Thedemandforinnovativefintechsolutionsissurgingastechnologyadvancesandconsumer expectationsevolve.Today’suserswantfinancialservicesthatareinstant,personalized,and secure,pushingfintechleaderstothinkcreativelyandadaptquickly

Severaltrendsaredefiningthefintechlandscapethisyear Artificialintelligenceismakingwavesinfraud detectionandsecurity,whileblockchainisenhancingtransparencyandtransactionspeed.Mobilepaymentsand openbankingcontinuetogrow,reshapinghowpeopleinteractwithfinancialinstitutions.Fintechcompanies mustnowblendcutting-edgetechnologywithsimplicitytomeetthesenewstandards.

Traditionalbanking,meanwhile,facesarealchallengeinkeepingup.Asfintechinnovatorscatertoshifting consumerdemands,banksareunderpressuretoadapt.Manyareformingpartnershipsoradoptingtech-driven solutionstostayrelevant,acknowledgingtheneedtoinnovatewithinlong-standingsystems.

Theleadersmakingthebiggestimpactinfintechtodayshareuniquequalities.Resilience,adaptability,anda commitmenttoethicalfinancesetthesepioneersapart.Theybringafreshperspectivethatbalancestechnical expertisewithapeople-firstapproach,guidingtheircompaniesthroughacomplex,fast-pacedenvironment.

Inthisedition,wearethrilledtospotlight“TheTop10Next-GenPioneersLeadersinFintech,2024.”These leadersaren’tjustreactingtochange;they’releadingit,drivingforwardwithavisionforthefutureoffinance.

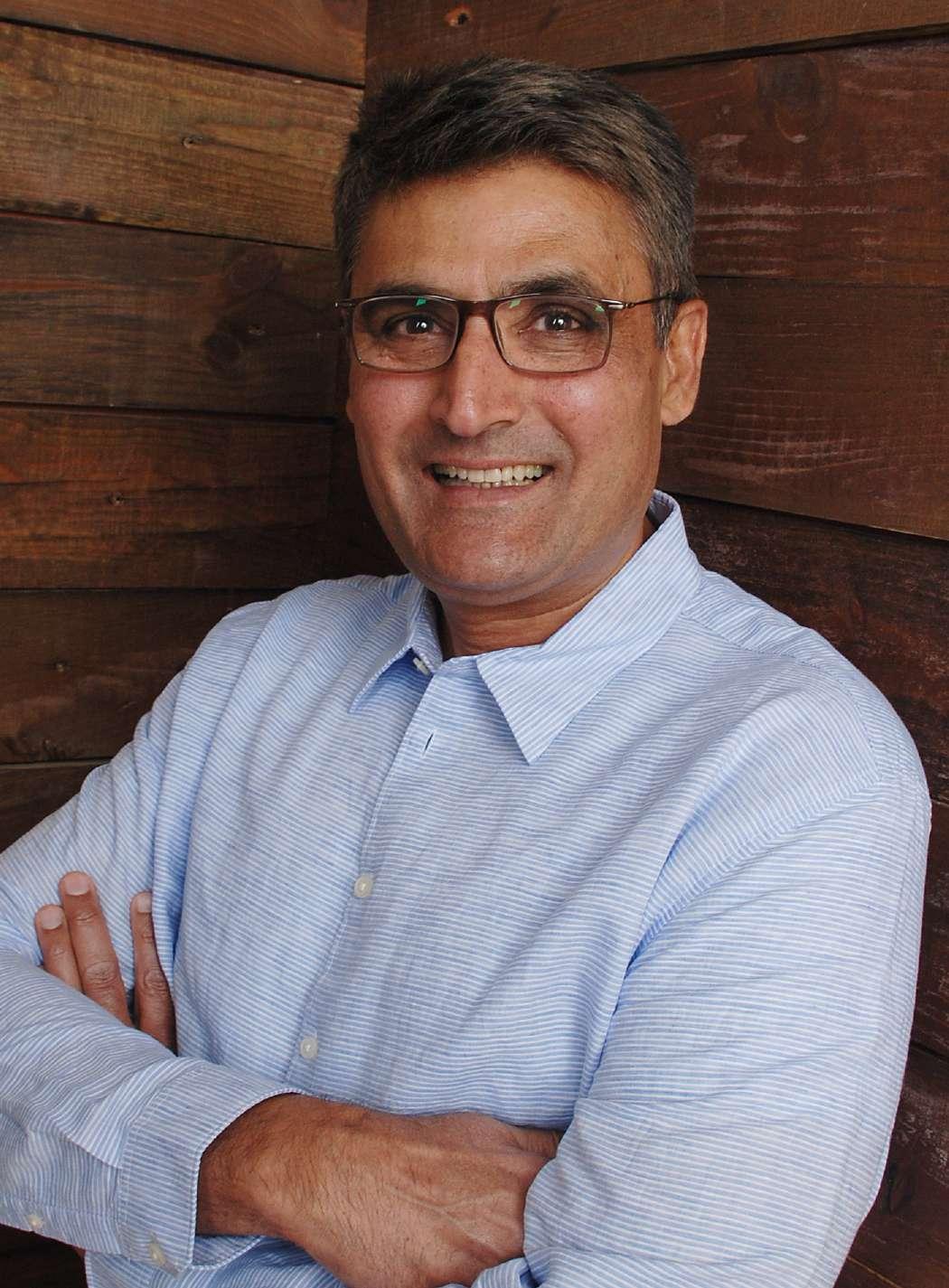

OurcoverstoryhighlightsNaazScheik,FounderandCEOofSoftPakFinancialSystems.Withabackgroundas aQuantitativeAnalyst,hefoundedSoftPakin1994torevolutionizeportfoliomanagement.Hisflagship product,UREBAL,useslinearprogrammingtooptimizeaccounts,drivingSoftPak’sglobalgrowthand innovationinfintechsolutions.

AlongsideNaaz,thiseditioncelebratesMarcRind,BabuUnnikrishnan,MatthewParker-Jones,andPrema Varadhan,eachofwhomismakingasignificantmarkontheindustry Theircombinedinnovationandexpertise areshapingthenextchapterinfinancialservices.

HappyReading!

Tejas Tahmankar Project Editor

EDITOR-IN-CHIEF

MANAGING EDITOR

PROJECT EDITOR

YASHWANT

PRATIK

CREATIVE

SACHIN KHARAT

VISUALIZER

MARK

GRAPHIC DESIGNER

HARSHADA MALI

AAKASH

ROBERT

RESEARCH

JAMES ADAMS

ADVERTISING

MARIA SMITH

KeyPoints

● NaazScheikfoundedSoftPaktorevolutionize financialtechnologysoftwarebyprovidingintuitive andeffectivetoolsforportfoliomanagers.

● Initiallyfocusedoncustomsoftware,SoftPakhas shiftedtowardsfull-scalesoftwaredevelopmentto bettermeetclientneeds.

● Theirflagshipproduct,UREBALisanawardwinningportfoliorebalancingtoolthat utilizesauniquelinearprogrammingmethodto optimizeaccountsandenhanceinvestmentadvisors’ performance.

In1994,NaazScheik,Founderand CEOof SoftPakFinancialSystems, launchedthecompanywithaclear vision:totransformfinancialtechnology softwareandempowerportfoliomanagerswith moreintuitiveandeffectivetools.Asaformer QuantitativeAnalystatWellington ManagementinBoston,Naazsawfirsthandthe inefficienciesinportfoliomanagement,risk analytics,andrebalancing.

NaazholdsaMaster’sinMathematicsand PhysicsandstudiedatTuftsUniversityandthe UniversityofKarachi.Usinghisstrong backgroundinmathematicsandquantitative modeling,hebuiltSoftPaktoaddressthese issues.

Underhisleadership,SoftPakhasgrownto over150employeesglobally,evolvingfrom customsoftwaresolutionstoarangeof productsandconsultancyservicesaddressing complexportfoliomanagementandrisk analytics.

InaconversationwithMirrorReview,Naaz shared,“Duringmymaster’s,Iperformedmany intricatesimulationsinthefieldofcomputer sciences.Mostofmyknowledgecomesfrom firsthandexperiencesusingmystrong foundationinmathematicsandpassionfor quantitativemodeling.”

MR:WhatinspiredyoutolaunchSoftPak FinancialSystems,Inc.?Canyousharethe storybehinditsfounding?

Naaz:Earlyinmycareer,Iworkedasa QuantitativeAnalystatWellington ManagementinBoston.Duringthattime,I appliedmyknowledgeofthefinancialindustry toconvertcomplexstatisticalmodelsinto computerprograms.Thisexperiencesparked theideaforSoftPak,whichIfoundedin1994.

WhileatWellingtonManagement,Iworkedon severalkeyprojects,suchascreatingbond yieldcurvesandrankingequitiesbasedon variousfundamentals.Afterspendingaboutfive yearsinthisfield,Irecognizedasignificant marketdemandforthistypeofwork.

Thisrealizationmotivatedmetodevelopgeneralpurposefinancialsoftware,whichIstartedfrom myhomeoffice.OnceIwassatisfiedwiththe software'scapabilities,Ihaditprofessionally designed.ThatdraftbecameSoftPak’sfirst fintechproduct.

MR:Whatsetsyourportfoliorebalancingtool, UREBAL,apartfromothersinthemarket? Howdoesitenhanceinvestmentadvisors’ performance?

