ClassNK is a major supporter of the Digital Era

ClassNK is a major supporter of the Digital Era

Kamal Chadha Editor in Chief

Jagdamba

Pandey Advertising Coordinator

RNI: MAHENG/2013/50159

Published by Marex Media Pvt Ltd C-209, Morya House, New Link Road, Andheri West, Mumbai 400058 Email: info@marexmedia.com

Printed by Young Graphics

Printed at Young Graphics, 208 Shankala Industrial Premises, Gogatewadi, Goregaon(E), Mumbai-400 063

Disclaimer

All advertisements in this magazine are placed with no liability accepted by the publisher for the material content therein. No responsibility is accepted by the publisher for omission or error or non-insertion of any advertisements. All advertisements and material in this magazine are subjected to approval by the publisher and are not necessary the opinion of the publisher. No liability is accepted for advertisements that are placed or any information that might be criminally connected. All information is checked to the best of our knowledge and is reliant upon the material submitted not being in contravention of all relevant laws and regulations and within the provisions of the Trade Practices Act.

Reproduction Prohibited

Maritime Matrix Today will not be responsible for the views expressed by contributors in their personal capacity. All rights reserved. Reproduction in part or whole without the permission of the Editor is prohibited.

Readers are recommended

To make appropriate enquiries before sending money, incurring expenses or entering into any commitment in relation to any advertisement published in this publication. Maritime Matrix Today does not vouch for any claims made by the Advertisers of Products and Services. The Printer, Publisher, Editor and Owner of Maritime Matrix Today shall not be held liable for any consequences, in the event such claims are not honoured by the Advertisers.

China’s leadership is making a concerted effort to bolster its manufacturing sector, particularly focusing on highertech industries like batteries, EVs, and solar panels. However, this strategy appears to be encountering some challenges.

Domestically, Chinese consumers are known for their frugality, while globally, there’s growing resistance to Chinese products. This trend is reflected in our forecast report, which highlights the imposition of duties on steel and other Chinese goods in various countries.

Recent steel production data underscores this declining momentum. With global steel prices low, Chinese manufacturers are finding it difficult to maintain profitability. A recent BHP report echoes this sentiment, suggesting that steel production in China may have peaked and is now poised for a decline.

Back from summer holidays we start to check all the main indicators for the Dry bulk trade. Our forecast report gives you the stories that are shaping demand.

A complaint has been filed with the WTO by China over the EU’s anti-subsidy investigation on imported battery electric vehicles from China. The subsequent imposition of provisional countervailing duties has also been challenged. The two sides have until early November to try and resolve their differences. After which, the provisional tariffs become official. Investigations into French cognac and European pork exports have since been launched by China raising fears of a damaging trade war with the EU.

An IMF country focus article said that China’s growth will remain resilient at around 5% in 2024. This is despite the continued property sector adjustment. However, it was noted that China has relied too much on investment as opposed to consumption. Growth is expected to slow to around 3.3% in 2029. Diminishing productivity and an aging population risk restricting this. The article argues that the country’s service sector is an under exploited driver of growth.

More people can be put to work by expanding the sector, especially younger people. GDP could be raised by an additional 1 percentage point through market-based structural and pension reforms.

China’s industrial output growth in July slowed to a four-month low of 5.1%. This aggravated concerns about a continued manufacturing slowdown. China’s July official manufacturing PMI remained in contraction mode for the third month.

The latest July 2024 crude steel production data was released from the World Steel Association. Global output across 71 reporting countries was at 152.8 million tonnes. This was down 4.7%year-onyear. Chinese output for the month was estimated at 82.9 million tonnes. This represents a fall of 9.0% year-on-year. Outside China, other major producers recorded year-on-year losses in July. These included Iran (-18.7%), Japan (-3.8%), South Korea (-3.4%), and Russia (-3.1%). There were yearon-year gains in Brazil (+11.6%), India (+6.8%), the EU (+5.7%), Turkey (+4.0%), and the US (+2.1%).

Chinese crude steel output in the first seven months of 2024 was estimated by the WSA at 613.7 million tonnes. This was down 2.2% year-on-year. Over the same period India’s output totalled 86.4 million tonnes. This was up 7.2%year-on-year. Meanwhile, EU production totalled 78.0 million tonnes. This was up 1.5%year-on-year.

A challenging future for the iron ore market has been set out in BHP’s latest commodity outlook

Chinese steel production has plateaued and is expected to decline in coming years. The real-time cost support for iron ore prices was estimated by the miner to have remained in the range of $80 to $100 per tonne on a 62% Fe CFR basis, in the first half of this year. However, the cut off CFR price for many high-cost producers is above $90. This means that around 130-140million tonnes/year could become too expensive to mine. A further 30-40 million tonnes are at risk if CFR prices fall towards $80/tonne. (This comprises roughly 75% seaborne and 25% domestic Chinese ores).

BHP’s outlook for coking coal is also somewhat negative. A mild surplus is forecast for 2025. However, the supply of premium coals should stay relatively tight. BHP believes that coking coalbased blast furnace iron making is unlikely to be displaced at scale by emergent technologies for decades. This is given that it accounts for 70% of global steel capacity today.

25% tariffs on Chinese steel and aluminium will be imposed by the Canadian government. 100%tariffs on Chinese electric vehicles will also be imposed. These are effective 1 October.

China’s crude steel production in July slumped o 82.94 million tonnes according to official data.

This was down 9.5% from June and the lowest level since December 2023. Total output or the first seven months of this year was613.72 million tonnes. This was down 2.2% year-on-year. Chinese steelmakers are also struggling with low steel prices. The benchmark steel rebar contract on the Shanghai Futures Exchange fell to its lowest level in more than four years in mid-August. This was down 24% from the start of the year.

Chinese finished steel exports in July totalled7.827 million tonnes according to customs data. This was down month-on month for the second straight month but still up 7.1% year-on-year.

Over the first seven months of 2024, finished steel exports totalled 61.227 million tonnes. This was up 21.8% year-on-year.

India’s steel demand is expected to grow by 8%annually in 2024 and 2025. This is driven by continued growth in infrastructure development according to India’s Steel Ministry.

Last month, we reported that India’s Steel Ministry wanted to establish central buying of coking coal imports. However, India’s steel sector had yet to get on board with the plan. It now appears that the plan has been abandoned due to differences among mills over the grades they need.

A country-specific import quota was proposed by the Indian government in April. This was to cap annual imports of low ash metallurgical coke at 2.85 million tonnes for one year. The move was to protect local coke producers who complained about rising imports. However, the Indian Steel Association is now reported to have lobbied the federal trade

ministry to relax the import restrictions. It argues that local coke production is not sufficient to meet the needs of steel mills. A consultation process with stakeholders is now expected to be started by the trade ministry.

