GOING GLOBAL

Create a Culture of Commitment

Create a Culture of Commitment

The Most Commercially Viable Solution for Cultivators. Engineered for maximum yield and profitability, the Cultivator Series empowers you to stay ahead of the curve and enhance your bottom line.

Hits The Vital Cannabis Phase Specific Shift

The Cultivator Series is the only 3-part WSP that addresses the significant phase-specific demands in macro, secondary, and micro-nutrient ratios, helping your cannabis unlock its full genetic potential for cannabinoid, terpene, and flower production.

For more information on the

A part of our eighth generation of products, the Cultivator Series is backed by the latest cannabis research, ensuring that you stay ahead of the curve and experience unmatched crop growth, potency, and quality. Keep your crop ahead of the curve…

Series, visit AdvancedNutrients.com/Cultivator-Series-Pre-Orders or contact your local Sales Representative.

At as low as 3.9¢/gallon, combined with unparalleled crop results, the Cultivator Series is the most cost-effective 3-part system on the market.

Partnering With Top Growers To Get The Highest Price Per Pound They Deserve

24 Years of Cannabis Research Pioneers of 57 Industry Firsts Behind More Cup Wins Than Any Other Brand

Global Network of Growers in 115+Countries

...And the only line to take cannabis anywhere near the peak of its known genetic potential.

News, data, trends, forecasts, and other tidbits worth knowing.

Richard Proud shares his insight about why retailers must go mainstream.

The Travel Agency on Fifth Avenue is a study in chic, sophisticated minimalism.

Decades of cannabis prohibition have led to persistent myths about growing the plant. It’s time to separate fact from fiction.

Whether buying or selling, proactive due diligence ensures businesses are ready when the right deal arises.

Automation is transforming the industry by streamlining production, enhancing consistency, and enabling widespread standardization from seed to sale.

Sunderstorm’s CEO leads the company’s pioneering expansion into global markets driven by a unique blend of scientific rigor and passion for natural healing

By making a long-term investment in his retail employees, Terrence White demonstrates the enduring value of benefits that inspire a culture of commitment.

As the vaping sector faces new opportunities and challenges, stakeholders must adapt quickly to capitalize on potential growth.

Richard Proud’s leadership has been instrumental in shaping product and business strategies for consumer retail brands including Abercrombie & Fitch, Hollister, and Garage. He currently serves as CEO at iAnthus, which owns and operates licensed cultivation, processing and dispensary facilities throughout the United States. iAnthus.com

As CEO at automation machinery supplier LeafyPack, Alain Vo has spearheaded advancements in packaging technologies for the past five years. He focuses on enhancing output speeds and integrating innovation while upholding world-class standards. LeafyPack.com

A returned citizen, Terrence White works to correct the disproportionate impact of criminalization on marginalized communities. He founded and serves as CEO for Monko, a luxury cannabis experience in the heart of Washington, D.C. He also owns the cultivation brand Pleasant Wellness. Monko.co

RYAN HURLEY, Esq.

Currently chairman of the cannabis practice at Rose Law Group PC, Ryan Hurley’s practice has focused on the business of legal cannabis since 2010. He was deeply involved in the 2016 and 2020 initiatives to legalize adult use in Arizona and, subsequently, in crafting the regulations. RoseLawGroup.com

As co-CEO of Ispire Technology Inc., Michael Wang is a leader in the development and commercialization of vaping technology and precision dosing. Previously, he served in executive roles at The Pharm/Sunday Goods, Onestop Commerce, Zazzle, and Honeywell. IspireTechnology.com

With legalization spreading worldwide, companies are looking to foreign markets for growth opportunities.

For this month’s feature, we spoke with several executives about how they overcame obstacles and the strategies they used to scale their businesses on the global stage.

Editorial Director KATHEE BREWER

editorial@inc-media.com

Creative Director ANGELA DERASMO

Digital Editor Jeff Hale

Contributing Writers Alain Vo, Alisha Holloway PhD, Allison Zervopoulos, Alyson Jaen Esq., Christopher Jones, Danny Reed, Dan Serard, David Kooi, David Sandelman, Derek Ross, Gary Allen, Henry Baskerville Esq., Howard Sykes, Jay Virdi, Jess Phillips, Kim Prince, Kris Krane, Kyle Sherman, Lance C. Lambert, Laura Bianchi Esq., Marc Beginin Esq., Michael Mejer, Michael Wang, Nohtal Partansky, Rachel Gillette Esq., Rachel Goldman, Randy Reed, Richard Proud, Robert T. Hoban Esq., Ruth Rauls Esq., Ryan Hurley Esq., Scott Johnson Esq., Shane Johnson MD, Sue Dehnam, Taylor Engle, Terrence White

Artists/Photographers Christine Bishop, Steve Hedberg, Mike Rosati

Digital Strategist Dexter Nelson

Circulation Manager Faith Roberts

ADVERTISING SALES & CLIENT SERVICES

BRANDI MESTA

Senior Account Executive

Brandi@inc-media.com (424) 703-3198

BUSINESS OFFICES

Chief Executive Darren Roberts

Tech Architect Travis Abeyta

Accounting

Diane Sarmiento, Brittany Gambrell

Subscriptions subscribe.mgmagazine.com

Back Issues store.mgmagazine.com

Mailing Address

mg Magazine

23055 Sherman Way, Box 5069 West Hills, CA 91308 (310) 421-1860 hello@inc-media.com

MEG CASHEL

Account Manager

Meg@inc-media.com (424) 246-8912

mg Magazine: For The Cannabis Professional Vol.10, No.9 (ISSN 2379-1659) is published monthly by Incunabulum LLC, located at 23055 Sherman Way, No. 5069, West Hills CA 91308. Periodicals Postage Paid at Las Vegas Post O ce and additional mailing locations. POSTMASTER: Send all UAA to CFS. NON-POSTAL AND MILITARY FACILITIES: Send address corrections to mg Magazine, 23055 Sherman Way, No. 5069, West Hills CA 91308.

mg is printed in the USA and all rights are reserved. © 2024 by Incunabulum LLC. mg considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur; consequently, readers using this information do so at their own risk. Each business opportunity and/or investment inherently contains criteria understanding that the publisher is not rendering legal or financial advice. Neither Incunabulum LLC nor its employees accept any responsibility whatsoever for contributors’ activities or content provided. All letters sent to mg Magazine will be treated as unconditionally assigned for publication, copyright purposes, and use in any publication or brochure and are subject to mg’s unrestricted right to edit and comment.

—CAMERON CLARKE SUNDERSTORM

Despite the stubborn refusal of the federal government to legalize the plant, the United States remains the world’s most lucrative cannabis market. In 2023, revenue totaled $33.6 billion, accounting for about 56 percent of global sales, according to analysts at BDSA.

But Europe is coming in hot. Although it’s unlikely the region will surpass the U.S. or Canada anytime soon, federal-level legalization, moderate taxation, and thoughtful regulations make Europe an attractive destination for American cannabis companies. We spoke with top executives at five of them to get their perspective and advice about operating overseas. You’ll find their words of wisdom in this month’s feature story. In addition, Cameron Clarke, chief executive officer at Sunderstorm, provides his take on underhyped markets that may boom soon.

Also in this issue, operators with their feet firmly planted in the U.S. will find advice for boosting employees’ spirits, mainstreaming retail operations, and preparing for the next wave of mergers and acquisitions.

Enjoy the read.

KATHEE BREWER EDITORIAL DIRECTOR

COLUMBUS, Ohio — Ohioans spent $11.5 million in the first five days after the state became the twentyfirst in the U.S. to launch an adultuse cannabis market. Combined with medical sales at a pace of $8.3 million per week, the state could be on pace to break $1 billion in its first year of adult-use operations.

By comparison, nearby Michigan is expected to surpass $3 billion this year (its fifth), and California is projected to hit $4.7 billion in combined sales.

Ohio joined Alaska, Arizona, California, Colorado, Connecticut, Illinois, Maine, Maryland, Massachusetts, Michigan, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, and Washington in the legal-recreational-sales club. Adult-use programs in Delaware, Minnesota, and Virginia are expected to be operational in early 2025.

The Ohio Department of Commerce Division of Cannabis Control granted

dual-use certificates of operation to ninety-eight dispensaries—down from the 110 provisional licenses granted in July—allowing them to sell both medical and recreational products.

