REALTOR JUNE 2024 Salt Lake Magazine ® What’s Trending in Yards p. 22

See a David Weekley Homes Sales Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to change without notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2024 David Weekley Homes - All Rights Reserved. Salt Lake City, UT (SLC-24-002061) Grove Acres Model Home NOW OPEN Learn more by contacting 385-509-3018 Your Clients’ dream home is in Grove Acres in Pleasant Grove, Utah. Tour The Caulfield model home, and discover top-quality craftsmanship your Clients will love in an intimate enclave of only 32 homesites with mountain views to the south, east and north. Homes from the high $700s in Grove Acres

David Weekley Homeowners Kellie & Mike Jackson with Zonie, Bergen, Ivy, Easton & Jones

Turning Houses into Homes® SecurityNational Mortgage Company complies with Section 8 of RESPA and does not offer marketing services in exchange for referrals or the expectation of referrals. This is not a commitment to make a loan. Loans are subject to borrower and property qualifications. Contact loan originator listed for an accurate, personalized quote. Interest rates and program guidelines are subject to change without notice. SecurityNational Mortgage Company is an Equal Housing Lender NMLS 3116. HelpYourClient@snmc.com Successful agents aren’t waiting for more clients, they’re generating more leads. We’ll help you create the volume you want, and then we’ll get them closed.

is Self-Supporting Salt

Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt

Realtor® Magazine comes from trees in managed timberlands. These trees are planted and grown specifically to make paper and do not come from parks or wilderness areas. In addition, a portion of this magazine is printed from recycled paper.

The Salt Lake REALTOR® (ISSN 2153 2141) is published monthly by Mills Publishing, located at 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106. Periodicals Postage Paid at Salt Lake City, UT. POSTMASTER: Send address changes to: The Salt Lake REALTOR,® 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106-4618. June 2024 volume 84 number 6 This

Table of Contents slrealtors.com Features 10 Yun: It's Impossible for Home Sales to Remain Low Graham Wood 12 A Loan Product Poised to Revolutionize Retirement Curtis Mangus 16 Mortgage Rates Curtail Home Sales, Yet Prices Surge Melissa Dittmann Tracey 18 6 Ways Your Buyers Can Save on Their Mortgage Melissa Dittmann Tracey 22 What's Trending in Yards Barbara Ballinger Columns 5 Class-Action

Prompts Changes Dawn Stevens

Message Departments 8 Happenings 8 In the News 28 Housing Watch 4 | Salt Lake Realtor ® | June 2024 On the Cover: Cover Photo: Brandon©/Adobe Stock 10 Yun: It's Impossible for Home Sales to Remain Low 12 A Loan Product Poised to Revolutionize Retirement Salt L ake REALTOR® Magazine slrealtors.com 18 6 Ways Your Buyers Can Save on Their Mortgage Leonardo©/Adobe Stock Krakenimages.com©/ Adobe Stock peerawat©/Adobe Stock

Magazine

Lake

Lake

Settlement

– President’s

READY TO GET REAL ABOUT REAL ESTATE?

As part of the legendary Berkshire Hathaway family of companies, we have the depth, strength and brand power to help grow your real estate business. Our network extends globally in reputation and strength. Locally, our company is the largest brokerage in Utah, ensuring that your property reaches a broad audience of real estate professionals and buyers. We are committed to providing you with the resources and support that will create greater success and enjoyment in your real estate career. So, talk with us at Berkshire Hathaway Utah Properties and let’s get you settled without ever settling for less

COMPLETE SERVICE ADVANTAGE / (801) 990-0400 / BHHSUTAH.COM RESIDENTIAL / MORTGAGE/LOANS / COMMERCIAL / RELOCATION PROPERTY MANAGEMENT & LONG TERM LEASING / TITLE & ESCROW SERVICES ©2024 BHH Affiliates, LLC. An independently owned and operated franchisee of BHH Affiliates, LLC. Berkshire Hathaway HomeServices and the Berkshire Hathaway HomeServices symbol are registered service marks of Columbia Insurance Company, a Berkshire Hathaway affiliate. Equal Housing Opportunity. @BHHSUTAH • UTAH PROPERTIE S – $17.3 BILLION IN SALE S STATEWIDE 2020-2023 • UTAH PROPERTIE S – OVER 500 AGENTS ACROSS 30+ OFFICE S • MORE THAN 50,000 NETWORK SALE S PROFE SSIONALS AND 1,500+ MEMBER OFFICES THROUGHOUT NORTH AMERICA, SOUTH AMERICA, EUROPE AND ASIA

REALTOR®

President Dawn Stevens Real Broker

First Vice President

Claire Larson Woodside Homes of Utah LLC

Second Vice President

Jodie Osofsky

Summit Sotheby's

Treasurer

Amy Gibbons

KW South Valley Keller Williams

Past President

Rob Ockey Berkshire Hathaway

CEO Curtis Bullock

DIRECTORS

Janice Smith

CB Realty (Union Heights)

Laura Fidler

Summit Sotheby's (Draper)

Jenni Barber Berkshire Hathaway

J. Scott Colemere Colemere Realty Assoc.

Chris Anderson Windermere Real Estate - Utah

Morelza Boratzuk RealtyPath (South Valley)

Michael Rowe CB Realty (SL-Sugarhouse)

Eric Santistevan Engel & Volkers (Holladay)

Hannah Cutler CB Realty (Union Heights)

Michael (Mo) Aller Equity RE (Advantage)

Linda Mascher Realtypath LLC (Advisors)

Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Managing Editor Dave Anderton

Publisher Mills Publishing, Inc. www.millspub.com

President Dan Miller

Art Director Jackie Medina

Graphic Design

Ken Magleby

Patrick Witmer

Office Administrator

Cynthia Bell Snow

Sales Staff Paula Bell Dan Miller

Salt Lake Board: (801) 542-8840 e-mail: dave@saltlakeboard.com Web Site: www.slrealtors.com

Class-Action Settlement Prompts Changes

As part of the recent class-action settlement, beginning Aug. 17, 2024, Realtors® “working with” a buyer will be required to enter into a written agreement with the buyer prior to touring a home, including both in-person and live virtual tours. We are fortunate in Utah to have already been using written buyer agreements for many years. Many states have not had such a requirement so the impact to Utah Realtors will be less.

