ANASTASIA DONDE Senior Editor, Middle Market Growth adonde@acg.org

As we set out to explore LP sentiment in this issue, several articles focus on what limited partners want from their private equity managers and how to best approach the still-slow exit environment. There were hopeful prognostications that this year would be more fruitful in terms of dealmaking, but so far M&A has continued to be slow—although slightly up from last year.

A summarized survey from law firm Barnes & Thornburg (“The LP Wish List,” p. 18) says that “fundraising, dealmaking and exit values all saw steep declines in 2023 as high interest rates and economic volatility continued to quash exit opportunities—leaving both limited partners (LPs) and general partners (GPs) on the hunt for liquidity.”

While secondaries, continuation funds and NAV lending have become solutions for the liquidity problem, investors aren’t wild about them. They cite concerns with high leverage and lack of transparency, as well as getting money back at a discount.

While many firms are holding on to assets longer than usual, operating partners are the ones working on improving performance at portfolio companies and getting them ready for exit. Our cover story on p. 34 describes how Ben Humphreys, a senior operating executive at Monomoy Capital Partners, uses a hands-on approach to boost performance at portfolio companies, especially during times of trouble. “All too often you get large-scale problems and big project teams, and nothing ever comes of it. But Ben takes complexity and breaks it into components that people can really focus on,” says Patrick Olson, CEO of ACA Group, who managed Humphreys in an earlier role at BlackRock.

It might seem like operating partners and LPs have different goals: LPs want their money back, and operating executives are doing the work that keeps companies longer. In reality, they’re on different ends of the same team. Operating partners are trying to get the best performance from the company before selling it—to deliver good returns to the LPs.

It’s obvious that operating partners already have a full dance card— Humphreys travels much of the year to work with companies in person. At the same time, it might be best to make operating partners more accessible to LPs to talk candidly about their value-creation plans, timeline and liquidity strategies. In fact, in The Workplace article on p. 12, Zorian Rotenberg, an operating partner at Charlesbank Capital Partners, talks about how LPs are particularly interested in dedicated on-staff operating partners at GPs, not just “curated lists of advisors.” This could present an opportunity for operating partners to get closer to LPs, make sure everyone’s goals are aligned and be as transparent as possible. //

Monomoy Capital’s Ben Humphreys is known to hop on a plane when a portfolio company needs help, part of his hands-on operating style that colleagues say has changed the trajectory of multiple businesses.

Amid a slowdown in private equity distributions, limited partners are adapting to alternative paths to liquidity while cautiously considering where to invest next.

CEO Brent Baxter bbaxter@acg.org

VICE PRESIDENT, ACG MEDIA

Kathryn Maloney kmaloney@acg.org

SENIOR EDITOR

Anastasia Donde adonde@acg.org

DIGITAL EDITOR

Carolyn Vallejo cvallejo@acg.org

ASSOCIATE EDITOR Hilary Collins hcollins@acg.org

ART DIRECTOR, ACG MEDIA

Michelle Bruno mbruno@acg.org

GRAPHIC DESIGNER Mary Parrish mparrish@acg.org

VICE PRESIDENT, SALES Kaitlyn Gregorio kgregorio@acg.org

ADVERTISING SALES ASSOCIATE Kelly Matava kmatava@acg.org

Association for Corporate Growth membership@acg.org www.acg.org

Copyright 2024 Middle Market Growth® and Association for Corporate Growth, Inc.® All rights reserved.

Printed in the United States of America. ISSN 2475-921X (print) ISSN 2475-9228 (online)

Business leaders face tough challenges – from finding qualified, committed talent to navigating complex reorgs and layoffs with finesse. Fortunately, you don’t have to go it alone.

Insperity’s dedicated team of HR professionals is here to help – with unmatched service, powerful workforce analytics and a suite of tools and resources to streamline talent management. Lead with confidence and discover your growth potential with ACG’s preferred HR solution for middle market companies.

insperity.com/acg | capital.growth@insperity.com

A

The CEO of Turning Rock Partners outlines the

Operating expertise and organic growth are top priorities for today’s investment firms, many of which are hiring operating partners full time even as compensation structures vary.

A survey of limited partners from law firm Barnes & Thornburg reveals LPs’ top priorities—and where they’re out of sync with private equity fund managers.

THE STAND-UP // On Trend

M&A experts weigh in on how election outcomes might impact dealmaking in the months ahead

BY ANNEMARIE MANNION

The 2024 election year has brought several surprises— most notably President Joe Biden’s exit from the presidential race. However, this cycle is not unlike other presidential election years in that M&A activity tends to accelerate ahead of a transition of power.

“We’ve definitely seen a pickup in M&A activity over the last two months,” Brad Haller, senior partner in Mergers & Acquisitions at Chicago-based West Monroe, told Middle Market Executive in August. “From mega-cap funds down to smaller funds, we’ve heard they are trying to do a deal prior to the election with the expectation that, regardless of which party wins, there is going to be some type of contested period.”

No one wants a contested election, which “would bring uncertainty to M&A and an overall slowdown in business activity as the uncertainty is worked through,” Haller says.

For that reason, M&A professionals are watching the election closely. And although they don’t anticipate sweeping change, they’re keeping an eye on an array of issues ranging from tax policy to tariffs and antitrust enforcement.

Any changes to tax policy will hinge on who wins the White House, and which parties prevail in the House of Representatives and Senate. However, Lyle Wallace, M&A partner at law firm Sherman & Howard, doesn’t expect the November elections to deliver major changes to the makeup of Congress.

“I think the presumption is, no matter who gets into office, whether it is Donald Trump or Kamala Harris, that the Senate and Congress are going to be relatively unchanged or pretty close either way,” Wallace says. “And it’s not likely that there is going to be a significant change in tax legislation.”

Divided government has its benefits, he adds. “I think the macro economy tends to do best when there is one

party in the White House and the other party is in control of Congress so, from a macroeconomic standpoint, the biggest issue would be who wins the White House and who takes control of Congress—one or both houses—and what that means for implementation of tax policy.”

One policy whose fate the election will determine is the 2017 Tax Cuts and Jobs Act, which brought major changes to the tax code, including lowering the corporate tax rate to 21%. Many of the changes are scheduled to sunset in 2025.

A tax plan Harris rolled out in August would result in $5 trillion in tax increases over a decade and raise the corporate tax to 28%, although Wallace doesn’t expect that to be applied across all sectors.

“I think the expectation is that if Donald Trump wins, there would be an extension of the tax credits,” Wallace says. “But a lot of business leaders that we speak to wouldn’t expect Kamala Harris to completely let them sunset. She’s shown some pro-business and certainly prounion tendencies, and I think those unions would push her to extend those within certain sectors.”

Wallace points to the service, automotive and residential homebuilding industries as among those likely to advocate for exclusion.

Political rhetoric around the capital gains tax is another area M&A practitioners are watching. Biden’s March budget proposal, which Harris has endorsed, would raise the capital gains tax rate on long-term investments from 20% to nearly 39.6%. In addition, she supports the idea of taxing unrealized capital gains for individuals with a net worth exceeding $100 million.

“Increases to capital gains taxes could have unfavorable impacts to the private equity community, including smaller fund sizes, longer hold periods, lower valuations and possible geographic shifts,” says West Monroe’s Haller.

Another area of interest is trade policy.

“Tariffs are an issue that companies, particularly those in manufacturing and distribution, are focused on,” Haller says. “A majority of companies have global operations at this point, even within the middle market—especially PE-backed companies that have grown through add-ons.”

Harry G. Broadman, a senior economist with think tank Rand and principal with WestExec Advisors, points to Trump’s fondness for tariffs and messaging that belies their true cost. “Trade is a big issue, particularly for Trump, who has never seen a tariff he doesn’t like,” Broadman says. “He’s been myopic, if not ill-informed, about how tariffs are paid. He thinks that, in the case of China or any other foreign country, that their firms and consumers pay tariffs that the U.S. imposes on their goods imported to the U.S. That’s not what one learns in Economics 101 or how real-world markets work.”

Trump in June floated the idea of imposing a 10% acrossthe-board tariff on all imports to generate revenue to offset a potential extension of the 2017 tax cuts.

