MANUFACTURING

MANUFACTURING TIDBITS

Rachel CooperMANUFACTURING

MANUFACTURING

Federal Reserve Chair Jerome Powell has publically stated that the Fed will continue to raise rates until they see continued slow growth, a “modest” increase in unemployment, and “clear evidence” that inflation is moving back to their 2 percent target. “The chances of a soft landing are likely to diminish as the Fed steadily raises borrowing costs to slow the worst streak of inflation in four decades,” he said.

The Fed has one tool – the interest rate hammer. Thus, everything must be a nail. Historically, the Fed has hit the economy nail a bit too hard and too often, resulting in a recession. It becomes a double whammy because the Fed raises rates aggressively to cool inflation while consumers are shifting their reduced buying power due to inflation from discretionary purchases to cover inflated but necessary purchases, such as food, fuel, and rent. “No one knows whether this process will lead to a recession or, if so, how significant that recession would be,” Powell said.

Really?!? Do we believe the Fed has a more artful swing in their ‘hammer down inflation’ game plan than in previous cycles? Does the general public buy this explanation as if things will be okay? When people begin losing their jobs, clearly there is a recession in their house. Rather than let the market correct itself, the Fed has repeatedly stepped in swinging its hammer in a china shop. This will likely end badly, and soon.

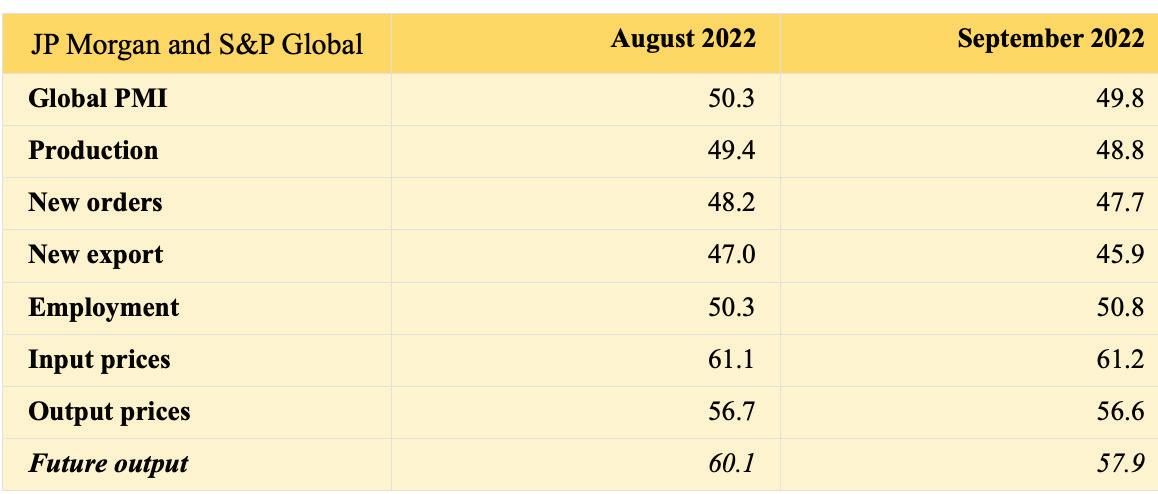

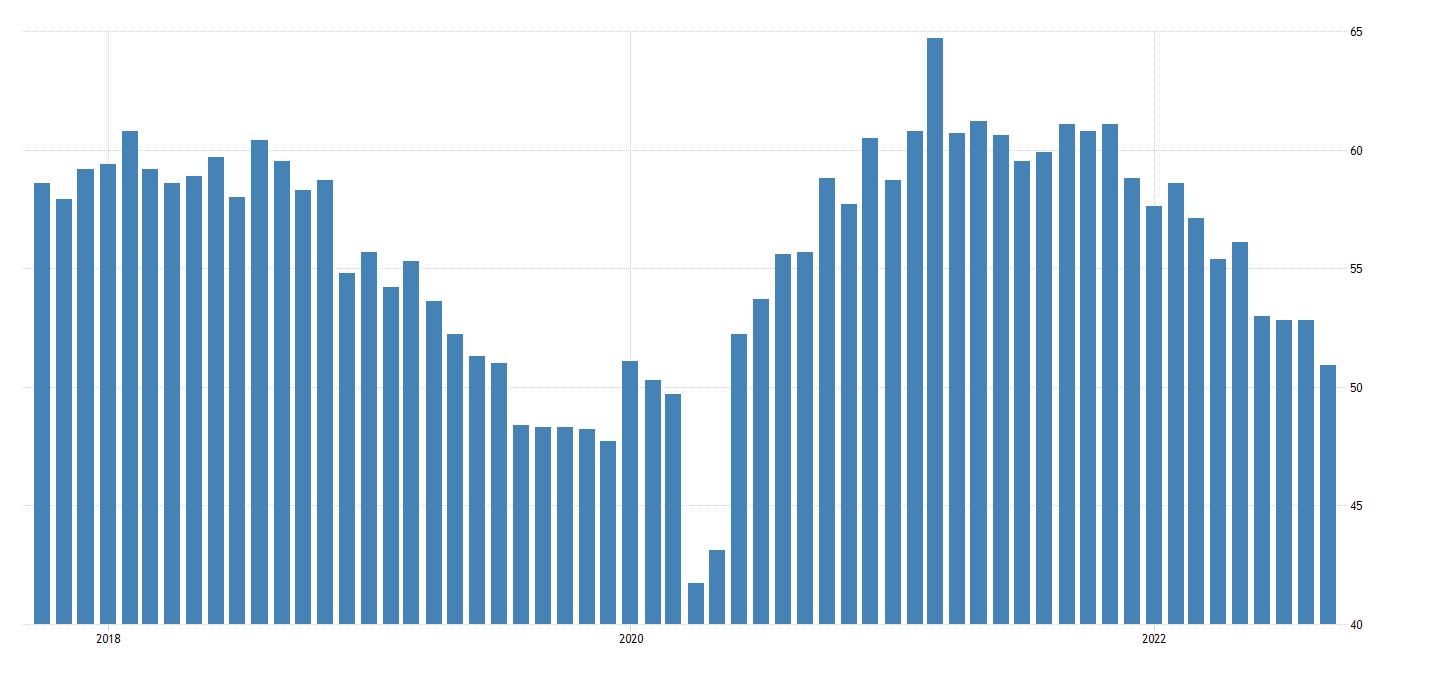

Manufacturing reacts first. The millions of open jobs in manufacturing will begin evaporating. Some companies are already announcing or adjusting headcount downward. The same holds true for the Services sector. The ISM’s Manufacturing Report on Business® recently showed some industry sectors cooling, and comments from respondents in the Services sector were mostly negative. Business optimism is at a 23-month low, and the JP Morgan Global PMI has slipped below 50 to 49.8, with New Orders declining each of the last two months. The ‘soft landing’ horse has already run out of the barn.

Manufacturing production is a long cycle from raw material inputs to product output, requiring anywhere from 3 months to 3 years, so manufacturers watch New Orders as their harbinger of whether or not to buy more or less raw materials and how many people they will need on the production lines 6 to 12 months from now. Unemployment is holding steady mostly because manufacturers could not find skilled labor, so they loathe to reduce their labor when the smart move is to upskill their workforce. Many of the job openings will be withdrawn, and the requirements will be folded into existing jobs. And that annoying ‘quits’ rate of 4 million job shifters a month should taper off soon and dramatically. For employees, adding skills and building seniority will be their employment lifeline.

Manufacturing Outlook includes the ISM Manufacturing Report on Business® as well as the Manufacturing Outlook summary, and we encourage our readers to go through this content carefully as the winds of change are blowing. There is no substitute for an early warning; if a recession doesn’t rear its ugly head, manufacturers will have steady demand and cash reserves to meet production. However, that is not what we are currently expecting, especially if the Fed raises their rates into the 4.0+ range rather than waiting for things to cool off over time just as they heated up over time. That has been their past pattern: too high, too fast, too bad. n

Lewis A. Weiss, Publisher

Lewis A. Weiss, Publisher

Contact laweiss@mfgtalkradio.com for comments, suggestions and ideas and guest requests for MFGTALKRADIO.COM podcast or any of our podcasts.

GLOBAL PMI IN CONTRACTION. MANUFACTURING, INTERNATIONAL TRADE STILL SLIDING. BUSINESS OPTIMISM AT 28-MONTH LOW. U.S. DOING A LITTLE BETTER.

By: Royce Lowe The JP MORGAN GLOBAL MANUFACTURING PMI – a composite index produced by JPMorgan and S & P Glob al in association with ISM and IFPSM (International Federation of Purchasing and Supply Management) – fell from 50.3 in August to 49.8 in September. Manufacturing production was down for the second consecutive month, with production falling in the intermediate and investment goods sectors. New orders and new export orders fell at faster rates in September. Employment was up for the 23rd consecutive month, with job creation seen in the U.S., the Euro area, Japan, the UK, India and Brazil. Busi ness optimism fell to a 28 month low.

The Bureau of Economic Analysis says the U.S. Real Gross Domestic Product decreased at an annual rate of 0.6% in the second quarter, according to the third estimate. This was following a decrease of 1.6% in the first quarter of 2022.

U.S. new-vehicle retail sales for September 2022, at 1,118,483 units, were up 10.1% year-over-year. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 13.6 million units, up 1.5 million units from 2021.

GLOBAL CRUDE STEEL PRO DUCTION WAS DOWN BY 3.0 PERCENT YEAR-OVER-YEAR IN THE MONTH OF AUGUST for the 64 reporting countries – which represent 98 percent of world crude steel production – to 150.6 million tons (MT). Production for the first eight months was down 5.1% yearover-year.

The global production of primary aluminum continued at its normal pace in August, with China produc ing almost 60% of the 5.888 MT total. The price of hot-rolled coil in the U.S. in early October is running around $800 per ton. The prices of non-ferrous metals in September were mostly headed down, with aluminum from $1.13 per lb. to $1.10 per lb; cop per from $3.50 to $3.45; nickel from $9.70 - peaking at 11.2 - to $9.52; zinc from $1.46 to $1.33.

THE ECONOMIST magazine, in its latest weekly report on world econ omies highlights changes in Gross

Domestic Product (GDP), Consumer Prices, and Unemployment Rates for what it considers the world’s major economies. These data are not neces sarily good to the present day, but are mostly applicable to at latest the past two months, and show definite trends in the world economy. The figures are qualified as being the latest available, and with reference to a given quarter or month.

The figures for GDP represent the percent change on the previous quarter, or annual rate. The consumer price increases represent year-overyear changes. The unemployment percentage figures are for the month as noted n

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Corre spondent, Contributing Writer, Manufacturing Outlook.

