For The Cannabis PROFESSIONAL

For The Cannabis PROFESSIONAL

Enhance cannabinoids, terpenoids, and yields at an unbeatable price with cutting-edge water-soluble powders.

The ONLY 3-part water-soluble powder that hits the vital, phase-specific shift of your cannabis so it can reach its true genetic potential

Complete nutrition with enhanced triple chelation of iron, manganese, zinc, magnesium, and sulfur for increased cannabinoids and terpenoids and superior yields

A seamless and hassle-free transition from any other 3-part powder

Highly soluble nutrients optimize plant absorption, fostering robust growth and maximizing crop yields

With 14 inputs, our plant nutrition is more comprehensive than competitors with 5-8 inputs. Coupled with 8th-generation chelation technology, growers often report better results at 2.5 EC compared to the 3.0 EC they were previously running with other brands

No dyes, 100% mineral inputs

Accessible nutrients: The zip-top closure simplifies access and storage of your nutrients

Triple-layer protection: Each bag is equipped with triple-layer protection, featuring three durable material layers that safeguard nutrients from moisture, light exposure, and pests, with the middle mylar layer—an effective metalized polyester—specifically designed to preserve freshness

Increased cannabinoid and terpene levels

Heavier yields

Faster nutrient absorption

Optimized plant growth and development

Increased nutrient utilization

LEARN MORE

Introducing HIGH TEK’S MINI WEIGHER: Cannabis automation that truly works! Achieve 0.01g Load Cell accuracy with our advanced technology.

Dispense up to 60 per minute of your 1g and 3.5g Target Weights effortlessly. Our HIGH TEK MINI WEIGHER comes equipped with Our Kief Screen, LED Light Kit, and a Diverting Collection Weight Check Reject Bucket.

With over 20 years of experience in manufacturing and sales of custom, automated weighing, and packaging equipment, HIGH TEK USA is your reliable partner. Contact us for a demonstration.

News, data, trends, forecasts, and other tidbits for the well-informed professional.

HUMAN RESOURCES

Eric Rosen predicts what 2024 may have in store for hiring and team-building.

RETAILING

Flora relied on community input to bring creativity and adventure to Michigan.

MARKETING

As the market and consumers evolve, so too must the reigning champ of marketing communication.

With rescheduling and several pieces of bipartisan legislation on the table, advocates, politicians, and industry insiders are bullish on reform in 2024.

PRODUCTS

Start the new year by tempting shoppers with a dozen new products.

COMMUNICATION

When the going gets tough, the savvy up their marketing game.

RETAILING

Union Square Travel Agency invites customers to embark on a journey of exploration.

OPERATIONS

The interplay between the industry and commercial real estate is shaping both sectors.

Dotan Y. Melech believes a lack of transparency is harming the investment climate.

TECHNOLOGY

Combining artificial intelligence with the human touch can create retail magic.

Experts weigh in on how a post-280E industry might evolve.

Although often linked in job titles, company divisions, and corporate reports, sales and marketing are related, but not identical, concepts. Ultimately, the two have the same goal—to sell more products to more people more often—but how they accomplish this goal is quite different.

This is important, so pay attention: Sales is the act of converting products or services into revenue. Marketing, on the other hand, creates relationships and desire. Sales is commoditydriven and always involves a call to action. (Think “Buy now!” or “$30 off this week only!”)

Marketing transforms commodities into brands and brands into icons. Instead of presenting the product or service to consumers, marketing brings consumers to the product by creating powerful emotional connections.

In practice, the differences may seem subtle. Consider Amazon’s approach. The company does a lot of selling. Its ads are ubiquitous online and easy to spot, typically following a prescribed formula that resembles products’ listing pages on the etail giant’s website. The company is relentless in emailing users who haven’t purchased anything in a while, inviting them to check out similar products or other item types they might enjoy based on past purchases. Both of those are sales tactics, and they compose the majority of Amazon’s consumer outreach. KFC uses similar techniques.

Now consider companies like Apple and McDonald’s. When was the last time either of them presented you with a direct exhortation to buy something? Instead, both are heavily invested in marketing a lifestyle or experience. They and Amazon use the same methods—advertising, media coverage, newsletters, social media—but the major focus is on how their products will make your life more fulfilling.

Procter & Gamble’s Charmin ads featuring a family of oddly colored, anthropomorphic bears are everywhere, seemingly determined to destigmatize bathroom habits. The Walt Disney Company is a master at creating desire with its aspirational consumer outreach (which occasionally does attempt direct sales). All of these are examples of marketing.

Sales and marketing are equally vital to a company’s success, and both require hard work, especially in a highly regulated, extremely competitive environment like the cannabis industry. In this issue, the mg team attempts to provide some assistance on the marketing front to help start off the new year with a fresh perspective. Get creative, start something new, or upgrade something you’re already doing. And don’t forget to have fun along the way—because when marketers enjoy what they’re doing, the target of their efforts will, too.

Kathee Brewer Editorial Director

DAVID KOOI, CEO and cofounder at Jointly, is dedicated to transforming the way cannabis is experienced and understood. He champions the concept of purposeful consumption, leveraging datadriven insights to enhance both consumer and retailer experiences. With his expertise in data analytics and technology, he was instrumental in developing Jointly’s Spark, an AIdriven platform that personalizes cannabis consumption based on real user data.

JointlyBetter.com

As a client strategist at executive search firm ForceBrands, ERIC ROSEN is responsible for business development across the company’s cannabis and beverage/alcohol divisions. He helps clients achieve growth goals through strategic leadership hires, organizational design, and venture-capital support. Rosen possesses seventeen years of consulting experience with small-tomedium, mid-market, and Fortune 500 companies including Purple City Genetics, Dark Heart Nursery, Adobe, and Omnicron. ForceBrands.com

DOTAN Y. MELECH is CEO at CTrust, the first credit-scoring and credit-monitoring agency for cannabis businesses. Given the limitations created by federal prohibition, Melech has facilitated receivership, reorganization, and liquidation for many businesses that could have been candidates for Chapter 11 had they not been working in cannabis, including the first and largest receivership in the history of the industry.

CTrust.io

RACHEL GOLDMAN is an associate advisor for SVN Commercial Advisory Group. She blends real-estate knowledge and business management skills with real-world applications, drawing on her experience developing, manufacturing, and marketing several patents granted by the United States Patent and Trademark Office. Goldman believes evaluating properties carefully to determine strengths and weaknesses allows for maximum efficiency and profitability. SVN.com

Editorial Director KATHEE BREWER editorial@inc-media.com

Creative Director ANGELA DERASMO

Digital Editor JEFF HALE Copy Editor JULES ZUCKER

Contributing Writers Alyson Jaen, Andrew Kaye, Brian O’Connell, Casey Ly, Christopher Jones, Cy Scott, Danny Reed, David Kooi, David Paleschuck, Denise Rustning, Dotan Y. Melech, Eric Rosen, Gary Allen, Henry Baskerville Esq., Jason Vedadi, Jess Phillips, Kris Krane, Kary Radestock, Katie Ford, Kim Prince, Kyle Loucks, Kyle Sherman, Lance C. Lambert, Lara Fordis, Laura Bianchi Esq., Mark Clemons, Patrick Rea, Paul Penney, Rachel Gillette Esq., Rachel Goldman, Ricardo Baca, Robert Mira, Robert T. Hoban Esq., Ruth Rauls Esq., Sue Dehnam, Sondra Saporta Esq., Taylor Engle

Artists/Photographers Cover: Union Square Travel Agency; Levi Wells, Christine Bishop, Steve Hedberg, Mike Rosati, Manifesto Art, Master1305

Digital Strategist Dexter Nelson

Video Editor Rafsun Sazid

Circulation Manager Faith Roberts

ADVERTISING SALES & CLIENT SERVICES

Senior Account Executive

MURRAY PARK Murray@inc-media.com (424) 253-8099

BRANDI MESTA Brandi@inc-media.com (424) 253-8134

Account Managers CHRISTINA WRIGHT Christina@inc-media.com (323) 302-8430

BUSINESS OFFICES

Chief Executive Darren Roberts

Tech Architect Travis Abeyta

Accounting

Diane Sarmiento, Brittany Gambrell

Subscriptions subscribe.mgmagazine.com

Back Issues store.mgmagazine.com

Mailing Address

mg Magazine

23055 Sherman Way, Box 5069 West Hills, CA 91308 (310) 421-1860 hello@inc-media.com

MEG CASHEL Meg@inc-media.com (424) 246-8912

mg Magazine: For The Cannabis Professional Vol.10, No.1 (ISSN 2379-1659) is published monthly by Incunabulum LLC, located at 23055 Sherman Way, No. 5069, West Hills CA 91308. Periodicals Postage Paid at Las Vegas Post O ce and additional mailing locations. POSTMASTER: Send all UAA to CFS. NON-POSTAL AND MILITARY FACILITIES: Send address corrections to mg Magazine, 23055 Sherman Way, No. 5069, West Hills CA 91308.

mg is printed in the USA and all rights are reserved. © 2023 by Incunabulum LLC. mg considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur; consequently, readers using this information do so at their own risk. Each business opportunity and/or investment inherently contains criteria understanding that the publisher is not rendering legal or financial advice. Neither Incunabulum LLC nor its employees accept any responsibility whatsoever for contributors’ activities or content provided. All letters sent to mg Magazine will be treated as unconditionally assigned for publication, copyright purposes, and use in any publication or brochure and are subject to mg’s unrestricted right to edit and comment.

