US and European CLO Market Reviews Bringing You CLOser The Market View from Scott D’Orsi, Putnam Investments US Corporate Transparency Act AN INDUSTRY NEWSLETTER FOR THE GLOBAL CLO MARKET MAY 2023

Your Maples Group global CLO team provides Cayman Islands and Irish legal advice and CLO issuer / co-issuer and fiduciary services in the Cayman Islands, Delaware, Dublin, Jersey, London and the Netherlands, in addition to Luxembourg legal advice and fiduciary services in respect of securitisation SPVs. This edition of The CLOser1 includes:

4 US and European CLO Market Reviews 10 Global Listings Update 12 Bringing You CLOser The Market View from Scott D’Orsi, Putnam Investments 14 US Corporate Transparency Act 20 Life After LIBOR 21 Trends in Luxembourg Securitisation 24 Your Global CLO Team –A CLOser Look 1 Data in this publication is derived from a variety of sources, including the Maples Group, Structured Credit Investor, LCD, Leveraged Loan, Creditflux, Moody’s, S&P, Fitch, Euronext Dublin and Central Bank of Ireland.

What’s Inside

The Maples Group is delighted to present our May 2023 edition of The CLOser.

In this edition, we:

• Bring you CLOser to the inside market view, with insights from Scott D’Orsi at Putnam Investments;

• Present key market updates from our US and European CLO markets and review the year since the Cayman Islands’ AML listing;

• Take a look at latest trends in global listings;

• Consider the impact of US Congress passing the Corporate Transparency Act;

• Note some of the recent securitisation trends that our Luxembourg team is seeing;

• Consider life after Libor; and

• Get to know Partner William Fogarty at Maples and Calder, the Group’s law firm; and Senior Vice President Jarlath Canning in the Group’s fiduciary team.

We very much hope you enjoy this edition and find the content engaging and informative.

Best wishes from the Maples Group CLO Team.

May 2023 | 3

US CLO Market Review

Cayman Islands’ EU AML ListingA ‘Year in Review’

In this US CLO market review, we provide observations and analysis in respect of activity in the period March 2022 through to the end of March 2023. This period was chosen as it represents one full year of the Cayman Islands being added to the EU AML list, which formally occurred on 13 March 2022.

Background to Listing

As many of our readers will be aware, the addition of the Cayman Islands to the EU AML list prevented the ‘establishment’ of new Cayman Islands securitisation special purpose entities (“SSPEs”) for purposes of the EU Securitisation Regulation. The reason was essentially two-fold. Firstly, in February 2021, the Financial Action Task Force (“FATF”) took the step of adding the Cayman Islands to its list of jurisdictions under increased monitoring due to perceived strategic deficiencies in its legal frameworks to counter money laundering, terrorist financing, and proliferation financing.

Critically, this ‘Monitoring List’ or ‘grey list’ as it is commonly referred, is not the same as FATF’s ‘black list’, which is reserved for high-risk jurisdictions only, which are subject to calls for action. The Cayman Islands has never been – and certainly never expects to be – on the FATF’s black list. Secondly, subsequent to such grey-listing, on 9 April 2021, the provisions of Article 4 of the EU Securitisation Regulation were amended by the EU. Originally, Article 4 had prohibited the establishment of SSPEs in countries on the FATF’s black list only, being the most high-risk jurisdictions. As a result of the amendment to Article 4, however, it then referenced instead any jurisdiction on the EU’s own AML list. This had the effect of placing the EU Securitisation Regulation out of line with the UK Securitisation Regulation in this regard, whose analogous prohibition to Article 4 continued (and still continues) to refer to FATF’s black-listed countries.

Critically, therefore, the establishment of Cayman Islands SSPEs is not – and has never been – prohibited under the UK Securitisation Regulation. However, after: (i) the jurisdiction’s FATF grey-listing in February 2021; (ii) the EU’s amendment of the EU Securitisation in April 2021; and (iii) the EU’s formal AML listing of the jurisdiction in March 2022, establishment of Cayman Islands SSPEs nonetheless became prohibited under the EU Securitisation Regulation.

Limited Impact

In the context of US CLO transactions, the principal impact of these developments has been on CLOs that are marketed in Europe and structured as EU risk retentioncompliant. In those circumstances – and others where European-regulated investors have dictated it – SPVs have had to be migrated to, or incorporated in, an alternative jurisdiction to the Cayman Islands. The Maples Group had planned for this eventuality well in advance of the jurisdiction’s EU AML listing and devised a unique ‘One Group’ full-service solution that minimised impact through limited changes to deal documentation and utilised a jurisdiction with a proven track record of securities issuances familiar to rating agencies and with a robust and sophisticated legal and regulatory framework. That jurisdiction was Jersey – and, in close collaboration with our legal and fiduciary services colleagues based in our Jersey office, we were able to provide the market with a temporary alternative option to the Cayman Islands that maintained existing relationships, facilitated knowledge sharing and achieved seamless deal execution with enhanced time-zone coverage.

Our solution has been well-received and effective – and while we can offer alternatives in addition to Jersey, the Maples Group has not been instructed to use any other jurisdiction thus far. Indeed, the market has very much coalesced on Jersey as the preferred option, which preference is strongly reinforced by the data analysed in this US market review.

4 | The CLOser

Cumulatively, Cayman Islands and Jersey SPVs were employed in around 82% of the priced deals, with quite notably only around 6% opting for Bermuda SPVs

May 2023 | 5

‘Priced’ US CLOs – Number and Issuer Jurisdiction

During the review period, approximately 317 US CLOs were priced. Of those 317 priced deals, somewhere in the region of 281 employed an ‘offshore’, i.e. non-US domiciled issuer.

The Maples Group acted on 50%, i.e. around 140 of those transactions, giving us a majority market share among offshore service providers. This leading position places us in an entirely unique vantage point with respect to visibility across the US CLO market, allowing us to share market intelligence and track data of interest to manager clients12

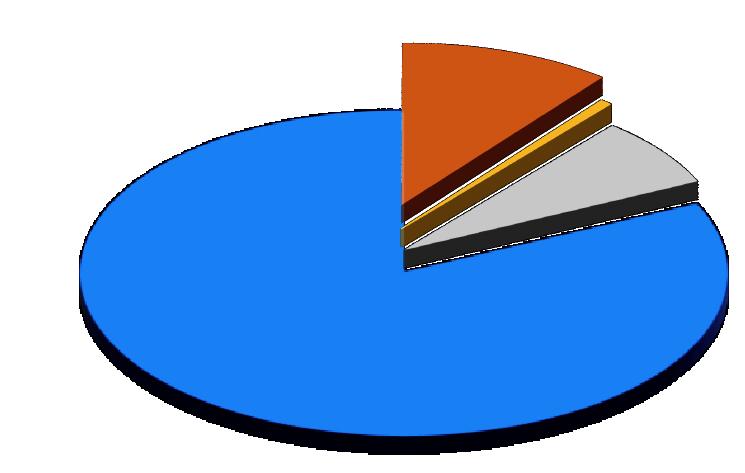

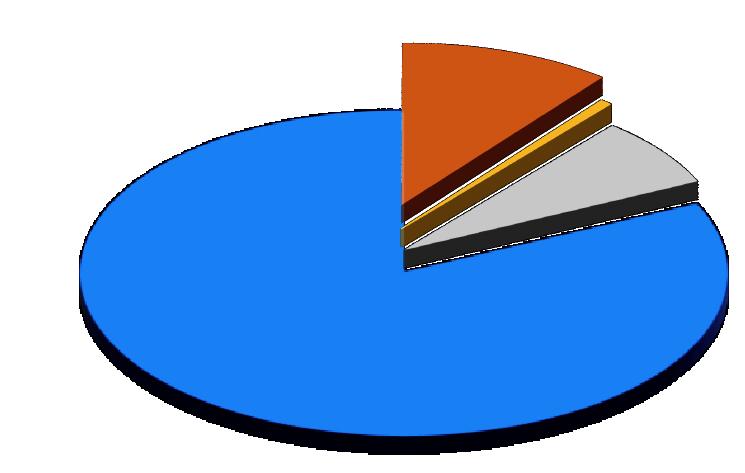

As noted in Figure 1, among the deals on which the Maples Group was engaged, around 50 different CLO managers were represented. Cumulatively, Cayman Islands and Jersey SPVs were employed in around 82% of the priced deals, with quite notably only around 6% opting for Bermuda SPVs –see Figure 2.

