Q: My daughter rents an apartment and the tub needs to be re-caulked. She contacted the property manager and then the owner and both told her she had to do it because it is in her rental contract. I talked to the property manager and was told the same thing. I explained she does not know how and if it is not done properly, water could get in the wall and rot it out. Their comment was that she would be responsible for that, too.

Caulking a tub is not rocket science but it does take some skill and practice. I would like to know if there is any regulation that requires the owner of the property to perform this maintenance item.

A: Excellent question. I’ve been writing this column for over 30 years. It’s great when someone comes up with a question I’ve never touched on before. And this is an important one for both land lords and tenants.

The quick answer is “yes,” this is the owner’s responsibility.

California Civil Code, Sections 1929 and 1941, require the landlord to keep the premises in a condition fit for occupancy. But like most things legal, things are not as simple as they appear.

Both the Legislature and the courts have, through the years, continued to define “fit for occupancy.” In many places in the world, a tent with a dirt floor is fit for occupancy. But here in California, that bar is a bit higher.

Civil Code Section 1941.1 defines a number of items that make up habit ability issues.

Heat, electricity, windows, water leakage, locks and even vermin are on the list. And so is plumbing. Plumbing must be up to code and in good condition. Building codes require caulking around bathtubs and showers, so the landlord has to provide it.

It’s really that simple.

Besides, when your daughter moves out, the only things a landlord can charge her for are items she has damaged. Normal wear and tear is always the responsibility of the landlord.

There are only two exceptions I can think of at the moment.

The first is that somehow the caulk ing was peeling up, your daughter didn’t report it to the property manager and the moisture created dry rot. A tenant has an obligation to report maintenance con ditions to the landlord. Failure to do so could result in liability for the tenant.

But that’s clearly not the case here.

The other reason is if the landlord is arguing your daughter somehow damaged the caulking. Perhaps a child sitting in the bathtub used a ballpoint pen or hard toy to dig up the caulking bead (I’ve seen it happen).

But if the caulking is just peeling up over time, as it all eventually does to my knowledge, then recaulking is simply the type of routine maintenance any home owner, including the landlord, should routinely do.

So what to do?

You could just go ahead and recaulk it, deducting the cost of the caulk from the rent. This is a bit iffy, though, because the landlord can argue the caulking wasn’t necessary and, in any event, didn’t affect the safety and welfare of your daughter. It’s not worth spending a lot of time arguing over a tube of caulk.

Your second choice is simply to doc ument the condition with photos, as well as your conversations with the property manager and owner. That way, at the end of your daughter’s lease, you can show that you properly informed the landlord and he refused to fix it, thereby releasing you from liability.

Tim Jones is a real estate attorney in Fair field. If you have any real estate questions you would like to have answered in this column you can send an email to AllThingsRealEstate@TJones-Law.com.

Traditional financial advice typically tells savers to put retirement first – even before homeownership. That’s because over the long-term, the stock market tends to outpace real estate and there are tax advantages to putting money in a retirement account.

But retired homeowners are in a much better financial posi tion than their peers who have rented. So it might make more sense to encourage younger savers to prioritize buying a home, despite the very real chal lenges of high home prices and interest rates.

Millennials have higher average 401(k) balances than Generation X did when they were the same age, but they’re not any better off financially, says Craig Copeland, director of wealth benefits research at the Employee Benefit Research Institute. A lot of that has to do with being less likely to own a home. That doesn’t bode well for later on.

“The benefits of homeown ership can’t be overstated in retirement,” says Copeland.

For older homeowners and older renters with similar incomes, there’s a significant gap in net wealth. A big portion of that is due to home equity, but homeowners also have more non-housing wealth, too. Homeowners age 65 and over in the highest income quartile had a

TOTAL SALES: 7

LOWEST AMOUNT: $375,000

HIGHEST AMOUNT: $1,250,000 MEDIAN AMOUNT: $680,000 AVERAGE AMOUNT: $715,357

142 Carlisle Court - $680,000 10-14-22 [3 Bdrms - 1365 SqFt - 1973 YrBlt]

1168 West L Street - $1,250,000 10-12-22 [3 Bdrms - 2040 SqFt - 1995 YrBlt]

506 Laurel Court - $650,000 10-11-22 [2 Bdrms - 1092 SqFt - 1984 YrBlt], Previous Sale: 07-17-13, $365,000

593 Rose Drive - $870,000 10-11-22 [4 Bdrms - 1964 SqFt - 1989 YrBlt], Previous Sale: 01-28-03, $407,000

1844 Shirley Drive - $455,000 10-12-22 [2 Bdrms - 873 SqFt - 1983 YrBlt], Previous Sale: 10-01-18, $335,000

900 Southampton Road #150 - $375,000 10-11-22 [2 Bdrms - 1119 SqFt - 1977 YrBlt]

347 Viewmont Street - $727,500 10-11-22 [3 Bdrms - 1120 SqFt - 1958 YrBlt], Previous Sale: 05-22-15, $440,000

TOTAL SALES: 3

LOWEST AMOUNT: $180,500

HIGHEST AMOUNT: $565,000 MEDIAN AMOUNT: $500,000 AVERAGE AMOUNT: $415,167

241 South 1st Street - $180,500 10-12-22 [3 Bdrms - 1590 SqFt - 1913 YrBlt]

745 Evans Road - $565,000 10-12-22 [3 Bdrms - 1462 SqFt - 1995 YrBlt], Previous Sale: 08-14-19, $432,000

438 La Esperanza Drive - $500,000 10-11-22 [4 Bdrms - 1413 SqFt - 1998 YrBlt], Previous Sale: 04-20-05, $375,000

TOTAL SALES: 16

LOWEST AMOUNT: $335,000

HIGHEST AMOUNT: $1,011,500

MEDIAN AMOUNT: $636,000 AVERAGE AMOUNT: $651,406

2757 Ambrosia Way - $828,000 10-14-22 [4 Bdrms - 2578 SqFt - 2021 YrBlt]

2776 Bay Tree Drive - $570,000 10-14-22 [4 Bdrms - 1705 SqFt - 1989 YrBlt], Previous Sale: 06-19-12, $208,000

2446 Beaufort Drive - $465,000 10-11-22 [3 Bdrms - 1272 SqFt - 1973 YrBlt], Previous Sale: 06-07-22, $390,000

3227 Corte Valencia - $750,000 10-12-22 [3 Bdrms - 2057 SqFt - 1996

YrBlt], Previous Sale: 09-26-14, $451,000

1240 Delaware Street - $1,011,500 10-12-22 [3 Bdrms - 3133 SqFt - 1941 YrBlt], Previous Sale: 05-05-22, $995,500

2375 Digerud Drive - $599,000 10-14-22 [4 Bdrms - 2289 SqFt - 2005

YrBlt], Previous Sale: 10-25-19, $486,000 305 Gardenia Circle - $519,000 10-14-22 [4 Bdrms - 1440 SqFt - 1969 YrBlt], Previous Sale: 04-11-12, $172,000

1376 Horizon Circle - $786,000 10-14-22 [4 Bdrms - 2385 SqFt - 2021 YrBlt]

1015 Scott Street - $457,000 10-13-22 [3 Bdrms - 1196 SqFt - 1985 YrBlt] 117 Sheffield Lane - $335,000 10-12-22 [2 Bdrms - 1014 SqFt - 1994 YrBlt], Previous Sale: 07-02-01, $164,997 2401 Sheldon Drive - $680,000 10-12-22 [4 Bdrms - 2564 SqFt - 2020 YrBlt], Previous Sale: 07-28-20, $562,000 2370 Sheldon Drive - $620,000 10-13-22 [4 Bdrms - 2395 SqFt - 2020 YrBlt], Previous Sale: 07-28-20, $544,000 2561 Shorey Way - $652,000 10-11-22 [4 Bdrms - 1920 SqFt - 2002 YrBlt], Previous Sale: 04-30-04, $420,000 2024 Swan Way - $565,000 10-12-22 [4 Bdrms - 1285 SqFt - 1966 YrBlt], Previous Sale: 04-21-22, $420,000 5224 Tuscany Drive - $800,000 10-14-22 [4 Bdrms - 2308 SqFt - 1999 YrBlt], Previous Sale: 11-16-99, $270,900 3266 Vista Del Lago Way - $785,000 10-12-22 [5 Bdrms - 3381 SqFt - 2000 YrBlt], Previous Sale: 08-14-12, $350,000