Naaz:Portfoliorebalancingisoneofthemost crucialtoolsforinvestmentadvisorstoday While someRegisteredInvestmentAdvisors(RIAs) relyonsimplemacrosandmodelstorebalance theirportfoliosandmanageassets,ourUniversal Rebalancer(UREBAL)operatesonamuch largerscale.UREBALisdesignedtobemore tax-awareandcost-effectivethanothersolutions inthemarket.

Whatmakesourapproachuniqueistheuseofa linearprogrammingmethod,alsoknownasthe methodofgradientdescent.Thistechnique optimizesaccountsbycontinuallyswapping securitiesandevaluatingtheportfolio's optimality,ensuringthatwereachthemost efficientandeffectiveversionpossible.

MR:HowdidSoftPakevolveintofull-scale softwaredevelopment,andhowdoyoumeet theuniqueneedsofyourclients?

Naaz:Intheearlydays,wheneverweinstalled newlydesignedsoftwareforacompany,we quicklynoticedthateachclienthaduniquesetups andrequirements.Akeytakeawaywastheir consistentrequest: “Can your software integrate seamlessly with our existing systems?” Whether itwasperformancemanagement,training,or historicaltransactionsystems,theneedfor seamlessintegrationwasalwaysapriority

ThisdemandnaturallyledSoftPaktomovemore intofull-scalesoftwaredevelopment.Overtime, wealsoexpandedourprojectmanagement solutions.Westartedaugmentingourstaffwith additionaltoolsorevenbringinginclientprovidedstafftomeettheirspecificneedsand helpdevelopthesoftwaretheyrequire.

‘‘

Always ask yourself, what value am I adding to this? Are you doing what others are doing or are you making something unique?

MR:Howdoyoubalanceyourpassionfor technologywithoverseeingvariousdepartmentsat SoftPak?Couldyousharehowyoumanagethese responsibilities?

Naaz:Personally,Iconsidermyselfatechenthusiast. AtSoftPak,wecurrentlyhavefourtechnologyteams, andImakeitapointtodividemytimeamongallof them.WhetherI’mbrainstormingwiththeproduct developmentteam,overseeingprojectmanagement,or focusingonqualityassurance,testingautomation,and processmanagement,I’mdeeplyinvolvedinthe technicalsideofouroperations.

Atthesametime,theotherdepartments,likebusiness developmentandaccounts,havetheirowndedicated managerswhoreportdirectlytome.Thisstructure allowsmetostaycloselyconnectedtothetechnology whileensuringthatallaspectsofthebusinessrun smoothly

MR:Whatchallengesdidyoufaceearlyinyour career,andhowdidyouovercomethemtoensure SoftPak'ssuccess?

Naaz:OneofthebiggestchallengesIfacedearlyon wasmaintainingaconsistentlevelofstandardsand coordinationineverythingSoftPakdelivered.Since mostofourclientsareinternational,ithasalwaysbeen aprioritytoworkeffectivelywiththeirteamswhile stayingproductive,cost-effective,andensuringhighqualityassurance.

I’mproudtosaythatSoftPakhasexceededall expectationsinthisregard,asseenbyourstrongbase ofreturningclients.

MR:Howdoyouapproachbuildingandnurturing talentatSoftPak,particularlyinsupporting diversityandgenderequality?

Naaz:I’vebeenfortunateinthisarea.AtSoftPak,I’ve alwaysemphasizedbuildingastrongteamfromwithin bypromotingtalentedindividuals,bothmenand women.Imakeitapointtorecognizeandrewardtalent whereverit'snecessary

Inaddition,Iplaceastrongfocusontrainingand development,especiallyforourfemaleengineers.I believethateveryone,regardlessofgender,shouldhave equalopportunitiestogrowandsucceedatSoftPak.

MR:Whatrecentinnovationshaveyouintroduced atSoftPak,andhowdotheyreflectyour company'sgoals?

Naaz:Oneofourlatestinnovationsisfullyintegrated softwarethatworksseamlesslywiththeAxioma optimizer.It’ssimilartoourmanagedaccounts rebalancingsoftware(MARS),whichworkswiththe Northfieldoptimizer.Webelievethisnewproduct willbeamajorgamechangerinthefintechindustry.

We'vealsorecentlylaunchedAdvisorSketchbookin collaborationwithPartiPris.Ourmaingoalnowisto makeastrongimpactinthesoftwaredevelopment marketandtoclearlydefineourfocusandvisionwith eachnewproductweintroduce.

MR:Howdoyoumaintainahealthywork-life balance,andwhatactivitiesdoyouenjoyinyour downtime?

Naaz:Maintainingwork-lifebalanceisallabout focus.Inmyfreetime,Ienjoyworkingout,playing golf,traveling,andindulginginmybiggesthobby: hiking.LivingintheUSprovidesmewithmanygreat hikingopportunities.Ofcourse,Ialsoprioritizemy day-to-dayresponsibilitiesasafatherandaloving husband.

MR:Whatadvicewouldyougivetoreaderswho arelookingtobuildasuccessfulbrandor business?

Naaz:Mykeyadviceistonevercutcorners. Buildingasuccessfulbrandorbusinessrequireshard workanddedication.Alwaysbepatientwithyour deliverablesandensurethateverythingyouproduce meetsyourhighstandards.

Askyourselfwhatvalueyouareadding.Areyou simplyfollowingthecrowd,orareyoucreating somethingunique?Andremember,neverstop innovating.AtSoftPak,weareconstantlypushingthe boundariesofinnovation.Forinstance,asof2024, weareexploringwaystointegrateAIandneural networksintoourexistingsolutions.

Management-JimmyLee,CEO

URL-www.dnbcgroup.com

Founded-2017

Description-DNBCFinancialGroupoffersinternational moneytransferswithpersonalizedcustomerservice, empoweringstartupsandSMEs Theyprioritizesafety, transparencywithnohiddenfees,andprovidevaluable financialknowledge

Management-SamanthaTran-Jiao,CFO

URL-www.lotusdomaine.com

Founded-2014

Description- LotusDomaineisaprivateequityfirm specializingingrowthopportunitieswithinEnterprise Software.Theyprovidecapital,guidance,andflexible meetingoptions(telephone,video,orin-person)for businessesseekingsupport.

Management-MarcRind,ChiefTechnologyOfficer

URL-www.fiserv.com

Founded-1984

Description-Fiservisafinancialservicestech companyofferingsolutionslikepaymentprocessing, digitalbanking,andfraudprevention Itserves businesses,financialinstitutions,fintechs,withastrong focusonsocialresponsibilityanddiversity

Management-DavidDonovan,ExecutiveVicePresident

URL-www.publicissapient.com

Founded-1990

Description-PublicisSapientisadigitalbusiness transformationcompanyleveragingAI Theirunique SPEEDapproachdrivesimpactfuldigital transformations,focusingondeliveringmeaningful resultsandvaluefortheirclients.

Scotiabank

Management-MatthewParker-Jones,SeniorVicePresident

URL-www.scotiabank.com

Founded-1832

Description-Scotiabankisaglobalbankthatoffersa varietyofbankingservices,includingpersonaland commercialbanking,wealthmanagement,and investmentbanking

Management-NaazScheik,FounderandCEO

URL-www.softpak.com

Founded-1994

Description-SoftPakofferssoftwaresolutionsforthe financialindustry,includingrebalancingtools,risk analytics,andmanagedaccounts Theirservicesalso includeportfoliooptimization,enterpriserisk management,andtalentplacement

Management-BabuUnnikrishnan,ChiefTechnologyOfficer

URL-www.tcs.com

Founded-1968

Description-TataConsultancyServices(TCS)isaglobal leaderinITservices,consulting,andbusinesssolutions, offeringserviceslikeartificialintelligence,cloud computing,andcybersecuritytoclientsworldwide

Management-PremaVaradhan, PresidentofProductandCOO

URL-www.temenos.com

Founded-1993

Description-Temenosisacloud-basedplatformthat providesbankingcapabilities,AI,amarketplacetobuy andsellbankingproducts,andacommunityfor knowledgesharing

BabuUnnikrishnan

,theChiefTechnology

OfficerforBanking,FinancialServices,and Insurance(BFSI)-AmericasatTata ConsultancyServices(TCS),isnostrangertoleading throughtransformation.Overthecourseofhis27-year career,hehasfacedimmensechallengesinbuilding technologystrategiesforsomeoftheworld'smost complexfinancialinstitutions.

Today,hestandsattheforefrontofanindustryonthe brinkofanAI-drivenrevolution.TheBFSIsectorisripe forchange,andUnnikrishnanisoneofthekeyfigures responsibleforshapingthatchange.Withafocusoncoinnovation,customerexperience,andcostoptimization, hisworkinAIandmachinelearningispoisedtoredefine howbanks,insurers,andfinancialservicecompaniesdo business.

APioneerinaRapidlyChangingIndustry

Unnikrishnan’srisetoleadershipwasn’taccidental.Over nearlythreedecades,hehasnavigatedtheevolutionof financialservicestechnology,watchingfirsthandas digitalsolutionstransformedfromaluxurytoa necessity AtTCS,Unnikrishnanisresponsibleforthe technologystrategythatpowerstheBFSIsector, particularlyintheAmericas,wherethemarketdemands rapidinnovationandunrelentingfocusonefficiency.

Hehasseenthetrendsshiftfromcorebankingsystems andearlydigitalpaymentsolutionstothesophisticated, data-drivenservicesthatcustomersexpecttoday.Now, AIisthenextfrontier,andUnnikrishnanhastakenit uponhimselftoensurethatTCSnotonlykeepspace withthechangesbutleadsthem.