“A lot of people in the U.S. political space don’t comprehend who in our economy ultimately would bear the cost of such a policy,” Broadman continues. “It’s paid by firms that are procuring the imports which, in turn, will raise their costs and reduce their profits.” Consumers ultimately pay for the tariffs via price increases.

Industries that use steel or machinery or anything made in China are particularly affected by tariffs, Broadman notes.

The Biden administration has focused on competition in the markets, but whether that attention continues if Harris wins the presidency remains to be seen.

“The Federal Trade Commission and the Department of Justice have increased scrutiny, particularly of larger deals, which may be outside the middle market, but also in the middle market,” Wallace says. “I am making an assumption that Kamala Harris is getting a lot of pressure from donors, particularly corporate donors, to fire the current head of the Federal Trade Commission and replace her to decrease the level of scrutiny on transactions, because it has created a significant challenge in the regulatory environment to get middle-market and larger deals done. She could bow to that pressure and replace [the FTC chairman], but it’s an unknown.”

Haller agrees that the antitrust issue is a hot topic, particularly in the technology sector. “There seems to be momentum from Silicon Valley leadership moving from traditional left-leaning toward right-leaning, because they feel it’s hard for founders to exit [their companies] if they can’t sell to a Google or an Amazon,” he says.

The extent to which the election is driving deal activity is up for debate. “Overall deal volume and deal values are up a bit primarily due to pent-up demand and private equity seeking deals, not due to the election,” says Sherman & Howard’s Wallace.

Experts agree, however, that falling interest rates through the rest of 2024 will greatly impact dealmaking, regardless of the election results. “The Fed policy on interest rates is very closely watched and really important because it can have an instantaneous effect on business decisions,” Wallace notes.

At its September meeting, the Federal Reserve lowered interest rates by 50 basis points, to a range between 4.75% and 5%. The Fed will meet two more times this year, and Chair Jerome Powell has hinted it will lower rates further at those meetings, albeit via smaller cuts.

As for the impact of elected officials, Broadman cautions middle-market executives against planning their business strategies on who occupies the White House, because those leaders come and go. Rather, they should consider the stability of the U.S. economy, the rate of growth and their organization’s exposure to international competition. “If firms believe they will move ahead or stall simply based on what they think the election outcome might be, then I think something is wrong with their business model,” Broadman says.

Fortunately, business leaders are unlikely to have much change to contend with stemming from the November election. For his part, Haller expects continued gridlock, which he argues can be a good thing. “With gridlock, while it creates some level of uncertainty, it also doesn’t bring about sweeping changes,” he says. //

ANNEMARIE MANNION is a former reporter for the Chicago Tribune and a freelance writer who covers business topics.

PMAGGIE ARVEDLUND CEO and Managing Partner, Turning Rock Partners

rivate credit has caught the attention of many privately held companies seeking to raise capital without meaningfully diluting their ownership. For business owners, selecting the right private capital partner is essential for growth, alignment of interests and longterm success.

The growth in the private credit market can be traced back to the decline in bank lending. The dramatic rise in interest rates in 2022 caused significant deterioration in banking conditions. Elevated borrowing costs put pressure on regional banks that were already credit constrained, resulting in a pullback in lending. The reduction in bank lending increased the demand for alternative or “non-bank” lenders. The private credit market stepped in to fill the lending gap and is now estimated at $1.7 trillion and growing.

Traditionally, private credit was dominated by sponsorbacked lending, focusing on dividend recapitalizations or traditional leveraged buyouts. The non-sponsor lending market has now emerged as a dynamic and attractive alternative. Non-sponsor lenders provide capital directly to businesses seeking loans. Founder-led companies often prefer private credit investment, as it can be less dilutive by keeping equity in the hands of the business owner and his or her key executive teams.

With so many new entrants into the private credit market, finding the right financing partner is essential. What do private credit investors look for in underlying companies?

FOUNDER COMPETENCY: Private credit investors are looking for sophisticated founders and executives who understand all facets of their core business. If we get the sense this is more of a passion project or a side hustle, then we are moving on. We also want to see the depth of the team. The founder should have aligned incentives, roles and responsibilities for key players on the bench.

SKIN IN THE GAME: Founders who have substantial dollars on the line, reinvest dividends and invest most of their own capital into the company are far more attractive to potential private credit partners. We also review management incentive plans, employee compensation and benefits.

USE OF PROCEEDS: What is the use of our capital?

We prefer to see founders and ownership teams utilize the funds to recap the company, expand their footprint, invest in critical equipment, make strategic acquisitions or expand into new business lines.

TRACK RECORD: An essential element is management that has achieved definable and repeatable success in scaling operations. While not a guarantee, our experience has been that those businesses with asset-heavy balance sheets, definable cash flow, diversified revenue streams and expert management tend to have better outcomes. Companies with executive boards of directors that are diverse, inclusive and made up of industry experts and independent thinkers are preferred.

STRATEGIC EXITS: Before we invest, we are already planning our path to exit. It is critical that the founders we partner with are on board with our outcome goals. Founders should be receptive to exploring a range of exits such as M&A, refinancing, asset sale proceeds or even tapping the public markets. Our networks can play a vital role in pursuing the next chapter.

Private credit firms are choosing their investments carefully in today’s challenging market. The upside is that owner-led companies typically perform well in uncertain times. Now more than ever, business owners can benefit from strong investment relationships with private capital partners who can help them weather shifting macroeconomic and regulatory environments. //

The competitive environment of private equity M&A requires dedicated full-time operating partners, prompting firms to move away from the advisor model

BY ANASTASIA DONDE

The private equity industry has grown exponentially in the past several decades, and competition is fierce.

Coupled with high interest rates and a slow M&A environment, the days of “easy money” and financial engineering are gone, experts say. It’s no longer enough to just “buy low and sell high” with cheap and easily sourced debt capital.

For these reasons and others, operating expertise and organic growth are more important than ever. “The private equity industry has doubled or tripled in the past decade, which puts pressure on valuations, and there is more competition,” says Francois Auzerais, head of North America for Korn Ferry’s Private Markets Practice.

Market forces have put pressure on private equity firms to grow their businesses significantly to achieve target returns. “Private equity firms have to create real value, not just bet on interest rates being low,” says Zorian Rotenberg, an operating partner at Charlesbank Capital Partners. “Top-performing PE firms know how to create real value to generate superior risk-adjusted returns.”

Private equity firms used to have external advisors who

helped them run the companies they acquire. Most experts say that model is outdated and dedicated operating partners are necessary.

Some firms now employ full-time operating partners, while others hire contract workers who report income on a 1099 tax form. Some large firms have separate subsidiaries where they house their operating partners. Across these arrangements, a multitude of models and compensation structures has emerged. Headhunters say there is no “one size fits all” approach. Instead, private equity firms employ different methods based on what they need and can afford.

“We’re seeing less of the consulting approach,” says Laurie Canepa, managing director at executive search firm StevenDouglas, who adds that operating partners tend to fill a variety of roles depending on the firm. Some help find portfolio companies to buy, while others occupy a temporary C-suite role to help “stand the company up” in the first few months post-acquisition. Still others are deployed as functional experts across portfolio companies.

Headhunters say the operating partner role has gone through several iterations since the beginning years of the private equity industry in the 1980s. At that time, most firms had senior advisors who were typically retired C-suite executives from major corporations, says John Rubinetti, partner at Heidrick & Struggles. Eventually, some of the larger firms began bringing advisors on staff who typically had consulting backgrounds and were often younger than the retired advisors.

Now, in the second, third or fourth iteration of the operating partner role, most firms have dedicated on-staff operating partners who are involved in the latter stage of diligence and come in with a value-creation and execution plan for the portfolio company. Many are also functional experts in areas like finance, IT, human capital, go-tomarket/sales and supply chain/procurement, Rubinetti says. He estimates that the trend of hiring dedicated operating partners began about 10-12 years ago and ramped up in the past five.

“The old model was that a handful of former CEOs or CFOs who were semiretired would help out on a part-time project basis as needed,” says Bill Matthews, partner at executive search firm BraddockMatthewsBarrett. “Over time it has evolved into a recognized function as the need for specialization grew.”

