Brought to you by www.jacketmediaco.com The Manufacturing & Business Podcast Network LISTEN TO OUR PODCASTS AT: OUR PODCASTS: JULY ISM PMI: 46.4% Released August 1s -The Full Executive Summary Report On Business - Page 14 [ Soaring Into The Future: FAA Approves First Flying Car FEATURE STORY: THE KEY TO THE FUTURE FOR MANUFACTURERS IS IN THE PAST PAGE 10 CASS INDEX OUTLOOK PAGE 12 PAGE 8 AFRICA OUTLOOK PAGE 24 CYBER SECURITY OUTLOOK PAGE 40

3 Manufacturing Outlook /August 2023 Forging Deliveries Got You Down? How About 8-10 Weeks? U.S. (973) 276-5000 Toll Free (800) 600-9290 Canada (416) 363-2244 STEELFORGE.COM • SALES@STEELFORGE.COM ALLOY • CARBON • STAINLESS • TOOL STEEL • NICKEL • ALUMINUM • TITANIUM ISO 9001 SINCE 1994 AS 9100 SINCE 1998

4 Manufacturing Outlook /August 2023 © 2023 All Metals & Forge Group LLC. No part of this publication may be reproduced or used in any form without the prior written permission of the publisher. Manufacturing Outlook is a registered trademark of All Metals & Forge Group LLC. Publisher LEWIS A WEISS Editor in Chief TIM GRADY Creative Director CRAIG ROVERE Contributing Writers ROYCE LOWE TIM GRADY CHRIS KUEHL CHRIS ANDERSON CHRISTINE CASATI KEN FANGER VINCE SASSANO Production Manager LINDA HOPLER Advertising ADVERTISE@MFGTALKRADIO.COM Editorial Office JACKET MEDIA CO. 75 LANE ROAD FAIRFIELD, NJ 07004 (973) 808-8300 TABLE OF CONTENTS Recession Is Unlikely In 2023 By Lewis A. Weiss PUBLISHER’S STATEMENT 5 The Global South Part 3: Focus On India By Christine Casati ASIA OUTLOOK 28 Composites in Aerospace By Royce Lowe AEROSPACE OUTLOOK 32 Turbine Troubles By Royce Lowe ENERGY OUTLOOK 34 Not doing well, with Europe bringing up the rear. India doing well. By Royce Lowe GLOBAL MANUFACTURING OUTLOOK 6 The Compliance Conundrum: Cybersecurity Compliance Should Be Your Company’s Culture By Ken Fanger CYBER SECURITY OUTLOOK 40 ISSUES OUTLOOK 42 Neighbor up North by Royce Lowe MATERIALS OUTLOOK 36 Nickel, From Land And Sea By Royce Lowe Open call for... Contributing Writers for new and existing content. Let’s start a conversation –Contact us at info@jacketmediaco.com ISM MANUFACTURING REPORT ON BUSINESS 14 The Manufacturing PMI Is 46.4% 8 COVER STORY: SOARING INTO THE FUTURE: FAA APPROVES FIRST FLYING CAR FEATURE STORY: By Tim Grady by Cass Transportation Systems CASS INDEX OUTLOOK 12 THE KEY TO THE FUTURE FOR MANUFACTURERS IS IN THE PAST By Vince Sassano 10 Waymo and Cruise - Backseat Driving By Royce Lowe AUTOMOTIVE OUTLOOK 38 NORTH AMERICAN OUTLOOK • UNITED STATES • CANADA • MEXICO 18 By Dr. Chris Kuehl What Recession? LATIN AMERICA OUTLOOK 22 Who’s Listening? by Royce Lowe Helping Africa By Royce Low AFRICA OUTLOOK 24 TRY OUR SUBSCRIPTION FOR FREE Definitely in a Recession that Will Impact Trade By

