Avoid These Mistakes When Listing and Showing Properties p. 10 REALTOR June 2023 Salt Lake Magazine ®

We know even the smallest requests are a big deal. At David Weekley Homes, creating your Clients’ ultimate home isn’t just about custom finishes and high-end materials. It’s about having a personal Team that puts your Clients’ dreams, desires and requests above all else. That’s why we created a website where your Clients can track the progress of their new home as it’s being built. Our Team of experts is deeply committed to making sure you and your Clients have the best possible experience — even before they move in. That’s The Weekley Way!

Homes from the low $500s to $1 million+ in the Salt Lake City area Ready Now! Ready Now! David

*Jennifer

is also

David

See a David Weekley Homes Sales Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to change without notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2023 David Weekley Homes - All Rights Reserved. Salt Lake City, UT (SLC-23-002353) Learn more by contacting 385-501-1862 Ascent at Daybreak The Mammoth 6751 W. Lake Avenue 4,480 sq. ft., 1 Story 6 Bedrooms, 3 Full Baths, 1 Half Bath, 2-car Garage Ascent at Daybreak The Copperton 6932 W. Docksider Drive 4,496 sq. ft., 2 Story 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage

Weekley Homes Team Members with Jennifer*, Tracy & Lucas Allen

Allen

a

Weekley Homes Team Member

Turning Houses into Homes® This is not a commitment to make a loan. Loans are subject to borrower and property qualifications. Contact loan originator listed for an accurate, personalized quote. Interest rates and program guidelines are subject to change without notice. SecurityNational Mortgage Company is an Equal Housing Lender. WWW.SNMC.COM My goal is to help your clients step out of the rental cycle and begin building equity with a home. With down payment assistance programs and other loan options with relaxed credit requirements, it’s easier than ever to become a homeowner. Buying a home is one of the best ways to move towards financial independence. HELPING CLIENTS INVEST IN THEMSELVES!

Salt L ake REALTOR® Magazine slrealtors.com The Salt Lake REALTOR® (ISSN 2153 2141) is published monthly by Mills Publishing, located at 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106. Periodicals Postage Paid at Salt Lake City, UT. POSTMASTER: Send address changes to: The Salt Lake REALTOR,® 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106-4618. June 2023 volume 83 number 6 This Magazine is Self-Supporting Salt Lake Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt Lake Realtor Magazine comes from trees in managed timberlands. These trees are planted and grown specifically to make paper and do not come from parks or wilderness areas. In addition, a portion of this magazine is printed from recycled paper. Table of Contents slrealtors.com Features 10 Master the Art of Listings and Showings: Avoid These Common Mistakes The Professional Standards Committee 14 Is the Remodeling Boom Over or Just on Pause? Melissa Dittmann Tracey 16 NAR Chief Economist Offers Commercial Real Esate Market Forecast The National Association of Realtors® 18 5 Data Points Brokers Need to Know About the Market Nicole Slaughter Graham 20 The Negative Impact of Overly Favorable Tenant Laws Paul Smith 24 Realtors®, It's Time to Raise Your Voice for Consumers Katie Johnson Columns 7 Building Stronger Communities through Respectful Social Media Discourse Rob Ockey – President’s Message Departments 8 Happenings 8 In the News 28 Housing Watch 4 | Salt Lake Realtor ® | May 2023 On the Cover: Cover Photo: Phimwilai ©/Adobe Stock 18 5 Data Points Brokers Need to Know About the Market 16 NAR Chief Economist Offers Commercial Real Esate Market Forecast 24 Realtors®, It's Time to Raise Your Voice for Consumers New Africa©/Adobe Stock THINK B ©/Adobe Stock David Gn©/Adobe Stock