Notably, Ohio’s market launch did not include a social equity program, a point of contrast with many other states’ rollouts.

Verano Holdings Corp., which expanded its footprint to 150 dispensaries in fourteen states with the acquisition of Arizona and Virginia cultivation, processing, and retail properties from The Cannabist Company Holdings Inc., began serving adult-use customers at four locations, including a dispensary in Cincinnati near the Kentucky state line. With Ohio sharing borders with five other states—only one of which, Michigan, has legalized adult use—sales near the state lines are expected to drive significant revenue.

Ohio’s entry into the adult-use market follows a voter-approved initiative in November 2023, reflecting a growing trend toward recreational legalization in the Midwest.

Reasons consumers believe AI assistants are better than humans at customer service.

51%

AI provides more precise suggestions.

49%

AI provides faster recommendations.

48%

AI knows preferences and shopping habits.

48%

AI provides unbiased suggestions.

38%

AI understands and acts on feedback better.

(Source: SurveyMonkey)

IT HAS BEEN A HIGHLIGHT OF MY CAREER TO FOCUS ON GROWING

STAMFORD, Conn. — After two years at the helm of one of the world’s largest publicly traded cannabis companies, Matt Darin in mid-August stepped down as chief executive officer at Curaleaf Holdings Inc. In his place, the board of directors appointed Executive Chairman Boris Jordan chairman and CEO.

The company announced the change in executives during its second-quarter earnings call, during which Curaleaf reported quarterly revenue of $342 million, representing year-over-year growth of 2 percent. The company also reported adjusted gross profit of $163.1 million and adjusted gross margin of 48 percent.

Darin joined Curaleaf in 2020 when the company acquired Grassroots Cannabis, a multistate operator he founded in Illinois in 2014. At the time of the $700-million acquisition, Grassroots owned more than seventy licenses to grow, process, and sell in a dozen states. The deal more than doubled Curaleaf’s footprint. Darin will remain with the company as a special advisor through the end of the year.

Jordan, an American-born entrepreneur and investor with

Verano Acquires AZ, VA Operations

Multistate operator Verano Holdings Corp. acquired cultivation, production, and dispensary operations in Arizona and Virginia from The Cannabist Company Holdings Inc. for $105 million in cash, stock, and debt. The deal added Virginia to Verano’s footprint and subtracted Arizona from The Cannabist’s. Verano now owns properties in fourteen states.

$2M

Growlink, a provider of controlled-environment agriculture solutions, secured $2 million in a seed financing round led by Casa Verde Capital. Ten-year-old Growlink serves 2,200 customers in thirty-five countries. The company plans to use the funds to expand its products’ artificial intelligence capabilities and enhance third-party integrations.

assets primarily in the U.S., Canada, and Europe, co-founded Curaleaf by way of a previous investment in a medical device manufacturer named Palliatech. The company pivoted to cannabis and changed its name to Curaleaf in 2014.

Curaleaf operates 147 dispensaries, nineteen cultivation sites, and twenty-two processing facilities in seventeen U.S. states. The company also operates in fifteen other countries, holding cultivation licenses in Canada and Portugal and operating manufacturing facilities in Canada, Germany, Spain, and the United Kingdom. On the distribution side, Curaleaf operates in Canada, Germany, Poland, Switzerland, and the United Kingdom and wholesales plant material to operators in Australia, Germany, Italy, New Zealand, Poland, and the U.K.

€100-Million

Demecan, one of Germany’s largest licensed cultivators, raised an undisclosed amount reported as a “high seven-digit number,” mostly in equity, in a funding round led by Florida’s Trog Hawley Capital. The infusion elevated Demecan’s valuation to nearly €100 million (US$109.24) and represented the company’s first U.S.-based institutional investment.

NEW YORK – In what the company characterized as a bid to strengthen its craft-beer presence in the United States, Tilray acquired four breweries from Chicago-based

Molson Coors Beverage Company. Financial details of the transaction were not disclosed.

Tilray expects the acquisition to add 15 million cases of product to its beverage alcohol sales annually.

The four new brands—Hop Valley Brewing Company, Terrapin Beer Co., Revolver Brewing, and Atwater Brewery—join an existing portfolio of fourteen beer, distilled liquor, sparkling cocktail, and energy drink brands including SweetWater Brewing Company, Montauk Brewing Company, Alpine Beer Company, Green Flash Brewing Company, Shock Top, Breckenridge Brewery, Breckenridge Distillery, Blue Point Brewing Company, 10 Barrel Brewing Company, Redhook Brewing Company, Widmer

Brothers Brewing, Square Mile Cider Company, HiBall Energy, and Happy Flower CBD.

The existing brands are available primarily on the east and west coasts. Tilray said two of the acquisitions, Revolver and Atwater, will “anchor” the company in Texas and Michigan, where they are based, respectively. Hop Valley and Terrapin will strengthen the company’s position in the Pacific Northwest and Georgia.

In July, Tilray posted beverage alcohol revenue of $76.6 million for the fourth quarter of fiscal 2024, an increase of 137 percent over the $32.4 million the company reported for the same period last year.

Do consumers tend to slow down consumption as the weather gets cold and the days get shorter?

We checked to see how seasonal change might a ect cannabis sales.

e answer is yes, there is a trend toward slower sales in the Fall versus Summer.

Recommendations:

Prepare for slightly slower sales months by clearing inventory with special incentives. Entice customers with deals like BOGO o ers and product bundles to get them in the door.

The road to dispensary profits is paved with the experience of traditional retailers.

BY RICHARD PROUD

In the earliest days of adult-use sales, many (possibly even most) dispensaries still gave off a slightly illicit vibe. Found in locations off the beaten path and far from other retailers, the first dispensaries often were heavily branded with oldschool imagery and jargon—think lots of green leaves and “pot” puns. What’s more, the first stores licensed to sell adult-use products almost always featured an armed security presence. At the time, consumers were accustomed to seeing security guards primarily at banks, airports, or large events.

While this environment was mostly agreeable (and even enjoyable) for adultuse consumers who were simply happy to have legal access to cannabis, the atmosphere served as a big turnoff to many new consumers. In addition, it provided fodder for critics who saw recreational use as a burden on communities.

Despite these initial challenges, the great adult-use legalization movement that began in Colorado and Washington demonstrated cannabis could hold widespread consumer appeal. Those who

initially were hesitant eventually began to reconsider and, as they did, it quickly became clear some were interested in cannabis for health reasons but hadn’t participated in their state’s medical program. Over time, customers began seeking a variety of experiences from cannabis, from social lubrication to relaxation, wellness, and beyond.

As legalization proliferated, the number of consumers with access to the plant grew exponentially. Today, according to a 2024 Pew Research Center survey, eight out of ten Americans (79 percent) live in a county with at least one dispensary. The typical customer is more suburban dad than stoner dude. Increasingly, the customer base includes suburban moms and young professionals, while what we used to call stoners are now “connoisseurs.”

Dispensaries are judged by modern retail standards like service speed, convenience, product quality, and attention to details like branding, experience, and value. Customers increasingly want a frictionless retail

experience from an industry that is still finding its way.

If operators are going to capture this market for the long haul, they must take a mainstream approach to retail and marketing. By borrowing lessons from traditional retailers and adapting the teachings so they work within each state’s regulatory framework, businesses will project legitimacy in the eyes of modern consumers.

Here’s where they can begin.

Provide a modern retail experience. Strong traditional retail brands with the highest loyalty achieved their status by providing an exceptional retail experience. These brands intimately understand customers and the shopping environment they desire. Take Abercrombie & Fitch, a clothing brand whose stock price has surged more than 75 percent in 2024. The brand’s focus on social media interaction, influencers, and affiliate marketing—while moving away from dark stores with loud music and fierce cologne—shows how well A&F knows its customers. Its customercentric approach touches the product offerings, the marketing strategy, the sourcing strategy, and the store-versusdigital business breakdown.

Cannabis consumers have the same expectations of their favorite brands, and the industry can deliver similar performance outcomes. Customers expect cannabis businesses to have a robust digital presence, a welcoming environment, knowledgeable associates, and a commitment to the plant.

Broaden product variety and sales approach. According to a new study by researchers at Carnegie Mellon University, the number of people who consume cannabis daily now exceeds the number who drink alcohol daily, strongly suggesting the audience stretches across multiple market segments. In order to meet this growing and varied demand, the industry

must adapt to the needs of consumers. This begins with creating an evolving product assortment that addresses a variety of needs and moods.