If we look at the jurisdictional split in terms of closed CLOs that the Maples Group specifically engaged, we see from Figure 3 below that around 54% had Jersey SPV issuers.

Although market sentiment had generally appeared in favour of Jersey, this data helps to quantify the appetite more precisely and starkly, serving not only as testament to the sophisticated nature of the jurisdiction’s legal and regulatory framework, but also the responsiveness and engagement of the Jersey regulator with service providers. Indeed, the Maples Group actively engaged with managers and counsel to identify and address any concerns through ongoing feedback and constructive engagement and cooperation with the Jersey Financial Services Commission (JFSC).

Breaking that figure down into: (1) SPVs that migrated from the Cayman Islands to Jersey; and (2) SPVs that were incorporated at the outset in Jersey, the percentages are 26% and 28%, respectively. Of course, many of the migrated SPVs were incorporated either prior to or relatively shortly after the EU AML listing, but that is not exclusively the case. In fact, we have seen warehouse SPVs continue to incorporate in the Cayman Islands and subsequently migrate upon CLO close to the extent required. We have also seen at least one warehouse SPV with European-facing investors being ‘opened’ in Jerseybut then migrated to the Cayman Islands for CLO close on the basis that the CLO itself did not need to utilise an alternative to the Cayman Islands since it was not structured as EU risk retention-compliant.

6 | The CLOser

1 ² https://www.linkedin.com/posts/maplesgroup_clos-thecloser-caymanislands-activity-7060266906955501568-rPrq?utm_source=share&utm_medium=member_desktop

Cayman Islands 46% Jersey 54% Jersey Incorporated 28% Migrated to Jersey 26%

Figure 3: Closed CLOs and Issuer Jurisdiction

81.7% 7.0% 0.7% 10.6%

Figure 2: SPV Jurisdiction

CAYMAN ISLANDS STOCK EXCHANGE

THE INTERNATIONAL STOCK EXCHANGE - JERSEY EURONEXT DUBLIN

NO LISTING

Figure 4: Stock Exchange Listings

FOR =

Figure 1: Priced CLOs by Manager with the Maples Group

The following are additional trends and observations based on closed CLOs that the Maples Group engaged:

• Listings

Around 18% of CLOs that closed during the review period saw their notes being listed on a stock exchange. As illustrated in Figure 4, there were more listings on the Cayman Islands Stock Exchange (10.6%) than on Euronext Dublin (7.0%), with one deal listed on The International Stock Exchange - Jersey. For a more detailed listings update please see pages 10-11.

• Trustee Market Shares

US Bank appeared to have the clear majority of deals, with Citibank and BNYM almost level-pegging in second place. Those top three trustees enjoyed, collectively, engagement on 85% of our closed CLOs. Figure 5

• Average Deal Size

Overall, across all closed CLOs, average deal size was around US$430 million. Notably, a slight downwards trend has been observed over the 12-month period. Figure 6.

• Price-to-Close Durations

Again, a slight downward trend has been observed. In the last few months of the review period, there were twice as many ‘print and sprint’ deals, with price-toclose periods of less than 20 days. Figure 7.

• Loan Tranches

Approximately 16% of CLOs included loan tranches, a slight increase based on prior recent trends.

Correlating Structural Features with Efficiency of CLO Execution

• EU Risk Retention

As noted previously, given the market standard approach of utilising Cayman Islands SPVs in US CLOs the need for Jersey SPVs in the majority of cases arises since the SPV is being treated as an SSPE for EU Securitisation Regulation purposes, indicating that the deal is structured as EU risk retention-compliant. The jurisdiction correlation depicted in Figure 8 therefore gives a possible hint as to the impacts of marketing in EU, where it can be seen that the average warehouse duration for Jersey SPV issuers has been largely static (at slightly below five months).

• Loan Tranches

There are no obvious correlations between inclusion of loan tranches in CLOs and the duration that the deal remains in warehouse, save that those with loan tranches appear to have consistently (slightly) longer warehouses. Figure 9.

May 2023 | 7

DEAL SIZE IN US$ CLO CLOSING DATE $100 000 000 $200 000 000 $300 000 000 $400 000 000 $500 000 000 $600 000 000 $700 000 000 $800 000 000 $900 000 000 08/02/2022 19/05/2022 27/08/2022 05/12/2022 15/03/2023 23/06/2023

CLO CLOSING DATE $100 000 000 $200 000 000 $300 000 000 $400 000 000 $500 000 000 $600 000 000 $700 000 000 $800 000 000 $900 000 000 08/02/2022 19/05/2022 27/08/2022 05/12/2022 15/03/2023 23/06/2023 0 5 10 15 20 25 30 35 40 45 50 P R I C E T O C L O S E D U R A T I O N I N D A Y S CLO CLOSING DATE

Figure 6: Deal Size

COMPUTERSHARE STATE STREET WILMINGTON DEUTSCHE BANK BNYM CITIBANK U.S.BANK

Figure 7: Trends in Number of Days ‘Priced’

Figure

5: Trustee Market Shares

Figure 8: Possible Signs of Correlation between EU and Non-EU Risk Retention Compliant CLOs and Efficiency of Deal Execution

an increase based upon figures quoted in October 2022. Average warehouse duration with respect to closed CLOs, on the other hand, is around 162 days (or 5.3 months) as compared to around 180 days in October 2022. One can therefore conclude that, where deals are proceeding to successfully close, they are doing so more quickly, but the market is proving more challenging generally leading to a growing number of open warehouses that are continuing to ‘age’. At this point, we have not identified any trend in warehouse terminations, save for those involving Credit Suisse.

Figure 10: Warehouse Financing Arrangements –Debt and Equity

2023 Market Conditions and Outlook

• Warehouse Financing Arrangements

The scatter plot in Figure 10 suggests that, over time, the positive impacts of including equity investment in CLO warehouses (38% of deals) with respect to warehouse duration has tended to diminish. There are signs that pure debt arrangements are perhaps resulting in shorter warehouse durations although the general trend in the review period was for warehouse duration to steadily increase.

Update Regarding Open Warehouses

In the last edition of The CLOser published in October 2022, we reported having approximately 82 ‘open’ warehouses on our book of deals. At the time of writing, that figure now stands at approximately 88. The average age of those open warehouses is currently around 8.5 months, which reflects

For this edition of The CLOser, we are thrilled to bring you expert views from Scott D’Orsi of Putnam Investments. Please see our feature Bringing You CLOser article on page 12 for an excellent overview of current market conditions and future outlook.

