Getting The Message Getting The Message

Onur Ozan Managing Director, Middle East, North Africa and Türkiye at Swift

ROADMAP TO EMBARK ON THE GLOBAL HORIZONS

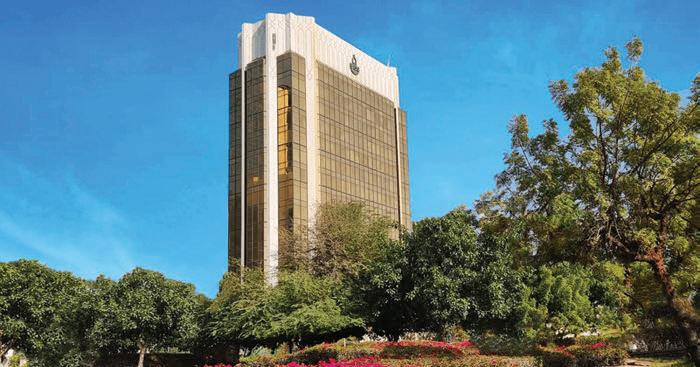

As one of the leading business banking partners in the UAE, National Bank of Fujairah takes pride in being the best Trade Finance Bank in the region to provide tailored trade finance solutions, helping our clients to grow their business on the world map. With nearly four decades of expertise, we provide innovative banking solutions using our digital platforms that are designed to complement your business and offer banking services that meet your working capital and term financing requirements in a simplified manner.

Technology Transfer

Welcome to the May 2024 issue of MEA Finance magazine.

The heading of this letter, Technology Transfer, is a term that when looked up is explained as the spreading, disseminating or transferring of technology from an individual or organisation to other individuals or organisations, or the process thereof. Here it serves to sum up of the main themes of this month’s coverage in the magazine. Inside you will encounter ample coverage of the deepening role of technology across wider parts of the regional banking sector as well as content covering the movement and transfer of finance in the processes of settling transactions. Both being vital to the health and growth of regional economies and both, very much mingling in their commission.

Our cover story for this month features an interview with Onur Ozan, Managing Director for the Middle East, North Africa and Türkiye at Swift. Onur describes how Swift is enabling regional growth and focusing on innovative new products and services that will be a key part of the dynamically changing payments landscape of the region, “Our instant and frictionless strategy is closely aligned with the G20’s goals to enhance the speed, cost, transparency, choice and access of cross-border payments”.

In keeping with the theme, we look into the central importance of Transaction Banking. This important banking function, key to client relationships and essential to the health of economies is in the in the throes of an evolution

that will witness this essential but slow to modernise banking sector develop in ways that will create new opportunities for incumbents and disrupters, “transactional banking holds a critical status within regional banks as it fosters a robust relationship with clients,” says Kyle Boag Managing Director, Regional Head of Global Payments Solutions, Middle East, North Africa and Türkiye at HSBC.

Our examination of banking technology throughout this issue is extensive, much like the impact it is making across the sector. Technology is effectively changing the fundamental identity of banks, bringing welcome efficiencies, growth and opportunity, as well as encouraging inclusivity. We hear from a large selection of regionally active businesses, discussing the current technology priorities of the banking sector and what is top of mind for the region’s CIOs and CTOs.

SMEs, often held up as the backbone of regional economies, are also given an airing in this issue. We look at their role in markets and how, recognising their importance and latent potential, authorities are mandating initiatives to encourage their growth and smooth their paths, “The UAE government has actively implemented several initiatives to bolster the SME sector,” says Emad Ahmed, EVP and Head of Commercial Banking at RAKBANK.

Our perennial market focus this month is on Bahrain, whose economy though linked to the fluctuations in oil prices, experiences narrower effects from them when compared with other GCC countries, due to well-established alternative revenue generating sectors and numerous economic diversification initiatives.

So, once again, it is our privilege that you transfer some of your valuable time in the reading of this issue, whether in the form of the traditional paper product or via your personal technology.

Significant fluctuations in online payment transactions across various sectors following recent severe weather conditions in the UAE

47% increase in airline online payment transactions and 11% increase in hotel and accommodation bookings

In the aftermath of recent severe weather conditions the UAE witnessed, global payments solution provider

Checkout.com has conducted a comprehensive analysis revealing significant shifts in transaction volumes across various sectors. The data sheds light on the profound impact of adverse weather on consumer online shopping behaviour and purchasing patterns.

Key findings underscore notable changes in transaction volumes particularly in sectors such as Supermarkets, Food & Drink, Vehicle Hire and the Motoring industry as a whole. The adverse weather conditions led to a significant decrease in online payment transactions, indicating a notable shift in purchasing patterns.

Supermarkets, a vital component of daily life, experienced a marked decline of 24% in transaction volumes. Disruptions in supply chains and reduced traffic movement, attributed to individuals staying indoors during the storm period, contributed to this decline.

The food & drink sector similarly witnessed a notable decrease in transaction volumes, with online payments declining by around 11%. Furthermore, sectors such as vehicle hire and the motoring industry also

Consumers in the UAE turn to online training and education as a method of self-development amidst severe weather conditions, as the sector sees 31% increase in transaction

experienced a 14% decline in online transaction volumes, reflecting the broader impact of severe weather on consumer behaviour and economic activity. This decline is consistent with the overall trend of decreased mobility and outdoor activities during adverse weather conditions.

Contrary to the downward trend observed in several industries, the clothing sector experienced a notable surge of 13% in online payment transactions. This increase can be attributed to consumers opting for the convenience and safety of

online shopping from the comfort of their homes during the storm period.

Additionally, the hotels & accommodation sector emerged as another domain witnessing an uptick in transactions, reaching as high as 11%.

This sector was directly affected by the severe weather conditions as stranded individuals had to seek alternative accommodation solutions, while others were forced to make amends as a response to their changed travel plans.

Checkout.com also uncovered a significant surge in online payment transactions within the training & education sector. The data reflects a 31% increase within this sector, a trend that underscores the growing demand for accessible and flexible learning options, particularly during periods of disruption caused by adverse weather.

Furthermore, flight tickets witnessed a significant increase in online payments amidst the severe weather conditions, reaching a remarkable 47%. This data suggested that travellers turned to online platforms to reschedule their flights or make new bookings in response to disruptions caused by the storm.

Commenting on these trends, Remo Giovanni Abbondandolo, MENA General Manager at Checkout.com, stated:

“The fluctuations in online payment transactions following the recent unprecedented weather conditions highlight the dynamic nature of consumer behaviour and market conditions. Our data-driven insights enable businesses to adapt and thrive in such challenging environments.”

Connectivity

Scale globally and accept payments across channels and devices with over 200 acquirer connections

Flexibility

Exceed customer needs with a dynamic suite of services, partners and solutions

Security

Innovation

With the right connections, anything is possible

mastercard.com/gateway

Protect all players from fraud and risk with advanced technology and built-in compliance Mastercard Gateway

Futureproof your business and lead the competition in an always evolving market

Arab Monetary Fund sees growth potential in Takaful market

The fund projects a continued annual growth of 5-8% for the Takaful sector

The Arab Monetary Fund (AMF) said that the Takaful sector, a Shariah-compliant form of insurance, remains a small player within Islamic finance, accounting for less than 2% of the total market.

Though the sector accounts for less than 2% of the Islamic finance market, it surpassed $30 billion in 2023.

A report that was released by the fund projects a continued annual growth of 5-8% for the Takaful sector in the

in the coming years

coming years, which is considered robust growth compared to conventional insurance market.

The AMF attributes this positive outlook to rising consumer awareness of Islamic finance, supportive government policies in many countries, and ongoing technological advancements.

However, the report also acknowledges the challenges facing the Takaful industry. Internal hurdles include difficulty in pricing risks, the potential for adverse

selection due to limited information, and the need for a standardised framework for governance and risk management.

External challenges arise from economic slowdowns caused by monetary tightening policies. This puts pressure on the entire insurance sector, including Takaful, due to factors like increased claims from business losses, lower investment returns and limited Sharia-compliant investment options.

