We know even the smallest requests are a big deal. At David Weekley Homes, creating your Clients’ ultimate home isn’t just about custom finishes and high-end materials. It’s about having a personal Team that puts your Clients’ dreams, desires and requests above all else. That’s why we created a website where your Clients can track the progress of their new home as it’s being built. Our Team of experts is deeply committed to making sure you and your Clients have the best possible experience — even before they move in. That’s The Weekley Way!

about our special incentives! See a David Weekley Homes Sales Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to change without notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2023 David Weekley Homes - All Rights Reserved. Salt Lake City, UT (SLC-23-003773) *Jennifer Allen is also a David Weekley Homes Team Member Homes from the low $500s in the Salt Lake City area 385-722-2329 View

Ask

Our Quick Move-in Homes

David Weekley Homes Team Members with David Weekley Homeowners

$565,990 The Carriages at Ridgeview The Coppell 4819 W. Washoe Court 1,706 sq. ft., 2 Story 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage Ready now! $565,990 Cottage Courts at Daybreak The Peninsula 6773 W. Meadow Grass Drive 3,030 sq. ft., 2 Story 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage Ready now! $644,990 The Carriages at Ridgeview The Eagleview 4813 W. Washoe Court 2,645 sq. ft., 2 Story 3 Bedrooms, 2 Full Baths, 1 Half Bath, 2-car Garage Ready now!

Jennifer*, Tracy & Lucas Allen

Helping your clients with dollars & sense. Connect with us! 801.727.4015 helpyourclient@snmc.com Our down payment assistance program saves your clients’ dollars. TM TM TM We help your clients make sense of their home loan. Turning Houses into Homes® HELPYOURCLIENT@SNMC.COM SNhome™ is an EXCLUSIVE program to SecurityNational Mortgage that makes 100% financing possible for more than just first time buyers. Plus, we keep you & your clients in the loop with clear communication every step of the way. This is not a commitment to make a loan. Loans are subject to borrower and property qualifications. Contact loan officer listed for an accurate, personalized quote. Interest rates and program guidelines are subject to change without notice. Some assistance and grant programs are offered and provided by third-party entities which set the regulations, restrictions, and qualifications criteria. Some programs require repayment and/ or conditions which may trigger repayment, while others may not. SecurityNational Mortgage Company is not responsible for non-qualification, program availability, nor conditions of the program. *3.5% or 5% repayable DPA with 10-year term and interest rate 1% higher than interest rate on the first mortgage. See loan officer for more details. SecurityNational Mortgage Company is and Equal Housing Lender NMLS 3116.

Salt L ake REALTOR® Magazine slrealtors.com The Salt Lake REALTOR® (ISSN 2153 2141) is published monthly by Mills Publishing, located at 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106. Periodicals Postage Paid at Salt Lake City, UT. POSTMASTER: Send address changes to: The Salt Lake REALTOR,® 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106-4618. September 2023 volume 83 number 9 This Magazine is Self-Supporting Salt Lake Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt Lake Realtor® Magazine comes from trees in managed timberlands. These trees are planted and grown specifically to make paper and do not come from parks or wilderness areas. In addition, a portion of this magazine is printed from recycled paper. Table of Contents slrealtors.com Features 10 Goodbye Bathtub and Living Room. America’s Homes Are Shrinking Maggie Eastland 14 Realtors® Relief Foundation Announces $1.5 Million Relief Grant for Victims of Maui Wildfires Melissa Dittmann Tracey 16 Why It Should Be Easier to Get a Mortgage Melissa Dittmann Tracey 20 NAR Triumphs in REX Antitrust Lawsuit Charlie Lee 22 Attack Affects Tens of Thousands of Realtors® 24 How Brokers Help Clients Get the Most for Their Homes Lee Nelson Columns 7 Civility is Key When Understanding Views Different From Our Own Rob Ockey – President’s Message Departments 8 Happenings 8 In the News 28 Housing Watch 4 | Salt Lake Realtor ® | August 2023 On the Cover: Design: Kelley Wright Illustrations/Photos: Houses – Cybonax; Clouds – GenieStock; Grass – Stokkete, andreusk ©/Adobe Stock 24 How Brokers Help Clients Get the Most for Their Homes 20 NAR Triumphs

SOMKID©/Adobe Stock 14 $1.5 Million Relief Grant for Victims

Maui Wildfires WavebreakmediaMicro©/Adobe Stock RandyJay©/Adobe Stock

in REX Antitrust Lawsuit

of

Each franchise independently owned and operated. DAVIS COUNTY DAVE HAWS (801) 915.4315 UINTA COUNTY NANCY BIRCHELL (435) 724.4953 SOUTH VALLEY RP (801) 633.1990 MIDVALE ANGELA JONES-FABER (801) 703.6553 ComeJoin Check Out the New 100% commission MODEL

slrealtors.com

President Rob Ockey

Presidio Real Estate

First Vice President

Dawn Stevens

Presidio Real Estate

Second Vice President

Claire Larson

Woodside Homes

Treasurer

Jodie Osofsky

Summit Sotheby’s

Past President

Steve Perry

Presidio Real Estate CEO

Curtis Bullock

Directors

Carlye Webb

Summit Sotheby’s

Jennifer Gilchrist

KW South Valley Keller Williams

John Lucky Berkshire Hathaway

Janice Smith

Coldwell Banker

Laura Fidler

Summit Sotheby’s (Draper)

Amy Gibbons

KW South Valley Keller Williams

Jenni Barber Berkshire Hathaway (N. SL)

J. Scott Colemere

Colemere Realty Assoc.

Hannah Cutler Coldwell Banker

Michael (Mo) Aller Equity RE (Advantage)

Morelza Boratzuk RealtyPath

Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Civility is Key When Understanding Views Different From Our Own

In today's climate, discussing topics like race, religion, gender, and politics often feels perilous, fraught with the risk of descending into animosity. Yet as the presidential race looms and these subjects dominate our screens, avoiding dialogue seems less like a solution and more like a forfeit. Isn't it vital to understand perspectives different from our own, and perhaps, discover shared values?

I recently seized an opportunity to explore this by initiating a candid, civil conversation about politics with a Realtor® colleague who holds opposing views. Contrary to apprehensions, the dialogue was enlightening for both of us. We discovered shared concerns on key issues and where we diverged, we managed to broaden each other's horizons, all while maintaining mutual respect.