For further details, please contact:

James Reeve

+1 345 814 5129

james.reeve@maples.com

Scott Macdonald

+1 345 814 5317

scott.macdonald@maples.com

8 | The CLOser

08/02/2022 30/03/2022 19 05/2022 08 07/2022 27 08/2022 16/10 2022 05 12 2022 24 01/2023 15/03/2023 04/05/2023 CLO CLOSING DATE W A R E H O U S E D U R A T I O N I N M O N T H S 0 00 2 00 4 00 6 00 8 00 10 00 12 00 14 00 16 00 18 00 08/02/2022 30/03/2022 19/05/2022 08/07/2022 27/08/2022 16 With Loan Debt Without Loan Debt Linear (W 0 0 2 0 4 0 6 0 8 0 10 0 12 0 14 0 16 0 18 0 W A R E H O U S E D U R A T I O N I N M O N T H S I S S U E R J U R I S D I C T I O N & W A R E H O U S E D U R A T I O N Cayman Is ands Issuers Jersey Issuers Linear (Cayman slands Issuers) Linear (Jersey Issuers)

CLO CLOSING DATE W A R E H O U S E D U R A T I O N I N M O N T H S 0 00 2 00 4 00 6 00 8 00 10 00 12 00 14 00 16 00 18 00 03/2022 19/05/2022 08/07/2022 27/08/2022 16/10/2022 05/12/2022 24/01/2023 15/03/2023 an Debt Without Loan Debt Linear (With Loan Debt) L near (W thout Loan Debt) 30/03/2022 19/05/2022 08/07/2022 27/08/2022 16/10/2022 05/12/2022 24/01/2023 15/03/2023 I N C L U S I O N O F E Q U I T Y I N V E S T M E N T I N WA R E H O U S E S T R U C T U R E V I A P R E F E R E N C E S H A R E S With Prefs Without Prefs Linear (With Prefs) Linear (Without Prefs)

CLO CLOSING DATE W A R E H O U S E D U R A T I O N I N M O N T H S 0 00 2 00 4 00 6 00 8 00 10 00 12 00 14 00 16 00 18 00 W A R E H O U S E D U R A T I O N I N M O N T H S 0 00 2 00 4 00 6 00 8 00 10 00 12 00 14 00 16 00 18 00 08/02/2022 30/03/2022 19/05/2022 08/07/2022 27/08/2022 16/10/2022 05/12/2022 24/01/2023 15/03/2023 With Loan Debt Without Loan Debt L near (W th Loan Debt) Linear (Without Loan Debt) 30/03/2022 19/05/2022 08/07/2022 27/08/2022 16/10/2022 05/12/202 I N C L U S I O N O F E Q U I T Y I N V E S T M E N T I N WA R E H O U S E S T R U C T U R E V I A P R E F E R E N C E With Prefs Without Prefs Linear (With Prefs) Linear

Figure 9: Loan Tranches and Warehouse Duration

European CLO Market Review

2023 So Far

Since 2023, there has been a slow start to the European CLO market, with the collapse of Silicon Valley Bank and the restructuring of Credit Suisse adding to market volatility. As of 24 April 2023, there have been €7.5 billion of CLO issuances from 20 deals, compared to €10.99 billion from 26 deals at the same point in 2022. Between mid-March and mid-April 2023, only one European CLO deal priced. Market participants are of the view that market volatility is here to stay with primary loan activity down in recent months which makes the arbitrage on CLO deals more challenging. The difficulty in getting deals priced has meant that open warehouses are increasing, with some suggestions that the number is between 60 and 70. However, there have been few warehouse liquidations suggesting managers are willing to wait until market volatility subsides to get deals priced and the CLOs closed.

However, there are signs of a resurgence in European CLO activity. Some managers have been able to complete postpricing upsizes of their CLOs which shows investor appetite is still strong and some platforms have continued to price deals and open new warehouses at their normal issuance pace. Furthermore, managers are of the view the market conditions are more favourable in 2023 versus when CLOs priced in 2022, with some managers indicating that they are now able to raise funds from a broader group of new and existing investors.

2023 Trends

Notwithstanding the challenging conditions, new managers continue to enter the European market with several debutants at advanced warehouse stage already. Furthermore, there is a trend of managers consolidating their businesses, for example, the sale of NIBC’s North Westerly franchise to Aegon Asset Management announced in late April 2023. ESG continues to be a trend in the European CLO market with managers willing to amend and adapt their offerings to entice ESG-focused investors, with an increasing percentage of the manager market

advancing their approach from negative screening-only to applying in-house and outsourced-ESG scoring models. Indeed, more so-called Article 8-aligned deals are expected in 2023.

On the legislative side, the European Union (“EU”) announced on 28 February 2023 that provisional agreement had been reached on the European Green Bond Regulation (the “Green Bond Standard” or “GBS”). The GBS will establish an EU voluntary ‘gold standard’ for bonds that finance climate and environmentally-friendly investments, and providing for a degree of harmonisation of EU buy-side investor requirements with the sell-side (the GBS will also be available for non-EU issuers to opt into).

Though the text has not been published, it is expected that the GBS will facilitate securitisation structures, both through the use of proceeds approach and the recognition of the role of the SPV issuer in a securitisation compared to the bond markets. GBS criteria may likely be too restrictive for current BSL CLOs to qualify under the label, i.e. until the loan market also sufficiently matures from an ESG perspective, but the implementation of the legislation by the EU shows the trajectory of ESG-related debt in the European marketplace.

Notwithstanding the challenging conditions, new managers continue to enter the European market

It is also encouraging that securitisation technology appears to have incorporated into the policy discussion in a positive manner, a signal noted in other policy discussions also and driven by the centrality of the Capital Markets Union to the EU project currently.

On the market side, the European Leveraged Finance Association (“ELFA”) issued a CLO ESG questionnaire (the “Questionnaire”) to assist investors in asking ESG-related questions of CLO collateral managers. The Questionnaire aims at increasing transparency and standardisation in ESG disclosure, thereby making comparisons easier for investors.

The questions focus firstly on the running of the CLO manager itself and then on how ESG fits into the manager’s investment framework. ESG will only become more prominent and important in the minds of CLO investors in the years ahead. In light of this, questions such as those set out by ELFA will be asked more frequently of CLO managers. Therefore, managers should seek to establish procedures and practices in order to accurately and efficiently answer such ESG queries in the future. The Questionnaire was tested and developed by ELFA in close collaboration with the European CLO community, so is viewed as fit for purpose to streamline some of the friction that differing investor ESG requirements and policies often create.

For further details, please contact:

Stephen McLoughlin

+353 1 619 2736

stephen.mcloughlin@maples.com

Callaghan Kennedy +353 1 619 2716

callaghan.kennedy@maples.com

Rory Beasley +353 1 619 2084

rory.beasley@maples.com

Global Listings Update

Ireland

During the second half of 2022, 45 CLOs (US and European), were listed on Euronext Dublin. Of these listings, 33 were Irish issuers (73%), 6 were Jersey issuers (13%), 4 were US issuers (9%) and 2 were Cayman Islands Issuers (5%). The Maples Group’s Dublin office listed 22% of all Euronext Dublin-listed CLOs listing on Euronext Dublin. For the entire year, 117 CLOs (US anEuropean) were listed on Euronext Dublin. Of these listings, 86 were Irish issuers (74%), 12 were Cayman Islands Issuers (10%), 9 were Jersey issuers (8%), 9 were US issuers (8%) and 1 was a Bermuda Issuer. The Maples Group’s Dublin office listed 26% of all Euronext Dublin-listed CLOs listing on Euronext Dublin

For further details, please contact:

Ciaran Cotter

+353 1 619 2033

ciaran.cotter@maples.com

Cayman Islands

As noted in our US market overview above, in March 2022, the European Commission added the Cayman Islands to its list of ‘high-risk third countries’ identified as having strategic deficiencies in their anti-money laundering / counter-terrorist financing regimes (“EU AML List”).

Although Cayman Islands SPVs have historically been used as the issuer-entity in US CLOs, the inclusion of the Cayman Islands on the EU AML List caused a jurisdictional split in US CLO issuers, with some CLO issuers incorporating in a jurisdiction other than the Cayman Islands. Although not an occasion for celebration, with a full year on the EU AML List behind us, such an anniversary does afford the opportunity to examine how the inclusion of the Cayman Islands on the EU AML List affected CLO listings on the Cayman Islands Stock Exchange (“CSX”).

10 | The CLOser

A Review: March 2022 – February 2023

During this period, 35 CLOs, comprising new issuances, refinancings and resets, listed on the CSX.

