50 minute read

MANUFACTURING OUTLOOK: COVID DRIVES REMOTE WORK WITH B2B

Manufacturing Outlook: COVID Drives Remote Work

with B2B eCommerce by MOTTI DANINO

As the COVID pandemic wears on, manufacturers and distributors of industrial products continue to be impacted. Economic shutdowns greatly reduced the demand for some industrial products. While some industries were able to operate with a remote workforce, many manufacturing jobs must be performed on-site and cannot be performed remotely.

Early in the pandemic many manufacturers, distributors, and those selling physical products, assumed remote working would not be possible. These companies realized the importance of optimizing effectiveness in the pandemic environment and are finding solutions for some members on the team to work safely and remotely.

Manufacturers succeed in managing a distributed team

Increasingly manufacturing leaders are embracing digital technology through process automation, while others still rely on the physical presence and

interaction of humans. During COVID some believe it is difficult for industries to adopt distributed, remote work policies and maintain workplace productivity. That is a false presumption.

Manufacturers and distributors of physical goods can review workflows identifying areas where technology can bring additional improvements. Even if automation, robotics, and cloud computing are being used, manufacturers must revisit communication, project management, CRM, and B2B eCommerce tools to see how they can further digital transformation.

Most manufacturing firms of $75M+ are embracing B2B eCommerce

With online traffic at an all-time high, manufacturers are investing in digital selling channels that recover losses from in-person sales and creating a new channel to serve online customers. That is just a portion of doing business in the new, pandemic manufacturing world.

Manufacturers determine what teams must be present on the production or warehouse floor and how they can socially distance and still maintain safety. Reviewing engineering tasks is essential when determining whether IIOT (industrial internet of things) can enable remote work. Identifying how photo, video, and teleconferencing technology can enhance safety and performance is critical. Implementing digital communication methods on the shop or warehouse floor, such as instant messaging and tele-conferencing limits physical contact.

All businesses have been forced to work from home and face the communication, productivity, and security challenges of managing remote teams. These challenges are amplified for manufacturers as many product management, production, and warehousing activities simply cannot be done remotely.

Manufacturers managing customizable products from engineer-to-order (ETO) to assemble-toorder (ATO) must adjust processes which require less frequent iteration and collaboration with in-person teams. Manufacturers relying on a limited number of specialized suppliers in the supply chain must work together to adopt new communication methods, processes, and tools. Organizations with cross-functional teams must enable asynchronous communication while

maintaining a positive work environment and accountability. Many manufacturers are operating with legacy tools and systems must be optimized or changed in favor of cloud technologies that make it easier to collaborate and share data remotely.

Manufacturers adopting best combination of digital tools, processes, and communication methods

While it may be challenging to offer product demos or check for defects with a webcam, it may be the only option during COVID. A good web camera, fast connection, and the right web conferencing software goes a long way.

With a lack of tradeshows and travel restrictions, the world of physical B2B sales is changing quickly. Diverting field sales resources to communicating with clients, spending more time on sales calls, and shipping more samples is the new normal.

Manufacturers must give more time to vendors and suppliers so they can make changes well ahead of the production schedule. Leaving a larger window to rectify communication issues is especially important with overseas suppliers. Seeking alternatives across the value chain to preserve relationships and create mutually beneficial partnerships, dissipates risks, and diversifies points of failure during dynamically changing environments.

Technologies and collaboration tools are the glue that holds remote manufacturing teams together. Fortunately, there are great tools that help B2B manufacturing businesses work around the challenges of industry. To market, sell, and offer customers the best experience, manufacturers need a single source of truth offered by CRM and eCommerce solutions.

OroCommerce is a powerful B2B eCommerce software for distributors, manufacturers, wholesalers, and suppliers. OroCommerce offers B2B businesses an unmatched selling experience, supporting complex workflows and business models such as B2B2C, D2C, and B2B marketplaces. It empowers remote teams by eliminating data silos and providing everyone

greater visibility into the B2B buyer experience. With the most features out-of-the-box, it speeds up time to market and reduces the sales cycle.

OroCommerce comes with an out-of-thebox natively integrated CRM, OroCRM. It is an excellent tool for distributed teams because it gives team members a comprehensive view of customers. The software’s open-source nature provides companies the freedom to customize the look, feel, behavior, and functionality of the software. It is easy to use on mobile and boasts a long list of technology partners, integrations, and a robust API for additional customization.

Author Profile:

Motti Danino (pictured left) serves as Chief Operations Officer at Oro Inc. He oversees global operations, partner relations, and marketing of OroCommerce. Prior to Oro, Danino was part of Magento where he launched and led the eCommerce cloud business unit, a SaaS eCommerce platform targeting small and medium businesses.

BREAKING NEWS

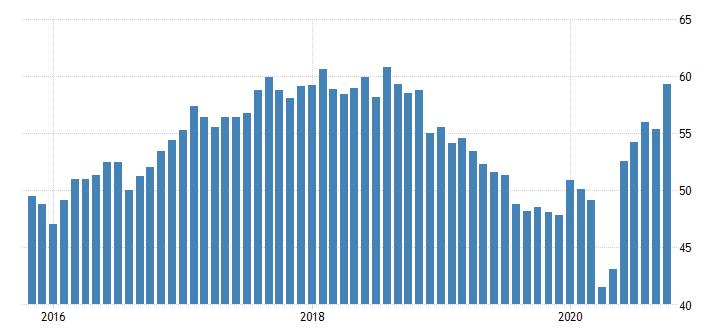

ISM PMI at 59.3% for October ISM PMI for the past 5 years

OCTOBER 2020 59.3%

INSTITUTE FOR SUPPLY MANAGEMENT® reportonbusiness

Analysis by Timothy R. Fiore,CPSM, C.P.M.,

Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

Economic activity in the manufacturing sector grew in October, with the overall economy notching a sixth consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business® .

The October Manufacturing PMI® registered 59.3 percent. The New Orders Index registered 67.9 percent, an increase of 7.7 percentage points from the September reading of 60.2 percent. The Production Index registered 63 percent, an increase of 2 percentage points compared to the September reading of 61 percent. The Backlog of Orders Index registered 55.7 percent, 0.5 percentage point higher compared to the September reading of 55.2 percent. The Employment Index registered 53.2 percent, an increase of 3.6 percentage points from the September reading of 49.6 percent. The Supplier Deliveries Index registered 60.5 percent, up 1.5 percentage points from the September figure of 59 percent.

Of the 18 manufacturing industries, 15 reported growth in October, in the following order: Apparel, Leather & Allied Products; Fabricated Metal Products; Nonmetallic Mineral Products; Food, Beverage & Tobacco Products; Plastics & Rubber Products; Machinery; Furniture & Related Products; Paper Products; Wood Products; Chemical Products; Primary Metals; Computer & Electronic Products; Transportation Equipment; Electrical Equipment, Appliances & Components; and Miscellaneous Manufacturing‡ . ISM

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

14 ISMWORLD.ORG

PMIPMI® at 59.3% MANUFACTURING

Manufacturing grew in October, as the Manufacturing PMI® registered 59.3 percent, 3.9 percentage points higher than the September

2018 2019 2020

59.3%

reading of 55.4 percent. The month-overmonth gain of 3.9 percentage points is the second-biggest positive change in the Manufacturing PMI® since May 2009, when it increased by 4.2 percentage points. (There

50% = Manufacturing Economy Breakeven Line

42.8% = Overall Economy Breakeven Line

was a 9.5-percentage point increase in June 2020, as activity picked up significantly after coronavirus-induced shutdowns.) The Manufacturing PMI® signaled a continued rebuilding of economic activity in October, with all five contributing subindexes in moderate to strong growth territory. Five (Fabricated Metal Products; Food, Beverage & Tobacco Products; Chemical Products; Computer & Electronic Products; and Transportation Equipment) of the big six industry sectors continue to expand.

