Relocating is a chance to put down new roots. When your Clients move into a David Weekley home, they can rest easy knowing that every detail will be just as they dreamed — both with their home and with their experience. Their Sales Consultant, Personal BuilderSM and Design Consultant will guide them through every step of the journey, and our industry-leading Warranty will ensure that your Clients are taken care of long after closing. With regular Team calls and their own personal website, your Clients will be kept up-to-date whether they’re across the country or around the corner. That’s The Weekley Way!

See

Homes Sales Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to

notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2022-23 David

Homes

$649,900 The

Ready Now! $559,900 The

Cottage

Ready Now! $879,900

Ascent

$549,990

Ready in September! Ready Now!

a David Weekley

change without

Weekley

- All Rights Reserved. Salt Lake City, UT (SLC-22-004605) Homes from the low $500s to mid $700s+ in the Salt Lake City area

Casale The Enclave at Highland Park 11079 South Willow Walk Drive 1,924 sq. ft., 2 Story 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage

Eastlake

Courts at Daybreak 11562 South Bingham Rim Road 1,924 sq. ft., 2 Story 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage

The Copperton

at Daybreak 11471 South Bingham Rim Road 4,211 sq. ft., 2 Story 6 Bedrooms, 3 Full Baths, 1 Half Bath, 2-car Garage

The Coppell The Carriages at Ridgeview 9757 North Caldwell Place 1,706 sq. ft., 2 Story 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage

Learn more about our homes by contacting 385-910-0551 Explore move-in ready homes

David

Weekley Homeowners Alysha & Chris Johansen and a David Weekley Homes Warranty Service Representative

Celebrate Your Company’s Top Producers Take this opportunity to recognize your company’s top producers, associates, and affiliates. Keep the momentum going! Advertise in Salt Lake Realtor® Magazine March 2023 GOOD POSITIONS ARE STILL AVAILABLE–RESERVE YOUR SPACE NOW! 801-467-8833 | info@millspub.com Your audience awaits... REALTOR® 500 TOP PRODUCERS

Image licensed by Ingram Image

Salt L ake REALTOR® Magazine slrealtors.com The Salt Lake REALTOR® (ISSN 2153 2141) is published monthly by Mills Publishing, located at 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106. Periodicals Postage Paid at Salt Lake City, UT. POSTMASTER: Send address changes to: The Salt Lake REALTOR,® 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106-4618. January 2023 volume 83 number 1 This Magazine is Self-Supporting Salt Lake Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt Lake Realtor Magazine comes from trees in managed timberlands. These trees are planted and grown specifically to make paper and do not come from parks or wilderness areas. In addition, a portion of this magazine is printed from recycled paper. Table of Contents slrealtors.com Features 10 The Top States People Moved to—and the Ones They Left—Last Year Clare Trapasso 12 The Salt Lake County Residential Real Estate Market: Inflation, Mortgage Rates, and Housing Prices, 2022-2023 James Wood 18 Making a Leader Jared Lloyd Columns 7 Civility Costs Nothing and Buys Everything Rob Ockey – President’s Message Departments 8 Happenings 8 In the News 20 Housing Watch 4 | Salt Lake Realtor ® | January 2023 On the Cover: Cover Design: Kelley Wright 12 The Salt Lake County Residential Real Estate Market: Inflation, Mortgage Rates, and Housing Prices, 2022-2023 10 The Top States People Moved to—and the Ones They Left—Last Year 18 Utah’s Kenny Parcell rises from humble beginnings to lead the National Association of Realtors® Leonid Andronov ©/Adobe Stock aiisha ©/Adobe Stock Photo courtesy of NAR

farmington midvale draper vernal TO JOIN ONE... call RP (801) 633.1990 or Angela (801) 703.6553 Each franchise independently owned and operated. (801) 915.4315 ROG SIGNATURE (435) 724.4953 ROG SIGNATURE (801) 671.6158 ROG GOLDMARK (435) 602.4141 ROG GOLDMARK (801) 633.1990 ROG SIGNATURE (801) 703.6553 ROG SIGNATURE (801) 671.6158 ROG GOLDMARK ROG GOLDMARK (435) 602.4141 MIDVALE | DRAPER | VERNAL | PARK CITY | KANAB | FARMINGTON | ST.GEORGE | CEDAR CITY Happy New Year Just a Reminder... If you paid your brokerage more than 6% last year, you paid too much. When the going gets tough, the tough looks to get a raise.

THE FIRST-EVER, ALL-ELECTRIC

i4 & iX BMW BMW

The Ultimate Driving Machine®

Go electric. Go anywhere. The BMW i4 Gran Coupe and BMW iX Sports Activity Vehicle® arrives with class-defining style and performance, game-changing sustainable materials, and innovative technology. They deliver far-reaching range and efficiency, with all the breathtaking power that define all BMWs. Experience our electrifying performance with a test drive of the Ultimate Driving Machine® today and see why BMW is the new electric standard.

© 2022 BMW of North America, LLC. The BMW name, model names and logo are registered trademarks.

© 2022 BMW of North America, LLC. The BMW name, model names and logo are registered trademarks.

President Rob Ockey Presidio Real Estate

First Vice President Dawn Stevens Presidio Real Estate

Second Vice President

Claire Larson Woodside Homes

Treasurer

Jodie Osofsky Summit Sotheby’s

Past President Steve Perry

Presidio Real Estate CEO Curtis Bullock

Directors

Carlye Webb Summit Sotheby’s

Jennifer Gilchrist

KW South Valley Keller Williams

John Lucky Berkshire Hathaway

Janice Smith Coldwell Banker

Laura Fidler Summit Sotheby’s (Draper)

Amy Gibbons

KW South Valley Keller Williams

Jenni Barber Berkshire Hathaway (N. SL)

J. Scott Colemere Colemere Realty Assoc.

Hannah Cutler Coldwell Banker

Michael (Mo) Aller Equity RE (Advantage)

Morelza Boratzuk RealtyPath

Civility Costs Nothing and Buys Everything

A rise of incivility has infected America. It is present in our conversations, social media, sporting events, political discourse, on our highways, and in the workplace.

“Incivility is like a virus you can catch anywhere — online, at work, in families, in our communities,” Georgetown professor Christine Porath said in a recent interview. “We can see that people pass it on to others even when they’re not aware of it and may not mean to demean others. It can be spread simply by someone who is on edge and just took in a lot of negativity and turns around and shouts at someone else. This is why our small actions matter so much.”