By: John McEleney

By: John McEleney

Preparing for the uncertain is a business imperative – whether it’s an unexpected crisis like the pandemic or a humanitarian emergency brought about by natural disasters. Any such setback is bound to impact the economy and businesses, irrespective of region. I believe challenges also result in opportunities to help people or companies pivot to meet market demands.

Take, for example, Onshape. During the pandemic, our SaaS software

was in high demand as it was used to develop lifesaving products within days – from emergency ventilators to masks. Why? Because Onshape is the only cloud-native product development platform that allows engineers to collaborate in real-time and design products on demand. So when everyone was working from home, Onshape became a fan favorite as stakeholders could innovate in the cloud, working off the same design file, eliminating version confusion. In addition, more than a million students

and teachers were using Onshape for remote learning.

While we are still recovering from the supply chain challenges brought about by the pandemic, companies are working hard to leverage lessons learned as they look ahead. With the recent war in Ukraine, I expect their recovery will be much slower than anticipated, further impacting the manufacturing industry – which is already facing numerous challenges.

Here are a few recommendations to help revive the manufacturing sector.

Solve image problem to attract young professionals: The manufac turing sector added 349,000 jobs in 2021, but the total number of people employed in manufacturing last year was 219,000, less than before the pan demic, according to the U.S. Bureau of Labor Statistics. Baby Boomers are retiring in hordes leading to more labor shortages, and younger workers are not interested in working in an industry with an image issue. With more than 75 million Baby Boom ers retiring sooner rather than later, the skills gap is bound to increase significantly. Therefore, it’s time for manufacturing companies to start investing big to dispel the image that manufacturing is old school and the work is boring and repetitive. They should focus on reviving the sector as a modern, vibrant community with unlimited opportunities. Develop additional partnerships with high schools and academic institutions and create design competitions to encour age more students to enter the field and build our future.

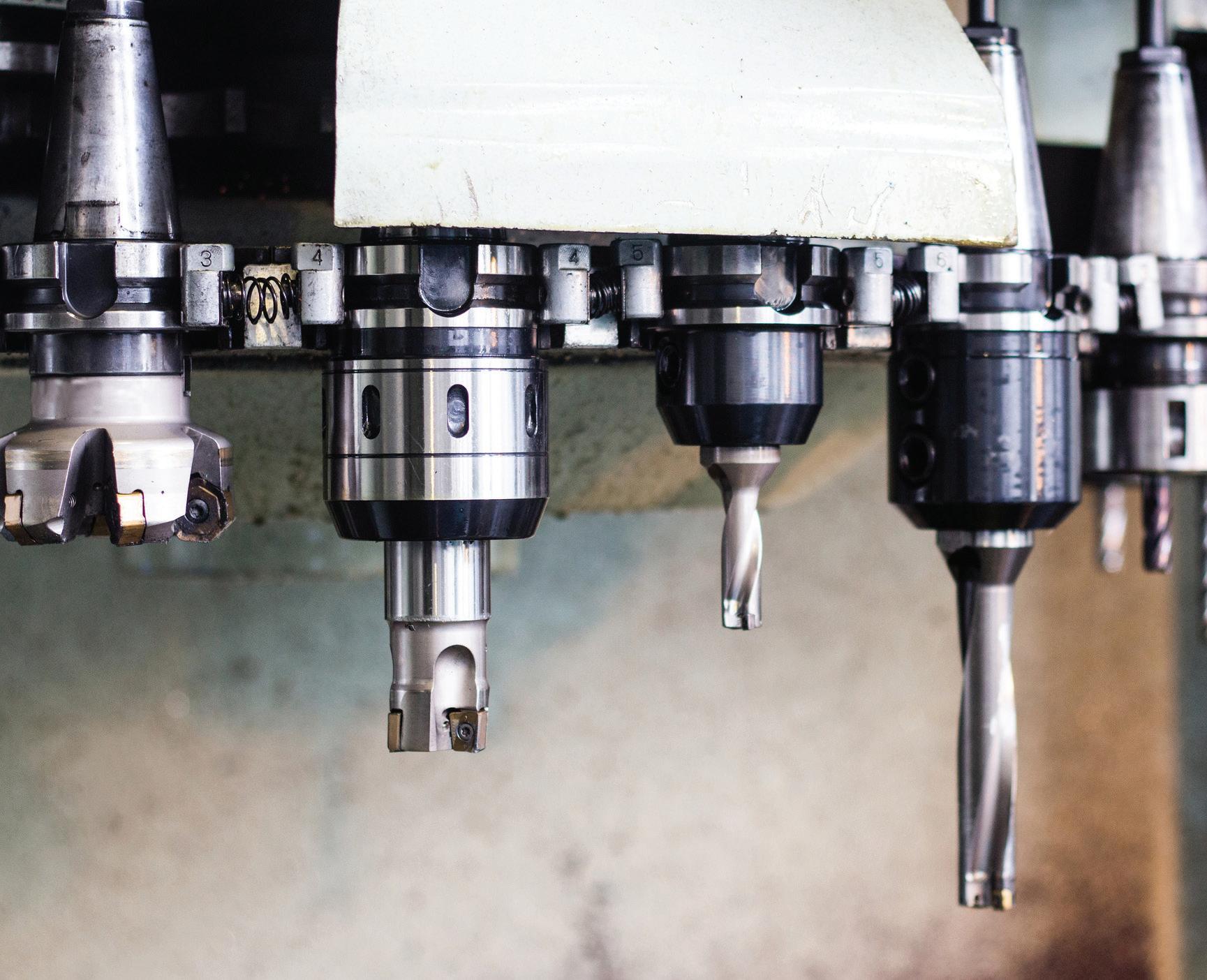

Continue to invest in flexible man ufacturing infrastructure. For com panies that make discrete products, flexible manufacturing infrastructure

that can be reconfigured digitally pays off when change needs to take place rapidly. Take, for example, how factories doing heavy assembly now use digital motors that can be recon figured with software to produce or move new items, rather than mechani cal cams and follower equipment. The older equipment was highly reliable but inflexible. To the extent you can take a hardened process and make it digital, it becomes flexible. Digitized processes can then act as a platform for rapidly adapting your assets and capacity to new growth areas.

Rethink collaboration with new sup pliers. The pandemic has elevated the need to rapidly adjust or expand our supply, production, and distribution networks. While I believe global com ponent and contract manufacturing sourcing will continue to a large de gree, many companies should recon figure their supply chains to reduce risk. New sites, new suppliers, and realignment of fulfillment networks should be created so companies can rapidly adjust to new risks or emerg ing opportunities. Companies must quickly embrace digital transforma tion to onboard new suppliers or ramp up production at new sites quickly.

Invest in new technology to acceler ate innovation. Given the relentless

drive for manufacturing optimiza tion—to reduce time and cost while enhancing workflows and quality— the strategic push for more data and closed-loop analysis will increase. We’ll also see additional investment in industrial automation while smart devices will continue to find their way into production lines. Since the pan demic, cloud-native platforms such as Onshape are in demand as it allows innovators and engineers to collab orate simultaneously with all stake holders and design in real-time. As for manufacturing, technology like 3D printing will see greeted adoption as it allows engineers to design parts and products right the first time, accelerat ing the innovation process.

Bottomline: I expect the disruptions in manufacturing and supply chain to continue as companies shift to a just-in-case strategy – building up inventory to accommodate disrup tions arising from various situations and global crises. However, I believe that in addition to re-imagining how to manufacture goods, teams must also rethink how to quickly take an idea from digital to physical as well as ways we can better collaborate in today’s hybrid world so as to create a more innovative and better future for all.

Entrepreneur and industry luminary, John McEleney has spent his career transforming businesses, driving cor porate strategy and forecasting what’s next in product development and man ufacturing.

With more than 30 years of experience in mechanical design and software, McEleney understands the innovation challenges customers face in today’s hyper-connected world, and helps them navigate the digital era. Co-founder of Onshape, McEleney is currently corporate vice president of strategy at PTC. n

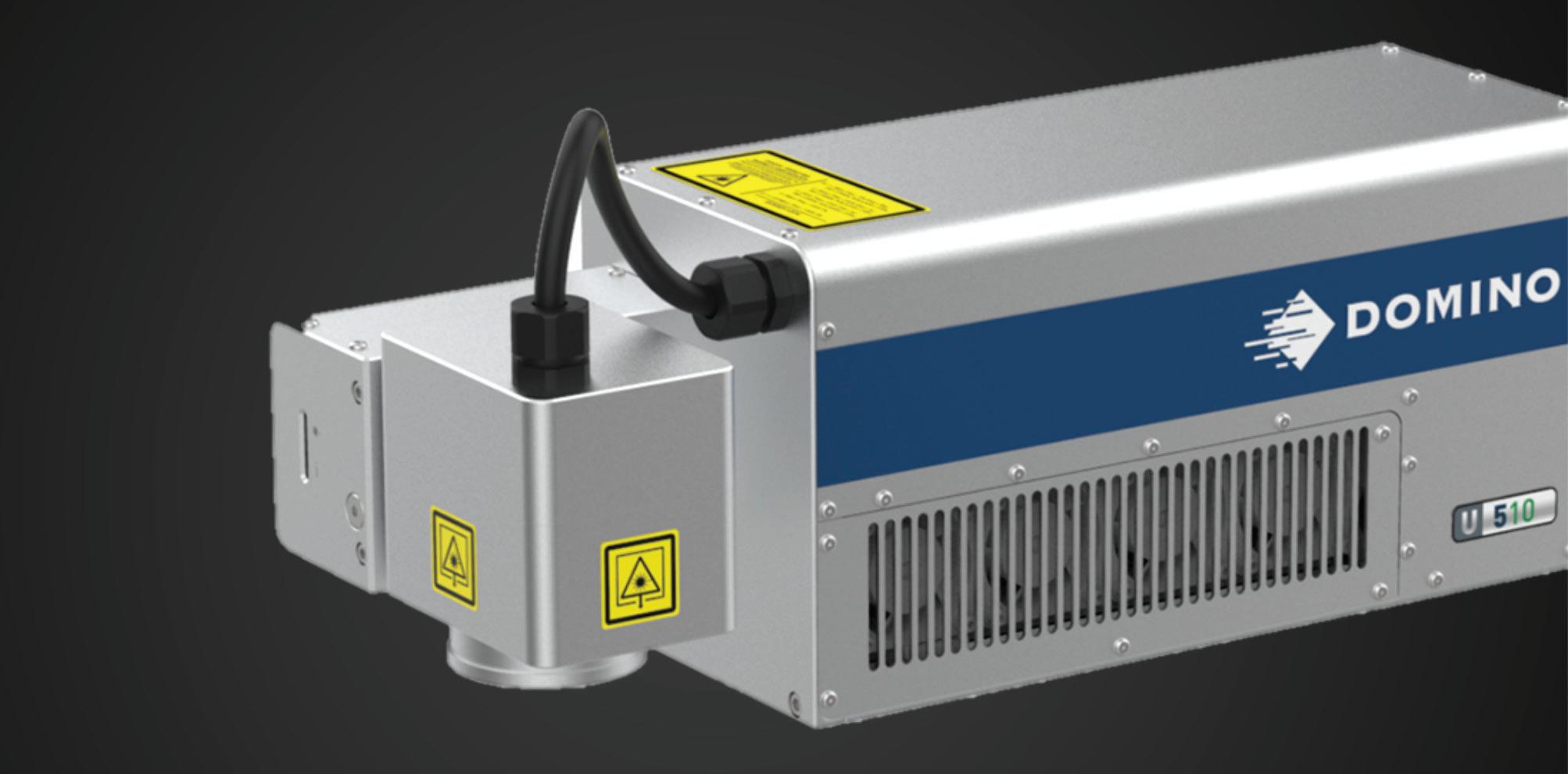

September 29th, 2022 In response to growing industry and regulatory demand for recyclable plastics, Domino Printing Sciences (Domino) is pleased to announce the new U510 laser coder. The U510 is a state-ofthe-art UV-based laser coder for high-speed, high-precision coding on recyclable, mono-material, colored plastics, including flexible food packaging films in horizontal and vertical form-fill-seal (HFFS and VFFS) applications.

