MAREI

MID-AMERICA ASSOCIATION OF REAL ESTATE INVESTORS

MICHELLE THOMAS FROM CNB CUSTODY & CARMEN MATZKE FROM MAINSTAR TRUST JOIN US MAY 9TH TO ANSWER ALL OUR SELF DIRECTED IRA QUESTIONS

MICHELLE THOMAS FROM CNB CUSTODY & CARMEN MATZKE FROM MAINSTAR TRUST JOIN US MAY 9TH TO ANSWER ALL OUR SELF DIRECTED IRA QUESTIONS

MAY MAREI Meeting

Self Directed IRAS

JUNE MAREI Meeting

AI Marketing Richard Roop

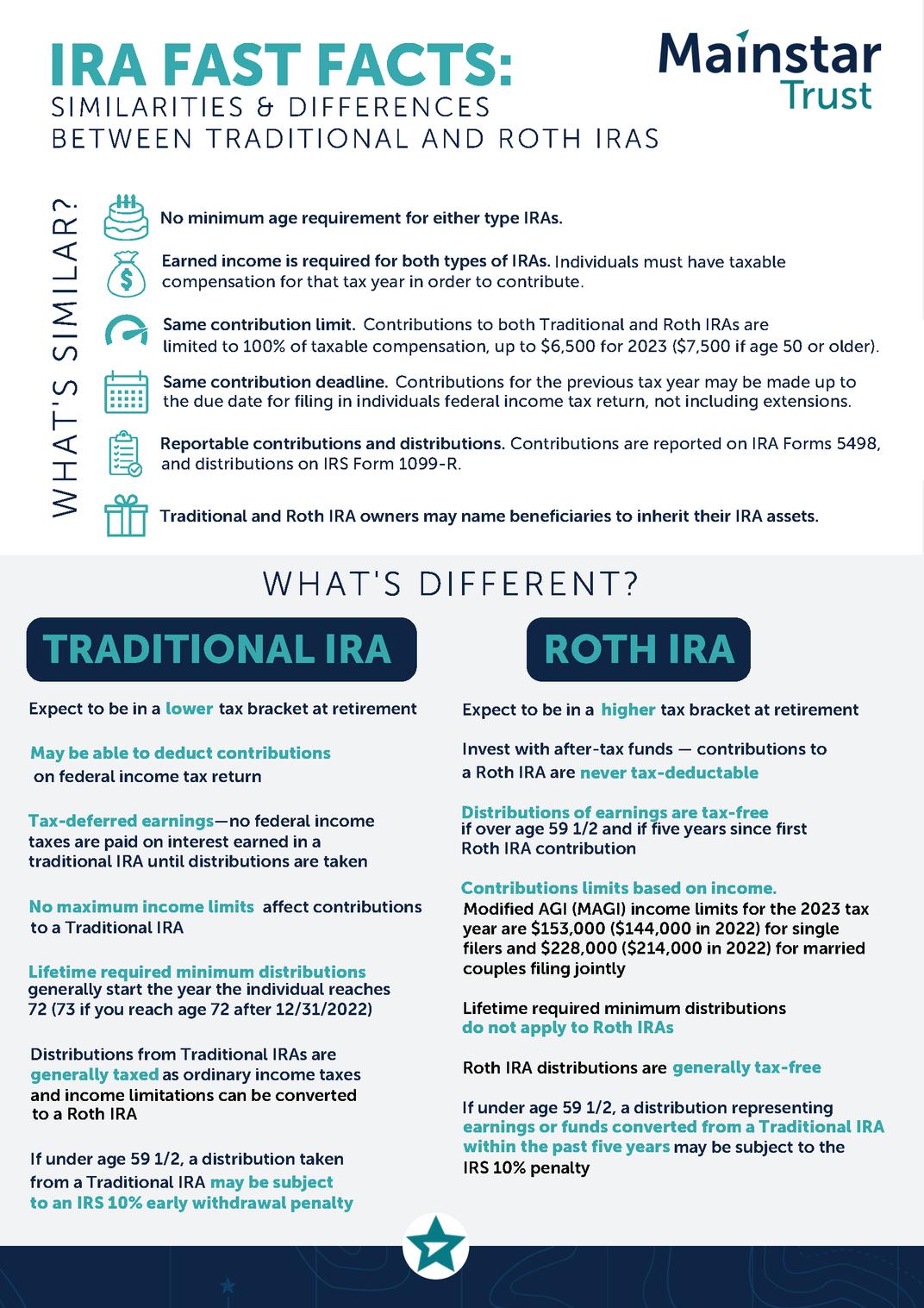

Smart real estate investors utilize tax advantaged Self Directed IRAs to invest in real estate and mortgage notes as a way of using their specialized knowledge to grow their retirement accounts And because the accounts are tax advantaged, they grow these accounts much faster as they are not paying taxes on the profits as they are made, only as they are taken out, or never if the account is a Roth.

Read through this newsletter to learn more and then register for the May 9th MAREI meeting to join us for a night of Self Directed Q & A with our experts Michelle Thomas from CNB Custody and Carmen Matzke from Mainstar Trust Both are brining their teams, so come early and bring questions

All attendees will receive guides on using your Self Directed IRA to Invest in Real Estate. Watch your emails when you pre-register.

Go to MAREI.org

JULY MAREI Meeting

Annual Trade Show

Find all of the following on our Calendar

Monthly Event's

Carrot Challenge

Landlords of Johnson County

Virtual Live - Direct Mail Marketing

MAREI Meeting

Bridge Meetup

InvestHer Meetup

Northland Real Estate Investors

KC Lend Meeting

Eastern Kansas REI

Landlords Inc

Weekly

Home Resource Network - Tuesdays

WinVestors - Wednesdays

Cashflow Game Night - Thursdays

PROP-erty Shop - Thursdays

MAREI's Virtual Live - Mid Week

Register for MAREI Events and Link to Outside Events Hosted by Members of MAREI at MAREI org/Events

Theeventisourannualtradeshow,where all100soflocalrealestateprofessionals cometogethertofindoutthelatestand greatestofferingsfromMAREI'sBusiness Associates.

Wehavelotsofnetworking,greatfood, cashbarandatonoffun.

