Homeownership Builds Wealth p. 10 REALTOR May 2023 Salt Lake Magazine ®

Collaboration is not an option. It’s a promise. When we work with Homebuyers, we build homes around their lives – not the other way around. The same is true when we work with you. At David Weekley Homes, we work hand-in-hand with you and your Team to ensure that your Clients’ path to homeownership is as seamless and fulfilling as possible – and so is your experience in helping them get there. That’s The Weekley Way.

Homes from the mid $500s to the high $800s in the Salt Lake City area Ready Now! Ready Now!

See a David Weekley Homes Sales Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to change without notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2023 David Weekley Homes - All Rights Reserved. Salt Lake City, UT (SLC-23-001339)

David Weekley Homes Team Member with Valerie Manis and Real Estate Agent Shanni Lo

Learn more about our Quick Move-in Homes by contacting 385-955-3672 Ascent at Daybreak The Mammoth 6908 W. Docksider Drive 4,480 sq. ft., 2 Story 6 Bedrooms, 3 Full Baths, 1 Half Bath, 2-car Garage Ascent at Daybreak The Elkhorn 11543 S. Outfitter Way 3,991 sq. ft., 1 Story 6 Bedrooms, 4 Full Baths, 1 Half Bath, 2-car Garage

YOUR CLIENTS GET UP TO 5% DOWNPAYMENT ASSISTANCE Plus, their credit score can be as low as 580! TM TM TM Turning Houses into Homes® This is not a commitment to make a loan. Loans are subject to borrower and property qualifications. Contact loan originator listed for an accurate, personalized quote. Interest rates and program guidelines are subject to change without notice. SecurityNational Mortgage Company is an Equal Housing Lender. WWW.SNMC.COM We can help your client’s achieve their dream of homeownership with our NEW and exclusive SNhome™ Down Payment Assistance (DPA) program. SNMC Exclusive!

Salt L ake REALTOR® Magazine slrealtors.com The Salt Lake REALTOR® (ISSN 2153 2141) is published monthly by Mills Publishing, located at 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106. Periodicals Postage Paid at Salt Lake City, UT. POSTMASTER: Send address changes to: The Salt Lake REALTOR,® 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106-4618. May 2023 volume 83 number 5 This Magazine is Self-Supporting Salt Lake Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt Lake Realtor Magazine comes from trees in managed timberlands. These trees are planted and grown specifically to make paper and do not come from parks or wilderness areas. In addition, a portion of this magazine is printed from recycled paper. Table of Contents slrealtors.com Features 10 Building Wealth Through Homeownership The National Association of Realtors® 16 Yun: Latest Fed Hike ‘Unnecessary and Harmful’ Melissa Dittmann Tracey 18 Knowing How Local Broker Marketplaces Work Katie Johnson 20 The Salt Lake Board of Realtors® Rocks 22 Seven in 10 Metro Areas Posted Home Price Gains in Q1 2023 The National Association of Realtors® 26 Experts: U.S. Debt Demands a Long-term Plan Stacey Moncrieff Columns 7 Enhancing Civility: Extracting Lessons from Sportsmanship for the Workplace Rob Ockey – President’s Message Departments 8 Happenings 8 In the News 28 Housing Watch 4 | Salt Lake Realtor ® | May 2023 On the Cover: Cover Photo: Michael O’Neill ©/Adobe Stock 18 Knowing How Local Broker Marketplaces Work 16 Yun: Latest Fed Hike ‘Unnecessary and Harmful’ 20 The Salt Lake Board of Realtors® Rocks Jim Vallee ©/Adobe Stock Photo: Dave Anderton Jirapong ©/Adobe Stock

www.jointheUNBROKERAGE.com OVER 75 YEARS EXPERIENCE TO SUPPORT YOUR EVERY NEED UNRIVALED BROKER SUPPORT Each franchise independently owned and operated. DAVIS COUNTY DAVE HAWS (801) 915.4315 UINTA COUNTY NANCY BIRCHELL (435) 724.4953 SOUTH VALLEY RP (801) 633.1990 MIDVALE ANGELA JONES-FABER (801) 703.6553 midvale DAVIS COUNTY DRAPER Angela Jones-Faber PRINCIPAL BROKER Dave Haws BRANCH MANAGER Ravath Pok BRANCH BROKER UINTA COUNTY Nancy Birchell BRANCH BROKER

LIBERTY HOMES (801) 573-7722 Liberty Homes.com/ParkerPlace Your Client’s Dream Home Awaits! Parker Place is West Jordan’s newest 55-plus community! Enjoy lower maintenance, single-story living in one of these move-in ready homes: 1736 W Drake Lane (Lot 1) 2,989 sq. ft. (1,492 finished) 2 Bedrooms Plus Office 2 Bathrooms 2 Car Garage $589,950 MLS #1860333 1748 W Drake Lane (Lot 2) 3,568 sq. ft. (1,778 finished) 2 Bedrooms Plus Office 2 Bathrooms 2 Car Garage $629,950 MLS #1860351 1756 W Drake Lane (Lot 3) 3,505 sq. ft. (1,747 finished) 2 Bedrooms Plus Office 2 Bathrooms 2 Car Garage $629,950 MLS #1860373 1764 W Drake Lane (Lot 4) 2,902 sq. ft. (1,492 finished) 2 Bedrooms 2 Bathrooms 2 Car Garage $579,950 MLS #1860381

REALTOR

Magazine slrealtors.com

President Rob Ockey

Presidio Real Estate

First Vice President

Dawn Stevens

Presidio Real Estate

Second Vice President

Claire Larson Woodside Homes

Treasurer

Jodie Osofsky

Summit Sotheby’s

Past President

Steve Perry

Presidio Real Estate

CEO

Curtis Bullock

Directors

Carlye Webb

Summit Sotheby’s

Jennifer Gilchrist

KW South Valley Keller Williams

John Lucky

Berkshire Hathaway

Janice Smith

Coldwell Banker

Laura Fidler

Summit Sotheby’s (Draper)

Amy Gibbons

KW South Valley Keller Williams

Jenni Barber

Berkshire Hathaway (N. SL)

J. Scott Colemere

Colemere Realty Assoc.

Hannah Cutler Coldwell Banker

Michael (Mo) Aller Equity RE (Advantage)

Morelza Boratzuk RealtyPath

Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Enhancing Civility: Extracting Lessons from Sportsmanship for the Workplace

In recent times, there has been a distressing decline in sportsmanship and decorum within the realm of sports. Incidents like a fan throwing a water bottle at an NBA player, a heated exchange between soccer players leading to an unsightly confrontation, or a middle school wrestler being sucker-punched by an opponent after a match are indicative of a broader erosion of civility in society. As professionals, it is vital for us to address this issue and uphold the highest standards of conduct in the real estate industry.

Managing Editor

Dave Anderton

Publisher Mills Publishing, Inc. www.millspub.com

President

Dan Miller

Art Director

Jackie Medina

Graphic Design

Ken Magleby

Patrick Witmer

Office Administrator

Cynthia Bell Snow

Like any other profession, real estate thrives on trust, cooperation, and mutual respect. As agents, we serve as intermediaries between buyers and sellers, working towards bringing people together and assisting them in achieving their dreams of homeownership. It is incumbent upon us to navigate these relationships with grace and professionalism. The lessons derived from the world of sports serve as a reminder that we must collaborate to cultivate an environment of respect and courtesy.

When we witness poor sportsmanship in athletics, it serves as a striking reminder of the significance of civility in our daily interactions. The principles of good sportsmanship, encompassing fair play, respect for opponents, and graciousness in victory or defeat, should also guide our actions as real estate professionals. Just as athletes are expected to shake hands after a match, we must treat our colleagues and clients with an equivalent level of respect and dignity.

Sales Staff

Paula Bell

Paul Nicholas

Salt Lake Board: (801) 542-8840

e-mail: dave@saltlakeboard.com

Web Site: www.slrealtors.com

to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin.

The Salt Lake REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS®

Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

OFFICIAL

OF THE

REALTOR is a registered mark which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS

The absence of civility in sports often leads to penalties, suspensions, and reputational damage. In the real estate world, the cost of incivility can be even more severe. Unprofessional behavior can result in a tarnished reputation, strained relationships, fines, lawsuits, and missed business opportunities. As Realtors®, we pledge to hold ourselves to a higher standard, the Code of Ethics, and actively promote and embody the values of respect, integrity, fiduciary duty, and courtesy.

Fortunately, amidst the negativity, the sports world also presents shining examples of athletes who epitomize sportsmanship and humility. These role models inspire us to strive for improvement and demonstrate that courtesy and professionalism are not outdated notions.