EUROZONE OUTLOOK 27

Chris Anderson

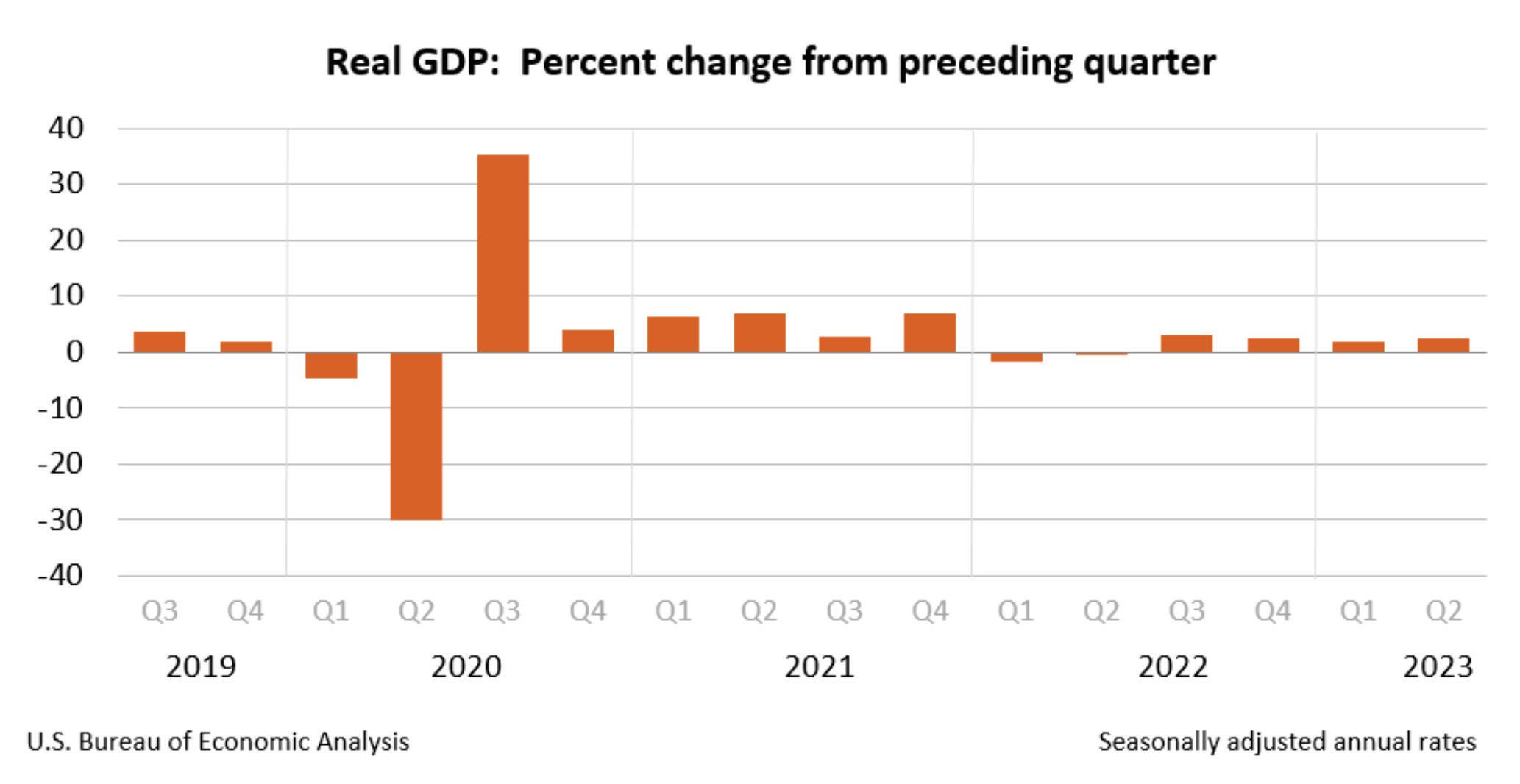

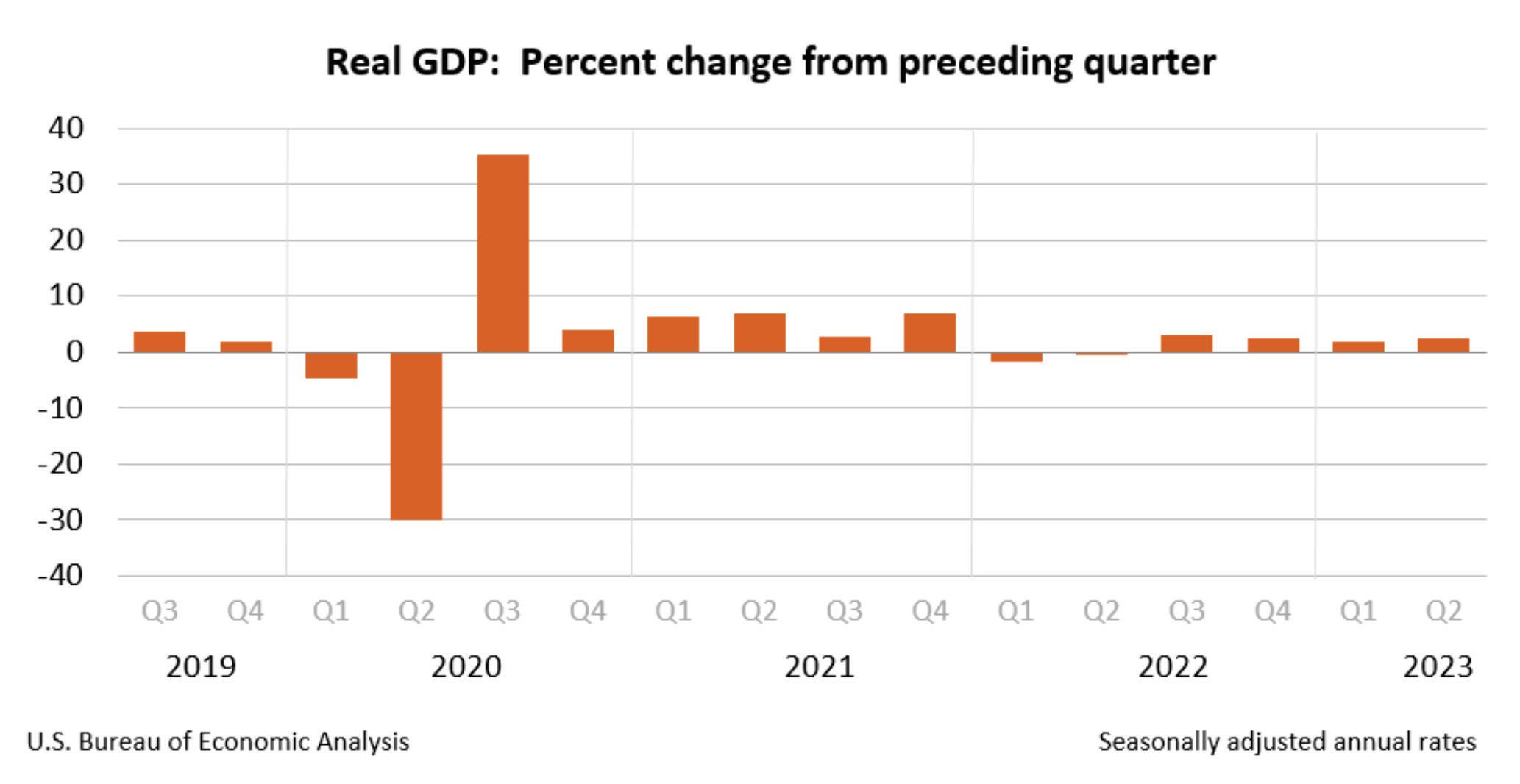

Recession is Unlikely in 2023

Over the last 18 months, we have talked about every possible recession scenario that prognosticators were forecasting. Instead of a recession, what has transpired is a slowing yet growing economy. The adjusted GDP for Q1 was 2.0. The first reading for Q2 is 2.4. Q3 looks like 2.0 and Q4 at 1.8, or just over 2.0 percent for the year. For a year that was expected to be weak or even recessionary, 2 percent annual growth is quite respectable.

Unless the Fed overcompensates for cooling inflation, consumers get nervous because some job openings are being sidelined as new hiring is frozen and attrition reduces headcount, or some geopolitical event spins out of control, the balance of 2023 will be good – not great, but certainly not negative. It seems likely that 2024 will do about the same.

The latest discussion on the Manufacturing Talk Radio Podcast with Tim Fiore, Committee Chair for the ISM’s Report on Business®, centered around a possible bottom for the Purchasing Manager’s Index, with companies increasing their inventories a bit, moderating their headcount, and experiencing a slight uptick in New Orders. The report didn’t reflect any serious warnings of a recession. Although some sectors showed weakness, others showed strength. Overall, it was a good report in the face of previous predictions.

This is encouraging news. Manufacturers have been retooling their operations with modern software, plant expansions or upgrades, and any other efficiencies they could garner before staff reductions. This has put them in a strong position to retain skilled labor to respond to new orders. Unless the economy does a dramatic downshift, manufacturers are geared to be right where they need to be. Their next steps will be to retain customers and hunt for new ones through cost-effective marketing, such as social media and website traffic improvements.

The Outlook may be tepid for the balance of 2023, but it isn’t dire. Most of manufacturing will have a good year. This is the kind of environment to invest in training and cross-training of staff. One resource for effective training programs is the Academy of Business Training, headed by Mark Fleming, who removed the three biggest bugs that make training programs ineffective. You can hear that discussion on the Manufacturing Talk Radio Podcast at https://www.youtube. com/watch?v=NOpPiajpD7c&t=5s. Visit the growing library of helpful episodes at https://www.youtube.com/@ Mfgtalkradio. Search for a keyword or phrase to benefit from nearly 10 years of weekly manufacturing-related content.

With a 2023 recession off the table, manufacturers should be relieved. However, there is still an air of uncertainty looming over the industry, much of it coming from the cost of implementing regulations and whether more regulations might be created and dropped on various sectors. This is burdensome to all manufacturers, especially small and mid-size companies. Don’t lose sight of the cost of compliance, which gets passed on to us, the consumers. The regulatory outlook may be the gloomiest of all. n

Lewis A. Weiss, Publisher

Contact laweiss@mfgtalkradio.com for comments, suggestions and ideas and guest requests for MFGTALKRADIO.COM podcast or any of our podcasts.

5 Manufacturing Outlook /August 2023

PUBLISHER’S STATEMENT FOLLOW US: TRY OUR SUBSCRIPTION FOR FREE

GLOBAL MANUFACTURING OUTLOOK

By Royce Lowe

By Royce Lowe

The Global manufacturing scene of late has been the victim of falling demand in most of the major economies. This led to caution on the part of manufacturers, with purchasing cut back sharply, inventory destocking, employment broadly flat, and business optimism dipping to a seven-month low. France and Germany are forecasting production to fall over the next 12 months. In the PMI rating, India is still out front, but powerhouse Germany, and Austria, are claiming the last two places.

The global PMI for June was at 48.8, down from May’s 49.6. There is no encouraging news at the moment to suggest an upturn in the situation. That said, both Japan and China showed a manufacturing PMI just above the 50 mark. There is still good demand for Indian-made products both domestically and internationally. India’s PMI for June fell marginally to 57.8 from May’s 58.7. The PMIs for the U.S. and Canada were both below the 50 mark, with further drops in June.

The ASIS intelligence report (https:// asisintelligence.com/) is looking to an approximately 7% drop in the U.S. manufacturing sector over the next months, including primary and fabricated metals, through 2024. This is not a drop of the same magnitude as the COVID drop, nor the 2008 recession drop, but in the short to medium term is considered to be significant. Economist Intelligence is looking for global growth in 2023 of 2.1%, which represents a slowdown. The oil price is expected to remain above $75 USD

6 Manufacturing Outlook /August 2023 MANUFACTURING OUTLOOK

continued

Not doing well, with Europe bringing up the rear. India doing well.

per barrel until 2025. Global inflation will ease in 2023 but will remain high at around 7%. The U.S. Bureau of Economic Analysis’s third estimate for the first quarter GDP was 2.0%. Global steel users are seeing production increase at the fastest rate for several months but a slowing in new order growth. This increase is concentrated in the U.S. and Asia; Europe is showing the sharpest deterioration for three years.

Asia is the only copper user showing an increase in new orders and production at mid-year. Europe and the U.S. are showing a lack of demand. Aluminum’s recent production growth was the highest since February, but new orders are rising at a weaker pace. The upturn was led by the strongest expansion among Asiabased firms for four months, while there was also a renewed rise in the US. The rate of contraction among European users was the steepest since May 2020.

Times are certainly not of the best for most of the world’s major manufacturing nations. The U.S. and Europe are suffering from a lack of demand and, in fact, a tendency for a reduction in employment. Despite all this, a European consensus tells us there is no cause for panic. Non-ferrous metal prices are settling down - the emphasis on the word down. Recent prices, compared with those six months ago, are: Aluminum $1.00 per lb ($1.28); Copper $3.90 per lb ($4.20); Nickel

The Outlook: No telling when Europe’s fortunes will return to favor, and China’s readings are expected to weaken. China’s population decreased in 2022 due to its previous one-child policy which may cause a worker shortage for two decades. Japan is still working through several decades of decline caused in large part by an aging population and zero population growth. Japan has reached a historical turning point. In eight years, it is estimated that the number of women of childbearing age will fall to a point where population decline cannot be reversed. The U.S. is also approaching zero population growth.

Historically, nations that have approached zero population growth or a population decline have experienced a parallel, protracted period of economic decline until birth rates reverse and feed the country with bright, young minds. However, it may take several generations for such a reversal to be achieved. Japan may become an unfortunate case study.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

7 Manufacturing Outlook /August 2023 MANUFACTURING OUTLOOK

$10.00 per lb ($12.00) and Zinc $1.10 per lb (1.50.)

Soaring Into The Future: FAA Approves First Flying Car

By Tim Grady

Before anything was ever manufactured, it was an idea in someone’s head. That dream or idea became a reality through belief, trial and error, and often sheer persistence. What was initially thought of as impossible by others became a reality through the efforts of a determined person and the group they formed to move the idea from theory to practicality.

