Q: A number of years ago I went in with an old college buddy to buy a little cabin near Truckee. Over the years, each of our families have enjoyed using it for vaca tions and weekend getaways. We each own half of the cabin and have always shared the costs of maintaining it. Now I’m going to be moving, permanently, to New York so I won’t be using it anymore and I want to cash out my investment. I offered to sell my half to my friend, but he just went through a nasty divorce and is pretty broke. I’d like to find a Realtor to market and sell my interest. Is there anything I should know about this process?

A: It’s been said than owning 50-percent of real estate is tanta mount to owning half that.

OK, I don’t know if anyone else has ever said that but let me explain why it’s often true.

The first thing you need to know is that you’re going to have trouble selling your 50-percent interest and actually getting someone to pay you anything close to half the value of the whole property.

Owning half of the property worked for you because you and your buddy were, well, buddies. You were friends who got along and cooperated with one another. Now you want to bring a stranger into the relationship.

Nobody wants to pay market value for your half interest and then be a 50-percent owner in a property along with a complete stranger.

And frankly, your buddy isn’t going to be thrilled with the idea that someone he doesn’t even know, and may really dislike, is going to be able to come and go as he pleases in his house.

Of course, that probably won’t be an issue anyway.

Why? Because anybody who would buy your half of the property is doing so because

Tim Jones

Frequent readers will recall

real estate sues the other owners to make them sell the property

three choices.

First, you can try to find a mutual friend who is willing to take your place and who your buddy would accept as a co-owner.

Assuming that’s not a possibility, you can offer your buddy terms. Perhaps he will agree to pay all future costs of maintenance and make small monthly payments to you, much like a mortgage.

If you can work out the particulars, I suggest you have an attorney draw up the papers so the terms of the deal don’t inevitably fade with memories.

Home prices in the U.S. rose for a third straight month, pushed up by growing buyer demand for a tight supply of listings.

offer to buy your interest at an extremely discounted price (e.g. 20%), and then immediately file suit against your buddy in order to get the entire thing sold at market value, thus making an immediate profit.

That should help your friendship along.

Unless you are ready to let your interest go at a fire sale price and sell your friend down the river, you really only have

And finally, if the other two options don’t work, you’ll have to decide how valuable your friendship is. Since the only remaining avenues for you are to file suit and partition the property yourself, or simply deed the property over to your buddy and walk away, you are going to have to make a tough choice.

Tim Jones is a real estate attorney in Fairfield. If you have any real estate questions you would like to have answered in this column you can send an email to AllThingsRealEstate@ TJones-Law.com.

A national gauge of prices increased 0.5% in April from March, according to seasonally adjusted data from S&P CoreLogic Case-Shiller.

The U.S. is in what’s traditionally its busiest homebuying season, with only about half the properties that were listed for sale in spring 2019. The inventory shortage is keeping a lid on transactions, but shoppers determined to seal a deal are often forced to pay more than the asking price in many areas of the country.

“The ongoing recovery in

home prices is broadly based,” Craig Lazzara, managing director at S&P Dow Jones Indices, said in a statement Tuesday. On a year-over-year basis, prices slipped 0.2%, compared with a 0.7% increase in March. Miami, Chicago and Atlanta reported the highest annual gains among the 20 largest cities. The housing market is still adjusting to mortgage rates that have about doubled from early 2022, cutting into affordability for would-be buyers and discouraging current homeowners from moving.

Continued improvement

“will depend on the how well the market navigates the challenges posed by current mortgage rates and the continuing possibility of economic weakness,” Lazzara said.

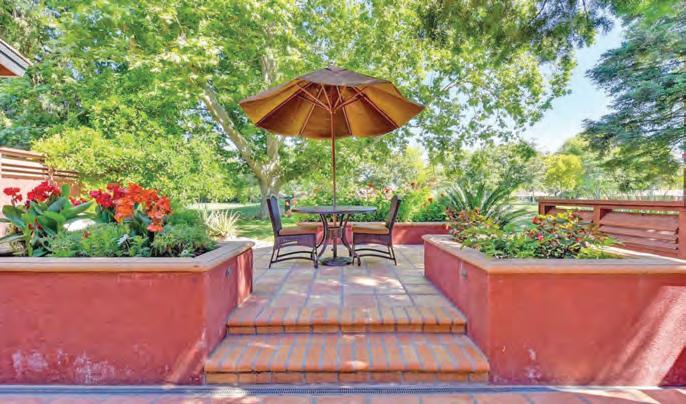

open floor plan, a spacious inviting family room with a fireplace, custom plantation shutters, and window coverings throughout. The kitchen welcomes you into an chef ’s kitchen with granite countertops, breakfast nook. An oasis awaits you as you stroll around the lush and well maintained backyard. $679,999

An HECM (Home Equity Conversion Mortgage) is a unique loan, also referred to as a “reverse mortgage.”