As real estate professionals, we possess the power to make a positive difference by committing to upholding the values of civility and professionalism in our interactions. It begins with treating every client, colleague, and competitor with the respect and kindness they deserve. By doing so, we create a positive environment that not only benefits our profession but also contributes to a more civil society.

Rob Ockey President

May 2023 | Salt Lake Realtor ® | 7

The Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers

October 2005

SALT

OF

PUBLICATION

LAKE BOARD

REALTORS ®

Salt L ake

®

Happenings

Salt Lake Homeowners Gain $238K in Equity Over Past Decade

New data from the National Association of Realtors® reveal middle-income homeowners in Salt Lake City accumulated $238,240 in wealth as their homes appreciated over the last 10 years. The data, which was featured prominently in NAR’s new report, Wealth Gains by Income and Racial/Ethnic Group, speaks to the value agents and Realtors® bring to consumers when helping buy and sell homes that build generational wealth. “The economic rewards of homeownership significantly surpass that of renting,” stated Rob Ockey, President of the Salt Lake Board of Realtors®. “This report demonstrates that owning a home builds equity, yields tax incentives, and establishes a secure foundation for personal development and community relationships.” Even low-income homeowners in Salt Lake City were able to build $207,270 in wealth in the last decade from home price appreciation only, while upper-income households saw an increase of $281,880. Salt Lake City’s homeownership rate is 71.7% for middle-income earners.

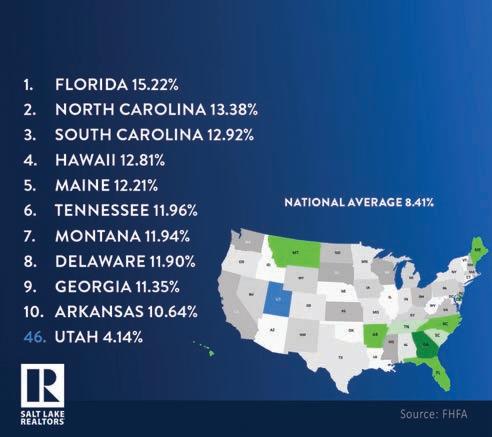

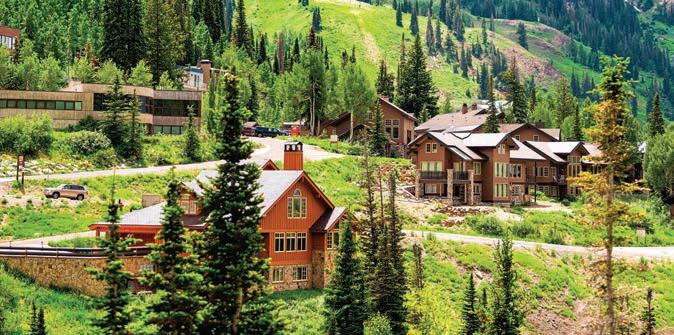

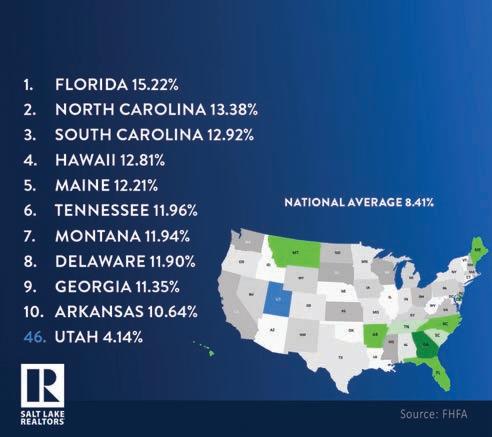

Utah’s House-Price Appreciation Drops to No. 46 in 2022

For years, Utah held the distinction of being the national leader in housing price appreciation. However, following a spike in mortgage interest rates last summer, the state’s ranking dropped to nearly the bottom. In 2022, Utah experienced a modest 4.14% increase in home prices—marking the sixth lowest percentage increase among all states, as per data from the Federal Housing Finance Agency. Comparatively, the nationwide average increase in house prices reached 8.4% between the fourth quarters of 2021 and 2022. This deceleration in Utah’s housing market is a silver lining for firsttime homebuyers who continue to grapple with affordability concerns.

In the News

In Memoriam

Jerry Reed – father, husband, papa, brother, uncle, and friend – passed away surrounded by family on the morning of March 20, after a threeyear battle with colon cancer. Jerry was born on Nov. 27,1950, in South Salt Lake. He was an active member of the Salt Lake Board of Realtors® for 50 years. He joined the Board as an agent with Prowswood Realty. He worked for Coldwell Banker both as an agent, and as a branch manager. He also worked for Realtypro, Equity Real Estate Advantage, and opened his own brokerage, Realty Group USA. He finished his career as the principal broker of My Home Utah. Jerry served on the Education Committee, was a GRI instructor and taught classes at the Board for many years. Jerry is survived by his wife, Shelley Burton Reed, his daughters, Jennifer (Bruce Wayne Jr.) Spitzer and Michelle Reed (William Thompson), his much-adored grandchildren, Zoe Scarlett and Benjamin Spitzer, brothers Don Reed and John Nash, Sister Elaine Torgerson and their families.

Supreme Court Considers Takings Case

The Supreme Court on April 26 heard oral arguments in Tyler v. Hennepin County, a Minnesota case examining the practice of “home equity theft,” where the National Association of Realtors®, American Property Owners Alliance, and the Minnesota Realtors® filed an amicus brief in defense of homeowners private property rights. At issue is whether taking and selling a home to satisfy a debt to the government, and keeping the surplus value as a windfall, violates the Fifth Amendment’s takings clause. Geraldine Tyler, a 94-year-old grandmother, lost her Minneapolis condo when she failed to pay the property taxes for several years.

“Tyler does not dispute that Hennepin County could foreclose on the $40,000 property and sell it to obtain the $15,000 in taxes and costs that she owed it,” writes Amy Howe, attorney, and court observer.

“But she argued that the county violated the Constitution when it kept the $25,000 left over after the property was sold.” A decision in the case is expected this summer.

8 | Salt Lake Realtor ® | May 2023

FASTEST RISING HOUSE PRICES Percent change Q4 2021 through Q4 2022

Andriy Blokhin ©/Adobe Stock

READY TO GET REAL ABOUT REAL ESTATE?

As part of the legendary Berkshire Hathaway family of companies, we have the depth, strength and brand power to help grow your real estate business. Our network extends globally in reputation and strength. Locally, our company is the largest brokerage in Utah, ensuring that your property reaches a broad audience of real estate professionals and buyers. We are committed to providing you with the resources and support that will create greater success and enjoyment in your real estate career. So, talk with us at Berkshire Hathaway Utah Properties and let’s get you settled without ever settling for less.

2022 NETWORK AWARDS – CONGRATULATIONS TO OUR TEAM OF AMAZING REAL ESTATE PROFESSIONALS AND THANK YOU TO OUR VALUED CLIENTS FOR A VERY SUCCESSFUL 2022.

#1 PRIVATELY OWNED BROKERAGE #1

#7 BROKERAGE OVERALL #7

#1 OFFICE IN OVERALL TOTAL PRODUCTION #1

#8 OFFICE IN OVERALL TOTAL PRODUCTION #8

13 OF THE TOP 25 AGENTS & TEAMS TOP 25

UTAH PROPERTIES IS THE #1 INDEPENDENTLY OWNED AND OPERATED BROKERAGE IN OUR GLOBAL NETWORK

UTAH PROPERTIES IS THE #7 BROKERAGE OVERALL IN OUR GLOBAL NETWORK

OUR PARK CITY OFFICE IS THE #1 OFFICE IN OVERALL TOTAL PRODUCTION IN OUR GLOBAL NETWORK

OUR SALT LAKE CITY OFFICE IS THE #8 OFFICE IN OVERALL TOTAL PRODUCTION IN OUR GLOBAL NETWORK

UTAH PROPERTIES HAS 13 OF THE TOP 25 AGENTS & TEAMS IN OUR GLOBAL NETWORK

COMPLETE SERVICE ADVANTAGE / (801) 990-0400 / BHHSUTAH.COM RESIDENTIAL / MORTGAGE/LOANS / COMMERCIAL / RELOCATION PROPERTY MANAGEMENT & LONG TERM LEASING / TITLE & ESCROW SERVICES ©2023 BHH Affiliates, LLC. An independently owned and operated franchisee of BHH Affiliates, LLC. Berkshire Hathaway HomeServices and the Berkshire Hathaway HomeServices symbol are registered service marks of Columbia Insurance Company, a Berkshire Hathaway affiliate. Equal Housing Opportunity. • UTAH PROPERTIE S – $4.9 BILLION IN T OTAL ANNUAL SALE S FOR 2022 • UTAH PROPERTIE S –

AGENTS ACROSS 30+ OFF ICES • MORE

PROFE SSIONALS AND

OFFICE S

@BHHSUTAH

OVER 500

THAN 50,000 NETWORK SALE S

1,500+ MEMBER

THROUGHOUT NORTH AMERICA, EUROPE AND ASIA

Building Wealth Through Homeownership

The net worth of a typical homeowner is about 40 times the net worth of a renter.