Food and beverage manufacturers worldwide are under increasing pressure to make their packaging more sustainable – in the EU, this includes a requirement that all packaging be made 100% recyclable or reusable by 2030. Under these new regulations,

mixed materials, including PET and aluminum foil laminates typically used in food applications, will no longer be permitted.

“Laser coders are a very popular solution for many food and beverage manufacturers looking to add reliably crisp, machine-scannable QR codes, batch, and product information, and logos at very high speeds,” says Felix Rief, Head of Laser and Extraction, Domino. “However, certain new sustainable food packaging materials, including mono-material recyclable plastics, can prove challenging to code using traditional fibre or CO2 laser coders. We developed the U510 UV laser to offer manufacturers a reliable laser coding solution for these new sustainable packaging solutions.”

The U510 codes directly onto white and coloured mono-material plastics and films without the need for additional additives or laser-activated fields on the substrate. Codes result from a photochemical reaction on the very top of the plastic, creating a smooth, indelible mark without the risk of compromising the product packaging. Like all Domino lasers, the U510 is optimized to deliver highcontrast text, graphics, and 2D codes at very high speeds to satisfy the demands of fast-paced food production lines. The all-in-one laser head and controller unit are completely protected against dust and water (IP55 rating) to meet the challenging environment of dusty, moist, or even sticky food and beverage production lines.

“The upcoming European legislation is causing many food manufacturers to evaluate their product packaging, often necessitating a change in the coding solution. We were approached by one of the world’s leading food manufacturers for an extended 24/7 trial to replace competitor CO2 laser coders at one of the company’s main manufacturing sites,” says Dennis Gesellgen, Global Sector Manager, Domino.

“The trial was a huge success – with its compact design, the U510 could replace the competitor laser very easily, and the customer was delighted with the laser performance and, in particular, with the high IP rating for dust and water protection, which is a differentiator for Domino lasers. The customer commented that the U510 had outperformed competitor lasers in all trials, with significantly improved code quality and zero laser-related downtime over the entire duration of the trial.”

The U510 was designed for ease of integration, with an all-in-one printhead and controller unit that integrates seamlessly into existing production lines and an adjustable laser head that can be mounted horizontally or vertically for extra flexibility. In addition, U510 lasers come with Domino’s extended service

and support plan and Domino Cloud connectivity for remote diagnostics and monitoring to optimize performance and uptime.

“We know that new and upcoming regulations necessitating the use of recyclable plastics will be of significant concern to our customers now and in the future. So we are very pleased to be able to offer a reliable, UV laser coding solution for these new packaging materials,” says Dr. Stefan Stadler, Team Lead, Domino Laser Academy.

“Developments in new sustainable packaging solutions will continue for many years to come, and Domino wants to remain at the forefront of these developments so that we can continue to meet the needs of manufacturers in all industries,” continues Stadler. “As such, we would like to invite any company working with new and emerging packaging materials to contact Domino, so we can continue to develop and manufacture solutions for the latest substrates.”

For further information on Domino, please visit www.domino-printing. com Rachael Cooper is a Marketing Campaigns Specialist for Domino Printing Sciences and can be reached at Rachael.Cooper@domino-uk.com n

The U.S. freight volumes continued to exceed low expectations in September with more buoyant demand than feared in the start of peak shipping season.

The shipments component of the Cass Freight Index® fell 2.9% m/m in September (-2.9% SA), reversing much of the 5.5% rise in August.

On a y/y basis the index was up 4.8%, accelerated from 3.6% in August, with the acceleration more than explained by an easier comparison.

After a soft 1H’22 as freight demand has been buffeted by both inflation

and the substitution from goods back to services, the considerable improvement in the past two months likely reflects a combination of several temporary factors: retail discounting to clear excess inventory in some categories, seasonal inventory building ahead of the holidays, repositioning mis-timed inventory easing supply constraints, particularly in auto production, easier prior-year comparisons. Normal seasonality from here would have shipments slowing to 2%-3% y/y growth in October on a tougher comp, down slightly y/y in Q4 and about flat for the year. Tougher comps in November and December

also suggest the recent increases are temporary.

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, rose 0.3% m/m in September after a 1.9% m/m increase in August. Against a shipment decrease of 2.9% m/m in September, we can infer that rates overall were up 3.3% (see our inferred rates data series below). The increase in rates m/m appears mainly due to mix changes and seasonality.

The expenditures index was still 21% higher than year-ago levels in

September, accelerating slightly from 28% in August.

On an SA basis, expenditures fell 1.9% m/m in September, with shipments up 5.5% m/m and rates down 2.4%.

This index includes changes in fuel, modal mix, intramodal mix, and accessorial charges.

Simply following normal seasonality from here, this index is on track for a 23% increase in 2022 and would turn down on a y/y basis next February.

The freight rates embedded in the two components of the Cass Freight Index rose 16% y/y in September, decelerating by <1% from the 16% y/y increase in August.

Cass Inferred Freight Rates rose 3.3% m/m (1.1% SA) in September. Fuel prices were up slightly, but the m/m increase was mainly due to seasonality and modal mix. With looser truckload market conditions, further deceleration remains all but assured. While comparisons suggest double-digit increases will persist in October, this series should slow to mid-single-digit growth rates by year end and declines by early next year.

The supply/demand balance in U.S. trucking markets has loosened significantly this year, and as a result freight rates are leveling off and set to slow sharply in the months to come.

While shippers aren’t seeing any real savings yet, considerable cost relief is now highly probable for 2023, which we think will be welcome news for the broader inflation picture.

The Cass Truckload Linehaul Index®, which measures changes in truckload linehaul rates, slowed to a 3.9% y/y increase in September after rising 7.4% y/y in August.

On a m/m basis, the Cass Truckload Linehaul Index fell 2.2%, larger than the 1.8% m/m declines of the past three months.

As a broad market indicator, this index includes both spot and contract freight, and with spot rates already down significantly, it’s only a matter of time until the index begins to decline on a y/y basis (projected for January ’23 in the ACT Freight Forecast).

Similar to what has occurred in the spot market, the recent resurgence of fuel costs, which are excluded from this index, will also likely act as a brake on linehaul rates.

It sure doesn’t feel like freight volumes were up nearly 5% y/y in September, does it? Our analysis suggests this will not repeat for quite some time, and it took the right combination of easy comps and temporary factors to make happen. So, though we know it will raise questions, we don’t think the y/y comp is too meaningful here. The Cass data line up with ACT’s recent industry conversations finding resilience, though there is little real questioning of the consensus that the freight economy is in a soft patch that could be with us for a while.

How can this recent demand strength be compatible with consistent and significant downtrends in ocean container and truckload spot rates? In a word, supply. In our view, it’s the

cumulative massive effort of ramping up supply chain capacity over the past two years, amid varying stages of crisis, which is now bearing fruit.

While demand is still looking about flat this year, the supply side recovery has turned the market from tight to loose. Thus, the reason market dynamics are much different this year it is not that there is less freight. It’s more capacity.

For example, dry van and flatbed spot rates jumped for a few days after Hurricane Ian. The storm is likely to lead to considerable reconstructionrelated freight next year, but rates gave up the brief increase and have fallen since in a sign of ongoing loose capacity. In a tighter market, we think the effect on rates would have been much greater.

In our view, though the demand softness will be limited by the strong financial position of the U.S. consumer, the factors behind the past two months of strong volume data are likely to fade from here.

The story concludes in ACT Research’s monthly Freight Forecast. Now that the pendulum is swinging, some crucial questions about the freight rate cycle have been raised: How long? And when will it turn? The ACT Research Freight Forecast report provides monthly, quarterly, and annual predictions for the truckload (TL), less-than-truckload (LTL), and intermodal markets through 2024, including capacity, volumes, and rates. The report provides monthly updates of forecasts for the shipments component of the Cass Freight Index and the Cass Truckload Linehaul Index, as well as DAT spot rates by trailer type, including and excluding fuel surcharges. n

Economic activity in the manufacturing sector grew in September, with the overall economy achieving a 28th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®

The September Manufacturing PMI® registered 50.9 percent. The New Orders Index returned to contraction territory at 47.1 percent, 4.2 percentage points lower than the 51.3 percent recorded in August. The Production Index reading of 50.6 percent is a 0.2-percentage point increase compared to August’s figure of 50.4 percent. The Prices Index registered 51.7 percent, down 0.8 percentage point compared to the August figure of 52.5 percent. This is the index’s lowest reading since June 2020 (51.3 percent). The Backlog of Orders Index registered 50.9 percent, 2.1 percentage points lower than the August reading of 53 percent. After a single month of expansion, the Employment Index contracted at 48.7 percent, 5.5 percentage points lower than the 54.2 percent recorded in August.

Nine manufacturing industries reported growth in September, in the following order: Nonmetallic Mineral Products; Machinery; Plastics & Rubber Products; Miscellaneous Manufacturing‡; Apparel, Leather & Allied Products; Transportation Equipment; Food, Beverage & Tobacco Products; Computer & Electronic Products; and Electrical Equipment, Appliances & Components. ISM

Analysis by

Timothy R. Fiore, CPSM, C.P.M.

Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

The U.S. manufacturing sector grew in September, as the Manufacturing PMI® regis tered 50.9 percent, 1.9 percentage points below the reading of 52.8 percent recorded in August. The Manufacturing PMI® continued to indicate sector expansion and U.S. economic growth in September. Of the five subindexes that directly factor into the Manufacturing PMI®, three (Production, Supplier Deliveries and Inventories) were in growth territory.

