9 minute read

Callao Gears Up

Rob Ward reviews DP World and APM Terminals’ expansion plans in Peru’s main port of Callao. DPW’s project is underway, APMT’s is still waiting for government approval while new competition from Chancay looms

With the looming threat of fi erce competition from the Cosco-backed Chancay port project (see Port Strategy October edition), AP Moller Terminals Callao (APMTC) and DP World Callao (DPWC), the two occupants of Peru’s gateway port of Callao, are keen to push ahead with their own investment plans.

DPWC is leading the way for the Callao expansion plan, by investing more than US$350million on what is being called the Bicentennial Dock Project, as it marks 200 years since Peru was declared an independent state.

The Dubai headquartered port operator broke through the 1.5m TEU barrier last year as it handled 1,502, 375TEU in 2021, and this year it looks set to go even higher, having set a monthly record, in July, of 137,154 TEU. By increasing its market share from 60 to 66 per cent (based on figures so far from Eclac), DPWC will be slightly up and APMTC slightly down on last year.

Overall throughput at Callao for 2021 was 2.48m TEU, up from 2.28m TEU in 2020 (a Covid year), which was down from the 3.4m TEU of 2019 (pre Covid). For the first four months of this year the port registered 457,300 TEU of full exports and imports; down from 484,600TEU in 2021, which was exceptional as it was making up for a poor 2020, when just 385,500TEU were handled in Callao (statistics from UN body Eclac). Overall throughput is now slightly ahead of 2019. In 2021, DPWC moved up to eighth position in overall TEU in the entire Latin America and Caribbean region, overtaking San Juan, in Puerto Rico.

However, the downside to such throughput success is that port operations are heaving at the seams, as DP World Callao is already over its theoretical capacity, according to sources in the port.

“Long delays and congestion are an everyday occurrence at DP World’s South Terminal and it even has high prices to go with all that which rubs salt into the wound,” said one Lima-based shipping agent, who does business with DPW Callao and did not wish to be identified.

EXPANSION PLANS

To counter this congestion, DPW Callao is expanding its pier by 33 per cent to nearly one kilometre in length, will add 40 hectares of yard and will also bring in two new gantry cranes, thereby increasing the capacity from around 1.5m TEU per annum up to just over 2m TEU. The company is forecasting that the first phase of the Bicentennial Project will be completed at the end of next year and the rest during first quarter 2024.

“While many international companies have hesitated to continue investing in Peru, we made the decision a year ago to launch this megaproject of the Bicentennial Dock” Nicholas Gauthier, CEO of DPW Callao, told local journalists recently.

And APMoeller Terminals Callao (APMTC), which operates a general cargo and box facility out of the North Terminal in the Peruvian port (TNM), would also like to get in on the Investment Act as it tries to increase its capacity – currently hovering around 1m TEU per annum for containers – and its productivity to pre-empt any future exodus to Chancay.

However, APMTC has been stymied by the “frequent changes of government” in Peru in recent years which have seen various peaks and troughs of optimism in talks with various governments – including the current one headed up by under-pressure President Pedro Castillo, since July 2021 – over a five-year period but still no contract signings. A former teacher and Marxist, Castillo has made his mark in the Peruvian economic history books by presiding over a record four different governments in six months and has faced two (failed) impeachment procedures.

Back in May, 2011 APMTC signed a 30-year concession contract with the Peruvian state to operate TNM, promising

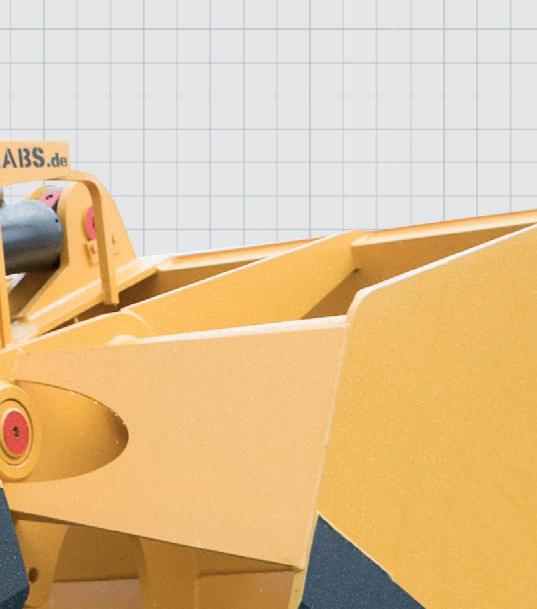

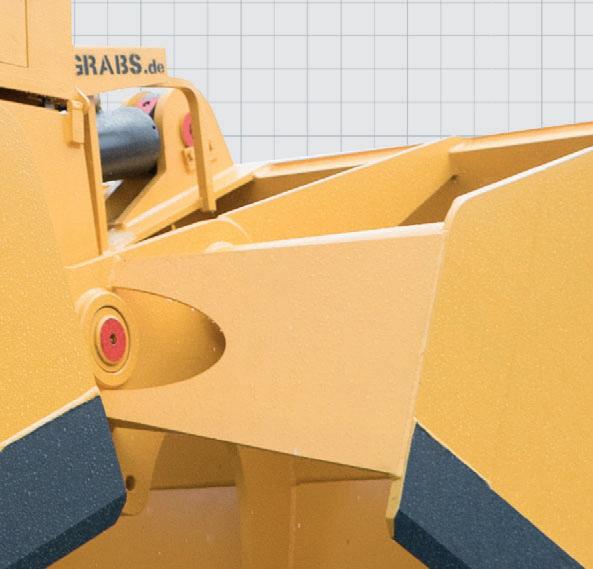

8 APMT has a multi-

faceted expansion plan including deepening the draft alongside general cargo/multipurpose quays

DPW is off and running with its expansion plan, APMTC still awaits the green light ‘‘ from government

in the details to invest US$1.2billion during the course of the concession: depending on performance and volumes. So far, the Danish terminal operator has invested US$700m, so a further $500m needs to be spent before 2041, but a good slice of that is needed sooner rather than later to meet growing demand since Covid.