By The National Association of Realtors®

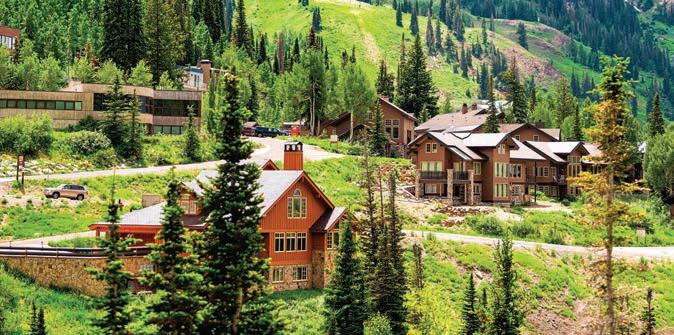

Research has consistently shown the importance of the housing sector on the economy and to the long-term social and financial benefits of individual homeowners. The housing sector accounted for approximately 19% of the total economic activity in 2022. Meanwhile, from an individual’s perspective, owning a home can drastically help people to improve their net worth. According to the U.S. Census Bureau, home equity and retirement accounts represent over 60% of households’ net worth.

Specifically, people can build wealth through homeownership in two ways. First, a mortgage is often also considered a forced savings account. A mortgage “forces” people to pay their monthly mortgage payment if they want to keep their property. Each monthly payment pays down the debt held by the borrower. In addition, the value of a home increases over time,

and homeowners can build wealth from the price appreciation of their property. Over the last decade, the median-priced home has become worth about $190,000 more. As a result, the net worth of a typical homeowner is about 40 times the net worth of a renter.

However, not everybody has had the same opportunities for homeownership, with many facing more constraints in their effort to become homeowners. Data shows that there are substantial variations and inequalities in homeownership rates across different income and racial/ethnic groups.

Most low-income households rent, and the homeownership rate for this group is 47%. Nevertheless, the homeownership rate rises to 69% for middle-income and 87% for upper-income households. Compared to a decade ago, however, even fewer low-

10 | Salt Lake Realtor ® | May 2023

income households own a home now. Specifically, the homeownership rate for low-income households was 48% in 2011.

Moreover, across racial/ethnic groups, the Black homeownership rate continues to be well behind the rate of any other group. At the end of 2022, the homeownership rate for Black Americans was 44.9% compared to 74.5% for white Americans, 61.9% for Asian Americans, and 48.5% for Hispanic Americans. In the meantime, the homeownership rate rose for each of these racial/ethnic groups compared to 10 years ago. But the Black homeownership rate hasn’t kept pace with increases in the other racial/ethnic groups, making the gap even larger between white and Black homeownership rates.

Thus, data shows that significantly fewer low-income households and households of color own their home and are able to build wealth compared to other income and racial/ethnic groups.

This analysis looks at how homeownership can be a catalyst for building wealth for households in these groups. NAR computed how people can increase their

net worth through homeownership by income level and racial/ethnic group.

Areas with the Highest Concentration of Low-, Middle-, and Upper-Income Households

Before analyzing wealth gains by income group, it’s important to understand where these households live.

Geographically, most low-income households are in the South and West regions. College towns and big city centers tend to have the most low-income households. For example, the share of low-income households in College Station, TX (46%), Tuscaloosa, AL (43%), and Charlottesville, VA (41%) was above 40%, as most college students report very low incomes. Due to the higher cost of living, more than 40% of the households in both New York and San Francisco metro areas were low-income households.

Respectively, most middle-income households are in the Midwest and some states in the West. Small/ middle-sized metro areas had the largest concentration of middle-income households. For example, Salt Lake City (47%), Provo (46%), and Ogden (46%) in Utah were

May 2023 | Salt Lake Realtor ® | 11

Newport Coast Media ©/Adobe Stock

some of these areas with the highest share of middleincome households. In addition, Appleton, WI (47%), Green Bay, WI (46%), and Evansville, IN (46%) were areas in the Midwest with a share higher than 45%.

Homeownership Rates Among Income Groups

While the homeownership rate varies by area, the National Association of REALTORS® computed the homeownership rate for each income group and identified areas with the greatest shares of low- and middle-income households that own their home as well as the areas with the smallest homeownership rate gap between income groups.

Among the 200 largest metro areas across the country, 38% of these areas had a homeownership rate for low-income households higher than 50%. The homeownership rate for low-income households varied from 27% to 73%, while the homeownership rate for middle-income households ranged from 47% to 86%.

Ocala, FL (73%) had the highest homeownership rate for low-income households in 2021, followed by Prescott, AZ (68%) and Barnstable Town, MA (67%).

Ocala, FL, Prescott, AZ, and Salinas, CA, were the areas with the smallest homeownership rate gap between low- and middle-income households.

The top 3 areas with the highest homeownership rates for middle-income households were Barnstable Town (86%), Ogden, UT (85%), and Port St. Lucie, FL (83%).

Length of Tenure and Home Value

Among other factors, wealth gains from owning a

home also depend on the home price and the number of years these households own their property. Data shows that the amount of wealth gained typically increases by home price level and the number of years of owning the property. For example, a 10% increase in the median-priced home equals $36,300, compared to $50,000 for homes with a value of $500,000. In addition, while homes tend to appreciate over time, wealth gains increase as well. For instance, the median-priced home is worth $189,800 more now than 10 years ago and $151,000 compared to 7 years ago.

Among income groups, low-income households typically own a home with a value of $65,000 lower than the value of homes owned by middle-income households. However, low-income owners spend more years in their properties. The average length of owning their home was 19 years compared to 16 years for middle-income and 14 years for upper-income households in 2021.

Across racial/ethnic groups, Black Americans own homes that are less expensive by nearly $64,000 than homes that white Americans own. In the meantime, Black homeowners tend to stay in their homes longer, about 19 years, compared to 16 years for white owners, 12 years for Asian owners, and 14 years for Hispanic owners.

Wealth Gains by Income Level

The National Association of Realtors® computed how much homes owned by low-, middle-, and upperincome households appreciated in the last 5, 7, 10, and 15 years. It’s interesting to see that while the amount of home appreciation in dollar value rises for more expensive homes, the percentage change in home

12 | Salt Lake Realtor ® | May 2023

Dragana Gordic ©/Adobe Stock

values is significantly larger for properties owned by low-income households.

In the last 10 years (2012-2022), the median value of homes owned by low-income households rose by $98,910, or 75%. Thus, low-income owners were able to build $98,910 in wealth in the last decade solely from home price appreciation. Middle-income buyers were able to accumulate $122,070 in wealth as their homes appreciated by 68%. Upper-income households built over $150,810 in wealth since 2012.

Among racial/ethnic groups, Asian homeowners accumulated the most wealth gains in the last decade, followed by Hispanics. While Asian households own more expensive homes than any other group, it’s interesting to see that Hispanic homeowners had faster appreciation than white homeowners. Black

Francisco and Salinas were some other areas where all owners – any income level – experienced substantial wealth gains due to price appreciation. Many of these expensive areas had also relatively smaller income inequalities in wealth accumulation between low and middle-income owners than other areas. In the last decade, homes owned by low-income households appreciated faster than homes of middleincome owners in the San Francisco, Salinas, Los Angeles, and Sacramento metro areas. Surprisingly, lowincome owners were able to accumulate larger wealth compared to upper-income owners in the Santa Maria, Salinas, and Los Angeles areas.

Low-income Owners: The wealth gains for low-income owners from owning their homes for the last decade (2022-2012) varied by area from $13,880 to $627,880. All top 10 areas with the largest wealth gains – surpassing $290,000 – were located in California. However, due to low affordability, the homeownership rate for lowincome households in the top 10 areas with the largest wealth gains was lower than the national level at 42% on average. In contrast, in the areas with the highest homeownership rates for low-income households, wealth gains were $140,000 on average.