Hiscoreresponsibilityliesinbuildingrobusttechnology ecosystemsthatharnessthepowerofAIanddata analyticstostreamlinebusinessoperations,enhance customerservice,anddrivegrowth.Yet,thechallenges areimmense.Inanindustrywheretrustisparamount,

introducingnewtechnologiesmustbedonewithprecisionand care.Unnikrishnanunderstandsthis,andhisapproachtoAI adoptionreflectsthecautionandforesightthatdefinehis leadershipstyle.

Theterm“artificialintelligence”maysparkexcitement,but Unnikrishnanviewsitwithapragmaticlens.Infinancial services,heexplains,AIadoptionisnotaboutjumpingonthe bandwagon.It’saboutreal-worldimpact.

Forhim,themaindriversbehindAIintheBFSIsectorare clear:improvingcustomerexperience,drivinginnovation,and optimizingoperationalcosts.Thesearenotjustbuzzwords. Theyarefundamentalneedsofthefinancialinstitutionshe workswithdaily.Unnikrishnanhelpstheseinstitutions embraceAIinawaythataddressestheseneedshead-on.

“AIhasthepotentialtocompletelytransformhowbanksand insurersoperate,”heexplains.Butit’snotjustabout technologyfortechnology’ssake.Unnikrishnanbelievesin thepracticalapplicationofAI,whereitsroleistosolve specificbusinessproblems,makedecisionsfaster,anddrive operationalefficienciesacrosstheboard.Theshift,hesays,is fromtreatingAIasatacticaltoolforspecificusecasesto leveragingitasacoredriverofstrategicdecisions.

However,Unnikrishnanisalsoarealist.Hedoesn’tsugarcoat thedifficultiesthatcomewithAIintegration.Financial institutions,particularlylegacyfirms,oftenfacesignificant hurdleswhenitcomestoadoptingcutting-edgetechnologies. Systemsareoutdated,dataissiloed,andchangecanbeslow. AIpromisesmuch,butwithouttherightinfrastructure,itcan fallflat.

Unnikrishnan’sroleistohelptheseinstitutionsnavigatethese complexities.Hisyearsofexperiencehavetaughthimthe importanceofpatienceandmethodicalplanning.AIisn’ta

plug-and-playsolution.Itrequiresadeep understandingofdata,aclearvisionforitsuse,anda commitmenttolong-termtransformation.

“There’samisconceptionthatAIisamagicalsolution thatwillinstantlysolveallproblems,”Unnikrishnan says.“Butthetruthis,AIisonlyasgoodasthedata andstrategybehindit.”Thisunderstandinghashelped himguideorganizationsthroughtheoften-difficult processofpreparingtheirsystemsforAI.He emphasizestheimportanceofclean,organizeddata, thebackboneofanyAIsolution.Withoutit,AIcan’t providetheinsightsfinancialinstitutionsneedto makebetterdecisionsorimprovecustomerservice.

InhispositionatTCS,Unnikrishnanisnotworking alone.Oneofthemostsignificantmoveshehas spearheadedinrecentyearsisTCS’scollaboration withOpenText,agloballeaderininformation managementsolutions.Together,thesetwogiantsare workingtounlockthefullpotentialofAIintheBFSI sector.

ThepartnershipbetweenTCSandOpenTextisa marriageofdeepindustryexpertiseandcutting-edge technology.OpenTextbringsitsadvancedinformation managementandAIsolutionstothetable,whileTCS offersitsvastknowledgeoffinancialservices,along withadeepunderstandingofhowtheseinstitutions functiononaday-to-daybasis.

Unnikrishnanhaspositionedthiscollaborationasa keyelementinthefutureofBFSIinnovation.The combinationofAIandtraditionalanalyticssolutions willenablefinancialinstitutionstonotonlyimprove theiroperationalefficienciesbutalsodrivebusiness growththroughnewcapabilitieslikecontentmining, summarization,andknowledgemanagement.

Aswithanytransformativetechnology,AIbringsits ownsetofchallenges—particularlyaroundethicsand culturaladoption.Unnikrishnanisacutelyawareof therisksposedbyAI,especiallyinanindustryas sensitiveasfinancialservices.EthicalAIuseisa majorconcern,andUnnikrishnanisattheforefrontof conversationsaroundensuringthatAIapplications adheretostrictethicalstandards.

Heunderstandsthattrustisacurrencyinfinancial services,andmishandlingAIcouldjeopardizethevery foundationsofthattrust.“Wecan’tignoretherisks,” Unnikrishnansays.“Butthatdoesn’tmeanweshyaway frominnovation.Itmeanswehavetobesmarterabout howweimplementAIandmoretransparentabouthow it’sused.”

Culturally,too,theintegrationofAIisnosmallfeat. Manyorganizationsstilloperateonlegacysystemsand processesthathavebeeninplacefordecades.Introducing AIintotheseenvironmentsrequiresmorethanjusta technologicalshift.Itrequiresaculturalone.

Unnikrishnanhasledtheseculturaltransformationswith asteadyhand,advocatingforaslowbutsteady integrationofAIintothecoreofbusinessprocesses.His strategyisclear:focusonsmall,tangiblewinsthat demonstrateAI’svalue,andbuildmomentumfromthere. Bydoingso,hehashelpedBFSIfirmsovercomethe inertiathatoftenholdsbackinnovation.

Lookingahead,UnnikrishnanseesafuturewhereAIis notjustanadd-onbutafundamentalcomponentofthe BFSIindustry.HepredictsthatAIwillplayamajorrole inreimaginingentirevaluechainsandtransforminghow financialinstitutionsoperate.

Unnikrishnan’sleadershipisdrivingthisshift.Hiswork withTCSandOpenTexthaslaidthegroundworkforAI’s mainstreamadoptioninfinancialservices,butheknows thejourneyisfarfromover.Thereismuchworktobe donetoensurethatAIisimplementedresponsibly, ethically,andeffectively

Asmorefinancialinstitutionsbegintoseethevaluethat AIcanbring,Unnikrishnanwillcontinuetobeatthe forefront,guidingtheindustrythroughitsnextphaseof evolution.HisleadershipiscriticalinhelpingtheBFSI sectorembracethefuturewhilemaintainingthetrustand securitythattheindustryrelieson.

InanindustryonthecuspofanAI-drivenrevolution, BabuUnnikrishnan’sroleasatechnologyleaderisclear: he’snotjustnavigatingthefutureoffinancial services—he’sbuildingit.Hisworkisreshapinghowthe BFSIsectorthinksaboutdata,AI,andinnovation, positioningTCSanditsclientsforlong-termsuccessina rapidlychangingworld

WhydoesIBMdividendhistorymattertoinvestors?

Investingindividend-payingstocksisa

powerfulstrategyforbuildinglong-term wealth.And,dividendhistoryoftenprovides invaluableinsightsintothefinancialhealthandfuture prospectsofacompany.Forlong-terminvestors, dividendscanbeareliablesourceofincomeanda keyindicatorofhowacompanyallocatesitsprofits.

Sincetheearly2000s,IBM’sdividendhistoryshows aclearpatternofconsistency,ifnotaggressive growth.Thecompanyhassteadilyincreasedits dividendpayouts,evenduringeconomicdownturns andperiodsofinternalrestructuring.Buthowmuch doyoureallyknowaboutthistechgiant’sdividend history?

Inthisblog,wedugdeepintothenumbersto uncover12surprisingfactsthatmightchangehow youviewIBM’sstock.

1. IBMhasPaidDividendsforOver100Years

IBMdividendhistoryshowsthatthecompanyhas beenpayingdividendsconsistentlysince1916. What’sevenmoreimpressiveisthatIBMhasn’t missedadividendpaymentinover30years,even duringeconomicdownturnssuchasthedot-com crashandthe2008financialcrisis.

IBMDividendOverview

● Ex-DividendDate:08/09/2024

● DividendYield:2.86%

● AnnualDividend:$6.68

● P/ERatio:28.69

2. $6.68AnnualDividendin2024–AThirteenfoldIncrease

In1999,IBMwaspayingshareholdersjust$0.12per shareeachquarter.Fastforwardto2024,andthat figurehasrisento$1.67perquarteror$6.68 annually That’smorethanathirteen-foldincreasein justovertwodecades.Thisupwardtrend demonstratesIBMdividendhistoryasareflectionof itsfinancialstrengthandcommitmenttoreturning capitaltoshareholders,evenasitreinventsits businessmodel.

3. DividendYieldBeatstheS&P500Average

● IBM'sdividendyieldin2024:2.9%(Figure mayvary)

● Averagedividendyield,last5years:4.75%

IBMdividendhistoryalsoindicatesacurrent dividendyieldofaround2.9%,whichishigherthan theS&P500’saverageofabout1.6%basedon recentdata.ThishigheryieldmakesIBMan attractiveoptionforincome-focusedinvestors lookingforreliabledividendsfromablue-chip company

4. HowIBM’sDividendsComparetoIndustry Peers

UnlikeAmazonandGoogle,whichreinvestalltheir profitsintogrowingthebusiness,IBMchoosesto shareitsprofitswithinvestors.ComparedtoApple andMicrosoft,IBMhasalongerhistoryofpaying dividendsandoffersahigherreturn.