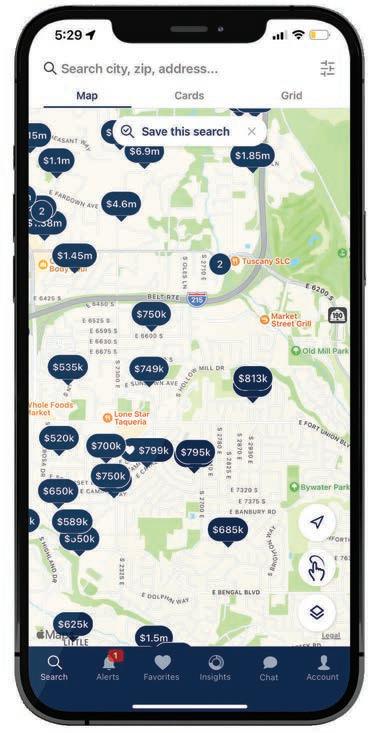

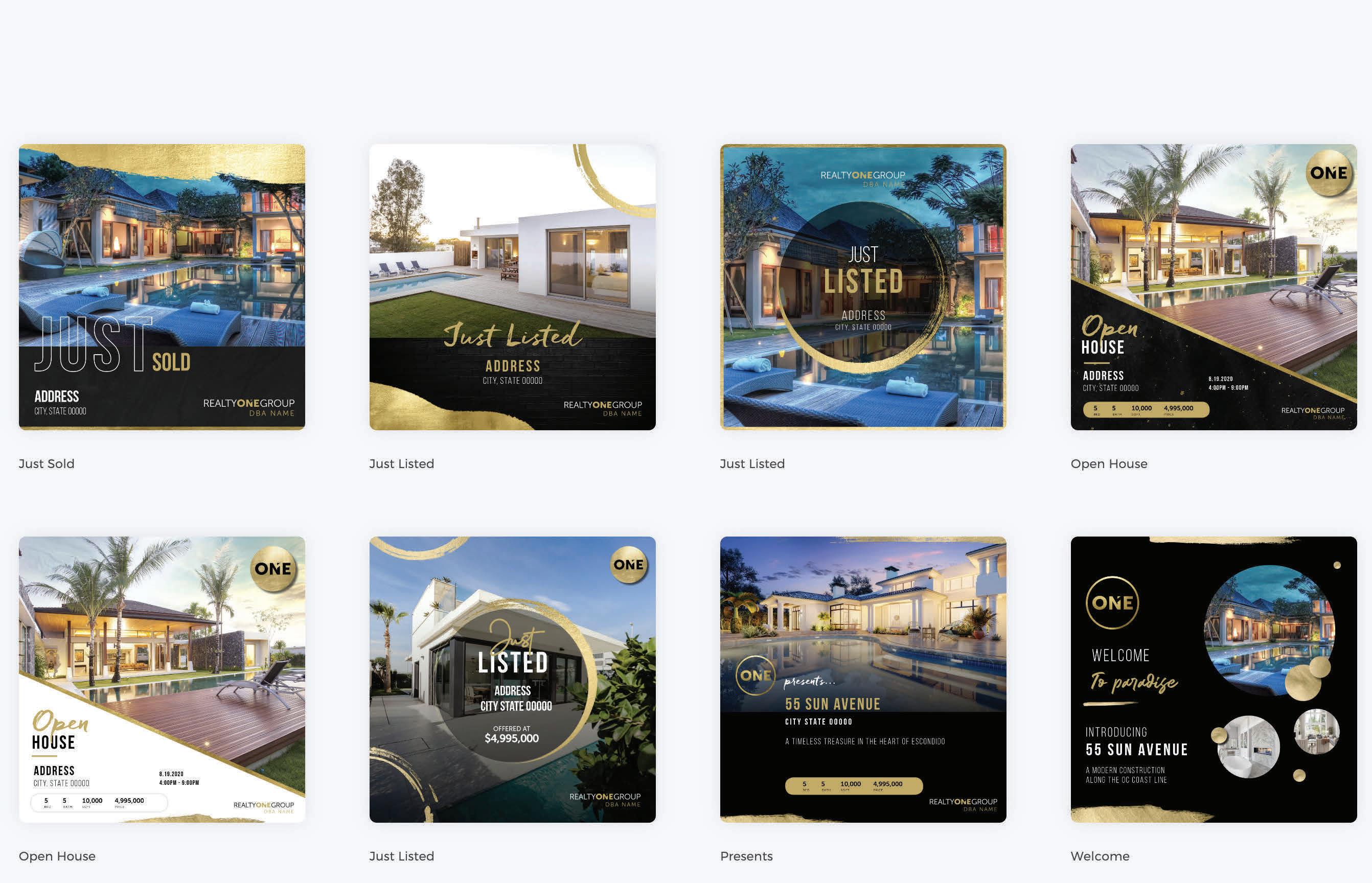

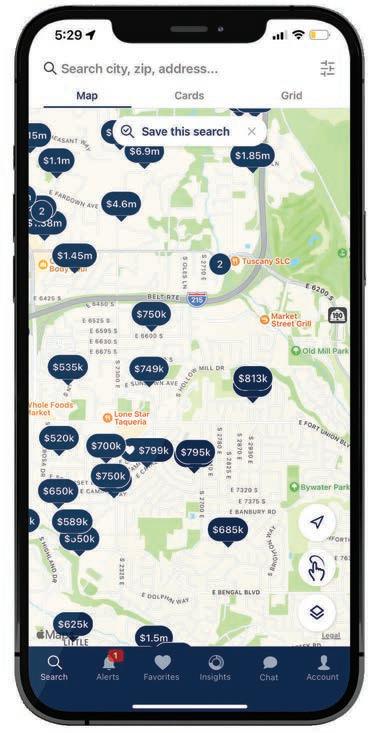

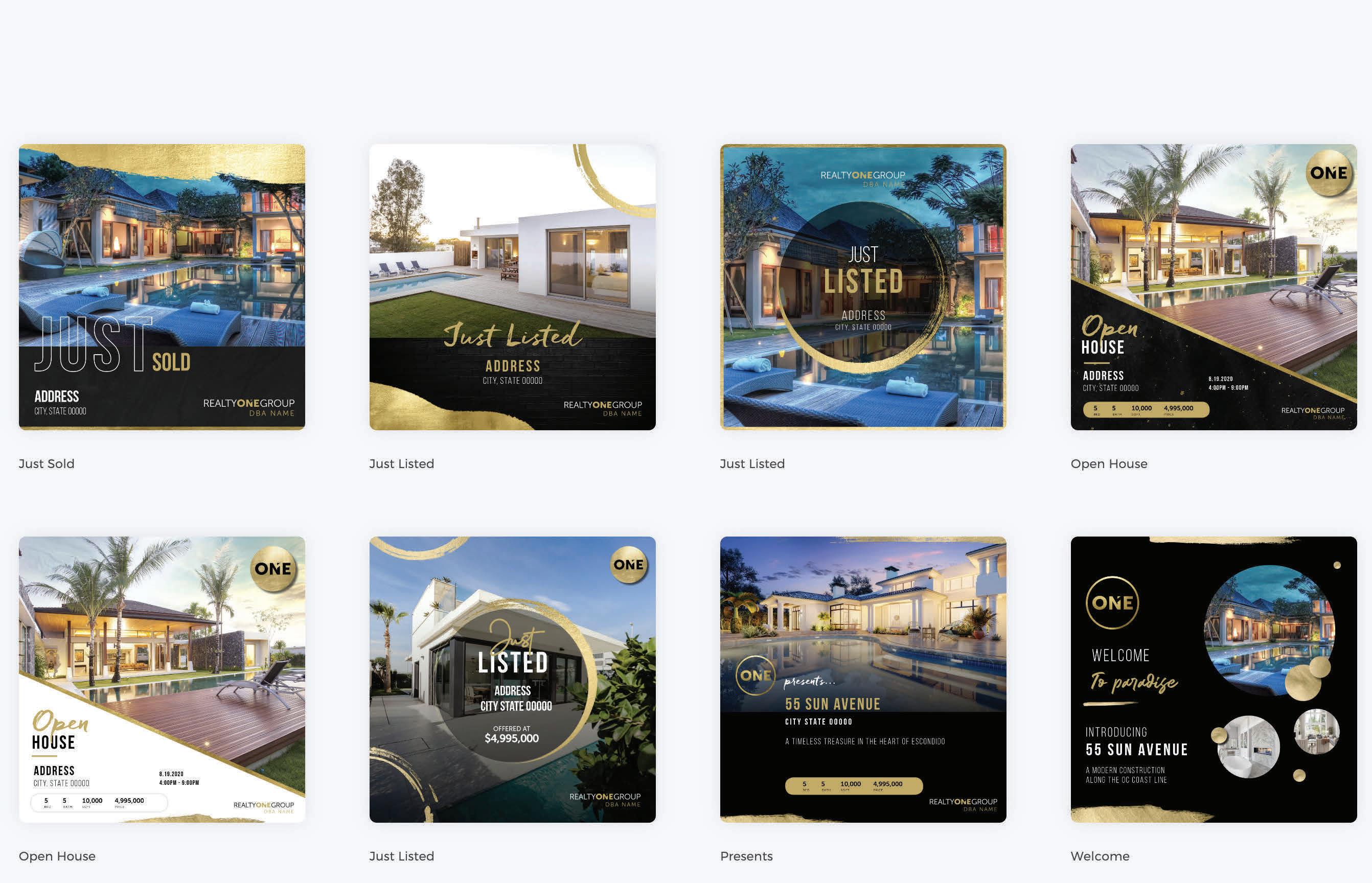

www.jointheUNBROKERAGE.com DAVIS COUNTY DAVE HAWS (801) 915.4315 UINTA COUNTY NANCY BIRCHELL (435) 724.4953 SOUTH VALLEY RAVATH “RP” POK (801) 633.1990 MIDVALE ANGELA JONES-FABER (801) 703.6553 HUNDREDS OF FREE SOCIAL MEDIA MARKETING ASSETS PROFESSIONALLY DESIGNED JUST FOR YOU

slrealtors.com

President Rob Ockey

Presidio Real Estate

First Vice President

Dawn Stevens

Presidio Real Estate

Second Vice President

Claire Larson Woodside Homes

Treasurer

Jodie Osofsky

Summit Sotheby’s

Past President

Steve Perry

Presidio Real Estate CEO

Curtis Bullock

Directors

Carlye Webb

Summit Sotheby’s

Jennifer Gilchrist

KW South Valley Keller Williams

John Lucky Berkshire Hathaway

Janice Smith

Coldwell Banker

Laura Fidler

Summit Sotheby’s (Draper)

Amy Gibbons

KW South Valley Keller Williams

Jenni Barber Berkshire Hathaway (N. SL)

J. Scott Colemere

Colemere Realty Assoc.

