As one of the leading business banking partners in the UAE, National Bank of Fujairah takes pride in being the best Trade Finance Bank in the region to provide tailored trade finance solutions, helping our clients to grow their business on the world map. With nearly four decades of expertise, we provide innovative banking solutions using our digital platforms that are designed to complement your business and offer banking services that meet your working capital and term financing requirements in a simplified manner.

SERVICES TAILORED TO YOUR NEEDS

Structured trade & commodity nancing

Con rmation of export Letters of Credit (LCs)

Other services:

Treasury & corporate advisory

•Global connectivity through our correspondent network

•Working capital & term financing, and more

WHOLESALE BANKING

Call 8008NBF(623) to start our partnership nbf.ae

Welcome to your June 2024 edition of MEA Finance Magazine.

The phrase, “May you live in interesting times”, often wrongly claimed as a Chinese curse, is an ironic expression with “interesting” used to mean troubled. However, in his instance, we are ignoring the irony in the expression and responding with a “thank you”. Why? Because now and through the preceding years of the region’s banking and finance world, these are indeed interesting times. This issue of MEA Finance brings this home with coverage from the leading edge of development in the regional banking sector.

Now established in the region’s banking technology calendar, our MEA Finance, Banking Technology Summit and Awards are comprehensively covered.

With a pantheon of visionary and market leading speakers bringing insights directly from the high velocity nose cone of the technology changing our sector, it is fair to say that this event is among the more authoritative oneday summits on this subject in the region. Our thanks to all our speakers and delegates, and congratulations to all the winners at the awards.

Our cover feature this month is an interview with Jan Pilbauer, Chief Executive Officer at Al Etihad Payments. In his genuinely interesting responses, Jan describes the growth and milestones in building a world-class payments infrastructure, and how it is their mission to develop and implement payment services that enhance financial inclusion and promote financial stability. “I strongly believe that the implementation of our advanced payment

services and infrastructure will change the financial landscape of the UAE”.

For a highly interesting take on AI in banking, turn to page 22. Here, Ali Khan, Head of Data & AI at the Commercial Bank of Dubai provides a refreshing look at its inevitably expanding role, where among his opinions he expresses, “What is key to understand is that the advantage of AI diminishes with complexity.”

Oscar Wendel, Editor-at-Large for MEA Finance was in Doha recently, reporting report from the Qatar Economic Forum where for this three-day program of high-level discussions between top political and global business leaders. And later, in his opinion piece, Oscar also turns his sights on AI and technology, with a clear alternative to the usual commentary on their benefits.

Our special interest features for this month hone in on Sustainable Finance and the challenges that come with this important market, with contributions from HSBC and Citi. We examine regional Real Estate Investment with the market perspectives of Apex Group on this growing sector and its wider economic effects. The importance of The Cloud in banking is also covered too, and added to by some of its biggest names including IBM, Microsoft and VeriPark who underline the need for financial institutions the be with it.

The country focus for this edition is on Kuwait, where special measures were taken in the face of continuing disagreements that have hampered reforms and Kuwait’s Emir Sheikh Meshal al-Ahmad al-Sabah is quoted, pointing out, “We were left with no option other than taking this hard decision to rescue the country and protect its higher national interests, and resources of the nation”.

We hope that, with all the coverage in this month’s copy of MEA Finance, you have an interesting time reading about our interesting times.

Dubai International Financial Centre

The report focuses on how regional IPO growth is expected to come in three phases. Firstly, the continued privatisation of state-related entities, followed by listings by family-owned companies and lastly, FinTech and tech-enabled start-ups.

Following two years of moderate IPO activity, 2024 shows signs of a rebound supported by the postponement of several 2023 deals in anticipation of more favourable market conditions. Based on data published by EY, 51 IPOs took place in 2022, raising USD 22bn, including a mix of both family businesses and the public sector.

The privatisation of state-related entities is leading to greater economic diversification, private sector development and sovereign liquidity creation. As of March 2024, Dubai had followed through on six out of the ten government entities it plans to take public, including Parkin, which was 165 times covered and attracted USD 71bn in orders – a new record for the emirate.

Another recent example includes the November 2023 listing of Dubai Taxi Co., a unit of Dubai’s Roads and Transport

Authority (RTA), which raised USD 315mn and was 130 times oversubscribed, while Saudi Arabia’s wider plans to privatise USD 55bn in assets by 2025 reinforce the increasing regional trend towards privatisation.

From the private sector, the listing of family-owned companies is helping to drive business growth, succession planning and enhanced governance and transparency. For example, Al Ansari Financial Services, one of the UAE’s largest remittance and foreign currency exchange companies, owned by a local family group raised USD 210mn from its 2023 IPO, while Spinney’s (Spinneys 1961 Holding PLC), which was incorporated in DIFC to list its shares on DFM, thereby benefiting from its extensive laws, regulations and stability, listed in April 2024.

Spurred on by the momentum of other, highly anticipated listings, such as Lulu’s forthcoming IPO, there is now an ever-growing list of demonstrable incentives for other family businesses to follow suit. A third wave of IPOs is expected through FinTech and techenabled start-up exits, helping to stimulate new industries with high-

growth potential, while creating strong demand from investors and viable exit options for VC investors.

Through increased IPO activity, banks, investment banks, brokerage firms and law firms within DIFC’s ecosystem also benefitted significantly from the privatisation of state enterprises, with fees for MENA deals alone exceeding USD 1.2bn and proceeds from MENA equity and equity-related deals exceeding USD 13bn in 2023.

The report also highlights how the region’s capital markets are becoming more mature, driven in Dubai by DIFC’s robust regulatory framework and commitment to innovation. DIFC is also home to more than 230 investment banks, all of which are stimulating capital markets.

Deepening of Dubai’s capital markets and market reforms, aligned with best practice have helped create greater opportunities for investors in different themes of the economy.

The region is home to a vast range of potential investors. Notably, these include family businesses and wealthy individuals who are represented by the influx of wealth of asset management firms.

According to recent data, the UAE attracted a record-breaking number of High-Net-Worth Individuals (HNWIs) in 2022, which continued into 2023 and beyond. Currently, there are an estimated 109,900 resident HNWIs, including 298 centimillionaires and 20 billionaires, prompting DIFC’s estimated 370 asset managers to strengthen their presence in the emirate.

Discover a new era of banking at CBD where simplicity and convenience meet.

Our suite of award-winning digital banking services empowers you and your business to manage your finances quickly and hassle-free, with just a few taps.

Join us today and experience a transformed banking journey, because at CBD we’re committed to making banking easier for you.

600 575 556 | www.cbd.ae

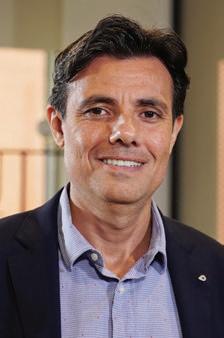

Ali Khan Head of Data & AI at the Commercial Bank of Dubai, in a compelling read, provides a refreshing perspective on the “copilot” that is Artificial Intelligence

AI technology is being deployed in every conceivable industry segment, by companies large and small. Several usecases have emerged and gained well deserved publicity. As a result, artificial intelligence tools as well as the people who use them are the new must-haves for the world’s financial institutions and central banks.

The financial services industry may well prove to be among the biggest beneficiaries of AI. AI is transforming finance in revolutionary ways to generate insights well beyond human

Ali Khan, Head of Data & AI at the

Ali Khan, Head of Data & AI at the

capabilities; the possibilities are endless: unicorns in the United states are driving financial inclusion by judging creditworthiness using non-traditional variables, South American Central Banks have experienced exponential gains in efficiency by utilising AI to conduct sentiment analysis on customer complaints, and the Bank for International Settlements has demonstrated the use of AI to detect money laundering patterns that traditional methods cannot identify.

