The start of a new year, as we come o a season of over consumption, is the ideal time to harness those feelings of guilty excess and summon the resolve to lighten up. If we are ever going to cut through the clutter that has accumulated in our closets, drawers, cupboards and garages, this is the time. Think of it as colonoscopy prep for your house.

I know it’s no fun. As I sort through my own home, I have a whole arsenal of excuses to avoid letting go of what should go. To fuel my momentum, I ran my top 10 excuses for not letting go by organizing expert Kim Krogh, owner of Elephant Organizing, of Orlando, and asked her to bust through my resistance.

“I’ve heard every one of these excuses,” she con rmed. Then cut through them one by one.

1. But I might need it someday.

How long has it been since you wore or used it? Five years? 10? If it’s been a long time, chances are you don’t and won’t need it. In the unlikely event you will, ask what your price threshold to replace it is. What dollar amount would you tolerate paying in the future to buy it again $10, $50, $100? If you can replace it for under your pain point, let it go. Chances are also good if you really need that never-used juicer, you can borrow it from a friend.

2. But so and so gave it to me.

A gi is yours to do with what you want. If the only reason you’re keeping something that you don’t like or use is because it was a gi , then it’s just taking up space. Regi , toss, donate, or otherwise pass it on. “You

Marni Jameson At Home

Photo credit Aleutie for Dreamstime

Find the Zen of decluttering this year by busting through your excuses for clinging.

have my permission to let go along with the needless guilt,” Krogh said.

3. But it was mom’s … … or another loved one’s. “These are loaded items,” said Krogh, who confesses she struggles with them, too. If you nd yourself saying, “I don’t really need this item, but it came from someone important to me,” then ask what good it’s doing buried in a closet or under a bed?

You’re not honoring your mother’s wedding dress or your grandma’s mink stole if it’s sitting in a box. Consider repurposing items. Make the wedding dress into a pillow or a skirt, interspersing lace with denim. Or donate them. Krogh had been dragging around vintage clothes circa early 1900 that belonged to her grandmother. She nally donated them to a high school theater department that needed costumes. “Now grandma’s clothes live on on stage.”

4. But it was expensive. So? That doesn’t mean it’s worth much now. Lots of people believe their China, crystal, oriental rugs, chandeliers “all of which I have and love,” Krogh said, are worth more than they are, but millennials don’t want that stu .

To con rm true market value of an item, look up “sold” (not listed) prices of similar items online in the used marketplace. If it is worth it to you to try to sell, then nd an avenue to sell it — and sell it. The quickest place is through an auction house, estate sale or consignment store. Take a percentage and be done with it. Don’t let stu you don’t need or use take up space just because you think

2

it has value.

5. But I want it to go into good hands. This is a lazy excuse. Are you really going to vet potential buyers? By waiting for that perfect recipient, you’ve created an unnecessary hurdle. Let the item go and nd its place in the world.

6. But my kids might want it.

“Uhh, probably not,” Krogh said. If you think they might want something, ask them in a clear, nonmanipulative way. Tell them you want to get rid of some things, but you don’t want to get rid of anything they want. Assure them they will not hurt your feelings. If they want something and they have their own homes, give them a deadline to get it or you’ll donate it. Unless they’re still in school, and not on their own, don’t become their storage unit.

7. But what if I regret letting something go?

Although Krogh hasn’t met anyone in her 15-plus years of organizing who has felt remorse from letting go, if you change your mind a er a piece is gone for good, the world will not come to an end, she assured. Moreover, it’s probably gone to someone who appreciates it.

8. But I can deal with it later.

Decisions delayed never get made, and by deciding not to decide, you have made a decision. Delaying decisions is the reason you’re in the pickle you’re in. Wouldn’t you rather decide the fate of these items than burden your kids or spouse with them?

9. But, what’s the harm in keeping it?

Space is nite. “I can

organize all day long, but I can’t make more space,” Krogh said. If you don’t create a habit of regularly letting go, your things will just keep piling up. Go on Zillow and nd out the square-foot value of your home. For instance, a 2,000 square-foot house worth $400,000, has a squarefoot value of $200. Is this how much you want to pay to store that chocolate fountain you never use or that 20-year-old set of golf clubs?

