Brought to you by www.jacketmediaco.com The Manufacturing & Business Podcast Network LISTEN TO OUR PODCASTS AT: OUR PODCASTS: JANUARY ISM PMI: 47.4% Released February 1st -The Full Executive Summary Report On Business - Page 12 [ HOW TO AVOID SUPPLY CHAIN DISRUPTION THE ISM MANUFACTURING REPORT PAGE 12 NORTH AMERICA OUTLOOK PAGE 16 AFRICA OUTLOOK PAGE 20 PAGE 10 FEATURE STORY: EMPLOYMENT SITUATION SUMMARY PAGE 24

3 Manufacturing Outlook / February 2023 MANUFACTURING TALK RADIO PODCAST (MFGTALKRADIO.COM) Streaming New Shows Every Week (Over 1,000 Shows Since 2013) Listen To The Experts And Their Guests Host Tim Grady Host Lew Weiss Listen to our entire family of podcasts at jacketmediaco.com

4 Manufacturing Outlook / February 2023 © 2023 Jacket Media Co. No part of this publication may be reproduced or used in any form without the prior written permission of the publisher. Manufacturing Outlook is a registered trademark of Jacket Media Co. Publisher LEWIS A WEISS Editor in Chief TIM GRADY Creative Director CRAIG ROVERE Contributing Writers ROYCE LOWE CHRIS KUEHL CHRIS ANDERSON CHRISTINE CASATI KEN FANGER Production Manager LINDA HOPLER Advertising ADVERTISE@MFGTALKRADIO.COM Editorial Office JACKET MEDIA CO. 75 LANE ROAD FAIRFIELD, NJ 07004 (973) 808-8300 TABLE OF CONTENTS Lazt Quarter/This Quarter/Next Quarter by Lewis A. Weiss PUBLISHER’S STATEMENT 5 Australia-China Trade Thaw and Security Concerns by Christine Casati ASIA OUTLOOK 26 GM’s Trillion by Royce Lowe AUTOMOTIVE OUTLOOK Fighters, the FAA Again, and Taxis by Royce Lowe AEROSPACE OUTLOOK 30 Small-Scale Nuclear Power by Royce Lowe ENERGY OUTLOOK 32 Global Manufacturing Downturn Continues by Royce Lowe MANUFACTURING OUTLOOK 6 Your Cybersecurity Journey: What’s a Business To Do? by Ken Fanger CYBER SECURITY OUTLOOK 38 ISSUES OUTLOOK 40 Advanced Manufacturing Update by Royce Lowe MATERIALS OUTLOOK 34 Green Aluminum; the Future Way? by Royce Lowe Open call for... Contributing Writers for new and existing content. Let’s start a conversation –Contact us at info@jacketmediaco.com ISM MANUFACTURING REPORT ON BUSINESS 12 The Manufacturing PMI is 47.4% 10 COVER STORY: HOW TO AVOID SUPPLY CHAIN DISRUPTION by Craig Rovere Turmoil Will Slow Its Growth by Royce Lowe SOUTH AMERICA 18 An Air Of Optimism by Chris Anderson EUROZONE OUTLOOK 23 Insights From Inside Manufacturing In Action MANUFACTURING TIDBITS by Bureau of Labor Statistics FEATURE STORY: EMPLOYMENT SITUATION SUMMARY 24 36 NORTH AMERICAN OUTLOOK 16 by Dr. Chris Kuehl Inflation Is The Focus Manufacturing in Africa by Royce Lowe AFRICA OUTLOOK 20

Last Quarter / This Quarter / Next Quarter

Let’s face it – no one really knows what is going to happen regarding a recession. People are watching a plethora of indicators, and like a hurricane getting closer, the spaghetti model paths of possibility and probability seem to be narrowing. And it looks like the U.S. will get hit with a mild recession in Q1 and Q2 – but not everyone.

Some sectors will do better than others, and one of the key sectors to watch is the chemical sector. That sector produces materials and liquids that feed manufacturing in the early stages of production, and they are purchased as manufacturers tackle their orders. The Chemical Products sector is still hovering around a 50 PMI, so it is not contracting and not yet expanding, but it is steady.

The Fed has become a bit more cautious about rate increases, adding 25 basis points to the Fed Funds rate at its late January/early February meeting. Their goal is to beat inflation down to less than 2%, and the indicator they go by is rising unemployment. In other words, they intend to throw people out of their jobs, so they don’t have money to spend, thus cooling demand and price increases. But, they have a problem: there are 11 million open jobs and 5.6 million people available to fill them – if those people wanted to go to work. And, manufacturers are unwilling to lay off the people that we so hard to find and cost manufacturers significant dollars to train. So, unemployment isn’t really budging or likely to change much in the near future.

Now the Fed has a new problem – the latest jobs report for January 2023 is an addition of 517,000 jobs, with 19,000 added in manufacturing. Unemployment decreased from 3.5% to 3.4%. Raising the Fed rates directly impacts borrowing costs, whether those are business loans, mortgage rates, or credit card rates. The impact on employment is less direct and “down the road” by about 6 months. So, the Fed may get more aggressive with rate increases that would adversely impact Q3 and Q4.

The stock market does its usual reaction – it drops several hundred points, and people gasp momentarily as if a 300+ point drop against a near 34,000 point DOW, or less than 1% for a couple of hours, tips the markets into bear territory. Even the 1-year and 2-year charts do not indicate anything more than a cooling-off period. The 5-year chart shows very strong long-term growth.

So, all the usual suspects of recession aren’t showing up to any significant degree so far in the 1st quarter. This is consistent with a relatively new manufacturing forecast called ASIS, or the Armada Strategic Intelligence System published by Armada Corporate Intelligence in partnership with Morris, Nelson and Associates. That report (https://asisintelligence.com/) has a 95%+ accuracy, both reflecting and forecasting manufacturing so far – a cooler Q1 (and Q2) followed by growth in Q3 and Q4. That would mimic 2022, which for many in manufacturing (and services) was a positive year.

At this point, unless there is a black swan event that sends things into an unexpected tumble, 2023 looks to be an overall growth year for manufacturing. This is likely what manufacturers see, as well, and thus they will hold on to their employees as long as possible, frustrating the Fed because manufacturing leads the U.S. into every recession and leads the U.S. out of every recession. It happens in manufacturing first, and the early indicators are softening order books and layoffs. Order books are softening a bit in some sectors, and layoffs are happening mostly in the tech sector, which is the Services side of the economy.

We don’t see either of these as worrisome at present. We expect order books to stay above 40 in the PMI reports, and some will be close to or slightly over 50 in the coming months. Prices are moderating, which will cool inflation, but it is unlikely that the Fed will drive inflation below 2% unless they break something badly with far too aggressive price hikes. That would be a black swan event in and of itself.

Read through the content of this issue of Manufacturing Outlook and see whether or not you agree! If you haven’t subscribed yet, go to www.manufacturingoutlook.com to be sure you don’t miss an issue of this forward-looking, forward-thinking digital ezine. n

Lewis A. Weiss, Publisher

Lewis A. Weiss, Publisher

Contact

5 Manufacturing Outlook / February 2023

PUBLISHERS STATEMENT FOLLOW US: SUBSCRIBE

laweiss@mfgtalkradio.com for comments, suggestions and ideas and guest requests for MFGTALKRADIO.COM podcast or any of our podcasts.

MANUFACTURING OUTLOOK

6 Manufacturing Outlook / February 2023 MANUFACTURING OUTLOOK

continued

GLOBAL MANUFACTURING DOWNTURN CONTINUES, BUT SLIGHTLY ENCOURAGING NEWS FROM EUROPE. GOOD NEWS

FROM THE INTERNATIONAL MONETARY FUND

By: Royce Lowe

Figures published on Thursday, January 26th, were expected to show that the U.S. GDP in the final three months of the year expanded at an annualized rate of about 2.5%. The figure that came in was actually 2.9%. This equated to two quarters of robust growth. If a recession is coming, when is it coming? Since the IMF last forecast global growth, the world economy has enjoyed good news.

Headline inflation has fallen, and Europe is having a warm winter, easing its energy crisis. China has done away with its zero-covid policy. The result is that the IMF now expects the world economy to grow by 2.9% in 2023-below the long-term average of 3.8%, but up by 0.2 percentage points on its previous projection in October. But the IMF warns that, of course, all will not be plain sailing. The fund states that underlying inflation is still rising, fueled by overheating labor markets. It will be harder to refill Europe’s gas storage for next winter without Russian inflows and with China hungry for energy. Financial stability risks “remain elevated.”

And growth is not on the up everywhere. The fund has downgraded its growth forecast for Britain by almost a percentage point to -0.6%, making it the only major economy projected to shrink in 2023.

In the U.S., the “flash” manufacturing PMI reading for January - representing data from 85% of respondents -

forecasts 46.8, versus 46.0 expected, (from 46.2 in December). The PMI came in at 47.4. The flash composite PMI for January was at 46.6 versus 44.6 in December. The year started on a disappointingly soft note, with business activity contracting sharply again in both manufacturing and services.

January saw a weaker rise in jobs than in most of 2022. The rate of input cost inflation is up into the new year, due in part to upward wage pressure. Results in the U.S. are pretty much in line with the data condensed last month from the ASIS intelligence report, which forecasts a downturn -recession - of some months duration, but mild. Business optimism hit a four-month high. Car sales in the U.S. are forecast to be appreciably higher in January than in December, with an SAAR of 15.6 million versus 13.6 million.

A marginal return to growth of production across the Eurozone as a whole was accompanied by a sharp improvement in optimism for the year ahead (please read the Eurozone Outlook in this issue). This sentiment was apparent in both manufacturing and services, across France, Germany, and the rest of the Eurozone. This good news led to additional hiring. Supply chain pressures eased, energy prices fell, the weather was warmer than usual, and governments chipped in with assistance.

In the UK, there was a sustained downturn in business activity with a rate of decline the fastest for two years. The UK flash composite production index for January, at 47.8, was down from 49.0 in December, at a 24-month low. The flash manufacturing production index was at 46.6 versus December’s 44.4, and the flash manufacturing PMI was at 46.7 versus 45.3 in December. The optimism in January is the strongest since May 2022, based on hopes of a “global turnaround.” Backlogs are lower, and there is a small reduction in employment. On the minus side, the UK auto manufacturing industry just saw its lowest production year since 1956.