TOTAL SALES: 2

LOWEST AMOUNT: $450,000 HIGHEST AMOUNT: $465,000 MEDIAN AMOUNT: $457,500 AVERAGE AMOUNT: $457,500 255 Yosemite Drive - $450,000 10-12-22 [3 Bdrms - 1172 SqFt - 1971 YrBlt] 260 Yosemite Drive - $465,000 10-13-22 [3 Bdrms - 1006 SqFt - 1972 YrBlt], Previous Sale: 05-24-22, $360,000

TOTAL SALES: 4

LOWEST AMOUNT: $399,000 HIGHEST AMOUNT: $565,000 MEDIAN AMOUNT: $450,000 AVERAGE AMOUNT: $466,000 706 Chula Vista Way - $500,000 10-11-22 [3 Bdrms - 1424 SqFt - 1983 YrBlt], Previous Sale: 00/1992, $134,000 502 Floyd Court - $565,000 10-12-22 [3 Bdrms - 1492 SqFt - 1989 YrBlt], Previous Sale: 06-27-16, $325,000 606 Tule Goose Drive - $400,000 10-13-22 [4 Bdrms - 2460 SqFt - 1978 YrBlt], Previous Sale: 07-08-98, $149,500 706 West Street - $399,000 10-13-22

TOTAL SALES: 19

LOWEST AMOUNT: $356,000 HIGHEST AMOUNT: $1,100,000

MEDIAN AMOUNT: $639,000 AVERAGE AMOUNT: $684,474 7585 Acacia Lane - $1,100,000 10-11-22 [3 Bdrms - 1688 SqFt - 1979 YrBlt] 372 Adobe Drive - $639,000 10-11-22 [4 Bdrms - 1682 SqFt - 1968 YrBlt], Previous Sale: 05-11-22, $538,000 1660 Amapola Street - $562,000 10-12-22 [4 Bdrms - 1433 SqFt - 1966 YrBlt], Previous Sale: 09-08-04, $359,000 224 Aster Street - $765,000 10-13-22 [5 Bdrms - 3010 SqFt - 2016 YrBlt], Previous Sale: 08-17-16, $516,000 590 Boone Drive - $785,000 10-13-22 [4 Bdrms - 2457 SqFt - 2001 YrBlt], Previous Sale: 01-11-13, $334,500 197 Brookdale Drive - $665,000 10-13-22 [4 Bdrms - 1888 SqFt - 1979 YrBlt], Previous Sale: 05-22-01, $240,000 324 Buck Avenue - $1,085,000 10-13-22 [3 Bdrms - 2649 SqFt - 1957 YrBlt] 3042 Casa Verde Court - $725,000 10-12-22 [4 Bdrms - 2483 SqFt - 2009 YrBlt], Previous Sale: 09-14-09, $391,000 330 Crimson Circle - $655,000 10-13-22 [3 Bdrms - 1864 SqFt - 2017 YrBlt], Previous Sale: 07-30-20, $555,000 135 Fairoaks Drive - $356,000 10-11-22 [2 Bdrms - 1445 SqFt - 1979 YrBlt], Previous Sale: 10-26-15, $235,000

567 Greenwood Drive - $565,000 10-11-22 [5 Bdrms - 1986 SqFt - 1975 YrBlt], Previous Sale: 07-16-10, $188,000

7506 Locke Road - $1,070,000 10-11-22 [3 Bdrms - 1714 SqFt - 1988 YrBlt], Previous Sale: 07-01-13, $599,500

674 Sereno Drive - $500,000 10-14-22 [3 Bdrms - 1306 SqFt - 1978 YrBlt], Previous Sale: 10-25-12, $167,500

554 Sitka Drive - $700,000 10-11-22 [4 Bdrms - 2241 SqFt - 2017 YrBlt], Previous Sale: 11-10-17, $475,000 273 Sparrow Street - $610,000 10-11-22 [4 Bdrms - 1980 SqFt - 1991 YrBlt]

6057 Vanden Road - $540,000 10-11-22 [4 Bdrms - 1471 SqFt - 1988 YrBlt], Previous Sale: 02-10-16, $370,000

513 West Street - $499,000 10-13-22 [2 Bdrms - 959 SqFt - 1940 YrBlt]

607 Whisperglen Court - $639,000 10-11-22 [3 Bdrms - 2066 SqFt - 1989 YrBlt], Previous Sale: 03-05-98, $178,000

742 Youngsdale Drive - $545,000 10-13-22 [3 Bdrms - 1382 SqFt - 1987 YrBlt], Previous Sale: 07-12-22, $400,000

TOTAL SALES: 17

LOWEST AMOUNT: $126,500

HIGHEST AMOUNT: $855,000

MEDIAN AMOUNT: $550,000

AVERAGE AMOUNT: $511,059

82 Baldwin Street - $855,000 10-14-22 [3 Bdrms - 988 SqFt - 1977 YrBlt], Previous Sale: 06-22-22, $180,000

227 Evans Avenue - $550,000 10-12-22 [3 Bdrms - 1749 SqFt - 1953 YrBlt]

1201 Glen Cove Parkway #306 - $126,500 10-13-22 [1 Bdrms - 665 SqFt - 1992 YrBlt]

4 Hilton Court - $519,500 10-11-22 [3 Bdrms - 1283 SqFt - 1955 YrBlt], Previous Sale: 04-17-12, $130,000

617 Kirkland Avenue - $680,000 10-11-22 [3 Bdrms - 2039 SqFt - 2005 YrBlt], Previous Sale: 08-15-16, $475,000

153 Lighthouse Drive - $225,000 10-14-22 [2 Bdrms - 840 SqFt - 1988 YrBlt], Previous Sale: 11-27-00, $112,500

573 Phoenix Circle - $450,000 10-11-22 [3 Bdrms - 1422 SqFt - 1980 YrBlt], Previous Sale: 08-08-12, $165,000

167 Prestwick Court - $595,000 10-13-22 [3 Bdrms - 2006 SqFt - 1982 YrBlt]

1004 Roleen Drive - $340,000 10-14-22 [3 Bdrms - 1000 SqFt - 1975 YrBlt]

745 Rollingwood Drive - $575,000 10-12-22 [3 Bdrms - 1100 SqFt - 1954 YrBlt], Previous Sale: 06-22-22, $429,000

1315 Ryder Street - $610,000 10-14-22 [4 Bdrms - 1433 SqFt - 1936 YrBlt], Previous Sale: 11-25-09, $120,000

28 Shoal Drive - $613,000 10-14-22 [3 Bdrms - 1795 SqFt - 1990 YrBlt], Previous Sale: 09-09-16, $415,000

1129 Symphony Way - $556,000 10-11-22 [2 Bdrms - 1513 SqFt - 2007 YrBlt], Previous Sale: 06-12-13, $360,000

419 Topsail Drive - $645,000 10-12-22 [3 Bdrms - 1288 SqFt - 1987 YrBlt], Previous Sale: 05-27-22, $695,000

330 Wallace Avenue - $388,000 10-12-22 [2 Bdrms - 1054 SqFt - 1939 YrBlt], Previous Sale: 12-24-13, $143,000

311 Wilshire Avenue - $515,000 10-13-22 [3 Bdrms - 1149 SqFt - 1955 YrBlt], Previous Sale: 07-18-13, $117,000

16 Winslow Avenue - $445,000 10-12-22 [2 Bdrms - 912 SqFt - 1942 YrBlt], Previous Sale: 02-04-03, $230,000

It’s been a wild real estate ride over the last few years.

After a red-hot market char acterized by bidding wars, low interest rates and elevated prices, mortgage rates increased to the highest level in 20 years, leading to a slowdown of both buying activity and purchase prices. Yet, with inventory still low, home price tags remain high in many parts of the U.S.

There are plenty of predic tions about where the housing market is going in 2023. But what about farther out? After all, buying a home often requires long-term planning. We asked several residential real estate experts to peer into their crystal balls and give us a five-year forecast of the housing market. Here’s looking at you, 2027.