It is designed for borrowers that are 62 years of age or older. It allows you to access your home equity in the form of monthly income, a line of credit to draw on or immediate cash, tax free, to use for any reason, without ever having to make a mortgage payment on the loan, as long as you live in your home, keep the home insured and the property taxes paid.

If you live in the home until your death, your heirs will have the choice to pay off the loan or sell your home and keep the remaining equity. What a concept! The mortgage company pays you instead of you paying them.

Below are are fables and myths about HECMs that are just not true:

n You turn title over to the bank.

n Debts from the HECM pass on to your heirs.

n You will be forced to sell your home.

n You pay taxes on the loan proceeds.

n You can outlive the loan and will have to start making payments.

n You cannot keep your home in a living trust.

n There are restrictions about how you can use the money.

n There are minimum credit scores.

n The bank owns your home when you are gone.

These myths are one reason why I am only closing six or seven of these loans per year at

my office but I can honestly say that every single HECM I have closed over the past 10 years has been life-changing for my client. Many of these clients have 740plus FICO scores, pension plans and even 401k-IRA accounts but wish to use the tax-free equity in their home to supplement their other income and assets.

The HECM is a government insured loan and is designed for the middle class and home values less than $1 million but there are new types of conventional reverse mortgage loans designed for multimillion-dollar homes in the high-rent districts of California that have very little in fees. I have never closed one personally but a colleague of mine did one on a $3.8 million home in the Oakland Hills where the healthy 79-year-old borrower took out a $1.5 million loan tax-free and paid cash for a vacation home with ocean views on the coast.

Jim Porter, NMLS No. 276412, is the branch manager and senior loan adviser of Solano Mortgage, NMLS No. 1515497, a division of American Pacific Mortgage Corporation, NMLS No. 1850, licensed in California by the Department of Financial Protection and Innovation under the CRMLA / Equal Housing Opportunity. Jim can be reached at 707-449-4777.

TOTAL SALES: 8

LOWEST AMOUNT: $365,000

HIGHEST AMOUNT: $1,225,000

MEDIAN AMOUNT: $1,087,000

AVERAGE AMOUNT: $884,625

1320 East 7th Street - $470,000, 05

-24-23 [2 Bdrms - 1104 SqFt - 1989 YrBlt],

Previous Sale: 01-28-20, $365,000

826 West 8th Street - $505,000, 05

-24-23 [2 Bdrms - 836 SqFt - 1942 YrBlt]

687 Belvedere Drive - $1,225,000, 05

-22-23 [3 Bdrms - 2094 SqFt - 1988 YrBlt],

Previous Sale: 05-26-22, $1,055,000

900 Cambridge Drive #39 - $365,000, 05

-23-23 [1 Bdrms - 687 SqFt - 1984 YrBlt],

Previous Sale: 08-14-20, $249,000

881 Channing Circle - $1,070,000, 05

-23-23 [4 Bdrms - 2076 SqFt - 1984 YrBlt],

Previous Sale: 07-06-18, $776,000

694 Earl Court - $1,104,000, 05

-26-23

2920 Capitola Court - $620,000, 05

-26-23 [3 Bdrms - 1624 SqFt - 1979 YrBlt]

2153 Crestview Court - $550,000, 05

-22-23 [4 Bdrms - 2291 SqFt - 1990 YrBlt],

Previous Sale: 00/1992, $214,000

106 De Leon Court - $516,000, 05

-22-23 [3 Bdrms - 1262 SqFt - 1983 YrBlt]

880 Deerfield Place - $405,000, 05

-26-23 [4 Bdrms - 3036 SqFt - 1990 YrBlt],

Previous Sale: 00/1989, $188,000

190 Del Sur Court - $231,000, 05

-26-23 [2 Bdrms - 805 SqFt - 1974 YrBlt],

Previous Sale: 06-29-15, $78,000

3043 Gulf Drive - $650,000, 05

-26-23 [4 Bdrms - 2569 SqFt - 1988 YrBlt],

Previous Sale: 08-15-00, $265,000

1501 Kansas Street - $560,000, 05

-22-23 [3 Bdrms - 1564 SqFt - 1954 YrBlt],

Previous Sale: 01-31-23, $368,000

1330 Kansas Street - $326,000, 05

-24-23 [3 Bdrms - 1316 SqFt - 1954 YrBlt],

Previous Sale: 02-26-13, $101,000

2213 Madrone Drive - $573,000, 05

-25-23 [3 Bdrms - 1624 SqFt - 1977 YrBlt]

1606 Mayberry Court - $549,000, 05

-26-23 [3 Bdrms - 2257 SqFt - 1964 YrBlt]