Middle-income Owners: Among the 200 largest metro areas, wealth gains for middle-income owners

May 2023 | Salt Lake Realtor ® | 13

Lifetime Servicing Multiple Loan Types No Down Payment Options LEARN MORE AT UFIRSTCU.COM We’ve Got You Covered HOME LOANS BUILD, BUY, REFI Federally insured by NCUA. Loans subject to credit approval. See current rates and terms. NMLS #654272 EQUAL HOUSING LENDER

ranged from $20,660 to $642,760. Homes owned by these households appreciated faster in expensive areas in California. In the top 10 areas with the highest homeownership rates for middle-income households, these owners gained $110,000 in wealth on average in the last 10 years. For example, middle-income owners in Barnstable Town, MA, gained about $170,000 due to price appreciation in the last decade.

Wealth Gains by Race in the Last Decade

Parsing out by racial/ethnic groups, owners from minority groups were able to accumulate the largest wealth gains in the West and South regions. In some of these areas, the median home value of homes owned by Black Americans is over $500,000 more than it was 10 years ago.

Bremerton, WA, Santa Maria, CA, and Lake Havasu City, AZ, were some of the areas with the largest wealth gains for Black Americans. With the Black population rising faster than nationwide levels in many of these areas in the last decade, the value of homes owned by this group increased substantially. For example, the number of Black households is nearly two times the number of households 10 years ago in Bremerton, WA, and about three times that of a decade ago in Lake Havasu City, AZ. In the meantime, Black homeowners accumulated more than $570,000 in both areas. Furthermore, comparing home appreciation by racial/ ethnic groups, homes owned by Black homeowners appreciated faster than homes owned by white homeowners in 27% of the areas included in the study. Black owners accumulated at least $200,000 additional wealth than white owners did in the following areas: Lake Havasu City, AZ; Bremerton, WA; Duluth, MN-WI, Fargo, ND-MN; and Provo, UT.

Mortgage Debt Dropped by 21% in the Last 10 Years

Along with the wealth gains that existing low- and middle-income owners were able to accumulate by

price appreciation in the last decade, they also need to keep in mind that while these owners pay the same amount for their mortgage every month, their debt has dropped by 21% and 36% after 10 and 15 years of owning their home, respectively. The easiest way to understand what borrowers pay every year for their mortgage is through the following example.

The median value of homes owned by middle-income households across the country was about $180,000 in 2012. While the mortgage rate was about 4% for the period 2012- 2019, these owners have already paid 21% of their mortgage during that time. Owners who purchased their homes in 2007 have paid off 36% of their mortgages in the last 15 years. While many owners were able to refinance and secure a rate lower than 4% during 2021, they may have paid off an even larger amount of their mortgage.

Methodology

The report used the following definitions in order to identify the different income groups: Low-income: income no greater than 80 percent of the area median income Middle-income: income higher than 80 percent but less than 200 percent of the area median income Upper-income: income higher than 200 percent of the area median income Using the ACS Public Microdata Sample (PUMS) data, NAR was able to estimate the homeownership rate and the median home value of homes owned by different income and racial/ethnic groups at the national and metropolitan area levels. The American Community Survey releases the Public Use Microdata Sample (PUMS) files every year, which includes population and housing unit records with individual response information. Applying the House Price Index growth from FHFA to the latest housing data from the American Community Survey (ACS), NAR estimated the 2022 median home value for the 200 largest metro areas across the country. Home values represent the value of all homes instead of home sales.

14 | Salt Lake Realtor ® | May 2023

Image licensed by Ingram Image

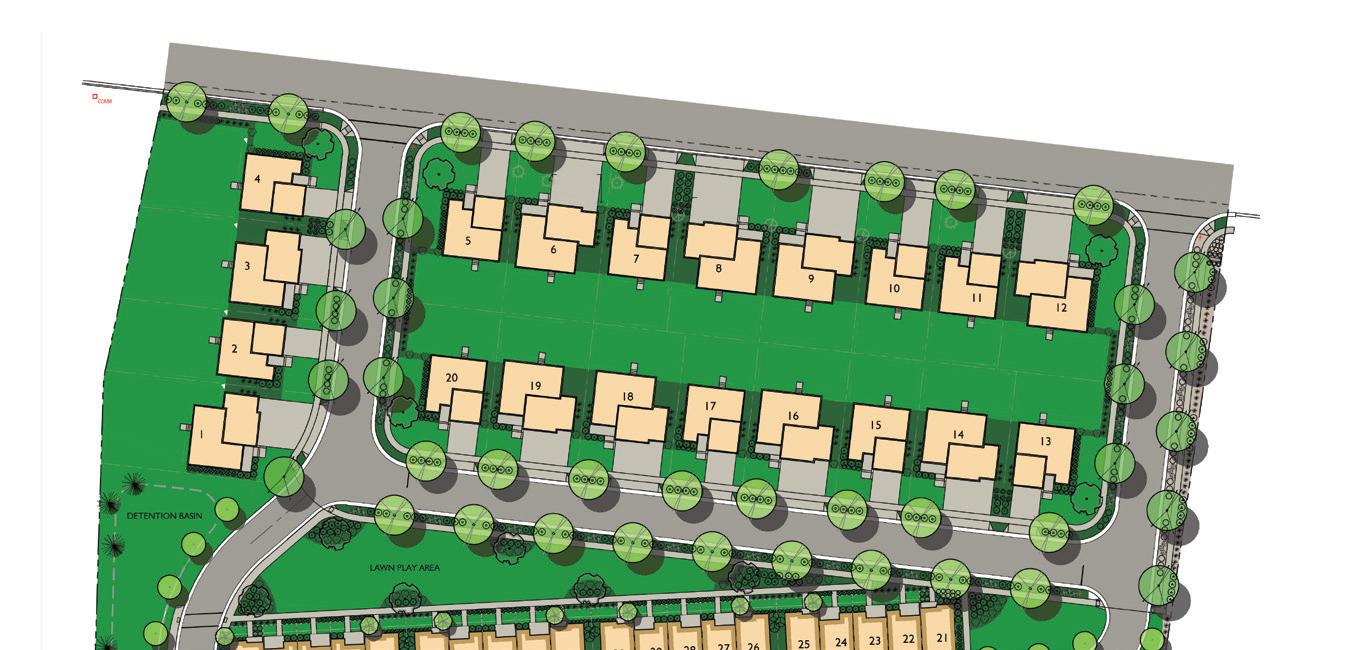

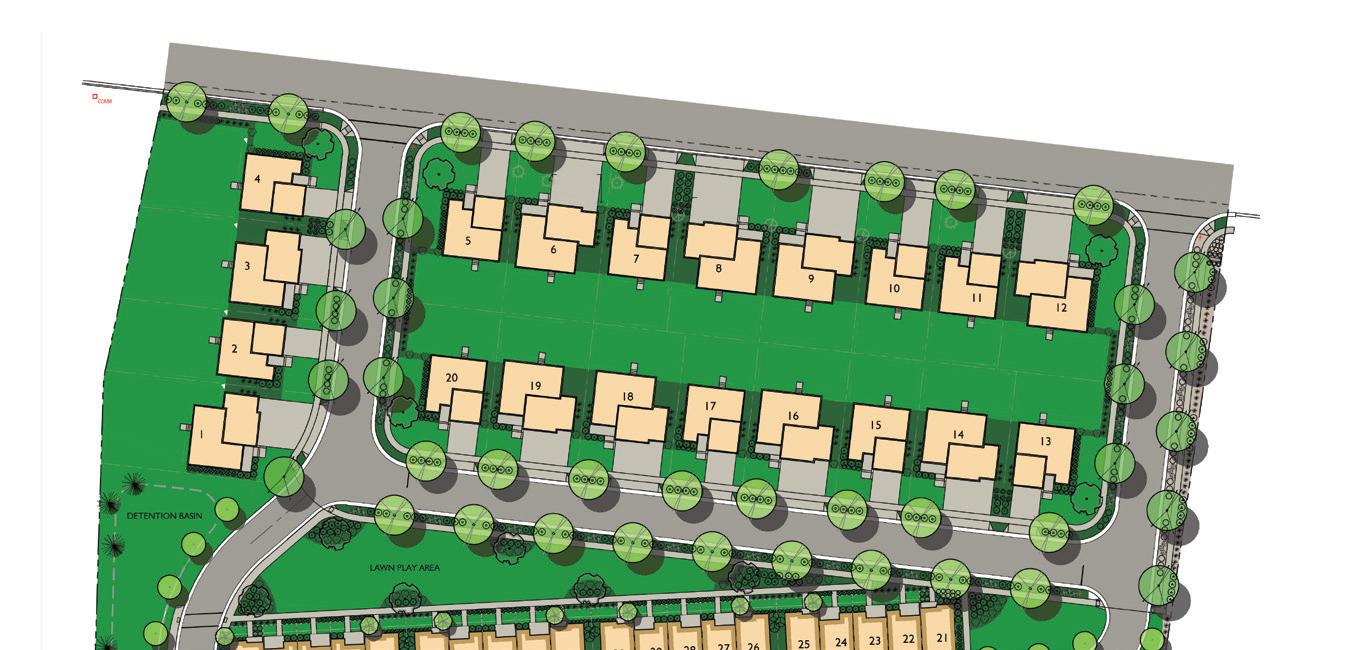

BULLION PLACE in Murray

New Homes by Brodsky Built

The Brodsky Built team has been building homes for over 50 years. Our Aberlour mixed-use condominium building in The Prestwick community in South Salt Lake has only one townhome left to sell. We have just opened for sales in our newest community in Murray, the Bullion Place community. In Bullion Place, we have two-story single-family homes and offer different floor plans and elevations. The homes feature gourmet kitchens with granite counter tops and a large pantry. The 2nd floor owner’s suite features a walk-in closet and double-sink vanities. LVP laminate flooring throughout the entire main level and bathrooms. Bullion Place is just minutes from the freeway and is 15 minutes to downtown!

