Business & Economy in Qatar WINTER 2022/23 85 ISSUE BANKING AND FINANCE ECONOMY AND COMMERCE USEFUL NUMBERS INVESTMENT AND TRADE THE HYDROCARBON INDUSTRY INFRASTRUCTURE IN QATAR FEATURES: NEW PROCEDURES TO SUPPORT BUSINESSES IN QATAR DATA PRIVACY PROTECTION LAW GUIDELINES ISSUED QETAIFAN ISLAND NORTH

QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

Business and Economy Business and Economy • Useful Numbers: Banks and Exchange Houses • The Banking Network in Qatar • Currency • The Banking Sector • Qatar Central Bank • Qatar Credit Bureau • Loans, Bank Charges and Interest Rates • Accounts • Financial Services and Insurance • Islamic Finance Banking and Finance • Economic Growth and Gross Domestic Product (GDP) • Trade Surplus • The Budget • Inflation and Cost of Living • Population and the Labour Force Economy • Incentives • Investment Regulations • Choosing a Business Structure • Company Structures • Commercial Registration • Export and Import • Taxation • Intellectual Property • Regulatory Bodies and Government‑owned Entities • Qatar Financial Centre • Qatar Exchange • Real Estate • Developers and Real Estate Agents Selling Property • Business Etiquette Investment and Trade Commerce Useful Numbers Feature – New Procedures to Support Businesses in Qatar Doing business in Qatar continues to get easier, with new initiatives launched to ease processes. © MARHABA M85 WINTER 2022/23 The information contained in this guide has been checked and verified as correct as at the time of compilation. Due to the COVID 19 pandemic, information is subject to change. Follow marhaba.qa for the latest updates. An overview of local infrastructure, ongoing megaprojects and new developments. Infrastructure in Qatar Feature – Qetaifan Island North Read the latest about Lusail City’s stunning new island project, with apartments designed by Elie Saab and the 85 metre Icon Tower! The Hydrocarbon Industry • Qatar’s Energy Companies • International Companies marhaba.qa PRINT and ONLINE

Hilary Bainbridge

Editorial

Marhaba endeavours to quote accurate information and updates each of its sections every issue. However, the company accepts no responsibility or liability for any false, inaccurate, inappropriate or incomplete information presented, whether in print, on the website, or on social media channels.

© 2022 Marhaba Information Guide. All Rights Reserved. No part of this magazine may be reproduced, in any form, without written permission of the publishers.

Dana Public Relations PO Box 3797, Doha, Qatar

Tel (+974) 4465 5533, 4465 0083

General Information marhaba@marhaba.com.qa

Follow us

Founder & Managing Editor

Sarah Palmer (Editor) Ola Diab (Deputy Editor) Terry Sutcliffe Advertising

Retail

Howard Bainbridge Charlotte Wright Maria Anicas

Sales Ayen Molina Online/Digital Lalaine Turqueza Weslee Dizon Design and Artwork Dick Tamayo Mar Principe

© MARHABA WINTER 2022/23

A 1 B C D E 2 3 Salwa Rd Bridge 55 55 55 56 56 38 52 52 37 36 53 53 53 53 54 54 54 35 34 70 70 70 70 30 31 67 33 32 51 51 51 51 68 68 5 2 1 6 4 3 Al Waab City Medical QNA GAC Traffic Dept HQ Hyatt Plaza KidsZania Villaggio Qatar Veterinary Centre Royal Vet Jassim Bin Hamad Stadium (Al Sadd Club) Garvey’s Al Rayyan Security Dept Racing& Equestrian Club Al Rayyan Traffic Police Awqaf Zakat Fund Al Maamoura Traffic Police Jarir Bookstore Food Centres Ansar Gallery Wathnan Mall Royal Hall Al Rayyan Municipality Academy Aspetar Aspire Park Al Aziziyah Boutique Hotel LuLu Al Gharrafa Sports Club Qatar Veterinary Centre Park View Pet Centre Dahl Al Hamam Family Park Doha Shooting Club Qatar Guest Centre FAHES Abdullah Bin Khalifa Stadium (Al Duhail Sports Club) Doha Festival City Duhail Water Pumping Station IKEA Qatar Environment and Energy Research Institute (QEERI) QSTP Car Park Gate 2 AmiriGuard Celebration Hall Mall of Qatar Al Wajba QNCC Gate 5 / Chef’s Garden Aspire Zone Al Rayyan MoI Immigration Department Directorate of Passports Al Gharrafa Park Rayyan 2022 Alfardan Gardens 4 Ain Khaled Gate Al Sulaiti Tebah Gardens Aziziya Beverly Hills Beverly Hills Gardens Messila Beverly Hills Al Rayyan Riviera Gardens Jelaiah Complex Education City Community Housing 1 2 Alfardan Gardens 2 NBK Mercedes Hyundai Auto Class MG / Maxus Mitsubishi Porsche Quick Service Dukhan Zekreet Al Sheehaniya Sheikh Faisal Museum Al Shamal Al Ruwais Ras Laffan Al Zubara Al Khor Umm Garn Umm Slal Ras Laffan Al Shamal Al Zubara Al Khor Al Shamal Rd Lusail Al Mazrooah Al Shamal Rd Al Khor Semaisma Lusail Int’l Circuit Omar Bin Al Khattab Qatar Nat’l Library EC Golf Club Mathaf Al Shaqab Education City College of Islamic Studies Education City Mosque Oxygen Park CGIS QATAR Map of Greater Doha prepared in cooperation with Hotel Shopping Mall Cultural Landmarks Government Office Housing Complex Auto Dealer Health Centre Legend Hospital Bookstore Sports Stadium School, College, Club Club Restaurant Road Interchange Mosque Religious Complex Petrol Station Veterinary Clinic Sub-station Non-stop Expressway Cycling/Jogging Track EducationCity (EC) 1. Academic Bridge Program (ABP) 2. Al Shaqab 3. Carnegie Mellon University in Qatar (CMU-Q) 4. Ceremonial Court 5. Georgetown University in Qatar (GU-Q) 6. Education City Golf Club 7. Hamad Bin Khalifa University (HBKU) 8. Education City Mosque 9. Multaqa (Student Center) 10. Northwestern University in Qatar (NU-Q) 11. Oxygen Park 12. Qatar Academy Doha (Primary School) 13. Qatar Foundation Headquarters 14. Qatar National Convention Centre (QNCC) 15. Qatar National Library (QNL) 16. Qatar Science & Technology Park (QSTP) 17. Sidra Medicine 18. Texas A&M University at Qatar (TAMUQ) 19. Virginia Commonwealth University School of the Arts in Qatar (VCUarts Qatar) 20. Weill Cornell Medicine-Qatar (WCM-Q) 21. Academyati Al Aziziyah