Successful applications of this technology have confirmed that AI democratises intelligence, is a process accelerator and exponentiates productivity. Despite these successes, AI cannot, will not, and should not replace humans in the short to medium term. The simplest way to explain this is that AI is – literally - a copilot. As pilots fly, the copilot simply helps them fly more efficiently and reliably.

However, the copilot cannot replace the pilot; just the same way that a wholly AI driven implementation could potentially be fatal if the interpretation, understanding and continuous check of algorithms is not taking place.

Our industry may have the most to lose if AI spurs theft, fraud, cybercrime or even an inconceivable financial crisis. What happens when AI tools exacerbate a crisis because they are trained on past data that may not reflect reality in an unprecedented situation? Take money laundering as an example. The act of hiding money is thousands of years old and money launderers, by nature, attempt to remain undetected by changing their approach continuously. AI models trained on past data will not pick up a change in approach and by the time the model is modified, hundreds of millions of dollars would have flown through financial systems.

In fact, AI may increase financial fragility as it could promote herding where shared data with 3rd party AI solution providers result in all banks making similar decisions because they trained on the same set of data or sit on the same base model. These errors will be exponentially magnified due to the enhanced level of volumes that the ‘AI cost efficiency business case’ will be inevitably trusted to process. When tools are making complex decisions or generating mission-critical content such as customer-facing communications, the consequences of an undetected mistake become much higher.

To avoid the risk of undetected mistakes, financial institutions have taken heed. This is particularly evident on the customer experience front. AI chatbots provide a round-the-clock customer experience at a significantly lower cost compared to human agents. These copilots are capable of comprehending natural language, seamlessly accessing customer information and addressing numerous common queries. Nevertheless, when it comes to complex issues, they hand

over to human representatives to resolve intricate challenges. The reason is that everyone understands that the cost of losing a customer versus the cost of acquiring a customer is not worth the Gen AI implementation risk.

From a regulatory standpoint, while the GCC-and UAE in particular-is significantly advanced in its school of thought, global financial regulations are rooted in earlier eras. The challenge arises when forced to make a choice that hovers on the

nexus of risk and convenience; inevitably, some institutions will choose to adopt the minimum standard. Consequentially, those very historic global regulations are likely to be sub-optimal in addressing the systematic risks posed by the broad adoption of deep learning in financial services.

This is why AI, for now, should be taken to stand for Average Intelligence. The ability to ask a computer a question, have it read the whole internet, summarise it with words and images or have it generate lines upon lines of code opens a new horizon of possibilities. However, it is of paramount importance that users of these tools understand how they should use and deploy AI. What is key to understand is that the advantage of AI diminishes with complexity; where event-based situations require individuals to draw on the right side of the brain: not only a range of knowledge

stemming from economics, history, ethics and philosophy, but an emotional quotient as well.

30 years ago, Lotus 1-2-3 was marketed as a killer app replacing the immensely popular VisiCalc. It still required plugins to track, calculate and manage data. It eventually gave way to Excel. Similarly, today, GPT needs plugins for audio, video and other non-text outputs. We are at the same stage in the algorithmic regression revolution. Given this, the challenge for all financial institutions is to remember that the hardest question to answer is not “what shiny new AI tools are we deploying today?” but “how we can effectively deploy capital to collectively flourish from a focus on the client experience with the implementation of AI?” The answer to which requires banks, big tech, fintechs, ecosystems and regulators to act with imagination and conviction.

To further progress the evolution of AI and support the national agenda, the Commercial Bank of Dubai (CBD) has partnered with the DIFC to establish a Digital Factory. This collaboration between the DIFC’s Innovation Hub and CBD will not only host the bank’s agile squads, digital teams, but also an AI Center of Experimentation (AICoE), the purpose of which is to create a platform to ensure that AI is being embedded in core business operations. The AICoE will house an ecosystem for use-case development, build collaboration across multiple interconnected AI project stakeholders, ensure multidisciplinary participation to drive a unified view on data and technology, and most importantly continuously measure observable business impact. At the opening of the Digital Factory, Dr. Bernd van Linder, CEO of CBD, stated “today we commit to pushing the boundaries of data and technology as we embark on a journey to shape the future through fostering collaboration with the DIFC. The Digital Factory and AI Center of Experimentation will serve to drive transformative applications of AI across financial services with clear measurable outcomes.”

Despite divisions and disagreements blocking necessary reforms, Kuwait got by on higher oil prices up to 2023, then benefited from non-oil GDP growth remaining robust, driven by domestic demand with well capitalised and profitable banks playing a key role in supporting the economy

Kuwait’s Emir Sheikh Meshal al-Ahmad al-Sabah dissolved parliament earlier in May for as long as four years in a bid to prevent the oil-rich Gulf state from “collapse” after years of political gridlock.

Sheikh Meshal also suspended some of the constitutional articles for a period not exceeding four years during which all aspects of the democratic process will be studied.

The emir, who succeeded his halfbrother Sheikh Nawaf al-Ahmad al-Jaber al-Sabah last December, has been working to rechart the country’s course after years of challenges.

“Unfortunately, we have faced some unimaginable, unbearable difficulties and impediments,” Emir Sheikh Mishaal said in a televised speech in May. “We were left with no option other than taking this hard decision to rescue the country and protect its higher national interests and resources of the nation.”

Economists say the new emir’s reformminded approach appears aimed at helping the country catch up with its Gulf neighbours, which have been implementing ambitious plans to wean their economies off oil.

Fitch Ratings said in a commentary in March that wrangling between the elected parliamentarians and the 15-member

cabinet is a recurring feature in Kuwait that often results in frequent resignations of ministers and dissolutions of parliament.

“We assume that political divisions will continue to constrain policymaking in Kuwait,” said Fitch Ratings.

Kuwait has seen prolonged bickering between the government and the elected parliament that has hampered fiscal reforms. The International Monetary Fund (IMF) has said that a resolution to the political gridlock could accelerate needed fiscal and structural reforms, boosting investor confidence and stimulating private investment.

The Gulf state’s finances reverted to average levels in 2023, after the country reaped the benefits of surging oil prices in 2022, as low prices and production cuts dragged its economy back into the doldrums.

The country remains heavily reliant on oil, which accounts for around 90% of government revenue and has failed to significantly reduce its spending on energy subsidies, social benefits and a large and unproductive public sector.

However, away from its economic woes Kuwait is one of the richest countries in the world, with its currency

(the Kuwaiti Dinar) being one of the highest-valued currencies in comparison with other global currencies.

The oil-rich Gulf nation’s banking system is stable and systemic risk is contained, supported by a strong prudential framework that should continue to be enhanced.

Kuwait’s economy is founded on petroleum-based wealth. The country’s growth potential hinges on higher oil prices, expansionary fiscal policy and the ability of the executive and the legislature to work hand-in-hand to push through the much-needed reforms.

Kuwait’s economic growth typically mirrors global energy market fluctuations. The Gulf state, one of the world’s top 10 oil exporters, enjoyed a strong finish to 2022 with gross domestic product (GDP) growth surging by a record 8.9%.

However, the country’s revenues dropped sharply in 2023 as prices eased and the government implemented a production cut under an agreement with OPEC and its allies (OPEC+). The coalition agreed to further oil cuts to shore up prices, with Kuwait extending its voluntary

UNFORTUNATELY, WE HAVE FACED SOME UNIMAGINABLE, UNBEARABLE DIFFICULTIES AND IMPEDIMENTS. WE WERE LEFT WITH NO OPTION OTHER THAN TAKING THIS HARD DECISION TO RESCUE THE COUNTRY AND PROTECT ITS HIGHER NATIONAL INTERESTS, AND RESOURCES OF THE NATION

production cut of 135,000 barrels per day until the end of June.

