College Preparedness

JUNE 2024 | www.educationandcareernews.com

“You can find an affordable and high-quality higher education with a little planning, prudence, and independent thinking.”

Gail daMota, President, Education Finance Council Page 02

“Your student’s aspirations may shift, but it is important to talk openly and often, help them maintain perspective, and praise them for their big and little accomplishments.”

Yvonne Johnson, President, National PTA Page 06

An independent supplement by Mediaplanet to LA Times

The host of

College Tour”

college

the right programs for them Read more on Page 04

ALEX BOYLAN

“The

talks about helping aspiring

students find

The Top Strategies to Afford College

Once you have made the decision to go to college, your next step is to identify the pathway that will best enable you to achieve your goals.

Don’t let the sticker price of a postsecondary education discourage you. While it is true that, after accounting for inflation, published tuition and fee prices at public four-year institutions nearly doubled in the last three decades, the good news is that you can find an affordable and high-quality higher education with a little planning, prudence, and independent thinking.

Identify the right program

The first step to reducing the financial burden of postsecondary education is to think about the long-term value of what you study.

Where you go to school has a greater impact on your finances than you might expect. While many leading figures in popular culture focus on four-year residential baccalaureate degreegranting schools, the truth is that your return on investment may hinge more on the academic program you study than the perceived prestige of your institution.

The U.S. Department of Education’s free online College Scorecard tool allows families to see the debt and income outcomes for students broken down by institutional degree level and specific academic program. You should leverage this valuable resource to compare your prospective institutions and programs of study. Doing so will allow you to select the school and program that will reward you for your investment of time and money. You may be surprised to learn that a prestigious institution may not give you the best return on investment.

Save every penny you can

Not everyone has money to spare in their budget. But, for those who have some discretionary

income, one of the greatest tactics to make college more affordable is to set aside a little bit of your paycheck every month. The earlier you can start saving, the better. Every dollar you save today will reduce the stress of paying for school, textbooks, food, and housing while enrolled in college and set you up for financial success after graduation.

There are three approaches you can take to increase your savings: earn more money, cut back on expenses, or a combination of both. Choose the option that makes the most sense for you. For example, you can consider forgoing an expensive coffee once a month, increasing your carpooling or public transportation usage, finding additional roommates, starting a flexible part-time job, or buying more items second-hand. Remember, saving money does not necessarily require seismic changes to your lifestyle.

Find free financial assistance

Most people won’t be able to cover the cost of college using their personal income alone. In those cases, students rely on financial aid from other entities. You should prioritize finding aid that you do not have to repay. By exhausting free financial assistance, you can reduce reliance on student loans and keep college costs manageable.

The best thing you can do to access free aid is to complete the Free Application for Federal Student Aid®, or FAFSA. This newly simplified government form is free to complete and is the gateway to obtaining college funding from the

Publisher Max Lindner Managing Director Gretchen Pancak

U.S. Department of Education, including the Pell Grant. In the 2023-24 school year, the maximum Pell Grant award was $7,395 and the average Pell Grant recipient received $4,514 to go to college.

Filling out the FAFSA is always worth it. With this one application, you can unlock funds from the federal government, state governments, colleges and universities, and other private organizations.

There are also billions of dollars in scholarships awarded to students every year. Scholarships are like grants in that they are gifts you do not need to repay. In 2022-23, scholarship providers doled out over $8 billion to more than 5.3 million students, which resulted in an average $1,517 award per recipient.

Every scholarship or grant you earn will make college that much more affordable.

Bringing it all together

Financing your college education seems daunting at first. You can significantly reduce your anxiety by considering the long-term value of your intended program of study before enrolling in an institution, smartly saving your money now, and seeking out grants and scholarships.

Embrace the roadmap outlined in this article. Complete the FAFSA, apply for scholarships, and choose low-cost student loans. If you follow these steps, you will be well-prepared to make informed decisions and achieve your educational and financial goals.