Hannah Cutler Coldwell Banker

Michael (Mo) Aller Equity RE (Advantage)

Morelza Boratzuk RealtyPath

Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Building Stronger Communities through Respectful Social Media Discourse

As President of the Salt Lake Board of Realtors, I feel compelled to address an issue that has increasingly plagued our digital spaces: the erosion of civility in social media posts. In an era where technology connects us in unprecedented ways, it is disheartening to witness the breakdown of respectful and constructive dialogue. Today, I urge all individuals to rekindle the values of respect, honor diverse perspectives, and engage thoughtfully in our online interactions.

We are blessed with a variety of backgrounds, beliefs, and experiences. It is this very diversity that enriches our lives and strengthens our society. However, with the anonymity and detachment provided by social media, it has become all too easy to forget the importance of respecting these differences.

Managing Editor

Dave Anderton

Publisher Mills Publishing, Inc. www.millspub.com

President

Dan Miller

Art Director

Jackie Medina

Graphic Design

Ken Magleby

Patrick Witmer

Office Administrator

Cynthia Bell Snow

Respect is not an endorsement of another’s opinion; it is an acknowledgment of their right to hold it. By recognizing this fundamental principle, we can lay the groundwork for meaningful and civil discussions. Let us remember that behind each profile picture is a human being, deserving of our empathy and understanding, irrespective of their views.

Sales Staff

Paula Bell

Paul Nicholas

Disagreements are an inevitable part of any community, both online and offline. Rather than resorting to name-calling or personal attacks, let us embrace the opportunity to engage thoughtfully. Seek common ground, ask questions, and challenge ideas respectfully. By doing so, we create an environment where diverse perspectives can coexist and grow, fostering innovation, understanding, and progress.

Salt Lake Board: (801) 542-8840

e-mail: dave@saltlakeboard.com

Web Site: www.slrealtors.com

magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS®

Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

OFFICIAL PUBLICATION OF THE SALT LAKE BOARD OF REALTORS ®

REALTOR is a registered mark which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS

2005

It is crucial to understand that the impact of our words extends far beyond the virtual realm. Our online interactions reverberate into our offline lives, shaping the fabric of our communities and ultimately our nation. By embracing civility and respect, we strengthen the bonds that hold us together, enhancing our ability to tackle challenges collectively. Moreover, respectful dialogue can lead to personal growth. Engaging with individuals who hold different beliefs forces us to examine our own perspectives, challenging us to expand our knowledge and consider alternative viewpoints. By fostering an environment of open-mindedness and understanding, we create fertile ground for intellectual growth and personal development.

As Realtors®, we have a unique opportunity to lead by example in our online interactions. Let us promote respectful dialogue within our profession and throughout our community. By demonstrating the power of civil discourse, we can help bridge divides, create lasting connections, and build a better society.

Rob Ockey President

June 2023 | Salt Lake Realtor ® | 7

The Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin.

The Salt Lake REALTOR is the monthly

October

Salt L ake

® Magazine

REALTOR

Happenings In the News

All-Cash Home Sales on Rise as Interest Rates Spike

In March, allcash home sales accounted for 16.8% of transactions in Salt Lake County, slightly lower than the 17.2% recorded in March 2022. Nationally, all-cash sales represented 27% of transactions during the same period. Allcash sales jumped during the pandemic years, when the real estate market was intensely competitive and mortgage rates were low. Offering cash became a strategic approach to increase the likelihood of successfully closing on a home, especially when faced with multiple offers, explained Nadia Evangelou, senior economist at the National Association of Realtors®. Presently, the significant proportion of cash purchases reflects a growing trend among buyers who have the financial means to avoid interest payments due to the high borrowing costs associated with purchasing a home. According to Freddie Mac, the average 30-year fixed-rate mortgage currently stands at 6.57%, compared to 5.10% one year ago.

As U.S. Population Ages, Utah is Nation’s Youngest State

The U.S. population in 2020 was older and had fewer children under age five than in 2010 or 2000, according to the 2020 Census Demographic and Housing Characteristics (DHC) report. The baby boom generation (born 1946-1964) and millennials (born 1982-2000) — the two largest U.S. cohorts in 2020 — both continued to age over the past two decades. At the same time, smaller cohorts of children were born from 2010 to 2020. In contrast, Utah was the nation’s youngest state in 2020, with the lowest median age (31.3 years) and the country’s highest share (29.0%) of population under age 18. But Utah’s population both grew and aged during the century’s first two decades. The state’s population rose 46.5% (from 2.2 million in 2000 to 3.3 million in 2020). At the same time, the state’s median age increased by 4.2 years (from 27.1 to 31.3) and the share of its population age 65 and over increased from 8.5% in 2000 to 11.7% in 2020.

NAR Praises High Court Rulings

National Association of Realtors®

President Kenny Parcell issued the following statement in response to the Supreme Court’s favorable rulings for property rights in Tyler v. Hennepin County and Sackett v. EPA:

“NAR applauds the Supreme Court for both rulings further protecting the rights of property owners. Tyler v. Hennepin County, which NAR outwardly supported, confirms that the equity homeowners build in their properties is a constitutionally protected right and cannot be unduly or unfairly seized by the government. We also appreciate the clarity provided by the Sackett ruling, which helps property owners utilize their land to the fullest extent possible. This ruling has lifted a burden from homebuilders across the country, reinforcing that the government should not create excessive barriers in the homebuilding sector, especially when the United States currently has a housing shortage of 5.5 million units.”

In March, NAR, along with the American Property Owners Alliance and the Minnesota Realtors® filed an amicus brief in support of Tyler v. Hennepin County and the property owner’s entitlement to the surplus equity, arguing the state statute effectuates an unconstitutional taking of private property under the Fifth Amendment. The Sackett v. EPA ruling brings more clarity to the rules and regulations on the building on personal land under the scope of the Clean Water Act (CWA). NAR is part of ongoing litigation related to an EPA rule defining Waters of the United States (WOTUS) under the CWA, which will be directly impacted by this decision.