Manufacturing at a Glance

INDEX

Manufacturing PMI®

New Orders Production Employment Supplier Deliveries Inventories Customers’ Inventories

Prices

Backlog of Orders New Export Orders Imports Overall Economy Manufacturing Sector

Oct Index

59.3 67.9 63.0 53.2

60.5 51.9 36.7

65.5

55.7 55.7

58.1

Sep Index

55.4 60.2 61.0 49.6

59.0 47.1 37.9

62.8

55.2 54.3

54.0

% Point Change +3.9 +7.7 +2.0 +3.6

+1.5 +4.8 -1.2

+2.7

+0.5 +1.4

+4.1

Direction

Growing Growing Growing Growing Slowing Growing Too Low

Increasing Growing Growing Growing Growing Growing

Rate of Change Faster Faster Faster From Contracting Faster From Contracting Faster

Faster

Faster Faster

Faster

Faster Faster

Trend* (months) 5 5 5 1

12 1 49

5

4 4

4

6 5

*Number of months moving in current direction. Manufacturing ISM® Report On Business® data is seasonally adjusted for the New Orders, Production, Employment and Inventories indexes.

Commodities Reported

Commodities Up in Price: Aluminum (5); Aluminum Products; Base Oils; Copper (5); Corn; Corrugate; Ethylene; Freight; High-Density Polyethylene (HDPE) Products (4); Lumber (4); Plastic Products; Plastic Resins (2); Polyethylene Film; Polyethylene Resins; Polyethylene Terephthalate (PET) Bottles; Polypropylene (4); Polyvinyl Chloride; Precious Metals (4); Propylene; Soybean Products; Steel (3); Steel — Cold Rolled; Steel — Galvanized; Steel — Hot Rolled (2); Steel Products (2); and Wood Pallets. Commodities Down in Price: Caustic Soda. Commodities in Short Supply: Aluminum Products; Capacitors (2); Electrical Components; Labor — Temporary; Lumber; Personal Protective Equipment (PPE) — Gloves (8); Freight; Polyvinyl Chloride; Resistors; and Steel Products.

ISM REPORT OUTLOOK ISM® Report On Business®

Manufacturing PMI®

October 2020

Analysis by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

New Orders (Manufacturing)

2018 2019

20

2020

67.9%

52.5% = Census Bureau Mfg. Breakeven Line

Production (Manufacturing)

2018 2019

51.7% = Federal Reserve Board Industrial Production Breakeven Line 2020

63%

70 New Orders

The New Orders Index registered 67.9 percent. Of the 18 manufacturing industries, the 16 that reported growth in new orders in October — in the following order — are: Apparel, Leather & Allied Products; Wood Products; Plastics & Rubber Products; Primary Metals; Fabricated Metal Products; Electrical Equipment, Appliances & Components; Furniture & Related Products; Computer & Electronic Products; Paper Products; Food, Beverage & Tobacco Products; Machinery; Chemical Products; Petroleum & Coal Products; Transportation Equipment; Nonmetallic Mineral Products; and Miscellaneous Manufacturing‡ .

Production

The Production Index registered 63 percent. The 11 industries reporting growth in production during the month of October — listed in order — are: Nonmetallic Mineral Products; Fabricated Metal Products; Plastics & Rubber Products; Primary Metals; Food, Beverage & Tobacco Products; Machinery; Paper Products; Transportation Equipment; Chemical Products; Electrical Equipment, Appliances & Components; and Computer & Electronic Products. The only industry reporting decreased production in October is Textile Mills.

Employment (Manufacturing)

2018 2019

50.8% = B.L.S. Mfg. Employment Breakeven Line 2020

53.2%

20 Employment

ISM’s Employment Index registered 53.2 percent. Of the 18 manufacturing industries, the 11 industries to report employment growth in October — in the following order — are: Apparel, Leather & Allied Products; Wood Products; Food, Beverage & Tobacco Products; Fabricated Metal Products; Plastics & Rubber Products; Primary Metals; Nonmetallic Mineral Products; Computer & Electronic Products; Machinery; Transportation Equipment; and Chemical Products.

Supplier Deliveries (Manufacturing)

2018 2019 2020 53.1%

80

60.5%

Inventories (Manufacturing)

2018 2019 2020

51.9%

44.3% = B.E.A. Overall Mfg. Inventories Breakeven Line

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

Supplier Deliveries

The delivery performance of suppliers to manufacturing organizations was slower in October, as the Supplier Deliveries Index registered 60.5 percent. Fifteen industries reported slower supplier deliveries in October, listed in the following order: Textile Mills; Fabricated Metal Products; Furniture & Related Products; Wood Products; Paper Products; Plastics & Rubber Products; Machinery; Food, Beverage & Tobacco Products; Petroleum & Coal Products; Nonmetallic Mineral Products; Chemical Products; Computer & Electronic Products; Transportation Equipment; Miscellaneous Manufacturing‡; and Electrical Equipment, Appliances & Components.

Inventories

The Inventories Index registered 51.9 percent. The six industries reporting higher inventories in October — in the following order — are: Nonmetallic Mineral Products; Miscellaneous Manufacturing‡; Furniture & Related Products; Paper Products; Food, Beverage & Tobacco Products; and Chemical Products.

ISM® Report On Business®

Manufacturing PMI®

October 2020

Analysis by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

Customer Inventories (Manufacturing)

2018 2019 2020

Prices (Manufacturing)

2018 2019

52.5% = B.L.S. Producer Prices Index for Intermediate Materials Breakeven Line 36.7%

2020

65.5%

Customers’ Inventories

ISM’s Customers’ Inventories Index registered 36.7 percent. Of the 18 industries, the only one reporting higher customers’ inventories in October is Printing & Related Support Activities. The 15 industries reporting customers’ inventories as too low during October — listed in order — are: Textile Mills; Paper Products; Wood Products; Plastics & Rubber Products; Machinery; Fabricated Metal Products; Furniture & Related Products; Food, Beverage & Tobacco Products; Electrical Equipment, Appliances & Components; Primary Metals; Transportation Equipment; Chemical Products; Nonmetallic Mineral Products; Computer & Electronic Products; and Miscellaneous Manufacturing‡ .

Prices

The ISM Prices Index registered 65.5 percent. The 15 industries reporting paying increased prices for raw materials in October — listed in order — are: Apparel, Leather & Allied Products; Wood Products; Paper Products; Fabricated Metal Products; Electrical Equipment, Appliances & Components; Machinery; Plastics & Rubber Products; Food, Beverage & Tobacco Products; Furniture & Related Products; Primary Metals; Chemical Products; Textile Mills; Computer & Electronic Products; Transportation Equipment; and Miscellaneous Manufacturing‡ .

Backlog of Orders (Manufacturing)

2018 2019 2020

55.7% Backlog of Orders

ISM’s Backlog of Orders Index registered 55.7 percent. The 10 industries reporting growth in order backlogs in October, in the following order, are: Wood Products; Fabricated Metal Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Food, Beverage & Tobacco Products; Furniture & Related Products; Paper Products; Machinery; Computer & Electronic Products; and Chemical Products.

