Manufacturing Outlook is all about Forward-Looking and Forward-Thinking content. As we look forward this month, we need to look back at a few things we spoke about in previous 2022 issues to share our view of the rest of the year and a bit into 2023.

Employment – Manufacturing has added nearly 400,000 new jobs this year, the most since the early 1990s. There were also several million job openings in manufacturing at the start of 2022 that remained unfilled. While we expect to see manufacturers continue to hire, that flies a bit in the face of actions by the Fed to raise interest rates until the Fed sees unemployment rise to cool inflation. While that crude and cruel tool worked in the past, it may not work this time around. Manufacturers still have strong Backlog on the books, and New Orders haven’t plunged, so it is unlikely they will reduce headcount. It is more likely that they will consolidate jobs and up-skill existing workers in this environment where they cannot find yet still need skilled labor. Thus, job openings will diminish before unemployment rises, and the Fed would have to take interest rates to dangerous heights to drive unemployment up and cool inflation. If this plays out, expect a hard landing, if not a crash landing.

Recession – for the most part, the collective “We” are creating a self-fulfilling recession prophecy. We hear the pundits on mainstream media ask if we are approaching a recession or claim that we are in a recession which makes people nervous, from the Board of Directors to the shop floor workers. They begin to talk about and wonder what actions they should take to hedge against a downturn. Then they begin to implement some of those actions as precautionary, and the slide down the slippery slope begins. Consumers cut back on spending. Businesses stop hiring (this is key – keep an eye on it), some companies allow headcount to fall by natural attrition (retirements, quits), and some even implement reductions in force (already happening at some companies). These are not expansionary actions – they are recessionary actions that accelerate the slide down the slippery slope. Others see this happening, and they become cautionary, thus bringing the prophecy into reality – perhaps unnecessarily, all in the name of cooling inflation which self-corrects eventually anyways. The Fed just wants it to happen faster. They have forgotten that excessive speed kills – in this case, the economic expansion.

Outlook – we expect a recession to set in in 2023, likely by summer. The depth of it will be in inverse correlation to the height of the Fed rates. The soft landing is already in play as price increases tapper off, having little to do with Fed rates and more to do with the price/demand curve (as prices increase, demand eventually decreases). However, rate increases, particularly three-quarter basis points at a clip, will accelerate the onset and deepen the recession because borrowing costs for expansion will become too risky in an uncertain economy. The duration of the recession will depend on when the Fed would begin to reduce rates to stimulate the economy, whether prices have fallen to stimulate demand, and if consumer wage and employment rates are again rising. The self-fulfilling recession prophecy is in play.

Some countermeasures for manufacturers are to increase their market share and generate new revenue streams, such as with new product lines or direct-to-consumer sales to increase their revenues, while expecting new orders to slide back a bit in 2023 but support a sustainable level of revenues and profits. Just trying to weather the storm may lead to deeper layoffs and Chapter 11 or worse if the recession is long and hard. In our view, the Fed is using a monkey wrench where they shouldn’t be monkeying around. n

A. Weiss, Publisher

Contact laweiss@mfgtalkradio.com for comments, suggestions and ideas and guest requests for MFGTALKRADIO.COM podcast or any of our podcasts.

PMI STILL IN CONTRACTION. DEMAND, INTERNATIONAL TRADE, BUSINESS CONFIDENCE STILL SLIDING. U.S. AUTO SALES UP

By: Royce LoweThe industry we refer to as Manufac turing has certainly been topsy turvy of late, throwing to the wind many forecasts from many renowned fore casters. It’s mostly to do with tariffs, a pandemic, then a war, lockdowns

in China, turning off of natural gas supplies by the war’s aggressor, and hence an energy crisis. This has led to cost increase upon cost in crease, and inflation rates not seen in decades. The outcome of all these

deleterious factors is a serious drop in demand, at all levels.

So what looked like an upswing in 2022 turned into a somewhat discour aging dip in manufacturing and, of course, associated industries and ser vices. Now we are caught wondering about the rest of 2022, and particu larly 2023. Where are we going, and what will get in our way?

We should mention here the ASIS (Armada Strategic Intelligence System) Report, put out monthly by Armada-Intel.com, which uses an analysis of around 20 trigger points to predict manufacturing performance in the short term. It is looking at

a significant dip in manufacturing production, as exemplified by fab ricated metal production - a good barometer of what is happening in manufacturing - for the balance of this year through early 2023. Fabri cated metal is used in infrastructure, construction, housing, automotive, white goods, and a host of other applications.

The forecast for the Primary Metal Industry is embodied in recent re marks from U.S. Steel’s CEO, David Burritt, who said he sees reduced steel demand in the U.S. through the end of the year, with a likely improve ment in 2023 and beyond. He also notes improvements in the automo tive, machinery, and energy sectors, which are all fabricated metal users.

Prices for the non-ferrous metals aluminum, copper, nickel, and zinc continue at depressed levels com pared to six months ago, with LME stocks returning to something like normal levels.

The Economist Intelligence Unit (EIU) predicts that the demand for EVs will be the only bright spot in a gloomy 2023 for the auto industry. Sales of fossil-fuel cars and com mercial vehicles will continue to fall, but the EIU expects EV sales to rise by 25% to 10.7 million units.

Global energy consumption will grow by only 1.3% in 2023 amid a slowing economy, according to the EIU.

The aircraft services market will re cover to its pre-pandemic level by the end of 2023, and double in value over the next 20 years, Airbus said upon the release of its latest Global Servic es Forecast.

The manufacturing skills gap in the U.S. could result in 2.1 million unfilled jobs by 2030, according to a new study by Deloitte and The Manufacturing Institute, the work force development and education partner of the NAM. The cost of those missing jobs could potentially total $1 trillion in 2030 alone.

There is little doubt, judging from the sources consulted, that demand will continue to dip for the balance of 2022, but barring further global

continued

disasters, it seems the curve will turn upwards and will continue in that vein for at least the near future. There will be improvement, but it will not be extraordinary. We will

attempt to stay abreast of this critical situation, as accurately as possible.

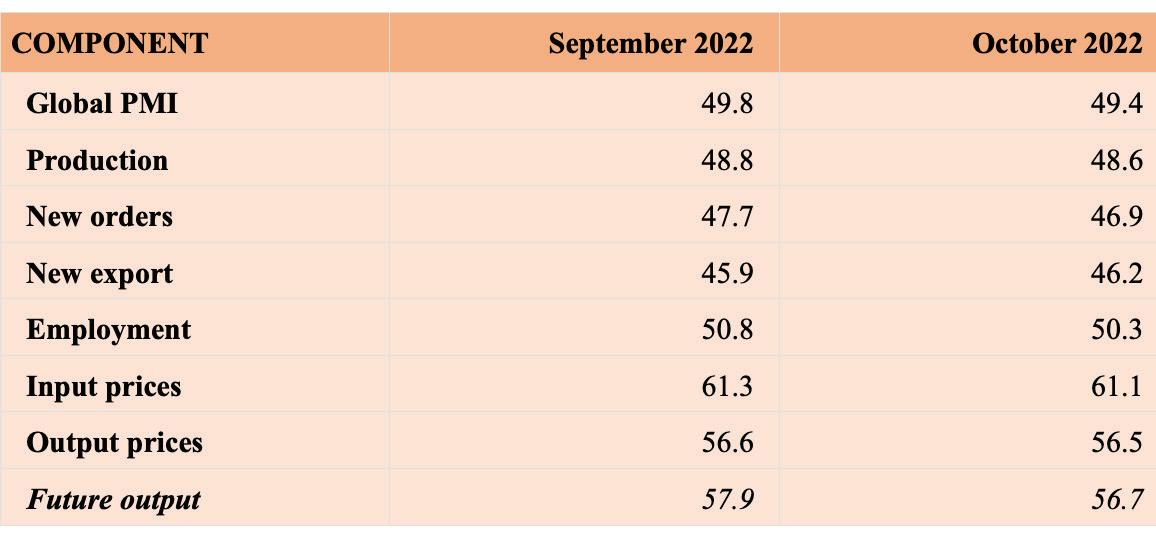

The JP MORGAN GLOBAL MANUFACTURING PMI – a composite

index produced by JPMorgan and S & P Global in association with ISM and IFPSM (International Federation of Purchasing and Supply Manage ment) – fell from 49.8 in September to 49.4 in October. Manufacturing production was down for the second consecutive month, and here was con nected to the intermediate goods area. Production increased in the consumer and investment goods areas. Employ ment was up for the 24th consecutive month, with increases in the U.S., the Eurozone, and Japan being partly offset by reductions in China and the UK. Business optimism fell to a 29-month low.

The Bureau of Economic Analysis says the U.S. Real Gross Domestic Product increased at an annual rate of 2.6% in the third quarter. This was following a decrease of 0.6% in the second quarter of 2022 and a de crease of 1.6% in the first quarter.

Reports from the U.S. auto industry for those companies reporting, show increased sales in October for GM, Toyota, Hyundai, Kia, and Subaru, with decreases for Ford, Stellantis, and Honda. Overall sales for October were up 11.2% year-over-year. The Seasonally Adjusted Annualized Rate for total new vehicles in the U.S. is 15.28 million units, up by 1.8 million units from 2021.

European new car registrations jumped in September, the second month in a row of growth after 13 months of consecutive decline. The number of new vehicles registered in the European Union, Britain, and the European Free Trade Association (EFTA) grew by 7.9% year-over-year to 1,049,926 units, according to the European Automobile Manufacturers Association.

