10 minute read

How the digitisation of the SME sector was an essential step for the industry’s growth-journey

LESSONS FROM THE PANDEMIC:

How the digitisation of the SME sector was an essential step for the industry’s growth-journey

Advertisement

Colin Dallas, Head of Retail Banking at National Bank of Fujairah (NBF) explains how they are working with SME’s to evolve the strength and agility to thrive in the new business landscapes of the post pandemic world.

The digital transformation is rapidly accelerating as a result of the COVID-19 pandemic, advancing in terms of consumer and business digital usage by up to five years in a matter of around eight weeks.

The playing field has shifted entirely and embracing technology has become pivotal for businesses to survive in the new climate. By now, many companies must have revaluated their existing business models and adjusted them to the digital landscape.

Evolving through change

At NBF, our strategy has been to not only respond to change with agility, but to thrive on it to enhance and strengthen our offering. When we take a closer look at retail banking, for instance, we can see how digital transformation has been sitting at the very centre of its development journey. Over the years, we have been working tirelessly to ensure the user experience reflects enhanced efficiency, better security and resilience, and faster and instant servicing.

Th e evo l v i n g re q u i re m e nts of customers have been serving as a guide for us to continually improve and enhance our operations to ensure maximum efficiency and the most positive customer experiences. With that, we have recognised that the road to

Colin Dallas, Head of Retail Banking at National Bank of Fujairah (NBF)

transformation is ever evolving and have applied this mindset to all our operations and divisions. Our relationships with our clients have transformed into partnerships, and we have been working with them to ensure that their needs are reflected in all our services and offerings.

