MAKING MINING SAFE R WITH EMERGENCY RESPONSE TRAINING

MADELEINE KING: AUST R ALIA’S NEW C R ITICAL MINE R ALS ST � ATEGY

DEEP SEA MINING MA K ING WAVES

MAKING MINING SAFE R WITH EMERGENCY RESPONSE TRAINING

MADELEINE KING: AUST R ALIA’S NEW C R ITICAL MINE R ALS ST � ATEGY

DEEP SEA MINING MA K ING WAVES

Aid in fire prevention and supression and limit costly stoppages caused by dangerous hot tyre events with on-site nitrogen.

Extended range of nitrogen generators including:

• Flow from <1 Nm3/hr to over 3000 Nm3/hr

• Purity from 95% to 99.9999%

• Offered in PSA and membrane

Available in fixed and portable installations

CALL 1800 800 878 OR VISIT CAPS.COM.AU

The Spring issue of Mining Magazine accompanies the beginning of a new financial year and, with a large number of organisations across the industry reporting strong results from the previous financial year, many are looking towards how the industry will continue to evolve and innovate in the future.

The buzz around critical minerals has heightened over the last few months, spurred along by the recent announcement of a new Critical Minerals Strategy. In addition to this, the Federal Government announcing its intention to update Australia’s Critical Minerals List has helped cement critical minerals at the forefront of the industry’s focus.

In this issue, we spoke to Federal Minister for Resources, Madeleine King, about all things critical minerals, including current exploration initiatives and Australia’s role in building secure supply chains.

As the frost of winter slowly gives way to the green of spring, so too, does the industry turn towards greener solutions to continue driving progress forward. This feature explores Curtin University’s work on accelerating the natural mineral carbonation process and drafting a decarbonisation roadmap for Western Australia.

Concurrent with the evolution of mining processes is the advancement of mine safety protocols and training. In this issue we discuss the mine safety competitions that are simulating real-life emergencies to train the next generation of safety response teams.

This issue also features a strong focus on something that is close to my heart – women in the mining industry. Recent data is showing a steady increase in women in the resources industry and in compiling this issue I had the opportunity to hear from a number of these experts. From research to leadership, I am proud to share the stories of the women who are making their mark in the resources industry.

As always, I am open to new things so if there’s a topic, project, technology or challenge you’d like to read in future editions, I’d love to hear from you. Please feel free to flick me an email.

Rebecca Todesco Editor

22

Critical minerals is the buzzword on the lips of the mining industry, with a multitude of state and federal funding and initiatives underway to further drive Australia’s critical minerals strategy. Federal Minister for Resources, Madeleine King, spoke to Mining Magazine Editor, Rebecca Todesco, to discuss the recently released Critical Minerals Strategy, and provide a snapshot on how the industry is shaping up in Australia.

A LEAP OF FAITH: THE JOURNEY FROM PERFORMING ARTS TO STEM

10

Following her graduation from the University of Newcastle, Kelsie Clarke threw herself into the deep end, packing up her life in New South Wales and moving across the country to take a job in Western Australia. Kelsie sat down to chat with us about how that decision led her to a role in leadership, a visit to Antarctica and being awarded the 2023 Chamber of Minerals and Energy’s (CME) Outstanding Young Woman in Resources Award.

16

Making dreams a reality takes work; something that CSIRO’s Dr Suneeti Purohit knows more than most. Here, Dr Purohit shares the barriers she overcame as she followed her ambitions halfway around the world to where she is now – working for Australia’s national science organisation and the winner of the 2023 Exceptional Woman in Victorian Resources award.

BHP has awarded an $8 million contract to an Indigenous Australianowned car hire company that will offer its employees an alternative for short or long-term vehicle hire across its Western Australian and South Australian operations.

Cedrent Enterprises has been awarded the three-year contract, and will provide light vehicle hire services for BHP employees at Olympic Dam in South Australia, and across the company’s Newman and Port Hedland operations in the Pilbara.

Cedrent General Manager, Dan Walmsley, said the contract was a significant milestone for the company.

“This collaboration with BHP not only underscores our shared commitment to social responsibility and sustainable development but also fuels our

efforts to create opportunities within the First Nations business sector,” Mr Walmsley said.

“We’re also proud to be providing a portion of our profits to Far West Coast Aboriginal Corporation in South Australia, or Yindjibarndi Aboriginal Corporation in Western Australia, which are both devoted to giving back to their communities through programs that upskill youth, support local businesses, and create a growing demand for Indigenous goods and services.”

BHP Head of Global Indigenous Procurement, Chris Cowan, said BHP is committed to doing more to build sustainable, profitable and enduring partnerships with Traditional Owner and Indigenous businesses across its operations.

“By selecting Cedrent’s services when hiring vehicles for work, our people will be supporting a business

Acontractor employee at Mineral Resources’ (MinRes) Onslow Iron project has died in a fatal incident on site.

The incident occurred at the Ken’s Bore site at approximately 4pm on 12 June 2023.

The victim was identified as father of two, Kieren McDowall.

Mr McDowall was a contractor for AAA Asphalt Surfaces at the time of his death. The company’s Managing Director, Frank Italiano, spoke to the ABC about the “profound sadness” he felt at losing his colleague.

“I extend my deepest condolences to Kieren's family and friends; in particular his partner Bella, their two young children, his parents Kylie and Craig, brothers Matthew, Jayden and Hamish and extended family," Mr Italiano said.

Following the incident, the Department of Mines, Industry Regulation and Safety (DMIRS) and Western Australian Police were notified and made their way to the site.

MinRes’s Employee Assistance Program service provider and senior leadership from the company were mobilised to site.

that creates opportunities for First Nations people, prioritising Indigenous community engagement, job creation and procurement,” Mr Cowan said.

“It’s the first time an Indigenous-owned business has been awarded a contract of this type with BHP, and we look forward to working together to help empower more Indigenous businesses and communities across Australia.”

In June 2023, BHP released its sixth Reconciliation Action Plan, which includes a target of achieving $1.5 billion of spending for procurement from Aboriginal and Torres Strait Islander and Traditional Owner businesses across all Australian assets by 30 June 2027. Up to May 2023, BHP shared partnerships with 192 Indigenous businesses around the country, including 89 Traditional Owner businesses.

MinRes Managing Director, Chris Ellison, expressed the company’s heartfelt condolences to the deceased’s family, friends and colleagues.

“We are shocked and deeply saddened by this tragedy. Our thoughts are with the family, friends and the whole Onslow Iron team, and our focus is on supporting them during this difficult time,” Mr Ellison said.

Site operations were temporarily suspended following the incident.

The Mining Journal Intelligence’s (MJI) Project Pipeline Handbook 2023 has announced the top-ranking mining project in all of Australia.

Achieving a score of 89 out of 100, Liontown Resources’ Kathleen Valley Lithium Project was named as the top project in the country and also ranked second in the world, only one point behind the Eskay Creek gold project in Canada, which scored 90.

The Project Pipeline Handbook 2023 assessed a selection of the 50 most promising mining projects worldwide, utilising an objective scoring methodology developed by MJI.

The method involves the collection of 25 key data points from economic studies, ranging from the early scoping stages to the comprehensive feasibility assessments. These data

points are then inputted into a system that calculates a score out of 100. The Handbook assesses projects across 13 metrics, covering six key categories: Economics, Jurisdiction, Confidence, Financeability, Engineering/Metallurgy, and Geology.

The Kathleen Valley Lithium Project received a perfect score out of ten in the Economics and Financeability category, and a score of 9.3 in the Confidence category, based on the project’s Definitive Feasibility Study conducted in 2021.

On track to commence production in mid-2024, the Kathleen Valley Lithium Project is expected to supply approximately 500,000t of six per cent lithium oxide concentrate per annum. Lithium demand is projected to surge in the coming years due to its vital role in the rapidly expanding electric vehicle market.

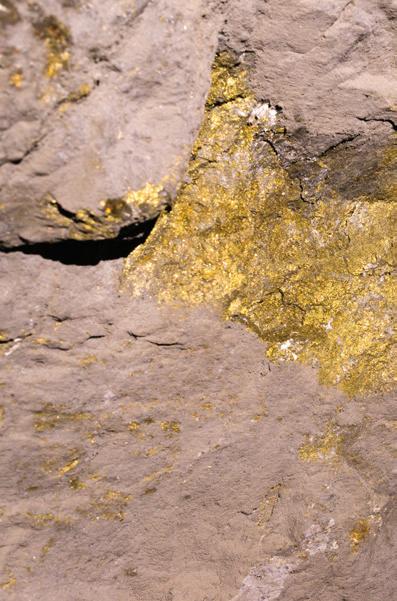

The Northern Territory Government has brought the Mt Bundy Gold Project one step closer with environmental approvals granted for the Rustlers Roost and Quest 29 open-cut mine redevelopment.

This major milestone is a crucial part of the Mt Bundy Gold Project approval process.