The China Association of Automobile Manufacturers reported total vehicle sales of 2.61 million for September, up 25.7% year-over-year. Passenger cars at 2.332 million were up 32.7% year-over-year. Total sales January through September, at 19.47 million, were up 4.4% year-over-year. NEV sales in September, at 708,000, were up 93.9% year-over-year, while sales January through September were up 110% year-over-year at 4.567 million units.

Global crude steel production was up by 3.7 percent year-over-year in the month of September for the 64 reporting countries – which represent 98 percent of world crude steel pro duction – to 151.7 million tons (MT). Production for the first nine months was down 4.3% year-over-year, at 1,405.2 million tons. In September,

Asia and Oceania produced 113.0 million tons, up 10.6% year-over-year; China produced 86.95 million tons, up 17.6% year-over-year. The price of hot-rolled coil in the U.S. in early November is running around $710 per ton, more than a $1,000/ton decrease from one year ago.

The global production of primary alu minum continued at its normal pace in September, with China producing almost 60% of the 5.702 MT total. There is effectively no change in non-ferrous metal prices from early October, with aluminum at $1.10 per lb; copper at $3.45; nickel at $10.00; zinc at $1.30.

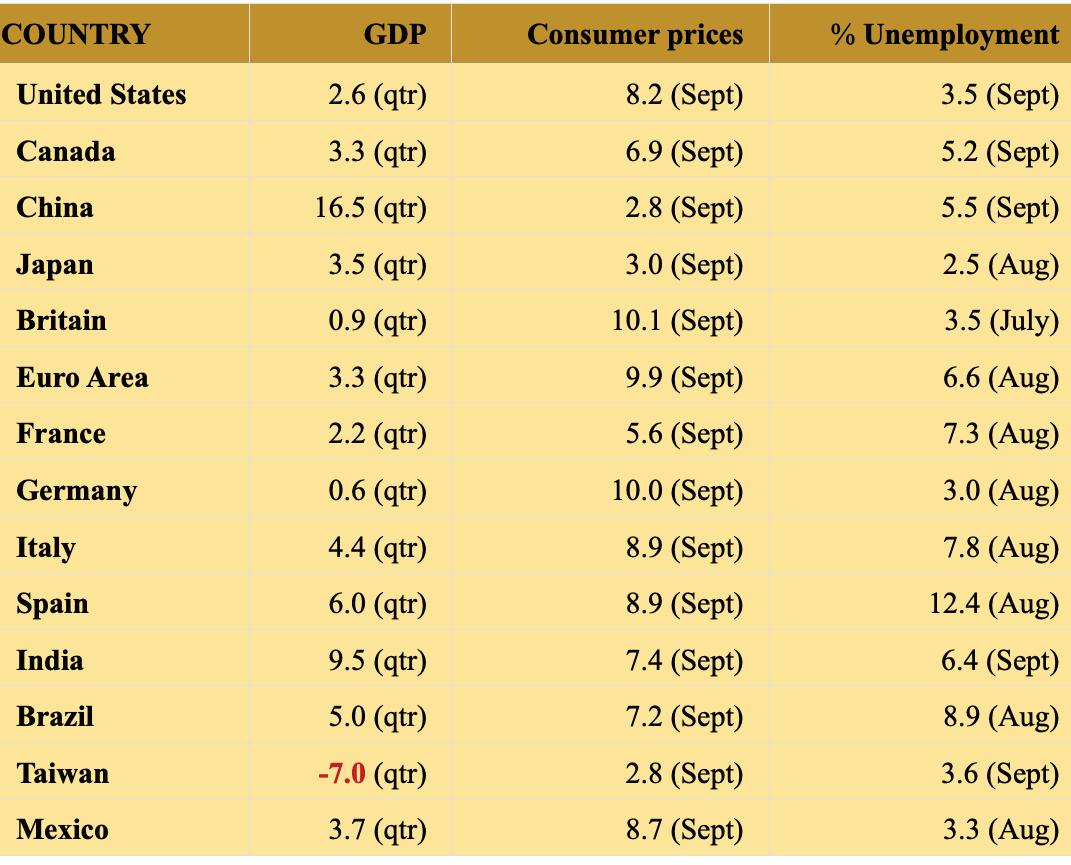

THE ECONOMIST magazine, in its latest weekly report on world econ omies, highlights changes in Gross Domestic Product (GDP), Consumer

Prices and Unemployment Rates for what it considers the world’s major economies. These data are not neces sarily good to the present day, but are mostly applicable to at latest the past two months, and show definite trends in the world economy. The figures are qualified as being the latest available, and with reference to a given quar ter or month. The figures for GDP represent the percent change on the previous quarter, or annual rate. The consumer price increases represent year-over-year changes. The unem ployment percentage figures are for the month as noted.

Author profile: Royce Lowe, Manufac turing Talk Radio, UK and EU Inter national Correspondent, Contributing Writer, Manufacturing Outlook. n

The need for a middleman is becom ing less and less necessary nowadays. Online retail has given businesses the means to act as their distributor, and made it easier than ever before. Brands need to connect more directly with customers, and they would be foolish not to answer those demands. It all starts with fulfillment when you already have products.

The unique challenge of providing a customized experience for consum ers isn’t difficult; it just takes time to set up the components of the system. Putting in the research to evaluate software, space needs, and people

solutions, from webpage content to customer service after the sale, is all part of the mix. Don’t worry, it’s not all gizmos and robots just yet. Today, let’s just discuss how you can start delivering your products directly to the customers.

It’s just as it says, the business sells their products directly to the individu als, without a big box retailer or other middlemen taking their cut. Inven tory management, packaging, and distribution of your products become your responsibility, although you are

doing most of that now, but in bulk as Direct-to-Business (D2B or DTB) rather than in eaches. The reliability of third-party delivery services has become solid. And great customer service when there is a problem often separates the big winners from the huge losers.

While this is completely subjective to the size and complexity of your business, it’s assumed that the upfront costs of this endeavor will be manage able and a sufficient ROI is attainable to warrant exploring. Hiring new people, having space for inventory,

implementing software systems, pick and pack equipment, and process training costs a lot of money. It’s important to have all of these things scoped out before you consider deliv ering products D2C.

Since all the efforts are now on you, that means hiring and training new people to execute within defined processes. Set-up isn’t just costing money, but precious time as well. The biggest challenge will be pick-packand-ship personnel and the systems to support them, and making the cus tomer happy when a problem arises.

Everything rests on you, and that means the miscues are also on you. Whether you need to compensate for late delivery or refund an item, it’s your people handling the process. Once again, if your product is for end user consumers, you are already conducting due diligence for product quality and liability.

This is a great opportunity to get feedback from consumers directly. Often times, a middleman makes most businesses lose touch with the comments from the end user. When everything is handled by a third party, new relationships aren’t easily tracka ble or nuturable.

Direct distribution makes you more in tune with the needs of your cus tomers. It builds brand loyalty in a

way that middlemen simply can’t by cross-promoting or upselling other products you manufacture. Direct delivery also makes the customer feel more exclusive and cared for if you add some little extras into the box, like a next-purchase coupon or thank you card.

With no middleman, you now have more control over distribution and customer relationships. It’s a refreshing change of pace, especially for businesses who have had to go through bureaucracy with big retailers. If something happens, you’ll be the first to know, as opposed to finding out about it way later from the busy retail er. However, you may want to con sider a bulk distribution channel, like Amazon, which sells to consumers, rather than create a channel where you control (manage) inventory, warehous ing, and pick-pack-and-ship.

Marketing Is Different Marketing to the consumer requires a focus on the individual end user, as compared to marketing to retailers or the supply chain professionals that feed the retail distribution channel. If you package in bulk, you may have to re package in eaches or small lots which changes the written words you use to present your product to consumers. This includes the content on your retail website and SEO on search engines, whether you have your own website or use a third-party like Amazon’s.

The Best Ways To Distribute Directly

Here are some options as a direct dis tributor of your products.

From Your ‘House’ to Theirs UPS, FedEx, the USPS, and other delivery services has seen their busi ness demand explode during Covid. In most cases, delays were minimal, even with other supply chain disrup tions. They are a key partner in your D2C business when the pick-up point is from your facility for delivery to the consumers’ homes or businesses. Keep in mind that you will need a sales platform, like a website with an e-commerce component, and the mar

keting (think SEO and social media) for market exposure.

There are warehouse and pick-packand-ship services where you can store your inventory and market D2C. Amazon is the most well-known, however, Walmart also provides a similar service. It will take some financial figuring and forecasting to determine if using a third-party fulfill ment operation will be favorable, and not cannibalize your retailer orders or compromise those relationships. In this model, you don’t have the full burden of the website, but you will have to manage your page content and pricing.

Direct-to-consumer sales isn’t a new revenue stream for manufacturers, but it is probably an underutilized one. There are many software choices available for each step in the process, from inventory management through pick-pack-and-ship to payment. If the volume develops, it should be an im provement in your cashflow, because your bank will release funds as soon as 3 days, as opposed to you selling in bulk at Net 30 or 60.

Companies as large as Walmart have a D2C website, and businesses as small as a local fudge shops and coffee roasters do, as well. It can be a beneficial way to create a new revenue stream if you do not have this one in place today, and in most cases, you can walk before you run with an initial product offering before you load all your SKUs online.

You can find more in-depth infor mation one this subject at https:// katanamrp.com/blog/winning-formu la-for-d2c-manufacturers/

About the Author Bash Sarmiento is a writer who focuses on business and industry. He can be reached at Bash Sarmiento bpsarmiento.writes@gmail.com. n

By: Faith Wanjiru

By: Faith Wanjiru

It’s no secret that the U.S. is not gathering enough energy from its water sources. In an effort to solve the issue, the Department of Energy (DOE) has committed $35 million in funding to advance tidal and river current energy systems. Ultimately this investment is supposed to raise up a sector that does not currently have a major presence in the states.