10. But it’s irreplaceable?

The hardest items to part with are those that have sentimental value, particularly heirlooms. “We can’t keep everything. Start there,” said Krogh, who gradually downsized her parents from a 5,000-square-foot home into assisted living. Ask family members if they want anything. Then make executive decisions about what can go. “I can’t keep it all and don’t want it all,” she said. Realism needs to surpass sentiment.

“As an organizer, I’m not a minimalist,” Krogh said, as we wound down our lively back and forth. “I am a normal person, but I know everything in my house, and whenever any item is old or tired or not useful it goes.”

May the force be with you. And may you have a clutter-free New Year.

Marni Jameson is the awardwinning author of seven books, including “Rightsize Today to Create Your Best Life Tomorrow,” “What to Do With Everything You Own to Leave the Legacy You Want” and “Downsizing the Family Home.” You may reach her at marnijameson.com.

Get your FREE Information Kit

Scheduling an annual insurance conversation with your insurance agent gives you the opportunity to ask questions about your home coverage, as well as ensure that all your vehicles are adequately covered - and new drivers are added to your coverage.

During your annual check, your agent can help you estimate the replacement cost of your home. While the amount of coverage you select is ultimately your choice, your agent can explain your options so you’ll make an informed decision based on the amount of coverage to rebuild if necessary. This is also a good time to ensure that you’ve told your agent about changes to your home that may impact your coverage needs, such as additions or remodeling.

It’s critical to understand the di erence between the market value of your home and the replacement cost: Market value: the amount a buyer would pay for your home, including the land, regardless of how much it would cost to rebuild the home.

Replacement cost: the rebuilding cost necessary to replace your entire home.

Insurance agents recommend purchasing an amount of coverage at least equal to the estimated replacement cost, but the choice is yours. To determine the most accurate current replacement cost for your home, you could ask if a replacement cost estimate is available during a home appraisal, or consult a local builders association or reputable builder for an estimate. Building contractors or professional replacement cost appraisers are good sources for determining the estimated replacement cost of your home.

When you upgrade or improve your home, you may need to increase your home’s estimated replacement

All real estate advertising in this newspaper is subject to the federal Fair Housing Act which makes it illegal to advertise “any preference, limitation or discrimination based on race, color, religion, sex, physical handicap, familial status or national origin, or an intention to make any such preferences, limitation or discrimination.” California also extends protection based on age and marital status. The Mountain Democrat makes every effort to comply with these federal and state regulations. We ask your assistance in maintaining an acceptable standard of advertising. While they may seem inconvenient at times, these laws are written to protect you, our readers and advertisers, as well as ourselves. This newspaper will not knowingly accept any advertising for real estate which is in violation of the law. Our readers are hereby informed that all dwellings advertised in this paper are available on an equal opportunity basis. For further information, you can call the Dept. of Fair Employment & Housing at (916) 445-9918 or the State Dept. of Consumer Affairs at (800) 344-9940.Note: Rental ads that contain the phrase “Single Occupancy” refer only to the physical characteristics of the dwelling and are not intended to state a preference of either marital or familial status.

cost, which is another good reason to reevaluate this regularly. Replacement cost estimates are also in uenced by labor and materials costs that are subject to change, so keeping up with the current market conditions in your area and changing your home insurance coverage amount accordingly will help you maintain coverage that’s at least equal to 100% of your estimated replacement cost.

Since it’s impossible to predict what the exact cost will be to replace your home in the future, assessing this amount annually means you’ll be more likely to have enough coverage to account for unforeseen circumstances.

Why a home inventory is crucial

Before scheduling your annual insurance check, take a complete home inventory so your records are up to date. It’s easy to be unaware of how many belongings accumulate in your

home over time, which is why it’s key for homeowners to conduct a home and personal property inventory before a catastrophe or unexpected damage might occur. A home inventory is an excellent way to make sure you will be able to replace things in your home including furniture, home essentials, clothing and more.

Whether you live in an apartment or a house, a home inventory is an excellent way to help you make the best homeowners or renters insurance decisions. This will also expedite insurance claims in the event of the , damage or loss. While it may sound daunting, there are three ways to make your inventory, so choose the method that seems easiest to you.

