RPAC Major Investors Issue

2023 RPAC Basketball Championship

2023 RPAC Basketball Championship

2023 RPAC Basketball Championship

2023 RPAC Basketball Championship

Go electric. Go anywhere. The BMW i4 Gran Coupe and BMW iX Sports Activity Vehicle® arrives with class-defining style and performance, game-changing sustainable materials, and innovative technology. They deliver far-reaching range and efficiency, with all the breathtaking power that define all BMWs. Experience our electrifying performance with a test drive of the Ultimate Driving Machine® today and see why BMW is the new electric standard.

Magazine slrealtors.com

President Rob Ockey

Presidio Real Estate

First Vice President

Dawn Stevens

Presidio Real Estate

Second Vice President

Claire Larson

Woodside Homes

Treasurer

Jodie Osofsky

Summit Sotheby’s

Past President

Steve Perry

Presidio Real Estate

CEO

Curtis Bullock

Directors

Carlye Webb

Summit Sotheby’s

Jennifer Gilchrist

KW South Valley Keller Williams

John Lucky

Berkshire Hathaway

Janice Smith

Coldwell Banker

Laura Fidler

Summit Sotheby’s (Draper)

Amy Gibbons

KW South Valley Keller Williams

Jenni Barber

Berkshire Hathaway (N. SL)

J. Scott Colemere

Colemere Realty Assoc.

Hannah Cutler Coldwell Banker

Michael (Mo) Aller

Equity RE (Advantage)

Morelza Boratzuk

RealtyPath

Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Managing Editor

Dave Anderton

Publisher Mills Publishing, Inc. www.millspub.com

President

Dan Miller

Art Director

Jackie Medina

Graphic Design

Ken Magleby

Patrick Witmer

Office Administrator

Cynthia Bell Snow

Sales Staff

Paula Bell

Jared Lewis

Paul Nicholas

Last month Lawrence Yun, chief economist of the National Association of Realtors®, addressed members of the Salt Lake Board of Realtors® at the annual Housing Forecast Breakfast event. He predicted that mortgage rates would likely fall to 5.5% by spring.

His prediction was based on the spread of the 10-year Treasury rate and 30-year fixed-rate mortgage. Historically, the 30-year mortgage rate runs approximately 1.7% higher than the 10-year Treasury yield. Over the past couple of months, the 30-year mortgage has been roughly 2.7% higher than the 10-year Treasury.

In 2008, during the foreclosure crisis, and in 2020, during the pandemic, the spread showed similar large differences.

“Sometimes the gap is a little larger than normal, other times a little less,” Yun said. “The large spread eventually disappears. Based on history, this abnormality will disappear in four to six months. If we go back to a normal spread, today’s rate should be 5.5%.”

The average 30-year mortgage rate climbed in November 2022 to 7.1%. Since then, it has fallen to 6.1% in the first week of February, according to Freddie Mac.

“Mortgage rates inched down again, with the 30-year fixed-rate down nearly a full point from November, when it peaked at just over 7%,” said Sam Khater, Freddie Mac’s Chief Economist, in a prepared statement. “According to Freddie Mac research, this one percentage point reduction in rates can allow as many as three million more mortgageready consumers to qualify and afford a $400,000 loan, which is the U.S. median home price.”

Few remember that in 1981, mortgage rates climbed to an all-time high of 18.45%. It wasn’t until the early 1990s that rates finally began to fall into the single digits. Rates fell to a record low of 2.65% in January of 2021. Since 1971, the average rate has been 7.75%.

Salt Lake Board: (801) 542-8840

e-mail: dave@saltlakeboard.com

Web Site: www.slrealtors.com

advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin.

The Salt Lake REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS®

Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

REALTOR is a registered mark which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS

The Mortgage Bankers Association said that although short-term rates will continue to increase as the Fed pushes them up the next few meetings, long-term rates have already peaked. “We expect that 30year mortgage rates will fall to 5.2% at the end of 2023,” the association said in a statement.

When it comes to interest rates, the worst may be over.

Rob Ockey President

Nearly one in five Americans plan to buy a home in 2023, according to CraftJack. com, a company that specializes in connecting home service professionals with homeowners. Of those planning to buy, 30% are first-time home buyers, while others are upgrading (22%), buying property as an investment opportunity (20%), or downsizing (13%). One in three of those surveyed said they are looking for homes in the suburbs and 56% are looking for a single-family home. “While many Americans anxiously look forward to buying a home in 2023, others simply can’t or don’t want to,” the report said. “Top deterrents include sky-high mortgage rates, followed by location, property taxes, crime rate, and the overall uncertainty of the housing market.”