Forexample,whileApple’sdividendyieldisabout 0.5%andMicrosoft'sisaround0.9%,IBM’sismuch higherat2.9%.ThismakesIBMauniquechoicefor investorswhowanttoreceivedividendsandinvest inthetechindustry

5. IBM’s~50%PayoutRatioReflectsItsStability

IBMdividendhistoryrevealsthatthecurrentPriceto-Earnings(P/E)ratiostandsat28.66,whichis relativelyhighcomparedtosomeofitspeers.

Regardingthepayoutratio,IBM’scurrentpayout ratiostandsat~50%.Thismeansthecompanyis payingoutabouthalfofitsprofitsasdividendswhile reinvestingtherestbackintothebusiness.

Thislevelisconsideredstable,suggestingIBMis capableofmaintainingitsdividendswithout significantriskofcuts,whilealsoretainingenough earningstoreinvestingrowthandinnovation.

6. DividendGrowthvs.StockPricePerformance

WhileIBMisknownforpayingsteadydividends,its stockhasn’tperformedaswellaspopulartech companieslikeAppleandAmazon.Inthepastfive years,IBM’sstockpricehasremainedrelativelyflat, rangingfrom$115to$150.

However,whenyouconsiderIBMdividendhistory andthedividendpayments,thetotalreturnlooksfar moreattractive.Forincome-focusedinvestors,this hybridofmoderatepriceappreciationandconsistent dividendgrowthrepresentsacompellingvalue proposition.

7. IBM's~5%DividendGrowthRateBeats InflationConsistently

IBMhasconsistentlyincreaseditsdividendoverthe pastdecade,withanaverageannualdividend growthrate(DGR)ofabout5.96%overthelast10 years.Incomparison,theaverageinflationratein theU.S.duringthisperiodhasbeenaround2%to 3%.

Thisgrowthindividendsisapositivesignfor investorslookingtohedgeagainstinflation,asthe consistentincreaseshelpoffsetrisingcostsofgoods andservices.

8. QuarterlyPayoutsMakeIBMaConsistent IncomeGenerator

IBMdividendhistoryrevealsthatIBMpaysits investorsdividendseveryquarter,whichprovides themwithareliablesourceofincome.Thecompany consistentlyincreasesthedividendamountevery May,ensuringasteadyincomestream.Forexample, thequarterlydividendwentupfrom$1.66inMay 2023to$1.67inMay2024,followingitstradition ofraisingdividendsannually.

9. IBM’sLargestDividendHikeinaDecade

In2018,IBMhaditslargestincreaseindividend payoutoverthepasttenyears.Thecompanyraised itsquarterlydividendfrom$1.50to$1.57,which wasalmosta4.7%increase.Thismarkedthe23rd consecutiveyearofIBMincreasingitsdividendand representeda5%riseindividendpayouts.

10. SurvivingMarketDownturnswithout MissingaBeat

Duringthe2008-2009financialcrisis,whilemany companiesslashedorsuspendeddividends,IBM dividendhistoryindicatesthatIBMcontinuedto increaseitsdividend.Forinstance,in2009,IBM raiseditsquarterlydividendfrom$0.50to$0.55.Its

earningspersharegrewfrom$8.93in2008to$10.01 in2009.Evenduringthepandemicin2020,IBM’s quarterlydividendremainedsteadyat$1.63.

IBMhasbeenabletomaintainandgrowitsdividend bymakingstrategicacquisitionsandtransformingits business.Overthelastdecade,thecompanyhas shiftedfromhardwaretocloudcomputing,AI,and quantumcomputing.

Inaddition,the2019acquisitionofRedHat,amajor open-sourcesoftwareprovider,for$34billion,isa primeexampleofthisshift.Despitethese investments,IBMdividendhistoryreflectsthatIBM hascontinuedtoprioritizeitsdividend,demonstrating itscommitmenttoinvestors.

UnderstandingtheimportantdatesforIBMdividend historyiscrucialforinvestors.IBM’sex-dividend dateisusuallysetaboutamonthbeforetheactual paymentdate.In2024,theex-dividenddatewas August9,andthepaymentdatewasSeptember10. InvestorswhoboughtIBMsharesafterAugust9 wouldnotreceivethatquarter’sdividend.Being awareofthesedatesisessentialforallinvestors,asit candirectlyaffecttheirreturns.

IBMdividendhistorysuggeststhatitisnotjusta technologyleaderbutalsoadividendaristocratinthe making.Itsfocusonmaintainingasolidpayouteven inchallengingtimesshowsacompanythatvaluesits shareholders.Ifyou’reseekingastockwithaproven historyofrewardingitsinvestors,IBMdeservesa placeonyourwatchlist.

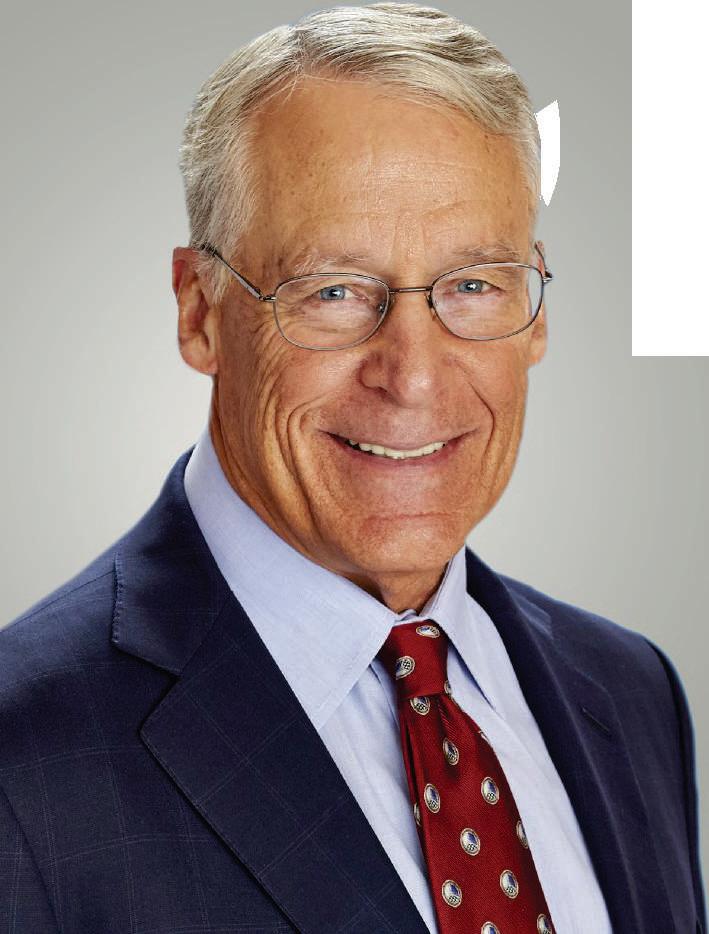

Whenacompanyisdrowningindata,ittakes

aleaderwithclarity,vision,andgrittosteer theshipthrough.MarcRind,theChief TechnologyOfficerofDataatFiserv,isthatman.Inthe fast-pacedworldoffintech,whereeverytransaction leavesadigitalfootprintandeverypieceofinformation holdspotentialinsight,MarchastakenFiserv’smountain ofdataandturneditintooneofthecompany’sgreatest assets.

Thisisthestoryofaleaderwhounderstandsthatdataisn’t justnumbers—it’sthefoundationoffinancialinnovation.

Marc'sjourneyintotheworldoftechnologydidn’tstartin thefinanceworld.Likemanytechleadersofhis generation,hiscareerkickedoffduringtheinternetboom ofthe1990s.FreshoutofEmersonCollegewitha Master’sdegreeinBusinessCommunications,Marcfound himselffascinatednotjustbywhattheinternetcoulddo formarketingorpublicrelations,butbythewaydataand technologywerebeginningtotransformindustries.

Hedidn’tstartoutinfintech.Marcspenttheearlypartof hiscareerworkingwithDotComstartups—atatimewhen everyonewasfiguringouthowtoturnthewebintoa businessplatform.Here,Marclearnedthenutsandbolts ofdata-driveninnovation.Hediscoveredthatthe companieswhowonweretheoneswhoknewhowtouse theirdata,notjustcollectit.

Itwasn’tlongbeforeMarcmovedtoAutomaticData Processing(ADP),oneofthelargestprovidersofhuman resourcesandpayrollsolutions.ThiswaswhereMarc’s talentscameintotheirown.

AtADP,Marcspent16yearsdevelopingoneofthe company’smostvaluableassets:theADPDataCloud.The goalwasn’tsimplytoamassdata,buttomakeitworkfor

ADP’s600,000clients.HRandpayrollsystemsgenerate immenseamountsofdata,andMarc’schallengewastounify itintosomethingcoherentandactionable.

Hedidn’tstopatbuildingaplatform.Marc’svisionextended tohowthedatacouldbeusedtogenerateinsights,driving newproductsandserviceslikeADP’sNationalEmployment Report.Underhisleadership,theADPDataCloudbecamea toolthatnotonlybenefitedthecompany’sclientsbutalsoset anewstandardintheHRindustry

Marcwasn’tjustthinkingabouttechnology.Hewasthinking abouthowtousethattechnologytosolverealbusiness problems.ThisisahallmarkofMarc’sapproachto leadership—technologyisnevertheendgoal;it'sthemeans toabigger,bettersolution.

In2020,MarcmadeaboldmovetoFiserv,oneofthelargest financialservicestechnologycompaniesintheworld.Why wouldaleaderatthetopofhisgameinoneofthemost influentialHRfirmsswitchindustries?Theansweris simple:thechallengeatFiservwasevenbigger

Fiserv’sbusinessspansacrossmorethan1,800financial institutions,providingeverythingfromcoreprocessing systemstopaymentsolutions.Thecompanyisanundisputed giantintheworldoffintech,butitsrealvalueliesinthedata itcollects.

