Americans’ everyday embrace of eating out and the foodservice sector’s rebound open the door to putting more fresh produce on the menu.

Fresh produce toppings can also help pizza operators stand out.

The pallet industry is adjusting to the new normal of an always changing business environment.

14 FROM THE PAGES OF THE PERISHABLEPUNDIT.COM What Are Grape Innovations Worth?

16 IFPA FOODSERVICE CONFERENCE BOOTH REVIEW

20 FRESH, QUALITY PRODUCE AT HEART OF HIGHLAND PARK MARKET

‘Produce dictates what kind of store you are,’ says Highland Park Market Produce Director Brian Gibbons.

Ocean

Reform

Regional

in the

By paying a little extra attention to garlic, produce departments can move more product.

The foundation items — oranges, mandarins, grapefruit, lemons and limes — have the most tonnage and largest volume.

91 SWEET TREAT: SHOPPERS CLAMOR FOR PEACHES

Even when summer wanes, retailers can still satisfy consumers who love peaches.

Dried apricot suppliers are looking to win this season, with merchandising near produce taking center stage.

Produce Industry

Geography Just One Key Variable For Marketing Produce

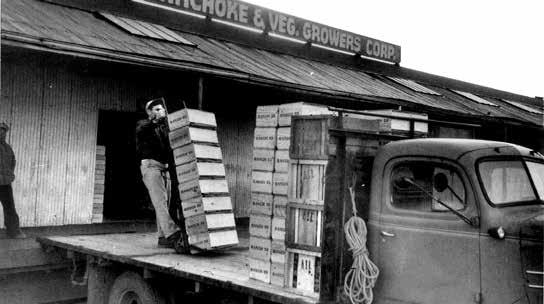

Ocean Mist Farms’ Standard of Excellence Took Root Nearly 100 Years Ago

102 INFORMATION SHOWCASE

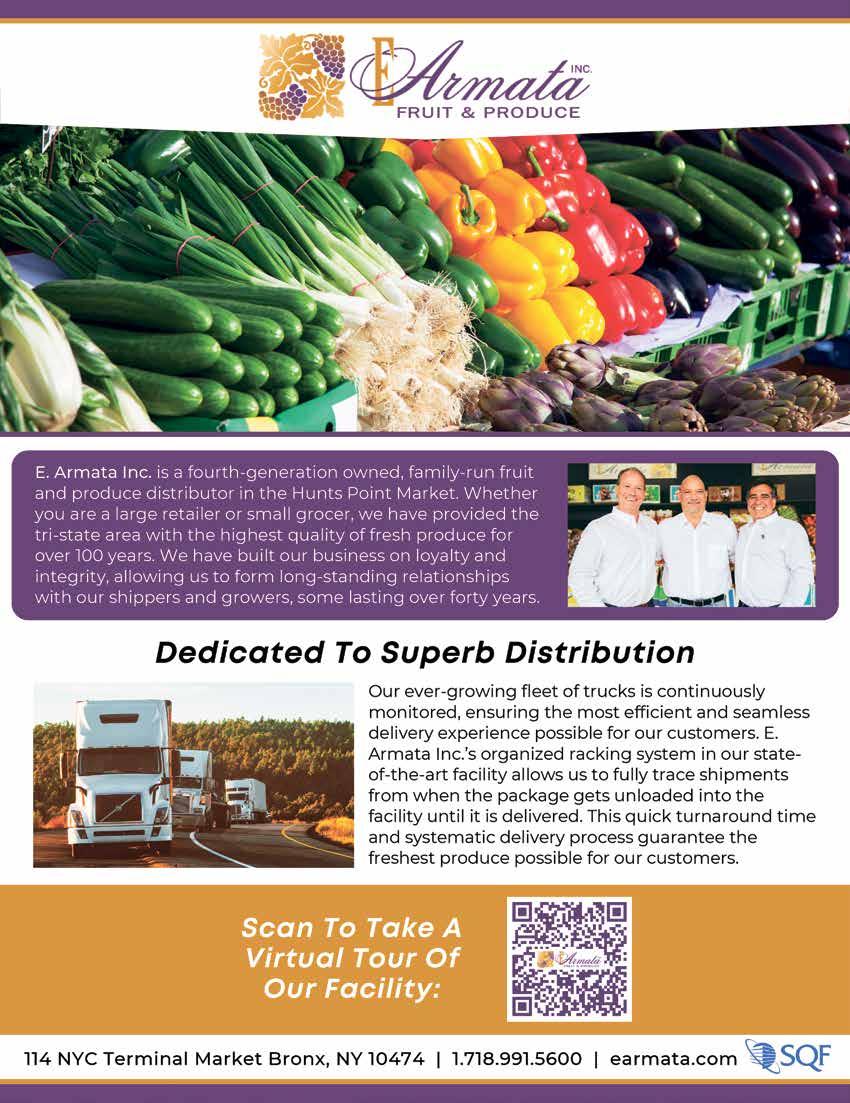

With potential infusion of funds from the city and state, the Hunts Point Market and its merchants are primed for a future of renewal.

Standing on recognized expertise, these off-market companies are reimagining and investing in the future.

82 GOURMET GARAGE ELEVATES THE EVERYDAY

With four NYC stores, this retailer’s flexibility allows it to keep the freshest possible produce on shelves.

12 THE FRUITS OF THOUGHT Restaurant Dining – Antidote to Heal A Less Civil Nation

98 RETAIL PERSPECTIVE Summer is Best Time to Rev Up Your Retail Operation

99 WHOLESALE MARKET Foodservice Customers Need Partners, Not Vendors

100 EUROPEAN MARKET UK Campaign Boosted (And Sustained) Veg Consumption

101 PRODUCE ON THE MENU

Celebrating the Impact of California’s Farm to School Program

POSTMASTER: Send address changes to PRODUCE BUSINESS, P.O. Box 810425, Boca Raton, FL 33481-0425

PRODUCE BUSINESS (ISSN 0886-5663) is published monthly for $58.40 per year by Phoenix Media Network, Inc., P.O. Box 810425, Boca Raton, FL 33481-0425

ALYSSA MCCARTER Store Worker

Kodiak DeCA Commissary

Kodiak, AK

As a military spouse, Alyssa McCarter has worked in a wide range of jobs as she has moved around the country with her husband. Her current gig as a store worker at Kodiak DeCA Commissary in Kodiak, AK, has brought her into occasional contact with the retailer’s produce department.

“I’ve worked in the commissary for just under two years,” McCarter says. “I’m a mili tary wife, so I have an interesting work back ground. I’ve done everything from making pizza by hand, working in church daycare centers and many other things traveling with my husband.”

McCarter particularly enjoys familiarizing herself with the store’s produce department.

“I like getting to see different produce items, especially in the summer,” she says. “For example, we recently got in a Picasso melon, and I didn’t know this was a thing, so that was interesting.”

On the store’s slower days, McCarter and

the head of the produce department like to read Produce Business together.

“The person in charge of produce and I go over the magazine, as I love learning facts and random knowledge. It’s fun to sit down and read through the magazine,” she says.

McCarter would eventually love to end up in one of the lower 48 states where there are more fresh product options, as it takes Alaska two weeks to get produce shipments in.

“This could happen if we end up back in California or in Virginia, where there are quite a few strawberry fields,” she says. “I’d love to be involved in produce and learning more about it.”

This was McCarter’s first time taking the Produce Business quiz, which her co-worker encouraged her to try. As this month’s winner, she will receive a $200 Amazon gift card.

How To Win! To win the Produce Business Quiz, the first thing you must do is read through the ar ticles and advertisements in the print or digital issue to find the answers. Fill in the blanks corre sponding to the questions below, scan and send your answers to the address listed on the coupon. If you wish to fill out the questions online, please go to: www.producebusiness.com/quiz. The winner will be chosen by drawing from the responses received before the publication of our SEPTEMBER 2022 issue of Produce Business.

Is there anyone in the industry who wouldn’t want $200 to buy something fun on Amazon? Or better yet… pass the card on to someone in need and make the world a better place!

1) “Packing Sunshine for the World to Enjoy” is the headline describing which company’s citrus packaging?

2) What is the telephone number for Fierman Produce Exchange?

3) What is the website address for Exp. Group LLC

4) What is the Facebook address for the New Jersey Peach Promotion Council

5) In which city and state is Highland Park Market located?