ATTOM released its Year-End 2022 U.S. Home Sales Report, which shows that home sellers nationwide realized a profit of $112,000 on the typical sale in 2022, up 21 percent from $92,500 in 2021 and up 78 percent from $63,000 two years ago.

Despite a market slowdown in the second half of last year, profits rose from 2021 to 2022 in 98 percent of housing markets. The latest nationwide profit figure, based on median purchase and resale prices, marked the highest level in the United States since at least 2008.

The $112,000 profit on median-priced home sales in 2022 represented a 51.4 percent return on investment compared to the original purchase price, up from 44.6 percent last year and from 32.8 percent in 2020. The latest profit margin also represented a high point since at least 2008.

Both raw profits and ROI have improved nationwide for 11 straight years, shooting up again in 2022 as the national median home price increased 10 percent to $330,000 – yet another annual record.

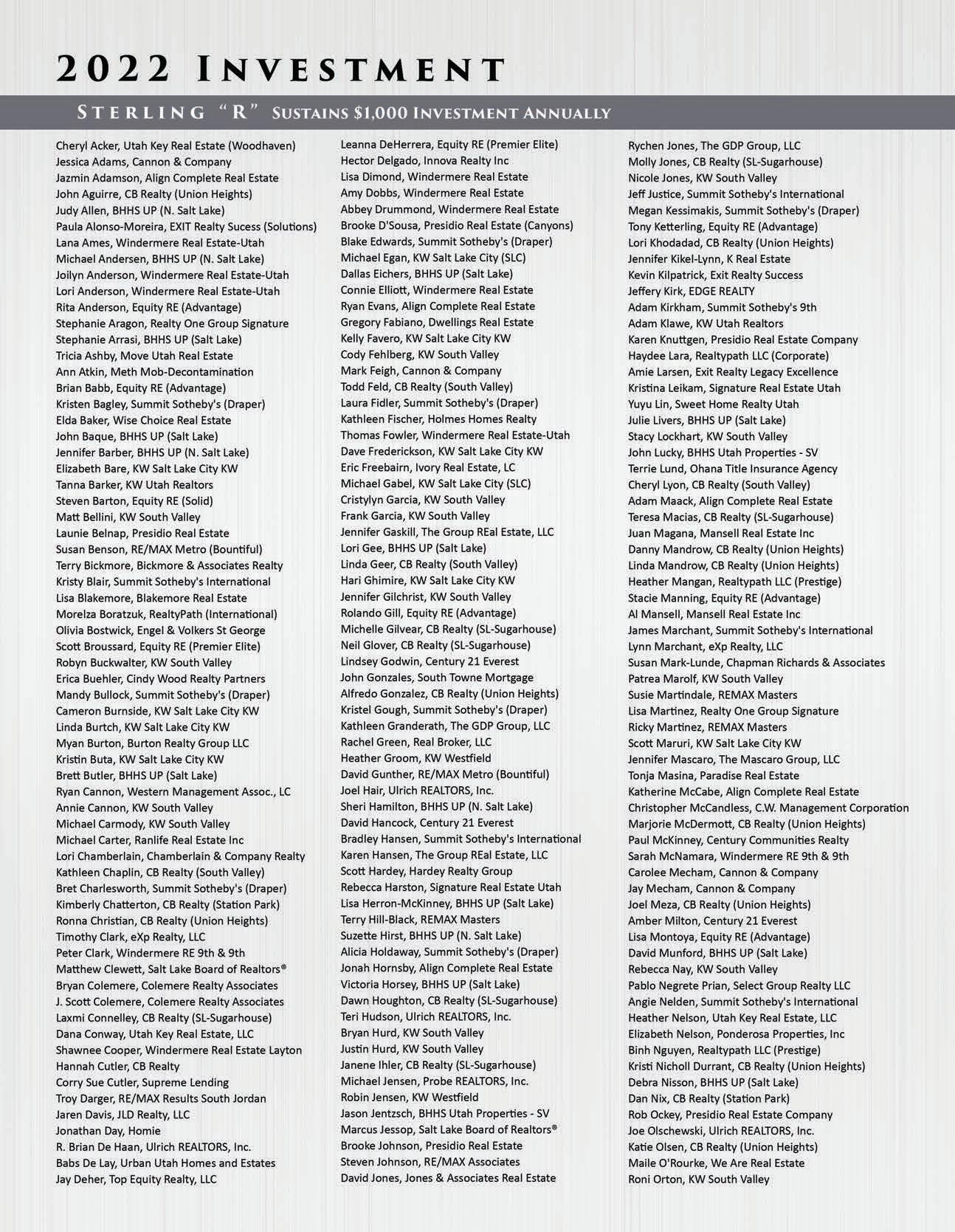

Members of the Salt Lake Board of Realtors® were treated to a buffet dinner and sky box seating as the Utah Jazz took on the LA Clippers at the Vivint Arena on Jan. 18. The event was a fundraiser for the Realtors® Political Action Committee (RPAC). RPAC promotes the election of pro-Realtor® candidates in Utah and across the United States. RPAC investments are not members’ dues; this is money given freely by Realtors® in recognition of the importance of the political process.

Lux Utah Rentals, LLC, announced a new branch location in Midvale and new regional property manager, Jennifer Rios Parker. Jennifer has more than 10 years of property management experience. Lux Utah Rentals is a full-service property management company. “We treat our clients’ properties as if they are our own and make decisions with this mindset,” said Heather Nelson, co-owner and principal broker for Lux Utah Rentals. “Our team provides top-notch services and results that you and your clients can depend on.”

As part of the legendary Berkshire Hathaway family of companies, we have the depth, strength and brand power to help grow your real estate business. Our network extends globally in reputation and strength. Locally, our company is the largest brokerage in Utah, ensuring that your property reaches a broad audience of real estate professionals and buyers. We are committed to providing you with the resources and support that will create greater success and enjoyment in your real estate career. So, talk with us at Berkshire Hathaway Utah Properties and let’s get you settled without ever settling for less

Our professional in-house marketing agency provides the best in graphic design, print marketing, and digital advertising.

Scan the QR codes with your smartphone’s camera to view some of our in-house publications online.