This change is aimed at ensuring transparency and clarity regarding compensation between agents and their clients Written buyer agreements must include the following four key areas:

1. Specify and conspicuously disclose the amount or rate of any compensation the MLS Participant will receive from any source.

2. The amount of compensation must be objectively ascertainable and may not be open-ended (e.g., “buyer broker compensation shall be whatever amount the seller is offering to the buyer”).

3. Include a statement that MLS Participants may not receive compensation from any source that exceeds the amount or rate agreed to with the buyer.

4. Disclose in conspicuous language that broker commissions are not set by law and are fully negotiable. Include any provisions required by law.

Another change is the elimination of offers of compensation through the Multiple Listing Services (MLS). This means that listing brokers can no longer offer compensation to buyer brokers via the MLS. However, listing broker offers of compensation may be communicated off the MLS (email, text, signs, broker website (for that brokers own listings), etc). Buyer agents will also be able to ask the seller directly in the REPC to cover some or all the buyer agent commission. Several Utah forms will soon be updated to correlate with these changes and to make it easier for Realtors® to adapt to these practice changes.

®

Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

OFFICIAL PUBLICATION OF THE SALT LAKE BOARD OF REALTORS ®

REALTOR

ASSOCIATION OF REALTORS

These points highlight the significant shifts in how real estate commissions will be handled and the need for realtors to adapt to new compensation structures and regulatory requirements The settlement does not diminish the important role Realtors® will continue to play in the real estate transaction. In fact, Realtors® are experts of the real estate transaction – a process that, for most consumers, is rare and filled with complexities. For instance, agents advise clients on disclosure law, competitive bidding situations, earnest money deposits, property security, and stipulated deadlines. Moving forward, Realtors® will be better positioned to help their clients achieve the dream of homeownership.

Dawn Stevens President

June 2024 | Salt Lake Realtor ® | 7

religion, sex, handicap, familial status, or national origin. The Salt Lake REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS

The Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color,

October 2005

is a registered mark which identifies a professional

real estate

subscribes to a strict Code of Ethics as a member

the NATIONAL

in

who

of

Salt L ake

Magazine slrealtors.com

Happenings In the News

Home Prices Rising Despite Higher Mortgage Rates

Home prices in Salt Lake City increased in the first quarter of 2024 as the 30- year fixed mortgage rate ranged from 6.60% to 6.94%, according to the National Association of Realtors®’ latest quarterly report. Over the past year, the median price for single-family existing homes in Salt Lake City increased by 5.5% to $551,200. While lower than many other western cities such as Denver ($651,000), Los Angeles ($823,000), Portland ($574,000), Reno ($605,900), and Seattle ($755,300), Salt Lake City’s home prices surpassed those in Boise ($471,500), Dallas ($377,700), Las Vegas ($465,400), Phoenix ($470,500), and Sacramento ($533,900). Nationally, more than 90% of metro markets (205 out of 221, or 93%) posted home price gains in the first quarter of 2024.

Broker Reaches $100K in Lifetime Investments

Congratulations to Dave Robison, principal broker of goBE, LLC (Realty 2), and past president of the Salt Lake Board of Realtors®! Dave has just reached an incredible milestone of $100,000 in lifetime investments in the Realtors® Political Action Committee (RPAC). Whether you like it or not, your ability to make a living as a Realtor® is affected by the decisions made by government officials. That’s why RPAC raises voluntary funds from Realtors® to elect public officials who understand the importance of homeownership and private property rights. The money is also used to combat legislation that would harm Realtors® or their clients. For every dollar contributed, 70% remains in Utah to focus on state and local government, while the other 30% goes to protect your interests at the national level.

Utah Cities Adding Residents

According to KSL.com, no Utah city led the nation in growth last year, but over a dozen communities gained at least 1,000 new residents between 2022 and 2023.

The state also topped the U.S. in housing unit growth for the third straight year, increasing its housing stock by 2.5% between July 1, 2022, and July 1, 2023, according to new data from the U.S. Census Bureau.

Salt Lake City padded its lead as the state’s most-populated city with an estimated 209,593 residents, over 75,000 residents more than any other Utah city.

Rounding out the top five most-populated cities were: West Valley City (134,470), West Jordan (114,908), Provo (113,343), and St. George (104,578).

The community data doesn’t explain why some cities grow faster than others or why some lose population, but it does show where Salt Lake County — Utah’s most-populated county — lost a sliver of its population. The agency previously estimated that the county lost nearly 800 residents between 2022 and 2023.

8 | Salt Lake Realtor ® | June 2024

Wild Awake©/Adobe Stock

Image licensed by Ingram Image

YEARS

BOLD

the coming years?

shaping

to be pretty exciting, too.

entertainment, shopping, dining,

SEE NEW HOMES AND MORE DaybreakUtah.com

A lot can happen in 20 years. Two decades ago, Daybreak was a grand vision for a transformative, walkable, bikeable, wonderfully close-knit community at the base of the Oquirrh Mountains. Today it offers the 5-minute life, exceeding all expectations as the Valley’s favorite destination. And what about

Well, they’re

up

Starting with Downtown Daybreak, which will add familyfriendly

events and more into the mix. You could say the best — and boldest — is yet to come.

Yun:

It’s Impossible for Home Sales to Remain Low

Long-term growth in the U.S. population ensures more elevated homebuying activity.

By Graham Wood

Given the long-term growth of the U.S. population, there’s no way home sales can remain historically low for much longer, National Association of Realtors® Chief Economist Lawrence Yun said.

At the Residential Economic Issues & Trends Forum during the Realtors® Legislative Meetings in Washington, D.C., Yun pointed out that there are 70 million more Americans today than in 1995. Housing

needs are only increasing, and that won’t change because of complicated economic factors, he said.

Although home sales are at a 30-year low as buyers face higher borrowing costs and stubbornly low inventory, housing options on the market are beginning to increase. To get markets moving, he said, NAR has been advocating for a variety of measures in Congress, such as giving mom-and-pop investors an incentive to sell

10 | Salt Lake Realtor ® | June 2024

to first-time buyers and increasing the capital gains exemption on the sale of a primary residence.