6) In what year was the Allen Lund Company launched?

issue

or scans of this form

send answers to one of the following:

JULY 2022 • VOL. 38 • NO. 7 • $9.90

P.O. Box 810425 • Boca Raton • FL 33481-0425 Phone: 561-994-1118 • Fax: 561-994-1610 info@producebusiness.com

President & editor in-Chief James E. Prevor JPrevor@phoenixmedianet.com

Publisher/editorial direCtor Ken Whitacre

KWhitacre@phoenixmedianet.com

exeCutive assistant Lori Schlossberg LSchlossberg@phoenixmedianet.com

ProduCebusinessuK.Com editor Chris Burt CBurt@phoenixmedianet.com

sPeCial ProjeCts editor

Mira Slott MSlott@phoenixmedianet.com

ProduCtion direCtor Diana Levine DLevine@phoenixmedianet.com

ProduCtion dePartment

Jackie Tucker

Contributing Writers

Carol M. Bareuther, Linda Brockman, Susan Crowell, Mike Duff, Bob Johnson, Steven Loeb, Gill McShane, Tad Thompson, Jodean Robbins, Jordyn White

advertising John Grecco

JGrecco@phoenixmedianet.com

Steve Jacobs

SJacobs@phoenixmedianet.com Sandy Lee Sandypnews@aol.com Ellen Rosenthal

ERosenthal@phoenixmedianet.com

direCtory shoWCase manager Zachary Kugel

ZKugel@phoenixmedianet.com

Send insertion orders, payments, press releases, photos, letters to the editor, etc., to Produce Business, P.O. Box 810425 Boca Raton, FL 33481-0425 PH: 561.994.1118 FAX: 561.994.1610

Produce Business is published by Phoenix Media Network, Inc. James E. Prevor, Chairman of the Board P.O. Box 810425, Boca Raton, FL 33481-0425. Entire contents © Copyright 2022 Phoenix Media Network, Inc. All rights reserved. Printed in the U.S.A. Publication Agreement No. 40047928

email: editor@producebusiness.com

P.O. Box 810425 • Boca Raton, FL 33481 or (3) Fax: 561-994-1610 Answer and submit your entry online at www.producebusiness.com/quiz

snail mail to: JULY PB QUIZ

The Ocean Shipping Reform Act (OSRA) was signed into law by President Biden on June 16, 2022. IFPA President and CEO Cathy Burns was honored to be invited to celebrate the work of our volunteers and IFPA team at the bill signing.

OSRA, a bipartisan, bicameral bill cosponsored by U.S. Reps. John Garamendi, D-CA, and Dusty Johnson, R-SD, and Sens. Amy Klobuchar, D-MN, and John Thune, R-SD, was first introduced in August 2021. The bill endured numerous changes and iterations before being passed in its final form unanimously in the Senate and by a resounding 364-40 votes. On March 15, IFPA submitted a letter to the Senate’s Majority and Minority Leaders Chuck Schumer and Mitch McConnell expressing the fresh produce industries’ strong support for the passage of the OSRA. This letter was signed by more than three dozen organizations and associations representing the produce industry.

Additionally, when IFPA convened the first Spring Policy & Regulatory Forum in April of 2022, OSRA was a key topic for a number of volunteer leaders who marched on the Hill to advocate for a variety of policy initiatives. Those in attendance for this event included the volunteer leaders serving on relevant IFPA committees, including the Food Safety Council, Political Advisory Committee, U.S. Government Relations Council, the Supply Chain Logistics Council, Organic Committee and Grower Shipper Council. These volunteers met with members of Congress from a variety of states to seek bipartisan participation in proposed solutions that are important to our industry, including the OSRA.

Of course, with the passage of the bill, the work now begins with the rule-making process. IFPA will shift from advocating for the bill to educating members on the regulatory requirements and changes to business operations based on the law.

Here are a few highlights of what we’re sharing with members about what comes next.

OSRA empowers the Federal Maritime Commission (FMC) and requires the commission to issue and enforce regulations to support the law. This includes the requirement that the FMC will issue regulations that define prohibited practices related to the detention and demurrage fee assessments for carriers, marine terminal operators, shippers, and ocean transportation intermediaries, and also to define “unfair or unjustly discriminatory methods” and “unreasonable refusal” to negotiate vessel space (for exports generally or a specific importer or exporter).

The law also requires the FMC to investigate complaints and publish results of investigations into charges assessed

by carriers. Under the law, carriers would bear the burden of proving the reasonableness of any charges. FMC is also required to disclose findings of false invoices by common carriers and penalties imposed against carriers for violations of the regulations.

It’s important to note that the law does not expand FMC juris diction related to charges and invoices, it only applies where the commission has existing jurisdiction. This is according to the notice provided by the Office of General Counsel at the FMC, which was issued on June 24, 2022.

One of the key changes based on the bill is regarding new requirements for ocean carriers. Under OSRA, ocean carriers would be prohibited from “unreasonably” refusing cargo when space is available, assessing fees that do not comply with appli cable regulations, and giving unreasonable preference to any commodity group or shipment.

The law also requires carrier invoices to include accurate detailed information and, through the rule-making process, the FMC may choose to impose penalties or require refunds if it find that a carrier’s invoice includes false or inaccurate information. In this case, shippers would not be obligated to pay fees if an invoice is inaccurate.

Additional provisions under the law affect shipping emergen cies, where the FMC would have 60 days of enactment to issue a request for information to determine if an emergency order could be used to reduce congestion. This is critical to maintaining the reliability of international transportation supply system.

In another effort to optimize supply chain efficiency, the FMC would also enter an agreement with National Academies of Sciences, Engineering, and Medicine to develop best practices for on-terminal or near-terminal chassis pools that provide service to marine terminal operators, motor carriers, and other stakeholders.

Ultimately, IFPA has been advocating for this important legis lation because it provides much needed relief for those in the fresh produce and other industries that rely on a fair system of commerce at our nation’s ports. The regulations that will come out of this legislation have the potential to provide even greater relief and much needed certainty for importers and exporters alike. This is particularly important to the fresh produce industry which, due to perishability, relies heavily on reliable, efficient ocean transport.

Calavo Growers Inc., Santa Paula, CA, has named Danny Dumas senior vice president and general manager Calavo Grown, filling the role held by Robert Wedin who is retiring after 49 years with Calavo. Dumas is a veteran of the produce industry with more than 30 years of experience, primarily with Del Monte Fresh Produce and, most recently, serving as president of Courchesne Larose USA. In April, Calavo said it would reorganize its business into two segments, Grown and Prepared, with a senior vice president and general manager responsible for each. Dumas will lead the Grown segment, which consists of fresh avocados, tomatoes and papayas.

The California Walnut Board (CWB) and the California Walnut Commission (CWC), Folsom, CA, have named Robert Verloop executive director and CEO. The CWB and CWC represent over 4,500 California walnut growers and nearly 90 handlers, producing over 1.4 billion pounds of walnuts in 2021 that ship to more than 50 countries around the world. Verloop recently held the position of COO for Coastline Family Farms, a family-owned vegetable grower/shipper. Previously, he held exec utive/leadership roles with Naturipe Farms/Natu ripe Brands, Sunkist Growers Inc. and the California Avocado Commission.

Duda Farm Fresh Foods, Oviedo, FL, has announced the company’s president, Samuel “Sammy” Duda, has been named CEO-elect. This decision marks the culmination of a nearly year-long process led by the company’s board of directors. Duda will continue to fulfill the responsibilities of his existing role until transitioning to CEO on Jan. 1, 2023. At that time, his role will shift to one of oversight for Duda Farm Fresh Foods as he begins guiding the family owned and operated diversified land company’s consoli dated business vision, goals and values.

Ippolito International, Salinas, CA, has promoted Keith Mallett to chief oper ating officer. His background in the produce industry is diverse, balanced between field operations and valueadded processing. Prior to Ippolito, Mallett worked at Taylor Farms for five years. In his new role as COO, he will continue leading the operations team as well as oversee the continued growth and expansion of the Ippolito International group of companies.

PRO*ACT, Monterey, CA, has hired William Foster as vice president of technology.

Most recently, Foster was IT director at ASP Global.

During his tenure, he moved the company headquarters, migrated the IT infrastructure to the Azure cloud, updated the ERP and automated many common functions for a variety of users, including a WMS implementation.

Prior to ASP, Foster was the IT-ERP manager and director of supply chain and logistics at TireHub, a joint venture between Goodyear and Bridgestone.

The Cosmic Crisp, Wenatchee, WA, has reported that its apple gained retail momentum this spring and made waves after appearing on the first season finale of NCIS: Hawaii. Stemilt’s review of April 2022 Nielsen retail scan data revealed that Cosmic Crisp was the No. 7 apple nationally, at 2.2% of apple volumes and 2.3% of apple dollars, and it took the No. 1 club apple position nationally by making up 20% of club apple volumes. It ranked second in average retail price per pound among the top 10 apples, trailing Honey crisp and excluding the other category made up of multiple varieties.