Managing Editor

Dave Anderton

Publisher Mills Publishing, Inc. www.millspub.com

President

Dan Miller

Art Director

Jackie Medina

Graphic Design

Ken Magleby

Patrick Witmer

Office Administrator

Cynthia Bell Snow

In real estate, conflict is par for the course; transactions are laden with negotiations and compromises. The same skills that make us effective in our profession—problem-solving, negotiation, and communication—can also make us adept at handling contentious topics. Whether it's with clients, peers, or vendors, difficult conversations are inevitable. The question is, do you shy away from these discussions or embrace them as opportunities for growth?

Sales Staff

Paula Bell

Dan Miller

Success in today's hyper-competitive market requires more than just business acumen; it calls for enhanced interpersonal skills. Those committed to elevating their communication while upholding civility and respect will not only find professional success but also personal enrichment.

Salt Lake Board: (801) 542-8840

e-mail: dave@saltlakeboard.com

Web Site: www.slrealtors.com

So, as the season of heightened opinions and political fervor rolls in, let's remember the power of civil discourse. Being able to disagree without being disagreeable is more than just a social nicety—it’s a cornerstone of a society that values diverse opinions. Being civil doesn't mean abandoning your beliefs; it means being open to understanding others, and that is where true progress lies.

handicap, familial status, or national origin.

The Salt Lake REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS®

Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

OFFICIAL PUBLICATION OF THE SALT

September 2023 | Salt Lake Realtor ® | 7

The Salt Lake Board of REALTORS® is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex,

October 2005

LAKE BOARD

REALTORS ®

registered

which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS

OF

REALTOR is a

mark

Salt L ake

® Magazine

REALTOR

Rob Ockey President

New Directors Elected

The Salt Lake Board of Realtors® is proud to have these five individuals on the Board of Directors for a four-year term, beginning January 2024. These candidates were approved by the Nominating Committee and received the greatest number of votes from the general membership. The Board is made up of 16 directors who meet regularly to discuss the business and mission of the association, such as budgeting, marketing, dues, key policies, etc.

Economist Speaks at Business Meeting

The Salt Lake Board of Realtors® held its annual Business Meeting in August. James Wood, the Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute at the University of Utah, was a featured speaker at the event. Wood said Utah’s housing shortage could worsen over the next two years as the number of households is projected to exceed the number of housing units being built. Residential real estate sales are on the decline, Wood added, as higher mortgage interest rates squeeze homebuyers and push the cost of housing higher. Wood predicted that there will be no recession in Utah in the next 12 months, but housing affordability will worsen over that period. Mortgage rates, he said, will remain high, in the 6.5% to 7.5% range. Home building in Utah will drop to 22,750 authorized permits in 2023, down 24% compared to 2022.

Realtor® Helps Others

Deea Hobbs, a Realtor® with RE/MAX Results South Jordan, was featured in the August edition of the

Sandy City Journal, for her volunteer work with LasagnaLove.org, a national nonprofit that delivers homemade lasagna to people in order to spread kindness.

For the past nearly three years, Hobbs, who lives in Sandy, has made a lasagna in her own kitchen and then delivers it to someone in need. She has made deliveries to her neighbors, across the Salt Lake Valley, and even as far away as Price.

The deliveries aren’t necessarily for people with food insecurities or financial needs. The reasons don’t matter. And the deliveries are made to people in modest homes to million-dollar mansions.

Hobbs is a local leader for the organization. She coordinates with roughly 30 volunteers across the state. Each volunteer makes a lasagna in their own kitchen and delivers to their assigned family. Some volunteers make a lasagna once a week, and others do it once a month or just one time.

“It all started when Covid hit,” Hobbs said. “I stopped going to church and missed the service part of it. There’s a lot of need and a lot of hard things people are going through. It helps me forget about my own problems. The message of Lasagna Love is a message we all need. You are not alone. Somebody cares.”

Hobbs said more than 100 lasagnas are delivered across Utah each month. The founder of LasagnaLove.org is RhiannonMenn, who, concerned about food insecurity in her Hawaiian community in 2020, started cooking and delivering homemade dishes to those in need, according to the City Journal.

To volunteer or request a meal go to LasagnaLove.org.

In the News

Happenings

8 | Salt Lake Realtor ® | September 2023

®

READY TO GET REAL ABOUT REAL ESTATE?

As part of the legendary Berkshire Hathaway family of companies, we have the depth, strength and brand power to help grow your real estate business. Our network extends globally in reputation and strength. Locally, our company is the largest brokerage in Utah, ensuring that your property reaches a broad audience of real estate professionals and buyers. We are committed to providing you with the resources and support that will create greater success and enjoyment in your real estate career. So, talk with us at Berkshire Hathaway Utah Properties and let’s get you settled without ever settling for less

COMPLETE SERVICE ADVANTAGE / (801) 990-0400 / BHHSUTAH.COM RESIDENTIAL / MORTGAGE/LOANS / COMMERCIAL / RELOCATION PROPERTY MANAGEMENT & LONG TERM LEASING / TITLE & ESCROW SERVICES ©2023 BHH Affiliates, LLC. An independently owned and operated franchisee of BHH Affiliates, LLC. Berkshire Hathaway HomeServices and the Berkshire Hathaway HomeServices symbol are registered service marks of Columbia Insurance Company, a Berkshire Hathaway affiliate. Equal Housing Opportunity. • #1 PRIVATELY OWNED BROKERAGE IN OUR GLOBAL NETWORK • OVER 500 AGENTS ACROSS 30+ OFFICES FROM LOGAN TO ST. GEORGE • MORE THAN 50,000 NETWORK SALES PROFESSIONALS AND 1,500+ MEMBER OFFICES THROUGHOUT NORTH AMERICA, EUROPE AND ASIA @BHHSUTAH

Goodbye Bathtub and Living Room. America’s Homes Are Shrinking

Faced with high mortgage rates, cost-constrained Americans are embracing smaller homes.

By Maggie Eastland The Wall Street Journal

By Maggie Eastland The Wall Street Journal

For many Americans, homeownership may be attainable only if they give up a dining room.