Fitch Ratings projected an average oil price of $79.8 per barrel in 2024, down 5% from a year ago, while oil output is likely to be broadly unchanged at 2.55 million barrels per day in line with OPEC+ constraints.

The IMF said while oil GDP growth declined in 2023, non-oil GDP growth remained robust, driven by domestic demand and is projected to remain steady over the medium term.

Kuwait’s budget outcomes are highly sensitive to changes in oil prices and production. The fiscal break-even oil price is expected to remain high, averaging $93 per barrel in 2024/25 and the non-oil primary deficit/non-oil GDP is weak at 81%.

Earlier in January, the country approved its state budget for 2024/25, which forecasts a deficit of $19.1 billion (KWD 5.89 billion), for the fiscal year that began April 1, 2024, and ends March 31, 2025.

The budget projects revenues of $60.7 billion (KWD 18.7 billion), down 4.1% and expenditures of $79.8 billion (KWD 24.6 billion), down 6.6% when compared to 2023/24 estimates, according to the Ministry of Finance.

Kuwait’s 2024/25 budget sees nonoil revenue rising by 5.7% to $7.87 billion (KWD 2.42 billion). The government said the budget’s revenue projections are based on a daily production rate of

2.7 million barrels per day and a price of $70 per barrel.

Meanwhile, Kuwait’s fiscal and external balances have strengthened, and external buffers are increasing.

“Helped by higher oil revenue, the current account surplus is estimated to have reached 33.8% of GDP in 2022 and is projected to remain high in 2023. Official reserve assets stood at $48.2 billion as of end-2022,” said the IMF.

The fund said fiscal surplus improved to 23.4% of GDP in 2022/23, benefiting mainly from high oil revenues and expenditure restraint, which helped increase the non-oil balance by about 2 percentage points of non-oil GDP to about -88.3%.

Kuwait’s heavy reliance on oil revenues makes its economy vulnerable to fluctuations in global oil prices. However, its significant external buffers, with a substantial sovereign wealth fund and ample official reserves, provide a cushion against economic uncertainties.

Kuwait’s large fiscal and external buffers give the Gulf state ample room to undertake needed reforms from a position of strength, according to the IMF but political gridlock between the government and Parliament could continue to delay reforms.

“Slow-moving bureaucracy and ongoing disputes between the government and parliament hinder

the progress of critical infrastructure projects and fiscal reforms,” according to Paris-based insurance firm Allianz Trade.

The political squabbles that have delayed Kuwait’s fiscal reforms have left the country economically paralysed. However, the impasse seems to be breaking as the Gulf state can no longer sustain a welfare state solely on depleted natural wealth – oil and gas.

Kuwait’s Prime Minister Ahmad Abdullah al-Ahmad al-Sabah’s government faces an uphill task to implement structural reforms that would pave the way for the country to tap both local and international debt markets, allow commercial banks into the market for property loans, end a monopoly long enjoyed by Kuwait Credit Bank and widen the tax base with new corporate taxes on local companies.

Kuwait sold its first and only Eurobond –an $8 billion dual-tranche deal consisting of a $3.5 billion 2.8% 2022 note and a longer-dated $4.5bn 3.6% 2027 piece — in March 2017. The issuance received orders amounting to $20 billion.

Though the deal was welcomed by international bond investors, thanks to the Gulf state’s high sovereign credit rating, domestically it attracted backlash from different segments including political and business class amid corruption and wastefulness allegations.

Following the expiration of public debt legislation in 2017, successive parliaments have failed to pass a permanent law, despite past government efforts.

Meanwhile, Kuwait’s juggernaut is the Gulf state’s $800 billion sovereign wealth fund - Kuwait Investment Authority (KIA). KIA controls the Kuwait Investment Office, which manages the General Reserve Fund (GRF) and the Future Generations Fund (FGF).

Last July, the Gulf state unveiled plans to launch a new sovereign investment vehicle to invest in the local market and boost economic growth. Ciyada Development Fund, as the investment vehicle is called, is tasked with accelerating the growth of the local

economy while advancing the quality of life and development in different sectors.

“Ciyada Development Fund would help realise the government’s long-standing goal of separating the state’s off-budget investment activities from politicised fiscal debates,” said Allianz Trade.

Kuwait needs to rise above domestic bickering to make any progress. Resolving the bickering is critical to accelerating reform momentum and thereby boosting growth and diversifying the economy.

Kuwait’s banking system is a cornerstone of the economy. Banks in the Gulf nation, both conventional and Islamic, are exceptionally well-capitalised and profitable.

Moody’s projected that Kuwaiti banks’ profitability will remain solid in 2024, citing continued growth in the non-oil economy. However, the ratings agency cautioned that the banks’ “concentrated lending to single borrowers and their international operations in weaker countries such as Turkey and Egypt, pose risks to banks’ solvency.”

The banking sector is playing a vital role in supporting the economy by financing development projects in line with Kuwait Vision 2035 while contributing to the diversification of the economy and the growth of the non-oil sector.

Kuwait’s exchange rate continues to be pegged to an undisclosed basket of currencies. This basket is dominated by the US dollar, the currency in which the majority of Kuwaiti exports are priced and transacted. The Kuwaiti dinar is the world’s most valuable currency, and thanks to some nimble monetary policies, it is likely to remain so.

Digital transformation is the future of Kuwait’s banking sector. AI is revolutionising the country’s banking sector, bringing faster and more personalised banking services through chatbots.

“Regulators are providing a roadmap for digital transformation in Kuwait’s financial services sector. They are fostering growth by enacting rules and regulations that are aimed at accelerating the growth of digital payments while fostering seamless and real-time payments,” Bushra Al Wazzan, the Group Chief Internal Auditor at Boubyan Bank said at a panel discussion during MEA Finance and SWIFT roundtable in October 2023.

Meanwhile, Kuwait Finance House (KFH) completed its historic merger with Ahli United Bank (AUB) in February, a year and a half after the banking behemoth acquired the Bahraini lender for $11.6 billion. Fitch Ratings said the deal made KFH the second-largest Islamic bank globally by assets behind Al Rajhi Bank of Saudi Arabia.

The acquisition also bolstered KFH’s market share in Kuwait which has increased to 28% from 22% of domestic assets, behind the National Bank of Kuwait’s 33%, according to Fitch calculations.

Kuwait needs deeper reforms if its future generations are to enjoy the same standard of living that is currently enjoyed, and the authorities cannot afford to implement these at the current leisurely pace. Economists say starting next fiscal year, fiscal consolidation should aim to increase non-oil revenue and tackle current spending rigidities while increasing capital outlays to raise potential growth.

We provide the reach, resiliency, security and innovation you need to compete in the world of digital payments

Connectivity

Scale globally and accept payments across channels and devices with over 200 acquirer connections

Exceed customer needs with a dynamic suite of services, partners and solutions

Security

Protect all players from fraud and risk with advanced technology and built-in compliance

With the right connections, anything is possible

mastercard.com/gateway

Innovation

Futureproof your business and lead the competition in an always evolving market

With vast sums required to meet climate goals and to achieve net zero emissions, financial institutions and governments, while facing conflicting pressures are instituting frameworks and building funds aimed at tackling the challenges of sustainability

The record-breaking rain that fell over the UAE and Oman in April this year, triggering flash floods, was exacerbated by climate change, according to a scientific analysis by the World Weather Attribution (WWA) research initiative, which pointed directly at warming caused by burning fossil fuels as the most likely explanation.

The rarity and irregularity of massive deluges in the GCC region brought home the growing threat of climate change and highlighted the urgency of commitment to climate transition, including the

important role of the financial services sector in aligning investment with net zero.