Zespri, Orange County, CA, is capturing that first bite of SunGold Kiwifruit with its “Go Sweet. Be Bold” national contest. Shoppers have a chance to win a grand prize, cash and more by posting a photo/video on Instagram, Twitter or TikTok of their first bite into the SunGold Kiwifruit. When posting, they tag @zesprikiwifruit and use the #GoSweetBeBold and #Contest. They can also participate by uploading their submis sion at GoSweetBeBold.com. To help promote the contest at retail, Zespri has free POS header cards that can attach to the shipper displays. A QR code is printed on the header card, allowing consumers to quickly scan for contest details.

West Pak Avocado, Murri etta, CA, recently celebrated the grand opening of its new distribution center in Logan Township, NJ, with an official ribbon-cutting ceremony and open house. In attendance for the event was Assemblywoman Beth Sawyer of the Third Legislative District in New Jersey, who presented West Pak with a Joint Legislative Commendation on behalf of the state. Sawyer and Commissioner Chris Konawel from the Gloucester Board of County Commissioners participated in the ribbon-cutting with West Pak CEO Mario Pacheco and vice presi dent of operations Trevor Newhouse. The full-ser vice avocado distribution center provides conve nience to customers by offering ripening, bagging, repacking and cold storage.

Sun World International, Bakersfield, CA, and Wash ington State University have joined forces to develop a new generation of high flavor sweet cherries that ripen earlier and are more practical to grow. Horticul ture Associate Professor and Stone Fruit Breeder Per McCord and Sun World scientists are sharing germplasm from promising cherry varieties under a new research collaboration launched this spring. The agreement allows researchers to exchange and study genetic material from their collections aimed at speeding up breeding and release of improved varieties for orchards in the Pacific Northwest, Cali fornia, the greater Northwest, and worldwide

Driscoll’s, Watsonville, CA, has launched its newest flavor innovation, Tropical Bliss, which expands its premium, high-flavor strawberry collection that also includes Sweetest Batch and Rosé Berries. Driscoll's Tropical Bliss Strawberries, with naturally white and yellow hues, combine the classic flavor of sweet berries and light flavor notes of tropical punch, pineapple and passionfruit.

William H. Kopke Jr., Inc., Great Neck, NY, has unveiled its redesign for the SWEETUMS family of branded citrus items. The family of branded produce includes citrus, grapes, cherries, pears, kiwi and berries. The refreshed brands, which continue to present each produce item as an illus trated personification of smiling faces, fitted with sunglasses, has stood out for over a decade across the produce department.

Oppy, Visalia, CA, is dialing up a high-volume season featuring preferred varieties and an increased focus on innovation. The fresh produce grower, marketer and distrib utor anticipates a 20% boost in California grapes over last year, with a wide array of new varieties — alongside tried and true favorites. Among the new varieties Oppy will market this season are Krissy, Magenta, Timco, Allison, Ivory and Great Greens. Oppy is also building for the future in the San Joaquin Valley through agriculture technology, focused most recently on labor savings and yield estimation. New trials are underway with Bloomfield Robotics’ proprietary FLASH camera, which collects data to be processed through deep learning AI to forecast yield down to the cluster level, informing decisions and enhancing the performance and health of every plant.

Produce & Floral Watch are regular features of Produce Business. Please send information on new products, personnel changes, industry, corporate and personal milestones and available literature, along with a high resolution image to: Managing Editor, Produce Business, P.O. Box 810425, Boca Raton, FL 33481-0425 or email us at info@producebusiness.com

Danny Dumas Keith Mallett Robert Verloop William Foster Samuel “Sammy” DudaEntry is Free of Charge. Just send us your product by October 1st and give us the reason why you think it is innovative.

High-volume buyers of produce and floral are constantly in search of items that will differentiate their stores and restaurants from the competition. But what is truly innovative and what will disrupt consumer buying behavior?

We invite all produce and floral suppliers to send us their most innovative products of 2022. Let us know why you think this product is innovative in less than 500 words.

Our editorial team will select the Top 10 items for

recognition in our November 2022 Cover of PRODUCE BUSINESS

Once the Top 10 items are announced, the produce industry at large will decide which item is the MOST INNOVATIVE PRODUCE ITEM OF 2022.

The final winner will be announced at this year’s New York Produce Show and Conference and will be featured in our January 2023 issue of PRODUCE BUSINESS.

Contact for more information: KWhitacre@ProduceBusiness.com Ph: 561-994-1118, ext 101

From coast to coast, the United States makes up approxi mately 3 million square miles. The country is the third most populous in the world and the fourth in square mileage. Size does matter, and the range of behaviors among such a wide variety of consumers is undeniable when it comes to fresh produce perceptions and purchasing habits.

The social, cultural, and geographic differences between the regions of the United States also influence consumers’ attitudes regarding sustainability and the environment. How do the regional differences impact grocery shopping behaviors among the 235 million Americans who consider themselves primary or secondary grocery shoppers?

Provoke Insights, a full-service market research firm and brand consultancy, conducts a biannual nationwide study among Amer icans. Provoke Insights’ latest fourth wave of research sought to understand Americans’ purchasing habits and trends in over a dozen categories, including fresh produce. Using this year’s fresh-off-thepress data from March 2022, it is possible to understand the latest consumer trends in fruits and vegetables and how they are affected by regional differences.

The majority of shoppers nationwide purchase fresh-packaged salads, with one-third picking them up at least weekly. The West and the Northeast has the highest propensity to purchase these versatile “salad kits.” Rural shoppers are the least likely to buy them, with only one-fourth purchasing them weekly. Meanwhile, urban and suburban shoppers have a higher likelihood of purchasing them weekly (33%).

Pre-cut produce is also popular with 81% of shoppers buying them. One-quarter of grocery-goers pick them up at least weekly. Like pre-cut salads, these shoppers tend to be from urban areas; there is no difference among U.S. regions.

Although plastic-packaged produce is common, grocery shop pers are becoming more aware of the impact their habits have on the environment. More than half of food purchasers prefer buying loose produce without plastic packaging. Uniquely, the Northeast is the most likely to buy loose produce (60%). This region is the most willing to pay more for sustainable products; they are also the most environmentally conscious.

Rural shoppers are the least likely to seek out loose produce (47%), compared to urban (57%) and suburban (55%) shoppers.

Locally grown produce is another crucial pillar of the produce industry, as many Americans venture to outdoor markets and homegrown sections of grocery stores. About half (55%) of shoppers seek local crops. Though there are no significant differences across

regions or urban/suburban/rural, Provoke Insights’ survey reveals stark generational differences.

Baby boomers have the highest propensity to purchase locally grown produce (59%) compared to any other age group. Millen nials and Generation X follow suit at 56% and 54%, respectively. Generation Z is the least likely to scour their grocery stores and local farmers markets for these items.

Unprompted awareness evaluates a grocery brand’s power, as shoppers can conjure a brand without being aided. This industry is unique, as one-third of these consumers cannot name a fresh produce brand. Of those who can name a brand, Dole overwhelmingly leads (26% awareness). Chiquita (4%) and Del Monte (2%) follow suit. Many private label brands remain top-of-mind, as Whole Foods 365, Kroger, and Trader Joe’s also rank in the top 10 brands.

• Regionally, the Northeast maintains the highest awareness of produce brands, with over three-quarters of shoppers (76%) able to name a brand. The top names include Dole, Whole Foods 365, Del Monte, and Chiquita.

• The West comes in second, with 68% of consumers being able to name a produce brand. Dole and Chiquita lead, but private labels rank high.

• The Midwest is close behind, with exactly two-thirds of grocerygoers (66%) able to name a brand; Dole, Chiquita, Del Monte, and Whole Foods 365 rank the highest.

• Shoppers in the South are least likely to be aware of grocery brands (62%). These shoppers are primarily aware of Dole, followed by Chiquita, Whole Foods 365, Del Monte, and Kroger.

Brand loyalty is a key metric for fresh produce brands looking to resonate with grocery shoppers. Over half (58%) of shoppers seek familiar brands when perusing fruits and vegetables. This is particularly true in urban areas, where nearly one-third (62%) of grocery shoppers purchase tried-and-true produce brands again and again — a 1% year-over-year increase from 2021.

Suburban shoppers (58%), followed by rural shoppers (54%), tend to be less loyal to their fruit and vegetable brands. pb

Provoke Insights is a full-service global market research and brand strategy firm. As a builder of brands, the firm solely focuses on research for branding, advertising, and con tent marketing initiatives. Provoke Insights empowers brands with the insights they need to navigate the cluttered marketing space and improve ROI. Carly Fink is the firm’s president and head of strategy and research; Breeda Bennett-Jones is an assistant researcher and strategist.