Charlesbank’s Rotenberg recalls talking to LPs at a recent private equity conference who said limited partners today are looking for full-time operating partners, not just “curated lists of advisors.” Investors want to see operating partners who are fully committed to the PE firm and have unique expertise to tangibly impact portfolio companies, where they lose sleep over the same issues and are focused on the same priorities. The LPs at that conference mentioned that they want operating partners to pass the so-called “shower test,” meaning that they think about their job and priorities at all hours.

Experts credit some large firms like Bain Capital, KKR and Vista Equity Partners with being ahead of the curve in building dedicated operating partner benches.

Olivia Howard, a partner in the Portfolio Group at Bain Capital, says her firm has been focused on partnering with management teams with an eye toward organic growth since its launch in 1984, when the firm spun out of

The old model was that a handful of former CEOs or CFOs who were semiretired would help out on a parttime project basis as needed. Over time it has evolved into a recognized function as the need for specialization grew.

BILL MATTHEWS Partner, BraddockMatthewsBarrett

consulting firm Bain & Co. “Our approach has always been about improving companies through operating performance, not financial engineering,” Howard says.

Since the firm’s founding, Bain Capital has dedicated resources to working closely with management teams in driving strategic and operational performance. The firm’s Portfolio Group, which split operating responsibilities from deal teams in the 1990s, has evolved to include functional specialists. Bain Capital also leverages management consulting firms and other third-party resources for advice and to help diagnose problems at portfolio companies and come up with solutions, Howard says. “We want to always be learning about what works and what doesn’t from a wide variety of sources.”

Korn Ferry’s Auzerais says that the “independent contractor” model for operating partners has been popular among private equity firms and still is in some places. These types of advisors are often hired on a project basis and report income using a 1099 form. Usually they aren’t exclusive with the private equity firm or portfolio company.

In the last five years, Auzerais says he’s seen that model recede in favor of full-time staff positions, where operating partners are paid a base salary and bonus with some type

of equity participation in the PE management company, at the portfolio companies they work with or both.

“From a candidate’s perspective, most prefer to be an employee rather than a contract worker. There is symbolic value in that,” says Matthews. “But there are a lot of good firms that make the 1099 thing work.”

Some larger firms have affiliates where they house operating partners or other consultants. For example, Lone Star Funds, Vista Equity Partners and KKR have affiliates called Hudson Advisors, Vista Consulting Group and Capstone, respectively.

The slow exit environment and market headwinds make it costlier to hire more operating partners, and some firms juggle the cost-benefit analysis by cutting corners. Operating partners who are hired as contract workers on a 1099, for example, tend not to have benefits or paid time off. StevenDouglas’ Canepa says the lack of exclusivity in these arrangements raises issues with confidentiality, especially since private equity firms like to keep their strategies close to the vest.

Compensation structures can vary widely. In two recent operating partner searches for similarly sized firms, Canepa saw very different offers. One had a $200,000 base salary, a $100,000 bonus and a small equity component. The other offer included a $325,000 base salary, a $150,000 bonus and equity participation in multiple portfolio companies.

Heidrick & Struggles’ Rubinetti says some compensation structures are heavier on equity stakes and profit sharing on exit, while others have larger base salaries and bonuses. His firm’s Operating Professional Compensation Survey this year shows that most respondents are seeing base salaries increase while bonuses decrease. The sources of cash compensation for operating partners are primarily fund management fees, portfolio company oversight fees and time billed directly to portfolio companies. The breakdown of where compensation comes from has remained relatively unchanged compared to prior years, according to the survey, with 49% of respondents getting paid solely from fund management fees, 14% solely from time billed to portfolio companies, and another 14% from portfolio company oversight fees and time billed directly to companies.

Canepa points out that some firms are very intentional and specific about how they structure equity plans for their employees, so as not to overly dilute the value of that equity. The affiliate structure sometimes allows firms to avoid paying equity shares to operating partners housed within the subsidiary, experts say. In some cases, firms will give operating partners equity but don’t put it in the offer letter up front.

Private equity 3.0 involves very specialized operations. You have to adapt to survive.

JOHN RUBINETTI Partner, Heidrick & Struggles

Headhunters say they’re seeing more functional specialization in the operating partner benches at private equity firms. Some are experienced in human capital, for example, while others might specialize in finance, transformation, commercial excellence or supply chain. “The big trend today is operating partners in AI and technology applications, where they can streamline data and analytics,” Auzerais says.

“Firms have become more specialized, where they compartmentalize their approach. They have dedicated business development teams, deal teams, operations teams,” Rubinetti adds. “Private equity 3.0 involves very specialized operations. You have to adapt to survive.”

“More firms are moving toward functional expertise and going narrow on specialization, whether it’s AI, talent, go-to-market or something else,” says Erin Carroll, partner at BraddockMatthewsBarrett. She notes that her firm’s clients have been hiring more people at junior- or midlevel experience levels, some of whom have a few years of consulting under their belt, in addition to seasoned former executives.

Private credit and special situations firms are also starting to add to their operations teams as restructuring and turnarounds become more prevalent, according to Rubinetti and Auzerais. Private equity firms that are more “deep value in nature” are actively seeking out operating partners, where they might be dealing with broken capital structures and need to transform businesses, Auzerais says.

The popularity of operating partners in recent years stems in part from the slow pace of exits and longer holding times. Those, in turn, require operating improvements over a lengthier period. Asked whether the trend would reverse once interest rates go down and financial engineering becomes easier, Howard says she expects operating expertise to be a lasting need: “Our experience over the long term is that you have to grow businesses in a sustainable way to achieve top-decile returns.” //

ANASTASIA DONDE is Middle Market Growth’s senior editor.

Private Equity firms prioritize cybersecurity to secure investments and enhance long-term value. Beyond regulations, it’s a strategic imperative that impacts deal certainty and investment risk. In today’s cyber landscape, resource-limited portfolio companies face heightened vulnerability, emphasizing the need for PE leaders to prioritize cybersecurity in transactions.

An LP survey from law firm Barnes & Thornburg shows that investors are interested in AI applications and succession planning at their private fund managers

BY ANASTASIA DONDE

Despite high hopes that this year would be an active one for M&A, 2024 has so far continued to be slow in terms of dealmaking, fundraising and exits. A survey of private market fund LPs from law firm Barnes & Thornburg shows that investors are interested in innovative strategies like secondaries, cryptocurrency and private credit. Many are also focusing on their GPs’ use of artificial intelligence and succession planning, two items that private fund managers have scored low on so far.

“Fundraising, dealmaking, and exit values all saw steep declines in 2023 as high interest rates and economic volatility continued to quash exit opportunities—leaving both limited partners (LPs) and general partners (GPs) on the hunt for liquidity,” the report said.

The survey showed that GPs continue to struggle with fundraising and extended investment periods, succession planning is more important to LPs than a year ago, and credit-focused respondents are concerned about workouts and restructuring. Many LPs also said they want the funds they invest in to use AI for investment analysis and decision-making.

Almost 40% of both GPs and LPs said they saw increases in expenses over the past 12 months—double the number of last year’s response. Higher costs and a slow dealmaking environment could be preventing GPs from making significant strides in succession or AI. The market environment is also a reason for LPs to consider private credit, crypto funds or secondaries for better returns or liquidity.

Barnes & Thornburg’s questionnaire found that succession planning was very important to LPs and that most GPs don’t have a plan in place. The survey, conducted in April, showed that a whopping 96% of LPs believe it’s important for the funds they invest in to have a succession plan, up from 66% last year. At the same time, only 38% of GPs have a plan, with 31% working on one, 16% considering doing so and 15% not even considering it. GPs with an existing plan referenced cost savings, governance priorities, disruption avoidance and talent management as key reasons for their thinking. “Only 20% attributed their actions to pressure from LPs, suggesting that some LPs may not be making their voices heard on this issue,” the report said.

The paper cited several reasons for GPs’ lack of preparedness in this area, including few other smooth transitions to use as models, consolidation that could solve the succession issue in a different way and high costs. “The market hasn’t seen many high-profile examples of seamless leadership transitions, which could be one reason why many GPs don’t have a plan in place,” the report said. “What’s more, the rise in fund consolidation could be a response to this quandary. After all, selling off a fund to another manager could be an effective business opportunity and a way to avoid some of the issues that arise during succession,” the lawyers wrote.