And while the Federal Reserve has delayed rate cuts that were expected to start this spring, Yun said he anticipates as many as six to eight rate cuts by the end of 2025, possibly beginning as early as September.

“If the Fed were to normalize its policy, then maybe mortgage rates could move lower. So, not only are we getting potentially more inventory, but we’ll also get more buyers as rates comes down,” he added.

“Over the next 10 years, eight of those years will likely see increases [in home sales].”

In addition, consumers may be adjusting to the feeling of “permanently high inflation” and looking for safe financial bets, Yun said. That will drive more homebuying decisions as consumers recognize real estate as an

appreciating asset that has historically provided a good hedge against inflation. And with 90% of home buyers and sellers saying would likely or probably use or recommend their real estate agent again, according to NAR research, that bodes well for business.

“The referral business is key,” Yun said. “Your past clients are super happy in terms of their wealth gains. Seven percent mortgage rates are high compared to a couple of years ago, but you have to buy a home in order to build wealth. Have Americans lost the dream of homeownership? I don’t think so.”

Graham Wood is Executive Editor of Digital Media for Realtor® Magazine. Reprinted from Realtor® Magazine Online, May 2024, with permission of the National Association of Realtors®. Copyright 2024. All rights reserved.

June 2024 | Salt Lake Realtor ® | 11

Leonardo©/Adobe Stock

A Loan Product Poised to Revolutionize Retirement

For retirees sitting on a lot of home equity, the FHA’s home equity conversion mortgage for purchase may be just the ticket for their next move.

By Curtis Mangus

For many older Americans, home equity is the missing link between a successful retirement strategy and financial struggles. That’s because a lot of retirees are living on a fixed income with a good portion of their net worth tied up in their primary residence. There are only two ways for them to access their home equity—sell the property or borrow against it.

Today, a growing number of seniors are taking hold of that missing link, accessing their equity to purchase another home through the FHA’s Home Equity Conversion Mortgage for Purchase, or H4P for short. This little-known purchase product was rolled out in 2008. I’ve taught classes on it for more than a decade. The H4P accounts for only about 6% of all FHA HECM originations, according to a recent HousingWire article,

yet that’s the highest share in the past five years, and I believe the program is poised for growth. It’s the bestkept secret in real estate finance and the key to many seniors being able to relocate successfully.

Home equity conversion products are also known as reverse mortgages. I avoid that term because it has an undeservedly negative connotation, stemming from deceptive claims and practices made by some unscrupulous lenders. The truth is, in the proper circumstances, an H4P can be life-changing.

Too often, seniors’ default retirement strategy depends on a poorly paying, poorly funded annuity: Social Security. The average Social Security payment right now is about $1,800 a month—less than $22,000 per year. Meanwhile, these seniors may be sitting on significant

12 | Salt Lake Realtor ® | June 2024 peerawat©/Adobe Stock

Thank You to Our Top Realtor Partners for 2023

We are so grateful to our valued realtor partners. Your expertise and commitment have been crucial in facilitating successful transactions and fulfilling the dreams of many. We deeply appreciate your partnership and look forward to achieving continued success together. ®

Learn how you can become an Ivory Preferred Realtor by Scanning the QR Code

VIP Realtor Events: Great networking opportunities to meet Ivory Sales Consultants and other realtor’s.

First to know about New Releases: Be among the first to know about new neighborhoods, floor plans, special offers, and other opportunities.

Exclusive Online Realtor Portal: Easy access to our available home inventory and other resources to help you sell more new homes.

Follow us @IvoryHomes Learn more at IvoryHomes.com

WADE URESK MARIA CUEVAS HEATHER GROOM

MELISSA COLLINGS

equity while still paying off a 30-year mortgage and slowly going broke. (It should come as no surprise that the root words for mortgage are the French mort for death and gage for pledge—a death pledge.)

You can help older clients turn this strategy on its head through use of the H4P.

Let’s take a hypothetical example: Marlene, 80, lives in a home with multiple levels. Ideally, she’d like to move to a new single-story home or condo near her only living relative, a beloved niece. Marlene is living on a fixed income, though, and feels the move to her niece’s higher-priced market will be impossible.

With a conventional 30-year mortgage, she’s probably right. If she nets $300,000 from the sale of her home and puts the entire amount down on a $500,000 ranch home in the new market, she’s starting out with a $200,000 mortgage. At a 7% interest rate, she’ll pay about $1,330 on her mortgage payment, not counting insurance and taxes. With her monthly Social Security payment and small retirement savings, she may not even qualify for a conventional loan. Even if she did, she’d be paying on her mortgage until age 110.

With the FHA H4P product, there’s no mortgage payment. Marlene’s age and the interest rate determine the amount she’s required to put down. At age 80 with a 6.98% interest rate, Marlene must put down 60% on a $500,000 property. Her initial loan balance is $223,000, including financed closing costs. Because she makes no payments on the loan, her loan balance increases over time. But her equity remains steady as her home

appreciates in value. Using FHA guidelines, H4P lenders figure 4% annual appreciation, the long-term historic average in the U.S.

Marlene still needs enough monthly income to cover her taxes, insurance and maintenance costs.

Appreciation is never guaranteed. What if, several years down the road, Marlene needs to sell the home and repay the mortgage, but the loan balance is more than the home is worth? With an FHA home equity conversion product, she’s not required to pay the excess. If she sells the home for its appraised value, the lender will accept the proceeds from the sale as full payment on the loan. FHA guidelines specify that borrowers will not have to pay more than the full loan balance or 95 percent of the home’s appraised value, whichever is less. The H4P is a non-recourse loan, which means FHA mortgage insurance will pay any shortage. Neither the borrower nor the heirs can be held liable for any short sale amount.

And the H4P isn’t just for those moving to a higherpriced home; it can be used when downsizing, too. This allows the buyers to have more funds available for their retirement.