Written inventory: List your belongings, including item descriptions (make, model and serial number, if applicable), value and purchase date. Create your list using a spreadsheet or ll out a home inventory checklist that’s ready to go, like a checklist

from State Farm Insurance. Gather documents like receipts or photos that support your inventory.

Digital inventory: If you have a smart phone, there are downloadable apps, some of them free, to help you make a digital inventory. Home inventory apps let you record a photo of each item along with its description, value and purchase date.

Visual record: You can use a visual record of your possessions to show proof of ownership with a video walk-through of your home, or through a series of photographs.

Another option is combining a couple of these methods, if that works best for you. Making an accurate, up-to-date record of your insurable assets will help you determine the right amount of insurance coverage you need. For additional tips and to help you get started, check out the blog “How to Create a Home Inventory” at StateFarm.com/simpleinsights.

2823 Coloma Street, Placerville

CHARMING VINTAGE VICTORIAN IN DOWNTOWN

Begin 2025 at 2823 Coloma Street in a charming Victorian era 2,900 square foot with the

suite on the entry level plus a detached garage with a gorgeous

located in the heart of historic downtown Placerville where you can enjoy live music, cuisine, museums and more! The Victorian has retained it’s vintage charm while sensibilities...the living, dining & kitchen spaces are light filled delights, a fenced friends & family, large bedrooms, well appointed bathrooms,gorgeous tiles and more. a tree house vibe sits above the detached garage and features soaring wood ceilings, charming windows and central HVAC. Don’t miss this opportunity to enjoy the history and all that Placerville & El Dorado County has to offer you and your loved ones MLS#224153693 $660,000

(4 1) 1908 1 224122028

$1,089,000 5085 Deerwood Dr 4 3 (2 1) 2743 3.24 224120653

$1,899,000 6275 Chablis Dr 5 5 (4 1) 4010 10.07 224121599

12701 Residential Homes

12702 Residential Homes el DoraDo, DiamonD sPrinGs

12707 Residential Homes mosQuito, sWansboro

12801 Residential Homes

Camino, CeDar Grove

$470,000

$475,000 2873 Camino Heights Dr 3 2 (2 0) 1454 0.22 224127933

$479,900

$489,900 5320 Andrews Ln

3 (3 0) 2214 1.01 224126807

$499,000 2682 Cresta Verde Dr 4 2 (2 0) 1560 1.41 224083425

$549,000 3080 Carson Rd 3 2 (2 0) 2068 1.06 224075385

$585,000 3188 Verde Robles Dr 3 2 (2 0) 2246 0.75 224152322

$699,900

$725,000

$745,000 2345 Dutchman Dr 4 4 (4 0) 3089 5 224092917

$775,000 3287 Vista Del Mundo 4 4 (2 2) 2612 0.63 224133622

$775,000 4387 Moss Ln 5 4 (4 0) 4605 3 224090630

$925,000 4686 Pinta Ct 3 5 (3 2) 2845 12.28 224118572

$999,000 4301 N Canyon Rd 3 4 (3 1) 3892 6.4 224087673

$1,350,000 3765 N Canyon Rd 3 3 (3 0) 3560 3.08 224103861

12802 Residential Homes

PolloCk Pines

$290,000 2880 Polaris St 4 2 (2 0) 1774 0.27 224120977

$299,000 777 Off Forebay Ln

1 (1 0) 600 0.6 224095148

$309,000 6521 Topaz Dr 2 2 (2 0) 1176 0.42 224053310

$319,000 5015 Shooting Star Rd 2 2 (2 0) 1179 2.25 224120536

(2 0) 1350 0.34 224152384 $344,000 2845 Pine Ct 2 2 (2 0) 1173 0.31 224131587

$350,000 6550 Onyx Trl 3 3 (3 0) 1785 0.32 224128900

$354,000 5578 Johnny Tuck Ct 3 2 (2 0) 1490 2.08 224103377

$375,000 5235 Sierra Springs Dr

$384,560

$399,000

$410,000

$410,000

$427,999 6229

12803 Residential Homes ameriCan river Canyon

12901 Residential Homes

GeorGetoWn, GarDen valley

Fees, and Guidelines are subject to change without notice. Restrictions apply. Not a commitment to lend. Land Home only conducts business in states we are approved to. Land Home Financial Services 3420 Coach Lane, Suite 15, Cameron Park, CA 95682. NMLS #705400. Licensed by the Department of Business Oversight under the California Finance Lenders law - #6073455. CA Department of Business Oversight - 866-275-2677. California - Bureau of Real Estate Branch Of ce License Endorsement #00988341 1-2025