1431 Minnesota Street - $520,000, 05

-26-23 [3 Bdrms - 1216 SqFt - 1954 YrBlt],

Previous Sale: 07-09-18, $330,000

1324 Monroe Street - $450,000, 05

-22-23 [4 Bdrms - 1100 SqFt - 1954 YrBlt],

Previous Sale: 06-05-17, $265,000

2119 Nottingham Drive - $465,000, 05

-24-23 [3 Bdrms - 1128 SqFt - 1960 YrBlt],

Previous Sale: 12-04-08, $100,000

550 Pear Tree Lane - $495,000, 05 -25-23 [3 Bdrms - 1200 SqFt - 1964 YrBlt]

3137 Potrero Way - $625,000, 05 -22-23 [3 Bdrms - 1783 SqFt - 1980 YrBlt], Previous Sale: 03-12-21, $569,000 3111 Puffin Circle - $550,000, 05

[4 Bdrms - 2250 SqFt - 2004 YrBlt], Previous Sale: 06-04-21, $499,000 5262

AVERAGE AMOUNT: $555,318

2386 Baltic Court - $455,000, 05

-25-23 [3 Bdrms - 1256 SqFt - 1973 YrBlt],

Previous Sale: 06-27-16, $220,000

1106 Bay Tree Court - $547,000, 05

-26-23 [3 Bdrms - 1476 SqFt - 1987 YrBlt],

Previous Sale: 06-25-20, $250,000

858 Bridle Ridge Drive - $811,000, 05

-24-23 [3 Bdrms - 3175 SqFt - 2005 YrBlt],

Previous Sale: 03-24-05, $1,054,500

4244 Brudenell Drive - $725,000, 05

-22-23 [4 Bdrms - 2184 SqFt - 1999 YrBlt],

Previous Sale: 12-07-99, $271,820

-25-23 [2 Bdrms - 858 SqFt - 1951 YrBlt],

Previous Sale: 11-04-03, $222,000

706 Riverwood Lane - $475,000, 05

-22-23 [2 Bdrms - 2031 SqFt - 2006 YrBlt],

Previous Sale: 08-24-09, $290,000

426 Saddle Rock Lane - $400,000, 05

-26-23 [2 Bdrms - 1154 SqFt - 2013 YrBlt],

Previous Sale: 05-02-18, $315,000

TOTAL SALES: 5

LOWEST AMOUNT: $400,000

HIGHEST AMOUNT: $570,000

MEDIAN AMOUNT: $530,000

AVERAGE AMOUNT: $508,700

413 Dickey Court - $570,000, 05

-26-23 [3 Bdrms - 1492 SqFt - 1989 YrBlt],

Previous Sale: 01-17-19, $418,000

1002 Liberty Drive - $530,000, 05

-22-23 [3 Bdrms - 1590 SqFt - 2005 YrBlt],

Previous Sale: 04-12-08, $250,000

111 Sunshine Street - $568,000, 05

-24-23 [3 Bdrms - 1700 SqFt - 2008 YrBlt],

Previous Sale: 07-12-17, $385,000

506 Trumpeter Drive - $400,000, 05

-22-23 [4 Bdrms - 1678 SqFt - 1978 YrBlt],

Previous Sale: 05-18-23, $400,000

1100 Worley Road - $475,500, 05

-23-23 [3 Bdrms - 1780 SqFt - 1975 YrBlt]

TOTAL SALES: 22

LOWEST AMOUNT: $310,000

HIGHEST AMOUNT: $950,000

MEDIAN AMOUNT: $612,500

AVERAGE AMOUNT: $622,705

1951 Aletha Lane #3 - $310,000, 05

-25-23 [3 Bdrms - 1155 SqFt - 1978 YrBlt],

Previous Sale: 02-20-18, $175,000

844 Arabian Circle - $680,000, 05

-26-23 [3 Bdrms - 2066 SqFt - 1990 YrBlt],

Previous Sale: 08-16-06, $544,500

98 Auburn Court - $728,000, 05

-26-23 [5 Bdrms - 2258 SqFt - 1978 YrBlt],

Previous Sale: 12-08-00, $300,000

530 Buck Avenue - $662,500, 05

-26-23 [3 Bdrms - 1910 SqFt - 1972 YrBlt]

800 Buck Court - $747,000, 05

-26-23 [4 Bdrms - 1795 SqFt - 1978 YrBlt]

8013 Claret Court - $790,000, 05

-25-23 [4 Bdrms - 2526 SqFt - 2015 YrBlt],

Previous Sale: 09-26-18, $615,000

112 Coulter Way - $590,000, 05

-26-23 [3 Bdrms - 2120 SqFt - 2007 YrBlt],

These are the local homes sold recently, provided by California Resource of Lodi. The company can be reached at 209.365.6663 or CalResource@aol.com.