The Salt Lake Board of Realtors® held its first Basketball Championship Tournament Jan. 18 at the Vivint Arena, home of the Utah Jazz. Eight teams participated in the event with roughly 75 players in a single-elimination bracket. Teams included: Realtypath, Century 21, Summit Sotheby’s International Realty, Coldwell Banker, First American Title Company, Zander Real Estate Team, Edge Homes, and Keller Williams. Edge Homes was the winning team (pictured on magazine cover).

By The Professional Standards Committee Salt Lake Board of Realtors®

By The Professional Standards Committee Salt Lake Board of Realtors®

A listing agent for a property received an offer from a buyer to purchase the property. The buyer was also a Realtor® and the Respondent in this ethics complaint. The buyer and seller entered a contract to purchase the property. Soon after the buyer and seller entered the contract, the listing agent discovered the property was being advertised by the buyer without permission or knowledge of the listing agent or the owner. The purchase contract was not assignable. Photos were taken of the property without the knowledge or permission of the owner or the listing agent. The photos were used in the advertising of the property. A private email containing information about the property went to over 900 potential buyers.

The email contained the following generic small-print disclaimers: House is being sold as-is, and buyer is to pay all closing costs. Buyer is not relying on any representations, whether written or oral, regarding

the properties above. Price based on a cash or hard money offer and is net to seller. All offers on properties require a minimum of $5000 non-refundable earnest deposit and have an average 7 day close of escrow. Buyers to do their own independent due diligence. [The Company], LLC members, directors or employees make no guarantees concerning property condition, value, characteristics, or financial benefits. [The Company] is considering all of our options including selling the trust that the property is in. We may not own this home. We do not represent the seller. The information is provided as a courtesy and not meant for the purposes of marketing this home. We’re considering offering this contract for sale which will allow you to purchase the property.

Based on the evidence and testimony, the hearing panel determined that the Respondent is in violation of Article 1 of the Code of Ethics. The Respondent failed to act honestly with all parties when they allowed pictures

Recent ethics cases in this quarter involve advertising properties without the seller’s consent, disparaging other Realtors®, and accessing properties without permission.

of the home to be taken and used for advertising purposes without the knowledge or consent of the owner or the listing agent. The email advertisement was misleading, confusing, and misrepresentative. The Property was not assignable and not in a trust. It is unclear who the owner was. The relationship between the owner and the advertiser was also unclear.