Porath should know. She has studied incivility, particularly in the workplace, for more than 20 years.

According to a survey of 2,000 people in 25 industries conducted by Porath: 76% of respondents experience incivility at least once a month. 78% witness incivility at work at least once a month, and 70% witness it at least two to three times a month.

Incivility, according to Porath, has sharply increased when compared with the results of her 2012 survey. Porath shared one example from an interview she conducted. One retail employee related a customer’s response to her saying, “Good morning”: “I do not need you for anything,” the customer snapped. “Leave me alone. If I need you, I will call you. You are here to serve, not to talk with me.”

Why the increase in incivility? Porath said it comes down to five factors: stress, negative emotions, weakened ties, technology, and a lack of self-awareness.

“We may have good intentions and work hard to be patient and tolerant, but our tones, nonverbal signals, or actions may come across differently to the people we interact with and those who witness the interactions,” she said. “Merely being exposed to rude words reduces our ability to process and recall information. Dysfunctional and aggressive thoughts (and sometimes actions) can skyrocket.”

Salt Lake Board: (801) 542-8840 e-mail: dave@saltlakeboard.com Web Site: www.slrealtors.com

The Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin.

The Salt Lake REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS®

Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

OFFICIAL PUBLICATION OF THE SALT LAKE BOARD OF REALTORS ®

REALTOR is a registered mark which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS

As the 2023 president of the Salt Lake Board of Realtors®, I hope we can replace rudeness and incivility with a soft answer and kind gesture. As Realtors®, we can be more patient with one another, especially during high-stakes negotiations and when facing deadlines. By doing this we not only increase civility, but professionalism.

Thankfully, civility and kindness spread, too.

This past Christmas, an unnamed man set off a chain reaction of generosity at a Massachusetts restaurant when he asked the waitress if he could pay for another customer’s meal. The man whose bill had been paid was so overtaken when he learned of the gesture that he paid the entire bill of a family sitting nearby. The chain reaction continued when the restaurant reopened the day after Christmas, with more than 10 tables and dozens of customers paying each other’s bills.

We can each make our communities and workplaces better by treating each other better. I believe civility costs nothing and buys everything.

Rob Ockey President

January 2023 | Salt Lake Realtor ® | 7

October 2005

Graphic Design Ken Magleby Patrick Witmer

Administrator

Bell

Sales Staff Paula Bell Paul Nicholas Managing Editor Dave

Publisher

Office

Cynthia

Snow

Anderton

Mills Publishing, Inc. www.millspub.com President Dan Miller Art Director Jackie Medina Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Salt L ake REALTOR®

Magazine slrealtors.com

Happenings On the Move

Presidio Hires COO

Record Number of Americans Working

According to Lawrence Yun, chief economist of the National Association of Realtors®, “there are more Americans working today than at any other time in history due to 223,000 net new jobs in the past month, 4.5 million in the past year, 11.2 million in the past two years, and 23.2 million since the low point during the economic lockdown in April 2020.” The U.S. unemployment rate is at a historic low of 3.5%. Wage growth over the past 12 months was 4.6%. Yun added that job additions will be critical in generating fresh housing demand as mortgage rates show signs of stabilization. “Housing affordability remains a challenge for those renters considering buying a home,” Yun said. “More homes, therefore, need to be built to ensure more supply and lessen the upward pressure on home prices and apartment rents. This will also help tame the overall consumer price inflation, permitting the Federal Reserve to stop raising interest rates and possibly lower its short-term fed funds rate before the year ends.”

Presidio Real Estate Company has hired Rob Ockey as Chief Operating Officer. Rob has worked in the real estate industry for 28 years and has been a principal broker of one of the largest brokerages in the state of Utah. He has also served for many years on local and state association committees, including Professional Standards, Government Affairs, and Grievance. He was chair of the Grievance Committee for the Salt Lake Board of Realtors® in 2017. “Rob is the epitome of what we look for in our leadership at Presidio,” said Jennifer Yeo, CEO of Presidio Real Estate. “He cares about people and the agents while selflessly giving of his knowledge for growth and progress. We are excited to work with someone of this caliber.” Rob is currently serving as the 2023 president of the Salt Lake Board of Realtors®.

Equity Names CEO

Members Sign Up for 2023 Committees

Members of the Salt Lake Board of Realtors® took part in the annual Committee Sign Up Day in December. The Board has eight committees and three NARaffiliated committees. To learn more about each committee visit: slrealtors. com/committees. The Salt Lake Board of Realtors® serves a four-fold mission: government advocacy, knowledge, communication, and service. Committees help the Board accomplish this mission. Realtor® and affiliate members are encouraged to volunteer to serve on one or more of the Board’s committees.

Tony Ketterling has been named CEO of Sandybased Equity Real Estate. As CEO, Tony will oversee Equity’s offices in 18 states and 3,600 agents. He has been with the company since 2010. Before being named CEO, Tony was a broker at Equity, where he oversaw 325 agents. Tony is a co-owner of Equity. He has served as an appointed member of the Board of Directors of the Salt Lake Board of Realtors® for 12 years and has been a Realtor® since 1997.

8 | Salt Lake Realtor ® | January 2023

Kurhan ©/Adobe Stock

Coldwell Banker and the

Banker logos are trademarks of

Banker Real Estate LLC. The Coldwell

of Anywhere Advisors LLC and franchised offices which are independently owned and operated. The Coldwell Banker System fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. 22SXUG_UT_11/22 WHAT YOU NEED TO THRIVE Don’t just make it through – learn how to thrive with Coldwell Banker Realty. Visit CareersCB.com to learn more. HELPING YOU LIVE AN EXCEPTIONAL LIFE Is your brokerage doing enough to help you through this challenging market? The Coldwell Banker ® brand has been helping agents grow their business through good times and bad since 1906. We offer competitive commission plans, personal branding packages and an industry-leading technology suite that will help you be more productive1 and earn more money 2 97% COMMISSION SPLITS AGENT SUCCESS PACKAGES AGENT BRANDING PACKAGES

1. Based on the average commission amount in 2021 of active agents and teams that (i) sent a CFL and/or Quarterly/Area/Market Report through Prospect Square, (ii) placed an order through Listing Concierge, (iii) created a buyer, seller and/or generic presentation in MoxiPresent, (iv) added a listing in Exclusive Look, (iv) placed an order within Design Concierge; and (v) downloaded graphics, shared claims, emailed claims, performed a search, viewed a report, and/or exported to pdf in Market Quest V2. 2. Based on Coldwell Banker Realty Listing Concierge usage data Jan. 1-Dec. 31, 2021 with an average sales price of properties marketed through Listing Concierge of $643,380. Any affiliation by you with the Company is intended to be that of an independent contractor sales associate, not an employee. ©2022 Coldwell Banker. All Rights Reserved.