It is essential that retailers monitor customer preferences to ensure top sellers are well stocked and new options are provided at regular intervals. Dispensaries that provide educational resources for curious consumers, as well as hire (and train) helpful budtenders to guide customers, will attract and retain new customers.

Dispensaries must reduce reliance on tired “pot” jargon and imagery to make stores as comfortable for the cannacurious and the wellness set as they are for the legacy crowd. (Save the iconic references for occasional use on appropriate events or products.)

Retailers must offer express-lane service, preorder capabilities, in-store kiosks, and store associates who act like sommeliers. Similar to the best retail

Powered by

brands, dispensaries must be places of education and intrigue.

Create and build brands with crossover appeal. Think twice (or more) before focusing solely on the “OG” cannabis buyer. Instead, develop retail and product brands that resonate beyond the core customer to speak to broader needs and desires. Today, consumers cite anxiety relief, sleep assistance, relaxation and, yes, feeling high, among the many reasons for consumption. Brands that focus exclusively on that last reason potentially ignore a huge portion of the market.

The best brands evoke a sense of wellbeing, health, community, and culture. Retailers welcome all kinds of consumers by providing a familiarfeeling space where customers feel free to express their needs. Product brands that resonate also tend to focus on positive outcomes over the potency of the product.

Brands need to resist the temptation to stereotype consumers (for example, “only potency matters”). Instead, create brands that reflect the needs of multiple audiences and build awareness through hosting or sponsoring niche educational events for women, seniors, and others; culture-focused music and art events; and community organizations.

Today’s consumer is much different from the people who ventured into dispensaries ten years ago. Where the industry once catered to a very specific, niche demographic, shops now are refining their appeal beyond the core early adopter. If retailers are going to succeed, mainstream cannabis must look and feel a lot more like Main Street than the mean streets.

As legalization continues to proliferate across the country and the winds of federal reform blow, this may be the industry’s defining moment. We must seize the opportunity.

The Travel Agency’s second boutique is right at home in a world-famous New York shopping district.

BY TAYLOR ENGLE

People from all over the world visit New York City for a culturally rich, cosmopolitan experience. The Travel Agency on Fifth Avenue wants to give them a taste of the high life, as well, in elegant retail surroundings. Located between 47th Street and 48th Street in Midtown Manhattan, The Travel Agency on Fifth Avenue is a stone’s throw away from Rockefeller Center, Radio City Music Hall, Bergdorf Goodman, and Saks. Patterned after its chic elder sibling, The Travel Agency Union Square, the new location blends into Fifth Avenue’s luxury vibe and echoes the diverse, highbrow, fashionforward savoir faire of its neighbors.

We really wanted to create a space that felt like a New York institution.

—Arana Hankin-Biggers

Co-founder and President Arana Hankin-Biggers wanted the Fifth Avenue store to feel “way more glam” than the equally elegant but somewhat more utilitarian original location. “That’s why we decided to partner with the Leong Leong architecture studio for the design piece,” she said. “We really wanted this space to be reflective of its community, and all of the firm’s designs are reflective of the broader Manhattan culture. We figured [Leong Leong] would be a perfect match for our Fifth Avenue location.”

The Travel Agency team let the architects take the lead, placing full trust in the firm after it brought the concept for the Union Square store to life. Sticking with a theme that centers on the mystique of travel—think romanticized, main-character-ata-train-station energy—Leong Leong developed Fifth Avenue to be reminiscent of an old-school, Grand-Central-like pit stop for the city’s most sophisticated stoners and the cannacurious alike.

“Fifth Avenue is such an iconic shopping space, and The Travel Agency is surrounded by other very upscale establishments,” said Chris Leong, founding partner at Leong Leong. “However, the location is also continuing on with elements that were originally developed in Union Square. Each location loosely takes on the idea of travel—not in a literal way, but more referentially and emotionally. With Fifth Avenue, you have this really tall storefront, so we wanted to take advantage of that and really give the location visibility and presence amongst its neighbors. Creating a waiting area behind the all-glass storefront was one of our first moves in that direction.”

Upon entering the space, visitors are confronted with a long, linear space that feels…well, trainsized. The unassuming displays—minimalism at its finest—are arranged so they “breathe,” spaced out enough so consumers can peruse the merchandise

without being overwhelmed by a barrage of brands. A circular light resembling a faceless clock sends a wash of warmth across the wall, playfully referencing the sun and engendering a buoyancy that imbues the space with a sort of mellowness that’s uncommon in the City that Never Sleeps.

“There’s also a gold palm tree displayed in the checkout space—a subtle reference to 1970s Viennese architect Hans Hollein, who often included similar golden palms in his postmodern retail designs,” Leong said. “We just wanted to have fun with that concept, so for us, the palm tree is both a reference to traveling imagined realities and a historical architectural Easter egg.”

Between the metallic tree, a papier-mâché cannabis plant, and the clever ways Leong Leong played with high, vaulted ceilings and moody lighting, The Travel Agency is arrestingly immersive, with each intriguing design tidbit gently pulling visitors through the space in a natural manner that satisfies the senses. It’s the sort of space Leong is most accustomed to designing. The team is wellversed in building pathways of fascination.

“We just finished the Metropolitan Museum of Art’s Costume Institute design for the season, and it featured a lot of parallels when it comes to the idea of observation,” Leong said. “We were able to pull a lot of those concepts into this project but, in general, most of our work involves building spaces that enable experience: immersive and activating for senses that go beyond the visual.”

In the case of cannabis, aroma was a big driver for the Leong Leong firm. The team focused on scent and taste when curating The Travel Agency’s Fifth Avenue presence, creating displays that invite consumers to understand different strains on a personal, synergistic level.

“Displays were core for us when it came to developing the brand’s environment,” Leong said. As with the Union Square store, “we wanted to create a surreal sanctuary—a place that is removed and serene from the business of the street. And

in terms of display, we needed to accomplish two things: One, follow the state’s regulations of keeping products behind lock and key, and two, make space for The Travel Agency’s visual merchandising strategy. The company puts a lot of intention behind curating products for their customers, and to best showcase those efforts, less is more. So, we created displays that act as frames or portals to the products in the best way.”

The Travel Agency Fifth Avenue is still new to the neighborhood, but according to Hankin-Biggers, feedback already has been “overwhelmingly positive,” partially because the design fits in so well.

“For this location, we really wanted to create a space that felt like a New York institution— reminiscent of the culture that has existed here for decades,” Hankin-Biggers said. “People are initially blown away by Leong Leong’s amazing designs, but once immersed in the atmosphere they are equally impressed by the quality of our budtenders and how knowledgeable they are. We spent a lot of time training our team so they could guide our customers through the best, most purposeful experience possible. We have a lot of foot traffic from people who’ve never set foot in a dispensary before, and we want to make sure they feel comfortable and willing to learn about the plant.”

The Travel Agency isn’t the first dispensary to try applying Fifth Avenue’s style and flair to cannabis (MedMen’s now-defunct store earned that distinction), but the brand aims to learn from its predecessors and hopefully adopt a more nuanced, sophisticated, and interesting approach.

“The reason we’ve done so well in such a short amount of time is that we’ve really invested in finding the best [retail] talent—the top performers in the industry,” Hankin-Biggers said.

The team also puts a lot of energy into making sure they’ve covered every product category.

“Part of that is selecting brands that have unique offerings, like vegan and/or sustainable products,”

Hankin-Biggers said. “Then, we also give special

accommodations to [Black-, indigenous-, and people of color-], women-, and queer-owned brands and as many New-York-born brands as possible. We have these larger West Coast brands coming in to crush it, so we’re trying to do what we can to support New York while also making sure we have something for everyone and at every price point. It’s an upscale location, but we can’t forget that all types of people walk down Fifth Avenue, and everyone is welcome in our store.”

The Travel Agency on Fifth Avenue also plans to follow the Union Square dispensary’s lead with community events. The new location recently hosted a film screening for a documentary about the intersection of cannabis and creativity, along with a few celebrity brand activations HankinBiggers called “major successes.”

“The great thing about working in cannabis is that you’re able to bring people together,” she said. “I feel like the most successful dispensaries are the

ones that are great at building community around their spaces, and we want to do more of that.”