The AMF emphasises the need for regulatory and supervisory authorities in Arab countries to actively support the Takaful sector. This includes providing effective oversight, identifying key legal and technical challenges, and fostering a conducive business environment.

Getting In Shape

Bahrain’s economy, though linked to the fluctuation in global crude oil prices, experiences narrower effects from this when compared with other GCC countries, due to well-established alternative revenue generating sectors and numerous economic diversification initiatives

Bahrain’s economic growth is expected to pick up in 2024 after slowing last year on the back of buoyant activity in the non-oil sector, as the Gulf state makes a push toward a sustainable and more diversified economic future.

The country’s economy moderated to 2.7% in 2023, driven by a 3.3% expansion in non-oil GDP, which was attributed to fiscal consolidation, increased interest rates and a base effect from strong growth in 2022.

Going forward, the International Monetary Fund (IMF) projected that GDP growth will recover to 3.6% in 2024 and

3.2% the following year, on the back of higher energy prices, easing monetary policy and stronger export growth.

“Bahraini economic growth in 2024 is expected to retain the firmness of 2023, supported by higher energy prices, easing monetary policy as a consequence of the peg to the dollar and stronger export growth,” French credit insurance firm Coface said last October.

Though oil accounts for 18% of the GDP and 75% of government revenues, Bahrain has taken significant strides to diversify its economy over the past two decades. The urgency of transitioning

to a greener economy cannot be over emphasised as the kingdom’s public finances deteriorate and a sustainable future beckons.

The country boasts of a relatively diversified economy, a beautifully regulated financial sector, a welleducated workforce and a friendly investment climate. Bahrain also has friends in high places.

Meanwhile, banks in the Gulf state have enjoyed steady growth over the past year, thanks to diversified business models and supportive domestic economic conditions.

Moody’s maintained its stable outlook on the domestically focused onshore Bahraini banking sector, citing growth in the non-oil economy and supportive operating conditions. The country is a highly banked economy that serves as a regional financial hub with a banking assets-to-GDP ratio above 600%.

Diversification drive

Bahrain, often seen as one of the weakest links among oil-rich Gulf nations, has the most diversified economy in the region with more than 83% of its GDP stemming

from the non-oil sector, according to the Bahrain Economic Development Board (Bahrain EDB).

The government in Manama has been implementing a series of reforms including increasing its standard valueadded tax (VAT), offering permanent residence to some foreigners and privatising some state-owned assets, as the country seeks to boost its public finances, balance its budget and trim its public debt levels.

“The authorities remain strongly committed to their fiscal and structural reform agenda as outlined in the Fiscal Balance Program (FBP) and Economic Recovery Plan with a focus on reducing the fiscal deficit, public debt and advancing diversification efforts,” said the IMF.

Bahrain’s golden license initiative has attracted $2.4 billion in investment since its launch in April 2023, contributing to economic diversification and growth, Bahrain EDB said in March. The longerterm business licenses offer benefits to companies bringing large-scale investment projects to the Gulf state.

Major investment and strategic projects that will create more than 500 jobs in the country or whose value exceeds $50 million will be eligible for the license.

Furthermore, Bahrain EDB said in February that it attracted $1.7 billion in direct investment in 2023 stemming from 85 projects across priority sectors including financial services, information and communication technology as well as oil and gas.

Bahrain also unveiled a permanent residency visa scheme in February 2022 to attract talent and investment, part of a growing trend in the region as states are offering more flexible and longerduration visas.

The golden residency visa will be renewed indefinitely and gives the holder the right to work in Bahrain, unlimited entry and exit and residency for close family members.

The Gulf state is reportedly considering selling stakes in state-backed entities

BAHRAINI ECONOMIC GROWTH IN 2024 IS EXPECTED TO RETAIN THE FIRMNESS OF 2023, SUPPORTED BY HIGHER ENERGY PRICES, EASING MONETARY POLICY AS A CONSEQUENCE OF THE PEG TO THE DOLLAR AND STRONGER EXPORT GROWTH

– Coface

including Nogaholding, which owns the country’s oil and gas assets, as the government in Manama is opening onceclosed industries to foreign investors.

The strategy mirrors initiatives that are being implemented by Saudi Aramco and UAE state-owned energy firm ADNOC Group.

Bahrain’s economy is closely linked to the fluctuation in global crude oil prices. However, the impact is much narrower compared to other GCC states due to the relatively diverse nature of the country’s economy.

Fitch Rating estimates that the breakeven fiscal price needed to balance the kingdom’s budget remains well above the budgeted target of $60 per barrel (bbl) in 2024, at $113/bbl.

Sustainable growth

Bahrain is taking threats to its longterm prospects head-on by encouraging high-value-added business sectors and leveraging its financial hub status to drive the next stage of economic growth.

Many analysts expect Bahraini firms to also benefit from large infrastructure and development projects taking place across the GCC, particularly in Saudi Arabia and the UAE, as contracts ripple across the region.

Coface said stronger economic growth in Bahrain’s key export markets –Saudi Arabia and the UAE – will sustain the contribution of net goods and services exports to the growth performance. The country is one of the world’s largest producers and exporters of aluminium,

which accounts for around 20% of the country’s total exports.

Bahrain unveiled its strategic projects plan two years ago. The initiative seeks to catalyse more than $30 billion of investments and a regulatory reform package designed to support $2.5 billion of foreign direct investment.

The Gulf state’s Vision 2030 economic blueprint is aimed at bolstering domestic employment and attracting investments in strategic non-oil sectors including tourism, housing as well as transport and logistics and energy. The projects include the building of five offshore cities, the country’s metro train and the expansion of Bapco’s oil refining capacity.

Meanwhile, the upgrade of the Bapco refinery, which will see production rise from the current level of around 240,000 barrels per day (bpd) to around 400,000 bpd by early 2025, is also expected to fill the government’s coffers.

Fiscal challenges persist

Bahrain’s public finances are in poor shape. The country pushed back a target of balancing the budget by two years to 2024 in response to the economic impact of the COVID-19 pandemic.

S&P Global Ratings revised the country’s outlook to ‘stable’ from ‘positive’ last November, citing spending pressures that could push its fiscal deficit wider than previously expected.

“Bahrain updated and extended its FBP in October 2021, changing the target date for a balanced budget to 2024 from 2022 (assuming an oil price of $60 per

barrel in all years),” the global rating agency said.

Bahrain’s budget deficit is projected to remain wide at 8.2% of GDP in 2024 and 2025, from an estimated 7.8% last year, according to Fitch Ratings, despite the country’s ongoing efforts to cut costs and control expenditure.

Though the authorities’ efforts to cut further both current and capital spending within the FBP will support the narrowing of the deficit, it will not be enough to reduce the debt burden.

Paris-based Allianz Trade projected that public debt would remain well above 100% of GDP in 2024, putting pressure on the government as interest rates stay high.

“We do not expect the government will achieve its fiscal balance target by 2024 but believe it will continue pursuing fiscal and structural reforms to strengthen its non-oil revenue. This will allow for continued, albeit slower, fiscal consolidation over our forecast horizon,” said S&P Global.

However, despite the reversal in some previous progress in narrowing the fiscal deficit, the National Bank of Kuwait (NBK) forecasted limited spending growth and the government’s commitment to its FBP remains intact.

Bahrain secured a $10.2 billion financial lifeline from its rich Gulf neighbours, the UAE, Saudi Arabia and Kuwait, in October 2018 to help cope with high debt levels and budget deficits. S&P Global said that though several billion of the GCC’s $10 billion zero-interest loan package remain to be disbursed by Kuwait, the fund might not be forthcoming in that form before the end of 2024.

However, the ratings agency said Bahrain’s wealthy neighbours remain committed to providing support through various channels including cheap loans from sovereign funds, capex grants and investment cooperation programmes.