China’s National Reform and Development Commission released a three-year plan to upgrade the country’s power transmission system, ramp up renewables and help meet the goal of reaching a peak in carbon emissions before 2030. It also called for creating standards for next-generation coalfired power, reducing emissions from coal power plants and blending coal with lower-carbon fuels.

Chinese customs data reported a jump in July coal imports to 46.23 million tonnes, a seven-month high and up 18% year-on-year. Shipments from Indonesia, Mongolia and Australia all rose but Russia exports were down slightly on payment difficulties and logistical constraints.

Meanwhile, China’s domestic coal production in July totalled 390.37 million tonnes, up 2.8%yearon-year. However, average daily output for the month was down 6.8% from June.

Denmark’s Orsted is to shut down its last coalfired power units at the end of August. This is its final major step in meeting its target of a 99%green share of energy generation by 2025. The

company is to close its coal-fired power plant in Esbjerg. Two coal-fired units at its Studstrup and Kyndby power stations will also be closed. Coal is still held as a reserve fuel at Studstrup’s unit 3by Orsted. This is while a wood pellet silo is being rebuilt. This is due to be completed by the end of the year.

Coal’s share of US energy generation will shrink to an all-time low of 16.1% in 2024. This is due to lower utilisation rates and ongoing capacity retirements according to the US Energy Information Administration. 2024 coal production was forecast at 499 million short tons. This was down 14.2% from 2023. Coal production in 2025 was expected to fall by another 5% to 474 million short tons. The EIA also commented that US coal-fired power plants will probably have to pull from their inventories in 2025. This is as coal production decreases at a faster rate than power sector coal consumption.

The International Aluminium Institute reported that global primary aluminium production in July rose 2.4% year-on-year. The total was 6.194 million tonnes, with 59.6% produced in China. Global production in the first seven months of this year totalled 42.074 million tonnes. This was up 3.8% year-on-year. The IAI also reported that global alumina production in July totalled 12.155 million tonnes. This was down 0.1% year-on-year. Global alumina production from January to July 2024 totalled 82.197 million tonnes. This was up 2.1% year-on-year.

The US Department of Agriculture’s August forecast updates contained only minor adjustments to 2024/25 season export trade forecasts. Looking across all the principal commodities (wheat, coarse grains, rice, soyabeans, and soyabean meal), net changes to the 2024/25 season saw an overall export trade increase of 1.29 million tonnes, a rise of 0.17%.

Australian and Ukrainian 2024/25 wheat export forecasts were both marked up by 1.0 million tonnes on expected larger crops. This was partly offset by a 0.5 million tonnes cut in the EU wheat export estimate. Several months of heavy rainfall in France have reduced quality and yield prospects for the EU’s largest wheat producer. The US maize export forecast for 2024/25 was raised by 1.90 million tonnes on larger supplies and price competitiveness. However, this was offset by trims to EU, Ukraine and Russian maize export forecasts based on expected smaller crops.

Egypt’s state grains buyer, the General Authority for Supply Commodities, announced in early August a massive tender for 3.8 million tonnes of wheat to cover imports between October 2024 and April 2025. The country usually buys in tenders under a million tonnes and for shorter duration. The shift in tactics appears to be an effort to take advantage of the current dip in wheat prices.

Ukraine’s agriculture ministry reported that grain exports in the 2024/25 July-June season had reached 6.4 million tonnes by 23 August up from 3.8 million tonnes by the same date in the previous season.

The International Fertiliser Association has released its latest medium-term outlook. It notes that, after declining for two consecutive years, global fertiliser use is forecast to increase by 4% in fertiliser year 2023 and by3% in fertiliser year 2024. The recovery was primarily due to improved fertiliser affordability. Global fertiliser use is expected to continue expanding in the medium term, but at a rate decreasing from 2.2% in FY 2025 to 1.5% in FY 2028. Latin America and South Asia are expected to be the main engines of global growth in the medium term.

Canada – Ten days ahead of rail labour disruption on the two main networks run by CN Railway and Canadian Pacific Kansas City, Fertiliser Canada warned that the dispute was already adversely impacting fertiliser shipments. The two rail operators have issued embargoes immediately halting certain fertiliser shipments ahead of the worker lockout that began on 22nd August.

Finland exported 3.9 million cubic metres of softwood-sawn timber in the first seven months of 2024, down 10% year-on-year.

The Finnish Natural Resources Institute reported that roundwood harvested in June was 4.1 million cubic metres, an increase of 4% year-on-year. However, industrial roundwood felling n the first half of 2024 totalled 29.4 million cubic metres, a drop of 1.2 cubic metres from the same period last year and a 5% fall from the five-year average.

The US Department of Commerce announced that anti-dumping and countervailing duties on Canadian softwood lumber products will rise from 7.99% to 14.54%, to the consternation of British Colombian wood processors. The US views the Canadian Crown-owned timber lands system as a form of subsidy, given that most US timber comes from privately-owned woodlands.

However, the National Association of House Builders in the US called on the government to suspend the tariffs due to their detrimental effect on housing affordability which was already near a historic low.

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,238,000according to the US Census Bureau, down 16.0%year-on-year and down 6.8% on the revised June estimate.

Russia has rerouted VLCC carrying oil around Africa to Asia, potentially to avoid Houthi attacks on merchant shipping in the Red Sea.

Two Suezmax-class ships, Apus and Arlan, transferred their cargoes to the Very Large Crude Carrier (VLCC) Gold Pearl near Egypt’s Port Said earlier this month. The Gold Pearl then took a detour around Africa, unable to pass through the Suez Canal due to its draft.

While the reason for the rerouting is unclear, it may be linked to recent Houthi attacks on Russian tankers in the Red Sea. Other Russian cargoes continue to sail through the area, but some crews and operators may be exercising caution.

The Apus and Arlan, carrying around 1 million barrels each from Novorossiysk, met the Gold Pearl

between August 6-8. Satellite imagery and tracking data confirm the transfer. The Gold Pearl is now heading to Singapore, having previously signalled a port call in Spain and paused near Malta to refuel.

This detour may be an exception, as most Russian crude shipments continue to pass through the Suez Canal and Red Sea to India and China. However, the Houthi attacks have raised concerns, despite assurances of safe passage for Chinese and Russian vessels. A similar ship-to-ship transfer occurred in early August, involving the Aframax tanker Arabela.