But first, a snapshot of the res idential real estate scene, as of autumn 2022.

Home sales price: The median existing-home sales price rose 8.4% from one year ago, to $384,800, according to September 2022 data from the National Association of Real tors (NAR). For new homes, the current average sales price nationwide is $470,600 – up around 14% from a year ago, says Danushka Nanayakkara-Skill ington, assistant vice president, forecasting and analysis for the National Association of Home builders (NAHB).

Inventory: Though higher than it was in January 2022, the supply of homes remains his torically low, says NAR Chief Economist and Senior Vice Pres ident of Research Lawrence Yun. The inventory of unsold existing homes was at a 3.2-month supply in September 2022.

Days on the market: With inventory still tight, homes continue to sell quickly. In Sep tember 2022, the median number of days on the market for sold homes ranged from 13-23, depending on the price, accord ing to the September NAR data. In a more typical market, it’s 45 days, says Yun.

Homes sold: Fewer existing homes are selling nationwide. According to the September NAR data, during 2022, the season ally adjusted total figure dropped from 6.49 million in January to 4.71 million in September. Meanwhile, sales of new single family houses in July 2022 were at a seasonally adjusted annual rate of 511,000 – which is 29.6% lower than in July 2021, says the U.S. Census Bureau and the Department of Housing and Urban Development.

Thirty-year mortgage rates: According to Freddie Mac, the current average 30-year fixed mortgage rate was 7.08%, the highest it’s been in 20 years.

New home starts: According to Nanayakkara-Skillington, the seasonally adjusted annual rate for new single family home starts is 892,000, which is down 18.5% compared to last year.

Mortgage interest rates could continue to increase for a few weeks or months, says Yun, adding that seven percent looks to be the level for the rest of this year and most of next year. Within two years, the rate should return to fiveand-a-half or six percent, he adds. Nanayakkara-Skillington agrees, predicting rates will drop to about six percent by the middle of 2024.

Because the rates are high, Yun foresees a greater inter

est in adjustable-rate mortgages (ARMs) through next year. However, after that, he predicts 90% of Americans will return to the traditional 30-year fixed mortgage route. Greg McBride, CFA, Bankrate chief financial analyst, agrees, stating that the 30-year fixed rate mortgage will remain the dominant product. “It provides the certainty borrowers want, lenders can sell them to investors, and there is a vibrant secondary market of global investors eager to buy them,” he says.

Yun foresees zero or minor changes in purchase price tags on a nationwide basis next year, with increases or decreases of about five percent. The only exception is California, he says, where the market could see 10% declines: “Because it’s so expen sive, California is always the most vulnerable to changes in interest rates.” Overall, in five years, he expects prices to have appreciated a total of 15-25%.

McBride has a similar per spective. He predicts home prices will average low- to mid- single digit annual appre ciation over the next five years. This rate of appreciation, he says, is consistent with the longterm average of home prices increasing by a rate that’ hovers a percentage point above the inflation rate.

While it’s been showing bub ble-like properties, Yun does not expect the residential real estate market to violently pop. Although he predicts that sales will be at a low point next year,

Open House Saturday 1-3PM

404 Riverwood Dr Rio Vista

No rear neighbors!! Located in Trilogy @ Rio Vista. Landscaping just freshened up. 2 bd/2ba, spacious home, w/covered deck. Watch the wild life! $445,000 Ralene Nelson

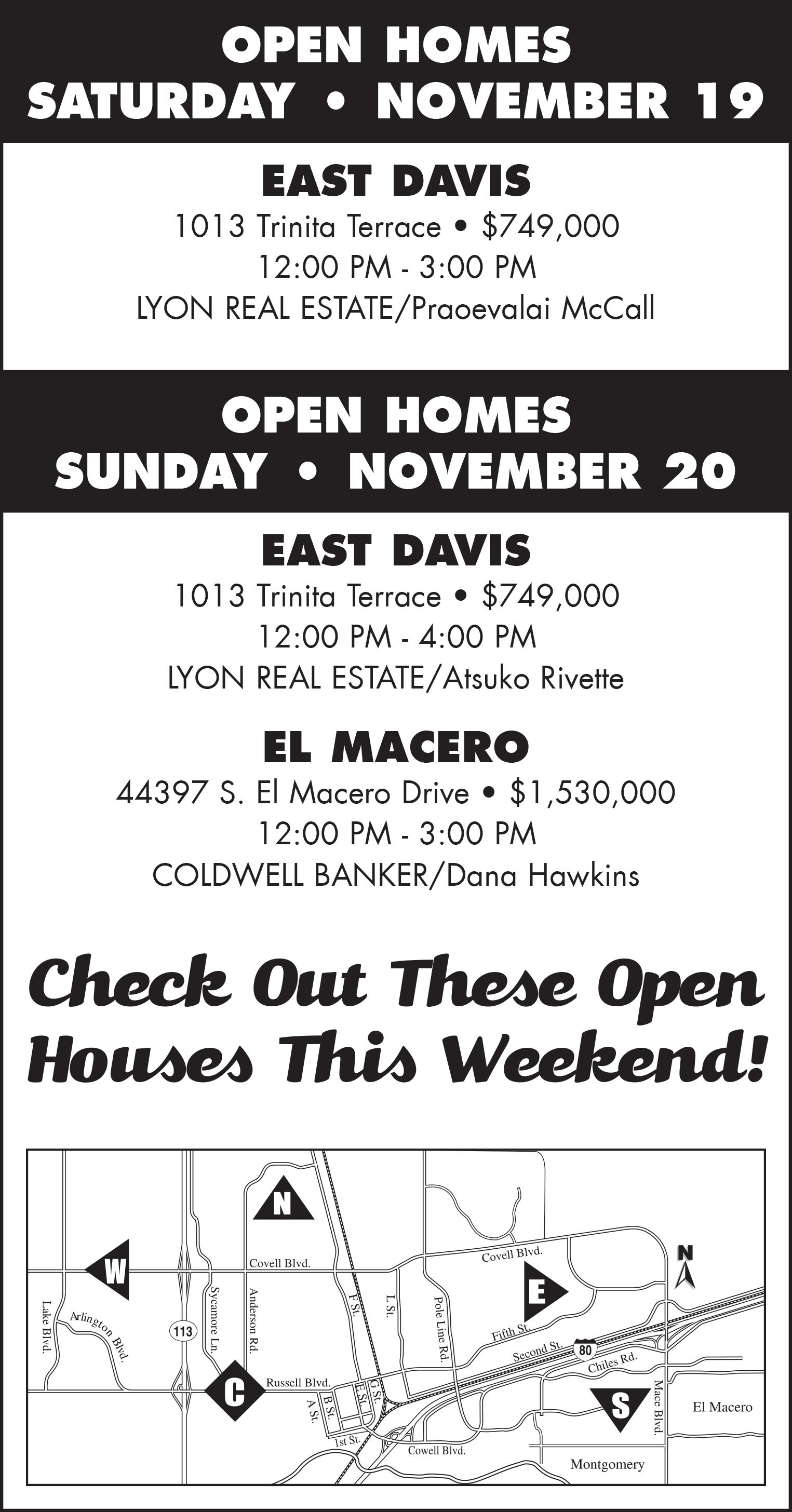

FOR THIS WEEKEND November 19th & 20th

Please Call for an Appointment to View 204 Camellia Street, Fairfield

One story lovingly upgraded. Light, bright, open. Many added windows and lights. Dual pane windows. Family room made wider. New carpet, 11/17/22. Tile, refinished original hardwood, engineered hardwood floors. Newer roof. RV parking. $499,500

864-8221

Please Call for an Appointment to View

857 Atchison Drive, Vacaville, CA

Warm, inviting, peaceful, relaxing home, lovingly maintained, displays pride of ownership. With over 4,000 sq ft, it of fers an amazing variety of rooms. Large primary suite with retreat, junior suite, two more secondary bedrooms. Two offices, plus a third office/library/den/living room. Four full baths. Generous open loft. Formal entrance with soothing water fall, cathedral ceilings. Dining room, butlers pantr y, family room with fireplace, large breakfast area. Three car garage (one is tandem). Pool, generous patio, covered patio. 0.21 acre. Built in 2003. $899,000

