Privacy

Guardian

Workforce

Create

Safety Stay

Schedule

St A ff Directory

Robert O’Koniewski, Esq. executive Vice President rokoniewski@msada.org

Jean Fabrizio Director of Administration jfabrizio@msada.org

Auto De A ler MAg A zine

Robert O’Koniewski, Esq. executive editor MSADA o ne McKinley Square Sixth f loor Boston, MA 02109

Subscriptions provided annually to Massachusetts member dealers. All address changes should be submitted to MSADA by e-mail: jfabrizio@msada.org

Auto Dealer is published by the Massachusetts State Automobile Dealers Association, inc. to provide information about the Bay State auto retail industry and news of MSADA and its membership.

AD Directory complyAuto, 2 ethos group, 49 gW Marketing Services, 39 Marcum, 41 Merchant Advocate, 35 nancy Phillips, 39 ocD tech, 43 PlugStar/Plug in America, 47 reynolds & reynolds, 44 Sprague energy, 56 Withum, 59

ADVertiSing rAteS inquire for multiple-insertion discounts or full Media Kit. e-mail jfabrizio@msada.org

us on X at @MassAutoDealers

Appreciation?

By Jeb Balise, MSADA President

Election Day – November 5 – soon will be upon us. The results that day will have considerable implications.

Who holds what offices will determine to what extent the business community will be regulated (over-regulated?). It seems each year the same founding American principle is under attack: free enterprise. Of course, the scope of that problem is well beyond any one industry. In our corner of the world, we use several outreach programs during the year to visit with our Members of Congress to make sure our representatives understand that the policies they pursue should be focused on making it easier to do business, not harder. We are not seeking any special favors or privileges, just a level playing field. To be able to confront such challenges, it is always important to engage our elected politicians and regulatory parties at all levels. As we previewed in last month’s magazine and cover in this month’s issue, September’s NADA Washington Conference afforded us the opportunity to meet with our Members of Congress and their staffs to provide the dealer side of several on-going matters that impact our businesses and the livelihood of our employees.

Without our input, politicians would be free to decide matters unaware of our perspective, which is never a good thing.

I want to thank the dealers who traveled to D.C. for the annual conference with MSADA Executive Vice President Robert O’Koniewski to make sure our voice is heard:

MSADA Immediate Past President Chris Connolly of Herb Connolly Chevrolet; Next Gen dealers Chad Bouchard of the Ron Bouchard Auto Stores, plus Ruddy Brito and Vinnie and Rich Mastria of the Mastria Auto Group; and Ray and Brianna Butler of Midstate Mitsubishi. More importantly, Vinnie, Rich, Ray, and Brianna were first-time attendees. It is vital to our success as an organization that our next generation of dealership leaders become involved with our legislative outreach.

We can never stop putting effort into making sure our representatives know who we are, what we do, and how vital our contribution is to their districts and our communities. Without our input, politicians would be free to decide matters unaware of our perspective, which is never a good thing.

I want to continue to stress the importance of your voice in this process. We make the trip down to D.C. so you do not have to, but that does not mean you should not pick up the phone and let your legislator know what issues you care about as an important economic engine in their community. Please let me or Bob know if you would like any talking points or other tips for representing our business.

Barnstable County

Brad tracy, tracy Volkswagen

Berkshire County

Brian Bedard, Bedard Brothers Auto Sales

Bristol County richard Mastria, Mastria Auto group

Essex County

William Deluca iii, Bill Deluca family of Dealerships

Paul Bertoli, Priority chryslerJeep Dodge ram

Franklin County [open]

Hampden County

Jeb Balise, Balise Auto group

Hampshire County

Bryan Burke, Burke chevrolet

Middlesex County frank Hanenberger, MetroWest Subaru

Norfolk County

Jack Madden, Jr., Jack Madden ford charles tufankjian, toyota Scion of Braintree

Plymouth County

christine Alicandro, Marty’s Buick gMc isuzu

Suffolk County [open]

Worcester County

Steven Sewell, Westboro chrysler Dodge ram Jeep

Steve Salvadore, Salvadore Auto

Medium/Heavy-Duty Truck Dealer

Director-at-Large [open]

Immediate Past President

chris connolly, Jr., Herb connolly chevrolet

NADA Director

Scott Dube, Mcgovern Hyundai rt.93

OFFICERs

President, Jeb Balise

Vice President, Steve Sewell

Treasurer, Jack Madden, Jr.

Clerk, c harles tufankjian

ACV Auctions

Steve Sirko (856) 381-3914

ADESA

Elizabeth Morich (508) 270-5400

Albin, Randall & Bennett

Barton D. Haag (207) 772-1981

Allied Recycling Center

Joseph Castaneda (781) 316-7180

American Fidelity Assurance Co.

Kathleen Weisenbach (402) 523-5945

America’s Auto Auction Boston

Chris Colocousis (774) 218-8930

ArentFox LLP

Paul Marshall Harris (617) 973-6179

Sarah Decatur Judge (617) 973-6184

Armatus Dealer Uplift

Joe Jankowski (410) 391-5701

Assurant Dealer Services

Sean Skinner (603) 660-3647

Auto Auction of New England

Steven DeLuca (603) 437-5700

Bank of America Merrill Lynch

Dan Duda and Nancy Price (781) 534-8543

Bellavia Blatt

Leonard Bellavia (516) 873-3000

Broadway Equipment Company

Fred Bauer (860) 798-5869

Brown & Brown Dealer Services

Jason Bayko (508) 624-4344

CDK Global

Rob Steele (508) 564-1346

Clifton Larson Allen

Rick Parmelee (860) 982-9307

Cooperative Systems

Scott Spatz (860) 250-4965

Cox Automotive

Polly Penna (303) 981-1298

Creative Resources Group

Charlie Rasak (508) 726-7544

CVR

John Alviggi (267) 419-3261

Dave Cantin Group

Woody Woodward (401) 465-7000

Dealer Alchemist

Jeremy Wilson (804) 564-5740

Dealer Pay

Shannon Wischmeyer (636) 293-8038

Downey & Company

Paul McGovern (781) 849-3100

DP Sales Distributors

Andrew Prussack {631) 842-7549

Driving Dealer Performance

Kimberly Guerin (978) 760-0322

Eastern Bank

David Sawyer (617) 620-3484

EasyCare New England

Greg Gomer (617) 967-0303

Ethos Group, Inc.

Drew Spring (617) 694-9761

F&I Direct

Sean Wiita (508) 414-0706

Michelle Salas (508) 599-0081

Federated Insurance

Kevin Sundberg (559) 547-9694

Fisher Phillips LLP

Joe Ambash (617) 532-9320

Jeff Fritz (617) 532-9325

Josh Nadreau (617) 532-9323

Freedom Solar Power

Ryan Ferrero (970) 214-4433

GW Marketing Services

Gordon Wisbach (857) 404-0226 Hilb

Group

James Pietro (508) 791-5566

Huntington National Bank

Mark Flibotte (781) 724-3749

iHeart Media

Paul Kelley (757) 328-1431

ION Bank

Timothy Rourke (203) 439-9400

JM&A Group

Chris “KC” Hwang (954) 415-6961

JM Electrical Co.

Christopher Cedrone (781) 581-3328

John W. Furrh Associates Inc.

Pamela Barr (508) 824-4939

Key Bank

Tom Flynn (716) 998-6247

KPA

Abe Cohen (503) 902-6567

M & T Bank

John Federici (401) 642-5622

Marcum LLP

Nichole Rene (203) 781-9690

McWalter Volunteer Benefits Group

Shawn Allen (617) 483-0359

Merchant Advocate, LLC

Dan Giordano (973) 897-2778

Mintz Levin

Kurt Steinkrauss (617) 542-6000

Murtha Cullina

Thomas Vangel (617) 457-4000

Nancy Phillips Associates, Inc.

Nancy Phillips (603) 658-0004

National Business Brokers

Peter DiPersia (603) 881-3895

National Grid

Nicole Caruso-Carlin (347) 426-6331

NEAD Insurance Trust

Charles Muise (781) 706-6944

Northeast Dealer Services

Johna Cutlip (401) 243-7331

OCD Tech

Michael Hammond (844) 623-8324

Performance Brokerage Services

Jacob Stoehr (847) 323-0014

Performance Management Group, Inc.

Dale Ducasse (508) 393-1400

Piper Consulting

Jim Piper (207) 754-0789

Plug In America

Joel Levin (237) 925-1364

Portfolio

J. Gregory Hoffman (800) 761-4546

Priority Payments Local

Andrew Pollina (732) 372-4352

Pullman & Comley LLC

James F. Martin, Esq. (413) 314-6160

Reynolds & Reynolds

Austin Ziske (802) 505-0016

Rockland Trust Co.

Joseph Herzog (508)-830-3241

Santander Bank

Richard Anderson (401) 432-0749

Chris Peck (508) 314-1283

Schlossberg, LLC

Michael O’Neil, Esq. (781) 848-5028

Shepherd & Goldstein CPA

Ron Masiello (508) 757-3311

Southern Auto Auction

Joe Derohanian (860) 292-7500

Sprague Energy

Steve Borelli (508) 768-5252

The Towne Law Firm P.C.

James T. Towne, Jr. (518) 452-1800

TrueCar

Pat Watson (803) 360-6094

Truist

Andrew Carmer (401) 409-9467

US Bank

Vincent Gaglia (716) 649-0581

Wells Fargo Dealer Services

Rich DeFreitas (857) 205-2780

Withum

Kevin Carnes (617) 471-1120

Zurich American Insurance Company

Steven Megee (774) 210-0092

By Robert O’Koniewski, Esq.

MSADA Executive Vice President

rokoniewski@msada.org

Follow us on X (formerly Twitter) • @MassAutoDealers

The National Automobile Dealers Association rang the bell once again for 2024 and asked its member dealers to hit our Nation’s capital in mid-September for its 49th version of its annual Washington Conference. For those who attended, there was no lack of issues and attendee camaraderie.

Every time we travel to D.C. for our annual NADA confab, it never ceases to amaze just how insular their world is in the 2-0-2 area code. There is surely no place on Earth like it. That is why our visits with our elected officials are so important. They need to hear from their local businessmen and women – our member dealers – on a continual basis to fully grasp our importance to the local, state, and national economies.

Putting aside the cynicism and skepticism about the ability of getting anything done positively for our nation, when in Washington it is always important for dealers to remember why they are there and to stay in their own lane regarding those issues important to our industry. We have been successful over the years by avoiding the very fights everyone else seems to want to jump into, regardless of the relevancy to their own industries. When in D.C., we step gingerly into the sandbox others use as a smack down pit.

Dealers and their association executives from across the country use the annual Washington Conference to meet with their Senators and Representatives to discuss various legislative and regulatory issues affecting dealership operations. This is also a chance for dealers to see their legislators

in the halls of power where they conduct their business, in contrast to the usual district functions like chamber of commerce rubber-chicken luncheons, holiday parades, and ribbon cuttings.

NADA, as part of the festivities, in addition to policy briefings and other NADA-related materials, schedules politicians and commentators to provide attendees with a flavor of the current situation in Washington and what may be in store for us prospectively. As we flew in, we find ourselves deep into this presidential election year, in which the full House and one-third of the Senate are standing for election which will determine who will control those chambers. This year’s crop of speakers included Rep. Cathy McMorris Rodgers (R-Washington), the chair of the House Energy and Commerce Committee, and David Wasserman, senior election analyst for the Cook Political Report.