Flash data for Japan’s manufacturing sector show a weaker decline for production and new orders, and a stronger decline for new export orders. There is stronger growth in employment, and a stronger positive outlook. The flash composite production index for January was at 50.8 versus 49.7 in December; the manufacturing production index for January was at 47.1 versus 46.6 in December.

China’s manufacturing PMI came in at 50.1, versus 49.8 expected; its services PMI came in at 54.4, versus 52.0 expected. China’s car sales for 2022 came in at 26,864,000 units, up 2% on 2021. BEV sales were at 5,364,000, up 84% year-over-year; hybrid sales at 1,523,000 up 153% yearover-year. However, the accuracy of data from China is often suspect.

The seasonally adjusted Global Steel Users Purchasing Managers Index™ (PMI) – a composite indicator designed to give an accurate overview of operating conditions at manufacturers identified as heavy users of steel – rose to 48.7 in December, from

7 Manufacturing Outlook / February 2023 MANUFACTURING OUTLOOK

continued

47.6 in November, signaling a fourth successive deterioration in operating conditions but at a weaker rate.

Employment in the global steel-using sector fell for the sixth month running in December, albeit at the weakest rate over this period. U.S. steel users cut employee numbers for the second month running, while Asia posted only a marginal decline. European steel users raised employment at the fastest rate in six months. Purchasing fell for the fourth time in five months, with all three regions seeing declines for the second successive month.

The PMI for manufacturers who are heavy users of copper went from 47.8 in November to 48.7 in December.

There was a slower downturn in Asia, while the U.S. and Europe showed faster declines in production and new orders. New orders fell for the fourth month running in December, and at

the second-strongest rate since May 2020. Input price inflation eased to a two-and-a-half year low. The Global Copper Users PMI™ for December pointed to a broad-based deterioration in conditions across the three monitored regions. There was an easing in the overall rate of decline, however, mainly due to developments in Asia which recorded slower falls in new orders and output, and a stabilization in employment. The U.S. and Europe both posted faster declines in production and new orders, with Europe and the U.S. expanding jobs.

Heavy users of aluminum saw a downturn continuing for the fifth month, but at a slower rate. There were slower declines in production and new order,s and near stabilization in employment. There was deterioration across the U.S., Europe and Asia, with employment

rising at aluminum users in Europe, unchanged in the U.S., and falling in Asia. The PMI rose from 47.3 in November to 48.3 in December.

The prices of non-ferrous metals in January were mostly on the up. During the month of January, aluminum went from $1.18 to $1.27 per lb; copper from $3.75 to 4.20; (nickel from $13.30 to $13.70) and zinc from $1.36 to $1.58. As of this writing nickel is currently 14.09 per lb. LME stocks are trending down. Volatile is the word that best describes non-ferrous metal prices of late.

Global crude steel production was down 10.8% year-over-year in the month of December for the 64 reporting countries – which represent 98% of world crude steel production – to 140.7 million tons (MT). Production for the year 2022 was down 4.2% year-over-year at 1,878.5 million tons. The global production of primary aluminum continued at its normal pace in December, with China producing 59% of the 5.859 MT total.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contribut

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contribut

ing Writer, Manufacturing Outlook. n

8 Manufacturing Outlook / February 2023

MANUFACTURING OUTLOOK

9 Manufacturing Outlook / February 2023 MANUFACTURING OUTLOOK We want your participation. Now interviewing for additional podcast hosts Now interviewing for regular and contributing writers for Manufacturing Outlook ezine New ideas wanted for monthly Manufacturing Talk Radio topics Contact Jacket Media Co. at 973-808-8300 or info@jacketmediaco.com

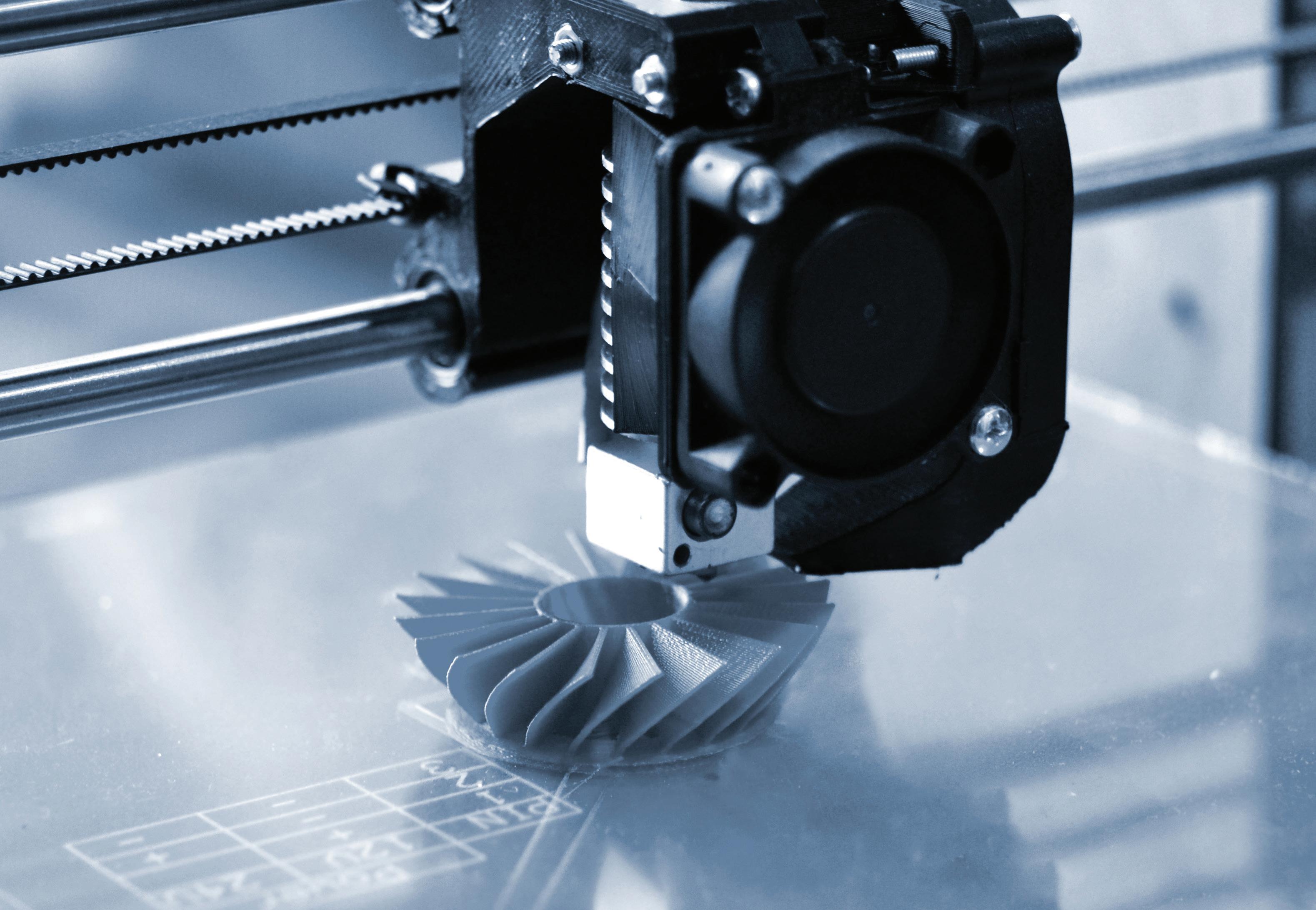

How Manufacturers Can Mitigate Supply Chain Disruption

Supply chain disruption has become a serious, ongoing issue for manufacturers. Here are a few ways manufacturers can help avoid disruptions and better deal with them when they arise.

by Craig Rovere

Manufacturers rely on a complex network of suppliers, partners, and logistics providers to produce and deliver their products. When any part of this supply chain is disrupted, it can have a ripple effect that causes delays, increases costs, and reduces revenue. Mitigating supply chain disruption is crucial for manufacturers to maintain their competitiveness and profitability in an increasing unpredictable world.

Manufacturers can mitigate supply chain disruption by diversifying their suppliers. By sourcing materials and components from multiple suppliers, manufacturers can reduce their dependence on a single supplier as their source and minimize the impact of a disruption. This also allows manufacturers to compare prices, delivery times and quality, and to negotiate better deals.

Manufacturers can also work with suppliers to improve their supply chain resilience. Remember, it’s a supply chain, and a chain is only as strong as it’s weakest link. Encourage suppliers to adopt lean manufacturing principles that reduce waste and improve efficiency, or to invest in new technologies and logistics solutions that increase flexibility and responsiveness.

10 Manufacturing Outlook / February 2023 continued

COVER STORY

Another strategy manufacturers can use to avoid supply chain disruption is to build up their inventory levels. Having a buffer of materials and components on hand can help manufacturers weather disruption and continue production until the supply chain is restored. Manufacturers can also use advanced forecasting and demand planning tools to better predict their needs and avoid stockouts. Investing in logistics solutions that provide greater visibility and control over their supply chain, such as tracking systems, transport management systems, and warehouse management systems will help as well.

Manufacturers can also mitigate supply chain disruption by improving their logistics and transportation capabilities. For example, they can develop more efficient and flexible logistics networks that allow them to quickly redirect shipments in response to disruptions. They can also invest in transportation solutions such as air freight or sea freight,

which are often more reliable than road or rail transport. Additionally, manufacturers can work with logistics partners to develop contingency plans and emergency response protocols that can be quickly activated in the event of a disruption.

Emerging technologies can help as well. One example is the use of digital twins, which are virtual replicas of physical assets such as machines, facilities, and logistics networks. These digital twins can be used to simulate and analyze the impact of disruptions on the supply chain, and to identify and implement mitigation strategies. Additionally, manufacturers can use advanced analytics and machine learning to monitor supply chain performance and identify patterns and trends that can indicate potential disruptions.

Finally, manufacturers can mitigate supply chain disruption by building strong relationships with their suppliers, customers, and logistics

partners. By working closely with these partners, manufacturers can gain a better understanding of their needs and challenges, and develop joint solutions that improve supply chain resilience. They can also share information and collaborate on risk management, such as sharing data on disruptions and agreeing on a common plan to mitigate them.

In conclusion, supply chain disruption is a major risk for manufacturers, and it is crucial for them to take steps to mitigate it. By diversifying suppliers, building up inventory levels, improving logistics and transportation capabilities, using technology to monitor and respond to disruptions, and building strong relationships with partners, manufacturers can increase their supply chain resilience and maintain their competitiveness and profitability.