Home prices are near record highs, frustrating millions of potential buyers who feel priced out of the housing market. Home builders are having to find ways to make their product more affordable to increase their pool of customers.

Shrinking the size of a new single-family home is an increasingly popular way to do it. Smaller homes can help cost-constrained buyers facing high mortgage rates. They also boost the bottom line for builders who

are contending with spiraling labor and construction costs.

Since 2018, the average unit size for new housing starts has decreased 10% nationally to 2,420 square feet, according to Livabl by Zonda, a listing platform for new construction homes. Construction starts for new singlefamily homes declined in 2022. But starts for homes with fewer than three bedrooms increased 9.5% over the same period, according to a Zillow report.

Home sizes are shrinking the most in some of the hotter markets of previous years. The Seattle area, where the

10 | Salt Lake Realtor ® | September 2023

size of newly built homes is 18% smaller than it was five years ago, tops the list. New homes in Charlotte, N.C., and San Antonio shrank by 14%, Livabl by Zonda said. Most builders and architects follow the same basic playbook to produce tighter, more efficient living spaces. They are axing dining areas, bathtubs and separate living rooms. Secondary bedrooms and loft spaces are shrinking and sometimes disappearing. At the same time, they are increasing the size of multiuse rooms like kitchens and great rooms. Shared spaces like bunk rooms and jack-and-jill bathrooms, which are located between and shared by two bedrooms, are on the rise. In some cases, the kitchen island has become the only eating area in the home.

Estridge Homes, a semi-custom new-home builder that operates near Indianapolis, recently launched a new neighborhood concept with detached homes 300 to 500 square feet smaller and $50,000 to $75,000 cheaper than it typically builds.

The builder is slashing some bedrooms and bathrooms and trading some indoor living space for outdoor space. Lots in the neighborhood are smaller too, but the builder is working with limited acreage by landscaping to create privacy.

Home buyers began moving in earlier this year, and demand has been strong from both entry-level buyers and empty-nesters.

Those two groups “are both big demographics,” said Clint Mitchell, chief executive at Estridge. “They kind of want the same thing.”

In December, Brad and Julie Redman downsized from their more-than 7,000 square-foot custom-built home to a 3,400 square-foot semi-custom model in Westfield, Ind., after their children left home.

Despite the smaller house and yard in a denser neighborhood, the couple is happy with the decision. They gave up a formal dining area when they moved,

September 2023 | Salt Lake Realtor ® | 11

jpldesigns©/Adobe Stock

but their new eating area easily converts to space for entertaining guests.

“We can use the same space for more than one thing,” Julie Redman said.

Shrinking homes are also beginning to reshape the furniture market. Companies like Bob’s Discount Furniture are creating designs suited to tighter spaces. Demand has increased for items with multiple functions, from kitchen islands with drawers and wine racks to sleeper sofas and smaller, drop-leaf dining tables, said Carol Glaser, executive vice president of merchandising at Bob’s Discount Furniture.

“If they are in smaller homes,” she said of her customers, “they need their furniture to work harder.”

Still, even smaller homes won’t make a big enough dent in the purchase price for most entry-level buyers or provide an answer to the nation’s severe housing shortage. Estridge’s semi-custom homes and townhomes, for example, still range in price between $400,000 and $800,000.

The share of new home projects priced below $400,000 has declined in nearly every major home-building metro since 2018, according to Livabl by Zonda. For entry-level buyers across the nation, the cost of owning a home increased 72% from February 2020 to May 2023, according to an analysis by John Burns Research

and Consulting that estimates monthly payments, maintenance and other costs of ownership.

And the smaller floor plans usually mean that buyers are getting less space for their dollar. Lower list prices might make the overall price cheaper, but buyers are still paying more a square foot, according to the U.S. Census Bureau. Inflation-adjusted cost a square foot increased about 2.5% on average between 2012 and 2020. In both 2021 and 2022, it increased nearly 4%, according to John Burns Research and Consulting.

Builders have also ramped up activity for other costsaving methods, like starting home construction off-site and building more attached homes. In Lexington, S.C., buyers are willing to share a wall with a neighbor when it saves thousands and makes homeownership more attainable.

Sonia Mendez, a real-estate agent in the area, said she has seen builders increase construction of 1,500 to 1,700 square-foot townhomes.

“They are being bought just as fast as the single-family home,” Mendez said. “The first-time home buyers are excited. They don’t see a small home. They see it as a dream come true.”

Reprinted by permission of The Wall Street Journal, Copyright © 2023 Dow Jones & Company, Inc. All Rights Reserved Worldwide. License number 5616040216233.

12 | Salt Lake Realtor ® | September 2023

Image licensed by Ingram Image

the coldwell banker way

At Coldwell Banker Realty, culture isn’t just a concept, it’s at the heart of everything that we do. Our agents love what they do and we love supporting them. Working alongside them, celebrating them, and their hard work, every chance we get. Our Culture of Awesomeness shines through in every smile, collaboration, high five and celebrating every win with them whether great or small.

At Coldwell Banker you’re part of a family and this family knows how to have fun.

#workhardplayhard #meetthenewCB

©2023 Coldwell Banker. All Rights Reserved. Coldwell Banker and the Coldwell Banker logos are trademarks of Coldwell Banker Real Estate LLC. The Coldwell Banker® System is comprised of company owned offices which are owned by a subsidiary of Anywhere Advisors LLC and franchised offices which are independently owned and operated. The Coldwell Banker System fully supports the principles of the Fair Housing Act and the Equal Opportunity Act.

Learn More

Realtors® Relief Foundation

Announces $1.5 Million Relief Grant for Victims of Maui Wildfires

Unity and community spirit are invaluable, especially when facing such trying circumstances

By Melissa Dittmann Tracey

Dozens of real estate professionals are among the thousands of Maui residents who lost everything after the deadliest U.S. wildfires in more than a century torched the Hawaiian island. One Maui practitioner reportedly is still missing.

The Realtors® Relief Foundation announced that it is donating $1.5 million in disaster aid to the Hawaii Realtors® association to help devastated communities. The funds will go toward housing assistance for displaced victims. RRF also is asking NAR members to donate toward relief efforts in Maui.