ForMarc,thiswasagoldmine.Fiserv’sdatawasspread acrossvariousbusinessunits—siloedandunderutilized.The opportunitytocreateaunifieddataecosystemwasimmense.

Fiservhadallthedataitneededtodriveinnovation,butit wasn’tconnected.Differentbusinessunitshandledtheirown data,makingithardtoleveragetheinformationforinsights thatcouldbenefitthecompanyasawhole.Marcsawthis fragmentationasanopportunity

WhenhejoinedFiserv,thefirstquestionhewasasked was,“Whattechnologystackshouldwebeusingfordata goingforward?”Itwasn’tjustaboutpickingtheright tools.Marcknewthattherealchallengelayinuniting Fiserv’sdataintoacommonplatformwhilemaintaining theintegrityandownershipofthatdatawithinthevarious businessunits.

Marcwasn’tgoingtoteardownsystemsthatwereworking foreachunit.Instead,hecreatedastrategythatallowed theseunitstokeepcontroloftheirdatawhilecontributing toalargercloud-basedecosystem.Thisfederatedapproach letFiservleverageitsdataacrosstheentireorganization withoutdisruptingwhatwasalreadyworkingatthe individualunitlevel.

MovingacompanylikeFiservtothecloudisnosmall feat.Thesheerscaleoftheoperationisdaunting,andwith databeingoneofthecompany’smostcriticalassets,the risksarehigh.ButMarcthrivesoncomplexity.He understoodthatFiserv’sfuturerestedonitsabilityto managedataefficiently,andthecloudwasthekey.

Fiserv’sdataneedsfluctuatedramatically,particularly whenitcomestocomputeresources.Marcsawthatby movingtothecloud,Fiservcouldnotonlyscaleits operationstohandlethesespikesindemandbutalso managecostsmoreeffectively Theelasticnatureofthe cloudwouldallowFiservtoscaleupwhenneededanddial backwhendemandsubsided.

ButMarcwasn’tjustthinkingaboutthetechnicalside.He knewthatasuccessfulmigrationwouldrequirebuy-in fromacrossthecompany.Differentteamshaddifferent needs,andMarc’sjobwastoensurethateveryone understoodthebenefitsoftheshiftwithoutfeelinglike theywerelosingcontroloftheirdata.

Theresult?AcloudinfrastructurethatallowsFiservto harnessitsdatalikeneverbefore.Thecompanyisnow abletopullinsightsfromacrossitsbusinessunits,driving newinnovationsandgivingitsclientsaccesstoalevelof data-driveninsightthat’sunmatchedintheindustry

TheAchievements:RealResultsforFiserv

UnderMarc’sleadership,Fiservhastransformedits approachtodata.Thecloudmigrationiswellunderway, andthebenefitsarealreadybecomingclear.Fiserv’s

unifieddataplatformisgivingthecompanynew capabilities,allowingittocreateproductsandservicesthat simplyweren’tpossiblebefore.

TheintegrationofdataacrossFiserv’svariousbusiness unitsisdeliveringinsightsthataredrivingbothinnovation andefficiency.Clientsnowhaveaccesstoinsightsthey wouldn’tgetanywhereelse,andFiservisabletorespondto marketchangesfasterthanever.

Butperhapsthemostsignificantachievementisthecultural shiftthatMarchashelpedtofosterwithinthecompany.By focusingoncollaborationandkeepingdataownersinvolved intheprocess,Marchasbuiltasystemthatnotonlyworks butisembracedbytheteamsthatuseit.

Marcisn’tfinished.Thecloudmigrationmaybeunderway, buthe’salreadylookingahead.ForMarc,dataisthe foundationofeverythingFiservdoes,andhe’sconstantly pushingtofindnewwaystoleverageit.Hisvisionisone whereFiservisn’tjustaleaderinfintech,buttheleaderin howfinancialinstitutionsusedatatodrivebusinesssuccess.

Marc’sapproachtoleadershipissimple.Hedoesn’tbelieve intechnologyforitsownsake.Everydecisionhemakesis groundedintheneedsofthebusinessanditsclients.It’sthis focusonpracticalsolutions,combinedwithhisdeep technicalexpertise,thatmakeshimoneofthemost influentialfiguresinfintechtoday.

MarcRindisn’tjustaCTO—he’saproblemsolver.His abilitytotakecomplexdatasystemsandturntheminto actionableinsightshastransformedbothADPandFiserv As thefintechworldcontinuestoevolve,Marc’sleadershipwill becriticalinshapinghowcompaniesusedatatodrive innovation.

Fiserv’sfutureisbright,andwithMarcRindatthehelmof itsdatastrategy,thecompanyispoisedtoleadthenext waveoffinancialtechnology.Marc’sstoryisatestamentto what’spossiblewhenaleadercombinesvision,expertise, andarelentlessfocusonresults.

Didyouknow,thatRobWalton,theeldestsonof WalmartfounderSamWalton,isn’tjustknownfor hisfamilyconnections? Well, he is a billionaire in his own right! Asoneofthewealthiestindividualsinthe world,RobWalton’snetworthhassparkedcuriosityand respectinmanyhearts.

FromtheboardroomofWalmarttothetopofthebillionaire list,RobWalton’sfinancialsuccessisextraordinary However,RobWaltonmightnotbeahouseholdname,but hiswealthcertainlyspeaksvolumes.So,inthisblog,you willlearn,howRobWalton’snetworthreached$93.3 billion.Excited?Let’sgetstarted!

Firstly,let’stalkabouttheearlyyearsofRobWaltonin theWalmart’slegacy

RobWaltonjoinedWalmart’sboardin1978,followinginthe footstepsofhisfather,SamWalton.Hisearlyinvolvement laidthefoundationforhispowerfulimpactonthecompany. Asaboardmember,hecontributedtostrategicdecisionsand witnessedWalmart'sgrowth.

WeallknowthatRobinheritedavaluableretailempirebut, hedidn’trestonhiscrown.HeactivelyshapedWalmart’s direction,ensuringitremainedcompetitiveandinnovative.

Interestingly,RobWaltonwasthelongest-servingdirectorof Walmart.Rob’sassignmentasChairmanfrom1992to2015 markedatransformativeperiodforWalmart.Duringthese years,hechampionedglobalexpansion,highlighting efficiencyandcustomersatisfaction.Therefore,his leadershipsolidifiedWalmart’spositionasaretailgiant.

ButwhatwasRobWalton’scontributiontoWalmart’s legacy?

Eventhough,RobWaltoninheritedtheretailempirefounded byhisfather,SamWalton.Hiscommitmenttothevalues instilledbyhisfathershapedWalmart’scultureandsuccess.

RobWalton’slegacyliesinhisstrategicleadership,global impact,anddeterminedcommitmenttoWalmart’s mission.Hiswealthreflectsinheritanceandpersonal achievement,makinghimanimportantfigureinretail history.

WeallknowthatRobWaltonplayedakeyroleinshaping Walmart’sstrategicvision.Butwhat’sevenmore interestingisthathisleadershipguidedthecompany through,variousphasesofexpansion,highlightingcost efficiency,customersatisfaction,andinnovation.

UnderWalton’sinfluence,Walmartexpandedglobally, establishingastrongpresenceinmultiplecountries.This globalreachgreatlycontributedtothecompany’srevenue growth.

Waltonchampionedinnovativeapproacheswithin Walmart.Whetheritwassupplychainoptimization, technologyadoption,orsustainabilityinitiatives,he encouragedthecompanytostayaheadofthecurve.

Walton’sassignmentaschairmanwitnessedremarkable growth.Underhisleadership,Walmart’sannualrevenue skyrocketedfromnearly$44billionto$482billion.

Indeed,hehadacustomer-centricapproach.He highlightedcustomerexperience,ensuringthatWalmart remainedago-todestinationformillionsofshoppers worldwide.

Also,Walton’sdedicationtotransparencyandshareholder engagementearnedhimrespect.Approximately91%of outstandingshareswererepresentedduringthe2024 AnnualShareholdersMeeting.

Additionally,Walmart’s2024AnnualReporthighlightsits strongfinancialhealth.Thecompany’sfocusondigital innovationsandeCommerceexpansionassures stakeholdersofabrightfuture.

Furthermore,Waltonofficiallyretiredfromthe WalmartBoardofDirectorsinJune2024after morethan40yearsofservice.But,hislegacy survivesasanambitiousforcebehindWalmart’s success.

ButhaveyouwonderedwhatmakesRobWalton massivelywealthy?Well,hisnoteworthy ownershipstakeinWalmart,combinedwiththe company’sexceptionalgrowth,contributesgreatly. Hisnetworthisestimatedtobe$93.3Billion.

Nowletputsomelightonthechallengesfaced duringRobWalton’snetworthjourney

Firstly,RobheadedWalmart’sentryintonumerous newmarkets,adaptingtovariouscultures, consumerbehaviors,andregulatoryenvironments. Theseexpansionsweren’twithoutchallenges,but hisleadershipensuredWalmartsucceededinthese territories.

Additionally,talkingabouttechnological innovationsandkeepingpacewithtechnologywas essential.Robchampionedinnovations,making Walmartatrendsetterinefficiency.

Furthermore,balancingtraditionandmodernization wastrulyatask!HehadtohonorSamWalton’s legacywhilemovingmodernization.However,he managedtodoitwell!