For more on how you can reduce the risk of supply chain disruption, listen to Moser On Manufacturing podcast. n

11 Manufacturing Outlook / February 2023 COVER STORY

12 Manufacturing Outlook / February 2023

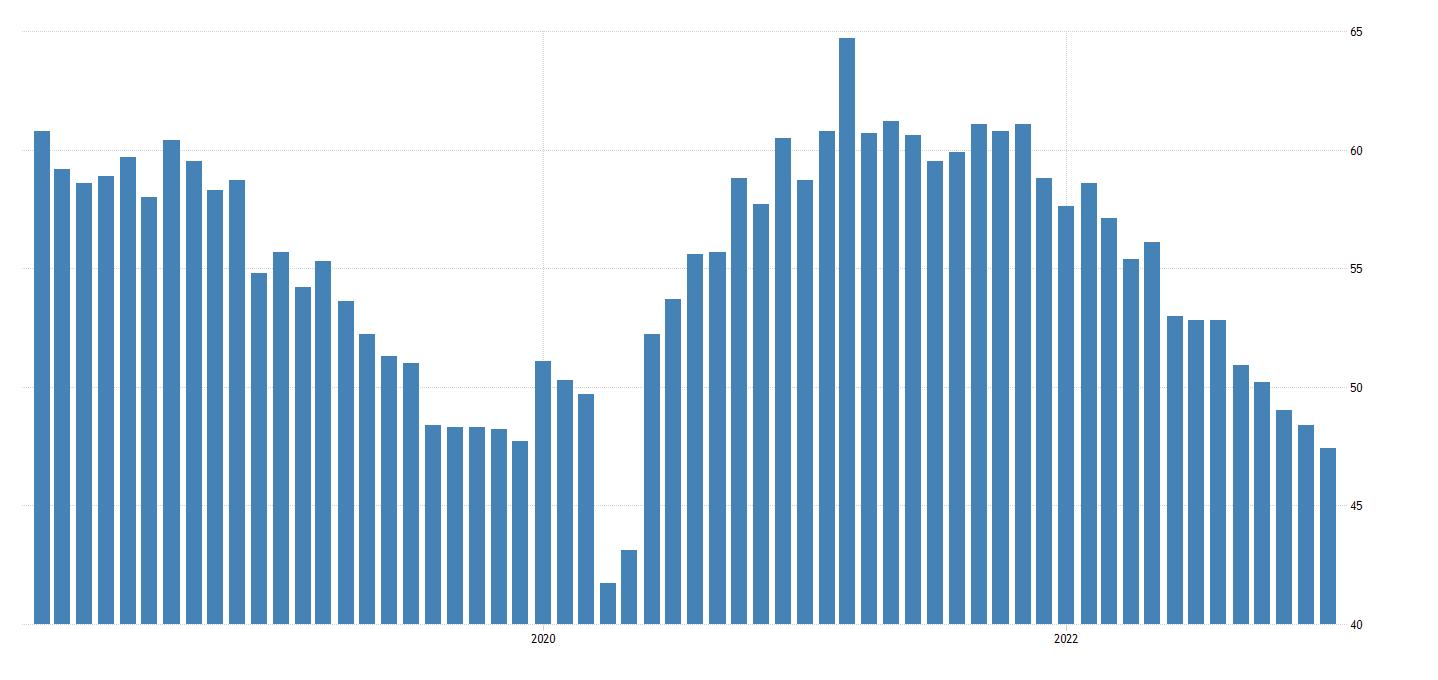

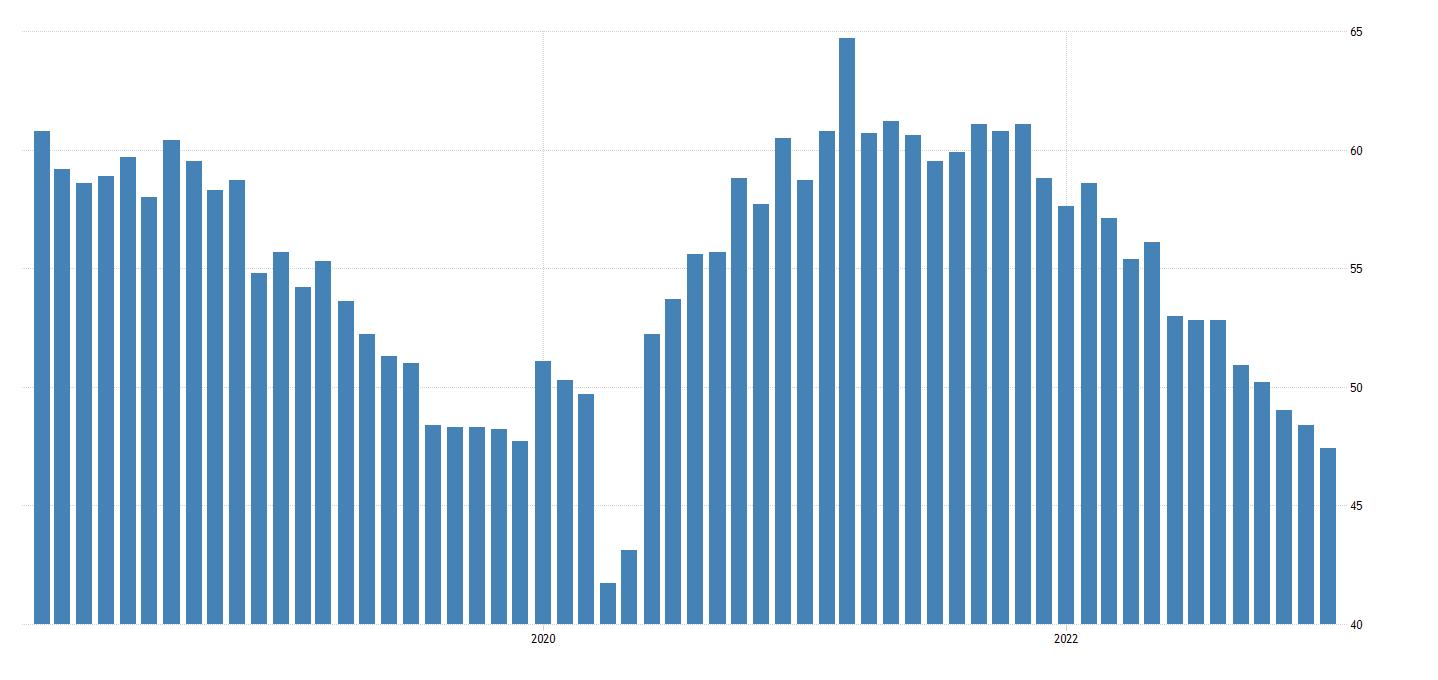

BREAKING NEWS ISM PMI at 47.4% for January 2023 ISM REPORT OUTLOOK JANUARY 2023 47.4% Released February 1st ISM PMI for the past 5 years Expanding Contracting continued

THE INSTITUTE FOR SUPPLY MANAGEMENT’S MANUFACTURING REPORT ON BUSINESS®

INSTITUTE FOR SUPPLY MANAGEMENT®

Economic activity in the manufacturing sector contracted in January for the third consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®

The January Manufacturing PMI® registered 47.4 percent, 1 percentage point lower than the seasonally adjusted 48.4 percent in December.

The New Orders Index remained in contraction territory at 42.5 percent, 2.6 percentage points lower than the seasonally adjusted figure of 45.1 percent recorded in December.

The Production Index reading of 48 percent is a 0.6-percentage point decrease compared to December’s seasonally adjusted figure of 48.6 percent. The Prices Index registered 44.5 percent, up 5.1 percentage points compared to the December figure of 39.4 percent. The Backlog of Orders Index registered 43.4 percent, 2 percentage points higher than the December reading of 41.4 percent. The Employment Index continued in expansion territory (50.6 percent, down 0.2 percentage point from December’s seasonally adjusted 50.8 percent) after emerging from contraction territory (48.9 percent, seasonally adjusted) in November.

The two manufacturing industries that reported growth in January are: Miscellaneous Manufacturing‡; and Transportation Equipment. Of the six biggest manufacturing industries, one — Transportation Equipment — registered growth in January. ISM

Analysis by Timothy R. Fiore, CPSM, C.P.M.

Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

PMI® at 47.4% MANUFACTURING

The U.S. manufacturing sector contracted in January, as the Manufacturing PMI® registered 47.4 percent, 1 percentage point below the seasonally adjusted reading of 48.4 percent recorded in December. This is the third month of slow contraction and the continuation of a downward trend that began in June 2022. Of the five subindexes that directly factor into the Manufacturing PMI®, two (Employment and Inventories) were in growth territory; however, both slowed compared to December. The PMI® registered its lowest level since May 2020, when the index registered a seasonally adjusted 43.5 percent.

Manufacturing at a Glance

Commodities Reported

Commodities Up in Price: Aluminum*; Copper (2); Copper Products; Electrical Components (3); Freight* (2); Packaging Materials; Portland Cement; Steel — Carbon; Steel — Hot Rolled; Steel — Scrap; and Steel Products*.

Commodities Down in Price: Aluminum (9)*; Aluminum Products (2); Coconut Products; Corrugate (2); Corrugated Boxes; Crude Oil (2); Diesel (2); Freight* (3); High Density Polyethylene (HDPE) Resin; Lumber; Methanol; Natural Gas (2); Ocean Freight (5); Petroleum Based Products; Plastic Based Products; Plastic Resins (8); Polyethylene Terephthalate (PET); Polypropylene (6); Polyvinyl Chloride (PVC); Solvents; Steel (9); Steel Bars; and Steel Products (7)*.

Commodities in Short Supply: Bearings (2); Electrical Components (28); Electronic Components (26); Hydraulic Components (9); Semiconductors (26); Steel — Stainless; and Steel Products.