In a statement made last month, the DOE said that this new funding opportunity represented the largest investment in tidal and river energy technologies in the United States. This money is currently slated to become available sometime in 2023.

The DOE has posted a notice of intent online {https://eere-exchange.energy. gov/Default.aspx#FoaId110aceb4394b-4aa2-8c3e-1232302c0ab2}. The organization has outlined within the document that the final goal of this funding will be to:

Build upon state clean energy strategies with local partners; Attract competitive tidal/current developers for technology site integration; Improve tidal/current Research and Development (R&D); Build site infrastructure and supply chains, with increased participation at the state level, including local

agency, tribal and university research participation; and establish a working business model covering site development to commercial scale

Alejandro Moreno, who is the acting assistant secretary for Energy Efficiency and Renewable Energy, has said that the country’s oceans and rivers have a huge potential as a renewable energy source. According to the DOE, the funding is coming from the Bipartisan Infrastructure Law.

Various countries from around the globe have been experimenting with tidal energy over the past few years.

Back in July of 2021, Scotland turned on their tidal turbine which has been dubbed “The world’s most powerful” off the coast of Orkney at the European Marine Energy Centre.

Scotland also opened a $5.64 million facility in May of 2022 that has the ability to test tidal turbine blades under strenuous conditions. The researchers behind this project hope it will help accelerate the development of marine energy technology and lower costs.

Japan also has its own solution in the works known as Kairyu. This 100-kilowatt-class generator completed a 3 ½ year long test back in February held by the Tokyo-based engineering firm, IHI Corporation. Engineers have proposed the system’s deployment in the Kuroshio current along the eastern coast of Japan and could be fully up and running by 2030.

Although many are excited for the potential this technology holds, it is hard to ignore some of the challenges that come with scaling tidal energy. A point that the DOE acknowledged in its announcement.

“The U.S. tidal and river current energy industry requires long-term and substantial funding to move from testing devices one at a time to establishing a commercial site,” they said.“The complexity of installing devices and navigating permitting processes, combined with a lack of connection to local power grids, have

proven to be a consistent barrier to advancing tidal and river current energy.”

As of now, the United States power generation is heavily reliant on the use of fossil fuels. According to figures shared by the U.S. Energy Information Administration, in 2021 fossil fuels accounted for 60.8% of electricity generation. Renewables only represented 20.1%, while nuclear sat at 18.9%.

In recent years companies have focused their efforts on a variety of different systems. One of these developments includes tidal stream devices which the European Marine Energy Centre says are similar to submerged wind turbines. The scale of tidal stream and wave energy projects is relatively small when compared to other renewables.

According to data released in March of 2022, Ocean Energy Europe (OEE) said 2.2 megawatts of tidal stream capacity was installed on the continent last year, compared to the 260 kilowatts in 2020.

This technology holds huge potential for the entire planet. With water making up 71% of Earth, it is imperative that tidal energy grows as a resource to make up for the large amount of fossil fuels being used. Hopefully, this new investment from the DOE is the catalyst needed to usher in a new era of renewable energy advancements. n

The shipments component of the Cass Freight Index® fell 1.4% m/m in October (+0.3% SA).

On a y/y basis, the index rose 2.9%, decelerated from 4.8% in September. After a soft 1H’22, with freight demand hit by inflation, substitution from goods back to services, and now excess inventory, the improvement in the past few months is still a little puzzling. It likely reflects a combination of:

• unique comparisons

• inventory building ahead of the holidays

• repositioning of mistimed inventory

• consumers getting ahead of rising interest rates

• easing supply constraints, particularly in auto production These are all temporary to varying degrees, and quickly declining import trends suggest they may end soon.

Normal seasonality from here would have shipments slowing to flat y/y in November, down 5% y/y in December, and about flat for the year.

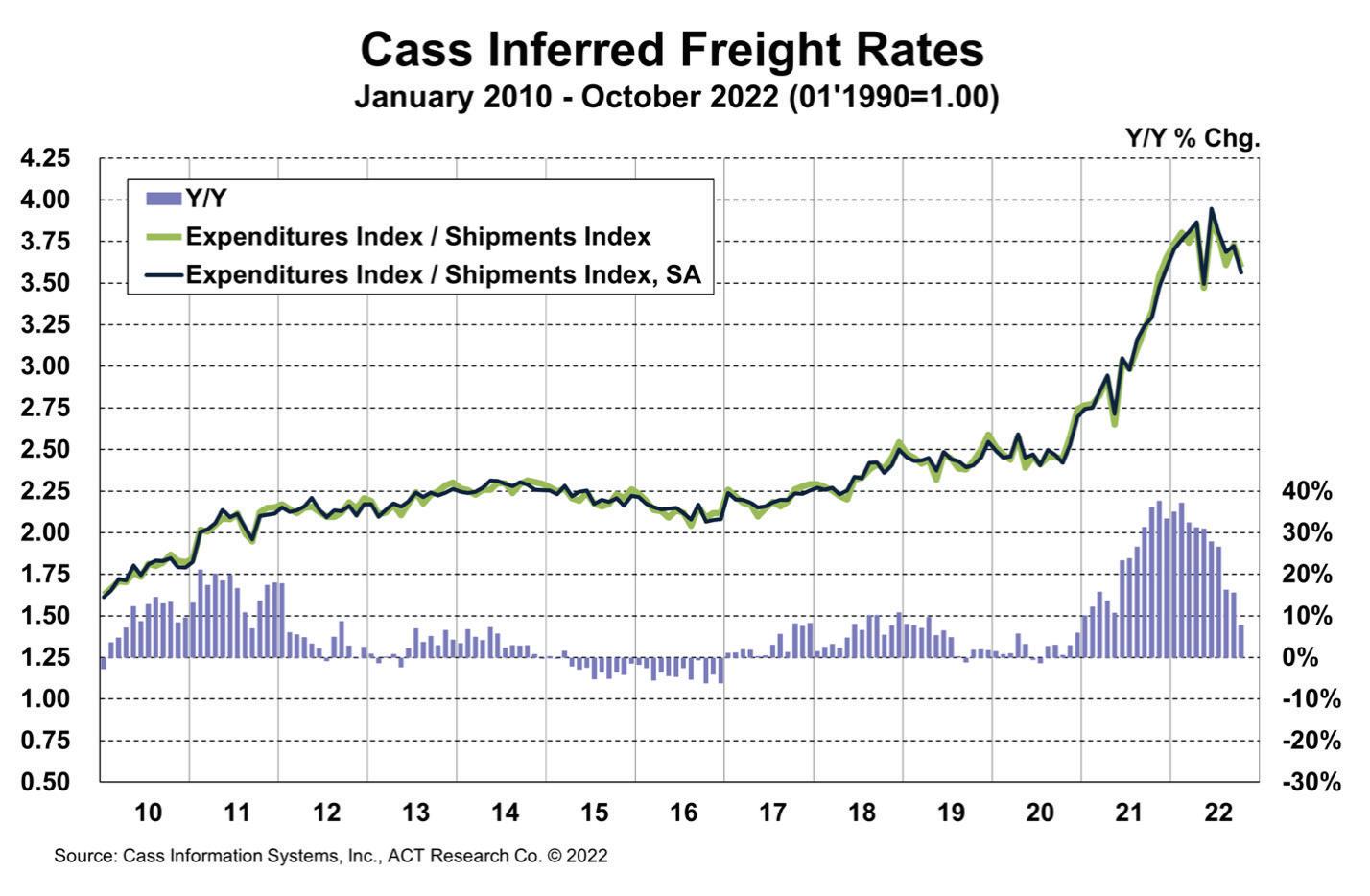

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, fell 4.9% in October after a 0.3% m/m increase in September. Against

a shipment decline of 1.4% m/m in October, we can infer that rates overall were down 3.6% (see our inferred rates data series below). The increase in rates m/m appears mainly due to mix changes and seasonality.

The expenditures index slowed to an 11% y/y increase in October from 21% in September. On an SA basis, expenditures fell 4.0% m/m in October, with shipments up 0.3% m/m and rates down 4.3%. This index includes changes in fuel, modal mix, intramodal mix, and accessorial charges.

Following normal seasonality from here, this index is now likely to turn down on a y/y basis in December.

The freight rates embedded in the two components of the Cass Freight Index slowed to 7.9% y/y growth in October, from 16% y/y growth in September.

Cass Inferred Freight Rates™ fell 3.6% m/m (-4.3% SA) in October. After considerable noise from fuel prices, which remain elevated, and modal mix, we see the decline as the result of the looser freight market supply/demand balance, and a downturn is nearing on a y/y basis. The supply/demand balance in U.S. trucking markets has loosened significantly this year, and as a result freight rates are leveling off and set to soften further in the months to come.

The normal seasonal pattern would have this index up just 1% in November, and with considerable declines beginning in truckload contract rates, the negative inflection in freight costs may well happen this coming month.

While shippers aren’t seeing any real savings yet, considerable cost relief is now highly probable for 2023, which

we think will be welcome news for the broader inflation picture.

Cass Inferred Freight Rates are a simple calculation of the Cass Freight Index data—expenditures divided by shipments—producing a data set that explains the overall movement in cost per shipment. The data set is diversified among all modes, with truckload representing more than half of the dollars, followed by LTL, rail, parcel, and so on.

The Cass Truckload Linehaul Index®, which measures changes in truckload linehaul rates, slowed to a 2.0% y/y increase in October after rising 3.9% y/y in September.

On a m/m basis, the Cass Truckload Linehaul Index fell 1.5% after a 2.2% decline in September.