“The key enabler of climate progress is finance – developing countries will need an estimated $2.4 trillion every year by 2030 to keep the 1.5°C goal within reach,” Majid Al Suwaidi, COP28 Director General and CEO of ALTÉRRA said at World Bank- International Monetary Fund (IMF) Spring Meetings in Washington in April.

Banks in the Gulf region have adopted environmental, social and governance

(ESG) and sustainable finance as key strategic elements in their commitment to going green.

First Abu Dhabi Bank (FAB), Qatar National Bank and HSBC Bank Middle East, among other regional financial giants, have facilitated billions of dollars in sustainable finance and adaptationrelated investments.

“While the importance of sustainability is obvious on a broader level, green initiatives enable banks to achieve a unique selling point and thereby set themselves apart from their competitors,” according to German consulting firm Roland Berger.

Calls have been mounting for financial institutions to play a more active role in facilitating the transition to a more sustainable economy.

Global accountancy firm EY said that board directors and senior executives within banking feel increasing pressure to make commitments and take action, even as they seek to understand the massive scope, intricate complexity and many moving parts of these issues.

However, the transition risks associated with sustainable finance and the related topic of ESG are new and hard to quantify. Industry experts say there is a scarcity of data and consensus on transition risks on changes in policy and customer preferences.

There is an undisputed, fast-growing interest in the sustainable finance world, with more and more banks offering financial products as an alternative to traditional loans.

Banks have made considerable progress in aligning ESG into their commercial strategies, however, the financial services sector is being hampered by a lack of consensus on frameworks and methodologies, as well as different regulatory priorities among the regions.

A survey of 55 global financial institutions that was conducted by Bain & Company shows that views differ on whether ESG pillars primarily represent downside risks to be managed or upside.

When it comes to transition risks, financial institutions have an even more challenging job on their hands. Banks could see their earnings decline, businesses disrupted and funding costs increase due to policy action, technological changes as well as consumer and investor demands for alignment with sustainability policies.

“Financial watchdogs including the European Central Bank are stepping up their supervisory engagement with banks on climate-related efforts and this may result in punitive measures on those institutions that fail to meet expectations,” said S&P Global.

Despite the wider economic downturn over the years, sustainable investments managed to weather the storm reasonably well driven by wealthy investors’ growing demand for sustainability. Capgemini said that asset and wealth managers are increasingly integrating ESG into their primary portfolios in response to growing client demand—a trend that can be attributed to a paradigm shift in client demography.

Morgan Stanley said in a report that sustainable funds outperformed their traditional peers across all major asset classes and regions in 2023, generating median returns of 12.6%, almost 50% ahead of the 8.6% returns of traditional funds.

“Investor demand for sustainable funds remained strong with assets under management (AUM) up 15% from 2022 levels to reach $3.4 trillion last year,” Morgan Stanley said in a report, adding that sustainability-linked funds now account for 7.2% of total global AUM.

The world’s top banks are increasingly under the scrutiny of wealthy investors, shareholders and climate activists over their role in funding coal, oil and gas projects – the leading causes of manmade greenhouse gas emissions.

“Transition risks materialise on the asset side of financial institutions, which could incur losses on exposure to firms with business models not built around the economics of low carbon emissions,” said the International Monetary Fund.

However, the pivot toward sustainable investing has also led to greenwashing as companies and financial institutions are purporting to be environmentally conscious for marketing purposes but they are not making any notable sustainability efforts.

GCC countries have made grand sustainability pledges. Governments are accelerating massive economic transformation programs as countries pursue their national visions that seek to put economies on a more diversified and sustainable footing.

Green finance-built momentum in 2023, including a more than doubling issuance of green bonds and sukuk in the Middle East to $24 billion, the majority coming from the UAE and Saudi Arabia, according to global accounting firm PwC.

The issuance spanned a wide range of entities including banks Dubai Islamic Bank, Abu Dhabi Commercial Bank and

Al Rajhi; corporates Saudi Electricity Company, DP World, Masdar, RAQA and Aldar Properties and sovereign wealth funds Mubadala and the Public Investment Fund and the GCC’s first sovereign sustainable bond from Sharjah.

The amount of cash needed for the energy transition, climate adaptation and disaster relief is overwhelming. As much as $792 million has been pledged for loss and damage funding arrangements – of which $662 million has been pledged to the fund to date – including $100 million from the UAE.

The importance of green financing was highlighted by multilaterals at COP28 in the UAE. The World Bank said it aims to increase climate funding to 45% of its total lending, which equates to an increase of $9 billion annually.

The Development Bank of Latin America and the Caribbean plans to invest more than $2bn annually until 2030 in Latin America to fight climate change. The Asian Development Bank also allocated $10 billion for climate investment in the Philippines between 2024 and 2029.

Similarly, Japan and France pledged to back a plan by the African Development Bank and Inter-American Development Bank to leverage IMF Special Drawing Rights for climate and development.

“Parties made history on the first day of COP28 by operationalising the funding arrangements and Fund for loss and damage after 30 years. This outcome reflected global solidarity among all Parties to support developing countries that are particularly vulnerable,” Abdulla Balalaa, the UAE Representative on the Loss and Damage Fund board said in April.

The Loss and Damage Fund is aimed at keeping up with the rising costs caused by extreme weather and slow-onset disasters such as sea level rise, ocean acidification and melting glaciers.

Over the years, GCC countries have initiated many projects and actions –particularly within the financial sector and sustainable finance – focusing on introducing systems to deliver funds

from private finance to unlock necessary infrastructure investment and meet netzero targets.

The UAE launched ALTÉRRA, a $30 billion fund to invest in clean energy and other climate projects worldwide, at the COP28 climate change summit.

Launched in collaboration with global asset managers BlackRock, Brookfield and TPG, the fund will allocate $25 billion towards climate strategies and $5 billion specifically to incentivise investment flows into the Global South.

Banks in the UAE also committed to mobilise $270 billion (AED 1 trillion) in green finance at the COP28 climate talks earlier in December.

Mashreq Bank was hailed as one of the top contributors to the UAE Banks Federation-backed (UBF) pledge, promising to facilitate $30 billion (AED 110 billion) by the end of the decade, as part of the Dubai-based lender’s Climb2Change global initiative.

FAB facilitated $7 billion (AED 26 billion) for sustainable projects in the first three months of 2024 and the UAE’s biggest lender by assets has facilitated AED 150 billion to date, approximately 30% of its 2030 target of AED 500 billion.

The Abu Dhabi-based bank also unveiled the FAB Sustainable Development Goals Fund (FAB SDG Fund) in December, an ESG-oriented fund for private banking clients that will be managed by FAB Private Bank (Suisse). The fund will concentrate investment flows directly towards sustainable outcomes through 17 exchange-traded funds (ETFs).

RAKBANK is also a key contributor towards the UBF’s commitment to mobilise AED 1 trillion in sustainable finance by 2030. With finance playing an important role in addressing climate change issues, Abu Dhabi Islamic Bank is engaging on multiple fronts to drive the climate change agenda including facilitating as much as $2 billion worth of sustainable projects.

Most banks in the GCC region now have sustainable finance frameworks in place. The frameworks allow the banks

to issue green and sustainability-linked Islamic and conventional bonds to fund projects as investor demand for ESGlinked financing is surging in the GCC and wider Middle East region.

Creating an enabling environment

GCC financial regulators are implementing frameworks focused on sustainable finance as the transition towards a more sustainable economy gathers pace and the need to respond to the risks presented by climate change becomes more urgent.

Abu Dhabi’s financial center, the Abu Dhabi Global Market (ADGM), unveiled its sustainable finance regulatory framework in July 2023. ADGM’s framework encompasses rules on sustainabilityorientated investment funds, managed

exemption of regulatory fees on green or sustainability-linked bonds or sukuk listed on the local exchanges until December 2024.