Al Messila Al Rayyan Al Qadeem Al Shaqab Qatar National Library Education City Al Sudan Sport City Qatar University Lusail Al Waab Ahmad Bin Ali Stadium Lusail Stadium Al Bayt Stadium Al Bayt Stadium is in Al Khor City, 30 km to the north on Al Khor Road 3-2-1 Qatar Olympic and Sports Museum Education City Stadium Khalifa International Stadium AlMajdRoad 2 AlTarfaStreet Lusail Al Khor Road Jeliah St Al Khafji St Al Markhiya St Khalifa St Omar Bin Al Khattab St Al Jaz ra Al Arabiya St J a s i m B i n H am a d S t Al Rayyan Road DohaExpressway Wholesale MarketSt mU m AlMearadSt SalwaRoad Ain KhaledSt KhaledBinAhmedSt AlAziziyaSt A s pire ZoneSt/S portsCityRd Al Sidr St AlWaabSt SabahAlAhmadCorrid o r UmmLekhbaI/C –HIA AlAmirSt Al Rayyan Al Jadeed St AlRayyanAlAteekStHuwarSt AlMadeena St 22 Feb St Makkah St Makkah St Al Luqta St Thani Bin Jassim St A l G harrafa St AlDuhailSt Zekreet S t AlIzghawaSt AlGhezlaniyaSt ZekreetSt Al Shamal Road Al Rufaa Street Ghaffafa A l Rayyan St AlTerhabSt AlLuqtaSt Al WajbaSt Al Shafi St A Q alah S t Al Wajba St AlFurousiyaSt Rasheeda St Al Salam St Al KhufousSt Sedaira St AlSailiyaRoad Al Furousiya St Dukhan Road Al Ghaf HazmAlM Jasi m Bi n Hamad S t (S treet 245 was Arab L e a g u e S t ) Al Majd Road J e r yan N e j a m a S t e e Jeryan Nejaima Street JassimBinAliSt Bangladesh Qatar Scientific Club Dreama ASD AIA Step by Step CESK British Council Study Plus Debakey DESS English Modern School University Foundation College Philippine School of Doha Little Academy Edison Starfish Lane Kids Elder Tree KG Compass French Nursery Swiss International Compass ACS Int’l School Edison Qatar Canadian School University of Doha for Science and Technology Starfish Lane Kids 2 Qatar Finland Int’l School Newton The International School of London in Qatar ACS Gulf English School Driving School Appletree Nursery University of Calgary Belgravia Lycee Voltaire Newton Doha Academy Al Waab Campus Summit Academy Doha British Elder Tree Nursery Edison Sherborne Japan School Compass Compass Newton Doha College Al Wajba KhaledBinAhmed Al AlRayyan AlGharrafa Duhail UmmLekhba AlJahhaniyaI/C Izghawa AlKharaitiyat Al Meera Al Mall 01 Mall Dar Al Salam Mall Lulu North Gate Gulf Mall Landmark Mall Ezdan Mall Tawar Mall J Mall Souq Al Ali Doha Metro Network All trains connect at Msheireb Station Green line Al Riffa Mall of Qatar - Al Mansoura Red line Lusail QNB - HIA T1 - Al Wakra Metro Stations Gold line Al Aziziyah - Ras Bu Abboud ORANGE LINE LUSAIL Legtaifiya to Energy City South Madinat Khalifa Abu Bakir Siddique Mesaimeer Vaccination Unit AlRayyan Hotel Ezdan Palace Imperial Suites Premier Inn Doha Education City Hotel Torch Al Messila Resort & Spa THE ZONES OF DOHA (zones comprise one or more districts, some of which are listed below) Full details of Qatar s districts and zones at gisqatar.org.qa 1 Al Jasra 2 Al Bidda 3 Mohd Bin Jasim 4 Mushaireb 5 Barahat Al Jufairi 6 Old Al Ghanim 7 Al Souq 10 Wadi Al Sail 11 Arumaila, Armeilla 12 Al Bidda 14 Abdul Aziz 15 Al Doha Al Jadeeda 16 Old Al Ghanim 17 Sharg Zone/ Al Hitmi/Al Rufaa 18 Sharg Zone/Slata 19 Doha Port 20 Wadi Al Sail 21 Al Rumeila, Armeilla 22 Bin Mahmoud 23 Bin Mahmoud 24 Rawdat Al Khail 25 Al Mansoura/ Bin Derhem 26 Najma 27 Umm Ghuwailina 28 Sharg Zone/ Al Khulaifat 29 Ras Bu Abboud 30 Duhail 31 Umm Lekhba 32 Madinat Khalifa (N) 33 Al Markhiya 34 Madinat Khalifa (S) 35 Kulaib 36 Al Messila 37 New Al Hitmi/ Bin Omran Hamad Medical City 38 Al Sadd 39 Al Nasr/Al Sadd Al Mirqab Al Jadeed 40 New Slata 41 Nuaija 42 Al Hilal 43 Al Maamoura, Nuaija 44 Nuaija 45 Old Airport 46 Mesaimeer/ Al Thumama 47 Al Thumama 48 Doha Int'l Airport 49 Hamad Int'l Airport/ Banana Island 51 Al Gharrafa/ Bani Hajer 52 Al Luqta/Lebday Old Al Rayyan/ Al Shaqab 53 New Al Rayyan Muaither, Al Wajba 54 Al Soudan, Mehairja, Muraikh, Luaib, Baaya 55 Al Soudan, Al Waab 56 Bu Hamour, Mesaimeer, Ain Khaled 57 Industrial Area 60 Al Dafna 61 Al Dafna, Al Gassar 62 Lekhwair 63 Onaiza 64 Lejbailat 65 Onaiza 66 Legtaifiya, Onaiza 67 Hazm Al Markhiya 68 Jelaiah, Al Tarfa 69 Al Egla 70 Wadi Al Banat, Al Ebb Rawdat Al Hamama Al Gharrafa Park See more details of the area in our map of INDUSTRIAL AREA See our map of the area north of Doha MAP of AL KHOR

Al Riffa - Mall of Qatar

A B C D E 4 5 OldAirportStreet 56 48 49 41 42 43 40 39 37 69 66 65 64 33 63 61 62 60 66 20 1 3 13 14 15 16 17 27 26 25 24 22 23 6 7 4 5 44 46 45 45 47 47 2 10 11 12 61 Ras Bufontas Qatar Free Zone Qatar Free Zone Fox Hills North Beverly Hills Lusail Crescent Park Fox Hills South Place Vendome WOQOD WOQOD WOQOD Marina District QIPCO QT MOCI Doha Heliport Imam Muhammad Ibn Abdul Wahhab Al Mourjan Cruise Ship Terminal Museumof IslamicArt Doha Port Viva Bahriya Oyster Diplomatic Club Marsa Katara Porto Arabia Medical City Lusail City Island Island Qatari Diar Katara Hospitality Katara Legtaifiya Lagoon Doha Golf Club Ooredoo Hotel Park Tornado Tower Alfardan Tower Barzan Financial Square Al Jabor Vision Marhaba Jarir Cafe Batteel QNA AlBidda Park Amiri Diwan MIA Park Souq Waqif Qatar Sports Club Honda Civil Defence MoI HQ QBS QTV Khalifa Tennis & Squash Complex Qatar National Theatre Qatar Post Sub-station Commercial Avenue Meteorology Drainage Dept Qatar Red Crescent Kahramaa Awareness Park Kahramaa QDC Mesaimeer Services Indian Cultural Centre Tank Farm Immigration Regency Halls Ministry of Education Al Jazeera Qatar Centre Hamad Ambulance Fire Station Rumailah NCCCR Heart Vet Surgery Capital Police Concourse C D A B E Gulf Warehousing Gulf Times Arrayah ME & HE Airport Al Ahli Sports Club Darwish Travel CAA Al Arabi Club Rawdat Al Khail Park Al Emadi Hospital DOHA HOP-OFF BUS SIGHTSEEING ROUTE stops at MarriottHotel SharqVillage&Spa Fisherman’sWharf MuseumofIslamicArt TheCorniche OrrieOryx CityCenter-Doha HotelPark HiltonHotel InterContinentalHotel Katara ThePearl-Qatar LagoonaMall AlBiddaPark SouqWaqif NationalMuseumofQatar GrandMosque QNCC AlShaqab MathafMuseum National Museumof Qatar Palm Towers Jarir Bookstore BoxPark The Pearl Hamad International Airport (HIA) Katara Al Dafna DIA Arrivals DIA Departures Doha Int’l Airport (DIA) Ras Bu Abboud Beach 974 Alfardan Gardens Le Mirage Al Jazi Gardens Alfardan Gardens 3 Banana Island Resort Doha by Anantara Chevrolet Al Mana Chrysler Ford AAB Nissan Volvo Nissan Porsche Abu Bakr Al Mansoura Free Zone Oqba Ibn Nafie Al Matar Al Qadeem Umm Ghuwailina Al Doha Al Jadeda National Museum Souq Waqif Bin Mahmoud Al Sadd Joaan Al Bidda Corniche DECC Al Qassar Katara Legtaifiya Hamad Hospital White Palace Msheireb HIA T1 Ras Bu Abboud West Bay 5/6 Int’change Lusail Stadium Stadium 974 Al Thumama Stadium Arch at Intersection of Al Tarfa and Lusail Streets AlWakra Rd AlFadaillSt Abu AyyoubAl Ansari St NajmaSt ERingRd Oqba Bin Nafie St Ras Bu Abboud St NajmaSt E Ring Rd AirportSt DRingRd C RingRd C R n g R d Ras Bu Abboud St Grand Hamad St Al Corniche St Dafna St AlBiddaSt Onaiza St OmarAlMukhtarSt Lusail St Al Khafji St Wadi RawdanSt UniversitySt LagoonSt Legtaifiya St asuL i l tS Lusail Street AlTarfaStreet Lusail Boulevard AbdulAzizBinJasimSt AlMarkhiyaSt Ahmed Bi n AliSt Onaiza St MohammedBinThaniSt Al BiddaSt Road Jawaan S t Al Sadd St uS h a m B i n Hamad S t Bin Mahmoud St A Khal ee j S t WadiMushairebSt Expressway SalwaRoadAliBinAbiTalibSt HaloulSt D Ring Rd Rawdat Al Khail St AlMaadeedSt IndustrialAreaRd UmmLekhbaI/C – H d Ai t SabahAlAhmad Corridor Najma St B Ring Rd AlCorniche Ghaf St OmarAlMukhtarSt arkh y a S t Lusail Towers AlFunduqSt SabahAlAhmadCorridor UmmLekhbaI/C–HamadInt’lAirport CRingRoad Ideal Indian Qatar Ind Tech Al Jazeera Academy Park House Pak Education Centre Doha Modern Indian MES TEK Cambridge Girls Summit KG American Academy King’s College Berlitz Egyptian Language Qatar Skills Academy Girls Creativity Centre Montezine Newton Int’l German School Doha Doha Academy Elder Tree Nursery IAID Skills Development Center New Aslata Park CCoQ Debakey Edison SEK 5/6 Park CCoQ Kanga’s Pouch Lycee Voltaire Newton Chouiefat Newton Institut Francais du Qatar Shafallah Centre Newton Qatar Aeronautical College AhmedBinSaif Mesaimeer AirForceI/C Asiri 21 High St Al Meera Lagoona Mall Al Meera Al Hazm City Center Town Centre The Centre Al Mirqab Mall Family Food Centre Al Meera Al Meera Al Asmakh Mall Royal Plaza The Gate Zaks Uniform Store LuLu Family Food Centre The Mall Shoprite Al Meera Safeer Doha Mall QanatQuartier 1 Abraj Quartier Perlita Gardens Floresta Gardens 2 4 6 7 10 12 14 15 18 20 22 23 29 31 30 LaCoisett e L a C e tte Beach Novo Cinemas Beach GewanIsland Medina Centrale Medical Commission Mesaimeer Omar Bin Al Khattab Al Muntazah West Bay Al Ahli Hospital Doha Clinic Hospital American Hospital Turkish Hospital Staybridge Suites Hilton The Pearl Al Liwan Gulf Pearls Alwadi Park Hyatt Al Muntazah Plaza Rawda St. Regis Marsa Arabia Island Cielo Movenpick Saraya Jouri Marsa Malaz Kempinski Grand Hyatt Ritz-Carlton Mondrian The Chedi Katara Al Qassar Resort Katara Hills InterContinental Residences InterCon The City Hilton The Curve W Dusit Four Seasons Sheraton Wyndham Warwick Le Park Central Inn The Avenue Banyan Tree Sharq Village & Spa Sheraton Westin Doha La Cigale Millennium Swiss Belinn Musherib Ramada Encore Victoria Concorde Premier Inn Doha Airport Hotel Crowne Plaza Holiday Inn Steigenberger Safir Strato by Warwick Hyatt Regency Oryx Doha Holiday Villa Al Mansour Suites Radisson Blu dusitD2 New Blue Rose Le Royal Meridien Waldorf Astoria Century DoubleTree Al Sadd Sterling Sedra Arjaan by Rotana (Tower 26) Four Points Oryx Airport Hotel Oryx Garden Hotel Women’s Bin Zaid Afghanistan B3 Albania B4 Algeria C4 Argentina B3 Armenia B3 Australia C4 Austria C4 Azerbaijan B4 Bangladesh D4 Belarus B3 Belgium C3 Benin C3 Bosnia&H B3 Brazil B3 Brunei B3 Bulgaria B3 BurkinaFaso B3 Canada C4 C.AfricanRep B3 Chile C4 China B3 CostaRica C3 Croatia B3 Cuba B3 Cyprus C4 Djibouti B4 Dom.Rep. B3 Ecuador B4 ElSalvador B4 Eritrea E4 Eswatini B4 Ethiopia B4 France C4 Gambia E4 Georgia C4 Germany C4 Ghana B3 Greece B4 Hungary B3 India C4 Indonesia D3 Iran C4 Iraq C4 Italy C4 IvoryCoast B4 Japan B4 Jordan C4 Kazakhstan B3 Kenya B3 Korea (S) B4 Kosovo C4 Kuwait C4 KyrgyzRep C3 Lebanon B4 Liberia C4 Libya B3 Malaysia C4 Mali B4 Mauritania C4 Mexico C4 Moldova B4 Morocco C4 Nepal E3 Netherlands C4 Niger C3 Nigeria C4 NorthMacedonia C4 Oman B4 Pakistan C4 Palestine C4 Panama B4 Paraguay B4 Peru C3 Philippines B3 Poland B4 Portugal C4 Romania C4 Russia B4 Senegal C3 Serbia B3 Singapore B4 Somalia C4 SouthAfrica B3 Spain B4 SriLanka E4 Sudan B4 Sweden C4 Switzerland B3 Syria C4 Tajikistan C3 Tanzania C4 Thailand C4 Tunisia C4 Turkey B4 Uganda B3 Ukraine B3 UnitedKingdom C4 UnitedStates ofAmerica C3 Uruguay C3 Venezuela B4 Vietnam B3 EMBASSY LOCATIONS Meryal Waterpark AlSa’ad Plaza Qetaifan Island Lusail Winter Wonderland Doha Sports Park Icon Tower Yacht Club Promenade Marina Qetaifan Island North The Pearl Island Raffles and Fairmont Hotels are housed in the iconic Katara Towers Al Fardan Tower Tornado Tower Palm Tower B West Bay North Beach See our detailed map of the area south of Doha MAP of AL WAKRA