8 | Salt Lake Realtor ® | June 2023

Monkey Business ©/Adobe Stock

READY TO GET REAL ABOUT REAL ESTATE?

As part of the legendary Berkshire Hathaway family of companies, we have the depth, strength and brand power to help grow your real estate business. Our network extends globally in reputation and strength. Locally, our company is the largest brokerage in Utah, ensuring that your property reaches a broad audience of real estate professionals and buyers. We are committed to providing you with the resources and support that will create greater success and enjoyment in your real estate career. So, talk with us at Berkshire Hathaway Utah Properties and let’s get you settled without ever settling for less

COMPLETE SERVICE ADVANTAGE / (801) 990-0400 / BHHSUTAH.COM RESIDENTIAL / MORTGAGE/LOANS / COMMERCIAL / RELOCATION PROPERTY MANAGEMENT & LONG TERM LEASING / TITLE & ESCROW SERVICES ©2023 BHH Affiliates, LLC. An independently owned and operated franchisee of BHH Affiliates, LLC. Berkshire Hathaway HomeServices and the Berkshire Hathaway HomeServices symbol are registered service marks of Columbia Insurance Company, a Berkshire Hathaway affiliate. Equal Housing Opportunity. • $4.9 BILLION IN TOTAL ANNUAL SALES FOR 2022 • OVER 500 AGENTS ACROSS 30+ OFFICES • MORE THAN 50,000 NETWORK SALES PROFESSIONALS AND 1,500+ MEMBER OFFICES THROUGHOUT NORTH AMERICA, EUROPE AND ASIA @BHHSUTAH

Master the Art of Listings and Showings: Avoid These Common Mistakes

The following cases and sanctions were heard in the second quarter by the Professional Standards Committee.

By The Professional Standards Committee Salt Lake Board of Realtors®

Case No. 1 False and Misleading Statements

The Complainants were referred to the Respondent to potentially represent them on the purchase of a new home. The Complainants identified a home they were interested in after attending an open house. They decided to make an ato the Complainants as required in Article 9 of the Code of Ethics. Rather, the buyer agency agreement was mixed in with the purchase contract documents making it somewhat confusing for the Complainants. During the course of communication between the Complainants and Respondent, a text message was sent by the Respondent that stated,

“[builder’s name] peeps appear to be evasive . . . They can put you in a bad spot if we’re not careful.” The hearing panel determined that the statement made in this text message was in violation of Article 15 of the Code of Ethics which prohibits Realtors® from recklessly making false or misleading statements about other real estate professionals. The Respondent was found in violation of Articles 9 & 15 of the Code of Ethics. The Respondent was required to pay a $1,000 fine and required to take a live 2 hour CE course covering agency law for no CE credit.

10 | Salt Lake Realtor ® | June 2023

Case No. 2 Disclosure, Disclosure, Disclosure

The Respondent acted as an owner/agent on a duplex that was sold to the Buyers. The Complainant is a licensed agent who represented the Buyers. After going under contract on the duplex, the Buyers encountered several problems with the transaction during and after closing. The problems primarily involved issues with tenants remaining on the property, difficulty receiving tenant security deposits, non-disclosure of damage occurring while under contract, and property damage resulting from a water leak. During the hearing, there was some discussion relating to whether the Respondent incorrectly informed the Buyer’s that the tenants were on a month-to-month lease. After taking possession of the property, one of the tenants argued that they did not want to vacate the premises which caused some concern for the Buyers. Concerning Article 1 of the Code of Ethics, the panel did not find clear and convincing evidence that showed the Respondent was dishonest during the transaction as it related to the tenant’s lease. The Panel determined

that there was evidence to suggest the tenant was aware of some water leakage issues that were occurring on the property and that the Respondent/Seller was aware of this fact. It was determined that this was not disclosed to the Buyer and resulted in a violation of Article 2 of the Code of Ethics which requires disclosure of pertinent facts relating to the property. During and after the transaction, the Respondent avoided discussing and attempting to resolve the problems encountered by the Buyers and asked not to be contacted any further in violation of Article 3 of the Code of Ethics which requires cooperation with the other broker. There was considerable discussion relating to whether the Respondent adequately disclosed he was an owner/agent in the transaction as required by Article 4 of the Code of Ethics. On page 1 of the REPC, the Respondent’s legal name was listed as the seller of the property. The Respondent’s legal name was also included in section 5 of the REPC which indicated he was also the listing agent. While it is preferable and recommended to include the Disclosure of Interest Addendum in the REPC, in light of the verbal disclosure to the buyers at the time of the first showing, and in consideration of the written disclosure on the REPC, the panel did not find a violation of Article 4 of the Code of Ethics. The Respondent testified at the hearing that he felt that as long as the Seller Disclosures were provided to the Buyer no later than the Due Diligence Deadline that this was satisfactory and acceptable. The Hearing Panel determined that the Respondent did not fully understand that Seller Disclosures, including relevant leases, are to be provided by the Seller Disclosure Deadline in the REPC. This resulted in a violation of Article 11 of the Code of Ethics which requires Realtors® to conform to the standards of practice and competence which are reasonably expected. On the MLS listing for the duplex, the agent remarks noted that a 30-day lease back at closing would be required by the tenants. This contradicted the 12-month leases that were provided to the Buyers and created a potential conflict. As a result, the Panel found that there was a violation of Article 12 of the Code of Ethics which requires that all advertising is truthful and that it presents a true picture of the transaction. The Respondent was fined $500 and required to take the Mandatory Residential Course for no CE credit.

Case No. 3 Accessing a Listing without Permission

A buyer’s agent (the “Respondent”) used the key box to enter a listed property with their client without an appointment and without permission from the owner or the listing broker. The access lasted 14 minutes. The Respondent had an appointment to show a similar property nearby. The Respondent thought he was accessing the property for which he had a scheduled appointment. He failed to verify that the property he accessed was the same property for which he had the appointment. The owners of the property were

June 2023 | Salt Lake Realtor ® | 11

Gorodenkoff ©/Adobe Stock

not home at the time of the access, but their children were home. Once the Respondent realized there were children in the property, he recognized his mistake, and left the property. Based on the evidence and testimony, the panel found the Respondent in violation of Article 1 of the Code of Ethics. The Respondent failed to act honestly with all parties and failed to act in the best interests of his client when the Respondent entered a listed property without proper authorization. The Respondent was found in violation of Article 3 of the Code of Ethics. The Respondent failed to cooperate with the listing broker when the Respondent entered a listed property without proper authorization. The Respondent was required to pay a $250 fine and take the 3 hour Code of Ethics course for no CE credit.