As the shipping industry transitions to cleaner fuels, ammonia as marine fuel is gaining momentum. Alfa Laval is at the forefront of enabling this shift. Through research, product development, and strategic partnerships, the company is building the expertise and solutions needed for a safe and efficient transition to alternative fuels.

Addressing challenges with an innovative portfolio

The unique properties of ammonia, including its low flash point, high toxicity, and low calorific value, pose distinct challenges for its use as a fuel. Ammoniafuelled ships require advanced systems for tank containment, boil-off management, fuel supply, and purge/vent control. Drawing on its extensive expertise with fuels like methanol and LPG, Alfa Laval is now accelerating the development of new technologies for ammonia.

• Developing steam boiler technology as a 2-in-1 solution

A steam boiler can offer a comprehensive solution to the challenges of using ammonia as a marine fuel. The Alfa Laval Aalborg ammonia dual-fuel boiler system can be a cost-effective, multi-purpose system for ammonia-capable ships. Together with meeting the ship’s heat demand through steam generation, it can help to safely handle boil-off ammonia evaporation, and effectively remove ammonia vapor in the purge/ vent stream, without adding bulky equipment. At present, the ammonia dual-fuel boiler design concept is under development, in collaboration with its partners.

Sameer Kalra President Marine Division, Alfa Laval

The new Alfa Laval FCM Ammonia, designed for secure use of ammonia includes a fuel supply system (FSS) as the primary solution for feeding the fuel to the engine. This base system is integrated with fuel valve train (FVT) for isolating the engine from upstream systems and vent treatment system (VTS) for ensuring a controlled vent release into the atmosphere. The dedicated automation system of FCM Ammonia regulates all critical functions of FSS, FVT and VTS. FCM Ammonia is available for purchase, with a tested and capable supply chain. The marine design will be consolidated by the end of 2024 with the first marine delivery expected by end of 2025, in line with the timeline for the first dual-fuel ammonia marine engines.

• Widest

Alfa Laval offers the widest and most comprehensive heat transfer portfolio in the market. Alfa Laval Semi-welded Plate Heat Exchanger (SWPHE) portfolio has been used for ammonia heating and cooling in refrigeration systems for many years. The SWPHE are likewise suitable and used for ammonia fuel gas supply system (FGSS), where the ammonia flows through welded channels. With a maximum design pressure of up to 65 bar, SWPHEs provides optimized operations while minimizing ammonia hold-up volume. Apart from SWPHE, Alfa Laval also offers printed circuit heat exchangers (PCHE) for ammonia FGSS applications that requires higher design pressures.

• Tank management solutions for ammonia carriers

Alfa Laval’s brand, Scanjet offers the SURVEYOR

system as a tank management solution for ammonia carriers. This versatile solution provides accurate cargo monitoring and overfill prevention. With features like full volume calculations and pump/valve control integration, SURVEYOR optimizes cargo and bunker operations while meeting stringent safety standards.

To support its customers with the fuel portfolio, Alfa Laval has a strong service network with fuel experts around the globe. Alfa Laval Marine Service offers worldwide and 24/7 support throughout the lifecycle of the equipment, ensuring greater uptime and optimized performance.

In 2022, Alfa Laval got approval for testing ammonia at the Alfa Laval Test & Training Centre in Aalborg. As with other alternative fuels, the centre has deepened its knowledge of ammonia combustion, a crucial aspect of safe fuel handling.

Alfa Laval has recently signed a MOU with WinGD, ABS and K Shipbuilding to jointly develop an ammonia-fuelled MR tanker design. The initial project scope included designing the new Alfa Laval FCM Ammonia system for these vessels. Recently, the scope has been expanded to incorporate the design of ammonia dual-fuel boiler system. The boiler system will help to efficiently handle purge/ boil-off gas, meet the vessel’s heat demands, thereby minimizing vessel’s energy consumption.

Furthermore, following the Joint Development Agreement with WinGD in 2022, Alfa Laval will deliver two fuel supply systems (FSS) for testing WinGD’s ammonia-fuelled engine from Q4 2024.

Alfa Laval is also an active partner of Maersk McKinney Moller Center for Zero Carbon Shipping. Through collaborative research and innovation activities, it works to accelerate the development of solutions and drive transformation towards zerocarbon shipping.

“By investing our resources in research, development and innovation, we are steadily advancing in our ambition to enable a future powered by alternative fuels,” says Sameer Kalra, President Marine Division, Alfa Laval. “Many shipowners are exploring the use of ammonia as fuel, and Alfa Laval is ready to be a key enabler of this transition— with innovative solutions, technological capabilities and experience in handling a wide range of fuels. We welcome collaboration with our customers, partners, and industry leaders to accelerate the transition to new fuels.”

The Foreign Shipowners Representatives and Ship Managers Association (FOSMA) was founded in India in 1989 with the goal of raising issues of common interest for member companies and their seafarers with relevant authorities, aiming to achieve sensible resolutions to these issues. From humble beginnings, FOSMA has grown to its current distinguished position, representing thirty-three member businesses that encompass the vast majority of Indian seafarers operating on foreign flag vessels.

Capt Sankalp Shukla, a graduate from Chennai, embarked on his seafaring career in 1995 and sailed until 2008. After returning to shore, he earned an MSc in Shipping, Logistics, and Supply Chain Management from the University of Plymouth. He has served as a Marine Superintendent, Crew Manager, Director, and ultimately as Managing Director of a BSM Crew Service Centre in India. He has had the distinction of serving as Chairman of FOSMA since April 1, 2021.

In his personal time, Capt Shukla enjoys cooking, watching films, driving, and swimming. His preferred cuisines are South Indian non-vegetarian and Pan-Asian.

In a heartfelt conversation, Capt Shukla discusses FOSMA’s developments and future plans with Miss Delphine Estibeiro of Marex Media.

Current developments at FOSMA…

At FOSMA, our major project is the development of a state-of-the-art training institute in Greater Noida to meet the future demands of seafarer training. The land has been acquired, and construction has commenced. FOSMA is also actively providing meaningful feedback on revisions to the STCW and the MS Act of India.

Growth Potential of the Shipping/Maritime Industry…

Global manpower demands are increasing. With additional LNG ship orders on the horizon, there

is a significant need for workers experienced in gas operations. As ships are being ordered with dual-fuel capabilities and more complex engines, the shipping industry requires a more competent workforce. Conversely, due to the crises in the Middle East and Eastern Europe, particularly regarding Ukraine and Russia, fewer young people are willing to pursue careers in seafaring.

