Our journey begins with meetings to establish rapport, wants/needs, and counseling about the buying process. Our collective goal at Meybohm is to serve you throughout the buyer’s journey.

When you get a mortgage pre-approval, you have more negotiation power during the buying process and you will learn the price range to focus your home search upon.

Most buyers, 90% of them according to national statistics, use the internet as a resource to look for homes. We have several tools, including mobile options, to help you look for homes.

At some point, through a process of elimination, you will find a home which closely matches the wants and needs you have come to identify in your home search. We are here to help guide you through the process of buying real estate.

Writing an offer is your official response to the seller of the home that you are interested in becoming the next owner.

Not all buyers and sellers are thinking exactly the same when it comes to transferring legal ownership of a home. In the end, negotiations are a NORMAL part of the buyer’s journey.

As the buyer, you make the first step with your initial offer to purchase at the price you determine and other conditions you may want. It is FAIR and REASONABLE for the seller to make a counter offer back to you.

At some point in the offer/negotiation/counter offer process the buyer and seller agree with each other. This is when the contract is accepted.

There may be issues found in the inspection that are hidden from normal observation. These issues may be minor or they may be major enough for you to cancel your outstanding offer to purchase and begin looking for another home.

It is FAIR and REASONABLE for you, the buyer, to ask that repairs be made after the home is inspected. Most sellers will do repairs.

Banks, mortgage companies, and cash buyers want to know that the legal property they think they are purchasing is correctly identified and clear of all legal liens.

Banks, mortgage companies, and cash buyers often require an independent review of the value of the home or property being purchased. This is a NORMAL part of the buyer’s journey.

Once the financing and inspection phase is complete, a closing date is set for the parties involved to sign the official legal paperwork and transfer of money between parties.

As a buyer, you want to have a final walk-through before you sign the papers.

This is where you meet to sign the legal papers to transfer ownership and write checks for any monies due at closing. This is where you get to move forward towards the life you want for yourself and your family members.

This is where you take the keys you got at closing and walk into your new home or property as the new legal owner. CONGRATULATIONS... this is the American dream.

Benefits of using buyer’s agents-”A buyer’s agent will guide you through the homebuying transaction and be your disposal for any questions or concerns,” says Shane Wilcox, A REALTOR® with Partners Trust.

Here are some of the things a buyer’s agent can do:

Find the right property. After determining what clients are looking for and what they can afford, the agent will schedule appointments to tour homes that fit the bill. The agent can also explain the ins and outs of various properties and neighborhoods to help buyers decide which home is right for them by explaining the pros and cons of various options.

Negotiate the offer. The buyer’s agent will advise clients on an appropriate price to offer and present it to the seller’s agent. “Then they will negotiate on your behalf and write up the contracts for you,” says Matt Laricy, a REALTOR® with Americorp Real Estate in Chicago. This is where the agent’s experience in negotiating deals can save you money and help you avoid the pitfalls like a fixerupper that’s more trouble than it’s worth.

Recommend other professionals. A buyer’s agent should also be able to refer you to reliable mortgage brokers, real estate attorneys, home inspectors, movers, and more. This can also help expedite each step of the process and move you to a successful sale all the faster.

Help overcome setbacks. If the home inspector’s report or appraisal brings new issues to light, a buyer’s agent can advise you on how to proceed, and then act as a buffer between you and the sellers or their agent. If negotiations become heated or hostile, it’s extremely helpful to have an experienced professional keeping calm and offering productive solutions. We are here to help make the process of purchasing a home go as smoothly as possible. We know the area, pricing, and pride ourselves on helping to find the right home for each buyer we work with.

Typically people like to know who they are doing business with, especially when it comes to trusting them with their largest asset. Sometimes the best way to get to know someone is to learn how they spend their free time. Aiken businesswoman Kim Cooper has non-stop energy that keeps her in perpetual motion. In addition to real estate, she teaches group fitness classes and also plays USTA league tennis. “Exercise is for me...I spend time with my friends and relieve stress at the same time.” She has three children and began her real estate career over 19 years ago as a single mom which left her no room for error. Kim holds designations such as ABR, SRS, and e-Pro, but her energy and determination is what has made her so successful as a premier Aiken REALTOR®. She will not quit until she has exhausted her endless resources to help meet the real estate goals of her clients.