While every transaction is different, in the scenario outlined here, Marlene maintains a significant equity position on her home into her 90s and beyond. The H4P is simply an equity split that enables her to use part of her equity in lieu of a lifetime of mortgage payments; the rest is left for her niece as an inheritance.

According to SeniorLiving.org, nearly one in two Americans 55 or older say their biggest fear is not having enough money saved for retirement. If you have clients who are 62 or older, consider connecting them with a lender who’s knowledgeable about the H4P. The lender will need only their birthdates and the purchase price of the home to run amortization schedules.

Home equity conversion isn’t for everyone, but for some older clients, it can revolutionize the way they think about retirement.

Curtis Mangus is a 40-year mortgage industry veteran and has been a real estate instructor for the last ten years. You can reach him at curtis@thelendingspot.com.

14 | Salt Lake Realtor ® | June 2024

Image licensed by Ingram Image

2024 PARADE OF HOMES COMING SOON in the july issue

An Exclusive Preview of the Stay in the Forefront of Over 10,000 TRANSACTION MAKERS. RESERVE YOUR AD SPACE NOW. (LIMITED AVAILABILITY) *Realtors® Sell Nine Out of Ten Homes. 801-467-8833 info@millspub.com *In the Mountain State Region (which includes Utah), 94 percent of sellers used an agent to sell their home, according to the National Association of Realtors® research. SALT LAKE PARADE OF HOMES | AUGUST 2 – 17, 2024

Chris Ryan ©/iStock

Mortgage Rates Curtail Home Sales, Yet Prices Surge

Home buyers who require mortgage financing aren’t just facing higher rates but also increased competition from cash buyers.

By Melissa Dittmann Tracey

Existing-home sales in the U.S. fell in April as mortgage rates eclipsed 7% and home prices continued to rise.

But some market segments are showing resilience: High-end home sales—listings at $1 million and above—posted significant gains in April, increasing 40% compared to a year ago, according to the National Association of Realtors® latest housing report. The share of first-time home buyers also is rising.

Still, higher mortgage rates are likely the prime culprit for causing a slower spring market. NAR’s existing-home sales index, which reflects completed transactions for single-family homes, townhomes, condos and co-ops, shows sales fell nearly 2% in April compared to March and are down by about 2% from a year ago. All four major regions of the U.S. saw a decline in home sales last month.

“Home sales changed little overall, but the upperend market is experiencing a sizable gain due to more supply coming onto the market,” said NAR Chief Economist Lawrence Yun. The market for homes priced

at $1 million or more saw listings jump 34% in April compared to a year ago, and buyers responded to the greater housing choices.

High-end home sales likely were behind the rise in the media price for an existing home, which climbed to $407,600—the highest price on record for the month of April. That’s nearly 6% higher than a year ago.

“Home prices reaching a record high for the month of April is very good news for homeowners,” Yun said. “However, the pace of price increases should taper off since more housing inventory is becoming available.”

More homeowners are listing this spring, with inventory of unsold existing homes climbing 9% in April compared to March. National housing inventory is at about a 3.5-month supply at the current monthly sales pace, which is still considered a brisk selling market.

Homes continue to sell quickly, with properties typically remaining on the market for 26 days in April, down from 33 days in March, according to NAR’s report.

16 | Salt Lake Realtor ® | June 2024

IRStone©/Adobe Stock

First-Time Buyers Find Their Way

Higher home prices and mortgage rates didn’t appear to deter first-time home buyers, who have emerged in greater numbers this spring. First-timers comprised 33% of home sales last month, up from 29% a year ago, NAR reports. Consumer surveys are showing that aspiring first-time home buyers feel optimistic about the 2024 housing market, even amid their concerns around affordability and mortgage rates. Nearly three in four Americans who plan to buy their first home say they feel upbeat

from cash buyers. Cash sales continue to account for a sizable share of the market, comprising 28% of transactions in April, NAR reported.

Individual investors and second-home buyers tend to make up the biggest bulk of all-cash sales; they purchased 16% of homes in April.

Regional Breakdown

Here’s a closer look at how existing-home sales fared across the country in April, according to NAR’s report: Sales fell 4% from March, reaching an annual rate of 480,000. That represents a decrease of 4% from a year ago. Median price: $458,500, up 8.5%

Sales dropped 1% compared to a month ago, reaching an annual rate of 1 million. Sales also are down 1% from one year ago. Median price:

Sales decreased 1.6% from March, settling in at an annual rate of 1.9 million. Sales are down 3.1% from the prior year. Median price: $366,200, up 3.7%

Sales fell 2.6% from a month ago, reaching an annual rate of 760,000 in April. However, sales posted a 1.3% increase from a year ago. Median price:

June 2024 | Salt Lake Realtor ® | 17

NMLS #654272 EQUAL HOUSING LENDER Federally insured by NCUA. Loans subject to credit approval. See current rates and terms. Lifetime Servicing Multiple Loan Types No Down Payment Options LEARN MORE AT UFIRSTCU.COM BUILD, BUY, REFI We’ve Got You Covered

6 Ways Your Buyers Can Save on Their Mortgage

With rates around 7%, your clients are feeling the financial squeeze. Here are a few secrets to ensuring they get the best deal they can on their loan.

By Melissa Dittmann Tracey

Although mortgage rates, which have been hovering near 7% over the last few weeks, are expected to fall in the second half of the year, home buyers have adjusted to higher borrowing costs and home prices. Still, affordability is a big issue: 60% of U.S. cities saw gains in home prices in the second quarter, according to data from the National Association of Realtors®. And the median monthly mortgage payment for a typical existing single-family home is $2,234, factoring in this week›s 7.09% average mortgage rate.

