8 minute read

PREPARE FOR TOMORROW’S FORGING MARKET

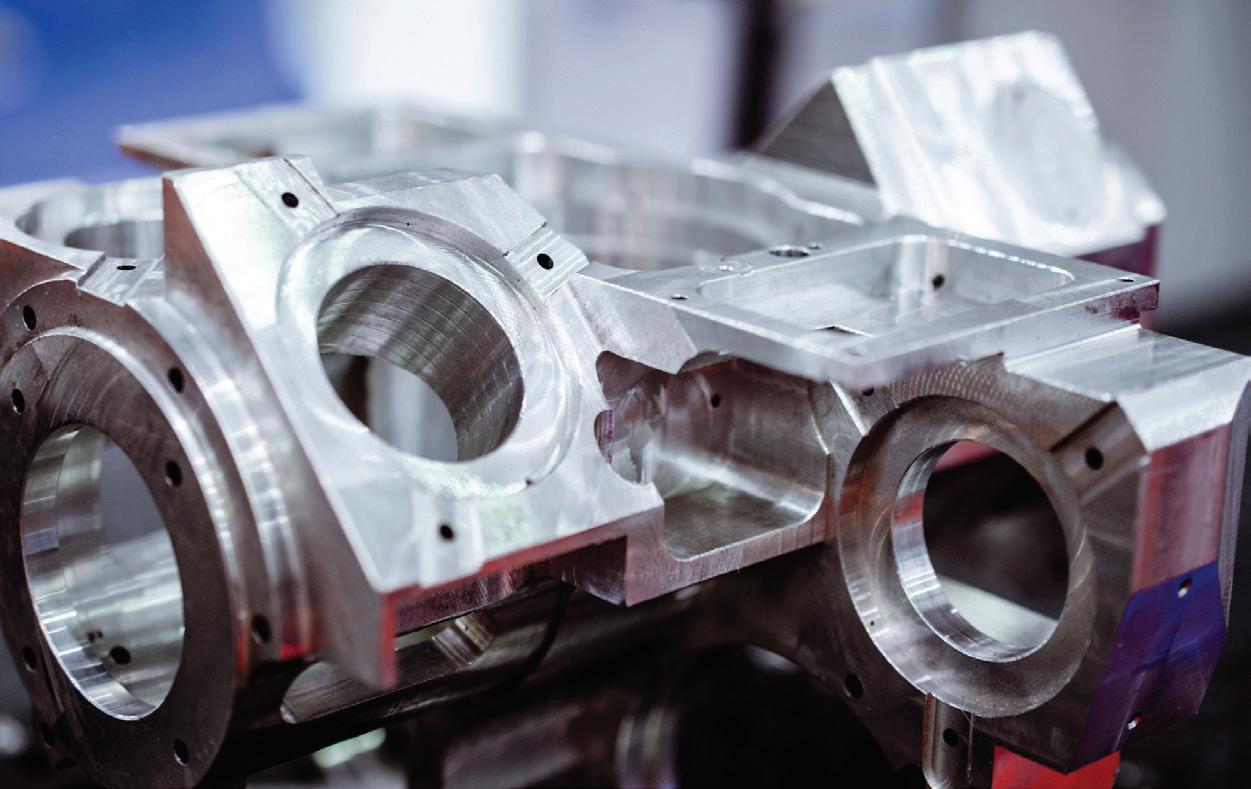

The Future of Aluminum Closed Die Forging is Upon Us

by TOM LEFAIVRE

The future of closed-die aluminum forging is wide-open. The value of the global metal forging market, with a predicted compound annual growth rate of 6.3% over the next several years, is set to grow to over $130 billion by 2027 according to recent reporting. With a growing demand for commercial and electric vehicles, a coming resurgence in aerospace, and an increasing need for forged parts in markets ranging from the sugar industry to machine equipment, the closed-die aluminum forging market is well-positioned to reach new heights in the coming years. However, in its present state, the forging market is also significantly fragmented and faces a variety of challenges. Forging companies that are able to recognize these difficulties and adapt to a shifting landscape will be in the best position to reap the benefits set to come over the next decade. Accelerating Markets The onset of the ongoing coronavirus pandemic has resulted in numerous changes to how people are going about their daily lives. One of the more unsurprising results, given the benefit of hindsight, has been the growth in the used-car market. Consumers, eager to avoid public transportation or ride-hailing services, have taken to purchasing used cars. Online automotive platform Edmunds.com has reported a surge in the sale of used vehicles. With a booming automotive market, the need for aftermarket automotive parts is set to multiply as these consumers look to maintain their new, pre-owned vehicles.

In addition to used vehicles, the increasing emergence of electric vehicles (EVs) is also set to significantly expand

the closed-die aluminum forging market. As companies continue to enter the EV market, from established brands such as General Motors and Volkswagen to burgeoning startups like Lucid Motors and Rivian, the industry’s need for lightweight, high-strength components has steadily been moving upward. Auto components with a superior strength-to-weight ratio, such as those produced by Anchor Harvey, are ideal for manufacturing this next generation of vehicles. As automotive companies increasingly turn to U.S. based closed-die aluminum forgers to reshore their supply lines and secure production capacity for components, the EV market is on course to provide a sustainable trajectory for growth in the closed-die forging industry.

Growth Opportunities With a backlog for new aircraft orders already spanning multiple years and a decrease in consumer travel, many commercial airlines have been increasingly focusing on establishing more robust relationships with MRO facilities and suppliers of aftermarket forgings. Even military operators are flying aging fleets longer, bolstering the demand for aftermarket aerospace components. Closeddie aluminum forging companies that are AS9100 certified, like Anchor Harvey, are in a prime position to fulfill the current market needs for high-quality aftermarket aerospace components. As civilian travel picks back up, those same companies will be primed to manufacture new lightweight aerospace parts for new aircraft orders as airlines eventually move to retire and replace their fleets.

