Retirement Preparedness

When Marlene Enns lost her husband, she thought she had done everything right to protect her future — until the Canada Revenue Agency (CRA) came calling with a $150,000 bill.

In a pivotal ruling, the Federal Court of Appeal has ruled in favour of Marlene, an Alberta widow, allowing her to retain her late husband’s retirement savings without the obligation to pay his outstanding tax debts. This decision clarifies the interpretation of the term “spouse” under the Income Tax Act, overturns a previous Tax Court of Canada ruling, and has significant implications for tax law and family finances.

The case

Marlene’s late husband, Peter Enns, had designated her as the sole beneficiary of his Registered Retirement Savings Plan (RRSP), valued at $102,789. He died in 2013, and the funds were paid to Marlene in accordance with the beneficiary designation. Several years later, the CRA sought to recover Peter’s unpaid tax debts, amounting to nearly $150,000, from Marlene. Under section 160(1) of the Income Tax Act, the CRA attempted to invoke a provision that holds individuals who receive property from a tax debtor at less than fair market value jointly liable for the debtor’s tax obligations.

In 2023, the Tax Court of Canada ruled in favour of the CRA, concluding that Marlene remained a “spouse” for the purposes of section 160, despite her husband’s death.

The appeal

Marlene appealed this decision, arguing that the term “spouse” should not include a

widow, as a marriage legally ends upon the death of one partner. In its decision, the Federal Court of Appeal agreed with her position, overturning the Tax Court’s ruling.

Justice Wyman Webb, writing for the court, stated that, according to legal and dictionary definitions, a “spouse” is defined as a married person, and marriage ceases upon death. Consequently, when the RRSP was transferred to her after his death, Marlene was not considered Peter’s spouse. As a result, the court determined that the CRA could not use section 160 to collect Peter’s tax debt from Marlene.

The court also found that the definition of “common-law partner” contemplates two individuals who are cohabiting in a conjugal relationship and that a person is no longer a “common-law partner” following the death of their partner. The court held that treating “common-law partners” and married couples equally, transferring a deceased individual’s RRSP to their surviving partner as the designated beneficiary, would not be a transfer of property to a “spouse” under section 160.

This decision also highlighted the broader context of Canadian tax law, noting that provisions like section 60 and section 146 of the Income Tax Act allow for tax deferral on RRSPs, which was the intent when Peter designated Marlene as his beneficiary. The court emphasized that requiring Marlene to pay Peter’s tax debt, especially given that she would face further taxation upon withdrawing the funds, would impose unfair financial hardship, contrary to the purpose of the legislation.

How this affects Canadians

This landmark decision clarifies the definition of “spouse” for individuals across

Canada, especially those who have lost a partner and are dealing with the complexities of inheritance. The Tax Court had been divided on this issue, with conflicting rulings on whether a widow could be considered a spouse under the provision. The Federal Court of Appeal’s ruling resolves this uncertainty, affirming that the legal definition of a spouse ends upon the death of one partner and that the surviving partner cannot be held liable for tax debts under section 160 unless the property transfer occurs during the marriage. This allows the surviving partner to retain their inherited retirement savings without facing additional hardship.

The Federal Court of Appeal’s decision in Enns v. Canada, 2025 FCA 14 sets an important legal precedent regarding the interpretation of the term “spouse” under the Income Tax Act. This decision provides certainty for surviving partners in similar situations and reinforces the intent behind tax deferral provisions for retirement savings. As a result, the ruling appears to protect individuals from unjust financial burdens that could arise from the death of a partner — ensuring that tax law aligns more fairly with the realities of family finances — and highlights the vital role of consulting a skilled estate planning lawyer to provide clarity and safeguard the interests of surviving loved ones.