In addition, The Travel Agency team is focused on developing new spaces in historic downtown Brooklyn and Manhattan’s fashion capital, SoHo.

“We’re planning to bring some compelling art activations into each space, which is super exciting,” Leong said. “Downtown Brooklyn is going to have more of an industrial vibe, while SoHo will be more future-forward. We’re still building off the DNA of the previous locations, but SoHo in particular will feel really gallery-like and will have the most space for art activations down the line.

“I think part of the DNA of the brand is that each location has a different relationship with travel and a different expression of that communion,” he added. “And for each location, the different artworks on display will give presence to the space so it can uniquely connect with each customer.”

BY TERRENCE WHITE

In the ever-evolving retail landscape, one truth remains constant: The quality of your staff directly impacts the success of your business. As a dispensary chief executive officer, I’ve seen firsthand how investing in retail floor staff not only has improved our operations but also significantly boosted customer loyalty.

Retail floor staff are more than just employees; they are the face of your brand and the primary point of contact for your customers. They have the power to turn a routine shopping trip into a memorable experience that keeps customers coming back. However, this potential can be fully realized only when staff members are well-trained, motivated, and genuinely invested in their roles.

One of the most effective ways to invest in retail staff is through robust training programs. These programs should cover a wide range of skills and knowledge areas. For example, in today’s digital age, retail staff need to be comfortable with a variety of software systems including point-of-sale systems, inventory management software, and customer relationship management tools. Extensive training in software tools will ensure staff efficiently handle transactions, check stock levels, and access customer information, leading to smoother operations and better customer service. Training in the finer points of customer relationshipbuilding also is important, because outstanding

customer service is at the heart of maintaining customer loyalty. Staff should learn how to communicate effectively, handle difficult situations, and go above and beyond to meet customer needs. Active listening techniques and conflict-resolution skills are essential in retail environments, as they can help employees defuse tense situations and turn dissatisfied shoppers into devotees of your brand.

Because we believe every staff member has leadership potential, we offer leadership training to all our retail employees. This not only prepares them for future management roles but also empowers them to take initiative and solve problems on the sales floor. A proactive approach enhances the customer experience and builds confidence in our staff.

We also train beyond the baseline in product knowledge, ensuring staff understand not just features but also how products can benefit different types of people. This deep product knowledge allows the team to offer personalized recommendations, enhancing the shopping experience. Customers appreciate knowledgeable staff members who can provide accurate information and helpful recommendations tailored specifically to them.

Luxury service standards matter, too. Even if you’re not operating in the luxury sector, training your staff as though you were can elevate the overall customer experience. Personalized attention, discretion, and

anticipating customer needs before they’re expressed all play a part in encouraging customers to return again and again.

Another crucial aspect of staff development is close collaboration between retail and marketing teams. Our marketing department regularly provides salesenablement resources for new products and customer interaction strategies, including items like detailed product-launch briefings, customer persona guides, tailored talking points for different customer types, and regular updates about marketing campaigns and promotions. This collaboration ensures retail staff members are always up to date with the latest product information and marketing messages, allowing them to provide consistent and informed service.

Investing in your retail staff goes beyond training; it also means providing fair and competitive compensation. We’ve made the decision to pay our retail staff well above the minimum wage—specifically, $7 more per hour. The approach has multiple benefits. Higher wages allow us to attract and retain the best retail professionals in the industry. Well-compensated employees are more likely to stay with the company, reducing turnover costs and maintaining consistency in customer service. Fair pay demonstrates we value our employees, which in turn motivates them to perform at their best. And last but not least, satisfied employees are more likely to provide excellent customer service, directly impacting customer loyalty.

In addition to competitive wages, offering a comprehensive benefits package—including health insurance, retirement plan, and other perks such as subsidized parking or transportation allowances where possible—is an investment that pays off. Benefits demonstrate commitment to employees’ overall wellbeing, which translates into better performance and customer interactions.

We also invest in our employees by promoting from within and providing clear career paths. To facilitate this, we provide mentorship programs and opportunities to cross-train in multiple departments. When employees see opportunities for advancement, they’re more motivated to excel in their current roles. In addition, the prospect of career growth encourages

staff to stay with the company long-term, which allows us to retain valuable institutional knowledge and company culture. Moreover, long-term employees often develop strong relationships with regular customers, fostering loyalty.

Investments in retail staff pay other dividends, as well. Satisfied employees naturally become brand ambassadors, conveying genuine enthusiasm for the company and its products to customers. Additionally, engaged employees often provide valuable insight and ideas for improving the customer experience, which drives continuous improvement.

Retail staff are not just employees. They’re the living embodiment of your brand.

In today’s retail landscape, customer loyalty is more valuable than ever. While there are many strategies to foster loyalty, investing in your retail staff is one of the most effective approaches. By providing comprehensive training, fair compensation, career development opportunities, and a supportive work environment, businesses create a team of engaged, knowledgeable, and motivated professionals who deliver exceptional customer experiences.

Remember, your retail staff members are not just employees. They’re the living embodiment of your brand in the eyes of your customers. By investing in their success, you’re investing in the success of your entire business. It’s a strategy that requires commitment and resources, but one that pays dividends in long-term success.

Sunderstorm Inc. Chief Executive Officer

Sunderstorm’s co-founder and chief executive officer is among the vanguard of industry leaders exploring the next generation of international markets.

BY JACK GORSLINE

Cameron Clarke embodies a rare autodidactic blend of scientific rigor, entrepreneurial spirit, and deep-rooted passion for natural healing. With an academic foundation in science and engineering at Stanford University, Clarke’s career trajectory has been anything but conventional. His journey has spanned diverse fields including international politics, commercial trade, and technology startups, showcasing his multifaceted interests and relentless curiosity.

Clarke’s fascination with the power of natural wellness began more than twenty years ago when he became attuned to the importance of nutrition. The interest blossomed into a profound exploration of plantbased medicine, propelling him into a unique odyssey that took him from the laboratories of molecular biology to the remotest jungles of the Amazon and Africa.

“I lived in the Amazon and African jungles for months with indigenous tribes, learning their way of life and working with elder shamans,” he said, adding immersion in the lifestyles and traditions of indigenous peoples gave him extraordinary access to ancient wisdom about the healing properties of plants.

The experiences not only deepened his understanding of traditional medicine but also solidified his belief in the transformative potential of plant-based therapies. It was his belief in the power of plant medicine that ultimately spurred Clarke’s decision to enter the cannabis industry.

“About a decade ago, I was studying molecular bio[logy] and working on engineering algae to clean polluted rivers when I saw the opportunity developing with cannabis,” he said. “My interests in science, plant medicines, global business, and natural healing converged into the launch of Sunderstorm in 2015.”

Since then, Sunderstorm has become one of the rare manufacturers to thrive in California’s brutal market. The company’s flagship brand, KANHA, is the third-best-selling edibles brand in the state and the fourth-best-selling in Massachusetts. Monthly, according to market tracker Headset, the brand sells more than $4 million worth of gummies across 900 locations in four markets: the two previously mentioned plus Illinois and Nevada.

Last year, in partnership with THCG Group Ltd., Sunderstorm opened a state-of-the-art manufacturing facility in Thailand. With 70 million citizens and 40 million tourists annually, Thailand is expected to be a large medical and recreational market. The University of the Thai Chamber of Commerce expects the country’s combined cannabis and hemp market to grow 15 percent annually, reaching 43 billion Thai baht (approximately US$1.2 billion) by 2025.

Then, in May 2024, Sunderstorm secured strategic partnerships to launch two wellness lines in Japan, a nascent market that saw 500-percent growth in cannabinoid product sales over the past four years, according to The Japan Times KRx by KANHA and KANHA Wellness will be distributed to retailers and clinics by one of Japan’s oldest and largest consumer packaged goods companies.

Clarke’s journey—and Sunderstorm’s success on a now-international stage—is a testament to the power of following one’s passions across disciplines and cultures. His leadership at Sunderstorm is not just about building a successful business, but also about pioneering a movement that merges traditional wisdom with modern science to promote holistic healing.

As the industry continues to evolve worldwide in both perception and regulation, Clarke’s diverse background positions him as a unique and influential voice—one whose insights are grounded in a lifetime of learning, exploration, and innovation.

How do you go about evaluating new markets, and what is your growth strategy?