Allproceedsfromthiseventgodirectlyto Harvesters. Sponsorfeesandallatthedoor donations.

AFEWOFOURSPONSORS FROM2022WHEREWE RAISEDOVER60,000MEALS

Oneofthebestwaystotakepartinthis eventistoformyourownTeamtoraise fundsthroughourJuly11thevent. Themore youraisethemorewefeed,andthemore visibilityforyourcompany.

Raise$250-ReceiveaFullTableatEvent

Raise$500-AddaHalfPageAdinBrochure

Raise$750-ChangeAdtoaFullPageAd

Raise$1000-YourLogoinallourMarketing

Thesooneryouformyourteamandraise funds,themoreexposureforyourcompany.

A Self-Directed IRA is really just a regular IRA as far as the IRS regulations are concerned, but they typically allow a wider variety of investment types than other IRAs and can be directed by you, the IRA owner Traditional, Roth and SEP IRAs can all be set up as Self-Directed By having funds in a Self-Directed IRA, you can diversify your investments into a wider mix of products than the standard publicly traded stocks, bonds, or mutual funds. A Self-Directed IRA can hold alternative investments, such as real estate, which can be held direct, under the umbrella of an LLC, or in the form of a real estate investment trust (REIT). Other types of alternative investments that can be held are limited partnerships, notes, and precious metals to name a few

There can be several benefits to using an IRA to purchase real estate investments. Any income, such as rent, that the property produces is held

Jennifer Heimanwithin the IRA and grows tax deferred For traditional IRAs, these proceeds would not be taxed until withdrawn from the IRA, and in Roth IRAs it may be possible to never pay tax on this income. Along these same lines, capital gains taxes do not apply when real estate is purchased and sold inside an IRA

Another benefit is having an additional funding source. If you have an investment property you would like to purchase but do not have cash available and do not want to take out a loan, you can look to your existing IRAs or retirement plans Money in a 401(k), 403(b), pension, or other retirement account can be rolled into a SelfDirected IRA to create funding for your purchase.