-26-23 [3 Bdrms - 1858 SqFt - 1976 YrBlt],

Previous Sale: 09-03-20, $540,000

142 Manzanita Drive - $539,000, 05

-22-23 [3 Bdrms - 1472 SqFt - 1967 YrBlt],

Previous Sale: 07-13-20, $440,000

209 Marna Drive - $525,000, 05

-22-23 [3 Bdrms - 1276 SqFt - 1985 YrBlt]

143 Mesa Court - $575,000, 05

-25-23 [3 Bdrms - 1306 SqFt - 1978 YrBlt],

Previous Sale: 08-03-98, $138,500

233 West Monte Vista Avenue -

$471,000, 05

-22-23 [3 Bdrms - 1002 SqFt - 1954 YrBlt],

Previous Sale: 01-18-22, $470,000

2019 Newcastle Drive - $784,500, 05

-22-23 [4 Bdrms - 2687 SqFt - 2015 YrBlt],

Previous Sale: 11-17-15, $532,500

642 Periwinkle Drive - $658,000, 05

-24-23 [3 Bdrms - 1959 SqFt - 2020 YrBlt],

Previous Sale: 10-14-20, $577,500

361 Rancho Murieta Court - $559,000, 05

-23-23 [3 Bdrms - 1769 SqFt - 2001 YrBlt],

Previous Sale: 07-29-11, $228,000

412 Rosso Court - $530,000, 05

-26-23 [3 Bdrms - 1507 SqFt - 2007 YrBlt],

Previous Sale: 06-25-14, $281,100

1169 Syracuse Circle - $516,500, 05

-23-23 [3 Bdrms - 1370 SqFt - 1992 YrBlt],

Previous Sale: 09-29-20, $410,000

501 Wicklow Drive - $550,000, 05

-24-23 [3 Bdrms - 1182 SqFt - 1995 YrBlt],

Previous Sale: 03-31-16, $360,000

221 Wykoff Drive - $950,000, 05

-23-23 [4 Bdrms - 3205 SqFt - 1972 YrBlt]

TOTAL SALES: 32

LOWEST AMOUNT: $150,000

HIGHEST AMOUNT: $981,000

MEDIAN AMOUNT: $545,000

AVERAGE AMOUNT: $538,391

941 5th Street - $470,000, 05

-23-23 [3 Bdrms - 1228 SqFt - 1961 YrBlt],

Previous Sale: 08-27-13, $173,000

8092 Carlisle Way - $635,000, 05

-25-23 [3 Bdrms - 1665 SqFt - 2004 YrBlt],

Previous Sale: 08-17-17, $450,000

428 Corcoran Avenue #3 - $265,000, 05

-25-23 [2 Bdrms - 880 SqFt - 1976 YrBlt]