Coldwell

Coldwell

Banker® System is comprised of company owned offices which are owned by a subsidiary

The Top States People Moved to—and the Ones They Left—Last Year

Texas, Florida, and South Carolina were the top U-Haul growth states in 2022. Utah ranked No. 12.

By Clare Trapasso

Americans packed up their belongings and headed for cheaper destinations last year.

The top spots for those moving across state lines in 2022 were the sunny South and more rural, Northeastern states that boasted a more affordable cost of living, according to statistics released by three national moving companies.

“The 2022 trends in migration followed very similar patterns to 2021 with Texas, Florida, the Carolinas and the Southwest continuing to see solid growth,” stated John “J.T.” Taylor, U-Haul International president. “We still have areas with strong demand for one-way rentals. While overall migration in 2021 was record-breaking, we continue to experience significant customer demand to

move out of some geographic areas to destinations at the top of our growth list.”

Popular destinations for those moving across the country included Florida, the Carolinas, and some of the chilliest Northeastern states. U-Haul, Atlas Van Lines, and United Van Lines all released reports detailing the states the most people moved in and out of in 2022.

“You have people moving from the colder Northeastern and Midwestern states to the warmer Southern and Western states. That trend has been going on for 30 years and seemed to accelerate during COVID,” said Michael Stoll, professor of public policy at the University of California, Los Angeles, who studies migration trends. “Residents of the Midwestern and

10 | Salt Lake Realtor ® | January 2023

aiisha ©/Adobe Stock

Northeastern states tend to be a little older … so a lot of folks are thinking retirement locations.”

The Northeastern states picked up new residents as those who could work remotely or were retiring sought out less populated areas with more outdoor activities, lower home prices, and a less expensive cost of living that were still within a few hours’ drive of the larger cities.

“These areas in the Northeast became increasingly attractive,” said Stoll. “A lot of people in Manhattan moved to these areas.”

While the top destinations for movers varied depending on who conducted the study, there wasn’t as much variation in the ones people were leaving. Illinois and New York made the top five among all the moving companies. Both states are relatively cold and have high costs of living, with Illinois having some of the heftiest tax burdens in the nation.

According to the U-Haul Growth Index, more people left California in 2022 than any other state. Demand for equipment out of California, Illinois and New York remained strong in 2022, as more people opted to leave areas of the West Coast, Northeast and Midwest. California and Illinois ranked 50th and 49th,

respectively, on the U-Haul Growth Index for the third consecutive year, meaning those states saw the greatest net losses of one-way U-Haul trucks.

Fewer people moved in 2022 compared with 2021 as the pandemic began to wane, according to the U-Haul study as well as the Atlas Van Lines report. The number of people relocating because they could work remotely declined a bit.

Older members of Generation X and baby boomers were the most likely to relocate, according to United Van Lines’ 46th Annual National Movers Study. More than half of those who booked a move through United Van Lines were 55 and older.

They typically moved to less populated areas because of a career change, retirement, or the desire to be closer to their family. Younger millennials were more likely to head to larger cities.

“Americans are moving from expensive cities to lowerdensity, more affordable regions,” United Van Lines spokesman Eily Cummings said in a statement.

Clare Trapasso is the executive news editor of Realtor.com where she writes and edits news and data stories.

We’ve

January 2023 | Salt Lake Realtor ® | 11 Construction

us online at

or give us a call

CONSTRUCTION LOANS NMLS #654272 EQUAL HOUSING LENDER

Got You Covered Visit

UFirstCU.com

at 801-481-8840

The Salt Lake County Residential Real Estate Market: Inflation, Mortgage Rates, and Housing Prices, 2022-2023

By James Wood Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute

Board of Realtors®

By James Wood Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute

Board of Realtors®

When asked what he had learned from more than 40 years of housing research, Chip Case of the S&P Case-Shiller Price Indices replied, “housing markets can turn on a dime.” And that’s certainly the case for the Utah housing market in 2022. In May, the median sales price of a single-family home in Salt Lake County hit $650,000, but by December, it had dropped to $540,000. That same month prices registered their first year-over-monthly decline since 2012, a 2.1% drop. The abruptness of the 2022 correction raises a hard question, what can we expect for mortgage rates and housing prices in 2023?

THE RISE IN INFLATION

Inflation underlies the housing market’s correction. It forced the Federal Reserve to raise the federal funds rate, which contributed to higher mortgage rates, making housing more expensive. Higher home prices reduced homebuyer demand causing real estate sales to decline. Inflation set off this chain of events and the correction of 2022.

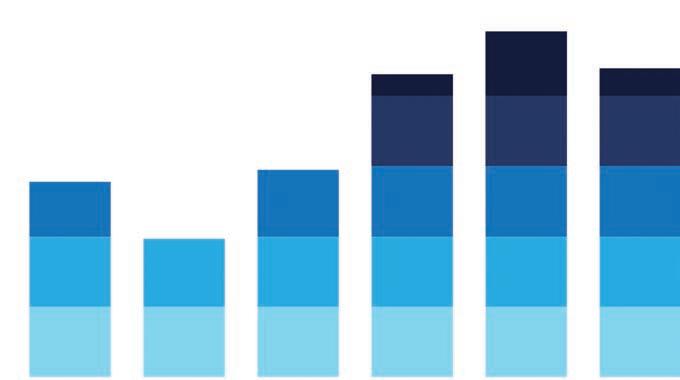

There are several measures of inflation. The most often used is the Consumer Price Index (CPI). The CPI had been stable for nearly 10 years. From 2012 to early 2021, price increases fluctuated in a narrow range of 1%-2%, Figure 1. What caused

12 | Salt Lake Realtor ® | January 2023

This report was commissioned by The Salt Lake

Inflation,

of housing research, Chip Case of the S&P Case-Shiller Price Indices replied, "housing markets can turn on a dime." And that’s certainly the case for the Utah housing market in 2022. In May, the median sales price of a single-family home in Salt Lake County hit $650,000, but by December, it had dropped to $540,000. That same month prices registered their first year-over-monthly decline since 2012, a 2.1% drop The abruptness of the 2022 correction raises a hard question, what can we expect for mortgage rates and housing prices in 2023?