2 MEDIAPLANET READ MORE AT EDUCATIONANDCAREERNEWS.COM @educationandcareernews Contact information: US.editorial@mediaplanet.com @MediaplanetUSA Please recycle

Production Manager Dustin Brennan Creative Director Kylie Armishaw Cover Photo courtesy of “The College Tour” All photos are credited to Getty Images unless otherwise specified. This section was created by Mediaplanet and did not involve LA Times.

WRITTEN BY Gail daMota President, Education Finance Council

College as an Investment: Which Majors Deliver the Best Bang for the Buck?

A college education is one of the most expensive things any of us will ever buy. For the 2023-24 academic year, the average cost of college tuition was roughly $41,000 for private schools and $23,000 for out-of-state students at public schools, according to U.S. News and World Report.1

Is college worth it?

Spoiler: yes. College is worth it. After studying this question for decades, the upshot remains straightforward and uncontroversial: “The return on investing in college appears to be high,” according to a 2023 study published by the Federal Reserve Bank of St. Louis,2 and a slew of other studies undertaken over the past 10 years. So, perhaps a more interesting question to explore is whether some majors are a better investment than others.

The answer is, again, yes. A 2024 analysis of data collected from 5.8 million high school and college graduates and published by the American Educational Research Journal3 suggests that the return on a college degree varies considerably by major.

Though there are nuances that differentiate the data for men and women and different racial groups, the collective results are clear: Engineering and science majors have the highest rate of return on their educational investment. The next highest rates

of returns are associated with degrees in business, health, math, and science. And education, humanities, and arts majors have the lowest rates of return on average.

There’s more than one way to maximize the impact of a college education. Choosing a college, a major, and a career are personal decisions that should reflect a student’s own criteria and financial situation. But accounting for the different majors’ “earnings trajectories” is an additional dimension for consideration while undertaking one of the largest financial transactions of a lifetime.

Written by Maureen Shelly and Justin Jaffe, SoFi Bank, N.A.

REFERENCES

U.S. News & World Report, 2024.

2 Federal Reserve Bank of St. Louis, 2023.

3 American Educational Research Journal, June 2024.

To learn more, visit SoFi.com/ privatestudent-loans

3 MEDIAPLANET READ MORE AT EDUCATIONANDCAREERNEWS.COM

Sponsored

“The College Tour” Host Alex Boylan Reveals His Top Tips for Aspiring College Students

The Season 2 winner of CBS’s hit show “The Amazing Race,” Alex Boylan knows a thing or two about adventure, especially when it comes to one of life’s most pivotal and transformative journeys: college. In recent years, Alex has played co-creator and host of the award-winning Amazon Prime Video streaming series “The College Tour,” a revolutionary program that brings colleges directly to the viewers, saving them both time and money.

Now in its 11th season, what started as a way to bring equity to college readiness has become a lifeline for students, parents, teachers, and counselors all around the world who rely on the show to help them make informed decisions about higher education, thanks to the show’s intimate format that brings to life real students’ stories from each campus.

After showcasing 170 colleges and counting, Boylan shares with us his inspiration for starting the show, what he’s learned from being on campuses, and how aspiring students should best prepare for their college journeys.

Every episode tells the story of a single college from multiple students’ perspectives. Why do you think it’s

so important to showcase so many different students in each episode?

No two students are alike, and no two pathways to success are alike, and it’s important for us to let students know they have options. College isn’t a onesize-fits-all scenario, and our job is to show you all your options.

We have filmed at large state schools, small private schools, community colleges, HBCUs, Hispanic Serving Institutions, and everything in between. By having a diverse group of students from each school, we allow more viewers to visualize what life can be like at that school.

What has been the most rewarding part of doing the show for you?

By far, it’s been seeing how much it’s helped high school students find the

right school, and most of the time the students tell us that their choice school wouldn’t have even been on their radar if it wasn’t for “The College Tour.”

The show takes away all financial and time constraints. You can be a high school junior in Florida but be able to “travel” via the show to schools in Alaska, Colorado, New York, etc.

