38 minute read

First THS2 reference

The watchwords for MTU’s turbocharger development are agility and efficiency, its director of development, turbocharging and fluid systems, Johannes Kech, told The Motorship

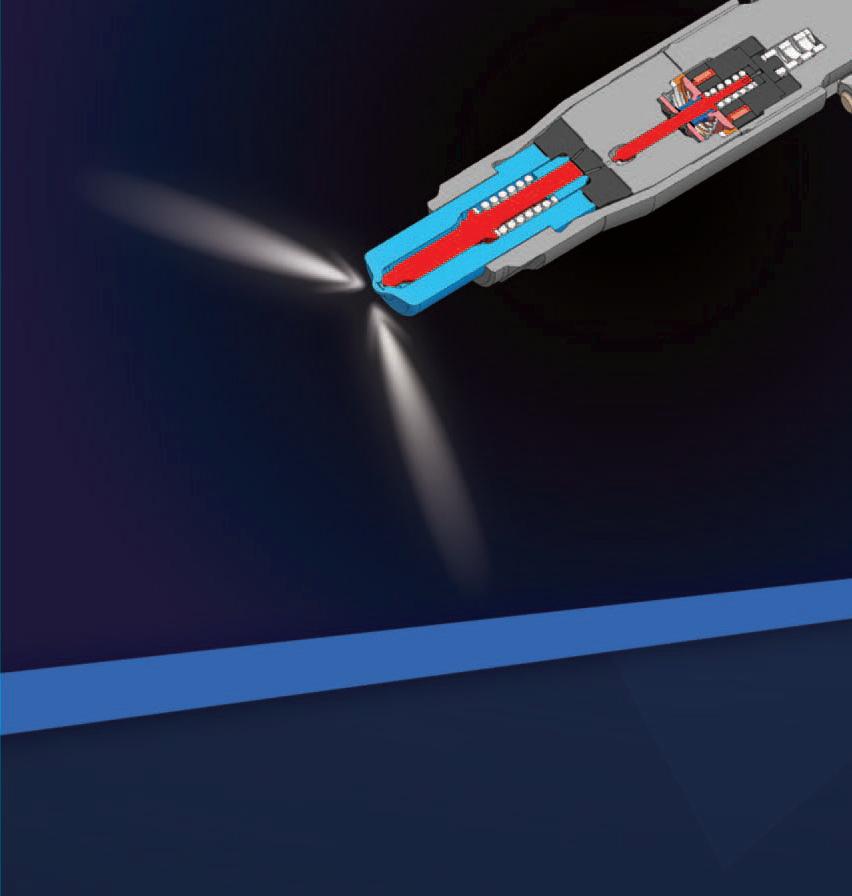

For projects where high agility is needed, MTU can now consider using its new electrically assisted turbocharger, which has successfully passed its field tests, Dr Kech said. This was announced in 2018 as a solution to the frustration of ‘turbo-lag’, which occurs at low speeds because there is not enough exhaust to drive the turbocharger.

MTU’s solution uses an electric motor to support the turbocharger using technology licensed from G+L innotec and it appears that its development is on track or even ahead of that 2018 announcement: at that time, it predicted a market debut for its first engines with electrically-assisted turbocharging in 2021.

Meanwhile, it is focusing development efforts on increasing turbocharger efficiency by developing individual solutions for specific engines. In a way, this is returning to its historical roots, which date back 45 years to when the first MTU engine (series 396) was fitted with an in-house ZR turbocharger, Dr Kech recalled.

At that time, turbocharger systems were matched to an engine’s specific requirements, he said, an approach that gave way some years ago to a modular system that could be used across engine platforms.

But now “trends in engine development demand more and more specific turbocharging systems that need individual solutions,” he said. “They impose various requirements such as efficiency, compressor pressure ratio and map width, power-toweight ratio and acceleration capability.” In response, MTU is supplementing its modular approach by applying “modern design methods to cope with the broad set of requirements imposed by [each] engine application,” he explained.

In particular, MTU uses “fully automated, multidisciplinary optimisation methods for wheels, flow guiding systems and bends,” which shortens design cycles and minimises development efforts, he said. It also delivers high efficiency and high pressure ratios and the approach is now being applied to gas engines for stationary applications “to ensure highest efficiencies and a minimum of CO2 emissions,” he said.

8 An electric motor

ensures that extra fresh air is available whenever the engine needs it

First delivery for new ABB models

Two new ABB turbochargers have completed their testing and the first delivery of one of the new models was scheduled to take place as this issue went to press, Alexandros Karamitsos, ABB’s head of global sales for low-speed turbocharging, told The Motorship in late April. The first A260-L turbocharger following in Q4.

Although he could not disclose what ships they were destined for, he said that “a good number” of orders for the new units had been confirmed, destined for containerships, chemical tankers, small product tankers, LPG carriers, bulk carriers and general cargo ships. “The market has been very responsive,” he said, describing them as “the ideal duo for vessels up to 50,000dwt.” This is a segment where turbocharger cost and size are particularly relevant, and both of these new compact models will “fit through a door,” he said.