New Procedures to Support Businesses in Qatar

By Sarah Palmer

The authorities in Qatar have introduced two new important decisions as part of efforts to support businesses and the local economy.

Local value system to be used for government tenders

In August 2022, The Amir, HH Sheikh Tamim bin Hamad Al Thani ratified Cabinet Resolution No 11 of 2022, amending some provisions of the Executive Regulations of the Law on Regulating Tenders and Auctions No 24 of 2015.

Under these amendments, procurement processes in Qatar will now implement the in-country value (ICV or local value) system – companies will now have to add ICV or local value certificates to their financial bids.

The ICV certificates will be used as a measurement tool during the awarding of tenders to companies. Now, national products, companies with high local value, and those submitting the least expensive monetary bids after ICV calculation will be given preference during the procurement processes. Micro, small and medium-sized enterprises (MSMEs) will also now receive greater privileges and exemptions with more tenders available to them, according to the Ministry of Finance (MoF). MSMEs, which are defined by the Ministry of Commerce and Industry (MoCI), are now permitted to have limited participation in tenders valued under QAR5 mn. These companies are waived from bid and performance bonds and tender fees, providing their turnover is less than QAR1 mn, and are exempted from half the value of the fee prescribed for classification.

The decision to amend the law is to increase the participation of non-oil sectors and the private sector in the local economy.

According to Nayef Al Hababi, Director of Government Procurement Regulations Department at the MoF: 'Perhaps one of the most important additions to the regulation is defining the local value of

companies, which means the total amount spent by the contractor, supplier or service provider within the country to develop national business, services or human resources to stimulate productivity in the local economy. The local value is determined through a certificate of previously executed contracts and the plan presented by the bidder within his bid.'

The amendments also provide for clear guidelines on the timeframe for awarding tenders. Government agencies must organise the offering procedures within 60 working days, and sign the contract within a period not exceeding 20 working days from the date of the contractor submitting the final insurance. The contract must be implemented within 90 working days after its signing, but no later than 180 days.

Specifying the duration of the procedures in the amended Executive Regulations aims to speed up procedures, improve the efficiency of tenders, and not incur any losses caused by the length of the previous procedures period.

The new system is expected to provide valuable opportunities for local business owners, and attract foreign investors to set up businesses in Qatar.

The ICV system was previously in place for some government tenders in the oil and gas sector. The Ministry of Finance (MoF) launched the TAHFEEZ programme in 2021, aimed at enhancing local services and products in an effort to strengthen Qatar’s private sector and homegrown companies. The programme has three pillars: Qatar In-Country Value (QICV); Environmental, Social and Governance (ESG); and Small and Medium Enterprises (SMEs).

The QICV pillar was launched in February 2019 and is itself an extension of QatarEnergy's Tawteen programme. Phase 1, starting in Q1 2022, was available to contractors in collaboration with the Public Works Authority (Ashghal), before extending to other government entities and institutions.

FEATURE

QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

Ministry of Commerce and Industry launches provisional commercial licence service

The Ministry of Commerce and Industry has joined forces with the Ministry of Interior and the Ministry of Labour on a new initiative, launching a service to issue provisional commercial licences.

This is available for all commercial activities except for 'administrative offices', such as contracting, limousine and cleaning services.

The initiative is part of national efforts to support the private sector and ease the procedures for doing business in Qatar, while also allowing investors time to establish their business, complementing new online services and streamlined procedures.

According to the Ministry, the following conditions should be noted for the issuance of a provisional commercial licence:

• The provisional licence is valid for one year only, and it can only be renewed with the approval of the relevant authority.

• The provisional licence is issued without external approvals, so long as all necessary approvals are obtained when the final commercial licence is issued.

• The provisional commercial licence is not a permit to begin operating, but offers a period of time to establish business sites and obtain approvals from third parties – registration of the establishment, receiving labour approvals, provision of raw materials for the commercial project, adhering to any bank procedures and requirements, etc.

• A note will be placed in the title description, to the above condition's effect: 'a provisional licence, valid for one year from the date of issuance of the commercial licence. Practising the commercial activity is prohibited before all requirements are met.'

There are two stages for the issue of a provisional licence. Under Stage I, these requirements must be met: licence application form (provisional licence); lease agreement acknowledgment form; construction completion certificate, a building permit, or a contract with the State; and a copy of the applicant's ID card. A provisional commercial licence can then be issued.

Stage II takes effect after the expiry of the provisional commercial licence, ie after one year, when applicants must submit the Civil Defence Certificate and the construction completion certificate (if not submitted in Stage I).

Applicants must also abide by certain provisions of Law No 5 of 2015 on Commercial, Industrial and Similar Public Stores and Street Vendors.

Article No 7 states that:

• The relevant department will decide on the licence application, informing the applicant of its decision the same day, providing the applicant has provided all requested documents.

• The applicant must fulfil any and all general and special requirements, as per the type of licensed activity, before practising the commercial activity. Additionally, Article No 19 states that the licence shall be revoked if there are changes to the business site or licenced activity without receiving prior approval, if the business becomes inoperable, or does not meet the conditions stated in the licence.

Under Article No 20 'the licence shall be revoked in cases other than those stipulated in the previous article, if the public interest so requires.'

Any violations of Law No 5 of 2015 will attract penalties: imprisonment for a period not exceeding one year, and a fine of not more than QAR50,000, or either of these penalties, shall be imposed.