Imagine a world where commuting through the sky is as commonplace as driving on the roads. In a realm where traffic congestion becomes a distant memory, the concept of distance loses its relevance. While it may sound like something out of a science fiction movie, the future of flying cars is closer than ever.

For decades, flying cars have captured the imagination of visionaries, futurists, and dreamers. Popularized in literature, movies, television, and even cartoons like The Jetson’s, produced by Hanna-Barbera Productions that aired on Saturday mornings on ABC, these vehicles sparked the imagination about personal mobility, transforming how we get from place to place. While the concept has seemed tantalizingly close, several challenges have impeded its realization: technological limitations, regulatory hurdles, and concerns over safety.

However, recent advancements in aerospace technology, artificial intelligence, and electric propulsion have accelerated the development of flying

cars. Industry pioneers and startups have emerged, bringing us closer to the long-awaited revolution in personal transportation. Companies like Terrafugia, Kitty Hawk, and Volocopter have made significant strides in developing prototypes and conducting successful test flights, demonstrating the feasibility and potential of this innovative mode of transportation. In an exciting leap forward, the Federal Aviation Administration (FAA) has approved the first-ever flying car, marking a significant milestone in the evolution of transportation.

The FAA Approval Milestone

On a historic day for transportation, the FAA has granted its first approval

8 Manufacturing Outlook /August 2023 continued COVER STORY

for a flying car, signifying the regulatory authority’s recognition of this emerging technology. Unveiled in October of 2022, California automaker Alef Aeronautics announced a Special Airworthiness Certification from the FAA in June of 2023, allowing their $300,000 “Model A” to start testing by land and air. The Model A is the first flying vehicle drivable on public roads. It also has vertical takeoff and landing capabilities. The prototype can carry one or two occupants with a driving range of 200 miles and a flying range of 110 miles at about 25 miles per hour.

This momentous event represents a pivotal step toward integrating flying cars into our daily lives. With the FAA’s stamp of approval, the floodgates are set to open for a new era of urban air mobility. Alef Aeronautics expects to sell the vehicle for $300,000 each, with the first delivery projected for the end of 2025. Owners can place a $150 pre-order deposit or $1,500 to get into the priority pre-order queue.

The approved flying car embodies the cutting-edge technologies driving this transformative industry. The vehicle combines electric propulsion, autonomous capabilities, and advanced safety systems, ensuring a seamless and secure travel experience.

Implications for Transportation

Flying cars herald a multitude of transformative implications for transportation.

As the Crow Flies: From the days of plying the sea by ships, the saying “as the crow flies” reflects the most direct path to the destination. The cost of building and maintaining roads could diminish greatly in the future as travel becomes in the air rather than on the ground. Our cities face ever-increasing traffic congestion as populations grow. By taking to the skies, flying cars can alleviate the strain on ground transportation networks, reducing travel times and enhancing overall efficiency.

Increased Connectivity: Flying cars hold the potential to connect urban and rural areas, effectively shrinking distances and making remote locations more accessible. This enhanced connectivity opens up new business opportunities, tourism, and personal mobility options.

Emergency Response: Flying cars can revolutionize emergency response efforts. These vehicles have the potential to reach disaster-stricken areas swiftly, enabling faster search and rescue operations, facilitating the transportation of critical medical supplies in, and transporting victims out.

Environmental Advantages: Electric propulsion systems in flying cars contribute to a cleaner and greener environment, reducing carbon emissions and noise pollution compared to traditional aviation. This sustainable aspect aligns with the global push for eco-friendly transportation solutions.

New Industry and Job Opportunities: The development, manufacturing, and maintenance of flying cars will create many employment opportunities. From aerospace engineers and pilots to air traffic controllers and maintenance technicians, the rise of flying cars will foster a whole new sector of the economy. Your next Lift ride may be just that – upward.

Regulating the Sky

As flying cars become more commonplace, it becomes crucial to establish comprehensive regulatory frameworks to ensure safe and efficient operations. The FAA and other regulatory bodies worldwide will play a pivotal role in shaping the future of urban air mobility. Balancing the need for innovation with robust safety protocols and air traffic management systems will be essential to harnessing the full potential of flying cars.

As we soar into a new era of urban air mobility, flying cars promise to transform how we move, connect, and explore the world around us. While there are still challenges to overcome, the advent of this groundbreaking technology brings us one step closer to the realization of a cartoon and sci-fi-inspired dream. Buckle up; the future of flying cars is about to take flight!

Tim Grady is Editor-in-Chief of Manufacturing Outlook and a host on Manufacturing Talk Radio. He can be reached at timgrady@mfgtalkradio. com. n

9 Manufacturing Outlook /August 2023 COVER STORY

The Alef Aeronautics team. Image: Alef Aeronautics.

The Key to the Future for Manufacturers is in the Past

By Vince Sassano

Merriam-Webster defines the future as “a time that is to come” and in most cases, “an expectation of advancement or progressive development.” Automated data collection, artificial intelligence (AI), and other advanced process controls and equipment are all contributing to the promise of a better future. The question is: where is the future for manufacturers headed?

Data: As the pace of business quickens, and good labor is increasingly hard to attract and retain, it becomes more important than ever to be in the know. In the know about why things are not performing as expected. In the know about what expectations to have in the first place. But more importantly, being more aware of the fact that you don’t know what you don’t know.

While this may sound cliché, it is the reality for most manufacturers, and it

often results in a proliferation of the status quo. Evidence of complacency is often heard in statements like, “Everything is chugging along just fine.” Data can provide objective evidence that improvements are possible. Insights from the data enable better understanding of downtime causes, performance bottlenecks, quality issues, and workforce impediments.

As data becomes more freely available to all levels of the organization, transparency replaces siloes, thereby enlightening and empowering the operation. And that improves culture.

Culture: Change to a manufacturing culture is like a trip to the doctor or dentist. It usually only happens when something is REALLY wrong. But it doesn’t have to be that way if the future path is ‘easy’, because nothing beats ‘easy’. Being able to push a

button and have the production process run, without injury, without error, and with high quality and efficiency is the holy grail for manufacturing. But that requires people, procedures, paperwork, meetings, and all the other glue that runs the operation. Whenever change is introduced into this chain, panic often ensues. Clear objectives, training, progress measurement, and defining WIIFM (What’s In It For Me) will make acceptance and commitment much more likely. It also requires new leadership skills.

Leadership: Good leadership will become even more important as organizations strive to increase employee engagement and foster a positive and productive work environment. New skills will need to be added, however, including data analysis and the development of a common language. In the movie “Patton”, General George

10 Manufacturing Outlook /August 2023

FEATURE STORY

continued

Patton quoted George Bernard Shaw saying, “The English and Americans are two people separated by a common language.” Communication in the future will become easier for management and operations to not only get on the same page, but also agree on what needs to be done. Why? Because data, especially trusted data, is objective. This allows the discussion to proactively focus on solutions where everyone in the organization can demonstrate leadership. Profits follow.

ROI and the Bottom Line: Competition, consolidation, increasing customer expectations, and rising costs will dictate a tighter run operation and rigorous measurement of return on investment. Capital expenditures, special projects, and digital transformation efforts will need to be justified and measured by the impact they have on the bottom line. Consequently, manufacturers will move towards a more agile approach that emphasizes

smaller, more modular investments that will generate quick wins to build upon, rather than large, expensive implementations with long payback periods. Expertise, both internal and external, is vital to staying on target now and in the future.

One of the most powerful forces that exists in manufacturing today is the desire to maintain the status quo. To move forward, manufacturers only need to look to the past to understand how things are and how they got that way. Once an initial assessment is made, focus in these areas will increase the probability of future success:

Data. This is the foundation for generating insights and action plans. It will objectively inform the organization on the best path forward and focus the team on solutions rather than debate.

Culture. Change is tough. There is widespread agreement on the behav-

ioral patterns of change, including the path from disillusionment to acceptance. Clear communication of the ‘why’ behind change and the benefits to the organization and employees is critical for success.

Leadership. The right mindset, coupled with trusted data and an open culture will empower the workforce at all levels to have a voice in the future of the company.

ROI. The days of managing by gut feel are over. Data-driven decision-making is critically important for manufacturers to compete in today’s environment. It takes two points to draw a line. The future is the end point while the past holds the key to showing you where to begin.

Author profile: Vince Sassano is the owner of the Strategic Performance Company. n

11 Manufacturing Outlook /August 2023 FEATURE STORY

by CASS INFORMATION SYSTEMS, INC.

Cass Transportation Index Report

Cass Freight Index - Shipments

The shipments component of the Cass Freight Index® fell 2.2% m/m in July and fell 1.2% m/m in SA terms.

July volumes were on par with January in absolute terms, despite 10% stronger seasonality. On a y/y basis, the index was 8.9% lower in July, after a 4.7% decline in June.

The freight market downcycle is now 19 months old, which compares to a range of 21 to 28 months in the past three downcycles.

Declining real retail sales and

destocking remain the primary issues, but dynamics are shifting as real incomes improve and the worst of the destock is in the rearview.

In seasonally adjusted (SA) terms, the index is now 13% below the December 2021 cycle peak, slightly greater than the peak-totrough declines in two of the three downcycles in the past dozen years.