Your MSADA delegation consisted of MSADA Immediate Past President Chris Connolly of Herb Connolly Chevrolet; Next Gen attendees Chad Bouchard of Ron Bouchard’s Auto Stores; Ruddy Brito of the Mastria Auto Group as well as his colleagues Vincent and Richie Mastria, who were first-time attendees; Ray Butler and his daughter, Brianna, of Midstate Mitsubishi, also first-time attendees; and yours truly.

Once on Capitol Hill, we engaged in dealer dialogue on such issues as defunding the Federal Trade Commission’s enforcement of its anti-dealer Vehicle Shopping Rule, which was promulgated in late 2023; catalytic converter anti-theft legisla-

tion; so-called “right to repair” legislation; and defunding the EPA’s efforts to impose onerous rules on fuel economy standards and EV mandates.

During our two days of meetings in D.C., we conferred with Rep. William Keating (D-Bourne) and staff members for Reps. Lori Trahan (D-Westford), Jake Auchincloss (D-Newton), Jim McGovern (D-Worcester), Stephen Lynch (D-South Boston), Katherine Clark (D-Melrose), Seth Moulton (D-Salem), and Richard Neal (D-Springfield), and Sen. Ed Markey (D).

Moving forward, we need to keep in mind that for two days we collectively were a group of small businessmen and women who, on behalf of their fellow dealers back home, gave up time from their dealerships and families to fly to Washington to discuss issues important to their stores and making sure the economy remains progressing in a positive direction. Back home in the Commonwealth, however, we are an association of 427 members, whose dealerships employ on average 60 men and women, and who are responsible for almost 20 percent of the Commonwealth’s retail economy.

There always exists a great need to go before our elected officials and inform them of our concerns and desires. As we ask dealers to get more engaged in contacting their Congresspeople and local legislators, we ask that you not be shy and let others carry the load. All dealers – big and small, domestic makes and international – are in the same boat. If we give the Members of Congress a free ride and do not engage them on the issues, they will think we have no problems. The same is true when we are fighting for or against certain laws on Beacon Hill.

In the future, please heed the call from your Association to contact your elected officials when issues arise. Without our input, our esteemed Members of Congress, if left to their own devices, could find a way to pour more gasoline on the fire. After all, the easiest vote they can take is one in which no one talks to them.

Massachusetts car and truck dealers presently operate under a regimen of vehicle emissions rules that essentially originate from unelected bureaucrats housed in California. As has been written in these pages previously, Massachusetts’s adoption of the California rules will have major implications for dealership operations of all sizes and types.

Under the U.S. Clean Air Act, a state may obtain a waiver to establish emissions rules that are stricter than that which are set by the federal government. California many decades ago undertook that process and received a federal waiver from the Environmental Protection Agency. The California Air Resources Board continuously establishes rules which the EPA must sign off on, as set in federal law.

Over 30 years ago, Massachusetts enacted a law – MGL Chapter 111, Section 142K – which requires the adoption of California’s standards for motor vehicle emissions as long as those standards achieve greater emissions reductions than federal standards. Under our law, the Legislature is charged with addressing problems with the Commonwealth’s compliance with the CARB standards should issues arise.

CARB, since the 1990s, has set emissions and EV commitment requirements for passenger vehicles and trucks of all class sizes (2-8). This includes the Advanced Clean Cars II (ACC II) Rule, which requires new passenger vehicle and light-duty truck sales to increase as a percentage basis of all sales until it hits the required benchmark of 100% in 2035.

In 2021, during the tail-end of the Baker administration, Massachusetts adopted California’s standards for medium- and heavy-duty trucks with the passage of the Motor Vehicle Emissions Standards law. Those standards come in the form of two state regulations: (1) the Heavy-Duty Omnibus (HDO) Rule, requiring manufacturers to sell lower emissions engines, and (2) the Advanced Clean Trucks (ACT) Rule, which requires a certain percentage

of manufacturers’ overall sales to include sales of zero emission vehicles.

The impact of CARB’s Rules on medium- and heavy-duty truck sales in Massachusetts and the other CARB states is threefold.

First, in March 2023, the EPA granted CARB’s Advance Clean Truck (ACT) Rule waiver request. To date, ten states have adopted the Advanced Clean Trucks rule: Oregon, Washington, Massachusetts, Vermont, New York, New Jersey, New Mexico, Maryland, Rhode Island, and Colorado, while several other states are in the process of adopting the rule. The ACT Rule requires certain manufacturers of medium- and heavy-duty trucks to sell ZEVs as an increasing percentage of annual truck and bus sales in California.

Second, the California Heavy-Duty Engine and Vehicle Omnibus Regulation for Specified Entities is a separate regulatory action to ACT and designed to reduce NOx emissions from heavy-duty trucks. EPA has not granted California a waiver for the Omnibus Rule.

On July 6, 2023, CARB announced the Clean Truck Partnership between CARB, the Truck and Engine Manufacturers Association (EMA), and major medium- and heavy-duty truck and engine makers. Through the Clean Truck Partnership, CARB agreed to give truck and engine makers additional time to meet the new heavy-duty emissions requirements and more protection for legacy engines due to the impossibility of meeting multiple CARB emission standards.

The agreement raised the caps on legacy engines, allowing truck and engine makers to continue to sell more diesel engines over the next three years if enough zero-emission vehicles are sold to offset the emissions. The challenge they face is that market demand for commercial electric trucks is not materializing, resulting in a reduction in allocation to the California truck dealers from their OEMs of anywhere from 70% to 100% in order to comply with the CARB ACT Rule.

Furthermore, California’s existing Heavy-Duty Vehicle Omnibus Standards have been relaxed so they align more closely with the federal government’s rules. They become more stringent, however, starting in 2024 as they eventually converge with EPA’s NOx rule in 2027. The manufacturers still do not offer for sale a CARB-compliant engine to meet the CARB NOx rules as of May 2024. Additionally, CARB did not change its requirement that half of all heavy-duty trucks sold in California will be electric by 2035.

California agreed that, in the future, it will provide at least four years of lead time before imposing new standards and that any new mandates will stay in place for at least three years before they can be changed. In return, the truck and engine makers agreed that they will meet California’s zero-emission vehicle targets and air pollution limits – even if they are later overturned in court. The manufacturers agreed to meet California standards, no matter what the outcome of any litigation challenging EPA Agency waivers or authorizations for those regulations or of CARB’s overall authority to implement those regulations.

Overall, the Clean Trucks Partnerships agreement favors the manufacturers, but does not relieve much of the pain points of the ACT and related CARB rules for dealerships and their customers.

On December 17, 2023, CARB provided a letter to EMA providing clarity on its exercise of enforcement discretion of the Omnibus Regulation. CARB states that it will not initiate enforcement actions against EMA members from sales of new 2024-2026 MY engines certified to the emissions standards of both the Omnibus regulation’s legacy engine provisions and applicable federal emission standards, to customers intending to register these vehicles outside of California. The letter responds to mounting requests by EMA and industry stakeholders, including California dealerships, that CARB exercise enforcement discretion amid concerns that there will be extremely limited Om-

nibus-compliant engines to sell and outof-state customers would not be allowed to buy non-California compliant engines from California dealers.

Third, on November 15, 2023, CARB requested an EPA waiver for its Advanced Clean Fleets (ACF) Rule, which is a first-of-its-kind demand-side regulation that imposes ZEV purchase requirements on specified truck buyers. Significant questions as to the ACF Rule’s constitutionality and legality are pending in the courts, and it is highly questionable as to whether the Rule satisfies the mandatory lead time and feasibility conditions for receiving an EPA waiver. Like CARB’s ACT and Omnibus Rules, the ACF Rule is not only far ahead of engine technology, charging infrastructure, and the market, but CARB’s efforts to implement it simultaneously concurrent with the ACT and Omnibus rules has placed immense pressure on manufacturers, dealers, and customers, and is causing a precipitous decline in trucks sales.

Readers may recall these pages included in the Trucks column testimony on August 14, 2024, from Kim Mesfin, a Volvo truck dealer and ATD board line representative, to the EPA in opposition to CARB’s waiver request. Her testimony urged the EPA to deny CARB’s waiver request based on the pending litigation regarding the ACF rule, CARB’s intention to amend the ACF rule, and on the ACF rule’s failure to satisfy the statutory criteria for a waiver set out in the federal Clean Air Act.