“Maui’s recent wildfires have deeply impacted its

residents, and we stand by them during this challenging time,” said RRF President Mike McGrew. “RRF grants aim to ease the path toward recovery, offering tangible aid to those rebuilding their lives. As real estate agents, we recognize that unity and community spirit are invaluable, especially when facing such trying circumstances.”

The wildfires were stirred by powerful winds from Hurricane Dora, which did not make a direct impact on Hawaii, and swept through Maui’s western coast. Entire towns, including the tourist haven of Lahaina, were shrouded in clouds of billowing smoke and flames.

14 | Salt Lake Realtor ® | September 2023

Lahaina before the Aug. 8 wildfires.

RandyJay©/Adobe Stock

September 2023 | Salt Lake Realtor ® | 15 Construction We’ve Got You Covered Visit us online at UFirstCU.com or give us a call at 801-481-8840 CONSTRUCTION LOANS NMLS #654272 EQUAL HOUSING LENDER

Why It Should Be Easier to Get a Mortgage

By Melissa Dittmann Tracey

For many first-time and low- and moderate-income home buyers, a loan insured by the Federal Housing Administration is the best product to finance a home purchase. The 3.5% down payment requirement makes FHA-insured loans an important financial tool, particularly at a time of low-home affordability, helping more buyers achieve homeownership. Yet many sellers and their agents may decide not to accept offers from FHA buyers based on pervasive myths about such financing, and that can have the effect of creating

another barrier to homeownership for underserved consumers.

Federal Housing Commissioner Julia Gordon is on a campaign to dispel misperceptions about FHA loans, such as the belief that they have unreasonable property condition requirements. At the Realtors® Legislative Meetings in May, Gordon implored real estate professionals to get educated on FHA financing so they can accurately explain their benefits to clients.

16 | Salt Lake Realtor ® | September 2023

Homeownership is still the asset class that most effectively helps families change their economic circumstances.

fizkes©/Adobe Stock

Gordon recently sat down with Realtor® Magazine to discuss how FHA is broadening access to homeownership, not only through its traditional loan products but also by enhancing its property rehab programs and expanding housing counseling resources.

High home prices and mortgage rates, as well as low housing inventory, are sidelining many buyers. What steps is FHA taking to expand mortgage access and make its loans more competitive with conventional financing?

The FHA’s role is to serve borrowers who are not served by the conventional market. Homeownership is very expensive right now. So, we’re looking at what areas we can lean into that offer promise for lower-income families. One of the most exciting policy changes at FHA is being able to factor in positive rental payment history in the underwriting and eligibility process. We serve a lot of people who don’t come with a robust credit history. Looking at rental history can help get more households into homeownership.

larger multifamily buildings. People who have a home that has an ADU can build wealth by renting it out, and ADUs also have the benefit of creating more affordable units. That’s especially important in places where teachers or first responders otherwise can’t afford to live. We hope soon to release a policy that enables existing or potential income from an ADU to count toward income requirements for underwriting purposes.

We’re taking a similar look at manufactured homes and factory-built homes. The cost of production is lower for these homes, and they tend to be more affordable. Modern technology also is enabling them to be almost indistinguishable from site-built homes. We want to make sure we have financing products available to support them.

Earlier this year, the FHA reduced its mortgage insurance premiums, which is estimated to help borrowers save $800 annually. It was a move that NAR strongly supported. Could there be any future

As Summer comes to an end, don't let your business "Fall" behind! Let our team of Title/Escrow Experts provide you excellent service while helping you grow your business. WHERE YOU ARE FAMILY www.ohanatitleutah.com Education Property Profiles Farming Searches Abstracts

801-758-7277 PLAT MAPS Industry Connectors and MORE!

Izabelle

Terrie Kenadee

we could reduce costs and make it easier for people to qualify for a loan or pay monthly bills.

Now that we’ve made that change, we plan to wait and see how we’re doing. Volumes are lower right now, and that could persist for some time. Also, we’re seeing the lowest inventory levels ever in our time. So, let’s see how this reduction plays out. Let’s see how borrowers perform. Let’s see what happens with rates. But one thing we’ve done is create a template for how we look at our premium levels and whether they need to be adjusted in the future.

The FHA’s 203(k) program enables buyers and homeowners to add renovation costs to their mortgages. Can you explain how this loan program helps revitalize existing housing stock?

The average age of our housing stock is reaching 50 years old. If we’re not replacing the boiler, the HVAC system and fixing the roof routinely, that house is going to go offline. We really need to be focusing on the aging of homes much more than we are. We are working with

the National Association of Realtors® to try to distribute more information about the 203(k) program. At the same time, we’re looking to see how we can improve that product. For all of FHA’s products, it’s important to realize that both the loan limits and product features can get out of date, and they need to be revisited regularly if they are not indexed in some way.

The FHA also recently increased its price threshold for large multifamily loans, which could foster greater development and ease the inventory shortage. Can you talk about the significance of this change?

Increasing the threshold enables us to improve efficiency and reduce costs for multifamily sector at a time when we need more affordable rental homes. We know that a lot of luxury rental homes have been built. But in affordable housing, we continue to face a shortage. For the lowest-income households, the shortage is dire. We need to continue to push on the supply in the affordable multifamily space, where so

18 | Salt Lake Realtor ® | September 2023

Image licensed by Ingram Image

much of our FHA business is. This change seemed like a great way to make sure we were keeping pace with the economic environment.

More supply, ultimately, is good for everybody. But we also need to build it in a way that the economics work out and to preserve affordability for existing buildings. So, we need to repair, maintain, and update buildings to make them more energy-efficient and climate resilient.

You said at the Realtors® Legislative Meetings that real estate professionals and the FHA need each other. Can you expand on that?

We want to make sure that practitioners understand FHA mortgages are good loans. The fallout rate is no different than that of a conventional mortgage. FHA borrowers are well-qualified borrowers who perform well over time. And we hope you will join us in dispelling some myths that have arisen about FHA mortgages. There’s a lot of outdated information, like what the minimum property requirements are. It’s important to be current on what is actually required because it may not be as big of a deal as you think. Real estate professionals are on the front lines. When people start thinking about buying a home for the first time, they’re depending on their agent as a gatekeeper. So, it’s important that we work together and that we continue to push out information that’s easy to understand. Through our Office of Housing Counseling, we’ve rolled out a new public campaign called “Let’s Make Home the Goal” to raise awareness about the value of housing counseling. It’s aimed at reaching underserved home-ready individuals and families. We’re focused on delivering culturally and linguistically appropriate information for communities that often have been left out of homeownership. We believe that both pre-purchase and post-purchase housing counseling is a critical tool, especially for first-time buyers. It’s an opportunity for home buyers to learn about the process from a disinterested party and make sure they’re getting into the right loan at the right place.