However, there are ways buyers can save on their mortgage. Buyers are eligible for the lowest mortgage rates from lenders when they come with a stellar credit

score, particularly above 740. But there are additional ways to save, including:

1. Shop around for a loan. Gathering multiple mortgage rate quotes from lenders can pay off. A recent study from LendingTree shows the average borrower could save $84,301 over the life of their loan by shopping around for a mortgage. Broken down further, borrowers could save $2,810 a year and $234 a month. Borrowers who receive two rate offers from different lenders could save an average of $35,377 over the life of their loan, while borrowers who gather more than five offers could save an average of $105,912, the study finds. “Different lenders have different standards and

18 | Salt Lake Realtor ® | June 2024

Krakenimages.com©/ Adobe Stock

criteria that they look at when deciding who to lend to,” said Jacob Channel, LendingTree’s senior economist. “It’s for that reason that different lenders can offer such drastically different rates to the exact same people.” When shopping around, said Brandon Snow, executive director of Ally Home, buyers should compare interest rates, terms and additional fees—not just who has the lowest mortgage rate. Also, shop around by gathering quotes from mortgage bankers, regional banks, credit unions and national banks.

2. Negotiate. While 63% of home buyers say they have negotiated for home price reductions, only 39% of buyers say they’ve tried to negotiate the initial APR or refinance rate on their most recent home purchase. Yet, those who’ve tried to negotiate on their mortgage have found an 80% success rate, according to a separate study from LendingTree.

Thirty-eight percent of buyers negotiated on closing costs, which are the fees lenders charge to process a loan. “Different lenders often have varying levels of flexibility in negotiations, but it never hurts to ask,” Snow said. “Leveraging quotes from competitive lenders may show your lender that you are seriously considering your options but are open to negotiation to keep your business there.”

3. Buy down the mortgage points. Borrowers may want to consider buying down points—typically done in 0.25 increments—to reduce the interest rate on a loan. But that means paying more upfront at closing. Mortgage points are the fees borrowers pay a mortgage lender to reduce the interest rate on the loan, which then lowers the overall interest paid on the mortgage. Bankrate uses the following example of how this might work: A borrower has a 7% mortgage rate on a $320,000 loan, with a monthly payment of $2,129. The borrower purchases points to get the mortgage rate to 6.5%. That costs him or her $6,400 at closing and lowers the monthly mortgage payment to $2,022—a $107 difference.

Financial experts caution that when buying down points, it can take time to recoup the savings. Lenders can help calculate the break-even point to see how long you’d need to stay in the home to make it worth paying the upfront costs.

4. Ask for discounts. If you are already an existing customer who banks with a lender, ask about “relationship discounts,” Snow suggested. For example, some lenders like Chase Bank may waive a loan processing fee if you have a minimum amount of existing money deposited or in an investment account.

June 2024 | Salt Lake Realtor ® | 19

We build stylish innovative homes that offer joinable private suites (ADU), fully sound insulated and customized for rent or independent generational living. Come see our affortable FLEX-ADU models. (801) 871-9098 | R5homes.com Your Home Built Your Way R5 Homes.indd 1 5/7/24 2:56 PM

U.S. Bank offers up to 0.25% off the loan amount in closing costs, up to $1,000, for those who have a personal checking account with them.

5. Be aware of float-down policies. Mortgage rates can fluctuate over the course of the closing timeline, and every swing can make a difference. “Many lenders will also allow you to adjust your rate downward if there are significant changes in the market rate while you are in the process,” Snow said. “Proactively asking about float-down and renegotiation policies upfront will ensure you know the requirements to get your rate reduced from the get-go and protect you from paying a higher rate than you should.”

6. Consider the mortgage terms. The 30-year fixed-rate mortgage is the most used type of loan, but some lenders may offer even longer terms, like 40-year mortgages. Borrowers may be able to save around $100 on their monthly mortgage payment by extending their mortgage term—but that means they’ll pay significantly more in interest over the life of the loan. In 2023, the Federal Housing Administration announced a 40-year option for borrowers experiencing a financial hardship who need a loan modification.

Lenders may be able to offer other types of loans to help borrowers lower their monthly payments. For example, adjustable-rate mortgages have been surging in popularity as 30-year rates edge higher. ARMs accounted for nearly 19% of single-family mortgages in the spring, although they remain below pre-2008 levels, according to CoreLogic data. ARMs tend to offer a lower introductory interest rate, but they will reset to current rates in five or seven years, depending on the terms.

For home buyers who may be trying to “time” the market and snag the best interest rates, real estate has adopted a new mantra: “Marry the house; date the rate.” As the phrase implies, buyers may be better off committing to the home they love long-term, regardless of current rates, and refinancing later should interest rates ever drop.

Melissa Dittmann Tracey is a contributing editor for Realtor® Magazine, editor of the Styled, Staged & Sold blog, and produces a segment called "Hot or Not?” in home design that airs on NAR’s Real Estate Today radio show.

20 | Salt Lake Realtor ® | June 2024

Image licensed by Ingram Image

Image licensed by Ingram Image

“We believe that every human who walks through our door is to be treated like family because we are built on family. We believe in honest, transparent, loyal, loving, authentic relationships and will carry these values to our clients and their clients. Your peace of mind during the Real Estate Transaction is our peace of mind. After all, Ohana means family, and family means nobody gets left behind or forgotten (thank you Lilo and Stitch).”

June 2024 | Salt Lake Realtor | 21 WHERE YOU ARE FAMILY www.ohanatitleutah.com Education Property Profiles Farming Searches Abstracts 801-758-7277 PLAT MAPS Industry Connectors and MORE! Meet Your

Title Team! Terrie Lund Owner Escrow Officer Kenadee Martinson Escrow Officer Britney Bown Escrow Officer Izabelle Reece Client Relationship Manager Emma Haws Escrow Assistant Simone Mier Escrow Assistant

Ohana

Untitled-1 1 5/30/24 2:37 PM

What’s Trending in Yards

A continued focus on maximizing space has homeowners making intentional decisions about how to use their outdoor spaces.

By Barbara Ballinger

The desire to spend more time outdoors remains a priority for homeowners. The trend of transforming outdoor spaces into distinct “rooms” maximizes square footage with areas to cook, dine, relax, garden and be active.

While the old rule of budgeting suggested 10% of a home’s value for outdoor improvements, that number is on the rise. Steve Chepurny, landscape architect, at Southampton, N.J.-based Beechwood Landscape & Construction notes an increase of 20-25%. Denver-area landscape designer Abby Rupsa of Botanical Living puts the number in her market closer to a 15% average.