Case No. 4 Showing the Wrong Home

The Complainants represented the sellers. The Respondent represented a buyer. The Respondent was showing homes to a buyer and entered the sellers’ home after 8 p.m. believing they had an appointment and that the home was vacant. The Respondent’s assistant had made an error in property addresses and mistakenly told the Respondent that he had an appointment to view this property when he did not. The sellers were home in bed at the time and were startled by people coming into their home unannounced. The Respondent talked to one of the sellers and told him that he had an appointment. The seller contacted the Complainant upset that she would make an appointment and not tell them. The Complainant explained that there was no appointment scheduled. The Respondent apologized for any mix up, did a quick tour of the home and left. Concerning Article 1 of the Code of Ethics, the panel finds the Respondent in violation of this article. Access to a seller’s property is a serious trust placed in the Realtors® involved. The panel did not believe that enough care was taken in this instance to preserve that trust. A Realtor® must ensure that they are entering the correct property when accessing a property through the key box system. The burden on following showing instructions falls on the Realtor® accessing the key box. Although the Respondent claimed that the seller gave him permission after he had entered the home and been discovered by the seller, the panel found that the violation occurred prior to this encounter with the seller when the

Respondent entered the property without permission. Concerning Article 3 of the Code of Ethics, the panel determined the Respondent was in violation of Article 3 for the reasons stated above. The Respondent is to pay a fine of $200 within 90 days.

Case No. 5 Misinterpretation

The Complainants were the sellers. The Respondent represented the buyer. The Respondent contacted the Complainants prior to their house being listed on UtahRealEstate.com. One of the Complainants spoke with the Respondent about the house and told him that he could bring a potential buyer by. On or around August 2, 2022, the Respondent did bring the buyer to the house late in the evening and was told to come back the next morning. The Respondent returned the next morning with the buyer and toured the home with one of the Complainants. On or around August 4th, the Respondent submitted an offer to purchase the

12 | Salt Lake Realtor ® | June 2023

Image licensed by Ingram Image

Complainants’ home. The Respondent was notified that the Complainants were not going to accept offers until the home was listed on the MLS. The property was listed on or around August 15th with the showing instructions of by appointment only. The Respondent took the same buyer through the property with a scheduled appointment on or around August 16th. The Respondent submitted an offer which was accepted on or around August 19th. On or around August 23rd, the Respondent made an appointment through the listing agent for August 24th, at 9 a.m., to have an inspection done. The Respondent asked the listing agent if he could access the property on the evening of August 23rd, and the listing agent via text responded with, “Yes, they won’t be back till Friday they are still moving things out just a heads up. But go ahead and view it.” The Respondent accessed the property on the evening of the 23rd, and

on the 25th, the Complainants arrived at approximately 9 p.m. to find the Respondent in the home. The Complainants were not happy and immediately notified the listing agent of the unscheduled access. The listing agent notified the Respondent that the Complainants were not happy about the unscheduled visits. Further visits to the property by the Respondent and or any contractors for the buyer were handled through the listing agent. The transaction successfully closed. Concerning Article 1 of the Code of Ethics, the panel found the Respondent in violation of this article. Access to a seller’s property is a serious trust placed in the Realtors® involved. The panel did not believe that enough care was taken in this instance to preserve that trust. The Respondent erred in interpreting the listing agent’s comment that the Complainants would not be back until Friday as an open invitation to access the property until Friday without any further permission or notice given. Concerning Article 3 of the Code of Ethics, the panel found the Respondent in violation for the reasons stated above. Respondent was fined $250 and required to take the Code of Ethics

June 2023 | Salt Lake Realtor ® | 13

Lifetime Servicing Multiple Loan Types No Down Payment Options LEARN MORE AT UFIRSTCU.COM We’ve Got You Covered HOME LOANS BUILD, BUY, REFI Federally insured by NCUA. Loans subject to credit approval. See current rates and terms. NMLS #654272 EQUAL HOUSING LENDER

Is the Remodeling Boom Over—or Just on Pause?

By Melissa Dittmann Tracey

By Melissa Dittmann Tracey

During the pandemic, Americans became ultra-focused on upgrading their homes, taking on remodeling and DIY projects in record numbers. But as recession fears mount, more homeowners are putting on the brakes and showing less willingness to dole out large amounts of money on home improvement projects.

New data this week shows home improvement giants like Lowe’s and Home Depot posting lower profits. These firms also are downgrading their sales outlooks for the year. Home improvement experts say consumers are becoming jittery about the economy and are moving from large-scale remodels to smaller, cheaper projects—or just scrapping their renovation plans altogether. Consumers have a case of the “home improvement blues,” Neil Saunders, a retail expert and managing director at Global Data, said this week. Despite several possible reasons for the remodeling slowdown, it won’t be a bust, experts say. One reason

is that homeowners often remodel before and after moving. As home sales remain slow this spring, there may be fewer new homeowners to make these remodeling changes—at least for now, said Jessica Lautz, deputy chief economist and vice president of research at the National Association of Realtors®.

Elevated prices also may be causing homeowners to back away from remodeling, as the median price for a home improvement project surged to $22,000 in 2022, a record high and a 22% jump from 2021, according to the 2023 U.S. Houzz & Home Study. Labor shortages are continuing to drive up renovation costs and timelines, according to the second-quarter reading of the Houzz Renovation Barometer, which is based on responses from about 1,500 home improvement firms. Ninety percent of survey respondents reported ongoing delays for cabinetry, indoor furniture, windows, and lighting fixtures.

14 | Salt Lake Realtor ® | June 2023

Andy Dean©/Adobe Stock

A slowdown in renovation projects is settling in after a pandemic-fueled boom, but there are plenty of reasons why the pullback may not last long.

As we come out of the pandemic, people have more activities to engage in outside the home, removing some of the urgency to remodel that owners felt when they were stuck at home. The pandemic-fueled remodeling boom “seems to be settling as people have more time to travel and go to dinner versus picking up a paint brush or hammer and reinventing their home,” Lautz said. She views the remodeling slowdown as short-lived because homeowners who locked in lower mortgage rates in recent years are likely to stay put rather than trade up at a higher rate. “As these homeowners stay put, they may need to invest in improvements or want to reimagine their space to fit their changing needs,” Lautz added.

Why Remodeling May Remain Strong Long-Term

A Houzz survey earlier this year found that more than half of homeowners say they intend to renovate in 2023. The U.S. debt ceiling crisis and a fragile economy may have an impact on renovation activity, but there are some factors that may keep the remodeling sector strong in the long run.

Low inventory. Faced with few housing options on the market, many homeowners may feel stuck and wary of today’s higher mortgage rates and home prices. As they

home to accommodate their lifestyle and needs for longer than they intended.

Aging homes. The median age of a home in the U.S. is 39 years old. As homes age, they often need repairs or updates to maintain their value. Nearly 30% of homeowners updated their plumbing, followed by electrical and home automation upgrades, according to a recent Houzz survey. Homes enter their prime remodeling years when they are between 20 to 29 years old, and an additional 2.9 million homes will be entering that age range by 2027, according to data from the National Kitchen & Bath Association.