Saudi Arabia’s Public Investment Fund (PIF) recently earmarked $5 billion in a specialised investment vehicle for Bahrain, focusing on tourism, transportation,

WITH DEBT ISSUANCE PICKING UP IN 2023-2024 TO COVER A LARGER FISCAL DEFICIT, BAHRAIN’S DEBT-TO-GDP RATIO

COULD

EDGE BACK UP SLIGHTLY

National Bank of Kuwait

–

infrastructure and the environment. Earlier in March, the Saudi wealth fund signed an MoU with Bahrain’s Mumtalakat to boost cooperation and investment in strategic sectors.

Bahrain’s relationship with its Gulf allies remains strong. The kingdom is likely to receive full disbursements under the GCC Support Package and there remains room for additional financial support beyond the program’s expiration in 2024.

“With debt issuance picking up in 2023-2024 to cover a larger fiscal deficit, Bahrain’s debt-to-GDP ratio could edge back up slightly,” NBK said in a report earlier in January.

Bahrain faces external debt redemptions of between $2 billion to $2.5 billion (5% of GDP) annually from Eurobond and Sukuk issuances. Its sale of $2 billion of debt in February was met by strong investor demand, as the country is taking advantage of a drop in US yields to help fund fiscal deficits.

A robust banking sector

Bahrain’s financial sector plays a preeminent role among GCC countries and contributes significantly to the local economy. The country’s financial services sector contributes 18.08% to the real GDP, according to official governmental figures.

The banking sector remains resilient with ample buffers and has so far withstood the phasing out of COVID19 measures and tightening financial conditions. Bahrain’s banking sector experienced a landmark year in 2023 and remains on a strong footing.

Banks in the Gulf state, like their GCC peers, continue to benefit from significant

noninterest-bearing deposits and despite some migration to time deposits, margins continued to strengthen over 2023.

“Net profit improved to 1.4% of tangible assets in the first nine months of 2023 as higher interest rates boosted net interest income. We expect net interest margins to remain at high levels, driving further growth in net interest income, until the cycle of rising interest rates begins to reverse, likely in H2 2024,” Moody’s said in a report in March.

Digital transformation is the future of Bahrain’s banking sector. The island nation has been actively trying to expand its fintech and finance industry to diversify and strengthen its nonoil economy.

Singapore’s Whampoa Group unveiled plans to set up the headquarters of its new digital bank in Bahrain in May 2023. Singapore Gulf Bank, as the digital bank is known, secured an investment from Mumtalakat in February, which is expected to enable the neobank to launch and grow its business after receiving a banking license from the Central Bank of Bahrain.

Banks in Bahrain are leveraging artificial intelligence to develop new customer experience initiatives aimed at shifting competition away from products to lifestyle banking.

Bahrain maintains business-friendly regulatory and legal frameworks and the government has taken significant strides to diversify the economy away from heavy reliance on oil revenues. However, the IMF emphasised the importance of implementing a mediumterm fiscal adjustment plan, safeguarding financial stability and accelerating structural reforms.

Agile Solutions Empowering Smart Banking with

Join the new generation of banking with our innovative tech solutions. Harness the power of AI Ops, Cloud Technology, and Open Banking Strategies.

Our advanced analytics system and robust data management ensure smarter, more efficient operations for the future of finance.

Agile Solutions

Embrace flexibility and rapid innovation with our agile solutions designed to adapt to changing business needs efficiently. gbmdubaimarketing@gbmme.com

AI Ops (Artificial Intelligence Operations) Open Banking

Revolutionize operations with AI-driven technologies that optimize performance, enhance security, and drive intelligent decision-making

Foster collaboration and innovation by leveraging open banking platforms that promote secure data sharing and enhanced customer experiences.

The Birth of an Era

The impact of multiple new technologies is changing the fundamental identity of banks, bringing new growth opportunities and opening a door to innovative in-service delivery and new entrants to the market, but also to new threats and vulnerabilities

The global banking sector stands on the verge of transformational change. The adoption of artificial intelligence (AI), data processing and storage and cloud computing is creating a generational explosion of opportunities in banking.

“New-age players, emerging technologies and expanding regulatory compliance are transforming the banking landscape,” global consultancy firm Capgemini said while emphasising that innovations such as generative AI (GenAI) and Open banking will distinguish competitive frontrunners.

Banks in the Middle East region understand the critical importance of digital transformation. Incumbent banks face existential threats without modernisation as fintech disruptors and big tech firms are luring away customers with superior digital experiences.

From an institutional perspective, digitalisation is reinventing business processes and models while creating new compelling value propositions by leveraging Big Data, AI and other innovative technologies such as the cloud.

Industry experts expect AI to replace or at least lend a hand in tasks that take

up almost three-quarters of the time bank employees now spend working. Some of the region’s biggest banks have been experimenting with GenAI, spurred by the promise that the technology will boost staffers’ productivity and cut costs.

“The financial sector’s high density of data and communications makes it ripe for both improvement and attack by AI tools,” the World Economic Forum said in January, adding that greater transformation in the sector is coming with the fusion of AI and quantum technologies.

Furthermore, Open banking has gained momentum in the Middle East in the recent past – especially in the GCC region – making it a core element in the digitalisation of financial services.

By embracing Open Banking frameworks and APIs, the region’s banking system can create ecosystems that enable seamless integration of services, advance customer experiences and drive innovation.

Open banking drives improved collaboration between financial services providers, greater innovation and better products and services for customers,

global consultancy firm EY said in a report, as banking customers expect more convenience and flexible access to services.

Meanwhile, the cloud and other innovative technologies have opened up opportunities for banks to embrace an open banking strategy. Cloud computing provides banks with an opportunity to enhance their information technology (IT) services, acting as a powerful engine for business model innovation.

Banks in the GCC region are pushing full steam ahead with the transition to an agile culture, removing barriers to cross-functional collaboration and creating semiautonomous teams that can deliver solutions quickly in alignment with enterprise strategy.

The new operating environment calls for financial institutions that can identify and swiftly respond to customer demands.

Open banking

Open banking can seem a threat to traditional financial institutions, but the implementation of PSD2 in Europe demonstrated that the most forwardlooking banks see open banking for what it truly is – an opportunity.

Saudi Arabia, Bahrain and the UAE have been at the forefront of open banking implementation in the Middle East. PwC projected that Open banking has the potential to reshape the financial services landscape and several financial centres in the emerging markets, the GCC region included, are making considerable moves in this space.

NEW-AGE PLAYERS, EMERGING TECHNOLOGIES AND EXPANDING REGULATORY COMPLIANCE ARE TRANSFORMING THE BANKING LANDSCAPE

– Capgemini

Bahrain was the first to mandate open banking and the UAE and Saudi Arabia are now making moves to follow their neighbour’s example. The kingdom issued its open-banking rules in 2018, followed by a framework with guidelines on data sharing and governance in late 2020. The government is implementing a Europeanstyle regulation-driven approach.

Following the issuance of its open banking policy in January 2021, the Saudi Central Bank (SAMA) published its full open banking framework in November 2022, with an initial focus on account information services to be followed in the second phase by a focus on payment initiation services.

SAMA introduced an ‘Open Banking Lab’ in December 2022 to speed up the development of open banking in Saudi Arabia. The ‘Lab’ constitutes a ‘technical testing environment’ to enable established banks and fintech companies the opportunity to ‘develop, test and certify’ open banking services to ensure compatibility with the framework.

“To succeed in open banking, banks in Saudi Arabia and the UAE should start thinking like platform companies, flexing

OPEN BANKING HAS THE POTENTIAL TO RESHAPE THE FINANCIAL SERVICES LANDSCAPE AND SEVERAL FINANCIAL CENTRES IN THE EMERGING MARKETS, THE GCC REGION INCLUDED, ARE MAKING CONSIDERABLE MOVES IN THIS SPACE

– PwC

their business models to connect people and processes with assets and backing that up with technology infrastructure that can manage interactions from internal and external users,” said Accenture.