13 Manufacturing Outlook / February 2023 ISM REPORT OUTLOOK continued 12 ISM WORLD.ORG

PMI 48.7% = Overall Economy Breakeven Line 50% = Manufacturing Economy Breakeven Line 2023 2022 2021 47.4%

INDEX Jan Index Dec Index % Point Change Direction Rate of Change Trend* (months) Manufacturing PMI® 47.4 48.4 -1.0 Contracting Faster 3 New Orders 42.5 45.1 -2.6 Contracting Faster 5 Production 48.0 48.6 -0.6 Contracting Faster 2 Employment 50.6 50.8 -0.2 Growing Slower 2 Supplier Deliveries 45.6 45.1 +0.5 Faster Slower 4 Inventories 50.2 52.3 -2.1 Growing Slower 18 Customers’ Inventories 47.4 48.2 -0.8 Too Low Faster 76 Prices 44.5 39.4 +5.1 Decreasing Slower 4 Backlog of Orders 43.4 41.4 +2.0 Contracting Slower 4 New Export Orders 49.4 46.2 +3.2 Contracting Slower 6 Imports 47.8 45.1 +2.7 Contracting Slower 3 Overall Economy Contracting Faster 2 Manufacturing Sector Contracting Faster 3

‡Miscellaneous Manufacturing (products

as medical

and supplies,

sporting

and

supplies). *Number of months moving in current direction. Manufacturing ISM® Report On Business® data has been seasonally adjusted for the New Orders, Production, Employment and Inventories indexes. Indexes reflect newly released seasonal adjustment factors.

such

equipment

jewelry,

goods, toys

office

Note: To view the full report, visit the ISM ® Report On Business® website at ismrob.org The number of consecutive months the commodity has been listed is indicated after each item. *Reported as both up and down in price.

reportonbusiness

ISM® Report On Business®

New Orders

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey Committee

ISM’s New Orders Index registered 42.5 percent. None of the 18 manufacturing industries reported growth in new orders in January. Seventeen industries reported a decline in new orders in January, in the following order: Wood Products; Textile Mills; Apparel, Leather & Allied Products; Paper Products; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Furniture & Related Products; Plastics & Rubber Products; Primary Metals; Fabricated Metal Products; Machinery; Petroleum & Coal Products; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing‡; Chemical Products; Computer & Electronic Products; and Transportation Equipment.

The Production Index registered 48 percent. The only industry reporting growth in production during the month of January is Computer & Electronic Products. The 14 industries reporting a decrease in production in January — in the following order — are: Textile Mills; Nonmetallic Mineral Products; Printing & Related Support Activities; Paper Products; Plastics & Rubber Products; Wood Products; Primary Metals; Furniture & Related Products; Electrical Equipment, Appliances & Components; Food, Beverage & Tobacco Products; Machinery; Miscellaneous Manufacturing‡; Transportation Equipment; and Chemical Products.

ISM’s Employment Index registered 50.6 percent. Of 18 manufacturing industries, five reported employment growth in January: Nonmetallic Mineral Products; Machinery; Plastics & Rubber Products; Transportation Equipment; and Fabricated Metal Products.

Supplier Deliveries

The delivery performance of suppliers to manufacturing organizations was faster for a fourth straight month in January, as the Supplier Deliveries Index registered 45.6 percent. Two of 18 manufacturing industries reported slower supplier deliveries in January: Textile Mills; and Petroleum & Coal Products.

Inventories

The Inventories Index registered 50.2 percent. Of 18 manufacturing industries, the nine reporting higher inventories in January — in the following order — are: Printing & Related Support Activities; Miscellaneous Manufacturing‡; Nonmetallic Mineral Products; Paper Products; Electrical Equipment, Appliances & Components; Transportation Equipment; Plastics & Rubber Products; Food, Beverage & Tobacco Products; and Computer & Electronic Products.

14 Manufacturing Outlook / February 2023

Manufacturing PMI®

New Orders (Manufacturing) 52.7% = Census Bureau Mfg. Breakeven Line 2023 20 2022 2021 42.5%

Employment (Manufacturing) 50.4% = B.L.S. Mfg. Employment Breakeven Line 2023 2022 2021 50.6% 20 Supplier Deliveries (Manufacturing) 2023 80 2022 2021 53.1% 45.6% Inventories (Manufacturing) 44.4% = B.E.A. Overall Mfg. Inventories Breakeven Line 2023 2022 2021 50.2% Production (Manufacturing) 52.4% = Federal Reserve Board Industrial Production Breakeven Line 2023 2022 2021 48% 70 Production

Employment

January 2023 ISM REPORT OUTLOOK continued

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

ISM® Report On Business®

Customers’ Inventories

January 2023

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey Committee

ISM’s Customers’ Inventories Index registered 47.4 percent. Seven industries reported customers’ inventories as too high in January, in the following order: Apparel, Leather & Allied Products; Paper Products; Plastics & Rubber Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Primary Metals; and Chemical Products.

Prices

The ISM Prices Index registered 44.5 percent. In January, four industries reported paying increased prices for raw materials: Fabricated Metal Products; Miscellaneous Manufacturing‡; Computer & Electronic Products; and Machinery.

Backlog of Orders

ISM’s Backlog of Orders Index registered 43.4 percent. Two industries reported growth in order backlogs in January: Food, Beverage & Tobacco Products; and Chemical Products. Fourteen industries reported lower backlogs in January, in the following order: Textile Mills; Paper Products; Wood Products; Printing & Related Support Activities; Furniture & Related Products; Electrical Equipment, Appliances & Components; Nonmetallic Mineral Products; Primary Metals; Plastics & Rubber Products; Fabricated Metal Products; Machinery; Transportation Equipment; Computer & Electronic Products; and Miscellaneous Manufacturing‡

New Export Orders

ISM’s New Export Orders Index registered 49.4 percent. Four industries reported growth in new export orders in January: Nonmetallic Mineral Products; Wood Products; Printing & Related Support Activities; and Fabricated Metal Products.

Imports

ISM’s Imports Index registered 47.8 percent. The eight industries reporting an increase in import volumes in January — in the following order — are: Textile Mills; Paper Products; Printing & Related Support Activities; Primary Metals; Nonmetallic Mineral Products; Food, Beverage & Tobacco Products; Transportation Equipment; and Miscellaneous Manufacturing‡

15 Manufacturing Outlook / February 2023

Manufacturing PMI®

Customer Inventories (Manufacturing) 2023 2022 2021 47.4% Backlog of Orders (Manufacturing) 2023 2022 2021 43.4% New Export Orders (Manufacturing) 2023 2022 2021 49.4% Imports (Manufacturing) 2023 2022 2021 47.8%

Prices (Manufacturing) 52.9% = B.L.S. Producer Prices Index for Intermediate Materials Breakeven Line 2023 2022 2021 44.5%

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

ISM REPORT OUTLOOK

NORTH AMERICA OUTLOOK

Inflation Is The Focus

by Dr. Chris Kuehl

There has been a great deal of moodshifting as 2023 gets underway. At this juncture, it is as easy to find a pessimist predicting a deep and prolonged recession as it is to find an optimist asserting the downturn will be mild. Why the variability?

The easy answer is that some very significant motivators for the overall global economy have started to change, and nobody is quite sure how real these changes are. The fundamental question through all of 2022 was what to do about inflation. The rate had exploded to levels not seen in 40 years, and at this stage, the numbers are still high but not as high as they have been. The assertion is that global inflation started to peak in the fourth quarter of last year, and the data suggests that this is true. The latest CPI showed inflation down to 6.5%, and just about a year ago, it was at 9.2%. The wholesale inflation

rate fell by .06 when the expectation was for a fall of about 0.1%. There have been declines in the producer price index, commodity prices, and even shipping rates. The inflation rate is by no means low – the Federal Reserve watches the performance of the PCE (Personal Consumption Expenditures), and it has dropped to around 4.5% (their target is 2.0% to 2.5%). Why does all this matter to the manufacturer? Beyond the obvious reason that it means that prices for inputs are slightly lower, there is the connection between inflation and the interest rates that are set by the central banks. The Fed has indicated that it will slow and even halt hiking rates when it determines it has done enough to break the back of inflation. Has that point been reached?

Generally, the central banks (including the Fed), use employment

as their indicator, but the job market has been skewed by the chromic worker shortage. This has been very obvious in the manufacturing sector. By this point, many in the industrial community would have been laying people off, but they are reluctant to lose the trained and skilled people they had to work so hard to find. This has meant a delay in the employment gauge, and the banks are looking at other indicators to determine whether they have done enough. One of these is the performance of the Purchasing Managers’ Index, and the U.S. is now down to 47.4. Globally there are now 22 nations that have fallen below that 50 line. Two of the most notable exceptions have been Mexico (51.3) and India (57.8). Canada is not all that far from expansion, with a reading of 49.2.

Obviously, interest rates matter, and now there is considerable debate

16 Manufacturing Outlook / February 2023 NORTH AMERICA OUTLOOK

FEBRUARY 2023

continued

over what they might look like in the months to come. There are still those that predict rates at 5.0% or even 5.5%, but there are many that are asserting they will not go that high after all. The trigger for this reassessment has been the erosion of inflation. There have been many indicators pointing towards that easing. Wholesale inflation fell more than expected, the Germans have seen their Producer Price Index fall, energy prices are down, and so are shipping rates. Inflation is undoubtedly still high and still at levels not seen in close to three decades, but the trend has been in a direction that has the markets believing that central banks are close to halting interest rate hikes. If past patterns hold, that means that rates could start heading down again as soon as the coming summer.

Canada and Mexico are also looking to their central banks for guidance. The Bank of Canada is hiking rates to a peak of 4.5% - the highest seen in years. The message from the BoC

is that Canada’s economy is still close to overheating and still has the resilience to handle more hikes. The commodity surge has faded a little, but oil prices are still high relative to what they had been. Natural gas prices are falling pretty quickly, however. The unemployment rate remains very low, and this is still a marker as far as the BoC is concerned. Until the jobless number climbs, there is a sense that rates can go up a bit higher. This hike is expected to be followed with a pause. Inflation fell to 6.3% in the last reading, but that is still three times higher than would be preferred.

Mexico is seeing higher inflation in contrast with the U.S. and Canada and that has Banxico considering another rate hike in February. The inflation rate had been dropping but has risen to 7.85% - well past the target rate of 3.0%. The interest rates have been shoved past 10% and may jump a bit more at the next meeting. Three factors seem to have been driving inflation, and they are

certainly familiar to both the U.S. and Canada. Labor rates are climbing for skilled and trained workers, and that has spurred consumer spending. Then there is the rise in commodity prices (especially food). Finally, there has been supply chain pressure even as reshoring and nearshoring accelerate. Many items remain in short supply, and that results in more upward price pressure; i.e., inflation.