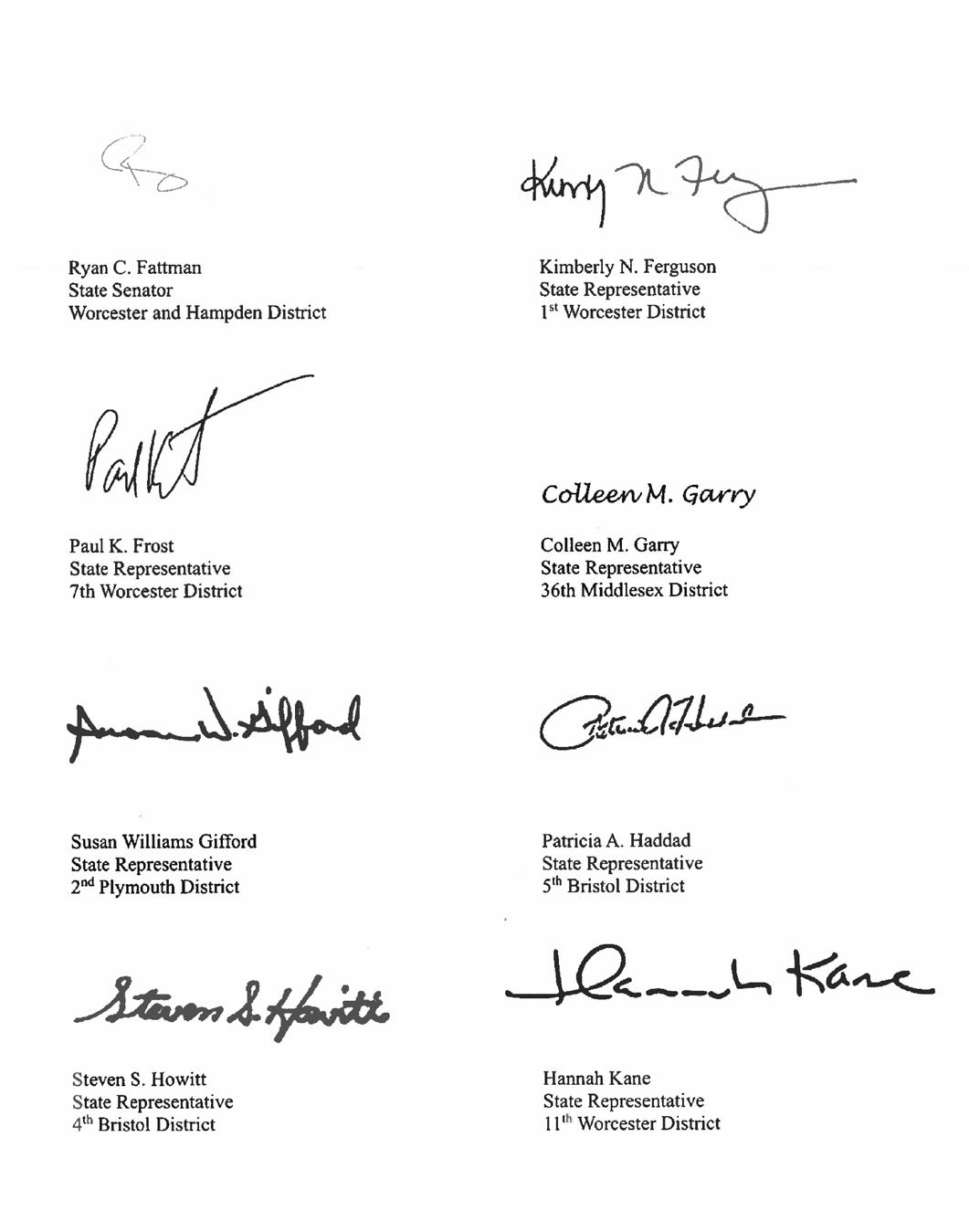

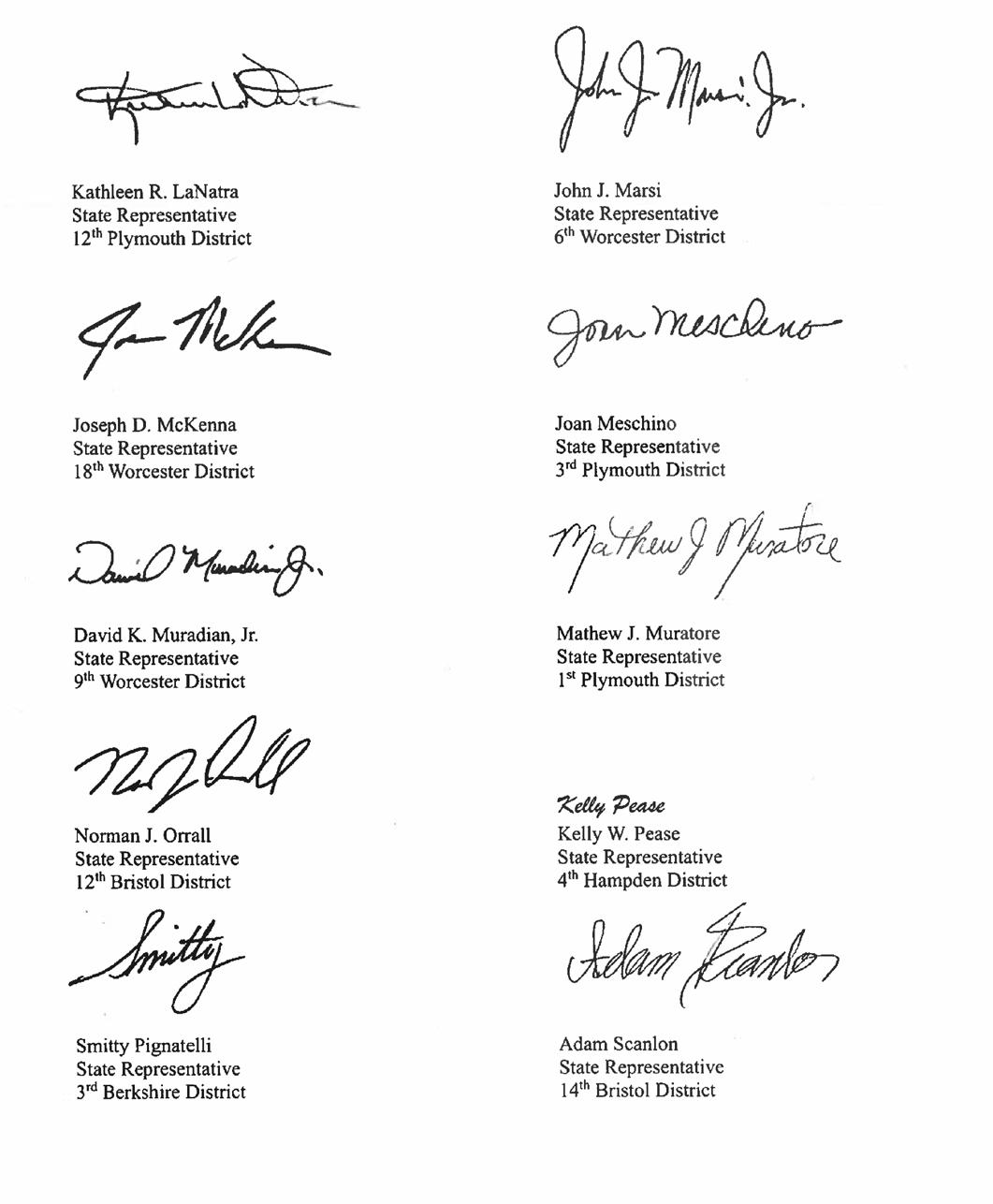

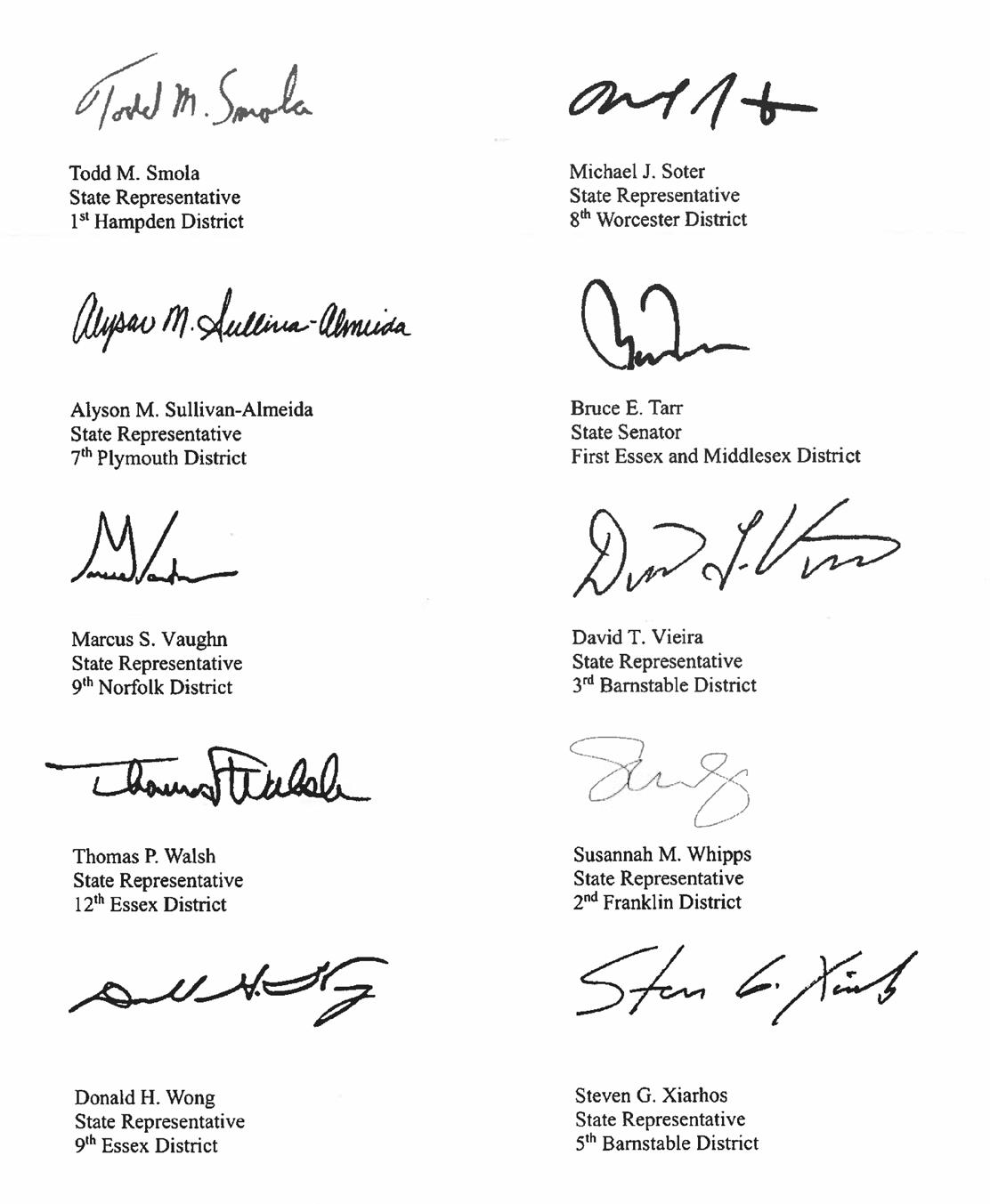

Of immediate concern for Massachusetts’s medium- and heavy-duty truck dealers and purchasers is ACT’s January 1, 2025, implementation date here. Following this Roundup column, please find three letters sent to the Gov. Maura Healey asking for a one-year delay in ACT implementation – a joint MSADA and Trucking Association of Massachusetts letter; a coalition letter signed by over 50 stakeholders (including MSADA and TAM), especially those dependent on the use of heavy-duty trucks; and a bipartisan letter signed by 38 legislators.

In addition, there exists the CARB HDO

rule, with which Massachusetts is committed to comply, but for which CARB has not received the required EPA waiver. Since there is no waiver yet issued, California (and Massachusetts) cannot enforce the HDO Rule. Further, the Massachusetts Department of Environmental Regulation, our state enforcement agency, has been informed that there may not be a sufficient supply of engines which comply with the HDO Regulation.