295 Sage Meadows Dr. Rio Vista

Calistoga model, with private courtyard, located on a corner lot. New interior paint (including garage) & tile/grout cleaned, gives this home a fresh look. Island kitchen w/granite tile, blk appliances, w/5 burner gas stove top. $559,000

Ralene Nelson

REALTOR® BRE#01503588

(707) 334-0699

Open House Saturday 1-3PM

689 Waterwood Dr. Rio Vista

Breath taking views as you step into this beautiful home, located on the 11th green & pond. Popular Reflect model with quartz counters, white cabinets, 5 burner gas stove top & refrigerator is included. Tile floors with carpet in bedrooms $585,000

Ralene Nelson

REALTOR® BRE#01503588

(707) 334-0699

3404

With over 4000sf, this elegant beauty sits on a cul-de-sac in the exquisite Rancho Solano hills. Boasting 5 bedrooms which includes a downstairs junior primary, complete with en suite bathroom, 2 bonus/media rooms (1 upstairs/one downstairs). Super spacious cook’s kitchen with adjoining great room and an intimate outdoor courtyard with gas fireplace. Charming landscape with outdoor kitchen and exclusive seating areas, great for entertaining. $1,099,900

Open House Sat & Sun 12:30-3:30

51 81 Palace Cour t, Fairfield

Price Reduction! Great buy for this gorgeous 5bd/3ba, 3,007sf w/Tesla Solar & NO HOA! Full bd/ba on 1st flr. LR, DR & FR. Beautiful kitchen w/granite counters, SS appliances, tiled backsplash, walk-in pantr y. Backyard w/built-in sitting & gazebo! $918,888

Vivian Betita

631-2064

Open House Sunday 1-3PM

424 Mandarin Cir, Vacaville

Senior living at its BEST in beautiful Diamond Grove. 2bd/2ba+den, 1323sf. Gas fireplace between LR & dining area. Eat in kitchen. Large covered patio runs width of home. Easy care garden w/fruit trees & roses. Community pool. $519,000

Omar Hampton & Associate

REALTOR® DRE#01242723

529-7545

As you look ahead to the winter season, you’re likely making plans and think ing about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year.

If the location or size of your current home no longer meets your needs, finding a house that better suits your lifestyle may be a top priority for you. But with today’s cooling housing market, is it really a good time to sell your house, or should you wait?

If you’re ready to make your decision, here are three reasons you may want to consider selling before the holidays.

Typically, in the residential real estate market, homeowners are less likely to list their houses toward the end of the year. That’s because people get busy around the holidays and depri oritize selling their house until the start of the new year when their schedules and social calendars calm down.

Selling now, while other homeowners may hold off until after the holidays, can help your house stand out. Start the process with a real estate professional today so you can get your house on the market and get ahead of your competition.

Even though housing supply has increased this year as buyer demand has moderated,

Don McDonald

it’s still low overall. That means there aren’t enough homes on the market today, especially as the millennial generation reaches their peak homebuy ing years. As Mark Fleming, chief economist at First Ameri can, says: “While not the frenzy of 2021, the largest living gen eration, the millennials, will continue to age into their prime home-buying years, creating a demographic tailwind for the housing market.”

Serious buyers will still be looking this winter and your house may be exactly what they’re searching for. If you work with an agent to list your house now, you’ll be able to get in front of the eager buyers who are hoping to make a move before the year ends.

Don’t forget, today’s home owners have record amounts of equity. According to Core Logic, the average amount of equity per mortgage holder has climbed to almost $300,000. That’s an all-time high. That means the equity you have in your house right now could cover some, if not all, of a down payment on the home of your dreams.

And as you weigh the reasons

From Page 5

with only 5.3 million units sold, he foresees a gradual increase afterward, up to an annual six million units by 2027. Despite the higher mortgage rates, home prices are still above what they were one year ago, he adds. Even if they decline five percent (or 10% in California) next year, that’s not close to crash ing – which is characterized by a one-third drop. “A 30% decrease will not happen because there isn’t enough inventory,” he explains. “A crash happens with oversupply.” He believes the housing shortage will continue this year, with the supply bal ancing out by five years.

Yun expects the seller’s market to continue, while housing inventory remains low. By five years, though, he fore sees a balanced market, where neither the buyer or seller holds sway. Instead, the negotiating power between parties will be more equal and depend on the individual case.

Caroline Feeney, executive editor, HomeLight, feels the shift away from a seller’s market has already begun. According to a recent survey the company conducted, only 51% of HomeLight agents described their current local market as a seller’s market. She also expects a balanced market within a few years.

With hybrid work sched ules becoming the norm and commuting no longer as relevant, Yun predicts the suburban market will con tinue to be strong. Meanwhile, 55% of top HomeLight agents believe the markets that heated up the quickest during the

pandemic (including Austin, Phoenix and Boise) are likely to be the first to cool down and see the biggest decreases during a market correction, says Feeney. Yun expects growth in areas with rising pop ulations, namely the Carolinas, Florida, Texas and Tennes see. Backing up his prediction, 50% of new single-family con struction is in the South, notes Nanayakkara-Skillington.

The number of single-family homes under construction has decreased over the past four months. In contrast, the number of multi-family homes under construction has increased over the past few years, says Feeney, who credits this growth in part to their lower price tags – apartments tend to be cheaper than detached houses – and the pressure on municipalities to relieve shortages and provide more affordable housing. Still, with high mortgage rates and inflationary building material prices, Nanayakkara-Skillington expects the multi-family mar ket’s growth to stabilize within a few years, with the number of new starts decreasing eight percent in 2023, and another five percent in 2024.

Since buying a home is such a major purchase, starting to save up five years in advance is perfectly reasonable. Here are some strategies to get your finances in shape for down pay ments – you want to be able to swing the usual 20% down, to avoid the extra cost of mortgage insurance – and of course for mortgage pre-approvals.

1. Think about earning power

Of course you work for love, not money. But money’s impor tant too. Figure out the right way to ask your employer for a raise, or be willing to look for other opportunities – that’s usually the fastest path to a significant salary bump. Sixty percent of workers who switched jobs over the past year earned more money in their new roles, even accounting for the fast

pace of inflation, according to a recent study from the Pew Research Center.

Being able to purchase a home isn’t just about growing your bank account. It’s equally important to focus on paying down the amount of money you owe on credit cards, student loans and car payments. By low ering your debt-to-income (DTI) ratio, you’ll be in a better posi tion to qualify for a mortgage down the line.

The purchase price is the big expense, but homebuying has other, less obvious expenses. You’ll also need to be ready to pay closing costs – lender fees, property taxes, appraisal expenses and various other administrative and profession als’ fees. These add up quickly. In 2021, the average closing costs were $6,905, according to ClosingCorp.

Because you’ll be spend ing several thousand on closing costs, it’s imperative to stay in a home long enough to break even (let alone make a profit). If you’re buying a home and selling it a year or two later, you’re probably not going to come out ahead. Five years is the usual amount of time.

Yes, plenty of publications are full of generalizations about “the housing market.” But real estate markets are hyper-local ized, varying greatly not just from region to region, but from state to state, and even within states. Costs, prices and require ments are going to look much different in Pensacola than they will in Palm Beach, for example. As you think about budgeting for a house, bear the broader national trends in mind, but it’s more helpful to focus on housing market conditions in the city and even the specific neighborhood where you’re looking to buy or move to. Try to target the more affordable ones, where your dollars will bring the most bang for the housing buck.

Augusta Lavender heliotrope made its debut in 2022, and after having it in my garden for 18 months, I am even more sold on the plant. Keep in mind I also wrote about it in summer 2021 and January 2022 and it continues to demon strate award-winning traits.

This is an absolute musthave plant for the rare color offered the landscape, and of course, pollinators. The plant is really an anomaly to The Garden Guy for several reasons, and I’ll explain as I go.

According to the plant tag, it is cold-hardy in zones 9a and warmer. Not only have my plants per severed, I even had blooms for around 14 or 15 months. I have never been without Augusta Lavender plants since planting in April 2021. This year I was able to give it more part ners, which points out the second anomaly, the first being a remarkable longevity for a plant that was supposed to die. The reason I was able to create new partnerships is that my Augusta Lavender heliotrope patch has gotten larger with more plants.