Author profile: Dr. Christopher Kuehl (Ph.D.) is a Managing Director of Armada Corporate Intelligence and one of the cofounders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years. He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division –Finance, Credit and International Business. n

THE FLAGSHIP REPORTS

The Flagship Reports with Dr. Chris Kuehl is both an “Officer of the Watch” briefing of economic conditions and an Executive Briefing on specific situations impacting those conditions. Written and presented by the officers of Armada Corporate Intelligence, Dr. Kuehl lightens up the mood of sometimes distressful geoeconomic news with a bit of humor. This monthly podcast includes information from the Flagship Reports issued 3 times and week, and AISI, the Armada Strategic Intelligence System, a tool for durable goods manufacturers that dives deep into the sector each month to provide more than 95% accurate near-term forecasts.

17 Manufacturing Outlook / February 2023 continued NORTH AMERICA OUTLOOK

FEBRUARY 2023

South America Outlook

by Royce Lowe

Turmoil Will Slow Its Growth

South America is having more than its share of turmoil these days. Latin America has long been a favored destination for major mining companies as a reliable source of metals, particularly copper. But more and more it’s becoming a trouble spot. Chile’s raising taxes, Peru’s in social unrest. All is not well. The problem seems to be clear enough. State infrastructure, pensions, education and health care left much to be desired in much of the region, even before the pandemic that exposed deep inequities.

Inflation, still high, is making a bad situation worse, and governments have made expensive promises they’re now under pressure to fund. Social and environmental concerns are also top of the agenda in local communities.

It’s not just copper that’s causing the rumpus. Chile, whose president was elected with a green agenda, last week rejected a $2.5 billion iron-ore project near a nature reserve in the north and is creating a state company to unlock its lithium potential.

But concern focuses on copper production in a region where three countries alone -Chile, Peru and Mexico - account for roughly two-fifths of global reserves. Major copper mines are already involved in Peru’s upheaval. All this, plus optimism around demand as China reopens, plus low inventories, and it’s no wonder copper is trading near its highest levels in over seven months.

Chile’s state-owned giant Codelco, messed around for years by successive governments, is an extreme continued

18 Manufacturing Outlook / February 2023

SOUTH AMERICA OUTLOOK

example. Last year, it produced 10% less copper than planned due to operational setbacks, and its chairman has said keeping output steady is a “tremendous challenge.” Other miners in the country have also reported shortfalls, blaming low grades and drought.

The situation in these key mining jurisdictions will only be aggravated as Latin America settles into a period of sluggish growth. Peru faces an institutional crisis, while Chile still has major tax and constitutional questions to resolve. We may be only at the start of a new wave of popular disruption and resource nationalism with which miners - and the wider world - will have to contend.

Unrest has rattled Peru since the ouster and arrest of former President

Pedro Castillo, upending commodity supply chains from metals to organic coffee. The disruption comes at a particularly precarious moment for copper markets. Inventories stand at historically low levels while mining companies warn demand for the metal is poised to skyrocket with the growing electrification of vehicles.

Base metal prices have been on the rise since New Year’s after China, a top consumer, abruptly abandoned Covid-19 controls. Goldman Sachs Group Inc. predicts ongoing deficits and forecast a record price of $11,000 a ton for copper within 12 months. Strategic competition between the U.S. and mainland China, and a renewed global push for energy transition, are key potential drivers of new business opportunities in Latin America in the five to ten-year outlook.

An S&P Global Market Intelligence open-source review of 141 investment pledges made by firms investing in the South American region during January-October 2022 highlights how firms from China, South Korea, Japan, and Australia are increasingly positioning themselves in the region. Mining attracted most investment pledges, followed by hydrocarbons, automotive, and telecommunications. Over the five-year outlook, renewable energies, critical minerals, and advanced manufacturing should gain prominence.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

19 Manufacturing Outlook / February 2023

continued SOUTH AMERICA OUTLOOK Forging Deliveries Got You Down? How About 8-10 Weeks? U.S. (973) 276-5000 Toll Free (800) 600-9290 Canada (416) 363-2244 STEELFORGE.COM • SALES@STEELFORGE.COM ISO 9001/AS 9100D Registered ALLOY • CARBON • STAINLESS • TOOL STEEL NICKEL • ALUMINUM • TITANIUM

FEBRUARY 2023

AFRICA OUTLOOK

by Royce Lowe

by Royce Lowe

Manufacturing in Africa

When we think of manufacturing, Africa is not the first region that comes to mind. With just over 1.4 billion of population, it represents just under 2% of global manufacturing. Countries in Africa are rated by an industrialization index based on, among other parameters, manufacturing performance, capital, labor, business environment, infrastructure, and macroeconomic stability. As measured by this index, the top ten countries on the continent are South Africa, Morocco, Egypt, Tunisia, Mauritius, Eswatini, Senegal, Nigeria, Kenya, and Namibia.

The number one country, South Africa, saw its manufacturing production fall by 1.1% from a year earlier in November of 2022, following a 1% rise in the prior month and compared with market forecasts of a 2.3% decline. It was the first monthly decline in the country’s factory activity after four consecutive

months of increases as sustained and intense power cuts continued to weigh on the sector. Output fell in almost all sub-activities, notably electrical machinery (-6.9%); textiles, clothing, leather and footwear (-6%); wood and wood products, paper, publishing and printing (-4.5%); food and beverages (-2.5%) and petroleum, chemical products, rubber and plastic products (-2.5%). Conversely, production rose solidly for motor vehicles, parts and accessories and other transport equipment (13.4%). On a seasonally adjusted monthly basis, manufacturing output rose by 2% in November, rebounding from a downwardly revised 6.2% slump in the prior month and against market estimates of a 1.1% decrease.

Food and beverages, petroleum and chemical products, and basic iron and steel products represent almost 70% of the country’s total manufacturing industry. The

country’s manufacturing output is on the order of $50 billion, and this represents some 12% of its GDP. The latest news from South Africa suggests that its manufacturing industry is not in the greatest shape. Power cuts plague the national grid, and the mining company Seriti Resources, a top thermal coal supplier to the struggling state power utility Eskom, is investing in wind power in the latest move by industry to wean itself off the national grid. Foreign Direct Investment (FDI) seems to be currently propped up by Britain and France.

As mentioned, the biggest piece of manufacturing in South Africa comes from the Food and Beverages industry. Six of the top ten companies are in this field, with Coca Cola being the fourth. ArcelorMittal is in there with building materials, and another company produces industrial machinery and equipment.

20 Manufacturing Outlook / February 2023 AFRICA OUTLOOK continued

South Africa doesn’t produce very much steel for a country with a population of some 60 million, around 6.5 million tons at last count. In 2021, the country imported some 1.7 million tons, or about a third of what it consumes. All this is to say that the country is somewhat lacking in producing heavy equipment. Besides imports of steel, reduced infrastructure spending, which has decreased demand for steel, is identified as a key challenge facing the domestic steel value chain.

The infrastructure and buildings sector accounts for over 60% of domestic steel consumption.

South Africa needs Foreign Direct Investment (FDI). It needs to fix up its steel production-import mix. The

country is not really “well.”

China has been actively investing in Africa over the last 20 years and put together funding packages that had some devastating claw-back hooks in them. When the local government could not pay back the Chinese, the entire development and land reverted to Chinese ownership and control. Several African nations were quick to jump at these opportunities for infrastructure, including roads, railroads, dams, airports, and sea ports, believing some kind of magical economic transformation would take place as a result which would allow them to cover the long-term bet.

Almost all of the “deals” failed to produce the gains to cover the bet, and some significant infrastructure

ownership reverted to China, giving them a foothold in countries for mining, transportation, airports, and sea ports. However, significant resistance kicked up, and China has since worked out other arrangements, although it still maintains key ports that give it a presence on Africa’s east coast and the Atlantic ocean. We will follow the continent’s progress, or lack thereof, and various countries within it with great interest in future issues.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

21 Manufacturing Outlook / February 2023 AFRICA OUTLOOK

*Toll free within the U.S. * ISO9001:2015 SINCE 1994 AND AS9100D SINCE 1998 NIST SP 800-171 (COMPLIANCE UNDER DEVELOPMENT)

EUROZONE

by Chris Anderson

by Chris Anderson

Flash PMI data for January forecasts the Eurozone manufacturing PMI at 48.8, versus 47.8 for December, with the corresponding manufacturing production index at 49.0 versus 47.8 for December. These numbers were, in fact, verified. All eight major European economies saw an increase in PMI (to a 5-month high.) A marginal rise in business activity suggests a tentative return to growth after six months of decline. Business confidence jumped higher, with order books showing reduced rates of contraction. The composite PMImanufacturing and services - was up for the third consecutive month, from 49.3 in December to 50.2 in January. There was a pick up in employment, and firms are preparing for a year ahead better than previously expected.

There is an air of optimism presently in the Eurozone manufacturing - and services - sector. The order books show reduced rates of contraction, while input cost inflation cooled further thanks to alleviation of supply chain stress, but the average selling price inflation for both goods and services went slightly higher. It is boiling down to the first expansion in business activity since last June.

Manufacturing production contracted modestly, showing the smallest drop in factory production since last June. This optimistic sentiment was apparent in both manufacturing and services, across France, Germany, and the rest of the Eurozone as a whole. This good news led to additional hiring. Supply chain pressures eased, energy prices fell, the weather was warmer than usual, and governments chipped in with assistance.

While all the data seem to be “teetering on the edge” the overall news is encouraging. A renewed slide

into contraction should not be ruled out as borrowing costs rise, but the survey brings welcome good news to suggest that any downturn is likely to be far less severe than previously feared and that a recession may well be avoided altogether.

Car registrations in Western Europe came in at 10.15 million for the year 2022, with sales for the year down 4.1% compared to 2021. Registrations for 2022 were up 16.5% year- over-year. n

23 Manufacturing Outlook / February 2023 EUROZONE OUTLOOK

GLOBAL OUTLOOK

EMPLOYMENT SITUATION SUMMARY

From the Bureau of Labor Statistics

Total nonfarm payroll employment rose by 517,000 in January, and the unemployment rate changed little at 3.4 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Employment also increased in government.

This news release presents statistics from two monthly surveys. The household survey measures labor force status, including unemployment, by demographic characteristics. The establishment survey measures nonfarm employment, hours, and earnings by industry.

Changes to The Employment Situation Data

Establishment survey data have been revised as a result of the annual benchmarking process, the NAICS 2022 conversion, and the updating of seasonal adjustment factors. Also, household survey data for January 2023 reflect updated population estimates.