As a broad market indicator, this index includes both spot and contract freight, and with spot rates already down significantly, it’s only a matter of time until the index begins to decline on a y/y basis (December isn’t out of the question).

Similar to what has occurred in the spot market, the recent resurgence of fuel costs, which are excluded from this index, will also likely act as a brake on linehaul rates.

We would still describe the freight market as soft, with much of the recent strength on a y/y basis more statistical noise than signal, as evidenced by the 5% y/y decline in shipments that will take place in December if normal seasonality plays out from here.

To highlight the growing contrast between data sets as the economy slows, the ACT For-Hire Volume Index, a survey-based sentiment indicator, recently registered a new cycle low. So, it feels a lot softer to the industry than the Cass data suggest, but the bridge between the two is supply. It doesn’t feel like a good environment because there is more supply chasing a similar amount of freight. And it is this imbalance that is allowing freight costs to begin to come down.

Now that the pendulum is swinging, some crucial questions about the freight rate cycle have been raised: How long? And when will it turn? The ACT Research Freight Forecast report provides monthly, quarterly, and annual predictions for the truckload (TL), less-than-truckload (LTL), and intermodal markets through 2024, including capacity, volumes, and rates. The report provides monthly updates of forecasts for the shipments component of the Cass Freight Index and the Cass Truckload Linehaul Index, as well as DAT spot rates by trailer type, including and excluding fuel surcharges. n

Economic activity in the manufactur ing sector grew in October, with the overall economy achieving a 29th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business® .

The October Manufacturing PMI® registered 50.2 percent. The New Orders Index remained in contrac tion territory at 49.2 percent, 2.1 percentage points higher than the 47.1 percent recorded in Septem ber. The Production Index reading of 52.3 percent is a 1.7-percent age point increase compared to September’s figure of 50.6 percent. The Prices Index registered 46.6 percent, down 5.1 percentage points compared to the September figure of 51.7 percent. This is the index’s lowest reading since May 2020 (40.8 percent). The Backlog of Orders Index registered 45.3 percent, 5.6 percentage points lower than the September reading of 50.9 percent.

Eight manufacturing industries reported growth in October, in the following order: Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Machinery; Petroleum & Coal Products; Transportation Equipment; Miscellaneous Manufac turing‡; Plastics & Rubber Products; and Electrical Equipment, Appli ances & Components. Of the six biggest manufacturing industries, three — Machinery; Petroleum & Coal Products; and Transportation Equipment — registered moderateto-strong growth in October. ISM

Analysis by Timothy R. Fiore, CPSM, C.P.M. Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

The U.S. manufacturing sector grew in Octo ber, as the Manufacturing PMI® registered 50.2 percent, 0.7 percentage point below the reading of 50.9 percent recorded in Septem ber. The Manufacturing PMI® indicated weak sector expansion and U.S. economic growth in October. Of the five subindexes that directly factor into the Manufacturing PMI®, two (Production and Inventories) were in growth territory.

INDEX

Oct Index Sep Index % Point Change Direction Rate of Change Trend* (months)

Manufacturing PMI® 50.2 50.9 -0.7 Growing Slower 29 New Orders 49.2 47.1 +2.1 Contracting Slower 2 Production 52.3 50.6 +1.7 Growing Faster 29 Employment 50.0 48.7 +1.3 Unchanged From Contracting 1

Supplier Deliveries 46.8 52.4 -5.6 Faster From Slowing 1 Inventories 52.5 55.5 -3.0 Growing Slower 15 Customers’ Inventories 41.6 41.6 0.0 Too Low Same 73 Prices 46.6 51.7 -5.1 Decreasing From Increasing 1

Backlog of Orders 45.3 50.9 -5.6 Contracting From Growing 1 New Export Orders 46.5 47.8 -1.3 Contracting Faster 3 Imports 50.8 52.6 -1.8 Growing Slower 5

Overall Economy

Growing Slower 29

Manufacturing Sector Growing Slower 29

Commodities Up in Price: Caustic Soda; Corn; Diesel; Electronic Components (23); Freight (24); Gasoline; Labor — Temporary (2); Metal Based Products; and Paper (3).

Commodities Down in Price: Aluminum (6); Aluminum Products; Brass; Copper; High-Density Polyethylene (HDPE) Resin (2); Low-Density Polyethylene (LDPE) Resin; Lumber (2); Natural Gas; Ocean Freight (2); Plastic Resins (5); Polypropylene (3); Polyvinyl Chloride (PVC); Steel (6); Steel — Carbon (4); Steel — Hot Rolled (6); Steel Products (4); and Wood Pallets. Commodities in Short Supply: Bearings; Electrical Components (25); Electrical Motors; Electronic Components (23); Hydraulic Components (6); Labor — Temporary (2); Paper Products; Plastic Resins; and Semiconductors (23).

Note: To view the full report, visit the ISM ® Report On Business® website at ismrob.org The number of consecutive months the commodity has been listed is indicated after each item.

The Production Index registered 52.3 percent. The six industries reporting growth in production during the month of October — listed in order — are: Plastics & Rubber Products; Computer & Electronic Products; Transportation Equipment; Primary Metals; Machinery; and Fabricated Metal Products.

ISM’s New Orders Index registered 49.2 percent. Of the 18 manufacturing industries, three reported growth in new orders in October: Apparel, Leather & Allied Products; Petroleum & Coal Products; and Plastics & Rubber Products. Twelve industries reported a decline in new orders in October, in the following order: Wood Products; Furniture & Related Products; Printing & Related Support Activities; Paper Products; Textile Mills; Fabricated Metal Products; Primary Metals; Nonmetallic Mineral Products; Food, Beverage & Tobacco Products; Transportation Equipment; Chemical Products; and Miscellaneous Manufacturing‡ Employment (Manufacturing)

ISM’s Employment Index registered 50 percent. Of 18 manufacturing industries, nine reported employment growth in October, in the following order: Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Petroleum & Coal Products; Food, Beverage & Tobacco Products; Machinery; Plastics & Rubber Products; Miscellaneous Manufacturing‡; Electrical Equipment, Appliances & Components; and Chemical Products.

The delivery performance of suppliers to manufacturing organizations was faster in October, as the Supplier Deliveries Index registered 46.8 percent. Four of 18 manufacturing indus tries reported slower supplier deliveries in October: Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Textile Mills; and Transportation Equipment.

The Inventories Index registered 52.5 percent. Of 18 manufacturing industries, the nine reporting higher inventories in October — in the following order — are: Machinery; Primary Metals; Computer & Electronic Products; Electrical Equipment, Appliances & Components; Furniture & Related Products; Nonmetallic Mineral Products; Miscellaneous Manufacturing‡; Transportation Equipment; and Food, Beverage & Tobacco Products.

Manufacturing PMI®

Customer Inventories (Manufacturing) 2022 2021 2020 41.6%

Prices (Manufacturing)

October 2022

ISM’s Customers’ Inventories Index registered 41.6 percent. Four industries (Paper Products; Wood Products; Electrical Equipment, Appliances & Components; and Primary Metals) reported customers’ inventories as too high in October.

Backlog of Orders (Manufacturing) 2022 2021 2020 45.3% New Export Orders (Manufacturing) 2022 2021 2020 46.5%

ISM’s Backlog of Orders Index registered 45.3 percent. Three industries reported growth in order backlogs in October: Apparel, Leather & Allied Products; Petroleum & Coal Products; and Food, Beverage & Tobacco Products.

ISM’s New Export Orders Index registered 46.5 percent. Three industries reported growth in new export orders in October: Miscellaneous Manufacturing‡; Plastics & Rubber Products; and Food, Beverage & Tobacco Products.

ISM’s Imports Index registered 50.8 percent. The seven industries reporting growth in imports in October — in the following order — are: Primary Metals; Electrical Equipment, Appliances & Components; Miscellaneous Manufacturing‡; Transportation Equipment; Food, Beverage & Tobacco Products; Plastics & Rubber Products; and Machinery.

The ISM Prices Index registered 46.6 percent. In October, five of 18 industries reported paying increased prices for raw materials: Paper Products; Food, Beverage & Tobacco Products; Primary Metals; Miscellaneous Manufacturing‡; and Computer & Electronic Products. ‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

Pressure Builds Regarding Recession

by Dr. Chris Kuehl

Pressure Builds Regarding Recession

by Dr. Chris Kuehl

This issue is a little more focused on the U.S. economy in general than usual. There are obviously differences between the three North American players, and we will get back to that breakdown in future pieces. For now, the specter of inflation-driven recession dominates, and there are as many theories floating around as there are economists floating them.

What to make of recession angst?

I really don’t want to be a media basher – really, I don’t. I understand that this is a tough task, and those in the media are trying to explain very complicated issues in a sound bite or two. I never know who to lay the blame on – the consumers who seem to have the attention span of a gnat or the media outlets that don’t try to stretch people’s understanding. It has

long been an adage that “if it bleeds, it leads,” a reference to the tendency to go for maximum drama. The same issue affects the coverage of the economy. The behavior of over 320 million US consumers, 31.6 million small businesses, and 32.6 million total businesses is immensely difficult to assess, much less predict. It is quite impossible to lump all of these actors into one bucket, but yet we

try. Is every industry suffering from recession? Is every person facing economic ruin? Of course not. The fact is that the U.S. never experiences a 100% boom or bust – there are always those that buck the trend.

In the last several months, I have been on the road at a feverish pace. I have spoken to a dazzling assortment of industry groups, and every one has had a different experience with the last few years. There was the Casket and Funeral Supply Association, whose members had a very good year in 2020. The Self Storage industry boomed in 2021. The automotive sector has been seeing solid growth as demand has outstripped supply. Machinery producers have not been so lucky, and now there is a slump underway as far as production of memory chips, and the bloom is off the rose for the virtual workplace.