·Single or Multi-Family Homes

·Farms

·Commercial Real Estate Raw Land

You can also buy Notes & Mortgages and Lend Money

You may be wondering how your IRA might grow once you invest in real estate Following is an example of how an investor used his IRA

Greg purchased a residential property that had a three-bedroom, two-bathroom home with a two-car garage for $200,000 with his IRA. Within his market, he was able to rent the home to Tom and Jane for $2,000 per month

Tom and Jane pay their monthly rent of $2,000 to Greg’s IRA, rather than to him personally. Assuming all rent is paid monthly, and the tenants stay for an entire year, the IRA would have the potential to gain $24,000 per year. The income will grow tax deferred inside of the IRA until a distribution is requested

At that point, taxability will depend on your account type, your age, and which IRS exceptions you may qualify for at the time. Distributions from a Traditional or SEP IRA would be taxable as you request the funds Roth IRAs grow tax-deferred and may potentially be tax free upon distribution if the IRS distribution qualifications are met.

According to the IRS, just as all income is deposited to the Self-Directed IRA, all expenses to maintain the property must be paid by Greg’s IRA and not from his personal funds For example, Greg decided to put a fresh coat of paint on the inside of the home before Tom and Jane moved in .According to Internal Revenue Code 4975, Greg is not allowed to paint the home himself, so he hired John’s remodeling company to do the work for him Greg chose the paint colors and John purchased the supplies and painted the home. John’s company sent Greg an invoice or labor and supplies. Greg submitted the invoice and his payment authorization to his IRA custodian so John’s company could be paid The invoice was for $5,000, thus annual earnings after this expense would be $19,000, assuming no other expenses.

Many other expenses to maintain Greg’s property may apply over time, such as property taxes, insurance, utilities, etc All expenses must be paid by the IRA Budgeting was important to

Greg to ensure that the income would cover the expenses as they occur Otherwise, additional funds may have to be transferred from another IRA, or he may contribute to the IRA to cover expenses if he is eligible to do so.

Another important consideration for Greg was that the expenses for the IRA property are not deductible on his personal tax return, like they might be if he owned the rental property in his personal portfolio Since income is tax-deferred, the IRS doesn’t allow a personal tax deduction for expenses. After considering this, Greg determined that the benefits of deferred taxes outweighed not being able to take the potential deductions

Greg held this property inside his IRA for 5 years and was fortunate to have had excellent tenants. He ended up with $120,000 in rental income over those five years and had expenses that totaled $25,000 during that time His net income was $95,000 over the five-year time frame that he owned the property, which is now held as cash inside his IRA along with the rental home.

Since the market was very favorable after his initial five years, and he was nearing retirement, he thought it would be a good idea to sell the property to create some liquidity Greg was able to sell the property for $235,000, which was deposited to his IRA. Now, he has $95,000 in earnings as well as the $235,000 from the sale in his Self-Directed IRA, which he can use to invest into other types of investments or purchase another property Five years ago, he started with $200,000 and turned it into $330 000 all tax deferred and with a nice

Before making an offer on property, do your research and locate a Self-Directed IRA custodian that will service an account which holds real estate. It is a good idea to establish your account and fund it prior to making an offer so the earnest money, if required, is available to send by contract deadlines

Funding your account may include several options. You may transfer funds from another IRA that you have. If you are eligible, rolling funds over from a qualified plan such as a 401k or defined benefit plan to an IRA is another way to fund your account Annual contributions may also be made according to the IRS contribution limits.