Last June’s CIMAC World Congress was given a pre-launch overview of the new additions to ABB’s range, at which time they were still in development, and their official launch took place in December at the Marintec China exhibition. Now, with tests completed at ABB’s research centre at Baden in Switzerland, their “high performance levels have been reconfirmed as expected, demonstrating their leading efficiency,” he said.

According to a presentation prepared for Marintec visitors, the new members of its A200 series are 50% lighter than the previous generation and 2% more efficient, helping operators save fuel. The same presentation predicted that service costs will be 30% less than the previous generation of turbochargers.

It was costs that Mr Karamitsos particularly emphasised. Because they are smaller than their predecessors, the new models have a lower CAPEX and are easier for engine builders to fit. From a shipowner’s point of view, their smaller size will reduce operating costs. There will be further savings because of their impact on fuel consumption.

The A255-L covers engine powers of 3-6MW and the A260-L is intended for engines of 5-7MW, which overlap its existing A160-L. But that model will continue to be available since it has become an established turbocharger in many ship machinery specifications, Mr Karamitsos said.

In developing these turbochargers, ABB has collaborated with the two leading low-speed engine designers, MAN Energy Solutions and WinGD, “as a response to their demands for higher turbocharger performance for their modern small-bore engines,” Mr Karamitsos said.

maritime professionals across Europe Informing over 30,983 Maritime Journal is relied upon by marine professionals across Europe, covering activities of inshore, offshore, coastal zone and short sea commercial maritime businesses.

NEW SERIES AND NEW FACILITIES FOR NEW BRAND

Field trials of a single stage variant of the TCT turbocharger series are ongoing, marketing manager at PBST, Denis Pissarski told The Motorship

Less than a year after its formation, PBST has had a promising start and is already “co-developing an updated radial turbocharger series, which will be available to highspeed engine manufacturers very soon,” its marketing and communications manager Denis Pissarski told The Motorship. No details about that project are available yet, “but this is a huge step for us,” he said.

Another big step planned for later this year will see a new Turbocharger Performance Centre open in PBST’s home town, Augsburg in southern Germany. At €50M, it will be the largest investment ever in the city and “proves that we see a bright future in turbocharging,” he said.

PBST was formed last July to bring together MAN Energy Solutions’ air management systems and the Czech turbocharger manufacturer PBS Turbo, creating a company that covers not only turbochargers but also other exhaust gas technologies, such as electrical turbo blowers and catalytic converters for selective catalytic reduction.

That distinction is reflected in how the products it delivers are labelled. As The Motorship reported last July, OEM customers receive PBST-branded turbochargers while MAN engines, including those manufactured under licence, will continue to be equipped with MAN-branded turbochargers.

A few months before PBST’s formation, MAN Energy Solutions had launched its TCT turbocharger series, which is smaller than its predecessor, the TCA generation, “to meet current market requirements,” the company said in a statement at the time.

Its development passed to PBST and Mr Pissarski said that a number of TCT40 and TCT60 units have been sold as the low-pressure component in two-stage turbocharging installations, both for MAN engines and for other OEM

customers. Combined with its TCX turbocharger as the high-pressure stage, “we can achieve up to 80% efficiency, which is really fantastic,” he said.

As a stand-alone single-stage turbocharger, however, field tests are still being run “due to unforeseen complications,” he said. Together with the impact of the coronavirus slowdown, “we are a bit behind schedule [but] the feedback is very positive so far” and enquiries from shipowners and yards are also encouraging, he added. “All in all, we are very satisfied with the start of PBST brand. We have not only met but exceeded our targets,” he said.

Viral load: COVID-19’s impact on the turbocharger sector

8 PBST has already

supplied some TCT turbochargers in two-stage combinations

Turbocharger makers and engine builders accept their operations have been disrupted by the COVID-19 pandemic, and that the after-effects will be long-lasting.

Of most concern is whether supply chains can continue to bringing essential components and material. For one manufacturer, one of its main supplying countries has been hit hard by the virus, causing a shortage of parts and short-time working in its factory.

Another hopes to mitigate the problem by continuously monitoring its supply chains and looking for alternative suppliers. “That enables us to keep production as stable as we can and to deliver punctually in what is a very challenging situation,” one of its directors said.

One turbocharger maker said that, if its supply chain is disrupted, it will focus on providing spare parts to avoid long shutdowns of engines that need mandatory maintenance, such as emergency generators. With that in mind, it has been increased its own stock since late February to reduce the impact of supplier shutdowns on its production.

Another executive said that his company’s management team had established rules to keep production going without compromising employee safety, as long as the supply chain continued to function. The biggest effect it is experiencing is with on-site consultations with customers, which are impossible because of travel bans, so it is providing customers with smart glasses to enable remote assessments for planning new installations.

Commercially, the impact is likely to build. One manufacturer said that there had been no effect on its Q1 business and its forecast for Q2 predicts no decrease in orders or its spare part business. But further ahead, there will be a decline if the coronavirus shutdown period extends, its director said. That view was shared by another of our interviewees: “I expect difficulties in 2021 or 2022,” he said.

Yet the underlying market seems firm. One company reported good business in the four-stroke sector, thanks to naval and cruise work. The two-stroke market is more challenging, it said and “this year we might lose some market share.”

It seems that timing will be crucial in gauging both the medium- and long-term impact of the current global health crisis.