Given the challenges in attracting growth capital today, we take a very disciplined approach to evaluating new markets. One of the significant hurdles in this industry is the need to establish operations in each state. For a company like ours, which is meticulous about every detail of manufacturing and strives for perfection in every batch of edibles and vapes, the capital expenditure to launch [a new] market can be daunting.

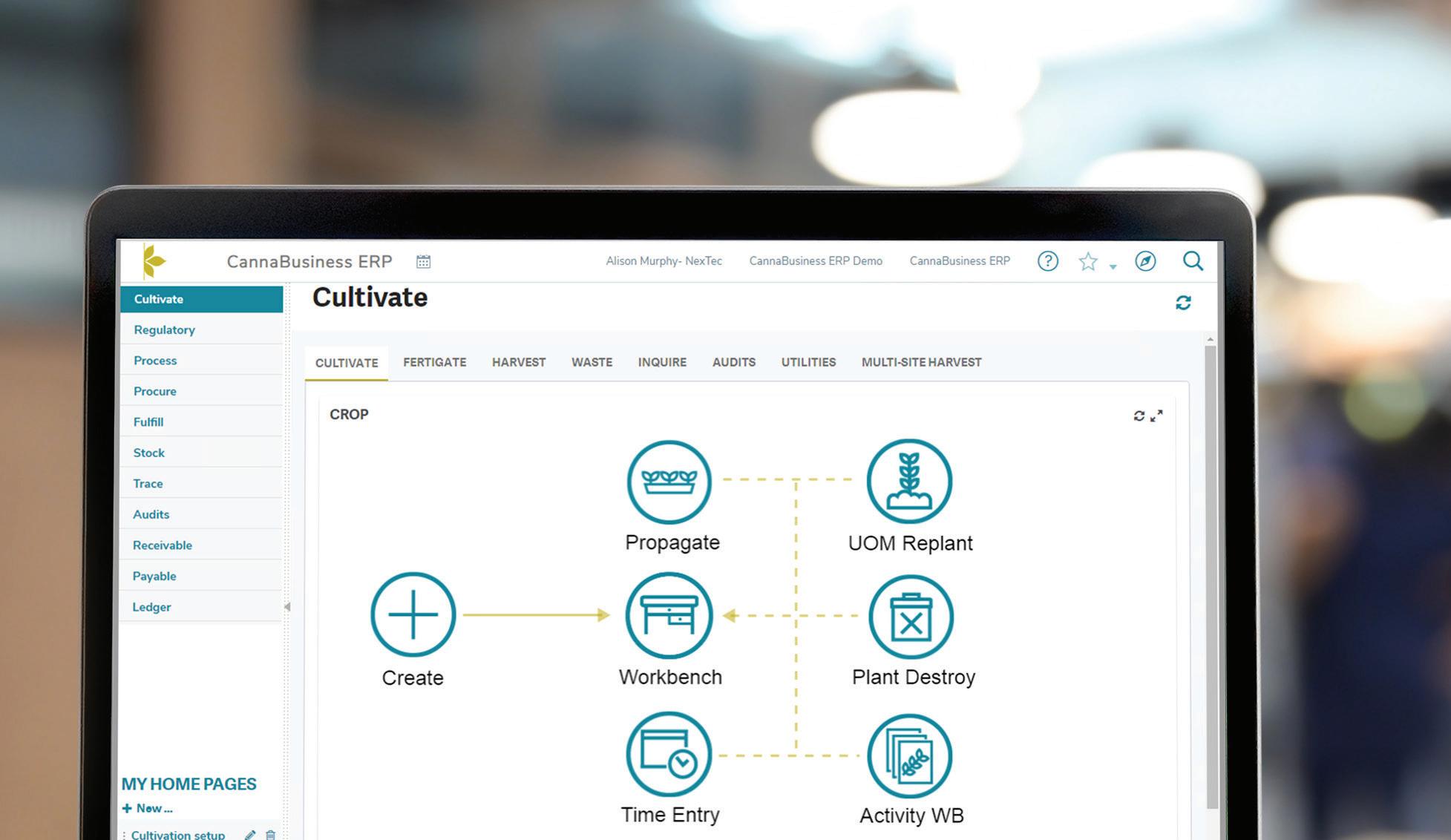

We believe our products need to taste and function the same whether purchased in Boston or Bangkok. This is a heavy lift when you must operate production facilities in many markets. Fortunately, we have the most sophisticated [enterprise resource management] systems implementation I’ve seen in cannabis. This allows us to scale quickly and efficiently. Making great edibles is difficult, but we never veer from our commitment to making beautiful, delicious edibles.

Most international markets are medically legal right now. Do you see them adopting adult use anytime soon?

Not really. Most international markets are still focused on medical cannabis. We love the wellness aspect of the industry, and we are happy to see the global market is ripe for focusing on that. For example, we will be opening a Kanha Clinic with traditional Thai medical doctors on staff in the coming months in Thailand. We are excited about this prospect. While we’re eager to see adult-use cannabis go global, I think it’s going to take some time.

In your opinion, what’s the most underestimated international market worth exploring right now?

There’s a lot happening globally, but I’m really interested in Brazil. I think it has huge potential, but it’s going to take time to develop.

That’s a tough one. Perhaps Colombia? I have been surprised at how slowly this market has developed, and there has been a lot of interest there over the years.

Where, both in the United States and internationally, are you trying to expand your brands? Why those markets?

We are focusing on newer East Coast markets in the U.S. because they are not yet overwhelmed. Internationally, we are looking anywhere we can get a foothold. While the international markets are still in their infancy, we have a great opportunity to build global brand recognition through exports from Thailand.

What are your criteria for expanding Sunderstorm and KANHA’s presence?

My definition of a brand is trust between the consumer and the manufacturer. We do not believe we can build this trust without manufacturing our products ourselves. This is the single biggest challenge in new markets for us. It requires capital, fierce attention to detail, commitment not to sell products that are out of spec no matter the cost, and an incredible team of engineers, along with [research and development], quality control, and production staff who never compromise on our promise to the consumer.

Our philosophy is to always retain control of our manufacturing. We believe that no licensee will be as committed to the quality and precision of our products as our own KANHA production teams. Consequently, we target markets that are large enough—typically $1 billion plus—and have not yet been saturated by low-cost, low-quality edibles. We also prefer markets with 150 to 300 retailers, as this is a manageable number to service effectively. Our focus on premium customer service means that our own sales and marketing teams are in stores every day, providing the necessary support in this challenging industry. Our strategy is to proceed with humility, taking our time to ensure we can meet our high standards.

Beyond North America, we have recently launched in Thailand, where our products are now available in more than 100 retail locations within just the first few months. KANHA has become the top-selling edible in most of these stores. This success in Thailand marks a pivotal step in our global expansion strategy. We have also secured a partnership to enter the Japanese hemp market, with a launch planned in the near future.

Sunderstorm sells more than $4 million in product monthly across 900 locations in four markets: California, Massachusetts, Illinois, and Nevada.

Through July 2024 (the most recent data available), the company’s KANHA Blue Raspberry Tranquility Gummies 10Pack (50mg CBD, 50mg THC, 50mg CBN) consistently ranked as its number-one product, selling more than 26,000 units monthly. The rest of the top five, in order:

Sleep Marionberry Plum Gummies 10-Pack (150mg CBD, 100mg CBN, 50mg THC)

Hybrid Watermelon Gummies 10-Pack (100mg)

Sativa Cherry Gummies 10-Pack (100mg)

Indica Strawberry Gummies 20-Pack (100mg) (Source: Headset)

Thailand serves as a strategic springboard for us to establish KANHA as a global brand. Unlike the fragmented U.S. market, our single facility in Bangkok enables us to serve customers worldwide efficiently. The potential for growth is vast, and we are enthusiastic about bringing our brand to as many new markets as possible. This international expansion is a critical component of our growth strategy over the next few years, alongside our efforts to enter new U.S. markets.

We have also begun offering hemp-derived delta-9 products with the same level of care and safety in U.S. markets where we currently do not operate. As these diverse markets gradually integrate, KANHA will become accessible to tens of millions of consumers around the globe.

Speaking of hemp… How would you describe the relationship between the U.S. hemp and cannabis industries? How might that relationship evolve over the next three to five years?