Once your account is open and funded, you can make an offer on a property that is a good fit for your financial goals Check with your custodian on the paperwork they require prior to submitting an offer to avoid any delays. Your offer must be made in the name of your custodian for your benefit. To comply with the IRS regulations, do NOT make an offer personally or pay any earnest money out of personal funds The offer must be signed and submitted by your custodian and earnest money must be sent from your IRA to avoid any prohibited transactions.

What if my IRA doesn’t have enough money to purchase a property?

A couple of options you might visit with your legal and/or tax advisor on is either partnering your IRA with other funds or applying for a non-recourse loan. Your IRA may “partner” with personal funds of your own, another IRA of your own (i.e. Traditional and Roth funds together) or with another person’s funds, whether they are personal or retirement funds

Let’s continue our story about Greg…. Once Greg sold his property and had $330,000 available in his IRA, he decided to invest a portion of the proceeds back into another property but wanted to keep some of it in assets that were easily redeemable in case he needed the funds for his upcoming retirement.

He decided to invest $100,000 back into another property but realized he would need more than that to purchase the type of property he had in mind He

was discussing his idea with his long-time friend, Jack, who also owned a few properties. Jack said he had $150,000 available he wanted to invest, so they decided to partner their funds to purchase a property together

In this scenario, with a $250,000 property purchase Greg’s IRA would be 40% owner and Jack would be 60% owner. Meticulous records would need to be kept with a partnership, since 40% of the income would go to Greg’s IRA and 60% would go to Jack. Expenses would also have to be paid according to the 40%/60% ownership established upon investment When Greg and Jack sell the property, the proceeds would also be split in this manner.

Once the property is purchased, the ownership percentage must not be changed, thus it is important to have a good understanding of the cash flow of your chosen partner(s) If Greg or Jack’s funds run low and one of them is not able to cover their share of expenses, the IRS doesn’t allow the other partner to cover them. If Greg’s IRA started paying all the expenses for a couple of months until Jack was able to pay his 60% share, the IRS may consider this a prohibited transaction

What would the deed to the property look like if I partnered my IRA funds with other funds?

When Greg and Jack put their funds together, their agent recorded the deed to the property as follows:

“IRA Custodian” FBO: Greg Brown IRA, an undivided 40% interest and Jack Jones, and undivided 60% interest as Tenants in Common(Jack used personal funds)

If you don’t have an opportunity to partner your IRA funds with other funds, another idea to research is applying for a non-recourse loan for your IRA These types of loans may have a fixed or variable rate. The collateral for the loan is the property held in the IRA. Your remaining assets not held inside the IRA would not be tied to the non-recourse loan in the event of default Usually, the non-recourse lender will require a higher down payment for a loan of this nature, but please visit with your lender to see what would be required for the property you have in mind.

It is important to discuss potential unrelated debt financed income (UDFI) before taking out a nonrecourse loan with your tax advisor UDFI is taxable income attributable to borrowing funds within an IRA, and if due, must be paid by your IRA.

A Self-Directed IRA can be a powerful tool for investors looking to diversify retirement funds into different types of investments. Many scenarios can be used for purchasing real estate inside of an IRA, especially with the option of partnering with other funds of your own, or with another trusted individual with the same goals in mind. Income received from the property can grow tax deferred in a Traditional, Roth, and SEP IRA and may even be tax-free with a Roth IRA. Imagine all the possibilities! As always, please consult with a tax advisor as well as with an attorney that is well-versed in Internal Revenue Code 4975 before investing in real estate inside of your IRA. With a good understanding of the rules, combined with property that fits your portfolio, your IRA can gain substantial wealth to help you reach your financial goals.