Household Survey Data

Both the unemployment rate, at 3.4 percent, and the number of unemployed persons, at 5.7 million, changed little in January. The unemployment rate has shown little net movement since early 2022.

Among the major worker groups, the

unemployment rates for adult men (3.2 percent), adult women (3.1 percent), teenagers (10.3 percent), Whites (3.1 percent), Blacks (5.4 percent), Asians (2.8 percent), and Hispanics (4.5 percent) showed little change in January.

The number of persons jobless less than 5 weeks decreased to 1.9 million in January. The number of long-term unemployed (those jobless for 27 weeks or more) was essentially unchanged at 1.1 million. The long-term unemployed accounted for 19.4 percent of the total unemployed in January.

In January, both the labor force participation rate, at 62.4 percent, and the employment-population ratio, at

24 Manufacturing Outlook / February 2023 MANUFACTURING TIDBITS continued

FEBRUARY 2023

60.2 percent, were unchanged after removing the effects of the annual adjustments to the population controls. These measures have shown little net change since early 2022 and remain below their pre-pandemic February 2020 levels (63.3 percent and 61.1 percent, respectively).

The number of persons employed part-time for economic reasons, at 4.1 million, was little changed in January. These individuals, who would have preferred full-time employment, were working part-time because their hours had been reduced or they were unable to find full-time jobs.

The number of persons not in the labor force who currently want a job was 5.3 million in January, little changed from the prior month. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force, at 1.4 million, changed little in January. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, was also little changed over the month at 342,000.

Establishment Survey Data

Total nonfarm payroll employment rose by 517,000 in January, compared with an average monthly gain of 401,000 in 2022. Job growth was widespread in January, led by gains in leisure and hospitality, professional and business services, and health care. Employment also increased in government, partially reflecting the return of workers from a strike.

Leisure and hospitality added 128,000 jobs in January compared with an

average of 89,000 jobs per month in 2022. Over the month, food services and drinking places added 99,000 jobs, while employment continued to trend up in accommodation (+15,000).

Employment in leisure and hospitality remains below its pre-pandemic February 2020 level by 495,000, or 2.9 percent.

In January, employment in professional and business services rose by 82,000, led by gains in professional, scientific, and technical services (+41,000). Job growth in professional and business services averaged 63,000 per month in 2022.

Government employment increased by 74,000 in January. Employment in state government education increased by 35,000, reflecting the return of university workers after a strike.

Healthcare added 58,000 jobs in January. Job growth occurred in ambulatory healthcare services (+30,000), nursing and residential care facilities (+17,000), and hospitals (+11,000). In 2022, healthcare added an average of 47,000 jobs per month.

Employment in retail trade rose by 30,000 in January, following little net growth in 2022 (an average of +7,000 per month). In January, job gains in general merchandise retailers (+16,000) and in furniture, home furnishings, electronics, and appliance retailers (+7,000) were partially offset by a decline in health and personal care retailers (-6,000).

Construction added 25,000 jobs in January, reflecting an employment gain in specialtytrade contractors (+22,000). Employment in the construction industry grew by an average of 22,000 per month in 2022.

In January, transportation and warehousing added 23,000 jobs, the same as the industry’s average monthly gain in 2022. Over the month, employment in support activities for transportation increased by 7,000.

Employment in social assistance increased by 21,000 in January, little different from the 2022 average gain of 19,000 per month.

Manufacturing employment continued to trend up in January (+19,000). In 2022, manufacturing added an average of 33,000 jobs per month.

Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; wholesale trade; information; financial activities; and other services.

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3 percent, to $33.03. Over the past 12 months, average hourly earnings have increased by 4.4 percent. In January, average hourly earnings of privatesector production and nonsupervisory employees rose by 7 cents, or 0.2 percent, to $28.26.

The average workweek for all employees on private nonfarm payrolls rose by 0.3 hour to 34.7 hours in January. In manufacturing, the average workweek increased by 0.4 hour to 40.5 hours, and overtime increased by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.2 hour to 34.1 hours.

The change in total nonfarm payroll employment for November was revised up by 34,000, from +256,000 to +290,000, and the change for December was revised up by 37,000, from +223,000 to +260,000. With these revisions, employment gains in November and December combined were 71,000 higher than previously reported. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors. The annual benchmark process also contributed to the November and December revisions.). n

25 Manufacturing Outlook / February 2023 MANUFACTURING TIDBITS

FEBRUARY 2023

ASIA OUTLOOK

by Christine Casati

TRADING AND SECURITY IN ASIA: BEHIND THE SCENES SNAPSHOTS

Australia-China Trade Thaw and Security Concerns

Australia and China have been major trading partners for decades and formally established diplomatic ties in 1972. But the past three years have been fraught with tensions over

Australia’s direct criticism of China’s human rights record, retention of Australian citizens, aggressive military posturing in the Asia Pacific, and lack of transparency over the origin of Covid-19. Australia also banned 5G network projects with

China’s Huawei, following the U.S. This resulted in China’s unofficial bans on Australian coal, wine, beef, and other commodities. At one point, there were boatloads of Australian coal clogging up Hong Kong’s ports. In late November 2022, after securing continued

26 Manufacturing Outlook / February 2023

ASIA OUTLOOK

his third term, President Xi invited Foreign Minister Penny Wong to visit Beijing on December 20 to celebrate the 50th anniversary of their official ties. This was the first such state visit since 2019, after Xi’s brief meeting with Prime Minister Albanese on the sidelines at the G20 Summit in Indonesia.

The outcome so far has been some relaxation in allowing coal imports by select companies, which China needs during an uncommonly cold winter in Northeast China while it faces natural gas shortages. Some wine and lobsters have also been permitted, no doubt in time to satisfy yearnings for the first time in three years during the Chinese Lunar New Year celebrations. The lifting of Covid restrictions will help facilitate normalization of regular trade flows. But any further relaxation of trade bans still in place will likely take time due to the complications of Asia Pacific security concerns on both sides.

It is notable that Australia is the world’s largest exporter of lithium, and China buys most of it. Lithium imports to China have never been banned. In 2021, 85% of Australia’s total lithium exports went to China. In 2022, China accounted for 94%. Lithium exports are set to contribute $9.4 billion to Australia’s economy by mid-2024 (ABS Australia Bureau of Statistics). Australian exports of lithium are primarily in the form of spodumene concentrate. Several mines are starting to produce another form, lithium hydroxide. And as demand for China’s lithium battery-charged electric vehicles (BEVs) continues to surge worldwide, this trend will continue.

Australia is using foreign direct investment and aid to counter both China’s growing influence, and the

climate change threats in the Pacific Islands. The island of Fiji and many other far-flung island nations in the Indo-Pacific are facing potential catastrophic sea level rise, storm surges, and saltwater damage to freshwater aquifers. For these “coastal megacities” to survive, they need financial resources to prepare using newer technologies. The only alternative would be migration.

In May 2022, China introduced a sweeping 5-year trade and security pact for the island nations of Fiji, Samoa, Tonga, Kiribati, Papua New Guinea, Vanuatu, Solomon Islands, Niue, and the Federated States of Micronesia, who so far have not reached consensus agreement. Australia, the U.S., Japan, and New Zealand are worried about the regional consequences of the agreement and China’s establishing a military presence close to Australia, especially after Solomon Islands separately signed its own security agreement with China in April. China has condemned the attempts

of allies to influence the agreement. Australia is taking other steps to help these nations develop the regional architecture they need to survive, and has established a visa program for those who wish to migrate

Russia: Daily Trains of Precious Cargoes From China To Europe

It is ironic that while confronting the security threats posed by Russia’s invasion of Ukraine, Europe needs freight trains to cross Russia from China for the supply of critical rare earths which feed its electric vehicle, semiconductor, military, and strategic metals industries. China supplies over 90% of rare earth requirements to Europe. Competition for Chinese-mined rare earths, such as lanthanum used for armor-piercing ammunition, and tungsten, a heavy metal used for anti-tank weapons made by Thales Air Defence Ltd. and Rheinmetall AG, is heating up. Demand is being driven by the Ukraine-Russian conflict.

According to Bloomberg, two-thirds continued

27 Manufacturing Outlook / February 2023

ASIA OUTLOOK

of identified world reserves are controlled by China and Russia (Source: Tungsten West Plc). 83% of world production of tungsten comes from Chinese mines. At the center of the rail route supplying Western arms manufacturers is Russia. 15 train cars per day carrying these cargoes typically cross the northern Belt and Road route, which begins in Wuhan, China, and ends in Duisburg, Germany, taking 16 days (Ocean freight takes twice as long). So far, Russia has not disrupted this trade route, but they could, or they could increase the costs. The U.S. has not sanctioned rare earths or nickel from either Russia or China. The entire scenario is astonishing. So is the fact that Russia itself does not have the technology to use these rare earths to make chips for smart weapons.

Japan: Expect China Retaliation

For Supporting U.S. Chip Curbs

Japan has recently reversed course and committed to developing its defense sector. It is also one of the world’s major semiconductor equipment manufacturers, along with the Netherlands. China has been a major customer. Now that Japan has agreed to go along with U.S. export controls which basically outlaw the export to China of advanced semiconductor equipment produced outside the USA,

Japanese lawmakers are certain of future retaliation against Japanese businesses operating throughout China. We don’t yet know what that will look like. The Biden administration has also banned both software designs and manufacturing processes using U.S. developed technology as a major firewall to prevent China from using it to further their own advanced semiconductor development. Even if the software is pirated, China won’t be able to buy the essential production equipment, nor spare parts, for the equipment they already have. (China is reportedly cutting back on its lavish spending plans for the semiconductor industry in the midst of Covid turmoil, instead turning to EVs and less advanced chip production which is not subject to controls.) The Dutch company ASML which produces the world’s most advanced chip etching equipment has finally agreed to go along with the U.S. and Japan and not sell to China, a former customer, but claims this will not hurt its business.

(Bloomberg 1/26/23)

Renewed Optimism Over China Markets: What To Watch

All eyes are on China, which has the potential to help drive global growth this year, along with India. Worry over potential upward pressure on inflation due to increasing Chinese

demand for commodities has been tempered by positive developments and market optimism in many sectors, including EVs, Solar, Asian chip stocks, Platform, Casino and Luxury sectors. Softening demand for export freight services has lowered the cost of shipping a 40-foot container from China to the U.S. West Coast from more tham $10,000 just a year ago to $1323, the lowest since March 2020. (Freightos index of rates 1/25/23)

U.S. consumers will hopefully see lower prices at Target, Walmart, Home Depot, etc. by summer as a result. And China’s isolation over the past few years has created its own huge potential domestic market. Chinese consumers are increasing demand for internet and travel services, not just personal consumption.