CONTACT US

Elizabeth ‘Annie’ Nelson REALTOR®

M: 801.560.3488 annie@ponderosaprop.com

Paula Swenson REALTOR®

M: 435.557.1931 paula@ponderosaprop.com

Mo Wilkerson REALTOR®

M: 801.699.3945

mowilkersonslc@gmail.com

JT Wilkerson REALTOR®

M: 801.699.1662

jtwilkerson@msn.com

Located at 935 W Bullion Street in Murray

NEW CONSTRUCTION

www.BrodskyBuiltUtah.com

Yun: Latest Fed Hike

Average annual percentage rates for credit cards are now over 20%. Home equity lines of credit are up to 7.99%.

By Melissa Dittmann Tracey

The Federal Reserve voted in early May to raise its benchmark interest rate for the tenth time in a year, putting too much pressure on small regional banks, said NAR’s chief economist.

The Federal Reserve’s monetary policy may now be hurting banks and, in turn, the housing market. The Fed voted Wednesday to raise its benchmark interest rate another quarter point—the tenth hike in a year— adding financial pressure to banks and, eventually, borrowers. The Fed’s rate often influences mortgage rates but is not tied directly to them.

Lawrence Yun, chief economist for the National Association of REALTORS®, called the Fed’s latest hike “unnecessary and harmful.”

“Consumer price inflation has been decelerating and will continue this trend,” he said. “After the awful 9% consumer price inflation in the summer of last year, the latest data shows 5% inflation. It will be even lower as the heavyweight component to inflation, which is rent, will inevitably slow down given the robust, 40-year high in construction of new apartment units.”

Yun said the continual rate hikes have upended the balance sheets of many small regional banks. “They are becoming zombie-like banks, unable to lend even to good businesses, as they are more concerned with balance sheet shuffling for survival,” Yun noted. “This situation will worsen with each additional rate hike by the Federal Reserve. Only by stopping the rate hikes—

16 | Salt Lake Realtor ® | May 2023

‘Unnecessary and Harmful’

or even a reversal later in the year if inflation continues to calm—will the small banks have a better chance of survival against the big banks.”

The Fed hinted after its May meeting that it would likely pause its streak of rate hikes soon, saying that it would weigh several factors in “determining the extent” to which future hikes would be needed.

The federal funds rate is the interest rate at which banks borrow and lend to one another. CNBC reports that the average annual percentage rates for credit cards are now over 20%—marking an all-time high. Also, home equity lines of credit, which are closely connected to the Fed’s rate, are up to 7.99%, according to Bankrate.

Mortgage rates, which are more directly tied to Treasury yields and the economy, have been rising, too. As of May 4, the 30-year fixed-rate mortgage averaged 6.39%, which is significantly higher than its 5.27% average just a year ago, according to Freddie Mac.

The Federal Reserve hinted after its meeting that it would likely pause its streak of rate hikes soon, saying that it would weigh several factors in “determining the extent” whether any future hikes would be needed.

Reprinted from Realtor® Magazine Online, May 2023, with permission of the National Association of Realtors®. Copyright 2023. All rights reserved.

May 2023 | Salt Lake Realtor ® | 17

Jim Vallee ©/Adobe Stock

Knowing How Local Broker Marketplaces Work

Recent lawsuits disregard how local MLS broker marketplaces serve the best interests of American home buyers and sellers.

By Katie Johnson

By Katie Johnson

In the litigation landscape that the National Association of Realtors® is facing today, much of what NAR is fighting is misinformation, mischaracterization and lack of understanding or education. There are classaction attorneys and other challengers who have a blatant disregard or lack of appreciation for the value Realtors® bring consumers and how local MLS broker marketplaces serve the best interests of American home buyers and sellers.

Litigation is a long, complex process that will not be resolved for years, and NAR takes each case and legal development seriously. NAR leadership is taking proactive measures to ensure consumers continue to benefit from the access and opportunities they have today and that real estate professionals continue to be equipped and positioned to serve the best interests of those consumers. On the front, NAR has legal teams

actively engaged to defend pro-consumer and procompetitive practices in local broker marketplaces. We want you to understand major developments, what we’re doing to address them and how you can help.

Several Cases Remain Unresolved

Let’s start with the Department of Justice.

In a clear victory for NAR in January, a district court ruled that the DOJ must adhere to its previous agreement with NAR to more explicitly state the spirit and intent of NAR’s Code of Ethics and MLS guidelines in certain key areas. In fact, NAR has already adopted clarifications to its guidance for local MLS broker marketplaces to strengthen transparency for consumers.

18 | Salt Lake Realtor ® | May 2023

Jirapong ©/Adobe Stock

Though the DOJ recently appealed the decision, NAR remains confident that it will ultimately prevail, saying the association has upheld its end of the agreement and simply expects the DOJ to do the same.

Next, let’s discuss seller class-action lawsuits.

Four years ago, class-action attorneys brought lawsuits against NAR and four corporate defendants in Missouri and Illinois, alleging home sellers have been damaged because their listing broker compensates the buyer’s representative. The lawsuits also suggest that real estate professionals are being paid too much as a result.

While the Illinois case is in earlier stages, the Missouri case is set to go to trial this fall. NAR’s attorneys will make it imminently clear that the association has the law and facts on its side.

Lastly, let’s look at challenges to the Clear Cooperation Policy.

Two lawsuits stem from private listing networks wanting Realtors® to bypass local broker marketplaces and market properties to consumers only within these private networks. The plaintiffs’ original complaints were dismissed; a federal judge agreed with NAR that the Clear Cooperation Policy provides consumers with «access to more information regarding market conditions, enabling them to make better informed choices about the bundle of real estate brokerage services that will best serve their needs.”

However, due to appeals, the cases are still ongoing. Regardless, NAR is prepared to present its position at trial, if needed, and prove that the rule promotes competition and ensures transparent, equitable access to real estate listings for the benefit of consumers.

Help NAR Educate the Public

NAR continues to anticipate and prepare for these various legal milestones via ongoing positive, proactive storytelling moments in the media and other places to spread the word about the pro-consumer and pro-competitive nature of local broker marketplaces and Realtors®’ reputation as trusted, valued experts. NAR also continues to equip state and local associations with toolkits and other content to help them motivate members and educate consumers.

This is where you come in: NAR needs your help to educate consumers about how local MLS broker marketplaces work and promote equity, transparency and market-driven pricing options for consumers as well as the incredible value you provide. That’s why NAR has developed the website competition. realtor. This site is a place to send

people who have questions, and it’s a resource for you to pull things you need to be ambassadors with clients and others in your community. The site hosts fact sheets, FAQs, articles, infographics and other information you can use that:

• Illustrate how Realtors® are consumer champions.

• Describe how local MLS broker marketplaces create highly competitive markets that promote equity, greater access, more choices and greater pricing options when it comes to real estate services.

• Provide soundbite updates on NAR policy changes and legal matters.

In addition, NAR has created a simple consumer website at realestatecommissionfacts.com to aid consumers’ understanding of broker services and how real estate professionals are compensated.

At the end of the day, we all know that Realtors® are consumers’ advocates. We all know that Realtors® lead as entrepreneurs, small business owners, experts and philanthropists to protect consumers, build generational wealth and contribute to local and national economies. And we also know local MLS broker marketplaces create the largest, most efficient and convenient markets that ensure equity, transparency and market-driven pricing for home buyers and sellers.

It is imperative that right now, Realtors® do all they can to communicate that reality every day in all the conversations they have and channels at their disposal. While NAR’s legal team is helping the association win in a court of law, the association asks members to play their part to help win in the court of public opinion.