Part of the uptick is also due to labor and cost of materials, said landscape designer Michael Glassman, whose eponymous firm is based in Sacramento, Calif. “Costs have doubled and tripled in recent years,” he

said. “To cut back, some homeowners do some work themselves or scale back projects. Those who stay put also put in more sustainable features that will last,” Glassman said.

Yards are often versatile spaces that can offer everything from leisure to fun. Sometimes though, it’s hard to know where to start. Seasoned homeowners offer the following tips to help:

• Plant according to a local climate, water and soil specifications.

• Develop a cohesive design plan up front.

• Forgo features that require lots of maintenance and will detract from leisure time, unless hiring help is part of the budget.

22 | Salt Lake Realtor ® | June 2024

Florian©/Adobe Stock

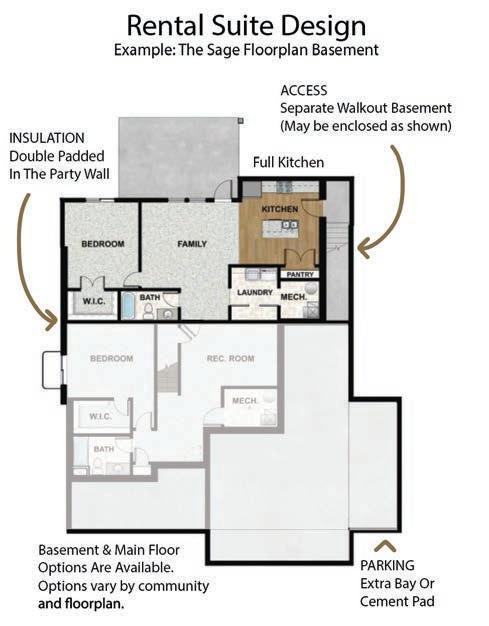

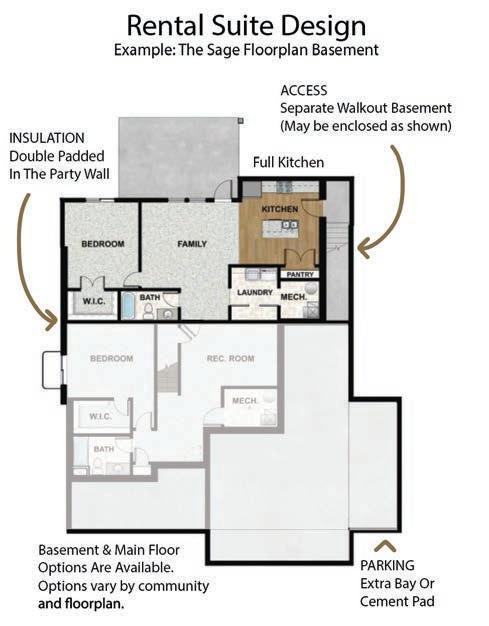

RENTAL SUITE/ADU

ADD AN APARTMENT FOR RENTAL INCOME OR FOR YOUR FAMILY.

FieldstoneHomes.com | 801.895.3526

NOW AVAILABLE IN 6 COMMUNITIES LEHI | SARATOGA SPRINGS | EAGLE MOUNTAIN | CLEARFIELD | MAPLETON | ST. GEORGE FINANCIAL BENEFITS

A NEW LOAN

TAX

ABOUT ADU’S ADU MODEL HOME IN SARATOGA

ACCESSORY DWELLING UNITS AVAILABLE RAMBLER & 2-STORY PLAN ADU OPTIONS AVAILABLE!

INCREASES INCOME TO QUALIFY FOR

RENTAL INCOME TO REDUCE MORTGAGE PAYMENTS

BENEFITS ADU

SPRINGS

Below is a compendium of popular options.

Pools and Water Features

Pool trends continue to shift, but it is clear that homeowners continue to prioritize water features. Chepurny has had several clients who asked to remove their existing pools for modern designs with better materials such as gunite instead of vinyl. Updates to tile and surrounds are also in demand. The classic rectangle is again gaining traction. John Algozzini, senior design associate at Chicago area Hursthouse, said 90% of his firm’s clients want a rectangular pool. Smaller pools and spools—splash pools—are popular based on available space and lot coverage restrictions, he adds.

Many pools may incorporate water jets and walls, sun shelves in the shallow end, deeper diving zones, an adjacent spa, lights for night-time use thanks to LED technology and an area for a cabana to give a resort feel. Even in urban areas, water features are popular.

Designer Amber Freda of New York-based Amber Freda Landscape Design said clients like the zinc fountains from Restoration Hardware, which recirculate and don’t require plumbing. “All you do is refill them with a garden hose,” she said.

Plants and Landscaping

With concern about the survival of bees, butterflies and birds, more professionals encourage the use of plant species that attract them such as native cone flowers, native black-eyed Susans and milkweed, said Algozzini.

Go native

A native landscape encourages local pollinators, which means plants are heartier and healthier and can conserve water. Because of her Denver area’s high desert plains elevation, Rupsa said her palette is narrow, so she tends to repeat choices such as Hardy geranium, Hyssop, Yucca, Manzanita and Spirea.

Conserve water

More homeowners are cognizant of water usage in their homes and their gardens. To conserve water, Ruspa focuses on xeriscape gardens with drought-tolerant plants. She also incorporates small pocket lawns with new lower water Bermudagrass called Tahoma 31 rather than Kentucky Bluegrass, which requires more water than other cool grasses.

Keep it wild

Ruspa also sees a trend toward a more natural even wild look, though sometimes it can be a challenge

24 | Salt Lake Realtor ® | June 2024

Stock

bmak©/Adobe

for HOAs to appreciate. She uses ornamental grasses such as Grama Grass, Switchgrass and stipa. She also incorporates pollinator-friendly perennials that have interesting structure and provide seed heads for hungry birds. She inserts boulders and smaller rocks in faux riverbeds to add winter interest and break up plantings. She will often recommend clients not clean up their fallen leaves during dormancy to provide cover for beneficial insects.

Make it edible

Edible landscapes remain popular, and Freda has had success with blueberries, strawberries, figs and grapes for her New York area clients, some of whom garden on rooftops.

