRED TOM BARRY PAUL CLARK MARION HARRISON MICHAEL KAHN GRANT LEBOFF ROBERT MANDELL Contact Us Charter UK, 2nd Floor, Ashley Park House, 42-50 Hersham Road, Walton-on-Thames, Surrey, KT12 1RZ +44 (0) 845 5 198 960 enquiries@charter-uk.com Spring/Summer 2014 CLEANING UP CONSUMER CREDIT –WHAT CONSUMER CREDIT FIRMS NEED TO DO TO AVOID THE WRATH OF THE FCA BLOWING A FUSE We examine the reasons why complaints in the energy sector are up 300 per cent, and highlight what firms need to do in order to break the circuit and re-engage customers CREATING BRAND FANS –IS YOUR COMPANY DOING ENOUGH TO ENCOURAGE CUSTOMER ADVOCACY? GOING FOR GOLD –OLYMPIC-WINNING STRATEGIES FOR EVERYDAY SUCCESS Insight_2014_Spring-Summer_OFC-OBC.indd 16/05/2014 15:32

3

BLOWING A FUSE

As energy complaints reach record levels and customers start voting with their feet, Paul Clark, CEO, Charter UK, looks at what will be required by those firms hoping to buck the trend.

Following last year’s Retail Market Review, suppliers in the energy sector have been tasked with meeting strict new standards of conduct in order to ensure that domestic consumers receive fairer treatment. More importantly, Ofgem now requires suppliers to demonstrate exactly how they are achieving this goal, across the entire organisation, at every level.

But is this tough stance really working?

Figures released by Ombudsman Services show that complaints against UK energy providers have tripled in the past year, as consumers become less tolerant of poor service – and more willing to contact the Ombudsman Service for Energy (OS:E) if they’re unhappy with how the provider has handled their problem.

For rms operating in the energy sector, simply ignoring these complaints will be a costly mistake. Starting this year, Ofgem will force suppliers to introduce standard charges for all energy tari s, which will reduce the competitive distinctions between providers and elevate quality of

service to be a key di erentiator. As such, e ective complaint management will not only be essential for avoiding nes and reputational damage, but will also be vital for attracting and retaining customers within an increasingly competitive market But where should companies begin?

First, rms operating in this sector need to make it much easier for consumers to contact them – starting right now. They must also respond to all complaints promptly and act courteously to put things right. However, even this won’t be enough to satisfy Ofgem.

Energy companies must also now publish statements each year that clearly show what actions they are taking to ensure that customers are being treated fairly. Firms that fail to comply with these new standards of conduct will face steep (and increasing) nes, since Ofgem has con rmed its commitment to delivering credible deterrence by ensuring visible and meaningful consequences for businesses that do not comply with its rules.

“FOR FIRMS OPERATING IN THE ENERGY SECTOR, SIMPLY IGNORING THESE COMPLAINTS WILL BE A COSTLY MISTAKE.”

Insight ENERGY

4

COMPLAINTS

For this reason, from 1st June 2014, Ofgem has decided to place a greater emphasis on deterrence when imposing penalties for future breaches. This is likely to mean a substantial increase from the levels of penalty that it has typically imposed to date.

This sharp focus on consumer protection is likely to create some major challenges for energy rms, as rising complaint gures in this sector are the result of problems in three key areas: people, platforms and processes. The latter two are relatively simple to rectify with the right approach, as many companies simply lack the platforms and processes they need to identify key trends and to conduct an e ective root cause analysis of the problems being reported.

The problem is that most complaints management solutions simply aren’t able to handle the vast amount of diverse data collected from across the business, which makes it very di cult to extract any useful business intelligence (BI) from that data. As a result, it’s more or less impossible

to identify any key trends or to conduct an e ective root cause analysis of the problems being reported.

However, despite the di culties posed by disjointed platforms and inadequate processes, the rst issue – people – is without a doubt the hardest to tackle as it requires a culture change driven from the very top of the organisation. All too often, we see that it is the fear of punitive action that precipitates action in this area, rather than a real desire to put the customer rst.