Nowlet’shavealookatRobWalton’swealth accumulation

Asofearly2024,RobWalton’snetworthis estimatedtobe$93.3Billion.Mostofthiswealth comesfromhisWalmartshares.And,hisfinancial understandingandcarefulmanagementcontributed tothisimpressivefigure.

Interestingly,Robdiversifiedbyowningthe DenverBroncos,anNFLteam.Thisshowshislove forsportsandsmartinvestments.OwninganNFL teamisnosmallaccomplishment,anditaddstohis legacy

BeyondWalmart,Rob’sinvestmentsshowhis businesssense.TheBroncos'sownershipdisplays hisabilitytorecognizeprofitableventuresbeyond retail.

Furthermore,underRob’sleadership,Walmart embracedtechnologicalinnovation.Fromefficient supplychainstoe-commerce,heensuredWalmart stayedaheadinthedigitalage.

Robalsotooksustainabilityinitiatives,makingWalmart aleaderineco-friendlypractices.Hiscommitmentto responsiblebusinesssetsanexampleforothers.

BesidesRobWalton’snetworth,let’salsoknowhis generosity

TheWaltonfamily,includingRob,iswidelyknownfor hisphilanthropicefforts.Theircontributionsto education,healthcare,andcommunitydevelopment havealastingimpact.

Accordingly,Rob’sjourneycombinesinheritanceand personalachievement.Hislegacyisshapedbyhis influenceonWalmart’shistoryandhisinspirationfor futureentrepreneurs.Well,RobWalton’snetworthand achievementsinspirebusinessenthusiastsworldwide.

Therefore,RobWalton'sstoryisoneofwealth, influence,andstrategicleadership.Hisimpacton Walmartandbeyondisproofofhisremarkable journey

Asweconcludewerealizethat, “Rob Walton’s net worth is not just a figure, it’s a story of legacy, leadership, and strategic growth.” AsWalmart continuestodominatetheglobalretailmarket, Rob’sfinancialsuccessprovesthepowerofvision andhardwork.

Additionally,thewealthgatheredbyRobWaltonis afascinatingexampleofhowastrongfoundation, coupledwithsmartbusinesssense,canleadto extraordinaryfinancialsuccess.So,ifyouare impressedbyRobWalton’snetworthjourney sharethisblogwithallyourfriendswhoenjoy inspiringstoriesfromtheworld'srichest individuals.

Youdon’tbecomealeaderbysittingback.

Youearnitbydoingthingsdifferently, challengingconvention,andtransforming businessesfromtheinsideout.MatthewParkerJones,SeniorVicePresidentforGlobalTransaction BankingatScotiabank,embodiesthisphilosophy.He doesn’tbelieveinmanagingthestatusquo—hetearsit apart,rebuilds,andscalesitforafuturethat’sfaster, smarter,andbetterequippedforglobalcompetition.

He’snotinterestedinshinyinnovationsthatdon’tstick. HisjobistoreshapehowScotiabankdoesbusinesson agloballevel—solidifyingitsroleasafinancial powerhouseintransactionbanking.Inanindustry wheresubtlechangescanmeanthedifferencebetween winningorlosing,Matthewhaspositionedhimselfasa manofstrategy,precision,andaboveall,results.

Matthewisnotyourtypicalbanker.Hisapproachis pragmatic,strippedofexcessandfiller.Hisexperience atglobalfinancialinstitutionslikeJPMorganCase taughthimthatbankingisn’tjustabouttransactions. It’saboutsolutions—onesthatcanbescaledfor everyone,frommom-and-popstorestomultinational corporations.

WhenhetookoverasSVPatScotiabank’sGlobal TransactionBankingdivision,hewasn’tcontentwith simplyrunningthedepartment.Hewastaskedwith transformingit.Thiswasn'tjustatitlepromotion;it wasacalltoinnovate.Andthat’sexactlywhathe's doing.

“IcametoScotiabankwithonemission:topush boundaries.Transactionbankingisn’taboutroutine

work;it’saboutbuildingplatformsthatallowour clientstotransactsmarter,faster,andwithfewer barriers,”saysMatthew.

He’sdoingwhateverygreatleaderdoes—looking beyondthehorizon.Globaltransactionbankingmight soundmundane,butunderMatthew’sleadership,it’s anythingbut.He’stakingthebank’stransaction servicesintothefuturewithastraightforwardplan rootedincustomerneeds,operationalefficiency,and relentlessinnovation.

Peopledon’tusuallythinkoftransactionbankingasan excitingfield.It’softenconsideredaback-office function,thekindofthingthatonlytechteamsworry about.ButtoMatthew,it'sthefoundationonwhich modernbankingisbuilt.

“Paymentsarepersonal,”hesays.“Peoplethinkabout theirbusiness’scashfloweveryday Whetherit’sthe ownerofalocalbakeryortheCFOofamultinational corporation,paymentsmatterbecausethey’rethe heartbeatofeveryoperation.”

ForMatthew,understandingpaymentsis understandinghowbusinessesrun.It’sthecenterof commerce.AtScotiabank,he’sbeenlaser-focusedon makingpaymentsandtransactionbankingassmooth andsecureaspossibleforclientsacrossmorethan25 countries.Eachmarket,heemphasizes,hasitsown challenges,butit’sthiscomplexitythatexciteshim.

Hisstrategy?Knowyourclients.Knowtheir challenges.Thencreatesolutionsthatsimplifytheir world.

Scotiabank,headquarteredinCanada,servesbusinesses inover25markets.That’snotjustanumber—it’san opportunity Thisglobalreachmeansthebankneedsto thinkandoperateonalevelfewotherscanmatch. Matthewunderstandsthat,andheleverages Scotiabank’sinternationalpresencetocrafttailor-made solutionsforeachregion.

“Ifyou’reabusinessinCanada,youmightnothavethe sameneedsasacorporationinPeruortheCaribbean,” Matthewpointsout.“Ourjobistomakesureevery business—regardlessoflocation—getsasolutionthat fitstheirmarketandtheirspecificrequirements.”

Thislocalizedstrategyiskey.Matthewisn’tinthe businessofofferingone-size-fits-allsolutions.He’s leadinghisteamstodevelopproductsthatfitregional differenceswhilemaintainingthecoreprinciplesof speed,efficiency,andreliability

Andit’spayingoff.Underhisleadership,Scotiabank’s GlobalTransactionBankingdivisionhasgaineda reputationfordeliveringmarket-leadingsolutions. Whetherit’shelpingastartupwithcashflow managementoramultinationalstreamlineitssupply chainfinancing,Matthew’steamisthere,offeringasuite ofservicesthat'sasrobustasitisflexible.

Matthew’smantraissimple:Ifitdoesn’tevolve,itdies. Transactionbankingcannolongerrelyonlegacy systems.Thedigitalerademandsinnovation,andthat's whereMatthewseesthefuture.

“We’renotjustabank;we’reaplatformforbusinesses togrowon,”saysMatthew.“Ourclientsneedtoknow thattheirfinancialtransactionswillbehandledwith speedandsecurity.Buttheyalsoneedtoknowthat we’refuture-proofingtheiroperationsthrough technology.”

Tomakethishappen,Matthewhasdoubleddownon fintechpartnershipsandinternaldigitaldevelopment. HisgoalistoensureScotiabank’splatformsdon’tjust meettoday’sneedsbutanticipatetomorrow’s challenges.Whetherit’sblockchain,artificial intelligence,orfasterpaymentsystems,hisvisionfor thebankisfirmlyrootedindigitaltransformation.

Matthewdoesn’tbelieveinworkinginsilos. Collaboration,bothinternallyandexternally,iscrucial tohisapproach.Herecognizesthatinaglobal organizationlikeScotiabank,teamsmustworkacross departmentsandevenacrossborderstoensurethe bankdeliversthebestproductsandservices.

Oneofhiskeystrategieshasbeenbuildingstrong partnershipswithfintechcompanies.Insteadofseeing fintechasathreat,Matthewviewsthesefirmsas essentialcollaboratorsinScotiabank’smissionto innovate.

“We’repartneringwithsomeofthemostforwardthinkingfintechsoutthere,”hesays.“It’snotjust aboutkeepingupwithchange—it’saboutleadingit.”

ThesepartnershipshaveallowedScotiabankto integratenewtechnologiesfaster,streamline operations,andofferenhancedservicestoitsclients. It’sastrategythatputsScotiabankaheadofthecurve inanindustrythat'sevolvingatbreakneckspeed.

Despitethesuccesses,Matthewiswellawareofthe challengesthatlieahead.Globaltransactionbanking issubjecttoconstantregulatorychanges, technologicaldisruptions,andevolvingclient expectations.Thecompetitionisfierce,andthepace ofinnovationisunrelenting. ButifMatthewisfeelingthepressure,hedoesn’t showit.

“Challengesaren’tsomethingtobeafraidof,”hesays. “They’reopportunitiestobebetter.Ifyou’renot improving,you’refallingbehind.”

OneofthekeyhurdlesMatthewfacesisnavigating thedifferentregulatoryenvironmentsacross Scotiabank’s25+markets.Eachcountryhasitsown setofrules,andcomplianceiscritical.Butratherthan seethisasaburden,Matthewviewsitasanother puzzletosolve.

“We’vegotagreatteamthatunderstandslocal markets,”hesays.“Ourjobistomakesurewe’re alwaysaheadoftheregulatorycurvewhilestill deliveringthebestpossibleservicetoourclients.”