With a fragile economy—high inflation, uncertainty in the banking sector and an uptick in foreclosures—some people fear a major slowdown in the housing market. How are you preparing for any potential disruption?

We’re here to fill a particular gap in the market, regardless of what the total volume picture looks like. Yes, the slowdown is already here. FHA is experiencing the same volume decreases that the rest of the market is experiencing. But we’re continuing to serve the type of borrowers that we want to be serving. And we stand ready to act as a countercyclical force, as we have time and again, when economic conditions threatened to constrain liquidity in the mortgage market.

When you run into any kind of economic headwinds, you also want to make sure the people who already

have a house can keep that house. Our rate of serious delinquency continues to remain somewhat elevated from pre-pandemic levels. But we have done an enormous amount of work to create better home retention options, like a monthly payment reduction, for servicers to offer borrowers when they are delinquent or need help. There will be some people who will face a hardship that they can’t overcome. But those families should be able to be served through a short sale or a deed in lieu rather than going through foreclosure. Foreclosure is just a loss for everybody.

What are the FHA’s priorities over the next year?

We are at that time in the trajectory of the Biden administration where we have very long to-do lists. We’re very focused on pushing many priorities forward over the next year, like the 203(k) and FHA Title I program revisions, continued expansion and modernization of manufactured housing, and enhancing our ability to provide home buyers with access to quality FHA-insured mortgages. We also will continue to focus on loss mitigation and home retention solutions so that buyers who use an FHAinsured mortgage are able to maintain homeownership over the long term.

It’s tempting in this position to not take any risks—to have this job and just keep things running smoothly and not address crises. But I think that’s why it’s so important that President Biden chose to put someone in this position who comes from a background of advocacy on behalf of consumers. I did not come here with the intention of surviving a few years and then leaving.

Is homeownership still a critical piece of the American Dream? Do you believe that it is achievable for most Americans?

Homeownership is still the asset class that most effectively helps families change their economic circumstances. It’s the only sophisticated financial product available to a lower-income family where they can use the power of leverage. A mortgage is an instrument that allows households to access an interest rate that is good relative to other financial products and where they can own an asset that serves as their home. It creates stability for families. Homeownership is also associated with other positive outcomes, whether it’s health, education or public safety. Even as we’re at a point now where I think homeownership is as expensive as it has ever been relative to incomes, the drive is still there. This is what people aspire to have.

Melissa Dittmann Tracey is a contributing editor for Realtor® Magazine. Reprinted from Realtor® Magazine Online, August 2023, with permission of the National Association of Realtors®. Copyright 2023. All rights reserved.

September 2023 | Salt Lake Realtor ® | 19

NAR Triumphs in REX Antitrust Lawsuit

Claims that NAR influenced how Zillow displayed listings in its website redesign were dismissed in federal court Wednesday.

By Charlie Lee

A federal judge in the Western District of Washington on Wednesday dismissed claims against The National Association of Realtors® stemming from an antitrust lawsuit filed by REX (Real Estate Exchange Inc.). A culmination of a two-year battle, REX filed the lawsuit in March 2021 against Zillow, Trulia and NAR, taking issue with Zillow’s website redesign implementing a two-

tabbed interface that indicates properties listed on the MLS versus those that are not.

REX claimed that NAR influenced how Zillow displayed listings, which is false, and the judge’s decision establishes that the allegations in this case have no merit. NAR says this is a positive and encouraging development for REALTORS® and the entire real estate industry.

20 | Salt Lake Realtor ® | September 2023

How It Impacts You

Most importantly, this decision means local MLS broker marketplaces can continue to decide for themselves how their data is displayed on other listing sites. NAR policies recognize that each real estate market is different, and the guiding principle is to empower REALTOR® association-owned MLSs, as well as their participants and subscribers, to be an independent, local broker marketplace that can best serve the evolving business needs of their markets. The goal is to provide flexibility in light of emerging technology and workplace trends and encourage value-driven competition among local broker marketplaces. The

court’s decision protects this market dynamic and allows local broker marketplaces to continue to foster competition, promote equal access to listings and ensure consumers have access to the most accurate, transparent and up-to-date information on home listings.

The bottom line is that NAR has and always will work to ensure that local broker marketplaces continue to provide information on homes that is accurate, reliable and transparent to the advantage of buyers and sellers. Otherwise, without NAR and the local broker marketplaces, buyers and sellers likely would have less choice among brokerages, services and compensation models, hurting the average consumer.

Benefits of Local Broker Marketplaces

• Local broker marketplaces create the largest opportunity for connections between real estate agents with properties to sell and those with clients looking to buy.

• They give first-time, low-income and other buyers better access to the American dream of homeownership while also exposing a seller’s property to the greatest number of potential buyers.

• Local broker marketplaces benefit competition and fair housing and provide consumers with the most accurate, transparent and up-to-date information on home listings.

• They provide verified, trusted, detailed and accurate property information.

• Ensure equal opportunity for all home buyers and sellers, leveling the playing field between large and small brokerages.

• They provide unprecedented competition: Many different service and fee business models—from varied commission models to flat fees—thrive in local broker marketplaces.

NAR encourages members to continue to educate themselves and the public about how local broker marketplaces work and promote equity, transparency, and market-driven pricing options for consumers. Check out competition.realtor, which provides a comprehensive overview and suite of materials related to how Realtors® and local broker marketplaces benefit consumers, or read about NAR’s legal win in HousingWire.

Charlie Lee is Senior Counsel and Director of Legal Affairs at the National Association of Realtors®.

September 2023 | Salt Lake Realtor ® | 21

SOMKID©/Adobe Stock

"The bottom line is that NAR has and always will work to ensure that local broker marketplaces continue to provide information on homes that is accurate, reliable and transparent to the advantage of buyers and sellers."

oz©/Adobe Stock

Attack Affects Tens of Thousands of Realtors®

UtahRealEstate.com, which uses a completely different system, was not affected by the attack.