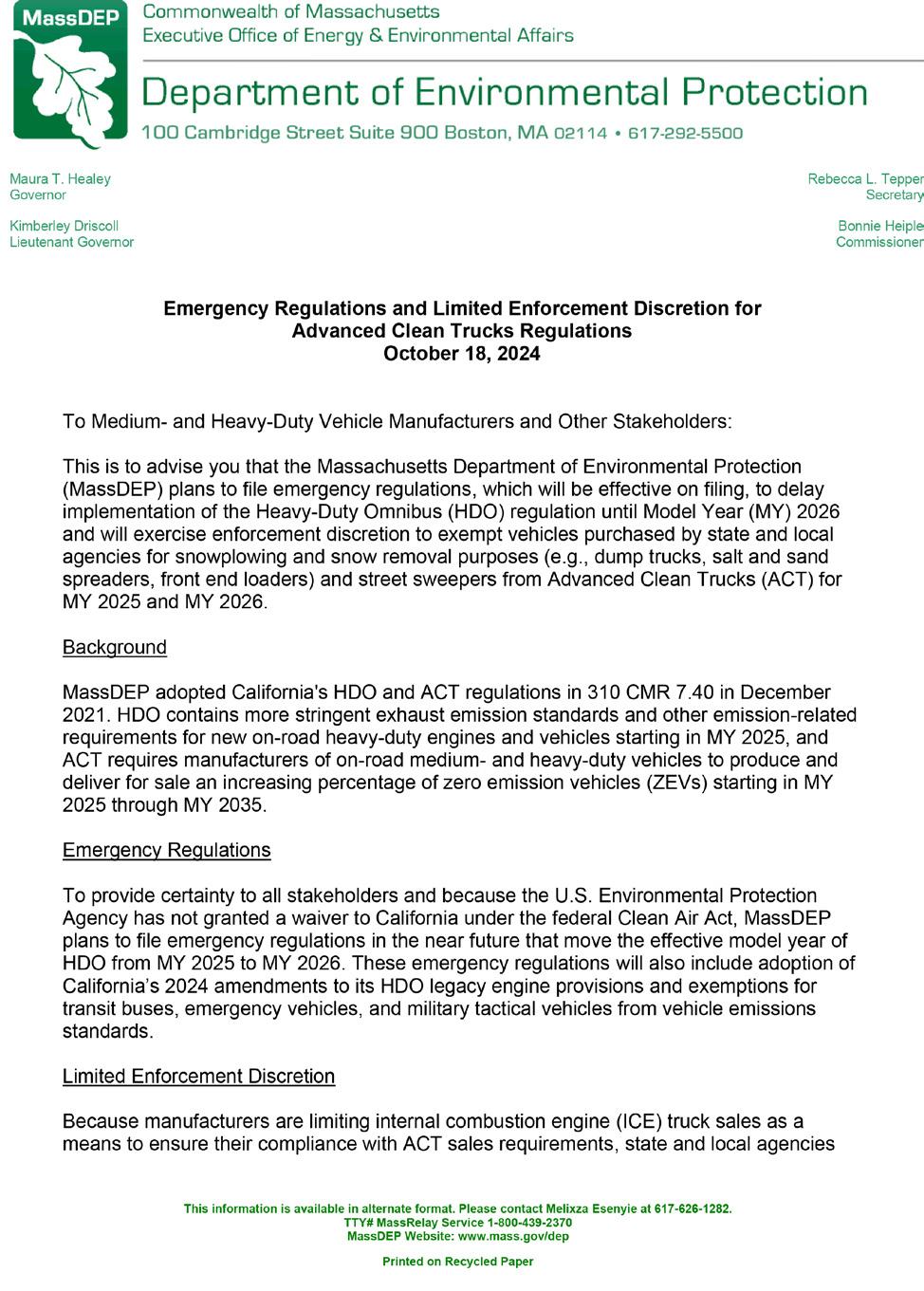

Hence, on October 17, 2024, the DEP announced that it would be filing an emergency regulation, effective immediately, to delay the implementation of the HDO regulation until Model Year 2026 and will exercise enforcement discretion under the ACT regulation to exempt vehicles purchased by state and local agencies for snowplowing and snow removal purposes (e.g., dump trucks, salt and sand spreaders, front-end loaders) and street sweepers for MY 2025 and MY 2026.

As reports from California detail cratering truck sales and other economic disruptions, all eyes will be on CARB’s next moves at its October 24 public hearing, with subsequent ramifications for Massachusetts and the other CARB states. The impacts nevertheless will be felt nationwide as the manufacturers rejigger their commitments to meeting EV sales requirements at the expense of their inventory of diesel products.

We will provide updates as they occur. Your Association, along with the coalition stakeholders, will continue with our advocacy efforts with the governor, applicable agencies, and legislators.

We will be holding our annual meeting on Friday, November 1, at the Encore Hotel and Casino, in Everett. We are in the process of developing our speakers line-up, running 1-5pm after our Noon welcome reception. The day will conclude with our cocktail reception, 5-8pm. Please use the registration information that we have emailed to you to sign up. We look forward to seeing you on November 1.

The FTC has issued a final rule on the Use of Consumer Reviews and Testimonials, which took effect on October 21, 2024. The Rule sets strict standards regarding prohibiting fake reviews, clearly disclosing reviews posted by employees (and their families), incentivizing reviews to express a certain view, and suppressing consumer reviews.

For many years, dealerships have relied on the FTC Guides Concerning the Use of Endorsements and Testimonials in Advertising (Endorsement Guides) that were updated as recently as 2023. While the Endorsements Guides are still active and address conduct in all advertising, this new Rule more specifically addresses practices regarding reviews and testimonials. Proceeding with a Rule makes it easier for the FTC to claim violations and collect fines. Dealers should closely adhere to the Rule and the Guides.

NADA has developed a Frequently Asked Questions guidance for dealerships to comply with the rule. In addition to reviewing the FAQs and the Rule, dealerships should review: With employees:

• Policies and practices you have for engaging employees and their families on whether and how they post reviews or recommendations; and

• If employees and their families are posting reviews, how you are asking them to disclose that connection.

At the dealership:

• Moderation practices – specifically the criteria for posting reviews;

• Incentivizing reviews to ensure you are not soliciting or expressly asking to post reviews that express a certain point of view; and

• Ensure all reviews are treated equally without regard to content.

The FTC discussed the Rule at an open meeting on September 19 and said more guidance would be forthcoming at www. ftc.gov/reviews to assist businesses with compliance. At the time of this writing, no further guidance has been issued. Dealers

should educate employees and vendors on the new rule to ensure compliance.

For more information, including the FAQs, please access MSADA Bulletin #128 (9/30/24).

In October the Internal Revenue Service made operational new functionality tools for processing returns and cancellations in the Energy Credits Online (ECO) portal, as well as a new secure two-way messaging tool for communicating with the IRS. The IRS also soon will announce a temporary suspension of the submission deadline for 2024 time-of-sale reports.

After extensive engagement with NADA, the IRS took these actions to provide long-awaited relief for dealers that encountered problems when using the ECO portal, including the issues outlined in NADA’s May 30 letter regarding outstanding reimbursements for clean vehicle tax credits applied to 2024 clean vehicle sales.

The new functionality will enable dealers to process returns and cancellations after the 48-hour void period for submitted time-of-sale reports, which is especially important for dealers that issued time-ofsale reports for lease transactions in error. Dealers that need to repay an advance payment for a cancelled time-of-sale report will receive an invoice from pay.gov via the e-mail provided when they registered for the Advance Payment program. For returns and cancellations regarding vehicles that were not placed in service, dealers should expect the VINs to be available for a new credit transfer transaction approximately 2-3 weeks after submitting the return or cancellation in the portal.

Importantly, dealers that submitted regular time-of-sale reports mistakenly after applying credit transfers at the time of sale must request assistance from the IRS through the new messaging tool to correct these submissions.

The affected dealers must work directly with the IRS to demonstrate that their customers made knowing and voluntary credit transfers, and that all legal requirements of

the advance payment program were satisfied. This confirmation would ordinarily be established via the attestations displayed in the portal for credit transfers. However, because the transactions were not entered correctly, the affected dealers must provide explanations and documentation to the IRS for review via the new messaging tool to obtain relief.

Once implemented, the suspension of the 3-day time-of-sale report deadline will enable dealers who missed the deadline, either because their registration remained pending or for other reasons, to submit time-of-sale reports and seek reimbursement for credits applied to their outstanding 2024 transactions.

On October 9, a three-judge panel of the Fifth Circuit Court of Appeals in New Orleans heard oral arguments regarding the Petition for Review filed by the National Automobile Dealers Association (NADA) and the Texas Automobile Dealers Association (TADA) challenging the Federal Trade Commission’s Vehicle Shopping Rule. The case is National Automobile Dealers Association & Texas Automobile Dealers Association v. FTC.

The FTC’s Vehicle Shopping Rule is a sweeping trade regulation rule that will introduce strict regulations for motor vehicle dealers. The Rule has numerous requirements that would affect all aspects of dealers’ sales operations, including advertising practices, consumer disclosures, and recordkeeping, and would require dealerships to make substantial operational adjustments to comply. Although the Rule has been finalized, its implementation has been voluntarily “stayed” – meaning delayed – by the FTC pending the resolution of this legal challenge brought by NADA and TADA.

There is no deadline for the Fifth Circuit to issue its written ruling, though typically decisions are issued within 2-6 months after oral argument. It is likely we will have the Court’s ruling by early 2025. Depending on the ruling, it is possible that a party

may appeal to the US Supreme Court. If the ruling from the Fifth Circuit favors the FTC, however, the FTC may attempt to implement the Rule pending any appeal to the Supreme Court.

Even though the Rule’s implementation is currently delayed, it is important for dealers to start reviewing their advertising practices, disclosure processes, and recordkeeping systems to comply with both existing regulations and those likely to come.

Go to MSADA Bulletin #134 (10/11/24) for additional information, including a link to the audio recording of the oral arguments on October 9 provided by the National Automobile Dealers Association.

We appreciate the contributions we receive from our member dealers who answer our calls for donations to our PACs.

Each year MSADA expresses itself politically through NADA’s federal PAC, NADAPAC, and through our state PAC, the New Car Dealers Political Action Committee (NCDPAC). We depend on contributions from our dealers to keep these PACs strong, as we need to have an active voice in Washington and on Beacon Hill. Contributions to our PACs are an inexpensive insurance policy. Since by law we cannot use our membership dues or other association revenues for political contributions, the PACs help us to remain strong politically as we advocate for our dealers’ interests in the political process.

If you have not yet given to the PACs this year, please contact me at rokoniewski@msada.org and we can make sure your contributions happen. Thank you.

Our “Coffee with Coopsys” webinar series from our associate member, Cooperative Systems, continues with our next instalment on November 12. Coopsys works with businesses to increase their IT knowledge and understanding. The “Coffee with Coopsys” program is a series of brief webinars we provide to our members to expand upon and improve their experi-

ences regarding IT issues and dealership best practices.

Our upcoming webinar is scheduled for Tuesday, November 12, at 10:00 a.m.: AI in Auto - Navigating The Road Ahead With Innovation And Caution. You can register at https://coopsys.com/msada/.

The final webinar for 2024 will be on December 10, at 10 a.m.: What Is A CISO And Why Does My Dealership Need One?

The Veterans Day holiday, celebrated this year on Monday, November 11, is considered a restricted holiday. This means:

• An employee cannot be required to work.

• An employee cannot be punished or penalized for choosing not to work the day.

• If the dealership is going to be open prior to 1:00 p.m. on the day, a local permit is required.

• REMINDER: As of January 1, 2023, under state law, there is no holiday premium pay requirement. Non-exempt employees, if working the day, need to be paid at least the state minimum wage of $15 per hour for any hours worked the day.

• For employees who do not work the holiday, there is no legal requirement to provide a paid holiday. However, be sure to review your holiday policies in your Employee Handbook to determine whether you have previously agreed to paid holidays. If you have, you will need to follow your policies until they are revised.

The right to vote is the most essential right of our democratic system. This year, Election Day falls on Tuesday, November 5. All registered voters who do not vote by mail or vote early in-person will be able to vote in person on Election Day. Polling places across the Commonwealth will be open from 7:00 a.m. until 8:00 p.m. If you are in line to vote at the 8 p.m. closing time, you still must be allowed to cast your ballot. Voters who have already cast ballots by mail or during the early voting period will already be checked off on the voter list so they cannot vote again.

Under Massachusetts law (MGL Chapter 149, Section 178), an employer must give an employee up to two hours off to vote if the employee requests it. The employee does not have to be paid for this time but should be allowed a two-hour absence after the opening of the polls in the employee’s voting precinct.

The law specifically states: “No owner, superintendent or overseer in any manufacturing, mechanical or mercantile establishment shall employ or permit to be employed therein any person entitled to vote at an election, during the period of two hours after the opening of the polls in the voting precinct, ward or town in which such person is entitled to vote, if he shall make application for leave of absence during such period.”

This year’s Massachusetts ballot will include selections for U.S. president, senator, and representative in Congress, as well as state senator and representative, and various county offices.

Finally, what would a state election year be if we did not have to deal with the usual assortment of initiative petitions and ballot questions dealing with matters that the legislature did not take up? This year, there are five:

• Question #1: State Auditor’s authority to audit the Legislature;

• Question #2: Elimination of MCAS as high school graduation requirement;

• Question #3: Unionization for transportation network drivers;

• Question #4: Limited legalization and regulation of certain natural psychedelic substances;

• Question #5: Further regulating the minimum wage for tipped workers.

Many issues affecting our industry –government oversight of small businesses, economic policy and taxes, control of the Supreme Court, just to name a few – will depend on how all these national elections play out, whether we will have one party control the Congress and the White House or we will have a split government. The immediate and long-term futures of our dealership livelihoods could depend on the outcome.