17 19 TO NOV 2020 Hamburg Germany

BOOK NOW AND SAVE 20% * use code ‘early’

Join us for The Motorship Propulsion & Future Fuels Conference 2020, incorporating centenary celebrations for The Motorship Magazine.

SAVE €411 for a limited time

*Full price €2055

Delegate place includes: • Conference attendance on both days - choice of propulsion or fuels stream • Full documentation in print and electronic format • Lunch and refreshments on both days • Place at the conference dinner • Place on the technical visit

Propulsion stream | Alternative fuels stream | Technical visit

Meet and network with 200 CEOs and technical directors from ship owning, operating and management companies, and senior executives from classifi cation societies, policy makers, shipbuilding, fuel, equipment and technology suppliers.

To book online visit: propulsionconference.com Contact: +44 1329 825 335 Or email: conferences@propulsionconference.com

Sponsored by:

SILVER SPONSOR

TURBOS HAVE BOOSTED SHIPPING FOR 115 YEARS

Alfred Büchi was ahead of his time. He was the son of Johann Büchi, a chief executive at Sulzer, so heavy engineering was in his blood

He graduated in 1903 and worked as an engineer in Belgium and England for five years and became passionate about improving the efficiency of combustion engines, specifically by reducing exhaust heat losses.

It was during that time, in 1905, that he received a German patent for a “highly supercharged compound engine” that featured an “axial compressor, radial piston engine and axial turbine on a common shaft”. Unfortunately, neither the fuel nor the materials to build the engine were available at that time but the patent was enough to establish 1905 as the year that turbocharging was born.

He returned to Switzerland and joined Sulzer where Büchi produced his first prototype turbocharged diesel engine in 1915. It was not a success. The same year he opened talks with Brown, Boveri & Cie (BBC; now ABB) that took until 1923 to conclude.

BBC’s change of heart was prompted by the publication in 1923 of a report on low-pressure supercharging trials carried out by MAN and in 1926, two German passenger liner newbuildings, Preussen and Hansestadt Danzig, became the first turbocharged ships, fitted with BBC-built Büchi turbochargers. Their twin ten-cylinder diesel engines had a nominal output of 1,750hp (1,305kW) which was turbocharged to 2,500hp (1,865kW).

While they were under construction, Büchi received a patent in 1925 for “pulse operation for low-pressure supercharging” and this is generally considered to be his most important contribution to the technology.

Up until 1940, turbochargers were only effective on fourstroke engines but that year BBC carried out tests on a Sulzer two-stroke engine. The results were disappointing, and it was not until after WW2 that turbocharging became practical on two-stroke engines. Further refinements up until the 1950s and 1960s gradually increased boost pressures for all turbocharger types.

Büchi’s 1925 patent expired in 1950, opening up the market to wider competition and now there are a number of specialist turbocharger manufacturers. Collaboration has also become a feature of the industry, with many engine OEMs working closely with specific turbocharger manufacturers.

With power increases of 40% and more on offer, it was inevitable that the high powers demanded from marine engines would make them pioneers for turbocharging, both for the extra efficiency and lower fuel costs available, but also because engines could be smaller for the same power output as a non-turbocharged equivalent.

More recent developments have been prompted by environmental concerns. For achieving NOx reductions to meet IMO’s Tier II and Tier III standards, turbochargers have played a key role, for example by increasing pressure ratios, often by using two-stage turbochargers, which use highpressure and low-pressure turbochargers connected in series. These were initially introduced for two-stroke engines but have now extended across to four-strokes.

Other innovations in recent years include such things as variable turbine geometry and supplementary power-take-offs from turbochargers, such as Mitsui

Engineering & Shipbuilding’s Turbo

Hydraulic System. This month’s turbocharger feature mentions the latest developments in this technology.

Mitsubishi Heavy Industries Marine Machinery and Engine Company (MHI-MME) is also using turbocharger power for other purposes, working with the US company Calnetix. A small motor-generator inside the turbocharger’s silencer produces auxiliary power for the ship’s electrical systems.

As to the future for marine turbocharging, it is worth recalling comments made to The Motorship at the CIMAC Congress in June 2019 by Christoph Rofka, Vice President - Head of Technology at ABB Turbo Systems. The technological limits of single-stage turbocharging have been reached, he said, and predicted that new medium-speed engine platforms will need to be designed for two-stage turbocharging, such as the Wärtsilä 31.

As for the constant drive for higher pressure ratios, “Who knows, perhaps we will be able to achieve a maximum pressure ratio of 7.0,” he said. That goal has not yet been achieved for single-stage turbochargers but, with future fuelling preferences moving towards gas engines - which need high pressure ratios and efficient turbochargers - that will be a valuable parameter to reach.