This opened the door for partnerships with

From Page 8

If you’re thinking about selling your house so you can find a home that better suits your needs, don’t delay your plans. Let’s connect so you can accomplish your goals before winter.

Don McDonald (DRE License No. 01436448) is a founding partner of Re/Max Elite Part ners (License No. 01215931) in Fairfield. Reach him at 707-4950774, don@remax elitepartners.com or www. remaxelitepartners.com. Locally Focused-Glob ally Connected.

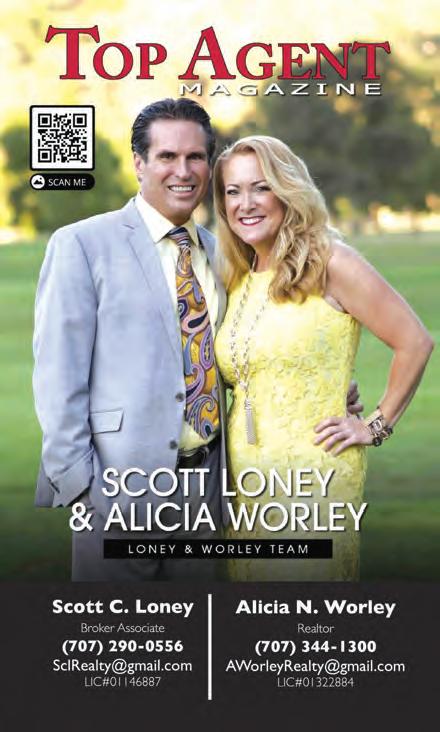

You’re invited to come and tour this beautiful single story home that has 4 bedrooms, 2 1/2 bathrooms and has approximately 2144 square feet of living space. It’s a rare opportunity that this floor plan comes available to purchase with a finished 3 car garage. This home has vaulted ceilings throughout. There’s a formal dining room. The front room could easily be converted into a 5th bedroom if desired. The kitchen has tile countertops, dual sinks, newer stainless steel dishwasher, built-in oven and microwave, 4 burner cooktop and pantry. The kitchen overlooks the family room with a brick wood burning fireplace. The fireplace has never been used. There’s over $20K in the front and back landscaping, hardscaping, lighting, sprinkler and automatic drip system. The exterior was recently painted with high end Dunn Edwards paint. This special type of paint helps to deflect the weather elements and is known to last for many years to come. Looking forward to meeting you and touring this amazing home together. Offered at $775,000 Fully hosted by “Loney & Worley Team” Refreshments will be served.

Saturday, November 19th • 2:00-4:00 PM 2643 Marshfield Road, Vallejo in the gated communit y of Hiddenbrooke

You’re invited to come and tour this beautiful single story home that has 4 bedrooms, 3 bathrooms and has approximately 3179 square feet of living space. It’s a highly sought after floor plan with tall ceilings and crown molding. The kitchen has granite countertops, stainless steel appliances, 5 burner gas cooktop, dual ovens and 2 pantry closets. The kitchen opens to the family room. There is a formal dining room, living room and family room with a fireplace. The fireplace has been completely remodeled. The laundry room has tile countertops, cabinetry and a sink. There’s cherry wood and tile flooring throughout the main part of the house. Primary bedroom has carpeting with upgraded padding, fireplace, 2 walk-in closets. The 3 bedrooms on the left side of the home all have carpeting. The 4th bedroom/office on the opposite side of the home has cherry wood flooring. The 4th bedroom/office that has its own separate entry doors at the front of the home. The backyard offers a pool with a spa, 2 waterfalls and fruit trees. Enjoy the sunsets with panoramic views of the golf course and hills. There’s a 2 car garage with painted flooring, insulated garage door and lots of storage space. Looking forward to meeting you and touring together. Offered at $1,029,000 Fully hosted by “Loney & Worley Team” Refreshments will be served.

If there’s one place in the home most of us can probably agree requires a regular scrubbing, it’s the toilet. But even if yours looks sparkling, truly getting it clean can be tricky since the toilet provides optimal conditions for all kinds of bacteria, mold and viruses.

Changjie Cai, an aerosol scientist at the University of Oklahoma’s Hudson College of Public Health, heads a lab that studies what lurks in the bowl and what each flush may send into the air. One takeaway from his research: “We sometimes don’t pay attention to clean ing the underside of the rim. It can become very nasty,” he says. “Salmonella can persist there for a long time – months even – because it has the perfect environment.” (Staph and E. coli. might be hiding there, too.)

For more expert insight into your toilet – and step-by-step advice on how to properly disin fect it – read on.

Selecting the right toilet brush is critical. Go for an angled one with stiff bristles, which will do a better job accessing the under side of the rim and inside the trap (the hole in the bottom of the bowl). An old toothbrush also works well for getting under the rim. Good Housekeeping recom mends cleaning your toilet brush after each use by filling its holder with hot, soapy water; rinsing the brush; then repeating with cold water and a little bit of bleach. If you follow that process and your brush still doesn’t look clean, it’s time to replace it.

When it comes to protect ing yourself, rubber dish gloves

(designated for use in the bathroom only) are a great choice because they extend nearly to your elbow. The pros at Molly Maids also recommend wearing a mask, particularly if your ven tilation is subpar and you’re using products that require good airflow to be safe, such as bleach.

The American Cleaning Insti tute merely advises using a “disinfectant” on your toilet – but there are so many on the market that picking one can be confusing. One crucial tip: if the label promises that the product “kills 99.9% of viruses and bacteria,” that means the Environmental

Protection Agency has verified it’ll get the job done. Toilet-bowl cleaners by Lysol and Clorox are both verified, for instance, as are bathroom disinfectant sprays by those same brands (which can be used on the outside of the toilet).

If harsh chemicals are a concern, look out for the EPA’s “Safer Choice” label, which a product receives only after the agency has determined that its ingredients meet certain criteria for human and environmental health, while remaining effective. Toilet cleaners by Seventh Generation, for example, carry the label.

For a simpler approach, good old-fashioned household bleach remains arguably the best germ-killing bang for your

buck. The EPA recommends a ratio of 1⁄3 cup liquid chlo rine bleach per gallon of water. (If you use bleach, be extra careful about properly ventilat ing the bathroom.)

While a lot of people reach for the white vinegar when it’s time to clean, its ability to disin fect is limited, according to NSF International, an organization that tests products and develops public health standards for them. The pantry staple, however, is worth adding to your toilet-cleaning arsenal if you’re contending with tough stains. Try scouring them with a paste of three parts baking soda to one part white vinegar, a safe and effective way to break down grime. One product to skip? Those

bleach-based tablets for your tank that promise to continu ously clean. They can damage a toilet’s rubber gaskets and seals. Plus, the ASPCA warns they’re unhealthy for pets who slurp toilet water.

Before you start cleaning, flip on the bathroom fan or open a window – or, if you can, do both. Between the fumes from your cleaning products and what ever’s kicked into the air while scrubbing, proper ventilation is essential.

To properly sanitize a toilet, according to the Centers for Disease Control and Prevention, its surfaces must first be free of visible grime that could obstruct your disinfectant. So, if you can see gunk such as hair, mold and you-can-imagine-what-else, it’s important to give exterior parts like the seat an initial wipe down, and the bowl a prelimi nary brushing.

Lowering the water level doesn’t require a plumber’s license. In some toilets, you can just turn off the tank’s water supply and flush. If that doesn’t work, empty the bowl by plunging or by pouring in around one-and-a-half gallons of water – either method will simu late a flush while preventing the bowl from refilling.

While this step might sound like overkill, we tried it

Treasury yields today are 4.5% for six months, 4.33% for two years, 3.90% for 10 years and 4.1% for 30 years. An investor can invest $10,000 and get 4.5% guaranteed by the government for six months so most will take this over a lower rate for 10 to 30 years. An inverted yield curve like this has pre ceded pretty much every recession we have had over the past 70 years.

When a stock market investor is dis gusted, like most of us are today, a 4.5% guaranteed yield is appealing for six months. We need institutional and individual investors to invest for the long term and companies to invest in long-term business expan sion projects, like Intel is doing with its huge new microchip manufacturing plant that will create jobs and wealth, if we want our economy and the stock market to thrive.