We entered the hemp market about a year ago to help build our brand in markets where we do not have licensed operations. We see this as a great opportunity. Frankly, my understanding is the U.S. cannabis, hemp, and illicit markets combine into a $100-billion opportunity.

Unfortunately, regulatory and taxation inconsistency have created barriers to the free flow of capital and goods. That has made it difficult for licensed operators and investors. Over time these barriers will dissipate, and the markets will slowly evolve into well-defined markets that are more fluid. A limited number of brands will dominate in the future, because they will have figured out how to work through the challenges of winning consumers in each segment while maintaining relevance and cost efficiencies. These brands are playing the long game and are already building brand equity today. Those who try to gain short-term market share only through a low-price strategy and don’t invest in brand-building or cost efficiencies will be left behind.

Where do you stand on the future of hemp-derived minor cannabinoid products? Do you envision Sunderstorm expanding its product line to include more hemp-derived, non-THC products?

We are quite bullish on this segment, and we are already selling fully legal products in markets where we are not

licensed through our KanhaLife.com website. This is an exciting moment for us, because we can grow from millions of consumers to tens of millions. We are very careful to abide by regulations and support our retailers in our licensed states.

I have learned the hemp lobby is quite strong [on a national level], and I predict low-dose, hemp-derived edibles and beverages are here to stay. We may see some bifurcation of the markets based on potency in the future.

Multiple U.S. states have tightened regulations surrounding hemp-derived THC products; in some places, intoxicating hemp products have been banned altogether. How has this impacted your evaluation of the market for hemp-derived THC products?

My prediction is that this is part of the ebb and flow of fullblown cannabis legalization. My science experience taught me evolution is not linear. Social change happens in spurts, and there’s a natural struggle involved. Cannabis legalization is no different. We no doubt will see the regulatory pendulum create some havoc as the industry moves toward free-flowing capital and goods. Did we ever believe three years ago that we would be seeing unlicensed [hemp-derived] delta-9 THC beverages on tap in breweries in Texas in 2024?

My advice is not to get hung up on the short-term tensions and flexing as these markets evolve. Look at the past and down the road, and you will notice more stable trendlines.

You actually have recent experience with that kind of “tension and flexing.” Not long after Sunderstorm opened its facility in Thailand, the Thai government flirted with reclassifying cannabis as a narcotic. This is another example of the natural tensions among forces of evolution and social change. When we entered the California market in 2015, the market had been chaotic for years as the revolutionaries fought for destigmatization of the plant. The chaos in Thailand feels the same to me. It requires a steady hand but quick tacks of the ship to sail through rough waters.

Our advantage is that our partners are politically well connected and were one of the first five medical license holders in 2019. This gives us a leg up. Navigating is difficult, but if we can rely on these advantages, then we can overcome future challenges more successfully.

Over the past several years, many U.S.-based cannabis companies have had a hard time raising money, both in public markets and from private sources. Has that been true for Sunderstorm?

Yes. The dearth of capital has slowed our growth. However, our story is a good one, because both [co-founder] Keith Cich and I have startup experience in our past. We know capital can dry up overnight. We have been very focused on managing our cost structure from inception. That’s why we have invested so heavily in infrastructure, systems, and automation. We manage our costs down to pennies in every aspect of our business. This is why we can maintain profitability despite challenges.

We also know the capital spigot can turn back on in an instant. We are ready to tell our story to any investors who believe in the future of this industry and recognize the power of brands.

In your conversations with investors, what are they most focused on when they consider putting money into a business?

Having raised money in multiple ventures in the past, I recognize investors want to see a balance between topline growth and bottom-line profitability. I also had a dotcom that survived through the chaos in that industry. I learned quickly that you watch every penny, focus on systems to drive efficiencies, and never get over your skis.

This industry is littered with companies that didn’t build a stable base or didn’t know how to manage their costs and focused on short-term goals instead of long-term profitability. That business model is just gambling with investor money. I remind investors brands will be the biggest winners in this industry and to look at our attention to detail in every aspect of our business from production to accounting. It’s a welloiled machine ready to scale with some fuel.

The industry’s dynamics have changed over the past five or so years. How has that affected Sunderstorm’s business model?

Five years ago I was expecting the overheated market to begin slowing, and that would drive poor operators out of business. COVID-19 changed the dynamic overnight and propped up the industry for two years.

Since then, we have seen the confluence of the costs of overregulation, raw material cost increases, market decline, new entrants using low-price strategies as a wedge to drive out industry veterans, and the dearth of capital. We have also seen the hemp boom. Together, they have created an intense environment for operators in mature markets. We have had to be extra-cautious in how we handle our business and fiercely attentive to every nuance. We have certainly been surprised by the degree of the intensity, but it’s made us even stronger in our commitment to perform well and win. It’s also made us even more sensitive to controlling our own destiny as much as we can. We have a great team that is committed to our corporate objectives. I am proud to lead them and grow KANHA as a global brand.

How will rescheduling change the industry?

It’s very difficult to build a brand without fluid access to markets. I’m hopeful rescheduling will grease the skids, but I think it’s too hard to make any predictions about how this situation will evolve. I’ve been telling everyone this industry can move in any direction at any time. We all need eyes in the back of our heads.

What are some of your strategic priorities moving forward—for both yourself as CEO and the company as a whole?

This year we launched our FX line of “smart gummies.” These are targeted to specific effects and are formulated by doctors. We have been planning this for many years, but we finally felt the industry was ready for functional products this year, and we’ve heard incredible feedback from our consumers, who want more. We will continue to add products that help consumers overcome conditions that impair their ability to live great lives.

I’ve also been working this year to improve how our team communicates, shares knowledge, and acts on that knowledge. I am a firm believer that the complexities of this industry require us to absorb as much data and knowledge as possible—for both me and Sunderstorm. By doing these things, we can make good decisions and avoid pitfalls. We have certainly made costly mistakes in the past; it’s impossible not to in this industry. However, I know insight will help us avoid traps and improve our performance.

Despite the federal government’s stubborn refusal to declassify the plant and Congress’s ongoing reluctance to address common-sense measures like banking reform, the United States remains the world’s most lucrative cannabis market. With the launch of new adult-use programs in several states this year, some optimistic estimates project 2024 revenue could reach $50 billion; combined with hemp, professional prognosticators predict the market could be worth more than $100 billion.

According to analysts at BDSA, the U.S. accounted for about 56 percent of global cannabis revenues in 2023. Because of the country’s size and population (345 million), it’s unlikely any other single-country market will overtake the U.S. soon. Considered as a whole, though, Europe (population 745 million) certainly could. With federal-level legalization spreading across the continent like wildfire and mostly sensible tax and regulatory structures, Statista projects the European Union will generate $6.2 billion in revenue this year—and the region’s market is just getting started.

Unsurprisingly, Europe—especially Germany, where 84.5 million residents gained legal access to adult-use products in April—is a primary target for American and Canadian companies seeking new markets. North American operators read early indicators on the continent as positive signs for future growth.

BY SUE DEHNAM

“Probably the best analogy would be to say it’s the U.S. circa 2014 or 2015,” said NewLake Capital Partners founder and Chief Executive Officer Anthony Coniglio, whose company is investigating opportunities in the region.

“It’s still very much the early innings there, and there are significant catalysts that are different from what we see in the U.S. For example, where [cannabis is] legal, it’s legal. There’s no piecemeal regulation like in the U.S., where some states are medical and others are recreational.”

That is not to say Europe has thrown the doors wide open for cannabis. It hasn’t. Many countries on the continent have legalized medicinal sales but remain cautious about authorizing recreational commerce. In fact, although a growing number of countries worldwide have decriminalized the plant, only a relative handful have legalized recreational use. Still fewer have established regulatory structures for recreational sales. Austria, the Czech Republic, and Greece reportedly have commercial recreational programs under consideration but have not announced official plans.

Much of the world now embraces cannabis as medicine, but regulations vary widely. Some countries allow only flower, some only vapes, and others permit only tinctures, oils, and capsules; some require a physician’s prescription and dispensing is permitted only by pharmacies.

“Every U.S. state has its own regulations, but at their core they’re fundamentally similar,” said Wana Brands President Joe Hodas, whose company recently entered the Swiss market. “I think Europe is considering the U.S. model, but Australia is a prescription model. Product brands must have compounding pharmacy partners in some countries, but those pharmacies can package fully prepared gummies, which counts as compounding.”