The Rise in Inflation

Inflation underlies the housing market’s correction. It forced the Federal Reserve to raise the federal funds rate, which contributed to higher mortgage rates, making housing more expensive Higher home prices reduced homebuyer demand causing real estate sales to decline. Inflation set off this chain of events and the correction of 2022.

There are several measures of inflation. The most often used is the Consumer Price Index (CPI). The CPI had been stable for nearly 10 years. From 2012 to early 2021, price increases fluctuated in a narrow range of 1%-2%, Figure 1. What caused the CPI to break out of this stable pattern? There are three generally accepted causes: (1) the pandemic’s fiscal stimulus, (2) supply chain disruptions, and (3) the Ukraine war.

Figure 1 Year-Over Percent Increase in the Consumer Price Index (U.S. City Average Urban Consumers)

Figure 1

Year-Over Percent Increase in the Consumer Price Index (U.S. City Average Urban Consumers)

Source: U.S. Bureau of Labor Statistics.

1

the CPI to break out of this stable pattern? There are three generally accepted causes: (1) the pandemic’s fiscal stimulus, (2) supply chain disruptions, and (3) the Ukraine war.

Fiscal stimulus – In March 2020, when the threat of Covid-19 emerged, U.S. unemployment quickly rose by 15.9 million,

and the unemployment rate increased by 10.3%, the largest one-month increase in the history of employment data (1948 to 2020). In five weeks, from mid-February into March, the Dow Jones Industrial Average lost 37% of its value, and second-quarter GDP declined at an annual rate of 31.7%. And importantly, the toxicity of Covid-19, an airborne virus that could be asymptomatic, was unknown. In this environment, both Republicans and Democrats overwhelmingly voted for immediate federal aid to state and local governments, businesses, and workers. The $2.4 trillion CARES Act was passed in March/April 2020. In December, a supplemental appropriation to the CARES Act was again overwhelmingly approved for $900 billion. The third fiscal stimulus bill, the American Rescue Plan Act, was passed along party lines in March 2021 for $1.9 trillion. The total appropriation of the three bills was $5.1 trillion. The pandemic’s fiscal stimulus was nearly six times larger than the $900 billion in fiscal stimulus for the Great Recession.

The pandemic brought legitimate worries that the global economy would collapse. The fiscal stimulus seemed necessary, as evidenced by the 96-0 vote in the Senate for the

Act and the 92-6 Senate vote for the CARES Act’s

January 2023 | Salt Lake Realtor ® | 13

CARES

Leonid Andronov ©/Adobe Stock

The Salt Lake County Residential Real Estate Market:

Mortgage Rates, and Housing Prices, 2022-2023

By James Wood Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute This report was commissioned by The Salt Lake Board of Realtors®

When asked what he had learned from more than 40 years

2.00% 4.00% 6.00% 8.00% 10.00% 2012 June November April September February July December May October March August 2017 June November April September February July December May October March August 2022 June November

9.10% 7.10% -2.00% 0.00%

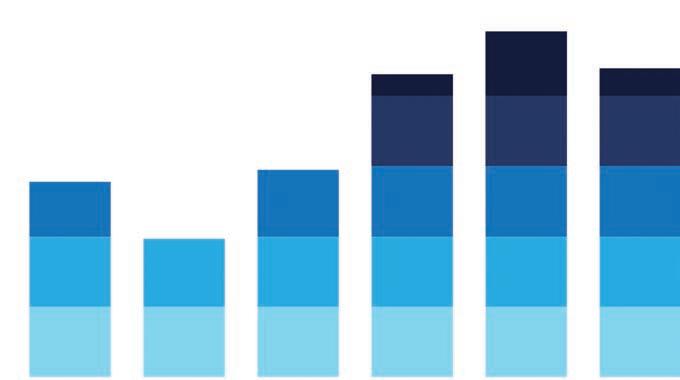

among lenders. In 2022, these factors combined to push mortgage rates from 3.2% in the first week of January to 7.0% by the end of October, more than doubling the rate in nine months, Figure 2. As the Federal Reserve's policies began to cool the economy, the average monthly mortgage rate dropped to 6.4% by the last week of December.

I

supplemental funding. The stimulus inevitably gave a big boost to demand (governments, businesses, consumers), which by 2021 began to push prices higher and, by 2022, accelerated price increases.

Supply chain constraints – For decades, globalization contributed to low prices and low rates of inflation, but when global supply chains are disrupted, as with a pandemic, shortages and higher prices become the norm. Thus, the pandemic not only boosted demand and prices via fiscal stimulus but also contributed to supply constraints that put upward pressure on prices.

Supply chain constraints center on China. The country plays a major role in supplying parts and finished products to foreign countries. But China’s zero Covid policy (recently relaxed) shut down major cities as well as manufacturing facilities producing critical component parts and popular finished products. Most notable was the chip shortage. Semiconductors or chips were backlogged for as much as two years as soaring demand outpaced supply creating delays in the delivery of products. Among the most affected was the auto industry, where the chip shortage hurt sales and increased prices.

Figure 2

Average Weekly Mortgage Rates

Figure 2 Average Weekly Mortgage Rates

While globalization has been a serious international constraint, the labor shortage has been a serious domestic constraint and contributor to inflation. Utah’s unemployment rate at 2% is hovering near an all-time low as employers scramble for workers who require higher wages. The shortage of workers adds to the upward pressure on prices as higher payroll costs are passed on to the consumer.

Ukraine war and inflation – The invasion of Ukraine by Russia in February 2022 setoff the largest land war in Europe since the Balkan Wars of the 1990s. The war added to global supply disruptions caused by scarcity and the rising cost of raw materials, particularly oil. The increase in oil prices in 2022 was due in part to the war.