METHODOLOGY. Provoke Insights conducted a 15-minute online survey among 1,500 Americans between ages 21 and 65. The study was fielded from March 1-10, 2022. A ran dom stratified sample methodology was used to ensure a high degree of representation of the U.S. population (household income, age, gender, geography, ethnicity, and paren tal status). Results based on this sample have a maximum margin of sampling error of +/- 2.5% at a 95% confidence level. Statistical differences between subgroups indicated in this research were tested at a 95% confidence level. Check out https://provokein sights.com/spring-2022-trends for the latest category research, including fresh produce.

Knowing that different products are popular in different parts of the country is valuable information. Shippers can know where to focus their marketing while retailers know what to stock.

In some cases, it is not the people but the situation that leads to variations in purchasing habits. For example, it is no shock that in urban areas, fresh-cut items and various salad kits are more popular. This author grew up in the suburbs, and we had a double Sub-Zero refrigerator/freezer in the kitchen, another large refrigerator/freezer unit in the basement, a third in a garage and a fourth out by the pool in a small cabana. When we moved to Manhattan, we just had one side-by-side refrigerator unit, literally less than a fifth of the refrigerator capacity we had back on Long Island. It is no surprise that we bought products that had already been cut and trimmed and took up as little space as possible.

There is also a chicken or the egg conundrum when evaluating consumer purchase practices. It may be true that consumers in the northeast are more likely to buy bulk produce. Perhaps, though, retailers are more likely to display bulk produce in that region. Is that a retail response to consumer demand? Or a consumer response to retail display practices? Just as they look for more fresh-cut items to avoid storing bulk produce, perhaps consumers in more urbanized areas also prefer to buy the amount they need to avoid storing things and filling up tight storage areas.

There is also a possibility of demographic differ ences. We shouldn’t assume that the desire to avoid packaging always has to do with the environ ment. Tight urban apartments tend to have more single people or couples without children. Anyone who has had teenagers who bring over friends after practice or other activities knows there is no limit to demand. So if you have the room, and you have the teenagers, buying a package of produce is not a problem. If, however, you are a single person living in a small apartment, you may prefer to buy exactly what you want. A related issue for the produce industry is that bulk purchases can allow a small household to buy a variety: One red apple, one green apple, one yellow apple, one pear, one peach, etc. The variety may actually encourage consumption.

An issue for future research is that geography is not the only variable differentiating consumers. For example, the population in the Northeastern United States has the highest percentage of college graduates among U.S. regions. Is the focus on sustainability a function of geography? Education? Or is the obtaining of higher education partly a result of class norms and this corresponds with emphasis on environmental sustainability?

It is very difficult to know the extent to which various expression

of interest actually alters behavior. When consumers answer a survey and claim they seek to purchase local, what does that mean? Do they switch retailers because one has more local choice than another? And what, exactly, is the motivation? We’ve done some studies that indicated that consumers thought local produce should be less expensive, figuring that less transportation would be required. Would the same consumers who claim they seek local continue to do so if they were informed that the cost would be higher because more efficient growing areas are further away, or that local transportation in less-than-trailer-load shipments is more expensive? Plus what about variety? Does preference for local mean they won’t buy bananas or pineapples or counter-seasonal produce? A related question is whether what consumers say on subjects such as this is actually true. Survey research alone can’t answer every question. If we actually looked at purchase data, it would be interesting to see whether consumers who claim to value local actually buy much more local than other people.

The unaided brand recognition numbers seem unusual to us, with proprietary research we have done for others, showing even relatively new brands such as Cuties and Halos scoring higher. It might be, though, that “unaided recognition” is not very important in selling produce anyway. It is rare for retailers to sell multiple brands of the same item, so the issue is how consumers react when they see Sunkist, or another label, on the shelf. Consumers being “brand loyal” in produce may just mean they keep shopping at the same store and that store continues to buy, and display, the same brands. If one is loyal to Tesla, because one thinks it is the best car, that person will probably stick with Tesla, even if the local dealership moves a few miles away. Most people don’t buy cars very frequently, so it is no big deal.

Produce is bought, typically, more than once a week. So, even if a consumer in a survey expresses a general preference for a particular brand, our experience is that as long as the retail outlet offers a compet itive product of good quality, the consumer buys it. Comparing urban vs. suburban vs. rural brand loyalty involves many different things. A consumer in Manhattan may walk by three fruit stores between work and home, so it easy to stop and buy an item that one prefers, such as a brand. Immigration levels are also heavier in urban areas, and immigrants may have less English fluency and thus rely on brands in a way those more fluent in English don’t need to.

In marketing, geography is important – but geographical differ ences are often caused by demographic differences in the resident population.

In marketing, geography is important – but geographical differences are often caused by demographic differences in the resident population.

After the pandemic challenged foodservice operators and their suppliers to even survive, we finally began to see a recovery. Now, with inflation zooming out of control and the prospects of a recession all too real, the possibility of another threat to the foodservice sector seems just too much to bear.

Fortunately, there may be a bit of light at the end of this tunnel. Consumer concerns about inflation and recession tend to lead to lower expenditures on major items. If you fear you might lose your job, you may hold off on buying a new car, taking a grand vacation or buying a new house. The savings can be substantial and lead to paying down debt and husbanding cash. It also makes resources available for small indulgences. This can mean buying more upscale foods for cooking at home and going out to eat more than one would when saving for a vacation or straining to cover a big monthly car payment.

So we have some good things to look forward to, some op portunities for growth. Yet there are also challenges that won’t be easily navigated.

Sadly, there are some new trends in society that may lead to people cocooning. When I was a boy, my father used to sell produce to the Caribbean, and one of his markets was Curaçao. We used to vacation there often so that my father could visit his customers, basically all the retailers on the island.

As a very young boy I went with my father to a central market where vendors would sell products from all over the world. Many of these vendors were members at the oldest surviving Jewish synagogue in the Western World. Then there was a series of race riots, which led to the vendors no longer feeling safe. Some left the country, and many of those who stayed moved out of the central city to fenced and secured suburban homes.

When we visited Curaçao before the riots, we would be taken out to many restaurants; after the riots, we were invited to dinner at their homes. One wonders if we are not going to experience some similar change here as the U.S. becomes more unstable socially.

Over at Sesame Place in Pennsylvania, a character was video taped during a parade, seeming to refuse to high-five two young black children. The Internet exploded, first with social media being filled with attacks on the person in the character suit and on Sesame Place, then the attacks spread to Sesame Workshop, formerly known as Children’s Television Workshop, which licenses the Sesame Street characters to the theme park.

We’ve been taking our children to the theme park since they were small and, since my children are so deeply interested in theme park management, we know many of the players inside the costumes. A significant portion of the character players are black. Though we are not doctors and have no special information about anyone’s condition, the young man who was playing the character in question seemed to be autistic or have a similar condition. Whatever happened, we have 100% confidence it had nothing to do with race.

Being in a costume like that one offers very limited vision, and there are rules. It appears that a woman was asking the character to hold her child, in order to get a photograph. Yet the characters are forbidden from doing that as they could easily drop a child. After engaging with the mom, the character went to walk away and declined to high five or otherwise engage with the two children.

The issue today is a lack of humility. Lots of people on line watch a video for a few seconds, deduce what they think is happening and go on line and start the attack. The person in the suit should be fired! The park should be closed!

To say that the people think they know what is happening significantly overstates the case. It is more a matter of virtue-signaling. From famous entertainers to people unknown, the desire to assert one’s virtuous nature by attacking others for racist be havior seems more important than actually finding out the truth.

United States Supreme Court Justice Brett Kavanaugh had to leave through the back door of a steakhouse in Washington, DC due to protests out front over his vote on the abortion case. This was shortly after a person was arrested for attempted murder of Justice Kavanaugh outside of his home. Yet, whatever policy preference one might have on abortion, such attacks misconstrue the nature of the Court. The role of the justices is to study the law and the constitution and determine what it means. It is to be expected, all the time, that justices will vote in ways inimical to their policy preferences.

There seems to be a horrible decline in civility. It is hard to see how we will get through all this as a country. And, this kind of hostile environment may well drive people away from foodservice venues, making them choose to retreat to the comfort, privacy and safety of their own homes. Yet, if we are to succeed as a nation, we have to find a way to transcend this isolation.

The social conviviality created by sharing a good meal can ease the exchange of ideas. The idea that you can enjoy some one’s company and still disagree politically, that one can respect someone with whom you might disagree – all this is a path to a friendly future.