With normal seasonality, this index would increase slightly m/m in August but decline about 11% y/y, comparing to the extraordinary time last summer when destocking was

actually creating freight demand as retailers were shipping out stale inventory. Even adjusting for the strange comparison, this will probably overstate the pressure on national freight volumes because the for-hire market is losing share to private fleets.

Freight Expenditures

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, fell 2.8% m/m and 24.4% y/y in July.

With shipments down 2.2% m/m in July, we infer rates were down 0.6% m/m.

12 Manufacturing Outlook /August 2023 CASS INDEX OUTLOOK

continued

On an SA basis, the index declined 2.0% m/m, with shipments down 1.2% and rates down 0.8%.

This index includes changes in fuel, modal mix, intramodal mix, and accessorial charges, so is a bit more volatile than the cleaner Cass Truckload Linehaul Index®.

The expenditures component of the Cass Freight Index rose 23% in 2022, after a record 38% increase in 2021, but is set to decline about 18% in 2023, assuming normal seasonal patterns from here. Both freight volume and rates remain under pressure at this point in the cycle, but fuel price increases could limit the savings for shippers.

Inferred Freight Rates

The rates embedded in the two components of the Cass Freight Index declined 17% y/y in July, after falling 21% in June.

Cass Inferred Freight Rates decreased 0.8% m/m SA after a 0.9% decline in June, as contract rates continued to reset lower. Based on the normal seasonal pattern, this index would decline slightly m/m in August, and the y/y decline would remain about 17%.

We estimate lower fuel prices are knocking about 5% off freight rates y/y, and while fuel is a big factor, there’s clearly also still market pressure on rates.

Cass Inferred Freight Rates are a simple calculation of the Cass Freight Index data—expenditures divided by shipments—producing a data set that explains the overall movement in cost per shipment. The data set is diversified among all modes, with truckload (TL) representing more than half of the dollars, followed by less-than-truckload (LTL), rail, parcel, and so on.

Truckload Linehaul Index

The Cass Truckload Linehaul Index, which—as its name implies— measures changes in linehaul rates only, fell 0.2% m/m in July to 142.0, after a 0.4% m/m decline in June.

The slower decline in the past two months likely reflects a combination of slightly higher spot rates and smaller declines in contract rates. On a y/y basis, the Cass Truckload Linehaul Index fell 12.7% y/y in July, after a 14.1% y/y decline in June. As a broad truckload market indicator, this index includes both

spot and contract freight. With spot rates already down significantly, the larger contract market.

Freight Expectations

We’ve been citing the key factors behind the freight downturn— substitution and inventory—for well over a year, but it’s not all macro factors.

One key and likely underappreciated industry-specific factor is the rapid growth of private fleets. The publicly traded for-hire truckload fleets reduced their collective tractor count by 3% in 1H’23 (see table) and operating authority revocations remain elevated, so for-hire capacity is contracting quickly. But Class 8 tractor production is still at maximum levels, growing the overall fleet, and consequently keeping downward pressure on spot rates.

Private fleets represent over half of Class 8 tractor capacity, and we believe their growth is pulling freight out of the for-hire market, prolonging the industry downturn.

Though significant progress has been made in rebalancing, we think it’s unlikely that industry capacity will broadly tighten until pressure from private fleet growth eases, which looks unlikely this year. Though the freight market is still near the bottom of the cycle, the first step in getting out of a hole is to stop digging. New truck orders in the next few months will be very interesting and, in our view, will be pivotal to setting the market tone for 2024.

The capacity contraction in the forhire sector is coiling the proverbial spring for better market conditions, but this outlook could be spoiled if the private fleet segment continues its massive fleet expansion. n

13 Manufacturing Outlook /August 2023 CASS INDEX OUTLOOK

THE INSTITUTE FOR SUPPLY MANAGEMENT’S MANUFACTURING REPORT ON BUSINESS®

14 Manufacturing Outlook /August 2023

BREAKING NEWS ISM PMI at 46.4% for July 2023 ISM REPORT OUTLOOK JULY 2023 46.4% PANDEMIC Released August 1st ISM PMI for the past 5 years Expanding Contracting continued

INSTITUTE FOR SUPPLY MANAGEMENT®

Economic activity in the manufacturing sector contracted in July for the ninth consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business® .

The July Manufacturing PMI® registered 46.4 percent. The New Orders Index remained in contraction territory at 47.3 percent, 1.7 percentage points higher than the figure of 45.6 percent recorded in June. The Production Index reading of 48.3 percent is a 1.6-percentage point increase compared to June’s figure of 46.7 percent. The Prices Index registered 42.6 percent, up 0.8 percentage point compared to the June figure of 41.8 percent. The Backlog of Orders Index registered 42.8 percent, 4.1 percentage points higher than the June reading of 38.7 percent. The Employment Index dropped further into contraction, registering 44.4 percent, down 3.7 percentage points from June’s reading of 48.1 percent. The Inventories Index increased by 2.1 percentage points to 46.1 percent; the June reading was 44 percent. The New Export Orders Index reading of 46.2 percent is 1.1 percentage points lower than June’s figure of 47.3 percent. The U.S. manufacturing sector shrank again, but the uptick in the PMI® indicates a marginally slower rate of contraction.

The July composite index reading reflects companies continuing to manage outputs down as order softness continues. The two manufacturing industries that reported growth in July are: Petroleum & Coal Products; and Furniture & Related Products. ISM

Analysis by Timothy R. Fiore, CPSM, C.P.M.

Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

PMI® at 46.4% MANUFACTURING

The U.S. manufacturing sector contracted in July, as the Manufacturing PMI® registered 46.4 percent, 0.4 percentage point higher than the reading of 46 percent recorded in June. This is the ninth month of contraction and continuation of a downward trend that began in June 2022. That trend is reflected in the Manufacturing PMI®’s 12-month average falling to 48.3 percent. Of the five subindexes that directly factor into the Manufacturing PMI®, none are in growth territory. Of the six biggest manufacturing industries, only one (Petroleum & Coal Products) registered growth in July.

Manufacturing at a Glance

Commodities Reported

Commodities Up in Price: Electrical Components (9); Natural Gas*; Plastic Resins*; Portland Cement; Steel*; and Steel Products*.

Commodities Down in Price: Aluminum (2); Caustic Soda; Corrugate (8); Diesel (3); Freight (9); Isocyanates; Methanol; Natural Gas*; Ocean Freight (2); Packaging Materials; Paper (3); Plastic Resins* (14); Polypropylene (3); Solvents; Steel* (4); Steel — Alloy; Steel — Hot Rolled (3); Steel — Stainless; and Steel Products* (2).

Commodities in Short Supply: Brake Components; Electrical Components (34); Electrical Controls and Equipment (2); Electronic Assemblies (2); Electronic Components (32); Hydraulic Components (2); Labor — Temporary; Semiconductors (32); and Steel Products.

15 Manufacturing Outlook /August 2023 ISM REPORT OUTLOOK continued 12 ISM WORLD.ORG

PMI 48.7% = Overall Economy Breakeven Line 50% = Manufacturing Economy Breakeven Line 2023 2022 2021 46.4%

INDEX Jul Index Jun Index % Point Change Direction Rate of Change Trend* (months) Manufacturing PMI® 46.4 46.0 +0.4 Contracting Slower 9 New Orders 47.3 45.6 +1.7 Contracting Slower 11 Production 48.3 46.7 +1.6 Contracting Slower 2 Employment 44.4 48.1 -3.7 Contracting Faster 2 Supplier Deliveries 46.1 45.7 +0.4 Faster Slower 10 Inventories 46.1 44.0 +2.1 Contracting Slower 5 Customers’ Inventories 48.7 46.2 +2.5 Too Low Slower 2 Prices 42.6 41.8 +0.8 Decreasing Slower 3 Backlog of Orders 42.8 38.7 +4.1 Contracting Slower 10 New Export Orders 46.2 47.3 -1.1 Contracting Faster 2 Imports 49.6 49.3 +0.3 Contracting Slower 9 Overall Economy Contracting Slower 8 Manufacturing Sector Contracting Slower 9

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

*Number of months moving in current direction. Manufacturing ISM® Report On Business® data has been seasonally adjusted for the New Orders, Production, Employment and Inventories indexes.

Note: To view the full report, visit the ISM ® Report On Business® website at ismrob.org The number of consecutive months the commodity has been listed is indicated after each item. *Indicates both up and down in price.

reportonbusiness

ISM® Report On Business®

New Orders

ISM’s New Orders Index registered 47.3 percent. The four manufacturing industries that reported growth in new orders in July are: Furniture & Related Products; Textile Mills; Nonmetallic Mineral Products; and Chemical Products.

The Production Index registered 48.3 percent. The three industries reporting growth in production during the month of July are: Machinery; Fabricated Metal Products; and Paper Products.

ISM’s Employment Index registered 44.4 percent. Of 18 manufacturing industries, three reported employment growth in July: Machinery; Fabricated Metal Products; and Paper Products.