17 Del Mar Court - $573,000, 05

-26-23 [2 Bdrms - 1314 SqFt - 1954 YrBlt],

Previous Sale: 09-03-15, $279,000

227 Edgemont Avenue - $566,500, 05

$382,000, 05 -24-23 [2 Bdrms - 976 SqFt - 1992 YrBlt],

Previous Sale: 09-10-20, $310,000

985 Glen Cove Road - $480,000, 05 -25-23 [5 Bdrms - 2841 SqFt - 1942 YrBlt]

116 Greeves Street - $645,000, 05 -22-23 [4 Bdrms - 1578 SqFt - 1972 YrBlt],

Previous Sale: 02-26-18, $485,000

317 Lighthouse Drive - $340,000, 05 -24-23 [3 Bdrms - 1058 SqFt - 1988 YrBlt],

Previous Sale: 06-08-05, $310,000

1549 Magazine Street - $322,000, 05 -22-23 [3 Bdrms - 966 SqFt - 1953 YrBlt]

1465 Montclair Street - $981,000, 05 -22-23 [4 Bdrms - 3029 SqFt - 2018 YrBlt],

Previous Sale: 12-28-17, $791,000

176 Newcastle Drive - $740,000, 05 -26-23 [4 Bdrms - 2362 SqFt - 1990 YrBlt],

Previous Sale: 04-28-04, $485,000

220 Nigh Street - $364,000, 05 -23-23 [2 Bdrms - 736 SqFt - 1938 YrBlt],

Previous Sale: 02-18-09, $52,500

730 Ohio Street - $441,000, 05 -26-23 [2 Bdrms - 2805 SqFt - 1930 YrBlt]

1301 Ohio Street - $415,000, 05 -26-23 [2 Bdrms - 863 SqFt - 1938 YrBlt],

Previous Sale: 06-29-00, $103,000

335 Pepper Drive - $615,000, 05 -26-23 [3 Bdrms - 1885 SqFt - 1958 YrBlt],

Previous Sale: 12-15-22, $387,000

200 Peppercorn Court - $750,000, 05 -24-23 [5 Bdrms - 2629 SqFt - 1979 YrBlt],

Previous Sale: 12-10-19, $548,000

180 Prestwick Court - $679,000, 05 -23-23 [5 Bdrms - 2241 SqFt - 1982 YrBlt],

Previous Sale: 07-17-19, $505,000

990 Prospect Avenue - $725,000, 05 -26-23 [3 Bdrms - 2153 SqFt - 2005 YrBlt],

Previous Sale: 06-17-20, $618,000

101 Rhododendron Street - $670,000, 05 -26-23 [4 Bdrms - 2117 SqFt - 1979 YrBlt]

1408 Roleen Drive - $537,000, 05 -24-23 [3 Bdrms - 1323 SqFt - 1965 YrBlt]

444 Rollingwood Drive - $510,000, 05 -22-23 [3 Bdrms - 1144 SqFt - 1962 YrBlt]

114 Saybrook Way - $502,000, 05 -24-23 [4 Bdrms - 2377 SqFt - 1988 YrBlt],

Previous Sale: 07-15-08, $395,000

291 Sea Crest Circle - $490,000, 05 -26-23 [2 Bdrms - 1464 SqFt - 1994 YrBlt],

Previous Sale: 06-06-19, $390,000

128 Tuolumne Street - $150,000, 05 -24-23 - 1000 SqFt - 1945 YrBlt]

815 Valle Vista Avenue - $550,000, 05

$422,500

AVERAGE AMOUNT: $437,083

Previous Sale: 03-12-21, $520,000

1097 Countrywood Lane - $635,000, 05

-26-23 [4 Bdrms - 2328 SqFt - 2002 YrBlt],

Previous Sale: 04-06-17, $451,000

161 Currant Lane - $565,000, 05

-24-23 [2 Bdrms - 1520 SqFt - 1998 YrBlt],

Previous Sale: 04-15-99, $172,175

542 Datura Drive - $660,000, 05

-26-23 [3 Bdrms - 1728 SqFt - 2020 YrBlt],

Previous Sale: 10-14-20, $518,000

917 Laurel Way - $395,000, 05

311 Edgewood Drive - $674,000, 05

-25-23 [2 Bdrms - 1226 SqFt - 1940 YrBlt],

Previous Sale: 12-04-18, $385,000

344 El Camino Real - $557,000, 05

-26-23 [2 Bdrms - 1659 SqFt - 1936 YrBlt]

242 El Camino Real - $770,000, 05

-26-23 [2 Bdrms - 2086 SqFt - 1935 YrBlt],

Previous Sale: 10-31-09, $270,000

199 Fleet Street - $540,000, 05

-24-23 [3 Bdrms - 1704 SqFt - 1978 YrBlt],

Previous Sale: 07-03-12, $250,000

1201 Glen Cove Parkway #111 -

-25-23 [3 Bdrms - 1829 SqFt - 1941 YrBlt],

Previous Sale: 10-05-10, $175,000

10 Werden Street - $290,000, 05 -26-23 [3 Bdrms - 988 SqFt - 1977 YrBlt],

Previous Sale: 10-22-10, $51,000

127 Winchell Court - $569,000, 05 -23-23 [3 Bdrms - 1267 SqFt - 1961 YrBlt],

Previous Sale: 03-15-22, $500,000

5187 Zinfandel Lane - $705,000, 05 -24-23 [3 Bdrms - 1857 SqFt - 2000 YrBlt],

Previous Sale: 02-22-11, $243,000

For many people, beating the heat this summer means one thing: cranking up the air conditioner. Experts say having access to air conditioning isn’t just about comfort. During extreme heat events, which are becoming more frequent and prolonged due to climate change, being in an air-conditioned space helps keep people safe.

But air conditioners can be expensive energy guzzlers. According to the Energy Department, air conditioning ranks as one of the biggest energy users in homes across much of the country – consuming about 6% of the nation’s electricity, at an annual cost of about $29 billion to homeowners.

There are, however, changes you can make to your space and how you use your air conditioner that can save energy, said Jennifer Amann, senior fellow in the buildings program at the American Council for an Energy-Efficient Economy, a nonprofit group. Even adjusting your thermostat a couple of degrees warmer than what you normally keep it at could yield savings that add up over time, Amann said.

“A few percent here and there can really make a difference over the course of the summer,” she said.

In the United States, experts say people with air conditioning are likely using one of the following: conventional central air conditioning, window units, or various types of heat pumps, which include central systems

Smart thermostats can be programmed to suit your schedule.

that require ducts or ductless technology such as mini-split heat pumps.

Together with taking steps to keep your home cool, switching to a high-efficiency air conditioner could reduce your energy use by 20 to 50%, according to the Energy Department.

Industry groups such as the Air-Conditioning, Heating, and Refrigeration Institute and the Association of Home Appliance Manufacturers provide efficiency ratings and can be helpful resources for consumers, said Wes Davis, technical services director of the Air Conditioning Contractors of America, a trade group.