What are the features you must have in a home? Are there things you would like to have, but are not essential? What are your needs versus wants? Getting a checklist of these items will help you to and your REALTOR ® to find you the home that works for your lifestyle!

Want-Something you would like to have and that you could change over time:

Paint

Flooring

Deck or Patio

Pool

Remodeled Kitchen or Bath

Windows

Landscaping

Lighting Fixtures

Need- Anything you must have and can not easily change over time:

Square Footage

# of Bedrooms/Baths

Garage Size of Lot Location

Newer Wiring or Plumbing

Changes to floor plan that would require structural modifications.

Once you have establishes the parameters of what you would like to have and what you need in a home, we can begin the process of seeing what is available within your budget. This is a great reason to meet with a lender to establish a budget, prior to looking at available homes!

Loan terms, rates, and products can vary significantly from one company to the next. When shopping around, these are a few things you should ask about:

• What are the most popular mortgages you offer? Which one would be best for my situation?

• How much house can I afford?

• What is the difference between pre-qualifications and pre-approval? Does my perqualification letter expire?

• What type of documentation will you need from me?

• Is there anything that I can do to lower my interest rate?

• How much down payment required?

• Can you give me an estimate of all fees/costs including down payment will be due from me at closing?

• Will I have to buy private mortgage insurance? If so, how much will it cost, and how long will it be required?

• How long will it take you to get my loan to fund? What percentage of your loans close on time?

• What would be included in my mortgage payment (homeowners insurance, property taxes, etc.)

• Do not apply for new credit.

• Do not close any credit accounts.

• Do not increase your debts.