“With GPs reluctant to dismantle legacy funds and beset by cost pressures, it should perhaps come as little surprise

that the group made less headway on succession plans this year than last,” the paper continued.

AI has been the talk of the town in the past two years as new products and companies keep launching. Of the LPs polled, 77% said they are encouraging the funds they invest in to use AI and machine learning for investment analysis and decision-making. This is another area where GP activity doesn’t match up with LP expectations. Of the GPs polled, 26% said they implemented AI for at least one function, about half (46%) are in the process of implementing at least one function, 16% are considering it, and 12% are not considering any AI functions at all. The most popular use cases among GPs for AI so far were market data analysis, compliance and target identification.

“AI is all the rage in 2024—and investment funds are just as bullish on the technology as other businesses,” the report said. Three-quarters of respondents agreed there will be more AI unicorns over the next year than any other startup type combined. Venture capital investors are the most active and outspoken supporters of AI, with Andreessen Horowitz aggressively investing in the sector from its recently raised $7.2 billion fund.

Looking ahead at the next two years, 36% of respondents said generative AI will likely make a significant impact on fund performance, with 29% answering that it’s already making an impact, 28% saying they are unsure if it will make an impact, and 7% saying it’s unlikely to make an impact.

In a lackluster M&A environment, some investors are searching elsewhere for returns. Eighty-four percent of respondents said private investment in cryptocurrency will increase in the next 12 months, for example, with 54% adding that they are more likely to invest in crypto funds than they were in the previous year. Almost 60% of respondents also expect the number of dedicated crypto funds to increase over the next 12 months.

The rise of private credit is also expected to continue, though some investors are wary of the potential for more defaults if market conditions worsen. “Tight lending conditions and high interest rates have fueled demand for

AI is all the rage in 2024—and investment funds are just as bullish on the technology as other businesses.

Barnes & Thornburg’s Private Funds and Asset Management Practice

private credit, with Blackstone projecting the industry will exceed $3.5 trillion by 2028,” the report said.

At the same time, investors are cautious about restructurings. “Though the sector is expected to keep gaining momentum in the year to come, defaults could also rise should interest rates remain high,” the report said. Over the next six months, 44% of respondents said workouts and restructuring in their private credit portfolios is expected to increase, 49% said it would stay the same, and 7% said it would decrease.

As investors search for liquidity, the secondaries market is growing as a way for LPs to offload private equity stakes. Barnes & Thornburg’s respondents agreed that the secondaries market would be stronger next year, with 34% saying it would be “significantly or moderately” stronger and 41% saying it would be “slightly” stronger.

The market environment is also creating more concentration and consolidation, with LPs placing more money with large brand-name managers. “Fundraising concentration [last year] reached its highest level in over a decade,” according to McKinsey, with the 25 most successful fundraisers collecting 41% of aggregate commitments to closed-end funds.

The Barnes & Thornburg survey polled 138 respondents, of whom 40% were sponsors, 37% were service providers, 22% were LPs and 1% described themselves as “other.” //

ANASTASIA

DONDE is Middle Market Growth’s senior editor.

Lion Equity Partners Operations Principal Travis Dziubla outlines his private equity firm’s three-step approach to building an effective management team. 22

The leader of the life sciences recruitment firm discusses staffing post-COVID, the role of AI in recruiting and more.

Recent hires and promotions, including PE operating partners, advisors and C-suite executives.

The CEO discusses how his firm uses AI and his plans for future growth

BY HILARY COLLINS

When Barrington James, a global life sciences recruitment firm, acquired S3 Science Recruitment in July, Dan Barrington, CEO of Barrington James, saw S3 as the perfect complement to his firm’s human capital offerings. He shares his plans for continued geographic growth, how artificial intelligence saves time for his team, and the trends and challenges he’s seeing in the life sciences recruitment world.

Middle Market Executive: What were you looking for in an acquisition, and what initially attracted Barrington James to S3 Science Recruitment?

DAN BARRINGTON: It was quite a long list to be honest with you, because we’re looking to grow our human capital offering both across life sciences and globally—anything

from executive search to contingent recruitment or contracting staffing. S3 worked predominantly in Europe in preclinical recruitment, something we don’t do, and although they’re small, it’s a very motivated team with good potential. We saw that S3 wasn’t getting much leadership development, and they were desperate to grow. It was the people at the end of the day who made us really excited about the company and the opportunity to increase our service offerings across life sciences.

MME: Can you talk about your plans to incorporate S3 into your operations?

BARRINGTON: S3 is keeping the name because they’ve got a great name in their industry, but it’ll be branded as a Barrington James company. Because it’s a smaller firm, all the systems have been integrated and we’ve spoken to

We’re using AI in a lot of ways, from updating records from CVs that come into our current CRM system, to helping write emails, to doing salary surveys.

all the clients we share. We’ve got a very comprehensive learning and development program at Barrington James, so members of the S3 team were all very keen to do that. We’ve also onboarded them into our benefits and rewards package, which is significantly better than what they had previously.

MME: What types of growth are you looking at going forward: organic, geographic, more acquisitions?

BARRINGTON: All of the above. In terms of geography, we’re targeting predominantly the U.S. and Europe, but we’re also looking at Australia. We’re always open to anything within the life sciences space; that’s the key thing for us. It’s the life sciences, human capital space—anything within that, inorganically and organically.

We believe that in the areas we’re in, there’s room to double, triple and quadruple the number of staff members we have, so we’ll continue to do that over the next four or five years.

MME: Per the press release announcing the S3 acquisition, it seems like you’re very interested in enhancing Barrington James’ technological capabilities. Are there any specific functions or applications you’re working on or hoping to add?

BARRINGTON: We’re always keen on looking at new technology, and it can really help us in the job we do. We’re looking at a new CRM now to help onboard and maintain candidate records according to the different rules and regulations in different countries, because there are quite a few of them.

All our tech is there to save time for our people rather than do the jobs of our people. What we’re trying to do is give our consultants back time in their day, so they can speak to our candidates and clients. Our unique sales proposition as a recruiter, as opposed to just being a mover of CVs, is to give our people time to build personal relationships. Any tech that can save our recruiters time is something we’re massively looking at.

Obviously, artificial intelligence is a big part of that now. We’re using AI in a lot of ways, from updating records from

CVs that come into our current CRM system, to helping write emails, to doing salary surveys.

MME: In the recruitment space more broadly, what challenges are you facing and what strategies are you using to overcome those?

BARRINGTON: It’s been a slower 18 months in every sector of recruitment since the post-COVID boom. The challenges we face are keeping our consultants motivated and keeping them hungry when times are hard and the market’s a bit tough and they have to work harder. That’s just about old-school managing and motivating people. We make sure we hire right, we have good career paths, great development paths and good incentives.

We continue to communicate to our staff, and we help them as much as possible with the tech that can make their day easier. One of our biggest challenges is getting people who want to do the job and work the hours and be the face of recruitment.

MME: What trends are you seeing in life sciences recruitment?

BARRINGTON: The life science world was turned upside down, like everything else, with COVID, but post-COVID we saw a massive uptick in companies recruiting staff, probably too quickly. The trend we’re seeing now is the opposite: People are recruiting staff too slowly. They want a perfect 10 for a job, whereas a couple of years ago they’d have taken a 4 out of 10. The truth is that a middle ground is probably their best option.

It’s also tough getting people to move jobs now, because people often want to bet on the devil they know. You can go to a company and then in two weeks be laid off—a “last in, first out” sort of thing.

I’d say one trend we’re seeing is a bit of an uptick in hiring for senior roles recently, which usually means that somewhere in the next six to nine months there will be an uptick in the slightly more junior roles. There’s been a lot of C-suite movement in our industry in the last year, so we think that’s going to come down the chain in early 2025.

HILARY COLLINS is the Association for Corporate Growth’s associate editor.

ITRAVIS DZIUBLA Operations Principal, Lion Equity Partners

n today’s rapidly evolving M&A market, carve-outs have become a strategic opportunity for both private equity buyers and corporations looking to sell. With excess dry powder on one side and rising costs of capital on the other, carve-outs are likely to continue making headlines as a way to achieve both parties’ objectives.