New Export Orders (Manufacturing)

2018 2019 2020

55.7%

Imports (Manufacturing)

2018 2019 2020

58.1%

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

New Export Orders

ISM’s New Export Orders Index registered 55.7 percent. The 11 industries reporting growth in new export orders in October — in the following order — are: Wood Products; Primary Metals; Nonmetallic Mineral Products; Food, Beverage & Tobacco Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Machinery; Miscellaneous Manufacturing‡; Transportation Equipment; Fabricated Metal Products; and Chemical Products.

Imports

ISM’s Imports Index registered 58.1 percent. The 12 industries reporting growth in imports in October — in the following order — are: Petroleum & Coal Products; Nonmetallic Mineral Products; Fabricated Metal Products; Paper Products; Transportation Equipment; Electrical Equipment, Appliances & Components; Chemical Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Machinery; Plastics & Rubber Products; and Miscellaneous Manufacturing‡ .

NOVEMBER 2020 NORTH AMERICAN

OUTLOOK by AMELIA ROY

The Institute of Supply Management PMI figure rose from 55.4 in September to 59.3 in October.

New orders, production and employment are growing; supplier deliveries are slowing at a faster rate; backlogs are growing; raw materials inventories are growing; customer inventories are too low; prices are increasing and exports and imports are growing.

Of the 18 manufacturing industries, 15 reported growth in October, in the following order: Apparel, Leather & Allied Products; Fabricated Metal Products; Nonmetallic Mineral Products; Food, Beverage & Tobacco Products; Plastics & Rubber Products; Machinery; Furniture & Related Products; Paper Products; Wood Products; Chemical Products; Primary Metals; Computer & Electronic Products; Transportation Equipment; Electrical Equipment, Appliances & Components; and Miscellaneous Manufacturing. The two industries reporting contraction in October are: Textile Mills; and Printing & Related Support Activities.

Comments from the industry are more optimistic than seen in a long time. Computer & Electronic Products state that COVID-19 hurting mostly as a lack of personnel.

Commodities Up in Price Aluminum (5); Aluminum Products; Base Oils; Copper (5); Corn; Corrugate; Ethylene; Freight; High-Density Polyethylene (HDPE) Products (4); Lumber (4); Plastic Products; Plastic Resins (2); Polyethylene Film; Polyethylene Resins; Polyethylene Terephthalate (PET) Bottles; Polypropylene (4); Polyvinyl Chloride; Precious Metals (4); Propylene; Soybean Products; Steel (3); Steel — Cold Rolled; Steel — Galvanized; Steel — Hot Rolled (2); Steel Products (2); and Wood Pallets.

Commodities Down in Price Caustic soda

Commodities in Short Supply Aluminum Products; Capacitors (2); Electrical Components; Labor — Temporary; Lumber; Personal Protective Equipment (PPE) — Gloves (8); Freight; Polyvinyl Chloride; Resistors; and Steel Products. Note: The number of consecutive months the commodity is listed is indicated after each item.

U.S. LIGHT VEHICLE SALES Ford is returning to monthly reporting, and said its October sales were down 6.1 percent, due in large part to a factory overhaul to produce the redesigned version of its F150 pickup. FCA and GM have no plans to return to monthly reporting. There was reportedly an industrywide one percent increase in sales in the U.S. in October.

CANADA saw a further strong increase in production, new orders - both domestic and export - and purchases in October. The ongoing recovery in client demand led to an increase in employment. There were intense supply-chain pressures as lead times from vendors lengthened further. The PMI for October, at 55.5, was slightly down from September’s 56.0. Rising demand for inputs and higher prices for raw materials led to the fastest increase in cost burdens for nearly two years. Canadian light vehicle sales for October were down 2.1 percent year-over-year to 156,095 units.

MEXICO is having a terrible time through the pandemic, which appears to be hitting all corners of its manufacturing industry. Even though the PMI is struggling back towards the fifty mark, the industry is seeing sharp reductions in total sales, production, input buying and employment. The PMI for Mexico in October was at 43.6, up from September’s 42.1. Manufacturing employment decreased further and Amelia Roy, Staff Writer business pessimism returned.

GLOBAL OUTLOOK SOUTH AMERICA

by JEANNE-MARIE LOWRIE

BRAZIL saw sharp growth again in October in new orders, production, and employment, and recordbreaking trends in new export orders. The PMI rose from 64.9 in September to 66.7 in October.

There was strong demand, capacity expansion plans, and heavy order backlogs. To go along with all this were high rates of input and output inflation, supply-chain pressures and delivery delays, together with difficulty in obtaining such inputs as chemicals, metals, packaging, paper, plastics and textiles. For the moment Brazil will take it.

Argentina remains in turmoil as it tries to balance its deficit spending and recover from the deep devaluation of its peso. The popularity of President Macri fell sufficiently for him to lose the 2019 election to Alberto Fernandez, just in time for COVID to decimate the weak Argentinian economy. Any outlook on Argentina, a country in turmoil for decades, will be bleak. All Latin American economies are experiencing severe downturns due to the pandemic, on top of the weak economies each country was experiencing prior to 2019. Brazil, at the moment, is the outlier because it resisted shutting down, but it paid a high price in the spread of COVID. Depending upon how long and how serious the pandemic remains will determine how quickly individual countries might bounce back.

Looking forward, all of South America will be in serious economic trouble through 2021. Latin America has not been a high-powered global economic center, largely due to political chaos and corruption, made substantially worse by the virus. Brazil may be the only country that surprises, but it could surprise either way, good or very bad. Jeanne-Marie Lowrie, Staff Writer

ASIA OUTLOOK

GLOBAL OUTLOOK ASIA OUTLOOK

by CHRIS ANDERSON

CHINA saw continuing expansion in October and a sharper increase in production and new orders. New export sales growth softened amid the resurgence of the coronavirus in certain export markets. Business confidence was at its highest in just over six years. The October PMI, at 53.6, was up on September’s 53.0. This marked improvement in business conditions was the strongest since January 2011, with the quickest increase in new orders for almost a decade. There was only a slight improvement in employment. Chinese vehicle sales were up 13 percent in September, with new electric vehicle sales up 68 percent. Tesla China’s sales were over 11,000 units, putting the company at number three in Chinese NEV sales. JAPAN’s PMI rose to 48.7 in October from September’s 47.7, but stayed in contraction. Both production and new orders fell at slower rates, and export orders were up for the first time since November 2018. Job cuts quickened. Business optimism is at its highest since July 2017. There are difficulties sourcing raw materials and inputs due to longer supplier delivery lead times. Overall, things are getting better in Japan. INDIA’s manufacturing PMI reached another level, with production increasing to the greatest extent in 13 years amid strong new orders growth. New export orders were also up strongly, the most pronounced in almost six years. Jobs were shed to allow adherence to government coronavirus distancing guidelines. The PMI rose from 56.8 in September to 58.9 in October. The level of optimism was at a 50-month high amid hopes of an end to COVID-19 and the reopening of other sectors of the Chris Anderson, economy. Staff Writer

PRO-ACTION EDUCATION NETWORKTM

APPRENTICESHIP PROGRAM

Apprenticeships offer many NJ workers the opportunity to receive an earn-whileyou-learn education. Relevant professional credentials support job performance and open the door to sustainable income.

Pre-apprenticeship programs create future applicants for full-time, paid apprenticeship positions with NJ employers.

Students in a pre-apprenticeship program learn skills needed for the occupation and have the opportunity to potentially bridge to a Registered

Apprenticeship Program.

Apprenticeship provides an additional option for NJ’s existing and future workforce in all industries. The Pro-Action model can be used for all industries.