THE SUDDEN INCREASE IN MORTGAGE RATES

In response to the highest rates of inflation in 40 years, the Federal Reserve raised the federal fund’s target range seven times in 2022. This aggressive policy contributed to the sharpest nine-month increase in mortgage rates in over 50 years. To be clear, the Federal Reserve does not set mortgage rates, but raising the target range indirectly influences long-term mortgage rates. Mortgage rates are also affected by overall economic conditions, inflation, the Treasury bond and note market, and competition among lenders. In 2022, these factors combined to push mortgage rates from 3.2% in the first week of January to 7.0% by the end of October,

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

7.00%

8.00% 2021 February March April May June July August September October November December 2022 February March April May June July August September October November December

3.22%

7.08% 6.42% 0.00%

among lenders. In 2022, these factors combined to push mortgage rates from 3.2% in the first week January to 7.0% by the end of October, more than doubling the rate in nine months, Figure 2. As Federal Reserve's policies began to cool the economy, the average monthly mortgage rate dropped 6.4% by the last week of December. I

Figure 2 Average Weekly Mortgage Rates

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

2.65%

Mortgage rates are a prime determinant of homebuyer demand. The increase in the rate in 2022 has resulted in a 29% increase in the mortgage payment for the median priced home. The mortgage payment in January, when the interest rate was 3.2%, was $2,851; by December, with the interest rate at 6.4%, the payment increased to $3,678, Table 1. The income required to finance the mortgage payment increased from $122,185 in January to $157,628 in December. The mortgage payment assumes a 5% down payment and a 1% charge for Private Mortgage Insurance. It's important to keep in mind that half of all homes sold were priced below the median. Nevertheless, the 29% increase in payment and income requirement would apply to homes at all price levels, above or below the median price.

7.08% 6.42% 0.00%

Source: Freddie Mac.

3.22%

more than doubling the rate in nine months, Figure 2. As the Federal Reserve’s policies began to cool the economy, the average monthly mortgage rate dropped to 6.4% by the last week of December.

8.00% 2021 February March April May June July August September October November December 2022 February March April May June July August September October November December

Table 1

Mortgage Payment for Median Priced Home in Salt Lake County (Single-Family, Condominium, Townhome, Twin Home)

Category January 2022 December 2022

Median sales price $501,000 $485,000

Amount to finance* $475,950 $460,750

Principal & interest** $2,063 $2,891 Insurance $100 $100 Private mortgage ins. $396 $404 Property tax $292 $283 Total mortgage pmt $2,851 $3,678

Mortgage

Mortgage rates are a prime determinant of homebuyer demand. The increase in the rate in 2022 has resulted in a 29% increase in the mortgage payment for the median priced home. The mortgage payment in January, when the interest rate was 3.2%, was $2,851; by December, with the interest rate at 6.4%, the payment increased to $3,678, Table 1. The income required to finance the mortgage payment increased from $122,185 in January to $157,628 in December. The mortgage payment assumes a 5% down payment and a 1% charge for Private Mortgage Insurance. It’s important to keep in mind that half of all homes sold were priced below the median. Nevertheless, the 29% increase in payment and income requirement would apply to homes at all price levels, above or below the median price.

Mortgage rates are a prime determinant of homebuyer demand. The increase in the rate in 2022 resulted in a 29% increase in the mortgage payment for the median priced home. The mortgage payment in January, when the interest rate was 3.2%, was $2,851; by December, with the interest at 6.4%, the payment increased to $3,678, Table 1. The income required to finance the mortgage payment increased from $122,185 in January to $157,628 in December. The mortgage payment assumes a 5% down payment and a 1% charge for Private Mortgage Insurance. It's important to keep mind that half of all homes sold were priced below the median. Nevertheless, the 29% increase payment and income requirement would apply to homes at all price levels, above or below the median price.

3

Table 1

Table 1

Payment for

Category

7.00% 3

Median

Priced

Home in Salt Lake County (Single-Family, Condominium, Townhome, Twin Home)

January 2022 December 2022

Median sales price $501,000 $485,000

Amount to finance* $475,950 $460,750

Principal & interest** $2,063 $2,891

Insurance $100 $100

Private mortgage ins. $396 $404 Property tax $292 $283

Total mortgage pmt $2,851 $3,678

Such a dramatic increase in mortgage payments in such a short time was bound to have a serious impact on real estate sales. The pool of potential buyers shrinks as the mortgage payment increases. Consequently, sales dropped sharply in

14 | Salt Lake Realtor ® | January 2023

Source: Freddie Mac.

2.65%

Income required $122,185 $157,628 *down payment of 95%. **interest rate, January 3.22%, December 6.42%

Source: UtahRealEstate.com, Freddie Mac

2022. Home sales in Salt Lake County totaled 13,087, down 26% from 2021; the steepest single-year drop on record (1997 to the present), Figure 3. Prior to 2022, real estate sales had been remarkably consistent for seven years at about 18,000 sales, only diverging in 2020, the pandemic year, when sales jumped to 19,000 units.

dramatic increase in mortgage payments in such a short time was bound to have a serious impact estate sales. The pool of potential buyers shrinks as the mortgage payment increases. Consequently, sales dropped sharply in 2022. Home sales in Salt Lake County totaled 13,087, down 26% 2021; the steepest single-year drop on record (1997 to the present), Figure 3. Prior to 2022, real sales had been remarkably consistent for seven years at about 18,000 sales, only diverging in the pandemic year, when sales jumped to 19,000 units.

Figure 3

Figure 3

Sales of Single-Family Homes, Condominiums, Twin Homes, and Townhomes Salt Lake County

Sales of Single-Family Homes, Condominiums, Twin Homes, and Townhomes in Salt Lake County

18,808 19,040 13,087 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Source: UtahRealEstate.com

quarter of 2022, was substantially higher at 27%. Of considerable interest, given the current price climate, are the red bars in Figure 4 denoting year-over-price declines. On only two occasions have prices experienced extended quarters of decline: nine quarters from 1987 to 1989 and 16 quarters from 2008 to 2012. Both occasions were associated with very weak job markets. In 1986 and 1987, job gains of only one percent led to a decline in housing prices, and during Great Recession, the 6% drop in employment and the loss of 80,000 jobs resulted in a prolonged period of housing price declines.