Students’ eyes light up when they watch episodes like the one featuring Semester at Sea. We truly open their world, and it’s such a rewarding thing to do!

As a reality TV veteran, what made you want to bring colleges to the screen? It really all started when my niece from Wisconsin came to visit me in Los Angeles to check out schools. We spent several days doing regular tours, pretty much only seeing the outside of

buildings. Nothing really sparked her interest and she wanted to visit schools in Texas. The only problem was that it was out of the budget.

I saw how disappointed she was and realized there must be millions of teens who were equally frustrated, and that’s when I knew we had to do this show. We needed to help students not just live out their dreams but find them first.

You have met with thousands of students from all walks of life. What is the greatest college-related lesson you have learned from them?

Getting to know these students has been incredible. The one thing I would say is a common takeaway — no matter where I am — is that it’s important to find a school not solely based on academics. You need to factor in your lifestyle, your interests, your hobbies.

There are enough schools out there that you don’t have to go somewhere that doesn’t offer what it is that you are looking for. You can curate the experience you want.

What are the most important factors a student should consider when choosing a school?

The four main factors to consider when starting the college search should definitely be location, campus culture, majors, and type of school. If you can answer those questions, you are off to a fantastic start.

What do you think is the biggest hurdle students face when it comes to the college admissions process?

I would say the biggest thing is trying to figure all of this out yourself, because really, there is just so much information.

The best piece of advice I can give you is this: When you’re interested in a school, reach out and make contact with someone in the admissions department, because there’s going to be someone who’s put onto your case and can start answering your specific questions. Don’t be afraid to ask for help.

4 MEDIAPLANET READ MORE AT EDUCATIONANDCAREERNEWS.COM

Alex Boylan Photo courtesy of “The College Tour”

The SAT: A Reason to Say “Yes”

Colleges are almost always looking for a reason to say “yes.” It may not feel that way to nervous students and families, but admissions offi cers open every application hoping to see evidence that a student is prepared for higher education, and all the ways that they’re ready to hit the ground running as a newly admitted college student.

And for most students, the SAT is a reason to say “yes.”

After experimenting with test-optional policies during the COVID-19 pandemic, many schools — including Dartmouth, MIT, Caltech, and Purdue — are reinstating testing requirements for admissions. And those that remain test-optional continue to use scores for critical decisions about admission, student support, and class placement.

“Standardized tests are a means for all students, regardless of their background and life experience, to provide information that is predictive of success in college and beyond,” explained Hopi Hoekstra, Harvard’s dean of the Faculty of Arts and Sciences, in the school’s recent decision to once again require test scores for admission. “More information, especially such strongly predictive information, is valuable for identifying talent from across the socioeconomic range.”

A useful tool

A wealth of recent research found

that amid all the components of a college application — grades, essays, extracurricular activities — test scores are among the most useful in identifying students who are ready to succeed. That’s because admissions officers know that not all students have the same support and resources, so they take care to read test scores in context of a student’s school and life experience.

“Our goals are to attract the best and brightest students, and to make sure every student is successful once they are here,” explained Jay Hartzell, president of the University of Texas at Austin. “Our experience during the test-optional period reinforced that standardized testing is a valuable tool for deciding who is admitted, and making sure those students are placed in majors that are the best fit.”

Standardized tests are a means for all students, regardless of their background and life experience, to provide information that is predictive of success in college and beyond.

more about college. Taking an exam, especially early in high school, can open the door to schools and career options that students may never have considered. “After I took the PSAT in my junior year, universities that had received my score flooded me with letters urging me to apply,” wrote author and Harvard graduate Emi Nietfeld, a firstgeneration student who doubted her own college potential. “I set my sights higher.”

Many educators are advising students who are on the fence about taking the SAT to take it and see how they do. And the SAT is easier to take than ever — now fully digital and nearly an hour shorter. Taking the SAT is a way for all students to aim higher, consider new options, and look hopefully to their path beyond high school.