Granted Major Project Status in 2022, the Mt Bundy Gold Project proposes to restart three mines approximately 100km south-east of Darwin on the Arnhem Highway.

Proponents, Primary Gold, plan to recommence open cut gold mining in Rustlers Roost and Quest 29, with expansion of all existing open cut pits and the development of two additional new pits.

The third mine, Tom’s Gully, an underground mine, was granted environmental approval in 2020.

Since 2018, the gold ore reserve has increased from one million ounces to three million ounces of gold through exploration and mining studies.

Early construction has begun, with the completion of a new bridge and the commencement of geotechnical drilling.

The company is advancing the Definitive Feasibility Study with Mintrex Engineering, with further construction to take place following its completion over 2023 and 2024.

Once operations commence, the Mt Bundy Gold Project is expected to create 300 full time jobs for ten years.

It is estimated the $412 million project will produce in excess of 135,000oz of gold, on average, each year.

Northern Territory Minister for Mining and Industry, Nicole Manison, said the Mt Bundy Gold Project is great news for local jobs and mining near Darwin, creating hundreds of well-paying jobs for the next decade.

“Gold is needed not just for jewellery and investments, but for the creation of electronics, high tech health care and aerospace, and the Northern Territory has the supply the world needs,” Ms Manison said.

“The Territory Government is delivering more mining projects, strengthening the economy and doing so in an environmentally responsible manner.”

The Federal Government has released the new Critical Minerals Strategy 2023-2030, which sets out a plan to capitalise on Australia’s critical minerals to create more resources jobs and support local and global efforts to achieve net zero emissions.

Federal Minister for Resources and Northern Australia, Madeleine King, has released the new strategy in a bid to make Australia a globally significant producer of raw and processed critical minerals and boost economic opportunities for all Australians, including First Nations people and regional communities.

As one of the first policy decisions under the strategy, the government will target $500 million of new investment into critical minerals projects, via the Northern Australia Infrastructure Facility.

The strategy highlights six focus areas:

♦ Developing strategically important projects, with targeted support

♦ Attracting investment and building international partnerships, to optimise trade and investment settings for priority technologies

♦ First Nations engagement and benefit sharing, to strengthen engagement and partnership with First Nations people and communities, and to improve equity and investment opportunities for First Nations interests

♦ Promoting Australia as a world leader in environmental and social governance (ESG) standards

♦ Unlocking investment in enabling infrastructure and services

♦ Growing a skilled workforce

Independent modelling has found increasing exports of critical minerals and energy-transition minerals could create more than 115,000 new jobs and add $71.2 billion to GDP by 2040.

However, the number of jobs could increase by 262,600, and the increase in GDP could soar to $133.5 billion by 2040 if Australia builds downstream refining and processing capability and secures a greater share of trade and investment.

The strategy will be an enduring framework to guide future government policy decisions to maximise the national benefits of Australia’s internationally significant critical minerals endowments.

The strategy will also establish a process to update the critical minerals list.

Ms King said the strategy makes it clear that Australia can play a crucial role in delivering the processed minerals the world needs for a clean energy future, building on a rich geological endowment and record as a reliable exporter of energy and resources.

“The new Critical Minerals Strategy outlines the enormous opportunity to develop the sector and new downstream industries which will support Australia’s economy and global efforts to lower emissions for decades to come,” Ms King said.

“While the potential is great, so too are the challenges. The strategy makes it clear our natural minerals endowment provides a foot in the door, but we must do more to create Australian jobs and capitalise on this unique opportunity.”

The decision builds on the government’s wider suite of policies to support the sector, including finance through the Critical Minerals Facility and National Reconstruction Fund, investments in research and development, and grants to help develop early to mid-stage critical minerals projects.

Australia is the world’s largest producer of lithium, the third largest producer of cobalt and fourth largest producer of rare earths. Australia also produces significant amounts of metals such as aluminium, nickel and copper, which combined with critical minerals, are crucial for low-emissions technology such as electric vehicles, batteries, solar panels and wind turbines. Critical minerals are also crucial components for medical technologies and defence applications.

International competition for investment in critical minerals is already intense, with incentives announced by the US and European Union designed to boost investment to diversify supply chains and to decarbonise their economies.

The Federal Government is also working with industry and international partners to help Australian projects link to emerging markets in the US, the UK, Japan, Korea, India, the EU and its member states.

The strategy will involve collaboration with state and territory governments, and will work alongside the government’s key agenda items including:

♦ Australia’s Critical Technology Statement

♦ National Reconstruction Fund

♦ Australian Made Battery Plan

♦ National Electric Vehicle Strategy

♦ Australia's National Hydrogen Strategy

♦ Powering Australia Plan

♦ First Nations Clean Energy Strategy

The new Critical Minerals Strategy 2023-2030 is available on the Critical Minerals website.

The Board of Australian lithium miner Core Lithium, announced the appointment of its new Non-Executive Director. Andrea Hall has stepped into the role, bringing her experience as a NonExecutive Director and member of the Board of ASX-listed Evolution Mining.

Ms Hall’s career has spanned more than 35 years in the financial services industry, including seven years as a Risk Consulting Partner at KPMG. Ms Hall brings a strong skill set to the Board that includes risk management, finance, external and internal audit and corporate and operational governance.

Core Lithium Non-Executive Chair, Greg English, welcomed Ms Hall to the Core Lithium Board.

“Andrea is a highly respected industry leader with a distinguished career as a company director and consultant.”

The company also welcomed two new Executive General Managers (EGMs) to its executive team, with Pierre Malan moving into the role of EGM of Development and Exploration, and Paul Benjamin stepping up as EGM of Commercial and Marketing.

Newmont Corporation also welcomed changes in its leadership team, with the appointment of its new Executive Vice President and Chief Financial Officer.

Karyn Ovelmen moved into the role, bringing extensive global leadership experience with her. Ms Ovelmen previously held Chief Financial Officer roles for highly complex and capitalintensive companies in the resource and energy sectors.

Newmont President and Chief Executive Officer, Tom Palmer, said, “Ms Ovelmen brings a breadth of global experience operating in complex financial environments and has proven leadership and commercial capabilities to enable success during periods of transformation.

“Ms Ovelmen is uniquely qualified to ensure our financial approach underpins the safe delivery of long term value to all our stakeholders through sustainable and responsible mining.”

Fortescue Metals Group announced the appointment of its new Chief Financial Officer, with Christine Morris commencing in the role from early July 2023, bringing with her more than 30 years’ experience across energy, media and telecoms, manufacturing and technology.

Ms Morris said she was delighted to be joining Fortescue and is dedicated to delivering the company mission of eliminating emissions profitably and leading heavy industry globally to decarbonise.

“My focus will be on continuing to provide exceptional value for Fortescue shareholders and maintaining and growing the strength of our iron ore and emerging critical minerals business,” Ms Morris said.

“I look forward to working with the company’s exceptional leadership team to continue Fortescue’s strong track record of outstanding financial performance and disciplined capital management.”

Although yet to officially leave their positions, Queensland Resources Council’s (QRC) Chief Executive, Ian Macfarlane, and Rio Tinto’s Chief Executive, Aluminium, Ivan Vella, have announced their intention to step down from their respective positions at the end of 2023.

Mr Macfarlane said the QRC was in very good shape, supported by a strong policy team and board, and its ongoing efforts to increase awareness about the critical importance of the resources sector to the Queensland economy continues to gain momentum.

At Rio Tinto, Mr Vella continues to lead Aluminium while the process to identify his successor is undertaken, but stepped down from the group’s executive committee immediately following his announcement.

Your industry personnel roundup – here we cover who’s moved where, which boardrooms have been shaken-up and the new leaders making big decisions in organisations across the industry.