According to Carma HoldCo co-founder and CEO Adam Wilkes, “The U.K. market also requires a prescription. Based on our reception there, we’re very optimistic about Australia.”

But Grove Bags Chief Marketing Officer Lance C. Lambert, who has attended almost every industry trade show in the

world at least once, offered a caveat. “Medical cannabis is legal in fifty-three countries around the world,” he said. “Their definition of medical is not necessarily our definition of medical. If a doctor prescribes a certain strain, that’s the only one the patient can get.”

Consumer preferences for product formats, flavors, strengths, cannabinoids, and terpenes vary by market, as well. Wilkes pointed out terpene profiles, strength selections, and strains “will be important in Australia.”

No matter how encouraging foreign markets may seem, none of them are the industry’s Shangri-La. Markets face similar stressors worldwide. For example, European online marketplace Bloomwell reported flower prices in Germany fell by as much as half after the country legalized adult-use sales. Overseas markets experience familiar growing pains, too.

Prohibition Partners reported German regulators received 226 social club applications in July, representing an increase of 250 percent over the previous month. Licensing lags, however, with only eight social clubs approved in a single German state by mid-August. Prohibition Partners blamed “growing frustration among aspiring clubs” on “complex bureaucracy and the absence of a clear regulatory framework.”

Tax structures in some international markets can seem convoluted and, in countries like Australia, taxes may be even more aggressive than they are in the U.S.

Energy, labor, and raw materials costs also vary widely, making location choices complex even though robust importation and exportation policies exist. According to Lambert, domiciliary requirements in some countries can stymie even the largest, most well-funded operators. That’s why many North American companies prefer partnerships, licensing agreements, and franchise-like relationships to owning operations in most international markets. He cited Germany as a prime example.

“Regulation and the way the market is set up in Germany makes it attractive to establish a corporate presence there,” he said. “But the Germans are pretty strict about personnel.

Companies need a physical presence, and they must pay VAT [value-added tax] not only on goods and services but also on employment.”

Establishing a foreign presence “can be a little scary and a little intimidating and expensive at the same time, and sometimes the red tape is just too much,” he added. “Companies experience delays because the rules change. It’s not uncommon for a non-plant-touching company to take a year to make a small deal.”

Sociocultural idiosyncrasies can limit international opportunities, as well, according to Coniglio.

“The people I’ve met who are looking to operate in Germany are German; in the [United Kingdom], they’re British,” he said. “You need to have people from that country on the front line. Local people are well positioned, as opposed to Americans stepping in and trying to navigate the regulatory structures.”

But the biggest hurdle for American operators seeking international opportunities isn’t regulations or cost factors or adapting to market preferences. Instead, most companies may find it uncommonly onerous to comply with manufacturing standards that far exceed what the strictest U.S. state currently requires.

“U.S. operators are accustomed to adapting to regulatory structures,” Coniglio said. “That doesn’t faze them. The biggest hurdle will be adapting to EU GMP [Good Manufacturing Practices] protocols.”

Lambert agreed. “You can’t just be all cocky and confident and extreme capitalist,” he said. “You have to meet the country’s standards. If you’re going to operate in Europe, you have to meet EU GMP— even if you’re a packaging company or equipment manufacturer.

“My best advice? Do your homework,” he added. “You really need to do your due diligence. You may have to do a lot of reverse engineering. Is your core client the same internationally? Make sure the market contains the right customer. And choose the best path: Is it better to partner with someone, or do you want to take the leap and spend tens of

thousands of dollars to incorporate overseas? It takes lots of time and money to establish residency in other countries.”

Despite the hurdles, adjustments to business processes and relationships, and regulatory rigor, American companies that have made an intercontinental leap report finding a warm welcome in most markets. Even better, they’re finding unexpected pathways to potential profitability.

Germany may be the buzziest European market right now, but Wana Brands’ Hodas isn’t convinced the country will live up to expectations—at least not right away.

“When you look at international markets, you have to look at what is viable,” he said. “The U.K., the Netherlands, Germany, Australia—the path to market in those countries is not simple. You have to look at opportunity cost. Does it make sense to explore these countries?

“Everyone’s excited about Germany, but [Germany hasn’t] created a pathway for edibles,” he continued. “So, it’s potentially a country that does very well down the road, but that’s not the case right now.”

In fact, he noted, most countries outside the U.S., Canada, and a handful of others aren’t sure they want to include edibles in their legal markets.That’s something of a stumbling block for Wana, which manufactures exclusively edibles— gummies, to be exact, and a lot of them. According to founder Nancy Whiteman, the company annually produces nearly 100 million of the infused treats through extensive licensing agreements in Canada and the U.S.

“I don’t think people really understand edibles in Europe yet,” Hodas said. “For one thing, I think the overarching perspective is ‘What about the kids? Don’t kids like candy?’” However, he added, like their counterparts in the U.S. (where 15–20 percent of legal sales are edibles), European regulators are overlooking a fact proved all too often in more mature markets: “If you don’t provide edibles in a legal, regulated, taxed market, people will just get them on the illicit market.”

Hodas also believes banning edibles in medicinal markets— which probably will compose the majority of the international scene for a while longer, he predicted—is counterproductive.

“If you take edibles out of the mix, your choices are tinctures, flower, vapes, and concentrates,” he said. “Inhaling smoke is not great for health, and some patients can’t do it. Medical patients will get far greater benefit from edibles than from smoking. And consumers are used to consuming medical products [and dietary aids] in edible formats.”

So, when the Wana team decided to take the European plunge, they focused on Switzerland, a country with one-tenth Germany’s population but much more opportunity for an edibles brand that offers both medicinal and adult-use products. The country has had a functioning medical program since 2022 and is in the midst of an adult-use pilot program that employs pharmacies, social clubs, and nonprofit retail outlets in all major cities as distribution channels. Outlets are limited to 5,000 participants each, and brands must apply to be part of the trial, Hodas said. Beyond that and some strict testing requirements, though, the program is among Europe’s most progressive and accessible adult-use frameworks, allowing for any product format as long as manufacturers and distribution points follow the rules.

In March, Wana became the first American edibles brand to formally enter the European market when it partnered with Swiss company Alpen Group to manufacture and distribute gummies in Switzerland. Hodas said the partners hope to have products in the marketplace by the end of the third quarter.

“Switzerland is a sleeper market,” he said. “Two things are going to occur: Ultimately, the Swiss will use these pilot programs to establish full legalization, and other countries will watch what happens and design their programs accordingly. They’ll be looking at whether the Swiss program works as a whole and, if so, what works best?”

Despite his confidence in the Swiss experiment, Hodas is a realist. As an industry veteran of ten years, he’s seen projects

fizzle, companies disappear, and markets collapse. His advice to others considering international expansion?

“Be aware Europe is a long-term play,” he said. “You won’t start making money tomorrow.”

Carma HoldCo, parent company of Tyson 2.0, has been extraordinarily busy establishing international partnerships. Since launching in Canada in 2022, the company has entered five additional regulated international markets including, most recently, the U.K. and Germany. CEO Wilkes expects Tyson 2.0 to be available in Jamaica and Puerto Rico (not technically an international market since it’s a U.S. territory) in September and Australia later this year.

Wilkes attributes the company’s brisk pace primarily to three things: his background in fast-food franchising, Mike Tyson’s international celebrity, and a wealth of accessory merchandise that is sold in unregulated markets worldwide. The hard goods, which are available in brick-and-mortar locations in sixteen countries as well as online, promote name and product recognition, Wilkes said, almost like a sales team on the ground even before legalization.

In addition to working with what he described as a network of “cultivators, manufacturers, and distributors all over the world,” the company also has a powerhouse partner already embedded in multiple markets: PHCANN International, a multinational pharmaceutical company headquartered in Amsterdam. Much of Carma’s international-markets flower is grown in PHCANN’S EU-GMP-certified indoor cultivation facility in North Macedonia. With an annual capacity of fifteen tons of dried flower, the facility exports to Germany, the U.K., Israel, and Australia.

Though Carma’s rapid expansion might suggest otherwise, Wilkes said challenges abound when “going international.” Regulations vary from country to country, supply-chain

issues can arise without warning, and standing out as a brand while adjusting to local cultures requires more than a little finesse. So does maintaining the brand’s storied authenticity and holding partners accountable. Additionally, providing marketing and operational support to so many disparate entities demands constant effort, as does keeping track of which markets allow which product formats.