As mentioned, seafaring as a vocation is evolving faster than ever. Automation, alternative fuels, new engines, and carbon footprint reduction programs are all progressing simultaneously. Consequently, the skill set required for today’s and tomorrow’s mariners differs significantly from that of the past. The new STCW must address these developments in mandated training and certification. A positive aspect of these changes for seafarers is that they will be better equipped to handle new challenges without needing additional training to bridge the gap between the skill set they prepare for their Certificate of Competency (COC) and what is necessary on board.

Due to the unfortunate developments in the Red Sea, prudent owners and operators have chosen to reroute their vessels via the Cape of Good Hope instead of the Red Sea. While this significantly impacts freight charges and delivery times, it is currently the only safe option. The Red Sea crisis

extends beyond missile attacks; there has also been an increase in piracy reports from vessels attempting to avoid missile strikes by approaching the Somali shore.

FOSMA will continue to be at the forefront of industrial progress. We now have associate members who are experts in medicine, education, and technology, which strengthens FOSMA’s ability to anticipate and prepare for future industry developments. We currently offer dual-fuel training at both of our institutes for LNG and are exploring development programs for methanol, ethanol, and ammonia. Additionally, we are collaborating with engine manufacturers to ensure that updated simulators for future engine types are available in

India for training our sailors. We are also working with the Directorate General of Shipping to ensure that the new e-governance system is robust and user-friendly.

The

era of post-cold war globalization has been marked by numerous shocks, including the 9/11 attacks, the global financial crisis, Covid lockdowns, and Russia’s invasion of Ukraine. Each of these events sparked fears that global

Despite these challenges, globalization now faces its biggest threat yet - the great-power rivalry between the US and China. The competition between these two economic giants is intensifying, with both countries using subsidies, tariffs, and export controls to gain an advantage in critical sectors such as semiconductors, clean energy, and telecoms.

Former Australian Prime Minister Kevin Rudd warned in 2019 that reducing economic links between the US and China could undermine global economic growth and lead to a new “iron curtain” between East and West. This warning is particularly relevant today, as policymakers in the US feel pressured to take a hawkish stance and cut economic ties with China.

Ngozi Okonjo-Iweala, director-general of the World Trade Organization, echoes these concerns, stating that “these are troubling times for global trade”. She notes that increased protectionism and geopolitical tensions are causing trade to fragment along geopolitical lines.

However, despite these challenges, global trade has shown remarkable resilience. Studies by the WTO and IMF suggest that while there has been a protectionist shift in the US and tariff wars with China, the evidence of a fundamental fracturing in investment and trade is tentative.

In fact, WTO economists estimate that goods trade has grown by only 4.2% less between US and China-centered geopolitical blocs than within them since Russia’s invasion of Ukraine. IMF studies also find relatively less trade and foreign direct investment between geopolitical blocs than within them, but describe the differences as relatively small.

As the global economy continues to evolve, it remains to be seen whether globalization can withstand the mounting pressures of US-China rivalry. One thing is certain, however - the future of global trade hangs in the balance.

trade would come to a grinding halt, but surprisingly, the system has not only survived but

thrived.

shipping.khimji.com

Russia’s shadow fleet of liquefied natural gas (LNG) carriers has come to a grinding halt after the Republic of Palau suspended the flag of three vessels. The Palau International Ship Registry pulled the registration of LNGC Pioneer, Asya Energy, and Everest Energy pending an investigation into their practice of deactivating or spoofing AIS signals while traveling to the sanctioned Arctic LNG 2 project.

As a result, all shadow fleet vessels have remained idle in Russian or international waters for over a week. The suspension has caused concerns about gas burn-off, with losses potentially reaching 7.5% of cargo per month. The vessels, which are older steam turbine vessels, are experiencing high gas burn-off rates, ranging from 0.15% to 0.25% per day.

The suspended vessels have been unable to transfer their cargo, with Pioneer and Asya Energy remaining idle off the coast of Port Said and Kola Bay, respectively. Everest Energy has been moored alongside a floating storage barge in Ura Guba Bay, which may help reduce boil-off rates.

The suspension has added to the challenges faced by Novatek, the Russian energy company, in marketing its sanctioned cargo. The company’s Chinese marketing arm was sanctioned by the US last week, and the delays will make it even harder to find a buyer.

Additionally, other LNG carriers, such as North Sky, have been included in sanctions, posing a risk of secondary sanctions for potential buyers receiving cargo from these vessels. The North Sky began offloading its cargo at the Yangkou LNG terminal over the weekend, but the vessel and three others from the same order were included in sanctions announced last week.

The State Department has committed to blocking the expansion of Russia’s LNG fleet and export capacity, and the suspension of the shadow fleet’s flag has brought operations to a standstill. With potential buyers facing the risk of secondary sanctions, the future of Russia’s LNG exports remains uncertain.

Foreign Policy Magazine outlines a contrarian view, as outlined here. It may border on wishful thinking; you can decide. The debate ranges between those who believe he will abandon Ukraine, withdraw from NATO, and herald a “post-American Europe”, and those who predict he will escalate the RussianUkrainian war and continue his fiercely anticommunist policies.

Foreign governments have been reaching out to Trump and Republicans to understand, and maybe influence, policy direction. The landscape will be dramatically different from when he took office in early 2017 with active wars in Europe and the Middle East, and the threat of another in Asia.

Globalisation is in retreat and great-power politics have returned. Now that Europe is increasing defense spending, under threat from Russian aggression, and as the US economy is recovering, he may decide not to abandon Europe. An alternative would be to build a broad international coalition to enable further China decoupling and to counter the menace of Russia, Iran and its proxies, and North Korea.

The US-Mexico border is a priority. FP mentions that in 2020, Trump’s last year in office, US Border Protection carried out 646,822 enforcement actions, including three individuals on the terrorist list. By 2023, this had risen to 3.2 million and 172 respectively. The unsecured border, broken asylum process, overwhelmed courts, and significant

- Bansi Jaisingh

fentanyl trafficking will need to be tackled by the next president as a critical national security issue. As the US Army and Navy may be deployed to the border, and given escalating regional conflicts, FP suggests that Trump would likely oversee the most significant US military buildup in almost 50 years.

The US defense industrial base has atrophied and the disastrous defeat in Afghanistan has led to a material drop in the confidence of Americans in its military. Such an expansionary move would not quite chime with Trump’s reputation for isolationism and disengagement. However, it would lead to a domestic manufacturing boom.

Trump will focus on energy security in contrast to Biden’s climate agenda. The US became a net energy exporter in 2019 and, since 2017, its total energy exports have nearly doubled, and it has surpassed Russia and Saudi Arabia to become the world’s largest oil producer.