8 Preussen was one

of the first pair of ships to go to sea with turbocharged engines

8 Two-stage

turbochargers such as this Power2 800-M surpass single-stage units for many applications

Credit: ABB Turbo

25 26 TO NOV 2020 Port of Antwerp Belgium

COASTLINK Antwerp 2020 Conference

Hosted by:

BOOK YOUR PLACE NOW Building connectivity between short sea shipping & intermodal networks

This year’s topics include:

• Market Sector Overview – Industry Challenges and New Opportunities for Short Sea & Feeder Shipping • Building Connectivity & Networks for the Future – Linking

Short Sea & Feeder Shipping to Intermodal Transport Routes • Looking to the Future – Improving Effi ciencies Through

Digitalisation and Innovation

Delegate place includes:

• One and a half day conference attendance • Full documentation in electronic format • Lunch and refreshments throughout • Place at the Conference Dinner • Place on the Technical Visit

Meet and network with international attendees representing shipping lines, ports, logistics companies, terminal operators and freight organisations

For more information on attending, sponsoring or speaking contact the events team: visit: coastlink.co.uk/book contact: +44 1329 825335 or email: info@coastlink.co.uk

Gold Sponsor:

Supporters: Sponsor:

Media partners:

PUSHING THE ENVELOPE: ROPAX DESIGNERS EYE EFFICIENCIES

Maximum ropax ferry capacities may have plateaued at 5,600 lane metres, despite strong incentives to meet efficiency improvements via economies of scale, writes Kari Reinikainen

Owners will also have to think of future regulatory considerations with their newbuilding plans. When Grandi Navi Veloci in Italy introduced its 32,746 gross ton newbuilding Majestic in the western Mediterranean in 1993, the ship was somewhat of a novelty.

It offered good quality passenger accommodation, but its lane metre capacity of 1,725 was much greater than that of Scandinavian cruise ferries of the time, which tended to hover in the region of 1,000 lane metres. By contrast, the ship only carried 1,205 passengers in cabins, which was roughly half of the figure of a similar sized cruise ferry of the time.

The template was quickly adopted by other operators in the Mediterranean and then elsewhere. The type of vessel quickly became known as a ropax ferry.

RAMPING UP CAPACITY

By 2010, Stena Line’s 64,000 gross ton sister ships Stena Britannica and Stena Hollandica could offer 5,566 lane metres of vehicle deck capacity, yet they only had accommodation for 1,380 passengers. Pure freight roros of more than 6,000 lane metre capacity have been built since then, but the capacity of ropaxes has not really increased since the days of the Stena Line Hook of Holland-Harwich duo.

A major reason why capacity growth has halted - at least for now - is that many ports that handle these ships can only receive vessels of up to 230 metres in length, said Anders Orgard, chief commercial officer at OSK Ship Tech in Denmark.

The port facilities are a crucial consideration not only when it comes to receiving the ships, but also the vehicles that are to be loaded and discharged onboard the ship. The vehicles to be loaded must be accommodated in the port and in case of large vessels, they take up a lot of space.

“Turn around in ports is another major constraint. Using two tier loading cuts the time needed to load and discharge dramatically compared to the use of just one tier,” he told The Motorship.

SLOWLY DOES IT

However, the largest pure roro vessels - their lane metre capacity is well over 6,000 - are already struggling to keep schedules due to the use of stern ramps, which pose a bottleneck for these operations. The stern ramps limit the number of tugmasters that move in and out at one time and to tackle that problem, OSK Ship Tech has produced a concept design for a ropax vessel with side doors that will significantly speed up loading and discharging of cargo.

This again means that the vessel can cruise at a lower speed than a conventional vessel of the same type, which saves fuel and cuts CO2 emissions, Orgard noted. “This design competes with the largest roros, so the range of services and locations where it could be used is limited,” he pointed out.

Another factor that is quite likely to affect the design of roro vessels in the future, ropax

ferries included, is what happens in the development of autonomous trucks. “Roros with internal ramps do not go well with autonomous trucks. This can also significantly influence how (roro) cargoes are handled in ports, Orgard said.

One way of paving the way for the arrival of autonomous trucks would be to arrange the vehicles so that they can be loaded on five tracks across the ship, with one ramp leading to the upper and one to the lower deck, both of which would be connected to a linkspan, he concluded.

The obvious advantage of roro vessels over e.g. container ships is the fact that roro cargo gets quickly to its destination: containers discharged from a ship are usually stacked in the terminal area or nearby logistics centre to wait for a pick up, while a trailer is quickly connected to a truck and is on its way to the recipient, said Vesa Marttinen, director of cruise, roro and yachts at Wärtsilä, the Finnish technology group.

“However, the capacity of ports and their immediate hinterlands may not have always developed hand in hand with the growth of roro vessels. Once this bottleneck has

8 The entry

Image copyright Volvo Truck Corporation

into service of autonomous vehicles, akin to Volvo’s Vera vehicle which trialled transporting goods between DFDS’ logistics centre and a port terminal in the Port of Gothenburg, will impact future ropax design

8 Vesa Marttinen,

director of cruise, roro and yachts at Wärtsilä, the Finnish technology group

been removed, we may see larger short sea roro and ropax vessels in the future than what we have today,” he told The Motorship.

ENVIRONMENTAL CONSIDERATIONS AND DESIGN

The development of ship designs of the future, of all types of ships, will be heavily influenced by tightening requirements for cutting green house gas emissions. However, these requirements only look at the ship and not the port operations, which may include considerable inefficiencies that affect the overall transport chain.

A leading theme in the design of ropax vessels is to get the passengers and freight quickly from home to their destination and in these vessels it is the volume that is available onboard that is a crucial bottleneck, not the weight of the cargo like for example in bulkers and tankers.