Katie Johnson is the General Counsel and Chief Member Experience Officer, National Association of Realtors®, the nation’s largest trade association representing more than 1.3 million members involved in all aspects of the real estate industry.

May 2023 | Salt Lake Realtor ® | 19

Image licensed by Ingram Image

The Salt Lake Board of Realtors®

Rocks Association Ends Its Year on a High Note

The Salt Lake Board of Realtors® gained recognition in the Spring 2023 edition of AEXperience magazine, a national publication for Realtor® association managers and executives, for its Holiday Social parody videos.

The article highlighted the association’s initial intention to showcase local leadership and Realtors®. However, the videos quickly gained popularity and went viral. The 2022 Realtor® Rhapsody parody, for instance, gathered more than 20,000 views within two months. In 2021, the Realtor® Thriller parody gained 37,000 views. Additionally, the association produced parodies of Adele’s “Hello” and Aretha Franklin’s “I Say a Little Prayer.”

These videos have not only made an impact on Realtors® in the Salt Lake Valley but have also resonated

with real estate professionals across the country. Realtors® from Vermont to Florida and Ohio to California have flooded the association with comments and accolades. “You have to win some kind of award for this,” said Bob Nachman, a Realtor® in Scottsdale, Ariz. “Weird Al Yankovic couldn’t do it any better than this!”

“In the 50 years of being a Realtor®, I haven’t experienced such a creative, fun, upbeat, and well presented statement of how important we are to the consumer,” said Steve Hanleigh, a Realtor® in San Jose, Calif. “Thank you Salt Lake Realtors®!”

Work on the parodies begins as early as July or August. Association staff identify a song, change the lyrics, rerecord the song at a studio, and develop a storyline.

20 | Salt Lake Realtor ® | May 2023

The videos introduce the incoming president, so the association looks for ways to highlight that person and current issues and market conditions in the real estate profession in a humorous way. The cast includes 20 to 30 Realtors® and affiliates.

The videos are directed by Ashley Mordwinow, the association’s communications editor, and Dave Anderton, communications director. Mordwinow is a professional singer, lyricist, and has appeared in several musical productions. The video is filmed by Brian Durkee, a professional videographer and owner of Salt Lake City-based Palinoia Productions.

Making a successful video starts with being open to ideas, using your imagination, collaborating as a team,

and casting the right people, Anderton said. “The video needs to be interesting and entertaining,” he added. “We look for personalities that shine and look for talent among members. We start with a good idea, then build on it.”

Filming is typically done in one full day (12-14 hours). Each script includes up to 15 scenes. The production is filmed at private residences. During the pandemic, the video almost didn’t happen. Instead of a private residence, filming was done at the Realtor® Campus. The final cut is presented to more than 1,000 members at the Holiday Social in December.

“Humor is captivating,” Anderton said. “It makes people feel good. And the videos have created a sense of camaraderie for our members.”

May 2023 | Salt Lake Realtor ® | 21

Photos: Dave Anderton

Check out the Salt Lake Board of Realtors®’ parody videos at this link.

Seven

in 10 Metro Areas Posted Home Prices Gains in Q1 2023

Multiple offers are returning, especially on affordable homes.

By The National Association of Realtors®

Nearly seven out of 10 metro markets registered home price gains in the first quarter as 30-year fixed mortgage rates fluctuated between 6.1% and 6.7%, according to the National Association of Realtors®’ latest quarterly report. Seven percent of the 221 tracked metro areas registered double-digit price increases over the same period, down from 18% in the fourth quarter of 2022.

In Salt Lake County, the median home price for all housing types in the first quarter fell to $500,000, down 4% from $520,500 in the first quarter of 2022, according to UtahRealEstate.com.

Compared to a year ago, the national median singlefamily existing-home price decreased 0.2% to $371,200. In the previous quarter, the year-over-year national median price increased 4.0%.

Among the major U.S. regions, the South saw the largest share of single-family existing-home sales (46%) in the first quarter, with year-over-year price appreciation of 1.4%. Prices climbed 2.9% in the Midwest yet slipped 0.1% in the Northeast and 5.3% in the West.

“Generally speaking, home prices are lower in expensive markets and higher in affordable markets, implying greater mortgage rate sensitivity for high-priced homes,” said NAR Chief Economist Lawrence Yun.

Yun noted that cities in the West like San Francisco, San

Jose and Reno saw home prices drop by at least 10% from a year ago. Conversely, prices rose by at least 10% from the previous year in cities like Milwaukee, Dayton and Oklahoma City.

“Home prices are also lower in cities that previously experienced rapid price gains,” Yun added. “For example, home prices grew an astonishing 67% in three years in Boise City and Austin through 2022. The latest price reductions in these areas have improved housing affordability and led to some buyers returning given the sustained, rapid job creation in their respective markets.”

Year-over-year prices in the first quarter declined by 13.5% in Austin, 10.3% in Boise and 7.3% in Phoenix.

“Due to the intense housing inventory shortage, multiple offers are returning, especially on affordable homes,” Yun said. “Price declines could be short-lived.” Inventory in the first quarter averaged 1,630,000 listings at any given time, a 40% reduction from the first quarter of 2019 – a year before the onset of the COVID-19 pandemic.

The top 10 metro areas with the largest year-over-year price increases all recorded gains of at least 11.7%, with three of those markets in Wisconsin and two in North Carolina. Those include Kingsport-Bristol-Bristol, Tenn.-

22 | Salt Lake Realtor ® | May 2023

Andrii Yalanskyi ©/Adobe Stock

Va. (18.9%); Oshkosh-Neenah, Wis. (16.5%); Warner Robins, Ga. (16.2%); Burlington, N.C. (14.7%); Elmira, N.Y. (14.7%); Oklahoma City, Okla. (14.7%); MilwaukeeWaukesha-West Allis, Wis. (13.7%); Appleton, Wis. (12.4%); Hickory-Lenoir-Morganton, N.C. (12.0%); and Santa Fe, N.M. (11.7%).

Seven of the top 10 most expensive markets in the U.S. were in California, including San Jose-Sunnyvale-Santa Clara, Calif. ($1,618,400; -13.7%); Anaheim-Santa AnaIrvine, Calif. ($1,195,500; -5.1%); San Francisco-OaklandHayward, Calif. ($1,192,600; -14.5%); Urban Honolulu, Hawaii ($1,029,000; -8.8%); San Diego-Carlsbad, Calif. ($880,000; -2.8%); Salinas, Calif. ($863,900; -6.8%); San Luis Obispo-Paso Robles, Calif. ($850,200; -3.8%); Oxnard-Thousand Oaks-Ventura, Calif. ($844,800; -5.6%); Boulder, Colo. ($836,900; -2.6%); and NaplesImmokalee-Marco Island, Fla. ($777,000; 4.3%).

Roughly three in 10 markets (31%; 68 of 221) experienced home price declines in the first quarter. In the first quarter, housing affordability improved slightly from the fourth quarter of 2022 when mortgage rates eclipsed 7%. The monthly mortgage payment on a typical existing single-family home with a 20% down payment was $1,859. This represents a 5.5% decrease from the fourth quarter of last year ($1,967) but a jump of 33.1% – or $462 – from one year ago. Families typically spent 24.5% of their income on mortgage payments, down from 26.2% in the previous quarter but up from 19.5% one year ago.

First-time buyers found a small measure of relief when looking to purchase a typical home during the first quarter with the quarterly declines in prices and mortgage rates. For a typical starter home valued at $315,500 with a 10% down payment loan, the monthly mortgage payment fell to $1,825, down 5.4% from the previous quarter ($1,930) but an increase of almost $450, or 32.5%, from one year ago ($1,377). First-time buyers typically spent 37% of their family income on mortgage payments, down from 39.5% in the previous quarter. A mortgage is considered unaffordable if the monthly payment (principal and interest) amounts to more than 25% of the family’s income.2

A family needed a qualifying income of at least $100,000 to afford a 10% down payment mortgage in 33% of markets, down from 38% in the prior quarter. Yet, a family needed a qualifying income of less than $50,000 to afford a home in 10% of markets, up from 8.6% in the previous quarter.

About NAR

The National Association of REALTORS® is America’s largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries. The term REALTOR® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of REALTORS® and subscribes to its strict Code of Ethics.

24 | Salt Lake Realtor ® | May 2023

Image licensed by Ingram Image

Experts: U.S. Debt Demands a Long-term Plan

Congress must make tough decisions to bring down the debt, which has ballooned to 98% of GDP.