PORTLAND, Ore. – Prohibition may unintentionally promote the use of delta-8 THC in states without medical or adult-use cannabis laws, according to a new federally funded study published in the Journal of the American Medical Association.

Cannabinoids synthesized from hemp have not-so-quietly moved from the shadows into a glaring multibillion-dollar market, but their safety and legal status have raised serious concerns within the federal government.

The research team, led by Adie Rae Wilson-Poe, PhD, set out to study the use of “emerging cannabinoids” CBD, delta-8 THC, CBG, and CBN among American adults across regulated and unregulated markets. According to the researchers, it’s the first study of past-year use for CBN, delta-8 THC, and CBG.

Race appears to play a significant role in CBD, delta-8 THC, CBG, and CBN consumption, with use reported by non-Hispanic Whites at 61.8 percent. Use among the other reported demographics, including Hispanic, non-Hispanic Black, and “other,” failed to reach 20 percent. The least-educated and lowest-income participants reported the highest levels of use across all demographics. More than 25 percent of the study’s participants reported using marijuana in the past year.

Key findings included:

• CBD was the most popular among the four cannabinoids reviewed, with 21 percent of participants reporting past-year use.

• CBD use has increased by 50 percent since 2019, when Gallup reported use at 14 percent.

• Nearly 72 percent of participants had heard of CBD.

• Delta-8 was the second-most popular, with nearly 12 percent reporting past-year use.

• More than 41 percent of participants had heard of delta-8.

• CBG and CBN use trailed at 5.2 percent and 4.4 percent, respectively.

• More than 18 percent and 16 percent of participants had heard of CBG and CBN, respectively.

• Delta-8 use was highest in states/areas where marijuana has not been legalized.

“Based on these results, we support ongoing public health surveillance efforts targeting emerging cannabinoids because of lack of industry standards to protect consumers and similar pharmacology or effects of delta-9 THC and its hemp-derived impairing analogues (e.g., delta-8 THC), which may be of particular concern for adolescents and young adults,” the researchers wrote. “Our results highlight the importance of future research to better understand perceptions of safety, motivations for use, and outcomes of use of these products.”

Findings were taken from a sample of 1,142 study participants representative of the adult population. The median age for the study was forty-eight, with slightly higher female representation at 51.7 percent.

Shoppers cite these reasons for returning to brands again and again.

33% affordability

33% product quality or brand trust

Glass House Brands Inc. closed a non-brokered private placement of preferred stock in its subsidiary GH Group Inc. With a face value of $1,000 per share, the offering represented about $4.1 million in new capital. Shares will pay an annual cash dividend of 15 percent for the first five years and 20 percent annually thereafter.

Curaleaf Holdings Inc. delisted from the Canadian Securities Exchange at the close of trading December 13 and began trading on the Toronto Stock Exchange under the ticker symbol CURA the following day. Shares gained about 1.5 percent on the first day of trading. The company’s market cap in mid-December was $25 billion.

8

service

CV Sciences acquired Polish vegan foods producer Cultured Foods in a cash-and-stock transaction valued up to $535,000. The move provides CV Sciences a pathway into fifteen European countries for its +PlusCBD products. The company also plans to introduce Cultured Foods’ products to the United States.

Chicago-based dispensary search and analytics firm CannMenus acquired Canadian data firm Nugget Data for an undisclosed amount. Former Nugget Chief Executive Officer Darcy McQuaid will serve as chief revenue officer of the combined operation, which now provides real-time retail data and search capabilities in both countries.

(SOURCE:

WASHINGTON – Citing “imminent hazard to public safety,” the Drug Enforcement Administration temporarily placed six synthetic cannabinoids on Schedule I under the Controlled Substances Act, the most restrictive classification reserved for drugs that have no accepted medical use and are subject to abuse. The initial classification period lasts through December 12, 2025, but may be extended or made permanent after further review, the agency said.

According to the DEA, the substances—MDMB4en-PINACA, 4F-MDMBBUTICA, ADB-4en-PINACA, CUMYL-PEGACLONE, 5F-EDMB-PICA, and MMBFUBICA—mimic the biological effects of delta-9 THC, the

main psychoactive ingredient in cannabis. They typically “originate from foreign sources, such as China,” the agency’s notice in the Federal Register states. “Substances in bulk powder form are smuggled via common carrier into the United States and find their way to clandestine designer drug product manufacturing operations located in residential neighborhoods, garages, warehouses, and other similar destinations throughout the country.

“According to online discussion boards and law enforcement encounters, spraying or mixing the [synthetic cannabinoids] with plant material provides a vehicle for the most common route of administration—smoking (using a pipe, a water pipe, or rolling

the drug-laced plant material in cigarette papers),” the DEA’s notice continued.

The powdered substances often take a circuitous route through Europe, New Zealand, or Australia before appearing in the U.S., the DEA noted. Products incorporating the nowbanned synthetic cannabinoids are marketed as a “legal high” or “legal alternative to marijuana” and are “readily available” online and in gas stations, convenience stores, and tobacco and head shops, according to the agency. Three of them—MDMB-4en-PINACA, 4F-MDMB-BUTICA, and CUMYL-PEGACLONE— sometimes are mixed with illegal hard drugs including heroin, fentanyl, and methamphetamine.

The American Association of Poison Control Centers (AAPCC) reported the six synthetic cannabinoids can produce “severe, life-threatening health effects, including severe agitation and anxiety, nausea, vomiting, seizures, and hallucinations.” MDMB-4enPINACA has been responsible for nearly 10,000 poison-control emergencies since 2019.

“Emergency department presentations involving MDMB4en-PINACA or CUMYLPEGACLONE have included seizures, sudden collapse, involuntary muscle spasms, jerking movements, catatonia, or increased violence,” the DEA’s notice states. “Multiple deaths have been reported involving MDMB-4enPINACA, 4F-MDMB-BUTICA, and CUMYL-PEGACLONE.”

Historical data from the past three years indicates a decrease in prices across all products, with ower decreasing in price the most.

is shift in consumer preference and market trends is worth considering when strategizing for the new year.

Recommendations:

Increase and diversify your concentrates o erings and use these products in your loyalty programs and promotions throughout the year.

THE INDUSTRY'S CONTINUING EVOLUTION WILL IMPACT LABOR RELATIONS, COMPENSATION, AND EMPLOYEE BENEFITS.

The human resources trends set to dominate 2024 are certain to disrupt the industry, mostly for the better. This year will be prosperous as multistate brands continue to expand into other states, but there will be challenges. One major inflection point will relate to rescheduling, with cannabis likely to shift from Schedule I to Schedule III. On the competition front, the biggest curveball will be the hempderived THC market, which offers a massive loophole for selling products outside dispensaries and without interstate constraints. While rescheduling isn’t a complete win at the level of descheduling altogether, the move is a solid indicator the industry is moving in a positive direction. With the change from Schedule I to Schedule III, which may be approved as early as mid-year, we will see monumental shifts in taxes as cannabis brands finally become able to deduct business expenses like traditional companies do by accessing write-off disallowed under Internal Revenue Code

THE TRENDS THAT WILL DOMINATE THIS YEAR ARE CERTAIN TO DISRUPT THE INDUSTRY, MOSTLY FOR THE BETTER.