You are urged to seek professional guidance and/or consider proper diversification and risk tolerance before directing any investment activity Community National Bank (CNB) does not recommend or evaluate the prudence, merit, viability, or suitability of any investment and will not be responsible for the performance of any investment product CNB will provide custodial services with respect to the investments in your IRA, but we do not provide investment advice or information, nor are we the agent, partner, employee, representative, or affiliate of any financial representative, product sponsor, or other individual or entity except as otherwise disclosed. We are not responsible for and are not bound by any representations, warranties, statements, agreements, disclosures, advice, or information made by any such person beyond the terms and provisions contained in the CNB Custodial Agreement, Disclosure Statements, or other CNB forms or CNB documents

MAINSTARTRUST COM

Jordan Scafe MAREI Business Associate

Jordan Scafe MAREI Business Associate

With direct ownership, the IRA may own 100% of the investment or a partial interest, but the IRA is listed as owner on the title of the property Purchasing an entire parcel of property with IRA assets is the simplest way to obtain full ownership if your IRA has enough cash to pay for the purchase and all costs of the transaction.

Another way of purchasing real estate in an IRA is to purchase shares in an entity that has underlying ownership rights in real estate In this indirect ownership structure, the IRA is not listed on the title as owner of the real estate; the entity is named as owner of the real estate and the IRA owns shares of the entity

IRA owners may use their IRA assets to purchase shares of REITs A REIT isa corporation or trust that pools the assets of multiple investors to purchase and manage real estate assets ormortgages Many REITs focus on owning and operating incomeproducing real estate (e g , office buildings, shopping malls, apartment buildings, hotels)

You may also choose to partner with another IRA, a private party, or a business to purchase a partial interest in real property The process is much the same as for the purchase of a sole interest in real property, Keep in mind that all income & expenses must be divided the same as the percentage of ownership.

Another option is to invest in mortgages and deeds of trust (i.e., real estate loans) where your IRA lends money to a borrower and receives repayments on the loan, plus interest, under the terms of a promissory note The real property is the collateral for the loan and is secured by a mortgage note or trust deed

When real estate is purchased through an IRA, the investor is not able to take tax deductions for depreciation ormortgage interest. Also, the proceeds on the sale of real estate, although tax-deferred until distributed from theIRA, will be taxed at the investor’s income tax rate at the time of the distribution not the more favorable capitalgains tax rate that may be available when real estate is owned and sold outside of an IRA

To properly complete the required reporting for IRAs, including specific requirements for investments that do not have a readily available fair market value, IRA custodians need annual valuations for each real estate investment or shares of ownership held by the IRA The IRA owner is typically responsible for obtaining valuations from a licensed or certified real estate appraiser

Any expenses associated with managing or maintaining a real estate investment inside an IRA must be paid from the IRA This includes expenses such as closing fees, taxes, insurance, utilities, and property management fees. The IRA should have enough liquid assets to pay for these expenses.

The unrelated business taxable income (UBTI) and unrelated debt financing income (UDFI) rules ensure that a business operating within a tax-deferred environment like an IRA does not receive tax advantages over a business that must pay taxes each year on its business income. If the IRA borrows money or operates a business, it may owe tax.

f a prohibited transaction occurs, the IRA loses its tax-qualified status and ceases to be an IRA as of the first day of the year in which the prohibited transaction occurred The IRA owner must include the entire amount of taxable assets in the IRA as income for the year If younger than 59½, the IRA owner is also subject to an additional 10% early distribution tax on the taxable amount in the IRA If a disqualified person, other than the IRAowner or beneficiary, engages in a prohibited transaction, the IRS may also impose an excise tax of 15%, whichraises to 100% if not corrected, on that disqualified person.

Individuals owning self-directed IRAs are accustomed to a high level of control over their investments Some times this level of involvement can create the potential for an IRA owner or related party to engage in a transaction that is not permitted under the tax laws for IRAs. To avoid a prohibited transaction, IRA owners must be aware of the rules and ensure that their IRA investments are made for the purpose of saving for retirement not to benefit the IRA owner or a “disqualified person ” personally before the assets are distributed.