Qatar Financial Centre unveiled its sustainable sukuk and bonds framework in March 2022 to promote appropriate disclosures, reporting, flow of information and curb risks of greenwashing.

The Bahrain Association of Banks also established a permanent sustainable development committee back in 2018 to “strengthen the role of banks and their contribution to sustainable development and economic growth.

Oman and Saudi Arabia sustainable finance framework in January and March, respectively, as part of the Gulf states’ broader strategy to reduce reliance on fossil fuels and attract investors.

THE KEY ENABLER OF CLIMATE PROGRESS IS FINANCE – DEVELOPING COUNTRIES WILL NEED AN ESTIMATED $2.4 TRILLION EVERY YEAR BY 2030 TO KEEP THE 1.5°C GOAL WITHIN REACH

–Majid Al Suwaidi, COP28 Director General and CEO of ALTÉRRA

portfolios and bonds as well as requirements for ESG disclosures.

UAE authorities have been introducing initiatives that are aimed at encouraging issuers to raise green debt. The Dubai Financial Services Authority (DFSA) said in December 2023 that it would waive all regulatory fees for issuers wishing to list sustainability-linked debt securities in the Dubai International Financial Centre in 2024.

Dubai’s Emirates NBD become the first financial institution to benefit from the DFSA sustainability-linked debt securities issuance fee waiver in February.

Similarly, the Securities and Commodities Authority extended its

Climate change caused by the emission of greenhouse gases is an urgent challenge. With $5 trillion required annually by 2030 to achieve net-zero emissions, the financial services sector is a critical partner in addressing the current financing gap and advancing the fight against climate change.

Banks in the GCC are expected to play a leading role in the transition to a net-zero economy. By providing the right finance to the right place at the right time, banks and investors can drive innovation, support scaling and avoid an unruly transition to a greener global economy.

100+ Countries

77% transaction banking customers are not completely satisfied today, and that’s an opportunity for your bank

According to a recent industry survey, your corporate customers may be looking for more from their bank's transaction banking products and services, particularly in cash/treasury management or payment capabilities.

1 billion+ customers

1.7 billion accounts

With Infosys Finacle’s comprehensive, cloud-native and fully composable suite of solutions, revolutionize your transaction banking business and deliver an unmatched banking experience seamlessly from front to back.

experience seamlessly from front to back.

Trusted by 100+ banks worldwide, Finacle can empower your

bank to:

■ Turbo-charge transaction banking across traditional and emergent channels.

■ Enable corporate customers to identify, analyze, and optimize cash and liquidity

■ Modernize payments for digital, real-time paradigms.

■ Transform trade and supply chain finance propositions

■ Power innovative business models and new ecosystem propositions

■ Deliver composability with right-grained microservices.

■ Drive intelligent transactions with a composable AI platform.

With our solution suite, deliver customized transaction banking offerings to enterprise clients of all sizes. Unlock a new era of banking excellence with Finacle, where seamless operations, enhanced experiences, and customer loyalty converge effortlessly!

www.fin

Jennifer Chammas Commercial Banking Regional Head of Sustainability and Sustainable Finance for HSBC in the Middle East North Africa and Türkiye region explains how HSBC is keenly involved with, and helping clients adapt and join in the growing deployment of sustainable finance in the region

How does your business or institution currently define sustainable finance?

Depending on the financing purpose, we provide a range of products tailored to clients’ business needs. In terms of lending products there are three types of product categories - proceeds-based financing, sustainability-linked financing (SLLs) and sustainable supply chain finance. The proceeds of green loans and social loans are used exclusively to finance eligible green or social projects, whereas SLLs can be structured to reflect a corporate’s existing sustainability strategy and targets. Examples of eligible green projects are those funding renewable energy, waste and water management, pollution prevention and control. Social projects can include those funding affordable basic infrastructure like access to drinking water, employment generation projects and those related to food security.

Sustainable linked solutions on the other hand, are not tied specifically to the use of proceeds of the loan but to specific environmental or social metrics such as reduction in greenhouse gas emissions, diversity & inclusion metrics

Jennifer Chammas, Commercial Banking Regional Head of Sustainability and Sustainable Finance for HSBC in the Middle East North Africa and Türkiye

Jennifer Chammas, Commercial Banking Regional Head of Sustainability and Sustainable Finance for HSBC in the Middle East North Africa and Türkiye

and increasing the usage of sustainable raw materials.

Sustainable supply chain finance provides financial benefits for suppliers to meet sustainability-related metrics and demonstrate continuous improvement. We align all policies and practices with recognised standards set

by The Loan Market Association and The International Capital Market Association.

Are clients willing to follow advice or choose products based in sustainable finance?

We support corporate, public sector, institutional and both personal and private banking customers with relevant transition solutions that include finance, risk management solutions and broader research, insights and tools to help their transition. This is where we can seek to make a material impact on reducing emissions in the real economy, while capturing commercial opportunities.

We can support companies to transition through our engagement with them, the products and services we offer and with our financing choices. Engaging with our corporate customers on their own transition plans will help inform those financing decisions and the kind of support we or other banks can provide. This engagement helps banks identify where they can channel finance to projects and plans that can deliver emissions reductions or even where credit or wider climate risks exist.

Customers often need support to overcome barriers to reaching net zero given the complexity of transition. Some of these challenges include nascent technologies with high capital expenditure requirements; uncertain policies and regulation; under- developed supply chains; lack of data and insights; and constrained resources – particularly for small and medium-sized enterprises (SMEs) in emerging markets.

We want to continue to scale and innovate in our sustainable finance and investment products and services to provide capital for climate technologies and other solutions to support our customers’ transitions, including in high-emitting sectors that are key to decarbonising the global economy.

How does your current portfolio of sustainably based products and services compare to your position before the global pandemic?

Sustainable financing has seen an uptick in the Middle East in the last few years as awareness has increased in the region due to several trends that are impacting business models.

First, with the backdrop of COP27 in Egypt and COP28 in the UAE, countries across the Middle East are increasing their sustainability ambitions. All countries in the GCC have submitted their Nationally Determined Contributions (NDCs), and almost all have committed to a net zero target. In addition, at COP28, the UAE submitted a new NDC target to the UNFCC with a strengthened emission target of 19% relative to 2019 baseline.

Supply chain pressures have also impacted corporates in the region as western buyers have committed to ‘Scope 3’ targets and are engaging with their suppliers on ESG best practices.

Last year, for example, Classic Fashion secured a new US$85 million sustainability-linked loan from HSBC in order to help enhance the sustainability of its manufacturing operations, as well as increase female inclusion even further. By incorporating its sustainability objectives into financing, Classic Fashion can further demonstrate its ESG commitments to its stakeholders, including key buyers such as Walmart.

These trends as well as other trends such as changing consumer demands as well as ESG regulations have encouraged businesses to advance their sustainability journey and commit to net zero targets.

In order to help customers respond to the trends, HSBC - in partnership with Diginex - launched the Sustainable Accelerator Programme and assisted 20 companies with the development of a foundational sustainability strategy.

Corporates are also investing more in green and social initiatives.

Sustainable finance engagement has therefore increased and is now spread very widely across the economy.

How are sustainable financial instruments such as green bonds, comparing in performance with conventional options?

Direct like-for-like comparisons either globally or for the region can be difficult but there are some interesting public data.

We can see from ISS Corporate that the first quarter of 2024 registered a total volume of $285 billion in ‘Green, Social, Sustainable and Other’ (GSS+) labelled bond and loan issuances which shows signs of recovery compared to the last quarter of 2023.