It’s rising exports of LNG to Europe could reduce Russia’s influence and improve trans-Atlantic relations while reducing the US trade deficit with Europe. US energy dominance would give it leverage over China and help reduce global oil prices and US gas prices, appeasing domestic consumers.

Trump 2.0 will aim to have greater influence over world trade via bilateral deals. The US economy is now stronger than during his 2017-2020 term with an estimated 26% of global GDP in 2024. In 2008, the US and Eurozone economies were of similar size. Today, the US economy is almost 80% larger, illustrating Europe’s decline. Trump is expected to re-open bilateral trade talks with the EU, UK, and Japan and aim to secure better deals for the US.

China is likely to be a more adversarial discussion.

The US economy has grown relative to China over the past eight years, with the US economy larger and the Chinese economy smaller than economists expected. China may no longer overtake the US after all, a popular prior assumption. China appears to be going through deep structural challenges in what may be a lost decade with the IMF projecting that China’s share of Asia-Pacific GDP will be slightly smaller in five years than it is today.

The US has become less dependent on foreign trade, and less dependent on China. The US is now reckoned to be better positioned to withstand a protracted trade war with China than it was a few years ago and it may aim for ‘strategic independence’ from China. In this respect, it will be more aligned with Europe after Covid-19, China’s support of Moscow, its wolf warrior diplomacy, tech competition, and flexing supply chains.

In the Pacific, the US is strengthening its regional ties with Taiwan, the Philippines and Vietnam and via multilateral bodies such as the Quad and AUKUS.

What is less clear is Trump’s ‘position’ on Taiwan which he pointed out is 9,500 miles away from the US but only 68 miles away from China. It is possible that, far from being unilateralist in foreign policy, he may build upon the very multilateral relationships that Biden was at pains to resurrect, as they offer greater strength in numbers.

First, Trump must regain the presidency.

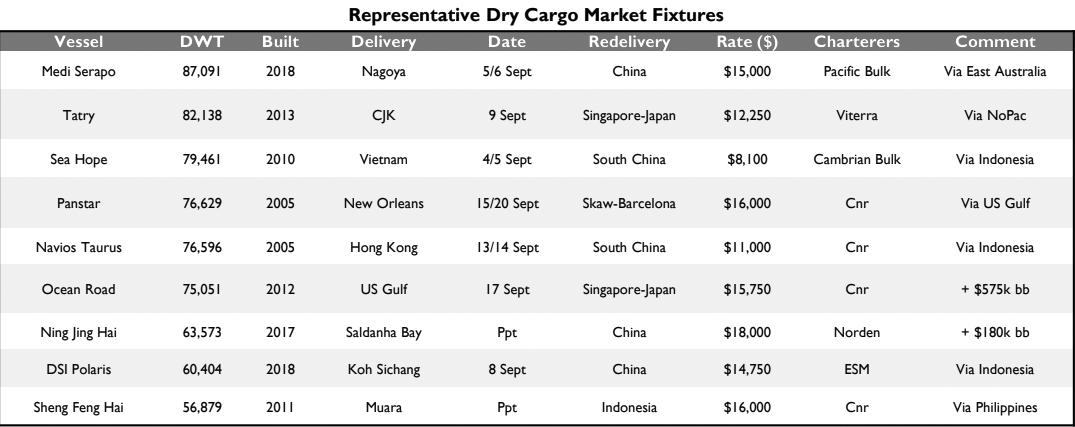

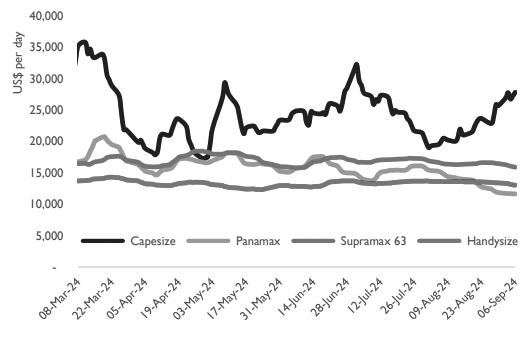

A mixed result for Capesize markets after a continued period of positivity. Rates began the week strong but took a significant dip mid-week. However, they rebounded considerably on Thursday and Friday, ending the week higher than when they started. The BCI closed at $27,832, up by $2,132 from last reported.

Plenty of activity was seen in the Australian iron ore markets this week, with Rio Tinto chartering seven vessels for mid-late September dates for 170,000 mtons 10% Dampier/China. Freight paid ranged from $11.00 pmt to $11.85 pmt.

From Port Hedland, FMG, BHP, and Jera took six positions between them for 160,000 mtons 10% into Qingdao, amongst them Genco Endeavour (181,060-dwt, 2015), paying from $11.20 pmt to $11.85 pmt.

In the Atlantic, CSE took an Oldendorff TBN for 150,000 mtons 10% Ponta Ubu/Taiwan at $31.60 pmt for late September, ECTP fixed NBA Peace (174,766-dwt, 2004) Tubarao option West Africa/ Qingdao at $27.25 pmt for mid-October dates, and Costamare reportedly fixed Cape Kensington (203,512-dwt, 2006) for 190,000 mtons 10% Tubarao/Qingdao at $27.00 pmt with ETA Brazil 4/6 October.

Panamax tonnage in the Atlantic continued to build up this week causing further downward pressure particularly in the South Atlantic.

Sentiment was more positive in the East with increased demand from loading areas. The BPI closed on Friday at $11,645, down by just $198. In the Pacific, Medi Serapo (87,091-dwt, 2018) fixed delivery Nagoya for a trip via Australia to China at $15,000, Cambrian Bulk chartered Sea Hope (79,461- dwt, 2010) delivery Vietnam for a trip via Indonesia to South China at $8,100, and Axiom took on MSXT Athena (81,723-dwt, 2018) delivery Huanghua 13 September for 5/7 months trading at $14,900 with worldwide redelivery.

In the Indian Ocean, we heard ASL Bulk fixed Calipso (73,691-dwt, 2005) delivery Tuticorin for a trip via South America to the Far East at $10,150.

From the Atlantic, Panstar (76,629-dwt, 2005) fixed delivery New Orleans for a trip via the US Gulf with grains to Skaw-Barcelona range at $16,000, while Bunge fixed Yarra Star (82,624-dwt, 2008) delivery APS East Coast South America for a trip to Singapore-Japan range at $15,650 plus $565,000 bb with an option for South East Asia redelivery at $15,400 plus $540,000 bb. Additionally, Jera took a Louis Dreyfus TBN for 70,000 mtons 10% coal Amsterdam/Jorf Lasfar at $4.60 pmt.