To learn more, visit satsuite.collegeboard.org

The SAT and PSAT are also crucial steps for helping students learn

Written by Eric Johnson

5 MEDIAPLANET READ MORE AT EDUCATIONANDCAREERNEWS.COM

Sponsored

How Parents Can Get Their College-Bound Students Ready

for Applications

Our panel of experts shared their top tips for aspiring higher ed students (and their parents) who are looking to bolster their college applications.

Montoya Chief of Membership, Governance, and Higher Education, College Board

Montoya Chief of Membership, Governance, and Higher Education, College Board

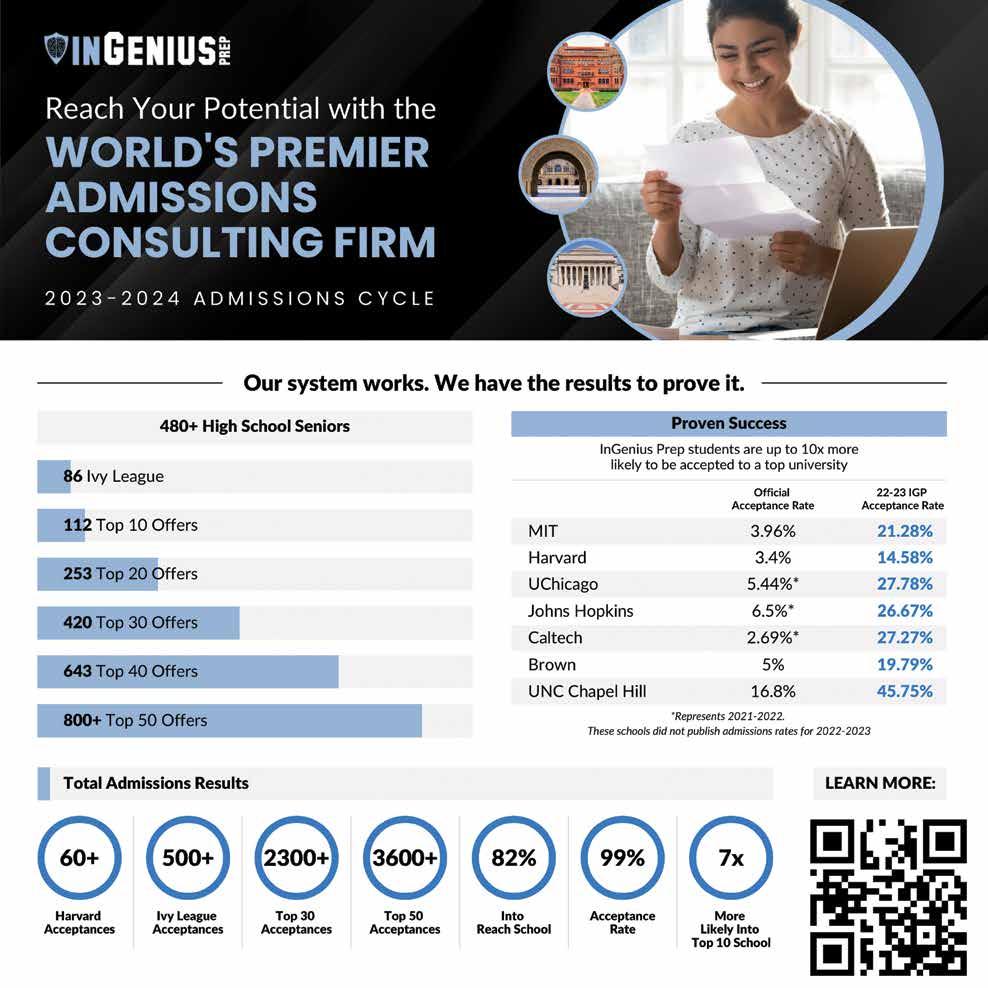

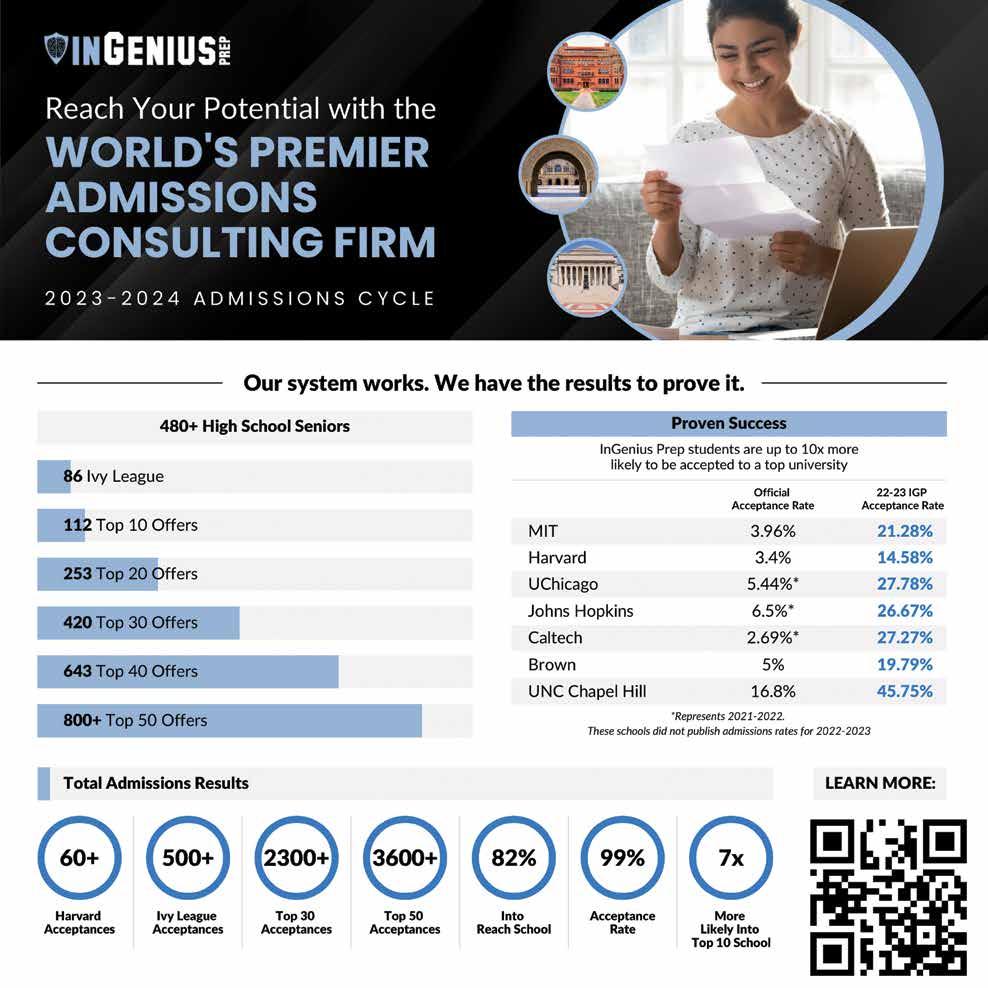

Chief of Staff, InGenius Prep; Former Admissions Officer, University of Chicago

Chief of Staff, InGenius Prep; Former Admissions Officer, University of Chicago

What advice would you give to a parent to help their student become more academically prepared for college?

JAMES MONTOYA: Don’t just focus on getting in; explain how academic readiness (achieved through a rigorous high school academic program) shapes the entire college experience. The more prepared you are for college-level work, the more you’ll be able to take advantage of the incredible opportunities — academic, cultural, and social — that come with college life.

If you’re prepared to manage your coursework well, you’ll have more time for extracurricular activities. You’ll have more capacity to explore study abroad opportunities. You’ll have more freedom to pursue research, internships, and career-mentoring. You’ll have more time to cultivate friendships or play sports.