Fortunes rise and fall fast in a complex economy such as that in the U.S. It would perhaps be simpler if the threat of recession was universal and everybody could just assume they will have to hunker down and endure, but the reality is that many sectors

will survive and even thrive in the midst of a downturn. What does this mean for the overall business community?

The first task is to understand what is driving the downturn. The immediate cause of the slowdown has been the residual impacts from the two “Black Swan” events that have dominated strategy since the start of 2020. The global Covid shutdown was a major mistake as nobody really understood the implications of such a massive economic blow. It was not supposed to last more than a few weeks but dragged on for nearly two years. That Black Swan crushed the supply chain, and there has yet to be a full recovery. This triggered a “cost-push” type of inflation, and that kind of inflation is something the central banks are ill-equipped to deal with.

The second Black Swan was the Russian invasion of Ukraine. Again, this was not supposed to be the long, drawn-out ordeal it has become, as most assumed Ukraine would fall quickly and the world would figure out how to work with Russia again.

The oil crisis, combined with the food crisis, drove prices very high – unpredictably high. The inflation surge forced central banks to unleash the only tool they have – higher interest rates. This is despite the fact that the bankers do not have much faith in the ability of the higher rates to calm this kind of inflation in the short term.

The second task is, in many ways, more important. How will this recession or downturn affect the industry that someone engages in. This is far harder to predict. The surge in demand for vehicles has been a combination of pent-up demand and supply chain shortage. Sooner or later, the demand is satisfied and/ or the supply chain catches up, but few know when this will take place. The recent surge in aerospace has been triggered by the return of the passenger. Airlines have implemented fare hikes due to fuel costs, but this has not slowed the traveler, and now even the business traveler is back. In contrast, the demand for virtual interaction has been fading, and along with that has come a reduction in demand for what powers Zoom and the others. As single-family housing demand declines in the face of higher mortgages and higher prices, the demand for multi-family units expands, and there is still a shortage of over 5 million homes.

Expanded multi-family demand means expanded demand for appliances and all the other elements of an apartment (from lumber and plumbing to textiles and furniture). And so it goes. Every day brings some depressing news for one sector of the economy and more encouraging news for another.

There is a third area of interest and concern, of course. How deep and how long? The truth of the matter is that most companies and individuals can handle a short and shallow recession or downturn. The majority of businesses have enough in reserve to get through a brief period, and most consumers have a cushion, as well. This is certainly not the case for every business or person. Those that are making less than $50k are

vulnerable almost immediately. They have little in the way of savings and live from paycheck to paycheck. They will have to dip into their credit cards right away. This group had only recently been digging out of the 2020 recession, and the same can be said for the business community. How long does this economic stress last?

tell a somewhat encouraging story. We started the year with two straight quarters of negative GDP growth (down by 1.6% in Q1 and down by 0.6% in Q2). These were not crushing levels but hardly encouraging. In the third quarter, the estimate called for extremely minor growth (perhaps no more than 0.3%). That was to be followed by another negative quarter in Q4 (down by perhaps 0.5%), and most expect that trend to continue into Q1 of next year with another decline of 0.5%. But then we get the shocking news that Q3 growth was at 2.6% due to a surge in demand for exports and a reduction in imports. We can thank the somewhat less dominant dollar for this. This was, nevertheless, a pretty miserable stretch and definitely

The Flagship Reports with Dr. Chris Kuehl is both an “Officer of the Watch” briefing of economic conditions and an Executive Briefing on specific situations impacting those conditions. Written and presented by the officers of Armada Corporate Intelligence, Dr. Kuehl lightens up the mood of sometimes distressful geoeconomic news with a bit of humor. This monthly podcast includes information from the Flagship Reports issued 3 times and week, and AISI, the Armada Strategic Intelligence System, a tool for durable goods manufacturers that dives deep into the sector each month to pro vide more than 95% accurate near-term forecasts.

shows that 2022 was a bad economic year. The good news is that after Q1 of 2023, the pattern is set to shift. The estimate for the second quarter is growth at 0.5% but third quarter is at 2.0%, and by fourth quarter the rate is back to 3.0%, and that is slightly above the normal rate of growth over the last twenty years (2.5%). If this all plays out as expected, the result is a year-long downturn that starts to reverse early in 2023.

There is one major factor that will have a great deal to do with the pace of growth this year and next. Not that there are not multiple factors to be concerned with (supply chain recovery, oil prices, threats from Russia and China, and so on). One will play a role right away, and the impact extends well into 2023. There

is still $3.5 trillion in excess savings in the hands of the consumer, and nobody is quite sure where that cash will go and when. If much of it is spent this holiday season, the prospects improve greatly for growth in Q4 of this year and Q1 of next. If that money is held on to by worried consumers trying to prepare for a slow next year, the recovery expected in 2023 may well be delayed. The economists are pleading with the consumer to spend like crazy, rack up their credit cards and strive to live far beyond their means. That way, the consumer spends the economy right out of recession. For the most obvious of reasons, the majority of consumers will resist that urge, but if they just spend like they once did on the holidays, the economy may start a rebound soon.

Author profile: Dr. Christopher Kuehl (Ph.D.) is a Managing Director of Armada Corporate Intelligence and one of the cofounders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years.

He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division –Finance, Credit and International Business. He prepares NACM’s monthly Credit Managers Index.

He is the Economic Analyst for the Fabricators and Manufacturers Association and writes their biweekly publication, Fabrinomics, which details the impact of economic trends on the manufacturer. n

After a nail-biting, somewhat smutty final campaign, Brazil’s October 30 run-off vote went to ex-president Lula, at 50.9 to 49.1. Bolsonaro won’t go quietly. Expect disruption. Bolsonaro truck-driver supporters are already reportedly blocking highways.

Sharing a border with Brazil, and a very long one with Chile, Argentina was, just over a century ago, the

place to go in South America. It had the pampas, so lots of beef. It had immigrants from all over the globe, mostly from Europe, and looked set to become one of the world’s major economies. It was very close to Britain, during Britain’s glory days. It invented the ballpoint pen. Then Argentina fell victim to political instability when a military junta took power in 1930. There were others in 1943, 1955, 1962, 1966, and 1976.

The country put very little emphasis on education, and thus struggled to create competitive industries. Today it is, once more, in the midst of an inflation crisis. The country is struggling.

But Whirlpool is taking a chance on Argentina. The company is betting on demand for front-load washing machines in Latin America with a new state-of-the-art plant in

Argentina, even as other foreign companies avoid the troubled country. The factory, built on the outskirts of Buenos Aires, required a $52 million investment and will export 70% of its output. Previously, front-load washing machines had to be imported into the region. The plant will produce a washing machine every 40 seconds and is expected to export $50 million worth of products a year. It will target a growing market of frontload machines in Brazil but will also export to neighboring countries including Uruguay, Paraguay, Bolivia, and Chile. Whirlpool has been in Argentina for 30 years, and according to its president is “used to volatility.” Argentina needs other investors to take a chance on it.

Argentina has the world’s secondlargest shale gas and the fourth largest shale oil reserves. It has

the third-largest proven lithium reserves in the world, after Chile and Australia, and is expected to become a leading exporter over the next decade. Over 70% of the proven lithium reserves have yet to be exploited.

Argentina’s top exports are Soybean Meal ($7.89B), Corn ($6.46B), Soybean Oil ($3.9B), Soybeans ($2.31B), and Delivery Trucks ($2.3B), exporting mostly to Brazil ($7.67B), China ($5.41B), United States ($3.47B), Chile ($2.91B), and Vietnam ($2.87B). Its major imports are (is USD) Machinery including computers: $9.5 billion (15.1% of total imports); Electrical machinery, equipment: $6.6 billion (10.5%); Vehicles: $6.4 billion (10.2%); Mineral fuels including oil: $5.8 billion (9.2%) and Iron and Steel : $1.8 billion (2.9%)

U.S. expertise, technology, and equipment are needed to further develop critical sectors of the economy, such as energy, mining, information and communications technology, infrastructure, and agriculture.

The key for Argentina to unlock its economic potential is political stability. This will help with economic stability, which, in turn, will help with economic investment. That, and a marketing campaign to woo investors and manufacturers will position Argentina as a come-back story.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

Global Contest Around Semiconductor Production Lifting of Covid-19 Restrictions, Save China Falling Currencies

A poll of European auto executives at the Paris Auto Show in October revealed that the carmaker they fear most is not TESLA, which pioneered EVs in California and has major

production facilities in China, but a little known Chinese EV manufac turer named BYD, backed by Warren Buffet. BYD had a major exhibit in Paris, as did Great Wall, alongside Renault and Peugeot. They have big plans to break into the European

market on the low end of the pricing range, coupled with incomparable customer satisfaction. Ten other Chi nese EV brands, including NIO, have similar plans. These are not the Chi nese automobile manufacturers from 15 years ago, trying to localize parts

production and learn from foreign brands such as VW along the way. These are technologically sophisti cated automakers with committed plans plus the investment backing to take Europe by storm, much like the Japanese did in the U.S. during the 1980s and 1990s.