Supramax markets across the Atlantic remained negative across all key regions this week, with very limited fresh enquiry. A similar story was seen in the Indian Ocean which continued its downward trend. Few cargoes were available for late September dates, causing the South African market to see a notable drop, while the Middle East-West Coast India region remained tight on demand. On the other hand, Asia observed a bounce back as more cargoes entered the market and stronger rates were discussed as a result. On Monday, the BSI 63 Ultramax index replaced the BSI 58 Supramax index as the average benchmark for this vessel size. The new BSI closed at $15,929 on Friday.

In the Pacific, Savita Naree (62,971-dwt, 2016) was fixed delivery Koh-Sichang prompt for a trip to Bangladesh with clinker at $15,250, DSI Polaris (60,404-dwt, 2018) also open Koh-Sichang on 8 September was fixed to ESM for a trip via Indonesia to China at $14,750. We heard that Andreas K (56,729-dwt, 2011) was taken by Drydel delivery Campha for 2/3 laden legs at $14,500 redelivery Middle East-Japan range, while Fednav took on Belisland (61,252-dwt, 2016) open China for 12/14 months at $15,500.

From South Africa, Ning Jing Hai (63,573-dwt, 2017) was fixed delivery Saldanha Bay for a trip to China with manganese ore at $18,000 plus $180,000 bb to Norden, Genco Laddey (61,085-dwt, 2022) was covered delivery Port Elizabeth for a trip to Norway also with manganese ore at $15,500, and ST Cergue (60,696-dwt, 2017) fixed delivery Richards Bay for a trip to Pakistan at $18,500 plus $185,000 bb.

In the Atlantic, V Noble (50,433-dwt, 2011) open Lagos spot was fixed to Guardian Bulk for a trip delivery Dakar at $14,500 for trip to China, and Sheng Heng Hai (56,649-dwt, 2013) open Otranto 6 September was heard fixed at around $11,000 delivery APS Mediterranean for a trip to West Africa.

The Handysize markets in the Atlantic were very uneventful this week, with most areas staying in the red aside from a hanging on the US Gulf market. Overall timecharter averages for the sector ended the week at $13,039, another slight decrease of $348 from last reported.

In the Atlantic, Erhan (38,695-dwt, 2013) open Puerto Cabello was fixed at $17,000 APS for a Southwest Pass trip to Tunisia, and CS Jaden (38,101-dwt, 2013) open San Pedro De Macoris prompt fixed for a trip with coal from Barranquilla to Poland at around $17,500 to Cetus Maritime.

We heard T-Bulk fixed a large Handy at $10,000 for a Continent to Adriatic trip with steels, and in the Mediterranean another large Handy fixed $10,250 for a clinker run ex East Mediterranean into the Adriatic.

Down in the South Atlantic, we heard rates for East Coast South America to Continent/Mediterranean range being exchanged in the $13,000s.

It was also a slow week for the Handy markets in the Pacific with limited activity and further softening. Rates were said to be dipping below last done across the region. We also saw an increase in

available tonnage and are expecting the market to continue softening next week.

In the Far East, CH Clare (33,144-dwt, 2010) was heard fixed at $13,300 DOP Fangcheng for a trip with steels to West coast India with Panocean. A 33k-dwt vessel open Qingdao was heard fixed for 3/5 months at around $12,000-$13,000, while a 32k-dwt vessel open Yantai was reportedly covered at over $12,000 for a trip to Singapore-Port Kelang range.

In South East Asia, a 32k-dwt logger was heard fixed delivery passing Singapore at around the $13,000 mark for 2/3 laden legs. For 28k-dwt vessels opening in South East Asia, Owners are holding out at around $10,000-$11,000 DOP while charterers are indicating around $9,000-$9,500 APS.

With market conditions anticipated to ease further, it is likely that Owners may begin to reduce their rates next week.

The Capesize market remains firmly in control at the crease, and while bad light has currently stopped play at the Oval in the third test against Sri Lanka, another three Caper sales have been added to the scoreboard this week. Elsewhere offers are expected on a number of Kamsarmax and Ultramax

sales candidates and hopefully next week we should have a clearer picture of how the ball is moving. The sense is that not enough buyers are ready to jump on Kamsarmax tonnage at current levels and it will be interesting to see if the sellers are prepared to dip their prices to conclude sales. This segment of the market feels a little overcrowded with sales candidates.

Norden has successfully offloaded another Cape. The scrubber-fitted Nord Magnes (179,546-dwt, 2011 Hanjin Subic) is reported sold to Chinese buyer for $31.5m, roughly what they paid for her eighteen months ago. Azure Ocean (180,184-dwt, 2007 Imabari) is sold for a firm $25m, and the upward price trend continues with the sale of Alpha Prudence (178,002-dwt, 2008 SWS) for $24.5m.

A strong price has been recorded for the Japanesebuilt Amis Miracle (62,601-dwt, 2018 Oshima). She is recorded sold at 34.35m, ahead of current benchmarks.

Older tonnage is finding it a little tougher, and the discounts for weak survey positions seem to be growing.

The TESS58 design Titan I (58,090- dwt, Tsuneishi Cebu) is sold for just $16.2m with surveys due, while the Dolphin57 design Jag Rani (56,819-dwt, 2011 COSCO Zhoushan) was likewise discounted to $13.6m with drydock due.

And so finally to the tailender, in the Handy sector, the logger Transformer OL (28,375-dwt, 2009 Imabari) is sold for a low $9.2m. Again, her surveys are due.

As the summer months come to an end, most are feeling refreshed and ready to have a strong finish to the year.

It appears MR tankers are the flavour of the week with five vessels reported sold. Scorpio continue to sell out more of their ten-year-old eco MR2s. STI San Antonio & STI Texas City (49,990-dwt, 2014 SPP) are reportedly being picked up for $42.5m

each with delivery in Q4 this year. This is a firm price comparing to the last sold MR built at SPP also from Scorpio, which was the year younger STI Manhattan (49,990, 2015 SPP) that achieved a price of $40.5m back in May of this year.

A third eco-product tanker has also been sold. Tenacity (50,143-dwt, 2014 GSI) has been bought by Aerio Ship Management at a price rumoured to be in the region of $40m. If true, this would be a very strong number against the same-aged Koreanbuilt tonnage also sold this week.

At the vintage end of the market, SPM Shipping has offloaded Pioneer (49,000-dwt, 2005 DSME) for $18m. A year younger sister Bahri Rose (49,631dwt, 2006 DSME) sold for the same price at the end of last year.