The key to a flourishing edible garden is to pay attention to two factors: what grows well in which seasons and what works for a homeowner’s specific location.

Pops of color

Marc Nissim, landscape architect at Westfield, N.J.based Harmony Design Group, advises aiming for color throughout the year. “Our goal is to design a garden with four seasons of interest. He has a list of favorites that add color and texture to each season:

Spring – flowering trees such as cherry blossoms and magnolias, shrubs like forsythia and lilac and bulbs like daffodils and tulips

Summer – perennials like Catnip, Purple coneflower and Black-eyed Susan, flowering shrubs like hydrangea and roses, and flowering trees like Crape myrtle for color

Fall – red maple, a perennial like Amsonia or a shrub like Itea Sweetspire

Winter – the Paperbark maple or the movement of ornamental grass, a shrub like Lindera angustifolia spicebush or Cornus alba red twig dogwood

Outdoor Kitchens and Dining

Cooking outdoors remains a widespread interest, but some professionals note an uptick in homeowners requesting less elaborate, smaller kitchens. Algozzini sees interest in a range of sizes, sophistication and prices. “Some want one with just a grill, counter and refrigerator and others want the grill, refrigerator, storage drawers, warming drawer, pizza oven, smoker and more,” he said.

Adds Nissim, “Creating an outdoor kitchen often can include a bar with granite countertop. This adds another seating area and a spot to hang out with the chef!” Chepurny said the decision process is “really a quality-of-life decision. Many still work from home post-Covid and are willing to pay to have such features.”

Relaxation Zones

Near a kitchen, most homeowners still favor a comfortable place to eat and entertain, with a cover to offer shade and shelter from rain and bugs. Nissim likes to use these spaces to add lighting. Algozzini sees interest in traditional cedar, composite materials and aluminum, the latter more expensive. Some add shades to pull down, which can be automated, a fan to move air and lighting for night-time use. Furniture groupings can serve as the equivalent of an indoor wall to mark zones. Other features that remain popular are fire pits, art for color, soft seating and

June 2024 | Salt Lake Realtor ® | 25

Photo: Ken Magleby

outdoor TV and sound systems, Nissim said. For those who have the space and the funds, pickleball courts or a combination pickleball/basketball court, putting green and tennis court are becoming more common.

Additional favorites: permeable hardscape, bigger sheds, better irrigation

Gardens aren’t all softscape and amenities. Popular options that conserve water include bluestone, limestone and gravel. Gravel allows for a semipermeable surface that lets water recharge and soak into the soil, Chepurny said. Freda recommends nontoxic materials such as petroleum-free artificial turf, due to concern about pets and children being around materials that may be hazardous to their health. In between pavers, Chepurny plants “steppables” or creeping perennials like sedum that tolerate a little trampling, he said.

For those wanting an escape from work, a hobby or storage, there’s a trend of having bigger sheds. Some mimic small homes with cupolas, windows and window boxes, Chepurny said.

When it comes to irrigation systems, the good news is that many incorporate smart controls to track temperature and time of day, he said. Drainage should be prioritized; otherwise, there can be water damage, erosion and flooding, said Aaron Brundage, director of operations at Orange County, Calif.-based System Pavers, an outdoor living and installation company.

Barbara Ballinger is a freelance writer and the author of several books on real estate, architecture, and remodeling. Reprinted from Realtor® Magazine Online, June 2024, with permission of the National Association of Realtors®. Copyright 2024. All rights reserved.

26 | Salt Lake Realtor ® | June 2024

Creative Stock©/Adobe Stock

JUNE 2024

The spring home buying season heated up, with home sales of all housing types in Salt Lake County increasing to 1,050 units in April, up 9.6% from 958 units sold in April 2023. Multi-family home sales led the increase at 12.85%, followed by single-family home sales at 8.23%. The sales volume in April exceeded $655.7 million, an 18.61% increase from April 2023.

Weber County was the only other area along the Wasatch Front to see an increase in home sales in April, with 307 homes sold, up 5.14% from 292 the previous year. In contrast, Davis County home sales fell by 10.97%, Utah County home sales were down nearly 1%, and Tooele County saw no change in sales.

Across the U.S., home sales fell 1.9% year-over-year, decreasing from 4.22 million in April 2023, according to the National Association of Realtors® (NAR). Lawrence Yun, NAR chief economist, forecasts that interest rates will fall in the long term. He predicts that existing-home sales will rise to 4.46 million in 2024 (up 9% from 4.09 million in 2023) and will increase to 5.05 million in 2025 (up 13.2% from 2024), with further gains expected in eight of the next ten years.

“Home prices reaching a record high for April is very good news for homeowners,” Yun said. “However, the pace of price increases should taper off as more housing inventory becomes available.”

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 7.02% as of May 16, down from 7.09% the previous week but up from 6.39% one year ago. The monthly Realtors® Confidence Index reports that properties typically remained on the market for 26 days in April, down from 33 days in March but up from 22 days in April 2023.

First-time buyers were responsible for 33% of sales in April, up from 32% in March and 29% in April 2023. NAR’s 2023 Profile of Home Buyers and Sellers, released in November 2023, found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 28% of transactions in April, the same as in March and one year ago. In Salt Lake County, all-cash sales represented 21% of all house sales in April. Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in April, up from 15% in March but down from 17% in April 2023. Distressed sales—foreclosures and short sales—represented 2% of sales in April, virtually unchanged from the previous month and the prior year.

“Home prices reaching a record high for April is very good news for homeowners, however, the pace of price increases should taper off as more housing inventory becomes available.”