In related developments, foreign car makers, such as Volvo, the Swedish carmaker backed by China’s Geely, have downgraded their production volumes in China due to sporadic lockdowns of suppliers, sometimes for 70 days, resulting in disruptions to their supply chains. Volvo has had to go to the open spot markets to purchase some types of semicon ductors at higher prices, cutting into third-quarter profits and forcing them to revise their 2022 forecast to a level “slightly lower” than 2021 wholesale volumes. But future orders remain strong. Moving forward, Volvo is trying to reduce its reliance on Chi nese components by sourcing more parts in Europe and the U.S. (FT Peter Campbell, London)

The American Chamber of Com merce in Shanghai released its annual investor survey in October. 307 companies participated in the survey. Only 55% remained optimistic about long-term prospects over three to five years. Most were profitable in 2021, but less than half expect their reve nues to grow in the foreseeable future, the lowest in a decade. Over half of the participants saw ongoing deterio ration of the economy as a major fac tor, in large part due to state manage ment decisions over which they have no control. 20% are pulling back on investment, and some companies no longer view China as “investable” due to structural issues, such as domestic competition, geopolitical uncertain ties, and rising labor costs.

Currently, the main culprit is ongoing Covid zero-tolerance policies, requir ing measures which have severely disrupted domestic activities. With volatile Omicron variants circulating, these measures have been stepped

up. Covid testing is a daily require ment when entering any public space or transport system. Some workers remain at factories during the entire course of a sporadic lockdown in what is called a “closed loop” sys tem. In late October, some videos of workers from Foxconn, which makes Apple’s iPhones, went viral stating they could not access supplies. In late October, a Chinese stock selloff by foreign investors was triggered by President Xi’s renewed five-year term at the 20th Party Congress, along with his appointment of loyal ists to the Standing Committee of the Politburo of the Chinese Communist Party, which serves as Xi’s highest governing cabinet. These appoint ments take affect next March for five years. Between now and then, all economic moderates and reform ers will likely be removed from the Politburo ranks, dampening the hopes of global investors for a pro-market voice and balanced economic deci sion-making without the influence of political ideology. But the new nor mal is whatever President Xi wants it to be, and this has rattled the markets. Xi’s primary objectives have been national security and control, as well as ideological unification and military strengthening, rather than economic growth. Xi has cautioned the 2300 attendees at the Party Congress that there is the potential for ‘huge storms” ahead. (A side note: accord ing to the Financial Times, no U.S. hedge funds currently maintain Chi nese investments in their portfolios.)

Xi has vowed to increase the ranks of “technocrats” in the 200-member Central Committee to spearhead China’s efforts to speed up domestic technological innovation, especially in the semiconductor manufacturing industry in the face of U.S. efforts to slow China’s tech rise. He has also vowed to bring about peaceful reunification with Taiwan but did

not rule out the use of force. Taiwan has growing concerns over China’s increasingly coercive behavior. And the U.S. is helping turn Taiwan into a “weapons depot” in response. The uncertainty caused by escalatory actions and rhetoric is a deterrent to investment in the region.

China released its third-quarter growth rate of 3.9% a week late and will undoubtedly not meet its own revised target of 5.5% for 2022. The World Bank has revised its forecast

to show lower growth for China than the rest of Asia for the first time since 1990, down to 2.8% for 2022 com pared to 8.1% last year. The rest of Asia is predicted to reach a growth rate of 5.6%, up from 2.6% last year. Economists are now predicting that China’s GDP will not exceed 5% for each year through 2024 based mainly on the assumption that China will take the slow approach to dropping its Zero Covid tolerance policy.

RIPPLE EFFECT: New U.S. Restric tions Causing Upheaval for Chinese Domestic Chipmakers and Customers

In October, the Biden Administration released new restrictions on exports to Russia and China of advanced AI Chips and the equipment and person nel needed to support the manufac ture of them. The goal is to cut Chi na’s ability to access advanced chips due to national security concerns.

U.S.-based equipment suppliers must cease all business and information sharing with Chinese semiconductor companies. This is a huge blow to China’s semiconductor industry and has caught U.S. support staff on the ground in China in the crosshairs. U.S. toolmakers such as LAM Re search, Applied Materials, and KLA Corporation have had to pull staff and stay away from fabricators in China. ASML has told all U.S. employees to “refrain –either directly or indi rectly—from servicing, shipping or providing support to any customers in China until further notice.”

The U.S. Department of Commerce Bureau of Industry and Security (BIS) has stated that these sanctions are part of an “overarching” policy to stem the use of these sensitive tech nologies by China to the “detriment

of U.S. national security and foreign policy interests.” Two major Asian semiconductor suppliers, Taiwan Semiconductor Manufacturing Cor poration (TSMC) and South Korea’s HYNIX, have told the Financial Times that they have received oneyear exceptions. Many U.S. cus tomers and suppliers in China that had plans to rely on more advanced Chinese chipmaking in their supply chains are also being affected. The impact of these far-reaching sanctions is still being assessed. The global semiconductor industry is also facing a slowdown in demand for chips used in devices such as PCs and smart phones, with related manufacturers expecting reduced revenues in 2022.

2022 GROUP OF TWENTY (G20) SUMMIT in BALI, INDONESIA World leaders of twenty nations, including U.S. President Joe Bid en, China’s President Xi Jinping,

and Vladimir Putin of Russia, will be hosted November 15-16 in Bali, Indonesia, by President Joko Widodo, this year’s rotating Chairman. At the time of this writing, it is unknown if there will be private meetings among the superpowers. The priority issues for engagement are threefold: Global Health Architecture, Digital Economy Transformation, and Energy Transition as an exit strategy to support global recovery. The results of this summit will be reported in December’s Manu facturing Outlook issue.

Author profile: Christine is cofounder and President of China Human Resources Group, Inc, a management consulting firm based in Princeton NJ. She has provided U.S. companies with strategic development and project implementation services for projects in China since 1986. n