Already today it is possible to follow the EU-MRV reporting system that shows transported volumes and the CO2- efficiency of each mode of transport. “This has shown that the most efficient ropax vessels are the ones that can accommodate large numbers of passengers and little cargo, apart from their cars, or the other way around,” Marttinen said.

“From this it could follow that passengers and their cars may be carried in the future on different vessels than trailers. In this case the number of vessels would grow meaning more material need for the same transportation work. In effect, the tail would wag the dog. Decisions of authorities will be in charge: it is not good if they start to favour one solution. As things stand, optimisation may mean something that the authorities define,” he continued.

The Energy Efficiency Existing Ship Index (EEXI) that the IMO was due to consider in March is a fairly straightforward question in the case of e.g. bulkers. “However, it is a much more complex question in the case of ropax and cruise tonnage, it may actually influence the designs of the future,”

Marttinen continued. He wondered whether unit cargo and passenger transport should be considered to include port operations in the remit of the IMO.

The efficiency - or the lack of it - of port operations plays a significant part an the overall efficiency and carbon footprint in the operations of these ship types. Efforts to optimise only the seagoing part’s performance may result in a sub-optimal outcome when these matters are considered against a broader perspective.

LIGHTWEIGHT CRAFT CODE

On a practical note, Marttinen suggests that level playing field thinking between transport modes should gain ground. “Sea lanes do not suffer from wear and tear. Roads do. And to build a railway line, you need space from the carbon capturing nature or from peoples living for the tracks. There has been little discussion about what are the emissions from a ship that is not fully loaded. Passengers want fast connections, but it is the freight that continues to grow in importance,” he added.

Against this broad spectrum of challenges, Marttinen suggests that the design of future ropaxes on some routes could be based on the international lightweight craft code rather than SOLAS. Their hulls could be built of high tensile steel that is relatively lightweight, while the superstructure could be built of composite materials. (The Motorship considered the issue of composite materials in an article in the April issue.)

On relatively short and sheltered crossings where this kind of design approach might be used, it would be possible to look at the optimisation of various parameters, such as fuel consumption and emissions plus freight and passenger capacity, speed and hence the frequency of service the vessel could deliver, from a new angle.

Although some investment decisions have slowed during the current coronavirus pandemic, ferry owners in Europe had already launched fleet modernisation programmes and as many companies still have ageing tonnage in their fleets, investment will be needed in the future as well. Finding an optimal design that meets both the commercial and environmental requirements will probably not become easier as times goes by.

8 The capacity of

ropaxes has not really increased since the Stena Hollandica (pictured) was launched in 2010

8 Anders Orgard,

chief commercial officer at OSK Ship Tec

VERSATILE NEW SERIES OF ETHYLENE TANKERS

Advanced, handysized tonnage from China will afford considerable scope as to liquefied gas cargoes, writes David Tinsley

Towards the end of 2019, Singapore-based Petredec Holdings exercised its options on two additional ethylene-capable liquefied gas carriers from Jiangnan Shipyard, augmenting the two-ship contract signed a few months earlier.

The newbuilds encapsulate an optimised and upgraded version of the 21,200m 3 -capacity Empery-class quartet completed by the Chinese yard over the course of 2016 and 2017. The nascent series offers a near-1,000m 3 advance in cargo volume within a similar hull envelope, plus IMO Tier III NOx emissions compliance. The prospective fleet additions occupy delivery slots in 2021 and 2022, and the design perpetuates the considerable versatility in liquefied product transportation displayed by the initial quartet.

Imbuing the capability to transport ethylene necessitates design engineering to ensure and maintain a cargo temperature of minus 104degC.

As well as serving the niche, ethylene segment of the market, the ships will offer a very high degree of cargo carrying flexibility, extending trading opportunities and potentially minimising time in ballast. The payload scope embraces ethane (at minus 80degC), anhydrous ammonia, propylene, propane, vinyl chloride monomer (VCM), butadiene, butane and isobutane. Ethylene, propane and isobutane can be received aboard from either refrigerated or pressurised storage.

Given the potential product range, and as with the Empery generation, the vessels may be described therefore as LEG/ LPG/ammonia/VCM carriers.

Having engaged TGE Marine Gas Engineering as the contractor for the cargo handling systems and tanks in the previous series of ethylene carriers from Jiangnan, and also for two 22,000m 3 semi-refrigerated LPG/ammonia carriers built by the same yard in 2018, Petredec has retained the German company for the latest project.

Rather than the four-tank layout employed before, each of

Photo: MarineTraffic/Ye Chia-Wei

the 22,000m 3 newbuilds will be configured with three cargo tanks of bilobe type, fabricated from 5% nickel-steel, and constructed to withstand a 5.3 bar maximum pressure. The gas plant will allow two segregations, with two liquid lines and two vapour lines feeding from and to the cargo manifold.

Cargo handling will be effected by six deepwell pumps, two per tank, located within the tank dome, and individually rated at 350m 3 /h. Loading and unloading is therefore anticipated at up to 2,100m 3 /h from refrigerated or pressurised storage, using vapour return. An LPG heater/vaporiser will be supplemented by a dedicated ethylene vaporiser.