INDEX

Index

of Change

Manufacturing PMI® 50.9 52.8 -1.9 Growing Slower 28 New Orders 47.1 51.3 -4.2 Contracting From Growing 1 Production 50.6 50.4 +0.2 Growing Faster 28 Employment 48.7 54.2 -5.5 Contracting From Growing 1

Supplier Deliveries 52.4 55.1 -2.7 Slowing Slower 79 Inventories 55.5 53.1 +2.4 Growing Faster 14 Customers’ Inventories 41.6 38.9 +2.7 Too Low Slower 72 Prices 51.7 52.5 -0.8 Increasing Slower 28

Backlog of Orders 50.9 53.0 -2.1 Growing Slower 27 New Export Orders 47.8 49.4 -1.6 Contracting Faster 2 Imports 52.6 52.5 +0.1 Growing Faster 4

Overall Economy

Growing Slower 28

Manufacturing Sector Growing Slower 28

Commodities Up in Price: Adhesives; Copper; Diesel*; Electrical Components (22); Electricity; Electronic Components (22); Freight* (23); Hydraulic Components (2); Labor — Temporary; Natural Gas (15); Paint; Paper (2); Plastic Resins* (9); Rubber Based Products (14); Semiconductors; and Steel — Stainless*. Commodities Down in Price: Aluminum (5); Diesel*; Freight* (2); High-Density Polyethylene (HDPE) Resin; Lumber — Hardwood; Lumber — Softwood; Methanol; Ocean Freight; Plastic Resins* (4); Polyethylene; Polypropylene (2); Steel (5); Steel — Carbon (3); Steel — Hot Rolled (5); Steel — Stainless* (2); and Steel Products (3).

percent.

the 18 manufacturing industries,

in September: Nonmetallic Mineral Products;

Miscellaneous Manufacturing‡; Computer & Electronic

percent. The eight industries reporting growth

the month of September — listed in order — are: Nonmetallic Mineral Products; Primary Metals; Plastics & Rubber Products; Machinery; Electrical Equipment, Appliances & Components; Miscellaneous Manufacturing‡; Fabricated Metal Products; and Computer & Electronic Products. Employment

Employment Index registered 48.7 percent. Of 18 manufacturing industries, six reported employment growth in September, in the following order: Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Plastics & Rubber Products; Electrical Equipment, Appliances & Components; Machinery; and Food, Beverage & Tobacco Products.

The delivery performance of suppliers to manufacturing organizations was slower in September, as the Supplier Deliveries Index registered 52.4 percent. Ten manufac turing industries reported slower supplier deliveries in September, in the following order: Apparel, Leather & Allied Products; Printing & Related Support Activities; Textile Mills; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing‡; Primary Metals; Transportation Equipment; Fabricated Metal Products; Computer & Electronic Products; and Chemical Products.

The Inventories Index registered 55.5 percent. Of 18 manufacturing industries, the 11 reporting higher inventories in September — in the following order — are: Wood Products; Miscellaneous Manufacturing‡; Nonmetallic Mineral Products; Petroleum & Coal Products; Electrical Equipment, Appliances & Components; Machinery; Transportation Equipment; Furniture & Related Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; and Plastics & Rubber Products.

Customer Inventories (Manufacturing)

Backlog of Orders (Manufacturing)

New Export Orders (Manufacturing)

Imports (Manufacturing)

Customers’

Index registered 41.6 percent. Three industries (Apparel, Leather & Allied Products; Wood Products; and Furniture & Related Products) reported customers’ inventories as too high in September. The 11 industries reporting cus tomers’ inventories as too low — listed in order — are: Nonmetallic Mineral Products; Transportation Equipment; Fabricated Metal Products; Machinery; Miscellaneous Manufacturing‡; Primary Metals; Electrical Equipment, Appliances & Components; Computer & Electronic Products; Plastics & Rubber Products; Chemical Products; and Food, Beverage & Tobacco Products.

The ISM Prices Index registered 51.7 percent. In September, 10 of 18 indus tries reported paying increased prices for raw materials, in the following order: Miscellaneous Manufacturing‡; Nonmetallic Mineral Products; Printing & Related Support Activities; Primary Metals; Computer & Electronic Products; Paper Products; Machinery; Transportation Equipment; Food, Beverage & Tobacco Products; and Chemical Products.

ISM’s Backlog of Orders Index registered 50.9 percent. Eight industries reported growth in order backlogs in September, in the following order: Plastics & Rubber Products; Petroleum & Coal Products; Nonmetallic Mineral Products; Transportation Equipment; Computer & Electronic Products; Primary Metals; Electrical Equipment, Appliances & Components; and Food, Beverage & Tobacco Products.

ISM’s New Export Orders Index registered 47.8 percent. Three industries reported growth in new export orders in September: Food, Beverage & Tobacco Products; Computer & Electronic Products; and Transportation Equipment.

ISM’s Imports Index registered 52.6 percent. The eight industries reporting growth in imports in September — in the following order — are: Textile Mills; Printing & Related Support Activities; Miscellaneous Manufacturing‡; Transportation Equipment; Machinery; Chemical Products; Plastics & Rubber Products; and Food, Beverage & Tobacco Products.

by NAM news Room: MFG Day; Jennifer Dallos, SME; FABTECH

by NAM news Room: MFG Day; Jennifer Dallos, SME; FABTECH

On Friday, Oct. 7, manufacturers across the country opened their doors in an epic Manufacturing Day (MFG Day) celebration of manufacturing in America. Students, parents, teachers, local leaders, and many others were welcomed into factories, technical schools, and similar venues to see what modern manufacturing is really about.

Led by The Manufacturing Institute (MI), the NAM’s workforce development and education partner, MFG Day, kicked off a monthlong series of events that provided an inside view of the industry and its exciting careers. MFG Day events included open houses, expos, job

fairs, roundtable discussions, and more across the United States, featuring many different types of manufacturing.

• This year, more than 500 companies and organizations were showcased on the national map of registered events, beating last year’s total.

• One of the flagship events was hosted by SAS at its world headquarters in Cary, North Carolina. It included remarks from SAS CEO Jim Goodnight and Gov. Roy Cooper, as well as discussions with manufacturing

leaders from Deere & Company, Mack Trucks, Johnson Controls, and ABB. Experts from SAS and the MI spoke about technology, analytics, and career paths in manufacturing, while manufacturing and technology exhibits were open to visitors.

• In addition, the NAM and MI’s Creators Wanted mobile experience stopped at Nephron Nitrile’s new glove factory in West Columbia, South Carolina, giving visitors the chance to complete challenges that resemble real, creative manufacturing work.

Why it matters: The manufacturing industry will need to fill about 4 million jobs by 2030, and a lack of high-skilled workers threatens to leave more than half of those positions empty, according to a study by the MI and Deloitte. MFG Day is designed to increase awareness among the young people who could become the stars of tomorrow’s industry, showing them how much they stand to gain from choosing manufacturing as their career.

• Changing misconceptions: MFG Day helps the industry push back against misguided stereotypes, demonstrating that today’s industry is high-skilled, high-tech, clean, creative, and welcoming to people of all backgrounds and talents.

• Opening doors: MFG Day events are always excellent opportunities to demystify the industry and show young people (along with their parents and teachers) a vision of an exciting future. The

coolness factor matters—taking students through a dynamic, high-tech factory floor can fire their imaginations and change the course of their lives.

What we’re saying: “This is manufacturing’s biggest annual stage to inspire the next generation,” said MI Director of Student Engagement Jen White. “We hope anyone who cares about the industry’s future will use their social media platforms and amplify #MFGDay22, to showcase why manufacturers are saying ‘Creators Wanted.’

FABTECH 2022 Heads to Atlanta and Offers Dynamic Lineup of Keynotes and Speakers following another Manufacturing Day

FABTECH 2022, North America’s largest metal forming, fabricating, welding and finishing event, is set to take place November 8-10 at the Georgia World Congress Center in

Atlanta. Exclusively focused on advancing the industries, this year’s event will offer a diverse and robust lineup of forward-thinking, solutionbased keynote speakers, leadership panel discussions and special events covering the industry’s most pressing issues, emerging trends and latest advancements.

“This year’s keynote speakers and panel discussions were handpicked to impart insights to transform businesses and address the challenges and opportunities facing the manufacturing industry today,” said John Catalano, SME senior director, US events and strategic partnerships, FABTECH. “Over three days, attendees will not only hear from these thought leaders, but will also connect with world-class suppliers, see the latest industry products and developments, find the tools to improve productivity, and discover the newest manufacturing solutions.”

– Thursday, 9 – 10 a.m.): In the FABTECH 2022 keynote presentations, experts from across the industry will provide their experiences in building and managing successful businesses and will offer guidance on leveraging innovation, building successful teams, effective leadership, and workforce development.

• FABx Tech Talks: As manufacturing processes are evolving at a rapid pace, it has become crucial for fabricators to leverage these innovations to stay competitive. In these FABx Tech Talks, Gillen Young, Chief Architect for IIOT Solutions at AT&T; Bryce Austin, CEO of TCE Strategy; and Richard Boyd, CEO of Tanjo AI, will share

insights on emerging trends and innovations that are changing the way businesses operate. Bill Carlton, owner and mastermind of Extensive Metal Works featured on the popular realityTV show Texas Metal, will make a special appearance.

• Winning the Manufacturing Race: Brad Keselowski, champion NASCAR driver and Owner of Keselowski Advanced Manufacturing (KAM), will highlight his ownership and operation of his company. Keselowski will share key insights on how his NASCAR experience, coupled with his passion for technological innovations, led him to build KAM.

• The One and the Nine: Groundswell Founder

and CEO Jake Wood will offer insights on how organizations can re-think what they know about leadership, change management and risk. He will use his own journey as an athlete, Marine Scout Sniper and co-founder of Team Rubicon to advise on how to build a successful team and be the leader that others look to.

(Tuesday – Thursday, 12:30 – 1:30 p.m.): The Leadership Exchange Panels will feature groups of subject matter experts who will discuss the next phase of advanced manufacturing, how innovation is key to outperforming the competition, tactics for cultivating the next generation of manufacturing talent and how to protect your company from a cyber security

continued

threat. This year’s Leadership Exchange Panels include Advanced Manufacturing Innovation and Opportunities, Planning for the Future of Work: How New Technology is Redefining the Workplace, and Considerations to Improve Your Cyber Security Strategy.

State of the Industry (Thursday, 8 – 8:45 a.m.): Washington, D.C. lobbyist Omar Nashashibi will discuss the latest information on the 2022 mid-term elections and the impact the results may have in 2023 on tariffs, taxes, trade negotiations, regulations, and workforce training.

Women in FABTECH Breakfast (Wednesday, 7:30 – 9:30 a.m.): Learn about manufacturing trends, marketing strategies, and

more through real-world examples shared by women leaders in manufacturing.