The following types of transactions are not allowed to take place between an IRA and a disqualified person:

•Sale, lease, or exchange of property

•Lending of money or extension of credit

•Furnishing of goods, services, or facilities

•Transfer or use of IRA income or assets

•Fiduciary using IRA assets for his or her own interest

Here are some examples of ways IRA owners could violate the prohibited transaction rules:

•Using an IRA to purchase real estate that will be used by the IRA owner ’ s business or that will provide housing to the IRA owner or other family members is not permitted.

•An IRA owner or a family member cannot provide services to property owned by the IRA, such as an office building or apartment complex, for free or pay IRA owners must hire an independent third party to handle tasks such as collecting rents and performing repairs.

•The IRA cannot purchase real estate from the IRA owner or other disqualified person

A “disqualified person ” under the prohibited transaction rules includes the following:

•IRA owner or beneficiary

•IRA owner ’ s spouse, ancestors, and lineal descendants (i e , children, grandchildren) and their spouses

•IRA custodian

•Fiduciaries to the IRA (includes those who exercise discretionary control over the IRA or its assets and those who provide investment advice to the IRA owner for a fee)

A corporation, partnership, trust, or estate that is 50% or more owned by the IRA owner (directly or indirectly)

•An officer, director, or 10% or more shareholder or partner of a disqualified entity

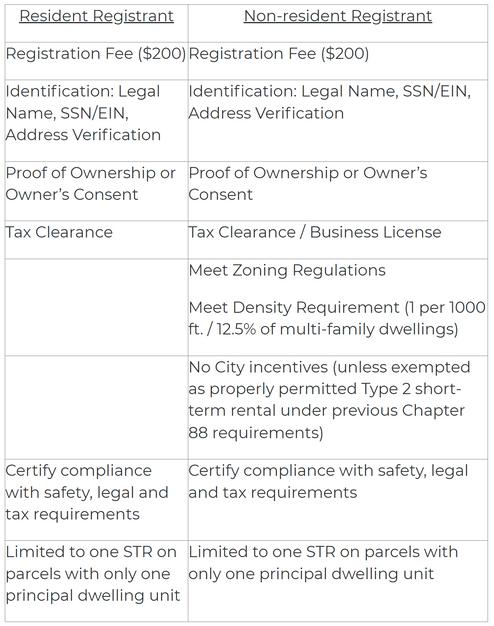

On May 4th the City Council voted unanimously to approve Ordinance 230267 and 230268 Making it easier to get a license, easier for them to enforce and banning any new licenses for non-owner occupied units in residential areas

Short Term Rentals do not currently have any rules in North Kansas City making them legal or illegal The city held a meeting on April 6th to discuss their options for creating new rules to license and regulate

Kansas City Missouri's General Election will be held on June 20th

At that time there are six progressive candidates endorsed by KC Tenants who are up for election Three who are new including Michael Kelley who is a policy director for BikeWalkKC, Jenay Manley who is a KC Tenants organizer, and Johnathan Duncan who is also an organizer for KC Tenants. Plus KC Tenants are endorsing three incumbents: Melissa Robinson, Eric Bunch, and Andrea Bough

We encourage all members to not only look up the sample ballot and see who is running, but to take the time to get to know the candidates and vote for the best ones

There will be a KCMO Housing Industry Candidate Forum on Monday, June 5th at 6:00 pm held at the Plaza Library. We encourage all to attend

In February the city of Lawrence expanded protections against discrimination in housing on the basis of a person's source of income or immigration status

Hosted by KC Housing Industry

Monday June 5th At 6pm Plaza Library

Moderated by Nick Haines from KC PBS

Would

The city of Kansas City Missouri issued a press release shortly after the vote on May 4th They tell us that there are about 2,000 short term rentals currently that represent an estimated 7% to 11% of the total supply of hotel rooms. With the passage of the Committee Substitutes for Ordinance Nos. 230267 and 230268 this will change. As only an estimated 300 of those short term rentals are currently licensed, and those that are not are primarily in R Zones, where they will no longer be allowed unless the owner lives in the property, how many of those 2000 will be going out of business in June?