Lawrence Yun

Chief Economist National Association of Realtors®

28 | Salt Lake Realtor ® | June 2024

Spring Home Sales Heat Up

Salt Lake County

June 2024 | Salt Lake Realtor ® | 29 Local Market Update for April 2024 Source: UtahRealEstate.com

KEY METRICS NO. OF SALES MEDIAN SOLD MEDIAN PRICE NEW LISTINGS PRICE PER SQ. FT All Housing Types 1050 $537,375 $258.58 1548 Single Family 697 $615,000 $246.28 1070 Multi Family 325 $430,000 $281.16 447 COMPARISON TO LAST YEAR 2023 All Housing Types 958 $493,000 $240.97 1225 Single Family 644 $579,500 $234.70 889 Multi Family 288 $420,000 $259.85 295 COMPARISON TO LAST YEAR -% DIFFERENCE All Housing Types 9.60% 9.00% 7.31% 26.37% Single Family 8.23% 6.13% 4.93% 20.36% Multi Family 12.85% 2.38% 8.20% 51.53% 9.60% 26.37% 4.35% 9.00% 1050 958 NO. OF SALES ALL HOUSING TYPES APRIL 2023 ALL HOUSING TYPES APRIL 2024 ALL HOUSING TYPES APRIL 2024 ALL HOUSING TYPES APRIL 2024 ALL HOUSING TYPES APRIL 2024 ALL HOUSING TYPES APRIL 2023 ALL HOUSING TYPES APRIL 2023 ALL HOUSING TYPES APRIL 2023 NEW LISTINGS MEDIAN CDOM MEDIAN SOLD PRICE 1225 1548 23 24 $537,375 $493,000

Pamela Abbott

Barton Allan

Judy Allen

Suzanne Allred

George Anastasopoulos

Brent Anderson

Clay Anderson

Diane Anderson

Kay Ashton

Sue Avalos

Margaret Averett

Laurence Bailess

Les Bailey

Brent Barnum

Veda Barrie-Weatherbee

Edward Belka

Ken Bell

Raymond Bennett

Richard C. Bennion

Steven Benton

Michael Black

Gregg Bohling

Russell Booth

Virginia Bostrum

Robert Bowles

Mary Ann Brady

Janet Brennan

Steve Brown

Stephen Bryant

Barbara Burt

Hedy Calabrese

Gregory Call

Tracey Cannon

Julie Carli

Carol Cetraro

Scott Chapman

Garn Christensen

Brian De Haan

Babs De Lay

Lynn Despain

Jerard Dinkelman

Darlene Dipo

Sally Domichel

Rebecca Duberow

James Dunn

Randy Eagar

Carol Edgmon

Douglas Edmunds

Michael Evertsen

Bijan Fakjrieh

Alan Ferguson

Jack Fisher

Gale Frandsen

David Frederickson

Howard Freiss

Brent Gardner

Heidi Gardner

Paul Gardner

Linda Geer

Sheila Gelman

J. Carolyn Gezon

Larry Gray

Richard Grow

D. Brent Gudgell

Klaire Gunn

James Haines

John Hamilton

Mark Handy

Grant Harrison

Stephen Haslam

Michael Hatch

Thomas Haycock

Bill Heiner

Jeffrey Helotes

Blake Ingram

Kent Ingram

Esther Israelson

Jackson Jensen

Kevin Jensen

Ron Jenson

Jeffrey Jonas

Steve Judd

David Kenney

Kay Kenyon

Henry Kesler

Douglas Knight

Peggy Knight

Wayne Knudsen

Karl Koenig

Randall Krantz

Leah Krueger

Kathryn Kunkel

Gary Larson

Teresa Larson

Vann Larson

Michael Lawrence

Clark Layton

Shauna Leake

Kaye LeCheminant

Daniel Lindberg

Michael Lindsay

Martin Lingwall

Mildred Llewelyn

Don Louie

Ted Makris

Margaret Malherbe

Al Mansell

David Mansell

Dennis Marchant

Susan Mark-Lunde

Paul Markosian

Margene Wrigley

Henry Youngstrom

Elizabeth Memmott

Uwe Michel

Gordon Milar

Kyle Miller

Preston Miller

David Moench

Richard Moffat

Gary Monk

H.Craig Moody

Randal Moore

Thomas Morgan

Thomas Mulock

Charles Mulford

Melanie Mumford

Jacqueline Nicholl

John Nielson

Michael Nielson

Robyn Nielson

Van Nielson

Victor Oishi

Joseph Olschewski

Brent Parsons

Joan Pate

Yvonne Pauls

Derk Pehrson

Douglas Pell

Robert Plumb

Noel Quinton

Helen Rappaport

David Read

Jerry Reed

George Richards

W. Kalmar Robbins

Stan Rock

Emilie Rogan

Elizabeth Smith

Kenneth Smith

Rick Smith

Skip Smith

Jeffrey Snelling

Lorenzo Spencer

Kenneth Sperling

Anna Grace Sperry

Robert Spicer

Trudi Stark

Lee Stern

Sandra Straley

Gary Strang

John Strasser

Kevin Strong

Thomas Swallow

Sonny Tangaro

Joan Taylor

Rosanne Terry

Martin Vander Veur

Craig Vierig

Peter Vietti

Hilea Walker

H. Blaine Walker

Richar dWalter

Dana Walton

Sally Ware

Jerry Webber

William Wegener

David Weissman

Jeffrey Wells

Wayne Whetman

Jeff White

Darlene Whitney-Morgan

Clayton Wilkinson

Thomas Wilkinson

Kimball Willey

Byron Christiansen

David Clark

Deborah Clark

Terry Cononelos

Jeffery Cook

Philip Craig

Dan Davis

Robert Davis

Marvin Hendrickson

Terry Hill-Black

Lynda Hobson

Ted Holmberg

Sheryl Holmes

Rhys Horman

Carol Howell

Gary Huntsman

Ronnald Marshall

Susie Martindale

Christopher McCandless

Curtis McDougal

Miriam McFadden

John McGee

Russell McKague

Andrew McNeil

John Romney

Marie Rosol

Christopher Ross

David Sampson

Mark Schneggenburger

Gary Shiner

Jeff Sidwell

Debra Sjoblom

Douglass Winder

Robert Wiskirchen

James Witherspoon

Linda Wolcott

Cynthia Wood

Sherrill Wood

Tech That Works For You, Not Against You. Miriem Boss 949.836.4029 DIRECTOR / BUSINESS DEVELOPMENT Brad Hansen 801.230.5236 GENERAL MANAGER Grady Kohler 801.815.4663 OWNER / PRINCIPAL BROKER 2020 Walker Lane, Holladay | Listed by Jim Bringhurst