Along with breakfast and networking, this special session will feature keynote speaker, Scarlet Hao, Digital Strategy Consultant at Accenture, who will then also lead an expert panel with Holly Gotfredson, President of American Metalcraft and Finishing Dynamics, Shelly Foland, CEO of Softies, and Lisa Winton, CEO, Winton Machine Company. In addition to the special events, FABTECH 2022 will include over 150 carefully curated education sessions, an expansive show floor featuring more than 1,200 exhibitors and 300 new products and technologies across every facet of the industry, and unmatched networking opportunities with peers, industry

leaders, buyers and manufacturers. For more information, visit fabtechexpo.com or follow on Facebook, Twitter, LinkedIn, and Instagram. To secure a free exhibit hall pass, register here https://bit.ly/3etB1FF.

FABTECH is North America’s largest metal forming, fabricating, welding and finishing event. The event provides a powerfully aligned hands-on, face-to-face business growth experience. FABTECH is held annually in the U.S., rotating between Las Vegas, Chicago and Atlanta. FABTECH Mexico also occurs annually rotating between Mexico City and Monterrey and FABTECH Canada occurs biennially in Toronto. These events are made possible by FABTECH’s five event partners, all of whom represent the varied and diverse makeup of the manufacturing industry. They include the American Welding Society, the Chemical Coaters Association International, the Fabricators & Manufacturers Association International, the Precision Metalforming Association and SME. n

The old jokes seem more appropriate than ever. It is said to be a downturn when your neighbor loses their job, a recession when you lose your job, and a depression when the economist loses their job. It would seem simple enough to define a recession, but the truth is that it isn’t. The arbiter of defining a recession is the National Bureau for Economic Research (NBER), and it defines a recession

as follows - “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” Vague enough for you? This is more than reporting that GDP declined for a quarter or two – this determination involves employment, personal income, consumer spend, industrial production, and a host of other factors. The challenge now is that

some of these are indeed pointing at recession, but several are not.

There is an important intangible when looking at recession. Expectations on the part of the consumer and the business community play an immense role. To be frank, people can talk themselves into a recession. The behavior of consumers and businesses can either

pull an economy out of the slump or accelerate it. If consumers assume that things are going to get worse, they generally react with caution. They decide to spend less, they become more concerned about their job security, and they shy away from big investments (cars, homes etc.). They postpone travel and reduce discretionary purchasing in general. Business reacts similarly with reduced desire for hiring, reduced investment in equipment, reduced levels of output. Even as demand continues there is a reluctance to try to meet it for fear that this demand will be short-lived. Then the recession becomes a self-fulfilling prophecy.

A look at the data shows an economy that is closer to the edge of downturn than anybody wants to see but it has not yet tipped in some significant ways. Employment remains strong with rates well under what would be considered recessionary. Not only are overall rates still close to 3.5%, but the quit rate remains high, and new claims for unemployment are still low. The issue for most companies remains labor shortage, and that has inhibited the normal pace of layoffs that might have been expected. There

are also solid numbers when it comes to capacity utilization. After three months in a row of readings above 80%, there was a very slight drop to 79.9% in August. Given that numbers between 80% and 85% are considered normal, these are solid. The automotive sector continues to surge on steady demand. Durable goods orders are stable. The fact is these numbers are not exactly spectacular, but they are not in the doldrums either.

The factors that have people worried include the impact of inflationfighting measures by the Fed. As long as these rates keep climbing, there will be pressure on the economy to slow down, and thus far the Fed has not suggested they are satisfied with the impact they have had on inflation. If you are looking at some of the more unusual indicators of an impending recession, you can take your pick of these. The “men’s underwear” index holds that when men stop buying new underwear, there is a recession. When women start buying more lipstick that is a sign as well (assuming that women are focusing on little luxuries). Finally, there is the measure that was developed in south Florida some

decades ago. It is the “Vixen Index” which holds that when there are more attractive wait staff and servers, there is a shortage of jobs. Not very politically correct and not very easy to quantify either.

Many of the manufacturing-centered indices are still pointing in a positive direction, but even these have shown some fading in recent weeks. The two sectors that are showing the most aggressive growth have been aerospace and automotive. This is according to the Armada Strategic Intelligence System. Automotive has been on a tear for the last several months as there has been steady demand combined with a disrupted supply chain that has only recently shown signs of recovery. The rebound in aerospace has been more recent. It has been driven by airlines anticipating a return to some more normal levels of demand and a renewed interest in replacing older fleets with more fuel-efficient aircraft. The sectors that have not been doing so well have included machinery and electronics.

The Canadian economy continues to perform reasonably well – especially as compared to the performance in the US. This is because Canada has seen continued demand for its commodities (oil, gas and food). There has been a bit of a slump in the manufacturing sector, but not a pronounced one as the automotive sector has been fairly strong in North America as a whole, and that centers the Canadian manufacturing community. The OECD is expecting growth of 3.8% in 2022 and a dip to 2.6% in 2023. This is certainly slower than was achieved in 2021 but far from recessionary. The Bank of Canada predicts that Canada’s economy will return to the 2019 trend

line for growth by the beginning of 2024 and is currently at 85% of recovery.

The three factors that have the ability to throw this optimistic assessment off are familiar by now. At the top of the list is labor shortage – a problem that has vexed Canada and the US for the better part of two decades. The situation has become a bit more complex as recession worries develop. Many companies have reacted to the labor shortage with investments in technology and robotics, but that has been slowing down of late as companies put off some of those CapEx projects. Canada has seen some reshoring activity of late (not as much as in the US), but the same limitations exist as in the US – not

enough people and not enough in the way of investment dollars.

The second factor that might inhibit growth is harder to deal with directly. Recessions are often self-fulfilling prophecies. If people and businesses think a major downturn is coming, they react accordingly – less spending and less investment. Right now, almost half of the Canadian population thinks recession in 2023 is very likely. The least pessimistic are in Quebec, and the most pessimistic are in Manitoba, Saskatchewan, and Alberta.

The third factor is inflation fighting. As long as employment numbers remain strong, there is room for the Bank of Canada to continue hiking

rates. The rates are currently at a 14-year high of 3.5%, and the latest statements from Tiff Macklem have continued to be very hawkish. The priority remains taming inflation (despite the fact it has been driven by factors hard to control by central banks). The sense is that another .75% hike is in the near future.

The most recent performance of the Mexican economy has improved as two of the four pillars of the system have been performing better than expected. Unfortunately, the other two have not seen anything close to that recovery. The oil and gas sector has been performing as well as can be expected in an era of energy shortage, and the manufacturing sector has continued

The Flagship Reports with Dr. Chris Kuehl is both an “Officer of the Watch” briefing of economic conditions and an Executive Briefing on specific situations impacting those conditions. Written and presented by the officers of Armada Corporate Intelligence, Dr. Kuehl lightens up the mood of sometimes distressful geoeconomic news with a bit of humor. This monthly podcast includes information from the Flagship Reports issued 3 times and week, and AISI, the Armada Strategic Intelligence System, a tool for durable goods manufacturers that dives deep into the sector each month to pro vide more than 95% accurate near-term forecasts.

benefited from the improvement in the automotive arena. The tourism sector is still way down and may be years from recovery, while remittances from the U.S. are also down. The workers in the U.S. have not been able to send as much money home as in the past as their expenses in the U.S. have increased.

The primary concern is the state of the U.S. economy, as Mexico remains very closely tied to what happens in the rest of North America. The gains in GDP for the last few months have been around 0.2%, but the Bank of Mexico expects Q4 growth to be only 1.8%, and it could well fall further in 2023. The headwinds from the AMLO government are still a major factor. It remains very hard to

attract foreign investment into key sectors such as energy, and there has been a lot of interest in further nationalization. The immigration patterns have changed dramatically in the last few years, and that has put a significant burden on Mexico. The majority of the migrants attempting to enter the U.S. are no longer Mexican – they originate in Central and South America and are moving through Mexico. There is no desire or capability in Mexico to absorb this influx, and they are subsequently pushed north. The majority of the Mexican migrant population from the southern parts of the country are staying in northern Mexico as they find work there.

Author profile: Dr. Christopher Kuehl (Ph.D.) is a Managing Director of Armada Corporate Intelligence and one of the cofounders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years. He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division –Finance, Credit and International Business. He prepares NACM’s monthly Credit Managers Index. He is the Economic Analyst for the Fabricators and Manufacturers Association and writes their biweekly publication, Fabrinomics, which details the impact of economic trends on the manufacturer. n

by Royce Lowe

by Royce Lowe

Brazil went to the polls on October 2nd to choose a new president. Advance polls gave former president Lula a lead that would see him through in the first round over the incumbent Bolsonaro. Brazil will, however, go back to a runoff on October 30th, following a 48 to 43 result in Lula’s favor. Bolsonaro, supposedly, was handing out money. The result will doubtless affect the direction of Brazil’s economy.

There are presently over 4 million more people employed than prior to the pandemic. The country is reaping the fruits of billions of dollars

invested in its infrastructure over the past two decades. Despite welldocumented corruption cases and a fall in public investment in the past few years, Brazil’s airports, highways, ports, and irrigation channels are in significantly better shape than they were. But there’s still a need for more infrastructure building in Brazil.

An optimistic note for the country comes from ArcelorMittal’s executive in Brazil, who says that Brazil’s steel consumption should double within the next 10 years thanks to “gigantic opportunities” and a need

to build more infrastructure in Latin America’s biggest economy. Steel demand will potentially grow due to the need to build more housing, renewable energy projects, ports, and oil-and-gas assets, especially if Brazil “does the homework” on structural reforms, Jefferson De Paula, president of ArcelorMittal Brazil, said in an interview.

Despite the worldwide talk of recession and a definite lull in steel production and consumption, industry executives feel that we may have reached the bottom of the curve.

Evidently, nothing is for sure, but it may offer relief for Brazil, whose steel consumption has stagnated for years relative to other countries.

Brazil’s annual steel use per capita was around 123 kilograms last year, compared to the global average of 233 kilograms, according to the World Steel Association. Brazil’s steel industry, which is operating at about 67% capacity, is investing 52 billion reals ($10.2 billion) in the next four years to modernize and expand output, according to the nation’s steel group Instituto Aço Brasil. A boost in output, even with higher domestic demand, may lead to more steel exports.

ArcelorMittal itself is investing close to 20 billion reals ($3.9 billion) in the South American nation, with nearly 40% of that for expanding production capacity by 2024, and $2.2 billion to buy Brazilian steelmaker CSP from shareholders including Vale

SA. The takeover, which requires regulatory approval, doesn’t close the door on further deals in Brazil, a country that accounts for 20% to 25% of ArcelorMittal’s financial results, De Paula said. “We can never say it was the last (deal,)” said De Paula, who’s also chairman of Instituto Aço Brasil. “We are always looking for opportunities.”