The Chinese government is increasing support for private businesses, attempting to reverse the damage from nearly three years of lockdowns and business closures. They have a lot to do to win back the faith and favor of the middle class. And in light of declining population rates which are now impossible to reverse, as well as surveys showing that a high percentage of women do not want to have children in the current environment in spite of all the government perks, China needs to rethink its national goals and purpose in the world, with more focus on what the people want and need, such as reduced censorship and improved health care, and less on achieving the pipe dream of global economic dominance.

Author profile: Christine is cofounder and President of China Human Resources Group, Inc, a management consulting firm based in Princeton NJ. She has provided U.S. companies with strategic development and project implementation services for projects in China since 1986. n

28 Manufacturing Outlook / February 2023

ASIA OUTLOOK

29 Manufacturing Outlook / February 2023 We want your participation. Now interviewing for additional podcast hosts Now interviewing for regular and contributing writers for Manufacturing Outlook ezine New ideas wanted for monthly Manufacturing Talk Radio topics Contact Jacket Media Co. at 973-808-8300 or info@jacketmediaco.com ASIA OUTLOOK

FEBRUARY 2023

AEROSPACE OUTLOOK

by Royce Lowe

Fighters, the FAA Again, and Taxis

Australia, Belgium, Czech Republic, Denmark, Greece, Israel, Italy, The Netherlands, Norway, Poland, South Korea, Switzerland, and the U.K. are already operating, or awaiting delivery of, different variants of the Lockheed-Martin F-35A fighter jet. Germany and Finland hopped aboard the list in the last 13 months.

Now Canada has come forward with an order for 88 F-35As for which it will pay $14.2-billion (C$19-billion), with deliveries expected to begin in 2026. The deal includes the cost of outfitting two Royal Canadian Air Force bases (Cold Lake, Alberta., Bagotville, Quebec.) to house the new aircraft, which are replacing Canada’s fleet of Boeing F-18 fighter jets. Canada chose the F-35 last March over options offered by Boeing and Saab, following a long debate in which the Trudeau government had

opposed the Lockheed selection.

The RCAF’s new fleet could be fully operational by 2032, according to Defense Minister Anita Anand.

The U.S. Federal Aviation Administration (FAA) appointed a new panel of aerospace experts and industry representatives to review safety-management procedures at Boeing Commercial Airplanes, and how those procedures are influencing the OEM’s “safety culture” in the aftermath of two 737 MAX crashes, in 2018 and 2019. Those incidents killed 346 passengers and crew members aboard the Lion Air and Ethiopian Airlines jets, and led to a 19-month shutdown of the 737 MAX program. The panel will have nine months to conduct its inquiry and issue a report, together with any recommendations.

The investigation into the causes of the two crashes focused on the electronic flight control systems of the 737 MAX, which Boeing redesigned before FAA and other safety agencies re-certified the aircraft’s airworthiness, and its return to commercial operations in 2021.

However, the 2019-2020 investigation into the 737 MAX also led to accusations that Boeing had pushed its engineers and safety inspectors to expedite their work on the aircraft in the period leading up to its initial certification, in 2017. Following those allegations, the U.S. Congress passed legislation to strengthen the FAA’s authority over aircraft production and certification processes. The new FAA panel is a product of that Congressional oversight. The panel includes representatives of FAA, NASA, aerospace unions, Boeing

30 Manufacturing Outlook / February 2023 AEROSPACE OUTLOOK continued

rival Airbus, engine builders GE Aviation and Pratt & Whitney, and 737 MAX operators American Airlines, Southwest Airlines, and United Airlines.

Stellantis NV will become a manufacturing partner to start-up Archer Aviation for Archer’s new electric vertical take-off and landing (eVTOL) aircraft, and will invest up to $150 million by 2024. Archer is building a manufacturing plant in Covington, Ga., which is scheduled to be in production by next year.

An eVTOL, which might be described as an urban air taxi, is an electric-powered aircraft able to hover, take-off, and land vertically. The Archer Midnight eVTOL will be powered by lithium-ion battery packs, and is designed to carry up to four passengers, plus a pilot. It will have a range of 100 miles, but will be mostly used for shorter distances.

It will have a short charging time, around 10 minutes. It will be effectively a shuttle craft for service in dense urban areas.

Archer will provide expertise in eVTOL design, electric powertrain and certification, and Stellantis will contribute advanced manufacturing technology and expertise, plus personnel. “The goal is for Stellantis to mass produce Archer’s eVTOL aircraft as its exclusive contract manufacturer,” according to a joint statement. In addition to the capital investment, Stellantis plans to raise its existing stake in Archer through open-market stock purchases, though CEO Carlos Tavares said the automaker would remain a minority stakeholder.

Among the airframe manufacturers involved in different eVTOL projects are Airbus, Boeing, and Embraer, with propulsion systems being

developed by GE Aviation, RollsRoyce, and Pratt & Whitney, among others. Honeywell Inc. is developing avionics technology specific to eVTOL operation.

Automakers involved in the eVTOL sector include Honda, Hyundai, Renault, and Toyota. Commercial airlines also are investors in eVTOLs, including United Airlines: it has committed itself to the Embraer Eve project as well as to Archer Aviation.

In November, Archer and United Airlines announced they will establish the first commercial electric air-taxi route in the U.S., from Manhattan to Newark Liberty International Airport. No launch date was indicated.