By Stacey Moncrieff

The 2023 Realtors® Legislative Meetings kicked off with a lively discussion on the debt-limit debate. Congress will reach a compromise—or create dire consequences for the economy and U.S. standing in the world, said two economists speaking at Federal Legislative & Political Forum, “How Banking and Institutional Investors are Influencing the American Dream of Homeownership.”

If a debt-ceiling resolution isn’t reached, “everything shuts down,” said Dana Peterson, chief economist for The Conference Board, a New York–based think tank for business leaders. That would cut 6 percentage points from GDP, ensuring a recession and driving up borrowing costs. “I don’t want to live through that. Let’s hope our policymakers in Washington don’t want to live through that,” she said.

“We’ve seen this movie many times,” said Doug Holtz-

Eakin, former director of the Congressional Budget Office. Agreement is likely to come in two stages, he said. “We’ll see a short-term debt limit increase until Sept. 30, and then there will be another round as they finally sort this out.”

Long term, Peterson and Holtz-Eakin said, Congress will have to come to make tough decisions to bring down the debt, which has ballooned to 98% of GDP.

“There needs to be a national conversation about our problem, and our problem is not the process. Our problem is debt,” said Peterson. “And the conversation needs to extend beyond a decade. We can’t solve it in a decade. We need to think about a 20- to 30-year solution.”

“We’ve got to take on entitlements,” said Holtz-Eakins. Medicare and Social Security are responsible for one-third

26 | Salt Lake Realtor ® | May 2023

of the debt obligation, he said, and dealing with that will “free up money for things we need in the 21st century.”

Peterson and Holtz-Eakin opined on a wide range of topics:

On high-profile bank failures: “These were three to four banks overexposed to one industry,” Peterson said, adding “most Americans’ savings are perfectly safe.” But a loosening of regulation on small- and mid-sized banks in 2018 led to poor risk management at these institutions. “No one likes regulation, but we need guard rails,” she said.

On the impact of institutional investors on housing supply: “I think it is a tremendous threat,” Peterson said. “More than 70 million millennials turning 40 want to buy a home and can’t.” Holtz-Eakin added, “I can’t figure out, economy wide, how big a deal these institutional investors are,” but whatever their impact, the fight against inflation is making it worse. “The Fed launched higher rates at a time [of] record low inventory. There isn’t a level playing field in competing with these investors right now. We need to focus during the next decade on getting greater housing supply, period.”

On inflation: “The Federal Reserve is doing what it needs to do,” said Holtz-Eakin. “Once you let inflation get embedded in the economy, you have no other choices.” But both said they expect rate hikes to end soon. Slowing rental rate growth, which doesn’t show up in inflation data right away, should help cool inflation, Peterson added.

Peterson and Holtz-Eakin offered advice on advocating for important housing policy issues. “Housing is roughly 5-6% of GDP, but then if you add all the things that people put into a house or around a house and the taxes they pay—all those things contribute to the economy and their communities. Those are the things you should focus on,” Peterson said.

“It’s important to come with facts,” Holtz-Eakin added. “It is in [policymakers’] political interest for [people] to have better access to the American dream. There’s a great track record there that has to be redocumented for another generation of lawmakers.”

Stacey Moncrieff is executive editor of publications for the National Association of Realtors® and editor in chief of Realtor® Magazine.

