14 minute read

What the REIT Market Must Know About Changes in Tax Law

respondents ranked regulatory/ legislative risk among their top five macro risks, while 37% said the same in 2020.

Likely the uptick in middle-market executives’ concerns here is due to a change in administration and new and proposed regulatory changes, says Brian Williams, partner at New Yorkbased Carl Marks Advisors, a middle market investment banking firm.

Advertisement

“Just the general political climate toward business is different now than it was a year ago and that creates uncertainty,” Williams says. “The federal administration—it’s more people viewing it as a less business-friendly climate. If you really asked people what specifically changed, what can’t you do today that you could do two years ago, people would have a hard time pointing to anything specific, but it’s a feeling of the energy and attitude of what things are.”

Within regulatory/legislative issues, changes to regulations and tax compliance appeared to be of greater concern in 2021 compared to 2020.

For instance, 40% of respondents said changes to regulations that impact business was a top risk compared to 28% in 2020. In 2021, 20% said tax compliance was a top risk compared to 10% in 2020.

While regulatory changes and tax compliance were more concerning in 2021, legal compliance was cited slightly less often as a top concern. Twenty-one percent said sufficient compliance with regulatory laws was a top risk in 2021 compared to 26% in 2020.

BUSINESS INTERRUPTION

For many in the middle market, disruptions in the supply chain can be potentially disastrous. For example, earlier this year, New Jersey-based National Tree Company, a middlemarket provider of artificial trees, wreaths and other holiday décor had to make a decision about its supply chain, says Chris Butler, the company’s CEO.

Since its business is seasonal and revolves around the Christmas holidays, not getting supplies from China could obliterate National Tree Company’s profits for 2021. So, instead of waiting, the company decided to pay higher container rates early on to ensure it would receive its products. Had the company waited, it would be in far worse shape, according to Butler.

“For us, we had a crisis. We dealt with it very quickly,” he says. “We decided to pay the higher container rates, but a lot of people waited to see what was going to happen. We got in early and paid it.”