CALL TODAY FOR MORE INFORMATION - 973-998-9801 WWW.NJMEP.ORG • INFO@NJMEP.ORG

GLOBAL OUTLOOK EUROZONE

by CHRIS ANDERSON

IHS Markit’s Eurozone Manufacturing Composite Purchasing Managers’ Index (PMI), again backed by a strong performance in Germany, rose to 54.8 in October from 53.7 in September, the best for 27 months. Germany drove sharper increases in regional production and new orders. Backlogs rose appreciably, but firms continued to cut employment. There was growth across all three market sectors, with investment goods the strongest, and the highest for over two years. The new overall export business rose at a rate that was the best recorded by the survey since February 2018. There was a heightened increasing demand strain on suppliers.

Car sales in Western Europe were down 29.5% on a YTD basis, with September sales up 0.1 percent year-over-year. French sales YTD were down 29% ; German down 25.5%; Spanish down 38.3%; Italian down 34.3 % and UK down 33.2 %. Forecasts are putting the reduction in sales for the year at 24 percent. Plug-in hybrids and battery electric vehicles are now accounting for 1 million sales per year in Europe. Some 90,000 BEVs were sold in Europe in September.

IHS Markit’s PMI for the UK was at 53.7 in October, down slightly from 54.1 in September. The continuing expansion included both domestic and export business, with the trend in export business strengthening with increased demand from China and the U.S.

Both the intermediate and investment goods industries saw marked expansions of production and new orders, whereas consumer goods slipped back into contraction. Manufacturing employment declined for the ninth consecutive month.

Over sixty percent of manufacturers are looking for higher production in the coming year. There is ongoing concern re COVID-19 and Brexit. The UK produced 0.545 MT of crude steel in September, down 7.7 percent year-over-year. Chris Anderson, Staff Writer

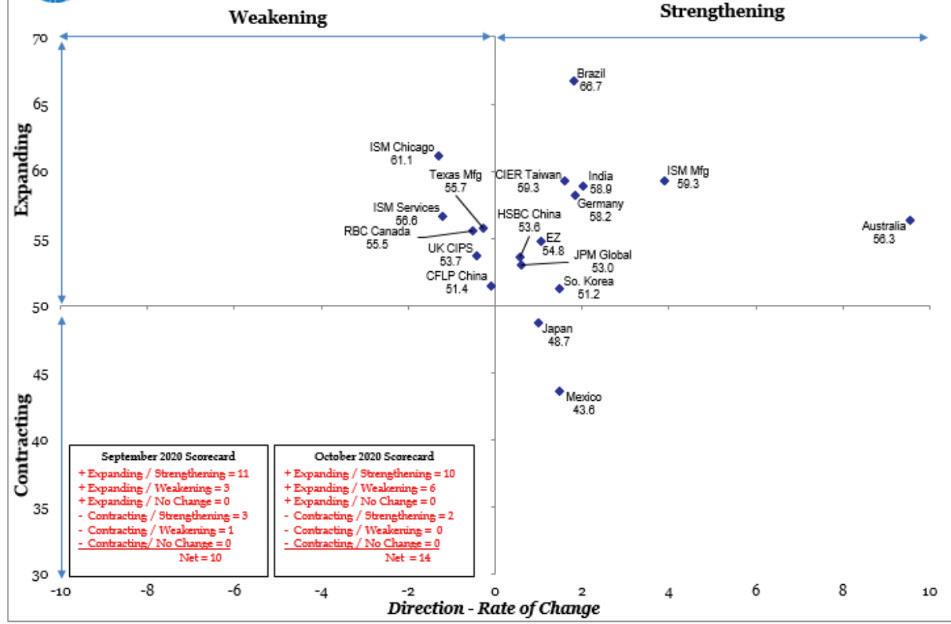

GLOBAL PMI OUTLOOK

by NORBERT ORE, DIRECTOR, HEAD OF INDUSTRIAL SURVEYS, STRATEGAS RESEARCH PARTNERS

The global recovery continues to strengthen as 15 of the 18 surveys that we follow printed a combined PMI of 56.6 (+0.3) percent. The laggards are Mexico (43.6) and Japan (48.7) in the major economies, and they are joined by the seven ASEA countries which have a combined PMI of 48.6 percent. Five months of growth is building confidence globally. The slower growth economies should continue to improve as the major economies continue broaden their recovery.

ISM U.S. Manufacturing PMI™ - An expansionary October PMI™ (59.3, +3.9) will drive manufacturing growth into Q1 2021. New Orders (67.9, +7.7), Production (63.0, +2.0), and Supplier Deliveries (60.5, +1.5) made major contributions to the rapid acceleration. The past relationship between the PMI®and the overall economy indicates that the PMI®for October (59.3) corresponds to 4.8-percent annualized GDP growth, according to the press release.

Drivers: In addition to the improvement in New Orders, Production, and Supplier Deliveries, Inventories (51.9, +4.8) indicates some accumulation is starting to take place while Employment (53.2, +3.6) moved at a slower pace of growth. October’s leaders in manufacturing are Brazil, Germany and the United States.

New Orders Minus Inventories: This key measure at +16.0 (67.9 minus 47.1) shows New Orders continued to expand faster than Inventories in October. Compared to the average gap (+6.8), inventory availability can become an issue. Concerns about constraints may become more prominent and a problem to supply chains.

Customers’ Inventories: Only one industry reported higher customers’ inventories in October: Printing & Related Support Activities. Fifteen industries reported customers’ inventories as too low during October: Textile Mills; Paper Products; Wood Products; Plastics & Rubber Products; Machinery; Fabricated Metal Products; Furniture & Related Products; Food, Beverage & Tobacco Products; Electrical Equipment, Appliances & Components; Primary Metals; Transportation Equipment; Chemical Products; Nonmetallic Mineral Products; Computer & Electronic Products; and Miscellaneous Manufacturing. We continue to believe a Customers’ Inventories Index at this level (36,7, -1.2) indicates inventory replenishment will be broad-based and spill over into 2021.

Norbert Ore, Director, Head Of Industrial Surveys, Strategas Research Partners

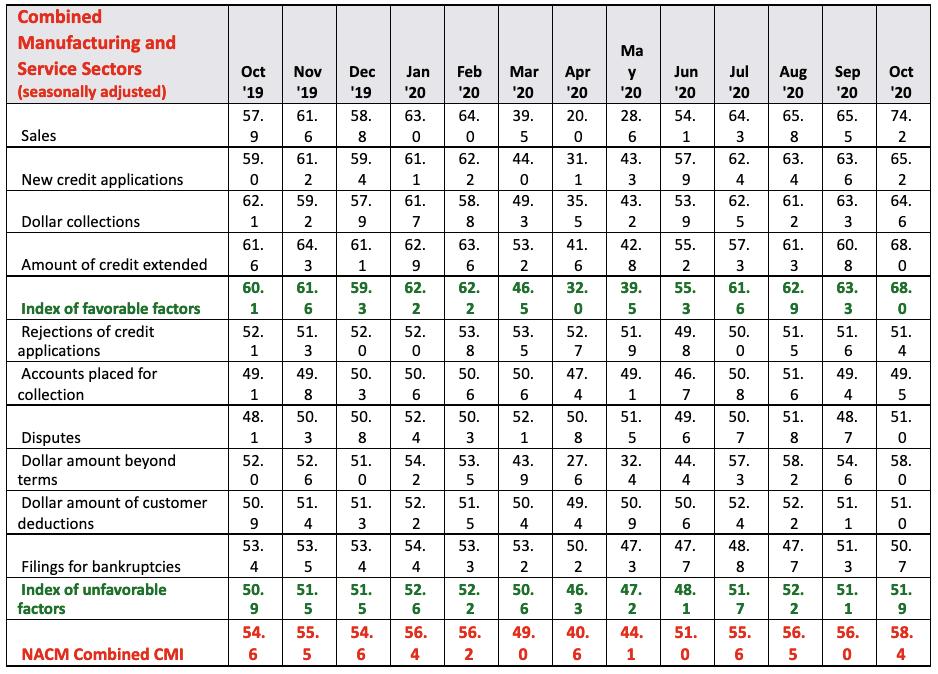

CREDIT MANAGERS’ OUTLOOK

by DR. CHRISTOPHER KUEHL MANAGING DIRECTOR OF ARMADA CORPORATE INTELLIGENCE THIS REPORT REPRINTED COURTESY OF THE NATIONAL ASSOCIATION OF CREDIT MANAGERS (NACM.ORG) WHERE MORE IN-DEPTH INFORMATION CAN BE FOUND.