The strength in prices for MR tankers remains in the older assets too. To round up this week’s tanker sales, Norwegian Owners Tailwind AS are reported to have sold Lyderhorn (33,849-dwt, 2006 Shin Kurushima - Stainless Steel) for $26.6m with drydock due next month. A slight premium against same aged sister Ulriken (33,888-dwt, 2006 Shin Kurushima - Stainless Steel) which sold for $26m in July with better survey positions.

The Cargo Integrity Group (CIG) has raised concerns over the lack of consistent reporting by national administrations on container inspections, a critical element in ensuring maritime safety. An analysis by CIG revealed that less than 5% of 167 national governments are submitting inspection results to the International Maritime Organization (IMO), despite a decadesold agreement to conduct and report routine inspections of containerized shipments. This deficiency undermines global efforts to improve the safety and sustainability of sea transport by limiting the availability of reliable data to draw safety conclusions.

The agreement, adopted over 20 years ago, requires annual submissions to the IMO for collation and analysis, creating a global picture of compliance with international safety regulations such as the SOLAS Convention, the CSC Convention, the IMDG Code, and the CTU Code. The findings are meant to help address potential safety gaps and

improve shipping standards. However, the lack of submissions hinders efforts to address issues like poor packing, mishandling, or misdeclared shipments, which have been linked to recent incidents, including fires and explosions aboard container ships.

The CIG calls for national administrations to uphold their commitment to submit these inspection results and urges the IMO to continue publishing the findings for public access. The industry collective emphasizes that consistent reporting and transparency are essential to targeting communication and training programs for the global supply chain, ultimately helping to protect lives and the environment.

Given the potential discontinuation of the IMO’s reporting system, CIG is stressing the urgency of maintaining these safety measures to prevent further incidents and improve compliance with global shipping regulations.

The city of Heraklion will host the 8th Posidonia Sea Tourism Forum next May, as the organizers of the East Med’s most important cruise conference, with the support of the Region of Crete and the Heraklion Port Authority and in collaboration with local authorities, prepare to bring this CONFEX event to the country’s largest island for the first time.

2025’s Posidonia Sea Tourism Forum (PSTF) will be held at the Creta Maris Resort Hotel, located in close proximity to Crete’s capital. Heraklion port is expected to see a 20% increase in cruise passenger numbers this year with an equally busy season expected in 2025.

With Piraeus, Santorini and Mykonos accounting for nearly 60% of all cruise activity in Greece, and many destinations in the Mediterranean calling for and some already adopting measures to limit over-tourism in popular destinations, the PSTF 2025’s theme, “The Med: A Compelling Need for New Marquee Ports & Destinations” couldn’t be more topical. The event will bring global cruise industry decision-makers and industry organizations like Cruise Lines International Association (CLIA) and MedCruise, in touch with East Med’s stakeholders, to explore solutions and create new exciting itineraries going forward.

Alleviating pressure on overcrowded ports of call, exploring the potential of lesser-known and visited destinations for inclusion in cruise itineraries, and

fostering dialogue on sustainable tourism practices are among the key themes to be tabled at the Forum and discussed with cruise executives who have extensive knowledge and operational knowhow of the Mediterranean.

“Topics to be discussed during the two-day conference will include sustainability, marketing and tourism product delivery, guest immersion and satisfaction, overcrowding, new destination entries, port infrastructure, green initiatives and solutions, effective berth allocation solutions, and daily caps on arrivals,” said Theodore Vokos, Managing Director of Posidonia Exhibitions S.A.

In parallel to the thought-provoking panel discussions, the exhibition will feature and promote new and emerging cruise destinations, ports and related infrastructure, cruise companies, travel agencies, tourism consultants and cruise ship suppliers amongst others. The event’s exhibition floor will serve as the platform for the region’s destinations and stakeholders to meet with itinerary and excursion planners, while new port investments and other infrastructure projects, such as the new Heraklion Airport, currently in full swing will be showcased to the cruise industry.

Vokos added: “At the Posidonia Sea Tourism Forum, cruise executives and key stakeholders will have the opportunity to examine ways to secure a sustainable future for ultra-popular destinations, as well as seek a cooperative approach towards introducing cruise passengers to new or emerging ports of call with marquee potential.”

The Regional Governor of Crete, Stavros Arnaoutakis said: “The Region of Crete actively supports the

Posidonia Tourism Sea Forum for the cruise sector, which will be held for the first time in Crete.

The presence of numerous cruise lines, specialized tourism agencies and organizations from around the world at the Forum poses a significant opportunity for the continued growth of cruising on the island, which will contribute to reducing seasonality and enhancing Crete’s tourism products. It also showcases the island’s rich historical, cultural, and environmental assets to visitors from across the globe.

It is with great joy and high expectations that we are preparing to host the forum, organized by the organizers of Posidonia, the most important maritime exhibition in the world. The selection of Heraklion was made in the context of the strategic choice of the Region of Crete for a strong, extrovert, sustainable and competitive tourism sector in Crete.”

Welcoming the selection of Heraklion for the 2025 Forum, Minas Papadakis, CEO, Heraklion Port Authority, Diamond sponsor of the event, noted: “We are excited to announce that the Heraklion Port Authority, with the support of the Prefecture of Crete, will be hosting the 8th Posidonia Sea Tourism Forum 2025 in Heraklion. As we prepare for this prestigious event, we look forward to showcasing our port’s strategic capabilities and our commitment to sustainability and maritime innovation. The forum will offer a unique platform for fostering global partnerships and engaging in forward-thinking discussions that will shape the future of sea tourism. We look forward to welcoming the cruise industry to Heraklion to an event filled with valuable insights and collaboration.”

Significantly important for any port city is the economic impact of cruise activity for the local economy. One

such port is Heraklion, where the direct economic impact of the cruising sector brought in €36.05 million to the local economy in the 12-month period ending May 2024, according to a University of Piraeus study.

According to the same study, 72% of cruise passengers who visited Heraklion would recommend it to friends and relatives as a destination of choice for holidays, with 29.1% saying that they would themselves revisit the city as conventional tourists.

During the 13 years since the Forum’s inception, Heraklion will become only the second city, outside Athens, to host the event following the successful 2023 event in Thessaloniki. Heraklion Port, its vibrant city and the Region of Crete are excited to welcome delegates and exhibitors to the May 6-7 Posidonia Sea Tourism Forum.