The foodservice industry has been depending on the government to help out with plans and programs to help the industry survive during difficult times. Now, perhaps the tables have turned, and the country needs the restaurant and hospitality sectors to thrive, that the country itself will come to remember that one can disagree and still be civil. That with good food and drink, with a nice environment, with a focus on friendship, we can get past disagreements and find common ground to build a better tomorrow.

We have carefully followed the VitisGen and VitisGen2 project for a long time. It is a multi-institution research collaboration, funded by the USDA-NIFA Specialty Crop Research Initiative and focused on enabling the production of new grape varieties.

At the most recent New York Produce Show and Conference in December 2021, we had an important presentation: Consumers, Grapes and Gene Editing Cornell’s Brad Rickard Sheds Light on What the Research Shows and What’s Yet to Be Learned.

Now the Global Grape Summit, to be held in Bakersfield, CA, on August 20, 2022, will continue this exploration with a presentation by Julian Alston, Ph.D., Distinguished Professor of Agricultural and Re source Economics and Director of the Robert Mondavi Institute at the University of California, Davis. This presentation — titled What are Grape Varietal Innovations Worth? — is designed to help an industry wrestling with an explosion of vari eties. This is a brief selection from a much longer article running in Jim Prevor’s Perishable Pundit:

Q: At our New York Produce Show in December, Brad Rickard revealed the new VitisGen2 research built around table grape innovations, focusing on consumer attitudes and industry dynamics related to gene editing. Brad discussed proliferation of grape varieties, and how priorities on trait de velopments may not always align between producers, retailers, and consumers.

How have you been involved in this collaboration?

A: In 2017, I asked Brad and Karina Gallardo (from Washington State University) to join us for VitisGen2. Our component of [the study] is focused on the economics of varietal innovation in California table grapes. Within that, Karina led the part on eliciting consumer preferences, and Brad’s contribution in New York was based on preliminary results from that work.

That element is now complete, and we have a couple of papers submitted to professional academic journals.

Q: That’s exciting. Could you provide abstracts?

A: One paper looks at Consumer Acceptance of New Plant-Breeding Technologies: An Application to the Use of Gene Editing in Fresh Table Grapes. This study estimates consumers’

willingness to pay for specific product (quality) and process (agronomic) attri butes of table grapes, including taste, texture, external appearance, expected number of chemical applications, and the breeding technology used to de velop the plant.

JIM PREVOR EDITOR-IN-CHIEF

Considering varietal traits, on average our survey respondents were willing to pay the highest price premiums for specific offers of improvements in table grape taste and texture, followed by external appearance and expected number of chemical applications.

Considering breeding methods, on average our respondents were willing to pay a small premium for table grapes developed using con ventional breeding rather than gene editing (e.g., CRISPR).

The group of consumers most likely to reject gene editing consid ers both genetic engineering and gene editing to be breeding tech nologies that produce foods which are “morally unacceptable and not safe to eat.”

Another submitted paper, Consumers’ Willingness to Accept Gene Edited Fruit, An Application to Quality Traits for Fresh Table Grapes, compares consumers’ willingness to pay (WTP) for selected quality attributes of green varieties of table grapes. Data was collected using an online survey that includes a dis crete “choice” experiment, where one group of respondents considered table grapes developed using gene editing (CRIS PR-Cas9), while the other considered table grapes developed using conventional breeding.

The highest WTP value across attributes was for sweetness, followed by crispness, uniform skin color, flavor, and size.

The rank order of the WTP values for the table grape attri butes was the same for both breeding technologies. We found no differences in the attribute-specific WTP values for grapes between the two breeding technologies. Our estimates indicat ed a slight discount in overall WTP for table grapes produced using CRISPR compared with conventional breeding, but this discount was neither economically nor statistically significant.

Considering varietal traits, on average our survey respondents were willing to pay the highest price premiums for specific offers of improvements in table grape taste and texture, followed by external appearance and expected number of chemical applications.

Q: That seems to be a critical and enlightening point that the difference was not statistically meaningful between gene edited and conventional breeding.

A: In the paper’s conclusion, the analyses suggest the ex istence of four groups that vary in level of knowledge about Genetic Engineering (GE) and CRISPR. The variation in self-re ported knowledge about breeding methods is directly related to the perception that grapes developed using CRISPR are safe, natural, and ethical to eat. Respondents reporting that they are well-informed about GE and CRISPR are also more likely to have positive attitudes toward these breeding methods.

Q: This suggests an educational/marketing component...But this raises other questions. Will retailers stock the products if they are concerned of vocal activist protests?

A: For now, USDA treats gene editing differently than GMOs, so no distinctive label is required. Will there be counter market ing against gene editing. Perhaps a non-GMO project extended to gene editing? Could gene edited product in the U.S. become an issue for exporters to Europe? These are important questions we will discuss at the Global Grape Summit.

The other main part of VitisGen is a monograph, in process, looking back wards at varietal innovation in California table grape production and measuring the value of those innovations. I am primarily responsible for that part, and much of the writing remains to be done, including on the table grape breeding industry. For that, I envision spending some time over the next few months talking with table grape breeders to learn more about the economics of their industry. Participating in the Global Grape Summit should be helpful.

I can summarize what we have learned so far in this project. For context, I can provide some broader background on how we economists think about the value of varietal traits. I will also provide an overview of the changing mix of table grape varieties being grown in California and traits being emphasized and how we value them. And I will give some of the results from our analysis of the consumer attitude surveys.

The guts of the presentation begins at the consumer research. I can spend some time on background and motivation for the research….

California grape producers face many challenges:

*Competition for resources (land, labor, water)

*Concern over reliable availability of labor and water

*Climate change

*Regulatory environment

*Pests and diseases and technologies to manage them

*Shifting demand, markets and prices; foreign competition

*Concentrated agribusiness sector

This has led to enhanced demand for innovations, including new varieties.

In terms of California grape production, table grapes are quite a small share of daily acreage, and the total area of table grapes has been fairly flat. But they're relatively high-yielding, so they're a bigger share in volume, and an even bigger share of value. It gets up to about 20% of volume, and about 30% of value. And that's partly because table grapes are found in finished retail, where wine grapes are just for processing.

So that's one story to say table grapes have been a relatively profitable segment of the industry in the Central Valley. They’ve actually been doing okay, compared with raisin grapes, and even wine grapes in the Central Valley.

In table grapes, we've had big changes in the varieties grown over the past 50 years, and especially, over the past 20 years.

Q: Yes. Brad noted there were essentially seven main varieties back in 1970, and today we see 20 main varieties, adding that Thompson Seedless used to be about 70% of the acreage back in 1970, and it’s probably closer to 25% now.

A: The story you want to tell is that there's been a lot of innovation going on in table grapes, compared with other grapes. There's been almost no innovation in variet ies of wine grapes or raisin grapes in comparison.

Q: When you say there's a lot of in novations in table grapes, what types of innovations are you talking about? Are these focused on eating qualities, such as taste and texture, size and appear ance, or more agronomic, less obvious consumer-facing traits like increasing yields, pest and disease resistance, longer shelf-life, reduced chemical use...although there could be a sustainability marketing side there.

Is the issue varietal differentiation on the retail shelf with novel products, such as the Cotton Candy or Gumdrops, that could demand premiums?

A: The guys who breed table grapes and grow them talk about flavor, good eating attributes, whether it’s crunchy and sweet, that it’s seedless, what it looks like, the size and color, the shelf life, and what part in the season it’s available.

These are the attributes they are stressing in their marketing. I don't know whether all these varieties also have desirable agronomic attributes like yield, but I'm betting they can't sell a variety that has lower yield.

To hear Professor Alston’s full presentation and learn how to get on top of the dramatic changes going on in the world of grapes, register to attend the Global Grape Summit in Bakersfield, CA, on the August 20, 2022. You can find out more and register for the Summit at www.GlobalGrapeSummit.com, and if you have additional questions regarding the event, just let us know by emailing info@globalgrapesummit.com

In table grapes, we’ve had big changes in the varieties grown over the past 50 years, and especially, over the past 20 years.

July 28-29, 2022 | Monterey Conference Center and Portola Hotel and Spa | Monterey, CA

World’s largest grower of asparagus. We are a family owned and operated business committed to offering the best quality fruits and vegetables. This same vision was applied when expanding into our other commodities, which include green onions, Brussels sprouts, grapes, parsley, broccoli, avocados, cilantro, radish, spinach and more.

Allen Lund Com pany, established in 1976, is a 3PL, working with ship pers, growers and carriers across the nation to arrange the transport of dry, refrigerated and flatbed freight through their nationwide network of of fices. Experts in produce transportation, ALC has a superior reputation in the transportation and produce industries. Their logistics and software division, ALC Logistics, provides solutions via AlchemyTMS, and their international division is licensed as an OTI-NVOCC.