• Do not make a late payment or skip a payment

• Do not move money without a paper trail

• Do not change or quit your job

• Do not spend your savings

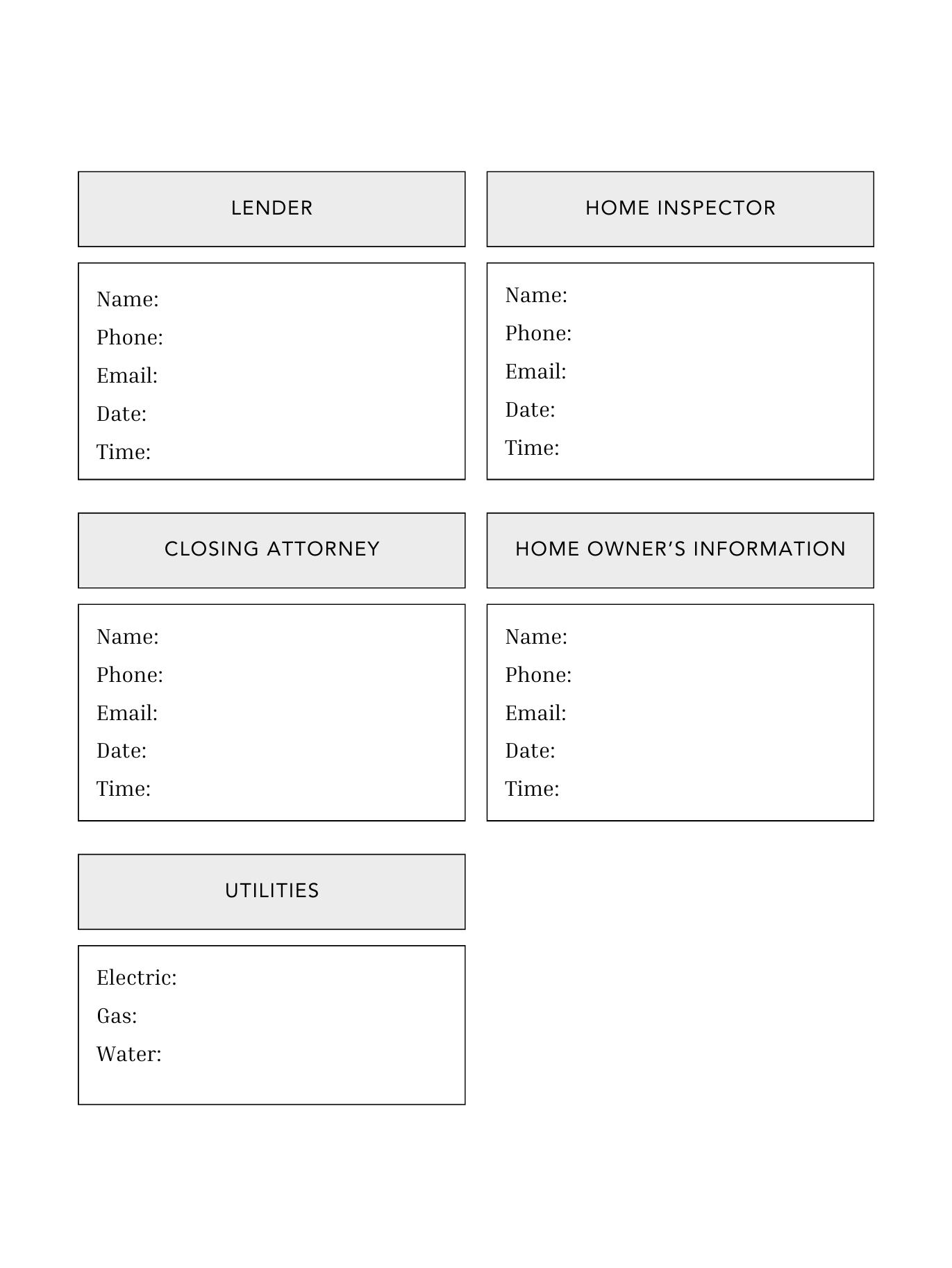

This is a list of lenders that we have worked with in the past and is not meant to limit your choices. You may select one of these lenders or any other lender.

Mike Harley

Guild Mortgage

1310 Pine Log Rd. Suite A Aiken, SC 29803

803-341-0404

mike@guildmortgage.net

Virginia Smith

Security Federal 1705 Whiskey Road Aiken, SC 29803 vsmith@securityfederalbank.com

Office : 803-641-4469

Cell : 803-641-3026

Matt Hunter

Hunter Mortgage

408 Silver Bluff Road Aiken, SC 29803

matt@hmi-aiken.com 803-644-4010

Chad Parrott

TD Bank

142 Chesterfield St. SE Aiken, SC 29801

Chadwick.parrott@td.com 803-645-6075

Wade Ratke

SRP Federal Credit Union 1060 Silver Bluff Road Aiken, SC 29803

Wratke@srpfcu.org

Office : 803-202-4380

Malinda Howell

Queensboro Bank 4226 Columbia Road Martinez, GA 30907

mhowell@qnbtrust.com 706-869-6980 706-993-6946

Steve Hales

Coastal Carolina National Bank

128 Laurens Street NW Aiken, SC 29801

steve.hales@myccnb.com

Office : 803-617-0207

Cell : 803-221-7921

Gordon Leopard

Movement Mortgage

3662 Wheeler Road #100 Augusta, GA 30909

803-508-9152

What is a home inspection?

A home inspection is an objective visual examination of the physical structure and systems of a house, from the roof to the foundation.

What does a home inspection include?

The standard home inspector’s report will cover the condition of the home’s:

heating system, central air conditioning system (temperature permitting) plumbing electrical systems the roof

attic and visible insulation

walls, ceilings, floors

windows and doors the foundation, basement and structural components

What do I need a home inspection?

Buying a home could be the largest single investment you will ever make. To minimize unpleasant surprises and unexpected difficulties, you’ll want to learn as much as you can about the newly constructed or existing house before you buy it. A home inspection may identify the need for major repairs or builder oversights, as well as the need for maintenance to keep it in good shape. After the inspection, you will know more about the house, which will allow you to make decisions with confidence.

Do I have to be there?

While it’s not required that you be present for the inspection, it is highly recommended. You will be able to observe the inspector and ask questions as you learn about the condition of the home and how to maintain it.

What if the report reveals problems?

No house is perfect. If the inspector identifies problems, it doesn’t mean you should or shouldn’t buy the house, only that you will know in advance what to expect.

What happens after the inspection?

After the inspection, the home inspector will email you a copy of the report. With your permission, the inspector will also email a copy to us. We will review the report with you and compile a list of items that you would like to have repaired. We will then prepare a repair addendum that you will sign and this will be submitted to the seller’s agent.