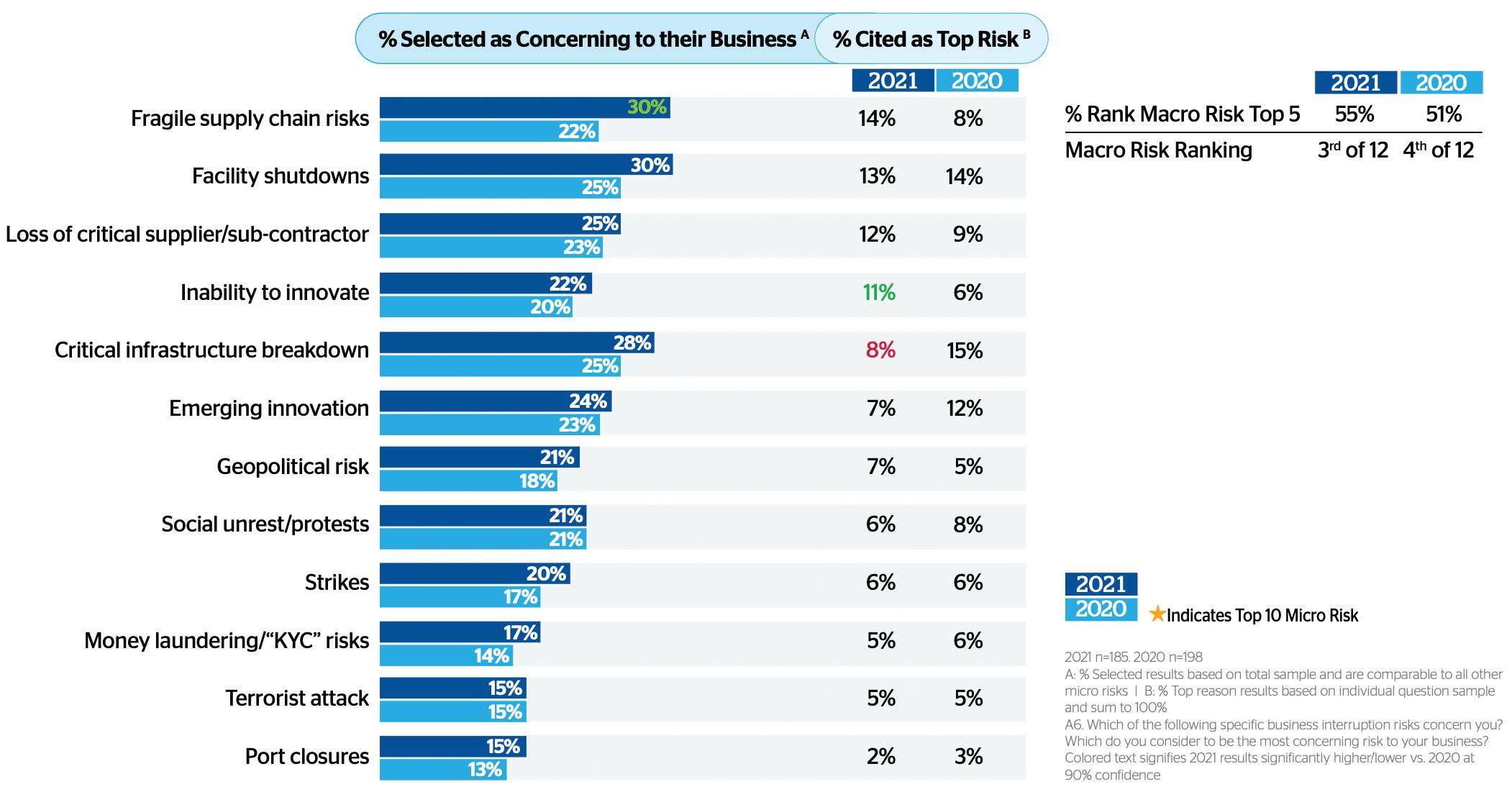

Like Butler, many survey respondents were concerned about supply chain disruption. Business interruption risk ranked in third place among the top concerns cited in 2021, rising from fourth place in 2020.

Within business interruption, the micro risk—fragile supply chain risk— increased significantly between 2021 and 2020. Thirty percent of respondents said it was concerning to their business in 2021 while 22% said that in 2020. Also, 14% said it was their top risk, up from 8% in 2020.

Butler says that the middle market might be better able to weather the supply chain storm, compared with smaller businesses or those without private equity funding. Since National Tree Company is backed by Floridabased private equity firm Sun Capital Partners, it has support that other companies don’t.

“Smaller companies that don’t have backing will be in big trouble,” Butler says. “Their liquidity will be tough. A lot of mom-and-pop businesses will have been massively impacted by this, and it’s an unfortunate problem.”

Brian Williams

Partner, Carl Marks Advisors

IMPROVEMENTS OVER 2020

While the middle market appears more concerned about cybersecurity, business interruptions and regulatory issues, executives said that some of their worries have lessened in the last year.

Pandemic macro risk declined in the minds of middle-market executives as an overall concern. In 2020, it was the third-highest macro risk, but in 2021, it’s fourth, according to the survey.

For every pandemic micro risk in 2020—employee safety, pandemic impact on supply chain, lack of demand, ability to interact with colleagues, customer safety, cash flow, inability to meet demand and travel restrictions—business executives were equally or less concerned in 2021.

As businesses feel less affected by

Business Interruption Micro Risks

the pandemic, 2021 was more like a transitional year. 2022 will likely give a clearer picture of exactly where business is heading.

“I almost look at 2022 as the first real look at what the new normal will be for people,” says Williams. “A lot of government programs are gone, and in 2022, we are going to be dealing with— OK, here’s how much it costs to make my product with labor, here’s what my parts are costing, here’s my logistics costs and what does that mean for what my business model looks like.”

Also, reputational risk dropped two spots from 2021 to 2020 in the macro-risk ranking from sixth to eighth place. Within reputational risk, actions of errant employees was cited as the biggest risk factor.

During 2020, as social media platforms continued to grow and become more video-centric, some employees were caught on camera taking actions that embarrassed employers.

As tempers flared during the racial-justice marches in the summer of 2020, businesses cited this as a top concern. But in 2021, 13% cited actions of an errant employee as a top risk, down from 25% in 2020.

Another issue that dominated the fears of some middle-market businesses was the worry about a pending recession.

The survey showed that the macroeconomic risk category dropped two spots to 11th place as a top macro concern. Among the biggest drop within this macro risk category, the micro risk posed by a recession/economic downturn was less concerning in 2021 compared to 2020.

That decline is to be expected. In 2020, the specter of the 2009 crash loomed large in business leaders’ minds as some companies made preemptive layoffs in anticipation of a major downturn as businesses closed. But a recession did not materialize, and now it appears the pandemic is more under control.

In 2021, 16% of respondents said that a possible recession was concerning to their businesses compared to 23% in 2020. Twenty-seven percent said it was a top risk in 2021, compared to 35% in 2020.