Sponsors for the 2025 PSTF include: Diamond sponsorHeraklion Port Authority, Gold sponsor - ODAP (Hellenic Organisation of Cultural Resources Development), Bronze sponsor - Kyvernitis Travel Group, Sponsor –Thessaloniki Port Authority and is organized under the auspices of the Ministry of Maritime Affairs & Insular Policy and the Ministry of Tourism, and is supported by the Hellenic Chamber of Shipping, the Cruise Lines International Association (CLIA), the Association of Mediterranean Cruise Ports (MedCruise) and the Union of Cruise Ship Owners & Associated Members of Greece.

- MMT

Since the first conversion in October 2022, technology group Wärtsilä has reported fuel savings of over 14,000 metric tonnes and CO2 emission reductions of over 45,000 metric tonnes –equivalent to the annual emissions of 17,000 cars –across ten vessels retrofitted with Wärtsilä’s unique Fit4Power solution.

With decarbonisation high on the maritime agenda, retrofit technologies, such as Wärtsilä’s Fit4Power solution, have the potential to enable compliance with the rising tide of regulatory requirements. For many ship operators and owners today, the aim is to find flexible solutions that can assure the long-term fitness of fleets in terms of both economic performance and environmental compliance.

“Balancing these often conflicting demands is no easy task. Individual operators are seeking the best way forward, while at the industry level, supply chains are being decarbonised as a means to enable sustainable global trade. In other words, the transformation is happening at all levels and at the same time,” comments Andreas Wiesmann, General Manager, Global Sales, 2-stroke Engine ServicesWärtsilä Marine.

To add to the mounting challenges, operators are having to track against tighter emissions standards such as Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI). They also need to cope with disruption caused by geopolitical events and increasingly unpredictable weather conditions. Both of which are having a direct impact on fuel consumption and increase emission levels.

To mitigate these challenges and to extend the emissions-compliant lifetime of merchant vessels, Wärtsilä launched its Fit4Power solution to the commercial market in Spring 2023. The solution provides the existing two-stroke fleet with leaner, healthier and more optimised engines.

This advanced retrofit solution enables ship owners to reduce the bore size of two-stroke engines by 25 percent, enabling the engine to run at optimal loads and with outstanding fuel and combustion efficiency. This fuel efficiency in turn reduces greenhouse gas emissions. For owners, this will improve the efficiency of their existing fleet, ensuring compliance with CII regulations, and futureproofing assets against future environmental measures.

Analysis from Wärtsilä shows that without modification, more than 80 percent of the global merchant fleet could fall into the lowest CII rating by 2030, requiring mandatory corrective action and risking losing business to more efficient vessels. The Wärtsilä solution is also a step towards the economical use of alternative fuels to meet future emission reduction targets.

On a per ship basis, the annual potential savings of a vessel retrofitted with Fit4Power are estimated to be 2,000 tonnes of fuel, depending on the vessel’s operating profile, and 6,400 tonnes of CO2 emissions. In monetary terms, operating costs for a ship owner or operator could be lowered by as much as 2.18 million* euros in operational expenses annually.

Wiesmann continues, “Our Fit4Power solution is a key element in Wärtsilä’s committed strategy to support decarbonised shipping. It is a world-first development that provides an exciting means for us to showcase our capabilities in giving marine engines a new lease of life. Improving engine efficiency and optimisation with solutions such as Fit4Power is one of the simplest and most cost-effective means of reducing emissions.”

There are currently 30+ vessels in the scope of delivery for retrofitting with Fit4Power. Ten of these vessels are already converted and have been in operation for up to 20 months.

*The calculation of this figure is based on (voyage profile may vary):

• fuel cost of €700/ton

• Carbon levy of €100/ton

• Parts savings €0.14M/year

Alfa Laval has received an order to replace 18 ballast water treatment systems (BWMS) onboard vessels belonging to a major European shipowner. This significant order shows the high demand for the replacement of malfunctioning systems and a growing market for Alfa Laval’s BWMS replacement offering.

Strict regulations and frequent controls are driving shipping companies to ensure their ballast water treatment systems are fully operational to avoid high costs, downtime, and potential business losses. As the majority of the world fleet is now equipped, the BWMS retrofit market is nearing saturation. Many suppliers have reduced their commitment to customers or exited the market

entirely, leading to a lack of support and upgrade options as regulations evolve. This is especially challenging when the systems purchased are not functioning properly.

Over the past two years, Alfa Laval has replaced more than 250 systems from 30 different manufacturers, and the orderbook for replacement continues to grow. “With the consolidation of the BWMS market, we see a growing need for replacing installed BWMS systems”, says Tobias Doescher, Head of Global Sales, Business Development and Marketing, Alfa Laval PureBallast. “We have been contacted by an increasing number of shipowners

and ship management companies worldwide who are experiencing issues that their current supplier cannot resolve. We are happy to step in and support our customers with cost-efficient and sustainable solutions.”

Alfa Laval has experience replacing systems using electrochlorination (EC) and UV technology. The replacement projects are handled professionally by a thorough onboard assessment of the existing system by a qualified expert. This comprehensive evaluation determines necessary replacements and identifies components that can be reused, resulting in substantial cost savings for clients. The replacement process is customized for each customer, providing them peace of mind in meeting BWMS compliance.

“The success of this offering validates the way Alfa Laval has chosen to work - partnering for the entire lifecycle of ballast water management equipment rather than being a one-time supplier,” says Peter Sahlén, Head of Alfa Laval PureBallast. “While other suppliers are exiting the market, we are investing in our experts, actively following the regulations, and offering new services to facilitate compliance. We have even launched our new PureBallast 3 Ultra, developed based on years of customers´ feedback.”

GAC Shipping (India) Private Limited - Main office

GAC House, P.B. No. 515, Subramanian Road, Willingdon Island, Cochin 682 003, India

E: pricing.india@gac.com | T: +91 484 266 8372

CIN: U63090KL1983PTC003733

Bengaluru

Mr Gopala Krishna

T: +91 96863 55008

E: gopala.krishna@gac.com

Chennai

Ms Ranjani Kumar

T: +91 98846 62852

E: ranjani.kumar@gac.com

Cochin

Mr Swaraj Joseph

T: +91 79943 33270

E: swaraj.joseph@gac.com

Delhi

Mr Jaya Shekar

T: +91 98992 05424

E: jaya.shekar@gac.com

Kandla

Mr Jatin Joshi

T: +91 98251 58583, E: jatin.joshi@gac.com

Kolkata

Mr Dipayan Hore

T: +91 99036 27997

E: dipayan.hore@gac.com

gacshippingindia

Mumbai

Mr Sanket Chandwade

T: +91 83697 44069

E: sanket.chandwade@gac.com

Pune

Mr Arjun Bangar

T: +91 98196 69622

E: arjun.bangar@gac.com