S151

H331

H290

H329

S204

H270

H289

S150

H351

Sen Crighton Rep Hunt

Rep Finn

Rep Howitt

Sen O’Connor

Rep Chan

Rep Finn

Sen Crighton

Rep Lewis

Amendments to Ch. 93B, the auto dealer franchise law.

RTR law amendments to fix Model Year start date and consumer notice.

Creates process to appeal improperly issued Class 1 license.

Modernize on-line vehicle purchase process.

S199 Sen Moore Amends definition of heavy-duty trucks in RTR law.

S220 H400 Sen Velis Rep Walsh Open safety recalls notifications.

H354 Rep Linsky Allows an OEM to open a factoryowned store, without a dealer, if there is no same line-make dealer in the state.

(The so-called “Tesla Exemption.”)

Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into study.

Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into extension order.

Joint Committee on Consumer Protection held public hearing on July 17, 2023. H270 reported favorably on Jan. 25, 2024; sent to House Ways and Means.

Joint Committee on Consumer Protection held public hearing on July 17, 2023. H351 reported favorably on Jan. 25, 2024; sent to House Steering & Policy Committee; House ordered to third reading on 2/12/24.

SUPPORT Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into extension order.

SUPPORT Joint Committee on Consumer Protection held public hearing on July 17, 2023. Redraft H4277 reported favorably on January 25, 2024; sent to House Ways and Means.

OPPOSE Joint Committee on Consumer Protection held public hearing on July 17, 2023; placed into study.

S688

H1095

H1118

S639

H1121

H995

Sen Moore

Rep McMurtry

Rep Philips

Sen Feeney

Rep Puppolo

Rep Donahue

Creates process to increase the insurance reimbursed labor rate paid to auto body repairers.

Protects consumer choice in vehicle service contracts.

S2219 H3255 Sen Cronin Rep Arciero Eliminates initial state inspection for new vehicle.

Joint Committee on Financial Services held public hearing on October 3, 2023; reported redraft H4412 favorably and sent to House Ways and Means.

Joint Committee on Financial Services held public hearing on October 3, 2023; H995 reported favorably and sent to House Steering & Policy Committee.

SUPPORT Joint Committee on Transportation held public hearing on Jan. 24, 2024; placed into study.

H3348 Limit doc prep fee amounts. OPPOSE Joint Committee on Transportation held public hearing on Jan. 24, 2024; reported favorably and sent to House Ways and Means Committee. Rep Howitt

S2210

Sen Crighton

Sen Creem Rep Carey

Safety shutoff for keyless ignition technology.

Joint Committee on Transportation held public hearing on October 17, 2023; reported favorably.

S25 H60 Personal data privacy and security. OPPOSE Joint Committee on Advanced Information Technology, the Internet and Cybersecurity held public hearing on October 19, 2023. On 5/13/24, Committee reported redrafts S2770 and H4632 favorably; each sent to respective Ways and Means committee.

S227 Sen Finegold Mass. Info Privacy & Security Act. OPPOSE Joint Committee on Economic Development and Emerging Technologies held public hearing on October 19, 2023. Bill sent to AITIC Committee on November 2, 2023.

S171 H311 Sen Feeney Rep Gonzalez Protect consumers in auto transactions. OPPOSE Joint Committee on Consumer Protection held public hearing on July 17, 2023; reported S171 favorably on 1/25/24 and referred to Senate Ways and Means. SWM reported redraft S2736 favorably on 4/22/24. Senate engrossed on 4/25/24.

WHENEVER there is something to talk about that affects the entire nation, people find the best place to gather is in a place where their voice is best heard. Typically, that place is close to the seat of the federal government. For a few days in September, it was auto dealers that came to gather in Washington, D.C. to discuss the state of the industry and chart a path forward at NADA’s 49th annual Washington Conference and Congressional fly-in.

More than 400 NADA members and state dealer associations’ staff gathered at the Capital Hilton for the conference on September 16-18. The event also included Capitol Hill visits and a welcome reception at the Smithsonian’s Natural History Museum.

Chris Connolly has been attending the conference for over a decade, making sure the Members of Congress receive the dealers’ side of each pertinent issue. The importance of dealer input on public policy matters can never be underplayed.

“I have been to the Washington Conference with NADA year after year because it helps protect our biggest investment – our business and our employees,” Connolly said. “The easiest vote these people will make in a session are the ones that no one talks with them about. We have to meet with our delegation and talk to them about the issues that affect our dealerships and what it means for our employees.”

NADA kicked off the conference with the sole focus on Next Gen dealers, beginning with an evening reception on Monday, September 16, followed by a full slate of speakers and policy briefings on Tuesday morning, which focused on getting young, new attendees up-to-speed on NADA’s legislative priorities. After NADA’s legislative affairs team instructed the group of NextGen attendees on how to be successful advocates for the retail auto and truck industry, attendees put their new skills to the test by holding mock Congressional meetings.

“I was there, once again, as part of NADA’s Next Gen program which is specifically for aspiring dealers under 40,” said Bouchard of the Ron Bouchard Auto Stores, who was attending his fourth conference. “It was exciting to see both new and familiar faces at

This year our Massachusetts dealers were represented on Capitol Hill by MSADA Immediate Past President Chris Connolly; dealer Ray Butler; Next Gen dealers Chad Bouchard, Ruddy Brito, Richie and Vincent Mastria, and Brianna Butler, Ray’s daughter; and MSADA Executive Vice President and General Counsel Robert F. O’Koniewski.

this year’s Washington Conference. It felt like the combination of experience and new ideas from the dealer body made an impact on all of the legislators and their assistants as we continued to talk about ongoing issues as well as new headwinds in the political world that continue to make the automotive world for both dealers and their customers more difficult.”

“One of the biggest takeaways this time around was how much Washington overlooks the real-world impact of policies, especially when it comes to the automotive industry.”

This was the second consecutive year for Ruddy Brito, CEO of the Mastria Auto Group, who was also part of MSADA’s efforts to have next generation dealers more involved in these lobbying efforts.

Ruddy Brito CEO, Mastria Auto Group

“One of the biggest takeaways this time around was how much Washington overlooks the real-world impact of policies, especially when it comes to the automotive industry,” Brito stated. “The FTC’s Vehicle Shopping Rule, for instance, was pushed through without undergoing the mandatory rule-making process. These rules will add $24 billion in costs over the next 10 years, and none of us—dealers or consumers—were part of the conversation.”

“This highlights why it’s crucial for more dealers to get involved and tell their stories. Our customers deserve better, and we have to be part of the solution by making sure our voices are heard,” Brito continued. “There’s nothing like sitting face-to-face with lawmakers to share how these policies affect our businesses and the people we serve.”

NADA, as part of the festivities, always does an excellent job bringing in speakers to provide a full flavor of what is going on in the extremely insular world of D.C. politics. In order to set aside more time to visit the federal legislators at the Capitol, NADA this year streamlined its speaking program. This year’s crop of speakers included Rep. Cathy McMorris Rodgers (R-Washington), the chair of the House Energy and Commerce Committee; David Wasserman, senior election analyst for the Cook Political Report; and legislative briefings from NADA staff.

The key issues dealers focused on this year – as highlighted in last month’s Massachusetts Auto Dealer magazine – were Congressional efforts to defund the Federal Trade Commission’s Vehicle Shopping Rule; overturning the EPA’s new emission rules for cars and light-duty trucks with their de facto EV mandate; supporting passage of a bill to address catalytic converter thefts; and opposing so-called “right to repair” legislation.

Once the speeches and briefings were over, dealers were ready to spread the message on Capitol Hill. During MSADA’s two days of meetings in D.C., they met with Rep. William Keating (D-Bourne) and staff members for Reps. Lori Trahan (D-Westford), Jake Auchincloss (D-Newton), Jim McGovern (D-Worcester), Stephen Lynch (D-South Boston), Katherine Clark (D-Melrose), Seth Moulton (D-Salem), and Richard Neal (D-Springfield), and Sen. Ed Markey (D).

ly had not been exposed to the legislative machinations in Washington until this year’s conference.

“It was all very exhilarating being in our nation’s capital and being able to express our opinions and views on upcoming bills and legislative votes that will impact the automobile industry,” Ray Butler commented. “Being able to introduce my daughter, who is my successor, to the process and opportunities we have as dealers is of the utmost importance. I am hoping my daughter will be a big part of our efforts in the future years to come.”

Ray’s daughter, Brianna, certainly brought an invaluable and unique perspective to the group and the legislative meetings.

“This was my first experience lobbying at the Capitol advocating for the automotive industry. It was an eye-opening, invaluable, powerful experience,” Brianna Butler stated. “It has left me inspired and even more committed to being part of our industry’s advocacy efforts. Especially being a woman in the industry, I’ve always believed in the importance of being a voice for the automotive industry. NextGen is very important to me, and it was great to meet new people and see my fellow NADA Academy Alumni enthusiastically being part of this process as the future voices for our industry.”

The November election will determine which parties will control the White House and the two chambers of Congress. As the nation looks ahead to see how and who will be confronting such matters as the economy, immigration, and foreign affairs, those in dealer world cannot rest –NADA, MSADA, and other state dealer associations must remain on top of the activities in Washington.

First-time attendees, and Next Gen members, Richie and Vinnie Mastria, enjoyed the chance to be part of a process everyone hears about but not many take advantage of.

“This was my first experience lobbying at the Capitol advocating for the automotive industry. It has left me inspired and even more committed to being part of our industry’s advocacy effort, especially being a woman in the industry.”

“Attending the conference this year was a real eye-opener. It made me realize just how vital our voice is in shaping policies,” Richie said. “Experiencing the process first-hand revealed that, while many laws are written with good intentions, they often have unintended consequences that impact both customers and dealers negatively.”

–Brianna Butler

Vincent concurred with his brother. “That’s why it’s crucial to speak up, share our insights, and work together to protect the interests of our customers and businesses, striving toward a common goal—delivering the most efficient and customer-focused experience possible,” he said.

Ray Butler, an established dealer in Worcester County, previous-

“A substantial part of what MSADA does for our members is to stay in touch with our U.S. senators and representatives so that they know that what they are doing, or not doing, has an impact back home at our members’ dealerships,” said MSADA Executive Vice President Robert O’Koniewski. “We can never stop putting effort into making sure our representatives know who we are, what we do, and how vital our contribution is to their districts and our communities. Our engagement cannot be sporadic. Building relationships through constant communications can help to move policies in certain directions at times. Vigilance, education, and dealers’ active participation are pillars in our lobbying efforts throughout the year.”

As government becomes more involved in the auto industry, the future of dealers’ advocacy is in good hands with Massachusetts’s Next Gen dealers.

ADAMS

The Berkshire Eagle

Haddad Auto Group has purchased the two remaining GMC dealerships in Berkshire County and, at the direction of the automaker, will operate only one of those locations while offering the employees of both businesses jobs within the organization.

In the transaction, Haddad Auto Group purchased McAndrews-King GMC in Adams and Berkshire GMC in Sheffield.

McAndrews-King GMC, now Haddad GMC, will stay open with all of its employees. Berkshire GMC in Sheffield has closed its doors, and its nine employees have switched to jobs at either one of Haddad’s four franchise locations in Berkshire County or other dealerships and repair shops.

“It was part of the agreement with GMC that I buy both [dealerships] because they only want to have one dealership in the county,” President and CEO of Haddad Auto Group George Haddad said.