However, carve-outs are hardly the easiest deals to execute. Imagine a scenario where a large conglomerate decides to divest a small and sleepy division. That division must suddenly stand on its own two feet. The strategy is new and aggressive, cash is tight, the pace of change is fast, and mistakes are costly. This is the exact scenario where the right management team can make or break the success of the carve-out. At Lion Equity, we’ve seen firsthand the transformative power of a well-built management team in corporate carve-outs but have also found that building the right team requires a well-executed hiring process.

Inheriting a full management team in a carve-out is unlikely. Even if you do, it can be challenging for everyone to adapt to new owners and expectations. The post-close environment is usually starkly different from the parent company, demanding different skills for success. At the same time, ownership must be strategic with any management additions or changes to avoid early-onset change

fatigue or the loss of valuable institutional knowledge. This calls for a thoughtful and targeted approach to building the management team.

At Lion Equity, we specialize in corporate carve-outs and have deep experience building great teams that can guide our new portfolio companies through the fast-paced changes those carve-outs entail. To do this, we follow a three-step approach, starting in diligence, to quickly scope and build effective management teams: Define the strategy, lead the selection, and accelerate the transition.

Our experience shows the best management teams are fit-for-purpose. While a great general athlete may perform well, executives with skills and experiences tailored to the specific needs of the new standalone business will significantly outperform. Here’s how we identify those specific needs:

BUILD OUT THE OPERATING STRATEGY: Work with the acquisition team and management to form a hypothesis on the post-close strategy and define what success will look like.

SCOPE THE TRANSFORMATION: Identify major initiatives and investments required to execute the strategy, as well as the risks involved in that transformation.

IDENTIFY REQUIRED SKILLS: Determine the

While a great general athlete may perform well, executives with skills and experiences tailored to the specific needs of the new standalone business will significantly outperform.

capabilities and expertise needed across functional and core strategy areas to deliver on these initiatives. This gives you a clear picture of the specific needs of the carve-out.

ASSESS EXISTING TEAM GAPS: Evaluate the existing organization design and management team to identify gaps between what you need and what you have today. Use this “gap analysis” as a guide for determining which roles need to be added, which roles should be rescoped or which roles require talent changes.

At Lion Equity, this pre-close work allows us to identify potential talent changes in a targeted way. It gives us a North Star as we look to add the right people to the team.

The management selection process is a critical step and often where many new owners stumble. It requires time, persistence, diligence and leadership—tasks that cannot be easily outsourced and should be led by owners and the board. Below are some elements that help guide our selection process:

SCORECARDS: Develop scorecards that translate the business strategy into actionable skills, experiences and characteristics. These guide search partners in their hunt to find great candidates consistently and also provide future interviewers with a clear rubric for the questions to ask.

SEARCH PARTNERS: Establish relationships with two to three search partners specializing in the roles you commonly need. Develop long-term relationships so they understand your style, needs and expectations.

INTERVIEW PROCESS: Our experience is that Goldilocks rules apply: not too many, not too few and just the right people. Ownership needs to test whether the candidates have the skills and experiences that the strategy and scorecard highlight, so only choose interviewers who can assess those areas well. Make decisions collectively, objectively and, most importantly, quickly.

LEADERSHIP ASSESSMENTS: While personality or intelligence assessments are common, Lion Equity takes a different angle: leadership assessments. How do our candidates make decisions? Will their leadership style work well with the existing team and culture? Will their approach to decision-making be effective given the strategy we need to execute? These are important questions a good

organizational psychologist can help you think through. Maintaining focus throughout this process is crucial. Searches that drag on can demoralize the company and deter top-quality candidates. Keep your eye on the ball and close those searches swiftly.

A common mistake operating partners make is taking their foot off the gas once a hire is made, leaving new executives to figure things out by themselves. Our experience at Lion Equity is that most new executives who struggle will fail within the first 12 months. To remove early barriers to success, owners should:

PROVIDE CONTEXT: Offer a half-day session with new executives to give them all the context they need about the company, including diligence outputs, operating strategies and an assessment of the company’s current position.

DEFINE THE MANDATE: Clearly define what success looks like for this role. Hold a session outlining the core objectives of the investment thesis and key results ownership will use to measure success, tying both of those back to the new executive and their role.

ALIGN INCENTIVES: Ensure everyone understands how success is measured and achieved, and what that means financially for the executive. This alignment helps executives start with the right focus and momentum.

CHECK-INS : Hold formal 90- and 180-day check-ins with new executives to understand their progress but also their lessons learned and observations along the way. Some of Lion’s best value-creation plan additions come from these check-ins, so don’t skip them!

In all PE, but especially in carve-outs, building a company with the right talent is a key factor for success. While it takes time, effort and a bit of luck, following these guidelines helps Lion Equity consistently define, find and establish the right talent with a clear line of sight to success. //

TRAVIS DZIUBLA is an operations principal at Lion Equity Partners, where he leads the strategy and operations efforts for the firm, including carve-out execution, integration support, strategy development and overall management of portfolio company performance.

By Andy Jones Private Equity Info Founder & Managing Partner

Private equity firms are focusing on smaller acquisitions, representing a shift to a pre-pandemic trend.

Private equity firms are investing in smaller deals and exercising caution with larger deals, according to new data from Private Equity Info’s M&A research database.

Although platform acquisitions by private equity firms are

down substantially in 2024, our data shows that the share of deals that are under $50 million have become the focus in 2023 and the first half of this year.

The sentiment seems to be: “If acquisitions are a mistake in this season, then make them small.”

This represents a shift back to pre-pandemic trends when smaller transactions were a larger percentage of acquisitions, before firms started acquiring larger portfolio companies as a result of a boom created from the economic stimulus.

The sentiment seems to be: “If acquisitions are a mistake in this season, then make them small.”