This is a marked difference in volume from the same period the previous year where 134 CLOs listed on the CSX and is also lower than the same period two years prior where 55 CLOs listed on the CSX. Of course, 2021 was somewhat of an outlier year, as we saw unusually high levels of activity in both the new issuance and refinancing markets. Last year, although new issuance levels more or less kept pace with 2019 and 2020 figures, the absence of a refinancing market through the majority of 2022 likely took its toll, resulting in fewer CLO listings.

During this period, the Maples Group listed 49% of all the CLOs listed on the CSX, which kept pace with the previous year, in which the Maples Group also listed 49% of all the CLOs on the CSX.

Of particular note, just under half (49%) of the CLO listings on the CSX during this period were by Cayman Islands issuers with a Delaware co-issuer, as compared to the same period the previous year, where 93% of the CLO CSX listings were by Cayman Islands issuers with a Delaware co-issuer. This jurisdictional shift is undoubtedly due to the inclusion of the Cayman Islands on the EU AML List.

During this period, Jersey issuers with a Delaware coissuertook second place in the rankings with 31% of the CLO listings on the CSX, a clear indication that the market has firmly settled on Jersey as the primary alternative jurisdiction for the CLO issuer when the Cayman Islands is not available. The Maples Group listed 64% of the Jersey issuer CLOs listed on the CSX.

Delaware issuers comprised 11% of the CLO CSX listings during this period, and Bermudian issuers with a Delaware co-issuer made up the remaining 9% of the CLO CSX listings during this period.

During the same period the year prior to the EU AML listing, there were no Jersey or Bermudian CLO issuers listed on the CSX, and Delaware CLO issuers only accounted for 4% of the CSX listings. Two managers account for the three CSX listings we have seen to date by Bermudian CLO issuers. Whereas middle market managers have appeared to favour a transition to Delaware-only issuer CLOs when the Cayman Islands is not an option for formation. This continues the upward trend of Delaware CLO issuers listing on the CSX, as 2021 saw at least six such listings, compared to one in 2020.

Not surprisingly given market conditions this past year, March 2022 was the most active month for CLO CSX listings with seven CLO listings. The same month the previous year also saw seven CLO listings; however March 2021 was one of the slowest months for new CLO CSX listings the

prior period, with eight months of 2021 hitting double-digit numbers of CLO listings. December 2021 was the most active month in the period prior, with 20 CLO listings on the CSX.

New issue CLO CSX listings far outpaced refinancing listings from March 2022 to February 2023, with new issue CLO listings accounting for 83% of the CSX listings. By comparison, from March 2021 to February 2022, new issue CLO listings accounted for 54% of the CSX listings, with refinancing CLO listings making up 43% of the CSX listings, and European CLO warehouse vehicles making up the remaining 3% of CSX listings.

This is a significant change, with new issuance listings going from comprising just over half to well over three-quarters of all CLO listings on the CSX, but this downward trend of refinancing CSX listings is reflective of the lack of any real refinancing activity seen last year.

Thus far in 2023, we have seen 10 CLO listings on the CSX, all of which are new issuance listings, five of which are Cayman Islands issuers with Delaware co-issuers, and five of which are Jersey issuers with Delaware co-issuers. This year to date, the Maples Group listed 60% of all the CLOs listed on the CSX. Until conditions alter to encourage the re-emergence of the refinancing market, we expect the current trends to continue, with a pre-dominance of the CLO CSX listings being new issue listings. In addition, until the Cayman Islands is removed from the EU AML List, we also expect the jurisdictional split of CLO issuers to continue, weighted more heavily towards Cayman Islands and Jersey issuers.

Although the volume of CLO CSX listings was down for the year from March 2022 to February 2023, our data indicates that the decrease in volume had more to do with the general absence of viable refinancing conditions during much of 2022, rather than the inclusion of the Cayman Islands on the EU AML List. During this past year, in addition to the usual suspects of the Cayman Islands issuers, issuers incorporated in Jersey and Bermuda, as well as higher numbers of Delaware issuers, elected to list CLOs on the CSX, demonstrating that the CSX remains an efficient and effective choice for investors who require a CLO listing on a recognised stock exchange.

For further details, please contact:

Lazier

May 2023 | 11

Amanda

+1 345 814 5570 amanda.lazier@maples.com

Bringing You CLOser

In our fifth ‘Bringing You CLOser …’ with an inside view from recognised CLO industry participants and experts, we hear from Scott D’Orsi, Portfolio Manager for 37 Capital within Putnam Investments’ Fixed Income Group.

Q: How would you describe the CLO market currently?

A: Functioning. I am impressed by the fact US$43bn in deals have priced thus far in 2023, including both US and Euro deals, which is ahead of the issuance level at this point last year. The ability to find market clearing levels despite the ongoing broader volatility reflects convictions behind a unique, all-weather asset class. But that is not to say deals have had a straightforward path to the finish line.

Q: Can you elaborate on that point?

A: Well, we recently priced our third deal, and I never would have thought our first deal would be easier than the third one but that was indeed the case, all due to the macro backdrop. Investor participation levels are well below where they were in 2021 and early 2022, although there is a reasonable amount of liquidity among the core investor base - namely insurance companies, some banks, and structured credit funds. It is a matter of being dogged in terms of finding that liquidity.

There is also a fair amount of direct negotiation taking place with individual investors – all to be expected - whether it be pricing, structure or specific indenture provisions. It is very important that the manager and arranger bank work closely together to respond in a timely manner to where and how investor interest surfaces. The face of a deal can change multiple times right up to pricing.

Q: What is the equity picture for new issue CLOs? Do you think deals can achieve targeted equity returns?

Q: With AAAs currently pricing at S+ (180-220bps) and portfolio weighted average spreads ramping to S/L+ (350380bps), the current arbitrage is certainly at the tighter end of where deals historically get priced. For example, CLO equity is typically modelled to a 14-15% IRR range but given existing CLO liability pricing, equity is getting underwritten to a 9-11% range, at best. The path to achieving those targeted equity returns is also less clear. Some managers have done ‘print and sprint’ executions whereby an entire portfolio is ramped immediately upon liability pricing, hoping to time the market at a point of asset price cheapness and then be able to release trading gains to the CLO equity. Managers have also elected to use shorter-life deals to strike a shorter non-call period on the liabilities with the expectation of re-financing some or all the liabilities at lower coupons after one year as opposed to the more standard two-year non-call period. Upside to the equity can also be achieved from re-pricing activity on the assets. We are beginning to see an uptick in companies seeking to extend their loan maturities and in nearly all instances, that maturity extension will require a higher spread loan, so the portfolio spread at pricing should have some organic uplift in the coming quarters.

12 | The CLOser

Q: Do you have a view as to whether CLO issuance conditions improve in the next six months?

A: I think they will improve. If you look at historical periods of CLO liability spread widening such as the sharp oil / energy sell-off, sovereign debt crisis, and the COVID pandemic, AAA liabilities retraced more quickly than what we are now experiencing. One major difference between then and now is the role of Fed-enabled liquidity: there is zero expectation for it currently. AAAs, which have hovered in the 180-220 range for nearly a year now, continue to be the toughest part of the stack to execute due largely to the fact many of the biggest AAA buyers haven’t been active. I view that retreat as more of a forced capital allocation issue rather than the value proposition of buying CLO AAAs at, say, SOFR + 170. There is a reasonable upside scenario, however, from these buyers re-entering the market over the next six months and that AAA spread range tightens. CLOs are being funded of late by captive or quasi-captive equity willing to accept fairly high cost of capital debt. Given how sensitive that cost of debt is to AAA pricing, it won’t take much for AAA spread tightening to attract new equity capital and drive more CLO activity. The other component to a constructive near-term outlook comes from the asset side. Loan issuance has been very, very low and that cannot persist absent a material decline in GDP. Higher coupon deals will arrive and help restore the arb to allow more CLO formation.

Q: What are the conditions for new issue broadly syndicated loans?