May 2023 | Salt Lake Realtor ® | 27

Tada Images ©/ Adobe Stock

HOUSING WATCH

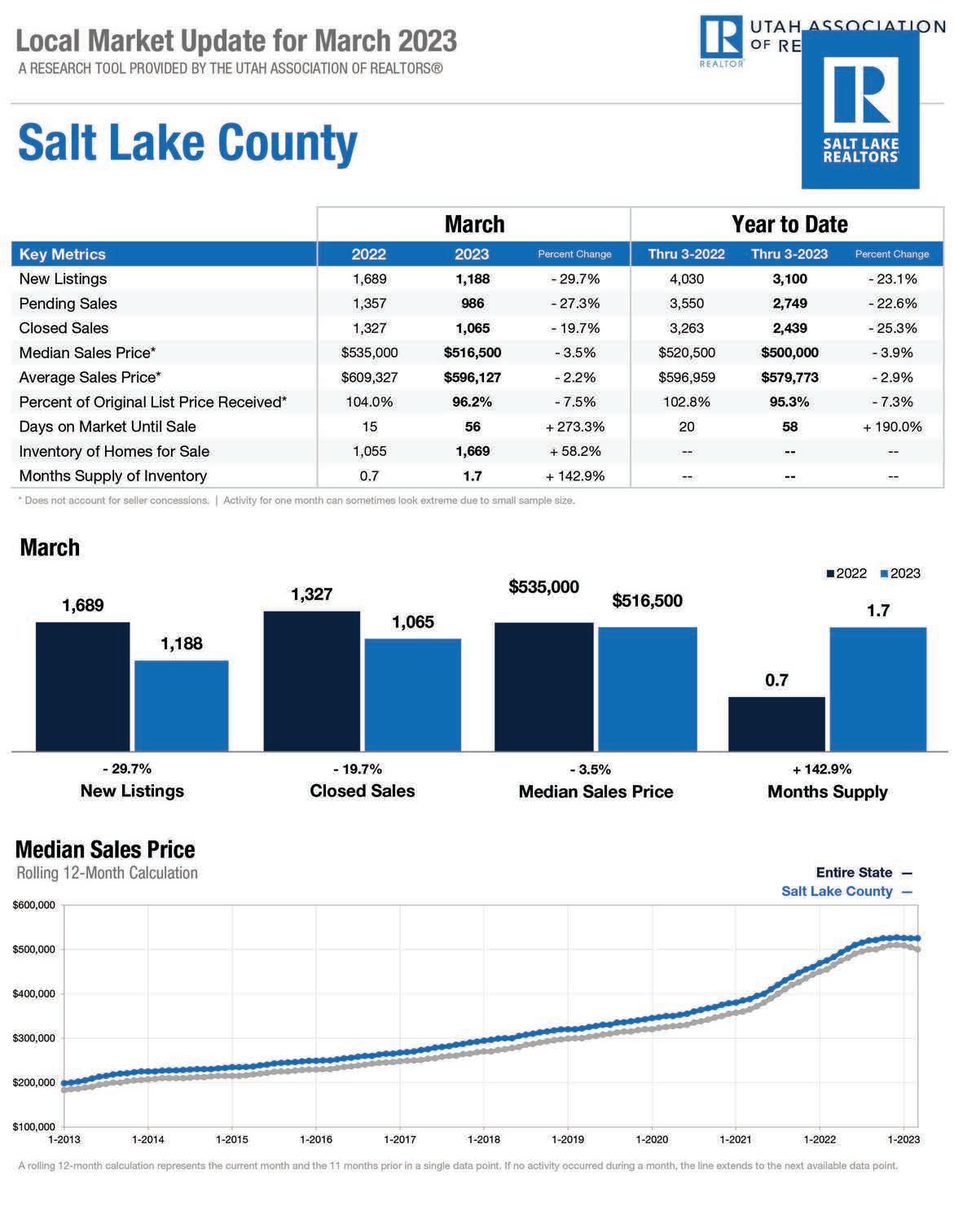

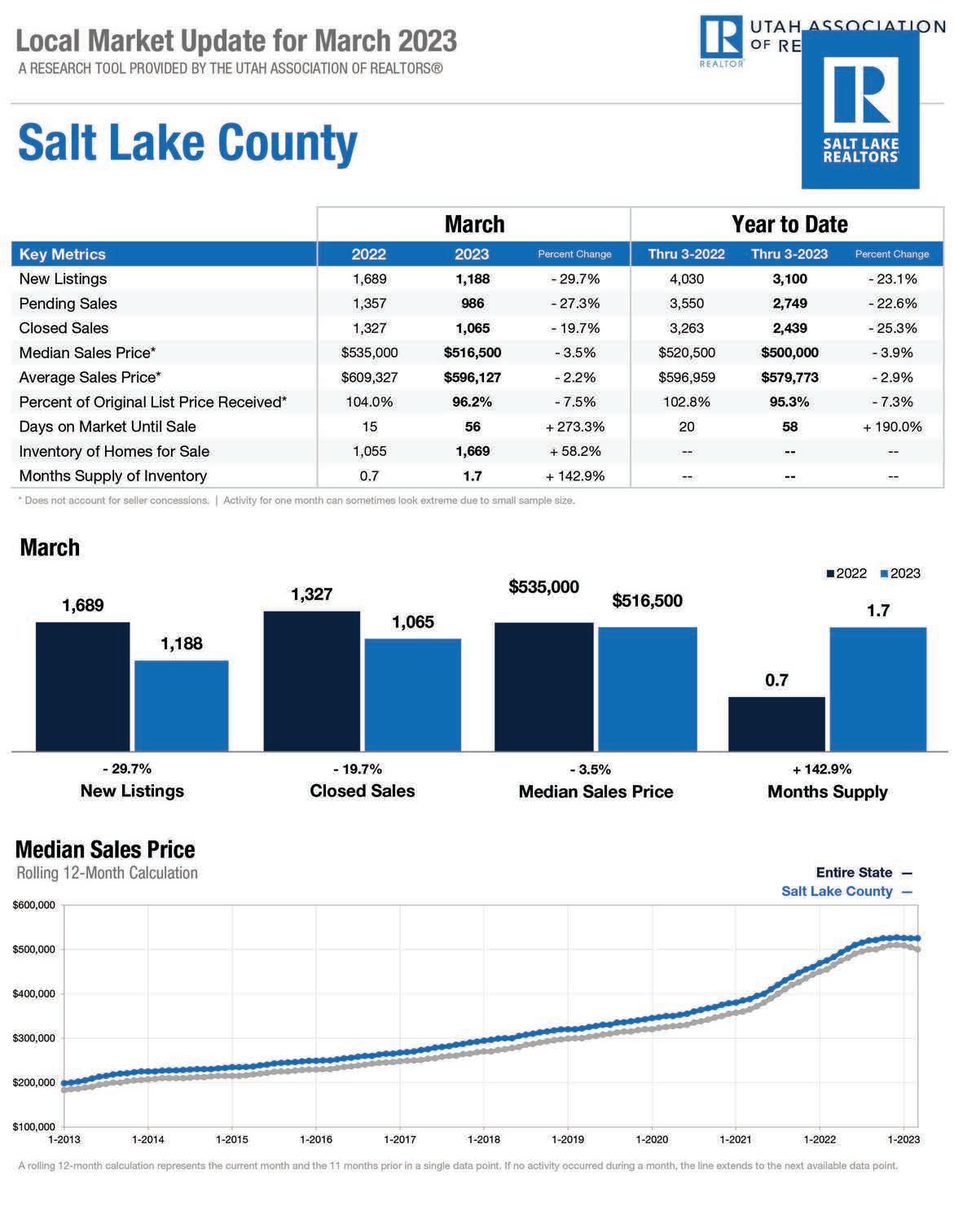

Are Home Sales and Prices Stabilizing in Salt Lake?

Despite a year-over-year decline, Salt Lake’s housing market showed signs of recovery in March, with sales rebounding from February and a slight increase in median prices. A total of 1,063 homes were sold in March, a 19% drop from the 1,319 sales in March 2022 but a significant 40% jump from the 758 sales in February.

Rob Ockey, President of the Salt Lake Board of Realtors®, commented, “Although home sales are gradually picking up pace, they remain vulnerable to mortgage rate fluctuations. The spring buying season has witnessed multiple offers on homes, highlighting the need for additional supply to satisfy demand.”

In March, the median price for all housing types declined by 3% year-over-year to $516,895 but increased by 5% compared to February’s $494,500. Single-family homes registered a median price of $575,495, down 8% from $624,950 in March 2022, yet up 3% from February’s $560,000 median. These homes seemed to hit their lowest price in January at $535,750, with prices rising by 7% from January to March.

Multi-family homes (condominiums, townhomes, twin homes) recorded a median price of $420,000 in March, an 8% decrease from the previous year but a 1% increase from February’s $416,000. After bottoming out at $400,000 in December, multi-family home prices have risen by 5%.

The recent upward trend in housing prices may indicate that the market is approaching a turning point. In March, properties typically remained on the market for 29 days, down from 44 days in February, but significantly longer than the mere five days in March 2022.

Nationally, home sales dropped by 22% in March, down from 5.69 million in March 2022, according to the National Association of Realtors®. The U.S. median existing-home price for all housing types in March was $375,700, a slight decline of 1% from March 2022 ($379,300). Prices increased modestly in three regions but fell in the West.

All-cash sales represented 27% of transactions across the nation in March, down from 28% in February and the previous year. In Salt Lake County, all-cash sales accounted for 16% of closings in March.

Individual investors or second-home buyers, who often make cash sales, purchased 17% of homes in March, down from 18% in February and the previous year.

Distressed sales – foreclosures and short sales – made up 1% of sales in March, nearly identical to the previous month and year.

28 | Salt Lake Realtor ® | May 2023

March

May 2023 | Salt Lake Realtor ® | 29

NORTHERN UTAH COMMUNITIES

MAGNA

1 LITTLE VALLEY GATEWAY Single Family & Townhomes 8528 W Cordero Drive

GRANTSVILLE

2 SUN SAGE MEADOWS/TERRACE

Single Family & Townhomes 11 N Kent Street

3 GRANTSVILLE ESTATES Single Family Quirk Street & Pear Street Sales Office @ Sun Sage Meadows/Terrace

TOOELE

4 WESTERN ACRES Townhomes 300 E 1500 N

5 LEXINGTON GREENS Single Family 502 W 1300 N

LEHI

6 SKYE - COMING SOON Single Family, Townhomes & Active Adult 400 N Center Street

7 COLD SPRING RANCH Single Family & Townhomes 700 N Old Ranch Road

SARATOGA SPRINGS

8 NORTHSHORE Single Family & Townhomes 1043 E Batten Court

EAGLE MOUNTAIN

9 EAGLE POINT TOWNHOMES

Townhomes 1765 E Eagle View Lane

AMERICAN FORK

10 EDGEWATER- COMING SOON Townhomes 1122 West 310 South

PROVO 11 OSPREY TOWNHOMES

Townhomes 686 W 1920 S

SPANISH

SANTAQUIN

1413 S Fox Run Avenue

CEDAR CITY

16 OLD SORREL RANCH Single Family 337 S Sherratt Dr. Sales Office at Summiet Ridge Townhomes

17 OLD SORREL TOWNHOMES

Townhomes 550 S Cross Hollow

WASHINGTON 18 LONG VALLEY Single Family, Townhomes, Active Adult 1482 S Wagon Box Way

ST. GEORGE 19 DESERT COLOR Single Family 699 W Fire Sky Drive

FORK 12 HAYMAKER Single Family 800 North & Spring Lane Sales Office at Mapleton Grove 13 QUIET VALLEY Single Family & Townhomes 1268 S Windy Ridge Drive

14 FOOTHILL VILLAGE Single Family 949 Red Cliff Dr. 15 SUMMIT RIDGE TOWNS Townhomes

COMMUNITIES

SOUTHERN UTAH

Road

UTAH COMMUNITIES STATEWIDE

Red Hills Pkwy Southern Pkwy Bingham Rd Virgin River St. George Blvd Dixie Dr St. George RegionalAirport Snow Canyon State Park Zion National Park Capitol Reef National Park Cedar City Regional Airport Grand Staircase Escalante National Monument WASHINGTON HURRICANE CEDAR CITY ST. GEORGE 19 18 17 16 56 9 14 7 Sand Hollow Quail Creek Evanston, WY Wendover, NV SANTAQUIN NEPHI SYRACUSE MAPLETON PROVO SPANISH FORK LEHI EAGLE MOUNTAIN TOOELE MAGNA SALT LAKE CITY AMERICAN FORK 3 4 9 10 12 13 14 15 8 7 2 6 5 11 84 36 Utah Lake Great Salt Lake SARATOGA SPRINGS GRANTSVILLE Evanston, WY Wendover, NV SANTAQUIN NEPHI SYRACUSE MAPLETON PROVO SPANISH FORK LEHI EAGLE MOUNTAIN TOOELE MAGNA SALT LAKE CITY AMERICAN FORK 2 3 8 9 12 13 14 15 7 6 1 4 5 11 84 36 Utah Lake Great Salt Lake SARATOGA SPRINGS GRANTSVILLE 10 D.R. Horton is an Equal Housing Opportunity builder Map is an artist’s conception only Map is not to scale. Home and community information, including pricing, included features, terms, availability and amenities are subject to change at any time without notice or obligation. See sales agent for complete details. This message is an advertisement or solicitation by D.R Horton for a planned future community. Some communities may still be in the acquisition and development process, and D.R. Horton may elect to delay or cancel their opening for any reason at any time without notice or obligation. © Copyright 2023 D.R. Horton, Inc. 5/2023

801.683.2466

Your guide through uncertain territory. Looking for clarity on the latest economic and housing news? winutah.com/MondaysWithMatthew Call or text Monica Draper at 435.313.7905 for access to a special recorded webinar for Utah with Matthew All in, for you. Windermere’s Chief Economist Matthew Gardner gives his take on the latest developments every Monday.

By Katie Johnson

By Katie Johnson