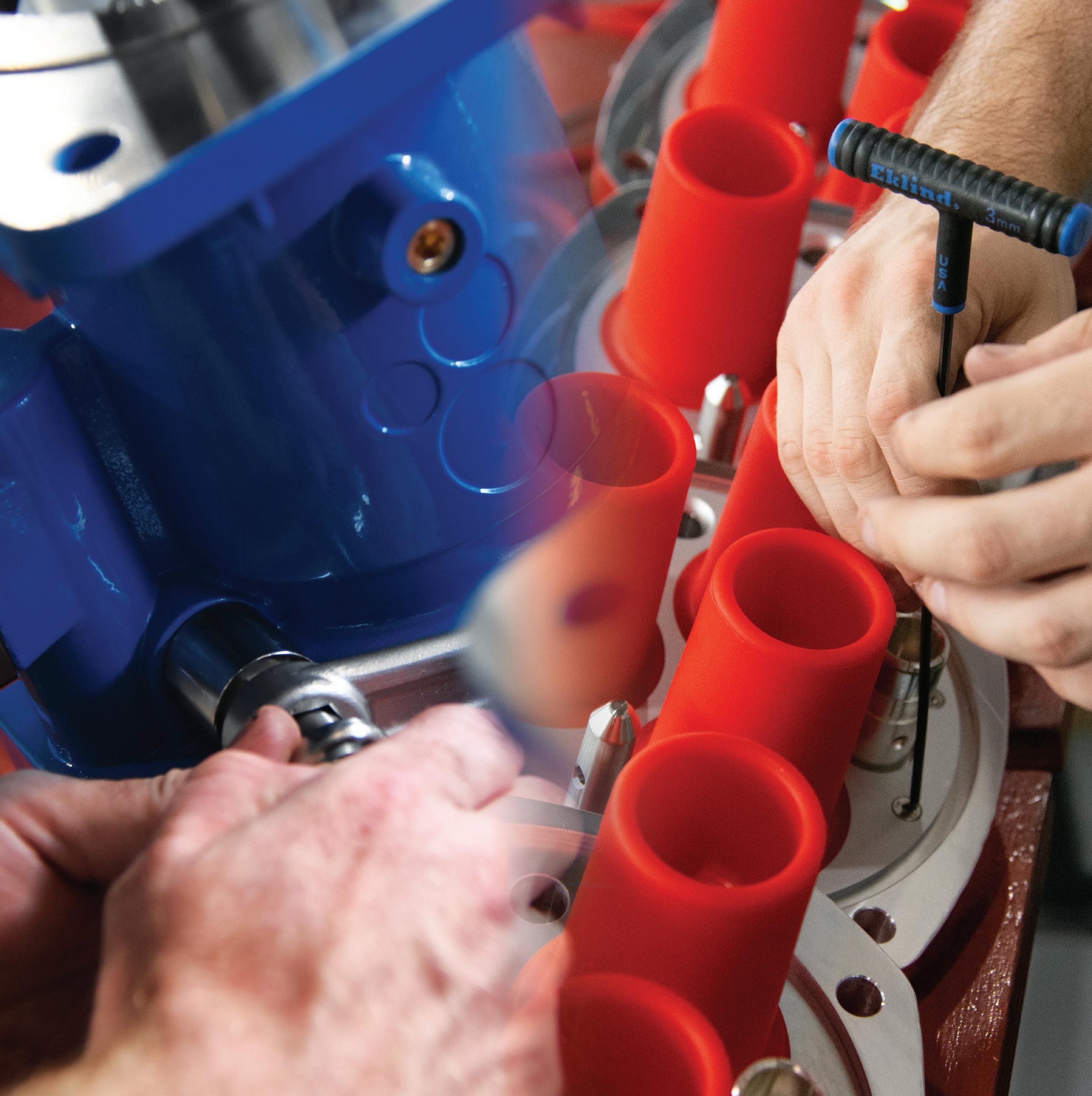

Stainless steel plays a vital role in numerous Australian industries – including mining –thanks to its remarkable corrosion-resistance and durability properties. However, not all stainless steel is created equal. Quality can vary significantly based on the raw materials used and the manufacturing process involved. As such, understanding the quality of stainless steel in the Australian mining industry is of the utmost importance.

One region that stands out for producing highquality stainless steel is Europe. European stainless steel is highly regarded due to its exceptional quality standards, which are achieved using refined steel, pure nickel and chromium. This ensures a consistent blend of materials, resulting in a product of superior quality. In contrast, other regions rely on lower-quality nickel-pig-iron, which can lead to issues like corrosion and spotting. As such, it is evident that the origin and composition of the stainless steel used can have a significant impact on its performance and longevity.

Identifying the true origin of stainless steel products can be challenging, particularly when misleading marketing tactics are employed. For instance, products bearing the label ‘Designed in Europe’ may give the impression of European quality, when in reality, they might be manufactured in regions known for subpar raw materials and less rigorous manufacturing processes. This deceptive messaging can potentially expose consumers to risks and compromise the integrity of their projects.

To ensure that you are truly receiving the quality you are paying for and expect, Ibex Australia recommends consumers request and examine original mill certificates. These certificates provide crucial information about the manufacturing location, chemical composition, and traceability of the raw materials used. Genuine mill certificates clearly indicate the name of the mill, material heat number, material grade, specific heat treatment, material dimensions and certified mill signature. It is important to be aware that fake mill certificates without the aforementioned information have been increasingly prevalent in the Australian market.

In this context, Ibex Australia distinguishes itself by dedicating significant resources to sourcing the best stainless steel products. With extensive technical knowledge and expertise, Ibex Australia ensures that the stainless steel it offers meets the highest quality standards. Ibex Australia understands the critical role of stainless steel in the mining industry and strives to provide reliable and durable solutions. Ibex Australia's commitment to quality is supported by a comprehensive range of press fit products, specifically designed to suit various applications in the mining industry.

By reaching out to Ibex Australia, you can benefit from extensive technical skills and support, ensuring that the stainless steel products you choose are of exceptional quality and meet your specific requirements. Ibex Australia's dedication to sourcing superior products and extensive technical knowledge make them a trusted partner for your stainless steel needs in the mining industry.

“No welding, low labour costs, easy installation and reliable results make the product a ‘no-brainer’.”

- Installation Manager at Citic Pacific MiningTo learn more about Ibex Australia and their range of high-quality press fit products and fittings, and their commitment to excellence, head to www.ibexaustralia.com.au

At Ibex Australia, we know that efficiency is crucial in the mining industry. That's why we offer fast, clean, and safe industrial piping systems that eliminate hot works and passivation.

With our commitment to quality, timely delivery, and responsive customer service, Ibex is your trusted partner in delivering exceptional results and boosting your bottom line.

Experience the difference with Ibex Australia.

Following her graduation from the University of Newcastle, Kelsie Clarke threw herself into the deep end, packing up her life in New South Wales and moving across the country to take a job in Western Australia. Kelsie sat down to chat with us about how that decision led her to a role in leadership, a visit to Antarctica and being awarded the 2023 Chamber of Minerals and Energy’s (CME) Outstanding Young Woman in Resources Award.

How did you get into your chosen field? Was it something you were always interested in pursuing?

I grew up in Newcastle, New South Wales and attended a selective performing arts school. I was great at STEM subjects, however I also loved acting and even directed a few plays. Some of my teachers suggested that I attend science and engineering events, which is where I met a chemical engineer who offered me work experience at the CSIRO, which lit the fire.

Up until this point, I didn’t know one single engineer. I decided to study civil engineering at the University of Newcastle, and the rest was history.

You started your career at Woodside as a graduate civil engineer. Can you tell me about the various roles you’ve had within the company that have led you to where you are now?

After graduating, I rejected chances to work closer to home to take a position in Perth. My only previous visit to Western Australia had been for the interview at Woodside, however I knew that if I didn’t make a leap of faith and go outside my comfort zone then, I never would.

I worked in various civil and structural engineering roles during the graduate program, including offshore and subsea, before

transferring to Karratha as a Structural System Engineer, where I was responsible for structural integrity management at the Karratha Gas Plant (KGP). I moved into a Project Engineer role, managing external engineering resources and projects at KGP.

I later became an Engineering Team Lead, leading a team of project engineers, project services and data scientists, and then a Maintenance Engineering Team Lead, leading a team of structural, rotating and mechanical engineers and overseeing end-to-end support for maintenance activities and strategies at KGP. I was also the Engineering Lead for a number of major shutdown maintenance activities.

Following my move back to Perth in 2022, I moved into a Business Adviser role, before moving into my current role as Business Readiness Lead for the SAP/4HANA project implementation at Woodside.

Outside of work you participated in a three-week expedition to Antarctica with Homeward Bound. Can you tell me what you learned from that experience that you try to bring to your job and your role as a mentor for women in STEM?

The remoteness of Antarctica generates a level of learning and reflection not experienced anywhere else in the world. What I have learnt from that experience is a deep sense of resilience, to be authentic, and to foster a place of trust with those around you. I have embedded these principles into the way I work, and in the advice that I provide to others, leading by example with these foundational skills.

You’ve been involved with Engineers Without Borders (EWB) for many years now. What is it about EWB’s vision that resonates with you?

EWB believes in a world where technology benefits all.

Engineering has improved the lives of people throughout the world, however there are still many people who do not have access to things that are taken for granted in Perth. Access to clean water is engineering, access to healthy fuels for cooking is engineering – it is woven through society in every way.

I became involved with EWB in my first year of university and have been in a range of roles, from supporting Sanitation projects and earthquake research, to being Chapter President of Western Australia. I am now Deputy Chair of the Board of EWB.

Engineers can change lives, and I believe that if this was more widely appreciated through society, we would have a larger pool of people entering the profession.

What do you consider to be the biggest challenge you’ve encountered in your career to date?

Becoming a leader at a young age has been the most rewarding and challenging experience of my career. Working with good and intelligent people is enriching, yet there are hard conversations and decisions that need to be made. Acting with integrity and addressing this front on is vital to leadership.

Through leading teams, I have experienced so much growth and a deep sense of reward, knowing that my leaders are there to back me and believe in me. What I have learnt and my advice to others pursuing a leadership pathway is to maintain credibility in everything that you do, listen and trust your team and hold empathy towards others, which is incredibly important.