By leveraging APIs, Open banking platforms authorise retail and enterprise clients to access consumers’ financial data in real-time and share account information and transaction history with external parties such as vendors, suppliers, business partners and other banks. However, the proliferation of advanced technologies is exposing banks to risks that they may have never grappled with in the past.

Open banking and the increase in partnerships with technology partners can open banks to new vulnerabilities and cyberattacks. Similarly, fourth-party risks are becoming more of a threat as banks engage in more partnerships with service providers that have their vendors.

The GCC is one example of an emerging global Open banking microcosm and PwC expects the innovative technology to reshape the financial services landscape. The region’s varying levels of open banking implementation and regulation present distinct opportunities for the financial service sector.

Banking on AI

Financial institutions are leveraging data and AI in a variety of ways, though many current use cases are still focused on risk management and cost savings rather than advanced customer engagement. McKinsey forecasted that GenAI could have a significant impact on the banking sector, boosting productivity by between 2.8% and 4.7% of annual

turnover, representing an additional gain of between $200 billion and $340 billion.

“The emergence of AI is disrupting the physics of the banking industry, weakening the bonds that have held together the components of the traditional financial institutions and opening the door to more innovations and new operating models,” said Deloitte.

GenAI is making remarkable progress in a wide array of industries, the financial services sector included, as demonstrated by the rollout of OpenAI’s GPT-4 and Google parent Alphabet’s Bard.

“GenAI offers CEOs the chance to reshape their bank, empower customers, amplify their productivity and increase profitability,” Accenture said in a report earlier in 2024. However, the global consultancy firm highlighted that many banking executives recognise that to realise the full potential of the innovative technology it should work in tandem with human ingenuity.

“The banking industry is highly digitalised, data-driven and its staffing costs are high. All these factors position it well for broad efficiency gains from AI,” said Moody’s. The innovative technology can help banks reduce costs and increase profitability, maintain a competitive edge in a rapidly changing financial ecosystem and improve operational efficiency across front-to-back-office functions.

The use of AI will allow banks to transition from reacting to queries to proactively solving problems, thereby improving the customer experience even more. Hyper customisation is a big trend within the banking sector as customers are looking for a personalised, tailored service rather than a one-size-fitsall approach.

“Traditional AI and predictive analytics will decide on the prompts and the messages to deliver to the customer while GenAI will deliver those prompts and messages in a nonintrusive, human-like and personalised manner,” according to Boston Consulting Group (BCG).

Banks have unique issues that require unique solutions. AI allows

banks to identify actionable insights by analysing customer data and providing personalised services.

The emergence of GenAI technology, capable of creating and predicting based on massive amounts of data, is a huge change that promises to further transform banking operations and strategy.

Cloud banking

The cloud is the backbone of digital innovation, and it is shaping the future of the banking sector. The transformative technology gives banks access to on-demand resources – such as networks, servers, storage and APIs – that can be rapidly provisioned and released with minimal management or service provider interaction.

unavoidable with on-premises systems,” according to PwC.

Data analytics and the cloud have become essential pillars of the GCC region’s banking sector, revolutionising traditional banking practices and ushering in a new era of innovation and customer-centricity.

The innovative technology especially the Software as a Service (SaaS) and Banking as a service (BaaS) models offers banks several opportunities such as easier customer data analytics and sharing, improved marketing time, cost reduction and enhanced flexibility and operational efficiency.

Deloitte said the cloud delivers an array of innovative ‘products-as-a-service’ that can help banks implement business and

GENAI OFFERS CEOS THE CHANCE TO RESHAPE THEIR BANK, EMPOWER CUSTOMERS, AMPLIFY THEIR PRODUCTIVITY AND INCREASE PROFITABILITY

– Accenture

BCG said in a report last October that the cloud can help banks remain competitive in a rapidly digitalising world, enabling them to adopt new functionalities and solutions efficiently and rapidly in a cost-effective manner without the time and cost-intensive need for significant internal investment.

Banks are unlocking new ways to get closer to their customers as digitalisation is reshaping the financial services sector. The cloud offers several business benefits for incumbent banks including increased flexibility, business agility, lower cost of IT and quicker access to innovation.

“Cloud computing has opened countless doors for financial services firms, giving them the freedom and flexibility to innovate, without the time and resource commitments that are

operating models to augment revenue generation, increase customer insights, cut costs and deliver market-relevant products quickly and efficiently.

The shift toward digitalisation, accomplishing tasks digitally instead of on paper or in person, has accelerated rapidly over the years.

Digital transformation in the banking sector is more than just a trending topic but is a necessity for institutions to cope with regulatory requirements in order to identify and mitigate potential risks, empower customers and provide them with personalised services and products. Going forward, investment in digital transformation across the Middle East is expected to continue as banks seek to further accelerate the modernisation of their technology platforms.

1 billion+ customers

100+ countries

1.7 billion accounts

will accelerate your journey.

With presence in over 100 countries, impacting over a billion lives and millions of businesses every day, Finacle solutions can help your bank to build better business models to lead the future.

BANKING TECHNOLOGY

The Trajectory of Technology

Murali Rajagopalan Banking & Financial Services Leader at GBM Dubai explains the accomplishments, the priorities, the development paths and the top concerns of bankers as the technological driven momentum continues

What are the current technological priorities or essentials for banks in the region?

The banking industry is experiencing rapid transformation and continues to lead in implementing digital initiatives across the region. According to IDC, banks in the META region are poised to increase technology investments by 6% this year, focusing on critical areas such as security, data modernisation, big data analytics and AI and machine learning solutions.

These changes are driven by the evolving technology landscape, shifting customer expectations and the need for banks to grow their customer base and enhance profitability. As a result, banks are prioritising embracing various emerging technologies in their digital transformation journey, to offer secure and innovative digital services, streamline operations and enhance customer engagement.

Within this, cloud migration and security are a key focus for improving trust, agility, scalability and cost-efficiency. Adoption of intelligent platforms utilising automation and GenAI are also a focus for enhancing customer experiences. This is specifically to cater to “Digitally Native” consumers who demand convenient

mobile-based financial transactions. Furthermore, the rise of Neobanks, or digital-only banks, is also noteworthy, leveraging cloud-based technologies to deliver fully digital services.

How do you see Open Banking developing over the next few years?

Open Banking is poised to undergo significant developments over the next few years, shaping the future of the financial industry. APIs are enabling banks to experiment with cutting-edge technologies and novel use cases,

creating new business opportunities and microservices, particularly in enhancing customer experiences and establishing digital ecosystems. Some regional banks are providing API sandbox environments, allowing Fintechs to experiment and develop real-world applications and services. Ultimately, these collaborations between traditional banks, FinTechs and other third-party providers will further drive competition and open up new avenues for innovation, creating diversified financial solutions for consumers.

One major trend that will continue to gain traction is embedded finance, where we see financial services increasingly integrate into everyday applications, offering consumers greater accessibility and convenience. We will also see GenAI and predictive analytics play a bigger role in Open Banking, offering personalised experiences, tailored products and recommendations.

Moreover, Banking as a Service (BaaS) and Variable Recurring Payments (VRP) are two other trends that we’ll also see in the future of Open Banking. BaaS allows nonbanking entities to offer financial services, erasing the boundaries between traditional banking and other industries. VRP, on the other hand, enables flexible and variable payment schedules, offering consumers greater control over their finances.

Furthermore, as Open Banking expands, there will be a heightened emphasis on security measures. To address expanding attack surfaces, comprehensive and innovative security approaches including proactive API security and governance will continue to be crucial.

Are we now seeing tangible instances where the use of AI has brought enhanced benefits to banks?

Conversational, personalised banking experiences are becoming the norm, where banks are now able to reach out to customers proactively with timely advice and offers. This is made possible through

enhanced online and mobile banking, as well as AI and ML-based customer service tools like chatbots and smart branches.