The specified cargo boil-off and fuel gas system is of the cascade/direct cycle type, using three refrigerant (propylene) compressors and three cargo compressors.

Petredec’s preceding programme of four ethylene carriers at Jiangnan had received German financing from KfW IPEXBank working with credit insurance provider Euler Hermes. With EUR50 million-worth of gas and tank systems

PETREDEC ethylene carriers

Jiangnan yard no.

H2567 H2568

H2569 H2570

H2669 H2670

H2671 H2672

Name

Empery Ellington

Emilius Earth Summit

Eclipse Electra

Exhibitionist Enable

Capacity

21,200m 3

21,200m 3

21,200m 3

21,200m 3

22,000m 3

22,000m 3

22,000m 3

Delivery

2016 2016

2017 2017

2021 2021

2022 2022

8 Petredec’s new

series of ethylene carriers will be an optimised version of the Empery type

contracted to TGE Marine of Bonn, the funding reflected the German export component to the deal.

The propulsion system in each of the existing ships entails a 500mm-bore two-stroke engine providing direct drive to a fixed-pitch propeller. The MAN six-cylinder S50ME-C8.2 diesel has a specified rating of 7,170kW at 114rpm and operates on either very low sulphur fuel oil (VLSFO) or low sulphur marine gas oil (LSMGO). Consumption of VLSFO at maximum service speed is in the order of 25t per day.

The auxiliary outfit is substantial, as befits such an extensively-equipped vessel, and comprises four aggregates powered by Daihatsu DK-20e series engines manufactured under licence from the Japanese designer in China. Two sixcylinder models and two eight-cylinder versions are installed, yielding individual outputs of 950kW and 1,250kW respectively, giving a total availability of 4,400kW.

Two of the four gensets have to be run to provide the requisite power in port for taking on or discharging a full cargo, and two are needed at sea to maintain cargo tank pressure. When carrying ethylene, a third set has to be brought on-line so as to ensure refrigerated temperature control of the cargo. When no cargo machinery is being activated, as on a ballast leg, a single aggregate is sufficient to cover the ship’s sea-going electrical load.

Technical husbandry of the ethylene tanker flotilla is the province of Anglo Eastern Ship Management’s Singaporean company, which is also responsible for the crewing arrangements, whereby each vessel has a complement of 21.

Ethylene is a primary building block of the petrochemicals industry and is used in the production of polyethylene, ethylene dichloride, ethanol, styrene, glycols and many other products.

PRINCIPAL PARTICULARS - Empery-class ethylene carrier

Built 2016-2017 Length overall 159.99m Length bp 152.81m Breadth, extreme 24.80m Depth, extreme 16.70m Draught, scantling 9.40m Corresponding deadweight 16,925t Gross tonnage 17,235t Cargo capacity @100% 21,220m 3 Cargo capacity @98% 20,795m 3 Main engine power 7,170kW Speed, loaded 16kts Auxiliaries 2 x 950kW + 2 x 1,250kW Class Bureau Veritas Crew 21 Flag Singapore

In print since 2003, Port Strategy magazine provides key insights into the issues and developments affecting the port operations and port maintenance industries.

port and terminal professionals around the world Informing over 21,317

TO SIGN UP FOR YOUR THREE MONTH FREE TRIAL

portstrategy.com

Experts in marine engineering equipment

•Bilge water monitors & filtration •Seals and bearings •Dry dock services •Underwater repairs •Additives to prevent leakage •Marine engineering consultancy •Project management •Service contracts NAUTIC PRO

THE COMFORTABLE

CONTROL & MONITORING

atzmartec.com

NAUTIC PRO

THE COMFORTABLE 9 High quality upholstery with individual logo stitch (optional) 9 Adjustable armrests 9 Variable seat depth 9 Infinitive height adjustment o f the seat top 9 Seat angle adjustment 9 Length adjustment of the seat top

Tel: +49-2938-98769-0 info@chair-systems.com http://www.pilotchairs.com

Maintaining the highest possible standards for our customers. Service, upgrades and retrofits. ● Governors / Actuators ● Support for all Viking based products and our new simple to install Viking35- 2G upgrade pack (below) ● Spare parts & Service ● OEM quality overhauls and service exchange units ● Propulsion Controls ● Generator Controls ● Power Management ● Turbocharger Condition

Monitoring systems Maintaining the highest possible standards for our customers. Service, upgrades and retrofits. ● Governors / Actuators ● Support for all Viking based products and our new simple to install Viking35- 2G upgrade pack (below) ● Spare parts & Service ● OEM quality overhauls and service exchange units ● Propulsion Controls ● Generator Controls ● Power Management ● Turbocharger Condition

Monitoring systems

ENERGY STORAGE

FUELS & OILS

Regulateurs Europa Limited Port Lane, Colchester. CO1 2NX UK Phone +44 (0)1206 799556 Fax +44 (0)1206 792685Email sales@regulateurseuropa.comWeb www.regulateurseuropa.com Regulateurs Europa Limited Port Lane, Colchester. CO1 2NX UK Phone +44 (0)1206 799556 Fax +44 (0)1206 792685Email sales@regulateurseuropa.comWeb www.regulateurseuropa.com

Powering a clean future

We are the leading supplier of Energy Storage Systems to the maritime industry.

www.corvusenergy.no

MAINTENANCE

0 10 10 20 20 30 30 40 40 50 50 60 60 70 70

Powering a clean future

We are the leading supplier of Energy Storage Systems to the maritime industry.