Combined Sectors

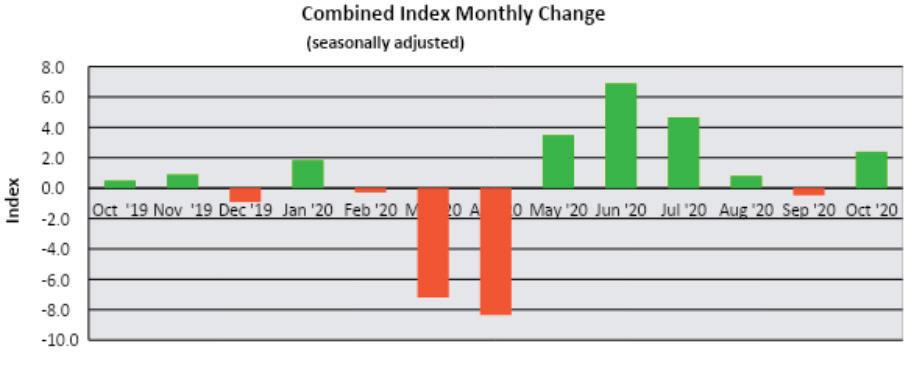

This is the point where hyperbole and comparisons seem to fail. How does one even attempt to describe the economic situation the US and the world faces right now? There has been so much of this crisis that has been unexpected and so much of it has been artificial. The recession was not organic and thus took everybody by surprise. The downturn in 2008 was predicted by credit managers as they saw significant distress showing up in 2007. There was no such warning this time – favorable numbers ranged from 58.8 to 64.0 in February and in April the range was from 20.0 to 41.6. This was an utter collapse and one that nobody could have anticipated. Since then there has been a dramatic rebound in some areas and continued distress in others. The favorable factor range is now from 68.0 to 74.2 – numbers that have not been seen in many years. This is dramatic to be sure but needs to be put in some perspective. Remember that it is estimated that third quarter GDP will have climbed by over 20% but also remember that second quarter GDP was down by over 35%. The bottom line is that month to month comparisons will be very unreliable for a few more months.

The current combined index holds at the highest level seen in years – 58.4. This is in contrast to the reading in April when it was at 40.6. That gain of nearly twenty points is a bounce back to be sure but not really as impressive as it would appear at first glance. The combined index for the favorable factors has staged the biggest gains with a reading of 68.0 compared to 63.3 last month and 32.0 in April. The combined index for the unfavorables has not shown this wild variability. This month it registers a reading of 51.9 and last month the reading was 51.1. In April when the favorables were crashing the unfavorables read a much less dramatic 46.3. The fact is that this recession has been so sudden and so unusual there has not been time for many businesses to get into the kind of situation that would trigger unfavorable readings. As one would expect the biggest jump occurs in the sales category. Last month was impressive in its own right as it had jumped to 65.5 – a very, very far cry from the 20.0 reported in April. Now its stands at 74.2 and that is nearly unprecedented in the history of the survey. The new credit applications data stayed a little closer to last month with a reading of 65.2 compared to 63.6 in September. The dollar collections numbers also stayed a little closer to September levels but they still improved quite a lot as they went from 63.3 to 64.6. The amount of credit extended jumped almost as dramatically as the sales numbers with a reading of 68.0 compared to 60.8 last month. In April, this reading was down to 41.6. The trend seems to be that companies that have been able to emerge from the lockdown are seeing significant demand and new opportunities and are asking for more credit in order to expand. This is actually a hallmark of a short and sharp recession. Weaker companies fail and stronger companies move aggressively to gain market share given up by those that have gone out of business.

The unfavorables are not showing as much drama but there has been movement, nonetheless. The good news is that the rate of rejections of credit applications has not moved much and most importantly it has stayed in the expansion zone with a reading of 51.4 as compared to 51.6 in September. This is good given the surge in new applications as it suggests that those newly applying for credit are indeed creditworthy. The data for accounts placed for collection have remained more or less stable. The reading last month was 49.4 and this month it is 49.5. It is still in the contraction zone below 50 but hovering very close to breaking back into expansion. There had been an expectation these numbers would look worse by now but those who took on debt have been able to keep current. The disputes category surged back into expansion territory with a reading of 51.0 – contrasting nicely with the 48.7 registered in September. The dollar amount beyond terms shot back into expansion territory with

a vengeance as it registered a gain to 58.0 after a respectable 54.6 in September. This is as interesting as the improved performance in dollar collections as it signals that debtors want to stay on good terms with those they are seeking credit from. The dollar amount of customer deductions held steady and in expansion territory with a reading of 51.0 compared to 51.1 in the prior month. The filings for bankruptcies slipped a bit from 51.3 to 50.7 but the important point is that these numbers stayed in expansion territory.

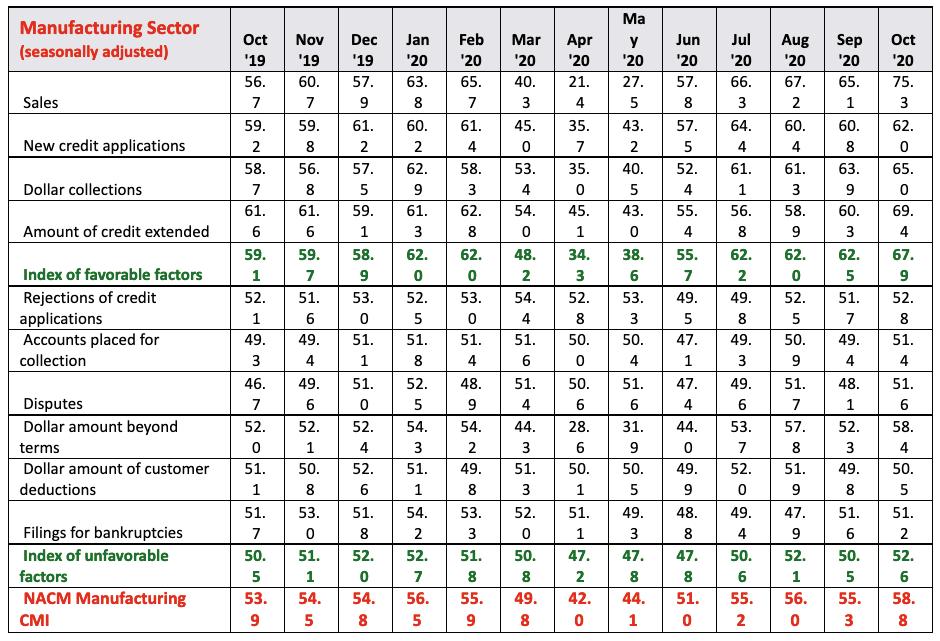

Manufacturing Sector

The manufacturing sector has been somewhat immune from the economic gyrations created by the lockdowns. It has depended to a great extent what sector a given manufacturer serves. Those that are engaged in aerospace have not seen much progress and neither have those that orient towards sectors such as hospitality or tourism in general. The automotive sector has been up and down but is currently trending up and so is the construction equipment sector. Oil and gas have been likewise up and down – you get the idea. The majority of the damage has been felt by the service sector.