Being in a leadership role is so rewarding and has provided me with some of the best moments in my career so far.

You recently won CME’s Outstanding Young Woman in Resources Award. What does winning the award mean to you?

I am incredibly proud and humbled to have won this award and to represent a strong cohort of young women in the WA resources and energy sector. To be able to stand up and call to action my peers and industry leaders to actively back young women in this industry at the stellar CME Women in Resources awards was an experience I will never forget.

I always strive to leave an easier path for younger women coming after me in this industry and I hope this award will showcase what is possible to others.

Winning this award has put you in a position where other young women in the industry can look up to you as a mentor – what are you hoping to convey to them?

My encouragement to other young women in the industry is to be authentic, be bold and back yourself. As the world transitions to a lower carbon future there will be so many new opportunities in resources that emerge. This industry presents an existing opportunity to be at the forefront of that change, and the equal representation of women will ensure a fair and just transition for communities around the world. It won’t be easy, but unless you push yourself, you will never realise your full potential. Think authentic, think bold and be your own advocate.

Can you give us some insight into your experience working in such a male-dominated industry? What are some of the obstacles you have had to overcome?

In male heavy teams, the tiny micro exclusions that I have experienced have been much more challenging to overcome than the typical, more obvious forms of gender bias. Like myself, many women in this industry have experienced the more obvious forms of bias and exclusions. But it’s the things that are not so obvious that can really dig under your skin. These are hard to call out and challenging to resolve, such as someone talking over the top of you or moulding yourself to fit in with the culture.

My approach has always been to focus on forming strong relationships with my peers, seeking to understand other perspectives, and focusing on delivering good outcomes for the business.

If we want an inclusive culture where we retain valuable people, we all need to work together to counteract these subtle behaviours, otherwise we will erode over time the progress that we have worked so hard for.

There’s work being done to diversify the workforce but in your opinion, what still needs to be done in the way of gender diversity in the industry?

Systemic and evidence-based structural change at the school, university and workplace level.

Gender diversity is improving, however, the mix of gender is not where it needs to be to be sustainable. I have seen incredible improvements to gender balance over my career and I have also seen gender balance go the opposite way with a few people moves or resignations.

The site engineering lead team that I was part of when I worked in Karratha was all female, bar one colleague and our boss. This was an incredible, delivery focused team that achieved a lot of value. The environment that we fostered for the wider engineering team is a highlight of my career so far and I now know what it feels to be part of a high performing team. Only a year later, I was working in a male dominated team (who were great colleagues). The numbers and distribution of women in operational, technical and leadership roles is not yet at a critical mass but I believe that this can absolutely be turned around.

We should not lose sight of how far the industry has come, however, there is still a large gap that needs to be closed to ensure gender balance in the resources industry is achieved and truly sustainable.

What advice would you give to people who are interested in or are in the early stages of their career in your industry?

Change begins at the end of your comfort zone. I have found the greatest opportunities and experiences have come to me by pushing myself to continuously learn and explore the unknown.

This industry is unique in that it gives you the ability to either find the niche you love, or if you enjoy trying new things, there is a lot of flexibility to move around into different roles. There are so many options in front of you right now, and it is only yourself who can decide which pathway to go next.

What do you like to do outside of work? How do you spend your free time?

I’m an avid theatre and ballet goer, I like to run, go to the beach and travel as much as I can with my husband. My time in Karratha gave me a love for camping and the outdoors.

I have a dog and two cats, and over the past year we have embarked on a large renovation at our house, which has kept us very busy.

Although still a male-dominated industry, recent years have seen the number of women in the resources industry slowly but surely rising, including an increase in the participation of Indigenous women. Despite Indigenous women being regarded as the cornerstone of many families and communities, Development Partner Institute (DPI Mining) Executive Director, Florence Drummond, identified the lack of an established platform for these women to share their stories and communicate with other Indigenous women in the industry.

Seeing the lack of connection amongst Indigenous women in the mining and resources sector in Australia prompted Ms Drummond to launch Indigenous Women in Mining and Resources Australia (IWIMRA), which aims to provide a network for Aboriginal and Torres Strait Islander women in the country’s mining and resources sectors.

“IWIMRA formed in 2017 as an organic response to being curious about the participation of Indigenous women in the mining and resources sector in Australia,” Ms Drummond said.

“At that time there was not a lot of social engagement online and, living remotely, we had to think about how we could connect with each other in the most practical way possible.”

The first step to determining the reach of this curiosity was to establish a Facebook group, and as IWIMRA built its capacity as a network and a voice for Indigenous women in the global sector, the creation of a group on LinkedIn was the next step.

“In reflection, the leadership of the incredible women in the team has also shaped this into reality, built with trust in a culturally safe way. I am very proud that IWIMRA is what it is today.”

When IWIMRA first started, Ms Drummond said the organisation needed to consider how to ensure all the efforts

that were being dedicated towards participation created a legacy impact for future generations of Indigenous women.

As well as this, showcasing continued collaboration with industry has always been an important factor for the organisation and, as such, members work closely with industry to build solutions-driven, cross-culture influential relationships in the hopes this will contribute towards a sustainable future.

“Building our capacity, we wanted to align to other efforts that are focused on the betterment of Indigenous peoples in Australia. IWIMRA Indigenous Corporation realigns to what is now the new normal at both a national and global level,” she said.

Initially hoping to benefit Indigenous women in the mining and resources sector, Ms Drummond was determined to spread the idea that Indigenous women's participation and influence in the industry could be utilised to strengthen relations within the Indigenous workforce and to promote retention initiatives.

“The intersectionality of Indigenous women in this specific industry is quite complex,” she said.

“Some of our early conversations reflected the continued impact of racism in the workplace before gender. There have been many studies by specialised academics in this space that have confirmed these echoing stories across a number of mining jurisdictions.

“What IWIMRA does focus on is the importance of language and the use of how we continue to build our narrative. The IWIMRA inaugural conference was a very important space

to collect more in-depth data sets to continue to shape best practice.”

Since its inception, IWIMRA has expanded its reach to include Indigenous women from all over the country.

“As the original scope of IWIMRA continues to grow, it has demanded the organisation build its rigidity and team.

“The transition into IWIMRA Indigenous Corporation will ensure the participation of IWIMRA is carried into the energy transition with the strength and agility it has built since inception. It will continue to serve the network as a culturallysafe space for Indigenous women to connect, to be informed and to also inform best practice as a vital component of social performance in the industry.”

Through members’ experiences and narratives of Indigenous intersectionality, IWIMRA strives to facilitate the visibility, voice and quality participation of Indigenous women. Despite being based in Perth, IWIMRA’s membership now encompasses more than 2,000 women across the Australian minerals sector.

“IWIMRA continues to build its membership and with the success of the inaugural conference held in Perth on 15-16 June, it has a truly stable membership base that is ready to meet the needs of the sector, uphold the values of the community and to ensure future generations know that they belong in this sector.”

Indigenous women across the globe have been identified as most vulnerable in their opportunities to innovate with fast-paced society. As such, IWIMRA and the platform it offers Indigenous women in Australia has attracted attention on a global scale.

“Over the past years the IWIMRA conversation has travelled to many continents across the globe in growing its global reach to other Indigenous women and rights holders in the minerals sector,” Ms Drummond said.

“I believe this will only continue to be realised as IWIMRA matures as a space for contextual conversations that matter the most to us.”

The growth of the organisation and its platform was on full display at the inaugural IWIMRA Conference.

“The inaugural IWIMRA conference was a moment of our vision coming to life. We invited 150 of our IWIMRA membership to join us for the two-day event.

“Our aim for the conference was to ensure that we extended the invitation to women who would not usually be attending professional development conferences for many different reasons. It has always been important to IWIMRA that we make sure no one is left behind.

“Our IWIMRA network is represented by many women who are at the grassroots level – women who are operators, live in communities and share a similar lived experience like us.

“The conference brought us all together, where we are now convinced that we are no longer alone. It was an incredible experience for us all,” Ms Drummond said.

The conference hosted a collection of speakers who shared their experiences and journey in the resources sector. Ms Drummond said the speakers all “honoured the three elements that we always make time for: the past, the present and the future”.

The conference also hosted a panel of women from around the globe, with the organisation’s WIM sisters from the UK video calling in to share their story. As well as this, a panel of Indigenous male leaders were also welcomed as a demonstration of IWIMRA’s commitment to working as a community for its future participation and success.

“There were so many more connections and outcomes that we accomplished on a personal and professional level for all of our delegates and we look forward to raising the bar for our conference in 2024,” Ms Drummond said.