“Marketing Bright” since 1986, Babé Farms grows, packs, and ships a diverse assortment of baby and specialty vegetables in California’s Santa Maria Valley. Rainbow root vegetables, baby lettuces, specialty greens, sig nature salad blends, and a collection of crucifers are just a few of the categories that compose this ever-expanding colorful conglomerate. Babé Farms is family owned and operated, and blessed with an ideal Mediterranean growing climate which allows owners Jeff Lundberg and Judy Lundberg-Wafer to cultivate the farm’s 1,000 acres year-round. With food safety and sustainability always at the forefront, we are committed to growing the highest quality, gourmet vegetables. Babé Farms is the “couture” label top chefs and fine retailers look to for their specialty vegetable needs.

Please join us as we celebrate 60 years of premium Bobalu strawberries grown right here in California. As a family grown, farmer-owned company, we are proudly hand packing every berry under our family name. Learn more about our program, our family, and our delicious berries by visiting our booth as we cele brate this family milestone.

Fresh Prep, the pro cessing arm of historic company Boskovich Fresh Food Group, is committed to meeting the demands of customers and consumers for innovative, convenient, and safe fresh products. Fresh Prep offers an extensive line of value-added produce products spe cifically for the foodservice industry. Visit Booth 508 to learn more about Fresh Preps’ diverse line of foodservice items.

California Heirloom

Garlic, fresh bulk and peeled, year-round supplies! We’re the largest grower, packer, shipper of fresh California Heirloom Garlic in the U.S. Growing garlic since 1956, from carefully selected seed to preserve excep tional flavor and quality. Produced with GAP, GMP, HACCP, USDA & FDA inspections. Variety of sizes, packs.

Join the Romaine revolution! Church Broth ers Farms presents the Romaine of the future: Washed & Trimmed Romaine. With savings in labor, waste, time, and money, this product is a must-have on your orders! Stop by booth #409 to learn more.

Contamination from “food compliant gloves” was responsible for a recent recall. Mitigate this business risk: visit Eagle Protect at booth 805 to learn about their multi-layered Delta Zero proprietary glove test ing program, ensuring Eagle gloves adhere to the highest level of consistent glove food safety and performance.

Situated in the Sacramento Valley, Premier Mushrooms offers the best quality mushrooms in California with a wide variety of white, browns and portabellas for both foodservice and retail. Growing and harvesting over 250,000 pounds per week, we service the California region weekly. Our portfolio is compet itive — we pack all sizes of sliced mushrooms in 10- and 5-pound cartons, including pails and trays. Please stop by and say hi! It’s our first time at the IFPA Foodservice Conference.

Fortune Growers is a fully vertically integrated produce grower and manager of a co-op of growers that provide our customers with the highest quality and freshest product. Our goal is to work collaboratively with customers for more sustainable practices. We manage and maintain a vested interest in the entire supply chain. Visit our booth!

Where avocados are ripe. Henry Avocado Corpo ration, the packer and distributor of Bravocado and Green Goddess, the best avocados in foodservice. Come meet our ripe avocado experts to learn what makes our ripe avocado program the best, and receive a bag of avocados to enjoy.

For over 65 years, the Idaho and Eastern Oregon growing area has been producing large yellow, red, and white varieties of Spanish onions. Grown under Federal Marketing Order #958, the Idaho-Eastern Oregon Onion Committee sets grade and quality standards that exceed USDA requirements. Contact an Idaho-E. Oregon Onion Shipper today!

Franklin Farms is a one-stop shop plant-based supplier with over 100 SKUs, offering a wide as sortment of veggie burgers, seitan, veggie balls, tempeh and tofu. Franklin Farms’ top selling, innovated Tofu Bite offering includes both plain and seasoned options, including Lemon Pepper, BBQ, Sesame Ginger and more. Extra firm and already cubed, the tofu bites are ready-to-eat and can be easily used in your signature recipe. Stop by Franklin Farm’s booth #303 to taste our new Extra Firm Cubed Tofu served with a Teriyaki Gochujang sauce!

Limoneira is spotlighting its extraordinary Pink lemons. They are nature’s way of creating a distinctly new variety. The outer appearance ranges from rose blush to more yellow with stripes, with the interior varying from light to darker pink. Similar to a classic lemon, they are sour, yet they have a hint of grapefruit with slightly less acidity. The Pink lemons will surely delight consumers while offering them a unique and distinctive flavor profile. This lovely citrus will brighten and enhance beverages to meal presentations. Pink lemons typically have a strong shelf-life and are available year-round.

From field to table, we are committed to bringing you fresh and flavorful tomatoes, bell peppers, jalapeños, and organics that will keep you wanting more. Live Oak Farm’s dedication to meet your produce needs is second to none. Stop by our booth to learn more about what we can offer.

Local Bounti is redefining indoor farming with its propri etary Stack & Flow Technol ogy,, which significantly improves crop turns, increases output and improves unit economics. Local Bounti operates advanced indoor growing facilities across the United States, servicing approximately 10,000 re tail doors with its two brands: Local Bounti and Pete’s. With a mission to Nourish Humankind and Protect our Planet, Local Bounti’s food is fresher, more nutritious, and lasts 3 to 5 times longer than tradition al agriculture.

For five gener ations, Maglio has proven to be a leader in pro viding innovative solutions to meet every customer’s unique fresh produce needs. We have main tained a steadfast commitment to forward-thinking food safety practices and have not shied away from investments in equipment and facility technology.

Our Wash and Trim lineup is minimally processed and ready to use! Minimizing prep time vs. field-packed options, our washed and trimmed Green Leaf and Romaine is versatile, fresh, and can be used as a gluten alternative for tacos, wraps, and many other items! Stop by Booth #418 to check out our lineup.

Stop by booth #234 for a snack, to learn more about fresh mango and to talk about the National Mango Board’s foodser vice program. Did you know that mango is found on nearly 40% of all restaurant menus, with an 8% predicted growth rate, and that mangos are expected to outper form 81% of all other foods, beverages and ingredients over the next four years? Eighty-two percent of consumers say they would pay more for fresh mango when featured on the menu! Visit mango.org/foodservice for information and to be inspired. (Source: Datassential).

Stop by booth #505 to check out Naturipe’s full line of food service berries, avocados and value-added products. Offering con ventional and organic strawberries, blueberries, raspberries and blackberries in a variety of sizes ideal for foodservice operations. Washed and ready-toeat blueberries save time and labor for back-ofhouse operations, available in 18 oz and 32 oz packs. And introducing 3 oz. Smart Cups from Naturipe Snacks, containing USDA recommend ed snacking portions for K-12 schools. These convenient, grab-n-go packs with washed and ready-to-eat fresh fruit are perfect for students, teachers, or anyone seeking a healthy snack.

Booth

Booth #303

Booth

July 28-29, 2022 | Monterey Conference Center and Portola Hotel and Spa | Monterey, CA

Booth

Booth #303

Booth

July 28-29, 2022 | Monterey Conference Center and Portola Hotel and Spa | Monterey, CA

July 28-29, 2022 | Monterey Conference Center and Portola Hotel and Spa | Monterey, CA

With a 28-day shelf life, Arctic apple slices stay orchard-fresh lon ger! Arctic apples are available in multiple package sizes, cuts and varieties — in cluding our new 20 oz. foodservice pack and Arctic Fuji variety. Come meet our president Neal Carter and taste the difference for yourself at Booth #704.

As the largest year-round grower, packer and shipper of peppers in the U.S, Prime Time is committed at all levels of the production chain, providing premium quality produce 365 days a year. In addition to peppers, asparagus and sweet mini peppers, Prime Time offers a variety of seasonal produce items.

Procurant is transforming the global food supply chain with technology to reduce waste, increase visibility, improve food safety and dig itize business from production to consumption. For more information, go to www.procurant.com.

Since 1990, Produce Pro Software has been the leading all-in-one ERP software providing innovative business and technology solutions specifical ly designed for all business types within the produce and perishables industry. Combining powerful, cutting-edge software solutions while leveraging perishable food industry expertise and consulting services, Produce Pro can in crease organizational efficiency, minimize waste and loss, reduce operating costs and provide real time data. For more information, visit us at Booth #616, or visit producepro.com.

Fresh green house-grown vegetables available year-round. Pure Flavor is a family of greenhouse vege table growers who share a commitment to bringing A Life of Pure Flavor to communities everywhere. Our passion for sustainable greenhouse growing, strong support for our retail and foodservice cus tomers, and focus on engaging consumers is built on a foundation drawn from genera tions of growing expertise. We are the next generation of vegetable growers, inspired to put quality, flavor, and customers first by providing greenhouse-grown vegetables from our farms that are strategically located throughout North America.