Building a community

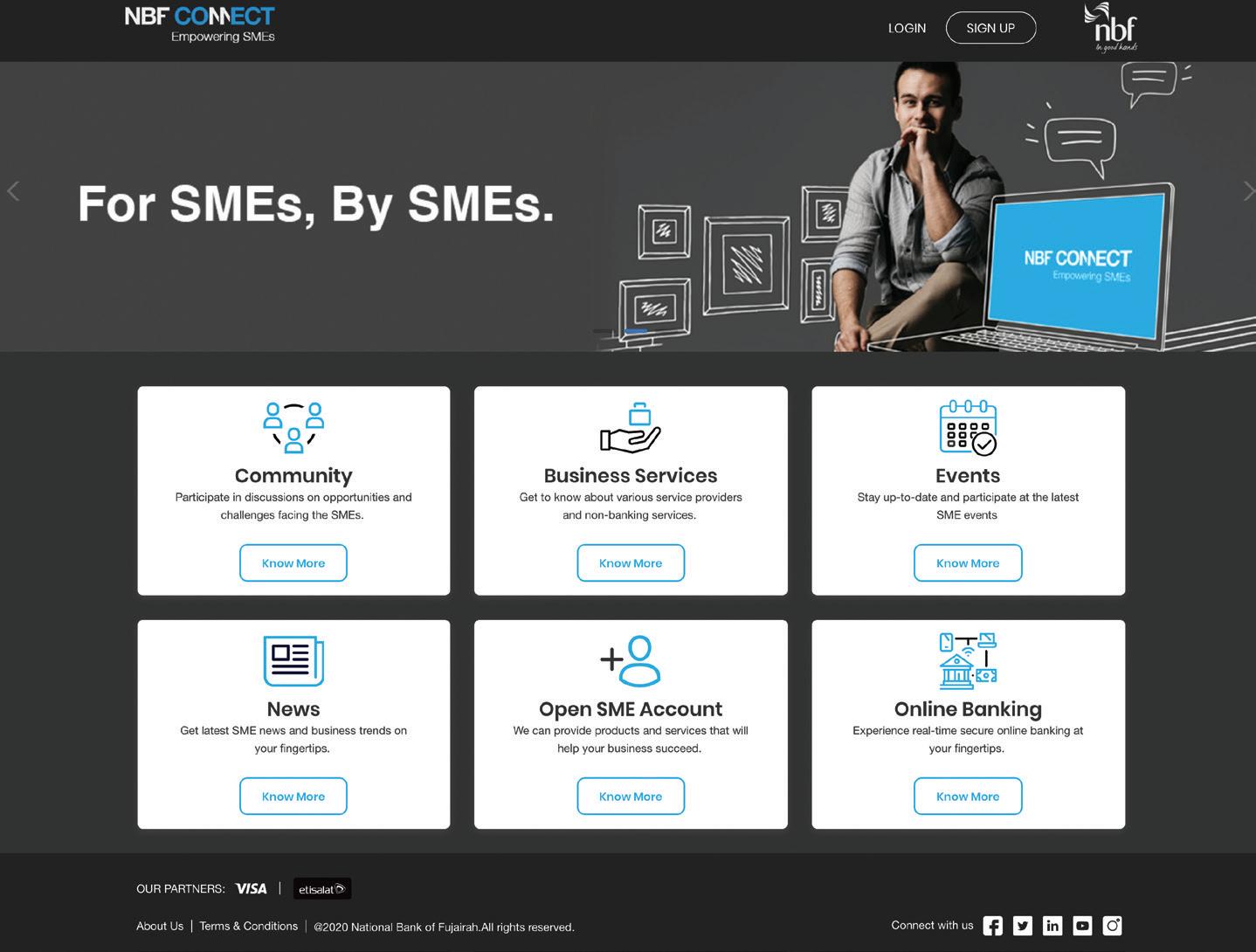

A great example of this is our latest innovation, NBF Connect, a platform that has been co-created alongside our fellow SME clients. We have long recognised the indispensable value that SMEs bring to the country’s economic engine, and with COVID-19 accelerating the transition to the digital world, we wanted to step in and be the first to help digitise this vital sector. As such, we joined forces with SMEs to build a platform that meets their business needs and helps them navigate their growth-journeys.

The aim was to alleviate some of the challenges that currently exist by creating a community where SMEs can share their knowledge and expertise, connect, and engage in industry-related conversations, as well as receive the latest market insights and learn about e-commerce and marketplace management. As a result, NBF Connect became a one-stop-shop for small business owners from all walks of life, allowing them to connect and discover avenues of growth.

What singles out this platform is the community element and the strong support system that it offers. More so, it brings together like-minded

entrepreneurs and allows them to gain invaluable insight into a wide range of non-banking offerings, all provided by fellow enterprises. Recognising that knowledge and information are powerful resources, our platform ensures that registered users’ have access to the

latest SME news and insights about key business trends and updates. Furthermore, NBF Connect gives access to a calendar so users can stay up-to-date and participate in the latest featured SME events.

For entrepreneurs who are nurturing a new company or transforming their business model to the digital space, NBF Connect features an excellent suite of business services to meet every SME need provided by fellow SMEs such as HR services, legal support, e-commerce, digital tools, a n d m a r ke t p l a c e m a n a g e m e n t . Moreover, new enterprises can easily open a business bank account online within a simple-to-navigate system, and registered clients have access to NBF’s secure online banking service whenever they like and wherever they need it.

It is no surprise that the world has experienced change on a scale that we have not experienced in our lifetime. In a world where we have adopted a new way of working, shopping and living, it becomes instrumental to not only remain abreast of these changes but to move along with this wave with agility, strength and resilience. Platforms like NBF Connect facilitate the necessary transformation and serve as a vital information hub, connecting all those who embark on this vital business revolution.

UK lead on Sustainable & SRI Finance and opportunities for IF

HM Treasury is confident that the Islamic finance industry can play an important role in unlocking the investment needed to deliver UN Sustainable Development Goals. The current funding gap is estimated by the UN at $2.5 trillion per year. This will be a massive commitment for any financial system whether the conventional or Islamic finance sectors.

By Mushtak Parker

The UK Government is taking the lead in pushing the sustainable a n d s o c i a l l y res p o n s i b l e finance agenda whose ethos is eminently compatible with Islamic principles of financial intermediation. In July, the UK Government through the Economic Secretary to HM Treasury, John Glen, in partnership with the Islamic Finance Council UK (UKIFC) convened the inaugural Islamic Finance & UN Sustainable Development Goals (SDGs) Taskforce through a virtual meeting bringing together 40 global Islamic finance leaders from the UK, Nigeria, Malaysia and the Gulf Cooperation Council (GCC) countries. The meeting explored the role Islamic finance can play in addressing the US$2.5 trillion funding gap for the UN’s17 Sustainable Development Goals agreed in the UN’s 2030 Agenda for Sustainable Development (SDGs) as part of the postCOVID-19 economic recovery.

Bridging the gap

“Islamic finance,” explained an HM Treasury spokesperson, “is one of the fastest growing sectors in the global financial industry, with assets expected to reach US$3.8 trillion by 2022. As you have stated, there is currently a funding gap of around US$2.5 trillion per year that needs to be addressed to achieve the SDG’s. Therefore, there is great potential for Islamic Finance to help bridge this gap. We are supporting the UKIFC’s SDG Taskforce because it aims to generate concrete outcomes that will practically enable Islamic finance to contribute towards achieving the SDG’s.”

