3 minute read

SAUDI ARABIA A WORLD ON ITS OWN FOR RETAILERS AND SHOPPING CENTRES

Acountry once known for oil reserves, desert and camels has now undergone a remarkable transformation under the guidance of its strong and visionary leadership and the implementation of the ambitious Vision 2030 program. Today, the country is covering the ground at a great pace and the potential this land holds is now the focus of the international market.

Saad is a seasoned real estate professional with a remarkable track record spanning 14 years in prestigious locations such as the UAE, UK, Qatar, KSA, Kuwait, and Turkey. He specializes in Strategic Business Advisory, mainly retail and real estate. Currently serving as the Senior Manager of Strategic Consultancy at Land Sterling in KSA, Saad exhibits a keen interest in tenant mixes, brand introductions, and Mall placements. He has a portfolio of investors looking to establish profitable assets both in Retail and Hospitality within KSA.

Advertisement

With its revised policies for business ownership, lifestyle, tourism and open visa policy along with the robust and supremely integrated digital platform, Saudi Arabia is attracting international businesses and mass economic migration into the country.

Post COVID Bounce Back and the Developing Scene

KSA market has shown a significant recovery and bounce back post COVID as if it was laying down the racetrack during the COVID period. Saudi Arabia’s retail market is anticipated to project robust growth in the forecast period on account of rising tourism, growing presence on online platforms, an increasing number of retail stores throughout the nation, etc. launched a strategic plan for its retail business in Saudi Arabia until 2026, intending to provide a variety of options for the shopper with a unique experience, through the company’s sales points, supermarkets, developed corners, wholesale and online platforms.

Due to rising inflation and consumers’ increased spending on essentials, retailers in the Gulf Cooperation Council region are reporting greater turnover rates. Post COVID-19 in the first half of the year, Saudi Arabia’s retail sector saw an expansion in retail space and a robust recovery in domestic demand. The value of point-ofsale transactions increased by 16% year over year, in April 2022 and May 2022 to a total of USD24.79 billion throughout the kingdom. Riyadh’s entire retail stock expanded by 55,000 square metres of gross leasable area (GLA), Jeddah’s retail space increased by 16,000 square metres to 1.7 million square metres, and Makkah’s retail space increased by 17,500 square metres to 1.4 million square metres in the first half of the year 2022.

Also, according to a study from the investment ministry, net foreign direct investment in Saudi Arabia increased by 257.2% in 2021, according to the official Saudi Press Agency. Also, according to SPA, the wholesale and retail sector continues to dominate the issuing of foreign investment licenses, posting 1,481 licenses in the second half of 2021.

Conclusion:

The above is just the synopsis of the big that is happening in KSA. It is pivotal for the international retail market players and Middle Eastern groups to start looking at the KSA market with interest, if they are not till now.

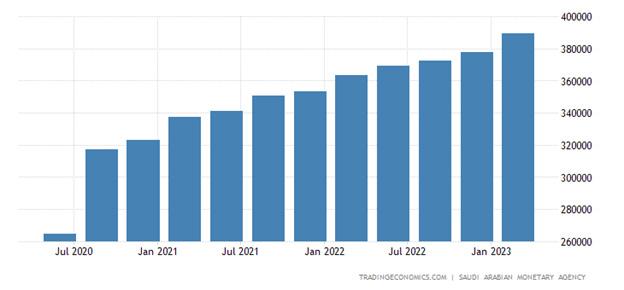

Consumer spending From SAR 320Bn to SAR 390Bn from Jan 2021 to January 2023 a rise of 22% in two years.

Moreover, major retail chains in the country have observed significant growth in the year 2022. For instance, in the first quarter of 2022, Abdullah Al Othaim Markets Co. established nine new branches, enhancing its branch network by 7.31%. Additionally, Al Othaim’s first-quarter profit for the year 2022 increased from USD15.57 million in the same period in 2021 to roughly USD24.57 million. Also, BinDawood, a Saudi Arabian retailer, reported a 5.4% increase in first-quarter profit on higher revenue, in 2022. Moreover, companies have been improving their strategies to enhance their services and attract a consumer base. For instance, in 2022, Abdullah Al-Othaim Markets Company

With major Real Estate projects and developments planned by PIF and the Downtowns being built in and around major cities, there is a massive appetite for retailers and shopping centre operators in the Kingdom.

When I meet the investors, the landowners and even Government officials, as their retail advisors and placement partners, there is always an interest in bringing retail variety to the consumers here and making it a place for everyone – I strongly believe and would advise it’s the right time to set the trend with your brand rather than becoming the trend chaser.