The panel found the Respondent in violation of Article 12 of the Code of Ethics. The Respondent failed to be honest and truthful in their real estate communications and failed to present a true picture in their advertising, marketing, and other representations. They also failed to ensure their status as a real estate professional was readily apparent in their advertising, marketing, and other representations. The Respondent emailed an advertisement to sell the home without authority.

The Respondent is an investor and licensed Realtor® who sent out an email advertisement that stated his company was “in possession of an Assignable Purchase Agreement that will allow us to purchase the property. We are considering selling the Purchase Agreement that will allow you to purchase this property.” The ad included other information about the specific property. The Property in question was actively listed on the MLS with a different agent at the time the Respondent sent out the above advertisement. The listing agent for this Property was not aware of the Respondent’s advertisement and did not consent to the Property being advertised in this way. An offer was presented on behalf of the Respondent to purchase the Property but it did not disclose until after it was accepted that the Respondent was a licensed agent. The offer included the phrase “and/or assigns” on the contract and was accepted by the seller. The contract was later cancelled by the Respondent. The Respondent recognized during the hearing that in the future he will handle these types of transactions properly and with the guidance of his broker. The hearing panel felt that the Respondent did not have authority to offer the Property for sale since the listing agent and seller were unaware of the Respondents advertisement of the “assignable contract.”

The hearing panel determined that the Respondent should have ensured that his status as a real estate professional was included on the offer prior to it being presented to the seller. The hearing panel noted that while contracts may be legally assigned, there are certain disclosures, consents and other legal documents that must be included to ensure the transaction is fully transparent to all parties. The Respondent was found in violation of Articles 4 & 12 of the Code of Ethics and required to take a 3 hour COE class and 3 hour live Advanced Forms CE class not for CE credit.

The Complainant represented a buyer. The Respondent represented a seller. On Easter Sunday, the Respondent had an appointment to show a listing down the street from the Complainant’s listing. Believing it was the correct address, the Respondent accessed the key box on the Complainant’s listing and entered the property. The seller was at home in bed and was surprised by the Respondent. The Respondent apologized for the mix up and left the property. The Respondent did not try to contact the Complainant that day and was advised by her broker not to contact the Complainant at a later date. Concerning Article 1 of the Code of Ethics, the panel finds the Respondent in violation of this article. The trust that the public places in Realtors® by allowing access to their property is significant and must be taken seriously. Although this unauthorized entry was not intentional, the damage was done to the trust of the seller. Proper care must be taken to ensure only authorized entry is allowed into a seller’s property. The panel did not believe that proper care was taken in this instance. The Respondent was found in violation of article 15 of the Code of Ethics and required to pay a $250 fine and take a live COE course for no CE credit.

The Complainant represented a Buyer. The Respondent represented a Seller. The Respondent had an appointment to take a Buyer through the Complainant’s listing. After the showing late in the evening, the

Respondent emailed the Complainant a question about accepting FHA loans but did not submit an offer. The next morning the Seller accepted an offer from a different buyer. The Respondent contacted the Complainant and they spoke over the phone. The Respondent was upset at not having a chance to submit an offer for her Buyer and the conversation deteriorated. Several texts were exchanged as well. The Respondent posted a comment on a private local agent page on the social media app Facebook. The post referenced the brokerage by the first letter of its name but not the full name. Stating that she had “just had a horrible experience” with this brokerage and to “Please advise your sellers better.” She further wrote, “I feel bad for these particular sellers that are being represented by them.” The Complainant confronted the Respondent about the post and the Respondent eventually took it down. Concerning Article 15 of the Code of Ethics, the panel finds the Respondent in violation of this article. The Respondent referenced the Complainant’s brokerage in a way in which they could be identified. Furthermore, by implying that the Complainant was not representing the Buyer in a competent way, the panel believes the Respondent violated this article by recklessly making a misleading statement about another real estate professional. The Respondent was required to take a live COE class and pay a $500 fine.

The Respondent placed an advertisement on a Facebook group page that stated “Have one at 69% in Salt Lake County based on a very strong set of data. PM me for details.” There was nothing in the ad that indicated the Respondent was a licensed Realtor® nor did it state the brokerage firm he was currently affiliated with. In a private message from the Respondent to the Complainant, the Respondent did indicate that he would be the buying agent. However, this information was not contained in the Facebook ad for all to see. Respondent was found in violation of Article 12 of the Code of Ethics and was required to take a live COE class not for CE credit and pay a $150 fine.