ForMatthew,successisn’tmeasuredbyflashy innovationsorindustrybuzz.It’smeasuredbyresults. SincetakingontheroleofSVP,he’sdriventangible improvementsinhowScotiabank’stransaction bankingdivisionoperates.Fromcuttingtransaction timestoimprovingsecurityprotocols,hisfocushas alwaysbeenondeliveringrealvaluetoclients.

“We’renotheretomakepromises,”hesays.“We’re heretodeliver.Whenabusinessworkswith Scotiabank,theyneedtoknowthatwe’renotjusta vendor—we’reapartnerintheirsuccess.”

Thisno-nonsenseapproachiswhatsetsMatthewapart asaleader.He’snotinterestedinhype;he’sinterested inresults.Hisleadershiphasalreadymadea significantimpactatScotiabank,andashecontinues topushforinnovation,there’snodoubtthathis influencewillonlygrow.

MatthewParker-Joneshassetanewstandardfor leadershipinglobaltransactionbanking.He’snotjust leadingScotiabank’sGlobalTransactionBanking division—he’stransformingit.Withafocusondigital innovation,client-centricsolutions,andoperational excellence,MatthewispositioningScotiabanktothrive inarapidlychangingfinanciallandscape.

ForMatthew,leadershipisaboutmorethanjust managingateam.It’saboutpushingboundaries,driving results,andconstantlylookingforwaystoimprove.In anindustrywherechangeistheonlyconstant,Matthew Parker-Jonesstandsoutasaleaderwhoisn’tjustkeeping upwiththefuture—he’sbuildingit.

Whenitcomestotheaccounting world,notallfirmsarecreated equal.Somestandoutnotjustfor theirsizebutfortheirinnovation,leadership, andglobalreach.Asweheadinto2025,these10 topaccountingfirmsareleadingthe charge—settingstandardsintechnology, sustainability,andmarketinfluence.Thislistof thetop10CPAfirmsintheU.S.willshowyou who’sontopandwhy.Ifyou’reinterestedinthe bestandbrightestinaccounting,keep reading—thesefirmsarechangingthegame.

The10topaccountingfirmsareasfollows

1.DeloitteLLP

● NetRevenue:US$64.9billion(FY2023)

● HQ:NewYork,USA.

● TopExecutive:JoeUcuzoglu(Global CEO)

● Servingacross:150+countries

● WorkforceExpansion:457,000

DeloittehasestablishedtheDeloitteCenterfor SustainableProgresstodevelopitssustainability initiatives.Thiscenterisfocusedondeveloping research,solutions,andthoughtleadershipthat effectivelyaddressclimateandsustainability challengestoo.

Moreover,Deloittehasbeenrecognizedasa Leaderinthe“IDCMarketScape:Microsoft ImplementationServicesWorldwide2024

VendorAssessment.”Thisdistinction highlightsDeloitte’sexpertiseinleveraging amultidisciplinaryapproachtomeetclient needsandadapttomarketdisruptionstoo.

2.PricewaterhouseCoopers(PwC)

● NetRevenue:US$53.1billion (FY2023)

● HQ:London,UnitedKingdom.

● TopExecutive:RobertMoritz (Global Chairman)

● Servingacross:152countries

● WorkforceExpansion:364,000

PwChasmadeseveralsignificantleadership appointmentsrecently.JenniferMantiniwill leadthePhiladelphiaofficestartingJuly1, 2024,andSaraGrootwassinkLewishas beenappointedboardobserver,effective July1.

Moreover,MohamedKandehasbeen selectedasthenextglobalchairofPwC.So, thishighlightsashiftinleadershipdynamics withintheorganization.

Forinstance,PwCUShasannounceda strategicinvestmentof$1billionoverthe nextthreeyearstoenhanceitsgenerativeAI capabilities.Thisindicatesinvestment underscoresthefirm’scommitmentto leveragingadvancedtechnologiesinits serviceofferings.

3.Ernst&YoungLLP

● NetRevenue:$49.4billion(FY2023)

● HQ:London,UnitedKingdom.

● TopExecutive:CarmineDiSibio (GlobalChairmanandCEO)

● Servingacross:150+countries

● WorkforceExpansion: 395,442

Ernst&YoungLLP(EYUS)recently announcedplanstoinvest$1billionoverthe nextthreeyearstoenhanceopportunitiesfor early-careeraccountingprofessionals.Thus, thisinvestmentisaimedatimprovingthe attractivenessofthetopaccountingfirms throughincreasedcompensation.Also,it enhancedwell-beingbenefitsforemployees.

Additionally,EY’srecentreportsindicatethat technologicaladvancements,particularly artificialintelligence,arecrucialinachieving net-zerotargetsinthepost-COVID-19 landscape.ThisreflectsEY’scommitmentto leveraginginnovativetechnologyfor sustainabledevelopmentsolutions.

● NetRevenue:$36.4billion(FY2023)

● Headquarters:Amstelveen, Netherlands.

● TopExecutive:BillThomas(Global ChairmanandCEO)

● Servingacross:143countries

● WorkforceExpansion:270,000

KPMGLLPhasrecentlymadeheadlinesby launchingitsfirst-everdynamicAudit QualityReport.Therefore,thismodernizes itsapproachtoauditingbyincludingadata dashboardthatwillbeupdatedfrequently. However,thisdemonstratesthededicationof leadingaccountingfirmstomaintainingaudit quality

Notably,inJuly2024,KPMGannouncedthe integrationofgenerativeAIintoKPMG Clara.However,itsglobalsmartaudit platformindicatesthatthetopaccounting firmsfocusonenhancingauditefficiencyand effectivenessthroughadvancedtechnology

● NetRevenue:$14billion(FY2023)

● HQ:Chicago,Illinois

● TopExecutive:WayneBerson(CEO)

● Servingacross:166countries

● WorkforceExpansion:115600

MarkEllenbogenwasrecentlychosenasthenew ChiefOperatingExecutive.Thatmeanshewill overseeinitiativestoenhanceauditpracticesand technologyandimplementthefirm’sEmployee StockOwnershipPlan(ESOP).Furthermore,Natalie KotlyarhasbeennamedthechairofBDOUSA's boardofdirectors,effectiveJuly1,2024.

Recently,BDOUSAhaslaunchedanEmployee StockOwnershipPlanthataimstoprovidebroad employeeownership.Also,itencouragesacultureof sharedinvestmentinthefutureofoneofthetop accountingfirms.Therefore,thismoveispartof BDO’sstrategytoaddresstalentshortageswithinthe industry.

● NetRevenue:$3.7billion(FY2023)

● HQ:Chicago,Illinois,U.S

● TopExecutive:BrianBecker(CEO)

● Servingacross:TheUnitedStatesandCanada

● WorkforceExpansion:16800

RSMUS,LLPwasrecentlyRankedNo.6on ModernHealthcare’s2023LargestHealthcareIT ConsultingFirmslist,reflectingitsgrowinginfluence andexpertiseinhealthcaretechnologyconsulting.

Possibly,RSMhasafocusonservingthemiddle market,leveragingitspositionasaleadingU.S. providerofassurance,tax,andconsultingservices tailoredtothissegment.Hence,thiscommitmentis evidentinitsfocusonunderstandingclients’unique challengesandprovidingsolutionsintheirbusiness.

● NetRevenue:US$2.4billion(2023)

● HQ:Chicago,Illinois,U.S.

● TopExecutive:SethSiegel(CEO)

● Servingacross:140countries

● WorkforceExpansion:56000

GrantThorntonUShaspromotedalotof professionals,announcing87newpartners, principals,andmanagingdirectorsacross variousservicelines.Additionally,thefirmhas recentlyappointednewleadersforspecific practices.

Besidesthat,thisisoneofthetopaccounting firmswhichrecentlyannouncedthelayoffof 350employees.So,itrepresentsabout3.5%of itsUSworkforce.Thisisduetoevolving demandsinafewbusinesssegments.Finally, thisreductionbringsthetotallayoffsin2023 toapproximately850.

8.ForvisMazarsLLP

● NetRevenue:US$2billion(2023)

● HQ:Springfield,Missouri

● TopExecutive:TomWatson

● Servingacross:100+countries

● WorkforceExpansion:7000

TheformationoftheForvisMazarsglobal networkmarkedasignificantdevelopmentin theprofessionalservicesindustry.Itcombines Mazars,aninternationalpartnershipoperating inover100countries,withFORVIS,oneof thetopaccountingfirmsintheUnitedStates.

Inadditiontothat,ForvisMazarshasfocused itscommitmentondeliveringanunmatched clientexperience.Interestingly,thefirmaims tolistenactivelytoclients’needsandadapt.It offersconsistent,high-qualityservices worldwide.Lately,leadersfromtop accountingfirmshavereaffirmedtheir commitmenttoprovidingappropriatesolutions toaddressthechallengesclientsfacein differentindustries.

9.CLA(CliftonLarsonAllen)

● NetRevenue:US$2billion(2023)

● HQ:US

● TopExecutive:JenLeary(CEO)

● Servingacross:130countries

● WorkforceExpansion:9000

CLAhasrecentlyexpandeditsportfolioby announcingtheacquisitionofRonaldBlue&

Co.CPAs,effectiveMay1,2024.Additionally, thiscompanyoffersover45yearsofexperience inaccounting,auditing,andtaxservices.Its teamaimstoenhancetheresourcesand solutionsavailabletoclientswithintheCLA framework.