Section 280E. Beyond the financial benefits, research implications are enormous: Scientists finally will be able to lean into research at all levels. What remains to be seen is the impact on banking relationships and investment.

Brand-building will be enormous in 2024. Flower brands already compete with hemp-derived THC products from a substitutable-goods perspective. In other words, the average new consumer might opt for convenience and familiarity in a bodega rather than visit a dispensary for the first time. Connoisseurs, purists, and regular consumers may take issue with this—and for good reason—but nothing will contribute more to the true normalization of cannabis than hemp-derived-THC-infused beverages sitting on shelves next to Pepsi and Coca-Cola products. Savvy infused-beverage and edibles brands will continue to pivot toward the hemp-derived THC market opportunity while preserving their hard-earned market share in the dispensary market.

Will 2024 see the emergence of true household brand names in cannabis? Possibly. We’ll continue to see an increase in licensing agreements from established brands in new states. The companies with the highest growth potential in this new industry are the ones operating under the strategic assumption that federal legalization is never going to happen. These organizations are setting up their business models, teams, and dynamics accordingly. With rescheduling, we likely will see more cannabis businesses with structures that resemble traditional companies.

So what does that mean from a talent perspective?

One major talent-related trend is the rise of multistate brands, which will continue to consolidate and leverage vertical integration where possible to improve margins. And with the rescheduling of cannabis to Schedule III, we’re likely to see more visible involvement from mainstream consumer companies and pharmaceutical brands, which will accelerate talent demand across job functions.

The influx of talent from more traditional consumer sectors means compensation will have to keep pace. Talent competition has never been higher. When it comes to salaries, the industry is lucrative for employees, especially those in leadership roles. According to ForceBrands’ 2024 Cannabis Salary Report, chief executive officers at the largest companies by revenue earn annual salaries that top $416,000—almost ten times what mid-level managers in the industry make. Though not quite as highly compensated, presidents, chief revenue officers, and chief marketing officers are among the highestpaid positions.

Cannabis brands must reorient their thinking about fair market compensation at the leadership level. More junior roles have aligned with fair market compensation in recent years, but employers that catch up to mainstream compensation ranges will be the ones most likely to succeed in the next three to five years as competition continues to reach new heights.

This year will prove to be a dynamic one for the industry. Sweeping reforms like rescheduling and potential relief via 280E’s recision will

NOTHING WILL CONTRIBUTE MORE TO THE TRUE NORMALIZATION OF CANNABIS THAN HEMP-DERIVED-THC-INFUSED BEVERAGES SITTING ON SHELVES NEXT TO PEPSI AND COCA-COLA PRODUCTS.

bring about changes that will impact the industry and influence how companies chart their growth strategies.

Brands are hiring seasoned and elevated talent that can maximize reward and minimize risk depending on how the market unfolds. While 2024 has the potential to be prosperous, it undoubtedly will be another nail-biting year with a few added market forces at play. Companies will need to plan accordingly and hire not just seasoned external talent but also talent with the ability to pivot in real time.

All these nuances will present opportunities for particularly adaptable leaders. Building teams and hiring for multiple possible outcomes will be more important than ever as the industry enters this exciting new chapter of growth.

After a decade of finding their feet amidst intense brand competition and strict regulatory oversight, Michigan’s dispensaries are beginning to see a return to the familiar: forging wellness-centric community connections that center on the plant and its benefits. During the legal market’s infancy, some opportunistic brands prioritized revenue at the expense of developing community, but today’s licensed operators are more in tune with the movement’s origins and are focused on building hyper-local relationships.

Flora is among the leaders in the effort. With a choose-your-own-adventure retail journey gently guided by budtenders the store calls “florists,” a next-door coffee shop and cafe that inspires visitors to stay for a while, and neighborhood input through every step of the design and development process, Flora considers itself a dispensary for the people of East Lansing by the people of East Lansing. It’s a place where seasoned consumers and first-timers come together to explore new products, learn about the plant, and settle into a community of like-minded partakers who prefer to shop locally.

Founder Thadd Gormas and Director Ahvi Aungst intended from the beginning to create a space that fit East Lansing’s legacy atmosphere. As one of the denser Michigan regions when it comes to industry representation, Flora faced a healthy amount of competition.

“There’s been a lot of consolidation in the Michigan market recently,” Gormas said. “We’re seeing a lot of local brands buying up smaller shops and then conforming to a more streamlined approach. We didn’t see that happening in this community, so we decided to stay aligned with a vision that focuses on art and culture as we try to define a space that captures our love and passion for cannabis.”

Gormas, Aungst, and their team asked themselves, “How do we bring cannabis and artists together?” The answer, they decided, was to make the location approachable enough to feel like a community gathering place. Instead of a storefront-only approach, the Flora team developed a whole plaza of related businsses, including a dispensary with a drive-thru lane. The result reflects relaxed creativity that inspires locals and visitors alike to come in and take a load off.

“We’ve put years into building this experience, asking the community what they needed to feel at home,” Aungst said. “Flora is really tailored to that feedback. Every person who comes into our store feels like they’re part of a community, and that’s exactly how they’re welcomed by us.

“I think that’s why Flora has been embraced by the neighborhood,” she continued. “It’s been a great place for people to learn about new ways to use cannabis and feel comfortable asking those questions that go beyond the standard indica versus sativa. At the end of the day, our mantra needs to stand true: Relax, energize, clarity, and balance. We aim to make it easy for consumers to pick a vibe that is right for their next adventure.”

The location opened on 4/20 last year with an all-day party complete with popular Detroit DJs. Consumers were invited to check out the goddessthemed space as they perused products from local boutique brands, participated in education and networking opportunities, and learned more about the store.

“Flora is really focused on being a place where you can come in and safely ask questions,” Aungst said. “We make sure every person who walks in is having a meaningful interaction with one of our florists, and we make sure to create unique experiences that help people figure out what they’re looking for.”

A journey through Flora is an interactionheavy experience. The team off ers consumers educational games that may result in special perks, the drive-thru features an exclusive menu, and local vendors and brands regularly collaborate with the shop to provide deals, discounts, and resources.

“Our experiences and adventures are big hits,” Gormas said. “It’s a fun way for people to get to know new products, and it hits to the core of our approach: being a safe space for everyone who is part of the community, whether or not you have previous cannabis experience.

“The drive-thru is another example of how we listen to our community,” he continued. “We spent three years in discussion before we started building, and even after that, we kept listening. Opening post-pandemic, we realized a lot of people still weren’t ready to get out of their car and go inside. So to meet them where they were, we tore out some concrete, ripped a hole in the side of the building, and took a whole new approach. Now, consumers are able to

drive up to a screen, talk to a person, and look through a streamlined menu of our products.”

Flora has seen 25 percent of its consumers opt for the drive-thru over walking into the store, and the team expects the number to grow. Thankfully, this projected growth was factored into the design by SevenPoint Interiors when the design-build firm took on the project.

“When we met with the Flora team for the first time, we quickly realized they wanted the store to be an immersive experience for consumers,” said Desmond Chan, creative director at SevenPoint Interiors. “They wanted people to be able to visit the coff ee shop and cafe, take advantage of the drive-thru, and have a clear view into the team’s grow space, which is next door to the dispensary.

“We installed large windows so consumers can enjoy transparency into the operations side of things, some fun floral installations, dreamy wallpaper, and modular waiting areas,” he continued. “We wanted to create this cheeky, disruptive, countercultural influence. The customer journey is super-important, so we installed express checkout stations for quick orders and made sure the drive-thru was built in the right location to be able to service the frontof-house, receive deliveries from the back, and service the drive-thru seamlessly.”

Not only was SevenPoint Interiors thorough when considering the customer journey, but the team also played a major role in defining Flora’s atmosphere and providing the dispensary with the branding that has helped cement the store as an East Lansing staple.

“When we signed on with Flora, we learned the meaning behind the brand’s name: the goddess of flowers,” said SevenPoint Head of Design Randy Simmen. “That immediately painted a really nice picture for us to get started. We leaned into flower as a means to empower women with beauty, harmony, and trust.”

Based on directions from the Flora team, Simmen and Chan selected brand colors, materials, and an overall aesthetic that resulted in a thorough mood board for the dispensary’s team to consider.

“Their color references were pretty solid,” Simmen said. “They knew they wanted earthy tones like terracotta, sage, turmeric, and dark evergreen. They were also pretty clear on

what didn’t inspire them. They didn’t want to be ultra-modern—no sharp edges or dark atmospheres. They wanted to create an elevated experience centering on this concept of flower as goddess.”