Thousands of Realtor Multiple Listing Services (MLS) across the country were shut down Aug. 9, when their MLS provider, California-based Rapattoni, was hit by a ransomeware attack. “We went from super low inventory to no inventory” said Peter Chabris, CEO of The Chabris Group in Cincinnati. Real estate agents nationwide were unable to search or update any listings.

Coldwell Banker agent Peg King of Petaluma told the therealdeal.com “It’s paralyzed the real estate industry. We can’t add listings. We can’t make price changes. We have no idea how to show properties unless we try to figure out who has something listed.”

Rapattoni provides MLS software and data services nationwide to over 100,000 members. They sent out a memo, saying it had been targeted. The service remained down 24 hours later preventing brokers from accessing listings or open house information for the weekend showings.

As of Aug. 14, Rapattoni MLS was still not fully restored for brokers. Some services had been restored, but others were still unavailable.

“This is a perfect example of how wide the ransomware attack surface has become” said Carol Volk, executive vice president of BullWall. “This mirrors the increase in attacks we’re seeing on public infrastructure. There’s just no aspect of our lives not impacted by digital transformation which has the unfortunate side effect of making it all vulnerable. Every one of us is a provider of services to others in our social supply chain and we are responsible to those we serve, both locally and across the “chain,” to maintain the highest level of cyber security to both protect our data and our ability to provide service. It has been shown time and again that the follow-on damages of a cyber attack can be much greater than just the loss of data with regards to the direct and imputed costs.”

22 | Salt Lake Realtor ® | September 2023

How Brokers Help Clients Get the Most for Their Homes

Three brokers explain the services and consultation they provide to help clients maximize profit.

By Lee Nelson

In Houston, the mansion of a former professional baseball player sat on the market two years. Two different brokerages represented the property during that time, and still, it failed to sell. Things were dire for the owners, who would soon face foreclosure. In a final effort to sell the home, they brought in Tricia Turner, CEO of Tricia Turner Properties Group brokered by ExP in Houston.

“It should have sold for $4 million [when it was first listed]. But when I entered the home, I saw clearly why it hadn’t sold,” said Turner.

The home was cluttered with dated furniture, as the couple couldn’t afford to spend anything on staging or cleanup, and Turner knew that was needed to sell

the home. In a two-week time frame, she and her team brought in a cleaning crew and removed all the dated or dingy items. Those items were replaced with new, stylish furniture, and key areas like the pool deck were staged to entice interested buyers. Turner spent a total of $9,000, but the home sold for $3 million, and the transaction closed one week before the home went into foreclosure.

Turner and other brokers offer an array of services to help their clients maximize profits, which she says leads to more money for everyone and a better experience for the client. Brokers know better than anyone what sells in their communities, and are therefore positioned to help clients in this way.

24 | Salt Lake Realtor ® | September 2023

Upfront Services

Through her Make it Pretty Program, Turner offers sellers services including cleanup, staging and minor repair work to transform their homes into listingready shape. Her motto is “Fix now, sell for more, pay at closing.” Turner pays for the costs upfront, and the money is recouped once the home is sold.

She’s realized over the years that many reasons prevent homeowners from possessing the funds to fix up their homes when it’s time to sell. Seniors might have lots of equity but no cash. Medical issues act as a continuous siphon. Fixed incomes and raising children are expensive. She belives that these life circumstances should not prevent sellers from making the most money on their homes. She says that nearly three-quarters of her clients use the Make it Pretty Program.

“If we can invest a few thousand dollars, the sellers get a better experience and sell it faster, and everyone makes more money,” said Turner. “We absorb the cost at first and bring in the manpower. I believe it’s our job to help homeowners with their biggest assets and to go beyond the call of duty.”

Pay It Forward

Kyle Morris has a past that informs how he operates in the real estate world today. As someone who lost everything because of substance abuse, he knows what it’s like to be at the bottom, and he worked hard to get back to equilibrium, he said. If it hadn’t been for the people who took chances on him and helped him throughout his journey, his story might be very different, he added.

“It all started when I had been sober for six months and got my real estate license in March 2017,” said Morris, broker-owner of Morris Property Group powered by F.C. Tucker in Carmel, Ind.

At the time, he was learning the business, but not selling much, so he had more time to devote to putting in extra effort with his clients. The first home he helped rehab was a rental property in need of siding, new carpet and a landscaping makeover.

“I didn’t have anything else to do. I did it myself to stay busy to protect my sobriety. I knew how to do DIY stuff,” he said.

September 2023 | Salt Lake Realtor ® | 25

WavebreakmediaMicro©/Adobe Stock

After that, he acquired his first client: a woman who was in foreclosure and owed the bank $70,000. He spent several hours and $2,500 of his own money to fix up the property. When he listed the home, it sold for $100,000 in a matter of two days.

“The look on her face and her overwhelming gratitude made me think that I was onto something,” he said. Morris’ business grew through word-of-mouth, and today he’s a busy broker with a sizeable team of agents. Still, he and his team are committed to rehabbing the homes of clients in need. They use their own money and sweat equity, as Morris believes it’s his way of giving back to the community that held him up when he needed it. The efforts pay for themselves.

“I don’t make any cold calls. Just this month, I’ve [acquired] a dozen listings. We do something differently and with good intent and nature,” Morris said.

He and his team renovated 100 houses last year and are on schedule to do the same this year. Not every house needs the same amount of work, he said. On average, two out of three homes they sell have some level of upkeep or renovation completed by the team.

“It’s really been the most amazing experience, [including] the way it’s grown exponentially. It’s been mind-boggling,” he said.

Leverage Expertise and Connections

For years, Tana Lee worked as an interior designer for residential and commercial clients. A local builder convinced her to get her real estate license, and now she provides design consultation to her clients at no cost. Thanks to her years in the interior design field, Lee compiled a long list of professionals in the industry

as well—a boon to her clients who need these services.

“I enjoy sharing my expertise in a how a room can be transformed,” said Lee, SRES, broker-owner of Red Truck Real Estate in Billings, Mont. “I am happy to share my resources with my clients so that they are hiring reputable contractors who can get the job done right.”