Requirements from the Press Release Below

There may be questions on parts of the following:

Non Resident STR are NO LONGER ALLOWED ON RESIDENTIALLY ZONED PROPERTY

Previously approved NonResident STR are allowed to continue, just no new permits.

PREVIOUSLY APPORVED

STR under Chapter 88 must re-register under the new Chapter 56 once their old annual registration expires.

STR registered under the new Chapter 56 must reregister if the property changes hands

Addsa1YearDeregistration forViolationforNon-Resident STR.

Addsa3YearDeregistration for3totalviolationsorifSTRis foundtobeathreat.

Requiresbookingplatformsto REMOVEanyUNREGISTERED orDEREGISTEREDSTR.

Thecityhas$1000allocatedto educatingusthegeneral publicandindustry More informationwillbe forthcoming.

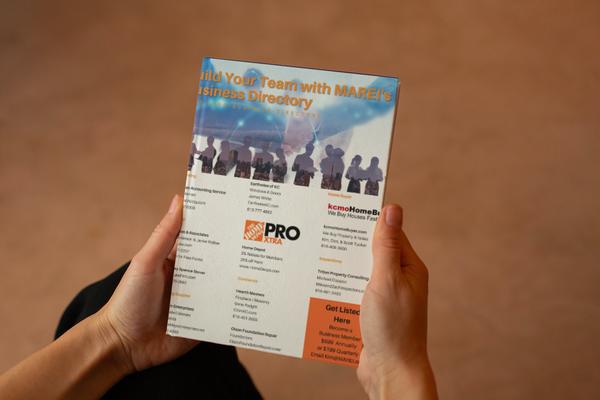

Accounting

Coleman Accounting Service

Bob Coleman ColemanAcctg com

913-787-0308

Attorney

Anderson & Associates

Julie Anderson & Jamie Walker

MOKSLaw.com

816-931-2207

See site for Free Forms

Attorney Spence Stover StoverLawFirm.com

(816)778-2992

Building Supplier

DeMayo Enterprises

Wholesale Cabinets

Mark Yanda

www DeMayoEnterprises net

913-980-4260

Earthwise of KC

Windows & Doors

John Norton

EarthwiseKC.com

816-316-3987

Contractor

Hearth Masters Fireplace / Masonry

Gene Padgitt

ChimKC com

816-461-3665

Olson Foundation Repair Foundations

Home Depot

2% Rebate for Members

20% off Paint

www HomeDeopt com

Cleaning

Cleaning Maids In & Out

Veronica Bolton

CleaningMaidsInandOut.com

(816) 659-2929

OlsonFoundationRepair.com/ (913) 592.3300

Home Buyer kcmoHomeBuyer.com

We Buy Property & Notes

Kim, Don, & Scott Tucker 816-408-3600

Inspections

Triton Property Consulting

Michael Coppoc

MikeandZachInspectors com

816-491-3483

Insurance Property

Millennial Specialty Insurance

formerly Arcana

Insurance for Investors

NREIA.ArcanaInsurance HUB.com

877.744.3660

CrossroadsInvestmentLending HardMoney

BrittonAsbell

KCLend.com

913-295-8083

FinishLineFunding

ShortTermFunding

BruceBelanger

FinishLineFunds.com

913-346-8090

FlatBranchHomeLoans

MortgageBanker

BethLangston

North Oak Investment

Bernie Richtor

NorthOakInvestment com

816-249-1001

Marketing

Build-A-Sign

Signs & Banners

www.MAREI.org/BuildASign

Call Porter

Answering Calls 24-7

MAREI.org/CallPorter

Rauber Insurance Agency

Brian Rauber

LoveIsOurPolicy.com

(816) 436-1016

IRA - Self Directed

CNB Custody

Jenny Heiman

www.CNBCustody.com

800-680-0340

Equity Trust Company

TrustETC com/NationalREIA

844-732-9404

Mainstar Trust

www.MainstarTrust.com

Jordan Scafe

1-800-521-9897

Lending

CentralGroupMortgage

MonicaZhang

CentralGroupMortgage.com

913-285-8998

ApplyWithBeth.com

816-679-4000

JMRealEstateCapital

MariounContursi

www.JMRECapital.com

727-390-7560

RollerMortgageTeamLeaderOne