The Salt Lake Board of Realtors® held its annual Forecast Breakfast on Jan. 13. Lawrence Yun, chief economist of the National Association of Realtors®, was the keynote speaker. James Wood, Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute, was a featured speaker. Kenny Parcell, president of the National Association of Realtors® and a lifelong Utah resident, introduced Yun. Gary Cannon, owner of Cannon & Company Real Estate Service, was recognized for a lifetime investment of $100,000 to the Realtors® Political Action Committee (RPAC). Yun predicted that mortgage rates could fall as low as 5.5% by spring. Wood said that the 2023 annual median sales price will likely be within a few percentage points of 2022. Worst case scenario, he added, prices down about 5%; best case scenario, prices equal to 2022. “Reluctant sellers and priced-out buyers will make for a year of reduced sales,” Wood said. “After seven years of sales averaging 18,000 homes, the high prices of 2022 dropped sales by 26% to 13,000. The level of sales in 2023 will not top 13,000 and will likely range between 11,000 to 12,000 homes.”

By Realtor® Magazine Staff

By Realtor® Magazine Staff

Congress gave final approval Friday to a bipartisan bill to fund the government through Sept. 30, 2023, clearing the last major piece of legislation for the year. The bill now goes to President Joe Biden for his signature. Included in the bill are an extension of the National Flood Insurance Program (NFIP) through Sept. 30 and a host of other housing programs supported by the National Association of Realtors®. Here’s a detailed list of NAR priorities included in the spending package:

1. Anti-money laundering: The bill provides funding for developing a beneficial ownership database, which includes information on real estate ownership to support anti-money laundering efforts.

2. Broadband: $364 million is appropriated to the USDA’s Rural Development Broadband ReConnect Program(link is external) to fulfill its mission of providing loans and grants to fund construction, improvement or acquisition of facilities and equipment to provide broadband service in eligible rural areas.

3. Community development funding: The bill allocates nearly $6.4 billion to the Community

Development Block Grant(link is external) (CDBG) program and other local economic development projects to benefit low- and moderate-income neighborhoods and people. This is a $1.6 billion increase in CDBG funding, including $85 million in grants to jurisdictions for the identification and removal of barriers to affordable housing production and preservation. The bill also allocates $324 million to the Treasury Department’s Community Development Fincanial Institutions Fund(link is external), which promotes economic and community development in lowincome communities, including investments in low-income housing.

4. COVID-19 assistance programs: There is increased funding in the bill for various programs under the pandemic-era CARES Act and American Rescue Plan, including housing and rental assistance.

5. Disaster assistance: $27 billion is appropriated for emergency funding to help communities recover from recent natural disasters, rebuild infrastructure and prepare for future events.

6. Elderly housing assistance: $1.4 billion is appropriated for the Housing for the Elderly and Housing for Persons with Disabilities programs under HUD.

7. Emergency disaster assistance: $38 billion is appropriated for emergency funding to help Americans impacted by recent disasters in the West and Southeast, including tornadoes, hurricanes, flooding and wildfires, as well as funding for FEMA’s Disaster Relief Fund.

8. Energy assistance: $5 billion is appropriated for the Low Income Home Energy Assistance Program(link is external) (LIHEAP), which helps lowincome families pay their energy costs, including home energy bills, weatherization and certain energy-related home repairs.

9. Federal Housing Administration: The bill sets a limit of up to $400 billion in FHA commitments to guarantee single-family loans and provides $150 million for administrative costs, available through Sept. 30, 2024.

10. Flood insurance: The bill extends the National Flood Insurance Program (NFIP) through the end of 2023. The program’s current authorization would have expired Friday. The bill also increases flood map funding from $275 million to $313 million.

11. Ginnie Mae: The bill provides up to $900 billion for new loan guarantee commitments and provides $40.4 million for salaries and expenses for the Government National Mortgage Association.

12. HOME Investment Partnerships Program: $1.5 billion is provided for HUD’s HOME Investments Partnerships Program(link is external), which provides grants to states and localities to fund housing-related activities, including building, buying and rehabilitating affordable housing units for rent or purchase, as well as rental assistance. This money is expected to lead to the construction of nearly 10,000 new units for the rental and sale markets.