For more information on government tenders, visit monaqasat.mof.gov.qa, The Unified Website of State Procurement. For setting up business in Qatar, see Investment and Trade in this section, and visit moci.gov.qa and investor.sw.gov.qa

© MARHABA WINTER 2022/23

m

Banking and Finance

Banking and Finance

Bank Telephone Website

Regional Banks

Ahlibank 4420 5222 ahlibank.com.qa

Commercial Bank of Qatar 4449 0000 cbq.qa

Doha Bank 4445 6000 qa.dohabank.com

Qatar Development Bank 4430 0000 qdb.qa

Qatar National Bank 4440 7777 qnb.com

Branches of Foreign Banks

Arab Bank Qatar 4438 7777 arabbank.com.qa

Bank Saderat Iran 4441 4646 bsi.com.qa

BNP Paribas 4453 7115 mea.bnpparibas.com

HSBC 4442 4722 hsbc.com.qa

Mashreq Bank 4408 3333 mashreqbank.com/qatar

Standard Chartered Bank 4465 8555 sc.com/qa

United Bank Limited 4444 1314 ubldirect.com

Islamic Banks

Dukhan Bank * 800 8555 dukhanbank.com

Masraf Al Rayan # 4425 3333 alrayan.com

Lesha Bank § 4448 3333 qfb.com.qa

Qatar International Islamic Bank 4484 0000 qiib.com.qa

Qatar Islamic Bank 4402 0888 qib.com.qa

Investment Banks

QInvest 4405 6666 qinvest.com

* Prev. Barwa Bank; merged with International Bank of Qatar in April 2019

# Merged with Al Khalij Commercial Bank in November 2021

§ Prev. Qatar First Bank; name changed in October 2022

The Banking Network

Currency and Exchange

Alfardan Exchange 4453 7777 alfardanexchange.com.qa

Al Jazeera Exchange 4436 3822 aljazeeraexchangeqatar.com

Al Mana Exchange 4442 4226 almanaexchange.com

Al Sadd Exchange 4432 3334

Al Amir Street

Arabian Exchange 4443 8300 arabianex.com

Gulf Exchange 4438 3222 gulfexchange.com.qa/en

Travelex Qatar 4443 4252 travelex.qa

Unimoni Exchange 4436 5252 unimoni.com/qat

Western Union Send money online and via the app, or find a branch at westernunion.com/qa/en

There are hundreds of bank branches and ATMs across the country, with most in Doha but also further afield. They are located in nearly all of the malls, hotels, souqs and petrol stations. Visitors can usually access funds in their home accounts by using their ATM cards here, and some allow the withdrawal of USD and Euro – check with the relevant bank(s) for commission or exchange rate fees. Major credit cards are widely accepted. Exchange houses provide remittance services and foreign exchange and are licensed by Qatar Central Bank. There are no exchange control regulations, but movement of money in and out of local accounts is monitored and a declaration of origin for large cash deposits may be required. The GCCNET system, established by the GCC countries, acts as a single ATM network linking all the GCC point of sale switches – in Qatar this is NAPS (National ATM & POS Switch).

Opening hours: Generally Sunday – Thursday 7:30 am – 1 pm, however many banks have extended branch operations. Check the respective bank's website for up to date timings and locations of branches and ATMs. All day/extended hours/weekends:

Ahlibank, City Center-Doha: Saturday – Thursday 9 am – 2 pm, Friday 3 pm – 8 pm

CBQ, mall branches: Saturday – Thursday 9 am – 2:30 pm/3:30 pm – 9 pm, Friday 3:30 pm – 9 pm

Qatar Islamic Bank, Medina Centrale, The Pearl Island: Sunday – Thursday 11 am – 6 pm

QNB, City Center-Doha, Lagoona Mall and Doha Festival City: Friday 3:30 pm – 9 pm

QNB, City Center-Doha and Lagoona Mall: Saturday 9 am – 2:30 pm/3:30 pm – 9 pm

Digital branches/services:

Global digital wallet services (Apple Pay, Google Pay, Samsung Pay): All are available and accepted in Qatar

HSBC Msheireb Downtown Digital branch: Sunday – Thursday 9:30am – 5 pm

QIB Video Banking: via the QIB mobile app

Virtual assistants: Dukhan Bank (Rashid), Qatar Islamic Bank (Zaki)

QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

Currency

The unit of currency is the Qatari Riyal (QAR), divided into 100 Dirhams (Dh), issued by Qatar Central Bank (QCB). It is pegged to the US dollar at a fixed exchange rate of USD1 = QAR3.64.

The fifth series of notes were introduced in December 2020. A new QAR200 note joins the QAR1, QAR5, QAR10, QAR50, QAR100 and QAR500 notes. The old notes ceased to be legal tender on 31 December 2021, although the public can change the old notes at QCB for another 10 years. Banknotes incorporate security threads, as well as special features for recognition by the blind and visually impaired, and the new QAR500 note features a holographic security thread, the first in the Middle East to do so. Coins remain unchanged at Dh5, Dh10, Dh25 and Dh50.

Four GCC countries support the creation of a Gulf Monetary Union (GMU) – Qatar, Saudi Arabia, Kuwait and Bahrain; the UAE and Oman have withdrawn entry. The GCC Supreme Council in 2008 approved the Monetary Union Agreement and the Statute of the Monetary Council. The headquarters of the Gulf Monetary Council opened in Riyadh in 2013 with monetary union proposed later in the year. Qatar, Kuwait, Bahrain and Saudi Arabia subsequently agreed to establish a unified central bank with currency pegged to the USD. There has been no further action since 2013.

The Banking Sector

Overseen by Qatar Central Bank (QCB), the sector comprises a number of regional, foreign and Islamic banks. State-owned Qatar Development Bank provides financing to SMEs, while QInvest focuses on investment banking, asset management and investing its own capital.

Barwa Bank and International Bank of Qatar (IBQ) signed a final agreement in August 2018 to merge the two banks, the first in Qatar's banking history, to create a Sharia-compliant financial institution with more than USD22 bn in assets. The legal merger was completed in April 2019, trading as Barwa Bank, with IBQ products converted to Sharia-compliant equivalents. Barwa changed its name to Dukhan Bank in October 2020.

In June 2020 negotiations began for another merger between Masraf Al Rayan and Al Khalij Commercial Bank (al khaliji). Masraf Al Rayan was previously involved as a third bank in the merger between Barwa Bank and IBQ. Masraf Al Rayan and al khaliji's merger agreement in January 2021 was completed in November 2021. al khaliji's business was absorbed into Masraf Al Rayan's, with the latter becoming the remaining legal entity operating in accordance with Islamic Sharia principles. It is now one of the largest Shariacompliant banks in Qatar and the region, with over QAR182 bn in total assets.

The Cabinet approved a draft resolution in December 2021, allowing a non-Qatari investor to own up to 100% of the capital in four banks: Commercial Bank of Qatar, Masraf Al Rayan, Qatar Islamic Bank, and Qatar National Bank.

A new loan-to-deposit requirement of 100% came into effect in 2018. The adoption of International Financial Reporting Standard (IFRS) 9 by QCB has strengthened the provision coverage at Qatar’s commercial banks – under the IFRS standard, banks and financial entities have to set aside a certain proportion of profit against losses for unseen reasons. QCB set up the Supreme Emergency Committee in 2018 to monitor the day-to-day activities of financial institutions in the country, addressing emergency matters and easing the flow of work.

Both the Institute of International Finance and the Economist Intelligence Unit have noted that Qatar's banking system 'remains resilient' during the COVID-19 pandemic. The ability to fully service its debt obligations is good, thanks to ample foreign reserves and the assets of sovereign wealth fund Qatar Investment Authority (QIA).

Qatar Central Bank

Under Law No 13 of 2012 Qatar Central Bank and the Regulation of Financial Services, QCB is deemed an autonomous corporate body, with a capital of QAR50 bn and under the direct control of The Amir. It is headed by a governor appointed by The Amir, and primary goals include financial stability, supporting developmental activities and strengthening the national economy. The law covers banks, insurance companies, exchange houses, Qatar Exchange and QFC-registered entities. Amiri Decision No 65 of 2021 appointed HE Sheikh Bandar bin Mohammed bin Saoud Al Thani as Governor of QCB.

Banking and Finance

© MARHABA WINTER 2022/23

marhaba.qa PRINT and ONLINE

Banking and Finance

Under Law No 13 of 2012, the Financial Stability and Risk Monitoring Committee shall study existing and future risks related to all banking, financial, insurance and stock market activities. The panel works closely with the Ministry of Finance to frame general policies.

The law provides strict penalties for anyone accepting deposits from the public without a valid licence from the banking regulator – violators can face a jail term of up to five years and/or a fine of up to QAR5 mn. For those refusing to accept the legal tender of Qatar, there is a jail term of three years and/or a fine of up to QAR5 mn. Issuing forged currency means 10 years in jail and/or a fine of QAR10 mn. Manipulating accounts incurs a prison term of up to three years and/or a fine of up to QAR200,000.

Regulations in 2013 curbed investment options for local banks. Equities and bonds can account for up to 25% of a bank’s capital and reserves; debt issued by the government and national banks are exempt. There is also a limit on the amount placed with individual companies and unlisted securities: a maximum of 5% of capital and reserves for foreign investments and 10% domestically. Total foreign equities is capped at 15%.

The Qatar Renminbi Centre opened in 2015 and is the first in the region to offer Renminbi (RMB) clearing and settlement, increasing financial connectivity between China, Southwest Asia and the MENA region. The centre provides access to China’s onshore RMB and foreign exchange markets to local financial institutions – Chinese companies have become active partners in Qatar, and the RMB centre will facilitate trade via their agreement with QCB. qatarrmbcentre.com

Law No 20 of 2019 on combating money laundering and terrorism financing was issued in September 2019, replacing Law No 4 of 2010, with implementing regulations following in December. The law is in accordance with the latest standards adopted by major international organisations including Financial Action Task Force, highlighting Qatar's regional role in setting standards in its legal and regulatory framework for combating money laundering and terrorism financing.

Fintech regulations

Noting the increasing growth and popularity of fintech, QCB has established the Fintech Regulatory Sandbox and launched Qatar FinTech Hub (QFTH) as a means of boosting financial innovation, one of the objectives of its strategic plan (see below). The regulatory sandbox, co-founded by Qatar Development Bank, invites entities to safely live-trial their services in the digital payment services space. A new fintech strategy is expected in Q4 2022. fintech.qa

The Second Strategic Plan for Financial Sector Regulation 2017–2022

QCB, the QFC Regulatory Authority (QFCRA) and the Qatar Financial Markets Authority (QFMA) jointly launched in December 2017 the Second Strategic Plan 2017–2022 for the future of financial sector regulation in Qatar, an extension of the First Strategic Plan 2013–2016. The new plan comprises five main goals:

• Enhancing financial sector regulation and promoting regulatory cooperation.

