7 minute read

Mix & Match Strategy

MIX AND MATCH STRATEGY

AJ Keyes charts the development approaches taken in Algeciras and Tanger-Med, the rationale behind them, and the potential for liner operators to mix and match between the two facilities

Algeciras has long been one of the principal hubs serving the West Mediterranean region off ering the ability to transship between East-West and North-South shipping routes, but its peripheral location in Spain means that despite numerous initiatives it is not well-suited to handle import-export gateway cargo, which is instead mainly moved via the likes of Valencia and Barcelona.

There are substantial container-handling facilities at Algeciras, as Table 1 highlights. The APM Terminals operation covers 67ha, offers 2000m of quay and 19 ship-to-shore gantry cranes, of which eight are Super Post-Panamax for Ultra Large Container Vessels (ULCVs). With 59 RTGs also available, the operator claims an annual capacity of 4.3 million TEU and also acknowledges it consistently operates on the basis of 93 per cent of throughput is transshipment and just seven per cent represents import-export gateway cargo.

By comparison, the other container operation has had a chequered past. Originally conceived and developed by former South Korean global container liner operator, Hanjin Shipping, the 30ha facility offers two quays on the Isla Verde Exterior Quay, of 650m to the East and 550m to the North, with draughts of 18.5m and 17.5m, respectively.

With eight gantry cranes, this facility was developed with automation in mind, now offering 32 ASC (Automatic Stacking Cranes) and 22 Shuttle Carriers in the yard.

The previous demise of Hanjin Shipping meant a change of ownership and since March 2021 it has been owned by a grouping consisting of South Korean liner operator, Hyundai Merchant Marine (with a 50 per cent +1 share stake) and Isla Verde Algeciras Terminal Holding, SL (with a 50 per cent -1 share stake). The interesting point to note here is that the latter company is 51 per cent owned by CMA Terminals Espagne (so, effectively, CMA CGM Group) and the remaining 49 per cent by financial investor, DIF Capital Partners Group.

With additional land not an option, investment in equipment continues across both terminals. Earlier in 2022, APM Terminals introduced 12 new RTGs from Konecranes and TTI Algeciras implemented a crane modification project that will see five of its eight Super Post Panamax units raised from 43m to 52m, to facilitate handling of up to twelve boxes high on deck, plus a 3m boom extension to enable reaching beyond row 24 onboard vessels. The initiative is slated for completion by the end of 2022.

Both terminals are integral to their shipping line owners’ network strategies, with the priority being to increase coverage with minimum visibility to cargo owners.

REAPING BENEFITS OF LINER PARTNERSHIPS

The newer Tanger Med container complex is located 35 nautical miles east of the city of Tangiers and, very importantly, offers almost no deviation for container ships from the main line East-West trading route linking North Europe with Asia. The initial rationale for development was the same as that for Algeciras but with a potentially lower (labour) cost base.

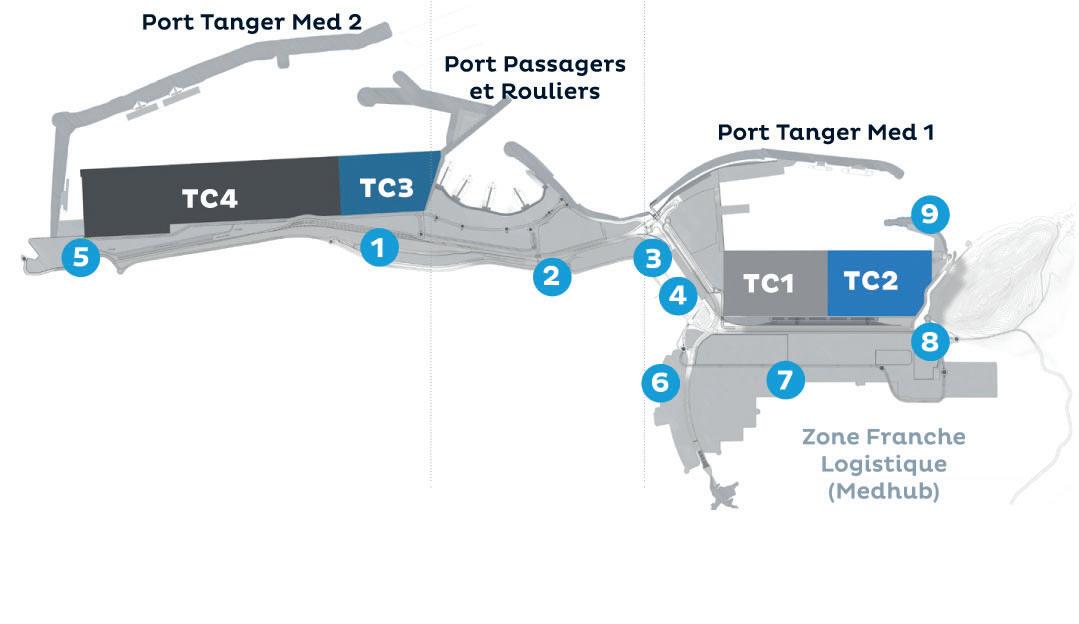

It now offers four terminals, as Figure 2 shows, with a combined handling capacity of nine million TEU per annum, which means that overall port utilisation is at 80 per cent. Based on 2021 seeing year-on-year growth over 2020 of 24 per cent, according to the port, then this figure can be expected to increase.