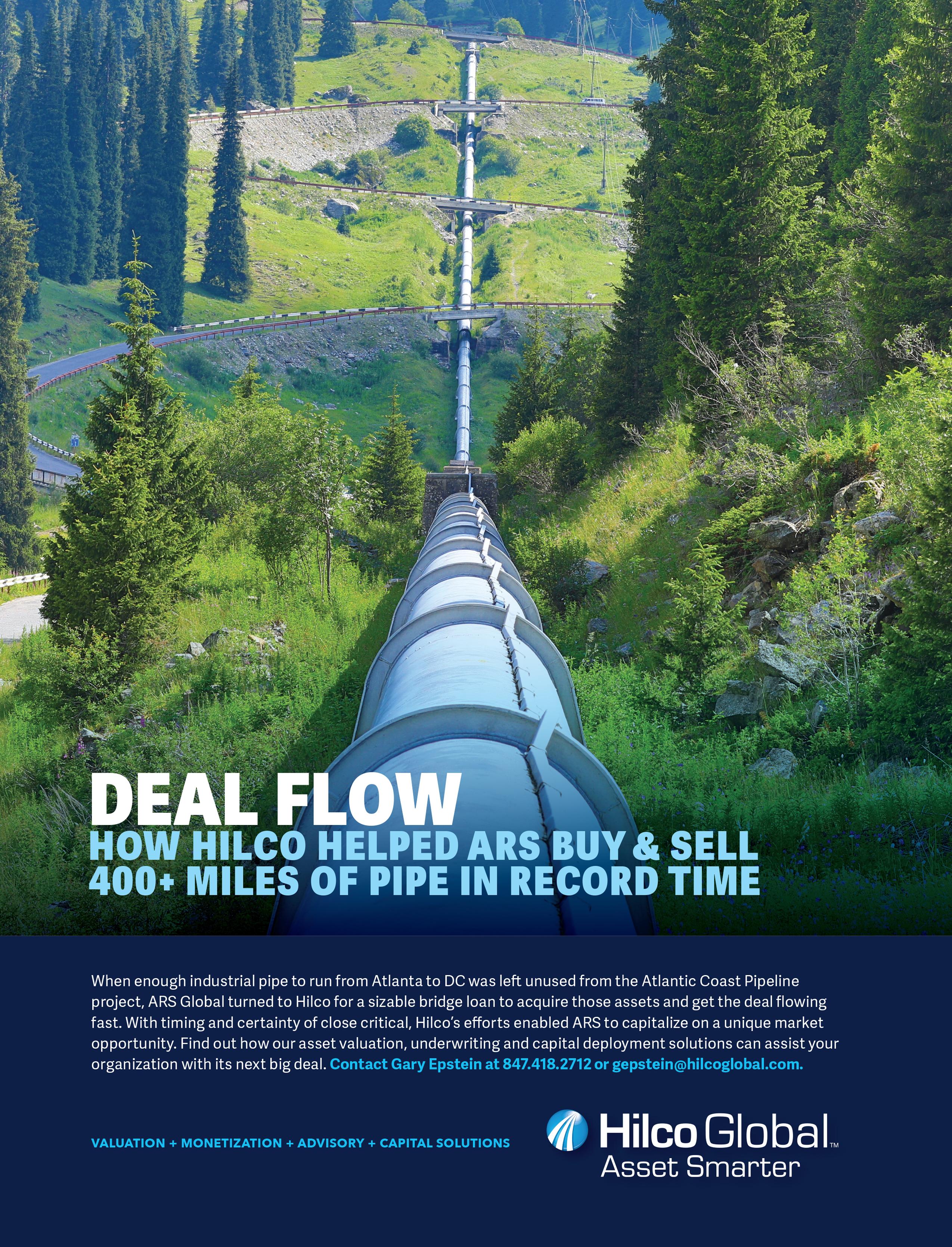

When evaluating the ratio of platform investments-to-exits, segmented by typical deal size from 2017 to June 2024, private equity firms focused on smaller deals are still active acquirers, while the firms that typically invest in mid-, large-, and mega-sized deals are showing significant reductions in acquisitions.

For the purpose of this study, deal sizes are determined by enterprise value ranges. Small deals are under $50 million; mid-sized deals are between $50 and $250 million; large deals are between $250 and $500 million; and mega-sized deals are more than $500 million.

For background, the private equity industry is growing in aggregate when the ratio of investments-to-exits is greater than one and contracting when the ratio is less than one. For the last 20 years, investments have outpaced exits as the private industry has expanded.

In 2018, private equity firms that typically invest in smaller deals made 3.3 platform acquisitions for every exit, while mid-, large- and mega-sized deals made 2.3 – 2.7 acquisitions for every exit.

From 2019 through 2021, there was more growth in large transactions, as the pace of smaller deals declined.

However, a reversal started in 2023 as private equity firms reverted to a focus on smaller deals again, which is especially acute considering exits are down significantly as well.

In the first half of 2024, small deals grew at a rate of 2.5 investments for every exit, while mega deals grew at 2.1 investments for every exit (down from its peak of 3.3).

The difference of approach between the periods is clear.

From 2015 to 2020, there was a strategic advantage in pursuing smaller deals, with less buyer competition and lower valuation multiples. Acquiring smaller companies presented a better value proposition with higher potential return on investment as the upper-end of the market became more competitive.

Over the past year-and-a-half, with the government stimulus invested, higher interest rates, and a higher inflationary environment, private equity firms are now deploying capital more cautiously.

A surge of available funds in 2021 led to a greater deployment of capital in mega deals. Now, macroeconomic events are driving firms back to smaller platform and add-on acquisitions.

Atar Capital

Nick Polanski has joined private investment firm Atar Capital as director in operations. He will focus on commercial and operational due diligence for new transactions and provide operational support to Atar’s affiliated companies. Prior to joining Atar, Polanski served most recently as president of filtration at Culligan International. He began his career at Danaher and held strategic roles at Stanley Black & Decker, Assa Abloy, Innocor and General Electric. His experience extends to management consulting at Next Level Partners, where he specialized in large-scale private equity transformations.

Presidio Investors

Meredith Moss has joined Presidio Investors as the private equity firm’s newest operating partner. She brings deep experience in the fintech sector, having held leadership roles that include CEO of Finomial, managing director at SEI and chairman of the board at Alliant National Title Insurance Co. At Finomial, she led the company to a successful acquisition by SEI.

PARC Auto

Kian Capital-backed PARC Auto, a Meineke Car Care Center franchisee, announced the addition of Russ Bowling as chief operating officer. Bowling has a deep background in the general automotive repair space, having previously served as vice president of operations for a large Jiffy Lube franchisee, managing the business operations of 187 retail oil change, preventive maintenance and general automotive repair locations. He began his career with Pro Oil Shop Inc./Havoline Xpress Lube.

SK Capital-backed Lacerta Group, a provider of thermoformed packaging solutions, has expanded its leadership team with the addition of Jim Pennoyer as chief financial officer and Tim Julian as chief commercial officer.

CFO Pennoyer brings over 30 years of strategic financial management experience to Lacerta. He previously served as executive vice president and CFO of Metrea and vice president and CFO of Textron’s Specialized Vehicles division.

CCO Julian joins Lacerta with over 25 years of customer-facing experience, primarily in the packaging and specialty materials industry. He previously served as executive vice president of global sales at Industrial Labels Holdings and president of Nelipak’s American division.

Greg Turk has joined the Illinois Police Officers’ Pension Investment Fund as deputy chief investment officer. He will focus initially on the planning and implementation of private market investments. Turk previously served as director of investments for the Teachers’ Retirement System for the State of Illinois and was most recently chief investment officer at NG4 Capital, a family office.

Perkins Coie

Kerry Potter McCormick has joined law firm Perkins Coie’s Corporate and Financial Regulation practices in New York as a private funds partner. She has extensive experience advising fund sponsors and alternative asset managers on the launch and operation of investment structures and products. She previously held roles at law firm Barnes & Thornburg and Apollo Global Management, where she was a private funds and products counsel.

Dan Petschke was named chief financial officer of Wellspring Capital Management-backed Rohrer Corp., a retail-packaging designer and manufacturer. Petschke comes to Rohrer from Velosio, a full-service technology organization, where he most recently served as CFO. He previously served as CFO with Dwellworks and with Northern States Metals, and he has held financial leadership positions with Barnes Group Inc. and Avery Dennison.

Bill Webner has joined Summit Technology Group, a portfolio company of private investment firm Enlightenment Capital, as chief executive officer of STG Public Sector. Webner brings decades of experience building and growing public sector management and technology consulting businesses, most recently as board chair, CEO and president of Capgemini Government Solutions. Prior to Capgemini, Webner was an executive at government and military contractor Booz Allen Hamilton.

Peter Kurto has joined private investment firm Angeles Equity Partners as an operating partner in the affiliated Angeles Operations Group. Kurto brings over 20 years of extensive P&L leadership experience within portfolio companies. Prior to joining Angeles Operations Group, Kurto served as an operating executive at Monomoy Capital Partners. Before that, he held leadership roles including CEO of Columbus Industries, COO at H.M. Dunn AeroSystems and CEO at American Air Filter. Kurto began his career at GE.

James Rooney was appointed CEO of Pretium Packaging, a designer and producer of sustainable packaging solutions that Clearlake Capital Group acquired in January 2020. He will also serve on the company’s board of directors.

Rooney brings more than 30 years of leadership experience in the packaging industry. Prior to joining Pretium, he served as the CEO of DazPak Flexible Packaging, where he led the integration of six businesses, streamlined operations and built a high-performing commercial organization. Prior to this role, Rooney led ALPLA Corp.’s North American business and held various leadership roles at Owens Illinois and Amcor.

Jake Fitzgerald was named CEO of PureTech Scientific LLC, a chemical manufacturer serving the life sciences and specialty chemical industries. PureTech was founded by Iron Path Capital, a private equity firm focused on healthcare and specialty industrials.

Fitzgerald most recently served as president of Americas Packaging at Essentra, where he had been promoted after five years as regional business director. Prior to Essentra, Fitzgerald was site manager at Dow Chemical.

Pete Chatel was named the new chief executive officer for Barco Products, a manufacturer and marketer of commercial outdoor furnishings and traffic safety products that teamed up with Argosy Private Equity in August 2023. A longtime leader of manufacturing companies in the hardware industry, Chatel was most recently the president of Hultafors Group North America. Earlier in his career, he held roles at Black & Decker and was part of the leadership team at Senco Brands, a private equity-backed manufacturer of fastening systems.