The UK Government is currently the Taskforce’s first Country Partner with the expectation that other traditional Islamic finance jurisdictions, such as Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Malaysia, Indonesia, Turkey, Nigeria and even South Africa, will join the taskforce in addition to industry bodies such as the Islamic Development Bank (IsDB), the IFSB, AAOIFI and IIFM.

“We see the main objective of the Taskforce as generating practical ideas which will enable Islamic financial institutions to act on the natural alignment between Islamic Finance’s sustainability principles and the UN’s Sustainable Development Goals. Other jurisdictions are invited to join the Taskforce both as host partners and contributors through their respective Governments, regulatory bodies or industry bodies. We hope to see this happen as it will further highlight the global nature of the Taskforce,” maintained the Treasury Spokesperson.

HM Treasury is cognizant of the enormous task ahead for the world in bridging the annual US$2.5 trillion SGD funding gap and the role Islamic finance can play in unlocking some of the investment needed to deliver SDGs. This could be done through partnerships also between Islamic finance and conventional institutions in areas of SDGs common to both and co-financing projects and initiatives with country international development funds, sovereign wealth funds and development banks.

“We are committed to strengthening the UK’s Islamic banking sector and ensuring the UK remains the leading Western hub for Sharia’a-compliant financial products and institutions.

Islamic Finance can play an important role in unlocking the investment needed to deliver sustainable development goals and we look forward to seeing the practical ideas the Taskforce will generate,” added the spokesperson.

Major challenges

The UN’s SDGs are the blueprint to achieving a better and more sustainable future for all, addressing issues such as climate change, education and equality. Achieving the SDGs requires a coordinated global effort with Governments and private sector, including the financial services sector. The UN estimates that the SDG financing gap can be closed by mobilising 1% of the global capital market value.

This has to be considered against a background where most of the economies of the 57-member Jeddah-based Islamic Development Bank (IsDB), the multilateral development bank of the Organisation of Islamic Cooperation, are forecast to contract sharply in 2020/21, with very few countries spared. The United Nations Development Program (UNDP) estimates that 100 million people will fall back into poverty in 2020 because of the economic and health impact of Covid-19.

The Taskforce will have its work cut out to achieve its stated objectives of creating a platform to encourage and support collaboration and practical action, and in developing a campaign to support Islamic financial institutions and their stakeholders to understand and engage with the SDG agenda.

As Omar Shaikh, UKIFC Advisory Board Member, explained in the virtual inaugural meeting of the Taskforce: “Despite a natural alignment our analysis suggests that few Islamic financial institutions are engaged in the SDGs. As we enter the decade of delivery, we have convened some of the leading global figures in Islamic finance to consider the steps to be taken to raise awareness of the Global Goals and inspire practical action amongst Islamic financial institutions.”

As such it will be up to governments through policy initiatives, regulators

John Glen, Economic Secretary to HM Treasury

through the required regulator y frameworks; multilaterals such as IsDB and shareholders and investors to push this real socio-economic agenda. Given that almost half of the IsDB member countries are classified as least developed countries (LDCs), the UN’s SDG agenda assumes an even greater importance.

But the imperative is for the Islamic finance industry to move from the rhetoric of aspiration to collective action to support the achievement of the Global Goals by 2030.

Taking action

One institution that has proactively pursued and shown its commitment to the UN SDGs is the IsDB, whose President Dr Bandar Hajjar, addressed the Taskforce meeting calling for greater cooperation between the public and private sectors and to use the SDGs to inspire financial innovation.

The synergy and complementarity between Covid-19 mitigation and progress towards achieving the UN SDGs is implicit. In this respect, the IsDB earlier

Omar Shaikh, UKIFC Advisory Board Member

this year issued a Call for Innovation under its US$500 million Transform Fund, launched in 2018, whereby the Bank will financially support ideas that help curb the spread of COVID-19, minimise the socio-economic impact of the pandemic and build the resilience of the Bank’s member countries in responding to

outbreaks and pandemics long-term.

“One of the many issues this pandemic has shown us,” explained Dr Hajjar, “is that survival depends heavily on investment in science, technology and innovation. We encourage entrants that have innovations with a focus on advanced technology, innovative health supply chain management, low cost rapid tests and capacity building innovations.”

T h e F u n d w e l c o m e d s eve ra l applications specifically linked to tackling COVID-19 in relation to the following six UN Sustainable Development Goals (SDGs): SDG2: Zero Hunger; SDG3: Good Health and Well-Being; SDG4: Quality Education; SDG6: Clean Water and Sanitation; SDG7: Affordable and Clean Energy; and SDG9: Industry Innovation and Infrastructure.