With this addition, the market has now surpassed $4 trillion. This encouraging start of the year has been fuelled by a rise in transition issuances, which are expected to become one of the key themes in the sustainability sector.

Investment in clean-technologies and global adaptation related solutions continue to rise. Investments in global clean energy transition are already growing. As recently reported by Bloomberg2, investment in the clean energy sector reached $1.77 trillion in 2023 which put global new investments at a compound annual growth rate of 24% over the past ten years ending in 2023.

Are elements of your sustainable finance programme specific to our region?

The incorporation of environmental, social and governance (ESG) considerations into the operations, offerings and investments of Islamic financial institutions has

1: https://www.iss-corporate.com/library/april-2024-sustainable-finance-market-highlights/#:~:text=MARKET%20 AND%20REGULATORY%20HIGHLIGHTS,%244%20trillion%20(EF%20data.

2: https://about.bnef.com/energy-transition-investment/

gained traction in the last five years. As awareness and understanding of ESG issues become more widespread among Islamic finance stakeholders, the integration of ESG considerations in these institutions’ decision-making processes is being increasingly demanded whether for better alignment with Shariah principles or for purely financial reasons.

Already this year, we saw this when acting as sole bookrunner, initial mandated lead arranger, investment agent, conventional facility agent and sustainability co-ordinator on DeFacto’s $125 million (dual-currency) multi-tranche Sustainability Linked Term Financing. This transaction was DeFacto’s inaugural sustainability-linked financing, incorporating a set of performance metrics aligning to core aspects of their sustainability strategy and to the fashion retail sector. It was the first of its kind in the fashion retail industry in Türkiye since it was the pioneer syndicated sustainability-linked transaction to include a Murabaha tranche. So there are elements to the growth of sustainable finance that are specific to the region.

Have recent extreme weather events spurred any further interest in sustainable finance products? It is still too early to see if recent weather events in the UAE have spurred further interest in sustainable finance products. However, it’s possible to argue the recent damage from heavy rains and flooding have highlighted the importance of factoring in climate related risks for corporates and financial institutions. Consideration now needs to be given to ensuring organisations plan not just for sea level rises, but also flood risk and other weather and climate risks - even in regions and areas not typically at risk of flooding or other adverse weather events.

Sanaa Mehra Head of EMEA Sustainable Debt Capital Markets details Citi’s firm commitments with examples of regional activities in sustainable finance, pointing out that financial instruments such as green bonds are attractive to the growing amount of assets under management

How does your business or institution currently define sustainable finance?

At Citi, we are supporting the growth of scalable financial solutions to address environmental and social challenges. One way we can do this is through the facilitation of sustainable finance. We set a goal to reach $1 trillion in Sustainable Finance by 2030, financing and facilitating activity that is compatible with the UN SDGs. The transactions that are counted towards the goal include environmental solutions and activities that further accelerate the transition to a low-carbon economy, such as renewable energy, sustainable transportation and sustainable agriculture. The goal also includes financing to activities that help address critical social issues, such as education, economic inclusion and food security. For the full list of our focus areas, please refer to Citi’s ESG Report. Are clients willing to follow advice or choose products based in sustainable finance?

Yes, we have seen clients across the globe including the MEA region adopt sustainable finance products. Over the past four years, we are proud to have

Sanaa Mehra, Head of EMEA Sustainable Debt Capital Markets

Sanaa Mehra, Head of EMEA Sustainable Debt Capital Markets

financed and facilitated $441.2 billion toward our $1 Trillion Sustainable Finance Goal. Products and services contributing to this goal include financing and advisory services to help companies achieve their sustainability strategies; green, social and sustainable bonds; sustainable supply chain finance; sustainability-linked lending and investments; and sustainability[1] focused mergers and acquisitions.

One example is; $130m Sustainable Securitisation for Sun King.

The off-grid solar energy company, Sun King and Citi established a first-of-its kind securitisation transaction designed to

expedite access to financing for affordable off-grid solar systems for those who cannot access or afford traditional electric grid connections. The four-year deal, arranged and structured by Citi with participation from leading development finance institutions and commercial lenders, injects $130 million into Kenya’s off-grid solar energy sector. The transaction builds on Sun King’s new Moody’s-rated Sustainable Financing Framework and is structured around credit Sun King extends to its Kenyan customers to pay for solar products in affordable instalments. Customers’ future payments for solar products bought on credit will be securitised and funded by investors, increasing access to financing for solar through support for unbanked and underbanked customers across Kenya, while also raising funding for Sun King’s future growth and expansion.

Masdar $750mn 10-year inaugural green bond issuance in 2023.

Citi acted as joint global coordinator on Masdar’s inaugural $750mn 10yr green bond issuance. This marks the first time Masdar has raised financing under its newly established $3bn bond program, the proceeds of which will support the development of renewable energy projects globally. This landmark transaction demonstrates the global investor support for the UAE’s clean energy champion ahead of COP28.

How are sustainable financial instruments such as green bonds, comparing in performance with conventional options?

Sustainable financial instruments such as green bonds are attractive to the growing amount of assets under management which include sustainability metrics in their investment decision making process. Therefore, there are examples where such instruments can attract demand from a larger pool of highquality sustainability focussed investors. The increase in demand can result in green bonds achieving better execution than conventional transactions and better secondary market performance.

AI represents one of the greatest opportunities for business transformation today. But what good is an opportunity left unrealized?

Introducing watsonx, IBM’s new AI and data platform. Designed specifically for enterprises, it helps you train and tune AI on domain-specific needs, using your data. So you can innovate with AI models and scale them across your business while addressing governance and traceability. Because for your business to seize the opportunities before it, you need something greater than AI.

You need AI tailored to your needs.

You need watsonx.

Learn more at ibm.com/watsonx

Believing in a responsibility to assist companies holding sustainability as a principle Rasha Badawi CEO of Barclays Private Bank UAE and Head of MENA describes how financial instruments incorporating such considerations are growing

How does your business or institution currently define sustainable finance?

For Barclays Private Bank, sustainable investing is about choosing to invest in businesses that aim to generate an above-market, risk-adjusted rate of return through providing solutions to the greatest challenges we face as a planet. We believe we have a responsibility to channel a proportion of the capital that we have been entrusted with into some of the world’s most innovative companies providing the critical products and services needed to protect and advance the future of our planet. It is these companies that are both best positioned for growth and have the greatest chance of achieving material sustainable development success.

Are clients willing to follow advice or choose products based in sustainable finance?

Yes, increasingly clients express interest in these areas. What was previously a ‘nice to have’, in our view is becoming more of a hygiene factor for some investors - although it is important to remember that this is a journey we and our clients are on, and there is still scope for interest to grow. Sustainable finance as an ecosystem is still growing and

maturing too and there is still work to do in the industry to educate and build consensus among colleagues and clients alike.

Some clients who invest in part across Shariah opportunities may also consider sustainable options for potential inclusion as a Shariah ‘light’ investment. This is because often these products involve a negative screen at outset, therefore they can be a natural place to look for prospects given the explicit restrictions imposed which mirror, in part, Shariah constraints.

How does your current portfolio of sustainably based products and services compare to your position before the global pandemic?

Our portfolio has grown with overall growing demand across the industry for

these types of products. The pandemic has not changed our overall approach but as mentioned, over time we have seen an increasing interest in sustainable investing among our client base.

How are sustainable financial instruments such as green bonds, comparing in performance with conventional options?

Given the pre-mature nature of this asset class, it would be inappropriate to use past performance as an indicator of future performance as this is unreliable. However, we are seeing a developing track record for sustainable investing and financial instruments. In our view, good quality investments where underlying businesses and cash flows are intrinsically tied to long term sustainable activity could bear a reward to an investor over the long term, however this should be viewed on a case-by-case basis.