Alice Lund

www.RollerMortgage.com

913.488.1769

Newieco

Private Money

Jeff Newhard

(816) 721-9869

Merchants Mortgage

Mushy Money

Susan Aubin

MerchantsMtg.com

913-522-2650

High converting websites

www.MAREI.org/InvestorCarrot

Constant Contact

Email Provider of MAREI since 2004

Email, Social Media & More

www MAREI org/ConstantContact

PropStream

Build Marketing Lists & Research properties

www.MAREI.org/PropStream

REI BlackBook

Total Marketing Package

Get free demo & MAREI waves your set up fee

www MAREI org/REIBB

REIPRO

Lists, List Mgmt, Direct Mail

Free trial

www.MAREI.org/REIPro

Office Supply

Property Management Software

Buildium

MAREI offers a FREE Trial

www.MAREI.org/Buildium

Realtor

ODP Solutions

www.ODPBusiness.com

Log into MAREIMember.com for discount information

Property Manager

Brown Bear KC Real Estate Services

Tyler Shirk

BrownBearKC.com

816-465-1252

Dan Reedy Inc.

Dan Reedy

www.MOREKC.com

(816) 564-5265

Home Rental Services

Paul Branton

www Home4Rent com

913-627-9543

M & M Property Pros

Michael & Michele Belman

www.MMPropertyPros.com

816-490-6745

PMI Destination Propertie

Ryan Kernicky

www PMIDestination com

913-583-1515

Voepel Property Managem

Christina Erickson-Hoffman

VoepelProperties.com

816-405.4845

Crown Realty

Rich Melton

RichMelton CrownRealty com

913-215-9004

Realty Resource

Scott Tucker

RealtyResourceKC.com

916-406-0701Screening

Screening

Title Company

Accurate Title Company

Dave Green

AccurateTitleCo.com

913-338-0100

Advantage Title LLC

www.AdvantageTitleLLC.com

Bud Whisler

816-279-8484

RD Title + Exchange

Rick Davis

www.rdtitle.com

(913) 777-4RDT (4738)

NETWORK AT MONTHLY MEETINGS SHARE KNOWLEDGE ON SOCIAL MEDIA PARTICIPATE IN PUBLIC & PRIVATE FACEBOOK GROUPS

SEND ANY 2 PEOPLE TO NETWORK AT MONTHLY MEETINGS SHARE KNOWLEDGE ON SOCIAL MEDIA PARTICIPATE ON SOCIAL MEDIA GROUPS BE LISTED IN ALL OUR BUSINESS DIRECTORIES

MUST BE A BUSINESS MEMBER PREPAY FOR A TABLE AT OUR MONTHLY MEETING FROM 6 TO 7 AND 9 TO 9:30. SOLD IN PACKAGES OF 3 MONTHS $200 PER REGISTER MONTHLY TO LET US KNOW YOU WILL BE THERE

$99 Annual $699 Annual $800 Annual*

There are a lot of different benefits of being a member of MAREI We offer three options to become a part of MAREI There is the FREE option that gives you no benefits other than access to our free public social media groups, an email subscription, and pay as you go at the meetings Our Investor member that comes with all benefits included Our Business members that get all benefits for 2 people, plus advertising opportunities Compare below

Attend Monthly Meeting

Public Facebook / LinkedIn

Private Facebook Group

Add Additional up to 4

Discounts Paid Events Newsletter Subscription Investor Website (Basic) Properties Marketed

Library / Directory