Using AI and automation, banks are also deriving invaluable benefits through realtime and contextual customer experience and centricity. These applications are transforming banking by offering more personalised experiences through the analysis of customer behaviors, trends and patterns, and by customising online and mobile banking services. The introduction of voice and facial recognition, along with other biometric data, is further refining personalised and secure offerings in banking.

AI is also enabling banks to achieve more with less, increasing productivity and consistency by optimising business processes and automating timeconsuming, mundane tasks. This shift is freeing employees from repetitive work, allowing them to focus on highervalue tasks.

Do you foresee any limits to the abilities of or to the usage of AI in banking?

AI is already proving to be a versatile technology that can be applied across a wide range of business functions, and there are various opportunities for banks to re-imagine how AI can improve their operations.

However, although most banks are undergoing digital transformation, they are not all at the same level of maturity when it comes to AI implementation and deriving meaning out of their data. To navigate this journey effectively, banks must address organisational and technological barriers and have a clear vision for the future. These include concerns around data privacy and security, regulatory compliance, ethical considerations and the potential for algorithmic bias. Upskilling employees with necessary tools and abilities is crucial, as is effective data management to ensure efficient use of the right data. Thus, working with technology partners who possess the right capabilities and industry understanding is crucial.

HAVING THE RIGHT CLOUD STRATEGY AND MAKING THE RIGHT DECISIONS ON CLOUD INFRASTRUCTUREAND WORKLOADS, ARE VITAL TO KEEPING BUSINESS COMPETITIVE

Looking ahead, banks should aim to leverage the potential of cognitive computing, positioning themselves at the forefront of technology with AI platforms that enable innovations like image recognition and new customer experiences. This approach can lead to faster time-to-value, supported by lightning-fast infrastructure and efficient AI tools that handle larger data models and deliver faster insights.

Which cloud use preferences are emerging amongst regional banks – Public, Hybrid, Private or a combination?

When it comes to cloud, there are many different solutions available, offering various levels of performance, scalability and efficiency. Having the right cloud strategy and making the right decisions on cloud infrastructure and workloads, are vital to keeping business competitive. With this, regional banks have fast-tracked their adoption and use of cloud and are increasingly adopting a combination of cloud use preferences, often leaning towards hybrid and private cloud models. While public clouds offer scalability and cost-efficiency, concerns about data security and regulatory compliance drive banks to prefer private or hybrid clouds.

This trend is highlighted by forecasts from Gartner, indicating that in 2024, the MENA region is expected to see the highest growth rate in spending on data privacy, with a projected increase of 24% year-over-year. Additionally, Gartner predicts a 17.4% increase in spending on cloud security for the current year. Hybrid clouds, combining on-premises infrastructure with public and private

clouds, allow banks to maintain sensitive data in a secure on-premises environment while utilising the scalability of public clouds for less sensitive operations. This approach offers flexibility and cost savings, making it an attractive option.

What currently keeps the region’s bank CTO’s and CIO’s up at night?

Cybersecurity remains a top concern for CTOs and CIOs in the banking sector, given the industry’s monetary nature and the increasing complexity of digital threats. There is a growing urgency for Zero-Trust architecture to take center stage and guarantee more robust security from all angles. Ensuring the 24/7 security and availability of applications and data is paramount to meet customer expectations. This include striking a balance between maintaining safety and accessibility, while still implementing new technologies around AI, blockchain, and cloud computing to enhance customer experiences and competitiveness. Accelerating efforts to bring digital resiliency and innovation to the heart of the digital transformation journey, while managing legacy systems alongside these new technologies adds to the complexity faced by CTOs and CIOs. Regulatory compliance is another significant challenge, requiring banks to navigate a complex regulatory landscape while maintaining operational efficiency. Success hinges on a strategic, longterm approach to technology adoption, prioritising initiatives that align with core business goals and avoiding the pitfalls of deploying multiple new technologies without clear alignment to business objectives.

BANKING TECHNOLOGY

Unrelenting Innovation

Muhammad Ameer Hasan Solutions Engineer, Backbase, explains that the GCC banking sector stands at the threshold of a revolutionary transformation shaped by the advent of generative artificial intelligence (GenAI), a cloud-first approach to digitalisation and the relentless pursuit to augment customer experience

What are the current technological priorities or essentials for banks in the region?

Banks in the GCC are proactively integrating emerging technologies into their operations, yet they recognise the crucial need to prioritise foundational improvements as well. This balancing act is essential as they strive to not only keep pace but to lead in a fiercely competitive market. Key focus areas include forging a future-proof operating model and enhancing digitalisation and automation to ensure seamless customer journeys.

As part of foundational improvements, banks are focusing on delivering use cases such as instant loans, alternative payments, digital account opening for Retail and SME, investing and more which have become essential in the region. Additionally, banks are also investing significant effort into emerging technologies like Open Banking, AI-driven chatbots, Blockchain and Super Apps to extend these capabilities for their customer base.

At Backbase, our current product and future roadmap is aligned with these priorities, with exciting out of the box offerings that include account aggregation, transaction enrichment, personalised financial insights, robo advisory, digital investing, super apps and more, all designed to enhance the customer banking experience.

How do you see Open Banking developing over the next few years?

Open Banking will play a pivotal role in reshaping the financial sector in the coming

years. Previously, financial institutions were cautious about sharing sensitive customer data, largely due to concerns over regulatory compliance and losing potential competitive advantages. However, with the advancement of Open Banking technologies, supported by robust regulatory frameworks and propelled by fintech innovation, we are witnessing a significant shift in this mindset. The IBSi forecasts that the Open Banking market in the Middle East will expand by 25% annually over the next five years, potentially hitting $1.17 billion. This growth indicates a strong, region-wide adoption as banks begin to realise the substantial benefits Open Banking offers—aligning perfectly with their strategic goals and performance metrics. Through the strategic application of Open Banking technology, banks are poised to introduce compelling use cases aimed at bolstering both customer acquisition and retention. These offerings encompass a spectrum of services, ranging from seamless account opening and account aggregation to transaction enrichment, credit scoring and beyond. These examples merely scratch the surface of the diverse array of use cases available in the market. Open Banking’s primary objective is to facilitate the unrestricted flow of valuable customer data. By harnessing this data, both banks and fintechs can further build exciting use cases that resonate with customers. The future of Open Banking remains promising, with ample opportunities for continued growth and advancement.

Are we now seeing tangible instances where the use of AI has brought enhanced benefits to banks?

Absolutely. Artificial Intelligence is not just enhancing but revolutionising banking operations, particularly in the Middle East where banks are pioneers in adopting AI-driven innovations. These solutions are significantly changing how banks operate, delivering profound efficiency improvements and superior customer experiences.

Examples include AI-driven chatbots, advanced credit scoring, personalised banking experiences and robo-advisory services. These use cases showcase AI’s versatility across different banking domains, from credit assessment to fraud detection and customer support, delivering extensive advantages. To optimise AI’s performance, my advice to banks is that they must first eliminate fragmented IT architecture and instead consolidate operations into a unified platform. This approach seamlessly aggregates data from various customer touchpoints, enhancing process efficiency and enabling AI-driven insights to identify critical events and uncover customer opportunities.

Which cloud use preferences are emerging amongst regional banks – Public, Hybrid, Private or a combination?

Lately, there has been a noticeable increase in interest towards cloud-only or hybrid deployment models. Banks are recognising that to remain competitive in a constantly evolving market, fostering rapid innovation is imperative. Hosting in an environment that offers flexibility, scalability and reliability is considered one of the most effective methods to drive innovation forward. However, from a bank’s standpoint, it’s understandable that not all systems and data can transition seamlessly to the cloud due to compliance, legacy systems and regulatory constraints. This is precisely where the hybrid model comes into play. Companies like Backbase remain entirely agnostic regarding deployment methods, thereby accommodating all potential models.

Within the realm of cloud offerings, the Software as a Service (SaaS) model is emerging as a particularly favored option, particularly among banks with smaller IT teams striving to compete with digital frontrunners. For such banks, a SaaS solution proves optimal, as it transfers the responsibility of hosting, maintenance and the development

of new capabilities entirely to the software provider, allowing the bank to concentrate on its core competency of customer service.