The collaboration was a success, and the designs were a tangible answer to the East Lansing community’s requests.

“From day one, we knew SevenPoint had vast experience and we’d learn a lot from them,” Gormas said. “We visited another store they’d designed and one of our partners said, ‘We don’t really like that store, so why would we want to go with this team?’ Another partner responded, ‘Because they designed exactly what those owners wanted.’ That was our ‘Aha!’ moment. We saw [SevenPoint wasn’t] trying to push us in any direction. They were trying to understand what makes us unique, which is exactly how we approached our community in the first place.”

The Flora team plans to keep listening to their neighbors when it comes to additions to their space. They’re in the process of creating a yoga event that will help people understand how to access a more balanced lifestyle beyond buying cannabis. They’ve also been inviting more local artists to exhibit in the store. But the team makes sure to keep one goal at the top of their minds.

“No matter what direction we go in, we always want to stay true to our roots,” Aungst said. “A memorable moment for me was when a customer came in who wasn’t used to consuming THC. Our florists provided additional options to meet their needs without THC, and [the customer] followed up by sending us a handwritten note saying, ‘I thought I was broken for life, and this has helped me heal.’ I consider that a major testament to what we’re doing, what we want to continue doing, and who we want to be to our community.”

Florael.com

THE MARKET AND CONSUMERS EVOLVE, SO TOO MUST THE REIGNING CHAMP OF MARKETING COMMUNICATION.

Despite proclamations about the next seismic shift in business technology disrupting everything you know, email marketing remains at the top of the food chain when it comes to reaching your target audience in 2024. In fact, for every dollar invested in an email campaign, brands produce about $44 in returns, and the tactic has proved to be forty times more successful at acquiring customers than Facebook and Twitter combined, according to Campaign Monitor studies.

Marketers across all industries have mastered the art of email, perfecting audience segmentation for nurture and drip campaigns to keep contacts engaged and invested with the right message or offer at the perfect time.

These segues to success have worked equally well for the cannabis industry—but with the rapid increase and implementation of artificial intelligence (AI) tools, added emphasis on data collection,

and a need to understand what speaks to younger audiences, brands still have a lot to learn if they want to continue sticking their inbox landings with messaging that resonates, inspires, and drives revenue.

Effective marketing emails are defined by engaging content, a header that hooks, clear objectives, and timely action points to keep the viewer’s attention. Without these key ingredients, your efforts will be wasted. But while most of today’s marketers understand the tried-and-true formulas for reaching targets, the industry is everevolving, which means what worked last year may not work now.

Take a look at some of the topline trends we’re predicting, based on insightful conversations with inner- and outer-industry experts alike. We’ve included some of the most notable email marketing trends we’re paying attention to for 2024, compiled to help you take on the new year and earn your highest engagement and conversion rates yet.

Since its advent, the legal cannabis industry has had to track data much more closely than other industries to stay on top of regulatory compliance. As tedious as it may seem in the moment, the practice has given operators a major advantage over traditional businesses when it comes to analyzing metrics for personalized communication.

“Cannabis retailers have had to overanalyze data to stay afloat. As a result, most of them can dive into deep-level metrics that are more intensive and thorough than any other industry,” said Brad Bogus, head of marketing at Happy Cabbage Analytics. “From there, the best way to be micro-segmented in your outreach is to use your sales data to determine which shoppers are buying what. That will help you figure out which deals you’re going to promote or what events you’ll host in your store.”

Bogus also recommended building email contact lists with great care. Don’t just capture addresses, he advised.

“If you can ask someone two to three questions that are enticing and convenient enough for them to respond, you automatically have a leg up,” he said. “With that information, you’ll have the power to segment your messaging more effectively. Now, I might be asking you for information you don’t really want to give me, but if I can ask you in a way that engages and acknowledges something you can relate to or understand, I’ve created a lasting connection with you.”

According to Kim Prince, founder and chief executive officer at Proven Media, email subject lines should be compelling and creative.

“When I worked in mainstream media, I was with an organization that had a team of reporters who strictly wrote compelling headlines. It’s an art, but one that can be mastered,” she said. “If you have a CTA [call to action], make sure it’s worked in clearly. Avoid phrases like ‘10 percent off.’ Instead, use the exact prices to drive interest.”

Mainstream retailers agree—like California-based fashion brand PacSun, where catchy, personalized subject lines regularly reap success.

“I like to focus on personalizing, whether it be adding a name in your email’s subject line or including the most recent products they’ve browsed or purchased in the body copy,” said PacSun Email Marketing Specialist Amy Gonzales. “I’ve also been playing around with AI subject lines, and it’s interesting to compare the performance data between what I wrote versus AI. If you have a tool available, I say test it out, even just for the sake of gathering inspiration or ideas. I use it for keywords or if I have writer’s block. Just be careful not to rely on AI if it doesn’t mesh well with your brand’s voice.”

Convey respect without being cryptic.

“People think if they’re sending an email, they have to cram it with as much content as possible, but the more you include, the more distracting and less effective your email is,” Bogus said. “Assume the people you’re trying to communicate with are running and gunning 1,000 things at once. The last thing they want to do

is read your email. Honor the fact that they don’t have a lot of time, and don’t overthink or overdesign. Keep things singular in topic and content so the person receiving the email doesn’t have to work hard to figure out your message.”

At the same time, don’t play too hard to get.

“It’s important to keep subject lines short and to the point, but try to make sure they’re not too cryptic,” said Wana Brands Director of Content and Strategy Kaitlin Mackenzie. “‘Five Ways to Cope When You’re Too High’ tells you enough to know you want to know more, but ‘You won’t believe this!’ is likely to be spotted for the fluffy clickbait it is.”

Botani Managing Director Alex Boone believes interactive communications will become a defining trend for cannabis marketers, inspiring recipients to take action.

“Interactive email that includes things like polls and surveys is taking the place of static email,” Boone said. “It’s undeniable: Interactivity increases engagement rates and leads to a better customer experience. This might look like linking out to a landing page, including product images and descriptions, and popping in purchasing opportunities.”

Boone classifies valuable content as interactivity, as well. This can come in the form of engaging information that drives recipients to come back for more, like a list of the top ten local places to bookmark for when you have the munchies.

Keep your company’s bigger picture top of mind when emailing marketing messages.

“Treat your email blasts as part of a larger marketing ecosystem,” Wana’s Mackenzie said. “How can you use email marketing to drive social traffic? How can you use social media to grow your email sendout list?”

Marry all your marketing efforts, consolidating where you can so you aren’t burning through your best content and losing sight of the main objective.

All the go-to email marketing platforms regularly update their systems with their industry’s latest power tools. This includes MailChimp’s new AI features and SMS builders, HubSpot’s TikTok integration, and Kajabi’s enhanced email receipts. Keep yourself and your team up to date to ensure you stay ahead of your competitors, reach new levels of engagement, and generally work smarter instead of harder.

“Use these tools to focus on the quality of your emails rather than the quantity,” said James Mao, director of marketing at Deep Roots Harvest. “You should also utilize them to make sure all emails are mobile-optimized, as we’ve found that 70–80 percent of users prefer to view their emails on their phones.”

Mao also stressed the importance of remaining compliant with federal law and local industry regulations—although that isn’t something about which cannabis operators ever have the luxury of forgetting.

“Make sure your compliance department reviews and approves all your email campaigns before they go out,” Mao said. “This will save you a potential headache down the line, when all the time you spent putting your email campaign together might be wasted because of a small compliance-based oversight.”

The cannabis industry is very young, and many brands still are learning standard email best practices. With that in mind, it’s important to know where to look for inspiration that’s backed by years of trial and error on someone else’s dime.

“One of the best practices cannabis email marketers can adopt is to follow what the big-bucks retailers are doing,” Prince said. “Whether it be Walmart, Target, or Amazon, follow the companies that have millions of dollars invested in figuring out what works. You don’t need to reinvent the wheel to have reach. The large companies have already spent the money to figure out what makes a person click. Study them. It’ll save you a lot of grief and hopefully make you a lot of money.”

A new generation of consumers has entered the market, and it’s important that email marketers understand precisely what those

consumers are looking for and how they want opportunities presented.