Supplier Deliveries

The Supplier Deliveries Index registered 46.1 percent. The three manufacturing industries reporting slower supplier deliveries in July are: Petroleum & Coal Products; Primary Metals; and Miscellaneous Manufacturing‡

Inventories

The Inventories Index registered 46.1 percent. Of 18 manufacturing industries, the four reporting higher inventories in July are: Petroleum & Coal Products; Electrical Equipment, Appliances & Components; Machinery; and Food, Beverage & Tobacco Products.

16 Manufacturing Outlook /August 2023

Manufacturing PMI®

New Orders (Manufacturing) 52.7% = Census Bureau Mfg. Breakeven Line 2023 20 2022 2021 47.3%

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey Committee

Employment (Manufacturing) 50.4% = B.L.S. Mfg. Employment Breakeven Line 2023 2022 2021 44.4% 20 Supplier Deliveries (Manufacturing) 2023 80 2022 2021 53.1% 46.1% Inventories (Manufacturing) 44.4% = B.E.A. Overall Mfg. Inventories Breakeven Line 2023 2022 2021 46.1% Production (Manufacturing) 52.2% = Federal Reserve Board Industrial Production Breakeven Line 2023 2022 2021 48.3% 70 Production

Employment

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies). July 2023 ISM REPORT OUTLOOK continued

ISM® Report On Business®

Customers’ Inventories

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey Committee

ISM’s Customers’ Inventories Index registered 48.7 percent. The eight industries reporting customers’ inventories as too high in July are, in order: Printing & Related Support Activities; Furniture & Related Products; Electrical Equipment, Appliances & Components; Paper Products; Fabricated Metal Products; Plastics & Rubber Products; Computer & Electronic Products; and Primar y Metals.

The ISM Prices Index registered 42.6 percent. In July, two industries reported paying increased prices for raw materials: Petroleum & Coal Products; and Computer & Electronic Products.

Backlog of Orders

ISM’s Backlog of Orders Index registered 42.8 percent. The three industries reporting growth in order backlogs in July are: Furniture & Related Products; Petroleum & Coal Products; and Transportation Equipment.

New Export Orders

ISM’s New Export Orders Index registered 46.2 percent. Three industries reported growth in new export orders in July: Wood Products; Primary Metals; and Electrical Equipment, Appliances & Components.

Imports

ISM’s Imports Index registered 49.6 percent. The five industries reporting an increase in import volumes in July are: Textile Mills; Food, Beverage & Tobacco Products; Transportation Equipment; Miscellaneous Manufacturing‡; and Machinery.

17 Manufacturing Outlook /August 2023

Manufacturing PMI®

Customer Inventories (Manufacturing) 2023 2022 2021 48.7% Backlog of Orders (Manufacturing) 2023 2022 2021 42.8% New Export Orders (Manufacturing) 2023 2022 2021 46.2% Imports (Manufacturing) 2023 2022 2021 49.6%

Prices (Manufacturing) 52.9% = B.L.S. Producer Prices Index for Intermediate Materials Breakeven Line 2023 2022 2021 42.6% Prices

July 2023 ISM REPORT OUTLOOK n

‡Miscellaneous

Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

NORTH AMERICA OUTLOOK

By Dr. Chris Kuehl

By Dr. Chris Kuehl

What Recession?

It would seem to be such a simple request. “Mr. Economic Forecaster: Are we or are we not in a recession? How bad might this be, and when might we expect to be out of it – if indeed we are in one?” Too bad we in the soothsaying business seem incapable of answering this. A survey commissioned by the World Economic Forum resulted in 45% of those economists queried asserting that recession had already started and would be long and severe. Another 45% said that there would not be an actual recession at all – more of a mild slowdown. Apparently, the remaining 10% didn’t understand the question. In truth, there is data to

support an optimistic view and data to support a pessimistic one. Lately, there have been some significant attitude shifts among previously downbeat economists, and they are starting to assert that the proverbial soft landing is not only possible but likely.

It all seems to depend on what sector of the manufacturing world a company is engaged in. When examining the Armada Strategic Intelligence System (ASIS*) there are sectors that are clearly doing better than others, although all of them have shown some signs of distress over the last several months. Automotive and aerospace lead the pack, but there has also been growth in the electrical

sector and computers. The challenges are most obvious in machinery, primary metals, fabricated metals, as well as the oil and gas sector (although that has started to perk up). The good news is that the most recent data is pointing in a positive direction as there has been some decline in the pace of inflation at the same time that job growth has remained robust and consumers are still spending. Most important of all is the pace of capital spending. It is still at over $74 billion, and that is a record level. Much of this expansion has been down to integrating technology and automation. The fastest sector for construction these days has been manufacturing, as it has been up by over 76% in the last year. This has been almost all down to the use of

18 Manufacturing Outlook /August 2023 NORTH AMERICA OUTLOOK

AUGUST 2023

continued

robotics and the accommodation needed.

Capacity utilization is a key indicator for manufacturing. Generally speaking, the ideal reading is between 80% and 85%, as that indicates there is little slack in the system, but there is also not enough pressure to cause shortages and bottlenecks. The national readings have been in the high 70s. There is more slack reported by the respondents, but these numbers are higher than they have been in previous surveys. The good news is that most are reporting increased capacity, or they have been stable. Overall surveys show 32.58% saw increasing capacity and 50.56% are stable. Only 16.85% reported decreasing capacity. This is consistent with other manufacturing observations as companies shift more and more towards automation and robotics to cope with chronic labor shortages.

Another key indicator is new order activity. It shows growth more accurately than normal order activity as it signals new consumption levels.

The new order numbers from the Purchasing Managers’ Index carry more weight than the other indices. The new order data is somewhat

encouraging as 31.28% report expanding new order activity, 39.11% report stable activity, and 29.61% indicate that new order activity is decreasing. The U.S. has recently slipped into contraction territory as far as the PMI is concerned –down to 46.4. This is not yet crisis territory but is getting worrisome. When these numbers are under 45, there is genuine concern regarding a slowdown. It was only a few months ago that the U.S. numbers were in the 50s. Canada is likewise in contraction territory with a reading of 48.8, but Mexico is still clinging to expansion territory with a 50.9 mark.

One of the key factors as far as the economy is concerned is employment, as it has been baffling. The anti-inflation efforts should have caused more of an impact on joblessness, but there have been relatively few layoffs.

Overall, respondents report that 24.44% are increasing their employment numbers and 60.56% report that employment has been stable. Only 15.0% report a declining workforce, and much of this appears to be attrition as opposed to laying people off. To be frank, the majority of manufacturers are reluctant to let people go as it has become so hard

to find the skilled worker that nobody wants to lose the ones they have. The labor shortage has been chronic for years, and the most common pattern has been for companies to poach employees from their competitors and even their customers. The fact that wage inflation is faster than overall inflation indicates that unemployment numbers are very unlikely to worsen anytime soon.

There have been some bright spots as far as inflation is concerned. We have been watching oil prices stabilize in the 70s as far as per barrel prices are concerned, and that has meant declines in the price of diesel and gasoline as well as feedstocks for plastics. The challenge in the oil sector is not in crude output but in refining capacity, and where there have been price hikes for feedstock, it has been a refinery or transportation issue. There have been similar declines in steel and aluminum, although this reduction has been more recent. Roughly 32.96% of respondents have seen increasing prices, but 38.55% have seen them stabilize, and 28.49% have seen these costs decrease slightly. One of the more important cost shifts has come in the logistics sector. Just a quarter or two ago, most respondents reported that logistics costs were increasing quickly. The latest report showed that 49.16% saw these costs going up, and 44.69% saw them stabilizing. Only 6.15% saw these prices start to come down. This should change as the year progresses as the capacity issue has faded in the transportation sector.

At the start of 2022, there were 14 loads for every truck, and there were similar issues in rail and maritime. Now there are less than four loads per truck, and many of the new entrants into the trucking business are leaving. In 2022 and

19 Manufacturing Outlook /August 2023 NORTH AMERICA OUTLOOK

2023, there have been over 65,000 new trucking operations (most of them single truck companies). Many of these new drivers came from the manufacturing community, and as they leave transportation, they will migrate back into their previous jobs in manufacturing and construction.

Yet another solid indication of a recession is declining capital spending and investment, but that rate is still very high overall. This is not pointing at a recession. Over $75 billion in Capex in the last year, and that is an amount that exceeds anything seen in three decades. Among manufacturers in general, 47.22% indicate their Capex investments are on track, 12.22% are delaying by only one quarter, 13.22% are delaying by two quarters. That still leaves 27.22% delaying indefinitely, and this is a concern long term.

In the final analysis, the real issue is confidence in the future. At this juncture, the attitude towards the future is generally positive. Fully 51.23% assert their business outlook is positive, while 31.48% report stability in that outlook. Only 17.28% report a negative outlook. This

confidence level exceeds that of the consumer, but generally speaking, a boost in business confidence is reflected in consumer attitude about a quarter later.