Figure 4

Figure 4

Year-Over Percent Change of FHFA Quarterly Price Index

Year-Over Percent Change of FHFA Quarterly Price Index

Salt Lake Metropolitan Area

Salt Lake Metropolitan Area

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

HOUSING PRICES RETREAT

Housing prices in the Salt Lake Metropolitan Area have a long history of volatility as shown by the four price cycles depicted in Figure 4. Price increases peaked in 1979, 1994, 2006, and 2022. The first three peaks were consistent at about 20%, whereas the most recent peak, in the first

Housing Prices Retreat prices in the Salt Lake Metropolitan Area have a long history of volatility as shown by the four cycles depicted in Figure 4. Price increases peaked in 1979, 1994, 2006, and 2022. The first three were consistent at about 20%, whereas the most recent peak, in the first quarter of 2022, was substantially higher at 27% Of considerable interest, given the current price climate, are the red bars in denoting year-over-price declines. On only two occasions have prices experienced extended of decline: nine quarters from 1987 to 1989 and 16 quarters from 2008 to 2012. Both occasions associated with very weak job markets. In 1986 and 1987, job gains of only one percent led to a in housing prices, and during Great Recession, the 6% drop in employment and the loss of jobs resulted in a prolonged period of housing price declines.

-5.0%

-10.0%

19.4% 19.7% 20.0%

27.0% 15.7% -15.0%

1978 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 2011 2014 2017 2020

Source: Federal Housing Finance Agency.

The median sales price of Salt Lake County homes (single-family, condominiums, twin homes, townhomes) peaked in May at $565,600, Figure 5. As interest rate rose, the median sales price declined. Over the next seven months, the median price fell by 14% to $485,829, and the month-over percent

the longest price deceleration ruined by the The initial response to the virus by policymakers was to lower interest rates and . A global intensified in putting heavy downward

January 2023 | Salt Lake Realtor ® | 15

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

spiritofamerica©/ Adobe Stock

Leonid Andronov ©/Adobe Stock

Leonid Andronov ©/Adobe Stock

Figure 5

Figure 5

Source: UtahRealEstate.com

Median Sales Price of Homes in Salt Lake County, 2022 (Single-Family, Condominiums, Townhomes, Twin Homes)

$440,000 $460,000 $480,000 $500,000 $520,000 $540,000 $560,000 $580,000

$501,275

$565,600 $485,829

Source: UtahRealEstate.com

Figure 6

Figure 6

Year-over Percent Change in Monthly Median Sales Price, Salt Lake County (single-family, condominium, townhomes, twin homes.)

Year-over Percent Change in Monthly Median Sales Price, Salt Lake County (single-family, condominium, townhomes, twin homes.)

30.0% 35.0%

20.0% 25.0%

10.0% 15.0%

-5.0% 0.0% 5.0%

30.0% 35.0%

20.0% 25.0%

Figure 6

The median sales price of Salt Lake County homes (singlefamily, condominiums, twin homes, townhomes) peaked in May at $565,600, Figure 5. As interest rate rose, the median sales price declined. Over the next seven months, the median price fell by 14% to $485,829, and the monthover percent increases got smaller and smaller until finally turning negative 2.1% in December, Figure 6.

10.0% 15.0%

-5.0% 0.0% 5.0%

JanuaryFebruaryMarch April May June JulyAugustSeptemberOctoberNovemberDecember 26.9% 24.7% 23.6% 24.0% 24.3% 14.7% 10.5% 10.5% 6.2% 9.1% 4.2%2.1% -10.0%

26.9% 24.7% 23.6% 24.0% 24.3% 14.7% 10.5% 10.5% 6.2% 9.1% 4.2%2.1% -10.0%

JanuaryFebruary March April May June July AugustSeptemberOctoberNovemberDecember

Source: UtahRealEstate.com

Year-over Percent Change in Monthly Median Sales Price, Salt Lake County (single-family, condominium, townhomes, twin homes.)

Median Sales Price of Homes in Salt Lake County, 2022 (Single-Family, Condominiums, Townhomes, Twin Homes) 6

exists until after it bursts. Alan Greenspan defined a housing bubble as a prolonged period of housing price declines. Such a decline is extremely unlikely in Utah in 2023-2024.

Inflation – Relying on the Federal Reserve’s December forecast (core Personal Consumption Expenditure Price Index), the rate of inflation will moderate in 2023. Following the trend of the projected PCE, the CPI should decline to around 5% this year.

JanuaryFebruary March April May June July AugustSeptemberOctoberNovemberDecember

Source: UtahRealEstate.com

Prices eventually must peak, followed by decelerating price increases. After probably the longest trough-to-peak run in the county’s real estate history —ten years and 41 quarters— price deceleration was becoming more and more likely. But the possibility of an orderly price retreat was ruined by the impact of Covid-19. The initial response to the virus by policymakers was to lower interest rates and provide unprecedented fiscal stimulus. “Irrational exuberance” overtook the housing market. A global depression was averted, but the inflationary tinder was laid. It ignited in late 2021 and intensified in 2022, forcing the Federal Reserve to respond aggressively, thus, in the end, putting heavy downward pressure on housing prices and real estate sales.

6

WHAT TO EXPECT IN 2023

Economic conditions - Expect slower job growth, but a recession in Utah is unlikely. There’s no formal or accepted definition of a state recession, but if job growth falls below one percent, that indicates weak economic conditions associated with a national recession. The employment growth forecast from the Utah Department of Workforce Services for 2023 is 2%, an increase of 35,000 jobs. Utah’s long-term annual employment growth rate is 3.0%

Housing bubble – It’s very unlikely that the recent price runup represents a housing bubble. We don’t know if a bubble

Mortgage rate - The Federal Reserve appears determined to hold the federal fund’s target at 4.25% to 4.5% despite improving news on inflation. The Fed could even have another rate increase in early 2023, which would present resistance to declines in the mortgage rate. Forecasts of mortgage rates vary widely from 5% to 9% but most settle on the 6.5% to 7.5% range. The Mortgage Bankers Association has the most optimistic forecast, with a 5.2% rate in the fourth quarter.

Housing prices - 2023 is not 2008. Fortunately, in 2023, very few desperate, unemployed homeowners face foreclosure. A large majority of homeowners don’t need to sell. They can step back and wait for the dust to settle. Consequently, the price declines since May 2022 will stabilize by the third quarter of 2023. The first and second quarters will likely see year-over price declines, but the annual median sales price for 2023 will likely be within a few percentage points one way or another of 2022. Worst case scenario, prices down about 5%; best case scenario, prices equal to 2022.

Residential sales - Reluctant sellers and priced-out buyers make for a year of reduced sales. After seven years of sales averaging 18,000 homes, the high prices of 2022 dropped sales by 26% to 13,000. The level of sales in 2023 will not top 13,000 and will likely range between 11,000 to 12,000 homes.