PLACERVILLE

$3,490,000

Once in a lifetime opportunity to own all or a part of the historic Shinn Ranch. Awesome Estate quality Land, 160 acres +- in 5 separate parcels are being sold as one. Sellers are in the middle of a boundary line adjustment and will soon list the land in 5 separate large parcels. Gorgeous large Country Homes surround this property. Minutes to Highway 50, and the Historic towns of Diamond Springs and Placerville. Fish in your own private stocked pond and be amazed at the wildlife that surrounds you. It currently has an approved tentative map for 141 parcels that expires in June 2024. It would be fantastic as an equestrian ranch, family compound, or a vineyard with Ranch Marketing. 1880’s Home is included in the purchase price. There is also a 3 inch Ag. meter. Locked gates, please do not trespass. Don’t miss out on this remarkable property.

$399,000

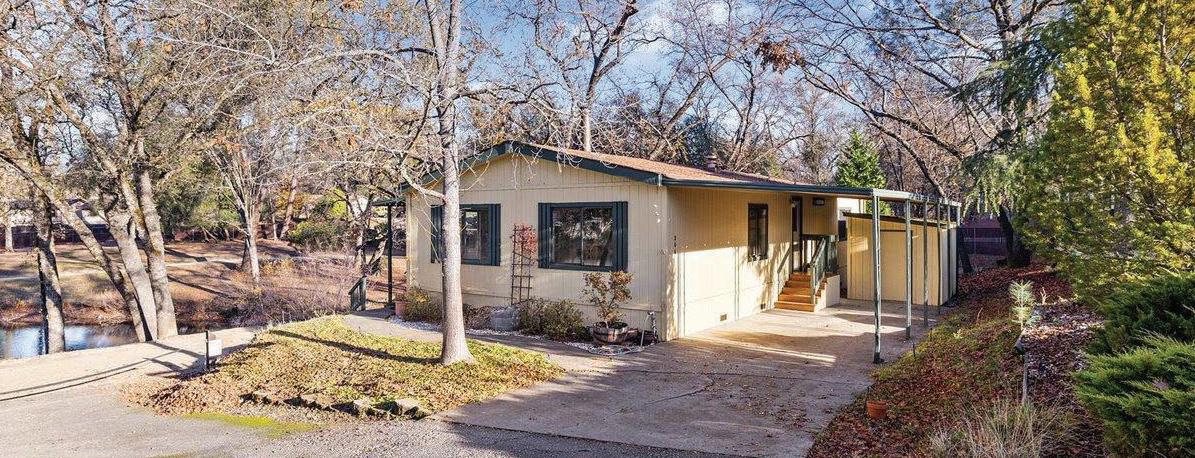

IT’S THE PERFECT

Experience

TIME TO MAKE THIS YOUR NEW HOME!

of vinyl plank flooring, and the modern convenience of upgraded appliances. Hardy board siding ensures longevity and charm, while the spacious layout floods the interior with natural light. Entertain effortlessly in the expansive great room, complete with a stylish kitchen island, dining bar, and cozy breakfast nook. Retreat to the luxurious master suite featuring a generous walk-in closet, while the convenience of a dedicated laundry room with a sink and a tankless water heater adds to the

Lovely home tucked away in this private cove location. Enjoy the wildlife & neighbors strolling along the recreation path from the spacious, covered front porch. Terrific, easy-living floor plan with spacious living, dining, kitchen, bedrooms, & laundry room. Move-in ready - freshly painted & cleaned! SALLY LONG JOHNS (530) 306-0821 $275,000

LAKEFRONT LIVING AT LAKE OAKS 55+!