by Chris Anderson

by Chris Anderson

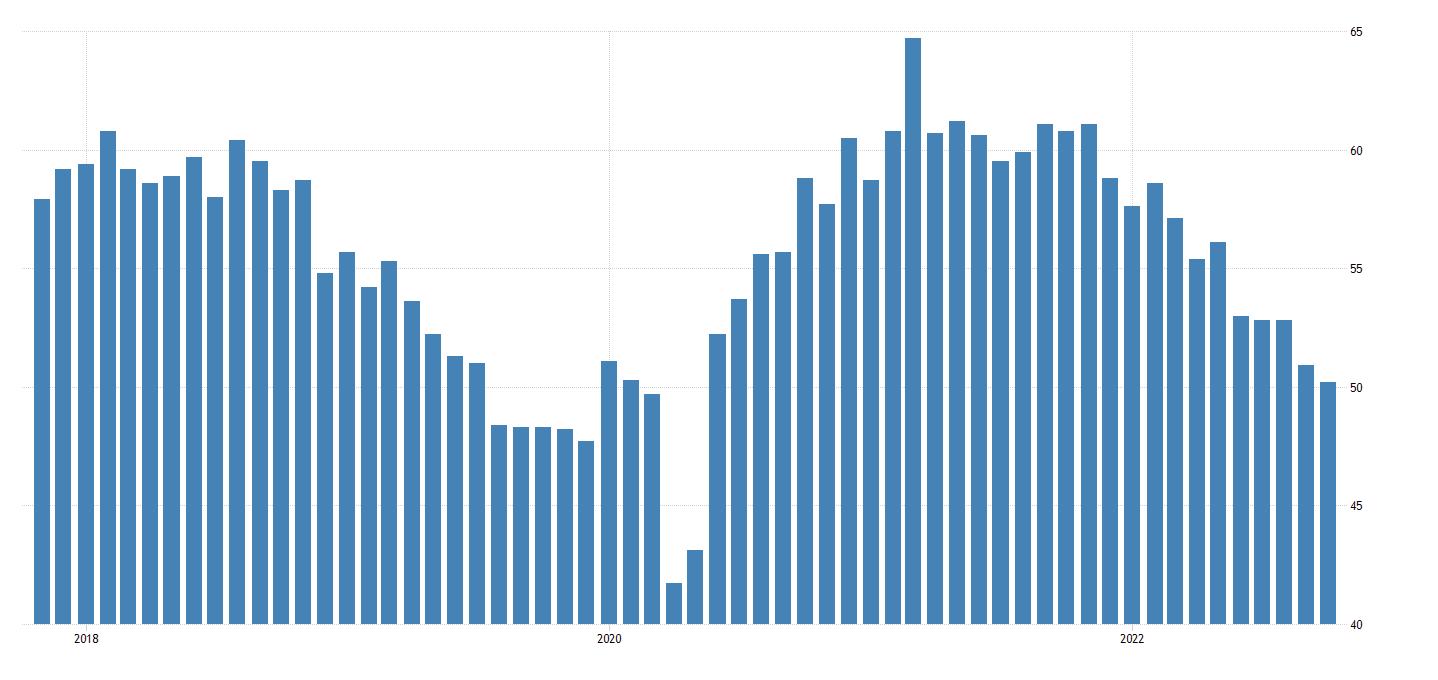

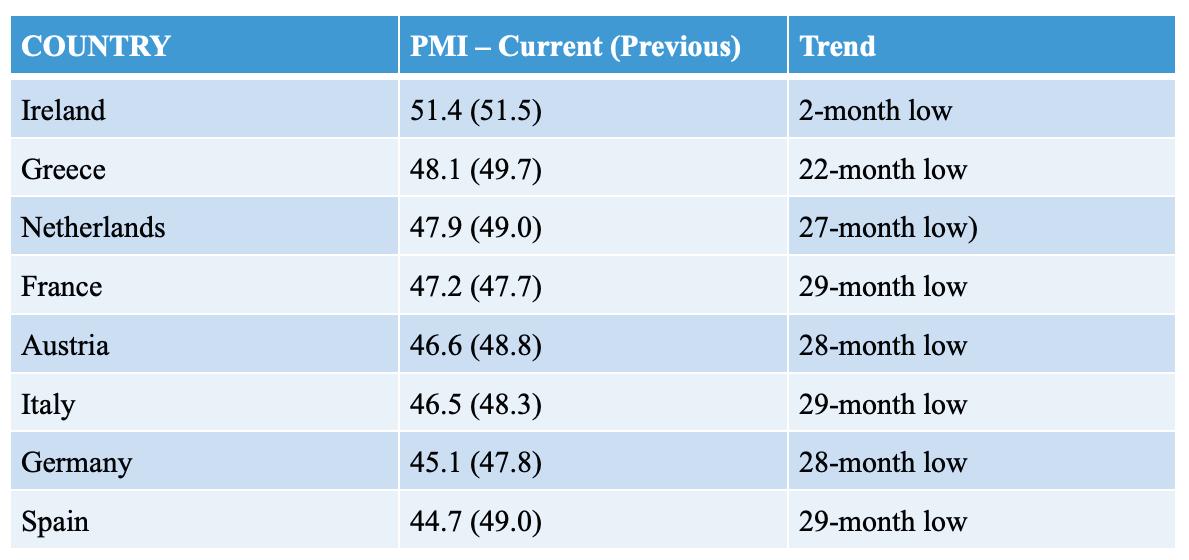

S&P Global Eurozone Manufacturing Composite Purchasing Managers’ Index (PMI), fell back from 48.4 in September to 46.4 in October, a 29-month low. The manufacturing production index fell from September’s 46.3 to 43.8 in October, a 29-month low.

The PMI fell further into contraction territory, with production and new orders falling at rates not seen in the past 25 years of PMI data collection. Export sales fell accordingly. Only Ireland saw improvement in October. The whole was aggravated by increasing energy prices. Eurozone manufacturers continue to expect falling production volumes over the next 12 months.

Germany, the world’s fourth-largest economy and its third-largest exporter of goods, (primarily motor vehicles and parts, machinery, and chemicals), is going through a tough patch. The majority of the countries in the world are going through their own tough patch, but Germany may be feeling it a little more. It doesn’t help that Germany’s largest trading partner, China, which bought some $100 billion of German goods in 2021, including cars, medical equipment, and chemicals, is also in slowdown mode.

German industry’s biggest problem is the Putin-induced spiraling cost of energy. The price of electricity for next year has already increased

15-fold, and the price of gas 10-fold, according to the BDI, the association of German industry. Companies are reducing output because of both reduced demand and the need to save on energy. Many companies are canceling or declining orders. Some relief is on the way from reduced energy usage, and imports of Liquefied Natural Gas (LNG), although this is somewhat limited by terminal capacity.

Germany is going through a period similar to that of the seventies, when it was desperately in need of immigrants for the workforce. Even as the energy squeeze tightens around German industry, and there are slowdowns in that industry, a serious labor shortage is on the horizon. Recent surveys in the second quarter of this year show estimated job vacancies in Germany at a record 1.93 million, 66% more than last year. Further to this, a think-tank found

that 49.7% of German companies cannot find enough skilled workers, up from 30% in 2019. Without changes to participation rates, retirement dates, or immigration, Germany’s workforce is set to shrink by 15 to 16 million by 2060. At its natural rate of decline, Germany’s workforce would lose 350,000 to 400,000 people a year. Without immigration, Germany’s population could fall almost 25% over the next 40 years, from 85 million to 65 million.

Germany has been through such crises before and will doubtless do its best to assimilate as many immigrants as possible into its cities and its workforce. It is rather ironic that the country that showed the world a lesson in apprenticeship programs now finds itself looking for people to teach. n

REMADE (Reducing EMbodied-energy And Decreasing Emissions Institute), a Manufacturing USA® institute, enables the early stage applied research and development of key industrial platform technologies that could dramatically reduce the embodied energy and emissions associated with industrial-scale materials production and processing.

Manufacturing USA, a public-private partnership with 14 manufacturing institutes across the nation, connects companies, academic institutes, non-profits, and local, state, and federal entities to solve industry-relevant advanced manufacturing challenges in new technology areas with the goals of enhancing industrial competitiveness and economic growth and strengthening national security.

U.S. manufacturing accounts for nearly 25 percent of the nation’s total an nual energy use. Embodied energy is the sum of all processes required to mine, produce, process, manufacture, transport and deliver products. The products created and manufactured embody a major portion of that energy. REMADE works to improve U.S. manufacturing competitiveness by part nering with industry to develop advanced manufacturing technologies that incorporate energy-reduction and sustainability principles. Lifecycle energy consumption for products can be greatly reduced by improving recycling and remanufacturing technologies. REMADE aims to drive down the energy and cost required to recover, reuse, remanufacture and recycle four classes of materials: metals, fibers, polymers, and electronic waste.

REMADE brings together experts from companies, universities, national labs and trade associations to explore cost effective-solutions to the technical and economic challenges facing the U.S. manufacturing landscape. This is done through:

Technology roadmaps and funded collaborative projects

Innovation early-stage research to address cross-cutting challenges focused on: System Analysis & Integration; Design for Recovery, Reuse, Remanufacturing, & Recycling (Re-X); Manufacturing Materials Optimization; Remanufac turing & End-of-Life Reuse and Recycling & Recovery

Education and training to prepare the U.S. workforce to deploy and manufacture REMADE-relevant technologies

Advanced Manufacturing National Program Office, NIST | www.ManufacturingUSA.com | 301-975-2830 | amnpo@nist.gov

“The REMADE Institute’s focus on supporting U.S. manufacturing with more efficient technolo gies and processes for industrial reuse and recycling is very much in line with our institution’s values and commitment to our region. Monroe Community College is partnering with REMADE to integrate new and emergent technologies into our technician and engineering curricu la, supplying our local manufacturing community with graduates educated in these relevant technologies and best practices around industrial-scale sustainable manufacturing.”

–Todd Oldham, Vice President, Economic Development, Workforce and Career Technical Education, Monroe Community College

Through the development of cost-competitive technologies that enable increased recycling, recovery, reuse, and remanufacturing of energy-intensive materials, the REMADE institute is positioning manufacturers to help the U.S. reduce its dependence on imports, compete globally, and reduce the energy required to manufacture its products. The institute’s first two projects have been awarded and are anticipated to start in the Summer of 2018. They are:

This project aims to evaluate the impact of single stream recycling (SSR) on paper contamination in recovery operations and explore emerging recovery processes for minimizing fiber contamination.

This project focuses on the improving the separation of nonferrous scrap metals from other non-ferrous metals using electrodynamic sorting (EDX) at high throughput and with greater purity and yield.

Additional projects are anticipated to start in Fall 2018 with proposals currently in the review process.

“REMADE’s collaborative consortium and early-stage research will provide us with innovative new ways to address industry challenges and remanufacturing technologies that can extend the life of our products and improve energy efficiency in our processes.”

– John T. Disharoon, Director Market Access, Caterpillar Inc.

Advanced Manufacturing National Program Office, NIST | www.ManufacturingUSA.com | 301-975-2830 | amnpo@nist.gov

Boeing’s ongoing 737 woes; the C919

Bloomberg and the Wall Street Journal recently studied and brought to light a letter from the Federal Aviation Administration (FAA) in which the agency posed further questions about the Max 7 version of the 737, making it more likely that Boeing will be unable to complete the necessary certification process by late December, and will have to undertake a costly redesign. The FAA, in an Oct. 12 letter, ordered Boeing to study the impact of pilot performance on a broader range of potential failures than had been previously agreed upon. The FAA letter also repeated warnings from last month that Boeing had additional work to perform on safety analyses it submitted to the agency. The letter is

the latest indication that the approval process of the last two 737 Max models is behind schedule and that the tensions between Boeing and the federal regulator have not been entirely swept away. Earlier versions of the Max are in service, while others are awaiting certification.

Once the original model in a family of airliners is approved, it is normally relatively easy for later versions, featuring nearly identical engines and other systems, to be certified. However, legal changes were ordered by Congress after two fatal Max crashes in 2018 and 2019. These changes, together with caution by FAA officials, have complicated Boeing’s task in meeting the

remaining Max approvals. The FAA sent a letter to Boeing in September saying for the first time that the Max 7 was in danger of not being certified by the end of the year. Earlier in October, the agency sent a letter to a senator saying it didn’t expect to conclude certification of the larger Max 10 until next summer. Boeing declined to comment on the letter, referring instead to a prior statement that it’s “focused on meeting all regulatory requirements to certify the 737-7 and 737-10, and safety remains the driving factor in this effort.”

Congress, in a 2020 law passed in response to the Max crashes, said all new airliners must have modern alerting systems for emergencies, but

gave Boeing two years to complete the process of certifying the remaining two Max jet models. Unless Congress changes the law, Boeing will have to add the alerting system to the Max 10 and Max 7, which the company says would be costly and unnecessary.

Boeing has an unlikely ally in the pilots of the world’s largest 737 operator as it lobbies Congress to extend the deadline for certifying its Max 10 and Max 7 models and avoid a potentially costly cockpit redesign.

The Southwest Airlines Pilots Association is behind Boeing’s efforts to obtain an extension for certification, thus avoiding the costly cockpit refit.

China formally certified its homegrown aircraft to take on Boeing and Airbus in the narrowbody jet market, according to the official Xinhua News Agency. The announcement of the certification

of Commercial Aircraft Corp of China’s (COMAC) C919 was made in late September, with President Xi Jinping and other high-ranking Chinese government officials attending the event.