16 | Salt Lake Realtor ® | January 2023

Making a Leader

By Jared Lloyd | Daily Herald

When Kenny Parcell was a 7-year-old in the 1980s, his athletic ability earned him a spot on the All-Utah County baseball team.

While this was definitely an honor, it also presented logistical challenges.

Parcell lived in Orem and the practices took place at American Fork High School. Since his parents were both working in order to make ends meet, covering the 12 miles to be with the team was all up to Parcell.

For many, especially at that age, the obstacle would’ve been too much to overcome. But not for Parcell.

“I got on my BMX bike, put my glove on the handlebars and rode all the way on my own because I wanted to be on that team so badly,” Parcell said. “I had a specific route that I would come home so if my mom or dad got done with work, they would know where to find me to pick me up.”

He recalled how his mom told him that to be successful he needed to “work twice as hard, have twice the grit, be twice as polite and twice as good.”

Both his determination and that simple guidance have

molded Parcell into a successful businessman and a leader in his field. Now living in Salem, Parcell is the broker/owner of Equity Real Estate Utah in Spanish Fork and has sold more than 3,200 homes in his 24-year career.

On Nov. 10, Parcell became just the third Utahn to be installed as the president of the National Association of Realtors®, the largest trade organization in the country with nearly 1.6 million members in the real estate industry.

“Realtors® are good, hard-working people,” Parcell said. “Nobody volunteers more or does more for the community than those in our profession. We are the first to go to work, the last to come home and the last to get paid. There have been a lot of good people who have believed in me and seen things in me that even I didn’t see at the time.”

Few understand the significance of Parcell’s achievement like former Utah Gov. Gary Herbert, who is also a Realtor® and served in various roles in the same organization in addition to his political career.

“Kenny is a great person and a great individual,” Herbert said. “As a past president of the National Governors Association, I have a recognition of what we can do at

18 | Salt Lake Realtor ® | January 2023

Utah’s Kenny Parcell rises from humble beginnings to lead the National Association of Realtors®.

Photo courtesy of NAR

a national level through the good example of Utah, sharing information and learning from each other. The National Association of Realtors® does that through all the state presidents and the board of directors. I recognize how important it is to learn from each other to make the whole country better.”

Parcell’s road to the NAR presidency is one that includes perseverance, drive and, of course, unexpected-butfortunate twists of fate.

After seeing the challenges his family endured, working hard but not having much money, Parcell was determined to get a college degree.

His athletic ability opened some doors for him to reach that goal, and he was planning to go to the University of Utah to play football. While on a mission for The Church of Jesus Christ of Latter-day Saints, however, he found out that there was a chance to stay closer to home and have scholarship money to play at BYU.

That might not seem like it would have anything to do with becoming successful in real estate, but it was the first step on the path. That’s because one of Parcell’s Cougar teammates, linebacker Jeff Ellis, introduced him to his future wife, Heather.

“It changed everything because after a year, Heather and I got married,” Parcell said. “She was getting her MBA and I had three more years of school, so I thought why rent? I’ll see if I could own a house.”

The process of buying a home for the new couple, however, didn’t go well.

“We went to see an agent and she told me she was really busy, so for me to see if I could talk my way into any of the six homes you qualify for,” Parcell said. “So I did that and we got the offer accepted. Thirty days later we got married, closed on our home and went on our honeymoon. When we got back, the good white refrigerator was replaced by a lime green one that didn’t work. The kitchen cabinets were taken, and the air conditioning was taken. I called the agent and said, ‘we have a problem.’ She answered, ‘no, you have a problem.’ Because of that, for the first six months we lived out of a camping cooler.”

Not long after that, Parcell saw a classified ad about becoming a Realtor® and decided he never wanted to work through that nightmare again. He got his real estate license so he would understand the process, which turned out to be useful in the classroom when he wrote a paper about his experience.

“It was a family science class and the professor called me,” Parcell said. “She said the teaching assistant was sick and so he stumbled across my paper. She was transferring and wanted to interview me about selling his house. My very first client was my current professor, who then referred me to two other professors and that

just kept growing. The first year alone I sold 15 homes, which is pretty good business.”

Suddenly he had clients, many of whom didn’t even know he was actually a BYU student. He did get his degree and had 35 job opportunities, but he already knew what career path he was going to take.

“There is absolutely no regrets,” Parcell said. “If I didn’t go on a mission or went up to the University of Utah, or if I didn’t get my real estate license, none of this happens for me. I didn’t have any connection to the business, but here I am.”

He said he learned early on that kindness goes a long ways.

“Everyone is struggling with something,” Parcell said. “If you can be a little more empathetic with people, you have a lot more compassion. It makes a big difference.”

His business grew and he enjoyed significant success through the 1990s and early 2000s. He actually had no inclination to get involved with the Realtor® trade association until a colleague invited him to volunteer.

“I didn’t do anything with the state or local boards until another Realtor®, Randy Smith, called me up and asked if I had considered running,” Parcell said. “I asked him about the time commitment and when he said it was probably a couple of hours per week, I said I was too busy. He said, ‘Kenny, no one has been more blessed than you from this industry’ and then hung up. I thought about it and called him back about five minutes later to tell him he was right.”

That conversation led Parcell to get involved first at the local level in Utah Valley, becoming the president in 2008, before going on to serve at the state and national levels.

As he got to know other industry professionals throughout the country, he decided he wanted to serve them at the highest level.

“People gave me opportunities on committees and I built relationships,” Parcell said. “I got to see you could make a difference on a national scale. You can help people with homeownership across the country. (continued on page 22)

January 2023 | Salt Lake Realtor ® | 19

Photo courtesy of NAR

NOVEMBER

HOUSING WATCH

A Frozen Housing Market?

Higher mortgage interest rates are continuing to have an impact on Salt Lake County home sales. In November, sales fell to just 786 closings, down 49% compared to 1,532 sales in November 2021. There were roughly 500 fewer sales in November compared to the month’s 10-year average. Other Wasatch Front counties saw similar declines in sales.

The average 30-year fixed-rate mortgage was 6.42% in the final week of December, up from the previous week when it averaged 6.27%. In October, mortgage rates climbed as high as 7%. A year ago, the 30-year FRM averaged 3.11%.