In our experience, enlightened rms in other sectors don’t need to be forced to adopt this approach, as they understand the economic and reputational gains to be had by making this area a priority. By integrating the voice of the customer into the business, energy providers will soon nd that there is extraordinary value to be gained from customer feedback – including signi cant cost bene ts. As a result, this focus on customer feedback will not only make customers and the regulator happy, but will also save the company money operationally; it’s a win-win situation.

Unless rms in this sector are able to adopt this approach, complaint volumes will continue their upward trend and rms will pay the price – not only in terms of punitive nes, but also through irreparable damage to their reputation.

As such, if Ofgem really wants to show it means business and drive down complaints in this sector, this is where it should be focusing its attention and, where necessary, exing its regulatory muscle. Otherwise rms will simply continue to treat the symptoms, rather than the disease.

Ofgem clearly wants to see much greater openness, transparency and analysis of complaints across the board so that suppliers can understand what is causing their customers to complain and then act on it. In order to achieve this goal, however, organisations in this sector will need to use the lessons learnt from customer feedback to drive service improvements. Otherwise, the same issues causing dissatisfaction today will still be there tomorrow. issues causing dissatisfaction today

5

GOING FOR

There’s an apocryphal story –of which I’m sure you’ve heard a version – about a visitor to the NASA Space Centre in the late 1960s. On his way to see the latest Apollo space project, the visitor fell into conversation with a cleaner, sweeping the oor of a long corridor. “What do you do here?” asked the visitor. “I’m helping to put a man on the Moon,” came the direct reply. I’m still not sure if this story has any truth in it, but I do know that I’d like to run an organisation where all employees – no matter what they do – can link their contribution to its ambitious goals. Someone – probably that cleaner’s manager or supervisor – had done a wonderful job in connecting what we call the ‘Crazy’ goal of the organisation to the daily activities of a person who keeps the house clean and tidy.

If I came into your business today and repeated the question to your customer service teams, your front line sales, your support sta – what answer would I get? Would I meet men and women who are clear about the motivating Crazy goal of the business and the signi cance of what they do? Or would I nd employees who can’t see beyond the end of the keyboard or the headset – simply doing what’s in front of them rather than what will make the boat go faster?

The word we use for this challenge in your business is leadership. Although a much debated concept and practice, leadership is a key market di erentiator between newer organisations, each with broadly similar access to people, technology and capital. It’s also a marked competitive advantage that helps exceptional and established companies

Whether you are trying to improve your customer service or your business performance as a whole, Tom Barry, Director of Will It Make The Boat Go Faster, believes that applying the ‘team ethic’ of Olympic athletes in your organisation will take you to the top.

“THE RECESSION FORCED MANY ORGANISATIONS TO RE-EVALUATE THEIR STRATEGY TO SURVIVE; COMING OUT OF IT SHOULD MEAN ANOTHER LOOK AT WHAT IT TAKES TO THRIVE. IF YOU HAVEN’T YET DONE SO, DON’T DELAY ANY LONGER.”

GOLD Insight 6 KEY PERFORMANCE SKILLS

stay exceptional. And leading brands stay leading for so long, year after year.

You’ll instinctively recognise one of the core attributes of leadership of any customer service or sales function from your own experience – knowing what’s important and focusing everyone’s e orts on the goals that will make the boat go faster. Yet Will It Make The Boat Go Faster’s latest survey (see www. willitmaketheboatgofaster.com) revealed that only 16 per cent of respondents are fully clear on their organisation’s Crazy goal. Who are the 8 out of 10 employees who admit to not being clear on your excitements and ambitions – your Crazy goal? Are you one of them? Why is that, and what can you do about it?

The Olympic story and leadership

As Ben Hunt-Davis (pictured right) is the rst to admit, winning an Olympic Gold medal (in Sydney in 2000) is a relatively straightforward a air when compared to the complexities of many businesses. It’s a straight 2000m course, a well mapped out process to get to the nal and nine men all

intently focused on one clear objective –that Gold. But intently focused on one clear objective they were.