Brazil has a very strong natural resources economy. The country is rich in a variety of natural resources and is the world’s leading producer of tin, iron ore, and phosphate. It has large deposits of diamonds, manganese, chromium, copper, bauxite, and many other minerals. Its iron ore industry has suffered over the past couple of years from flooding and other production-related issues, many stemming from supply chain disruption. But the recent commodities boom resulted in a record trade surplus. Manufacturing, on the other hand, has been a different story.

There was a deficit of $53 billion (3.3% of GDP) in manufactured goods. No other country has seen manufacturing as a share of GDP vanish so fast. In the 1980s, manufacturing represented 34% of Brazil’s GDP; in 2020 it was a mere 11%. In 2019, Ford pulled out of the country completely, after a 100year presence.

But Brazil has the skills. It is home to Embraer, one of the world’s prominent aircraft manufacturers. It certainly knows how to make steel. It has, in other words, with the correct leadership and manufacturing industries, a huge potential to pull itself out of its present situation

Whoever wins the election on October 30th will have the task of guiding the country through the next phase of its manufacturing development.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

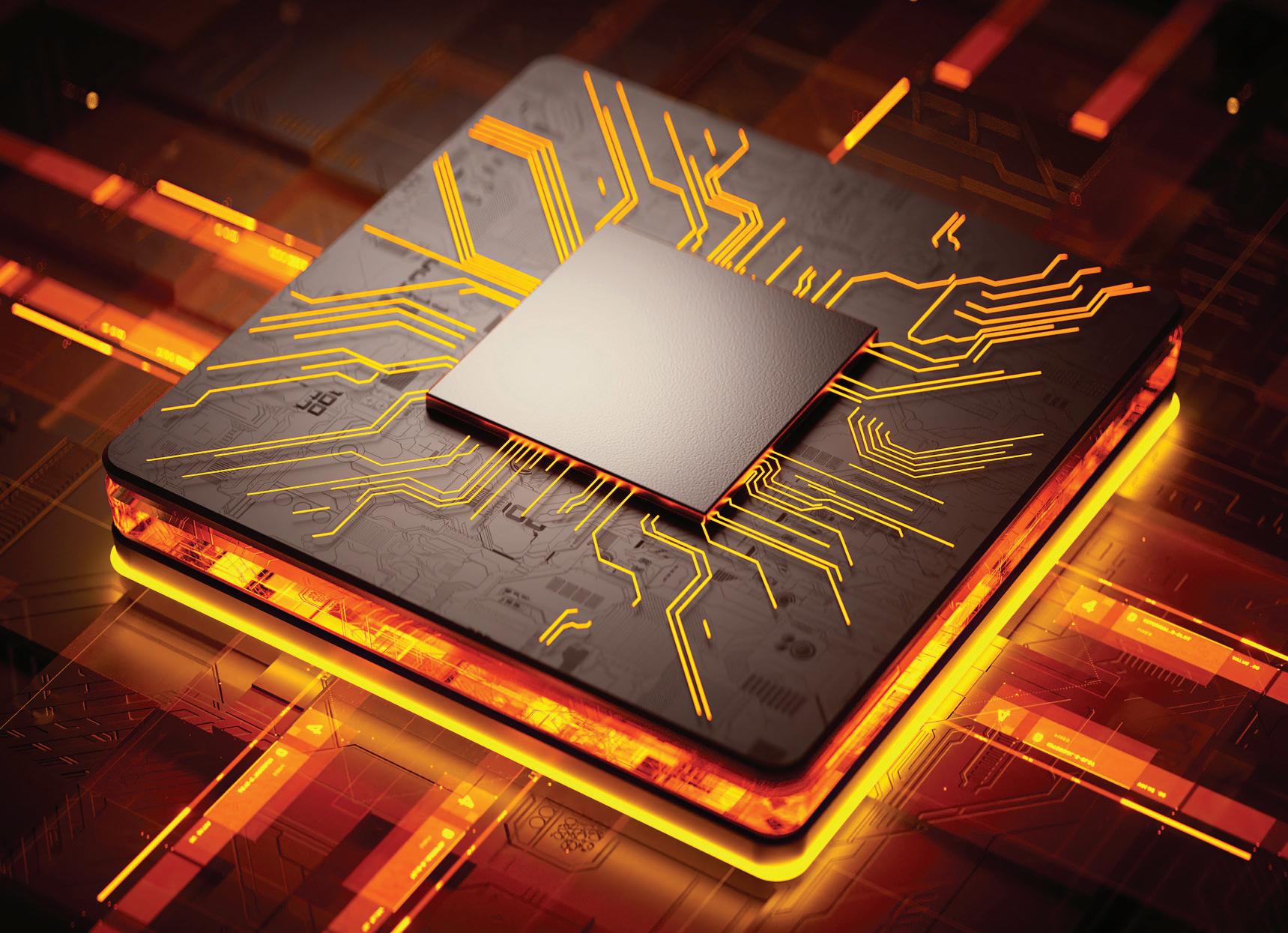

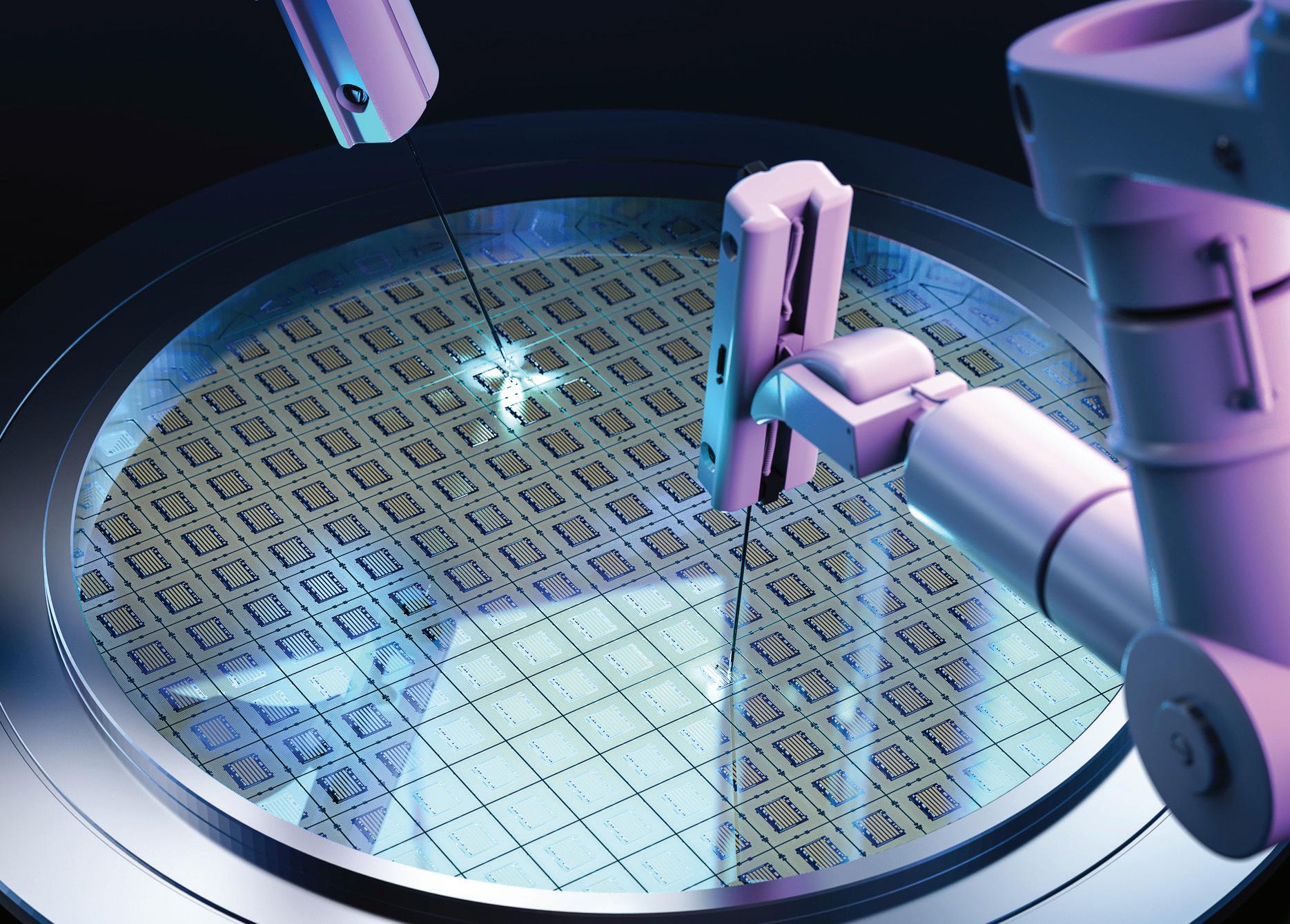

Global Contest Around Semiconductor Production Lifting of Covid-19 Restrictions, Save China Falling Currencies

CHINA:

The worst of the pandemic-related supply chain disruptions appear to be behind us. But there are still many challenges when it comes to chip manufacturing in China and its im port of chips. Is the Chip+ Act one of

them? Reshoring to the U.S. will take years, no matter how much taxpayer funds are made available to U.S. com panies. The greatest challenges in China are domestic. In the first three months of this year, integrated circuit

production in China fell by 4.2%, the worst quarterly performance since the beginning of 2019, when semicon ductor production fell by 8.7% in the first quarter. The spring lockdowns in Shanghai, a key chip manufactur continued

ing center, and the current drought in southwest China, a regional center for components, continue to be contributing factors as technology factories across the country are spo radically forced to close down. Many U.S. companies, such as Ford, with manufacturing operations in China relying on China’s domestic suppli ers, are still plagued with shortages of components and chips with result ing delivery delays. The economic losses for China (and for companies like Ford) can be immense and are just beginning to be felt. The consumer electronics industry in China has also slowed significantly while affected by lockdowns, with less demand for smartphones, PCs and TVs. The Chinese consumer would rather save for an uncertain future. Obtaining enough food has been the highest priority for two years. We expect this trend to continue to add risk to the economic downturn in China.

China relies on foreign technology for advanced chips. It has recognized its dependency on foreign import ed chips as a major risk factor as it

strives to lead the world in high-tech AI, supercomputers and EVs. In 2020 it allocated a whopping amount of cash to the tune of $35.2 billion U.S. dollars through primary and second ary markets. This was a stunning 407% increase from 2019. (China uses state-backed investment vehi cles to fund dual-use technologies, including semiconductors). Yet in spite of China enjoying double-digit growth in its own semiconductor industry for years amid the trade war with the U.S., it still had to import more than US$432 billion worth of chipsets in 2021 (data from the China Semiconductor Industry Association). Chinese semiconductor companies can only produce about 6 percent of chips needed to feed its world class consumer electronics industry. China depends on the Taiwan Semiconduc tor Manufacturing Company (TSMC) to make up 70 percent of the deficit.