A: In short, we have been under-supplied. YTD gross issuance is US$75bn compared to US$137bn YTD last year. LBO financings are way down at only US$5bn versus US$43bn last year. Adjusting to a materially higher interest rate environment and higher debt financing costs can quickly take a lot of M&A activity off the table, whether that be private equity led or strategic. The leveraged loan market actually contracted since June 2022 after expanding 10% per year over the past decade. But the best loans tend to be

made in the worst times, so I would certainly welcome more loan investment opportunities from new transactions. I believe there is more hesitancy on the part of issuers than investors.

Q: What are your views in terms of expected defaults and loan recoveries?

A: Exiting 2021, the loan market default rate was artificially suppressed, running well below 1%. By the end of Q1’22, however, as the markets started bracing for Fed rate-hikes some were calling for defaults to hit 5%, 6% and even higher. That obviously hasn’t been the case: the LTM default rate was 1.3% at the end of March. We will undoubtedly move higher, and I estimate peak in the 3.25% – 3.75% range over the next 12 months. I also think it will be a protracted climb into that default range, and not necessarily industry specific. There are some sectors more vulnerable than others such as retail, tech, housing and even healthcare, but coming off Q4’22 earnings, companies are coping better than many had feared, us included. The more important element to the question is recoveries. A 5% default rate at historic loan recoveries of 70% can leave you in the same spot as 3% defaults with 50% recovery. As an asset class that is anchored by CLO issuance, which itself is structured upon expected credit losses, I prefer the former over the latter because we can do a better job at predicting defaults than we can recoveries. There are a few dynamics behind the growth to the leveraged loan market that will likely undermine 70% recoveries. These dynamics include an increase in the loan-only issuer base, high tech becoming the largest single industry over the past decade (tech as a BSL sector was negligible pre-GFC), and the amount of B3 loan issuance in 2021. The net effect, in my opinion, will be actual recoveries in the 60% area but higher dispersion of recoveries around that figure, and so, credit selection will play out in a very meaningful way in the next 18 months or so.

May 2023 | 13

We are beginning to see an uptick in companies seeking to extend their loan maturities and in nearly all instances, that maturity extension will require a higher spread loan, so the portfolio spread at pricing should have some organic uplift in the coming quarters.

US Corporate Transparency Act

On 1 January 2021, the US Congress passed the Corporate Transparency Act (“CTA”). This will require the disclosure of beneficial ownership information (“BOI”) in respect of all in-scope, i.e. non-exempt, entities formed or registered to do business in the US to the US Treasury’s Financial Crimes Enforcement Network (“FinCEN”), the regulatory agency responsible for safeguarding the US financial system from illicit use. The beneficial ownership disclosure requirements under the CTA come into force on 1 January 2024.

Please visit the FinCEN’s Beneficial Ownership website3 for more information.

This new layer of transparency strengthens lawmakers’ efforts to generally bringing the US into compliance with international terrorist financing and anti-money laundering standards. The need to identify and report the information on the individuals who own and control US companies was illustrated in early 2022 as the events in the Eastern Europe conflict in Ukraine intensified and multiple agencies instituted related sanctions. Following the introduction of said sanctions, the US government determined that significant barriers existed in terms of connecting the sanctioned persons with their assets indirectly held through multi-layered US companies. Indeed, the CTA will have a significant impact on how most US and non-US entities are formed or registered to do business in the US and will serve as a new policy tool in assisting authorised government authorities with their law enforcement and prosecutorial efforts. The Maples Group’s Delaware office is long established and our expert team, specialising in US entity management, is well placed to assist with BOI compliance solutions in relation to the CTA. We have vast experience with the US corporate environment, as well as all state and federal filing requirements. Across our network, we have intimate knowledge of similar beneficial ownership regimes around

the world, utilising well established and market tested procedures to manage the vast numbers of filings potentially required by the CTA.

CTA Overview

Millions of US and non-US entities are potentially inscope of the CTA to disclose related beneficial ownership information albeit some will fall into one of the 23 exemptions. The rule states that all entities formed or registered to do business in the US (by filing a document with a Secretary of State or similar office on or after 1 January 2024) will be required to identify an exemption or file a BOI report (“BOI Report”) to FinCEN within 30 days of formation or registration, as applicable. The BOI Report must detail key information regarding: (1) the entity itself; (2) the individuals involved in the formation or registration; and (3) all beneficial owners, i.e. the individuals who, directly or indirectly, control the entity or own 25% or more of the ownership interest.

3 https://www.fincen.gov/boi

May 2023 | 15

FIGURE 1 : CORPORATE TRANSPARENCY ACT TIMELINE

Additionally, all in-scope entities formed or registered prior to 1 January 2024 will have until 1 January 2025 to file their BOI Reports to FinCEN. FinCEN’s analysis estimates some 36.2 million entities with disclosure requirements will be in existence on the effective date of the CTA. Please see Figure 1 for a timeline of the CTA.

Upon filing the initial BOI Report, the in-scope entities will have up to 30 days to provide updated information to FinCEN should any information change, including their exemption status. There are stringent reporting violations, such as a civil fine of up to US$500 a day for each day the violation continues and / or a criminal fine of up to US$10,000 and two years’ imprisonment. CLO managers will be well advised to begin reviewing this far-reaching legislation and its impact on their entity management processes.

Identifying In-Scope Entities in a Typical CLO Structure

While the CLO managers themselves may fall into one or more of the exemptions, certain entities used in most common CLO structures may have to file BOI Reports to FinCEN. Below is a brief analysis of each entity illustrated in Figure 2 and its potential CTA disclosure obligations. Please read our FAQ4 update for detailed information on the BIO disclosure requirements. CLO managers should work with their US counsel to gain a good understanding of the CTA filing obligations

CLO Issuer SPV – Non-US Entity

The CLO Issuer SPV – Non-US Entity is not required to perform a CTA analysis since, per the rule, it is not a USdomiciled entity nor registered to do business in the US5 This applies to other jurisdictionally and structurally similar vehicles used in certain CLO structures such as income note issuer vehicles.

4 https://maples.com/en/knowledge-centre/2023/4/the-us-corporate-transparency-act-faq

5 Typically non-US CLO entities would not be registered to do business in the US, but to the extent that is not the case the analysis/classification for CTA purposes may, of course, be different.

16 | The Closer

FIGURE 2: CLO STRUCTURE CHART AND CTA FILING OBLIGATIONS

CLO Co-Issuer SPV – US Entity

The CLO Co-Issuer SPV – US Entity (typically a Delaware LLC) will be in scope of the CTA and likely not fall into one of the 23 exemptions, and therefore may be required to file a BOI Report to FinCEN. The CLO Co-Issuer SPV – US Entity will need to obtain and disclose the requisite personal identifying information for the following individuals:

• the individual who files the formation document with the Secretary of State on behalf of the CLO Co-Issuer SPV –US Entity;

• the individual who is primarily responsible for directing or controlling such filing if more than one individual is involved;

• all directors, managers and / or senior officers of the CLO Co-Issuer SPV; and

• all individuals who, directly or indirectly, own or control 25% or more of the ownership interest of the CLO CoIssuer SPV – US Entity.

To identify its ownership interest, the Co-Issuer SPV – US Entity will have to look through to the ownership interest of its sole member, the CLO Issuer SPV. The Share Trustee holds the ordinary voting shares of the CLO Issuer SPV on trust, so the CLO Co-Issuer SPV may be required to disclose information on the individuals with authority to dispose of the trust’s assets such as the trustee. The Co-Issuer SPV – US Entity will be required to file any updated BOI Reports with FinCEN pursuant to the ongoing disclosure requirements of the CTA.