What currently keeps the region’s bank CTO’s and CIO’s up at night?

Bank CTOs and CIOs in the region face a relentless array of challenges, from escalating cybersecurity threats to the crucial tasks of developing internal talent and fostering an innovative culture. Attracting skilled professionals also remains an important priority. Furthermore, the pressing demand for rapid digital transformation initiatives cannot be overstated. This involves not merely modernising legacy systems, but also strategically harnessing data for actionable insights and integrating cutting-edge technologies like AI and blockchain into their operations.

Among these, two challenges particularly dominate the landscape: Fintech distribution: The emergence of non-traditional players such as

banks. The days of relying on physical branches for services or enduring lengthy application response times are swiftly fading into obsolescence.

Legacy Systems: Legacy systems in banking pose significant challenges to innovation. These systems, often outdated and inflexible, hinder banks’ ability to adapt to rapidly changing market dynamics and customer expectations. Additionally, maintaining and upgrading legacy systems can be time-consuming and costly, diverting resources away from innovation initiatives. As a result, banks end up losing market to nontraditional players mentioned above. To address these challenges, banks must commit to modernising their IT infrastructure. However, the complexity of transformation projects often weigh heavily on the minds of CIOs and CTOs. My advice to these banks is to adopt a progressive modernisation approach and prioritise the layers that will produce maximum impact. For instance, by focusing on transforming the

THE FUTURE OF OPEN BANKING REMAINS

PROMISING, WITH AMPLE OPPORTUNITIES FOR CONTINUED GROWTH AND ADVANCEMENT

neobanks and embedded finance use cases are steadily claiming market share. While various factors contribute to their success, one pivotal element warrants attention: their modern IT architecture. This infrastructure empowers them to thrive in innovation by swiftly developing new capabilities or seamlessly integrating with relevant systems to deliver tailored services to customers. Equipped with such a flexible platform, non-traditional players surpass customer expectations by providing personalised, seamless experiences and extending beyond traditional banking services. Consequently, customers now anticipate higher standards from their

engagement layer, banks can enhance all customer touchpoints, streamline operations through automation, and achieve a comprehensive 360-degree view of customers for more effective support. Looking ahead, the engagement layer will become the main driver for innovation, with other downstream modules serving primarily as systems of record for storing and sharing data.

At Backbase, we expedite Digital transformation projects by providing outof-the-box apps, configurable journeys, core, CRM and fintech connectors and more, empowering banks to accelerate their journey towards a modernised and customer-centric banking experience.

LEADING SAUDI ARABIA’S DIGITAL

BANKING REVOLUTION:

Arab National Bank’s Journey with Infosys Finacle

Naif Alharbi Chief Information Officer at Arab National Bank talks with Sriranga Sampathkumar Vice President and General Manager, Middle East and Africa and Infosys Finacle about their digital vision and strategy to lead in the market

In the shifting sands of Saudi Arabia, where the winds of change blow with the force of Vision 2030, Arab National Bank (ANB) stands as a beacon of digital transformation in the Kingdom’s financial landscape. As the Kingdom charts its course towards a tech-forward future, ANB emerges not just as a participant but as a leader, actively shaping the contours of digital banking in the region.

In a conversation with Naif Alharbi, the bank’s Chief Information Officer, Sriranga Sampathkumar, Vice President and General Manager – Middle East and Africa, Infosys delves into ANB’s visionary strategy, meticulously designed to navigate the digital terrain and emerge victorious. With an unwavering focus on

innovation and customer-centricity, ANB is poised to redefine the banking experience, leveraging advanced technologies and strategic partnerships to drive unprecedented growth and success.

Sriranga: I sincerely thank you, Mr. Naif Alharbi, for generously dedicating your time to this interview. I’m thrilled about having an insightful discussion ahead. To start with, tell us about your vision for ANB and how do you plan to succeed with scaling digital transformations?

Naif: Before delving into our vision, let’s zoom out and examine how we’ve been bolstering our digital banking initiatives. In early 2021, our focus shifted towards accelerating growth and making a significant impact in line with Vision 2030. Our mission is not only to keep pace but to lead in several critical areas.

To achieve corporate leadership, our goal is to become the preferred bank for large and mid-corporates. As an SME champion, we aim to emerge as the premier bank for SMEs in KSA. Targeting mass market growth, we’re expanding to cater to broader segments. To achieve affluent market dominance, our aim is to lead in serving KSA’s affluent customers. Being a capital market player, we strive to be top contenders in capital markets with ANBC.

It’s essential to note that technology isn’t just part of our strategy; it’s the foundation of everything we do. We’ve developed an evolving tech ecosystem that’s as dynamic as the market itself. To this effect, the bank has a three-pronged strategy: one, to embrace modern tech architecture and open systems that adapt swiftly; two, smart tech delivery, refining our approach to implementing tech solutions for effectiveness and timeliness; and three, to attract and retain the best IT talent to maintain our competitive edge.

Looking ahead, we envision ANB becoming a transformative leader in banking innovation. By leveraging advanced technologies such as AI, Cloud and big data analytics, we enhance service levels and operational efficiency.

This tech-driven approach not only enhances customer experiences but also positions us as pivotal players in the banking industry’s transformation.

Sriranga : How are the evolving demands of customers in Saudi shaping ANB’s digital strategy to meet their needs?

Naif: It’s no exaggeration to say that Saudi Arabia is sprinting ahead in the global digital banking race. As reinforced under Saudi’s Vision 2030 program, the country aims for cashless payments to make up 70 percent of the total by 2025 — effectively leading the charge in the Middle East for digital banking adoption. Saudi Arabia is all about digital. Indeed,

Naif: As highlighted in my response regarding our vision, we are committed to leading in digital transformation. A crucial part of this commitment has been modernising our legacy systems to not only achieve our business goals but to drive the industry forward. The core of this transformation is adopting a modern, flexible and open architecture. That’s exactly why we chose Finacle Core Banking. Its latest version offers a componentised, API-driven architecture that aligns perfectly with our needs.

Our IT transformation strategy was clear from the start: integrate Finacle seamlessly to enhance our service delivery and operational efficiency. By

SAUDI

IT’S

NO EXAGGERATION TO SAY THAT

ARABIA IS SPRINTING AHEAD IN THE GLOBAL DIGITAL BANKING RACE

with over three-quarters of the kingdom’s banking customers already embracing online and mobile platforms for their financial transactions, the bar is set high for meeting the expectations of our techsavvy customers.

In alignment with Saudi Arabia’s vision for a cashless society by 2030, we at ANB are pushing the boundaries just as aggressively. We’re not just keeping pace; we’re setting the pace. Our digital banking isn’t static—it’s dynamic. We recently gave our mobility solution a major facelift and continue to roll out new features almost monthly. This relentless innovation underscores our commitment to transforming our digital services to not only meet but exceed the growing needs of our digitallyadvanced customers.

Sriranga: What factors influenced your decision to adopt Finacle Core Banking and what was your IT transformation strategy to make this a success?

leveraging its advanced features, we’ve been able to innovate faster, deliver services more efficiently and provide a superior customer experience that keeps us at the forefront of the banking sector.

Sriranga : In what way was the adoption of an open, API-driven, and componentised architecture help power your business?

Naif : In my previous response, I touched upon our strategic shift towards a modern, flexible and open architecture at ANB. This isn’t merely an upgrade; it’s revolutionising how we operate. Here’s why this open, API-driven and componentised architecture is a gamechanger for us:

Innov ative Front-Ends: We’ve reimagined our customer interfaces to be more vibrant and user-friendly. Our open tech stack allows for an intuitive banking experience that evolves with customer needs, ensuring every interaction is seamless.

Efficien t Back-Ends: We’ve overhauled our legacy systems, drastically reducing the time to launch new digital features. This efficiency boost means we can speed products to market faster than ever, staying ahead in a competitive landscape.