The combined score for manufacturing rose sharply to 58.8 and this is up from the decent reading in September when the numbers were at 55.3. Through the last several months there have been reliable readings in the expansion zone – the last time they slipped into contraction was in May with a reading of 44.1. The index of favorable factors has been even more impressive with 67.9 this month and 62.5 last month. In April, these readings were down to 34.3 so it is important to note that the current high numbers are coming against that backdrop. The index of unfavorable factors improved but not as dramatically with a rise to 52.6 after a reading of 50.5 in September.

The bulk of the activity has been in the favorable categories for the bulk of the year. That trend has continued. The sales reading jumped to 75.3 after a 65.1 in September. There has been an observed surge in the acquisition of goods since the pandemic shut down the majority of the service sector. This has been good for a lot of consumer manufacturing as well as industrial activity. The new credit applications improved as well but the leap was not quite as impressive with a new reading of 62.0 compared to 60.8. The dollar collections data also made a nice jump from 63.9 to 65.0 and that is especially good news as compared to the 35.7 number in April. The amount of credit extended also improved dramatically with a

reading of 69.4 compared to 60.0 in September. The companies that are seeking credit are seeking quite a lot of credit as they try to take advantage of pent up demand and opportunities to expand market share.

The rejections of credit applications improved a bit as well and combined with the increase in applications this points to some solid future growth. The number last month was at 51.7 and is now sitting at 52.8. This factor has been consistently solid for the last several months. The accounts placed for collection jumped back into expansion territory with a reading of 51.4 after last month’s 49.4. This is good news given the increased pressure that had been building in many of the industrial sectors. The disputes numbers also returned to expansion territory with a reading of 51.6 as compared to the 48.1 in September. The low point for disputes was in June with a number of 47.4 – not in the stressed months of March and April. The disputes have emerged along with some of the expansion of business through the summer. The dollar amount beyond terms surged to a high of 58.4 as compared to the prior month at 52.3. The fact is that most companies are doing their best to get current and stay current as they anticipate more credit needs. The dollar amount of customer deductions moved out of the contraction zone as well as the numbers went from 49.8 to 50.5. The filings for bankruptcies remained very stable with a reading of 51.2 compared to 51.6. If there is to be an increase in bankruptcy activity it is more likely to hit after the first of the year and the end of the holiday spending season

Overall, the manufacturing data has been trending in a positive direction with gains seen in everything from the Purchasing Managers’ Index to capacity utilization, industrial production and durable goods orders. Granted, there is still a long way to go to offset the damage that was done earlier in the year but the data has been trending in the right direction.

Author profile Dr. Christopher Kuehl (PhD) is a Managing Director of Armada Corporate Intelligence and one of the co-founders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years. He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division – Finance, Credit and International Business. He prepares NACM’s monthly Credit Managers Index. He is the Economic Analyst for the Fabricators and Manufacturers Association and writes their bi-weekly publication, Fabrinomics, which details the impact of economic trends on the manufacturer.

Chris is the chief editor for the Business Intelligence Briefs, distributed all over the world by business organizations and he is one of the primary writers (with Keith Prather) for the Executive Intelligence Briefs. He also makes close to a hundred presentations each year to business and industry associations in the US and overseas. He is on the Board of the Business Information Industry Association in Hong Kong and serves as a resource for the media and for many trade publications.

Chris has a doctorate in Political Economics and advanced degrees in Soviet Studies and Asian Studies and was a professor of international economics and finance for over 15 years prior to starting Armada.

TO READ THE COMPLETE REPORT CLICK HERE OR VISIT MFGTALKRADIO.COM

NOVEMBER 2020 METALS OUTLOOK

by ROYCE LOWE

WHO’S HOLDING THE IRON REINS?

To make steel we need iron, to make cast iron we of the world’s leading technology companies, but gets need iron. To make iron we need iron ore, as a blast barely a sniff at one of the most basic industries of furnace feed and to make direct reduced iron pellets. all, iron mining, where it’s paying over $100 per ton to China imports 70 percent of the world’s iron ore, feed its steel mills. most of which comes from three companies. These are Rio Tinto and BHP, both Anglo-Australian firms, China has long hoped to back the development of a and Vale, a Brazilian one. The three have formed huge iron-ore deposit in Guinea called SIMANDOU, in what could almost be called a cartel, where none is which Rio Tinto has a joint venture with CHINALCO, keen to undercut the other two. This puts them in a China’s state-owned aluminium producer (and Rio’s strong position vis à vis their Chinese customers. biggest shareholder.) The story behind Simandou and the people trying to get to it reads like a spy novel, China, naturally, doesn’t like this, and wants to with bauxite miners and governments involved, and, change it. It’s in the strange position of having some of course, corruption. Suffice it to say that there’s

a north side and a south side to this deposit, which is estimated to contain 2 billion tons of some of the world’s highest-grade iron ore. China wants it, the Rio-Chins joint venture wants it, and its development, railway and port and all could cost over $20 billion.

All this could push down the price of iron ore by $10 per ton; but this might be happening anyway. Rio, quite wisely, is not doing too much to encourage further exploration into Simandou. So for the time being China will be taking a back seat, though we know not for how long. Starting up an iron-ore mine is a very expensive business, and although China rarely balks when it comes to money, it may take more than just that to allow it to seriously get into this particular game.

Rio Tinto ruffled feathers not too long ago by disastrously destroying a 46,000-year-old Aboriginal site in Western Australia. So Rio Tinto and China are at the proverbial loggerheads, with others waiting on the sideline to take a big bite of the iron-ore business.

The coronavirus saw rising raw material costs and weakening steel prices, with profit margins falling to multi-year lows between May and August of this year, but upping significantly in the past few months, particularly in the U.S. This was fueled by increased METALS OUTLOOK selling prices, rather than by reductions in mill output expenditure.

Iron ore is up since May, due mainly to China’s appetite for the stuff, and prices are predicted to remain elevated in the near term. Coking coal, an important blast-furnace feed, is up since the summer - when it saw a four-year low - and there were import restrictions on it into China, but increases in steel production in India, Europe and the U.S. should push up prices of this commodity in the coming months.

Scrap costs were rising until September, but have since stabilized or softened and will firm up as steel demand improves. There have been disaster-related outages in Brazil in the past couple of years, which have tended to up the price of the ore.

It is predicted that EU and U.S. profit margins will improve in the final two months of 2020. Steel price increases and relatively stable input costs will help steelmakers in these regions to return to profitability levels similar to those recorded in early 2019. Prices in Asia look stable for the balance of the year.

U.S. hot-rolled coil prices soared $100 per ton in October to reach $700 per ton, cold-rolled over $70 per ton. European hot-rolled coil increased by some 40 euros per ton. Meanwhile, there are reports of

200” Max O.D. 6” Min O.D. To 80,000 lbs.

ISO9100:2015 and AS9100D - Since 1994 - NIST SP 800-171 (Compliance Under Development)

TOLL FREE IN THE U.S. 800.600.9290 - 973.276.5000 - CANADA: 416.363.2244 - INFO@STEELFORGE.COM - STEELFORGE.COM

serious shortages on certain products in the North American and European markets. Selling prices have been adjusted accordingly.