To Haddad, adding domestically-manufactured GMC vehicles to his existing portfolio of all foreign-made brands — Hyundai, Subaru, and Toyota — makes sense. GMC makes heavier duty trucks than his current franchises, which Haddad says are in demand.

“We’ve got a lot of customers who want those, so it’s a natural fit,” he said.

Haddad chose to keep the northern location open over the southern location because it has more space and a full showroom.

“General Motors was fine with staying here because it was a full dealership,” he said. “The one in Sheffield, they [were] working out of a trailer.”

For Berkshire GMC, the decision to sell came at a time its owner, Brian Palmer, had decided to retire from the business, while McAndrews-King President Dan Maloney saw a sale as a way to keep the dealership open under new ownership.

Haddad, Maloney, and Palmer signed the deal on July 31 and Maloney started answering the phone with “Haddad GMC” the next day.

After 50 years answering the phone as “McAndrews-King,” the change will be hard to get used to, Maloney said. But he felt comfortable moving forward with the deal.

“The more time I spent with George Haddad, it started to seem like a comfortable fit for everyone,” Maloney said.

Haddad said that his company offered employment at Haddad franchises to “pretty much everyone” who worked at Berkshire GMC. “Some of them took it, and some of them didn’t,” he said.

Brian Palmer took over the franchise from his father in 1996, 22 years after it first opened. The dealership already faced closing in 2009 when General Motors declared bankruptcy. Back then, GMC wanted to consolidate to one dealership in Berkshire County, but the Palmers convinced GMC to let them stay, Haddad said.

After nearly half a century in business, Palmer was satisfied closing his store location.

“I had reached retirement age, and I thought it was time to move on with my life,” Palmer said. “I would like to thank all our loyal customers over the years for their patronage and their friendship.”

Palmer anticipates that the store location in Sheffield will be leased or sold.

For Maloney, making the sale was a way to keep the McAndrews-King dealership and its 23 employees intact. The dealership dates back to 1973, when Rick King and Owen McAndrews came together when King was only 28 years old to open McAndrews-King Pontiac-Buick.

Of the dealership’s 51 years, Maloney has been around for 50. He walked into the store at 19 years old, looking for a job, and Larry Choquette, the then-service manager, took a chance on Maloney. Four years later Maloney became the service manager.

“It’s been an incredible dealership and I’ve just so thrilled that I’ve had a job that is something I’ve enjoyed doing for all these years,” he said.

Maloney doesn’t have a child interested in taking over the business — his daughters are happy with their non-auto industry careers. He wasn’t sure where the business would go after him, but he knew he didn’t want to sell to just anyone.

“I wanted someone who was a local buyer who understands Berkshire County,” he said. “Having somebody who knows the community and has name recognition seemed like a nice fit for everyone.”

Maloney will continue to work at the dealership under Haddad’s ownership.

“I’m not ready to retire and I’m still very happy working,” he said. “There’s a small group of people here, and they are like family to us.”

Haddad does not plan on making any major changes to how the former McAndrews-King GMC operates, but he does plan to advertise more and put out more inventory from the manufacturer on the lot.

“They’ve got a great reputation, and I just want to expand on it,” he said.

Haddad noted that, with the exception of Toyota, all other car brands in the county have only one dealership location.

Audi Norwell, part of Ray Ciccolo’s Village Automotive Group, recently achieved Audi Magna Society Elite status for 2023, Audi of America’s highest level of dealership recognition. Audi Norwell has earned Magna Society status every year since 2017; however, this is the third time since 2018 that Elite status has been achieved by the dealership, a special honor for superior achievement as the best of the best.

Audi of America Area Sales Manager Jorgen Weikert and Audi of America Area Director Rick Fuller recently paid a visit to Audi Norwell to congratulate Owner and President of Village Automotive Group Ray Ciccolo along with Audi Norwell General Manager Michael Gaughran on their accomplishment of once again earning the Audi Magna Elite Award for 2023.

“I am extremely proud of our team at Audi Norwell for receiving this prestigious honor from Audi of America for a third time,” said Ciccolo. “This honor is a testament to the team’s commitment to excellence and customer satisfaction, which is a top priority throughout Village Automotive Group.”

Audi Magna Society Elite status is awarded to Audi Dealers who have outperformed their competition, exceeding customers’ expectations, and attaining the highest level of overall business performance. Each year 17 dealers across the country receive Elite status, which is based on accomplishing objectives set by Audi of America based on performance and customer satisfaction. Audi Norwell was recognized for its ability to go the extra mile in ensuring customer satisfaction and reflects a true understanding of the Audi brand and collective mission.

“This honor is truly a team achievement,” said Gaughran. “The award recognizes dealerships that display continuity throughout the operation and to achieve Elite Status in three of the last five years shows the experience and commitment the Audi Norwell team has to always surpass the expectations of our customers.”

More than 5,000 dealerships across the U.S. recently signed an open letter urging federal and state officials to relax emissions regulations and electric vehicle mandates. The dealerships are concerned about the EPA’s emissions rules

and certain states’ EV sales requirements. The flattening of EV sales growth has left the vehicles piling up on their lots, they wrote. If officials do not adjust the regulations, customers could end up competing for a smaller inventory of gasoline-powered vehicles, the dealerships added.

It is the third in a series of letters signed by thousands of dealerships. They addressed the original letter to President Joe Biden in November 2023 and wrote a follow-up letter in early 2024. The stores are now calling on officials from both parties to amend EV policy following elections this November.

The regulations “are out of touch with the state of EV technology, charging infrastructure, and most of all, the American consumer,” the letter said.

American consumers today are less likely to buy an EV than they were last year, according to the EY Mobility Consumer Index released September 9. In a survey of roughly 1,500 Americans, just 34 percent of those planning to purchase a new vehicle in the next two years said they would buy an EV, down from 48 percent in 2023.

Dealerships are seeing customers’ declining interest in EVs on the ground, said Mickey Anderson, president of Baxter Auto Group in Omaha, Nebraska. Consumers say they are concerned about affordability and access to charging, he said.

They also “worry about battery replacement costs, performance in cold weather, higher insurance costs, unpredictable electricity charging rates, and plummeting resale values,” the letter added.

In light of those concerns, many customers today want to find the right gasoline-powered or even hybrid vehicle option, Anderson said.

Franchised new-vehicle dealerships in the U.S. have committed to invest billions in electrification efforts such as training, facilities, and inventory, said Jared Allen, a spokesperson for the National Automobile Dealers Association. Dealerships will continue to promote EVs, but regulations are out of step with consumer demand, Allen said.

“The charging infrastructure is not ready, and the current incentives are not sufficient,” he said. “And high EV prices will price out millions of consumers, particularly low-income Americans, from the new-car market.”

If state and federal regulations push automakers to make more EVs than consumers will buy, then increased competition could drive up the price of gasoline-powered vehicles, the letter said.

More expensive gasoline vehicles could mean more consumers “will hold on to their older, less fuel-efficient cars,” the letter said.

“Which is exactly the wrong direction for the environment, automotive jobs, and the economy,” it said.

Thousands of dealerships predicted in their first letter that consumer demand would not meet the expectations of regulations, Anderson said. Now, those same dealerships are seeing that reality play out in their stores, he said.

“There is no question that there is a massive disconnect between what American consumers really need to have reliable, dependable transportation,” Anderson said, “and the cars that the EPA is requiring manufacturers to build.”