• Developing financial markets and fostering financial innovation.

• Maintaining integrity of and confidence in the financial system.

• Promoting financial inclusion and financial literacy.

• Developing human capital.

The plan aims to create a regulatory framework allowing growth, is 'inclusive and sustainable', promotes innovation and fintech, and successfully tackles cyber-security threats. qcb.gov.qa

Qatar Credit Bureau

Bad loans have been reduced since the Bureau started operations in 2011. The centre cannot grant credit facilities to individuals nor impose restrictions on banks. Qatar Credit Bureau provides analytical data and supports banks’ use of advanced techniques in risk management, as well as support sustainable growth of credit in Qatar. It provides banks with information on customers' total exposure in the market and the loans they hold, enabling banks to choose prospective customers. cb.gov.qa

Loans, Bank Charges and Interest Rates

Loans: Under QCB rules, the default period for a substandard loan is three months or more, for a doubtful loan six months, and a bad loan nine months. Banks have to closely monitor loan disbursement and forward reports on customer creditworthiness to QCB. There is also a duty to track and follow defaulting customers and seek resolution – if this fails, they will take legal action. Non-payment of loans could lead to a travel ban for Qatar and possibly the GCC.

QCB has imposed ceilings on the amounts a bank can lend as a personal loan to citizens and expatriates. Banks cannot lend more than QAR400,000 to an expatriate, over a maximum repayment period of 48 months, against a maximum 50% of total monthly salary, and at a maximum 6.5% interest rate. For Qatari citizens there is a maximum loan of QAR2 mn over a maximum 72 months. Banks cannot use post-dated cheques for the loan value.

QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

marhaba.qa PRINT and ONLINE

Mortgages: Check with each bank first.

Documents usually required: • Valuation Report from an approved real estate agent • Salary assignment letter if the home loan is the first facility with the bank • ID for Qataris or passport and valid residence card for expatriates • Copy of the Title Deed and map • Building insurance cover. Discuss provision for life assurance against any loan amount taken and consider updating your will.

Bank charges: Banks must prominently display all interest rates on personal loans and credit cards, as well as publish them in local newspapers.

Credit cards: A maximum 12% annual interest rate and usually only issued when customers transfer their salary or have an adequate deposit at the bank.

Interest rates: Announced by QCB on overnight deposit and loan transactions between QCB and local banks via the Qatar Money Market Rate Standing Facility, a monetary instrument through which local banks can request access to loan and deposit facilities with QCB at daily interest rates. QCB and Bloomberg jointly launched the first Qatar interbank offer rate (QIBOR) fixing in 2012. This is the interest rate charged by banks in Qatar for interbank transactions.

Given the fixed parity between the Qatari riyal and the US dollar, QCB short term interest rates policies are subordinated to the fixed exchange rate policy, making QCB overnight interest rates closely related to its USD counterpart, the Fed Funds Rate. Following adjustments by the US Federal Reserve in July 2022, QCB increased the overnight lending to 3.75%, the deposit rate to 3.00% and the repo rate to 3.25%.

Accounts

Standard bank facilities: Debit/credit cards, standing orders, money transfers, personal loans, vehicle loans, and mortgages on current and savings accounts (including joint accounts). Some accounts offer longer terms, higher interest and the option to save in USD, GBP and Euros.

24/7 telephone and internet banking services and apps offer additional options, while some services such as ordering a cheque book can be accessed via the bank's ATM network. With mobile banking a customer relations officer can visit you at home or work to assist with banking requirements. Most banks offer premium banking services.

International bank account number (IBAN): Adopted in January 2014 as a standard for identifying and numbering all bank accounts in Qatar, and effective from May 2014. The system applies to all accounts in banks operating in the

country, found on bank statements or online in account details. The existing account number is not replaced; additional characters appear in front of the account number to form a 29‑character IBAN. All incoming and outgoing transfers to and from banks and financial institutions must use IBAN.

Opening an Account: Documents usually required:

• A valid residence card or work visa. A worker’s dependants (eg spouse and family) can open an account but may require his permission as he is their sponsor (check with the individual bank).

• Valid passport.

• For current accounts, a letter from the employer/ sponsor confirming the monthly salary in Qatari Riyals, with the company’s official stamp. You may have to transfer your salary to the new account but check with the individual bank.

• Some banks may ask to see your tenancy agreement to establish your residential address.

• Take copies of these documents, along with identity photographs. Ask for photocopies of any documents signed.

The Wage Protection Scheme (WPS) is an electronic salary transfer system that ensures workers are paid as per their employment agreement, initiated by the Ministry of Labor and QCB. Employees therefore need a local bank account in order to receive their wages from the employer.

Cheques: A chequebook can be issued with a current account. They are not widely accepted for instant payment; post‑dated cheques are commonly used for house rental payments. The onus of responsibility is on the banks not to encash cheques before the designated date. Issuing a cheque without the necessary funds in your account is a serious criminal offence and the bank or creditor may notify the police, leading to possible prosecution.

Punishment for causing a cheque to bounce due to insufficient funds can be severe: jail terms of between three months and three years, and/ or fines of between QAR3,000 and QAR10,000. Cases being filed are on the rise in the country, mostly for cheques for large amounts, and the Capital Security Department records all cases electronically to speed up the process.

Under new QCB instructions, the Qatar Credit Bureau lists individuals and companies who have issued at least one bounced cheque. Banks are not obligated to issue new cheque books to these customers unless the amount has been settled and their name removed. Banks must also report any customer who has issued a bounced cheque.

Banking and Finance

© MARHABA WINTER 2022/23

marhaba.qa PRINT and ONLINE

Banking and Finance

marhaba.qa

Credit cards: Widely available with all the usual privileges, with the credit limit determined by the cardholder's salary or savings balance. Family members may also be eligible for a card. Check at the time of applying for issuance and renewal fees, conversion charges, and payment options.

Customers should notifiy their bank when travelling overseas and wishing to use their credit/debit cards. Since 2014 all card transactions made using the magnetic stripe inside and outside of Qatar will be declined. However, as certain countries (eg the US, India and the Philippines) still use the magstripe for transactions, customers should activate their card before travelling.

Offshore banking: Offshore banking can be a secure anchor for an expat's finances while out of their home country. Check with local banks for availability of international bank accounts in USD, GBP, or Euros.

Complaints: Unresolved consumer complaints can be made online to QCB's Consumer Protection Department. qcb.gov.qa

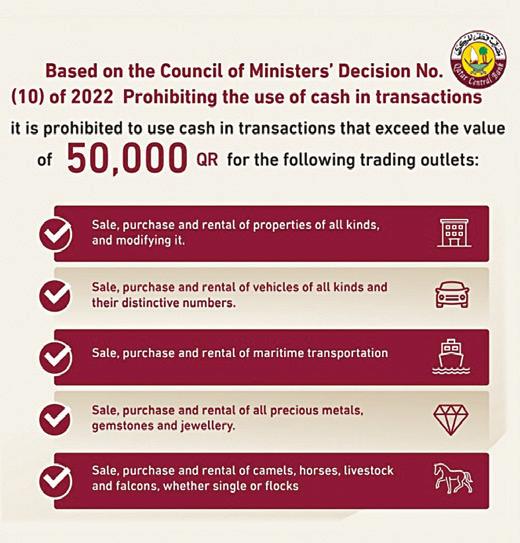

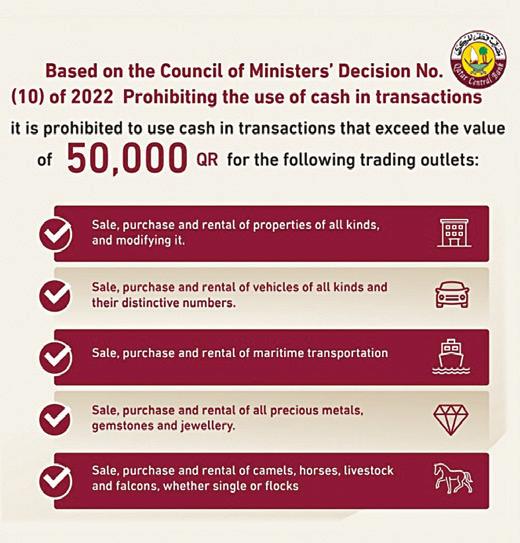

Cash transactions

above QAR50,000 prohibited!

Council of Ministers' Decision No 10 of 2022 prohibits the use of cash in transactions of more than QAR50,000. All such transactions can now only be made via credit card, debit card, cheque or bank transfer. It applies to the sale, purchase and rental of all types of properties, in addition to their modifications. The law also restricts the use of cash to purchase vehicles of all kinds, maritime transportation, all precious metals, gemstones, jewellery camels, horses, livestock, and falcons, whether single or flocks.

The move comes as part of efforts to combat money laundering and terrorism financing, as well as a move towards a cashless society.

Financial Services and Insurance

Financial services are provided by entities registered with the Qatar Financial Centre (QFC). Insurance products are widely available from local and international companies (see Living in Qatar).