Stop putting your engine at risk. Start protecting your most valuable asset.

www.totallubmarine.com www.corvusenergy.no

PROPULSION

AEGIR-MARINE, BUILT ON SERVICE

Call us at +31 343 432 509 or send us an email: info@aegirmarine.com

Tel: +49-2938-98769-0 info@chair-systems.com http://www.pilotchairs.com 9 High quality upholstery with individual logo stitch (optional) 9 Adjustable armrests 9 Variable seat depth 9 Infinitive height adjustment o f the seat top 9 Seat angle adjustment 9 Length adjustment of the seat top

To advertise here and online at www.motorship.com/ directory Call the Motorship

Team on +44 1329 825335 sales@motorship.com DAMPERS

RIVERTRACE produces a range of products that meet and exceed the I.M.O. resolutions MEPC 107(49) and MEPC 108 (49) relating to water discharges from ships.

Telephone: +44 (0) 1737 775500 Sales enquiries: sales@rivertrace.com

www.rivertrace.com/en-gb/marine Torsional Vibration

Dampers

Maintenance and Repair of Crankshaft Torsional Viscous Vibration Dampers Tel: +44 (0)1422 395106 Fax: +44 (0)1422 354432 davidwhitaker@metaldyne.com www.metaldyne.co.uk Formerly Simpson Ind - Holset Dampers Is your damper providing engine protection?

LUBRICANTS

Stop putting your engine at risk. Start protecting your most valuable asset.

www.totallubmarine.com

0 10 20 30

40 50 60 70 10

20 30 40 50

60 70

EMISSION CONTROL

Torsional Vibration Dampers

Maintenance and Repair of Crankshaft Torsional Viscous Vibration Dampers Tel: +44 (0)1422 395106 Fax: +44 (0)1422 354432 davidwhitaker@metaldyne.com www.metaldyne.co.uk Formerly Simpson Ind - Holset Dampers Is your damper providing engine protection?

Spares and services for hatch covers. – Rubber packing – Bearing pads – Cleats – Chain – Hydraulics

Explore our range of innovative, high performance and Environmentally Acceptable Lubricants, delivered with an unparalleled level of personal service. For more information please contact us at

Vickers Oils

6 Clarence Rd, Leeds, LS10 1ND, UK Tel: +44 (0)113 386 7654 Fax: +44 (0)113 386 7676 Email: inbox@vickers-oil.com Web: www.vickers-oil.com TRUSTED FOR GENERATIONS

PUMPS

High quality underwater repairs

SPARE PARTS

Hydrex offers underwater repair solutions to shipowners around the globe. Our experienced teams are qualified to perform all class-approved repair procedures in even the harshest conditions.

Hydrex headquarters Phone: +32 3 213 53 00 (24/7) E-mail:hydrex@hydrex.be

www.hydrex.be

O u r r e l i a b i l i t y . Y o u r m o v e .

TESTING & ANALYSIS VALVES

LABORATORY ANALYSIS FOR THE MARINE INDUSTRY

Start Systems for Two and Four-Stroke Engines Please visit: www.seitz.ch

Tel: +44 (0) 1256 704000

Email: enquiries@spectro-oil.com

Web: spectro-oil.com

TURBOCHARGERS

WASTE WATER

Hermann-Blohm-Str. 1 · D-20457 Hamburg Phone +49 40 317710-0 · Fax +49 40 311598

E-mail info@nds-marine.com www.nds-marine.com

Big enough to handle it Small enough to care

Your Ship Repair Yard in Lisbon Estaleiro da Rocha Conde de Óbidos 1399 – 036 Lisboa – PORTUGAL Tel. Yard (+ 351) 213 915 900 www.navalrocha.com navalrocha@navalrocha.pt

TEMP CONTROL

ENGINEERING CO. LTD. TEMPERATURE CONTROL VALVES

Comprehensive range of 3-way Valves suitable for Fresh Water, Lubricating Oil and Sea Water Systems

DIRECT • PNEUMATIC • ELECTRIC • GAS PRESSURE OPERA TED

Wide choice of materials. Robust construction, low maintenance, simple to use and cost effective method of temperature control Tel: +44 (0) 1727 855616 Fax: +44 (0) 1727 841145 E-mail: Sales@waltonengineering.co.uk Website: www.waltonengineering.co.uk

Installing Turbocharger Confidence

2950 SW 2nd Avenue Ft. Lauderdale, FL 33315 Toll free: 877-887-2687 Telephone: 954-767-8631 Fax: 954-767-8632 Email: info@turbo-usa.com www.turbo-usa.com

Jets AS Vacuum Toilet Systems and STP’s, Jowa Water Handling Systems, Libraplast A60 Doors, Metizoft Green Passport Solutions, Modular Wet Units, Vacuum Pipe De-Scale Solutions and all kinds of bathroom and plumbing accessories you may require for any vessel

For more information contact us Phone: +44 141 880 6939 Email: mrhmarineoff@btconnect.com Or visit: www.mrhmarine.com

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions evasion ‘‘

SUBSCRIBE NOW to receive a trial copy of GreenPort Magazine

• Comprehensive online directory • Instant access to industry news • eNewsletter • Magazine subscription • Expert opinion

www.greenport.com

SHIPBUILDING ENTERS UNCERTAIN TIMES

MOTORSHIP

INSIGHT FOR MARINE TECHNOLOGY PROFESSIONALS

THE

The international magazine for senior marine engineers

As this page is being prepared, at the peak of uncertainty of immediate prospects for shipping, shipbuilding and all other industries thanks to Covid-19, it was a bit of a shock to see equally dismal predictions in the May 1970 issue of The Motorship.