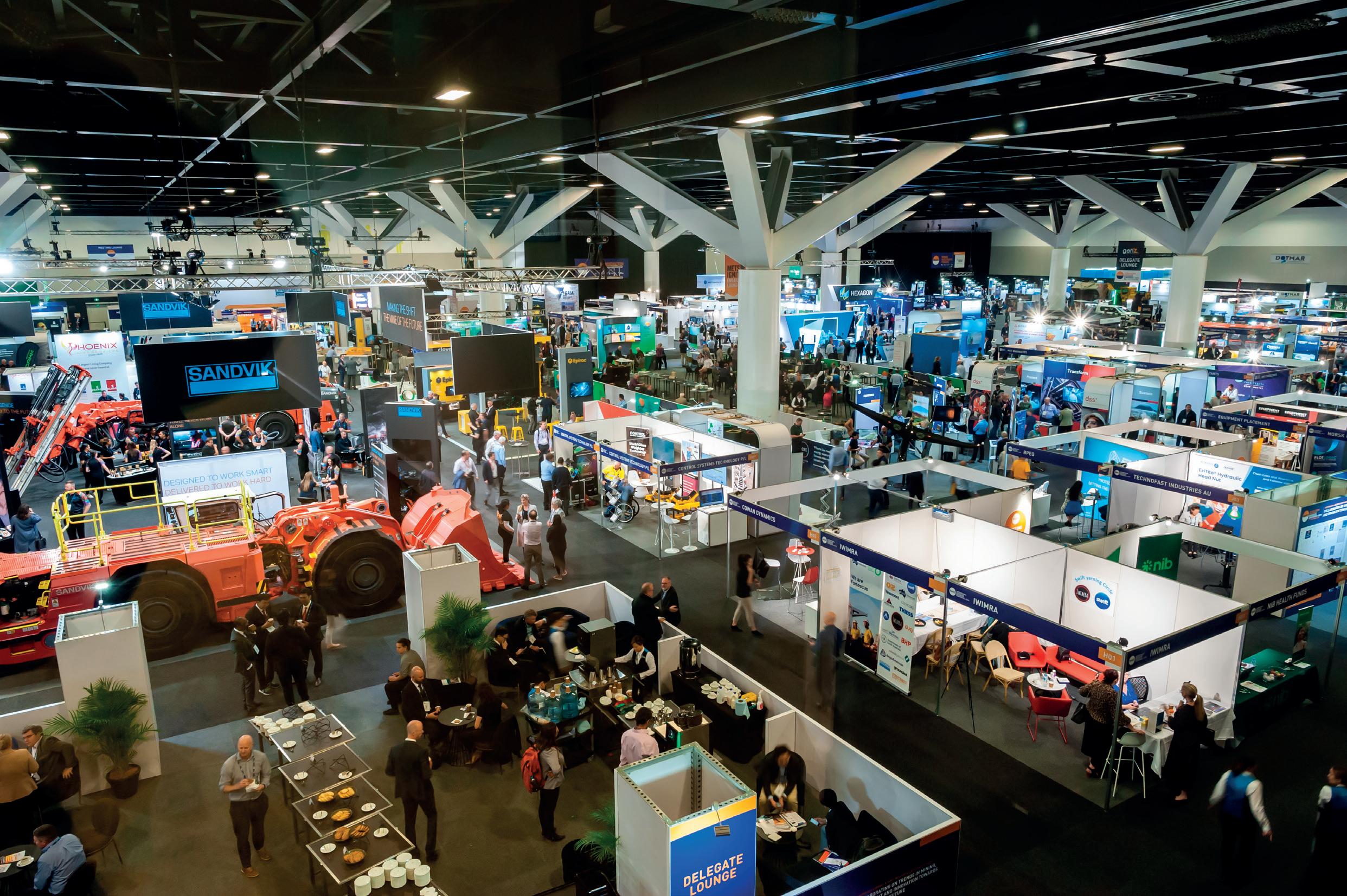

IWIMRA’s members continue to strive to widen the reach of their platform in the resources industry through participation in other industry conferences, including the International Mining and Resources Conference (IMARC).

At the 2022 IMARC event, IWIMRA invited attendees to participate in the creation of the 2022 IMARC official prints, which are available for sale on IWIMRA’s website.

“The IWIMRA and Bunya Design initiative at IMARC 2022 was one of the most impressionable initiatives that connected people from many walks of life and many different nationalities to connect through art.

“The three-piece set, titled Past, Present and Future, was created to reflect how we viewed our participation in the industry and most importantly how working together can create an even better future.

“There will be continued efforts to create interactive spaces for conversations – this has been an element of IWIMRA that has really shone across the globe. We are very proud of what we have created.”

Making dreams a reality takes work; something that CSIRO’s Dr Suneeti Purohit knows more than most. Here, Dr Purohit shares the barriers she overcame as she followed her ambitions halfway around the world to where she is now – working for Australia’s national science organisation and the winner of the 2023 Exceptional Woman in Victorian Resources award.

When asked to pinpoint where her interest in science came from, Dr Purohit can trace back to a conversation she had when she was nine years old.

“One morning I was looking at my reflection in a spoon while eating my breakfast. My father noticed and pointed me towards a rock. He said that the shiny spoon I was eating with was made from a rock like that.

“As a child I was very surprised and interested to know how they made it. That moment drove me to study science.”

She wasn’t, however, entirely sure which path she would pursue in the future, with her aspirations shifting from wanting to be a scientist, to occasionally desiring a career as a teacher, and even dreaming of becoming an astronaut.

“But one thing was certain, I wanted to study at top institutes of India,” she said.

Dr Purohit was born and raised in a rural village of India, named Kaudola, in the district of Kalahandi, and it was in that village where she completed her primary and high school education.

“My father – being a teacher – understood the importance of education and constantly encouraged me to study and participate in all types of academic competitions like debate, essay writing and even painting.”

It was when she started winning prizes in these competitions that her confidence was boosted and she became even more eager to learn.

“It ignited a strong desire in me to keep expanding my knowledge and continue my education.”

After graduating high school at the age of 15, Dr Purohit enrolled in a local college. She found, however, the education quality there to be poor and so sought to study at a better school outside her district.

“In those years, my family was not financially sound enough to afford the tuition and hostel fees. After about two months, my father managed to get a bank loan to support my decision, and I got admission to a private women's college.”

This experience was Dr Purohit’s first time living away from home and the first months were tough, especially with the language difficulties.

“Until high school, I had mostly spoken our local dialect, which is different from Odia. While I could read and write in Odia and English, I wasn't fluent in speaking. With time, I improved my skills and got better at studying. Eventually I became the bestperforming student at the women’s college in the state board examination in 2007,” Dr Purohit said.

The idea of studying metallurgy came to her during a visit from the women’s college Chairman while she was completing her higher-secondary education. The Chairman mentioned his background in metallurgy and Dr Purohit pinpoints that moment as the first time she considered studying metallurgy for her higher education.

In that same year, she qualified for the Odisha Joint Entrance Examination and started an undergraduate course in Metallurgical and Materials Engineering at a prestigious state government institute, Indira Gandhi Institute of Technology.

Following the undergraduate course, she wanted to pursue her master’s at one of India’s top-tier institutions, clearing the Graduate Aptitude Test in Engineering examination in her first attempt and securing admission into the Indian Institute of Technology (IIT) Kharagpur.

Deutscher Akademischer Austauschdienst (DAAD) scholarship and conducted my master’s research work at Karlsruhe Institute of Technology in Germany.”

Purohit worked for three years in the academic profession in Metallurgical and Materials Engineering. In 2016, after deciding to pursue a PhD, Dr Purohit was given the opportunity to research on her topic of interest at Melbourne’s Swinburne University of Technology and has been working at CSIRO in the same field since the completion of her PhD.

Dr Purohit is currently a member of CSIRO's Mineral Resources business unit, specifically working within the green-steel group.

“My past and current research work is primarily related to lowering the carbon footprint from the steelmaking value chain. I completed my PhD from Swinburne University of Technology, during which I developed an innovative low-temperature iron ore agglomeration technology, called Lime Magnetite Pellet (LMP) Process.”

Dr Purohit explained that the process has the potential to lower emissions from the predominant ironmaking method – the blast furnace – by up to 18 per cent without the use of expensive fuels like hydrogen gas. Additionally, the process works at lower temperatures, which could facilitate the effective use of renewable energy sources like solar power or green-H2 gas in the future.

“This process can use Australia’s vastly under-utilised magnetite reserves as well as lower-grade Pilbara-type iron ores. Australia, being one of the world's largest exporters of iron ore, could greatly benefit from this technology by exporting high-quality LMPs while also reducing emissions.”

“I have also worked on a project that explores using concentrated solar energy for high-temperature processing of iron ores, like iron ore agglomeration and ironmaking. This research is important for Australia because the country has an abundance of sunshine directly on the iron ore mining sites.”

Dr Purohit has also been part of projects with various iron ore and steelmaking industries – the Heavy Industry Lowcarbon Transition Cooperative Research Centre as well as the Department of Industry, Science, Energy and Resources (DISER). In these projects she focused on modelling emissions to assess the overall carbon dioxide emissions in the steelmaking process and evaluating the impact of lower-quality iron ore on future hydrogen-based steelmaking processes.

“Before choosing to study Metallurgical and Materials Engineering, I had an inkling that there wouldn't be many female students pursuing this course because none of my friends were considering it as an option,” Dr Purohit said.