Under Law No 13 of 2012 QCB and the Regulation of Financial Services, only local insurance providers are permitted to underwrite any kind of risk against properties in Qatar. Decision No 1 of 2016 issued by the Governor of QCB provides instructions related to licencing, regulation and controls, risk management, accounting, and other requirements. Listed companies must have capital in excess of QAR100 mn or a risk-based capital, while unlisted companies must have capital higher than that set by QCB or their risk-based capital.

QCB continues to regulate and develop the insurance market under the Second Strategic Plan for Financial Sector Regulation 2017–2022. Decision No 7 of 2019 sets out further instructions for licensing, organising and supervising the services of supporting insurance providers. It sets out the competencies and expertise, the nature of the work, areas of responsibility and functions, and the establishment of professional and ethical codes of conduct.

Islamic Finance

Current Islamic institutions include Dukhan Bank, International Islamic, Masraf Al Rayan and Qatar Islamic Bank. Qatar First Bank – regulated by the QFC Regulatory Authority – is the first independent, Sharia compliant investment bank.

Banks were required by QCB to separate their Islamic and conventional lending operations by 31 December 2011. Islamic banking by other conventional banks is now barred from Qatar's market. QCB took this action due to certain supervisory and monetary issues, namely that holding both Islamic and non-Islamic deposits incurs different risks and reporting methods.

Law No 13 of 2012 requires that Islamic banks must have a Sharia board with at least three qualified members approved by the shareholders. Neither they nor members of their family may be employed or hold shares in the entity.

Institutions and services must abide by regulations set out in the Holy Quran and Sharia (Islamic Law). Charging riba (interest) is haram (forbidden). Islamic banks charge fees for services and engage in profit sharing, enabling them to offer comparable facilities to those of conventional banks. Under a mudharabah (profit sharing) contract, the rabbul maal (owner of the money) authorises the bank to invest funds as per Sharia to make justifiable returns. Other concepts of Islamic banking include wadiah (safekeeping), musharakah (joint venture), and ijarah (leasing). Bai (saving) is halal (allowed).

QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

PRINT and ONLINE Checked & Updated October 20 22

m

Our main role is to organise business interests and represent the Qatari private sector locally and globally as well as support the country’s economic actors and productivity

© MARHABA WINTER 2022/23

www.qatarchamber.com info@qcci.org qatarchamber qatar_chamber

Economy

Economy

Economic Growth and Gross Domestic Product (GDP)

One of the main aims of Qatar National Vision 2030 is to diversify the economy and reduce dependence on the hydrocarbon industries.

The economy has weathered the impact of both the COVID-19 pandemic and the blockade that was imposed on 5 June 2017, with positivity after borders reopened between Saudi Arabia and Qatar following the AlUla Declaration in January 2021. Hydrocarbon exports were not affected.

Qatar's Economic Outlook Report 2021–2023, released by the Planning and Statistics Authority (PSA) in January 2022, estimates that the economy will recover in 2021 by 1.5% to 2.3%. It is expected to recover further in 2022, between 1.6% and 2.9%, mostly from the recovery of non-oil activities, with a growth rate of 2.8% to 4.7%.

The Arab Monetary Fund (AMF) stated in August 2022 that Qatar's economy is expected to grow by 4.4% this year and 3.6% in 2023, thanks to activities related to the FIFA World Cup Qatar 2022TM, and the growth of both non-hydrocarbon activities and contributions from the global gas market.

According to PSA, Qatar’s quarterly Gross Domestic Product (GDP) at current prices was QAR174.266 bn in Q4 2021. According to the Investment Promotion Agency Qatar in its policy paper on Circular Economy, 'Qatar is set to generate an additional USD17 bn by 2030, corresponding to 10% of its GDP, as well as create an estimated 9,000 – 19,000 jobs by 2030, increase disposable income, and attract more greenfield foreign direct investment (FDI).'

Export, Import and Trade Surplus

In July 2022, the total exports of goods (including exports of goods of domestic origin and re-exports) amounted to around QAR44.4 bn, an increase of 12.4% month-on-month (m-o-m) and an increase of 61.9% y-o-y. The y-o-y increase was mainly due to higher exports of petroleum gases/other gaseous hydrocarbons. India was the main country of destination, followed by Japan and South Korea.

Imports of goods in July 2022 was around QAR9.6 bn, an increase of 2.9% m-o-m and an increase of 21.8% y-o-y. China was the main country of origin, followed by the US and India. The foreign merchandise trade balance – the difference between total exports and imports –showed a surplus of QAR34.8 bn, an increase of nearly QAR4.6 bn or 15.3% m-o-m and an increase of QAR15.2 bn or 78.0% y-o-y.

The Budget

The State Budget for 2022 was announced in December 2021, been based on a conservative average oil price of USD55 a barrel, up from USD40 in the 2021 budget. HE Ali bin Ahmed Al Kuwari, the Minister of Finance, stated this was thanks to a recovery in global energy prices. The oil revenue for 2022 has been estimated at QAR154 bn, up 26.6% on the previous year.

Despite the implications of the COVID-19 pandemic on the global economy during the last two years, the State budget sees a significant increase compared to the previous year. There is an increase in revenues by 22.4% to QAR196.1 bn and an increase in expenditure by 4.9% to QAR204.3 bn, largely due to a temporary increase in current expenditure related to the hosting of the FIFA World Cup Qatar 2022TM This gives a budget deficit of an estimated QAR8.3 bn, to be covered by the Ministry of Finance (MOF) from available resources or via debt instruments in domestic and international financial markets, as required.

The 2022 Budget shows that QAR74.0 bn has been allocated for major projects. The State will continue work on development projects related to infrastructure, citizens’ land development and public services.

As seen in previous budgets, investment continues to focus on the education and healthcare sectors. Allocation for the education sector is QAR17.8 bn (8.7% of total expenditure), some of which will be directed towards the expansion of schools and educational facilities. There is QAR20 bn (9.8% of total expenditure) for the healthcare sector, for a number of projects and initiatives to improve the quality of healthcare services.

Inflation and Cost of Living

For July 2022, the Consumer Price Index (CPI), used to calculate inflation rates in Qatar, reached 103.65 points, an increase of 0.49% m-o-m and an increase of 4.98% y-o-y. The Arab Monetary Fund (AMF) stated in August 2022 inflation in Qatar is expected to be around 4.3% in 2022, declining to 3.5% in 2023.

Population and the Labour Force

Total population in August 2022 was 2,937,800: males 2,136,084; females 801,716. The Labour Force report for Q2 2021 showed the number of salaried workers decreased by 1.7% and the unemployment rate was 0.1%.

Sources of information: International Monetary Fund (IMF); Ministry of Finance (MOF); Planning and Statistics Authority (PSA); Qatar Central Bank (QCB)

Checked & Updated October 202 2

m QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

Qatar is a member of the World Trade Organisation and its trade policies create a competitive international trading market. The government supports the growth and success of businesses in a bid to diversify the economy. Qatar is a member of the Gulf Cooperation Council (GCC), which also includes Bahrain, Kuwait, Oman, Saudi Arabia and the United Arab Emirates. Following the ending of the blockade, Qatar has resumed trade with Saudi Arabia, the UAE, Bahrain and Egypt, and has continued to strengthen relations with a number of other countries such as Turkey, Oman, Kuwait, India, the UK and the US.

Organisation

Telephone Online Map

American Chamber of Commerce in Qatar 4020 6038 amchamqatar.org C4 Communications Regulatory Authority 103/4406 9938 cra.gov.qa C4 Department for International Trade (UK) +44 (0)20 7215 5000 gov.uk

General Authority of Customs 4445 7457 customs.gov.qa C4

German Business Council Qatar 4431 1152 gbcqatar.qa C4

Hukoomi (Qatar e-Government) 109/4406 9999 hukoomi.gov.qa/en C4

Mada Assistive Technology Center 4459 4050 mada.org.qa C4

Ministry of Commerce and Industry 16001 moci.gov.qa A4

Ministry of Communications and IT 4473 3333 mcit.gov.qa C4

Ministry of Education and Higher Education 155 edu.gov.qa C4

Ministry of Finance 16020/4446 1444 mof.gov.qa C4

Ministry of Justice 137/4021 5555 moj.gov.qa C4

Ministry of Municipality 184/4434 8888 mme.gov.qa C4

Ministry of Public Health 4407 0000 moph.gov.qa C3

Ministry of Transport 16016/4045 1111 mot.gov.qa C4

Planning and Statistics Authority 4495 8888 psa.gov.qa C4

Public Works Authority (Ashghal) 188/4495 1111 ashghal.gov.qa C4

Qatar

Qatari

Qatari

Qatar

Qatar

Qatar

Qatar

Qatar

Qatar

Qatar

Qatar

Qatar

QFC

Embassies can provide valuable information on commercial activities and can connect you with their business council/chamber of commerce – see the Discovering Qatar section for contact details. Translation services can be found in Day to Day Qatar in the Living in Qatar section.