Since 1958, three generations of the Nicholson family have mastered the art of harvesting and pressing premium fruits and juices. Our 100% cold-pressed juice is never from concentrate and we never add water, sugar or preservatives. You can taste our commitment to quality and freshness in every sip!

River Point Farms, located in the Uma tilla Basin of Oregon and Columbia Basin of Washington, is a large grower, packer and processor of red, yellow and white onions. As a unique, single source supplier, River Point Farms has all the necessary capabilities to be your food safe, secure onion supply partner. Please come and visit us at our IFPA Booth #706.

Founded in 2013, Spiceology is the fastest-grow ing spice company in America and is on a mission to bring the magic (and quality) back to spices. We’re a chef-owned and operated, one-stop spice provider that develops innova tive blends and offers over 400 ingredients that are ground fresh in small-batches and shipped fresh. Visit us at booth 914 to meet the team and snag some free samples!

The Garlic Company will be featuring fresh ly, peeled garlic from its new 2022 garlic harvest. Whole bulb garlic and peeled shallots will also be on display, amongst other items. We look forward to seeing everyone at the show.

Third generation and family-owned, Topline Farms has a strong back ground in bringing quality green house vegetables to market. A grow er/packer/shipper that’s located in Leamington, Ontario, Canada, they’re always growing and improving to meet the demand of their consumers. Topline Farms takes great pride in their new packaging innovation partnership — Apeel treated, plastic free, English cucum bers. With their own fleet of trucks and a strong quality management system, Topline Farms can satisfy the needs of foodservice customers across North America. pb

Booth #309

Booth #616

Booth #210

Booth #309

Booth #616

Booth #210

The story of Highland Park Market, located in Manchester, CT, began in 1886 when William White opened a small general store in the hope of providing his neighbors with a care fully selected stock of dry and fancy goods.

In 1958, Jack Devanney purchased this small, hometown market and held fast to those same traditions.

“Over the years, Highland Park has become synonymous with high quality, reliable perishables and grocery,” says Brian Gibbons, produce director. “We have become a relatively small, high-end grocery store, where we offer exceptional quality and service from the time you enter our store until the time you leave.”

In 1985, Jack’s son Tim took over as pres ident and expanded to locations in Glaston bury and Farmington, CT. “The stores have always been a family-owned and operated business,” says Gibbons. Today, five of Tim’s six children are in the business and have taken over the day-to-day operations of the stores.

From the beginning, Highland Park immersed itself into each community where stores are located. “We have been welcomed by a strong family base of customers in each

grocery store around. We offer only the freshest and finest produce available in the marketplace.”

Each store is around 20,000 square feet, with produce departments ranging from 3,000 to 4,000 square feet. Produce plays a vital role in all the stores. “Produce dictates what kind of store you are,” says Gibbons.

Produce is the first thing customers see when entering the store. The store offers a wide variety of both fruit and vegetables, including organic produce, which continues to grow each year. The department handles

them with exactly that.”

Produce runs an average of 18% of the store business. “This is tremendous for a grocery chain,” says Gibbons. “It’s one of the most profitable departments in the store.”

Even from outside the store, abundant produce or seasonal displays lure customers. At springtime, the front entrance of the store looks like a nursery bursting with flowers and plants. During fall, enormous displays of pumpkins and cornstalks put shoppers in a bountiful frame of mind. Inside the store, produce displays focus on sale items, seasonal items and colorful items. A fragrant, fresh cut flower display greets customers as soon as they enter the department.

Produce department décor balances an old-time grocer feel with clean and modern touches. A bright, open format presents an ideal showcase for produce. Signage gives a nod to the old-fashioned general store feeling while clearly identifying departments and sections.

The department uses low wood bins and tables with different designs such as octagons and squares. “The goal of these displays is to be able to merchandise different items next to each other while still seeing the whole way across the department,” says Gibbons.

‘Produce dictates what kind of store you are,’ says Highland Park Market Produce Director Brian Gibbons.In one of two large refrigerated cases in the Highland Park Market, 8 feet of wet greens and 36 feet of refrigerated vegetables give shoppers an enormous amount of choice and features vibrant and contrasting colors. Highland Park Market in Manchester, CT, uses low wood bins and tables in different designs such as octagons and squares to merchandise different items without hampering a shopper’s view of the entire department.

berries, grapes and different seasonal items up front on sale,” says Gibbons. “These displays especially include items such as strawberries, blueberries, green and red grapes, clementines and cherries.”

The department is flanked by large refrig erated cases. On the left side, eight feet of wet greens and 36 feet of refrigerated vegetables give shoppers an enormous amount of choice and draws them in with expert use of vibrant and contrasting color. The case also merchan dises a variety of salad dressings, dips and other value-added vegetable items.

A 40-foot case of refrigerated fruit, juices, cut fruit and other value-added fruit items lines the right side. This case includes bright, color-blocked displays of apples, pears and citrus to draw the shopper’s eye. Ample space between the twin refrigerated cases allows for wood tables of bountiful displays down the middle of the department for melons, toma toes and potatoes.

While some items remain constant, the staff tries to change the offering to continu ally display what is best for customers. “We constantly change our displays throughout the year to push the most seasonal items, as well as items on sale,” says Gibbons.

Principal produce sources start with wholesalers. “Our main wholesaler is Shapiro out of Boston and we also use C&S and Four Seasons,” says Gibbons. “We rely on our wholesalers for consistency and quality. Quality, sizing, price and daily deliveries are all important criteria in our sourcing.”

In the summer, Highland Park adds product from an abundance of local farmers. “Summer is great, with fresh, Connecti cut-grown corn, vegetables, blueberries and peaches delivered daily,” says Gibbons.

The store distributes a weekly circular, and every Saturday and Sunday, the store

says Gibbons. “It lists who we are buying from, so our customers know exactly where we are getting our great Connecticut-Grown Produce.”

Gibbons explains the store’s role is as a community partner. “We provide a safe, clean environment for residents to shop and for some kids to maybe work here also,” he says. “We work with all the schools and local orga nizations in town for school sports, road races and golf tournaments by helping out with donations and having a presence.”

The store’s other departments complement Highland Park’s commitment to freshness and quality in produce. In addition to its produce offering, the store also provides a complete, old-fashioned, full-service meat counter that is fully staffed with friendly professionals to ensure customer satisfaction. The store purchases fresh fish weekly from a local, upscale, fresh fish purveyor.

In the bakery, the store tenders a wide variety of signature desserts created by in-store pastry chefs, as well as an assortment of breads, rolls and breakfast pastries baked fresh daily.

Highland Park also caters to convenience. It boasts a nationally recognized full-service deli carrying a variety of quality products. Customers can easily pick up one of the store’s famous HPM sandwiches or choose from a selection of Grab-n-Go meal items or sushi made in-store by sushi chefs. pb

317 Highland Street Manchester, CT 06040 860-646-4277

www.highlandparkmarket.com

Hours: 8am - 7pm, Monday – Saturday 8am – 6pm, Sunday

A 40-foot case of refrigerated fruit, juices, cut fruit and other value-added fruit items lines one side of the Highland Park Market produce department. This case includes bright, color-blocked displays to draw the shopper’s eye.

BY CAROL M. BAREUTHER, RD

BY CAROL M. BAREUTHER, RD

Dining out once was, and still is for some people, an indul gent affair relegated to special occasions. Steak or seafood (or both) starred front row center on a diner’s plate and palate. But times are changing.

In 2016, for the first time since the U.S. Department of Commerce began collecting this type of data two decades ago, Amer icans spent more money eating out than in-home.

A big driver is that dining is now less celebratory and more mundane. There’s graband-go breakfasts, corner eatery and QSR (quick-service restaurant) work lunches, and socializing with friends while dining out or dialing out for delivery.

This trend in spend reversed briefly with the pandemic — but it didn’t last long.

According to U.S. Department of Agriculture’s Economic Research Service Food Expenditure Series data updated June 1, 2022, away-fromhome food spending outpaced dollars for food at home every month from January 2021 to March 2022, returning to the pattern seen pre-pandemic.

Americans’ everyday embrace of eating

out and the foodservice sector’s rebound open the door to putting more fresh produce on the menu. This is especially true in new and exciting ways and throughout the day.

Consumers want to eat healthier after COVID, says Nicholas Gonring, North American corporate consulting chef, Culinary R&D, N.A. Distribution for Gordon Food Service, in Wyoming, MI. Chefs can play this to an advantage by creating dishes that can’t easily be made at home — and take experien tial dining to a new level.

“I see produce as the new star in this arena,” Gonring adds. “Fruits and vegetables are healthful. They are also incredibly versatile and flavorful. It’s a great balance.”