“The Gen Z/millennial age group is one of the largest audience segments but, based on cart transactions, they spend the least amount of money,” Deep Roots’ Mao said. “This group is bargainhunters, but they’re also the most tech-savvy. Sending offers, deals, and incentives via email will be the most effective strategy with this group. Just keep in mind that the deals need to have value and be competitively priced.”

Young consumers also don’t have the patience to sift through long emails, so make sure your campaigns are fun, short, interactive, and actionable. Thankfully, you don’t have to get this right on the first try. Reviewing analytics will help you understand how to approach newer audiences, and classic tactics like A/B testing different subject lines, messaging, and CTAs will enable refinement where necessary.

This last point is simple, but it’s also evergreen.

“In my opinion, the hottest new trend in cannabis email marketing is really getting back to the basics,” Mao said. “While the rest of the industry has come far, email marketing platforms that cater directly to our industry still lack some of the most basic fundamentals, like variable e-blasts, A/B testing, and customer journeys.

“The best way to battle this is to push yourself forward by following proper email etiquette and best practices, ensuring you’re gathering clean data, leveraging customer segmentation, and exploring email automation,” he added.

B-REAL BERNER SWAMICHAITANYA MICHAEL‘BIGMIKE’STRAUMIETIS

STRAUMIETIS GARY ALLEN JILL AMEN LUKE ANDERSON

JIM BELUSHI ADAM BIERMAN JESSICA BILLINGSLEY

ERIC BRANDSTAD CHAD BRONSTEIN JAKE BULLOCK

BESS BYERS FRENCHY CANNOLI DINO CARTER ARIEL

CLARK JESSICACUEB DEREKCUMINGS STEVEDEANGELO

ISAAC DIETRICH CHRIS DRIESSEN OUTER ELEMENTS

DAVID ELIAS BOB ESCHINO JOSH FINK HYLER FORTIER

STEWART FORTIER MARA GORDON VIRGIL GRANT

BIANCA GREEN ADAM GROSSMAN JEREMY HEIDL

JULIE HERZOG JEREMY JACOBS AARON JUSTIS

TRIPPKEBER CHELSEAKITAHARA KRISTALKITAHARA

TYLERKNIGHT BENKOVLER KRISKRANE KYLEKUSHMAN

JACOB LAWRENCE BRUCE LINTON CONRAD LISCO

AARON LOCASCIO FIONA MA BRUCE MARGOLIN DARRNI

DANIMATHERS ROSIEMATTIO CHRISMCELVANY RALPH

MORGAN KENNYMORRISON KEVINMURPHY MELISSA

EMILYPAXHIA NATHANIELPENNINGTON DENNISPERON

ASHLEYPICILLO KARYRADESTOCK AMYRAZI FAITHROBE

KIMRIVERS EDROSENTHAL JOSHRYAN SOPHIERYAN

CODIESANCHEZ CHRISSAYEGH RICKSCARPELLO MIK

ADRIANSEDLIN LYNETTESHAW ERICSHEVIN AARONSMITH

SOFIOS NICK TENNANT PEBBLES TRIPPET

JONATHANVALDMAN ROGERVOLODARSKY WILWALKER

A collection of photography that showcases the people behind the business.

mgmagazine.com/moments

KYMBER WARD JIM ROBERT WEAKLEY JASON WHITE

WITH RESCHEDULING AND SEVERAL PIECES OF BIPARTISAN LEGISLATION ON THE TABLE, ADVOCATES, POLITICIANS, AND INDUSTRY INSIDERS ARE BULLISH ON REFORM IN 2024.

BY CHRISTOPHER JONES AND SUE DEHNAM

In 1919, a ban on alcohol exposed a cultural divide between urban and rural America and led to a spike in organized crime. Federal, state, and local governments struggled to adapt to the abrupt change in reality that came to be known as Prohibition.

The task of enforcing new regulations initially fell to the Internal Revenue Service (thus the term “revenuers” for federal agents who hunted moonshiners) before being passed to the Department of Justice (DOJ). While enforcement was concentrated in rural areas and small towns—where some folks made decent livings by operating homemade stills—urban dwellers continued to enjoy alcohol courtesy of bootleggers and speakeasies. With the end of Prohibition in 1933, after the broken bottles, blood, and dust finally settled, an article in The United States News (now U.S. News & World Report) attempted to give the citizenry an idea of how the path forward might look.

The open season for liquor-control laws is at hand. With repeal on December 5 of the Eighteenth Amendment accepted as a certainty, the states now face the problem of what to do about it. … Nine different states have adopted nine kinds of liquor laws. Already, rumblings of discontent are discernible in some of these states. And the federal government has barely made a start in caring for its share of the enforcement job. Several government offices have been accumulating data, now on the president’s desk. First steps are being taken by a Congress committee to prepare a legislative program. The whole system of federal and local governments now must undertake the herculean task of starting all over again with liquor control.

Strong disagreements developed among states over how liquor should be legalized and regulated. As a result, states passed dozens of different laws while the federal government tried to figure out what might make sense on a national level. Sounds familiar, doesn’t it?

The “other prohibition” hasn’t been repealed yet, but no doubt Americans from the 1930s would recognize the patchwork of legislation and regulatory systems that currently define the American cannabis space. Functionally illegal at the federal level since 1937, cannabis began a long, agonizing slog toward federal legality in 1996 with passage of California’s Proposition 215. Since then, forty states, four U.S. territories, six tribal nations, and the District of Columbia have established comprehensive medical programs. Twenty-four states, three territories, six tribes, and D.C. have legalized recreational sales. Yet the federal government stubbornly refuses to yield.

For several years now, Congress has been tantalizingly close to relaxing federal laws, but hope for a new era for the industry received a healthy dousing with cold water in October, when ultra-conservative Louisiana Republican Mike Johnson was elected Speaker of the House. Johnson has voted against every piece of reform legislation save the Marijuana Opportunity Reinvestment and Expungement Act, for which he missed a committee vote and declined to vote on the floor. Nevertheless, the industry may be poised to gain some ground in banking reform and rescheduling in 2024, even without his help.

What might a new regulatory framework look like? Would it be similar to the liquor industry’s—where each state designs its own rules and regulations within federal guidelines—or could cannabis be consigned to operate under something more restrictive, where federal agencies like the Drug Enforcement Administration (DEA) and U.S. Food and Drug Administration (FDA) have primary oversight?

This year is shaping up to be an interesting one for activists, lobbyists, and the representatives who are willing to participate in a legalization conversation that has been going on for far too long.

Despite widespread legalization at the state level, cannabis remains a Schedule I drug under the federal Controlled Substances Act (CSA). After President Joe Biden’s October 2022 request that the Department of Health and Human Services and the Department of Justice conduct a review of the current scheduling, HHS recommended reclassifying marijuana to Schedule III, where sale and use would be somewhat less restricted and state-legal businesses could reap some tax benefits.

“As part of this process, HHS conducted a scientific and medical evaluation for consideration by DEA,” a DEA spokesperson told news outlet The Hill in August 2023. “DEA [a division of the DOJ] has the final authority to schedule or reschedule a drug under the Controlled Substances Act. DEA will now initiate its review.”

NORML Political Director Morgan Fox noted the memo HHS delivered to the DEA, recommending the agency move cannabis to Schedule III, was so heavily redacted as to be “basically meaningless.” So without any clear explanation of what the recommendation said, it’s difficult to determine which way the DEA is leaning on the matter, Fox said.

“In a nutshell, the DEA has the final call. And while technically they’re supposed to listen to HHS on any health-related matters, the criteria by which HHS and DEA judge scheduling are significantly different and allow the DEA to input its own scientific opinion,” he said. “In some cases, the DEA response to these things has taken years, so just because there is a presidential mandate doesn’t mean they are necessarily being forced to [act soon].”

Aaron Smith, president of the National Cannabis Industry Association (NCIA), said while rescheduling would be appreciated, such a result wouldn’t address many of the industry’s major concerns. “A move from Schedule I to III under the CSA would be a historic step in the right direction,” he said. “It would provide tax relief for businesses unfairly burdened with [Internal Revenue Code] Section 280E, but it would not address other problems caused by federal prohibition. Removing cannabis from the CSA and enacting sensible regulations is the only way to bring federal law into harmony with state laws that have long made cannabis legal for adults and medical patients.”

Brady Cobb, chief executive officer at Sunburn Cannabis in Florida, maintains close ties with members of Congress who support the industry. Though he isn’t optimistic about significant legislation passing in 2024, he does believe rescheduling is a possibility—with assistance from a somewhat surprising ally.