Commerce

Business Forum

British

4496 2000 qbbf.com C4

Businessmen Association

4435 3120 qataribusinessmen.org C4

Business Women Association 4420

See

9109

Facebook/Instagram pages

Chamber

4455 9111 qatarchamber.com D4

Development Bank

4430 0000 qdb.qa D4

Stock Exchange 4433 3666 qe.com.qa C4

Financial Centre (QFC) 4496 7777 qfc.qa C4

Intl Court & Dispute Resolution Centre 4496 8225 qicdrc.com.qa C4

Investment Authority 4499 5919 qia.qa A4

Professional Women's Network qpwn.org

Science & Technology Park 4454 7070 qstp.org.qa C2

Tourism 4406 9921 visitqatar.qa A4

Commerce Checked & Updated October 2022 m marhaba.qa PRINT and ONLINE © MARHABA WINTER 2022/23

Regulatory Authority 4495 6888 qfcra.com C4

QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

Investment and Trade

Qatar has one of the fastest growing global economies thanks to the third largest concentration of natural gas reserves in the world. Recent legal liberalisation, economic diversification and an expanding economy provides many investment opportunities for non-Qataris. Investors can enjoy unrivalled world connectivity via Hamad Port, one of the largest in the region, and the world’s best airport, airline and air cargo carrier. Profits can be repatriated as can proceeds of sale and capital on liquidation. Major investment sectors are construction, oil and gas, education, and financial and legal services, with opportunities in ICT, sport, leisure and healthcare.

Incentives

The government welcomes foreign participation in joint ventures, with a number of incentives for investment:

• A developed infrastructure and ICT network.

• Easy access to world markets with good sea and air connections, continuously being upgraded.

• Natural gas, electricity, water and petroleum at subsidised rates.

• Land for development in the Industrial Area near Doha for nominal fees – companies can submit a request to the Ministry of Municipality for a lease contract of a plot under the Doha, Al Khor, Al Dakhira and Al Shamal Municipalities.

• Loans available from Qatar Development Bank.

• Fixed parity between the Qatari riyal and US dollar (USD1 = QAR3.64).

• No customs duty on the import of plant machinery; exemption from export duty.

• Five-year renewable tax holidays (based on government approval).

• No income tax on the salaries of expatriates.

• Tax on the profits of foreign-owned stakes in Qatari companies applied at a flat rate of 10%.

• Employment and immigration rules enabling the import of skilled and unskilled labour.

Investment Regulations

There are primarily two regulatory jurisdictions for foreign investors seeking to conduct commercial business in Qatar: the regulations of the State of Qatar, and the rules and regulations of the Qatar Financial Centre (discussed in more detail below).

Qatar also recently introduced new free zones designed to encourage certain bespoke investment vehicles to bring their businesses to the region.

Non-Qatari investors may only invest in Qatar in accordance with Foreign Investment Law No 1 of 2019:

• In January 2019 the Amir promulgated the new foreign investment law of 2019. According to the new law, foreign investors are permitted to hold more than 49% in commercial companies with special permission from the Minister of Commerce and Industry (MOCI) (subject to some prohibitions set out below). Under the former law such increased ownership was limited to those businesses operating in a specific set of sectors.

• Non-Qatari investors are prohibited from being appointed as commercial agents under Commercial Agencies Law No 8 of 2002, but the former prohibition preventing foreigners from investing in real estate businesses has been removed under the new Foreign Investment

Investment and Trade

© MARHABA WINTER 2022/23

marhaba.qa PRINT and ONLINE

Investment and Trade

marhaba.qa

Law. Approval from the Council of Ministers is required for foreign investment in banking and insurance.

• Foreign capital is protected against expropriation (although the State may acquire assets for public benefit on a non-discriminatory basis, provided the full economic value is paid for the asset).

• Subject to Ministerial approval, a foreign company performing a specific contract in Qatar may set up a branch office if the project facilitates the performance of a public service or utility.

• A non-Qatari company operating in Qatar under a Qatari government concession to extract, exploit or manage the State's national resources is exempt from the Foreign Investment Law. In practice this covers all large oil and gas companies.

• A company formed by a non-Qatari entity with the government or a government entity ('Article 207 Company') may be subject to special rules and exemptions from the Commercial Companies Law No 11 of 2015.

• All international companies securing mega infrastructure development work must share at least 30% of the contract with local entities.

• Law No 7 of 1987 governs the practice of commercial activity by GCC citizens in Qatar, and was amended in April 2017 under Law No 6 of 2017. GCC citizens as individuals or legal personalities can practice retail and wholesale trade in Qatar. However, the GCC citizen engaging in the activity must be directly responsible for it. Those undertaking retail business must do so via direct sale to customers in a shop, and those in wholesale trading are required to import and export the goods. NB: following the signing of AlUla Declaration regarding the blockade against Qatar, legal advice is recommended for this type of commercial activity.

• Law No 12 of 2020 regulating the partnership between the public and the private sector became law in July 2020, as per one of the following regulations: Allocation of land through a rental or usage licence, for development by the private sector; build-operate-transfer (BOT); buildtransfer-operate (BTO); build-own-operate-transfer (BOOT); operations and maintenance (OM); or any other form adopted by the Prime Minister, upon the proposal of the relevant minister. The Government or other administration may, on its own initiative or at the suggestion of the private

sector, identify a project for its implementation through partnership.

Choosing A Business Structure

To conduct business in Qatar on a regular basis, foreign investors are required to establish or register a legal presence from the following options:

• Incorporating as a company under the Commercial Companies Law which allows full access to Qatar's market and to work on an unlimited number of projects. A Qatari partner is required to own 51% of the capital of the company, except in the circumstances mentioned above. Various exemptions are available to attract foreign capital.

• Obtaining a licence for a branch office or trade representation office which does not require a Qatari partner. The licence for a branch is granted in respect of a specific project for a government client. The existence of the branch office is dependent on the duration of a particular project: once the project is completed, the branch office must close unless it has secured additional qualifying projects. Branch offices are only permitted to perform a specific contract and may not engage in general commercial activities with the larger local market. The branch will be fully taxable unless granted a special exemption. Trade representation offices are only permitted to market goods and services; they are not permitted to engage in commercial activities.

• Under Law No 7 of 2017 companies in GCC states can now establish companies in Qatar, subject to having had a commercial registration in one of the GCC states for at least three years, and be fully owned and managed by a GCC citizen. Refer to the preceding caveat in Investment Regulations regarding the blockade.

• Appointing a commercial agent means a nonQatari company does not establish a presence in Qatar; instead a 100% owned Qatari entity or Qatari national is appointed as an agent to market the relevant goods and services. Commercial agencies must be exclusive and registered in order to be afforded the protections provided under the Commercial Agents Law No 8 of 2002; non-registered distributorships are subject to the Commercial Law No 27 of 2006.

• There is a separate regime for establishing an entity in the Qatar Financial Centre (QFC).

This allows 100% foreign ownership and aims to attract international financial services companies and some professional support companies

QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

PRINT and ONLINE

to invest in Qatar. The number of permitted activities in which a QFC firm may engage has been increased to include a broader spectrum of investment options.

• The Qatar Science and Technology Park, a free zone in Education City, allows companies to engage in research and development, again with full foreign ownership.

• The new Qatar Free Zones have started accepting applications and international investors, at these zones:

° Um Alhoul, a 30 sq km site adjoining Hamad Port, south of Al Wakra – offers easy access to the water for maritime and logistics companies, and is a gateway for imports and exports. A port and marine cluster, 'Marsa', is able to support a wide range of marine businesses.

° Ras Bufontas, a 4 sq km site adjacent to Hamad International Airport – a technology and manufacturing hub for businesses requiring international connectivity.

• The Cabinet has added some areas to the Free Zones Law, including Msheireb Downtown Doha.

• Under Ministerial Decision No 242 of 2016, the MOCI will grant licences for small businesses at home conducting certain commercial activities including sewing, events services, electronic services, business services, cosmetic activities and food activities. A single license is issued per activity, with an annual fee, and cannot involve direct sales to the public from the residence. Decision No 163 of 2018 cancelled the requirement for signage at the house entrance.

Company Structures

According to the Commercial Companies Law No 11 of 2015, the following structures are permitted:

• Limited liability companies (LLCs) – subject to the Foreign Investment Law can now be established by a single person owning the entire share capital (previously the minimum number of shareholders was two). This replaces the single person company under the old companies law. Shareholders can determine the share capital of an LLC (previously the minimum share capital was QAR200,000 divided into equal shares).

• Article 207 company – a shareholding company where the Qatari government, a government owned entity or a public corporation must own 51% of the shares, unless the Council of Ministers consents otherwise. Certain provisions of the Commercial Companies Law are excluded from the company’s Articles of Association.

• General partnership – joint partners administer the affairs of the company, and trustee partners contribute to the company's capital.

• Simple limited partnership – a local entity formed by two or more Qataris.

• Limited partnership with shares – formed by joint partners, liable for the debts, or trustee partners, whose liability is limited to the share value.

• Unincorporated joint venture – formed by two or more people pursuant to specific contractual arrangements. The unincorporated joint venture does not have a separate legal personality distinct from its partners.

• Joint stock company (public or private) – the capital is divided into shares with a minimum of five shareholders. Permissible foreign share ownership depends on the type of company and is subject to Qatar Financial Markets Authority approval.

• Holding company – incorporated as a joint stock or limited liability company. The holding company must hold at least 51% of the shares in each of the companies under its control.

Commercial Registration (CR)

Virtually all companies use a government liaison officer or facilitator to assist with establishment formalities. Under Qatar Commercial Registration Law No 25 of 2005, companies must be approved or registered by one or more of the following entities: Ministry of Commerce and Industry (MOCI); Qatar Chamber; Ministry of Municipality; Ministry of Interior; Importers' Register/ Contractors' Register; and QFC Authority (where appropriate). Visit moci.gov.qa for details.

Amendments were made under Law No 20 of 2014 in order to expedite registration procedures, followed by Decisions 30 and 31 of 2019:

• The MOCI must respond to the applicant's request for registration on the same day.

• Reasons must be given for rejected applications. The Minister must accept or reject an appeal of the Ministry's decision within 15 days.