This is a list of home inspectors we have worked with in the past and is not meant to limit your choices. You may select one of these home inspectors or any other licensed area home inspector. After you select one, call Kim or Katie (704-441-7807) and we will schedule the home inspection for you as we must coordinate with everyone’s schedule.

Brady Home Inspections

Travis Brady

803-349-5086

bradyhomeinspect.com

Willis Home Inspections

Brad Willis

803-645-7327

www.willisinspections.com

Bassford Home Inspection LLC

Chris Bassford 803-507-3363

Realty Check Home Inspections

Paul Hurst

803-300-7201

realitycheckhomeinspections.net

Georgia/Carolina Home Inspection

Scott Huff

803-441-8920 georgiagecarolinahomeinspections.com

An attorney can help review the title search and explain the title exceptions as to what is not insured, and determine whether the legal description is correct and whether there are problems with adjoining owners or prior owners.

He or she can also explain the effects of easements and agreements or restrictions imposed by a prior owner, and whether there are any legal restrictions which will impair your ability to sell the property.

The deed and other closing papers must be prepared.

Title passes from seller to buyer, who pays the balance of the purchase price. A closing statement will be prepared prior to the closing indicating the debits and credits to the buyer and seller. An attorney is helpful in explaining the nature, amount, and fairness of closing costs.

The deed and mortgage instruments are signed, and an attorney can be assure that these documents are appropriately executed and explained to the various parties.

The closing process can be confusing and complex to the buyer and seller. Those present at the closing often include the buyer and seller, the attorneys, the title closer ( and the real estate broker. A good real estate attorney is essential to ensuring a smooth closing.)

If at any time, you have questions, please let us know!

This is a list of attorneys that we have worked with in the past is not meant to limit your choices. You may select one of these attorneys or any other real estate attorney. I will schedule the closing for you.

Brad Boni

The BG Law Firm

Office : 803-644-4460

Cell : 803-644-4469

759 Richland Ave. W Aiken, SC 29801

Bill Tucker

Hull, Towill, Norman, Barrett & Salley

Office : 803-648-4213

Fax : 803-648-2601

111 Park Avenue Aiken, SC 29801

Ray DuFour

Dufour & Dufour

Office : 803-649-3464

Fax : 803-642-9768

301 Park Ave. SW Aiken, SC 29801

Morris Rudnick

Rudnick & Rudnick

Office : 803-648-2565

Fax : 803-648-6705

135 Pendleton St NW Aiken, SC 29801

Danny Busbee

Dantzler O. Busbee ll Office : 803-648-3255

Fax : 803-648-3278

147 Newberry Street Aiken, SC 29801

William H. Tucker

Hull Barrett

Office : 803-648-4213

111 Park Ave. SW Aiken, SC 29801

Mary Guynn

Scott Patterson

Smith Massey Brodie

Guynn & Mayes

Office : 803-648-4110

Fax : 803-648-8140

210 Colony Parkway Aiken, SC 29803

Charles Simons

Charles E. Simons lll

Office : 803-649-6221

Fax : 803-648-7372

113 Waterloo Street SW

Aiken, SC 29801

Dominion Energy

1-800-251-7234

108 Barnwell Ave. NW

Aiken, SC 29801

Gas &/or Electricity

*Deposit or letter of credit from previous utility company required, may have to go in person.

Aiken Electric Cooperative, Inc

803-649-6245

2790 Wagener Road

Aiken, SC 29801

Electricity

*Deposit will be required, may have to go in person.

City of Aiken

803-642-7603

Water, Garbage, & Sewer

*Can set up via online, www.cityofaikensc. gov , all billed together

Beech Island

803-827-1004

Water

Breezy Hill

803-663-6455

Water & Sanitation

Montmorenci

803-648-9920

Water & Sanitation

Jackson

803-471-3925

Water & Sanitation

New Ellenton

803-652-2019

200 Main Street N New Ellenton, SC 29809

Tyler Sanitation

803-648-6714

Garbage

Atlantic Broadband

888-301-8649

Cable & Internet

Dish Network

800-333-DISH (3474)

Satellite & Internet

DirecTV

800-490-4388

Satellite & Internet

Moving is a significant step in life. Make sure that you make the most of yours by the right Real Estate Professional. choosing