Additionally, what may be viewed as a modest disclosure requirement may prove quite challenging for many US domiciled co-issuer vehicles, as they will be required to provide a US Tax Identification Number (“TIN”), such as an

Employer Identifier Number (“EIN”), within 30 days (in the case of new entities) and one year (in the case of existing entities). This will be a new and unique obligation for many co-issuer entities that are structured as single member limited liability companies. In most cases, the co-issuers utilise the default IRS classification to be treated as disregarded entities for US tax purposes. In the current ‘preCTA’ environment, the co-issuer does not typically apply for their own EIN. However, once the CTA comes into effect they may be required to do so solely for purposes of meeting the CTA’s requirement to disclose the TIN6

Furthermore, existing co-issuer vehicles may now have to apply for EINs to meet this requirement ahead of the 1 January 2025 deadline to file their initial BOI Reports. CLO managers should be mindful of the IRS limitation of assigning one EIN per day per responsible party, i.e. the co-issuer manager, and perhaps consider if their current service providers have a large enough team to serve as the managers of the co-issuer vehicles or whether one individual controls all co-issuer vehicles. If the latter is true, CLO managers may wish to begin reviewing their current procedures to ensure this seemingly minor administrative requirement does not result in financial penalties down the road. CLO managers may also wish to engage with their tax advisors to identify any tax implications.

Warehouse SPV – US Entity

The Warehouse SPV – US Entity will be in-scope of the CTA and likely not fall into one of the 23 exemptions. As such, it is anticipated that this entity will likely be required to file its initial BOI Report and any updated BOI Reports with FinCEN prior to being merged with, and into, the CLO Issuer SPV.

The Warehouse SPV – US Entity will have to identify and disclose information on the individuals involved in the formation, all directors, managers and / or senior officers

6 The Co-Issuer SPV will most likely not be able to provide the IRS TIN of its sole member for CTA disclosure purposes.

of the Warehouse SPV – US Entity and all individuals who, directly or indirectly, own or control 25% or more of the ownership interest.

In Figure 1, the Warehouse SPV – US Entity will have to look through to the ownership interest of its sole member, the CLO Issuer SPV7 and may be required to disclose information on the individuals with authority to dispose of the trust’s assets such as the trustee.

The Warehouse SPV – US Entity’s ongoing CTA filing obligations will cease concurrently with closing and merger of the Warehouse SPV with, and into, the CLO Issuer SPV.

The Tax Blocker SPV – US Entity will have to identify and disclose information on the individuals involved in the formation, all directors, managers and / or senior officers of the Tax Blocker SPV and all individuals who, directly or indirectly, own or control 25% or more of the ownership interest.

Similar to other US-domiciled SPVs in Figure 1, Tax Blocker SPV – US Entity will have to look through to the ownership interest of its sole member, the CLO Issuer SPV.

Tax Blocker SPV – US Entity will be required to file any updated BOI Reports with FinCEN pursuant to the ongoing disclosure requirements detailed below.

Ongoing Disclosure Requirements

Once the CTA comes into effect, many events that may occur throughout the life cycle of an in-scope entity must be tracked and reported to FinCEN.

If the CLO Co-Issuer SPV – US Entity changes its legal name or its manager is, for example, issued a new passport or driver’s licence, or changes residential address, then the CLO Co-Issuer SPV – US Entity must disclose these changes to FinCEN or potentially face significant penalties if they are not disclosed within 30 calendar days.

In the instance where a director resigns or is replaced, simply passing a resolution will no longer be sufficient - CLO managers will now have to obtain and disclose the full name, date of birth and residential address and provide a scan of an acceptable form of identification for the new director(s) and senior officers.

Tax Blocker SPV – US Entity

The Tax Blocker SPV – US Entity will be in-scope of the CTA and likely not fall into one of the 23 exemptions. As such, it is anticipated that this entity will likely be required to file its initial BOI Report.

Alternatively, individuals can provide their BOI Report to FinCEN to obtain a “FinCEN Identifier”. The FinCEN Identifier can be provided in lieu of their personal information when the entity files its BOI Report with FinCEN.

7 To the extent the membership interests of the warehouse vehicles are held subject to a declaration of trust or other third party (e.g. arranger), the analysis / classification for CTA purposes may, of course, be different.

all in-scope entities formed or registered prior to 1 January 2024 will have until 1 January 2025 to file their BOI Reports

It is important to note that the Final Rule does not contemplate a de-registration process, so the individuals with the FinCEN Identifier are responsible for making updates or corrections to their beneficial owner information on an indefinite basis by submitting an updated application to FinCEN, and are subject to the same timelines and terms as updates or corrections to a BOI Report by an entity.

Impact on CLO Managers

While it is likely that the direct impact to the CLO market will be relatively minimal and hence manageable, CLO managers may wish to consider one or two broader implications regarding implementation of the CTA. For instance:

• CLO managers may also want to liaise with their legal advisors to determine if any CTA-related language is eligible for inclusion in transactional documents, offering documents or other marketing materials, to assist with informing all parties of the new legislation and (possible) disclosure requirements.

• In-scope entities that qualify for an exemption do not proactively register for such exemption with FinCEN, so CLO managers should consider how the exemptions are documented, for good corporate governance purposes, i.e. resolutions or other means. As noted above, entities will have 30 days to file their initial BOI Report should they no longer qualify for an exemption.

Next Steps

While the market awaits further guidance from FinCEN concerning matters such as the development of the infrastructure to administer the requirements in accordance with the strict security and confidentiality requirements of the CTA, institutions will be well advised to begin putting the processes in place now to ensure timely filing of their BOI Reports.

Next Steps / What to do:

• Determine the entities in scope, applicability of any exemptions and the implications and actions required in respect of each.

• Ensure other business lines within your institutions are aware of the CTA and kept informed of any updates and guidance from FinCEN.

• Work with legal, tax, and other service providers to understand the practical implications of this legislation.

The Maples Group’s Delaware office is long established and our expert team, specialising in US entity management, has vast experience with the US corporate environment, as well as all state and federal filing requirements. Across our network, we have intimate 0knowledge of similar beneficial ownership regimes around the world, utilising well established and market tested procedures to manage the vast numbers of filings potentially required by the CTA.

For further details, please contact:

Daniel Grugan +1 302 340 9968 daniel.grugan@maples.com

James

Reeve +1 345 814 5129

james.reeve@maples.com

Life After LIBOR

The final days of LIBOR as a benchmark rate are upon us, with USD LIBOR ceasing to be published in just a few weeks at the end of June 2023. In certain markets, such as repack programmes, we have seen clients over the past year actively amending the terms of their products to transition from LIBOR to other benchmarks. In the CLO market, we have seen a relatively recent uptick in activity in this regard.

There is now an increasing stream of amendments being brought to market to address the transition away from LIBOR. Many managers had their amendment documentation teed up and ready to go, but they were waiting for either the April payment date to pass or to see the amendments that others brought to market before moving forward with amending their deals.

The documentation for older US CLOs do not contemplate the possibility of USD LIBOR falling away, and therefore lack language to address this. The US federal legislation, commonly referred to as the LIBOR Act, has provided helpful default fallbacks for many of these older deals. However, the LIBOR Act does not in every case provide a full solution and it may still be necessary to amend such deals to fully address the implications of LIBOR coming to an end. Furthermore, the legislated default fallback rate may not be desirable under current market conditions.

Transactions that contemplate LIBOR replacement are likely outside of the scope of the LIBOR Act. More recent CLOs will fall into this category. In such cases, the contractual fallback provisions will likely apply. Nevertheless, the transaction parties may wish to amend the deal terms to address shortcoming or to better align the terms with current market developments.

While the directors of Cayman Islands CLO issuers are generally aware of the issues around LIBOR transition, it is important to note that responsibility for addressing any required amendments typically falls to the manager.

The transition from LIBOR to other benchmarks will likely require careful consideration by managers and trustees. Legislative default fallback provisions may not apply or may only provide a partial solution.

As at the time of writing, and after analysing closed or ongoing amendments for 62 closed CLOs and one longterm warehouse spread across 11 different managers, we can confirm that all closed CLOs analysed opted to follow the ARRC recommended spread adjustment of 26 bps for a 3-month tenor. In the long-term warehouse analysed, the administrative agent in that deal was given the option of selecting the ARRC recommended spread adjustment or selecting another spread adjustment after giving due consideration to industry-accepted standards applicable at such time.