Non-ferrous metal data show price increases in the four metals we follow, with aluminum up from $0.775 per lb in early October to $0.830 in early November; copper up from $2.80 to $3.04; nickel up from $6.50 to $6.90, zinc up from $1.05 to $1.14.

Steel demand, this year and next.

The World Steel Association (worldsteel) recently released an update to its Short Range Outlook (SRO) which is much more optimistic than that released in June. The decline in demand, although significant, is much smaller than previously expected. It is forecast that steel demand in 2020 will contract by 2.4 percent, falling to 1.725.1MT, and that in 2021 steel demand is expected to recover to 1.795 MT, up 4.1 percent over 2020. A strong recovery in China will mitigate the reduction in global steel demand this year.

This forecast assumes that despite the current resurgence in infections in many parts of the world, nationwide lockdowns will not be repeated. Recent moves in France and the UK, for example, and significant resurgence of the virus in the U.S. are likely to affect steel demand to some (unknown) extent. Many steel-using sectors are still operating below their pre-COVID level.

China has been in strong recovery since late February, showing a steady improvement and positive GDP growth for the year, despite the 6.8 percent contraction in the first quarter of 2020. China saw improvements in real estate and infrastructure, and from August the machinery and automotive sectors showed year-over-year growth of 10.9 and 7.6 percent respectively. China is looking to a growth of 8 percent in steel demand in 2020, helped by a

government infrastructure stimulus and a strong property market.

In the advanced economies, double digit contraction in 2020 seems unavoidable. Recovery in the U.S. from the lockdown was strong, and the manufacturing downturn was shorter and less acute than expected, but the U.S. is struggling to control the virus spread, and the recovery momentum in the coming months is an unknown. The outlook for 2021 looks to be subdued for automotive and construction.

Europe’s recovery, post-lockdown, was stronger than expected, but the deep contraction of the major steel-using sectors, particularly automotive, will contribute to a double-digit contraction in 2020. Italy and Spain were hardest hit. Although they handled the virus quite effectively, both Japan and South Korea saw large reductions in exports, which will limit their recovery.

Overall, steel demand in the developed economies is expected to fall by 14.9 percent in 2020 and to recover by 7.9 percent in 2021. Infrastructure projects will constitute an important part of the global construction industry in the coming years, though there may be a slow start to 2021. The oil and gas industry is a big question mark for the coming years, with reduced consumption, hence production and lower prices contributing to a slow recovery. The green economy will likely take up some of the slack.

The automotive industry took a real hit from the pandemic, with a 70-90 percent contraction in many countries. There was a global 34 percent contraction in the second quarter. The industry is coming back, with China taking the lead. January to August saw car production in the U.S. and Germany down over 30 percent.

The machinery sector is suffering from supply chain disruptions, and this problem is ongoing in most countries. There is also a lack of orders in the sector.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.

NOVEMBER 2020 AEROSPACE OUTLOOK

by ROYCE LOWE

THE BOEING SAGA AND OTHER STORIES

The EU’s top aviation regulator said he is satisfied that the changes to the Boeing 737 MAX have made the plane safe enough to return to the region’s skies before year end, even as a further upgrade his agency demanded won’t be ready for up to around two years. Following September’s test flights, the executive director of the European Union Air Safety Agency (EASA), Patrick Ky, is reviewing the final documents prior to a draft airworthiness directive the agency expects to issue in November.

Future software development will take 20-24 months, for the development of a so-called synthetic sensor. Ky said the level of safety reached is high enough for the agency, and that what they discussed with Boeing is the fact that, with a third sensor, they could reach even higher safety levels.

The FAA, Boeing’s main certification body, is further along in its review, and has held back from predictions for the time being. The FAA chief, Steve Dickson, flew the MAX in late September and said its controls felt “very comfortable,” but the review process is not complete. Under International Law, the FAA must act before EASA and other agencies around the world can lift the grounding of the aircraft.

Ky said the synthetic sensor would simplify the pilot’s job when one or both of the mechanical angle-of-attack scanners on the MAX fails. This device, which monitors whether a plane is pointed up or down relative to incoming air, malfunctioned in both crashes. The MAX problem strained the rapport between the FAA and global aviation authorities, including EASA, which acted faster to ground the jet, and have made demands that go beyond U.S. requirements to clear its return.

The FAA’s relationship with Boeing has also shifted, after the planemaker was accused of hiding changes that magnified the differences between the MAX and the earlier 737 models in order to bring down costs and minimize training requirements.

China is a further question mark, where aircraft demand surged prior to the pandemic. China has participated in some reviews, but not in the flight testing that includes regulators from Canada and Brazil, along with the FAA and the EASA.

Boeing looks to be getting near to getting the MAX back in the skies. We’ll follow this.

Meanwhile, Airbus SE reportedly plans to increase the production rate of its top-selling A320neo aircraft in the second half of 2021, from 40 to 47 aircraft per month. They are betting on jetliner demand recovering, but may make adjustments. Deliveries in 2020 will be down 42 percent. The increase in production may be too optimistic, but it is thought they may be trying to time the market’s recovery while ensuring their suppliers are prepared to likewise increase their own production.

Elton Musk’s SpaceX, snubbed by America’s military in its early years, is now enjoying more success than ever in acquiring Pentagon business. SpaceX has launched satellites, improved weather forecasting for the military and built a whole new generation of small spacecraft intended to track hostile missiles. The company has worked with the Air Force and the Army to demonstrate communication links.

Elton Musk’s ultimate goal is to colonize Mars to provide humans a safe escape from Earth if necessary. But in the process, SpaceX amassed an order book of civilian launch contracts estimated at about $5 billion. It also has won contracts to supply the military with rocket launches and satellite prototypes eventually worth an estimated $6 billion and some $9 billion more in past and future NASA awards, primarily to ferry cargo and astronauts to the International Space Station.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.

NOVEMBER 2020 ENERGY OUTLOOK

by JOCELYN BRIGHT

DONALD’S FADING ENERGY

Europe and China are making efforts to move to clean energy, though in China’s case, we sometimes stop and wonder. President Trump, meanwhile, has been pulling in the opposite direction, sort of like a tug-o-war. In 2016, he promised to save American coal ; in 2020, he has put on the cloak of fracking’s last defense against an assault from the left. We might call him the carbon-emitting president; during his reign, America has become the world’s largest producer of crude oil, yet America’s oil boom is subsiding and coal-fired power is in decline.

The Environmental Protection Agency - what a misnomer - has sought to weaken regulations for reducing greenhouse gas emissions in the power sector, undermine the legal basis for limiting coal plants’ mercury emissions, loosen fuel-efficiency standards for cars, and ease rules for oil and gas producers’ methane emissions. But there’s more drilling in the cards as President Trump is in the

process of opening up an area of public lands larger than Austria and Switzerland combined.

Coal-mining employment dropped by 5 percent from 2016 to 2019, despite Trump’s campaign promises. Coal-fired power generation fell by 22 percent over the same period, threatened by cheap natural gas and increasingly cheap renewables. Four years ago, American coal produced twice as much electricity as did renewables; a recent government forecast says that this year renewable power looks to match coal-fired for the first time ever.

The dominance of oil and gas in the U.S. is not in the best shape either. President Obama was the one who started the fracking party, where oilmen blasted hydrocarbons from layers of shale. It was Obama who signed a bill that ended a fortyyear ban on crude oil exports, opening up new markets. Under Trump, sanctions on Iran and Venezuela have supported oil prices, but the China trade war depressed them.