And he puts on his creative chef’s toque: “Think citrus-like yuzu made into mari nades, sauces and dressings. Purple yam gnocchi. Persimmons are pickled in the fall and added to an appetizer or small plates charcuterie board. Pickled green strawber ries on salads. Tandoor beets are roasted in a wood-fired oven where the sugars cara melize.”

Especially with the cost of proteins today, moving produce to the center plate and using fruits and vegetables in creative ways in all

parts of the menu has a positive impact on a restaurant’s bottom line, Gonring says.

This produce-centric menuing move has the potential to increase overall fruit and vegetable consumption, too. The Brentwood, MO-based Produce for Better Health Foun dation (PBH) State of the Plate research examined fruit and vegetable eating occasion frequency from 2015 to 2020. Away-fromhome fruit consumption was flat across this time period, while away-from-home vegetable intake slightly increased, driven by foodservice outlets, including fast food, full service, and cafeterias.

“PBH’s State of The Plate data show that consumers are fans of fresh produce,” says Wendy Reinhardt Kapsak, MS, RDN, PBH’s president and chief executive officer. “There is an opportunity for the fresh produce industry to work with foodservice leaders to increase consumption by encouraging individuals and families to eat their favorites more often.”

She cites PBH data that demonstrates light frequency vegetable consumers signifi cantly depend on foodservice outlets to increase their consumption. On top of that, behavioral scientists say to increase produce consumption, it must be easy. “What could

Americans’ everyday embrace of eating out and the foodservice sector’s rebound open the door to putting more fresh produce on the menu.

be easier than ordering off the menu and having someone deliciously prepare it for you?”

“Innovation at foodservice has always inspired produce consumption,” agrees Megan McKenna, senior director of marketing and foodservice for the National Watermelon Promotion Board (NWPB), headquartered in Winter Springs, FL.

Here are how top culinary trends can serve as an inspiration for putting more fresh fruits and vegetables on the menu in different day parts.

From meal maker to garnish, topping produce and nonproduce platforms with fruits and vegetables — akin to the recipe for avocado toast — offers endlessly customizable opportunities.

“Several loaded and topped items where produce can be a key element continue to grow including, loaded tots,” says Claire Conaghan, associate director of Datassential, based in Chicago, IL.

Over the past year, this application of potatoes has grown 26% and over the past four years, it has grown on menus by 191%, according to Datassential research.

“Loaded tots are the top trend we are seeing on menus, which is popular with millennials and Gen Z. It’s a trend growing across all menu day parts and even more popular now with the fact that they travel well, so they are great for take-out and delivery menus,” says Jamie Quinno Bowen, director of marketing for the Idaho Potato Commission, in Eagle, ID.

A good example is the Veggie Tater Tot Skillet served at Breakfast at Tiffany’s, in San Francisco, CA, Bowen says. In addition to potatoes, the skillet topping incorporates fresh onion; red, yellow, and green bell peppers; mushrooms; spinach leaves; Roma tomatoes; kale leaves; and avocado for garnish.

Fresh produce is a mainstay in finishing a dish, offering a visual and textural contrast. Current favorites include pickled onions (on 12.6% of menus, up 35% over the past four years), microgreens (on 1.8% of menus, up 34% over the past four years), and watermelon radish (on 1.3% of menus, up 28% over the past four years), according to Datassential’s Conaghan.

“I love the idea of microgreens becoming a staple in the home and foodservice,” says Justin Timineri, executive chef for the Tallahassee, FL-based Florida Depart ment of Agriculture and Consumer Services (FDACS). “Usually reserved for garnish, it’s time to bring microgreens into the limelight. Packed with flavor and nutrition, they add a

huge boost to any dish. Citrus microgreens served with fruit, or in smoothies in the morn ings and microgreens added to a feature salad or sandwich at lunch.”

Plant-based foods ranked second only to sustainability in the National Restaurant Association’s (NRA) 2022 What’s Hot survey, which asked some 350 professional chefs what they thought would be the Hottest Culinary Trend this year.

Further, the top plant-based produce-ori

ented trends by day part include plant-based breakfast sandwiches; plant-based sandwiches, globally inspired salads and grain-based bowls at lunch, and plant-based burgers at dinner, according to the Washington, DC-headquar tered organizations survey results.

“Fresh produce is the original plant-based foods. Many of the branded plant-based burgers out there are sold at a premium and they are ubiquitous; they don’t give an operator a point of differentiation,” says Gordon Food Service’s Gonring. “How fresh fruits and vege tables are creatively prepared, plus their flavor

and health benefits, can offer this ‘something different’ to diners.”

Jackfruit is gaining (on 1.1% of menus, up 100% over the past four years), as consumers desire actual plants in their plant-based appli cations, says Datassential’s Conaghan. “Green jackfruit is being used anywhere you might use pulled pork, including tacos, bowls, sand wiches, lettuce wraps and nachos.”

For example, she says, Elephants Delica tessen, with locations throughout Portland, OR, offers a veggie breakfast sandwich with eggs, jackfruit black bean veggie sausage, Tilla mook cheddar, and spinach with hollandaise on ciabatta. And Blackwood BBQ, in Chicago, IL, has the option of beef brisket, pulled pork, or vegetarian jackfruit for its breakfast wrap catering meal.

Mushrooms are being smash-seared as the ultimate and real ‘plant-based burger,’ says Pam Smith, RDN, foodservice consultant to the Lee’s Summit, MO-based Mushroom Council. “I love seeing portabellas roasted

and shredded into ‘pulled ports’ and used for barbecue, on a tostada or in a bao bun, or as a sandwich topper.”

It’s exciting to see chefs and other menu developers think of mushrooms in creative ways, adds Smith, who shares three examples.

For one, in April, celebrity chef Spike Mendelsohn showcased an alternative to crab cakes with his Lion’s Mane Mushroom and Jackfruit Cakes at the Culinary Institute of America’s Global Plant-Forward Culinary Summit. Second, Chef Derek Sarno, chef-di rector of Plant-Based Innovation at UK retailer, Tesco, turned 400 pounds of mush

A great source of inspiration for menu innovation is the phenomenon of avocado toast. Not a new dish, its fame started to skyrocket after Bon Appetit maga zine published a recipe called ‘Your New Avocado Toast’ in its January 2015 issue.

“If we look back at what made avocado toast a success, it is the following: low cost, easy to execute consistently, customizable, applicable to all day parts, and appealing to multiple consumer bases,” says David Spirito, senior director of culinary and foodservice

for Irving, TX-headquartered Avocados from Mexico (AFM).

To have mass appeal, a dish needs to have visual appeal, taste great and have a nutritional aspect, adds Deena Ensworth, senior content manager for Markon Coop erative Inc., in Salinas, CA. “People want to feel they are eating healthy, but need a punch of texture or flavor to draw them in. The fact that avo toast is also vegetarian/vegan adds folks from those demographics, too.”

The best lesson learned from the

rooms into ‘vegan meat’ at the Hot Luck Festival, a meaty, major annual barbecue event in Austin, TX. Third, Jersey Mike’s Subs, a nearly 2,000-location sandwich chain headquartered in Manasquan, NJ, added its Grilled Portabella Mushroom and Swiss Sub to its permanent menu, after a successful 2021-2022 trial. The offering was named the best healthy fast-food sandwich in the 2022 Eat This, Not That! Food Awards. Plus, interest in this sub prompted the addition of two other new menu items: The Portabella Cheesesteak and the Portabella Chicken Cheesesteak, to the Jersey Mike’s menu.

Global fare and flavors ranked fifth in the NRA’s 2022 What’s Hot survey of the Hottest Culinary Trend in 2022. Specifically, the top three global trends were Southeast Asian (Vietnamese, Singaporean, Philippine, etc.); South American (Argentinian, Brazilian, Chilean, etc.); and Caribbean (Puerto Rican, Cuban, Dominican, etc.)

Elote, also called Mexican Street Corn, which features corn on the cob spread with mayonnaise, chili powder, lime juice, Cotija cheese, and cilantro, could be the next avocado toast, says Tara Murray, vice president of marketing for Rhome, TX-based Fresh Inno vations, LLC, makers of Yo Quiero branded produce-based dips. The company released its Elote dip in December.

A longtime favorite, the Mediterranean Diet, ranked No. 1 as the best diet overall by U.S. News and World Report, in its Jan. 4 release. It’s a position this diet has held for the fifth straight year.

“Produce-based dips and spreads are popular in Mediterranean cuisine. Most people don’t realize that 22 countries make up the Mediterranean. I think we’ll see much more innovation,” says Gordon Food Service’s Gonring, who, with his colleagues conducts live tastings annually in newly opened innova tive restaurant concepts in New York, Chicago