Proper installation and

maintenance of air conditioners can boost efficiency. Routinely replacing and cleaning filters, for instance, can lower an airconditioning unit’s energy consumption by 5 to 15%, the Energy Department says.

But Amann and other experts say how you run your air conditioner could also make a difference. Here are some energy-saving tips you can try:

Not running your air conditioner when you don’t need it can help cut down on energy use, but the savings often depend on a variety of factors, including how well your home is insulated, what type of system

you’re running and the weather outside, said Aisling Pigott, a graduate student studying building systems at the University of Colorado at Boulder who has researched whether shutting off cooling actually saves energy.

In a published analysis that was not peer-reviewed, Pigott and other researchers found that less energy was used across the three types of air conditioners studied when cooling was shut off for an eight-hour period, compared to running the systems all day at 76 degrees Fahrenheit.

While the researchers noted that energy use temporarily spiked to recover from the

higher indoor temperature that came from setting the thermostat to 89 degrees Fahrenheit, overall energy consumption was still less than having the air conditioners maintain cool conditions. In the case of a conventional central air conditioner, turning off cooling for eight hours a day could yield annual energy savings of up to 11%, the researchers wrote.

But Pigott said how much energy you could save isn’t straightforward. If you’re running your air conditioner at 72 degrees for 16 hours a day and then you turn it off for the eight hours you’re not home, “You don’t necessarily save one-third of your energy cost by turning it off for one-third of the day,” she said.

If the home is better insulated, the air conditioner is more efficient or the climate has less dramatic temperature swings, shutting the system off probably won’t save as much energy.

And while turning off your system is “the most efficient thing to do,” it could result in indoor temperatures becoming uncomfortably warm, Amann said.

“If you don’t have pets or you’re not in a particularly humid climate, you may be able to turn the system off,” she said. “You really just want to think about what the conditions get like in your home if you’re not there and you have the system turned off.”

But a ductless system, such as traditional window units or more advanced mini-split heat pumps, could allow for more flexibility, Amann said. These setups can offer more options

Making its debut this year is Luminary Sunset Coral tall garden phlox. I grew it last year as part of Proven Winners’ garden writer trial program and fell madly in love with it. The color is elec trifying in the garden – so thrilling in fact, that I just had to add more plants this year. For whatever reason, last year I decided to plant them around a windmill palm in com bination with Heart to Heart to Bottle Rocket caladiums and the chartreuse Royal Hawaiian Maui Gold elephant ears. There is simply no rhyme or reason to do such a combination, but I did

This year I added more of the phlox to the area and decided to try Heart to Heart Clowning Around as caladium partners along with the elephant ears and palm tree. The partnership was everything I dreamed. The coral colors in the caladium leaves

Admittedly, caladiums aren’t your first consideration in a

phlox partnership. In the front yard I combined Luminary Sunset Coral phlox with Rockin Playin the Blues salvia, Chestnut Gold Rising Sun rudbeckias, and Augusta Lavender heliotrope. I love the look, even though it is a little wildflower-like for the front entrance flower bed. During my years as director of the Coastal Georgia Botanical Gardens in Savannah, Georgia, I noticed constant butterfly activity around the tall garden phlox. With the advent of the Luminary series, I was anxious to see how they performed with regards

See Winter, Page 15

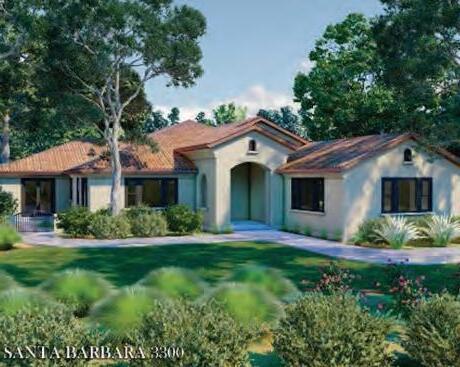

Open House Sunday 1-3PM

1200 Chula Court, Suisun City

3/2 w/RV parking! Kitchen w/granite counters, breakfast area, ceiling fan, gas stove, plenty of cabinets & natural light. Engineered wood floors in great rm w/fp. Primary bdrm w/2 closets, bthrm w/shower over soaking tub. Above ground pool. $600,000

Emmy Greene & Associate REALTOR® BRE#01350961 (707) 803-2733

For Sale a Successful Local Flower and Gift Business

4160 Suisun Valley Rd., Fairfield

If you have always dreamt of owning your own flower shop this is your opportunity. Green Valley Floral & Gifts has been an independently owned and operated full-service floral and gift shop for the past 37 years. They create unique fresh floral arrangements for all occasions and deliver locally. They also carry a large variety of one-of-a-kind gifts, and locally sourced specialty items. Inside is a beautifully appointed 1250 sf-Retail Space, 266 sf-Office and 250 sf-Storage, totaling 1766 sf. Centered in an area with heavy traffic patterns, wonderful restaurants, wineries/tasting rooms, event centers, and Ag Tourism locations of Suisun Valley. $115,000

U.S. pending home sales in May fell to the lowest level this year as high mortgage rates and inventory constraints continue to impact sales.