Yet it’s our experience that many leaders are too easily led into believing that business is fundamentally di erent from sport. That there’s little to learn from an experience like Ben’s. Or, even if leaders are willing to see the parallels, they’re not sure how to distil the principles of Olympic performance onto a busy sales oor, into a customer service team or within a complex marketing function.

Ben and I set up Will It Make The Boat Go Faster? in 2013 in order to do exactly that. We led – right from the start – the process that produced our own daunting, signi cant and engaging Crazy goal. That we will be ‘the UK’s most respected performance consultancy by 2017’. In capturing our equivalent of ‘putting a man on the Moon’, we’re far clearer on what’s important in our business. Far clearer on what Concrete goals we need to put into place to support that. And what we need to do, each day, to close the gap and make our boat go faster.

7

Start with yourself

It’s not a bad time, as we look towards the second half of 2014, to think about what you can do to lead and engage your team or organisation. So where can you start?

Start with yourself. How clear are you on your Crazy goal? When did you last clarify your team’s equivalent of putting a man on the Moon? And how long since you last gathered the team around you to hear your excitements and energy about what you’re leading them to do?

Effective leaders firstly focus on what’s important for their organisation (and next, interestingly, for themselves). They clarify, test, challenge and isolate what are the most important goals to focus on, and why these are important. They mix the aspirational,

the emotional and the practical, and when they’ve done this, they help everyone understand them. Quite rightly, leaders work hard to align the contribution of each individual with the Crazy goal. The NASA floor cleaner, after all, had to know what the purpose of his organisation was as a foundation for his connection. But don’t underestimate the focus and direction that you need to provide as the leader to have each person understand what will make the boat go faster.

Let’s give you some of our thoughts and experience on what you might do to help the men and women in your organisation make the boat go faster.

Set a clear direction. Engaged employees align their interests with organisational goals. That can’t happen if the organisation’s Crazy and Concrete goals are not defined or clear. The recession forced many organisations to re-evaluate their strategy to survive; coming out of it should mean another look

Insight 8 KEY PERFORMANCE SKILLS

“FOCUS ON DOING THE RIGHT THINGS, AND DOING THEM BETTER EVERY TIME CAN DRIVE REAL CHANGE IN YOUR LEADERSHIP.”

at what it takes to thrive. If you haven’t yet done so, don’t delay any longer. A clearly communicated strategy and goals also builds workforce confidence in you – which reinforces your trustworthiness as a leader.

Help employees discover ‘what floats their boat’. Engaged employees not only understand what needs to be done but also care enough to apply discretionary effort. As a leader, go first and declare your motivations and what’s in it for you to achieve the Crazy goal. Then ask them to discover the same. It can be an intriguing and uplifting process but to know why we’re all in the boat together is one of the foundations for high performance.

Focus on the performance as a leader – and the results will come. Sitting at the start of an Olympic final is much like starting a new sales year. The results you’re after will only come from doing the right things, better every time, throughout the year. What attitudes and behaviours do you need to focus on as a leader? How can you be sure to measure your progress throughout the year? How can you set a culture of challenge, to make sure you get better every time? Dreaming of hitting your Crazy goal is one thing. But leading yourself and others to perform better every time instils an attitude and belief that brings the right results, often later in the year.

Work with your direct reports –and have them work with each other.

It’s often tempting to do it all alone. As a leader and as a team member. Working with others to achieve your goals is a fundamental concept behind Will It Make The Boat Go Faster? and one that challenges my basic maths. 2 + 2 really does equal five!

Raise your own stakes. Size up your own leadership. Be clear on how you’re performing. Understand what drives you. Leadership is a contagious, uplifting and confidence-building role; it’s something you just can’t fake. If you’re not ready to lead yourself and your team to your Crazy goal, make some changes. List out the key changes you need to make to raise your performance – and set a plan to deliver on them.