Bloomberg News

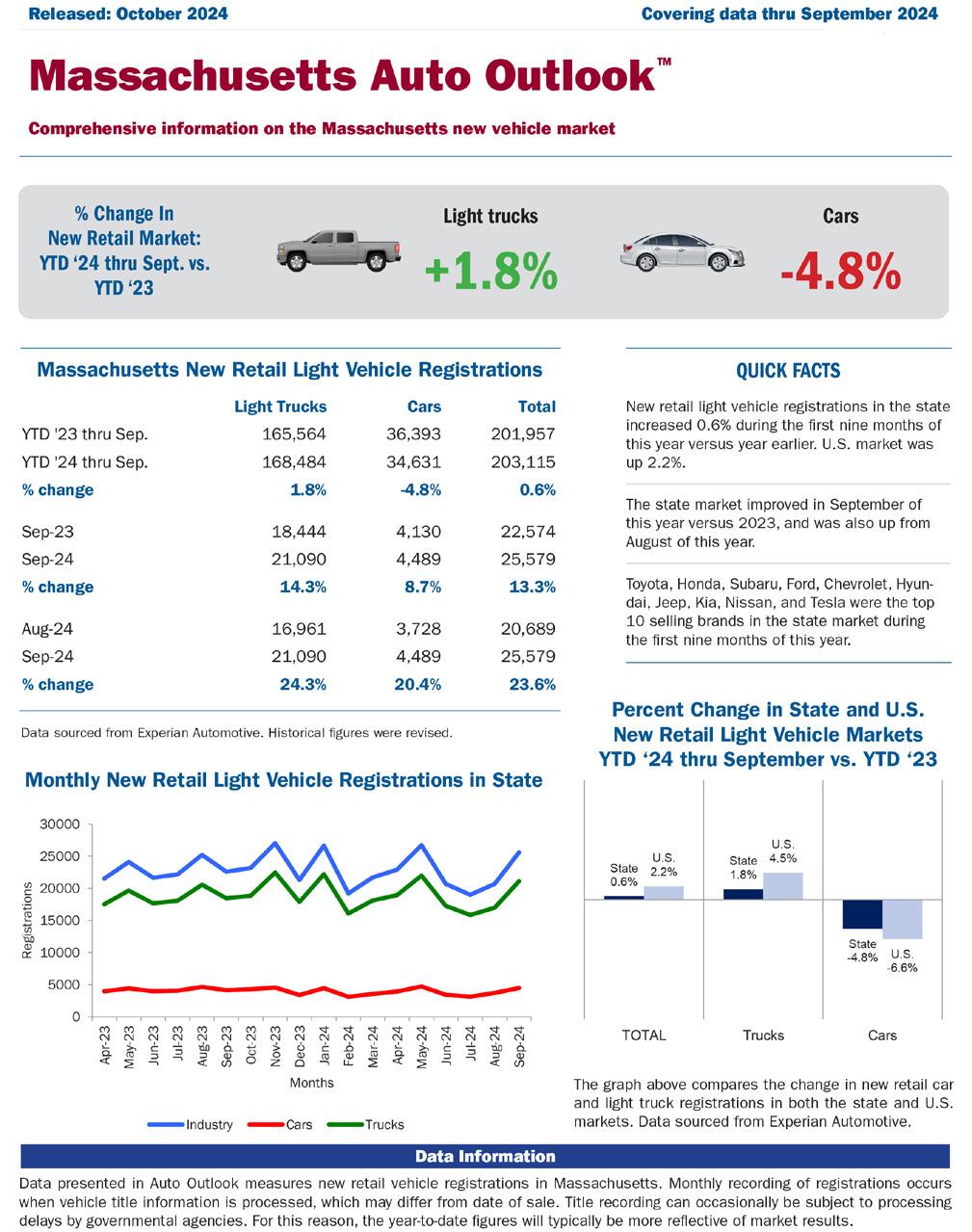

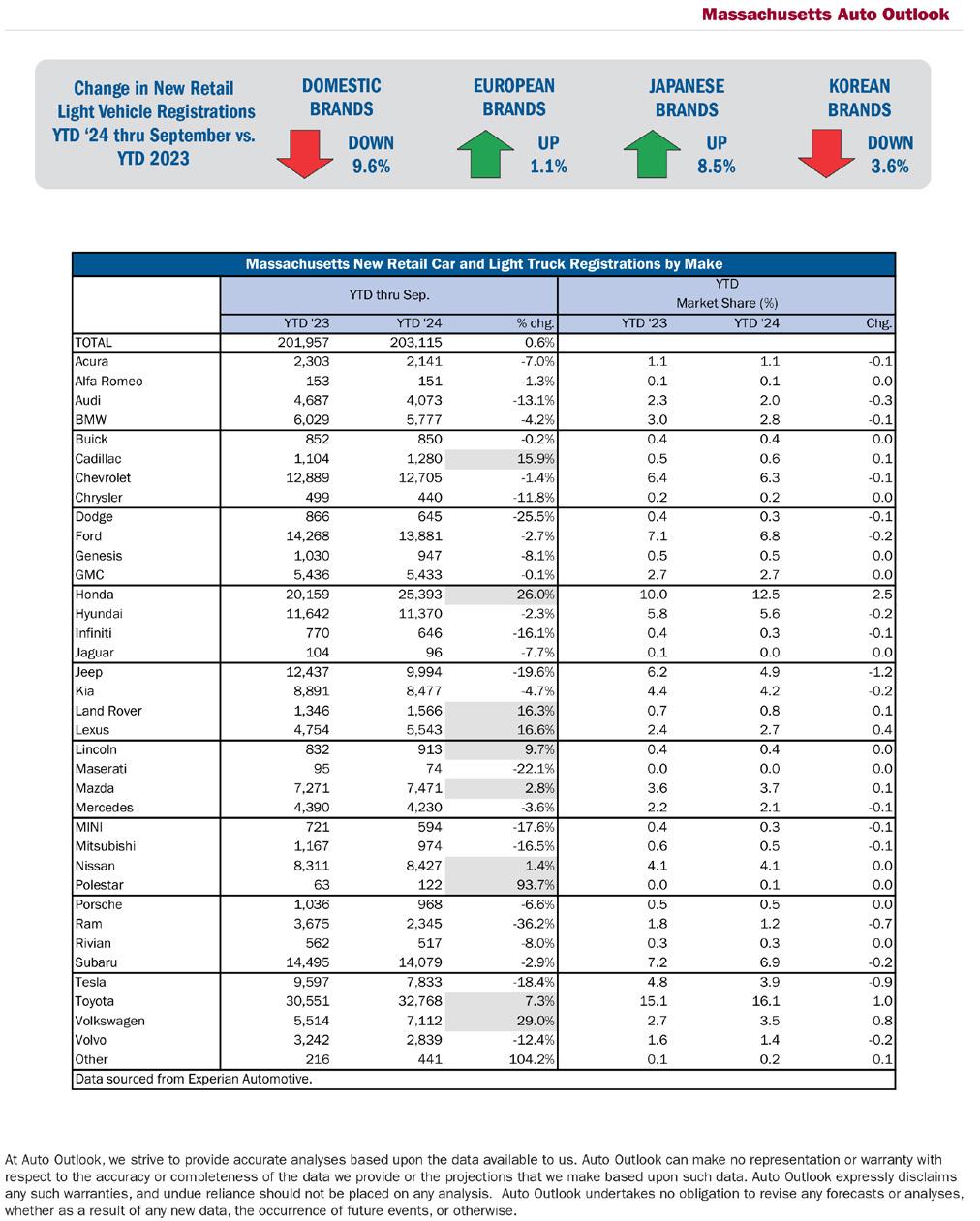

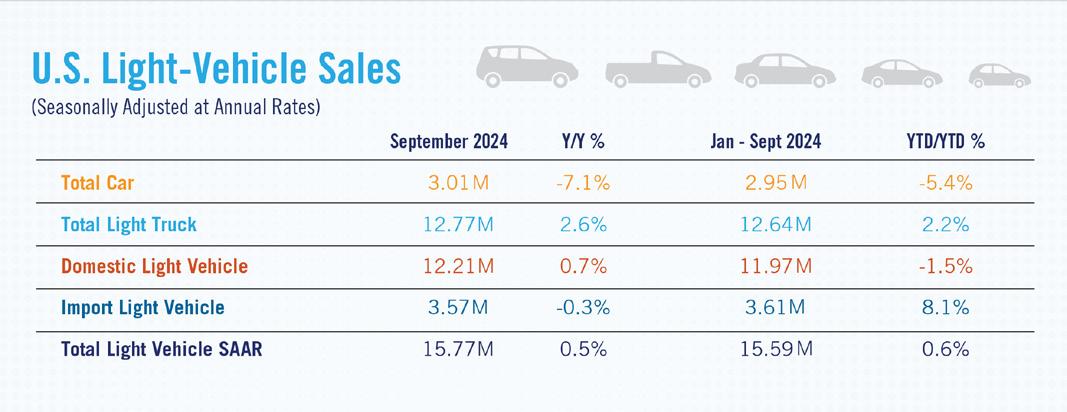

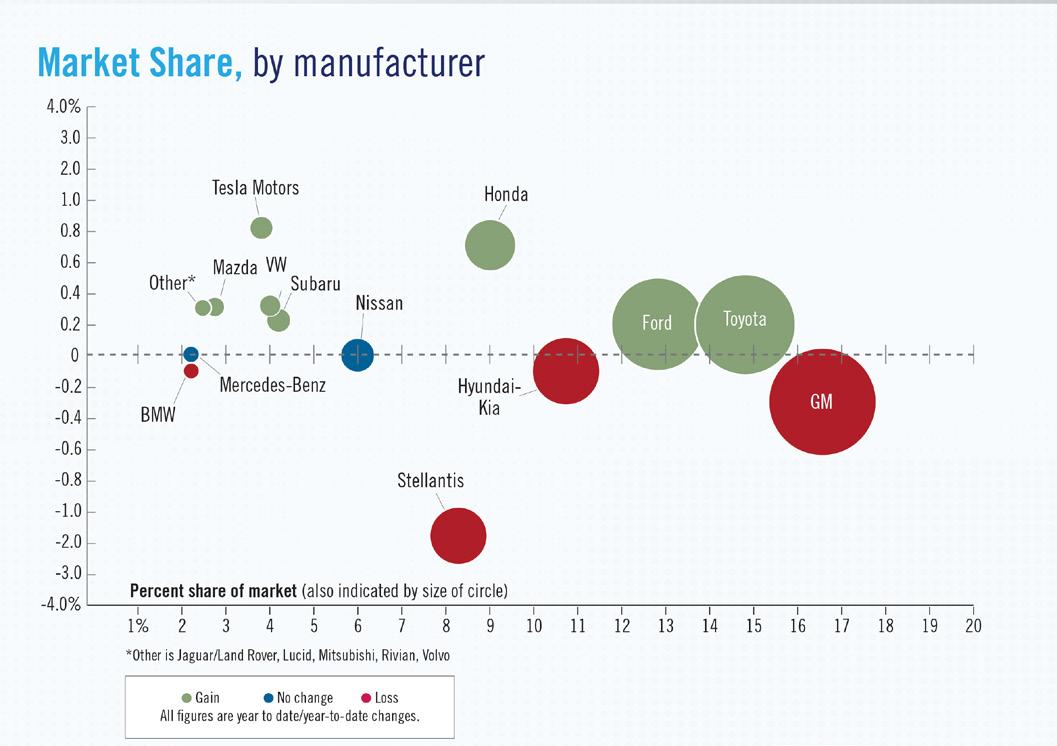

Sluggish car sales are expected to pick up later this year once the US presidential election is over and the Fed’s recent reversal on interest rates starts to ease financing costs.

Many car shoppers stayed on the sidelines in the most recent quarter, even with more discounts being offered and improved selection in showrooms. Americans bought an estimated 3.9 million cars and trucks in the third quarter, a 2.3% drop from a year earlier and off 4.7% from the second quarter, according to automotive research firm Edmunds.com Inc. Industry analysts attribute that to a more prevalent wait-and-see attitude about lower rates and the outcome of the race between Vice President Kamala Harris and former President Donald Trump, which could impact tax rates and subsidies for electric vehicles.

“Consumers don’t yet feel good about the future and confident that now is a good time to spend on big-ticket items,” Jonathan Smoke, chief economist at research firm Cox Automotive, said on a September 25 call with reporters. “But that’s within reach for the first time in a long time.”

One-third of car buyers said they are holding off on a new vehicle purchase until after the polls close on November 5, based on the results of an August consumer survey by Edmunds. The Federal Reserve Bank’s half percentage point reduction in benchmark federal funds on September 18 — and possible additional half-point cut by year’s end — will take some time to translate into lower car loan rates, which average 7.1% on new cars and 11.3% on used cars.

But the pace of sales is expected to pick up by year’s end, as auto loan rates recede and the next occupant of the White House is determined. Americans will buy 15.7 million cars and trucks this year, up 1.3% from last year’s 15.5 million, Cox has projected. That will help keep vehicles rolling off dealer lots and out of factories, especially high-demand models such as gas-electric hybrids and mid-sized SUVs and trucks.

At an average selling price of $47,870, up almost 20% since early 2020, Cox said many consumers still find new cars too pricey. That’s despite growing showroom inventory and a softening of manufacturer’s suggested retail prices, with average Monroney stickers down 1.7% from a year ago. Monthly payments on car loans still average $767, up 17% from four years ago, according to Cox.

“Hyperinflation has made these cars really, really expensive,” Rhett Ricart, a Columbus, Ohio, auto dealer of Ford, GM, Hyundai, and other auto brands, said in an interview. “And by increasing the technology content and the safety content on these vehicles, we packed on a lot of expenses.”

The closely watched annual sales rate fell to 15.6 million cars

in the quarter ended September 30, Cox estimated, down slightly from year earlier and well off the pre-pandemic pace of 17 million vehicles sold a year.

“New vehicle sales remain stuck in neutral,” said Chris Hopson, principal analyst at researcher S&P Global Mobility. “Consumers in the market continue to be pressured by high interest rates and slow-to-recede vehicle prices, which are translating into high monthly payments.”

For the month of September, however, vehicle sales rose slightly to an annualized rate of 15.88 million, based on the consensus of five market researchers, up from a 15.8 million pace a year earlier. While incentive spending on discounts has risen, auto manufacturers have kept that in check by showing restraint on production. So car buyers aren’t being offered the blowout deals they once enjoyed when sales softened.

“Automakers aren’t under as much pressure to move the metal at any cost,” said Jessica Caldwell, head of insights for Edmunds. “No one has started an incentives war in which other automakers feel obligated to join in to protect their market share.”

On October 3, U.S. dock workers and port operators reached a tentative deal that immediately ended a crippling three-day strike that shut down shipping on the U.S. East Coast and Gulf Coast, the two sides said.

The tentative agreement is for a wage hike of around 62% over six years, two sources familiar with the matter told Reuters, including a worker on the picket line who heard the announcement. That would raise average wages to about $63 an hour from $39 an hour over the life of the contract. The International Longshoremen’s Association (ILA) workers union had been seeking a 77% raise while the employer group - United States Maritime Alliance (USMX) - had previously raised its offer to a nearly 50% hike.

The deal ends the biggest work stoppage of its kind in nearly half a century, which blocked unloading of container ships from Maine to Texas and threatened shortages of everything from bananas to auto parts, triggering a backlog of anchored ships outside major ports. The union and the port operators said in a statement that they would extend their master contract until January 15, 2025, to return to the bargaining table to negotiate all outstanding issues.