There were eight female students during her undergraduate studies, and during her master's program, there were a total of four female students among approximately 30 students. Despite being fewer in numbers, Dr Purohit said female students – including herself – never encountered obstacles or mistreatment based on their gender, and in fact were actively encouraged by professors to participate in industry tours, seminars and conferences.

“The first time I encountered obstacles as a female metallurgist was when I was seeking employment in the steel industry. After completing my bachelor’s degree, I appeared for an interview for three Indian steel companies, and faced rejection.”

“In one interview, I was told to be underweight and therefore deemed unsuitable for working in the production line.

“Among my entire batch, only two female students were chosen for industry jobs, while most male students secured positions right after finishing their undergraduate studies.”

Seeking employment after completing her master’s degree exposed another challenge. While she was studying in Germany Dr Purohit missed out on the campus placement opportunities and had to resort to applying for jobs through online platforms.

While she wasn’t hearing back from the industry, she found that academic institutions consistently responded to her applications. This led Dr Purohit to pursue a career in academia.

“Over the course of my career, spanning from 2014 to the present, I have had the opportunity to work in a total of five academic institutions and research organisations in both India and Australia. Throughout this journey, I am grateful to say that I have never encountered any form of bias or criticism solely because I am a woman.

“In each of these professional environments, I have been treated with respect and fairness, regardless of my gender. I have received tremendous support and guidance from my male colleagues which has advanced my career and inspired me to push my limits.

“I consider myself very fortunate to have met and worked with such wonderful people.”

“Winning the Exceptional Woman in Victorian Resources award holds great significance to me. It is an incredible honour and validation to my hard work and contributions in the resources industry.”

Receiving an award and the recognition that comes with it is not something Dr Purohit ever expected or sought throughout her career in metallurgy. The journey she embarked on in her chosen field was driven by passion and curiosity and receiving honours is incredibly humbling for her.

“This award serves as a reminder of the challenges I faced and the assistance I received throughout my journey from Kalahandi to Melbourne. It signifies not only my personal achievement but also the success of my parents, teachers, and all those who believed in me. Moreover, it serves as inspiration for young girls who look up to me.

“As I reflect on my journey from a rural village in India to one of the most liveable cities in the world, I am reminded of the invaluable lessons it has taught me. Along this journey, I have experienced both triumphs and setbacks. There have been moments of pure joy, where I felt invincible and accomplished, as well as moments of demotivation with self-doubts and obstacles hindering my progress. I am incredibly grateful for the support of my family and teachers, who have guided me towards success.”

Dr Purohit’s goal is to extend this support to other young women who may need guidance, and inspire them to embrace their passions and view obstacles as opportunities for personal growth.

“I want to encourage them to pursue careers and fields of study that may traditionally be seen as male-dominated,” Dr Purohit said.

Using her new platform she plans to share her story in the hopes that it resonates with other young women.

“I want to convey the message that our backgrounds should not define our destinies. We can break barriers and carve our own path to success. Many remarkable women have dedicated their lives to challenging stereotypes and making it easier for us to pursue careers in male-dominated industries. Let us not be held back by small obstacles, but instead fearlessly pursue our aspirations.”

“Growing up in a rural village, I found inspiration in the stories of renowned Indian women who had achieved great success. Their accomplishments motivated me to pursue my studies and aspire to make a positive impact in my community.”

Whenever Dr Purohit visits her village in India, she takes the opportunity to visit local schools and colleges to interact with the students, in the hopes that sharing her journey and experiences will ignite a similar sense of determination and ambition in them.

“I firmly believe that my success story, rooted in a similar background, holds the power to influence and inspire other girls, motivating their parents to invest in higher education.”

Dr Purohit, alongside her husband, established a Facebook and Instagram page to share the stories of scientific discoveries in Hindi, with an aim to make science more accessible to young students of India.

Diversity and inclusion have gained significant recognition around the world in recent years which has led to changes in workforce dynamics, resulting in a growing trend of events and celebrations that promote the participation of women and underrepresented minority groups in the workforce.

“It is important to acknowledge that these positive changes were not easily achieved. It required people to speak up and advocate for their rights, and organisations adapting their policies to foster inclusivity.

“I think continuing this momentum is crucial in creating a diverse and inclusive workplace throughout all organisations.

“In my experience, I have encountered countless talented individuals who have not achieved the success they deserve due to limited opportunities. One prominent issue I have noticed is the heavy reliance on references during the hiring process, which disadvantages those without influential connections, particularly individuals from minority groups.”

Dr Purohit said it is important for organisations to recognise these biases and work towards creating a more inclusive and fair hiring process, as well as prioritising the sustainable retention of their diverse workforce.

“By fostering a culture that values and embraces diversity, where all voices are heard and respected, employees can feel a sense of belonging and contribute to their fullest potential.”

The importance of diversifying the workforce in the resources sector has made its way to the forefront of conversations on how organisations can create more inclusive and welcoming environments for employees. After years of noticing the lack of representation in leadership teams and Boards throughout the resources industry, Founder and Managing Director of consulting firm Premier Strategy and winner of 2023 Victorian Women in Resources’ Gender Diversity Champion Award, Joanna Stevens, decided to take matters into her own hands.

Mining Magazine (MM): Can you tell me a little bit about what you do?

Joanna Stevens (JS): I am the managing director of Premier Strategy; a communications, engagement and advocacy consulting company that specialises in the resources and renewables sectors.

I started Premier Strategy in my bedroom after I was made redundant while five months pregnant with my eldest child. Two decades on, and four children later, Premier Strategy has grown into one of Australia’s leading boutique consulting firms working for a range of clients across the renewable, mining, infrastructure, and manufacturing sectors.

Today, we have close to 30 employees operating across the southeastern coast of Australia with offices in Ballarat, Geelong, Brisbane and Sydney.

In my role, I love that every week is different. Some days I might be walking up the halls of Parliament House, engaging with ministers on a meaningful advocacy campaign, while on other days I could be seated at the kitchen table of a farmer’s property, listening to their feedback on a new wind farm project.

MM: In your words, what does gender diversity mean? Why is it important?

JS: In the resources sector, it’s no secret that women are vastly underrepresented in management positions. And yet research and real-life examples consistently show us that diversity in a workplace not only enhances financial and operating performance, but also boosts productivity and promotes innovation and strategic resilience.

In this fast-paced world, where the challenges of artificial intelligence and climate change are present, we need to tackle these obstacles head-on. We need a workforce that reflects the diversity of the world we live in.

It’s not just about ticking a box; it’s about harnessing the power of creative thinking and using our different perspectives and experiences to solve complex problems.

Achieving gender diversity requires the collective effort and commitment from everyone – not just a select few. We all have a role to play in making gender diversity a reality.

MM: What first brought your attention to the lack of gender diversity across Australian workforces?

JS: I honed my skills initially in a newsroom and then later within the walls of Parliament House – two professional environments heavily dominated by men. It was the nineties, and there were no provisions for flexible work arrangements, paid parental leave, or childcare support. There were also very few female mentors and leaders.

As my career progressed, and my company expanded in the resources sector, I was invited into more meetings, conferences, workshops. I was often the only female in these spaces.

This lack of representation is what inspired my vision: to help resource companies achieve 25 per cent female representation on their boards.

MM: In your opinion, how is the lack of gender diversity different in the mining and resources sector?

JS: Many years ago, I was invited to give strategic advice on how a mining company could attract and retain its female employees. When I looked at the leadership team and the Board, I noticed the complete absence of women. As I began researching, I realised they weren’t alone.

The underrepresentation of women in the mining and resources sector is a systemic issue deeply rooted in cultural norms, perceptions of physical demands and safety risks, a lack of female role models, limited educational pathways, and inadequate work-life balance initiatives.

However, the world has undergone significant changes over the past 20 years. We now have platforms like Zoom, we have more female CEOs, we have millennials and Gen Zs, we have gender quotas, greater access to sponsorships

and scholarships, and we have leadership teams that prioritise inclusivity and diversity.

While there is still much ground to cover, I believe we have the momentum and drive to shatter the glass ceiling.

MM: Why did you personally begin advocating for gender diversity? What are some of the ways you’re working to increase gender diversity?

JS: My drive for greater gender diversity stemmed from sheer frustration. I was tired of being the only female presenting to a Board or sitting in a minister’s office.

I wanted to see more women be at the helm, leading me on the tours of multimillion-dollar infrastructure projects, or running me through the groundbreaking renewable technologies. I wanted to see more women donning high-vis and hardhats!

But to talk the talk, you must walk the walk, which meant I had to look at my own company.

Today, I am proud to say I have created a workplace that is flexible, outcomebased, and breaks many traditional corporate rules – rules such as a workday is nine to five, a workweek is Monday to Friday, and a workplace is in an office.

As a result, Premier Strategy has become an attractive option for many women who prefer working for a boutique, regional business over a large corporation. My colleagues appreciate the freedom to balance the demands of household and family life while knowing they have the trust and support of their team.