Expanded Third-Party Ecosystem: Our new architecture facilitates smoother connections with third-party services, significantly broadening our ecosystem. This not only enhances our service offerings but also adds incredible value for our clients.

Data-Driven Insights: Our robust data architecture goes beyond mere data collection; it transforms data into actionable insights. This strategic use of data drives smarter business decisions and ramps up our operational efficiency.

BY LEVERAGING ADVANCED TECHNOLOGIES SUCH AS AI, CLOUD AND BIG DATA ANALYTICS, WE ENHANCE SERVICE

LEVELS AND OPERATIONAL EFFICIENCY.

the charge as we pivot towards a cashless economy. We’re not merely joining the digital payment revolution; we’re spearheading it. Our strategy? Offering a diverse and robust range of payment options that cater to our clients’ needs, from real-time settlements to a comprehensive suite of payment products.

With Saudi payment transactions poised to grow at over 8% annually and digital commerce projected to exceed USD 40 billion by 2025, the opportunity

operations—we’re revolutionising the way these integrations improve their experiences. This strategic move boosts both the scalability and resilience of our payment systems and places us in an ideal position to seize the growing opportunities in digital payments, ensuring ANB remains at the cutting edge of this dynamic field.

Sriranga: What were the reasons for choosing Infosys Finacle as a partner and how do you see this partnership evolving?

WITH SAUDI PAYMENT TRANSACTIONS POISED TO GROW AT OVER 8% ANNUALLY AND DIGITAL COMMERCE PROJECTED TO EXCEED USD 40 BILLION BY 2025, THE OPPORTUNITY FOR ANB TO STRENGTHEN OUR MARKET PRESENCE IS TREMENDOUS

Naif: Choosing Infosys as our partner was a strategic decision, influenced by their extensive experience in delivering innovative banking solutions. Our longstanding relationship with Infosys has fostered a deep understanding between our teams. This mutual comprehension has been crucial as they align well with our goals and overall vision.

Overall, this architectural transformation empowers us to respond dynamically to market demands, innovate continuously and maintain a competitive edge in the digital banking era.

Sriranga : How do you intend to enhance scalability and resilience of your bank to capitalise on opportunities in digital payments?

Naif : Payment innovation isn’t just on our agenda at ANB—it’s leading

for ANB to strengthen our market presence is tremendous. We’re dedicated to delivering payment solutions that are not just reliable but also scalable and resilient.

Our tactical approach harnesses the latest in Open Banking and Bankingas-a-Service (BaaS) innovations. By enhancing our platform and broadening our ecosystem, we’re doing more than just integrating our solutions into client

Through this partnership, we leverage their technological expertise, which includes componentised and APIdriven architectures, enhancing our operational scalability and our ability to serve our clients effectively. As we move forward, I anticipate this partnership will continue to evolve, adapting to new technological advancements and further enriching our service offerings, ensuring that ANB remains at the forefront of banking innovation.

Sriranga: As we conclude our insightful discussion, I want to extend my heartfelt gratitude to Naif for his valuable insights and vision. It’s been a pleasure exploring the innovative strides ANB is taking in the digital banking realm. I eagerly anticipate our continued collaboration and the achievement of more milestones together.

Supercharging the Economy’s Engine

The vital role of SMEs in drivng economic diversity and performance is a given, and now regional governments are further strengthening this vital sector by developing supporting initiatives and unlocking financing opportunities

Middle East countries are diversifying their economies away from reliance on oil revenues and the small and medium-sized enterprises (SMEs) sector is the engine of growth that is contributing to National Visions such as Saudi Vision 2030 and the UAE’s Operation 300bn.

“SMEs contribute significantly to GDP and provide jobs for the majority of private sector employees, an important asset in

the GCC where most countries have employee nationalisation programs,” according to Deloitte.

The Middle East is home to millions of SMEs, including startups, that see the region as a strong place to start and grow a business.

Within the region, the GCC scaleups segment – SMEs with proven business models that are undergoing a rapid growth phase – contribute between 15 to 30% of the GDP.

The success of the sector is being driven by a range of dedicated support initiatives, regulatory changes and a robust financial services sector.

Banks in the Gulf region, through their cautious lending approach, are increasingly focusing on lending to SMEs as the sector forms a booming market and provides an opportunity to diversify from concentrated lending.

However, SMEs still face challenges that are general with other entities within the economy and particular to their size and nature, especially in the wake of a slowing global economy, stickier-thanexpected inflation and higher-for-longer interest rates.

GCC countries recognise the importance of SMEs and startups as key to economic growth and governments are implementing an array of initiatives and programs to support and nourish them.

This support starts from the initial creation of SMEs or startups and expands to providing technical assistance, financial lines and access to local and global markets. “With the right support, small and medium-sized enterprises could significantly boost economic growth. Governments can help capture this opportunity,” said McKinsey & Co.

Though global shocks might have a ‘limited impact’ on oil-rich GCC countries, governments are creating enabling environments to ensure the resilience of SMEs to future shocks while fostering their ability to drive sustainable growth.

A cornerstone of GCC economies

Despite warnings of economic uncertainty due to geopolitical and OPECled oil production cuts, the Middle East region’s oil exporters are seen faring better, with the International Monetary Fund projecting 2.9% GDP growth in 2024, up one percentage point from the previous year.

The SME sector is a key pillar of GCC economies and the main driver of employment and economic growth. Small businesses in the region remain positive about the sector’s growth prospects, driven by state support for entrepreneurs and investors.

Both the public and private sectors in the Gulf region have been developing programs to catalyse the growth of SMEs, including startups.

“Governments and development organisations in the GCC region recognise the important role that SMEs play in promoting economic improvement, job creation and entrepreneurship and are working to support the development and growth of the SME sector,” global consulting firm Arthur D. Little said in a report in June 2023.

SMEs account for 94% of companies in the UAE private sector and contribute significantly to non-oil GDP and job creation, representing 86% of the private sector’s workforce. In Dubai alone, SMEs constitute 95% of all businesses, create

42% of employment opportunities and contribute 40% to the city’s GDP.

Small businesses in the UAE receive support from the National SME Programme, the UAE SME Council, Operation 300bn, the UAE’s industrial strategy, the Khalifa Fund and Dubai SME.

Earlier in January, Dubai unveiled an AED 500 million financing programme to bolster the emirate’s position as a global business hub and advance the role the private sector plays in nurturing the growth of its economy.

The latest report by Monsha’at shows that the number of SMEs operating in Saudi Arabia grew an impressive 3.1% in Q4 2023 to more than 1.3 million.

Saudi Arabia won the right to host the Expo 2030 world fair last November. The international fair is expected to foster key knock-on opportunities for SMEs, particularly in the design, hospitality, transport, clean energy and infrastructure sectors.

Monsha’at said SMEs across the ecosystem will benefit from nearly $1 trillion being invested over the next seven

SMEs CONTRIBUTE SIGNIFICANTLY TO GDP AND PROVIDE JOBS FOR THE MAJORITY OF PRIVATE SECTOR EMPLOYEES, AN IMPORTANT ASSET IN THE GCC WHERE MOST COUNTRIES HAVE EMPLOYEE NATIONALISATION PROGRAMS

– Deloitte

The first phase of the Dubai International Growth Initiative, which was launched in partnership with Emirates NBD, is open to select sectors including food and beverage, fast-moving consumer goods retail and e-commerce.

Last November, the Abu Dhabi Department of Economic Development (ADDED) also launched the ‘SME Finance Facilitator’ programme, in partnership with local banks to advance SMEs’ access to financial services. The new initiative is part of ADDED’s ongoing efforts to enhance the business ecosystem for SMEs as a key driver of a vibrant, diversified and sustainable economy.