“Effective immediately, all current job actions will cease, and all work covered by the Master Contract will resume,” the statement said.

Among key issues that remain unresolved is automation that workers say will lead to job losses. Union boss Harold Daggett said previously that employers such as container ship operator

Maersk and its APM Terminals North America had not agreed to demands to stop port automation projects that threaten jobs.

U.S. President Joe Biden’s administration had sided with the union, putting pressure on the port employers to raise their offer to secure a deal and citing the shipping industry’s bumper profits since the COVID-19 pandemic.

The tentative deal “represents critical progress towards a strong contract,” Biden said. “Collective bargaining works,” he added.

His administration has repeatedly resisted calls from business trade groups and Republican lawmakers to use federal powers to halt the strike - a move that would undermine Democratic support among unions ahead of the November 5 presidential election.

The White House had been heavily involved in talks to get a deal, sources said. After days of talks, White House Chief of Staff Jeff Zients convened a 5:30 a.m. virtual meeting on October 3 with the CEOs of ocean carriers and impressed upon them the need to reopen the ports to speed hurricane recovery efforts, according to a source briefed on the events. The port strike hit just as southeastern states were struggling for supplies following a deadly hurricane.

Top White House economic adviser Lael Brainard told the carriers at the meeting they needed a new offer to end the strike and asked them to put a new offer on the table. By midday the shippers had agreed to make a new higher offer. Acting Secretary of Labor Julie Su told the carriers they could get the union to the table and leaders would agree to extend the contract, if the new

offer was higher. She was in New Jersey to meet with union leaders to secure their agreement, the sources said.

On October 1, the ILA launched the strike by 45,000 port workers, its first major work stoppage since 1977, after talks for a new six-year contract broke down. At least 45 container vessels that have been unable to unload were anchored outside the strike-hit East Coast and Gulf Coast ports by the next day, up from just three before the strike began, according to Everstream Analytics.

JP Morgan analysts have said the strike would cost the U.S. economy around $5 billion per day. The strike affected 36 portsincluding New York, Baltimore and Houston - that handle a range of containerized goods.

“The decision to end the current strike and allow the East and Gulf coast ports to reopen is good news for the nation’s economy,” National Retail Federation said in a statement. “The sooner they reach a (final) deal, the better for all American families.”

National Association of Manufacturers CEO Jay Timmons said “cooler heads have prevailed and the ports will reopen” and called it “a victory for all parties involved - preserving jobs, safeguarding supply chains and preventing further economic disruptions.”

Economists have said the port closures would not initially raise consumer prices because companies had accelerated shipments in recent months of key goods. However, a prolonged stoppage would have eventually filtered through, with food prices likely to react first, according to Morgan Stanley economists.

By Barton Haag CPA, Albin Randall & Bennett

Protecting your business is critical, especially in the face of natural disasters such as hurricanes, floods, wildfires, and tornadoes. According to the Federal Emergency Management Agency, about a quarter of businesses are unable to re-open after being hit by a major disaster. Potential costs can include repairing damaged buildings, replacing lost inventory, restoring business operations, and other increased expenses during recovery periods.

Auto dealerships face unique challenges due to their large, valuable, and highly vulnerable inventories of vehicles. To safeguard your dealership and ensure a quicker recovery, a well-rounded disaster preparedness plan focused on financial readiness is essential. This plan should involve risk assessment, mitigation strategies, financial planning, and recovery actions tailored to the specific needs of automobile dealerships.

Start by identifying the natural disasters most likely to affect your region. Tools such as FEMA’s National Risk Index or NOAA’s local weather forecasts can help you evaluate potential hazards and guide your planning. This risk assessment will inform the strategies you implement to protect your facilities and inventory.

For your facilities, consider reinforcing buildings, adding flood barriers, or investing in backup generators to minimize property damage and reduce operational downtime. When it comes to your vehicle inventory, explore options like moving cars to higher ground, raising them on platforms, or pre-

paring to temporarily relocate them to safer locations when severe weather is anticipated.

Comprehensive insurance coverage is another crucial element of your disaster plan. Review your policies to ensure that you have proper protection, including coverage for flood, earthquake, and hurricane damage, as well as business interruption. Gaps in your coverage could leave you vulnerable to significant financial losses in the aftermath of a natural disaster.

Alongside robust insurance, it is prudent to establish a financial safety net. This can take the form of an emergency savings fund with several months’ worth of operating expenses or a pre-approved line of credit. These resources can help you cover urgent operational costs, pay employees, and begin repair work before other sources of aid become available.

In addition to physical and financial preparations, employee safety and preparedness are paramount. Create a clear disaster response plan that includes procedures for employee evacuation, emergency communication, and securing the facility. Regularly train your staff on these protocols and maintain up-to-date contacts for key personnel, insurance agents, and emergency services. This will help streamline your response and recovery efforts when disaster strikes.

Because of the highly valuable inventory involved, automobile dealerships face unique challenges that set them apart from many other businesses and require specific considerations when faced with disaster. Persistent maintenance of detailed records of your vehicle inventory should include photographs, serial numbers, and locations. Storing this crucial data securely offsite or in the cloud can ensure that it is not lost due to physical damage at your dealership. Additionally, establish pre-arranged agree-

ments with logistics companies to quickly relocate vehicles to safer areas before a disaster, which can significantly minimize damage to your inventory.

Be mindful of the increased risk of theft and fraud during natural disasters. Ensure that your dealership’s security system is robust and capable of functioning even during power outages, deterring potential looters. Additionally, be cautious of fraudulent schemes involving the sale of damaged vehicles as undamaged in the aftermath of a disaster.

Several resources are available to help dealerships financially prepare for and recover from natural emergencies. The Small Business Administration offers low-interest disaster loans, including funding for mitigation projects. The National Automobile Dealers Association also provides financial assistance to dealership employees affected by these events. Furthermore, FEMA and state-level programs may offer rebuilding support, temporary relocation services, tax relief, or grant programs to aid in your recovery efforts. Knowing what programs are available, which apply to your specific circumstances, and how to access these programs can be a difference maker at a critical juncture for your business.

By establishing a comprehensive disaster preparedness plan that addresses the unique needs of automobile dealerships, you can mitigate the impact of natural emergencies and ensure the continued success of your business. With the right financial safeguards and recovery strategies in place, you will be better equipped to protect your dealership, employees, and future revenue when disaster strikes. Consider consulting with a financial advisor who specializes in risk mitigation for automobile dealerships to help you create a tailored strategy. Please contact me or one of our Dealership Services team members for more information.

By Jeff Caruso

CPA, Partner at Withum

In a letter to the French scientist JeanBaptiste Leroy in 1789, Benjamin Franklin wrote, “Our new Constitution is now established and has an appearance that promises permanency, but in this world, nothing can be said to be certain, except death and taxes.” The Constitution indeed has changed over the years through amendments and judicial interpretations. Still, the fact remains the only certainties we have are death and taxes.

We are constantly hearing about new tax proposals in the media. So, while we will always have taxes, we are often left with the uncertainty of what the tax landscape actually will look like down the road. This always is exacerbated in a presidential election year. Even once the Oval Office is filled and the new Congress is established, where the “new” tax code will land is still in flux until it is not. We think that, if either party takes control, there will be sweeping tax reform. If the parties controlling Congress and the Presidency are split, we could end up with compromised legislation.

In any operational or long-term investment decision, you have to consider taxes; however, they should not be the only driver of the business decision. Does this expenditure help my business become more profitable? Should I sell this investment because I have maximized my expected return and could utilize the net proceeds for other investments? Should I implement my succession plan? What assets have a high probability of appreciation over the years?

Let us focus on what we do know with absolute certainty today about taxes. Absent any law changes, when the clock

strikes midnight on December 31, 2025, tax liabilities will increase for many business owners, and the amount of wealth that can be transferred tax-free will change dramatically due to expiring provisions of the Tax Cuts and Jobs Act. While there are several provisions that sunset, we will focus on a few key ones that will have the most significant impact.

The top tax rate for individual taxes will revert to 39.6% from 37%, and all rates and brackets will revert back to the 2017 amounts adjusted for inflation. This, coupled with the expiration of the qualified business income deduction of 20%, could raise a taxpayer’s effective tax rate by 10%. For example, taxable income of $1,000,000 from a passthrough entity for an individual in the highest tax bracket will see an increase of taxes of about $100,000.

This does not account for the impact of expiring bonus depreciation and interest expense limitations that will drive up the taxable income. Bonus depreciation has been declining by 20% each year and will be zero for property placed in service in 2027 (60% in 2024 and 40% in 2025).

The typical year-end tax planning point is to defer income and accelerate expenses where possible. However, coming into 2025, it may make sense to do the opposite and pay some tax at the “lower” rates. Place extra scrutiny on year-end accruals and lower cost or market inventory adjustments. Rather than deferring compensation, it may make sense to take that compensation now.

Tax planning and determining the timing of estimated tax payments will be essential to manage cash flow as there will be significant shifts in income taxes even when book income might remain in line with previous years.

With estate and gift taxes, the TCJA doubled the exemption from 2018 to 2025. For 2024, it is $13,610,000 per spouse. In 2026, it reverts to roughly $6,000,000, adjusted for inflation per spouse. Keep in mind that many states have separate exemption amounts. The Massachusetts exemption is

currently $2,000,000. Estates exceeding that amount are subject to state estate taxes. There is no clawback provision for those who gift before the sunset but pass after the sunset. Also, a donor cannot use part of his or her exemption now and preserve the balance for later use. If you are married, consider having one spouse make a large gift to utilize his or her exemption to get “at least one bite of the apple.”

With an appropriate valuation of assets completed, the value of the transferred assets can be discounted by the application of well-established factors. The amount of assets that can be transferred via the increased exemption amount is expanded substantially. Common discount factors include lack of marketability, lack of control, and restrictions on subsequent transfers. Despite repeated threats of the “loophole closing,” valuation discounts withstand IRS scrutiny.

Leveraging transfers through valuation discounts provides opportunities to transfer undivided partial interests in real estate and family businesses, including recapitalization of voting and non-voting stock. Focusing on assets expected to appreciate significantly in the future allows growth to occur outside of your taxable estate.

If you have been considering transferring wealth, this process should absolutely start now. As we approach the end of 2025, the professionals involved with valuing assets, preparing the appropriate documents, and filing the appropriate tax returns will be increasingly busy impacting turnaround times and the ability to complete it all on time.

As we approach significant shifts in tax legislation, particularly with the sunset of critical provisions of the Tax Cuts and Jobs Act, business owners and individuals alike must stay informed and proactive. Strategic tax planning, timely decisions, and leveraging available exemptions and deductions can help mitigate the impact of these changes. By focusing on what we can control and preparing for what lies ahead, we can navigate the uncertainties of the tax landscape with greater confidence and clarity.

There are over 1,500 attorneys in the United State who focus on legal actions against car dealers.

Who reviews your F&I documents for legal or regulatory changes?

What if your dealership had access to a complete suite of documents needed in F&I?

Only the LAW F&I Library™ provides:

A complete set of state-specific F&I documents in both pre-printed and electronic formats.

An industry leading team of in-house and outside legal resources reviewing forms for legally required and best practice updates.

A trained team of compliance consultants who can work with you to manage your compliance risks.

By Tom Vangel, Jamie Radke, and Lindsey McComber of Murtha Cullina LLP