One of the biggest challenges, Wilkes said, is vetting “wellqualified cultivators, manufacturers, and distributors all over the globe.” The Carma team evaluates potential partners based on a laundry list of characteristics including staying power, capital position, knowledge of applicable regulations, a functioning supply chain, and a following in the local culture.

“We’re pretty anal with who we bring in,” he said. “Obviously, in this space you need to do your own due diligence.”

Another super-sized challenge, according to Wilkes: “You’ve got to be able to adapt. What works here in the U.S. may not work somewhere else. For example, pre-rolls are one of our top products, but we can’t offer them in every market. Ingredients may be a problem in some markets. Shapes can be a problem: Some markets won’t allow ears.”

Mike Bites, one of the company’s most popular edibles, are gummies in the shape of a bitten ear—a tongue-in-cheek reference to the notorious title fight in which Tyson bit off a piece of his opponent’s ear … and promptly lost his boxing license. (The license eventually was restored.)

Despite what sometimes seems like endless travel and detail work, Wilkes said he’s never felt more energized.

“We could not believe how welcoming the U.K. community has been,” he said. “Pharmacies are ordering twice what we anticipated. Germany’s been great, too. I’m excited about Australia. We already have non-regulated products there, but we’re holding off the regulated launch to focus on the demand we currently have in the U.K. and Germany.

“There’s obviously some challenges, but it’s exciting at the same time,” he added. “I couldn’t be more excited about all the

opportunities. We’re extremely excited about the potential for cannabis as an industry on a global scale.”

His advice for others considering international expansion?

“Anybody going international needs to understand the regulated market landscape, find the right local partnerships, adapt, innovate, and build a strong, authentic brand consumers can connect with and relate to,” he said. “It’s not easy pushing into international markets, so just buckle up and enjoy the ride. It’s a challenge, but it’s a fun one. It’s keeping us on our toes.”

Sunderstorm co-founder and CEO Cameron Clarke is keeping an eye on Europe, but his main focus is farther east—in Thailand, to be precise, where in May his company became the first American firm to launch a manufacturing-and-distribution operation for medicinal products formulated for Asian markets. In partnership with one of Thailand’s first licensed cultivators, distributors, and retailers, the facility makes and ships KANHA-branded products to more than 100 Thai stores so far. Beginning in the fourth quarter of this year, the facility will manufacture and export two additional lines to Japan.

The status of recreational use is in flux in Thailand after a political shakeup earlier this year during which the government threatened to reclassify cannabis as a prohibited narcotic. That’s not a big concern for Clarke; he’s more interested in medicinal markets anyway, at least for now. Asia, which has employed plant medicine for centuries, represents a vast, untapped market for regulated cannabis, he believes.

“Belief in plant medicine is very strong in Thailand,” he said, adding that a large medical tourism market also bodes well for the cannabis trade in the country. In fact, he said, one of the most exciting aspects of the Thai market is the opportunity to develop wellness centers for global plant-medicine tourism. His company is taking part in one such effort that should debut this year.

Thailand also provides an environment conducive to profitability for the industry, Clarke said.

“Production and labor costs are low,” he said. “Thailand has a fantastic history of exporting pharmaceutical and nutraceutical products all over the world; they just needed to establish the regulatory framework for cannabis. They did that, and they’ve invested hundreds of millions of dollars into cannabis infrastructure to date. Now, they’re ready to export globally.”

Unlike other American companies that employ partnerships, licensing, or franchise-like models for their international operations, Sunderstorm prefers to partner on licensing, facility development, and distribution but maintain complete control of manufacturing.

“We manufacture, ourselves, in every location,” Clarke said. “We hire local people to support the local economy, then we train them and manage them. There’s a big cost in resources and finances to drive our business in this way,” but the system allows Sunderstorm to control intellectual property like formulations and recipes and ensures product consistency “from Bangkok to Boston.”

Clarke and his crew plan to begin exporting from Thailand to Europe during the first quarter of 2025. They also have designs on Australia and are watching as the plant’s legal status evolves in the Philippines.

“I’m hopeful about that one,” Clarke said. His advice to others considering international expansion is simple, yet profound.

“Recognize the global market is a very medical market, and it’s highly regulated,” he said. “It’s much more of a wellness story than a recreational story. In the end, that’s the best way for us to drive interest in the industry from consumers all over the world: We need to get back to our roots with this powerful plant medicine.

“The plant connects us,” he added. “The whole experience is cannabis wellness. To me, that’s what the global market is all about.”

Coniglio’s company doesn’t touch the plant. In fact, NewLake Capital Partners doesn’t touch products of any kind. The company is a real estate investment trust that acquires industrial and retail properties and then leases them to clients including Curaleaf, C3 Industries, and Calypso Enterprises. NewLake’s interest in international markets currently centers on Europe, where Coniglio and his team are “exploring potential opportunities.”

His study of the European environment has focused more on the sociocultural and financial differences between the North American and European industries, leaving him fascinated with what he called “macro dynamics” in the latter region.

Some of those dynamics may give European markets an advantage on the world stage, Coniglio said.

For example, “What keeps me up at night is [Food and Drug Administration] regulation and oversight [of the U.S. industry] that many in the industry today won’t be able to adapt to,” he said. “In order to exist going forward, U.S. businesses will have to adopt operating procedures more like those in Europe. European operators tend to look more like pharmaceutical companies than the average U.S. operator [does].

“The FDA [eventually] will regulate this industry,” he continued. “Operators will have to adjust to the FDA. Since the FDA is used to dealing with pharma, this industry will have to adapt and behave more like pharma.”

The pharmaceutical-like nature of industry operations in European nations isn’t just regulatory gamesmanship. From the start, stakeholders there set out to establish cannabis as legitimate medicine for some very good economic reasons.

“The more socialized nature of their medical reimbursement structures in Europe means you may find a more robust medical reimbursement system in the near term than you do in the U.S.,” Coniglio said. “France [which approved an extremely limited medical program this year after a threeyear pilot trial] is one example. If France decides to legalize

medical cannabis, speculation is that the government will reimburse for treatment.” In addition, he noted, in July the German Federal Joint Committee proposed allowing doctors to prescribe cannabis without reimbursement pre-approval from insurance companies.

“Markets may grow very, very rapidly because of the reimbursement system,” Coniglio said. “With reimbursement for medical products, there may be less competition from the illicit market because price pressure for the consumer won’t be an issue.”

Despite the differences between markets, operators worldwide can’t find enough of one essential resource: money. And that’s why NewLake is investigating markets beyond North America.

“Because cannabis is legal in [much of] Europe, operators should have access to the regular capital markets,” Coniglio said. “However, that’s not really what I heard when I was there. People complain about an inability to get mortgages and capital because of the type of business they’re in.”

Consequently, “many Europeans are looking for American partnerships—more for capital than expertise,” he continued.

“Europeans know how to manage European markets and rules, but they need more capital and knowledge. Europe is eight to ten years behind [the U.S.], but they can learn a lot from how the U.S. industry has scaled up.”

Coniglio believes the European market definitely bears exploration, particularly by cultivators. Since borders are legally porous, cultivators can locate where the climate, resource costs, and labor are propitious and export to anywhere they can find buyers. And, as it is in the U.S., flower is king on the continent—but unlike in some parts of the U.S., supply has not yet outpaced demand.

He offered one big caveat, though.

“Europe is not going to be your savior,” he warned. “It’s not going to be this growth engine. Make sure your house is in order before you head over there and before you go trying to manage a business that is a six- to eight-hour or more plane ride away and four to six time zones away. Make sure your core business is performing the way you want it to perform.

“Entering a new market is always harder than you think and takes longer than you think,” he added. “You have to earn the right to enter by being on a solid financial foundation.” .

Cannabis prohibition in the United States has impacted people and the plant in a number of counterproductive ways—among them, the persistence of myths about cultivation. Because research into agricultural best practices has been limited and cultivators worked in the shadows to avoid prosecution, farmers learned how to grow the plant primarily by word of mouth. Though lore is a powerful way to perpetuate cultures, it also can turn minor miscommunications into enduring fables.

Although there is some truth to certain old wives’ tales like harvesting at night when the temperatures are cooler will protect volatile terpenes, many of the surviving fables are far from accepted as fact in 2024.