13. Homelessness assistance: $3.6 billion for homeless assistance grants, enough to provide funding to assist more than 1 million people experiencing homelessness. This provision includes funding to expand assistance to special populations, including survivors of domestic violence, homeless youth and new permanent supportive housing for people experiencing homelessness.

14. Housing vouchers: The bill provides $130 million in new incremental funding for new Section 8 Housing Choice Vouchers, enough to support an additional 11,700 low-income households.

15. Infrastructure: The bill includes $62.9 billion for the Federal Highway Administration, which includes funding for federal highway programs from the 2021 Bipartisan Infrastructure Framework and money to address structurally deficient bridges.

16. Manufactured housing: $225 million is provided for the preservation and revitalization of manufactured housing units and communities.

17. Native community housing: Over $1 billion is appropriated for Native communities to purchase, construct or rehabilitate housing and related infrastructure to address production demand and the need for higher-quality housing stock.

18. Retirement savings: The bill updates rules relating to employer 401(k) and 403(b) plans, requiring them to automatically enroll all new, eligible employees.

19. Rural housing: $2 billion is appropriated for the USDA’s Rural Housing Service, an increase of $183 million over fiscal 2022. Within that increase is $40 million in rental assistance funds.

20. Small business programs: More than $1.2 billion is appropriated for the Small Business Administration (SBA), including funds for SBA disaster loans, entrepreneurial development grants and small business development centers.

21. Veteran housing: $2.7 billion is included for critical services and housing assistance for veterans.

The New Year is here, and no doubt you’ve thought long and hard about your goals for 2023. But are they SMART goals (S-specific; M-measurable; A-achievable; R-realistic; T-timely)?

In order to realize your SMART goals, you’ll have to get into a healthy business routine. Here are seven habits to consistently practice every day to make 2023 the best year for you and your brokerage.

1. Praise your team for their efforts, not results. Everyone thrives on praise. Praise encourages, motivates, and inspires people to achieve greater heights. But how you praise people is key.

culture where agents think anything is possible.

• Regardless of whether a deal closes, provide encouragement such as, “I have total confidence in you. I’ve never seen you give up. I know you’re going to get there.”

2. Be calm and unflappable, regardless of what happened before you walked in the door. You are the broker—the leader. Your mood sets the tone in the firm every day. Being calm enables you to sit in the driver’s seat and focus on your priorities to get things done. Calm brains are hardwired to perform.

3. Do not check your email in the morning. If there is an emergency, you’ll know or find out about it immediately. No one finds out about an emergency in an email.

• Praise your agents on their individual and group efforts. Never assume their talents or smarts are a given. Otherwise, they may think, “What if I don’t get a deal done next time? Maybe I’m not as smart as you think. Next time I might fail.”

• Praising effort creates a work environment that values growth and improvement. Strive to create a

• Give your best, most productive hours of the day to your own goals, not someone else’s as stated in their email.

• Set yourself up to act on an email, not react to it.

• Do not allow your priorities and goals to be hijacked by an email.

4. Only do what’s important.

• Complete your planned activities first, and ask yourself whether anything else is essential.

• There is a direct correlation between your use of time and your output, which is driven entirely by hours spent on your planned activities.

5. Make any and all distractions go away. Distractions are “culturally-generated ADD,” according to Ed Hallowell, former professor at Harvard Medical School and author of Driven to Distraction

• Change your environment by changing your behavior. For example, try working for an hour at home in the morning so that you won’t be interrupted every five minutes with a question or email.

6. Create a consistent routine. Routines work because they become automatic; you don’t have to think about them.

• Apply the 8-2 rule: Of the 10 things you do each day, only two of them are really responsible for the success of your company. Figure out what those two things are and do them every day. Try to eliminate doing the other eight things.

7. Define tomorrow’s one or two priorities or goals the night before.

• Make those goals SMART.

• Write them down.

• Take that list with you in the morning.

As long as you are clear about your SMART brokerage goals for 2018, these seven daily habits will help your firm—and you—make 2018 your best year yet.

Mortgage rates have been pulling back ever since surging to a 7.08% average in November.

By Melissa Dittmann TraceyMortgage rates likely will settle below 6% and experience less volatility this year, predicts Nadia Evangelou, senior economist and director of forecasting at the National Association of Realtors®. But we’re not there yet: The 30-year fixed-rate mortgage averaged 6.48% this week, according to Freddie Mac. “Although rates remain more than double a year ago, they will likely stabilize as inflation will continue to slow down in the coming months,” Evangelou said.