Lars Vang Christensen, the CEO for APMTC, explains that it is a Joint Venture and the Danish outfit has Terminal Investment Link (TIL), part of MSC, as a minority shareholder, in the terminal which has 3.7km of quayside, spread across seven quays and 15 moorings, mostly on finger piers. It is part of the Peruvian public port system, unlike Chancay, and receives multi-purpose as well as container ships, bulkers (fertilisers, metals, chemicals, etc), tankers, fishing boats, roro and even cruise vessels.

“General Cargo has experienced high growth due to the global shortage of containers and with this in mind we wish to improve our terminal. We have completed investment stages 1 and 2 and now we want to tap into 3 and make the port more efficient for our many customers,” Christensen told Port Strategy. “To do this we are working through the process with the authorities and we are five years into the negotiations. It’s been tough with so many changes in government, especially at the Ministry of Transport, but we feel we may get an agreement before this year is out.”

Several executives interviewed for this feature, as well as Christensen, said that APMTC is probably “THE key” terminal in the whole country not just for its contribution of capacity to box movement but also a “huge variety of other cargoes”. As APMTC declares on its website, it is the “only multi-purpose terminal in Peru” and handles 100 per cent of all vehicles imported into the South American country, as well as 100 per cent of the barley, machinery and cement, and of sodium carbonate, as well as 73 per cent of the wheat and 54 per cent of the corn. Christensen says that 1.6m people use APMTC annually and business is growing.

“There’s no question we’re a very busy place and that’s why we are so keen to get on with our investments,” adds the APMTC executive. “Some parts of our terminal need these investments more than others and we will move up to our eventual US$1.2 billion investment target in phases, depending on triggers that will be set off as we reach certain target volumes.”

Today TNM is most certainly a key facility for general cargo in all Peru, with 11.3m tons handled last year, hosting 1500 cargo ships and with 2600 trucks transiting in/out every day. In 2021 APMTC handled 980,000TEU and is expecting to break the 1m TEU per annum barrier before long, according to Andersen.

Several sources, both in Chile and Peru, told Port Strategy that the “messy politics” of Peru was causing “huge, harmful delays” at APMTC and, to a lesser extent, DP World Callao, making the “urgently needed” investments in Callao a “necessity if the facilities are to have any chance of competing with the new port of Chancay”.

“I figure that if Chancay comes on stream in 2023 or 2024, it will take a few years for it to get up to full steam,” suggested one veteran Chilean shipping agent and WCSA expert. “So, the two Callao terminals handling containers have about five years to enjoy their cargo handling monopoly for the Lima region and after that, well, who knows what their future will be but it certainly won’t be as profitable or as easy as it is today to maintain such a huge percentage of Peru’s maritime commerce.”

ANOTHER SCENARIO

“Yet another scenario could be that Chancay and the two Callao facilities work together and create a “dual port hub” and then tranship more and more cargoes down to and up from Chile,” added the veteran. “The next few years could be very interesting along the WCSA.”

Although APMTC offers 16m draft at its containership handling pier, according to Christensen, its finger piers could do with more depth and so the expansion project involves some dredging, thereby allowing the berthing of larger vessels for general cargo.

Christensen told PS that the largest container vessels calling WCSA (around 12,000TEU) can berth at TNM but more depth for the other cargoes at the finger piers would be a boon and would be part of the investment package if an agreement with the government can be reached.

“We continue our talks with the Peruvian government and, I guess, it will just take the time that it takes,” mused a philosophical Christensen.

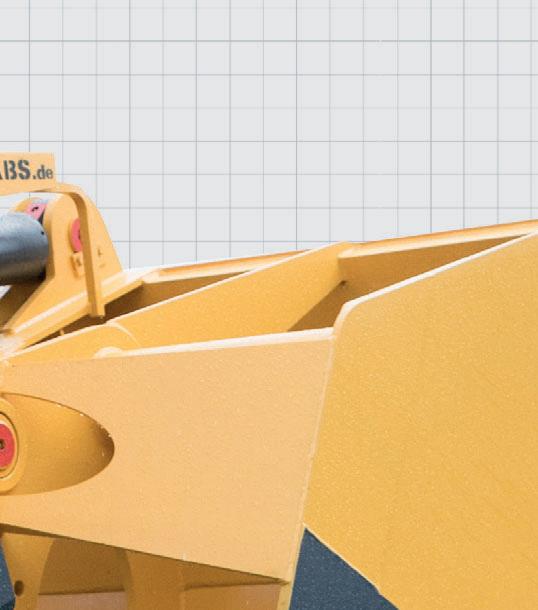

8 DP World Callao

working up to its limits but with new capacity in the pipeline

SAAM Towage takes Ian Taylor

Chilean tugboat operator SAAM Towage has bought the Peruvian towage operations of fellow Chilean company Ian Taylor, as part of its expansion plan.

The five tugs it has purchased from Ian Taylor, four in the port of Callao and one in Paita, now mean that SAAM operates more than 180 vessels in 80 ports around the world, including Brazil, Canada, Mexico, Uruguay, Ecuador, Colombia, Panama and El Salvador, as well as Chile and Peru.

“SAAM Towage is presently in the middle of a high investment cycle,” said a spokesman for the company, which now operates 11 tugboats in Peru, after entering the Peruvian tug sector in mid-2021.

A manager at Ian Taylor said that the Chilean firm would continue to operate their ship agency – Taylor Agencias SAC - in several ports in Peru.