The editorial comment page bemoaned the difficulties facing British shipbuilding, despite there being a demand for the industry’s products. The problem then was high labour costs, resulting from taxation as much as wages. The Japanese example was quoted, where even high levels of mechanisation and automation had not made a significant dent in the number of man hours to build a ship. The only answer was, reluctantly, the introduction of ‘escalation clauses’ as had begun at German yards, by the industry internationally to protect itself from heavy losses due to rapidly rising costs.

Another growing concern was the number of companies producing unauthorised, or ‘pirate’ spare parts for machinery, particularly in Japan, where it seemed others had got hold of drawings issued to official licensees and were making inferior quality replica parts with adverse effects on reliability. This, it was said, would impact on the engine designers’ and licensees’ otherwise good reputations if not snipped in the bud.

The main ship description centred on the Helene, first of a pair of Sunderland, UK-built bulk carrier newbuilds, powered by Sulzer 6RND76 engines, the first from British licensee Clark. The 26,176 dwt vessels were ordered by Greek owners, for transport of various mineral raw materials from Jamaica to the US. They provided a break for the Austin & PIckersgill yard from building SD14 Liberty Ship replacements. Construction was largely conventional, though the LR class did allow holds 2,4 and 6 of the seven compartments to be empty when the others were carrying ore. The main engine, of 12,000 bhp output, was fitted with a Napier turbocharger and drove a four-blade SMM propeller. Although the engine room

EDITORIAL & CONTENT

Editor: Nick Edstrom editor@mercatormedia.com

8 Bulker Helene, powered by the first Clark-Sulzer

6RND76 engine

was to be operated by seven engineer officers, an electrician, and 10 ratings, with no separate machinery control room, it was fitted out for potentially unmanned operation, with a number of remote control and monitoring features as well as safety innovations such as an enclosed fuel system. The writer noted that in order to provide maximum cargo space, and despite the large complement of personnel, the engine room was “somewhat compact and the machinery layout less than ideal.”

A somewhat different type of ship had just entered service on a new fast cargo route between Japan and Australia. Built by Kawasaki Heavy Industries for Australian National Line, the Australian Enterprise too had been designed to maximise cargo space, but in this case the cargo was a combination of ISOstandard containers and ro-ro traffic. With 233 TEU above deck, including 92 reefer units, the main hold could carry either cars, on removable ‘pontoons’, or up to 365TEU of containers, stacked two high, and loaded on trailers via the stern doors. Machinery and accommodation was all located aft, which necessitated a very compact engine room. Thus the propulsion plant was three Kawasaki-MAN V8V40/54 medium speed engines, each of 8,690 bhp MCR, said to be the highest-power medium speed installation to date. The engines were designed to operate at constant 400 rpm speed, driving a CP propeller through a system of Renk clutches and gearboxes, allowing any combination of one, two or three engines to be employed for either propulsion or auxiliary generation use, each alternator being driven directly from the gearboxes. The whole machinery installation was designed to be operated remotely from a separate control room, with propeller pitch controlled from the wheelhouse.

News Reporter: Rebecca Jeffrey rjeffrey@mercatormedia.com

Correspondents

Please contact our correspondents at editor@motorship.com Bill Thomson, David Tinsley, Tom Todd, Stevie Knight

Production

Ian Swain, David Blake, Gary Betteridge production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Brand manager: Toni-Rhiannon Sibley tsibley @mercatormedia.com

Marketing marketing@mercatormedia.com

EXECUTIVE

Chief Executive: Andrew Webster awebster@mercatormedia.com

TMS magazine is published monthly by Mercator Media Limited Spinnaker House, Waterside Gardens, Fareham, Hampshire PO16 8SD, UK

t +44 1329 825335 f +44 1329 550192

info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@motorship.com or subscribe online at www.motorship.com Also, sign up to the weekly TMS E-Newsletter 1 year’s magazine subscription £GBP178.50 UK & EURO Post area £GBP178.50 Rest of the World

© Mercator Media Limited 2020. ISSN 0027-2000 (print) ISSN 2633-4488 (online). Established 1920. The Motorship is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: Spinnaker House, Waterside Gardens, Fareham, Hampshire PO16 8SD, UK. Printed in the UK by Holbrooks Printers Ltd, Portsmouth, PO3 5HX. Distributed by Mail Options Ltd, Unit 41, Waterside Trading Centre, Trumpers Way, London W7 2QD, UK.

The Motorship magazine is a vital resource for ship owners, ship builders and all who are connected with shipping and the sea.

marine professionals Informing over 23,796