Increasing demands in other industries are also providing growth opportunities for closed-die aluminum forgers. As sectors including sugar, metal rolling, cement manufacturing, and nuclear power, in addition to several others, are experiencing periods of expansion, the need for an increasing number of aluminum components to ensure continued operations has been steadily growing. To make the most of these and similar opportunities, forging companies need to find the right balance between chasing fast-growing market segments while maintaining their established positions in other industries and growing their relationships with long-term customers.

Challenges Ahead The benefits of forging over other fabrication techniques have been instrumental in driving the growth of the market. However, with the forging market currently fragmented and the degree of fragmentation predicted to grow over the coming years, consolidation will be crucial in ensuring long-term viability and success for many closeddie aluminum forging companies. With numerous forge shops catering to niche markets, the need for closed-die aluminum forging companies to grow via mergers and acquisitions is already evident. As the forging market looks to become more fragmented, companies with the foresight to combine resources and market share will be able to grow their profitability and expertise rather than being increasingly relegated to smaller, specialized, or hobbyist market segments. Additionally, forging companies will need to find ways to differentiate themselves. Whether it’s through the addition of new technologies, the implementation of modernized processes or the achievement of advanced certifications, the ability to adapt to the evolving landscape of modern forging will prove critical to closeddie aluminum forgers’ success in the years ahead.

Ready For Tomorrow At Anchor Harvey, we’re already working to surmount the challenges of tomorrow. The achievement of our AS9100 certification ensures we stay forward-focused, while the addition of digital monitoring systems allows us to improve and maintain stellar safety and production records. Digital monitoring, in tandem with our data acquisition systems, ensures machine stability and part consistency from component number one to number one million. We modernized our process, implementing a cellular manufacturing operation, and turned five steps— sawing, hot forging, polishing, trimming, and inspecting— into one continuous workflow. These enhancements led to further improvements, such as the development of our proprietary, in-house ability to heat treat components continuously throughout the forging process. On-the-go heat treatment has already proven to be a significant differentiating factor for Anchor Harvey, delivering results that exceed ASTM standards with a 15% improvement in component properties and consistently recognized by major OEMs as “the best of all worlds” for providing superior components. At Anchor Harvey, we’re prepared today for whatever tomorrow may hold.