Monomoy Capital’s Ben Humphreys is known to hop on a plane when a portfolio company needs help, part of his hands-on operating style that colleagues say has changed the trajectory of multiple businesses.

Amid a slowdown in private equity distributions, limited partners are adapting to alternative paths to liquidity while cautiously considering where to invest next.

“Ben has

a unique ability to spot trends and insights and see numbers into the future in a way that I’ve never seen anyone else be able to do.”

PRAB SANDHU

Former Monomoy Capital colleague

How Monomoy Capital’s Ben Humphreys uses a hands-on approach—and frequent travel—to help portfolio companies soar

Although business is a popular college major, many M&A professionals wind up in finance by happenstance. For Ben Humphreys, it was a chance meeting through his college’s student government association that set him on the path to a career in private equity and his current role as a senior operating executive for Monomoy Capital Partners.

During his senior year at Colby College, a small liberal arts school in Maine, Humphreys was elected student government president and served as a representative on Colby’s board of trustees. It was there that he crossed paths with Robert Mettler, then CEO of Sears and Roebuck, who would go on to introduce Humphreys to the head of training programs for one of Sears’ major vendors, General Electric. After being encouraged to apply to GE’s financial management program, Humphreys was brought on by the company’s aircraft engine business—a move that would establish the trajectory of his career.

In the years since, his experience in aerospace restructuring at GE, operations work at Cerberus Capital Management and various roles at BlackRock and other firms helped prepare him to become a trusted advisor to Monomoy’s portfolio companies.

“Ben has a unique ability to spot trends and insights and see numbers into the future in a way that I’ve never seen anyone else be able to do,” says Prab Sandhu, a private equity investment professional who worked with Humphreys at Monomoy. “His ability to work with management teams and companies to understand not just the industry and the people but what the problems are that need to be solved is uncanny.”

Humphreys spent his first year with General Electric in Cincinnati, where he worked in accounting and credit, financial planning and analysis, and business development—what he refers to as “corporate speak for M&A.” But following the 9/11 attack on the World Trade Center and its upheaval of the aviation industry, Humphreys was given the opportunity to go to

Ben is the person who is always willing to question stuff, and in a really good way.

ETHAN KLEMPERER

Senior Operating Executive, Monomoy Capital Partners

Cardiff, Wales, to help restructure an aircraft engine repair facility that GE had purchased from British Airways.

“I went to Cardiff for what was supposed to be six months and spent the next two and a half years there,” says Humphreys, who was born in England but moved to the U.S. when he was only a month old, growing up between Chicago, Washington, D.C., and Maplewood, New Jersey, which he considers his hometown. “It was serendipity. I stumbled into a part of GE that needed some intensive restructuring. … We had to close some excess facilities, re-lay out the plant, renegotiate some commercial arrangements with our principal customers. It was a fantastic learning experience.”

It was during a visit home to New Jersey during this period that Humphreys began dating his nowwife, kicking off what he describes as a “whirlwind romance.” Just six months later, the two were married, and within months they welcomed their first of three children. “We basically went from being single to married with a child in a little over a year, but it was the best set of decisions that ever happened,” says Humphreys, now 46. When his wife’s efforts to get transferred to Europe didn’t pan out, Humphreys returned to the U.S. to work as a manager in financial planning and analysis at GE Water & Process Technologies.

After five years with GE, Humphreys followed a colleague who had moved on to Cerberus. “GE was such a fantastic place, and I always thought I was going to be there for my entire career. But having an opportunity at such a young age in private equity, my wife thought it was crazy not to take the chance, and she encouraged me.” Humphreys spent seven years at Cerberus, working his way up to managing director and partner. While there, he worked on the private equity operating team, taking on the chief financial officer role for multiple portfolio companies, including a bus company and DaimlerChrysler, in which Cerberus had a majority stake at the time.

In 2012, after the head of Cerberus’ human resources moved to BlackRock, Humphreys was one of the first people she recruited. He held multiple roles in his years with BlackRock, including corporate business operations, business finance, and global marketing and communications. Subsequent roles included a brief stint as the CFO of Canary, an early entrant into internet of things security that competed against Nest, prior to its acquisition by Google, and Ring, before its acquisition by Amazon. Humphreys

also worked as an operating partner at middle-market PE firm Staple Street Capital.

The multiple hats Humphreys has worn throughout his career have given him a wealth of experiences to pull from at Monomoy. His principal roles there involve working with the firm’s investment team to help underwrite new investments, then partnering with portfolio companies’ management teams.

With a team of 20 professionals at Monomoy, which has about $5 billion in assets under management, Humphreys says the firm is able to devote an inordinate amount of attention to value creation for an organization its size. He personally likes to take a hands-on approach. Those who have worked with him throughout his career describe Humphreys as not only a team player but quite often the MVP.

Humphreys’ work ethic and ability to dig deep and look at things differently from others were qualities that Ethan Klemperer, a senior operating executive and head of Monomoy’s operating team, sought

when he recruited Humphreys to the firm in 2019. “Ben is the person who is always willing to question stuff, and in a really good way,” says Klemperer, who also worked with Humphreys at Cerberus.

In one recent instance, Monomoy’s team was struggling to lower a product’s manufacturing costs. “The way Ben approached it was, ‘Well, maybe we should be thinking about changing our product.’ So, he partnered with the company to come up with a new product for that portfolio company—it’s the same product, but the way it gets put together and manufactured is totally different,” says Klemperer, who notes that the company was a second-generation family-owned manufacturer when Monomoy acquired the business.

Adds Patrick Olson, CEO of governance, risk and compliance firm ACA Group, who managed Humphreys during his time at BlackRock: “All too often you get large-scale problems and big project teams, and nothing ever comes of it. But Ben takes complexity and breaks it into components that people can really focus on.” Beyond that, Olson says that Humphreys applies an ownership mentality to the organizations he works with, demonstrating a level of commitment typically limited to business owners.

That commitment was on display in Humphreys’ work with a Monomoy portfolio company that was hit hard by inflation in 2022. The company was particularly vulnerable due to its steel-centric business and active importing, according to Sandhu. When freight rates surged, the company faced significant margin pressures while the CFO position was vacant. But Sandhu says Humphreys sprang into action and stepped in as the interim CFO, dedicating long hours, from 8 a.m. to 11 p.m. daily, to address the challenges.

“Typically, in a situation like this, third parties are engaged to support and fill in the gaps, but Ben took the initiative, working closely with the CEO and the team. He demonstrated strong leadership and resilience, effectively guiding the company and keeping everyone focused,” says Sandhu. “With Ben’s leadership, he was able to transform the finance function and the organization into a data-driven operation, implementing KPIs and reporting systems

that maintained a strong pulse on the business and directly improved the margin profile. This transformation contributed to the company becoming one of the top performers in the portfolio.”

Humphreys believes a recession could be on the horizon and describes a challenging revenue environment with low demand. To prepare, he and his team are focused on improving the efficiency of Monomoy’s portfolio companies, with an eye toward reaping the benefits when market conditions improve. “We can’t control the macro market or environmental behavior, but we can control our productivity plans,” says Humphreys.

At the same time, he’s aware that investors want GPs to put money to work. Humphreys says Monomoy has exited one to two portfolio companies per year on average and has consistently generated strong returns for its LPs. In early July, Monomoy closed its fifth PE fund, which was significantly oversubscribed, after only eight weeks of fundraising. Fund V, which set out to raise $1.6 billion, closed with $2.25 billion, with $250 million of that representing a GP commitment.

The potential impact of the November U.S. presidential election on the market is also on Humphreys’ radar, as is the political uncertainty among consumers that could make it harder for PE firms to deploy capital. He adds that Monomoy’s focus on industrial consumer products insulates the firm a bit from pressures other sectors may face because it tends to have a steadier stream of activity. Additionally, he notes that Monomoy is expanding its investment mandate into industrial services, which will enable it to cast an even wider net.

Monomoy mainly focuses on corporate carve-outs, family-owned businesses and some public-to-private deals in the $250 million-$500 million enterprise value range. But it can invest in larger businesses, according to Humphreys, as it did with the recent acquisition of Wisconsin-based Waupaca Foundry, one of the world’s largest suppliers of iron castings.