One of her clients, an elderly woman who had lived in her home for a few decades, had boxes upon boxes of her belongings stacked in every room. The home needed a host of cosmetic updates as well.

“She had spent her life as an elementary teacher and had the biggest heart. Her health was failing, and she was relocating out of state to be close to her children,” Lee said.

Lee knew that her client lacked the means to ready the house for listing. She also knew, however, that if she sold the house in its current condition, the client would lose out on tens of thousands of dollars in equity.

“I reached out to my connections of suppliers, installers and contractors, and we were able to give the home a fresh makeover of new paint, flooring and lighting without her having to pay upfront for the expenses. The renovations cost less than $15,000, and the home sold for $60,000 more than it would have likely sold for before.”

Since the client’s home was paid off, the suppliers were willing to submit their invoices to be paid out of escrow at closing, which avoided any requirement to come up with the money out of pocket.

“It felt amazing to help my client, who spent her life giving back to others, in this way.”

Lee said that she provides some level of design advice and coordination to about half of her clients. She also offers move-out cleaning services for her sellers so that the home is in move-in-ready condition for the buyer. This service, she said, is beneficial to all parties involved. Final walkthroughs are a breeze thanks to a freshly cleaned home, and the buyer is happy.

“Sellers are pretty excited to hear that they don’t have to go back and scrub out the refrigerator or showers,” she said.

When a home is as marketable as possible, everyone from the broker and the agent to the buyer and seller benefit. Sometimes, all it takes is consultation. Other times, clients need more help. Look at the skills and expertise that exist in your brokerage and see how you can leverage them to help clients at the beginning of the transaction. The upfront effort has the power to pay dividends in the end.