Author profile

As President of Anchor Harvey, Tom Lefaivre is responsible for overseeing all company facets and its data-driven aluminum forging business. Having served as the company’s president for over 17 years, Tom has a proven executive management track record and over three decades of experience driving sales and growth in the industry. He has spearheaded the transformation of the 100-year-old forge shop, evolving its next growth stage with deep integration of advanced technologies and entrance into a global array of new markets.

Consistent & Constant Messaging:

How Manufacturers Will Prosper in 2021

by T.R. CUTLER

Working out once a month will not produce the desired results of a strong body; nor will periodic dieting produce a lean body. Consistent behavior in diet and exercise are the only ways to achieve and maintain long-term health and optimal appearance. Similarly, it is foolish for any manufacturer to believe that one press release a month and one published feature article a year will accomplish a strong and healthy manufacturing reputation and grow market share.

Achieving media coverage is a good way to build a manufacturer’s profile, increase a well-earned reputation, and communicate messaging to target audience customers. Posting a single published feature article is not enough; it must provoke the implementation of cross-promotional PR strategies which exponentially increase the reach of the media coverage. PR is the protein shake to augment a good marketing campaign.

Manufacturers as thought leaders Research has shown thought leadership in manufacturing marketing makes a difference for B2B brands. Nearly two-thirds of decision-makers said that thought leadership is one of the top ways to gauge the caliber of thinking that a company can provide. This approach permits creativity, authentic voice of the manufacturer, and advances all other elements in manufacturing marketing.

Due to COVID, B2B manufacturing is still undergoing significant changes via digital transformation. While technology has been embraced on the shop floor, many marketers are still wondering about the best way forward in a world no longer defined by a calendar of industry events. Companies with opinionated leaders become the conduit to buyers who respect the thought leadership. Thought leadership is often opposed to the status quo in the manufacturing space.

Three press releases a week Advising manufacturers to issue at least three press releases a week is often met with shock. Most have no clue what could be announced with that level of frequency. The answer is simple, if the doors are open today, there is something to say today. From new products, new hires, and new customers, there is never a shortage of things to talk about. Since most small and midsized manufacturers have neglected to tell their story, the backlog of content is voluminous.

Customers can be interviewed, employees can be profiled, and products can be explained. When feature articles are published, they can be crosspromoted. Conferences (remote or in-person), webinars, and other events can be shared. Being nominated for awards can be a feather in the cap of manufacturers, whether announced as the winner or not.

Strategic partnerships with other vendors, systems integrators, and membership in associations are also cause for regular press releases. Only with this frequency can editors and members of the Manufacturing Media Consortium find something to announce. Competitors are shouting their virtues and differentiators. Silence is not an option for manufacturers to succeed in 2021. All these elements become fodder for social media as well. It takes time to grow Twitter followers, but like PR, that functionality can be outsourced. 2021 media planning session By early December it is best if all manufacturers work to create a 2021 media plan. In addition to the topics described above, there will also be unknown elements such as new clients, new employees, mergers & acquisition, that can be documented. Taking these functions one quarter at a time might be necessary baby-steps for manufacturers who have not performed strategic media planning sessions previously.

Author Profile: Thomas R. Cutler is the President and CEO of Fort Lauderdale, Florida-based, TR Cutler, Inc., celebrating its 21st year. Cutler is the founder of the Manufacturing Media Consortium including more than 8000 journalists, editors, and economists writing about trends in manufacturing, industry, material handling, and process improvement. Cutler authors more than 1000 feature articles annually regarding the manufacturing sector. More than 4700 industry leaders follow Cutler on Twitter daily at @ThomasRCutler. Contact Cutler at trcutler@trcutlerinc.com.