Saudi Arabia’s SME sector has proven resilience over the years, demolishing barriers to entry in traditional sectors and opening new avenues of growth. The Small and Medium Enterprises General Authority (Monsha‘at) is a significant player in the industrial SME ecosystem.

years ahead of Riyadh Expo 2030. Small businesses in Saudi Arabia are a force to reckon with as the country continues to diversify its economy in line with Vision 2030 economic transformation strategy. Similarly, countries in the GCC and the wider Middle East region are implementing dedicated SME strategies that incorporate small businesses in national development agendas. Small businesses represent a significant part of the region’s economy and the sector is one of the strongest drivers of economic development, innovation and employment.

Unlocking funding for SMEs

The increasing economic contribution of small businesses in the GCC presents many opportunities for growth in the region.

SMEs in the GCC demonstrate a strong rebound in growth following the external pressures faced during and post the COVID-19 pandemic,

RAKBANK said in a report in March while underscoring the significant optimism toward the future amid strong appetite to expand internationally.

Funding commitment to SMEs is key in realising the sector’s overall contribution to sustainable growth across the GCC region. GCC governments have introduced scale-up programs to help SMEs unlock their potential and grow faster.

Similarly, development funds, banks, lending and insurance institutions in the region are also extending support to SMEs. Last October, the Central Bank of Bahrain said funding for SMEs is targeted to comprise 20% of local retail banks’ local loan portfolio by 2025.

Initiatives such as the Al Waha Fund of Funds, the Bahrain Investment Market, Support for Phase 1 Startups and the Public Procurement Financing Programme for SMEs – have had a significant impact on developing financing processes in the kingdom.

The UAE’s state-run Emirates Development Bank has disbursed AED 3.3 billion in loans to SMEs in 2023 and a total of AED 1.3 billion under its credit guarantee scheme with partner banks as the country is targeting one million SMEs by 2030.

Last November, the Abu Dhabi Global Market unveiled Numou – a cutting-edge digital platform to financially empower and support the growth of the SME ecosystem in the UAE. The innovative digital platform’s partners include RAKBANK, Al Maryah Community Bank, Commercial Bank International, Khalifa Fund and Mastercard.

RAKBANK, Al Maryah and Commercial Bank International committed AED 100

million, AED 100 million and AED 20 million to Numou, respectively.

Saudi Arabia’s Small and Medium Enterprises Bank (SME Bank), a development bank under the National Development Fund, has disbursed $6.7 billion (SAR 25 billion) over the past four years and plans to raise the SME sector’s contribution to the GDP from 20% to 35% under to support Vision 2030.

The latest figures released by the Saudi Central Bank (SAMA) in December revealed that the total value of loans to SMEs increased by 17.8% year-on-year to $71.63 billion (SAR268.6 billion) in the third quarter of 2023.

SMEs are often the hardest hit when crises emerge and the recent global banking crisis, soaring inflation and soaring interest rates have been no exception. The sector wants banks to be timely, responsive and adaptable, working with the same agility and flexibility as them.

Scaling up innovation

SMEs in the GCC region are typically categorised as early-stage innovative startups, established successful startups, growing medium-size companies, stagnant or struggling medium-size companies, locally focused small businesses and informal micro businesses.

The region is well-positioned to continue its trajectory and foster the development of new unicorns in the foreseeable future, driven by continued government support, a thriving ecosystem, a conducive regulatory environment and increasing investor interest.

WITH THE RIGHT SUPPORT, SMALL AND MEDIUM-SIZED ENTERPRISES COULD SIGNIFICANTLY BOOST ECONOMIC GROWTH. GOVERNMENTS CAN HELP CAPTURE THIS OPPORTUNITY

– McKinsey & Co.

SMEs and startups often face challenges in accessing traditional financing options due to their size, limited operating history or risk profile. However, the Gulf region’s booming venture capital market is filling the gap by providing funding to high-potential startups and SMEs in exchange for equity stakes in the companies.

Dubai Integrated Economic Zones Authority unveiled a venture capital fund worth AED 500 million last November. The fund is expected to play a pivotal role in supporting startups – starting from the pre-seed stage and extending to the Series B investment stage.

Venture capital and startup data platform MAGNiTT said investment in Saudi startups surged by 33% YoY to $1.4 billion in 2023, driven by sovereign funds such as SVC, Jada and Sanabil as well as the government’s focus on innovation and dedicated unicorn projects.

Similarly, funding for startups at the in5 Dubai design district also surged by 25% in 2023 to reach AED 3 billion and the platform has incubated as many as 900 startups since its inception.

Furthermore, Qatar Investment Fund plans to deploy more than $1 billion in international and regional capital funds as part of a broader strategy to develop the Gulf state’s venture capital and startup market.

“The GCC has seen an unprecedented level of support and funding for startups, particularly in the technology sector, despite drying venture capital funding globally,” Hammad Younas, Chief Investment Officer at GFH Financial Group said in a blog post.

The GCC is expecting a boom in startups and SMEs, with 45 unicorns worth an estimated $100 billion expected to emerge from the region by 2030. Careem, HungerStation, Noon, Jahez and Kitopi are some of the region’s success stories.

SMEs are crucial actors in economies and societies worldwide. These businesses make outsize contributions to GDP, exports, employment and livelihoods in developed and developing countries alike, but they face challenges that threaten their growth and ability to contribute meaningfully.

Banking re-architected around your customers

Backbase offers a new generation Engagement Banking Platform, allowing you to progressively modernize your main customer journeys and re-architect your business operations around your customers. Maintain your competitive edge with a flexible platform structure that enables you to effortlessly adapt and innovate.

One platform to empower progressive modernization for banks

Go further and faster with 400+ industrialized and composable capabilities

Experience next-gen banking innovation that places your customers at the center

Get maximum flexibility within a polyglot ecosystem and infrastructure

Building Economies

Emad Ahmed and Thomas Baxendale from RAKBANK describe how SMEs and startups are an integral part of GCC countries’ economies, explaining how their development will be affected by ongoing technical and government mandated initiatives

Emad

Ahmed – EVP, Head of Commercial Banking, RAKBANKHow high up on the business banking priority list do you feel SMEs are at this time?

Emad Ahmed - At RAKBANK, we have a rich legacy of supporting SMEs and we are an SME banking leader in the region. We opened more than 15K accounts for start-ups and SMEs whilst providing them AED2.2 billion in financing to establish

Thomas

Baxendale – EVP, Head of Digital Platforms & Value Proposition –Business Banking, RAKBANKor scale their businesses in 2023. This clearly highlights our continued support to the SME community and depicts their priority for us. Additionally, various initiatives and programs are in place to support SMEs, such as curated products for start-ups, mentorship programs and business advisory services. We have also tied up with various licensing bodies and government guarantees schemes all

aimed at reaching out to and supporting SMEs in the region.

Taking a view of the wider market, the UAE government has been actively promoting SME growth as part of its economic diversification efforts, recognising their contribution to job creation, innovation and economic development. Many of the federal bodies offer skill development, subsidies, government funding (in partnership with banks) to support and grow the SME sector.

In the GCC region, including countries such as the United Arab Emirates, Saudi Arabia, Qatar, Bahrain, Kuwait and Oman, SMEs are generally considered important for economic growth and diversification, much like in the UAE specifically. While priorities may vary slightly among individual GCC countries due to differences in economic policies and regulatory environments, SMEs have been recognised as key contributors to job creation, innovation and overall economic development across the region.

Overall, SMEs are vital drivers of economic growth in the UAE, and the banking sector plays a crucial role in supporting their development and expansion.

What effects will the increasing

use of AI in banking have on startups and SMEs operating across the region?

Thomas Baxendale - The increasing use of AI in UAE banks will open up opportunities for SMEs and startups. AI can help analyse vast amounts of data to allow banks to offer personalised banking solutions and improve fraud detection. AI can also help assess creditworthiness

more efficiently which will allow SMEs to have faster access to credit and at the same time protect them from financial losses due to banking frauds.

AI powered chatbots and virtual assistants can also handle routine banking tasks, freeing up valuable time for SME owners to focus on running their businesses.