Another exporter of advanced chips to China is U.S. company Nvidia. Several Chinese electric vehicle man ufacturers rely on Nvidia’s semiauton omous navigating system chips. Tesla designs its own chips for this func

tion. Chinese EV companies are now using Nvidia to compete with Tesla. China is also looking to cooperate with Nvidia to develop its powerful H100 Artificial Intelligence chip. But on August 31, the U.S. government announced new U.S. restrictions on the export of super powerful AI chips for servers (A100 and H100) to China and Russia. Nvidia has already entered into agreements with China to develop its H100 AI chip. Nvidia expects a $400 million hit to revenue third quarter from these new restrictions. On September 1, Nvidia applied for an exemption and will still be allowed to develop the H100 in China, a big win for the company. But exports of the actual chips are still banned.

How does Taiwan fit into the semi conductor puzzle? TSMC not only makes up 70 percent of China’s con sumer electronics chip deficit; it also fabricates under contract 92 percent of the most advanced chips designed by U.S. semiconductor companies. In a nutshell, “The island dominates the production of the chips that power almost all advanced civilian and military technologies. That leaves the U.S. and Chinese economies extremely reliant on plants that would be in the line of fire in an attack on Taiwan.” (Reuters Yimou Lee, et. al). Obviously this vulnerability has “stoked alarm” in both China and the U.S. over the past several years. Taiwan Semiconductor Manufactur ing Company Ltd. (TSMC) accounts for more than 90% of global output of these chips. The importance of TSMC to the struggle for superpower economic and military dominance cannot be overstated. Both the U.S. and China recognize that military conflict might not leave the prized foundries intact and would likely cut off their links to a global supply chain “essential to their output.”

These prize foundries are referred to by many in Washington as a “silicon shield” that provides the greatest deterrent to war. (Richard Cronin 8/16/22 Stimson.org)

The U.S. has undergone a chip-mak ing push expected to boost U.S. innovation and be more self-sufficient

in the long run, thanks in part to the support contained in President Bid en’s Chips+ Act passed in July, 2022. But it will require more than the U.S. $52 billion allocated. It will take years of private and public invest ment, access to multibillion-dollar facilities and streamlining of the many regulatory approvals required by

numerous federal and state agencies in the process. In September, Intel broke ground in Ohio on a $20 billion semiconductor plant near Columbus with support from the Chips+ Act.

Taiwan, for several years, has been requesting and negotiating with the U.S. government to secure subsidies for moving or developing some of its semiconductor production to the USA. There is a large cost gap be tween manufacturing in Taiwan and producing in the USA. Congress did sign off on aid to TSMC in 2020 to establish a $12 million facility in Ari zona in 2021. The Chips+ Act will no doubt facilitate more cooperation of this kind.

Do these developments pose a threat to China’s plans to eventually dom inate in artificial intelligence and quantum computing? It turns out that continued

the greatest current threat to China’s potential economic dominance may not be the competition with Taiwan and the U.S. over advanced chip production, nor President Biden’s CHIPS+ Act. It’s their inability to wean their industries off Microsoft’s operating system Windows. Win dows is far more technology-friendly when managing the complex systems involved in semiconductor manufac turing. In trying to wean themselves from reliance on the U.S., there is this major roadblock. If they switch to the Linux system, it would set them back. So they are not likely to do so (FP: Tech and Business 9/21/22). One thing is for certain: with a global re cession on the horizon, or in process already as some believe, the world’s two largest economies have settled in for a long-term trade war with no end in sight.

Covid restrictions are being removed in many nations throughout the region, except for China’s relentless Zero Covid tolerance policies. Hong Kong removed its hotel quarantine restriction for visitors on September 26th. South Korea followed a week later. So did Thailand. We expect that these economies, which have suf fered slower growth and disruptions for years, to gradually return to better days, albeit amid a looming global recession.

Falling Currencies in the region, especially the “heavyweights” (Jap anese Yen, Chinese Yuan) have been tumbling against the U.S. Dollar, which continues its relentless rise along with the rise in interest rates. The Yuan has fallen to its lowest level within its trading band since 2015. Global sovereign treasury

leaders, such as the United Kingdom and European Union, are following suit to raise rates. The result is a huge “deadweight” on these Asian currencies with rippling effects on all regional currencies which could start to resemble the Asian financial crisis of 1997 if not tamed. Investors are even backing away from South Korea, reminiscent of those times. Something to watch out for in the coming weeks (WSJ 9/21/22).

Author profile: Christine is cofounder and President of China Human Resources Group, Inc, a management consulting firm based in Princeton NJ. She has provided U.S. companies with strategic development and project implementation services for projects in China since 1986 n

by Chris Anderson

by Chris Anderson

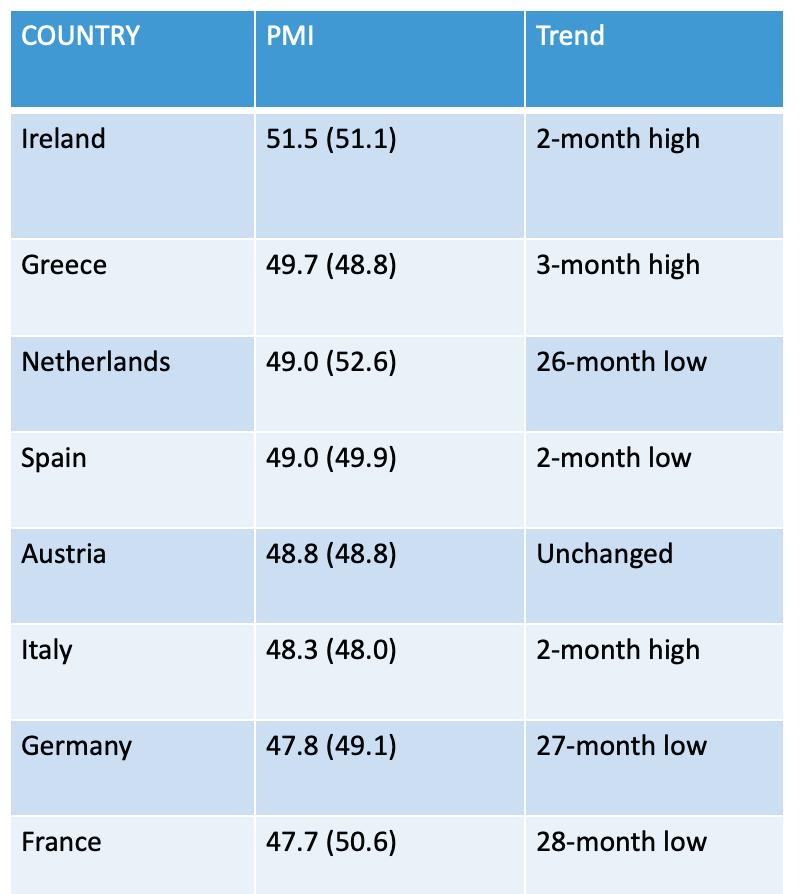

S&P Global Eurozone Manufacturing Composite Purchasing Managers’ Index (PMI), fell back from 49.6 in August to 48.4 in September. The manufacturing production index fell slightly from August’s 46.5 to 46.3.

In Europe, orders are slumping and energy prices soaring. There may be worse to come, with orders falling at a significantly steeper rate than production is being cut. There is falling demand and inflation, with business confidence at its lowest since June 2020.

Your business needs

New Word

guide through

evolution

economic

markets

economic analysis

RAPID (Rapid Advancement in Process Intensification Deployment), a Manufacturing USA® institute, resolves manufacturing process barriers to enable firms to be leaner, cleaner, and greener and become more compact, modular, productive. and profitable.

Manufacturing USA, a public-private partnership with 14 manufacturing institutes across the nation, connects companies, academic institutes, non-profits, and local, state, and federal entities to solve industry-relevant advanced manufacturing challenges in new technology areas with the goals of enhancing industrial competitiveness and economic growth and strengthening national security.

Process industries include chemicals, oil and gas, pulp, and paper. Modular chemical process intensification has long been known to lead to energy efficiencies in process industries but it also has been riddled with barriers to adoption. Costs, complexities, insufficient software and design tools, lack of standardization, and limited knowledge has made modular chemical process intensification difficult for most manufacturers to leverage.

RAPID is integrating approaches—in sectors such as chemical and com modity processing, natural gas upgrading, and renewable bioproducts—to overcome barriers and enable companies to improve productivity, reduce waste, and cut operating costs. Focusing further on modeling and simula tion, intensified process fundamentals, and industrial systems modulariza tion will enable RAPID to broaden use of process intensification technolo gies across diverse industry sectors.

+

New York, New York 800.242.4363

RAPID brings together partners in industry, academia, government, and nonprofits to collectively overcome manufacturing challenges in modular chemical process intensification to increase efficiency processes for firms. This is done through:

Funding projects that prototype technologies and adapt innovations to maximize accessibility to commercial appli cations across industries

Building deployment channels across the supply chain and industrial process sectors, as well as the design of a model ing knowledge-base to accelerate the adoption of modular solutions

Education and workforce development projects including online webinars and a summer intern program providing undergraduate and graduate students with hands-on training and immersion in process intensification projects

“RAPID’s focus on educating and training the next generation of PI leaders is critical to finding talented young people who will contribute to innovation within the manufacturing sector of the chemical process industries.”

– Paul Dimick, General Manager, IntraMicron, Inc.

MODULAR SOLAR-THERMOCHEMICAL CONVERSION PLATFORM: Oregon State and Pacific Northwest National Lab are partnering with RAPID to advance specific equipment manufacturing needs to accelerate the commercial adoption of solar thermo-chemical technologies.

PRODUCTION: With support from RAPID, Praxair and Georgia Tech are using a proprietary nitrogen-selective adsorbent to scale down a pressure swing adsorption system that can remove nitrogen from natural gas at the wellhead. This would enable the separation of hydrocarbon immediately upon production and sale of it to customers instead of being flared—avoiding losses of saleable hydrocarbons and reducing CO2 emissions.

REDUCING THE USE OF PETROLEUM PRODUCTS IN TRANSPORTATION AND ELECTRIC GENERATION: Iowa State University’s Bioeconomy Institute and Easy Energy Systems are developing a modular system to convert biomass into sugars, which can then be converted into ethanol and other fuels. This would replace the common enzyme-based process through a new technology called autothermal pyrolysis that uses heat (without oxygen), and could provide new markets for modular manufacturers and new uses for agricultural residues.

“RAPID is helping to simplify a process that can be daunting to a small company. It’s a significant benefit for a small business like ours.”

– Dr. Hannah Murnen, VP Business Development, Compact Membrane Systems

“We’ve been able to put theory into practice and develop commercial applications from our research based on the substantive feedback and input we have received through our involvement with RAPID.”

