6 minute read

Education

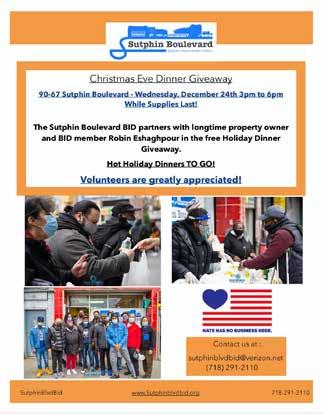

BUSINESS HARLEM COMMUNITY NEWSPAPERS 4 Ways to Uplift Small Businesses this Holiday Season

(Statepoint)

Advertisement

With nearly half of all Americans employed by a small business, these establishments need our support more than ever this holiday season and going into 2021.

According to the latest Wells Fargo/Gallup Small Business Index, 46 percent of business owners surveyed have seen a drop in revenue over the past 12 months, with some entrepreneurs seeing even more severe impact.

Wells Fargo is sharing four ways to brighten the season for small businesses: 1. Shop local. While one-stop holiday shopping on leading e-commerce sites can be tempting, the simple act of purchasing something from your favorite local retailer can go a long way in keeping business afloat and money in your community. Returning or exchanging gifts? Ask for store credit instead of cash. It helps keep money with a small business and makes their cash flow more stable.

Many shops have safety measures in place, such as limiting occupancy or offering contactless pick-up. This year, some cities are even hosting virtual holiday markets, a great way to support local artisans, farmers and more while shopping for loved ones. Check your local chamber of commerce or neighborhood association for details. 2. Eat local. Support your neighbors by dining at locally-owned establishments. Getting takeout or having food delivered? Order directly from the restaurant rather than through third-party sites that take a cut. When it comes to food shopping, opt for neighborhood grocers, which often carry produce from small family-owned farms and other locally-sourced goods. Many offer the same curbside pickup and delivery options as major chains. 3. Uplift diverse-owned businesses. Keep in mind that minority- and women-owned businesses have been hard hit by COVID-19. Many are counting on your patronage right now to help them survive the holiday season and into the new year.

To help entrepreneurs stay open and support local jobs, Wells Fargo is deploying approximately $50 million from its Open for Business Fund to Community Development Financial Institutions across 32 states. The initiative focuses on increasing access to training and flexible capital that businesses can use for rent, utilities, payroll and other business needs. If you are a business owner looking for assistance and resources, visit wellsfargo.com/ shoplocal to learn more. 4. Shine a light on your favorite business. Whether it’s expanding outdoor patios and installing heat lamps or updating tech to facilitate contactless checkout, small businesses have had to get creative to stay relevant. One simple way of supporting businesses as they make these changes is to follow them on social media and give positive reviews on websites like Yelp.

As part of its “Many hearts. One community” campaign, Wells Fargo is highlighting the determination, resilience and creativity that so many small business have shown in 2020.

“Community has meant everything to me,” says Kadijatu Ahene, owner of Dija’s Touch Designs, which benefitted from Wells Fargo and Local Initiatives Support Corporation working together. “The challenges we’re dealing with have brought us closer. Whether its friends and neighbors checking on me and my girls, delivering food and more, COVID has reminded us that we need each other to move forward in unity.”

3 ways you can support the small businesses that make our city a unique place to live:

1

2

3

Shop safely in person or online Buy a gift card Order delivery or curbside pickup

SHOP YOUR CITY

Find options to help you Shop Your City at nyc.gov/supportsmallbusinesses

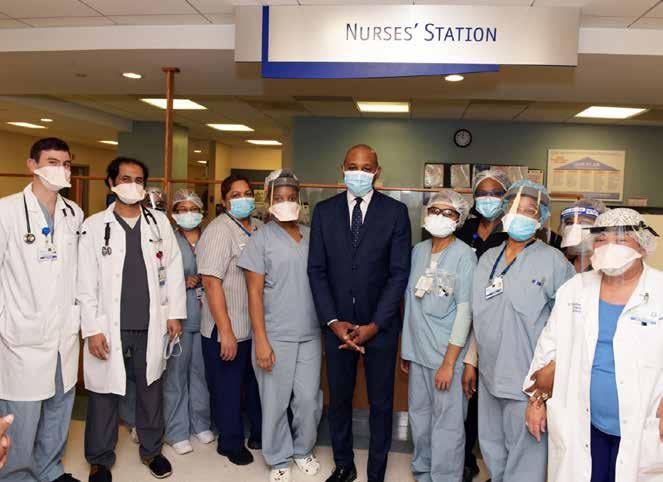

EDUCATION Burdens of COVID Hit Hardest Among Marginalized Students

(Statepoint)

Students are the greatest hope for the future, but for many, their plans are threatened due to burdens posed by COVID-19. Here are just a few of the issues students and families face today, and steps being taken to address these concerns: • The digital divide: Recent images of two Latino children doing their online schoolwork in a Silicon Valley restaurant parking lot calls attention to the deepening digital divide in the COVID-19 era. Nationwide, 16.9 million lack the home internet access necessary to support online learning. A phenomenon known as the “homework gap,” this issue disproportionately impacts students of color. According to the Alliance for Excellent Education, one out of three Black,

PHOTO SOURCE: (c) Drazen Zigic / iStock via Getty Images Plus

Latino, and Native American/ Alaska Native households doesn’t have access to a home internet connection and one in six doesn’t have access to a computer or device. • Housing insecurity: For students in the LGBTQ community, campus closures have sometimes meant the loss of in-school counseling and the support of like-minded, accepting peers. When “home” is an unwelcoming or even unsafe environment, students can be at a greater risk for depression, anxiety, abuse and homelessness. • Educational barriers: Distance learning creates new educational hurdles. With parents taking on an unprecedented instructional role, language barriers for non-English speaking parents can prove significant, like for Asian and Latino immigrants. What’s more, certain programming for students with disabilities, including speech and physical therapy, can be tough, if not impossible, to provide virtually. Lastly, certain learning disabilities can make virtual lessons especially difficult to follow. • Military family and school options: Continued access to quality education has always been a concern for military families, who often have no choice but to send their children to the nearest public school, whether it’s the right fit or not. Today, this problem has grown in severity, as the level and quality of remote instruction can vary wildly among school districts. • Lack of financial resources: Despite the economic disruption caused by the pandemic, colleges and universities are largely maintaining or increasing their tuition costs, leaving financially struggling students and families in a lurch.

Efforts to Help

In the face of today’s many unprecedented challenges, help is on the way. New emergency grants are being provided by organizations like UNCF, Thurgood Marshall College Fund, APIA Scholars, Point Foundation for LBGTQ youth, American Indian Graduate Center, Hispanic Scholarship Fund and Scholarship America for military veterans and people with disabilities. Career sites like Zippia offer annual scholarship lists for students such as this curated list for LBGTQ college students: zippia.com.

Additionally, organizations like Wells Fargo recently completed their new Wells Fargo Student Impact Scholarship in September 2020 to help students impacted by COVID-19. This initiative will provide 200 students with $5,000 each in funds, which could help them cover various costs for their instruction and potentially make the difference in being able to continue their education. Since 2010, Wells Fargo has provided more than $87.8 million across all higher education programs and sponsored events. For additional resources, visit the Beyond College Webinar Series for online training modules for students and recent graduates at collegesteps.wf.com.

While the hardships of the COVID-19 era can make it incredibly difficult to be academically successful or even continue school at all, new efforts are helping close the gap during this difficult time.