Boost value. Sixty-two percent of homeowners say their main motivation for taking on a recent renovation was to increase their home’s value, according to a survey conducted by Cinch Home Services, a home warranty company. Homeowners express concerns about selling their home in its current state, citing concerns their home needs too many repairs (65%); has an outdated interior (60%); lacks trendy fixtures (38%); or lacks curb appeal (33%), the survey notes. Use NAR’s Remodeling Impact Report to show your clients which projects tend to have the best returns at resale.

Melissa

June 2023 | Salt Lake Realtor | 15

OHANATITLEUTAH.COM OHANATITLEUTAH.COM || 801.758.7277 801.758.7277 CE CLASSES · PROPERTY PROFILES · FARM SEARCHES · ABSTRACT AND PLAT MAPS · REAL ESTATE INDUSTRY CONNECTORS Terrie Kenadee Izabelle #WHEREYOUAREFAMILY DON'T LET YOUR BUSINESS FALL INTO A ARE YOU WATERING ENOUGH FOR IT TO GROW? Let us find ways to help your business grow. After all, farming is what we do best!

Dittmann Tracey is a contributing editor for

NAR Chief Economist Offers Commercial Real Estate Market Forecast

Office markets will continue to see rises in vacancy rates due to falling demand.

By The National Association of Realtors®

By The National Association of Realtors®

National Association of Realtors® Chief Economist Lawrence Yun presented an overview of U.S. commercial real estate on May 9 as part of the 2023 Realtors® Legislative Meetings in Washington, D.C.

Yun emphasized challenges facing the commercial real estate market brought on by tightening lending policies among many small and regional banks, which have been a key source of commercial loans. Still, due to continuing U.S. job gains, net absorption has been mostly positive nationwide, Yun said, with the apartment, industrial and retail sectors helping to keep the industry relatively stable.

“The performance of commercial real estate markets will vary across the country,” Yun projected during the Commercial Economic Issues and Trends Forum.

“Markets with strong job gains will naturally hold on much better, while those with weaker job conditions will struggle to raise net occupancy.”

Yun said America’s apartment sector recorded 116,000 net positive absorptions in the past year, while the industrial and retail sectors added 361 million square feet and 64 million square feet, respectively, over the last 12 months. Office markets, however, saw a reduction in net absorption by 29 million square feet over the same period.

“The national office market will continue to see rises in vacancy rates due to falling demand,” Yun added.

“The apartment sector will record a modest uptick in

vacancy due to robust new supply.”

With the impact of mortgage interest rates on the housing market in focus throughout the week at NAR’s conference in D.C., Yun addressed the implications of Fed decisions on nationwide commercial markets.

“The Federal Reserve’s aggressive rate hikes have damaged balance sheets for regional and local banks, an important source of commercial real estate loans,” he said.

Yun estimated that continual rises in rates will in part cause commercial real estate transaction volume to decline by 27% overall in 2023.

“The lack of capital, higher costs of financing and refinancing, and the weakening economy will contribute to a lower overall valuation of commercial real estate prices,” Yun said. “Weaker prices will mean opportunities for those with deeper pockets to get deals done in the months and years ahead.”

Yun added that appraisal values have fallen by an average of 15% from peaks in early 2022.

The National Association of Realtors® is America’s largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries. The term Realtor® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of Realtors® and subscribes to its strict Code of Ethics

16 | Salt Lake Realtor ® | June 2023

THINK B ©/Adobe Stock

BULLION PLACE in Murray

New Homes by Brodsky Built

The Brodsky Built team has been building homes for over 50 years. Our Aberlour mixed-use condominium building in The Prestwick community in South Salt Lake has only one townhome left to sell. We have just opened for sales in our newest community in Murray, the Bullion Place community. In Bullion Place, we have two-story single-family homes and offer different floor plans and elevations. The homes feature gourmet kitchens with granite counter tops and a large pantry. The 2nd floor owner’s suite features a walk-in closet and double-sink vanities. LVP laminate flooring throughout the entire main level and bathrooms. Bullion Place is just minutes from the freeway and is 15 minutes to downtown!

CONTACT US

Elizabeth ‘Annie’ Nelson REALTOR®

M: 801.560.3488 annie@ponderosaprop.com

Paula Swenson REALTOR®

M: 435.557.1931 paula@ponderosaprop.com

Mo Wilkerson REALTOR®

M: 801.699.3945

mowilkersonslc@gmail.com

JT Wilkerson REALTOR®

M: 801.699.1662

jtwilkerson@msn.com

Located at 935 W Bullion Street in Murray

NEW CONSTRUCTION

www.BrodskyBuiltUtah.com

5 Data Points Brokers Need to Know About the Market

Nationally, for every house listed, there’s an average of three offers on that house.

By Nicole Slaughter Graham

By Nicole Slaughter Graham

Brokers already know many of the issues affecting their local marketplaces, but information in the broad scope helps put things into context. Jessica Lautz, deputy chief economist and vice president of research at NAR, provided data points during the Realtors® Legislative Meetings in Washington, D.C., to help brokers understand what stats play a part in their market.

Bidding wars. Inventory issues and migration patterns are driving division in the national real estate market, Lautz said. Current data shows that for every house listed, there’s an average of three offers on that house. Some areas of the country are still feeling the effects of multiple offers while others aren’t seeing this issue at all, she said.

Issues affecting first-time buyers. Buyers who are able to forego financing still make up 17% of the market at the moment, making it difficult for first-timers to secure a home, especially in areas where heavy migration compounds inventory issues. Cash buyers aren’t just investors, though, Lautz pointed out. “Buyers who have been in their homes a long time and built-up equity and are now ready to retire to a less expensive area are paying cash,” she said.

Mass migration. Migration is largely driven by two factors: retirement and remote work. Data shows that the Sunbelt region is the most popular destination for people who are moving, while people are leaving the Northeast, parts of the Great Lakes region and sections

18 | Salt Lake Realtor ® | June 2023

of the West. Traditionally, home buyers in the past moved an average of 10 to 15 miles when purchasing a home, but that mileage has shifted to upwards of 50 miles. Driving this trend is affordability, retirement and remote work, allowing homeowners more flexibility to choose where they live.

Distressed sales and foreclosures. Headlines often warn of calamity when it comes to the market, stressing that mass foreclosures are coming, Lautz said. But the data paints a very different picture. Right now, distressed sales and foreclosures account for less than 1% of the market. A combination of home price strength and equity gains make it unlikely that an influx of foreclosures will enter the market.

Generational breakdown of the marketplace. Firsttime home buyers represent less than 30% of the market, which is historically low, according to NAR’s 2022 Profile of Home Buyers and Sellers. While millennials for quite some time made up the largest

segment of buyers, pandemic-fueled price increases and cash buyers have changed that. Millennials are largely first-time home buyers and, therefore, often struggle to secure a home in the current marketplace. Baby boomers who have the equity and cash to purchase homes now make up the largest segment of the market, and the entrance of Gen-Z is also edging out millennials.