“I don’t anticipate a recession, but we avoided a recession by pumping so much money into the system that the rising tide raises all the boats. The question is what the cost is, and now we have these big infrastructure bills that are on the table, which will increase the national debt. Is that OK? Opinions vary,” says Howard Brownstein, a turnaround and crisis management professional and president and CEO of Pennsylvania-based The Brownstein Corporation. “The danger of a recession isn’t any likelier as we come out of the pandemic. The risk goes down because businesses can do business normally again, but it’s too soon to declare victory over the pandemic.” //

What the REIT Market Must Know about Changes in Tax Law

Given the uncertainty in the market due to the pandemic, investors and other professionals engaged in the real estate investment trust (REIT) market are currently waiting on the final outcome of a number of tax changes and how they will impact the overall REIT market.

The Biden Administration and Congress have passed several tax changes in order to fund a number of new government investments, including both infrastructure and education, among others; what we don’t know is how the tax changes will materially impact the REIT industry.

At a high-level, some of the changes could make REITs an even more attractive investment tool as people look for alternative investment options and REIT qualifying income and activity expands—ultimately fueling an increase. While some proposals may escalate REIT market activity, a few could also decrease activity, including a limitation of the Section 199A deduction and an expansion of the net investment income tax. Due to the purely speculative nature of many of these tax changes, the information available is ongoing and constantly evolving.

Nonetheless, here are a few changes and the impacts they could have on the REIT market:

Increasing the corporate tax rate

Some proposals have included an increase of the income tax rate for C-corporations to as much as 28%, up from the current rate of 21%. Large corporations would be impacted by a 7% increase in the corporate tax rate, potentially increasing their tax liability by a substantial amount, and in turn, decreasing profit and stock value.

Although it may appear the corporate tax rate is focused on large organizations, the truth is most businesses impacted by these changes are small. Of the 1.6 million registered C-corporations, over 1 million of them

have business receipts below $500,000 a year. This means a potential monumental impact to a myriad of businesses, depending on whether the rate increase is graduated and, if so, what the income thresholds would be for the top tax rates.

Moreover, investors may consider alternative investment strategies that provide a better return, like REITs. In general, REITs can provide a consistent source of income. In terms of taxes, REITs are eligible for dividends paid deductions such that their tax profile more closely resembles pass-through entities and would not be as significantly impacted by this increased tax rate as corporations are, so the overall REIT profits would generally not feel as much of an impact (whether directly or indirectly) as the C-corporation stock alternative, except to the extent that those profits are flowing into the REIT through Taxable REIT Subsidiaries (TRSs). This would mainly be attributable to the increased C-corporation tax liability and the resulting lower profits and stock value.

Section 199A qualified business income deduction

Section 199A of the Internal Revenue Code (the Code) allows a non-corporate taxpayer to take a potential deduction of as much as 20% of “qualified business income” plus 20% of the combined REIT dividends and qualified publicly traded partnership income. Qualified business income includes the taxpayer’s share of net income with respect to qualified trades or businesses.

One proposal has included the following limitations on the 199A deduction: The taxpayer’s aggregate deduction for any given tax year may not exceed $500,000 for a married filing joint return or surviving spouse, $250,000 for a married individual filing a separate return, $10,000 for an estate or trust, or $400,000 for any other taxpayer. This deduction is phased out for taxpayers with taxable income over $400,000, and a complete phaseout at $500,000.

While bringing in more revenue, this limitation could affect the ability of non-corporate REIT shareholders to apply the deduction to qualified REIT dividends they receive. Depending on

their taxpayer status and their income, they would face a greater limitation than under the current 199A regime. To the extent that the limitation does apply, the taxpayers might be more inclined toward receiving income through entities to which section 199A does not apply, e.g., corporations.

Net investment income tax

Section 1411 of the Code imposes a tax on net investment income in the case of certain individuals, estates, or trusts. The tax is currently 3.8% of the lesser of net investment income or the excess of modified adjusted gross income over a threshold amount. Net investment income is generally passive income that is not derived from a trade or business in which the taxpayer actively participates. A taxpayer who materially participates in a trade or business may be able to avoid the Section 1411 3.8% tax on income from that trade or business in some circumstances.

Some of the proposals would do away with the focus of this tax solely on passive income and provide that a high-income individual would be subject to net investment income tax on net income or net gain notwithstanding if the taxpayer materially participates in

a trade or business that generated the net income or net gain.