“Rescheduling has always been the goal, if for no other reason than it doesn’t require congressional interaction at all,” he said. “Getting anything done in Congress right now requires a Hail Mary [pass], and nobody wants to see [retired football quarterback]

Doug Flutie trotting out on the field. So it’s rescheduling, and we’ve got partnerships in the alcohol industry [on our side] for rescheduling and they’re controlling the process.”

Bills like the Secure and Fair Enforcement Regulation (SAFER) Banking Act have been making the rounds in Congress for several years, and both industry operators and cannabis-friendly politicians expected positive action in 2023. SAFER passed out of the Senate Banking Committee in September but has yet to be taken up by the House—and, despite an earlier version sailing through the lower chamber seven times previously, some opine SAFER won’t see action if Speaker Johnson has his way.

In social media posts as far back as 2020, Johnson has made his views crystal-clear, at times suggesting Democratic lawmakers and members of their staffs were stoned while writing proposed legislation. “In Pelosi’s 1,800-page [pandemic economic stimulus package], the word ‘jobs’ appears fifty-two times but the word ‘cannabis’ appears sixty-eight times,” he posted to Twitter in May 2020. “It makes you wonder if the people who wrote it were high.”

Despite the conservative tilt in the House of late, there is room for optimism. In September, Rep. Jerrold Nadler (D-NY) and thirty-three other Democrats reintroduced the Marijuana Opportunity, Reinvestment, and Expungement (MORE) Act, which would remove cannabis from the CSA, require federal expungement and encourage states to expunge as well, and initiate a 5-percent federal excise tax that would fund loans, licensing, and individual assistance for people impacted by the war on drugs.

The following month, Rep. Nancy Mace (R-SC) and four others reintroduced the bipartisan States Reform Act. Originally presented in 2021 with only Republican support, the 2023 version of the bill would repeal federal prohibition and treat cannabis much like alcohol by placing it under the Bureau of Alcohol, Tobacco, and Firearms. Regulation of raw plants would fall to the Department of Agriculture, while product oversight would be split between the Tax and Trade Bureau (TTB) for recreational products and the FDA for medicinal products. The legislation also would facilitate record expungement for nonviolent offenses, institute a federal excise tax, and allow states to regulate commerce within their borders. Additionally, the bill includes provisions that would make cannabis accessible to veterans.

NCIA’s Smith is a fan of Mace’s bill. “It’s simple, clean, but that’s just one way to look at it,” he said. “I think things are going in the direction of alcohol and having TTB as the primary regulator.”

As a business-friendly politician, Mace appears to understand the concern of stacking even more taxes on the industry. She has proposed a modest 3-percent federal excise tax, which is expected

to generate about $3 billion in revenue annually by 2030. She has the support of some heavy hitters in the Republican ecosphere, including Charles Koch’s political advocacy group, Americans For Prosperity. AFP is prepared to lobby on behalf of Mace’s bill and bring more Republicans into the mix with cannabis reform and federal legalization as potential campaign issues in 2024.

“I think there’s a tendency for lawmakers and other policymakers to try to overtax cannabis,” Fox said. “Unless higher tax rates mean higher revenue, then you’re looking at a cannabis market where there is a preexisting underground market that is flourishing everywhere and has been for many, many decades, giving consumers an underground alternative. So this is kind of a unique situation.”

Cobb also supports Mace’s bill, primarily because he believes the best way to regulate cannabis is to use a model politicians and regulatory agencies already are familiar with.

“The only way to really try to have a harmonized regulatory framework is to cut, copy, and paste everything that was done with alcohol,” he said. “So that’s why rescheduling to [Schedule III] fits perfectly in the alcohol narrative. It’s a three-tier distribution, so you have dry counties in some places, and then in some you have to buy the real stuff in a liquor store. All those nuances already exist. There’s already a regulatory system in place, there’s already a tax structure in place. In a hearing about it six months ago, Nancy Mace and others were in the House subcommittee hearing saying if you regulate it like alcohol, it could be legal tomorrow.”

But the alcohol model presents its own set of challenges. Economists Daniel Sumner and Robin Goldstein from the University of California, Davis, have been analyzing the unique dynamics of the industry since adult legalization began, capturing their findings in their 2022 book Can Legal Weed Win? The Blunt Realities of Cannabis Economics. Sumner explained that during Prohibition, California wine producers started growing a different type of grape with thicker skin so they could ship their harvest to the East Coast, where Italians and other ethnic groups continued to produce wine. After the ban was lifted the farmers went back to growing more delicate European varietals, but it took them many years to cultivate the same crops again successfully. He used the historical analogy to explain how cannabis is different from liquor when it comes to illicit-market distribution.

“One of the problems for illegal alcohol was you’re holding something that’s very, very bulky per unit of value, and the illegal [sellers] still were never able to service a large market,” he said, noting $2,000 worth of cannabis only weighs one to two pounds. “So you’re just orders of magnitude different in so far as illegal cannabis has been able to survive. Also, nobody in New York City has the stomach to go door to door and arrest people and throw people in jail for cannabis business these days when it’s legal for other people.”

Until the price of cannabis is similar in both legal and illicit markets, Sumner and Goldstein agree the underground will continue to thrive. “The price difference really can’t be overstated,” said Goldstein. “There is still a larger variety of product types in the legal market, with these weird designer products that have the latest and greatest technology, but those are just a tiny fraction of the market. There are a lot of folks who think they’re going to make a lot of money with a niche product, and you end up with a lot of people fighting for a very small segment of the market.”

Perhaps the boldest of the bills circulating in the House is Ohio Republican Rep. Dave Joyce’s Strengthening the Tenth Amendment Through Entrusting States (STATES) 2.0 Act, which attempts to address the illicit market as part of a much grander plan. A revamped version of a bill he introduced last session, STATES 2.0 does not propose removing cannabis from the CSA. Instead, the legislation would amend the statute so it does not apply to states that have legalized a regulated market. Co-sponsored by two Democrats and two Republicans, STATES 2.0’s text indicates it also would authorize interstate commerce and institute a federal tax “low enough to not exacerbate the level of taxation set by states.” Tax revenues would be used to “offset the costs of executing the administrative functions of a federal regulatory framework for marijuana, including requirements for testing, enforcement and policing, youth prevention, and substance abuse prevention and education.” Under the proposed law, states that prohibit cannabis sale and/or use would not be allowed to interfere with transportation across their borders.

Part of the federal tax revenue earmarked for “enforcement and policing” presumably would be devoted to federal action against illicit operators, whom the bill specifically denotes as anyone who “knowingly or intentionally manufactures, produces, possesses, distributes, dispenses, administers, or delivers any marijuana in violation of the laws of the state or tribe in which such manufacture, production, possession, distribution, dispensation, administration, or delivery occurs.” Violators of state laws, the bill notes, would be subject to federal prosecution.

In addition, Joyce’s bill would specify the FDA’s authority to regulate products that are marketed as drugs, food, dietary supplements, or cosmetics and prohibit combining cannabis with mind- or mood-altering substances including alcohol and tobacco. Importantly, the legislation also would bar the application of 280E to licensed businesses in legal states, relieving operators of a significant tax burden.

“The current federal approach to cannabis policy infringes on the rights of states to implement their own laws, stifling critical medical research, hurting legitimate businesses, and diverting vital law

enforcement resources needed elsewhere,” Joyce said. “The STATES Act does what every federal bill should do: Help all fifty states succeed. This bill respects the will of the states that have legalized cannabis in some form and allows them to implement their own policies without fear of repercussion from the federal government.”

Joyce, co-chair of the Congressional Cannabis Caucus, has more experience negotiating reform bills than nearly any other politician in D.C., having become curious about the issue when California Democrat Sam Farr introduced a 2015 bill to support federal medical research.

“Sam was talking about California at a time [when cannabis] was medically legal but the [United States Department of Veterans Affairs] wasn’t allowed to prescribe it to veterans,” Joyce said. “So he made a great argument for it, and I voted with him, and then someone said, ‘Get down to [then Speaker of the House John] Boehner’s office.’ [Boehner] said, ‘What the hell are you doing?’ I said, ‘Well, here are all the reasons, and I think it’s a states’ rights issue.’ He said, ‘Yeah, yeah. But don’t do it again.’ And lo and behold, look what ten years does. [Boehner’s] now part of the industry.” Now retired from Congress, Boehner sits on Acreage Holdings’ board of directors.