Lautz said that when it comes to boomers, certain misconceptions persist in the real estate industry. They operate quite differently than seniors of the past. Most are not downsizing, they want smart-home tech and green features and they have the equity or cash to purchase what they want. Typically, they’re also moving about 90 miles or more to their desired retirement locations.

June 2023 | Salt Lake Realtor ® | 19

David Gn©/Adobe Stock

Nicole Slaughter Graham is an independent journalist and consulting editor with Realtor® Magazine.

The Negative Impact of Overly Favorable Tenant Laws on Small Businesses

More than four in 10 rental properties are owned and managed by individuals.

By Paul Smith Executive Director, Rental Housing Association of Utah

Tenant laws play a crucial role in ensuring fairness and protecting the rights of both tenants and landlords. However, when these laws become excessively favorable towards tenants, it can have detrimental effects on small businesses, particularly those owned by individuals or families, who rely on rental income to sustain their livelihoods. This article examines the negative consequences of overly favorable tenant laws on these businesses, providing examples and insights from industry professionals.

Striking a Fair Balance

Utah, known for its balanced approach to landlordtenant laws, serves as a useful reference point.

According to SparkRental.com, Utah ranks in the middle in terms of landlord friendliness. By maintaining a reasonable balance, Utah fosters an environment where

both landlords and tenants can coexist harmoniously. However, in jurisdictions that heavily favor tenants, regulations can become burdensome, discouraging small, family-owned businesses from renting their properties. Balanced state laws protect and provide quick remedies for both sides. In Utah, we have achieved the following:

1. Landlords in Utah have the advantage of a groundbreaking law that allows tenants with eviction judgments for non-payment to petition the courts for expungement once the balance has been paid, effectively removing it from their record.

2. Tenants in Utah have the option of repair and deduct or rent cancellation if landlords fail to promptly address maintenance issues after being notified. This empowers tenants to take action when needed and

20 | Salt Lake Realtor ® | June 2023

Vitalii Vodolazskyi©/Adobe Stock

2023 PARADE OF HOMES COMING SOON in the july issue Chris Ryan ©/iStock An Exclusive Preview of the Stay in the Forefront of Over 10,000 TRANSACTION MAKERS. RESERVE YOUR AD SPACE NOW. (LIMITED AVAILABILITY) *Realtors® Sell Nine Out of Ten Homes. 801-467-8833 info@millspub.com *In the Mountain State Region (which includes Utah), 94 percent of sellers used an agent to sell their home, according to the National Association of Realtors® research. SALT LAKE PARADE OF HOMES | JULY 28 – AUGUST 12, 2023

ensures landlords maintain their properties.

3. Landlords who fail to send deposit refunds on time in Utah may face attorney’s fees and enhanced penalties, protecting tenants from unjust withholding of their deposits.

Lengthy Eviction Processes

One significant consequence of overly favorable tenant laws is the extended eviction process, which places an undue burden on landlords. In states like Vermont, where tenants are heavily favored, evictions can take a minimum of four to seven months to complete. This prolonged timeline leaves property owners in a precarious position, struggling to cover expenses such as property taxes, insurance, and mortgage payments, all while being denied rental income.

Impact on Small Businesses

According to the National Association of Realtors, 42 percent of rental properties are owned and managed by individuals, many of whom operate small, familyowned businesses. These landlords invest significant time and effort into painting, cleaning, and maintaining their properties, often juggling these responsibilities alongside other jobs. For them, rental income serves as a vital source of financial stability, supporting their families or helping to fund important goals such as their children’s education.

Misconceptions and Realities

Some argue that landlords have nothing to fear if they follow the rules. However, the experiences of industry professionals tell a different story. G. Brian Davis, a landlord and real estate investor, highlights how even when landlords strictly adhere to landlord-tenant laws, they can still face challenges. He emphasizes that being affected by tenant-friendly laws has led him to avoid investing in jurisdictions that prioritize tenant protection, regardless of the potential financial gains.

Conclusion

While it is essential to protect tenants and maintain a fair balance in landlord-tenant relationships, overly favorable tenant laws can have severe consequences for small businesses. Prolonged eviction processes and financial burdens can undermine the efforts of small property owners who rely on rental income. Striking a reasonable balance, as demonstrated by Utah, allows for the coexistence of thriving businesses and protected tenants. Policymakers should consider the broader impact of tenant laws and work towards creating an environment that supports the sustainability of small-scale landlords, who often play a crucial role in local economies.

22 | Salt Lake Realtor ® | June 2023

Image licensed by Ingram Image

Realtors®, It’s Time to Raise Your Voice for Consumers

If buyers were required to pay brokers, a series of hurdles would be put up in front of consumers.

By Katie Johnson

As members of the National Association of Realtors® (NAR), Realtors® are champions of homeownership, property rights and the communities they serve. And yet, in today’s world of technology, instant gratification and misinformation, local MLS broker marketplaces and real estate professionals can be taken for granted.

If you don’t educate your clients on the value you and local MLS broker marketplaces provide, consumers could miss out on the best possible experience they can have in navigating one of the most infrequent, complex and consequential transactions most will make in their entire lives.

So what can agents who are Realtors® do?

First, articulate your value to ensure everyone, especially your clients, understands what you do. Be

an advocate for local broker marketplaces and how the way commissions are paid create competitive, efficient markets for small businesses and ensure equity, transparency and market-driven pricing for home buyers and sellers. And, support the use of buyer-broker agreements to increase transparency on compensation and educate clients through every step of the process.

Articulate your value

When I was initially interviewing for my National Association of Realtors® job 15 years ago, I had only worked as a litigator until that point, so the NAR hiring attorneys thought I didn’t have the proper background in contracts required for this entry level role. Not so fast, I told them, as I went on to explain that my litigation experience taught me that every word matters.

24 | Salt Lake Realtor ® | June 2023

New Africa©/Adobe Stock

In litigation, we fight about what is said in negotiations and what is written in the contracts. Courts bend over backward to interpret the meaning of words in statutes. And one misspoken word can completely derail any possible resolution.

My experience as a litigator was actually the best preparation for a contract attorney because I learned how important it is to speak clearly, convincingly and concisely. It’s one of the most important aspects of both leadership and legal strategy — and for anyone trying to clearly explain their value proposition. No one has more facts, stories and testimonials to back up their value than you. As you set out to clearly articulate it to the world, remember that every word matters.

Real estate professionals navigate complex legal details and contracts. You understand and provide guidance on the financial aspects of the transaction, like mortgage rates, closing costs and appraisals. You uncover key community elements such as property taxes, neighborhood property information and price trends. There’s so much breadth and depth to what you do in all those areas. And let’s face it, you often become confidants, and sometimes even lifelong friends, of the clients you serve.