The National Association of Realtors’ index of contract signings to purchase previously owned homes dropped 2.7% to 76.5 last month, according to data released Thursday. The decrease was bigger than all but one estimate in a Bloomberg survey of

economists.

The resale market continues to face headwinds as high borrowing costs and low supply weigh on sales. Many homeowners who locked in lowers mortgage rates in the past are reluctant to move, adding to inventory constraints that are pushing many buyers into the new-home market and helping keep existing-home sales subdued.

“The lack of housing inventory continues to prevent housing demand from being fully real-

ized,” Lawrence Yun, NAR’s chief economist, said in a statement.

The pending home sales report is often seen as a leading indicator of existing-home sales given homes typically go under contract a month or two before they’re sold.

Sales declined in three of four regions, with transactions in the Midwest falling to the lowest level since April 2020. From a year earlier, U.S. home purchases were down nearly 21% on an unadjusted basis.

FRUSTRATED with your current Lender fumbling your Purchase or Refinance, Bring your loan to us so we can get you locked at a GREAT RATE and Finish it up QUICKLY! We don’t mess around, We Get it DONE, We are Local and we DELIVER!

When we write your Pre-Approval Letter to present to the seller, You WILL Close the Deal with us!

George R. Kalis Broker/Owner

707.759.5129

1300 Oliver Rd., Ste. 140 • Fairfield • George@NIMBLoan.com NMLS #270402 • DRE#02077932 • NMLS #1859425

From Page 5

for how they can be run than central systems, allowing you to focus on cooling or heating specific spaces instead of the entire home.

“You don’t necessarily need to run every unit in your home,” she said.

It’s important, she and other experts said, to consult with your contractor or HVAC professional about how to best

operate your system. For instance, Davis cautioned, more frequently starting and stopping your air conditioning unit could strain the system’s motor.

If you’re concerned about your home getting too warm, you can still get energy savings even though your system isn’t completely off by adjusting your thermostat, Amann said.

Smart thermostats, which can be programmed to suit your schedule, can help do this.

When you’re away from

home, Amann said you can probably let the temperature go as much as five to seven degrees higher than what would normally be comfortable for you. A smart thermostat could be set to take into account when you typically come home, so that the indoor temperature is where you would like it to be when you return.

“Certainly when you’re away from home, having those settings can make a big difference, particularly if you’re if away all day for work or if you’re away on vacation,” she said. “You definitely want to make sure you’re

setting the thermostat up to allow the heat of the house to get a little warmer than normal.”

You can help reduce the costs of running your air conditioner by taking other steps to keep your home cool.

Make sure blinds or shades are closed during the hottest parts of the day, particularly if you don’t have updated windows, Amann said. Try to avoid using appliances such

as dishwashers, ovens and stovetops or dryers, which can make spaces hotter and more humid and force your air conditioner to work harder, she said.

Using ceiling fans could also allow you to keep your thermostat at a couple degrees warmer and still feel comfortable, Amann said. But remember that “ceiling fans cool people, not rooms,” she said.

“You don’t want to run your ceiling fans all through your house,” she said. “You want to run them in the rooms that you’re in.”

When Maggie moved to Las Vegas from Michigan with her family and bought a house in December of 2020, interest rates were incredibly low.

“I think we got an interest rate at (2 or 2.2) percent,” she said about the $396,000 house she and her husband bought in the Prescott Park area in the northwest valley. “But now my husband has retired and we want to move back to Michigan and we’re going to take a huge financial hit. We’re kind of screwed.”

Maggie, a homeowner who wanted to be identified only by her first name to avoid revealing her family’s financial information, said that luckily their real estate agent was able to sell their house for more than $500,000.

However, this solved only half the problem, she said. Now they have to try buying another home at much higher interest rates.

“We’re probably looking at 7% right now; I mean are you nuts?” Maggie said. Unfortunately, she said, her family has no choice but to buy high in their return to Michigan and hope interest rates fall so they can refinance their mortgage down the road.

Maggie and her family are not alone. All across the country, homeowners who bought when interest rates were low now sometimes feel “locked” into their homes and unable to move as the average mortgage rate sits at 6.69% – more than double what it was in June 2020.

It’s a phenomenon being felt by many nationwide as higher rates can add hundreds of dollars a month in costs for homebuyers, limiting how much they can afford in a market. According to data from Redfin, an online real estate brokerage, 23.5% of

Americans with a mortgage at the end of the first quarter of 2022 had a rate under 3 percent, and 62% had one with a rate lower than 4 percent.