Joyce and House Minority Leader Hakeem Jeffries (D-NY) also reintroduced the PREPARE Act (Preparing Regulators Effectively for a Post-Prohibition Adult-Use Regulated Environment) in 2023, which they said is designed to help the federal government and the states prepare for what they believe is inevitable: the end of prohibition. The act would establish the Commission on the Federal Regulation of Cannabis and task the body with “develop[ing] a regulatory and revenue framework to ensure safe production and consumption of cannabis, which would account for the unique needs, rights, and laws of each state, and present such a framework to Congress within one year.”

According to Joyce, “When we first drafted [the PREPARE Act in 2022], it was a good way for people to wade in and set up a program so, when [cannabis] does become legal, there will be a format for the rest of the industry to follow. This isn’t rocket science, and we’re already doing something similar with beer and wine and spirits with a federal network where each state is allowed to develop [its own regulations] in the manner it sees fit, and then the federal government allows it to have interstate transfer and other things.”

Joyce is optimistic about more legislation moving through Congress soon because of all the tax revenue states have been collecting. With a current federal debt of nearly $34 trillion, Congress can’t afford to snub any potential revenue. “As my dear

friend Brady Cobb says, ‘[the cannabis industry is] the only group that comes to Washington D.C. wanting to be taxed and regulated.’”

In an election year, with parts of the Middle East and Europe embroiled in wars, it’s safe to say cannabis won’t be the highest priority for federal politicians. However, the topic also is not likely to be as contentious as other key issues: abortion, education, immigration, gender diversity, religious freedom, and whose name should appear at the top of each party’s ticket.

And a progressive stance on cannabis could sway some swing voters, considering an October Gallup poll found seven in ten Americans believe marijuana should be legal.

“You have to meet people where they’re at and what their problem is with [cannabis],” said Joyce. “[Nevada Republican Representative] Mark Amodei told me, ‘Well, I’ll help you, but I want to know you’re going to treat it like a casino. Everything’s on the table, and everybody comes in with clean hands.’ So I said, ‘I’m with you. That’s fine.’ We think it’s most important that everybody comes to have a seat at the table in a focused manner to be able to discuss this issue.”

Another approach to federal legalization that hasn’t been discussed openly in D.C.—but in a political environment prone to extremism conceivably could see some action this year—represents a more de facto process that utilizes executive orders. Economist Sumner said his libertarian instincts lead him to believe such a process would be not only feasible but also more efficient and practical in certain respects.

“This could be done tomorrow if the president said so. Most of what people want means just taking [cannabis] off a couple of lists, and that is an administrative action that doesn’t take legislation,” he explained. “Some people think you can’t do anything until you get a bill that passes both houses of Congress and is a compromise among a whole bunch of bad ideas. [When that happens], you get these federal regulations that are carrying a lot of baggage.”

Brady Cobb cautiously agrees.

“I think it’s a huge win the President needs and the Democratic Party needs, but I don’t think we’re going to see it fully come to fruition until October so they can score a win right ahead of the election,” he said. “When you look on the Twittersphere, everybody’s focused on whether the DEA is going to move [the plant] to Schedule III. I think the answer is yes. But then the rulemaking process has to happen. For this fledgling industry, that is the most important part of the process.”

START THE NEW YEAR WITH RECENTLY RELEASED PRODUCTS.

California

For the health- and environmentally conscious, Zen’s first-of-its-kind vegan chocolate bar may be just what the doctor ordered. Crafted from ethically sourced ingredients, the dairy-free product combines premium chocolate with 100mg THC from all-natural, full-spectrum cannabis. ZenCannabis.com

Nationwide

Illinois

Daze Off Party Favors, from aeroponic grower Aeriz, are personal-sized pre-rolls for those who prefer not to pass. Each vibrantly retro package contains twelve .25g joints to share with friends or whip out when it’s time for a pick-me-up.

DazeOff.com

California sweedies’ debut product, Mood Rings gummies, are sugar-free, low-calorie, snackable, and fast-acting. Each forty-fivecalorie pouch contains ten fruit-flavored treats infused with a total of 5mg THC and 5mg CBD plus schisandra, vitamins B5 and B6, and l-theanine.

Getsweedies.com

A Danish brand known for its sleek, sophisticated look and attention to detail, HØJ appeals to consumers who are willing to spend for quality. KLIP is a magnetic, customizable “slicer, not grinder.” KØL offers a cleaner, cooler experience with its magnetic snap-wipe-and-done construction.

Wholesale: Hoj.life/pages/business Hoj.life

Michigan

Sweet Justice’s five lightly carbonated flavors deliver as much as 10mg THC per can. A portion of each sale is donated to the Great Lakes Expungement Network to provide Michiganders fee-free help in clearing criminal records.

Wholesale: franklinfields.com/retail-inquiries DrinkSweetJustice.com

Arizona

Jukebox Shatter, from vertically integrated Copperstate Farms, is a nug-run butaneextracted product. In strain-specific 1g and 3.5g packages, Jukebox Shatter offers an affordable introduction for new concentrate users and aficionados alike.

JukeboxHitz.com

California

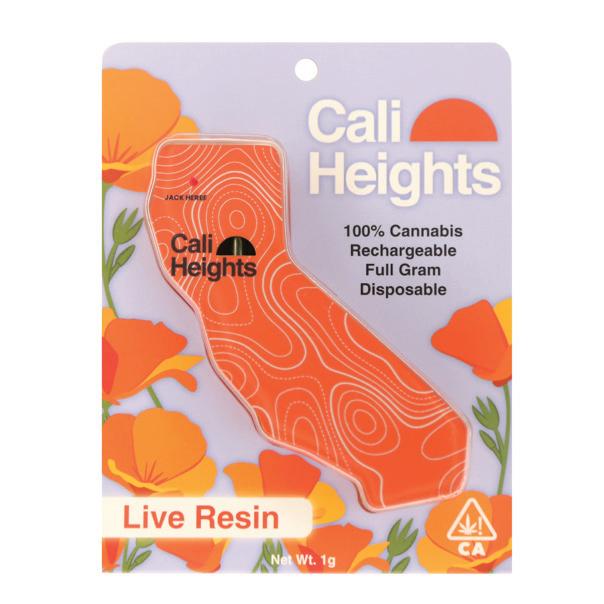

A California-shaped 1g vape pen, The Cali is compact and lightweight to fit seamlessly into hands, pockets, and purses. Available in four signature colors representing indica, sativa, hybrid, and live resin, the novelty product is a conversation-starter.

Nationwide

California

Flora Works’ 50mg TruCBN Soft Gels work with the body’s endocannabinoid system to enhance sleep quality by incorporating what the company calls “the first CBN ingredient to be clinically tested and validated for treating sleep disturbance.”

Sugar Drops are hard candy infused with 100mg THC per ten-piece package. Available in nine flavors including Grape, Dragon Fruit, and Island Punch, the confection is part of a growing line of products ranging from flower to vape pens, edibles, and concentrates.

CaliHeights.com

Flora-Works.com

GelatoCanna.com

Arizona

Optimally consumed around 430°F and stored in the freezer, Copperstate Full Melt Hash is produced with ice water and no solvents. Dabs are residue-free and potent, making the product appropriate for experienced consumers and connoisseurs. CopperstateFarms.com

Arizona

In October, Headset named Chill Pill THC soft gels to four of the five best-seller spots among capsules in the Arizona market. The newest addition, ResinTime, is a live-resin capsule available in a 100mg ten-pack.

ChillPillsAZ.com

In tough economic times and periods of uncertainty, the marketing budget usually is the first to take a hit. In December 2022, as the United States economy signaled a recession might be on the horizon, management consulting firm McKinsey & Company surveyed chief marketing officers at major North American consumer brands. Their responses revealed marketing budgets had been slashed by 8–20 percent from pre-pandemic levels.

“We often see companies following an unwritten rule: If they’re strapped for cash, they’ll stop investing in areas—such as marketing— that don’t generate an obvious direct return on investment,” McKinsey’s experts stated in the report “Beyond Belt-Tightening: How Marketing Can Drive Resiliency During Uncertain Times.”