For further details, please contact:

John Dykstra +1 345 814 5530

john.dykstra@maples.com

Joe Jackson +1 345 814 5287

joe.jackson@maples.com

Jonathan Brown +1 345 814 5620

jonathan.brown@maples.com

20 | The CLOser

Trends in Luxembourg Securitisation

We have seen a surge in structured finance transactions arranged in Luxembourg over the past few months, and more generally, an increased interest for the securitisation framework from a variety of market players.

Such trends result from several factors. Mainly, the modernisation of the 22 March 2004 Luxembourg law on securitisation8, as amended (the “Securitisation Law”), which entered into force in March 2022. The Securitisation Law played an important role by bringing the market’s attention to an already popular and widely used legal framework, and which was significantly upgraded for more flexibility, while adapting it to current market expectations and needs. In particular, we observe more future-flow securitisations structured through Luxembourg securitisation vehicles (“SVs”). In this type of transaction, an operating company raises financing by selling a pool of current and future receivables generated in the course of its ordinary business to a SV.

The consideration for the receivables received by the originator, i.e. the operating company, will be twofold.

Firstly, the proceeds from the senior bonds (or other types of debt instruments) issued by the SV to one or several investors. The purchase price of the pool of current and future receivables may sometimes be initially financed with the proceeds of a bridge loan granted by senior creditors for an interim period (the added flexibility allowed by the modernisation of the Securitisation Law becomes useful in that respect).

Secondly, the issuance by the SV of a subordinated financial instrument that entitles the originator to any surplus remaining after all prior ranking positions from the senior creditors have been satisfied.

Unlike common securitisation schemes, which have traditionally been implemented in Luxembourg over the past couple of decades, the collateral pool is neither determined nor quantifiable from the outset, but depends on the expected turnover of the originator’s business.

May 2023 | 21

⁸ the main features are addressed in the October 2021 edition of CLOser

While investors and senior creditors appreciate the high degree of over-collateralisation that these schemes operate (often more than tenfold), repayments under the senior bonds track the repayments under the receivables, and they remain ultimately exposed to the business risk of the originator and its capacity to generate further receivables.

In recent years, we have noted that Luxembourg SVs have become particularly popular with Latin American originators seeking access to European investors for these type of transactions. The Luxembourg securitisation framework is also sufficiently flexible to allow market players to replicate these transactions without deviating much from the standard documentation used in the North American market.

Ironically, some features of the Luxembourg securitisation framework, such as the use of fiduciary arrangements (the civil law equivalent of a trust), which have been hard to sell in common law jurisdictions, proved to be popular with Mexican originators, due to its similarities with local legal mechanisms (notably, the fideicomiso).

Is this use of fiduciary arrangements reflected in another local market trend?

This is indeed what we are seeing. As a preliminary remark, it should be noted that the legal concept of a fiduciary arrangement is, in Luxembourg, enshrined in statute, the Luxembourg law on trusts and fiduciary contracts dated 27 July 2003, as amended (the “Fiduciary Law”) and subject to the principles of contract law.

Despite the reluctance from civil law-trained lawyers to assimilate it to a common law trust, the fiduciary arrangement ticks all the boxes of the definition of a trust under the Hague Convention on the Law Applicable to Trusts and on their recognition, namely the:

• triangular relationship between settlor, trustee and beneficiary;

• legal ownership by the trustee (called fiduciary agent in Luxembourg) of the assets held in trust;

• enforceability of fiduciary duties imposed on the trustee; and

• segregation of the assets held in trust from the trustee’s personal estate.

In the context of a securitisation scheme, there are two ways of taking advantage of fiduciary arrangements.

The first consists of using a securitisation company (typically a SARL or an SA) as a fiduciary agent (the equivalent of a trustee) of a fiduciary estate. This is rendered possible as the Fiduciary Law expressly authorises securitisation companies to act as such. Similar to a balance sheet compartment (the mechanics are briefly described in the October 2021 edition of CLOser), the securitisation company can segregate several transactions by conducting them through one or more fiduciary estates, which, however, are typically treated off-balance sheet.

This method allows for the use of a single umbrella SV to carry out multiple on and off-balance sheet securitisation transactions. Taxation would occur at the level of the beneficial owner of the assets, which would typically be the beneficiary of the entrusted assets, subject to drafting considerations of the relevant documentation.

The second consists of using what is referred to as a ‘securitisation fund’. It is a particular type of a securitisation undertaking expressly provided for under the Securitisation Law. It can take the form of a fiduciary arrangement, in which case it is subject to the Fiduciary Law.

Each such securitisation fund must be managed by a separate unregulated management company, which is typically incorporated as a plain vanilla SARL. Securitisation funds benefit from all features of the Securitisation Law, and notably, the possibility to create compartments within the same fiduciary estate, along with other asset protection mechanisms.

A further advantage is that the tax regime is clearly set-out in the Securitisation Law, which treats it as a non-taxable entity, making it a truly tax-transparent entity. As opposed to the structure first described, only off-balance sheet transactions are possible, as the management company cannot itself act as a securitisation company.

Both options were available as early as 2004. In 2022, as part of the amendments, new legal forms were made available to securitisation undertakings, including partnerships that are also transparent and with which common law jurisdictions are typically more familiar.

However, in comparison, fiduciary arrangements retain some advantageous features which may be of critical interest in the context of future flow transactions that involve a high frequency of asset purchases, such as not being subject to the Luxembourg municipality tax (unlike partnerships).

Are there any other trends you are seeing in the market which evidence the renewed interest for securitisation undertakings?

We have observed a recent trend of setting up alternative investment funds (“AIFs”) in the form of securitisation companies subject to the Securitisation Law.

Although the investments funds and the securitisation frameworks have traditionally been kept separate, some market players are taking advantage of a narrow intersection between the two to benefit from both frameworks, notably in the context of loan origination platforms.

The advantages deriving from such hybrid structures are manifold, and might depend on the characteristics of the deal. These can range from addressing banking monopoly restrictions on foreign markets, the need for a tax opaque counterparty, benefitting from straightforward compartmentation or other asset protection features under the Securitisation Law (legally recognised validity of nonpetition, limited recourse and subordination provisions) to benefitting from the marketing passport throughout the EU offered to AIFs.

Despite existing controversies in the market as to how far reaching the use of these hybrid structures can go, there is definitely a trend of these structures being implemented in the market these days.

In conclusion, it is very encouraging to see that the securitisation framework in Luxembourg remains very popular and market players are taking advantage of the latest amendments to the law or the flexibility it offers by revisiting existing features in light of the current market’s expectations.

For further details, please contact:

Arnaud Arrecgros

+353 1 619 2736

arnaud.arrecgros@maples.com

Maurice Honnen

+353 1 619 2716

maurice.honnen@maples.com

Your Global CLO TeamA CLOser Look

William Fogarty

Partner | Legal Services

+353 1 619 2730 | william.fogarty@maples.com

What did you do before working at the Maples Group?

I have been with the Maples Group since 2011 when I returned from London. After I qualified as an Irish solicitor in 2003, I decided to move to London with my then girlfriend. She had secured a medical training job in Oxford and I was joining Macfarlanes in their tax team. For a brief period, we imagined we would split the difference and live halfway between London and Oxford. Beaconsfield was the halfway point.

However, Beaconsfield also has the most expensive property in the UK so we abandoned that strategy. I lived in Notting Hill instead, which was much more fun. My girlfriend became an ex-girlfriend, but only because she married me.

After several wonderful years in Macfarlanes, I moved to Linklaters where I focused on private equity and fund taxation. It was a very interesting time to be in law, as it coincided with the financial crisis and I was lucky enough to work on not one, but several, bank bailouts. Although the economy was struggling, I was coming home four nights a week after midnight.