• Incorporated branches must be in the exact name of the principal company, and are not considered separate legal entities.

• Amendments have also been made to penalties for those operating commercial premises without a CR, misusing the CR, and providing false/ wrong documents.

• Provisional licences and renewals are now possible online, with the relevant fees, at gov.qa

Investment and Trade

© MARHABA WINTER 2022/23

PRINT and ONLINE

marhaba.qa

Investment and Trade

Export and Import

Exports According to the Planning and Statistics Authority (PSA), Qatar’s total exports (including exports of domestic goods and re-exports) in July 2022 amounted to QAR44.4 bn, for such things as petroleum gases/other gaseous hydrocarbons, mainly to Asia. There are no duties on exports.

Imports According to PSA, imports in July 2022 totalled QAR9.6 bn, for crude materials, manufactured goods, chemicals and mineral fuels, from China, the US and India.

Import tariffs Importers of goods into Qatar must sign up to the Importers' Register and be approved by Qatar Chamber (QC). Customs duty and legalisation fees are levied on all commercial shipments, irrespective of its value. All goods imported into Qatar are subject to customs duties, based on a percentage value of goods (usually 5%), or on a 'per unit' basis. Effective from May 2021, incoming parcels and personal shipments with a cost, insurance and freight (CIF) value exceeding QAR1,000 is liable to 5% customs duties (previously QAR3,000).

Customs duty tariffs fall under these categories:

• Personal effects and household items, imports of charitable organisations and returned goods, diplomatic and military exemptions, merchandise for ‘free zones’ and duty-free shops – exempt. Goods in transit may be accepted at designated stations without duty.

• General cargo, eg clothing, perfumes, cars, electronic appliances and devices – 5%.

• Steel – 20%.

• Urea and ammonia – 30%.

• Cigarettes, tobacco and its derivatives – 100% or QR1,000 per 10,000 cigarettes, whichever is higher.

Law No 25 of 2018 on Excise Tax came into effect 1 January 2019. All businesses that import, produce or store/stockpile excise goods must comply with the requirements stipulated under the law. The following goods are subject to Excise Tax:

• Tobacco products – 100% • Carbonated drinks (non-flavoured aerated water excluded) – 50%

• Energy drinks – 100% • Special goods – 100%

In accordance with the Gulf Cooperation Council (GCC) Customs Union, more than 800 goods are exempted from customs duties, alongside exemptions granted to certain bodies and persons under Customs Law No 40 of 2004. There are fees for the attestation of the Certificate of Origin (from QC) and a tariff for the attestation of the Commercial Invoice, based on shipment value.

Qatar implemented the World ATA Carnet Council in 2018, an international customs system with nearly 80 member countries, permitting the dutyfree and tax-free temporary import and export of goods for up to one year. The system is being implemented by QC alongside ICC Qatar and the General Authority of Customs (GAC).

Import regulations All commercial shipments are examined by GAC prior to clearance. The Qatar Electronic Customs Clearance Single Window (Al Nadeeb) is a one-stop e-government system to facilitate international trade. customs.gov.qa

New regulations were introduced in 2013 to prevent fake products from entering the market. All general goods must have non-removable marking of their place of manufacture to be eligible for customs clearance. This applies to both air and sea freight. The import of vehicle tyres, spare parts and electrical home appliances has to be based on a 'certificate of conformity' issued by the authority concerned. All general cargo for customs clearance must be backed by an original commercial invoice on the shipper’s letterhead, with stamp and signature. They also require attestation by QC. The packing list of each consignment must have the number of pieces, weight and volume.

GAC requires all importers to obtain an HS Code, an international system for classifying traded products. This must be linked to the trader's Commercial Registration and import licence.

There are few restrictions on bringing personal effects into Qatar. However, anyone (importers, exporters or travellers) holding local or foreign currency, precious metals or jewellery worth more than QAR50,000 must complete a customs declaration form upon entry into or departure from the country. Banned imports include alcohol, pork and e-cigarettes. The import of pets is allowed, although certain breeds are not permitted. NB: The signing of AlUla Declaration regarding the blockade against Qatar means commercial cargo movement has resumed between Qatar and Saudi Arabia.

Points of entry Imports and exports are transitted via Hamad International Airport, Hamad Port, Doha Port, Mesaieed Port, Ras Laffan and the Salwa Overland Terminal.

Taxation

There are no personal taxes or statutory deductions from salaries in Qatar. Under Law No 24 of 2018 on Income Tax ('the New Tax Law') and its executive regulations, companies must pay tax on all profits at a flat rate of 10%. This is on all corporate income from sources in Qatar,

QATAR BUSINESS AND ECONOMY E-GUIDE © MARHABA

marhaba.qa PRINT and ONLINE

whether the entity has a physical presence in Qatar or not. The share of the profits due to a Qatari or GCC partner is exempt from tax.

Tax exemption applies for certain activities, and companies listed on the Qatar Exchange are also exempt, but companies are required to pay a 2.5% contribution to charitable and cultural activities. Taxpayers need to register with the Public Revenue and Taxes Department. Auditors must be a firm based in Qatar and registered with the MOCI or approved by the QFC. Taxpayers can access services offered by the General Tax Authority via the Dhareeba portal.

In January 2016 GCC member states agreed to introduce VAT, tentatively set for early 2018. The Council of Ministers approved the Qatar Value Added Tax (VAT) Law and Excise Tax Law and Executive Regulations in May 2017, based on the unified GCC agreement. To date, only the Excise Tax has been implemented.

Intellectual Property

Under Law No 9 of 2002, a trademark registration is valid for 10 years from the date of filing the application, renewable for further consecutive periods of 10 years. The court may be ordered to cancel a trademark registration if the owner fails to use it in Qatar within five consecutive years from the date of the registration.

Copyright Law No 7 of 2002 gives protection to authors of original literary and artistic works. Protected works include books, lectures, musical works, photographic works and computer software. The economic rights of the author/owner are protected during the lifetime of the author, and for 50 years after his death.

Patent Law No 30 of 2006 provides for the registration of inventions and foreign patents at the Qatar Patent Office, and implementing regulations were issued by the Minister of Commerce and Industry under Decision No 153 of 2018.

Qatar announced its accession to the Patent Cooperation Treaty in 2011. The Law of Trademarks in the GCC Countries was promulgated under Law No 7 of 2014, and the same year Qatar signed a cooperation agreement with the World Intellectual Property Organisation (WIPO) to jointly improve services. There is an electronic trademark registration service via the MOCI website to expedite submissions and preserve IP rights.

Law No 10 of 2020 on the protection of industrial designs was issued in April 2020. This will offer more comprehensive protection for designs once the implementing regulations are issued, as

previously protection was sought by publishing cautionary notices in Qatari newspapers.

Qatar recently won the presidency of the International Union for the Protection of Literary and Artistic Works (Berne Union). The Berne Union is a UN agency under WIPO, and is an agreement by member states to protect works and the rights of authors, as well as giving creators the means to place autonomy over their works. Acting Director of the office of Qatar to the World Trade Organisation (WTO) Ahmed Essa Al Sulaiti has been elected Chairman of the Committee of the Union for two years.

Regulatory Bodies and Government‑owned Entities

Investment Promotion Agency Qatar (IPA Qatar) A4 Custodian of the Invest Qatar brand, IPA Qatar was launched in 2019 and is registered at the Qatar Financial Centre. The agency provides investment solutions in Qatar, attracting foreign direct investment in all of the country’s priority sectors. invest.qa

Ministry of Commerce and Industry (MOCI) A4 Creates commercial policy for both private and public sectors in order to boost regional and international trade relations and support the development of businesses across the country. The ministry is a primary resource for information when opening a company and investing in Qatar. A number of services are available through the Single Window, part of the ministry's efforts to attract local and foreign investments. moci.gov.qa, investor.sw.gov.qa

Ministry of Finance (MOF) C4 Prepares the State Budget and proposes objectives and tools of financial policy in line with Qatar National Vision 2030. Its Tahfeez programme enhances local services and products to strengthen Qatar's private sector. The General Authority of Customs monitors the import of all goods, and the e-services of the Unified Website of State

© MARHABA WINTER 2022/23

marhaba.qa PRINT and ONLINE

Investment and Trade

Investment and Trade

Procurement include tenders and company registration. mof.gov.qa, customs.gov.qa, monaqasat.mof.gov.qa

Ministry of Justice (MOJ) C4 Records legal actions and documents, registers and protects IP rights, and reviews draft contracts and agreements in accordance with the law. The Ministry has a real estate registration/authentication office at Qatar Financial Centre (QFC) to provide services to QFC entities.

Ministry of Municipality and Ministry of Environment and Climate Change C4 The Foras investment portal promotes PPPs, currently for environmental, waste treatment, recycling and sustainability projects. mme.gov.qa

Qatar Chamber (QC) D4 Provides a wide range of services and support to local and international businesses, including certificates of origin (COO) for import/export and ATA Carnet, acting as liaison for international business delegations, and providing training courses. QC services are also available to QFC-licensed firms. The Qatar International Center for Conciliation & Arbitration (QICCA) was established in 2006 as part of QC to act as an efficient and swift mechanism to settle disputes between Qatari enterprises, or between national companies and foreign counterparts. qatarchamber.com, qicca.org

Qatar Development Bank (QDB) D4 Has an active role in the economic and industrial development of Qatar in the private sector by promoting and financing SMEs. The bank is 100% owned by the State of Qatar and provides a wide range of financial and advisory products, such as funding, incubation, and support services. qdb.qa

Qatar Financial Markets Authority (QFMA) C4