MATTHEW ROSENBAUM: If I had to choose a single piece of advice, it would be to forget whatever you’ve heard about “wellroundedness.” For some time, it has been clear that colleges desire well-rounded classes, not necessarily well-rounded students. My advice is this: Discover your passions or interests as early as possible, and go further in your passions than other students.

Should students take the SAT if colleges are test-optional?

JM: Taking the SAT keeps doors of opportunity open and is an important way to confirm a student’s grades or even demonstrate their strengths beyond what their high school grades may show. Through programs like SAT School Day and the SAT fee waiver program, all students can take the SAT, see how they do, and decide whether to send their scores.

What is something that is often overlooked in the college admissions process?

MR: A crucial, yet often overlooked, aspect is a college’s unique needs and priorities. As top-ranked schools attract global applicant pools, they strive for a student body that meets their institutional priorities and needs. This could involve geographic diversity, specific academic programs needing a boost, or even niche extracurricular talents that align with the college’s mission. By researching a college’s priorities, students can tailor their applications to highlight relevant strengths and experiences. Applicants should demonstrate genuine interests in the college’s specific offerings and show how they can contribute to the campus community to connect as a perfect “fit” — a factor that can make all the difference in admissions decisions.

How to Support Your Teen in Making Post-Secondary Decisions

Planning for life after high school can be exciting and daunting for teens. Choosing the right career, choosing the right school, applying to school schools, applying for fi nancial aid — the list of decisions and preparation tasks goes on and on, and can put a lot of pressure on our teens. As a parent of three now adult children, I have experienced this fi rsthand.

It’s important to remember not every child will be college-bound, and teens have a number of post-secondary options: going to college, doing a job-training program, going straight to work, going into the armed forces. The best thing we can do as parents is to be supportive throughout the process and equip our teens with knowledge to help them confidently transition to the best next step for them.

Creating a plan

At the beginning of high school, talk with your teen about their aspirations and goals. Then sit down with their teachers, counselor, or other adviser to discuss what it will take for your child to graduate, your child’s goals, their aspirations for after high school, and the best ways to support your child. Create a plan together to help your child reach their goals and review it every year to make sure they are on track.

This plan should include:

• An appropriate course sequence to meet your child’s goals. For example, if your child wants to study biosciences in college, they will likely need additional or advanced math and science courses in high school to be prepared for college-level coursework.

• The most appropriate extracurricular activities for your child to participate in. For example, if your child is interested in journalism or photography, encourage them to sign up for the school newspaper or yearbook. These activities will help your child expand

their learning outside of school and may help foster new hobbies or interests.

• Ways you can help your child prepare for college or career. For example, if your child is interested in a particular field, look to see if internships exist to build their work experience in that subject area.

• Finding ways to pay for college or advanced training. College can be expensive, but there are lots of ways to get financial help, such as scholarships, grants, work study programs, and student loans. You can start by helping your child fill out the Free Application for Federal Student Aid (FAFSA) during their senior year. Visit StudentAid.gov for more information on FAFSA and financial aid.

Change can be hard, and your student’s aspirations may shift frequently over their four years of high school, but it is important to talk openly and often, help them maintain perspective, and praise them for their big and little accomplishments.

And as you work collaboratively with your teens’ teachers, counselors, and other advisers, know that you are providing the critical support they need during this important time in their lives.

6 MEDIAPLANET READ MORE AT EDUCATIONANDCAREERNEWS.COM

James

Matthew Rosenbaum

WRITTEN BY Yvonne Johnson President, National PTA

Sponsored

may help prepare for your child look to work advanced but there such as programs, helping Application for their more aid. their important maintain big and your teens’ know support they lives.

READ MORE AT EDUCATIONANDCAREERNEWS.COM

Montoya Chief of Membership, Governance, and Higher Education, College Board

Montoya Chief of Membership, Governance, and Higher Education, College Board

Chief of Staff, InGenius Prep; Former Admissions Officer, University of Chicago

Chief of Staff, InGenius Prep; Former Admissions Officer, University of Chicago