Finally, keep your leadership a daily priority.

It’s challenging to deliver again and again, more and more, smarter and smarter in today’s competitive businesses. But remember our earlier comparison with an Olympic final. Focus on doing the right things, and doing them better every time can drive real change in your leadership, your teams and your organisation.

If you lead with your Crazy goal and improve your performance every day, bit by bit, you’ll soon succeed in creating the organisation or team you’ve always thought possible – but weren’t quite clear how to achieve. You’ll soon have your boat going faster!

www.willitmaketheboatgofaster.com

9

CLEANING UP CONSUMER CREDIT

Regulatory compliance can make or mar an organisation so it’s not surprising that consumer credit firms are already beginning to feel the heat as they adapt to the Financial Conduct Authority (FCA)’s strict enforcement regime and a regulatory landscape radically different from what they experienced under the Office of Fair Trading. Confronted with a regulator with far more ‘teeth’ than the previous incumbent, the biggest challenge for around 50,000 consumer credit firms will be how to avoid risk and penalty by ensuring their systems and processes meet the FCA’s exacting standards.

Therein lies the problem: whilst almost every firm is well aware that the rules have changed – and may even know what they need to do to comply – many still don’t know how to do it. Therefore, firms need to start by looking very closely at their internal processes, systems and tools –and then ask themselves whether they are actually ‘fit for purpose’ according to the FCA’s requirements.

The answer to that question will be vital, since the systems that underpin how customers are treated can now make or break the firms operating in this sector. The FCA is far more demanding than the OFT in terms of the requirements it places on consumer credit firms. Crucially, consumer credit firms are now in a shifting landscape

so they will need to ensure that they can not only meet today’s compliance challenges but also have the flexibility to meet what may come tomorrow.

Mass exodus

In order to avoid the wrath of the FCA, many firms operating within the consumer credit market will need to fundamentally change how they conduct their business, perform risk assessments, develop their products and treat their customers. The complexity of this company-wide review may mean that many firms will soon find their current systems and processes inadequate for the task of meeting the FCA’s exacting standards.

According to the FCA, these new pressures could result in a quarter of the UK’s payday lenders leaving the market altogether as they struggle to meet its higher consumer protection standards. Of course, the FCA is portraying this mass exodus as a good thing, but many consumers are likely to feel differently.

Whilst many of these firms that leave the industry are likely to be the sharks and charlatans that the press have warned us about, what about the rest? Even though we are seeing a lot of firms in this market being vilified by the media, that doesn’t take away from the fact that a strong market for short-term credit does exist and actually serves a vital role for many people.

Acting proactively

As such, instead of celebrating the closure of a large number of small and medium sized firms in this market, we should concern ourselves with ensuring that those firms which intend to remain operational are able to meet the burden of the FCA’s regulation as efficiently and effectively as possible. Larger firms are better placed to understand and react to these changes quickly; most mid-market firms have never felt the full weight of regulation before and are therefore the most likely to stumble and fall.

For this group, the best place to start is the FCA’s Principles for Businesses, known as PRIN, which are the fundamental obligations that all financial services firms must comply

With a tough new regulator promising that irresponsible firms and bad practice will have no place in the consumer credit marketplace, Paul Clark, CEO of Charter UK, looks at what action will be required from firms to avoid the wrath of the FCA.

Insight 10 CONSUMER CREDIT

with. One principle that the FCA often highlights in particular is principle 6: ‘A firm must pay due regard to the interests of its customers and treat them fairly’, which it commonly refers to as ‘treating customers fairly’ or ‘TCF’.

To support its commitment to TCF, the FCA has a number of consumer outcomes that it wants firms to achieve, and these are at the core of what the FCA now requires from consumer credit firms. For a start, firms will need to demonstrate that the fair treatment of customers is central to their corporate culture and that any products and services marketed and sold in the retail market are designed to meet the needs of identified consumer groups and are targeted accordingly.