In addition to the flexibility, we have also introduced a ‘buddy’ program where we pair our junior employees with experienced mentors. This initiative provides employees with opportunities for professional development, skillbuilding, and guidance.

MM: Can you discuss some of the processes organisations can employ to increase the diversity of their workforces?

JS: Practise what you preach – if you truly believe in the importance of gender diversity, you must reflect this in your leadership team and Board.

Invest in your staff. Offer opportunities for leadership development whether it’s through training programs or giving them the chance to take on important responsibilities like speaking at a client networking event, leading a team meeting, delivering a workshop.

Create a workplace that values flexibility. Offer options like remote work, flexible hours, and job-sharing arrangements. Recognise that people have diverse needs and responsibilities outside of work, and flexibility and trust helps them to thrive in both their personal and professional lives.

But above all, create a supportive and inclusive workplace culture. Promote an atmosphere that is respectful, kind and open, where every voice is heard and valued. Treat every team member the same, from the person who stocks the fridge with almond milk to the senior advisor who you turn to on your worst day.

It’s not just about listing your company values on your website, you must live by them.

MM: What more needs to be done to increase gender diversity, particularly in the resources sector?

JS: While progress has been made to increase gender diversity, there is still so much more to be done to achieve meaningful and sustainable change such as encouraging girls to pursue education and careers in STEM fields.

We must continue to challenge the stereotypes and biases that discourage women from entering the resources sector. We must continue to promote positive narratives and stories and highlight women’s achievements and contributions. We must create more mentorship programs, and networking opportunities.

But most importantly, we must improve the leadership opportunities for women. We need to encourage more boards to have gender quotas and more organisations to offer professional pathway programs.

With the Federal Government committed to acting on climate change and seizing the opportunities of the net zero transformation, Ms King said the government acknowledges that the country will not be able to meet net zero targets without the resources sector.

“The road to net zero runs through the Australian resources industry. Resources have been hugely important to our past and are even more important for our present and future.

“Critical minerals like lithium, vanadium, silicon and rare earths are the building blocks of clean energy technologies, such as batteries, solar panels and electric vehicles. Critical minerals are also essential inputs to technologies we take for granted everyday – and that help to power our homes, offices, factories and mobile phones.”

Ms King said that with demand for these minerals predicted to grow significantly over the next three decades, supply chains will be highly concentrated and it is crucial that Australia maintains a stable supply of critical minerals.

“We also know that critical minerals projects face complex challenges, including technical risks due to complex mineralogy and the need for specialised processing, as well as project risks associated with operating in remote areas, significant capital and energy requirements, and the fact many proponents are junior miners.”

Characteristics unique to Australia affect the country’s standing in the world’s critical mineral supply chains.

“Australia is well positioned to cement itself as a global supplier of choice for processed critical minerals to meet rapidly growing global markets and to become a renewable energy superpower.

“Large critical minerals reserves, technical expertise and long track record as a reliable and responsible supplier of resources and energy mean we are well placed to be a globally significant producer of raw and processed critical minerals.

“Australia is the world’s largest producer of lithium, the third largest producer of cobalt and fourth largest producer of rare earths. The country also produces significant amounts of metals such as aluminium, nickel and copper which, combined with critical minerals, are crucial for low-emissions technology such as electric vehicles, batteries, solar panels and wind turbines.

“Importantly, Australia’s mining industry operates to the highest ESG standards. The world demands that the extraction of resources is sustainable, and Australia meets that demand.”

Recent initiatives and funding across Australia have highlighted exploration as the first step to expanding Australia’s critical mineral offerings.

“We know that there is no net zero without resources, but there are no resources without exploration.

“Investment in Australian mineral exploration is at record highs, and the Australian Government is committed to ensuring

that this success continues. Exploration is vital to the global transition to net zero, it is key to unlocking and accelerating resource development at the scale and pace necessary.”

Despite previous exploration success, 80 per cent of Australia remains under-explored – meaning there is huge potential for further resource investment to meet the growing domestic and global demand.

“Current government initiatives target the earliest stages of exploration where there is greater investment uncertainty, and greater financial risk for industry. This includes the government’s $225 million Exploring for the Future (EFTF) program which provides world-leading data on Australia’s mineral, energy and groundwater resource potential in unexplored and underexplored areas of the country; and the $200 million Junior Minerals Exploration Incentive which encourages investment in small minerals exploration companies undertaking greenfield exploration through investor tax credits.”

The Exploring for the Future (EFTF) program provides precompetitive geoscience data to encourage investment in a pipeline of new resource projects today and into the future.

“Geoscientific data is a fundamental building block for future investment in resource exploration and development for a range of minerals and resources, including critical minerals. This is important as it accelerates net zero technologies, and increases the attractiveness of Australia as an investment destination.”

Ms King said that through the program, 419 new tenements have been taken up by 50 companies, encompassing an area of more than 246,000 square kilometres.

“At its core, the value and success of EFTF is underpinned by strong collaborative efforts across local communities, industry, academia and all levels of government.”

Geoscience Australia has recently released its Atlas of Mine Waste, which is an interactive online mapping tool that provides governments, industry and the community with accurate information about Australian mine tailings, waste rock, smelter residues and related mine waste materials.

“This Atlas provides data of sites across the nation that may contain previously overlooked critical minerals – including those used to produce electric vehicles and solar panels which can be an enable for Australia to recycle its riches.”

Ms King said that Australia has a world-class record for pioneering and adopting efficient, lower carbon, higher sustainability, and environmentally responsible practices across its traditional and critical minerals industries.

“Australia has a robust legal system, strong governance and world-leading environmental, social and governance (ESG) credentials.

“We are also working with global partners who are likewise committed to strengthening ESG practices in critical minerals mining and the broader supply chain.

“Critical minerals are essential to the technologies needed to decarbonise the global economy. In this context, the world will need more mining not less to reach its net zero targets.”

Critical minerals is the buzzword on the lips of the mining industry, with a multitude of state and federal funding and initiatives underway to further drive Australia’s critical minerals strategy. Federal Minister for Resources, Madeleine King, spoke to Mining Magazine Editor, Rebecca Todesco, to discuss the recently released Critical Minerals Strategy, and provide a snapshot on how the industry is shaping up in Australia.

Recent geopolitical dynamics around the globe have contributed to stresses within critical minerals value chains, with many countries eager to find secure, reliable supplies of minerals and resources.

In 2022, at the United Nations Biodiversity Conference (COP15), Australia – alongside other countries like France, Germany, Canada, Japan, the UK, and the US – announced the launch of the Sustainable Critical Minerals Alliance.

The Canada-led initiative strives to promote sustainable, environmentally and socially responsible mining practices for the critical minerals sector.

Ms King said that the mining and processing of critical minerals is crucial to helping the world lower emissions, and it’s important that those minerals are developed to high ESG standards.

“The Australian Government is committed to ambitious action on climate change, making meaningful contributions to the lives of First Nations peoples and supporting the highest possible environmental, social and governance (ESG) standards for global resource extraction.”

Ms King pinpointed growing Australia’s critical minerals resources and industries to support new clean energy technologies and global emissions reduction targets as a key element of the Federal Government’s commitment.

“Critical minerals like lithium, silicon and rare earths are building blocks of clean energy technologies, such as batteries, solar panels and electric vehicles. Without these minerals, and the mines that produce them, the world cannot reach net zero by 2050.”

“Sustainable and responsible progress towards net zero will only be possible if our extractive industries are underpinned by a commitment to the highest ESG standards,” Ms King said.

A key commitment of the Alliance is to support local and Indigenous communities, a view which Ms King said the government shares.

“First Nations engagement and benefit-sharing is one of six key focus areas identified in Australia’s National Critical Minerals Strategy.

“First Nations landholders and communities are key partners in all resources projects. Ongoing and genuine partnerships with First Nations Australians is essential to the future sustainability of a strong and responsible resources sector.”

Ms King said that more than 60 per cent of national resources projects operate on land covered by a Native Title claim or determination.

“By treating First Nations’ communities with respect and ensuring they gain maximum benefit from resources projects, the sector will in turn be supported by them. More than a quarter of a million people work in the resources sector and First Nations people make up a greater share of this workforce than any other sector.

“Stronger engagement practices and partnerships with First Nations peoples will benefit the critical minerals sector’s immediate and long-term social licence to operate, its ongoing sustainability, and Australia’s ability to leverage its ESG credentials world-wide.”

Ms King said the Federal Government’s resources policies are developed in close consultation with First Nations people.

“The Critical Minerals Strategy for example was developed following consultation with First Nations representatives and in line with the implementation of the Uluru Statement from the Heart, to ensure that the economic opportunities associated with a growing critical minerals sector are shared with First Nations Peoples.

Another key focus of the Alliance is adopting circular economy approaches, which Ms King said offers Australia the opportunity to capitalise upon the full life cycle value of its resources.