When everyone is selling their longterm holdings and making a flight to quality to the bond market or sitting on the sidelines in cash, recessions happen, and stock markets fall, like they have in 2022, down 25%. The average rate on the 10-year Trea sury bond since 1954 has been 5.6%, and since 2009 the average has been 2.3% thanks to the Fed since the Great Recession.

The raging bull 12-year run in the stock market and the crazy low mort gage rates we have seen over the past 10 years made us all comfort able and maybe even spoiled a bit. The Fed has again raised rates by 75 basis points, but the 10-year Treasury has

Creating an appealing looking table can actually be quite simple.

RODNAE PRODUCTIONS/PEXELSNoshing straight from takeout containers with a couch full of friends is almost always a great time. But maybe you’re ready to step up your hosting game and won dering where, exactly, to even start. Having the right equip ment in your kitchen can help guide your meal strategy and save you stress. We talked to professional event planners and prolific hosts to assemble this tool kit of basic pieces to give you the foundation for din ner-party success.

Before you embark on cooking in large quantities, make sure you have these kitchen workhorses on hand.

Dutch oven. This deep castiron pot is the perfect piece for all kinds of jobs, including braising meat and vegetables in the oven, making a saucy pasta on the stove, or even serving something like mulled wine. “And it looks good hitting the table,” says Camille Jetta, a founder and chef at Dinner Party in Brooklyn.

Casserole dish. Consider picking up a couple of these to hold baked mains, sides or

desserts. Jetta points out that they’ll help you cut down on dishes since, just like a Dutch oven, they can also transition straight from the oven to the table.

Sheet pans. These kitchen staples are just as suited to roasting vegetables as they are to baking cookies. Mere dith Hayden, a private chef and recipe developer, also uses hers to prep and organize ingredients.

Tall pot. Hayden recommends a tall pot (deeper than a Dutch oven) that can be used to boil large amounts of water or stock – for big batches of pasta, soups or stews – without

spilling over the sides. Meat thermometer. Invest in a decent meat thermome ter if you want to cook proteins like chicken or steak in large quantities. It’ll take away some of the guesswork – and stress.

How many? To deter mine how many place settings you need, Amber Mayfield, founder of event company To Be Hosted, suggests tabulat ing the maximum number of guests you’re likely to have at your table at one time, then

the new Double Coded Butter Pecan coneflowers and my favorite, which is a long sweep or drift in a pollinator garden with Heat it Up Yellow gaillardia, Rockin Blue Suede Shoes salvia and the new Meant to Bee Queen Nectarine and Royal Rasp berry agastache.

While that was my favorite, I was also able to use some in mixed containers with Supertu nias and Superbells calibrachoa. The use in containers really opens the door wide open for cre ative designer recipes, whether they be Proven Winners’ or your own.

Until mid-June I was looking and feeling as though I were at Butchart Gardens in Victoria, Canada. Then in late June and July, The Garden Guy turned in to The Grouchy Garden Guy. Temperature turned into stifling triple digits, and rain was a rare event. It became a daily event of dragging the 100-foot hose with water wand or sprinkler. I felt as though I had created a monster.

The nonstop heat brought on spider mites to verbenas and whiteflies to my Augusta Laven der heliotrope. I cut the verbenas back much earlier and a little harder than usual. When I looked at the Augusta Lavender helio trope, I despairingly told them, “I knew you were too good to be true.” I kept the water regimen going, and then, in true miracle fashion, it rained almost every day in August.

Today the Augusta Laven der heliotrope plants are more numerous. They are lush and green with intensely colored blooms even though we have had a much earlier freeze than normal. Since I garden for pol linators and hummingbirds The Garden Guy just doesn’t use insecticides or miticides.

The third anomaly to me was the survivability after the onslaught of whiteflies. The Augusta Lavender is one tough,

In another container, The Garden Guy combined Augusta Lavender heliotrope with Superbells Black Currant Punch with Superbells Grape Punch, both award-winning calibrachoas.

beautiful plant. Oh yes, the spider mite-laden Superbena verbenas survived too, demonstrating the effectiveness of cutting back and removal of infested material.

The Augusta Lavender needs plenty of sunlight to really perform. The soil needs to be well drained but doesn’t have to be luxuriously organic rich by any means. The plants will reach about 24 inches tall with a possible spread of 36 inches. I don’t really deadhead other than to spruce up for a photo.

The plant itself looks a little like a lantana but with lavender blue flowers and a cute cottage-looking yellow

throat. Swallowtails, fritillaries and a host of other butterflies along with bees will visit the nonstop blooms.

I am in zone 8a sharing my experience on a plant that has award-winner written all over it. Even if it is an annual where you live, it will be worth every penny.

Norman Winter is a horticultur ist, garden speaker and author of “Tough-as-Nails Flowers for the South” and “Captivat ing Combinations: Color and Style in the Garden.” Follow him on Facebook @NormanWin terTheGardenGuy. He receives complimentary plants to review from the companies he covers.

Page 17

improved, and mortgage rates have comes down a bit.

Fannie Mae is forecasting rates to be below 5% in the next year or two, and home prices to go down by only 1.5% next year. In normal times when 30-year fixed rate loans are high, we usually turn to 5-1 and 7-1 adjustable-rate mortgages because normally the adjust able-rate mortgages are lower than 30-year fixed rates.

Thanks to this inverted yield curve, adjustable-rate mort gages today are the same as 30-year fixed loans.

Remember, folks, most

mortgages have no prepayment penalty so if you buy a house today in this buyer’s market, you can always refinance to the lower rates coming. These rates smell like they really stink today but historically, a 6% mortgage rate has been normal. The 2.75% rate in 2021 was far from normal and something we may never see again.

Jim Porter, NMLS No. 276412, is the branch manager of Solano Mortgage, NMLS No. 1515497, a division of American Pacific Mortgage Corporation, NMLS No. 1850, licensed in California by the Department of Finan cial Protection and Innovation under the CRMLA / Equal Housing Opportunity. Jim can be reached at 707-449-4777.

5 bed, 3 full bath, 2,286 square feet, Lot 9,583 square feet You'll love this home in the heart of the Browns Valley community! It’s perfect for multi-gen living o ering a full bath and bedroom downstairs. Total of 5 bedrooms and 3 full baths. The kitchen has been updated with beautiful white cabinets and granite counters. Gorgeous engineered wood flooring on the main floor and a large laundry room. The large lot has a beautiful in-ground pool and lots of space for family entertainment. A short walk to the local park and elementary school. Don't forget the 3 car garage and possible RV parking. O ered at $750,000 www.SolanoHomes4You.co m