Are elements of your sustainable finance programme specific to our region?

We have local expertise in DIFC across both the Private Bank and Investment Bank and we work closely together on matters related to sustainable financing so clients have access to the wider Barclays network. We are also plugged into the DIFC Sustainable Finance Working Group alongside peers from across the industry to encourage the increased adoption of sustainability as a consideration.

At a group level, and in addition to our Sustainable Finance Framework more broadly, we have also introduced a new Transition Finance Framework, to help us meet the target we announced in 2022 to facilitate $1 trillion of Sustainable and Transition Financing between 2023 and the end of 2030. This reflects the need not only to scale up zero or near-zero emitting technologies and businesses, but also to support emissions reduction in high-emitting and hard-to-abate sectors. [1]

Providing opportunities for enhanced services, greater data based and actionable insights, the cloud is where banks will be finding new ways to create efficiencies and delight consumers while also serving as a powerful engine for business model innovation

The GCC banking sector is entering one of its greatest transformations ever seen as financial institutions are starting to make the most of the enormous possibilities that digitalisation presents. Today’s banking customers are hungry for digital banking products and services tailored to their individual needs.

“Digital transformation is an ongoing area of investment for the banking sector. In the year ahead, this will continue as banks seek to further enhance customer service and soldier on modernising their technology platforms,” KPMG said in a report in January.

Cloud adoption is the backbone of digital innovation and it is shaping the future of the financial services sector. The cloud gives banks access to on-demand resources – such as networks, servers, storage and APIs – that can be rapidly provisioned and released with minimal management or service provider interaction.

With customer expectations and technology evolving at breakneck speeds, moving to the cloud is increasingly becoming a strategic priority for banks. Furthermore, the disruptions of the past three years have dispelled the perception that cloud migration is a distant proposition.

“Cloud technology is a business game changer that has rewarded early adopters with an ability to scale quickly and innovate rapidly; and time is of the essence — more traditional businesses need to act now,” said Oliver Wyman

The innovative technology is seen as a pivotal factor for operational efficiency and overall transformation, with more than 90% of banks in the GCC region ranking their cloud programs a priority and more than a third regularly discussing progress at the executive-committee level.

Meanwhile, the financial services sector is among the most regulated businesses in the world. As financial institutions accelerate cloud adoption, cybersecurity risks have become a top priority for bank executives and board members in the GCC region.

The cloud is helping banks in the Gulf region develop digital services with greater ease and speed. With so many advanced plug-and-play financial features to tap into in the wider market, through digital and cloud-based banking platforms, the opportunity to augment and digitalise legacy core systems with modern customer experiences is ripe for the taking.

Digital transformation in the banking industry is rapidly reshaping the way financial institutions operate, engage with customers and manage their internal processes. The advancement in technology makes the shift imperative for financial institutions to adapt to changing operating environment.

KPMG said the seismic changes in the banking system are not solely due to advancing technologies, but a confluence of inter-related structural factors –demographic, socioeconomic, regulatory and environmental changes.

Banks are fighting growing competition from fintech firms and big tech – who have been quicker than incumbents to take advantage of the new innovative technologies, develop banking products that meet customers’ expectations, cost less to deliver and are optimised for digital channels.

To maintain a competitive edge, banks in the GCC must innovate and adopt new digital platforms that are more consumeroriented with rich personalisation, new AI-powered digital tools and services that help them remain relevant.

The cloud offers several business benefits for traditional banks including increased flexibility, business agility, lower cost of IT and quicker access to innovation. Banks are unlocking new ways to get closer to their customers as digitalisation is reshaping the financial services sector.

With growing digitalisation in the financial services sector, the way we bank is projected to undergo massive transformation over the next decade. The bank of 2030 will look and operate very different from today.

Growing competition from fintechs and neobanks, also known as digital attacker banks, emphasises how banks currently fall short of providing superior customer experiences. Customers expect personalised engagement from all businesses they deal with, banks included.

“The advent of the digital age is inextricably linked with tailor-made offerings that deliver personalised services, products and pricing to customers. Over the years, banks have deployed personalised offerings including micro-segmentation, packaged products and services to increase customer loyalty and maintain a competitive edge in the market,” according to Deloitte.

Banking customers are redefining their expectations, taking their cues from other industries that offer multichannel access,

access and process large volumes of data more efficiently and securely. Similarly, there is a growing desire among banking customers to get bundled services with banking products that are aligned with their interests. For banks in the GCC region to be able to engage customers with hyper-personalised or tailored value propositions, they not only need to know customers’ behaviour with financial institutions but also their preferences and behaviours outside the banking realm.

CLOUD TECHNOLOGY IS A BUSINESS GAME CHANGER THAT HAS REWARDED EARLY ADOPTERS WITH AN ABILITY TO SCALE QUICKLY AND INNOVATE RAPIDLY; AND TIME IS OF THE ESSENCE — MORE TRADITIONAL BUSINESSES NEED TO ACT NOW– Oliver Wyman

product simplicity, seamless integration and ‘segment-of-one’ targeting.

Customers are clamoring for the same level of sophistication, immediacy and personalisation in their interactions with banks as they do in other industries. Industry experts say banking customers are willing to share their data if assured of receiving personalised services.

The cloud can help banks transform the customer experience and improve personalisation thus providing them with a more holistic understanding of their customers. It enables financial institutions to manage and process huge data volumes across multiple sources.

“Banking customers generate an astronomical amount of data every day through hundreds of thousands of individual transactions,” global IT firm Hitachi Solutions said in a report, adding that the adoption of cloud-based banking analytics platforms will enable banks to

Cloud computing offers banks seamless and unified data access, decentralised ownerships, real-time interactions, elastic scalability and superior security. The proliferation of innovative technologies such as generative AI and blockchain as well as the use of data and advanced analytics is expected to accelerate cloud adoption in the GCC banking ecosystem.

The quest to augment customer experience is driving digital transformation at top banks, and new strategies that take advantage of the cloud and realtime customer data sets are creating real opportunities.

GCC banks that are accelerating cloud adoption are seizing the opportunity to transform not only their technology architectures but also how they operate and their relationships with their customers.

Speaking to the media in May, Abdulaziz Al Ghurair, the Chairman of the UAE Banks Federation said the UAE banking sector is accelerating digital transformation and developing innovative solutions that leverage artificial intelligence, blockchain as well as cloud computing and data analytics to provide services that meet and exceed customer expectations.

“Banking services in the UAE and the rest of the world are currently undergoing a profound transformation to meet the rapidly changing demands of the end-users and to keep pace with the technological revolution,” added Al Ghurair.

Front-to-back digitisation of the customer journey requires developing a data- and analytics-powered digital experience that provides personalised engagement, efficiency and convenience throughout the journey at low cost.

The cloud has been a vehicle of digital transformation in the financial services industry. It is an enabler of advanced analytics in banks as these computer system resources provide space to both stores and analyse large quantities of data in a scalable way, including through easy connectivity to mobile applications used by customers.

Cloud technology and especially the software as a service (SaaS) and banking as a service (BaaS) models offer banks several opportunities such as easier customer data analytics and sharing, improved marketing time, cost reduction and enhanced flexibility and operational efficiency.

Data’s worth depends on its accessibility and application as customer insight plays a critical role in product development and customer communication in the banking sector. “The cloud is the only place where customer data gains scale, agility and the power to drive reinvention so a business can soar,” said Accenture.

Technological innovations such as open APIs and cloud-native solutions enable banks to leverage data to augment their services and allow them to take action quickly when required. The hyper-personalisation of banking

products should be as granular as any other offering and through the capabilities of data insights, banking customers can get the experiences they demand from banks.