“The Australian Government understands the potential of a circular economy to achieve positive outcomes, and as the Minister for Resources, I am particularly aware of the opportunities the mining sector has to redesign the production and consumption of renewable energy enablers such as lithium, copper, cobalt, nickel and silver.”

Australia has been working to forge strong relationships with other countries in the resources space, including the recent AUKUS trilateral security pact between Australia, the UK, and the US, and the signing of a joint commitments with both Germany and the UK.

“The Joint Statement of Intent between Australia and the United Kingdom will see the two nations collaborate on shared commitments to promote diverse, resilient and sustainable supply chains which will underpin key technologies – including those that the world needs to decarbonise,” Ms King said.

“The Joint Declaration of Intent with Germany similarly focuses on developing diverse, resilient and sustainable supply chains, and is the basis to undertake research on critical minerals value chains to further both nations respective climate, energy and strategic ambitions.”

Ms King said Australia, as a global leader in the production of raw and, increasingly, processed critical minerals and refined products, has a lot to offer other countries.

“Australia has world-class expertise at extracting minerals and a track record as a reliable producer and exporter of energy and resources.”

With Australia expecting to continue to see growth in demand for its significant critical mineral resources, Ms King said it will continue to work with like-minded partners to further aims of achieving net zero, energy security and creating safe and secure supply chains.

“Last October, I signed a new Australia-Japan Critical Minerals Partnership to establish a framework for building secure critical mineral supply chains between Australia and Japan.

“Other bilateral agreements like the Australian-India Critical Minerals Investment Partnership will give our companies greater certainty.”

Ms King said the Federal Government is also working with the Biden administration in Washington DC to ensure Australia can make the most of opportunities offered by the Inflation Reduction Act.

“This includes the recently-announced Australia-United States Taskforce on Critical Minerals, which I will lead alongside counterparts in the US National Security Council, under the Climate, Critical Minerals and Clean Energy Transformation Compact.

“Furthermore, in the 2023-24 budget, the government announced a $57.1 million Critical Minerals International Partnerships Program aimed at securing strategic and commercial partnerships to develop new, diverse, and resilient supply chains underpinned by critical minerals processed in Australia.

“Included in this funding is a $40 million grant program, leveraging co-investment between Australia and like-minded partners to support projects that can develop end-to-end supply chains.”

When asked to single out one of her biggest achievements as Federal Minister for Resources so far, Ms King referred to the recent Critical Minerals Strategy, released in June 2023, and said it is a significant step in Australia’s ambitions to become a renewable energy superpower.

“The strategy sets out a vision to grow our critical minerals wealth, create Australian jobs in mining and manufacturing, strengthen global clean energy supply chains, and support the world to achieve net zero emissions.

“The strategy is aimed at making Australia a globally significant producer of raw and processed critical minerals and boosting economic opportunities for all Australians, including First Nations people and regional communities.”

The strategy will also see $500 million of new investment for critical minerals projects, via the Northern Australia Infrastructure Facility.

Ms King said the strategy builds on the Federal Government’s wider suite of policies to support the sector, including finance through the Critical Minerals Facility and National Reconstruction Fund, investments in research and development, and grants to help develop early- to mid-stage critical minerals projects.

“As Federal Resources Minister, my priority is to work with industry to ensure Australia maintains its position as a world leader in resource production so that the sector can continue to support our economy and create jobs and wealth for all Australians.

“A strong Australian resources industry is not only important for our nation, but for the region. Australian minerals and energy build and fuel countries across the region and beyond.

“We know that Australia’s critical minerals are key to the world’s fight to reduce global warming. The world can’t build the batteries, wind farms and solar panels it needs without Australian resources.”

At a time marked by growing concerns about climate change and its potentially devastating consequences, decarbonisation has emerged as a key global objective. Countries around the world are striving to mitigate greenhouse gas emissions in order to meet net zero targets, which has spurred a flurry of activity as academics from diverse disciplines explore innovative approaches to facilitate the green transition.

The pressing need to curb global carbon emissions and limit warming to 1.5° Celsius as set out in the Paris Agreement has sparked a wave of collaboration and research among scholars worldwide, as countries pursue novel ways to tackle the complex challenges of decarbonisation.

In June 2022, when the Western Australian Government announced that it would start decarbonising the state, the mining industry and academics began gearing up to collaborate. In the same month, the announcement of a ‘decarbonisation roadmap’ by Federal Mines and Petroleum Minister, Bill Johnston, symbolised the first step on the state’s journey to decarbonisation.

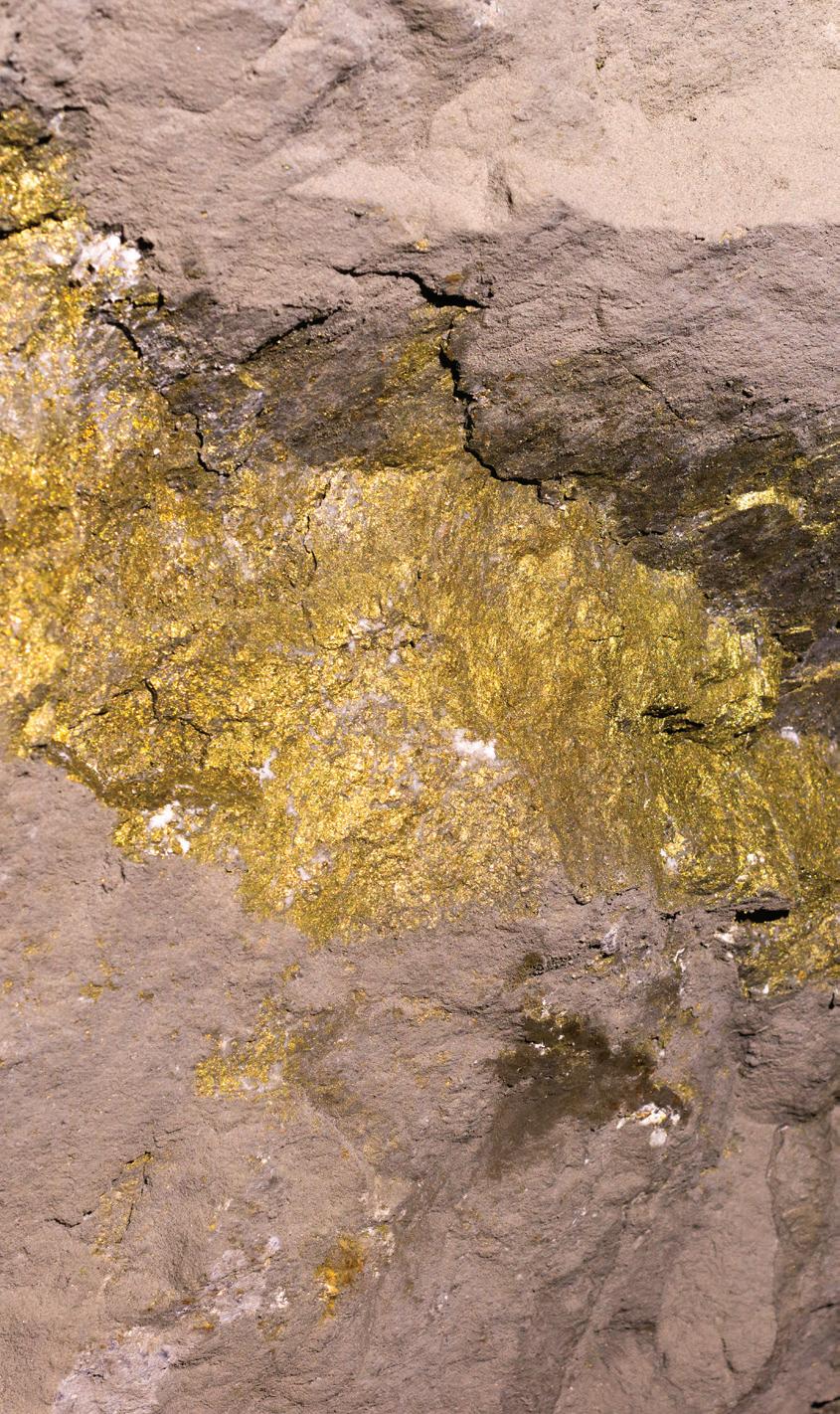

Spearheaded by Curtin University’s School of Mines: Minerals, Energy and Chemical Engineering and the Minerals Research Institute of Western Australia (MRIWA) the roadmap will look at decarbonising Western Australia through integrated mineral carbonation (MC).

MC is a form of carbon capture, use and storage (CCUS) that has the potential to be a versatile approach to both remove and permanently store carbon dioxide at a gigatonne scale. It also has the added potential of providing economic advantage to quickly transition Western Australia to a low carbon economy supporting global low carbon supply chains.

It is intended that the roadmap will cover not only the engineering and scientific aspects but also business case development and policy making. To achieve this overall goal, four key objectives have been outlined for the project:

1. Technology overview and mapping – an extensive review of literature for all technology for MC, which can then be mapped against potential use cases in the state