“The housing market remains in the doldrums with declining sales, inventory, and prices,” said Sam Khater, Freddie Mac’s Chief Economist. “The declines in sales and deceleration in home prices began swiftly earlier in 2022 but have moderated more recently. Forward leading indicators suggest housing will remain weak throughout the winter.”

The silver lining is nearly half (48%) of all active listings on UtahRealEstate.com are under contract, which indicates there is still strong buyer demand in our market.

The median price of homes sold in November in Salt Lake County was $500,000, a 3% increase compared to a median price of $483,700 in November 2021. The days on market until sale increased to 40 days, up from 22 days a year ago.

Nationally, year-over-year sales dwindled by 35.4% (down from 6.33 million in November 2021), according to the National Association of Realtors®.

“In essence, the residential real estate market was frozen in November, resembling the sales activity seen during the COVID-19 economic lockdowns in 2020,” said NAR Chief Economist Lawrence Yun. “The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes. Plus, available housing inventory remains near historic lows.”

First-time buyers were responsible for 28% of sales in November, which was unchanged from October, but up from 26% in November 2021. NAR’s 2022 Profile of Home Buyers and Sellers – released last month – found that the annual share of first-time buyers was 26%, the lowest since NAR began tracking the data.

All-cash sales accounted for 26% of transactions in November – identical to October and up from 24% in November 2021. In Salt Lake County, all-cash sales accounted for 17% of transactions in November.

Individual investors or second-home buyers, who make up many cash sales, purchased 14% of homes in November, down from 16% in October and 15% in November 2021.

Distressed sales (foreclosures and short sales) represented 2% of sales in November, virtually unchanged from last month and one year ago.

20 | Salt Lake Realtor ® | January 2023

January 2023 | Salt Lake Realtor ® | 21

The average net worth of a renter is $8,000 while the average net worth of a property owner is $340,000. To put more people in the marketplace to build wealth is something special.”

While uncommon for smaller states to have members become presidents of the national association, it is even rarer for an individual to run completely unopposed. But Parcell had such strong relationships that no one chose to run against him.

“I always say it is better to be prepared for an opportunity than it is to have an opportunity and not be prepared,” Parcell said. “I feel I’ve served at enough high-level capacities that I should be prepared for this opportunity.”

He comes in as the Realtor® organization is facing challenges, including inflation and skyrocketing interest rates, that are making real estate more difficult for many to afford.

“I believe that smooth sailing never made for skilled sailors,” Parcell said. “I’ve been doing this long enough that I’ve been through some challenging markets. I’m still in the business. My kids like to eat year-round so I’m out there hustling every day. Every member can know that their president is going through the same things they are.”

His goal as president for the next year is to show members throughout the country how much they are appreciated.

“We’re going to go to them and explain that they are the brand — that the brand is us,” Parcell said. “We all bring something good or bad to the Realtor® brand. We also want to show Congress how passionate we are about the value of private property rights, homeownership, and fair housing for all.”

Even though he has duties and responsibilities to such a large organization, he still feels that it is important to focus on his own personal improvement.

“There are three things I always do to evaluate my

day: Do something hard, do something fun and do somethings for someone else,” Parcell said.

Wherever he goes and whatever he does, Parcell said he is proud to represent his home in Utah Valley.

“I love our community,” Parcell said. “That’s why I live here. It’s not just because I was raised here but I love the values, the lack of crime, and the way we value business. I’m proud to be an American but I’m also proud to live in Utah Valley.”

Herbert said that Parcell’s story is a remarkable one and exemplifies the concept that hard work brings success.

“He is the personification of the American dream, the ability to have upward mobility,” Herbert said. “People have been coming to our country since its inception, not for any guarantees but for an opportunity to be the best they can be. Kenny dedicated himself to improvement. He was going to work hard to find a way to make himself better economically and spiritually. He has surrounded himself with great people who have motivated him to be better, while he in turn motivates them to be better. He is literally an embodiment of the American dream of self-improvement and upward mobility, who has then expanded his role to touch people nationally and worldwide.”

Parcell said his advice to anyone facing any of the same challenges he faced early in life reflects what his mother told him so long ago.

“I think if you don’t believe in yourself, nobody will believe in you,” Parcell said. “There has to be something that gets you out of bed in the morning — and that’s got to be you. You’ve got to get up in the morning and believe that you can do great things. You can’t expect somebody to do it for you. The world meets nobody half halfway. If you want something in this country, you can be anything or you can go get anything you want if you want to put in the time and hard work to be the expert of your craft. You have to be the one who will do what the average person won’t do.”

Reprinted by permission of the Daily Herald, Copyright 2022. All rights reserved.

22 | Salt Lake Realtor ® | January 2023

Kenny Parcell (continued from page 19)

Photo courtesy of NAR

LIBERTY HOMES

Montebello @ Liberty Village (Salt Lake County)

Centrally located in the Salt Lake Valley, this townhomes community offers 2- and 3story floor plans ranging from 1800-2150 square feet.

QUICK MOVE-INS AVAILABLE: 2-and 3-story units, both interior and exterior Starting in the $430s

Parker Place (West Jordan)

55-plus community located near shopping, entertainment, and majorthoroughfares. Fully landscaped yards and snow removal included.

QUICK MOVE-INS AVAILABLE: Rambler-style homes ranging from 2902-3505 square feet Starting in the $620s

The Crossings at Lake Creek (Heber)

Custom-desgined homes in the heart of the Heber Valley. Maintenance-free living with fully landscaped yard and snow removal.

QUICK MOVE-INS AVAILABLE: Single-family homes ranging from 4219-4575 square feet Starting in the high $900s

Special Incentives Available! Plus, 4.0% BAC on select homes. Contact us for details!

(801)573-7722 • LibertyHomes.com

Draper. All in, for 693 EAST 12200 SOUTH OPENING THIS SPRING We help you stand out and stand apart through meaningful innovation, tools, and education that complement your business, bring more balance to your life, and maybe even a bit closer to home. Select individual and team o ces are still open. Connect with us today for your private tour. MONICA DRAPER 435.313.7905 GRADY KOHLER Principal Broker SCOTT STEADMAN Branch Broker winutah.com/joinus

© 2022 BMW of North America, LLC. The BMW name, model names and logo are registered trademarks.

© 2022 BMW of North America, LLC. The BMW name, model names and logo are registered trademarks.

By James Wood Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute

Board of Realtors®

By James Wood Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute

Board of Realtors®