$629,900 14 La Cruz Ave Benicia 3 1/0 1124 0.13 322096895

$840,000 116 Mountview Ter Benicia 4 3/0 2,288 0.11 322031987

$459,000 1320 Blackberry Ct Dixon 3 2 /0 1487 0.073 322062507

$575,000 1410 Cornell Dr Dixon 3 3/0 1,917 0.07 322085404

$655,000 1950 Dailey Ct Dixon 4 2 /0 2021 0.248 322084370

$749,000 705 Wiegand Way Dixon 4 2 /0 1850 0.23 322055685

$785,000 515 West Cherry St Dixon 4 3/0 2755 0.124 322083817

$4,500,000 6156 Clark Rd Dixon 4 4 /0 5906 78.98 322047718

$434,950 56 Del Prado Cir Fairfield 3 2 /1 1234 0.038 322081681

$465,000 1655 Hemlock St Fairfield 3 2 /0 1,274 0.16 322082879

$474,900 2043 San Luis St Fairfield 3 2 /0 1,824 0.13 322098057

$485,900 231 E Utah St Fairfield 3 2 /0 1517 0.12 322083815

$489,585 2001 Bluebird Way Fairfield 4 2 /0 1,285 0.17 322096754

$499,000 2373 Cabrillo Dr Fairfield 4 2 /0 1704 0.13 322086472

$522,000 204 Camelia Street Fairfield 3 2 /0 1,403 0.17 322078544

$544,950 4 831 Silver Creek Rd Fairfield 3 2 /0 1082 0.185 322077342

$560,000 8 32 Tulare Circle Fairfield 4 2 /1 1934 6006 322080552

$575,000 2737 Almondwood Wy Fairfield 4 2 /1 1512 0.08 322080695

$580,000 782 Ash Ct Fairfield 4 2 /0 1773 0.13 322090911

$608,000 962 Julie Ct Fairfield 4 2 /0 1804 0.19 322097450

$640,000 4756 Canyon Hills Dr Fairfield 4 3/0 1,816 0.12 322076136

$650,000 2018 Windsor Pl Fairfield 3 2 /1 1862 0.26 322078194

$659,000 2907 Owens Ct Fairfield 3 3/0 2320 0.18 322084406

$695,000 4 480 Rolling Meadows Ln Fairfield 4 2 /1 2210 0.169 322086454

$799,000 505 East Meadows Lane Fairfield 5 3/0 2,549 0.14 322092262

$824,950 5080 Pyramid Way Fairfield 4 3/0 2,912 0.13 322087738

$824,999 3032 Muse Wy Fairfield 4 3/0 2841 0.135 322078149

$918,888 5181 Palace Ct Fairfield 5 3/0 3007 0.168 322082111

$1,149,000 1098 Skywest Ct Fairfield 3 2 /1 2709 24455sf 322098903

$1,297,500 4 427 Glencannon Dr Fairfield 3 3/0 2,409 2.5 322092157

$1,495,000 1106 Skywest Ct Fairfield 5 3/0 3414 0.804 322068078

$2,300,000 853 Bridle Ridge Dr Fairfield 4 6/0 3,937 0.97 322075479

$2,599,888 5324 Boulder Ridge Ct Fairfield 5 6/0 5,325 0.91 322099213

$420,000 101 Cedar Ridge Dr Rio Vista 2 2 /0 1671 0.129 322064595

$500,000 420 Canvasback Dr Suisun City 4 2 /0 1440 0.13 322096457

$525,000 411 Avalon Wy Suisun City 3 2 /0 2152 0.23 322067943

$534,000 719 Capistrano Dr Suisun City 4 2 /0 1620 0.170 322095047

$550,000 906 Anderson Dr Suisun City 3 2 /1 1759 0.116 322096978

$608,899 1709 Carswell Ln Suisun City 4 3/0 2,061 0.08 322095129

$639,997 429 Dobbins Ct Suisun City 5 3/0 2,338 0.14 322079187

$650,000 330 Engell Ct Suisun City 3 2 /1 2206 0.160 322070250

$949,997 406 Kings Way Suisun City 4 4 /0 3,228 0.89 322095606

$379,999 120 Mckinley Circle Vacaville 2 1/0 918 0.13 322098446

$385,000 167 Mckinley Cir Vacaville 2 2 /0 1,043 0.13 322089026

$399,000 116 Mckinley Cir Vacaville 2 2 /0 1,043 0.13 322086513

$434,000 101 Isle Royale Cir Vacaville 2 2 /0 1152 0.15 322080839

$444,000 105 Rainier Cir Vacaville 2 2 /0 1152 0.13 322078018

$460,000 125 Christine Dr Vacaville 3 2 /0 1,062 0.11 322080818

$478,000 135 Maple St Vacaville 3 1/0 1040 0.11 322093532

$525,000 4 84 Manchester Wy Vacaville 3 2 /0 1602 0.13 322083162

$529,000 424 Mandarin Cir Vacaville 2 2 /0 1323 0.116 322066345

$539,000 686 Mashall Rd Vacaville 3 2 /0 1402 0.18 322059279

$545,000 600 Fox Pointe Rd Vacaville 3 2 /0 1320 0.160 322089563

$549,900 137 Primivito Court Vacaville 3 2 /1 1497 0.08 322094034

$550,000 312 Woodhaven Dr Vacaville 4 2 /1 1840 0.14 322088768

$567,500 801 S Orchard Ave Vacaville 3 2 /0 1230 0.12 322073187

$569,500 201 Sungate Court Vacaville 3 2 /0 1596 0.17 322099010

$574,999 296 Plantation Way Vacaville 4 2 /1 1840 0.13 322062209

$575,000 107 Colony Way Vacaville 4 3/0 1,887 0.07 322068608

$589,999 332 Plantation Court Vacaville 5 2 /1 2043 0.16 322094970

$590,000 512 Florence Dr Vacaville 4 2 /0 1785 0.21 322090024

$595,000 148 Shefield Dr Vacaville 4 2 /1 1799 0.14 322089957

$597,777 231 Kildare Ln Vacaville 3 2 /1 1988 0.209 322091198

$610,000 667 Laurelwood Cir Vacaville 3 2 /0 1,750 0.14 322080908

$629,999 107 Diablo Creek Way Vacaville 3 2 /0 1728 0.15 322092111

$648,000 636 Silver Star Ct Vacaville 4 2 /0 1661 0.134 322071775

$675,000 263 Bantry Dr Vacaville 4 2 /1 2143 0.184 322086137

$675,000 643 Dahlia Dr Vacaville 3 3/0 1,728 0.08 322095268 $689,900 596 Dunsmuir St Vacaville 3 3/0 1,950 0.18 322053861 $690,000 764 Shannon Dr Vacaville 3 2 /1 2262 0.147 322099214 $710,000 754 Arabian Cir Vacaville 3 2 /0 2,066 0.26 322067856

$719,000 307 Epic St Vacaville 5 3/0 2,219 0.11 322094278 $739,000 173 Encinosa Ave Vacaville 4 3/0 1944 0.18 322098170 $750,000 201 Wrentham Dr Vacaville 5 3/0 2286 0.22 322099300 $759,000 901 Cedarcrest Dr Vacaville 5 3/0 3014 0.207 322061115 $775,000 8024 Claret Court Vacaville 4 3/1 2941 0.16 322074811 $899,000 1000 Brighton Ct Vacaville 5 3/0 3,431 0.21 322090634 $899,000 5845 Cherry Glen Road Vacaville 3 2 /0 2,250 19.98 322092749 $899,000 857 Atchison Drive Vacaville 4 4 /0 4,087 0.21 322098624 $899,500 155 Foothill Dr Vacaville 3 3/0 1,919 0.60 322068886 $989,000 7885 N Locke Rd Vacaville 3 2 /0 1,493 3.95 322095123 $460,000 2940 Georgia St Vallejo 3 2 /0 876 0.13 322087029 $550,000 398 Barcelona Street Vallejo 3 2 /0 1701 7406 322097980 $575,000 184 Smokey Hills Dr Vallejo 3 2 /0 1532 10890sf 322084742 $630,000 701 Keats Dr Vallejo 4 2 /0 10500 10018sf 322091636 $875,000 8 457 Pleasants Valley Rd Winters 2 1/0 22.16 321006700

PRICE A DDRESS CITY LOT/AC SUB TYPE MLS#

$550,000 Liberty Ln Vacaville 25.01 AGRI 322061524 $850,000 Gaddini Road Vacaville 14.89 AGRI 322085720 $4,500,000 6156 Clark Rd Dixon 78.98 AGRI 322049465 $500,000 360 Butcher Rd Vacaville 1.10 COMM 321098151 $1,250,000 8 362 Auction Ln Dixon 2.16 COMM 322014651 $1,870,000 2300-11 E Monte Vista Ave Vacaville 3.66 COMM 321102156 $265,000 2060 Pinecrest Ct Vacaville 1.15 RESA 322048328 $359,950 Gibson Canyon Vacaville 1.55 RESA 22029146 $384,500 3757 Wild Oak Trl Vacaville 4.96 RESA 322061715 $399,000 English Hills Rd Vacaville 6.09 RESA 322096839 $499,500 3745 Wild Oak Trl Vacaville 5 RESA 322061705 $875,000 8 457 Plesants Valley Rd Winters 22.16 RESA 321000406 $15,000,000 Mankas Fairfield RESA 21825708

PRICE ADDRESS CITY

adding four extras. Her pre ferred number for a dinner party is between eight and 12, which she considers “lively enough so everyone can find someone dif ferent to talk to, but still intimate enough so everybody can have the floor.”