The Monomoy portfolio companies Humphreys works with include Astro Shapes, a manufacturer of custom aluminum extrusions; Edsal Manufacturing, a steel shelving products company; Mac Papers + Packaging, a distributor of paper, packaging and envelopes in the southeastern U.S.; and Thetford, a designer, manufacturer and distributor of sanitation, refrigeration and cooking products for RVs and marine vessels.

Despite his wide range of experiences and competencies, Humphreys believes that to enact real change and enhance the value of portfolio companies, PE firms need to focus on just a few things to fix or change. “If everything’s a priority, nothing’s a priority,” he says. “We look for three to five key things and make sure they are resourced and can really drive differential returns,” he says, noting that most of his time with portfolio companies is spent helping them acquire the resources and capabilities needed to achieve those core things, which could include talent, margin optimization or working capital improvements.

Scott White, president and CEO of Edsal Manufacturing, says Humphreys actually “walks the talk” and is incredibly hands-on. “He is an excellent business partner in terms of pushing the envelope,” White says, noting that he includes Humphreys in all staff meetings, operations meetings and strategic offsites. “When there are issues, he doesn’t just sit in New York and run things from a computer. He’s on a plane and will show up at 8 o’clock Monday morning and be here until 5 o’clock Friday night and over weekends, if necessary, to help us resolve issues.”

Because of his hands-on nature, traveling is a major part of Humphrey’s life. “This is a guy who is on the road four days a week, most weeks of the year, and he never tires,” says Monomoy’s Klemperer. While that means frequently being away from home, Humphreys is dedicated to his family and is an active participant in the lives of his children, who are ages 20, 15 and 10.

Humphreys is an avid golfer and soccer player, trying to find time to hit the green or the pitch whenever possible. He shares his love for soccer with his three children. He’s coached a couple of their teams, though he freely admits that his youngest child’s soccer skills are so far beyond his own that he didn’t think about trying to coach her. “Now I just get to watch,” he quips. And, with his family being from Liverpool, all the Humphreys are Liverpool Football Club fans. “The only time I describe myself as not American is when England is playing in the World Cup or European Championship,” says Humphreys.

While some people describe him as a workaholic and say his expectations of people can sometimes be too lofty, Humphreys believes these are strengths. “I know my standards for excellence are high. I also recognize that being partners with a management team is largely about convincing them and helping them be successful without trying to be individually successful,” he says, joking that people in his role often get blamed for the rain but not praised for the sun. “It’s incredibly fulfilling to see these businesses and the teams that I partner with achieve incredible outcomes.” //

BRITT ERICA TUNICK is an award-winning journalist with extensive experience writing about the financial industry and alternative investing.

MONOMOY

CAPITAL PARTNERS

Senior Operating Executive September 2019 - Present

STAPLE STREET CAPITAL

Operating Partner June 2018 - July 2019

CANARY CONNECT

CFO May 2017 - June 2018

BLACKROCK

Variety of Managing Director Roles 2012 - 2017

CERBERUS CAPITAL MANAGEMENT

Variety of Roles, from Analyst to Managing Director 2005 - 2012

GE WATER & PROCESS TECHNOLOGIES

Variety of Roles, from Analyst and Manager 2000 - 2005

Limited partners hungry for distributions adjust to a challenging exit environment

WRITTEN BY Meghan Daniels

Broad economic uncertainty is weighing on the private equity market—and forcing the industry to get creative when it comes to liquidity solutions.

“We ended 2023 with a hopeful view, and we’ve seen some growth, although it’s been slower than anticipated,” says Jessica Mead, regional executive of North America at fund administrator Alter Domus. “The middle market has been directly impacted by the wider slowdown in the PE fundraising market generally.”

LPs are feeling the effects of a slowdown in distributions. Deal and exit activity have fallen significantly since the dealmaking rush of 2021, with distribution rates for private equity at just 15% in 2023, compared to 33.9% in 2021, and capital calls outpacing distributions to LPs by more than two to one, according to PitchBook.

“Deal activity and distributions are now moving in the right direction, but it’s been gradual,” says Bart Molloy, partner at placement agent Monument Group. “Dealmakers are always saying that the next quarter is going to be huge. We do foresee a busier Q4, as Q3 tends to be partly a wash with summer.”

The macro factors weighing on the market are familiar ones. Following the Federal Reserve’s aggressive tightening cycle in 2022 and 2023, interest rates have remained high, although the Fed announced a rate cut at its meeting in September. Geopolitical tensions and uncertainty around tax and regulatory policy leading up to the U.S. presidential election in November are exacerbating the “wait and see” nature of the current market.

Private equity funds globally collected $408.6 billion with 861 funds closing in the first half of this year, compared to $374.6 billion in the first half of 2023, according to Private Equity International (PEI).

In an environment with record amounts of dry powder—$2.62 trillion globally as of July, according to S&P Global Market Intelligence—and lagging distributions, some LPs are being highly selective with their capital outlay, choosing to focus on larger, well-established GPs with proven track records. In the first half of 2024, the top 10 funds globally raised

nearly $150 billion, according to PEI. “Even when the number of closings is down, the amount of aggregate capital has been more or less stable due to higher-than-average fund sizes being closed,” says Steve Hartt, managing principal at institutional investment consulting firm Meketa Investment Group.

The high level of dry powder—26% of which is 4 years old or older, according to Bain & Co.—is also increasing pressure on GPs to exit. “LPs are paying meaningful management fees on that capital and want to see it put to work. I’m hopeful we’ll see a bigger pickup in M&A and thus liquidity in the second half of the year, but there are always wild cards,” says Marc Lederman, co-founder and general partner at middle-market private equity firm NewSpring Capital, which in July raised $390 million for its fifth mezzanine fund.

In the U.S. middle market, private equity dealmaking was down 36.8% at the end of 2023 from its peak in 2021, according to PitchBook. Though no one expects a return to 2021 levels, signs of stability have been apparent in recent quarters, with the first quarter of 2024 measuring slightly ahead of the first quarter of 2023 in terms of deal value and flat by deal count, PitchBook data shows.

According to GF Data, an ACG company that tracks deals between $10 million and $500 million in enterprise value, deal volume in the first half of the year was up 23% on an annualized basis compared to 2023. Despite recent challenges, the middle market remains an attractive sector for LPs. “There tend to be lower prices, more opportunities for GPs to apply a value-creation playbook and more exit options,” says Hartt.

Buyouts have suffered in the current environment. Last year saw the overall buyout market decrease by 32.7% in deal value, though this number was somewhat less dramatic for middle-market buyouts between $25 million and $1 billion, which decreased 18.9% in value, according to PitchBook. Deal

volume in the middle market was down 12% in 2023 compared to 2022 for deals valued between $10 million and $500 million, according to GF Data, while average valuations dropped just 4%.

Many PE firms are still holding out on selling all but their most attractive assets. With traditional exit activity lagging, firms are looking for other ways to create liquidity. Secondaries—once a niche strategy—have continued to gain traction in the last few years. “Any stigma around using the secondaries market was removed five or even 10 years ago, but it took time for many institutions to get comfortable with the mechanics of these transactions. We’ve seen increasing comfort with using secondaries as a portfolio management tool to create fresh capital to deploy in the primary market,” says Molloy.

Secondaries and continuation fund strategies provide an alternative to buyouts in an uncertain market. In a traditional secondary transaction—sometimes referred to as an LP-led secondary transaction—an LP sells its interest in a partnership to another buyer, who then takes on the LP role. In recent years, GP-led secondary transactions have also been on the rise, with GPs restructuring the ownership of one or multiple assets to create liquidity for their existing LPs. These transactions often come in the form of continuation funds, in which GPs sell one or more of their portfolio companies from their primary fund to a new

I’m hopeful we’ll see a bigger pickup in M&A and thus liquidity in the second half of the year, but there are always wild cards.

MARC LEDERMAN Co-founder and General Partner, NewSpring Capital

investment vehicle, which they continue to manage. Relative to the overall market, secondaries are still a small player, but many see room for continued growth. “It’s becoming a bona fide exit alternative for GPs in a way that it hasn’t been historically. You’ve got very sophisticated capital that is focused on continuation vehicles. It’s something that every GP has to consider as an alternative,” says John May, founder and managing partner of private equity firm CORE Industrial Partners.