What to make of all this? The bottom line is that the US has not yet hit stall speed. The recession that was predicted to start at the end of last year has yet to manifest. The growth in Q1 was above 2.0%, and it appears that Q2 was close to 2.3%. This is about the twenty-year average for the US economy. There are still plenty of warning signs and more pressure will be applied by the Fed, but thus far, the likely pattern for the year is a slowdown but with some sensitive sectors facing recession. The U.S. almost never sees a 100% recession or a 100% boom, there are always sectors that do well even as others falter, and likewise, sectors that struggle when everybody else is growing. The strong sectors now include automotive, aerospace, technology, electrical equipment, and health care (just recently). The sectors still reeling include traditional retail, office development, single-family housing, and business aimed at the lower third of income earners. The entertainment and travel sectors are

starting to surge, and there has been more growth noted in the oil and gas sector. The plastic sector plays in all of these, and that creates the need for diversity.

CANADA

This has been consistent for North America as a whole. Canada has been seeing substantial differences between provinces, and that has combined to take some of the growth out of the national economy.

Ontario has been hit hard by shifts in the residential housing sector, and the RBC now thinks that the 3.2% pace of growth set last year will fall to 1.1%. This is no recession by any stretch, but it is far less robust than had been expected. The light at the end of the tunnel is that housing numbers started a little rebound in the last few weeks. Quebec has been hit even harder when it comes to the residential sector and has also seen declines in manufacturing. The growth expectation is just 0.6%. There is a marked contrast with the central provinces.

Alberta is on fire economically with the success of the oil sector – growth of 2.4% and the fastest in Canada. Saskatchewan is not far behind in the strength of the agricultural sector – growth of 2.0%. This is, however, down from the blistering pace set in 2022. That was the year the farm sector led the way toward 5.7% growth.

Manitoba is also slowing from the 3.6% pace of last year to around 1.5%. This is due to some issues with the manufacturing sector and a reduction in export volume to the US.

British Columbia is taking some significant hits in a variety of sectors and will be struggling to hit 0.6% growth. Residential housing is

20 Manufacturing Outlook /August 2023

NORTH AMERICA OUTLOOK continued

down, along with overall consumer sentiment. The financial sector has been affected as well. Exports are down as BC has been caught up in some of the growing tension between the U.S. and China.

The Maritime provinces (Nova Scotia, New Brunswick, PEI, Labrador, Newfoundland) are all continuing to see slow growth and remain in the economic slow lane although Nova Scotia has been seeing a great deal of incoming migration from the U.S. that has boosted tourism and residential housing.

MEXICO

The Mexican economy has been on something of a roller coaster the last few years (and, of course, they have not been alone). In 2020 the economy fell by 8.0% - one of the steepest declines of any nation in the western hemisphere. Tourism collapsed, and that had been the number three driver for the economy.

Manufacturing stuttered as well, and even remittances fell as migration into the US declined.

In 2021 there was a bounce back of 4.7%, but that only brought the economy back halfway. In 2022 the growth receded even more – to 3.1%, and the expectation for 2023 is between 2.0% and 2.5%.

For the last twenty years, the economy has underperformed, according to data from the World Bank. It has been averaging less than 2.0% growth, and the reasons have been persistent and varied. The issues include limited access to finance, bad infrastructure, regulatory burdens, and lack of security. The leftist government of Andres Manuel Lopez Obrador has stymied foreign investment and has prohibited much progress in terms of working with the U.S. on issues such as illegal immigration, drug smuggling, and the like. The relationship was

obviously miserable while Trump was in office but was expected to improve under Biden. It hasn’t.

* The ASIS Report can be found at https://asisintelligence.com/.

Author profile: Dr. Christopher Kuehl (Ph.D.) is a Managing Director of Armada Corporate Intelligence and one of the co-founders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years. He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division – Finance, Credit and International Business. n

THE FLAGSHIP REPORTS

The Flagship Reports with Dr. Chris Kuehl is both an “Officer of the Watch” briefing of economic conditions and an Executive Briefing on specific situations impacting those conditions. Written and presented by the officers of Armada Corporate Intelligence, Dr. Kuehl lightens up the mood of sometimes distressful geoeconomic news with a bit of humor. This monthly podcast includes information from the Flagship Reports issued 3 times and week, and AISI, the Armada Strategic Intelligence System, a tool for durable goods manufacturers that dives deep into the sector each month to provide more than 95% accurate near-term forecasts.

21 Manufacturing Outlook /August 2023

NORTH AMERICA OUTLOOK

LATIN AMERICA AUGUST 2023

By Royce Lowe

By Royce Lowe

Who’s Listening?

The Wall Street Journal reported in early June that the Communist government of Cuba had secretly agreed to allow China to set up an electronic-spying facility in the country. After both American and Cuban officials had denied this story, the White House came out a couple of days later to admit that a base had existed for some time. This is not the first time that China has been reported to have military or security footholds in the region. It has several ground stations in Latin

America, also believed to have spying purposes. A space observatory with opaque activities in Argentina is run by the Chinese army. Cuba and China have denied the media reports, and they didn’t stop Antony Blinken from visiting China.

There’s really nothing new here, and there’s not much the U.S. doesn’t know about it. There is no violation of international law, and the U.S. is thought to have similar sites in countries around the world, including

Japan, South Korea, Taiwan, and Australia. In short, it’s just something else for the U.S. and China to bitch at each other about.

The real issue here is the annual goods trade between China and Latin America, which rose to $445bn in 2021 from a mere $12bn in 2000. China is a big source of cash for the region, and between 2005 and 2021, according to The Economist, Chinese state-owned banks loaned $139bn to Latin American governments. China

22 Manufacturing Outlook /August 2023

SOUTH AMERICA OUTLOOK

continued

has invested billions of dollars in the region, mostly in energy and mining. Furthermore, some 21 countries in Latin America and the Caribbean have signed up for China’s Belt and Road Initiative, the massive global infrastructure project. Some countries are switching to the yuan for trade.

Do certain commercial projects cause concern? For example, those in telecoms or energy? A Chinese state-owned power company recently agreed to purchase two Peruvian power suppliers, giving China a nearmonopoly over the country’s energy grid. China is constructing a mega port near Lima in Peru. Would this be switched to military purposes, or would it be used to transport

ores back to China? There’s an agreement between the governor of Tierra del Fuego, at South America’s southernmost tip, and a Chinese petrochemicals group to build a port, power station, and chemical plant, at a cost of $1.2bn, and this is being challenged by Argentina’s opposition.

But for the most part, Latin America’s leaders aren’t concerned about the Chinese actions. China seems to avoid provocation of the U.S. by looking more to South America than Central America and the Caribbean. In view of China’s ongoing need for minerals in the area, it is certain that its presence will continue to manifest itself and that ties will deepen.

The Outlook: The U.S. is not developing strong ties to Africa, Central America, or South America to counter the influence of China. China is systematically isolating the political and economic might of America in its 100 Year Marathon* to become the dominant world superpower. While the U.S. is distracted with playing checkers, China is playing chess.

The Hundred-Year Marathon: China’s Secret Strategy to Replace America as the Global Superpower by Michael Pillsbury.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

23 Manufacturing Outlook /August 2023

MANUFACTURING OUTLOOK

AFRICA OUTLOOK

By Royce Lowe

By Royce Lowe

Helping Africa

Last December, according to Reuters, the United States pledged to commit $55bn to Africa over the next three years. This money was aimed at “a wide range of sectors to tackle the core challenges of our time” and was being distributed in close partnership with Congress, national security advisor Jake Sullivan said. Much of the funds appeared to come from previously announced programs and budgets. The summit was the first involving leaders from the U.S. and African countries since Obama established the President’s Advisory Council on Doing Business in Africa-or its acronym PAC-DBIA - in 2014.

At that time the White House said that of the $55bn, some $20bn would go to health programs, with $11.5bn allocated to HIV/AIDS, and over $2bn to “address the health, humanitarian and economic impacts of COVID-19.” Some $2bn would go to combating malaria. Between January 2021 and the summit date, the administration invested and planned to provide at least $1.1bn to support African-led efforts in conservation, climate adaptation, and energy transitions. These funds include U.S. International Development

Finance Corporation investments into Malawi’s Golomoti JCM Solar Corporation, and a Climate Action Infrastructure Facility.

At this same summit, President Biden highlighted $15 billion in trade and investment partnerships and deals, the White House said. These include over $1 billion in deals signed by the U.S. Export-Import Bank, including a $500 million memo of understanding with the African Export-Import Bank to support diaspora engagement, a $500 million deal with the Africa Finance Corp, and a $300 million memo of understanding with Africa50 to match U.S. businesses with medium- to largescale infrastructure projects. The deals also include a new “Clean Tech Energy Network” that supports $350 million in deals. One might say, “small potatoes.”

The Brookings Institution had quite a lot to say on the subject just a couple of months ago and came up with some very useful suggestions. When PAC-DBIA was established, it was an important initiative and is still highly relevant. It was, after all, charged with providing recommendations to the President of the United States through the Secretary of Commerce on how to

increase the U.S. commercial presence in Africa. Who better to provide advice than some of the leading American companies on the continent? The U.S. companies represented on the PACDBIA understand the challenges and opportunities of doing business in Africa. And a larger U.S. business presence in Africa is a priority for many African governments. Not only do our partners on the continent want closer commercial ties with the U.S., but they appreciate that most American companies create jobs, enhance skills, and comply with global best business practices, including anti-corruption.