“WHILST ALMOST EVERY FIRM IS WELL AWARE THAT THE RULES HAVE CHANGED –AND MAY EVEN KNOW WHAT THEY NEED TO DO TO COMPLY – MANY STILL DON’T KNOW HOW TO DO IT.”

11

Additionally, and more worryingly for many firms, they will need to demonstrate the specific steps they are taking to ensure that consumers are provided with clear information at all times, and are being kept appropriately informed – before, during and after the point of sale – and within a specific time frame. Moreover, in any scenario where consumers receive any kind of advice, firms must be able to prove that the advice they have given is suitable and takes account of their customers’ particular circumstances.

Evidence of change

Along with all of these requirements, consumer credit firms need to keep careful records which prove to the FCA that consumers are being provided with products and services that are of an acceptable standard and in line with customers’ expectations. Firms must also be able to provide evidence that customers are not facing any unreasonable ‘post-sale barriers’ that make it difficult to change products, switch providers, submit a claim or make a complaint.

But how can firms achieve all this? In practical terms, the FCA will want to see clear evidence that firms are integrating all of these consumer protection rules into their business culture, including the specific details of any resources and responsibilities that have been allocated, plans and processes that have been developed, and new capabilities that have been introduced where needed for this purpose. This will also require firms to have management information (MI) systems in place to test – and demonstrate –whether they are consistently treating their customers fairly and delivering the right outcomes for consumers.

At the moment, the main problem is that most credit firms are still managing processes like these with cumbersome paper-based systems, in-house applications, databases and Excel spreadsheets. Again, firms need

to ask themselves: are these tools fit for purpose? Will they make it possible to show clear evidence that all of their decisions, advice, sales promotions, complaint handling and customer information are being conducted fairly for the consumer?

Firms need to consider these questions very carefully and take whatever steps are necessary to bring these tools in line with the FCA’s demands. Aside from meeting key regulatory requirements, this approach will help firms to make improvements in customer satisfaction and increase business profitability by streamlining operations and identifying the root cause of costly problems. The result is a win-win scenario: not only will the regulator be appeased by these changes, but customers will quickly see the benefits as well.

In practice

It may be useful to consider how this process will work in practice. Take a typical payday lender, for example. It will have information flowing in via its call centre, email, mail, and even social media. Some of this will be from existing customers who have complaints, whilst some will be new business and some will be prospects lured in by marketing activity.

This payday lender must be able to absorb this data, from whichever channel it has arrived, and then co-ordinate a response within the FCA’s allotted time frame. If the customer then follows up by phone, the operator that receives the call will need to understand the previous communications with that customer, as well as the next steps prescribed by the regulatory guidance.

Above all, the systems that the company is using must have the ability to record all of these interactions, and make the information available to both internal management and the regulator to prove that the payday lender is adhering to all regulations, whilst highlighting to management any flaws in the system that may need to be fixed or altered.

Insight 12 CONSUMER CREDIT

A change for the better

In terms of compliance, the firms that are willing to up their game in this way and embrace the FCA’s requirements will be able to demonstrate that they are upholding a clear commitment to customers very easily. Firms that want to maintain a viable business in this sector will therefore need to ensure that they have a system in place that allows them to produce a sufficient audit trail, gain visibility of all complaints coming into the business, and to evidence how they are using complaint data to identify and eliminate the root cause of any issues that are causing detriment to consumers.

Whilst this is a worthy goal in its own right, firms also need to accept the fact that the FCA never stands still. As such, firms need to look beyond their current regulatory challenges and instead focus on adopting robust tools and systems that are flexible enough to cope with future changes as well.

Of course, credit firms will need to have a great deal of support on this journey – not only in terms of what they need to do, but also how they need to do it. Therefore, rather than using regulation as a way of penalising the firms that are getting it wrong, the industry should be focusing on educating firms in order to help them get it right. It is all well and good for the FCA to set detailed rules regarding the behaviours that it expects to see – but we also need to provide details of exactly how firms can meet these requirements most effectively.