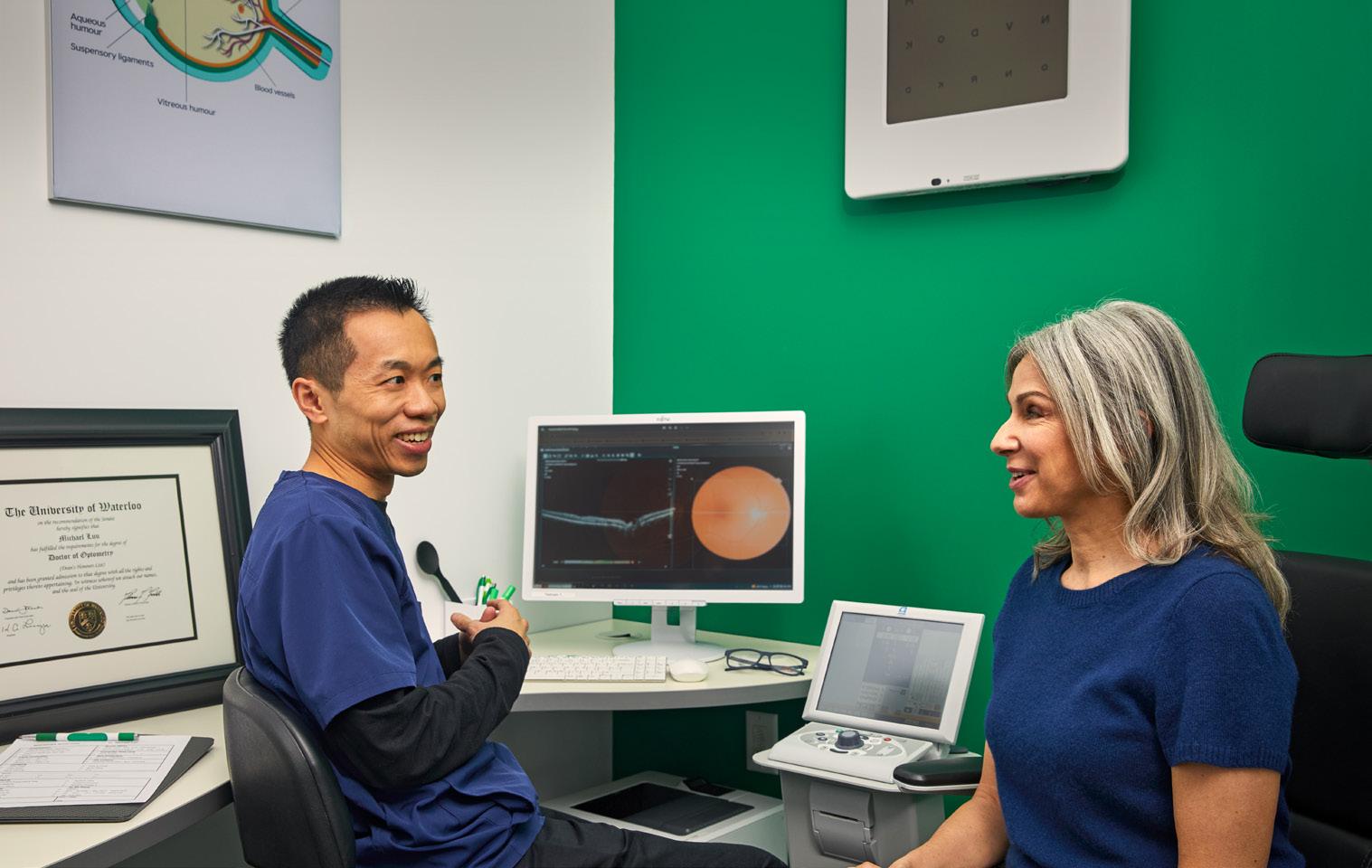

Regular eye exams are important for maintaining good health, but many of us put them off — often until we experience an issue.

Specsavers Canada

While some vision changes are common as we age, it’s important to separate fact from fiction to ensure we’re protecting our eyesight for the long term.

Dr. Hiba Mannan, an optometrist and Head of Professional Services at Specsavers Canada, sheds light on common myths and shares why regular eye exams are essential for aging well.

Myth: If something was wrong with my vision, I would know it.

It’s easy to assume that no change in vision means everything is fine. However, your eye health may change without any difference in your vision.

“Many common eye diseases progress without noticeable symptoms,” says Dr. Mannan. “This is why it’s important to have your eyes tested regularly, even if your vision hasn’t changed. Regular comprehensive eye exams can play an important role in maintaining overall eye health and help to identify significant health conditions, including diabetes and high blood pressure.”

Myth: Vision loss is an inevitable part of aging.

Eyesight can change for a lot of reasons, whether due to the natural aging process, eye disease, or the use of certain medications.

“The good news is that 75 per cent of vision impairment is preventable and treatable, but early detection is key,” says Dr. Mannan. “That’s why I recommend a comprehensive eye exam to ensure potential issues are detected before they become more serious.”

For example, presbyopia, a common condition that gradually affects your ability to see objects close, can often be managed with the right prescription.

It’s important to understand that the major eye conditions that affect vision tend to onset in later life.

Conditions like age-related macular degeneration (AMD) and glaucoma can lead to permanent vision loss if left untreated. These conditions often progress without significant symptoms at first, making regular eye exams even more crucial to detect them in their early stages.

Myth: A 3D eye scan is expensive and unnecessary for routine exams.

During the eye exam, your optometrist may use optical coherence tomography (OCT), a 3D eye scan, to take a closer look at what’s going on beneath the surface of your eye.

"An OCT scan shows the layers beneath the retina and can help in identifying gradual changes over time, facilitating early detection and treatment when needed,” says Dr. Mannan. “It can aid in detecting sight-threatening conditions such as diabetic retinopathy, glaucoma, and AMD at early stages.”

That's why participating independent optometric clinics located within Specsavers stores include an OCT scan as part of every standard eye exam.

Myth: The recommended frequency of eye exams is the same for all adults.

Once you reach age 65, it’s important to make an eye exam a yearly habit. The Canadian Association of Optometrists recommends that adults aged 65 and older have an eye exam every year, and those with diabetes should also aim for an annual exam. For most adults aged 20 to 64, a comprehensive eye exam every two years is recommended, though your optometrist may recommend more frequent visits depending on your health.

Many common eye diseases progress without noticeable symptoms. This is why it’s important to have your eyes tested regularly, even if your vision hasn’t changed.

By making eye exams with OCT a part of your wellness routine, you’re not only caring for your vision but also your overall well-being.