We might ask what the PAC-DBIA has accomplished over the course of seven meetings and five reports. When President Obama established the committee in 2014, U.S. direct investment in Africa was at an all-time high of almost $69bn, but seven years later, it dropped to about $45 billion.

Having said this, we can’t forget what Africa has been through over the past decade; ebola, COVID-19, Russia’s invasion, and the effects of climate change. Plus many internal conflicts. Africa has a serious problem with infrastructure; hence development of

24 Manufacturing Outlook /August 2023 AFRICA OUTLOOK

AUGUST 2023

continued

infrastructure should be a priority for the U.S. government. According to Moody’s Analytics research and as cited by the African Development Bank, Africa has the lowest default rate on infrastructure projects among the world’s regions at 5.5%, compared to 12.9% in Latin America and 8.8% in Asia.

Commercial diplomacy is very important. Meg Whitman, a former business leader and the current U.S. ambassador in Kenya, remarked this past May to a high-level business gathering in Nairobi, “When I was CEO, I’ll be honest, I probably thought of Africa about 1% of the time.” The ambassador’s refreshing candor underscores that most U.S. business leaders do not see Africa as a target market.

In fact, the U.S. has significantly stepped up its support of the private sector in vital ways, including the creation of the DFC and Prosper Africa

and, most recently, Vice President Harris’ recent visit, to name a few of the impactful initiatives. However, since Commerce Secretary Penny Pritzker and the DBIA undertook a fact-finding mission to Nigeria and Rwanda in 2016, U.S. commerce secretaries have spent one cumulative day on the continent (Wilbur Ross visited Ghana on July 6, 2018, with the advisory group).

The Brookings Institution recommends that the secretary of commerce lead a PAC-DBIA trade mission to Africa annually. Not only would this signal to U.S. business leaders that Africa is a priority market for the American government, but it would be an opportunity to begin the implementation of the many relevant recommendations made by the PAC-DBIA since its inception. Such commercial diplomacy inevitably will play an important role in fulfilling the private sector commitments, worth $15.7bn, that were made at the

2022 U.S.-Africa Leaders Summit and reversing the decline in U.S. investment in Africa.

At the risk of being tiresome, and we aren’t the only ones mentioning this, it might be noted that over the last three decades, every Chinese foreign minister’s first overseas trip of the year has been to Africa. China-Africa trade is some $200bn per year, and around 10,000 Chinese companies are operating in Africa.

The Outlook: To help Africa, the U.S. needs to take action and fulfill its promises of investment and direct involvement. Otherwise, the U.S. is merely a whisper in the winds of change.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

25 Manufacturing Outlook /August 2023 AFRICA OUTLOOK

*Toll free within the U.S. * CLICK HERE FOR OUR FORGING CAPABILITIES ISO 9001 SINCE 1994 AS 9100 SINCE 1998

EUROZONE GLOBAL OUTLOOK

Definitely in a Recession That Will Impact Trade

By Chris Anderson

The latest data collected in the Eurozone’s manufacturing sector does nothing to allay previously mentioned pessimism. Both France and Germany are looking to lower production targets over the next 12 months. With the exception of Greece, probably Europe’s lowest contributor to manufacturing, all countries are showing contraction. Austria has a PMI in the high 30s meaning their recession is deep.

Production is falling at the sharpest rate since October last year when concerns regarding the price and supply of energy soared. Demand for Eurozone goods fell sharply at the end of the second quarter, with weak sales performances particularly evident in Austria, Germany, and Italy.

Manufacturing employment declined for the first time since January 2021, and business confidence dipped to a seven-month low. The Eurozone PMI fell to 43.4 in June, down from 44.8 in May, and a twelfth successive month in contraction territory. Overall, the headline figure signaled the sharpest deterioration in the health of the Euro area goods-producing sector since May 2020.

At a country level, June survey data showed manufacturing performances were at their worst since the initial phase of the COVID-19 pandemic in the first half of 2020 for many of the monitored nations. Austria, Germany, Italy, Ireland, and the Netherlands registered their sharpest declines in business conditions in over three years. Greece once again bucked

the broad trend of deterioration and recorded a fifth consecutive improvement in manufacturing sector performance.

June survey data signaled a third successive monthly reduction in manufacturing production levels across the Euro area. The decrease was strong, accelerating since May to the strongest since October last year.

According to market groups data, contractions in consumer, investment, and intermediate goods output all accelerated during the month, with the latter recording the quickest decrease. Total new orders fell rapidly and at the strongest pace for eight months during June. New export orders declined for the sixteenth successive month.

Germany’s PMI dropped from 43.2 in May to 40.6 in June, its lowest reading in over three years. Demand has taken a hit, both domestically and abroad. This is not good news for the export powerhouse that is Germany. Hence the fastest rate of contraction in production for eight months. There is pessimism for the year ahead. But, despite all the negative signs here, the consensus is looking for a mild downturn, and the survey results, therefore, by no means suggest panic.

The Outlook: The Eurozone will remain in contraction, likely for the balance of 2023. At present, 2024 looks weak for the Eurozone unless they experience a soft landing. However, as discussed on Manufacturing Talk Radio, soft landings can become very protracted, and the subsequent takeoff may be a slow climb. n

27 Manufacturing Outlook /August 2023 EUROZONE OUTLOOK

AUGUST 2023

ASIA OUTLOOK

By Christine Casati

The Global South Part 3: Focus On India

In the lead-up to and aftermath of Prime Minister Modi’s state visit to the White House in June, there has

been a deeper dive by many analysts into the U.S. geopolitical and economic ties to India. The overall outlook is positive and dynamic. India’s reported human rights violations and ongoing decades-old neutral position

toward Russia have not damaged its growing global and regional clout. With a population exceeding China’s, and a major drive to expand export manufacturing, digital connectivity, and transport infrastructure, India continued

28 Manufacturing Outlook /August 2023

ASIA OUTLOOK

is poised to become a major global economic power, possibly exceeding China’s prospects in the decades to come.

G20 and India’s Growing Influence

This year it is India’s turn to host the Group of 20 (G20), the intergovernmental forum comprised of 19 countries plus the EU. The physical summit of leaders of these nations takes place September 9-10 in New Delhi. Modi is staking his reputation on bringing together these leaders, including Putin, along with Presidents Biden and Xi Jinping, to help address world crises and contribute to greater stability before India’s term ends in September. While India opposes a U.S.-led world order, its foreign policy is becoming increasingly assertive and hostile toward China’s growing influence. It supports a more multi-polar world. It has strong relations with Israel and has become a major partner in the tech sector there.

India is the world’s fifth largest economy, behind the U.S., China, Germany, and Japan. Its GDP is growing at an annualized rate of 6.5% so far this year. Goldman Sachs predicts it will become the second largest economy by 2075, mainly because its population will continue to grow through 2040 while China will decline.

India also boasts the greatest diaspora in human history. Since the U.S. opened to Indian immigrants in 1965, they have contributed greatly to GDP growth and to the ranks of engineering and media professionals, scientists, doctors, lawyers, lawmakers, and internet gurus, and have pioneered call centers and many software and iCloud services. 12 CEOS of Indian descent lead the world’s biggest companies (e.g., Alphabet, Microsoft), and over 200 are in leadership roles in 15 countries, including Kamala Harris of the U.S. and Rishi Sunak of the UK.

Manufacturing Challenges: Readiness and Reality

There has been a lot of hype about India taking over China’s position, becoming the “manufacturing factory of the world.” To that end, India has undertaken major business reforms and streamlined digital connectivity and logistics. There are currently over 760 million internet users, projected to be 900 million by 2030, providing a data goldmine for potential producers and consumers alike. Currently, India’s reliance on IT and consulting services exports are unusually high, about 40% of export income, generating a whopping $200 billion in export revenues. But that sector only employs 5 million people.

Thus, policymaking has focused on upgrading infrastructure to accommodate more domestic and export manufacturing and related employment. India’s roadways have expanded by 25%, and the number

29 Manufacturing Outlook /August 2023 continued

ASIA OUTLOOK

of airports has doubled under Modi’s two terms in office. India has continued to expand digital broadband connections and invested heavily in green energy infrastructure. It will add more solar generating capacity in 2023 than anywhere else in the world except the U.S. and China. If Modi wins a third term next year, expect continuity in expanding economic policies to support manufacturing and sustainable energy.

While major global companies and investors are convinced of India’s potential, and some have relocated partial operations there from China, many more have relocated to Vietnam where there are lower manufacturing costs, less red tape, and more predictability. For example, India is known for sudden electricity outages and occasionally shutting down the internet nationwide to control the flow of negative information. As India emerges on the world stage, a growing familiarity with these and other conditions has highlighted some

of the government’s challenges in making “Made in India” a reality.

versus foreign ones is unsettling. Modi needs to show more domestic support. Less than 50% of India’s massive population is employed, and education has been focused on the elite. While this creates a huge potential reservoir of young workers as India’s population grows and China’s declines, it will require major investments in education and training of unemployed workers.