It was very interesting work. I awoke one morning listening to Robert Peston on the BBC describe a bank bailout. My wife shouted from the kitchen asking whether this was something I knew about it. I replied that it was the reason I didn’t get home until 4:30am. This was long before the days of remote working.

While at Linklaters, I experienced working with the Maples Group Cayman Islands and Dublin teams and was really impressed with the quality of the people and the standard of the work.

The growing Dublin office had attracted some of the best lawyers in Ireland who seemed to be thriving in a truly international Irish firm.

In 2010, the managing partner of the firm’s Dublin office asked whether I would consider returning to help establish an Irish tax practice. An old friend had once told me that London was a great place to be young or be rich. I was starting to feel all of my years and was decidedly not rich. The two might have been related.

Happily, my wife and I were both delighted with the chance to return ‘home’ although 2011 was not the most opportune time to return to Dublin. As a consequence of the financial crisis, the International Monetary Fund (“IMF”) were in Dublin and I think they were on my flight back to Dublin in early 2011.

I’m happy to say that the IMF packed their bags but I’m still here. It has been a really rewarding experience, watching the growth of the firm and the Dublin practice. The everchanging nature of the tax landscape means the job is always stimulating and rewarding. Ireland is an increasingly central player in global tax policy and investment.

The ability to collaborate with our international colleagues and seek solutions for our clients is what sets the Maples Group apart.

24 | The CLOser

What do you like to do in your spare time?

I honestly do not have any spare time. I have three young children and am in charge of graduate recruitment in the Dublin office. It’s a busy time. I am lucky in that I live 10 minutes (by moped) from our office and am generally home for sport, homework and bedtime. I have read the Harry Potter series three times at this stage. As I have sports-mad kids, I spend most weekends on the side of a rugby pitch cheering (or consoling). All three want to captain the Irish rugby team. I hope they are as enthusiastic after the World Cup!

I do not have a television at home, so spend my evenings reading things (mostly about tax). One of my hobbies is reading tax judgements from the UK and Ireland. A number of the people I was lucky enough to work with in the UK are now tax tribunal judges.

It’s always interesting to see a turn of phrase or approach in a judgement and remember the days (and nights) of hearing the same tone or phrase in the midst of a tricky transaction.

If I do ever get more time, I suspect I might take to Twitter like Dan Neidle (the ex-Clifford Chance head of tax) and see what interesting tax things I can comment on.

William Fogarty Partner | Legal Services

May 2023 | 25

Jarlath Canning

Senior Vice President | Fiduciary Services

Jarlath Canning Senior Vice President | Fiduciary Services

Jarlath Canning Senior Vice President | Fiduciary Services

+353 1 697 3294 |

What did you do before working at the Maples Group?

Prior to joining the Maples Group, I worked as the Irish Compliance Officer and MLRO for a competing firm, having worked largely in corporate governance and risk up to that point. I’m inherently curious (some might even say suspicious!) so the area of compliance and risk was attractive to me and exposed me to a number of asset classes, structure types and governance standards across competing jurisdictions. This path eventually led me to joining a number of boards and it became apparent that was an area that I wanted to further focus on. An opportunity came along to join the Director Services team in the Group’s Dublin office, and nearly 10 years later, I still thrive in the dynamic environment that role provides.

Do you have any skills or talents that most people don’t know about?

In fact, I have a skill that I didn’t even know about! I found out serendipitously that I can carry out the Heimlich manoeuvre when a woman at a restaurant I was having dinner at started choking. There was some consternation with waiters and patrons who were slapping a lady on the back and shaking her so I jumped out of my seat, pulled her out of hers and proceeded to give her the Heimlich.

Luckily, a huge piece of steak popped out of her mouth on my second attempt and I got to feel like a hero for all of 20 minutes before my girlfriend reminded me that, having had no training, other than some passive TV watching, if things had gone badly, there was a high probability that I had just assaulted a woman before she surrendered to an untimely death.

If you could add a word to the dictionary what would you add and what would it mean?

I’ve always been a fan of words. My father would pick random words from a dictionary when my siblings and I were kids and quiz us on their meaning and spelling. It was the 80s in Ireland, there wasn’t much else going on.

Some words I’d like to see added to the Oxford Dictionary are ‘youre’, as a consolidation of your and you’re and ‘theiyre’, as a consolidation of ‘there’, ‘they’re’ and ‘their’, so that, over time, I would accept them as words for generic use and be less infuriated when they’re (theiyre) grossly misused.

Tell us two fun facts about yourself.

I am a twin. Having never not been a twin, I’m not sure I think it ‘fun’ but, for others, it does seem to raise a number of questions. Do I have powers of telepathy with my twin brother? No. Do I feel pain when he feels pain? No. Have we ever switched jobs for a day? No….

I am also a qualified sound engineer and music producer. I play a few different instruments (definitely operating within the realm of ‘Jack of all trades, master of none’) and have always been intrigued by sound design.

More recently, I’ve been enjoying producing ambient music to score alongside video but I also continue to be involved in a band as a songwriter and guitarist / bass player / keyboard player.

No doubt, there’ll be a ‘Maples Group Got Talent’ event at some point in the future where I can inflict the auditory pain of my ‘creative output’ on others.

I am a Senior Vice President in our Dublin office and provide management and administration services to Irish SPVs across a broad range of structure types including securitisation, aviation leasing and various structured finance transactions.

jarlath.canning@maples.com

A Global Team

Our CLO team comprises 33 specialist CLO lawyers and 63 specialist CLO fiduciary professionals across our global network. Since the inception of the CLO market over 20 years ago, we have provided our clients with the benefit of our unparalleled depth of knowledge, experience and insight into what we see across the whole structured finance market, from the latest warehousing structures, to the latest regulatory developments and how they impact CLOs, to ongoing post-closing CLO issues.

For further information, please speak with your usual Maples Group contact, or the following primary CLO contacts:

28 | The CLOser

Legal Services

Cayman Islands

Scott Macdonald +1 345 814 5317 scott.macdonald@maples.com

James Reeve +1 345 814 5129 james.reeve@maples.com

John Dykstra +1 345 814 5530 john.dykstra@maples.com

Tina Meigh +1 345 814 5242 tina.meigh@maples.com

Jonathon Meloy +1 345 814 5412 jonathon.meloy@maples.com

Anthony Philp +1 345 814 5547 anthony.philp@maples.com

Amanda Lazier +1 345 814 5570 amanda.lazier@maples.com

Dublin

Stephen McLoughlin +353 1 619 2736 stephen.mcloughlin@maples.com

Callaghan Kennedy +353 1 619 2716 callaghan.kennedy@maples.com

Andrew Quinn +353 1 619 2038 andrew.quinn@maples.com

William Fogarty +353 1 619 2730 william.fogarty@maples.com

Lynn Cramer +353 1 619 2066 lynn.cramer@maples.com

Hong Kong / Singapore

Michael Gagie +65 6922 8402 michael.gagie@maples.com

Jersey

Paul Burton +44 1534 671 312 Paul.Burton@maples.com

London

Jonathan Caulton +44 20 7466 1612 jonathan.caulton@maples.com

Luxembourg

Arnaud Arrecgros +352 22 55 12 41 arnaud.arrecgros@maples.com

Fiduciary Services

Cayman Islands

Guy Major +1 345 814 5818 guy.major@maples.com

Delaware

James Lawler +1 302 340 9985 james.lawler@maples.com

Dublin

Stephen O’Donnell +353 1 697 3244 stephen.odonnell@maples.com

Jersey

Robert Lucas +44 1534 671 371 robert.lucas@maples.com

London

Sam Ellis +44 20 7466 1645 sam.ellis@maples.com

Netherlands

Allard Elema +31 203 998 233 allard.elema@maples.com

May 2023 | 29

30 | The CLOser

maples.com/clo

Jarlath Canning Senior Vice President | Fiduciary Services

Jarlath Canning Senior Vice President | Fiduciary Services