Charter UK is hosting a series of free of charge industry briefings for consumer credit firms throughout May, June and July on how to implement the FCA rules on Complaints Handling (DISP) and Treating Customers Fairly (TCF). To find out more information or to book your place, call 0845 5198 960 or email enquiries@charter-uk.com

13

“CREDIT FIRMS WILL NEED TO HAVE A GREAT DEAL OF SUPPORT ON THIS JOURNEY – NOT ONLY IN TERMS OF WHAT THEY NEED TO DO, BUT ALSO HOW THEY NEED TO DO IT.”

CREATING Brand Fans

As early as 1967, Professor Johan Arndt from the Colombia Graduate School of Business, identi ed ‘word of mouth’ as “one of the most important, if not the most important source of information for the consumer”. As time marches on, ‘word of mouth’ only becomes more in uential.

The plethora of information to which the web provides access has resulted in ‘o cial’ marketing messages, produced by companies, being seen as less credible and, therefore, less in uential than in any previous age. This, together with the decline of trust in institutions, which has occurred steadily since the 1960s, has meant that we increasingly turn to our colleagues, friends and family for information we trust.

Of course, social proof, that is, what others say and do, has always been one of the most in uential factors in the decisions we make. However, the web, together with digital technology and the resulting rise of social platforms, means that today we can access more ‘social proof’ and with greater ease than ever before.

Of course, word of mouth has always happened face to face, and that is still the case. However, there are two important factors to consider. Firstly, the catalyst for

word-of-mouth conversations was often broadcast media such as TV, billboards and newspaper adverts, etc. Today, a growing catalyst for those ‘word-of-mouth’ conversations is media that we consume ‘online’. Secondly, conventional ‘word of mouth’ and ‘online’ are merging, as more of us post opinions on social platforms and other forums, having conversations online rather than always waiting for a face-to-face dialogue.

Search is going social and the web has become our primary source of information when searching for products and services. The result is that the most important marketers, for any company today, are its engaged community of customers, prospects, partners and suppliers.

The more public support or recommendations – in other words, ‘advocates’ – a company has, the more likely it is to be commercially successful. Rather than

Is your firm doing enough to encourage advocacy?

Regular columnist Grant Leboff, one of the UK’s leading sales and marketing experts, says supporting and providing platforms where your customers can leave reviews should be a pivotal part of your customer engagement strategy.

Insight 14 GRANT LEBOFF

broadcast messages as in yesteryear, marketers today are more like facilitators, creating value, fuelling conversations and encouraging people to become involved with the company. In so doing, it is the participants themselves who become the most e ective communicators of an organisation’s message.

This means businesses have to become masters of particular disciplines. Using social listening tools, a company must learn what its customers and prospects talk about and share. In so doing, it becomes more likely that a company will create content that will be well received and shared by the community it wishes to engage.

Data becomes vitally important in this endeavour as companies track their own content that has the biggest impact and is shared most widely. By obtaining an understanding of what content works, a business can then produce better material on an ongoing basis.

Using data to understand the people most likely to share, and those with the greatest in uence, means a business can invest extra time and resources nurturing these particular individuals.

Businesses should also be encouraging advocacy. That is, supporting and providing platforms where customers can leave reviews. In business to business environments, where companies are engaging face to face with their customers, when a company is given positive feedback it should be asking customers if they would be happy to post a testimonial on LinkedIn or provide a positive Tweet, etc.

Word of mouth has always been vital to businesses. In the past, many companies have left it to chance, hoping that providing a great experience will lead to positive recommendations. Of course, this is still the case. However, on its own, it is no longer enough. Businesses now have to be more strategic about garnering ‘word of mouth’. So, what are you doing to encourage advocacy?

“A COMPANY MUST LEARN WHAT ITS CUSTOMERS AND PROSPECTS TALK ABOUT AND SHARE.”

15

Sherelle Folkes Editor sherelle.folkes@charter-uk.com

Sherelle Folkes Editor sherelle.folkes@charter-uk.com