The C919 has an uphill struggle in its attempts to compete with Airbus and Boeing. It is behind on capacity and range, and hasn’t attracted much attention overseas. The major Chinese airlines still prefer A320s and 737s. COMAC started developing the C919 14 years ago, using foreign suppliers including General Electric, Honeywell International, and for the engines CFM International - a venture between GE and France’s Safran SA. The project has been marred by delays and missed deadlines.

COMAC says it already has 815 orders from 28 Chinese customers for the C919, though the majority

aren’t confirmed, and many are from aircraft lessors yet to place the jet with an airline. China’s so-called big three, China Eastern, Air China Ltd., and China Southern Airlines Co., along with Hainan Airlines have 2,241 Boeing and Airbus narrowbody aircraft between them, and at least 546 on order.

It will be some time, in fact, an unknown amount of time, before China can manufacture all the parts necessary to build an aircraft to rival the western duopoly. In the meantime, there will be lots of ongoing business for Airbus and Boeing, and for the major parts suppliers.

Author profile:Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.n

by Royce Lowe

by Royce Lowe

Around 70% of French electricity is derived from the splitting of atoms, and no other country produces more nuclear power per capita. It was even higher not that long ago, around 75 to 80%. France was normally Europe’s biggest exporter of electricity thanks to its nuclear industry. Now half the country’s reactors are out of action, and just as Europe is facing an energy crunch, France, for the first time, became a net power importer. In September EDF, the energy giant announced that even by 2024, output would still be well below normal levels. Embarrassing.

France’s problem is partly due to routine maintenance of the country’s 56 reactors, half of which are some 40 years old. Each reactor needs to be shut down periodically for inspection. In late 2021, corrosion issues were detected at one pressurized-water reactor, and by September this year at least 25 reactors were out of action, ten for routine maintenance and the rest for corrosion analysis or repairs.

Some problems are of France’s own making. The nuclear accident in Fukushima in 2011, together with French anti-nuclear protests and a

lot of politicking, led to a presidential pledge to cut the share of nuclear to 50%. It came back under Macron, who announced that France would build six new-generation reactors, possibly another eight by 2050. This shows new confidence but also means an awfully long time for the new reactors to come online.

With time, France can revive its industry. EDF has kept expertise going in Britain, where it is building reactors at Hinkley Point, with plans for others. It has promised that all the reactors currently closed will be up and running

by next February. So it looks likely that nuclear will win the day in France.

Meanwhile, across the Atlantic, in the U.S., critics of the nuclear industry are arguing that generation of clean energy has not changed the concerns about the technology. These include aging facilities in need of potentially costly improvements, the challenge of nuclear waste disposal, and steep cost overruns for new projects that are years late - if they reach completion.

The rising costs of other sources of power have made nuclear energy more competitive around the world, including in the United States. It has the world’s largest fleet of nuclear plants, and they produce about 20% of the nation’s electricity and 50 percent of its clean energy. The U.S. maintains 92 reactors, though a dozen have closed over the last decade - including, in June this year, the Palisades Nuclear Generating Station in Michigan,

about 55 miles southwest of Grand Rapids. Diablo Canyon is next to be decommissioned, but Gov. Gavin Newsom has proposed extending its life. This plant, on California’s central coast, supplies almost 10 percent of the state’s electricity.

Pacific Gas & Electric, its owner, announced in 2016 that it planned to close it when its licenses expired in 2025, saying it would focus more on solar and wind power as renewable energy sources. A study last year by Stanford University and the Massachusetts Institute of Technology found that keeping Diablo Canyon open for 10 years could reduce the California power industry’s carbon emissions by more than 10 percent from 2017 levels and reduce reliance on natural gas. It could also save $2.6 billion in electricity costs and help prevent brownouts.

Industry leaders recognize that new large-scale nuclear plants in the

United States are a thing of the past, mainly because of very high costs. Two new units at the Vogtle Electric Generating Plant in Waynesboro, Ga., expected to come online in 2023, are costing about twice the original estimate of $14 billion. A nuclear project in South Carolina drove the utility developing it into bankruptcy. Many in the industry say smaller reactors that can be expanded over time offer promise of avoiding long delays and high costs. These reactors, they say, can be built in factories and delivered to approved sites. And the reactors’ high-temperature steam could also yield significant amounts of hydrogen, an alternative fuel to natural gas. NuScale Power, a company that designs and markets small reactors in Oregon, recently received certification for its SMR (small modular reactor) design in response to its application submitted in December 2016. A developer will now need a license to build and operate the unit.

It appears that in spite of the problems with existing and future reactors, nuclear energy will play its part in the generation of clean power.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

Your business needs a guide through today’s economic turbulence to assess the direction of your markets and the evolution of your industry.

New Word Economics tailors economic analysis and data creation for the unique needs of every manufacturing organization.

For more information visit us at newworldeconomic.com

by Royce Lowe

by Royce Lowe

A million times thinner than a human hair, and 200 times stronger than steel; that’s graphene, a new wonder material that has been hyped for some years now - following its discovery in 2004. A Nobel prize was awarded for this in 2010.

Progress in the manufacture and application of the material has not been as fast as hoped, but researchers and manufacturers are starting to make some headway. We’re looking at a 2D material, one atom thick, with super mobile electrons that can move around freely, making graphene an extremely good conductor of heat and electricity, in fact the most conductive material

found to date. It is one of 25 twodimensional materials being studied at various universities and corporate research labs around the world.

Simply put, graphene is produced by applying sticky tape on a piece of graphite, then peeling it off, folding it, and repeating the process over and over again until a single layer of graphene is produced. The scientific community is looking for multiple uses of the material, with expectations ranging from a silicon replacement in transistors in the short term all the way to building the immense cable or tether that would be needed for a space elevator in the future. Needless to say,

the latter is a little way off, but like Moore’s Law, technological innovation has a way of accelerating things.

So there is a problem. Why are we not flooded with products when we have known how to make graphene for a good number of years? The problem is scaling up production while ensuring the quality is good enough for the intended applications. Because graphene is so expensive to produce, products must be significantly better than those already available for graphene to be considered worthwhile. Silicon, for example, has excellent semi-conducting qualities, as used in transistors. The use of graphene in this

application, with its extra costs, could not be justified. This left customers and investors disappointed. It was all done too soon, with insufficient followup research, and this put a lot of people off graphene as a marketable material for some time.

Progress has been made, however, with production methods, such as CVDchemical vapour deposition - where graphene is effectively grown on a metallic surface, such as copper, by combining carbon-bearing gases inside a high-temperature reaction chamber. This leads to graphene deposition onto the metal, and its subsequent separation and transfer to the substance that requires enhancement. The process requires lots of energy and yields only small amounts. Research continues into cheaper methods that require less power.

Flash graphene is a new method that uses any material with high carbon content, such as used rubber tires and even mixed plastics. The materials are converted to graphene in an instant by being heated to some 5,000 degrees F in just 10 milliseconds. This process was developed at Houston’s Rice University, where research continues on further methods.

Research is being conducted worldwide; it’s a work in progress, and we are now seeing the release of graphene-based products that do seem practical. Batteries that mix graphene with lithium, together with a composite layer of graphene, show significantly reduced charging times. Research on desalination is being carried out in the U.S. and China where a graphenebased desalination membrane has been invented that can remove salt from seawater. And we mustn’t forget its use as a cement additive, leading to muchincreased strength, hence less cement.

Research will continue, products will be made, and it looks like graphene might become another U.S. - China competitive issue. The Chinese have, in fact, according to The Guardian, made attempts to corner this nascent industry

by reaching into British Universities developing the technology. China has at least 10 separate research zones working on the material, with more than 200 companies working directly on the technology, according to Ron Mertens, the editor of Graphene-Info, an industry publication. China has targeted graphene as a key future industry. In 2015, China’s embassy said it wanted the UK and China to pursue the “cooperation of giants” in graphene research after a visit to facilities in Manchester from President Xi Jinping.

Huawei, the Chinese telecoms manufacturer that has been blocked from the U.S. and UK’s 5G infrastructure on national security grounds, invested in Manchester’s National Graphene Institute in 2015. UK-China knowledge-sharing has continued, and Edinburgh and Manchester universities have announced new collaborations in the past two years. However, political concerns about Chinese theft of UK intellectual property have mounted in recent years. In 2018, the Australian Strategic Policy Institute, a think tank, claimed China has sent soldiers to British universities to gain knowledge for its military. The outcome of all this was an attempt by China to take over Perpetuus, a Welsh graphene manufacturer. This attempt was subsequently blocked following a UK government investigation.

Graphene is now starting to penetrate higher–technology markets, and China is currently one of the front-running nations for adopting more advanced graphene products at a commercial level and holds one of the largest shares of the global market. This is not surprising, considering China’s large investments in the industry over the years. Much of the non–scientific population is familiar with graphene, as evidenced by the great interest in market adoption.

It is not clear from available literature how much research, and to what end, is being carried out in the U.S. Venture

capitalists reportedly shied away from the product when initial difficulties with upscaling were acknowledged. It is thought that the Defense Department will be backing research at some level. There should be research being carried out on the production of chips, as a substitute for, or addition to, the traditional silicon chip. Graphene or other 2D materials may become a replacement for or enhancement of some rare earths that could reduce the need for rare earths that are primarily supplied by China.

China, meanwhile, it is reported, has enhanced its Z-10 attack helicopter with extra graphene armor. With more global companies looking towards graphene batteries, the first commercial EV graphene battery comes from China’s Gac Group, claimed to charge from 0 to 80% in eight minutes. The Aion V SUV model, thus equipped, is expected to be on the market by the end of 2022. Other graphene batteries are being developed around the world, but won’t hit the market for a few years. Then there’s work on chips, and talk of processing times 1,000 times faster than silicon.