Plates. A flat, lipless plate is considered classic, while one with a higher edge can prevent spillage. White or cream will work for any season or occa sion. Each setting should have a dinner plate and one smaller plate for appetizers or salads. Standard dinner plates are typically about 10 inches in diameter, and appetizer plates are usually two or three inches smaller. (Salad plates can be used for dessert, too.)

Flatware and utensils. One complete set of flatware includes a dinner spoon, tea spoon, butter knife, dinner fork and salad fork. Don’t forget at least two or three pairs of sturdy serving forks and

spoons, too. They can be used together for salads, or separately to spear meat or spoon side dishes. (Mayfield recommends matching the number of serving sets to the number of serving platters and bowls in your stash).

Water glasses. Mayfield rec ommends tall, 17-ounce glasses for water. Mason jars can make a fun, less formal option.

Wine glasses. Many guests expect wine with dinner – or may bring a bottle as a gift – so you’ll want to have proper glasses, “even if you’re not a person who likes drinking wine in a wine glass,” says Connie Matisse, a frequent host and chief execu tive of East Fork, a homewares store in Asheville, N.C. Red wine glasses have wider bowls, while white ones are more U-shaped. But really, if you just want to pick one, a white wine glass can work fine for reds, too. While stemless glasses are arguably even more versatile, they won’t prevent warm hands from heating up chilled wines the way that stemmed versions do.

Beyond basic water and wine glasses, choose a set of cocktail glasses “that’s going to service the thing you’re most likely to drink,” says Matisse. Coupes are especially versatile – you can use them for martinis, Manhat tans or margaritas, for example. To avoid guests asking for drinks you aren’t prepared to make, try offering one signature cocktail, or a menu of a few options.

Appetizers. Wooden boards are inexpensive vessels for appe tizers of all kinds, including cheese and charcuterie, or warm snacks such as mini quiche. May field suggests buying one large board or a couple medium-sized ones to start your collection.

Platters and serving bowls. Flat platters with edges high enough to prevent spillage are both versatile and practical, says Hayden, the private chef. Con sider their heft: a couple smaller, lighter-weight options might make more sense than one large platter if you anticipate hosting

passed-around, family-style meals. Add a couple shallow bowls for sides, and at least one large wood salad bowl.

Desserts. Even if you’re not a baker, a cake stand elevates – literally and figu ratively – just about anything placed on it. Use it to display cakes or pies, or for stacking bread. When it comes to serving ice cream or custardy desserts, Matisse suggests using cocktail glasses: “You can double up in those sorts of ways” to save space and money, she advises.

Creating an appealing looking table can actually be quite simple.

Linens. A white tablecloth is a nice basic piece for a fledg ling host, though it tends to convey formality. For more casual events, you might try just a runner or place mats. Swap paper goods for machine-wash able linen or cotton napkins.

Flowers. Though flowers are a fun place to get creative, one rule worth following is to keep your arrangement low enough

that your guests can see and hear each other over it, says Darcy Miller, chief executive of Darcy Miller Designs and author of “Celebrate Everything! Fun Ideas to Bring Your Parties to Life.” Try one bunch of flowers in a single vase, or a grouping of bud vases.

Candles. Place several small votives around the table, or try a few pillar or taper candles. If you go with tapers, which are tall and slender, use an adhe sive like Stick-Um in their holders to keep them stable. Don’t use scented candles that will compete with the food, or so many candles that they interfere with passing dishes.

Once you have the basics, you can start to add items based on which types of events you most enjoy hosting, says Miller. If you love serving desserts, collect interesting cake plates. If cock tails are your thing, build up your bar. “The more you enter tain, the more comfortable you get,” she says.

net wealth of close to $1.3 million compared to $334,150 for renters, according to Harvard University’s Joint Center for Housing Studies (and this was based on 2016 data, before the big run-up in home prices).

For the majority of Ameri cans who haven’t put enough money aside for retirement, a home has often been their saving grace. The elderly poverty rate is around 10%, but would be much higher without the robust rate of homeownership among older Americans, says Chris Mayer, a real estate professor at Columbia University’s Business School. A home gives you a roof over your head, and you can always sell it if you really need cash.

Then there’s the budget ing stress that can come with renting. Studies show that housing accounts for a much bigger chunk of total expendi tures for older renters than for owners. This is even more appar ent for low – and middle-income households. In turn, older renters tend to have more creditcard and health-care related debt, and less cash savings, than homeowners.

Plus, the unpredictability of rent increases can wreak havoc when retirees are on a fixed income. Sure, homeowners may have to deal with property taxes and maintenance, but those seem relatively minor consid ering the double-digit jump in rents during the past year. (Some cities, such as New York, offer rent stabilized apartments, but that isn’t the norm in much of the country.)

Even before the pandemic,

about 55% of rental house holds headed by someone age 65 and over were cost-burdened, meaning more than 30% of their income went to housing costs, data from Harvard’s housing center shows.

No wonder retirees who rent report lower levels of retirement satisfaction.

Given the importance of homeownership to a secure retirement, it’s especially wor risome that the homeownership rate among older people has been declining, and even more precipitously among people of color. In 2004, 81.7% of house holds headed by 50-64 year-olds in the US owned a home. That number was just 75% as of last year, setting this group up to enter retirement age with lower homeownership rates than those of the previous generation at the same age, according to Senate testimony by Harvard’s Jenni

fer Molinsky.

Still, there are some caveats. You need to save at least some money for retirement even while you’re prioritizing a down payment. If your employer offers a 401(k) match, make sure you contribute at least enough to take advantage of that free money.

It’s also important to remember that the benefits of homeownership in retirement are greatest for those who have paid off their loans. Homeowners who enter retirement still paying off a mortgage – something more retirees are doing than in previ ous years – tend to spend more each month on housing costs than renters. (At least it’s a fixed expense, provided it’s a tradi tional mortgage.) So trying to pay off your mortgage before retiring should still be the goal.

But that’s all the more reason to focus on saving that down payment. The typical age of a

first-time homebuyer is now 36, the oldest on record, according to the National Association of Realtors. The older you are when you buy, the more years you’re missing out on those home equity gains.

For many prospective buyers, rising mortgage rates and high home prices are delaying home ownership. Given how crucial a home can be to a secure retirement, let’s hope today’s sidelined buyers don’t give up on it completely. Maybe that means buying a smaller home, or even borrowing from your 401(k) –but it’ll be worth it.

This column does not necessarily reflect the opinion of the edito rial board or Bloomberg LP and its owners. Alexis Leondis is a Bloomberg Opinion columnist covering personal finance.

From Page 16

ourselves and can attest that it’s a game changer. Less water makes cleaning the bowl mar ginally better because you’re not as likely to splash yourself. Reducing the water minimizes reflections, giving you a clearer view of what’s going on in the bowl, and allows cleaning prod ucts to work better since they’re not as diluted and spend more time in direct contact with the toilet.

Now you can really get down to business. Add your bowl cleaner and grab your angled brush. Be meticulous about scrubbing the underside of the rim, as well as the trap. Cai says both are often-neglected, hard-to-see areas that tend to become hot zones for bio films – essentially, slimy colonies of microorganisms that attach to surfaces.

A common mistake is to

Be meticulous about scrubbing the underside of the rim, as well as the trap. Changjie Cai says both are often-neglected, hard-to-see areas that tend to become hot zones for biofilms – essentially, slimy colonies of microorganisms that attach to surfaces.

immediately flush away the cleaning product inside the bowl, minimizing its effectiveness. “If you want to disinfect, you have to allow sufficient contact time” with the disinfectant, Cai says. Follow the directions on the label, or if you’re unsure, the CDC recommends waiting at

least a minute.

The final step is to disinfect the exterior parts of the toilet. Using your EPA-verified disin fectant, spray and wipe down the

top and underside of the seat, the bowl base, the top and underside of the lid, the tank, the handle, and the hinges that connect the lid to the bowl. If you use a gen erous wad of toilet paper for the job, you’ll be able to flush it when you’re done. If you use paper towels, toss them in the trash immediately so they don’t contaminate other areas. And remember: every flush – not to mention, every poor aimer who uses your loo – sends all manner of germs beyond the boundaries of your toilet, so take care to clean the rest of your bathroom regularly, too.