India also has a daunting maze of business operating regulations, tariffs, licenses, rules, and taxes, a legacy of post-Colonial and Soviet-style central planning, which India has been trying to shed through business reforms since 1991. But its policies are still fluid and uncertain. For example, India has simply banned many Chinese tech firms from competing there. There are unclear “rules of the game.”

Apple and Foxconn

It has also created instant digital payment platforms by cell phone, bypassing the need for individuals and suppliers to go to a bank or pay in cash, eliminating the potential for corruption. This is a huge boost for the entire population, most of whom are still poor by world standards.

Some potential threats and roadblocks for foreign investors concern the slow erosion of institutions like the court system as well as regional unrest along its border with Myanmar, Bhutan, and China under Modi. Also, a lack of clarity over protectionist policies moving forward regarding the support of domestic enterprises

Although Apple opened its first store in India in May and plans for many more, its component sourcing and assembly of handsets there remain at the lower end of the value chain. China still remains Apple’s primary assembly, quality, and export control center. Earlier this year, the Taiwanese electronics manufacturer Foxconn, a major OEM for Apple, had plans to break ground on a $500 mil factory in India but reversed course and pulled out in July. Days after it pulled out of a $19.5 billion chipmaking project, its joint-venture partner Vedanta said it had lined up partners for a modified semiconductor and display ecosystem project in Prime Minister Modi’s home state of Guja-

30 Manufacturing Outlook /August 2023

ASIA OUTLOOK continued

On the bright side, India has developed a stable and wellcapitalized financial system and major foreign exchange reserves.

rat. One of the partners is Taiwan’s Innolux for display fab manufacturing. Reuters has reported that among the reasons for Foxconn’s pullout were deadlocked talks to finalize the participation of European chipmaker STMicroelectronics as a tech partner and delayed government incentive approvals.

UPDATE: On July 31, India’s southern state of Tamil Nadu announced an agreement with Taiwan’s Foxconn to invest $194 million in a new electronics component manufacturing facility that will create 6000 jobs.

The facility will be for Foxconn Industrial Internet (FII) nearby the

state capital of Chennai but separate from the sprawling Chennai campus, which assembles Apple’s iPhones and employs 35,000 people. India has become one of Apple’s five top markets worldwide for iPhones. In the meantime, India’s Parliament on Aug. 3 abruptly announced new regulations restricting the import of laptops, including Apple’s iPads and MacBooks. Import licenses will now be required. The move reflects India’s growing efforts to boost local electronics manufacturing and curb imports from China. It has also recently restricted the imports of electronic components from China.

The Outlook: India has the op -

200” Max O.D.

6” Min O.D.

portunity to become the China of tomorrow, while China will struggle to regain its reputation as a desirable resource for global manufacturing. Dominance requires a certain savoir-faire, which may be off the Chinese rose.

Author profile: Christine is co-founder and President of China

Human Resources Group, Inc, a management consulting firm based in Princeton NJ. She has provided U.S. companies with strategic development and project implementation services for projects in China since 1986 n

To

31 Manufacturing Outlook /August 2023

ISO 9001 SINCE 1994 AS 9100 SINCE 1998

80,000 lbs.

TOLL

FREE IN THE U.S. 800.600.9290 - 973.276.5000 - CANADA: 416.363.2244 - INFO@STEELFORGE.COM - STEELFORGE.COM

ASIA OUTLOOK

AEROSPACE OUTLOOK

By Royce Lowe

Composites in Aerospace

What are composites, and how are they used in aerospace engineering? These great beasts that we see in the sky, that carry us thousands of miles, evolved from very early models whose fuselages were often made of wood, which had to be replaced by metals for the structural strength of larger airplanes, particularly aluminum and steel. Aluminum is light and corrosion-resistant, and can be alloyed for strength. It is also relatively inexpensive. Steel can be used where

strength is the major factor. Titanium is the best of all but hugely expensive. But materials that can be substituted for metals in many applications are carbon fiber reinforced plastics, or CFRPs, and other materials known as composites.

In these times, where carbon emission reduction is on every aircraft manufacturer’s agenda, the aim is fuel efficiency, which can, of course, be related to an aircraft’s weight. Airbus states on its website, “In CFRP production, thousands of mi-

croscopically thin carbon threads are bundled together to make each fiber, which joins others in a matrix held together by a robust resin to achieve the required level of rigidity. The composite component is produced in precisely shaped sheets laid atop each other and then bonded, typically using heat and pressure in an oven, called an autoclave, resulting in a high-quality composite.”

“Parts such as fuselage and wings can make extensive use of composites as the required fiber loading, the way continued

32 Manufacturing Outlook /August 2023

AEROSPACE OUTLOOK

AUGUST 2023

the fibers are laid up and cured in the autoclave, is simple. However, parts requiring complex loading will, for the foreseeable future, continue to use metal.”

Much of the credit for the move to composites is due to Boeing. It chose to follow the success of the 777, the best-selling widebody, with a new aircraft design in the 787. This design was lower capacity than the 777 and moved Boeing into the unproven market for a composite airframe. Airlines reacted positively, though. So much so that Airbus chose to revise its plans for the A350 and also design a new composite widebody with the A350XWB.

Aluminum-based, Magnesium-based, Titanium-based alloys, ceramic-based, and polymer-based composites have been developed for the aerospace industry with outstanding properties. However, these materials still display insufficient mechanical properties and are liable to stress corrosion cracking, fretting wear, and corrosion. Thus extensive studies have been conducted to develop aerospace materials with superior mechanical performance and are corrosion-resistant. Such materials can improve the performance as well as the life cycle cost.

The main advantage of composites is weight reduction, leading to lower fuel consumption, emissions, and

ultimately cost per seat for airlines. Such materials are also less susceptible to corrosion and fatigue, reducing maintenance time and cost for airlines. Composite structures can be molded into any shape. This has allowed separate entire fuselage ‘barrel’ sections to be made in different locations, rather than using aluminum sheets that needed to be bolted together. Boeing has used this extensively in its construction of the 787. Fuselage sections are fully assembled in different locations (including Italy and Japan) and then flown to Boeing’s US factories for final assembly using a specially designed aircraft to carry the fuselages inside.

Composites can allow larger windows since the fuselage is more resistant to fatigue. The 787 has the largest passenger windows of any passenger jet, and as composite use advances, bigger ones could appear.

The move to composites for passenger jets is now well underway and may bring with it certain drawbacks. Cost is one. CFRP components are more costly to produce than standard metallic parts, but this could change with increased volume. A reduction in maintenance costs could help here. There have also been concerns raised about the detection of damage to the fuselage. Impact damage is not as visible or easy to detect as it is on a metal airframe. Proposals from regulators to mitigate this include better training

and more monitoring and reporting of potential airframe contacts. Other tests (including optical, electrical, and acoustic) can check for airframe damage. Another challenge that might crop up is aircraft modification. This has been raised as an issue with freighter conversions, where cutting a cargo access door in a composite fuselage is more challenging than in an aluminum one. It may be easier if a fuselage is constructed from composite panels rather than complete barrel sections.

But with the savings in weight and improvements in efficiency, these drawbacks are likely ones that operators will be happy to live with, at least temporarily.

A relevant report published in MarketsandMarkets estimates the global market for aerospace composites at USD 29.7 billion in 2022, which is anticipated to reach USD 51.6 billion by 2027, expanding at a CAGR of 11.7% from 2022 to 2027. The market is expanding based on the advantageous performance and resistance characteristics of aerospace composites. Plus, there is a rising demand for fuel efficiency.

The Outlook: Global development of composites will result in materials that will ensure superior strength and performance. The creation and development of new base materials, such as graphene, could favorably alter the weight and strength of future composites and accelerate the change from metal as the primary component to metal as a tertiary component.

33 Manufacturing Outlook /August 2023

AEROSPACE OUTLOOK

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

AUGUST 2023

ENERGY OUTLOOK

Turbine Troubles

By Royce Lowe

globe. Some 800 of the 5.X platform have been produced to date, with 100 having been delivered to clients.

According to Reuters, Siemens Energy’s management board has set up a task force to establish the scope of deepening problems at its wind turbine division Siemens Gamesa, including quality issues at its two

most recent onshore platforms, two supervisory board sources, “people familiar with the matter,” said. The problems were discovered, or “unveiled,” in June, and led to a 37% drop in Siemens Energy’s shares. This fact itself is a reason for an investigation.

There is one particular question that

The problems surrounding recent turbine failures on Siemens Energy wind platforms have turned into a veritable media feast. There have been failures concerning predominantly the 5.X platformreferring to the height and power output of the turbines - which is a relief since there are some 63,000 Siemens turbines rotating around the continued

34 Manufacturing Outlook /August 2023 ENERGY OUTLOOK

needs to be answered, namely why did Siemens Energy’s leadership fail to spot the issues during the due diligence process ahead of its recent takeover of the remaining stake in Siemens Gamesa, the sources said.