Mortgage rates have been pulling back ever since surging to a 7.08% average in November. But the housing market may still be adjusting to higher rates; a year ago, the 30-year rate averaged 3.22%. “Mortgage application activity sunk to a quarter-century low this week as high mortgage rates continue to weaken the housing market,” said Sam Khater, Freddie Mac’s chief economist. “While mortgage market activity has significantly shrunk over the last year, inflationary pressures are easing and should lead to lower mortgage rates in 2023.”

Until then, home buyers may be in wait-and-see mode. Affordability has been hammered by higher rates in recent months. Evangelou said the qualifying income

for homeownership is now near the $100,000 threshold, which means only 32% of all households and 15% of all renters can afford to buy a median-priced home. The majority of these households are Gen Xers, whose median age is 51, she adds.

But many aspiring buyers from younger generations are still waiting to jump in. “Home buyers are waiting for rates to decrease more significantly, and when they do, a strong job market and a large demographic tailwind of millennial renters will provide support to the purchase market,” said Khater. “Moreover, if rates continue to decline, borrowers who purchased in the last year will have opportunities to refinance into lower rates.”

Freddie Mac reported the following national averages with mortgage rates for the week ending Jan. 5:

• 30-year fixed-rate mortgages: averaged 6.48%, up from last week’s 6.42% average. A year ago, 30-year rates averaged 3.22%.

• 15-year fixed-rate mortgages: averaged 5.73%, also up from last week when they averaged 5.68%. A year ago at this time, 15-year rates averaged 2.43%.

Mortgage interest rates fell to 6.13% as of Jan. 26, the lowest rate since September of 2022, according to Freddie Mac. Rates are predicted to fall to 5.5% this spring, according to Lawrence Yun, chief economist of the National Association of Realtors®.

“The spread between the 10-year Treasury and the 30-year mortgage rate is exceptionally wide,” Yun told Realtors® earlier this month while visiting Salt Lake City. “If we had a narrowing, or say, a normal spread condition, today’s mortgage rate would be 5.5%.”

Meanwhile, the median single-family home price in Salt Lake County settled at $541,900 in December, 6% lower than the median price in December 2021. It was the first year-over-year price decline since 2011.

From March 2020 through May 2021, the pandemic spurred a home-buying rush. This caused the median singlefamily home price to jump nearly 60% in Salt Lake County. The median single-family home price peaked in May 2022 at $650,000. Since then, home prices have fallen 17%.

“Home buyers have more negotiating power,” said Rob Ockey, president of the Salt Lake Board of Realtors®. “The good news for sellers is that, despite the recent price declines, most homeowners are sitting on plenty of equity. A large majority of homeowners don’t need to sell. They can step back and wait for the dust to settle. Consequently, the price declines since May 2022 will stabilize by the third quarter of 2023.”

Home-price declines will likely be tempered by a lack of housing. The University of Utah’s Kem C. Gardner Institute estimates that there is a 31,000-unit deficit of new homes in Utah.

“Demand for housing is strong because of net in-migration and population increase,” Ockey continued. “More than one-third (38%) of all active listings on UtahRealEstate.com are under contract, which indicates there is still strong buyer demand in our market.”

In December, the median time a home was on the market was 41 days, up from 9 days a year earlier.

Sales of all housing types fell to 761 units in Salt Lake County, down 50% compared to 1,508 sales in December 2021. Home sales in 2022 in Salt Lake County totaled 13,087, down 26% from 2021; the steepest single-year drop on record (1997 to the present). Prior to 2022, real estate sales had been remarkably consistent for seven years at about 18,000 sales, only diverging in 2020, the pandemic year, when sales jumped to 19,000 units.

Centrally located in the Salt Lake Valley, this townhomes community offers 2- and 3story floor plans ranging from 1800-2150 square feet.

QUICK MOVE-INS AVAILABLE: 2- and 3-story units, both interior and exterior

Starting in the $420s

55-plus community located near shopping, entertainment, and majorthoroughfares. Fully landscaped yards and snow removal included.

QUICK MOVE-INS AVAILABLE: Rambler-style homes ranging from 2902-3505 square feet

Starting in the $620s

LIBERTY

HOMES

Custom-desgined homes in the heart of the Heber Valley. Maintenance-free living with fully landscaped yard and snow removal.

QUICK MOVE-INS AVAILABLE: Single-family homes ranging from 4219-4575 square feet