– Professor Robert C. Brown, Director, Bioeconomy Institute, Iowa State University n

Last month we talked about the quality problems Lockheed was having with the production of the F-35 fighter, involving things done by a couple of companies for which there was really no excuse.

A further story recently broke, unearthed by Bloomberg, telling us that for many years Chineseproduced magnets have been used in the F-35 and that all of a sudden this just will not do. It’s a security issue, and somebody decided to put a stop to it, to put a hold on F-35 deliveries, and to “find” an alternative supplier of the part. Even though, after all these years, there is no evidence that

any harm at all was done. This is basically because China is on the “hit list” that also includes Iran, North Korea, and Russia.

The part in question is a samariumcobalt magnet, produced in China and magnetized in the U.S. Samarium is a rare earth, discovered by a French chemist in 1879, and mostly found in China, U.S., Brazil, India, Sri Lanka, and Australia. China is by far the world leader in mining and production of the metal, whose main commercial use is in samarium-cobalt magnets. Every one of the more than 825 F-35 fighter jets delivered so far contains this

component made with a Chinese alloy that’s prohibited by both U.S. law and Pentagon regulations, according to the program office that oversees the aircraft.

The magnet is used in an aircraftpowering device supplied by Honeywell International Inc. and has been used in the plane since 2003, the Pentagon’s F-35 program office said. The Pentagon recently suspended deliveries of new F-35s to make sure the program complies with regulations related to “specialty metals.”

Honeywell, an F-35 subcontractor, notified Lockheed in late August

that “alloy sourced from the People’s Republic of China” and provided by a “fifth-tier” subcontractor was used in a magnet, Laura Siebert, a Lockheed spokeswoman, said in a statement.

The F-35 program may produce over 3,300 jets. It will now seek a national security waiver from the Pentagon’s top acquisition official, William LaPlante, to resume deliveries of already assembled new aircraft containing the alloy, F-35 spokesman Russell Goemaere said. LaPlante said a waiver was likely if there were no security or safety issues.

The program does not foresee replacing magnets in delivered aircraft. Replacing them could entail costly and time-consuming retrofits of the over 500 U.S. training and operational aircraft. The Pentagon and Lockheed have found a U.S. source for the alloy for future planes, the company said.

A decade ago, the Pentagon granted a waiver to Honeywell to use Chinese magnets in other F-35 components, saying the program, already beset by delays and cost overruns, would have been slowed even more.

The program office says the part has no technical flaw, and it poses no security risk to the U.S.’s top stealth fighter or its 8 million lines of software code. Rather, it’s a question of supply-chain security and why the banned alloy wasn’t detected by Honeywell. The Pentagon’s judgment that China poses the biggest threat to the U.S. globally only adds to the challenge.

Honeywell has quite a history with China, and recently, at the end of 2021, through its Honeywell Aerospace Division, signed two lucrative MOUs there. But it goes back much further than that, at least

to the 2010 Farnborough Air Show in the U.K., where Reuters reported: U.S. manufacturer Honeywell hopes to win three more contracts on China’s C919 civil aircraft program by the end of 2010, according to its regional head of Europe, Middle East, and Africa, Paolo Carmassi.

The interview continued: Honeywell has already won three tenders for the upcoming C919, including its flight management system, which should bring in over $10 billion in revenue during the program’s lifespan. (We are aware of the delays with the C919, which are likely to see service in the near future.)

“We have submitted proposals for several mechanical and avionic parts. Final decisions should be made in the weeks to come,” Paolo Carmassi said in an interview with Reuters at the Farnborough Air Show.

Honeywell’s French rivals Safran and Thales are also bidding for supply contracts on the C919. CFM International, a subsidiary of Safran, and General Electric, won a multibillion-dollar deal to supply engines for the C919 in 2009.

So there is really nothing surprising about Honeywell doing business with China. What may be surprising is their use of a “fifth-tier” subcontractor. And why did they wait all this time to inform Lockheed et al? In fact, why did they tell them?

Aerospace is a very important segment of U.S. exports, and as such must be held onto. Honeywell has good relations with COMAC, the Commercial Aircraft Corporation of China, and has participated in the four China International Import Expos. There will definitely be aerospace business done between the U.S. and China for the near to

medium future. It should be done right.

Boeing will make dozens of 737 MAX aircraft built for Chinese buyers available to other customers because of the prolonged delay in gaining China’s clearance to deliver the jets. Boeing lists 290 of its topselling passenger jets in inventory and waiting for delivery.

Dave Calhoun, Boeing’s CEO, recently stated that Boeing wouldn’t wait indefinitely for a thaw in U.S.China trade relations. He told reporters that the U.S. planemaker was making available to other buyers a “small number” of the 140 or so already-built Max aircraft that had been earmarked for China. Good for him.

China’s regulator cleared the updated 737 to resume flights last year, provided its airlines followed certain protocols in retraining pilots and bringing aircraft out of storage. While several airlines began preparations for resuming service, they were halted as Covid lockdowns dampened demand for air travel.

It is to be hoped that Boeing can quickly resolve the 737 situation in China. Airbus has picked up significant orders in China in the past few months, and China Southern Airlines just gave them an order for 40 A320neo jets.

Aerospace is never boring; it probably never will be.

Author profile:Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.n

Wind and Sun, the Energy Givers. by Royce Lowe

Renewable energy, as we know, is all about wind and sun, the one we associate with the Danes, and the solar with the Chinese. Orsted is the Danish company responsible for the U.K.’s Hornsea Projects. We’ve already written about Hornsea1fully operational since 2020 - and the preparations for Hornsea 2, the latter being the world’s largest offshore wind farm. It is located in the North Sea, 90 km (55 miles) off the Yorkshire coast, adjacent to the Hornsea 1 Project, and it went fully operational at the end of August. This is all part

of the U.K.’s bid to achieve net zero carbon emissions by 2050.

The 1.3 GW offshore wind farm comprises 165 wind turbines, sourced from the turbine maker Siemens Gamesa, which will help power over 1.4 million U.K. homes with low-cost, clean, and secure renewable energy. The project is housed in an area of 462 sq. km. equivalent to 64,000 football fields, or about half the size of New York City. For this project, 8 MW turbines were used, with blades at 265 feet (81 m) long, and blade tips

reaching a height of 656 feet (200 m) above sea level. One revolution of the turbine can power an average home in the U.K. for 24 hours. A 242-mile (390 km) subsea cable will carry the power generated at Hornsea to the shore at Horseshoe Point in Lincolnshire.

Together Hornsea 1 and 2 can power 2.5 million U.K. homes.

Hornsea 2 may have started as a project to provide greener energy, but in the current circumstances will end up being much more. The ongoing conflict in Ukraine has

raised energy prices in Europe while raising concerns about energy security. Russia is in a position to play with the energy supply to the region at will, wreaking havoc on industry and population.

Large-scale facilities such as Hornsea 2 can be constructed in a relatively short period of time, and hence it is no surprise that the U.K. plans to follow up this project with Hornsea 3, a project with a 2.8 GW power generation capacity. The ambitious U.K. plans are an offshore wind generation capacity of 50 GW by the end of the decade. Ørsted now has 13 operational offshore wind farms in the U.K., providing 6.2 GW of renewable electricity, or enough to power more than 7 million U.K. homes.

Orsted has onshore wind projects in the U.S., in Illinois, Kansas, Nebraska, Texas, and South Dakota. The company is always looking for talent, as well as support subcontractors.

Wind energy is the obvious choice for the U.K., since the country mostly lacks the source for solar power. Things are different in China, and of late solar has overtaken wind to become that country’s primary energy generator. In some ways, solar is having too much success in China.

Installing panels has become so popular that Chinese officials drafted regulations to make sure developers don’t put them on land needed for other uses. But the solar frenzy is just getting underway. Solar panels have overtaken wind turbines in the

world’s biggest renewables market as photovoltaic manufacturers up their output.

China’s solar capacity rose 1.9% to 349.9 gigawatts in August, surpassing wind, which grew by just 0.2% to 344.5 gigawatts, according to recent National Energy Administration data. The country will have more capacity from panels than turbines on an annual basis for the first time by the end of this year, according to BloombergNEF forecasts.

It’s unlikely solar will give up that lead. The supply chain has slashed costs and boosted efficiency while greatly increasing production. This means the technology is now the cheapest energy option in many places. In terms of capacity, solar overtook wind globally in 2019 and is expected to be twice as large by 2030, according to BNEF.

BNEF’s analysis says that solar caught up on wind and is even cheaper now in most sunny countries. Plus solar can be installed in more places. Initial construction of both solar and onshore wind is cheaper than gas and coal. Turbines still generate much more power than panels over the course of a year because they’re in use far more often.

Solar’s dominance stems from larger and more sophisticated factories that increase economies of scale. This in spite of an increase in the price of modules this year due to a shortage of the key material polysilicon. BNEF says the cost of solar power in China

is about $44 per megawatt-hour, down from $183 in early 2014.

The technology’s versatility is also a plus. While both wind and solar are benefiting from China’s plans to build massive arrays of panels and turbines in the country’s vast deserts, solar is getting an additional boost from a government scheme supporting socalled distributed generation. More than 600 cities and counties are taking part in the program designed to boost rooftop solar by aggregating small projects into larger batches, luring bigger developers. More than half of all solar installations in China were on roofs last year.

Physical space for all of these panels is becoming a concern. The Ministry of Water Resources issued a rule in May banning projects on some waterways, lakes, and reservoirs to protect ecology and prevent over-development that could disrupt flood control. A separate draft regulation is under consideration that would prohibit new solar projects on cultivated land or forests.

This won’t really affect increased solar installation. China could install as much as 100 gigawatts of panels this year, almost doubling a record set in 2021, according to the country’s leading industry association.

Deserts in north China are set to host an unparalleled build-up of renewable energy. In recent months, construction began on wind and solar-power “bases,” which by 2030 will contain about as much renewable capacity as currently exists in all of Europe. There is little doubt that wind and sun are here to stay.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

The leaders of Nucor Corp. and U.S. Steel Corp. recently put down investors’ expectations of their thirdquarter results, saying that production had decreased from its levels earlier this year.

were forecast to be “considerably lower” in the third quarter than in the second. The main reasons given were shrinking margins coupled with lower volumes, particularly at the sheet and plate mills.

The executives at Nucor said its steel products division, which they boosted earlier this year via the $3 billion acquisition of C.H.I. Overhead Doors,

was on track for a good Q3, and its raw materials group’s results should be in line with the second quarter. But their steel mills’ performance suggests significantly lower Q3 earnings. U.S. Steel’s mid-September news was similar, maybe a little less severe. Burritt, its CEO, said U.S. Steel’s businesses have faced “market headwinds that have accelerated over the quarter” in several of its end