Indeed, the Port Authority states that its recent strong growth was due to the “optimisation of Tanger Med 2 Port, after the commissioning of Container Terminal 4 (TC4) in 2019 and Container Terminal 3 (TC3) in 2021” and taking its overall capacity to the stated nine million TEU per annum.

There is no doubt that the development of Tanger Med has been substantial over the past decade, and this is due in no small part to the partners in the various facilities and specifically the shipping line entities involved. There are now two terminals operated by Maersk affiliate APM Terminals, which accommodate Maersk Line (and 2M Alliance) vessels – TC1 and TC4. CMA CGM and MSC are shareholders in TC2, and Hapag Lloyd is a partner in TC3. These are all liner interests that help guarantee container volumes to this growing port facility.

APM Terminals is continuing to invest in Tanger-Med, with a further order for shuttle carriers from Kalmar. The latest 23 units, which are manually driven, semi-automated hybrid shuttle units, follow a previous batch of 42 units delivered in 2019, in support of the TC4 expansion project

MIX AND MATCH STRATEGY

In Summer 2022, Maersk Line dropped Algeciras due to ‘challenges’ on its SAECS service, with Tanger Med called instead. “Given the challenges being faced in Algeciras, and to continue providing the best service to our customers, we will be making some deployment changes to our SAECS service,” the line explained in a statement at the time. It

8 Maersk Line and

CMA CGM like to mix and match port use in the West Mediterranean, between Algeciras and Tanger Med, but the future regional strategy of MSC is not yet clear

Terminal Location in Port Size (ha) Quay Length (m) Water Depth (m) No of Cranes

APM Terminals Juan Carlos 1 Quay 67 2,000 17.0 19 TTI Algeciras Isla Verde Exterior Quay 30 1,200 17.5-18.5 8

Source: APM Terminals, Port Authority of Algeciras

added that the deployment changes will create a more competitive transit time with better connections into Northern Europe and the Mediterranean region, although the southbound call at Algeciras remains.

This demonstrates a clear confirmation of how AP Moller Maersk can utilise both of its assets in this unique location.

The key conclusion is that both terminals at Algeciras remain firmly within the control of major shipping lines and, as a result, are available to support the different strategies of the ocean carriers and their networks.

The same can also be said of Tanger Med and with the recent SAECS decision of Maersk Line, it is reasonable to assume that switching of services between ports will become more frequent. After all, if the service being switched involves transshipment activity – and especially relay transshipment which moves between two larger vessels at the convenience of the shipping line – it can be undertaken at different ports in the same location.

With Algeciras and Tanger Med extremely close geographically and both representing minimal, if any, deviation from the major shipping lanes, a “mix and match” strategy is likely to be maintained. Yet because the terminal concessions are controlled by offshoots of the ocean carriers themselves, then the ports involved will no doubt continue to evolve solely to support their liner shipping sister companies. This strategy of line-owned hub terminals at the few globally important nexus locations will clearly become even more dominant in coming years.

Terminal Operator Operations Start Quay Length Capacity/Annum

TC1 APM Terminals July 2007 800m 1.5 million TC2 Eurogate/CMA CGM/MSC August 2008 800m 1.5 million TC3 Tanger Alliance (Contship Italia/Hapag Lloyd/M.Maroc) January 2021 800m 1.5 million TC4 APM Terminals June 2019 2000m 5.0 million

8 Table 1: Container

Terminal Facilities at Algeciras

8 Figure 2: Overview of Tanger-Med and Container Terminals, Q4 20

Note: Numbers represent various port-related support services Source: Tanger Med Port Authority

Room for one more?

Algeciras is highly established, and TangerMed has successfully grown its throughout volumes to top seven million TEU per annum in the 10 years it has been operating, but is there room for any other ports, potentially off ering a similar strategic role in the West Mediterranean region?

One such candidate is Sines, although can it learn lessons from previous failed attempts? Malaga tried to develop a transshipment role as an Algeciras overflow, but it never worked, because it did not offer the scale of capacity, had higher (Spanish) labour costs and had no shipping line backing. Located 58 nautical miles from Lisbon in southern Portugal, Sines Container Terminal, called Terminal XXI, has been operated since 2004 by PSA Sines – Terminais de Contentores S.A. which is part of PSA International.

With water depth of 17m, a quay of 1040m, 10 Post-Panamax and Super Post-Panamax cranes, with a supporting 42ha yard, the 2.3 million TEU capacity offers the required attributes to be a transshipment hub, with a €547 million expansion ongoing. The quay length is increasing to 1950m, (plus 200m), to allow simultaneous berthing of four ULCV and one feeder ship. An additional nine Super Post Panamax cranes are planned, with the storage yard increasing to 60ha, thereby offering an annual capacity of 4.1 million TEU.

Total container traffic in 2021 was 1.82 million TEU, with the H1 2022 figure of 843,525TEU representing a drop of 6.8 per cent over H1 2021. With the additional capacity, there will be pressure on PSA Sines to attract increased traffic and targeting more transshipment, especially relay activity, could be on its agenda.

However, with Maersk Line and CMA CGM highly entrenched in the Straits of Gibraltar, then the 50 per cent shareholding retained by Terminal Investment Ltd (TiL – the terminal investment arm of MSC) will be crucial in fulfilling this additional space moving forward. However, could this then see transshipment traffic pulled away from MSC’s established hub port of Valencia, despite the liner operator targeting development of a new 5 million TEU per annum capacity facility as part of an investment of close to €1.4 billion at this port? An interesting regional strategy to be noted.