How are you telling that story? Look for every way you can share all that, from moments like your first interaction, to your bios and materials you provide, to how you tell stories of your value through others who can share their experiences.

Advocate for local broker marketplaces

Local MLS broker marketplaces create accessibility and ensure equity. They provide comprehensive and reliable information and data. With the listing broker paying the compensation of the buyer broker, they ensure buyers do not have to go out of pocket for professional representation.

And a bonus: Local broker marketplaces level the playing field for all types and sizes of residential real estate brokerages.

If buyers were required to pay brokers, a series of hurdles would be put up in front of consumers. Buyers would have to come up with the additional funds needed to compensate their broker at closing, making it significantly less likely that first-time and other aspiring buyers could afford a home. Or the alternative, potential buyers would be forced to forego professional representation and handle the transaction on their own – a daunting task for even experienced buyers.

At the same time, veterans would be disadvantaged because the Veterans Administration does not allow veterans to pay real estate commissions when using VA loans.

These lesser-known aspects of local broker marketplaces allow them to seamlessly and significantly do the good work of ensuring transparency and efficiency and equity for home buyers and sellers. It’s important that people who don’t work in our world every day understand that.

Use buyer-broker agreements

Buyer-broker agreements are important, full stop. They promote transparency and are crucial for consumer education during this critical purchase. They increase transparency by making clear to buyers how much their agent expects to be paid. They also serve as a natural opportunity for buyer agents to educate consumers both on how compensation is typically paid and why listing brokers making offers of compensation to buyer brokers benefits both buyers and sellers. Not to mention they protect you, too.

Every real estate agent can and should use a buyerbroker agreement. It benefits the consumer. It lends clarity, which benefits you. And if you’re not in one of the 12 states that requires buyer-broker agreements and you ever have a chance to advocate for them, I suggest you do.

There is so much good that the Realtor® family and local MLS broker marketplaces can do in raising your collective voices. It goes to the old saying: A rising tide lifts all boats. In this case, the boats are consumers and their trusted advisors.

The value real estate professionals provide consumers, guiding them through one of the most important decisions of their life, cannot be understated. Just with agents who are Realtors® alone, there are 1.5 million people who embody all that is being done to ensure generational wealth through homeownership, while abiding by NAR’s Code of Ethics and exhibiting their commitment to the highest professionalism in the industry.

That’s a story worth telling. And we in this industry know how much local broker marketplaces and buyerbroker agreements enable those opportunities for consumers.

At the end of the day, Realtors’® membership in NAR demonstrates their commitment to consumer advocacy. You lead as entrepreneurs, small business owners, experts and community advocates to protect consumers and create wealth.

There’s really no better story to tell than that. And there’s no better voice to give life to that story than you.

26 | Salt Lake Realtor ® | June 2023

Katie Johnson is chief legal officer and chief member experience officer for the National Association of Realtors®.

"If you don’t educate your clients on the value you and local MLS broker marketplaces provide, consumers could miss out on the best possible experience they can have in navigating one of the most infrequent, complex and consequential transactions most will make in their entire lives."

HOUSING WATCH

Rising Mortgage Rates Escalate Housing Affordability Predicament

The housing market in Salt Lake County experienced a slowdown in April, primarily due to the rising mortgage interest rates. Home sales declined significantly, with only 908 closings recorded, reflecting a 32.4% decrease compared to the 1,343 sales in April 2022.

Rob Ockey, President of the Salt Lake Board of Realtors®, emphasized the impact of higher mortgage rates on homebuyers, stating, “Increased mortgage interest rates have resulted in a considerable rise in monthly payments, posing affordability challenges for potential buyers. Additionally, homeowners are reluctant to sell their properties and lose their current low interest rates.”

In April, the median price for all housing types in Salt Lake County dropped to $495,000, marking a 10.8% decrease compared to the previous year. The median price for single-family homes was $577,000, down 8.9% from $633,000 in April 2022. Similarly, multi-family homes (including condominiums, townhomes, and twin homes) settled at $423,750, experiencing a 5.8% decline from the previous year.

However, the limited supply of houses is exerting upward pressure on prices. The price of a single-family home increased to $577,000 in April, representing an almost 8% rise from $535,750 in January. The days on the market for single-family homes decreased from 53 days in January to 19 days in April.

On average, all housing types remained on the market for 23 days in April, showing a significant increase compared to the five days in April 2022.

Nationally, all four major U.S. regions registered month-over-month and year-over-year sales declines, according to the National Association of Realtors®. Year-over-year, U.S. sales slumped 23.2% (down from 5.57 million in April 2022).

“Home sales are bouncing back and forth but remain above recent cyclical lows,” said NAR Chief Economist Lawrence Yun. “The combination of job gains, limited inventory and fluctuating mortgage rates over the last several months have created an environment of push-pull housing demand.”

The median U.S. existing-home price for all housing types in April was $388,800, a decline of 1.7% from April 2022 ($395,500). Prices rose in the Northeast and Midwest but retreated in the South and West.

“Roughly half of the country is experiencing price gains,” Yun added. “Even in markets with lower prices, primarily the expensive West region, multiple-offer situations have returned in the spring buying season following the calmer winter market. Distressed and forced property sales are virtually nonexistent.”

First-time buyers were responsible for 29% of sales in April, up from 28% in both March 2023 and April 2022. NAR’s 2022 Profile of Home Buyers and Sellers – released in November 20224 – found that the annual share of first-time buyers was 26%, the lowest since NAR began tracking the data.

All-cash sales accounted for 28% of transactions in April, up from 27% in March and 26% the previous year.

28 | Salt Lake Realtor ® | June 2023

April

June 2023 | Salt Lake Realtor ® | 29

45 YEARS 1,000,000 HOMES* SALES & INFORMATION — 801-683-2466 D.R. Horton is an Equal Housing Opportunity Builder. Home and community information, including pricing, features, terms, availability and amenities, are subject to change at any time without notice or obligation. *Homes built nationwide through 4/30/23 MORE HOMES, MORE YEARS MORE TO CELEBRATE (And Counting)

Work the digital world. Being a windermere agent is more than a job. It’s a calling. Let’s chat about how we can help you meet your goals. With a focus on mobility, our custom tech tools are engineered to connect you to your clients while streamlining the entire real estate experience. Your integrated tech takes 6 different tools and combines them into one powerful suite. CRM Interactive CMA Builder Print Marketing ToolsetEmail Marketing Platform Windermere Hub App Customized Agent Websites Monica Draper VP OF BUSINESS DEVELOPMENT monica@winutah.com 435.313.7905 Grady Kohler OWNER / PRINCIPAL BROKER grady@winutah.com 801.815.4663 winutah.com/joinus

By Melissa Dittmann Tracey

By Melissa Dittmann Tracey

By The National Association of Realtors®

By The National Association of Realtors®

By Nicole Slaughter Graham

By Nicole Slaughter Graham