Author profile:Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

31 Manufacturing Outlook / February 2023 AEROSPACE OUTLOOK

FEBRUARY 2023

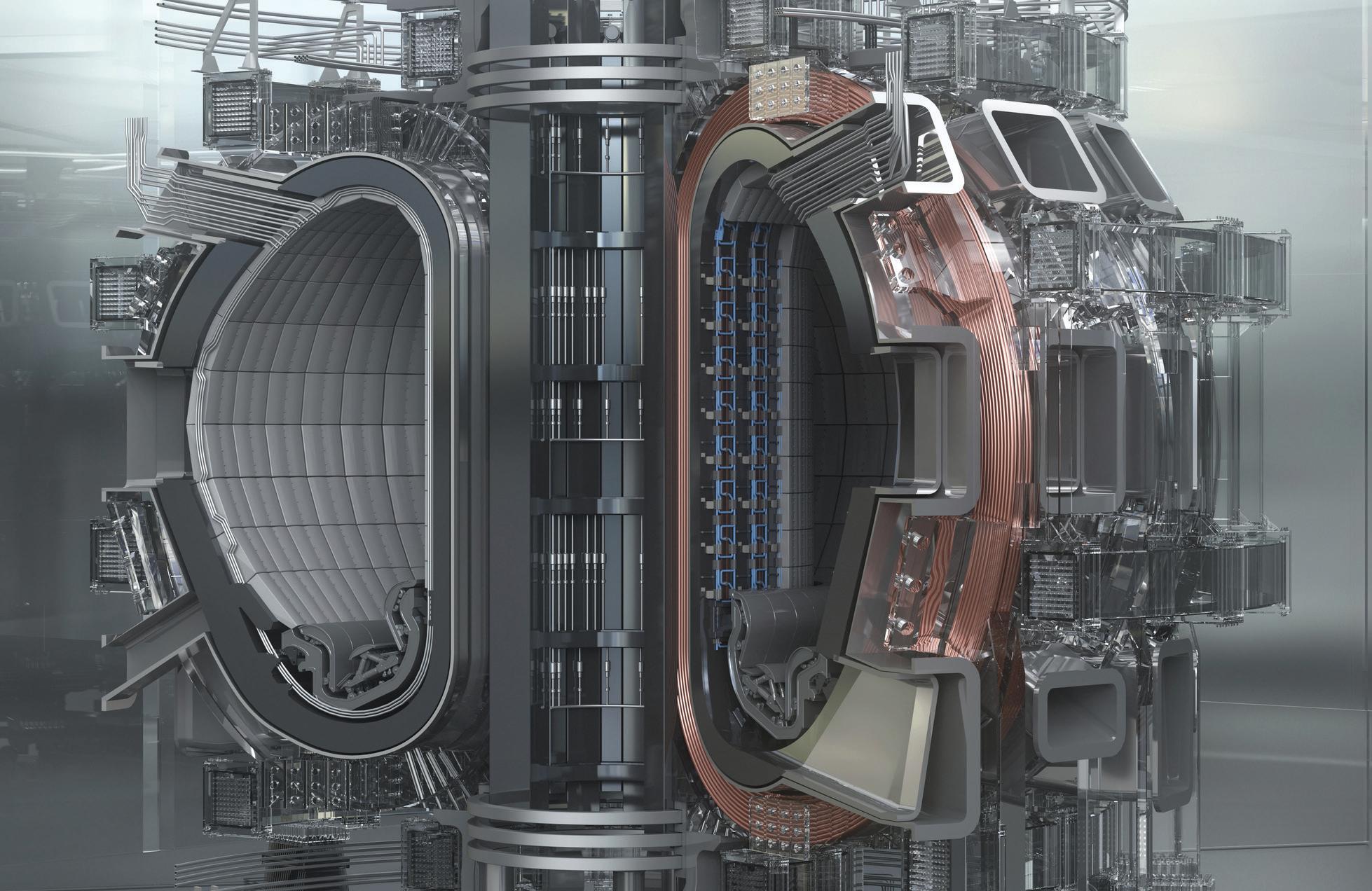

ENERGY OUTLOOK

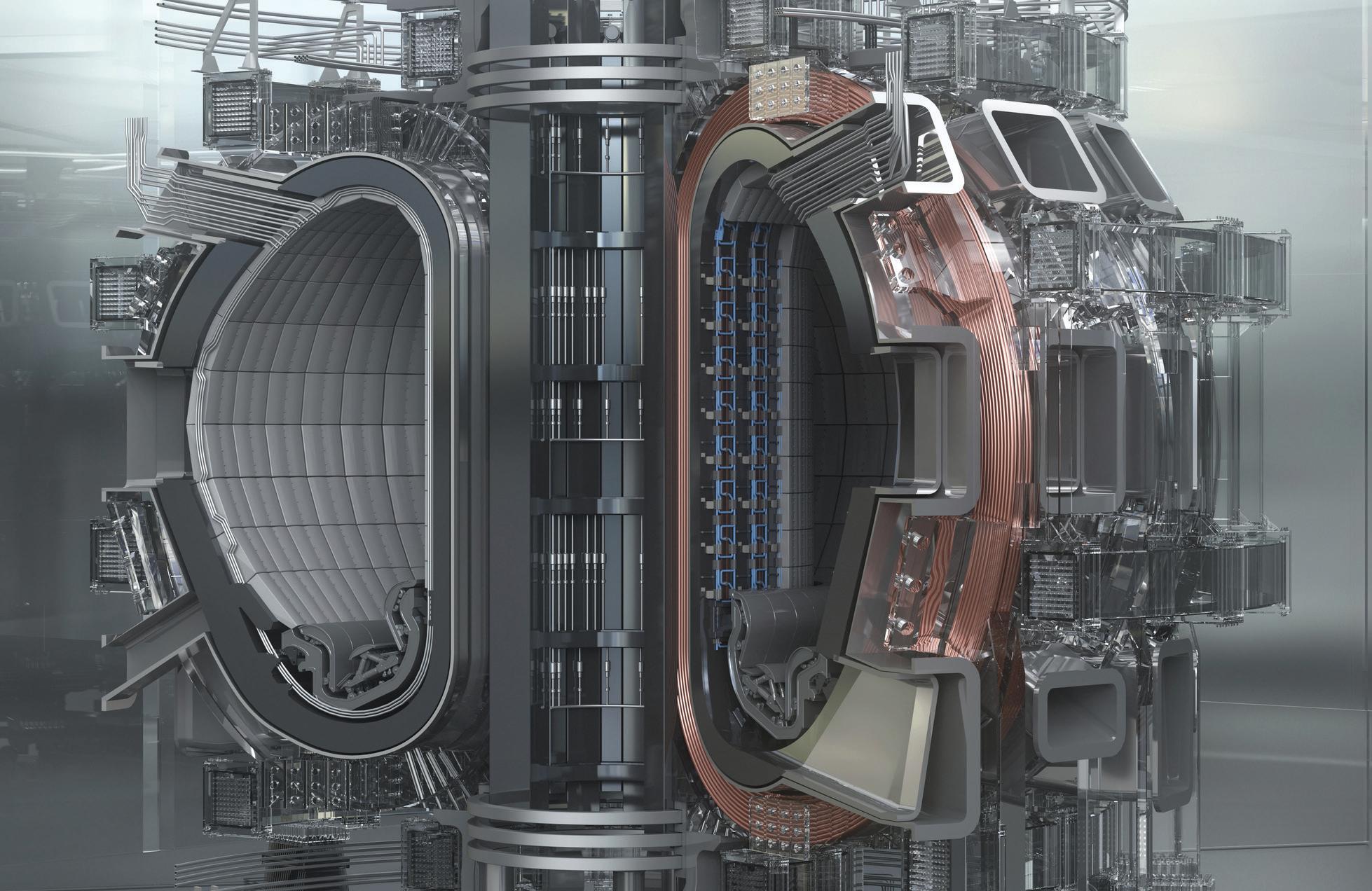

Small-Scale Nuclear Power

by Royce Lowe

Rolls-Royce is evaluating potential sites in the UK, specifically England and Wales, for its Small Modular Reactor (SMR) nuclear power concept, which it claims can provide the nation with a net-zero-carbon option for energy independence.

The SMR concept centers on low-cost, factory-built nuclear power stations with at least 440 MW of electrical energy-generating capacity. The plants’ compact scale would allow easier, lower-cost manufacture of the

SMRs at existing production sites, and transported to the installation sites.

Rolls-Royce is looking at an initial construction of four SMR plants, each with an estimated cost of $2.45 billion (£2 billion.) The regulatory approval process has been initiated, and is due for completion in mid-2024. RR had the backing of businesses and the UK government in 2020 to establish a series of SMRs in Britain by 2030. The government, at the time, provided $546 million in funding in 2021 for

Rolls-Royce to advance the nuclearenergy concept.

The present government, however, is not fully committed to the SMR program. Financial support is needed for the project along with regulatory clearance. It is more than likely that the government will fall in line with the project in the not-too-distant future. Britain draws 13% of its electricity from nuclear power plants, most of which are nearing the end of their lifecycles.

32 Manufacturing Outlook / February 2023 ENERGY OUTLOOK

continued

The U.S., meanwhile, is moving ahead somewhat faster with its SMR program. The Nuclear Regulatory Commission (NRC) recently certified the design for the country’s first-ever small modular nuclear reactor, and established a rule allowing the socalled “NuScale reactor” to be used within the U.S. beginning on Feb. 21, 2023. This is a green light for companies to construct reactors that require less space, capital, and labor than their conventional counterparts.

The design is courtesy of Oregonbased NuScale Power, which has been working to certify a small modular reactor (SMR) design since 2007. At the NuScale’s core are up to 12 power modules, or natural circulation light water reactors that each consist of a reactor core, a pressurizer, and two steam generators housed in steel. Each of these power modules generates 160 megawatts of thermal output (MWt) and 50 megawatts of electrical output (MWe). The lower portion of each power module is submerged in a below-ground pool that functions as a heat sink, thus precluding the need for emergency diesel generators for power outages, or water injectors to cool the reactor after an accident.

Proponents of SMRs argue that these factors, along with SMRs’ alleged safety benefits, make designs like the NuScale vital to the country’s

increased efforts to attain carbonfree energy. SMRs rely more on passive safety systems and built-in leak-prevention mechanisms than do conventional reactors, which means there’s less room for human error in the case of an emergency. SMRs’ smaller dimensions means they’re less susceptible to damage during earthquakes and other natural disasters. The NuScale, in particular, surrounds its power modules with 4.6-meter-wide steel vessels, which can withstand far greater pressure than the 40-meterwide concrete containment vessels found in the average power plant.

Not all are in favor. A Stanford University study from last year found that SMRs will probably add fuel to existing nuclear waste concerns. A conventional nuclear power plant produces radioactive waste that has to be isolated for hundreds of thousands of years. SMRs could end up increasing the volume of this waste “by factors of 2 to 30,” requiring more management and disposal than the U.S. currently has plans for. Some scientists feel that the waste problem alone negates SMRs’ other benefits.

In any event, the NRC’s new rule will allow nuclear power plant operators to pursue construction of the NuScale reactor and apply for a corresponding license with the NRC next month.

Because the reactor is officially certified for use, third parties will not be able to legally challenge individual license applications. NuScale, meanwhile, is beginning the approval process for a larger SMR design capable of 77 MWe per module.

Having reported last month on the excellent job Sophie Brochu is doing as the head of Hydro-Québec, we can report this month that she will leave the job this coming April 11. Brochu, one of Canada’s most prominent female business executives, will leave after three years in the job, the company said Tuesday. “Sophie’s contribution — marked by her human approach, strong communication skills and vast experience in the energy sector — will stand the test of time,” Chair Jacynthe Côté said in a statement.

Within Quebec, tensions had been building between Brochu and the government of Premier Francois Legault over how to deploy Quebec’s vast renewable-power capacity as a lure for industrial development in the province of 8.8 million people. Brochu had said in media interviews that she was concerned about putting too much pressure on energy supply.

“I spoke with Sophie Brochu and we share the same goal, to ensure that Hydro-Quebec evolves in an orderly fashion for the benefit of all Quebeckers,” Legault said in October after appointing Pierre Fitzgibbon to an expanded role as minister of economy, innovation, and energy.

In her statement, Brochu made no reference to disagreement with the government.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook . n

33 Manufacturing Outlook / February 2023

ENERGY OUTLOOK

FEBRUARY 2023

MATERIALS OUTLOOK

Green Aluminum; the Future Way?

by Royce Lowe

As some know, aluminum comes originally from bauxite, an ore that contains aluminum hydroxide, silica, and iron ore. The first step in aluminum production is the formation of alumina, or aluminum oxide, from bauxite. It takes 4 to 5 tons of bauxite to produce 2 tons of alumina, then 2 tons of alumina to produce a ton of aluminium. World reserves of bauxite are estimated at some 30 billion tons, so we’re not likely to run out soon. Guinea, Vietnam, Australia, and Brazil, in that order, account for some 21 billion tons of reserves.

Production of aluminum from alumina takes an awful lot of electricity, which is why the province of Québec was chosen in the seventies by companies from Canada and abroad to produce the metal. Québec’s electricity comes from hydro, from the James Bay project way up north in the province. Hence, the electricity is both cheaper and cleaner. But the process of taking the oxygen out of the alumina, and the gas’s combination with the carbon anode in the electrolysis process, leaves a serious carbon footprint.

Production of aluminum is based on

the electrolytic reduction of alumina, which, as mentioned, is an energy intensive process (about 13-16 kWh per kg aluminum) and produces significant emissions of greenhouse gases, mainly direct process emissions from CO2 and PFCs, and indirect emissions from electricity production. The HallHeroult electrolytic process that was developed in the late 19th century still forms the cornerstone of the aluminum production process. Most of today’s aluminum production facilities use carbon anodes that are dipped into an iron vessel or ‘pot’ that functions as a cathode and contains cryolite (sodium aluminum fluoride) and alumina. The

34 Manufacturing Outlook / February 2023 MATERIALS OUTLOOK

continued

electrical energy that runs through the anode initiates and continues the smelting process, where the molten aluminum thus produced is tapped for casting and further processing. Some 3% of global electricity supply is consumed by the extraction of aluminum. And that’s for a mere 60 million tons. Just under 1% of total global greenhouse gas emissions come from the process.

Primary aluminum production consumes about 20 times more energy than recycled aluminum. Electricity consumption constitutes roughly onethird of the production costs, hence reducing electricity consumption is one of the industry’s R&D priorities. Aside from recycling, several technologies to improve the performance of the aluminum production process are available, such as the use of inert anodes, instead of the conventional carbon anode. Inert anode technology is seen as one of the more promising options for the industry for the years to come.

When carbon or consumable anodes are used, the reaction frees up the oxygen present in the alumina, but it immediately reacts with the carbon from the anode to form CO2. The

process as such consumes over 400 kg of carbon anodes per ton of aluminum. Using inert (or non-consumable) anodes avoids the formation of CO2, so that only pure oxygen is produced as a by-product. If successfully developed and applied, inert anode technology could have significant energy, cost, productivity, and environmental benefits for the aluminum industry worldwide. When combined with other advances in electrolytic cell design, the technology should achieve even greater benefits.