“Of course (interest rates) are significantly higher than they were even a year ago,” said Nadia Evangelou, a senior economist and director of real estate research for the National Realtors Association. “And so that can mean existing homeowners don’t want to sell their homes and give up that interest rate that they were able to secure, say back in 2021, so this locking effect comes in.”

The U.S. housing market has been on a roller-coaster ride since the start of the Covid-19 pandemic, which saw a buyer’s boom fueled by cheap money that subsequently sent prices to record highs in 2021.

Then, in the second half of last year, Southern Nevada’s housing market came crashing down to earth as rising interest rates – introduced to quell rising inflation – led to a sharp jump in mortgage rates. This in turn forced buyers to pull back and sellers to slash prices.

Steve Miller, a professor of economics at the Lee Business School at the University of Nevada, Las Vegas, said the Federal Reserve’s top priority now is reducing inflation, which is running about 4% year over year, and its primary tool is raising interest rates.

“I think what is frustrating the Fed right now is inflation seems to be a bit sticky,” Miller said. “The inflation rate came down pretty quickly (the rate hit 8% in 2022) but for the last few months, it’s kind of been sticky.”

Miller said this has helped

create the phenomenon within the housing market where people like Maggie who bought when rates were low can’t afford to re-enter the housing market unless they’re willing to make much higher monthly mortgage payments.

“You have people who are living in homes that they could not probably afford at current interest rates, and so what do you do? The best thing for people to do is to continue to live there,” he said. “If you’re making that monthly payment it’s good, but the problem is that if you want to move you have to sell your house and then can you afford to get back in?”

However this creates a complicated ripple effect. National data indicates this phenomenon may be contributing to a supply issue all over the country. And, according to a June report from the National Association of Realtors, the pinch is hitting a specific demographic right now.

Households currently earning $75,000 – the median household income in the U.S. – can afford to buy a home up to $256,000. However, current housing market data shows that only 25% of the listings across the country have a price tag at, or below, $256,000. Five years ago this vast income group could afford to buy half of all available homes.

The news is better for households making more than $250,000 – 85% of the homes on the market are within their price range.

Evangelou, the Realtors association economist, said middle-income buyers “face the largest shortage of homes among all income groups, making it even

See Market, Page 15

From Page 6

to pollinators and resistance to powdery mildew.

I’m delighted to report that I have been growing Luminary Opalescence, Ultraviolet, Sunset Coral, and the new Prismatic Pink debuting in 2024, and there has not been a single leaf with powdery mildew. They are also spot-on with their reputation for attracting butterflies, particularly swallowtails.

So, my plan will be until further notice that if I am creating a pollinator habitat, there will be a place for at least one of the Luminary phlox varieties. That being said, I am now currently combining Luminary Ultraviolet phlox with reblooming hydrangeas, rudbeckias, Luscious lantanas, Mexican sunflowers and even SunPatiens.

Out of the five colors in the series, the white selection, Luminary Backlight, is just a little smaller in height and spread but by only a couple of inches. Luminary Prismatic Pink, which will be making its debut in 2024, is already extra-special to me for garden fragrance. You will love how its spicy sweet aroma permeates the air, welcoming you into their presence. It is definitely one for creating memories. The others are noted for fragrance, but this is the one my nose knows. Yes, Proven Winners describes the color as a

From Page 13

harder for them to build wealth through homeownership.”

Brian Gordon, principal at Applied Analysis, a data resource company in Las Vegas, said the numbers paint a pretty clear picture right now.

“The market has an overwhelming majority of owners

that are locked into lower mortgage interest rates than are available today, so they tend to remain in place and avoid overall higher housing costs by moving,” he said. “This is holding back inventory and simply leaving fewer homes to choose from, both for owner occupants and investors seeking rental properties.”

For Maggie, the Las Vegas homebuyer, the situation feels as if average Americans are getting pinched again by economic con-

The Lady Bird Johnson Wildflower Center calls these perennials “fall phlox,” but you probably grew up calling it summer phlox or tall garden phlox. They will bloom from early June until October. Remarkably, the Phlox paniculata is native to 36 states, but most of us have probably never seen one in the wild. The Luminary series no doubt is packed with native DNA, offering us carefree and easy-

to-grow plants. The native habitat is described as rich open woods, thickets, meadows and moist roadsides. Fertile soil with plenty of sun is all that is required to give you the green thumb.

The tall garden phlox, one of our best perennials, is not a garden center staple, which is one of the mysteries of life. I urge you to simply keep your eyes open and buy them when you see them.

ditions out of their control.

“When are we going to catch a break? We have families and kids to feed, and everything costs twice as much now. If I’m paying twice as much for bread, why is it that the interest rate is still so high and I want to move into a new house, but I can’t because the interest rate is too high? Because everybody could afford it when there were low interest rates, but nobody can afford anything now.”