Looking into the future, the majority of banks in the GCC region are expected to shift operations and processes from rules-based systems to AI-based systems, driven by advanced analytics that deliver actionable insights from

By leveraging, APIs open banking platforms authorise retail and enterprise clients to access consumers’ financial data in real-time and share account information and transaction history with external parties such as vendors, suppliers, business partners and other banks.

Built on the cloud, open banking platforms are facilitating ever-increasing on-demand needs of financial data. This can include transactions and consumer

BANKING SERVICES IN THE UAE AND THE REST OF THE WORLD ARE CURRENTLY UNDERGOING A PROFOUND TRANSFORMATION TO MEET THE RAPIDLY CHANGING DEMANDS OF THE END-USERS AND TO KEEP PACE WITH THE TECHNOLOGICAL REVOLUTION

– Abdulaziz Al Ghurair, the Chairman of the UAE Banks Federation

customer data. Customer data analytics enable financial institutions to provide personalised services, predict customer requirements and streamline operations.

The radical transformation in the financial services industry is partially being driven by the advancement in digital technology as previously closed industrial systems have become networked and open, providing ideal conditions for open banking to flourish. Cloud computing and other innovations have opened up opportunities for banks to embrace an open banking strategy.

“Open banking provides open access to a customer’s financial data from banks and other financial institutions using APIs. Built on cloud, open banking platforms are facilitating ever-increasing on-demand needs of financial data,” said IT software and consultancy services firm IBM.

experience for third-party providers, payment initiation service providers and account information service providers.

Customer data is critical in enabling multiple use cases for open banking, banking-as-a-service (BaaS) and the closely related concept of embedded banking, said McKinsey.

The cloud and other innovative technologies have opened up opportunities for banks to embrace an open banking strategy. However, banks in the GCC region should build up new ecosystems of services and data that comply with various data privacy regulations while adopting strong security models against cybersecurity risks.

To thrive in the digital era, banks in the GCC must harness advanced banking technology such as the cloud. This will allow them to match the seamless and intuitive customer experiences offered by fintech companies and big tech while maximising areas where they hold a natural edge.

The Cloud will become increasingly integral to the success of banks, says Mohamed Emad Eldin Head of IBM Public Cloud Business, ME A, who highlights the benefits it already does, and will continue to bring, though noting that understanding and making effective use of its services will be key to fulfillment of its potential

Beyond cost advantages, of the further benefits the cloud brings, which do you put the highest premium on?

I prioritise easy access to new technology and time to market as the most valuable benefits of the cloud. These aspects are intertwined, forming two sides of the same coin. In recent years, the pace of technological advancement has been remarkable, with innovations like blockchain, digital banking and more recently, AI and generative AI, becoming integral to every industry.

An IBM report ‘6 Hard Truths CEOs Must Face’ found that 44% of CEOs in

Mohamed Emad Eldin, Head of IBM Public Cloud Business, MEA

Mohamed Emad Eldin, Head of IBM Public Cloud Business, MEA

the Middle East & Africa region view hybrid cloud technologies as a crucial tool for achieving the results they want in the next three years. The ability to swiftly adopt such technologies is no longer merely a competitive advantage; it’s a survival tactic. It’s not a question of ‘if’ you can access and utilise these technologies on time, but rather ‘how’ you will leverage them to outpace your competitors and continue providing optimal services to your customers. Failure to do so in a timely manner could result in being left behind indefinitely. In essence, being able to swiftly adopt and adapt to new technologies through the cloud is essential for remaining

relevant and competitive in today’s fast-paced market.

Is cloud concentration risk a concern?

Cloud concentration can pose a multifaceted risk to banks. Operational risk arises from the potential for service disruptions or outages at a single cloud provider, which could impact critical banking functions and customer service. Vendor lock-in is another concern, as heavy reliance on one provider may limit flexibility and increase dependence on their ecosystem, potentially inhibiting innovation and competitive agility. Additionally, there’s the risk of suboptimal cost management, where over-reliance on a single provider may limit opportunities for cost optimisation and negotiation.

We are seeing regulations continue to emerge around cloud concentration risk in the banking sector, especially in the European Union and the United States. Moves like this indicate that regulators are paying closer attention to the evolving threat landscape and aim to minimise risk and close gaps in the supply chain. Prioritising resilience across hybrid, multicloud environments with a single point of control is key, allowing financial enterprises to gain a holistic view of their IT estate, as well as potential threats. We must remember that cloud is not a destination – it’s an enabler.

Is a hybrid cloud/on premises arrangement likely to be the norm for banking technology use?

Yes, a hybrid cloud approach enables greater resiliency, performance, security and compliance for banks and other enterprises in highly regulated industries. There is no one-size-fits-all approach to cloud for banks – it requires intentional placement of workloads based on where they will perform best whether that’s on-premises, in the cloud, or at the edge. IBM, for example, continues to make improvements to our enterprise cloud platform for regulated industries, striving to deliver the most resilience, high

performant, secure and compliant cloud. Years ago, we launched the first industry specific cloud platform, IBM Cloud for Financial Services, providing banks and other financial institutions with built-in security and compliance controls to adhere to the stringent regulatory and compliance standards of this industry.

practices, such as maintaining full capacity regardless of actual demand or overcommitting to reserved instances instead of utilising more flexible pay-asyou-go models.

Nevertheless, there’s reason for optimism as the industry’s understanding of cloud technology matures. Banks are

An intentional hybrid cloud approach lets banks leverage the benefits of both on-premises infrastructure and cloud services. With a full stack approach the enables data-sharing, resiliency, security and compliance, banks can have IT environments that are open, continuous and allow for speed innovation.

Has cloud use in the past few years brought tangible upsides to banks balance sheets?

In general, cloud adoption has indeed yielded tangible benefits for banks’ balance sheets, although the extent of these benefits can vary across different markets and countries. The shift from high capital expenditure investments in infrastructure to project-based operational expenditures is a notable advantage facilitated by cloud technology. However, the realisation of these benefits depends on various factors, including the approach taken by banks in adopting the cloud, the level of training and planning preceding the cloud journey, and the efficacy of tools utilised for optimising and managing cloud costs.

It’s worth noting that many banks have encountered challenges, particularly in cost management, which can affect the perceived benefits of cloud adoption. Common issues include improper usage

becoming more adept at optimising cloud usage and extracting maximum value from their investments with support from consulting experts like IBM Consulting and ecosystem partners, implementation can become increasingly seamless and drive positive impacts on their balance sheet.

Can any modern-day financial institution remain viable if not making some use of the cloud?

In today’s financial landscape, cloud technology is not just advantageous but essential for modern institutions’ viability. The absence of ‘Cloud only’ services underscores its ubiquity. Lagging in cloud adoption means delays in addressing challenges and seizing opportunities, as well as facing prohibitive operational costs. The cloud offers agility, scalability and cost-efficiency, crucial for adaptation and profitability. With evolving cloud technology and innovations like generative AI, institutions risk irrelevance without embracing the cloud’s transformative potential. An IBM report found that 72% of executives agree that improving ROI from the IT investment portfolio by 25% or more is a top C-suite priority for 2024. In short, cloud adoption is no longer optional; it’s a strategic imperative for staying competitive and future-proofing operations.

With an account of the advantages banks benefit from, Zubair Ahmed Chief Industry Officer, Financial Services, VeriPark points to increasing workload migration, speedier pay back times and faster provisioning, foretelling that new functionalities will only be available on The Cloud

Beyond cost advantages, of the further benefits the cloud brings, which do you put the highest premium on?

Beyond cost advantages, the cloud offers numerous benefits that we place a high premium on. One of the most significant advantages is that big tech companies are now releasing the latest technology and functionality on the cloud first. This has been the trend for the past few years. Consequently, customers who have already migrated to the cloud have early access to new functionalities, giving them a competitive edge.