26 | Salt Lake Realtor ® | September 2023

Image licensed by Ingram Image

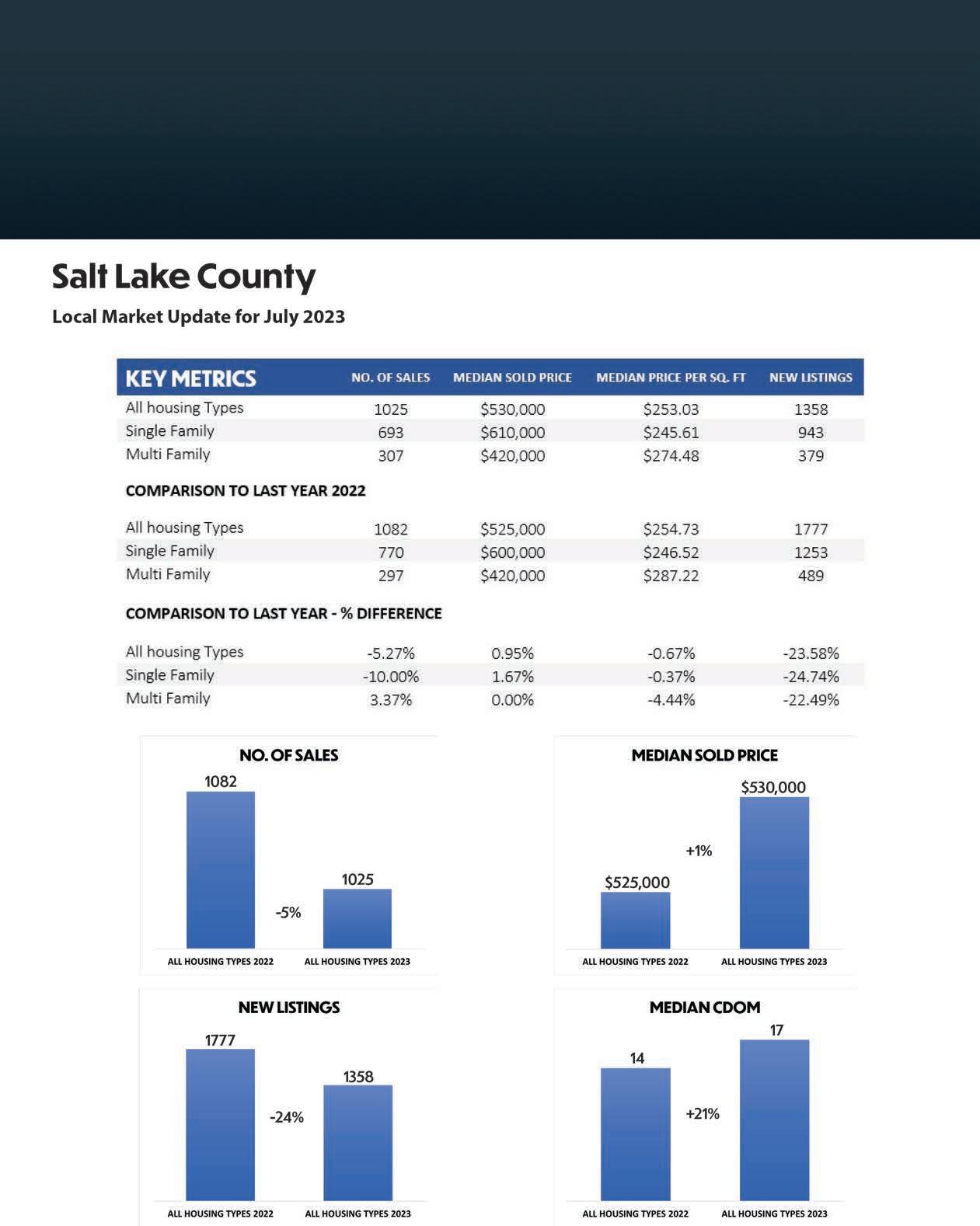

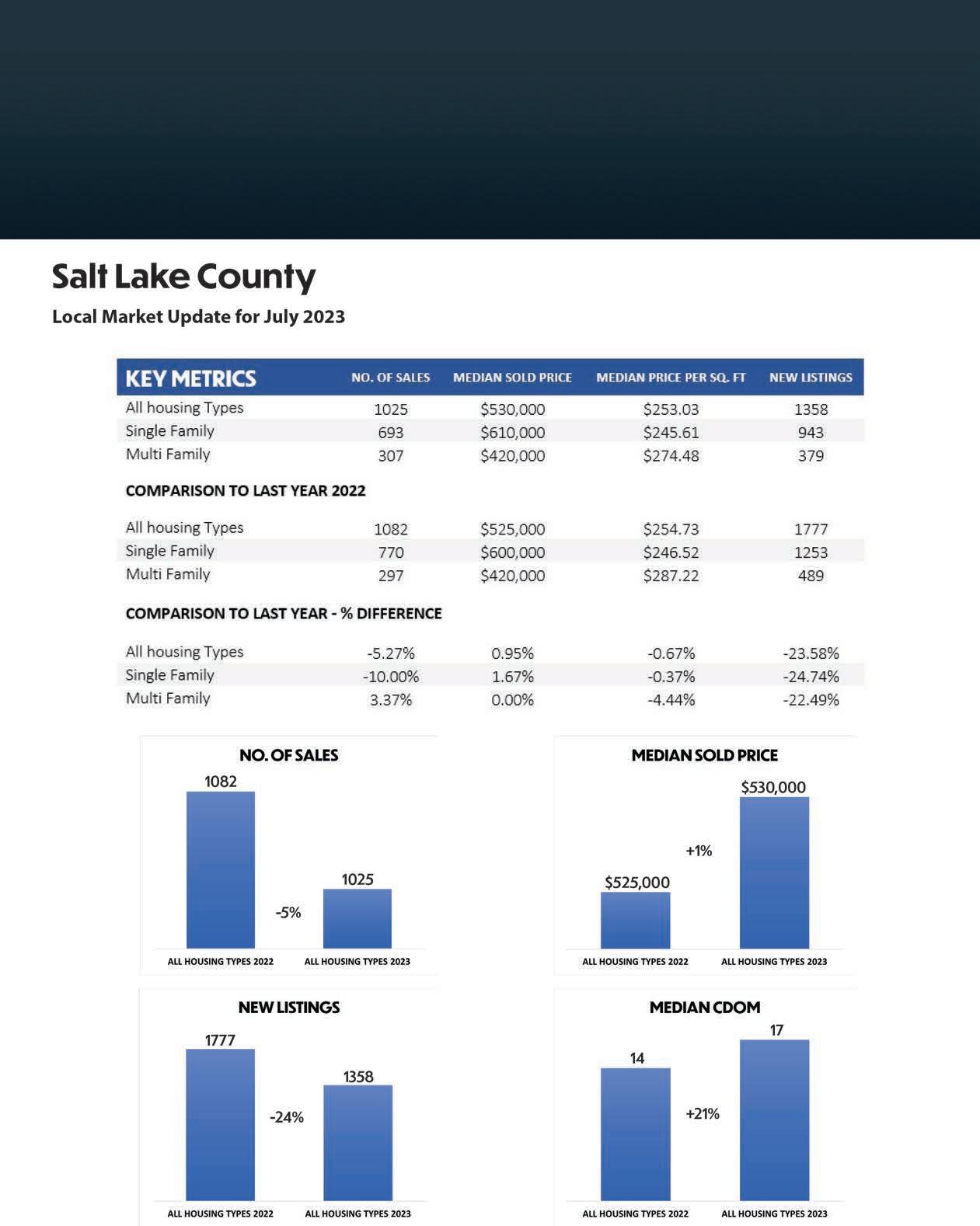

Homes Sales Affected By High Interest Rates July 2023

The price of a single-family home in Salt Lake County increased to $610,000 in July, up 2% from a $600,000 in July 2022. The increase follows a drop in the median single-family home price in the second quarter, when prices fell to $582,500, a 7% decline from $623,138 in Q2 2022, according to UtahRealEstate.com.

Despite the slight drop in home prices, homeowners are sitting on plenty of equity. At the start of the Covid-19 pandemic in March 2020, the median single-family home price registered $410,000 in Salt Lake County. As of July 2023, the median single-family home price had climbed to $610,000, a staggering 49% increase.

Recent data reveals that the most affordable single-family homes in the Wasatch Front region are in Salt Lake City’s Glendale community, within the 84104 ZIP code area. In this neighborhood, the median single-family home price dropped to $381,000 in the second quarter of 2023, marking a 7% decrease from the previous year’s median price of $409,000.

Other ZIP code areas rounding out the top five most affordable regions include:

• South Ogden (84403): $400,000, down 9% from last year

• Roy (84067): $410,000, down 8%

• Kearns (84118): $420,000, down 7%

• West Valley City (84119): $420,000, down 4%

Home sales fell to 1,025 units in July in Salt Lake County, down 5% year over year. In the second quarter, 2,161 units were sold, down 25% from 2,864 units sold in the second quarter of 2022. Sales also fell in the surrounding Wasatch Front counties.

One major factor to the fall in home prices across the Wasatch Front has been the rise in mortgage interest rates. Freddie Mac reports that the 30-year fixed-rate mortgage has now reached its highest level since 2001.

In terms of year-over-year changes in median home prices in neighboring counties in the second quarter:

• Tooele County experienced a 9% decline in single-family home prices

• Utah County observed a 7% drop

• Weber County noted a 6% fall

• Davis County saw a 5% decrease

In addition, the median sale price for condominiums in Salt Lake County fell to $415,000 in the second quarter of 2023, down 7% from $445,000 in the same period last year.

Homes in Salt Lake County remained on the market for an average of 17 days in July, up from 14 days in July 2022. In the second quarter, homes were on the market 37 days before going under contract, a notable increase from just 14 days in Q2 2022.

28 | Salt Lake Realtor ® | September 2023

September 2023 | Salt Lake Realtor ® | 29

Keep InTouch, effortlessly. Let's chat about how we can help you meet your goals. So many of our agents benefit from the InTouch program! I love keeping our agents organized; we work together to create a calendar of content to keep them top of mind for their clients, even during their busiest times. Our InTouch program is tailored to you and your unique SOI. MIRANDAH Program Coordinator, InTouch/Circle of Friends Exclusive client offerings Seamless SOI integration Tailored newsletters Monica Draper VP, BUSINESS DEVELOPMENT monica@winutah.com 435.313.7905 Brad Hansen DIRECTOR, WASATCH FRONT brad@winutah.com 801.230.5236 Grady Kohler OWNER / PRINCIPAL BROKER grady@winutah.com 801.815.4663 winutah.com/joinus "

By Maggie Eastland The Wall Street Journal

By Maggie Eastland The Wall Street Journal