This could become particularly problematic for individuals who qualify as real estate professionals. Currently, these professionals are generally exempt from the net investment income tax because they are materially participating in a trade or business related to real estate. These professionals might become subject to the net investment income tax even though they were not subject to that tax before because the proposal would remove the exemption. As a result, we may see fewer real estate professionals entering or engaging in the industry, potentially decreasing activity in the REIT market.

The BEAT

Section 59A of the Code (base erosion anti-abuse tax or BEAT) imposes an additional tax on taxpayers. The BEAT

applies to applicable taxpayers – any corporation (other than a regulated investment company, REIT, or S corporation) that has: (i) average annual gross receipts of at least $500 million for the three preceding tax periods; and (ii)a base erosion percentage (BE%) for the tax year in excess of the applicable threshold (the BE% test).

One proposal would increase the BEAT rate from 10% to 12.5%, and 15% for tax years beginning after December 31, 2023 and December 31, 2025, respectively. It significantly broadens the application of the BEAT and increases the tax rate on the base. REITs benefit from the increased application of the BEAT in that they will still not be subject to this new broad application of the BEAT, though their TRSs may be subject to it. Unlike corporations, this enables REITs to conduct more foreign business without worrying about triggering the BEAT, thereby potentially increasing activity in the REIT space.

Attribution rules

For purposes of determining the REIT’s percentage ownership of a corporation’s stock or a non-corporate entity’s assets and net profits, Section 318 of the Code’s constructive ownership rules apply. A special 25% attribution rule applies to partners owning stock when computing a person’s percentage ownership of a REIT or of a REIT’s tenant for purposes of determining whether certain payments qualify as rent in determining a REIT’s qualifying income. The problem is that if the attribution application determines that a REIT receives payments from an entity in which it is deemed to own 10% or more, this is deemed related party rent and is not qualified rent, potentially harming their REIT status. These attribution rules force REITs to analyze not only their own holdings, but those of their 10% and over stockholders and beyond, to ensure there is no rent disqualification.

One proposal would eliminate so-called “double downward” attribution that can result from the application of constructive ownership rules applicable to REITs. A person treated as owning an interest in a corporation or other person as a result of the application of attribution rules under Section 318 would not be treated as owning that interest for purposes of applying Section 318 to attribute that interest to another person. These changes are intended to simplify the attribution analysis.

Simplifying the attribution analysis under this change could make it less likely that entities would be treated as related. REITs might not have as much at risk for unknowingly having rent from a related tenant due to constructive ownership, thereby resulting in an invalid REIT status, which could allow for an increase in investor peace of mind.

Expansion of REIT qualifying property and income

Finally, due to the Infrastructure Investment and Jobs Act, REITs may have greater opportunity to invest in qualifying real estate and generate qualifying income. This package proposes numerous investment plans, such as in the electric vehicle market, giving both grant and tax incentives to build a network of charging stations, as well as investment plans for battery farms, carbon storage and high-speed broadband to every American household.

These potential opportunities would primarily be available to infrastructure REITs. As previously discussed, we could see an uptick in REIT investments as an alternative to traditional stock investments due to a potentially increased corporate tax rate. This increase in capital for the REIT market could allow infrastructure REITs to expand into the markets that the Biden Administration’s proposal is looking to promote, including broadband/telecommunication, electric transmission lines, and passenger and freight rail services.

This could allow more REIT options and opportunities, while playing a pivotal role within the infrastructure development plans. However, it is still unclear how the IRS would characterize income from such activities if these investment plans do happen to go into effect. “Strong balance sheets and access to credit and liquidity are helping the REIT market continue to take advantage of a growing economy,” says Toria Lessman, SVP, Underwriting Leader, at QBE. “But many are looking at the Biden Administration’s tax changes and wondering the implications for their businesses.”

As you can see, there is a lot of potential movement that could impact the REIT market, both increasing and decreasing activity based on the overall impact. Some of the key challenges for the REIT market would be a limitation of the Section 199A deduction or an expansion of the net investment income tax. However, the market could also benefit and see more activity due to an increase in the corporate tax rate, an expansion of the BEAT application and liberalization of rules regarding REIT qualifying property and income. While it’s impossible to know if or when any of these changes will become law, one thing is clear—REITs are not immune to the changes.

Please contact QBE for more information. //

This article is for general informational purposes only and should not be construed as legal, commercial or other professional advice. QBE makes no warranty, representation, or guarantee regarding the information herein or the suitability of this information for any particular purpose. Actual coverage is subject to the language of the policies as issued.