Furthermore,thefirmhasmadesignificant stridesinitsorganizationalstructure,recently celebratingtheadvancementofover700 professionalsacrossvariousroles.Hence,this growthreflectsCLA’scommitmenttoinvesting initstalent.Thisshowshowleadershipskills arebuiltinclientservice.

● NetRevenue:US$1.6billion(2023)

● HQ:MichiganAve,Chicago,IL

● TopExecutive:JeffFerro(CEO)

● Servingacross:141countries

● WorkforceExpansion:43000

BakerTillyhasmadeheadlineswithsignificant developments,includingastrategicinvestment fromprivateequityfirmsHellman&Friedman andValeasCapitalPartners.Hence,this investmentwasvaluedatapproximately$1 billion.

Finally,itwillenableBakerTillytobuyout retirementobligationsandimprovecapitalfor itspartners,positioningthefirmtobetter competeinthemid-marketadvisoryspace. Additionally,BakerTillyreportedarecord revenueachievement,surpassing$5billion globally,markingasignificantmilestoneforthe firm.

Intheend,wehopeyounowknowthatthetop accountingfirmsintheU.S.aremorethanjust industryleaders.So,theyareleadersin innovation,technology,andsustainability.So, whichfirm’sstrategyimpressedyouthemost? Ifyou’reeagertostayaheadofoneofthe10top accountingfirmsintheworld,keepexploring, keepquestioning,andmostlytakeaction,and followourbelowhandlesformoresuch interestingcontent.

President of Product and COO

Whenconsideringaleaderwhoissubtly changingthelandscapeoffintech,onename standsout:PremaVaradhan Althoughshe doesn’tseekthespotlight,herimpactontheindustryis undeniable.AsthePresidentofProductandCOOof Temenos,Premahasdedicatedyearstoshapinga companythatiscontinuouslyredefiningthefutureof banking.However,herstoryextendsbeyondtitlesand products;itembodiesarelentlesspursuitofimprovement inanindustrythatrequiresconstantinnovation.

Premaisactivelyinvolvedinshapingthefutureoffintech. Everyday,sheasks,“Howcanwemakebankingbetter, faster,andsimplerforourcustomers?”Thisfocusguides herleadershipoftheProductandTechnologyteamsat Temenos.WhatsetsPremaapartisthatshedoesn’t prioritizetechnologyforitsownsake.Instead,sheis deeplyinvestedinunderstandingthechallengesbanks facetodayandfindingeffectivesolutions.

InanindustrywherebuzzwordslikeAIandblockchain arecommon,Prema’sapproachisstraightforwardand practical.Sheisdedicatedtomeetingbanks’needs, whetherthatmeansimprovingefficiency,boosting customersatisfaction,orcreatinginnovativebanking solutions.Sheseesthebigpictureandfocusesonwhat mattersmost.

Premaearnedherleadershiprolethroughhardwork.She startedatTemenosasayoungsoftwareengineerandwas oneofthefirstdevelopersinTemenosIndia.Withouta bankingbackground,shefeltlikeanoutsiderinthe financeworld.However,thisessentiallyhelpedher.Prema viewedbankingwithfresheyesandlearnedasmuchas shecould.Shewantedtounderstandnotjusthowtowrite code,buthowthatcodecouldimprovebanking operations.

Hercuriosityanddeterminationquicklyledtosuccess.Injust afewyears,PremabecameatrustedvoiceatTemenos, especiallyinaddressingcustomerconcerns.Shefocusedon achievingresultsinsteadofbeingtheloudestpersoninthe room.Inbusiness,resultsmattermorethananythingelse.

DoyouwanttoknowwhyPremaisdifferent?It’sallabout herapproachtoproductdevelopment.Forher,it’snever aboutlaunchingflashynewfeaturesorfollowingtrends;it’s aboutaddressingrealproblemsforrealcustomers.Every productthatTemenosdeliversunderherleadershipis designedtomakelifeeasierforbanksand,byextension,their customers.

TakeTemenosPositions,forexample.Thisproductwasn’t createdsimplybecauseitwastrendy;itwasdevelopedin responsetobanksstrugglingwithoutdatedback-endsystems thatslowedthemdown.Premarecognizedthefrustrations banksfacedwhiletryingtomodernizetheirITinfrastructure withoutacompleteoverhaul.Shespearheadedthe developmentofTemenosPositions,providingasolutionthat enablesbankstograduallyupdatetheirsystemswithout disruptingtheiroperations.It’spractical,effective,andworks.

Premaisnotonlyredefininghowbanksoperatetoday;sheis alsofocusedonthefuture.AsastrongadvocateforSoftwareas-a-Service(SaaS)banking,sheviewsitnotasamagic bulletbutasavaluabletoolforbanks.SaaShelpsthem reducecosts,streamlineoperations,andconcentrateonwhat theydobest:servingtheircustomers.

So,whatdoesSaaSoffertobanks?Italleviatestheburdensof managingtechnologyinfrastructure.Banksnolongerhaveto worryaboutservermaintenanceorhardwareupgrades;that responsibilityfallstoTemenos.UnderPrema’sleadership, Temenoshandlestheheavylifting,enablingbankstofocuson innovation.

Furthermore,SaaSnotonlysavesbanksmoneybutalso increasestheirspeed.WithSaaS,bankscanlaunchnew servicesmuchfasterthanbefore.Thisagilityprovidesa substantialcompetitiveadvantage,allowingbanksto respondswiftlyandeffectivelytomarketchanges.Prema hasbeenvitalinensuringthatTemenosremainsatthe forefront,alwaysreadytoprovidethelatestandmost effectivesolutionstoitsclients.

Premaismakingasignificantinvestmentincloud technology,andsheisn’taloneinthisendeavor.Banks worldwidearebeginningtorecognizethatpubliccloud solutionsprovideunmatchedspeed,security,and scalability.Underherleadership,Temenoshasbeenatthe forefrontofthistransformation.However,Prema’s approachisnotmerelyaboutfollowingtrends;sheislaserfocusedonwhattrulybenefitscustomersincloudbanking.

Temenoshasmadesubstantialinvestmentsincloud-native technologies,andforgoodreason.Premaviewsthecloud asthefutureofbankingandisdedicatedtopositioning Temenosasaleaderinthatfuture.Banksthattransitionto thecloudcanquicklyscaletheiroperations,adaptto evolvingcustomerdemands,andlaunchnewproducts morerapidlythaneverbefore.

WhatdistinguishesPrema’sapproachisherdeep understandingofthesecurityconcernsassociatedwith cloudadoption.Sherecognizesthatbanksmusthave confidenceinthesecurityoftheirdata.Toaddressthis, Temenoshaspartneredwithtop-tiercloudproviders, ensuringthatitscustomersbenefitfromthebestsecurity measuresavailable.UnderPrema’sleadership,Temenosis demonstratingthatthecloudisnotjustaviableoption;itis theoptimalchoiceforbanksaimingtothriveinadigitalfirstworld.

Let’sdiscussartificialintelligence(AI).Premadoesn’t viewAIasjustabuzzword;sheseesitasatransformative technologythatcanrevolutionizehowbanksoperate. However,sheapproachesitwithcaution.Bankscannot affordtoadoptAIcarelessly;theymustensurethatits implementationisresponsible.

That’swhyTemenos,underPrema’sleadership,has investedmillionsinAIresearchanddevelopment.She prioritizescreatingAIsolutionsthatarenotonlycutting-

edgebutalsosafeandreliable.Thegoalis straightforward:touseAItoenhanceefficiencyand customerexperiencewithoutcompromisingsecurityor trust.

BanksutilizingTemenos’AIsolutionscanautomate processes,uncovernewinsights,andprovideimproved customerservice.Theyachievethisinacontrolledand securemanner,thankstoPrema’scarefulguidance.Sheis notfocusedonhype;sheisfocusedonachievingresults.

UnderPrema’sleadership,Temenosisnotonlyfocused onfinancialreturnsbutisalsoaleaderinsustainability. Cloudbankingnotonlylowerscostsbutalsoreducesa bank'scarbonfootprint.Movingoperationstothecloud candecreaseenergyusagebyupto95%comparedto traditionalon-premisesystems.Thisisbeneficialnotjust forbusinessbutalsofortheplanet.

Premarecognizesthatbankstodayfaceincreasing pressuretocomplywithclimateregulations.Temenosis supportingtheminthiseffortbyprovidingmoreenergyefficientcloudsolutions.Thiscommitmentisnotjusttalk; Temenoshassuccessfullyreducedthecarbonimpactof itssoftwarebyover50%since2021.Thisisthekindof leadershipthattrulymakesadifference.

Attheendoftheday,PremaVaradhan’sstoryextends beyondfintech;it’sfundamentallyaboutleadership.She hasdemonstratedthatyoudon’tneedtoshouttobeheard orfollowtrendstoachievesuccess.Whattrulymattersis focusingonsolvingrealproblems,deliveringtangible results,andstayingaheadofthecurve.

Premaisnotinterestedinfameoraccolades;herpriority isensuringthatTemenosremainsaleaderincloud banking,SaaS,andAI.Sheaimstocreateproductsthat areeffectiveinsolvingproblemsandhelpingbanksthrive inanever-changingworld.

Heruniqueabilitytocombineaclearvisionforthefuture witharelentlessfocusonexecutionmakesheroneofthe mostsignificantleadersinfintechtoday.AlthoughPrema Varadhanmaynotbeahouseholdname,sheis undeniablyaforcetobereckonedwithinthebanking sector

w w w . m i r r o r r e v i e w . c o m