But, according to a separate study in which McKinsey partners Martin Hirt, Kevin Laczkowski, and Mihir Mysore followed the performance of 1,000 publicly traded companies before, during, and for ten years after the recession of 2008, about 70 percent of the companies that maintained their marketing even in the face of economic chaos

drove growth and achieved above-market total shareholder returns— not just in the short term, but for the entire ten years of the study.

There’s a lesson there for cannabis operators striving to maintain their business in the face of illicit markets, over-regulation, burdensome taxes, small teams, and an economic downturn. In the current environment, marketing can seem like just one more thing with which to struggle, and the decision to cut the budget is easy. But if the McKinsey report is to be believed, short-term struggle can lead to longterm gains.

“The marketing budget usually gets cut first when companies don’t understand marketing,” said Steve Nolan, founder and chief executive officer at advertising agency Amplify and marketing firm Wunderworx. “As a result, recessions are a great time for companies to double down on their marketing, because there’s less clutter out there, less noise.”

Added Wonderworx Director of Content Jessica McKeil, “When everyone else is shutting down their marketing efforts, this is your time to shine.”

From the brand that brought pre-rolled tubes to the market, Kashmir now introduces the first and only Made in the USA cone! Kashmir 1-1/4 and King Size Cones feature the same high quality Kashmir Unbleached Rolling Papers along with a Kashmir paper tip and natural gum adhesive for the ultimate in consistency and smoking satisfaction. Kashmir 1-1/4 and King Cones are available in 6ct/3ct packs, (32ct display), 50ct containers and 1100ct/1000ct bulk packs.

No matter how difficult your slog seems right now, marketers who are crushing it in other industries have experienced very similar challenges in the past and lived to tell the tale. We sought their advice and insight.

First, recognize that for every person who knows your brand, there are countless people who have no idea your brand exists. “Whatever you’re trying to sell, there are a lot of different companies, and it gets confusing,” said Scott Floyd, a senior marketing executive who for the past twenty-five years has worked with some of the world’s top brands, including Pepsi, Anheuser-Busch, and T-Mobile. “There’s certainly a lot of room for cannabis companies to try to make a name for themselves or become a little more well known.”

Where does he see the most opportunity? In taking advantage of the underutilized-in-this-industry tactic of storytelling. “What’s the story and the positioning you can craft that is going to destigmatize cannabis and make it seem more enjoyable for people who don’t use it?” Floyd asked. He cited alcohol companies like Absolut and Miller Lite that have succeeded in normalizing their products even among teetotalers. As evidence, witness the eager anticipation for and discussion about Budweiser’s Super Bowl commercials every year.

“I don’t believe cannabis has cracked that code,” he said. “I don’t think they’ve found that common ground or common story between people who use it or celebrate it versus people who don’t.”

Patience Ramsey—an award-winning executive and entrepreneur who works at the intersection of mainstream brands, tech, sports, and entertainment—also sees a big opportunity for cannabis marketers who can figure out how to reach new target audiences.

“I’m assuming everyone’s looking for opportunities for growth … and that comes with trying to break down the barriers to make it less intimidating and more approachable,” Ramsey said. “Someone on the fringe could be a huge potential customer and could also be an advocate for your brand if they better understood it.”

One of the biggest misconceptions about marketing is that companies need a sizable budget to see any real return on investment. But Floyd is quick to nip that notion in the bud.

“Some of our more successful campaigns have had pretty low-frills budgets, just super-creative ideas,” he said. “Whether that’s Memorial Day or Labor Day and barbecues or football or something around music or whatever, just finding moments where we can generate a lot of conversation and then finding creative ways to insert ourselves.”

According to Floyd, even iconic, multinational brands like Pepsi often have smaller marketing budgets than one might imagine, but they compensate by developing scrappy campaigns. “Sometimes it’s about making fun of our competitors or just trying to pump up something we’re doing for the NFL season or preparing food, whether it’s pizza or hot dogs,” he said.

Many consumers actually relate better to lo-fi, down-and-dirty content versus highly polished, glossy content with extravagant production values, Ramsey said. “For the marketer who has a knack for creativity, I think TikTok is the place to win, right?” she said. “Anyone who gets stuck in the cannabis rabbit hole on TikTok should know about your brand. On a slim budget, you could put out 100 pieces of content, put a little [paid] media behind it, see what sticks, and then go deeper in that direction.”

Don’t overlook the potential of email marketing. According to AWeber, well-conceived and -executed email campaigns generate, on average, $42 for every $1 spent. A 4,200-percent return on investment is nothing to sneeze at.

But bear this in mind: No matter how simple or complex the strategy you want to implement, segmentation is perhaps the most crucial component, allowing organizations to communicate with customers based on specific preferences or demographics.

“Segmenting is how you personalize offers for your audience, and a lot of cannabis brands aren’t doing it, which is bizarre,” said Nolan. “The lack of segmenting translates to a lot of lost opportunities for these brands.”

Be sure to spread your efforts across multiple channels for maximum impact. Social media, “earned media” (mentions in news and feature stories), and owned promotional channels like websites, blogs, and newsletters all are important components of a well-rounded marketing strategy.

So is advertising—both print and digital. According to Isaiah Taylor, director of media and marketing for Advanced Nutrients, combining both formats can make the difference between customers simply seeing an ad and acting on one.

“When taking a holistic approach and building an economy of marketing repetition, it is understated how valuable tangible print ads can be in order to activate a scalable outcome,” he said. “We’ve surveyed many of our customers, and what they’ve remembered most was our print ad. The difference between a digital banner ad or social media post and a print ad is that the customer didn’t choose to see the digital ad, whereas a print ad feels like the choice of the customer because they owned every action: opening the publication, viewing the ad, and purchasing.”

According to Ricardo Baca, founder and CEO of marketing and public relations firm Grasslands, “Any successful integrated marketing strategy includes a thoughtful mixture of print and digital advertising—also known as paid media. [Paid media] works together alongside earned media such as PR placements and owned media, which includes content marketing on brand websites as well as social media marketing.”

Baca emphasized that one of the biggest misconceptions about print advertising falls in line with a wider misunderstanding of marketing in general.

“Some brands think they can make one marketing spend in one channel and see immediate impact, and that’s just not how it works,” he said. “Each marketing channel has a different benefit and hits the target audience at a different stage of the marketing funnel. We call it integrated marketing for a reason. Lesson number one here is: How are you aligning your marketing strategy with your funnel’s purpose of awareness, consideration, and conversion?”

The economic environment is hitting everyone in the pocketbook right now. With a little luck and some long-overdue congressional action, that may change this year. In the meantime, carefully consider your marketing budget. Overlooked opportunities and low-hanging fruit you may have underestimated in the past, along with a healthy dose of creativity, can help you sell more products, grow your market, and drive revenue in 2024.

Dispensaries could interpret a “travel” theme in a number of different ways. A psychedelic celebration of trippiness could be fun. A jumble of hot air balloons and electric railroad tracks seems literal enough. But these ideas don’t convey the glorious potential of new places, nor that delicious spark of a new adventure. Travel isn’t exactly tourism. At its best, travel is a journey; an experience.

New York City’s Union Square Travel Agency (USQTA) interprets the anticipation with a sweep of softened edges, indirect lighting, and a white-on-white palette that encourages exploration. The design evokes the majesty of flying in an age before security measures leeched airports of their magic. Bits of humor pop up in unexpected places.

Information hubs modeled after airport self-check-in kiosks are clustered in the middle of the space, and vitrines filled with products, resembling the windows of an airplane, line one wall. The small terpene room feels like an airline lounge, and slow washes of color behind the cashier counter suggest a changing sky. That element is inspired by artist James Turrell’s mesmerizing rooftop sky boxes.

USQTA unapologetically invites comparisons to Eero Saarinen’s 1962 masterwork, the TWA terminal at JFK Airport. Architecture firm Leong Leong adapted that landmark’s graceful white curves and vaulted ceiling to create a clean design that relies on the merchandise for pops of color.

“I was thinking about the geometry and the way light bounces around the really amazing space in the TWA Flight Center,” said Christopher Leong, founding partner at Leong Leong. “It was a kind of moment of mid-century modernism when architecture could be very optimistic.”

The positive environment, with its suggestion of soaring, girds USQTA’s relationship with its not-for-profit partner the Doe Fund, which receives more than half of the dispensary’s proceeds. The thirty-eight-year-old organization has provided housing, training, and jobs to more than 30,000 people, including men returning from incarceration. A majority of participants are people of color, often with cannabis-related convictions.