Oil and Gas companies are in turmoil. Even before COVID-19 pummeled oil demand, investors were running from American shale and its poor returns and the ongoing need for investment. If Trump succeeds in auctioning leases in the Arctic, it may be at bargain prices. Several big companies such as BP and Royal Dutch Shell have already left Alaska.

Since the beginning of 2020, the value of the S and P Global Clean-Energy Index is up 70 percent. So the next White House inhabitant might well toe this line.

Jocelyn Bright, Staff Writer

NOVEMBER 2020

AUTOMOTIVE OUTLOOK by LAWRENCE MAKAGON

A MOVEABLE POD

A Swedish company, Einride, founded in 2016 by Robert Flack, an engineer who worked for Volvo, is presently in the business of making, developing, tuning, and marketing what he calls the Pod. It looks something like a trailer of an articulated truck without a cab. Flack thinks the technology of autonomous vehicles, long in the experimental stages, has now evolved to the point where driverless freight vehicles might start working, earning a living so to speak. Some Pods are already in trials for jobs such as running between warehouses, hauling logs from forests and delivering goods for supermarkets.

The Pods use the same technology of cameras, radar, lidar (the optical equivalent of radar) and satellite positioning as do other companies in the field. They differ, however, in the way their

manufacturer tries to deal with the regulatory concerns which prevent fully autonomous vehicles from taking to public roads. Einride’s present approach is to avoid the regulations by avoiding the roads; thus, the Pod operates on designated routes within the confines of enclosed, private areas such as ports and industrial parks.

Einride also differs in its approach to the word autonomy, in that it always keeps a human in the loop - to keep an eye on what is happening and to take over the driving for a difficult maneuver or if something goes wrong. But this human operates remotely. This is unconventional, but not drastic. Aerial drones are usually controlled in this way. What may be termed radical is that Mr. Flack believes there is no need for a remote driver for each Pod. Einride already uses one person to control two Pods, but plans eventually for one driver to look after ten.

This hasn’t been cleared for open roads, and it is not yet known how regulators will take to it. Much will depend on how frequently the remote driver needs to intervene. Drones have taken the lead in this, and some test flights have been allowed where one remote pilot controls multiple drones.

Pods are now being developed that are intended for local roads and one suitable for highways is planned for 2023, with remote operators, if allowed. Such Pods will operate at higher speeds than the present Pods that are restricted to 20 m.p.h. All these vehicles, if successful, promise a change in the way that freight is delivered.

The more ‘normal’ side of the automotive business, if such can be said of this business anymore, sees FCA going electric at its Windsor, Ontario plant, where it will invest $1.1 billion and add 2,000 jobs. This is part of a three-year deal with the union UNIFOR, whereby the plant will produce plug-in hybrids and battery electric vehicles. The jobs will be added in 2024, and will effectively replace the 1,500 jobs cut earlier this year.

GM has invested $4.5 billion in electric vehicle technology in the past year-and-a-half. The company will produce an electric Cadillac, the Lyriq, at its Spring Hill plant in Tennessee.

GM is bringing back an oldie, a new Hummer. This over-powered beast, last produced in 2010, is coming back as a battery electric vehicle. The BEV will be assembled at a 35-year-old plant outside Detroit that is currently undergoing a $2.2 billion renovation. The new Hummer, which will see the light of day in just over a year, is part of GM’s $20 billion gambit to challenge Tesla, whose new Cybertruck will take to the road at around the same time. GM has promised 20 new electric models by 2023.

Ford, not to be outdone, is bringing out an electric Mustang Mach-E, already in production. Imagine that, a Lawrence Makagon, quiet Mustang. Staff Writer

The Manufacturing & Business Podcast Network

MFGTALKRADIO.COM

OUR PODCASTS:

LISTEN TO OUR PODCASTS AT:

www.jacketmediaco.com

NOVEMBER 2020 ISSUES OUTLOOK

by ROYCE LOWE

WHAT MIGHT JOE DO?

Economic data show there’s been no reversal of U.S. manufacturing decline during Trump’s trade war and Trump tariffs on $100 billion worth of Chinese goods to discourage imports. There was a reduction in the trade deficit with China in 2019, but the overall U.S. trade imbalance increased more than ever that year and has continued its increase, up to a record $84 billion in August, as U.S. importers looked to cheaper goods from Vietnam, Mexico and other countries. The trade deficit with China has risen during the pandemic, and is back to where it was at the beginning of the Trump administration.

Reshoring of U.S. production hasn’t happened either. Job growth in manufacturing started to slow in July 2018, and manufacturing production peaked in December 2018. January 2020 saw a phase one trade deal with China, because of tariffs, whereby Beijing agreed to buy more U.S. goods, some $200 billion over two years, enforce intellectual property protections, remove regulatory barriers to agricultural trade and financial services, and to not manipulate its currency. At the time of writing China has not imported the quantities of goods stipulated in the deal. It is also said that the tariffs that remain on some $370 billion in Chinese goods annually will, over time, force China to end unfair practices and help rebuild the U.S. manufacturing base.

The U.S. trade representative Robert Lighthizer said that tariffs “are having the effect of bringing manufacturing jobs back to the U.S.”, citing statistics showing a net gain of 400,000 U.S. manufacturing jobs from November 2016 through March 2020, when the pandemic forced widespread factory shutdowns. But some 75 percent of the increase in manufacturing jobs occurred before the first set of tariffs against China took effect in July 2018, when the annual growth in manufacturing jobs peaked and then started to decline. By early 2020, even before the pandemic struck in the U.S., manufacturing job growth in the U.S. had effectively ceased, and factories were shedding workers in four of the six months to March.

A Federal Reserve industry-by-industry analysis showed that tariffs did help boost employment by 0.3 percent in industries trading with China, by giving protection to some domestic industries to cheaper Chinese imports. But such gains were more than offset by the higher costs of

importing Chinese parts, which cut manufacturing employment by 1.1 percent. Further, the analysis found, retaliatory tariffs imposed by China against U.S. exports reduced U.S. factory jobs by 0.7 percent. Trump is not the only U.S. president to use tariffs to protect favored industries. President Obama - Chinese tires; President George W. Bush - steel; and President Reagan - Japanese TVs and computers, are cases in point. But Trump’s enormous increase in tariffs on Chinese goods represented a sharp departure in World War II economic history. Since the war, the U.S. has led rounds of global trade negotiations aimed at reducing tariffs. Trump put a stop to that, paving the way to the biggest use of tariffs since the Smoot-Hartley tariffs during the great depression. Some U.S. manufacturers benefitted, others did not. Some benefitted before the tariff war, suffered under it. Hemlock, a Midwestern manufacturer of polysilicon used in computer chips and solar cells, sold $1 billion of polysilicon to the Chinese solar industry in 2010 and anticipated continuing sales. It invested $1 billion in a new plant in 2012 for polysilicon production. China meanwhile specifically identified Solar as a strategic industry in its ‘made in China 2025’, its national plan to dominate high-tech manufacturing. The plan included the manufacture of solar-grade polysilicon, turning China into a competitor to Hemlock, instead of a customer. Hemlock’s solar-grade exports to China were down to just over $100 million by 2018. The new plant never operated and was closed in 2014. The overall benefits - if any - of the tariff imposition have been and will be, talked and written about for some time now. Tariffs were discussed in the recent presidential debates. Joe Biden’s moves on tariffs, should he be elected, may come as a surprise. They are as yet an unknown, but according to at least one of his advisors he may not commit to a total rollback. So we really don’t know, at this stage, what Joe might do.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.